We've detected your location as Mumbai . Do you want to switch?

Accurate city detection helps us serve more contextual content

- You are in (Delhi) Change City

- ETimes Home

- Web Series Trailers

- Movie Reviews

- Movie Listings

Visual Stories

- Did You Know?

- Bigg Boss 17

- Relationships

- Health & Fitness

- Soul Search

- Home & Garden

- Women's Day Special

Entertainment

- Music Awards

- Bhubaneshwar

- humburgerIcon humburgerIcon humburgerIcon

- Cast & Crew

- Movie Review

- Users' Reviews

Nandamuri Kalyan Ram’s acting prowess and presence, with a touch of action and comedy, make this action thriller work in parts. His portal of Bipin stands out. It’s not a perfect film, but it has enough to keep the viewer engaged.

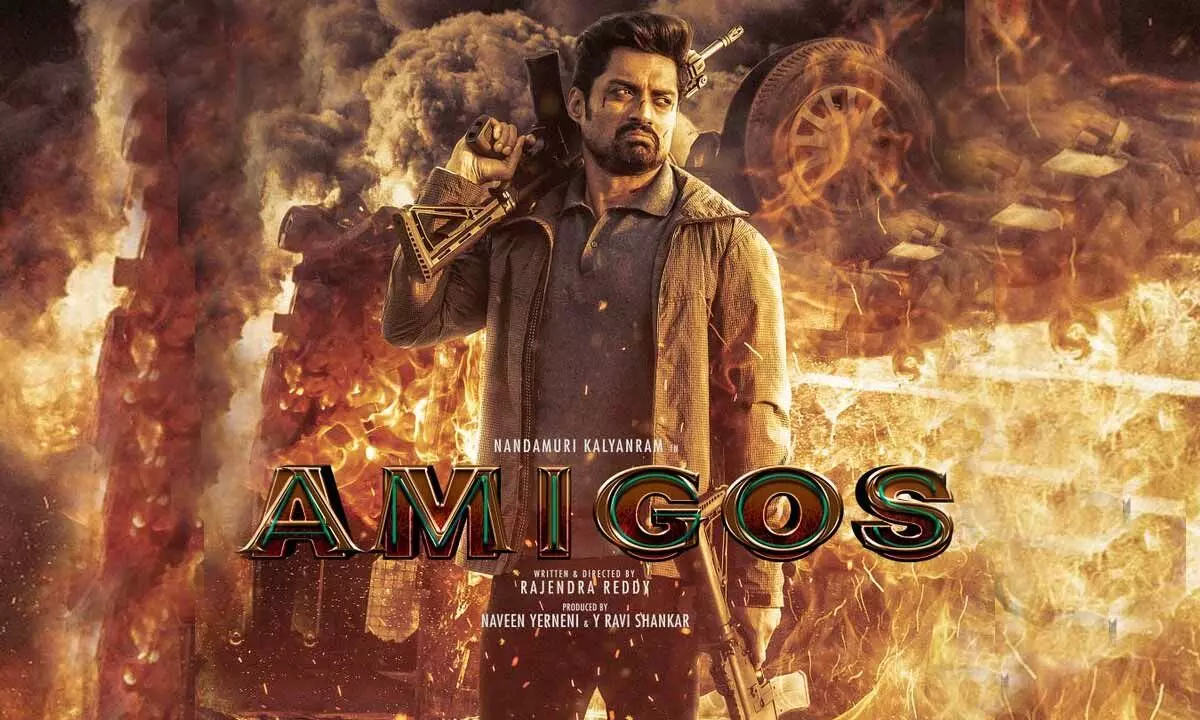

Amigos Movie Review: Kalyan Ram in the triple role makes this experimental film work

- Times of India

Amigos - Official Trailer

Amigos - Official Teaser

Amigos | Song Promo - Yeka Yeka

Amigos | Song - Yeka Yeka

SUBSCRIBE NOW

Get reviews of the latest theatrical releases every week, right in your inbox every Friday.

Thanks for subscribing.

Please Click Here to subscribe other newsletters that may interest you, and you'll always find stories you want to read in your inbox.

Pavan Kalva 309 days ago

Superb thiller

obulustar 406 days ago

New Concept

suhas jinka 180 410 days ago

it was gud but should hve more suspence

S Rebel S Rebel 410 days ago

10 baby names that mean 'light'

How to balance extended family in a relationship

Books about voting and elections every Indian citizen must read

10 effective ways to give your mind a detox

Sanyogita Yadav's gorgeous pics in red

A virtual tour of 'ShivShakti', Ajay Devgn and Kajol's beautiful home

8 summer-friendly healthy parathas to try

Kavyashree Gowda charms in georgette saree ensemble

Sachin Tendulkar's favourite Maharashtrian dishes

Sonakshi Sinha radiates ethnic bliss in a teal-hued embroidered kurta set

- Entertainment /

- Movie Reviews /

- This film marks the first collaboration of uncle-nephew duo Anil Kapoor and Arjun Kapoor. Arjun is the son of Anil’s brother Boney Kapoor. Share

- This film marks the first collaboration of uncle-nephew duo Anil Kapoor and Arjun Kapoor. Arjun is the son of Anil’s brother Boney Kapoor.

- This is the second time Arjun Kapoor is playing a double role, the first being Aurangzeb (2013).

- The song ‘Yamma yamma’ from ‘Shaan’ is sampled in the song ‘Partywali Night' for the film.

Choose your reason below and click on the Submit button. This will alert our moderators to take action

- Foul language

- Inciting hatred against a certain community

- Out of context/Spam

- Copied from article

Amigos Movie Review: Thrills more as an idea than a film

Rating: ( 2 / 5).

Amigos opens with its climactic scene. We see two bruised Kalyan Rams facing off each other on a dark night. One of them manages to get hold of the gun and shoots the other. The catch here is, we have no clue about the identities of these people. Did the evil Kalyan shoot the good Kalyan or the other way around? We have to sit through—in this case, endure—the whole film to reach there.

Cast: Nandamuri Kalyan Ram, Ashika Ranganath, Brahmaji

Director: Rajender Reddy

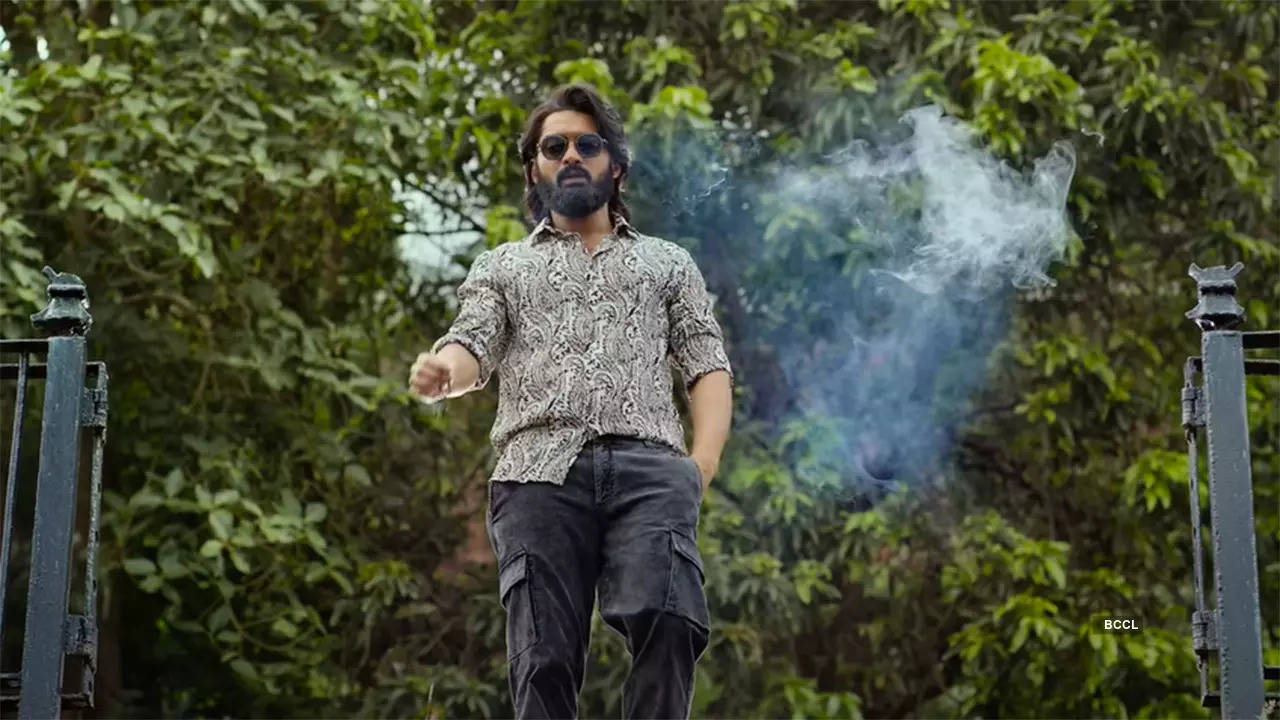

The film directed, directed by Rajender Reddy, has a thrilling idea at its core. Siddharth (he’s the hero of the story, let’s call him the ‘good guy’ for better understanding) is fascinated to find his doppelganger. Before we come to this point, we are fed information about doppelgangers twice—during the opening credits and a painfully verbal exposition by a nameless character played by Sapthagari. So when Siddharth comes across a website that lets one find their lookalike, he quickly manages to get in touch with two of his doppelgangers and they plan to meet in Goa. One of them is the clean-shaven, formally dressed Manjunath Hegde (let us call him the ‘meek guy’) and the other is Michael (he is the ‘bad guy’), who walks into the low-angle frame in slow-mo with a cigar. The central conflict in the film and about the film is that Siddarth and Manju fail to recognise the fact that Michael is the bad guy. While the good guy and the meek guy remain oblivious to the bad guy’s cruel intentions, the screenplay spends a good chunk of time on a cliched rom-com angle featuring Ashika Ranganath and a puzzle to get to her heart that you know has been planted to spin a comic moment out of the triple role facet.

It’s only at the halfway mark that the other two characters learn the true side of Michael, whom we have known for all the while as a bad guy on a mission that endangers Siddharth and Manjunath. This is perhaps why we barely feel any shock when this reveal drops. And while Kalyan Ram is neat as the good guy and the meek guy, his performance as Michael renders this evil character caricaturish, with a serious voice and a persistent smug expression that screams ‘evil’. What made the actor intimidating in Bimbisara is clearly missing here.

All the issues with Amigos can be traced to its weak and predictable screenplay. For example, the dog coming to the rescue in the climax of HIT 2 works beautifully because this scene has been set up so subtly somewhere in the first act. In Amigos , however, when information is being given out, we can discern that the only purpose of the scene is to set up another moment, robbing us of the surprise and joy we might have experienced when this lands. Here, a vegetable, yes, you heard that right, is used as a key plot point and we know that this vegetable will serve a purpose later in the film.

Moreover, we barely feel the stakes and the menace of the ‘bad guy’, even when people are killed and important characters are in grave danger because we are never truly invested in them. Sidharth’s father, mother, and sister are as lively as the cardboard stand-ins of the film placed outside the theatre I watched the film in. The mother wants her son to get married, the playful sister pulls pranks on her brother and the father… I don’t even remember; such is the genericness in writing. It is not that the artificiality in writing is restricted to the lighter portions. Even serious angles in the film are treated in a generic way. We are told that NIA (National Intelligence Agency, I assumed) is after Michael and you cannot help but laugh at their inefficiency. In the climax, the bad guy is caught, handcuffed and escorted by armed ‘agents’ in a convoy. He manages to destroy the entire convoy single-handedly. While we, as the audience, are willing to suspend our disbelief, I wish they at least tried to make it believable.

One can only imagine the fun this idea about lookalikes could have spawned. From comedy to thrills, the possibilities are endless. It is not that Amigos doesn't try, just that it leaves you craving the inventiveness the film truly deserved. Films like Amigos are reminders that having an exciting idea doesn’t suffice. One needs an equally strong screenplay to propel the film as a whole narrative.

Related Stories

- ఆంధ్రప్రదేశ్ ఎన్నికలు

- లోక్సభ ఎన్నికలు

- Photogallery

- Telugu News

- Telugu Movies

- Movie Review

- Kalyan Ram And Ashika Ranganath Starrer Amigos Telugu Movie Review And Rating

సినిమా రివ్యూ

‘అమిగోస్’ మూవీ రివ్యూ

విమర్శకుల రేటింగ్, యూజర్ రేటింగ్, మూవీకు రేటింగ్ ఇవ్వడానికి స్లైడ్ చెయ్యండి.

సూచించబడిన వార్తలు

మూవీ రివ్యూ

ప్రకటనల కోసం సంప్రదించండి..

సార్వత్రిక ఎన్నికల షెడ్యూల్ విడుదల.

- టీవీ సీరియల్స్

- మూవీ సీక్రెట్స్

- ఫోటోగ్యాలరీ

- వైరల్ వీడియో

- ఇన్స్పిరేషనల్

Amigos Movie Review : అమిగోస్ మూవీ రివ్యూ అండ్ రేటింగ్…!!

Amigos Movie Review : నందమూరి కళ్యాణ్ రామ్ అనగానే మనకు గుర్తొచ్చేది మూడే సినిమాలు. అవి అతనొక్కడే, పటాస్, బింబిసారా. ఈ మూడు సినిమాలు తన సినీ జీవితంలో పెద్ద హిట్. బింబిసారాతో ఇటీవల కళ్యాణ్ రామ్ సూపర్ డూపర్ హిట్ కొట్టి మంచి ఊపుమీదున్నాడు. ఆ ఊపుతోనే అమిగోస్ పేరుతో సరికొత్త కాన్సెప్ట్ తో సినిమా తీస్తున్నాడు కళ్యాణ్ రామ్. ఇది డాపల్ గాంగార్ నేపథ్యంలో రూపొందింది. అంటే మూడు విభిన్నమైన పాత్రల్లో కళ్యాణ్ […]

Amigos Movie Review : నందమూరి కళ్యాణ్ రామ్ అనగానే మనకు గుర్తొచ్చేది మూడే సినిమాలు. అవి అతనొక్కడే, పటాస్, బింబిసారా. ఈ మూడు సినిమాలు తన సినీ జీవితంలో పెద్ద హిట్. బింబిసారాతో ఇటీవల కళ్యాణ్ రామ్ సూపర్ డూపర్ హిట్ కొట్టి మంచి ఊపుమీదున్నాడు. ఆ ఊపుతోనే అమిగోస్ పేరుతో సరికొత్త కాన్సెప్ట్ తో సినిమా తీస్తున్నాడు కళ్యాణ్ రామ్. ఇది డాపల్ గాంగార్ నేపథ్యంలో రూపొందింది. అంటే మూడు విభిన్నమైన పాత్రల్లో కళ్యాణ్ రామ్ నటించి మెప్పించాడన్నమాట.

ఈ సినిమా తాజాగా ప్రపంచ వ్యాప్తంగా విడుదలైంది. ఈ సినిమాకు రాజేంద్ర రెడ్డి దర్శకుడు. అషికా రంగనాథ్ హీరోయిన్ గా నటించింది. మైత్రీ మూవీ మేకర్స్ వారు ఈ సినిమాను నిర్మించారు. ఈ సినిమాకు సంబంధించిన ట్రైలర్స్, టీజర్స్, పోస్టర్లు అభిమానులను బాగా ఆకట్టుకున్నాయి. అందులోనూ బింబిసార తర్వాత కళ్యాణ్ రామ్ నటిస్తున్న సినిమా కావడంతో ఈ సినిమాపై ఒక్కసారిగా అంచనాలు పెరిగాయి. మరి.. ప్రేక్షకుల అంచనాలను కళ్యాణ్ రామ్ అందుకున్నాడా అనేది తెలియాలంటే సినిమా కథలోకి వెళ్లాల్సిందే.

Amigos Movie Review and rating in telugu

Amigos Movie Review : కథ

సినిమా కథ ఏంటంటే.. ముగ్గురు ఒకే పోలికతో ఉండే వాళ్ల కథ. ఇందులో కళ్యాణ్ రామ్ మూడు పాత్రల్లో నటించాడు. ఒకటి సిద్ధార్థ్. ఇంకోటి మంజునాథ్, మరొకటి మైఖేల్. ఈ మూడు పాత్రల్లో నటించాడు. ఒక్కో పాత్ర ఒక్కో రకంగా ఉంటుంది. మూడు విభిన్నమైన పాత్రల్లో నటించి కళ్యాణ్ రామ్ బాగా మెప్పించాడు. ఈ ముగ్గురు ఒకరే తల్లిదండ్రులకు పుట్టిన వారు కాదు. ఒకరి ఫ్యామిలీకి, మరొకరి ఫ్యామిలీకి అస్సలు సంబంధమే ఉండదు. ఈ ముగ్గురిలో మైఖేల్ అనే వ్యక్తి గ్యాంగ్ స్టర్. ఇతడి కోసం, ఇతడిని పట్టుకోవడం కోసం ఎన్ఐఏ తెగ గాలిస్తూ ఉంటుంది. తనలాగే మరో ఇద్దరు ఉన్నారని తెలుసుకున్న మైఖేల్..

అతడు దొరకకుండా తప్పించుకొని తిరుగుతూ అమాయకులైన సిద్ధార్థ్, మంజునాథ్ లను వాడుకుంటూ ఉంటాడు. చివరకు.. తమలాగే మరో వ్యక్తి కూడా ఉన్నాడని వీళ్లు తెలుసుకుంటారు. ఆ తర్వాత ముగ్గురి పరిస్థితి ఏమైంది. చివరకు మైఖేల్ ను ఎన్ఐఏ వాళ్లు పట్టుకుంటారా? అనేది తెలియాలంటే సినిమాను వెండి తెర మీద చూడాలి. సినిమా పేరు : అమిగోస్, డైరెక్టర్ : రాజేంద్ర రెడ్డి, నటీనటులు : కళ్యాణ్ రామ్, అషికా రంగనాథ్, బ్రహ్మాజి, సప్తగిరి, నిర్మాతలు : నవీన్ ఎర్నేని, రవిశంకర్, మ్యూజిక్ డైరెక్టర్ : జిబ్రాన్, సినిమాటోగ్రఫీ : సౌందర రాజన్, విడుదల తేదీ : 10 ఫిబ్రవరి 2023

సినిమా ఎలా ఉందంటే?

ఈ సినిమా నిజానికి.. డాపల్ గాంగర్ నేపథ్యంలో తెరకెక్కింది. అదే ఈ సినిమాకు కొత్త పాయింట్. అది తప్పితే ఈ సినిమాలో మరో కొత్త పాయింట్ లేదు. రెగ్యులర్ కమర్షియల్ పంథాలోనే వెళ్తుంది. ముగ్గురు వేర్వేరు కుటుంబాల నుంచి వచ్చిన ఒకే పోలికతో ఉన్న వ్యక్తుల జీవితమే ఈ సినిమా. మధ్య మధ్యలో కొన్ని ట్విస్టులు అయితే ఉంటాయి. ఇంటర్వెల్ ట్విస్ట్ కూడా బాగుంటుంది. కాకపోతే.. స్క్రీన్ ప్లే సరిగ్గా లేదు. సెకండ్ హాఫ్ కూడా రొటీన్ గా సాగిపోయింది. హీరోయిన్ గా అషికా రంగనాథ్ బాగానే అలరించింది. మిగితా నటీనటులు కూడా తమ పాత్ర పరిధి మేరకు బాగానే అలరించారు. మొత్తానికి ఇది ఒక రొటీన్ కమర్షియల్ యాక్షన్ డ్రామాగా మిగిలిపోయింది. ప్లస్ పాయింట్స్, కళ్యాణ్ రామ్ నటన, డాపల్ గాంగర్ కాన్సెప్ట్, ఇంటర్వెల్ ట్విస్ట్, మైనస్ పాయింట్స్, స్క్రీన్ ప్లే, రొటీన్ కమర్షియల్ డ్రామా, సెకండ్ హాఫ్, దితెలుగున్యూస్ రేటింగ్ : 2.5/5

ది తెలుగు న్యూస్ వాట్సాప్ ఛానల్ ని ఫాలో అవ్వండి

- Amigos Movie Review

- nandamuri kalyan ram

- నందమూరి కళ్యాణ్ రామ్

ది తెలుగు న్యూస్లో డిజిటల్ కంటెంట్ ప్రొడ్యూసర్గా పని చేస్తున్నారు. ఇక్కడ తెలంగాణ , ఆంధ్రప్రదేశ్, జాతీయ, అంతర్జాతీయ వ్యవహారాలకు సంబంధించిన తాజా వార్తలు, రాజకీయ వార్తలు, ప్రత్యేక కథనాలు, క్రీడా, హైల్త్, ఆధ్యాత్మికం, విద్యా ఉద్యోగం, సినిమా, బిజినెస్ సంబంధించిన వార్తలు రాస్తారు. గతంలో ప్రముఖ తెలుగు మీడియా సంస్థలో అనుభవం కూడా ఉంది

Related News

"Family Star Movie Review : విజయ్ దేవరకొండ ఫ్యామిలీ స్టార్ మూవీ రివ్యూ అండ్ రేటింగ్..!"

"Tillu Square Movie Review : సిద్ధు జొన్నలగడ్డ.. టిల్లు స్క్వేర్ మూవీ ఫస్ట్ రివ్యూ అండ్ రేటింగ్..!"

"Razakar Movie Review : రజాకార్ మూవీ ఫస్ట్ రివ్యూ అండ్ రేటింగ్..!"

"Lambasingi Movie Review : లంబసింగి మూవీ ఫస్ట్ రివ్యూ అండ్ రేటింగ్..!"

"Gaami Movie Review : విశ్వక్ సేన్ గామి మూవీ ఫస్ట్ రివ్యూ అండ్ రేటింగ్..!"

"Bhimaa Movie Review : గోపీచంద్ భీమా మూవీ ఫస్ట్ రివ్యూ అండ్ రేటింగ్..!"

"Operation Valentine Movie Review : ఆపరేషన్ వాలెంటైన్ మూవీ ఫస్ట్ రివ్యూ అండ్ రేటింగ్..!"

"Ooru Peru Bhairavakona Movie Review : ఊరు పేరు భైరవకోన మూవీ రివ్యూ అండ్ రేటింగ్..!"

Advertisement, latest news, "venu swamy : మళ్లీ వరుణ్ తేజ్ని టార్గెట్ చేసిన వేణు స్వామి.. ఆ అమ్మాయి వల్లనే విడాకులు", "balakrishna : బాలకృష్ణ కూతుళ్లు, అల్లుళ్ల ఆస్తులకి సంబంధించి బయటకు వచ్చిన సీక్రెట్..", "court jobs : కోర్ట్ జాబ్స్ కోసం భారీ నోటిఫికేషన్… ఎన్ని పోస్ట్లు పడ్డాయంటే..", "kcr : ఏపీలో అధికారంలోకి వచ్చేది అతనే అంటూ కేసీఆర్ జోస్యం..", "posani krishna murali : అప్పుడు ఏం పీకావ్ పవన్ కళ్యాణ్.. పోసాని కృష్ణ మురళి..".

- Review Rayudu

Amigos Movie Review

Cast: Nandamuri Kalyan Ram, Ashika Ranganath, Nithin Prasanna

Director: Rajendra Reddy

Producers: Mythri Movie Makers

Nanadmuri Kalyan Ram is one of those rare actors who tries to experiment with each and every movie. The young actor who is riding high after the sensational blockbuster of Bimbisara has come out with a thriller Amigos, a never tried experimental movie in Telugu.

Backed by the leading production house Mythri Movie Makers, the movie created a decent buzz before its release and finally hit the theatres today. Let’s see whether Kalyan Ram can score another hit with Amigos or not.

Also Read: Michael Movie Review

Sidhu (Kalyan Ram) is a businessman who is into real estate and falls in love with RJ Ishika (Ashika Ranganath). One day Sidhu comes to know about a website where one can meet their doppelgangers and register on the site. Interestingly, he finds two more look-alikes, Manjunath from Bangalore and Michael from Kolkata.

The three doppelgangers finally meet and have blast. Everything seems happy and funny initially but things turn worse eventually when one among them is revealed to be a dangerous person. This puts the lives of the other two in danger. What’s the actual problem and how the other two come out of it is the rest of the story.

Also Read: Writer Padmabhushan Movie Review

Plus Points:

- Different Concept

- Parts in Second Half

- Kalyan Ram’s triple role

Minus Points:

- Love Track /Comedy

- Predictability

- Lack of thrilling elements

Unlike most movies in which the look-alike heroes are related to each other, Amigos is a different concept movie that was hardly tried in Telugu. The core story revolves around three doppelgangers who are nowhere related to each other.

Director has presented the concept in an interesting way, however, the love track tests your patience and the lack of entertainment is another major disadvantage.

To sum it up, Amigos is a different and out-of-the-box plot, however, the narrative fails to bring excitement and thrill. The movie goes flatty in many places and picks up during the second half. If you are someone who likes to watch different concept movies with low expectations, this is a decent watch.

RELATED ARTICLES MORE FROM AUTHOR

Ooru peru bhairavakona movie review, mangalavaram movie review, martin luther king movie review, the family star movie review, om bheem bush movie review, razakar movie review, gaami movie review, taapsee pannu latest photos, varun tej lavayna tripathi engagement photos, priyanka chopra latest photos, varun tej and lavanya tripathi get engaged, వరుణ్ తేజ్ తొలి ప్రేమకు ఊహించని షాక్.., పవన్ కు తాత కానీ అల్లు అర్జున్ కు మాత్రం తండ్రి.., యాత్ర సినిమా ఎలా ఉంది.. ఓవర్సీస్ టాక్ ఎలా వచ్చింది.., అప్పుడే అమెజాన్ లో వచ్చేస్తున్న ఎఫ్2...

- Privacy Policy

- Terms and Conditions

- Advertise With Us

హొమ్ పేజ్ >> సమీక్షలు >>అమిగోస్

'Amigos' Live updates in English Version

Pre Release Event

- AP Assembly Elections 2024

- Telugu News

- Movies News

Amigos Review: రివ్యూ: అమిగోస్

కల్యాణ్రామ్ త్రిపాత్రాభినయంలో నటించిన ‘అమిగోస్’ (Amigos Review) ఎలా ఉందంటే..?

Amigos Review .. చిత్రం: అమిగోస్; నటీనటులు: కల్యాణ్రామ్, ఆషికా రంగనాథ్, బ్రహ్మాజీ, జయప్రకాష్, సప్తగిరి తదితరులు; సంగీతం: జిబ్రాన్; ఛాయాగ్రహణం: ఎస్.సౌందర్ రాజన్; నిర్మాణ సంస్థ: మైత్రి మూవీ మేకర్స్; నిర్మాతలు: నవీన్ యెర్నేని, రవిశంకర్; రచన, దర్శకత్వం: రాజేంద్ర రెడ్డి; విడుదల తేదీ: 10-02-2023

‘బింబిసార’తో హిట్టు కొట్టి ఫుల్ జోష్లో ఉన్నారు కల్యాణ్రామ్ ( Kalyan Ram ). ఆ ఊపులోనే ఇప్పుడు ‘అమిగోస్’ (Amigos)గా అలరించేందుకు సిద్ధమయ్యారు. ఇది కల్యాణ్రామ్కు తొలి త్రిపాత్రాభినయ చిత్రం. కొత్త దర్శకుడు రాజేంద్ర రెడ్డి తెరకెక్కించారు. పాటలు, ప్రచార చిత్రాలు ఆకట్టుకునేలా ఉండటం.. కల్యాణ్రామ్ ఓ పాత్రలో ప్రతినాయకుడిగా కనిపిస్తుండటం ప్రేక్షకుల్లో సినిమాపై అంచనాలు పెంచింది. మరి ఈ ‘అమిగోస్’ కథేంటి? ప్రేక్షకులకు ఎలాంటి అనుభూతి పంచింది? అనేది తెలుసుకునే ముందు ఈ సినిమా కథేంటో చూద్దాం. (Amigos Review)

కథేంటంటే: సిద్ధార్థ్ (కల్యాణ్రామ్) ( Kalyan Ram )ది హైదరాబాద్. తండ్రి వ్యాపారాన్ని చూసుకుంటుంటాడు. రేడియో జాకీగా పని చేసే ఇషికా (ఆషికా రంగనాథ్)ను తొలి చూపులోనే ప్రేమిస్తాడు. ఆమెను పెళ్లి చేసుకోవాలన్న ఆలోచనతో వాళ్ల ఇంటికి పెళ్లి చూపులకు వెళ్తాడు. కానీ, ఆ వ్యవహారం బెడిసి కొడుతుంది. అదే సమయంలో సిద్ధార్థ్ ఓ వెబ్సైట్ వల్ల తనలాగే ఉండే మంజునాథ్, మైఖేల్ను కలుసుకుంటాడు. ఒకలాగే ఉన్న ఆ ముగ్గురు చాలా దగ్గరవుతారు. మంజు, మైఖేల్ సాయంతో సిద్ధార్థ్ తన ప్రేమను పెళ్లి పట్టాలెక్కిస్తాడు. ఆ తర్వాత సొంత ఊరు బెంగళూరుకు వెళ్లడానికి మంజునాథ్, కోల్కతాకు వెళ్లడానికి మైఖేల్ పయనమవుతారు. కానీ, ఇంతలో నేషనల్ ఇన్వెస్టిగేషన్ ఏజెన్సీ అధికారులు మంజునాథ్పై కాల్పులు జరిపి.. అతన్ని తమ కస్టడీలోకి తీసుకుంటారు. అప్పుడే సిద్ధార్థ్కు మైఖేల్ గురించి ఓ ఆసక్తికర విషయం తెలుస్తుంది. మైఖేల్ నరరూప రాక్షసుడని, అసలు పేరు బిపిన్ రాయ్ అని.. అతడిని పట్టుకోవడం కోసమే ఎన్ఐఏ వాళ్లు హైదరాబాద్కు వచ్చారని సిద్ధార్థ్ తెలుసుకుంటాడు. బిపిన్ చేసిన మోసం వల్ల మంజు, తాను సమస్యల్లో చిక్కుకున్నట్లు గ్రహిస్తాడు. మరి బిపిన్ రాయ్ ఎవరు? అతడు మిగతా ఇద్దరి జీవితాల్లోకి రావడానికి కారణమేంటి? అతడు వేసిన ప్లాన్ నుంచి వీరిద్దరూ ఎలా తప్పించుకున్నారు? ఎన్ఐఏకు బిపిన్ను పట్టించారా? లేదా? అన్నది మిగతా కథ (Amigos Review).

ఎలా ఉందంటే: ఒకే పోలికలతో ఉండే ముగ్గురు వ్యక్తుల మధ్య జరిగే కథ ఇది. అందులో ఒకడు ప్రతినాయకుడు. అతడు తన ఐడెంటిటీని దాచేందుకు తనలాగే ఉండే మిగతా ఇద్దరి జీవితాలతో ఎలా ఆడుకున్నాడు, అతని బారి నుంచి తప్పించుకునేందుకు మిగతా ఇద్దరు ఏం చేశారన్నది క్లుప్తంగా చిత్ర కథ. కథగా వినడానికి ఈ లైన్ చాలా బాగుంది. థ్రిల్లింగ్ ఎలిమెంట్స్, ఎత్తులు పైఎత్తులతో రసవత్తరంగా స్క్రిప్ట్ సిద్ధం చేసుకుంటే ఓ వినూత్నమైన యాక్షన్ థ్రిల్లర్ అయ్యేది. కానీ, దర్శకుడు రాజేంద్ర రెడ్డి ఈ అవకాశాన్ని సద్వినియోగం చేసుకోలేకపోయారు. సినిమాని ఆసక్తికరంగా నడపడంలో ఆది నుంచే తడబడ్డారు. సిద్ధార్థ్ పాత్ర కోణం నుంచి కథ ఆరంభించిన తీరు ఫర్వాలేదనిపిస్తుంది. ఆషికాతో అతని ప్రేమకథ కాస్త బోరింగ్గా అనిపించినా.. దాన్ని వెంటనే కట్ చేసి అసలు కథలోకి తీసుకెళ్లాడు దర్శకుడు. ఒకే పోలికలతో ఉన్న సిద్ధార్థ్, మంజునాథ్, మైఖేల్ ఒకచోటకు చేరాక కథలో వేగం పెరిగినట్లు అనిపిస్తుంది. కానీ, ఆ వెంటనే సిద్ధార్థ్ లవ్ ట్రాక్ను తెరపైకి తీసుకొచ్చి ప్రేక్షకుల్ని నిరుత్సాహ పరుస్తాడు దర్శకుడు. విరామానికి ముందొచ్చే మలుపుతో కథ ఒక్కసారిగా యాక్షన్ మోడ్లోకి టర్న్ తీసుకుంటుంది. మైఖేల్ వేసిన ఎత్తుగడ వల్ల మంజునాథ్ ఎన్ఐఏ బృందానికి చిక్కడం.. ఆ వెంటనే సిద్ధార్థ్కు మైఖేల్ అసలు రూపం తెలియడం.. ద్వితీయార్ధం ఏం జరుగుతుందన్న ఆసక్తి మొదలవుతుంది.

ఇక ద్వితీయార్ధంలో మైఖేల్ ఫ్లాష్బ్యాక్ ఎపిసోడ్ ప్రేక్షకులను మెప్పిస్తుంది. బిపిన్ రాయ్ అనే నరరూప రాక్షసుడిగా కల్యాణ్రామ్ను తెరపై చూపించిన విధానం బాగుంటుంది. కానీ, అతడిలోని క్రూరత్వాన్ని ఆవిష్కరించే సన్నివేశాలు అంత ఆసక్తికరంగా ఉండవు. మైఖేల్ నుంచి తనని, తన కుటుంబాన్ని, మంజునాథ్ను కాపాడేందుకు సిద్ధార్థ్ చేసే ప్రయత్నాలు ఏమాత్రం మెప్పించవు. పతాక సన్నివేశాలు ఊహలకు తగ్గట్లుగా సాగడం.. ఎలాంటి మెరుపులు లేకపోవడంతో ఓ సాదాసీదా చిత్రం చూసినట్లుగా అనిపిస్తుంది.

ఎవరెలా చేశారంటే: నటన, హవభావాల పరంగా కల్యాణ్రామ్ మూడు పాత్రల్లోనూ చక్కటి వేరియేషన్ చూపించారు. ముఖ్యంగా మైఖేల్గా ప్రతినాయక పాత్రలో కల్యాణ్రామ్ కనిపించిన విధానం ఆకట్టుకుంటుంది. ఆ పాత్రే ఈ చిత్రానికి ప్రధాన బలం. దీనికి తన వంతుగా ప్రత్యేకత చేకూర్చడానికి కల్యాణ్రామ్ చేయాల్సిందంతా చేశాడు. మిగతా రెండు పాత్రలు పరిధి మేరకే ఉంటాయి. ఇషికాగా ఆషికా అందంగా కనిపించింది. నటనకు పెద్దగా ఆస్కారం లేదు. నిజానికి ఈ కథలో ఆమె పాత్ర, లవ్ ట్రాక్ లేకున్నా సినిమాకి వచ్చే నష్టమేమీ లేదు. బ్రహ్మాజీ పాత్రతో అక్కడక్కడా ప్రేక్షకుల్ని నవ్వించే ప్రయత్నం చేశారు దర్శకుడు. కానీ, అది వర్కవుట్ అవ్వలేదు. దర్శకుడి కథాలోచన బాగున్నా.. దాన్ని ఆసక్తికరంగా తెరపైకి తీసుకురాలేకపోయారు. స్క్రీన్ప్లే పరంగా చాలా లోపాలు కొట్టొచ్చినట్లుగా కనిపిస్తాయి. జిబ్రాన్ నేపథ్య సంగీతం ఫర్వాలేదనిపిస్తుంది. ‘‘ఎన్నో రాత్రులొస్తాయి’ పాట బాగున్నప్పటికీ దాని ప్లేస్మెంట్ సరిగ్గా కుదర్లేదు. సౌందర్ రాజన్ ఛాయాగ్రహణం బాగుంది. నిర్మాణ విలువలు ఓకే(Amigos Review).

1. కథా నేపథ్యం; 2. మైఖేల్గా కల్యాణ్రామ్ నటన; 3. ద్వితీయార్ధం

1. కథనం సాగిన తీరు; 2. లవ్ ట్రాక్

చివరిగా: ‘అమిగోస్’.. అక్కడక్కడా మెప్పించే యాక్షన్ డ్రామా.

గమనిక: ఈ సమీక్ష సమీక్షకుడి దృష్టి కోణానికి సంబంధించింది. ఇది సమీక్షకుడి వ్యక్తిగత అభిప్రాయం మాత్రమే!

- Telugu Cinema News

గమనిక: ఈనాడు.నెట్లో కనిపించే వ్యాపార ప్రకటనలు వివిధ దేశాల్లోని వ్యాపారస్తులు, సంస్థల నుంచి వస్తాయి. కొన్ని ప్రకటనలు పాఠకుల అభిరుచిననుసరించి కృత్రిమ మేధస్సుతో పంపబడతాయి. పాఠకులు తగిన జాగ్రత్త వహించి, ఉత్పత్తులు లేదా సేవల గురించి సముచిత విచారణ చేసి కొనుగోలు చేయాలి. ఆయా ఉత్పత్తులు / సేవల నాణ్యత లేదా లోపాలకు ఈనాడు యాజమాన్యం బాధ్యత వహించదు. ఈ విషయంలో ఉత్తర ప్రత్యుత్తరాలకి తావు లేదు.

రివ్యూ: ఆర్టికల్ 370.. యామి గౌతమ్, ప్రియమణి నటించిన పొలిటికల్ థ్రిల్లర్ ఎలా ఉంది?

రివ్యూ: మై డియర్ దొంగ.. అభినవ్ గోమఠం నటించిన సినిమా ఎలా ఉందంటే?

రివ్యూ: సైరెన్.. జయం రవి, కీర్తి సురేశ్ యాక్షన్ థ్రిల్లర్ ఎలా ఉంది?

రివ్యూ: పారిజాత పర్వం.. క్రైమ్ కామెడీ థ్రిల్లర్ ఎలా ఉంది?

రివ్యూ: ఆట్టం.. మలయాళ సస్పెన్స్ డ్రామా ఎలా ఉంది?

రివ్యూ: డియర్.. భార్య గురకపెట్టే కాన్సెప్ట్తో రూపొందిన ఈ మూవీ మెప్పించిందా?

రివ్యూ: శ్రీ రంగనీతులు.. సుహాస్, కార్తీక్ రత్నంల కొత్త మూవీ మెప్పించిందా?

రివ్యూ: బడే మియా ఛోటే మియా.. అక్షయ్, టైగర్ ష్రాఫ్ నటించిన యాక్షన్ థ్రిల్లర్ ఎలా ఉంది?

రివ్యూ: గీతాంజలి మళ్ళీ వచ్చింది.. హారర్ కామెడీ థ్రిల్లర్ ఎలా ఉంది?

రివ్యూ: లవ్గురు.. విజయ్ ఆంటోనీ మూవీ ఎలా ఉంది?

రివ్యూ: మైదాన్.. అజయ్ దేవ్గణ్ కీలక పాత్రలో నటించిన స్పోర్ట్స్ డ్రామా మెప్పించిందా?

రివ్యూ: ప్రాజెక్ట్-Z.. సందీప్ కిషన్, లావణ్య త్రిపాఠి సైన్స్ ఫిక్షన్ థ్రిల్లర్ ఎలా ఉంది?

రివ్యూ: మంజుమ్మల్ బాయ్స్.. మలయాళ సూపర్హిట్ తెలుగులో ఎలా ఉంది?

రివ్యూ: ఫ్యామిలీస్టార్.. విజయ్ దేవరకొండ ఖాతాలో హిట్ పడిందా?

రివ్యూ: టిల్లు స్క్వేర్.. సిద్ధు, అనుపమ జోడీ మేజిక్ చేసిందా?

రివ్యూ: ఆడుజీవితం: ది గోట్లైఫ్.. పృథ్వీరాజ్ సుకుమారన్ సర్వైవల్ థ్రిల్లర్ ఎలా ఉంది?

Om Bhim Bush Review; రివ్యూ: ఓం భీమ్ బుష్.. కామెడీ ఎంటర్టైనర్ అలరించిందా?

ThulasiVanam Review: రివ్యూ: తులసీవనం: మిడిల్క్లాస్ కుర్రాడి బయోపిక్

Abraham Ozler review: రివ్యూ: అబ్రహాం ఓజ్లర్.. మలయాళ క్రైమ్ థ్రిల్లర్ ఎలా ఉంది?

Save The Tigers 2 Review: రివ్యూ: సేవ్ ది టైగర్స్ సీజన్ 2.. నవ్వులు రిపీట్ అయ్యాయా?

Sharathulu Varthisthai Review: రివ్యూ: షరతులు వర్తిస్తాయి.. సినిమా ఎలా ఉందంటే?

తాజా వార్తలు (Latest News)

టీ20 ప్రపంచకప్నకు టీమ్ ఇండియాను మీరే ఎంపిక చేయండి!

నాలుగో రోజూ లాభాల్లో.. 22,400 ఎగువన నిఫ్టీ

62వేల మంది వాలంటీర్లు రాజీనామా చేశారు.. కోర్టుకు తెలిపిన ఈసీ న్యాయవాది

ఎన్నికలను మేం నియంత్రించలేం: ‘వీవీప్యాట్’ కేసులో సుప్రీం కీలక వ్యాఖ్యలు

జగన్పై రాయిదాడి కేసు.. సతీష్ కస్టడీకి కోర్టు అనుమతి

హార్దిక్.. ముందు నీ ఆటపై దృష్టిపెట్టు: వీరేంద్ర సెహ్వాగ్

- Latest News in Telugu

- Sports News

- Ap News Telugu

- Telangana News

- National News

- International News

- Cinema News in Telugu

- Business News

- Political News in Telugu

- Photo Gallery

- Hyderabad News Today

- Amaravati News

- Visakhapatnam News

- Exclusive Stories

- Health News

- Kids Telugu Stories

- Real Estate News

- Devotional News

- Food & Recipes News

- Temples News

- Educational News

- Technology News

- Sunday Magazine

- Rasi Phalalu in Telugu

- Web Stories

- Pellipandiri

- Classifieds

- Eenadu Epaper

For Editorial Feedback eMail:

For Marketing enquiries Contact : 040 - 23318181 eMail: [email protected]

- TERMS & CONDITIONS

- PRIVACY POLICY

- ANNUAL RETURN

© 1999 - 2024 Ushodaya Enterprises Pvt.Ltd,All rights reserved.

Powered By Margadarsi Computers

Contents of eenadu.net are copyright protected.Copy and/or reproduction and/or re-use of contents or any part thereof, without consent of UEPL is illegal.Such persons will be prosecuted.

This website follows the DNPA Code of Ethics .

- General News

- Movie Reviews

Thank you for rating this post!

No votes so far! Be the first to rate this post.

Interested in writing political and/or movie related content for Telugubulletin? Creative writers, email us at " [email protected] "

Kalyan Ram is an actor who always tries to come up with different and interesting concepts which will entertain the audience. After his big hit with Bimbisara last year, the actor is now back with Amigos, his latest movie, which has been released today. Let us see how the film has turned out to be.

Siddhu is a family guy living in Hyderabad who gets to know about a website where you can meet your doppelgangers, through his friend. He reaches out to two of his doppelgangers, Manju from Bangalore and Michael from Kolkata. The three of them meet up and have a blast. Everything looks fun and easy in the beginning, but very soon, things change for the worst when one of the doppelgangers is revealed to be evil. This puts the other two in danger. What is the problem that the other two face and how they come out of it forms the rest of the story.

On-Screen Performances:

Kalyan Ram has undoubtedly stolen the show with his performance. The actor pulled off his three characters very well, and was very careful with each character’s mannerisms, bringing them out perfectly. He was especially wonderful to watch as Siddhu and Manju.

While Kalyan Ram’s performance as Michael is also quite good, his voice modulation could have been a tad bit better. On the whole, though, Kalyan Ram has done a fantastic job in all three characters.

Leading lady Ashika Ranganath, who made her debut with the film, looks good on the screen but doesn’t have a lot to do.

Brahmaji and Saptagiri are adequate in their roles. The rest of the supporting cast are alright as well.

Off-Screen Talents:

Director Rajendra Reddy came up with an interesting concept, as in, he didn’t get the three leading characters to be related, like in many other films. He came up with a few interesting scenes and setups, but couldn’t make good use of them. The first half of the film drags a lot and the second half is also not incredible, to be able to save the movie. The placement of songs is not right in the film, and the overall execution of the concept felt lackluster in the end. The director could have made his screenplay more interesting and racy, which would have made the film a lot better.

The background music is not up to the mark either, with certain tunes remaining underwhelming. The cinematography is great and stands out throughout the film.

The production design of the film is good, but the editing could have been so much better.

Plus Points:

- Kalyan Ram Performance

- Cinematography

Minus Points:

- Poor execution of the plot

- Underwhelming background music

- Weak first half

Verdict: Amigos is a film that had a lot of scope to explore. Kalyan Ram’s performance is good, but even three versions of him are not enough to be able to save this movie, which remains underwhelming at best.

Telugubulletin.com Rating: 2.25/5

Click Here for Live Updates

Amigos is an Action Crime Drama Movie, directed by Rajendra Reddy and produced by Mythri Movie Makers. Nandamuri Kalyanram and Ashika Ranganath are the lead cast of the movie. The film score and soundtrack are composed by Ghibran.

Watch this space for Exclusive Live updates from US premieres

6:15 PM – Movie starts with Saptagiri explaining Doppelgänger concept to Kalyan Ram and his friends

6:30 PM – Siddhu(KalyanRam), finds his look alikes on doppleganger website. Other look alikes are Manju Hedge from Banglore and Michael from Kolkata. They all decide to meet in Goa.

7:00 PM – Michael is on NIA’s watch list. Michael and Manju come to Hyderabad to help Siddu get in love with Ishika(Ashika).NIA arrests Manju thinking that he is Michael

First Half Report : Amigos 1st half is about introducing the three characters with very thin storyline and has some twist just before the interval. Okay narration so far, fate of the movie really depends on the second half. One may feel BGM is too loud at times.

Final report : Amigos is a thriller genre movie based on doppleganger concept that fails to live upto the expectations..eventhough kalyan ram gave good performance, director falls short of creating an impact on audience by not packaging it well..watch this space for detailed review

RELATED ARTICLES

Mega action schedule of nithiin’s thammudu underway, pushpa promo: very brief, wait continues, ashish, vaishnavi chaitanya’s ‘love me’ gets a new release date, 12 comments, silver screen, screenplay is the driving force for sabari, says varalakshmi sarathkumar, sudheer babu’s harom hara : soulful second single out, watch: pawan kalyan energizes jsp crowds, pawan kalyan braving extreme heat in pithapuram, kcr reveals why revanth reddy hates him, pawan kalyan’s most honest nomination wins accolades, pawan kalyan’s pithapuram poll result is decided already.

- TeluguBulletin

- Privacy Policy

© TeluguBulletin - All rights reserved

Thanks For Rating

Reminder successfully set, select a city.

- Nashik Times

- Aurangabad Times

- Badlapur Times

You can change your city from here. We serve personalized stories based on the selected city

- Edit Profile

- Briefs Movies TV Web Series Lifestyle Trending Medithon Visual Stories Music Events Videos Theatre Photos Gaming

Nawazuddin Siddiqui's daughter Shora wants to become an actor, Varun Dhawan starts new project on birthday, Preity Zinta joins Sunny Deol on 'Lahore 1947' sets: Top 5 entertainment news of the day

Shekhar Suman says that everyone lied about Parveen Babi that she was mad, though he cut out many portions from his interview with her

Ranbir Kapoor and Alia Bhatt step out for a drive with daughter Raha in their swanky new luxury car - See photo

'Deadpool and Wolverine': Iron Man to dead Ant-Man and more MCU Easter Eggs in the trailer

Ranbir Kapoor's trainer shows the actor's transformation from 'Animal' to 'Ramayana', drops before and after PICS - See inside

Aamir Khan gets told that he should settle down now after two marriages, here's how the actor reacted - WATCH

Movie Reviews

Silence 2: The Night Ow...

Amar Singh Chamkila

Bade Miyan Chote Miyan

Kung Fu Panda 4

Godzilla x Kong: The Ne...

Swatantrya Veer Savarka...

Madgaon Express

Ae Watan Mere Watan

- Movie Listings

Sanyogita Yadav's gorgeous pics in red

Sonakshi Sinha radiates ethnic bliss in a teal-hued embroidered kurta set

Aditi Rao Hydari looks radiant in her latest photo shoot!

Glimpses of Aparna Das' radiant Haldi celebration!

Khushi Kapoor's sun-kissed moments with her pet are picture-perfect

Kareena Kapoor to Parineeti Chopra: 5 Bollywood actresses who debunked pregnancy rumours in a hilarious way

Rashmika Mandanna radiates elegance in traditional indian attire

Rashmika Mandanna cherishes moments with her pet dog Aura

Rashmika Mandanna Adds Her Signature Charm to Her Saree Pictures

Priya Bhavani Shankar's gorgeous sareelooks

LSD 2: Love Sex Aur Dh...

The Legacy Of Jineshwa...

Do Aur Do Pyaar

Luv You Shankar

Mamu Makandaar

30 Hours Survival: Gau...

Detective Nysa

Bade Miyan Chote Miyan...

The First Omen

The Defective Detectiv...

Love Lies Bleeding

Knox Goes Away

Godzilla x Kong: The N...

Arthur The King

Finder: Project 1

Never Escape

Vallavan Vaguthadhada

Vaa Pagandaya

Oru Thavaru Seidhal

Marivillin Gopurangal

Varshangalkku Shesham

Vayassethrayayi Muppat...

The Goat Life

Secret Home

Jananam 1947 Pranayam ...

Naalkane Aayama

Dasavarenya Sri Vijaya...

Night Curfew

Appa I Love You

Bharjari Gandu

Avatara Purusha 2

Bengal Police Chapter ...

The Red Files

Chotto Piklu

Sheran Di Kaum Punjabi...

Jeonde Raho Bhoot Ji

Daddy Samjheya Karo

Chal Bhajj Chaliye

Fer Mamlaa Gadbad Hai

Rajkaran Gela Mishit

Alibaba Aani Chalishit...

Shishyavrutti

Lockdown Lagna

Bhagirathi Missing

Mahadev Ka Gorakhpur

Nirahua The Leader

Tu Nikla Chhupa Rustam...

Rowdy Rocky

Mental Aashiq

Raja Ki Aayegi Baaraat...

Bol Radha Bol

31st December

Maru Mann Taru Thayu

Sorry Sajna

Prem Ni Pathsala

Yaa Devi Sarvabhuteshu...

Jhopadpatti

Jajabara 2.0

Operation 12/17

Dui Dune Panch

Mo Kahanire Tori Naa

Your rating, write a review (optional).

- Movie Listings /

Would you like to review this movie?

Cast & Crew

Latest Reviews

The Sympathizer

Adrishyam: The Invisible Heroe...

Baby Reindeer

Parasyte: The Grey

Amigos - Official Trailer

Amigos - Official Teaser

Amigos | Song Promo - Yeka Yeka

Amigos | Song - Yeka Yeka

Users' Reviews

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive . Let's work together to keep the conversation civil.

- What is the release date of 'Amigos'? Release date of Nandamuri Kalyanram and Ashika Ranganath starrer 'Amigos' is 2023-03-10.

- Who are the actors in 'Amigos'? 'Amigos' star cast includes Nandamuri Kalyanram and Ashika Ranganath.

- Who is the director of 'Amigos'? 'Amigos' is directed by Reddy Rajendra P.

- What is Genre of 'Amigos'? 'Amigos' belongs to 'Action,Thriller' genre.

- In Which Languages is 'Amigos' releasing? 'Amigos' is releasing in Telugu.

Visual Stories

10 baby names that mean 'light'

How to balance extended family in a relationship

Books about voting and elections every Indian citizen must read

10 effective ways to give your mind a detox

Entertainment

A virtual tour of 'ShivShakti', Ajay Devgn and Kajol's beautiful home

8 summer-friendly healthy parathas to try

Kavyashree Gowda charms in georgette saree ensemble

Sachin Tendulkar's favourite Maharashtrian dishes

News - Amigos

It’s a wrap for Asif Ali-Suraj Venjaramoodu’s ‘Adios Am...

Asif Ali and Suraj Venjaramoodu team up for ‘Adios Amig...

Amigo Garage

Mahendran's Amigo Garage to release on March 15

'Amigos' twitter review: Check out what social media ha...

Upcoming Movies

Man Of The Match

Popular movie reviews.

Tillu Square

Om Bheem Bush

Family Star

Ooru Peru Bhairavakona

- Cast & crew

- User reviews

Three nearly-identical men become fast friends after meeting via an online doppelgänger-finding app. It's all fun and games until one of them turns out to be a notorious fugitive. Three nearly-identical men become fast friends after meeting via an online doppelgänger-finding app. It's all fun and games until one of them turns out to be a notorious fugitive. Three nearly-identical men become fast friends after meeting via an online doppelgänger-finding app. It's all fun and games until one of them turns out to be a notorious fugitive.

- Rajendra Reddy

- Nithin Prasanna

- Nandamuri Kalyan Ram

- 8 User reviews

- 6 Critic reviews

- Siddharth's Uncle

- Siddharth …

- All cast & crew

- Production, box office & more at IMDbPro

More like this

User reviews 8

- chand-suhas

- Apr 9, 2023

- How long is Amigos? Powered by Alexa

- February 10, 2023 (India)

- Mythri Movie Makers

- See more company credits at IMDbPro

Technical specs

- Runtime 2 hours 19 minutes

Related news

Contribute to this page.

- See more gaps

- Learn more about contributing

More to explore

Recently viewed

'Amigos' review: Thrills more as an idea than a film

Amigos opens with its climactic scene. We see two bruised Kalyan Rams facing off each other on a dark night. One of them manages to get hold of the gun and shoots the other. The catch here is, we have no clue about the identities of these people. Did the evil Kalyan shoot the good Kalyan or the other way around? We have to sit through—in this case, endure—the whole film to reach there.

The film directed, directed by Rajendra Reddy, has a thrilling idea at its core. Siddharth (he’s the hero of the story, let’s call him the ‘good guy’ for better understanding) is fascinated to find his doppelganger. Before we come to this point, we are fed information about doppelgangers twice—during the opening credits and a painfully verbal exposition by a nameless character played by Sapthagari.

So when Siddharth comes across a website that lets one find their lookalike, he quickly manages to get in touch with two of his doppelgangers and they plan to meet in Goa. One of them is the clean-shaven, formally dressed Manjunath ‘Manju’ Hegde (let us call him the ‘meek guy’) and the other is Michael (he is the ‘bad guy’), who walks into the low-angle frame in slow-mo with a cigar.

The central conflict in the film and about the film is that Siddarth and Manju fail to recognise the fact that Michael is the bad guy. While the good guy and the meek guy remain oblivious to the bad guy’s cruel intentions, the screenplay spends a good chunk of time on a cliched rom-com angle featuring Ashika Ranganath and a puzzle to get to her heart that you know has been planted to spin a comic moment out of the triple role facet.

It’s only at the halfway mark that the other two characters learn the true side of Michael, whom we have known for all the while as a bad guy on a mission that endangers Siddharth and Manjunath. This is perhaps why we barely feel any shock when this reveal drops. And while Kalyan Ram is neat as the good guy and the meek guy, his performance as Michael renders this evil character caricaturish, with a serious voice and a persistent smug expression that screams ‘evil’. What made the actor intimidating in Bimbisara is clearly missing here.

All the issues with Amigos can be traced to its weak and predictable screenplay. For example, the dog coming to the rescue in the climax of HIT 2 works beautifully because this scene has been set up so subtly somewhere in the first act. In Amigos, however, when information is being given out, we can discern that the only purpose of the scene is to set up another moment. Here, a vegetable, yes, you heard that right, is used as a key plot point and we know that this vegetable will serve a purpose later in the film.

Moreover, we barely feel the stakes and the menace of the ‘bad guy’, even when people are killed and important characters are in grave danger because we are never truly invested in them. Siddharth’s father, mother, and sister are as lively as the cardboard stand-ins of the film placed outside the theatre I watched the film in. The mother wants her son to get married, the playful sister pulls pranks on her brother and the father… I don’t even remember; such is the genericness in writing. It is not that the artificiality in writing is restricted to the lighter portions.

Even serious angles in the film are treated in a generic way. We are told that NIA (National Intelligence Agency, I assumed) is after Michael and you cannot help but laugh at their inefficiency. We are informed about the NIA’s arrival with on-screen text that reads, ‘NIA team landed in Hyderabad’ as we see a flight land. In the end, the bad guy is caught, handcuffed and escorted by armed ‘agents’ in a convoy. He manages to destroy the entire convoy single-handedly. While we, as the audience, are willing to suspend our disbelief, I wish they at least tried to make it believable.

One can only imagine the fun this idea about lookalikes could have spawned. From comedy to thrills, the possibilities are endless. Amigos do try, but it leaves you craving the inventiveness the film deserved. Amigos is yet another reminder that having an exciting idea doesn’t suffice. One needs an equally strong screenplay to propel the film as a whole narrative.

Cast: Nandamuri Kalyan Ram, Ashika Ranganath, Brahmaji Director: Rajendra Reddy

Follow The New Indian Express channel on WhatsApp

Download the TNIE app to stay with us and follow the latest

Related Stories

- తెలుగు

Amigos Review: Dull Doppelganger

Movie: Amigos Rating: 2.25/5 Banner: Mythri Movie Makers Cast: Kalyan Ram, Ashika Ranganath, Saptagiri, Brahmaji and others Music: Ghibran Cinematographer: Sounder Rajan Editing: Tammiraju Art: Avinash Kolla Producers: Naveen Yerneni and Y Ravi Shankar Written and Directed by: Rajendra Reddy Release Date: Feb 10, 2023

In the wake of Bimbisara's massive success, Kalyan Ram's movies became all the rage. The trailer for "Amigos" has piqued interest thanks to the intriguing premise of a doppelganger.

Let's find out its merits and demerits.

Story Siddharth (played by Kalyan Ram) is immediately smitten with Ishika (played by Ashika Ranganath), a radio host. After Siddharth's family contacts Ishika's family, a "pelli choopulu" (meeting of the families) is arranged. Despite this, Ishika turns down Siddharth's proposal because she would only consider marrying a man if he passes a test she created.

Meanwhile, Siddharth learns of a website that tracks down doppelgangers and, after searching for his own lookalike, he discovers not one, but two people who are strikingly similar to him: Michael from Kolkata and Manjunath from Bengaluru. In an effort to pass Ishika's test, Siddharth approaches them for help.

However, Siddharth does not realize until later that Michael is impersonating him. This raises the question: why is Michael posing as Siddharth? What is his sinister plan?

Artistes’ Performances: In his last film, Bimbisara, Kalyan Ram played two distinct roles. He goes one step further and gets to play three different characters here. There isn't much to say about his two positive roles, Siddharth and Manjunath, but he shines as the negative character Michael. Throughout the film, we only see Kalyan Ram, and he carries the film.

Ashika Ranganath's Telugu debut is adequate.

Brahmaji as Kalyan Ram’s uncle provides some laughs. JP as Kalyan Ram’s father gets some scenes worth noting.

Technical Excellence: The cinematography is impressive. There are two songs, one is the remix of “Enno Ratrulostayigani”. Background score is very bad.

Highlights: The concept of three lookalikes

Drawback: Flat narration Lack of high moments Second half

Analysis Regardless of the outcome of his efforts, Nandamuri Kalyan Ram never stops trying to surprise and delight his fans. Last year, his attempt to play an evil king in the time-travel thriller "Bimbisara" was a massive success. This time, he utilized the doppelganger concept to play three different characters.

The concept of "lookalikes" has existed for a while, and the Telugu film industry has been attempting to tell such stories since at least the days when Kalyan Ram's grandfather played a dual role in "Ramudu Bheemudu." However, the new director, Rajendra Reddy, brings a fresh take to this by incorporating the use of the Internet to find one's doppelganger.

The premise of the film appears promising. Despite the hero playing three similar roles, the screenplay is clear, and the director has been successful in explaining the concept of doppelgangers meeting through a website in the first half of the film, which is primarily devoted to the main character's love story.

However, the film lacks thrilling moments. The main plot twist appears in the second half of the film, but it fails to generate any excitement. The proceedings are not engaging. When the story reaches its main point, it becomes even more apparent that there are many logical problems. This is another Telugu film that portrays NIA officers as a group of buffoons.

With the exception of Michael, Kalyan Ram did not put much effort into portraying the other two characters, and they are also dull. The film feels repetitive as Kalyan Ram appears as one or more characters 90% of the time.

Overall, the film has only an intriguing premise going for it, but it offers nothing more. The narration is mostly dull and the film drags on for too long.

Bottom line: Not Exciting

- Paarijatha Parvam Review: Amateurish Kidnap Drama

- Geethanjali Malli Vachindi Review: No Scares, Little Laughs

- Manjummel Boys Review: Riveting Survival Thriller

Tags: Amigos Amigos Review Amigos Movie Review Amigos Telugu Movie Review Amigos Rating Amigos Movie Rating Amigos Telugu Movie Rating

ADVERTISEMENT

- ఆంధ్రప్రదేశ్

- అంతర్జాతీయం

- సినిమా న్యూస్

- Web Stories

- T20 వరల్డ్ కప్

- One Day వరల్డ్ కప్

- జాతీయ క్రీడలు

- అంతర్జాతీయ క్రీడలు

- లైఫ్ స్టైల్

- స్పెషల్ స్టోరీలు

- ఆటోమొబైల్స్

Amigos Telugu Movie Review: అమిగోస్ రివ్యూ

- Follow Us :

Rating : 2.75 / 5

- MAIN CAST: Kalyan Ram, Ashika Ranganath, Brahmaji, Jayaprakash, Kalyani Natarajan, Raviprakash

- DIRECTOR: Rajendra Reddy

- MUSIC: Gibran

- PRODUCER: Mythri Movie Makers

Amigos Telugu Movie Review: రివ్యూ: అమిగోస్ రిలీజ్: 10-02-2023 నటీనటులు: కళ్యాణ్ రామ్, అషికా రంగనాథ్, బ్రహ్మాజీ, జయప్రకాశ్, కళ్యాణి నటరాజన్, రవిప్రకాశ్ సినిమాటోగ్రఫీ: సౌందర్ రాజన్ సంగీతం: జిబ్రాన్ నిర్మాణం: మైత్రీ మూవీస్ నిర్మాతలు: నవీన్ ఎర్నేని, వై. రవిశంకర్ కథ, స్క్రీన్ ప్లే, దర్శకత్వం: రాజేంద్ర రెడ్డి

గత యేడాది ‘బింబిసార’ మూవీతో తన కెరీర్ బెస్ట్ హిట్ అందుకున్నాడు నందమూరి కళ్యాణ్ రామ్. ఇర మైత్రీ మూవీ మేకర్స్ సంస్థ ఈ యేడాది ఆరంభంలోనే ‘వీర సింహారెడ్డి, వాల్తేరువీరయ్య’ చిత్రాలతో డబుల్ సక్సెస్ అందుకుంది. ఇప్పుడు కళ్యాణ్ రామ్, మైత్రీ కలయికలో రూపుదిద్దుకుంది ‘అమిగోస్’. రాజేంద్ర రెడ్డి దర్శకత్వం వహించిన ఈ మూవీలో కళ్యాణ్ రామ్ ఏకంగా మూడు పాత్రలను పోషించాడు. సో… ఫిబ్రవరి 10 శుక్రవారం ఆడియన్స్ ముందుకు వచ్చిన ట్రిపుల్ రోల్ మూవీ ‘అమిగోస్’ ఎలా ఉందో చూద్దాం…

సిదార్థ్ (కళ్యాణ్ రామ్) హైదరాబాద్ లో ఫ్యామిలీ మెంబర్స్ తో జాలీగా ఉంటుంటాడు. తన మావయ్య(బ్రహ్మాజీ)తో సరదాగా పబ్ లో గడుపుతున్న సమయంలో అతనికి డోపెల్ గ్యాంగర్ వెబ్ సైట్ గురించి తెలుస్తుంది. తనను పోలిన మనుషుల గురించి తెలుసుకోవాలనే ఉత్సుకతతో ఆ వెబ్ సైట్ లో సెర్చ్ చేస్తాడు. అతనికి బెంగళూరు కు చెందిన మంజునాథ్ (కళ్యాణ్ రామ్), కోల్ కత్తాలో ఉండే మైఖేల్ (కళ్యాణ్ రామ్) టచ్ లోకి వస్తారు. వీరంతా గోవాలో కలుసుకుని ఎంజాయ్ చేయాలనుకుంటారు. అంతవరకూ బాగానే ఉంది. ఆ తర్వాత సిదార్థ్ కు ప్రేమ విషయంలో సాయం చేసేందుకు మిగిలిన ఇద్దరూ హైదరాబాద్ వస్తారు. అయితే అప్పటికే మైఖేల్ కోసం నేషనల్ ఇన్వెస్టిగేషన్ ఏజెన్సీ (ఎన్.ఐ.ఎ.) వెతుకుతూ ఉంటుంది. అతనే అనుకుని తనలా ఉన్న మంజునాథ్ను పొరపాటున అదుపులోకి తీసుకుంటుంది ఎన్.ఐ.ఎ. అసలు మైఖేల్ ఎవరు? అతని గతం ఏమిటీ? అతని కోసం ఎన్.ఐ.ఎ. ఎందుకు వెదుకుతోంది? మైఖేల్ బదులు ఎన్.ఐ.ఎ. అధికారులకు చిక్కిన మంజునాథ్ గతేంటి? తనలా ఉండే వ్యక్తుల కోసం వెబ్ సైట్ లో ఆరా తీసి, సాలెగూడులో చిక్కుకున్న సిద్ధు అందులోంచి ఎలా బయట పడ్డాడు? అనేదే మిగతా కథ.

మనుషులను పోలిన మనుషులను సినిమాల్లోనే కాదు… నిజ జీవితంలోనూ చూస్తుంటాం. ఒకే వయసు ఉన్నవారు కూడా అందులో ఉంటారు. అంతమాత్రాన కవల పిల్లలలా వారి ఆలోచనలు, హావభావాలు, ఆహార వ్యవహారాలు ఒకేలా ఉండవు. ఇక వివిధ ప్రాంతాలలో నివసించే మనుషులను పోలిన మనుషుల ఆలోచనల్లోనూ ఎంతో వ్యత్యాసం ఉంటుంది. ఈ మూవీ ద్వారా దర్శకుడు రాజేంద్ర రెడ్డి అదే తెలిపాడు. లీడ్ క్యారెక్టర్ లో కనిపించే సిద్ధూకు ఫ్యామిలీ లైఫ్ జత చేస్తే, మంజునాథ్ బేలగా ఉండేలా డిజైన్ చేసి తన పాత్ర తీరుతెన్నులను దానికి తగ్గట్టుగా మలిచాడు. ఇక మైఖేల్ క్యారెక్టర్ నరరూప రాక్షసుడికి ఏ మాత్రం తగ్గనిది. నందమూరి వంశంలో నటులకు ద్విపాత్రాభినయం, త్రిపాత్రాభినయం ఏమీ కొత్తకాదు. మహానటుడు ఎన్టీయార్ ఏకంగా ఐదు పాత్రలను కూడా సమర్థవంతంగా పోషించారు. కళ్యాణ్ రామ్ బాబాయ్ బాలకృష్ణ ‘అధినాయకుడు’లో త్రిపాత్రాభినయంతో పాటు ఎన్నో హిట్ సినిమాల్లో ద్విపాత్రాభినయం చేశయగా… సోదరుడు ఎన్టీయార్ సైతం ద్విపాత్రాభినయంతో పాటు ‘జై లవకుశ’లో త్రిపాత్రాభినయం చేసి మెప్పించాడు. అందుకేనేమో కళ్యాణ్ రామ్ కూడా ఈ ట్రిపుల్ రోల్ కథ వినగానే గ్రీన్ సిగ్నల్ ఇచ్చేశాడు. అయితే కథలో ఊహకందని మలుపులు లేకపోవడంతో సినిమా థ్రిలింగ్ ఎక్స్ పీరియన్స్ ను ఇవ్వలేకపోయింది. ఫ్రెండ్ షిప్ మీద సాగిన గోవా సాంగ్ ఓకె. బాలకృష్ణ రీమిక్స్ సాంగ్ ‘ఎన్నో రాత్రులు వస్తాయి కానీ…’ పాట పిక్చరైజేషన్ కలర్ ఫుల్ గా సాగింది. హీరోతో మూడు పాత్రలు చేయించాలని దర్శకుడు భావించినప్పుడు మరింత బలమైన కథను సిద్ధం చేసుకుని, ఆసక్తికరమైన సన్నివేశాలను రాసుకుని ఉండాల్సింది. అయితే… డోపెల్ గ్యాంగర్ వెబ్ సైట్… దాని ద్వారా లుక్ ఏ లైక్ వ్యక్తులను కలుసుకోవచ్చుననే అంశం ఆసక్తికరమైనదే!

నటీనటుల విషయానికి వస్తే… నెగెటివ్ షేడ్ ఉన్న పాత్రలను పోషించడం హీరో కళ్యాణ్రామ్ కు కొత్తేమీ కాదు. గతంలో తన సొంత బ్యానర్ లోనే అలాంటి చిత్రాలను నిర్మించి, నటించాడు కూడా. మొన్న వచ్చిన ‘హే రామ్’ తో పాటు ఇటీవల తీసిన ‘బింబిసార’లోనూ దాదాపు అదే తరహా పాత్రలను పోషించాడు. ఇప్పుడు ఈ సినిమాలో మూడు భిన్నమైన మనస్తత్త్వాలు కల పాత్రలను సునాయాసంగా చేసేశాడు. హీరోయిన్ ఆషికా రంగనాథ్ స్క్రీన్ ప్రెజెన్స్ బాగుంది. తనకు తెలుగులో మరిన్ని అవకాశాలు వచ్చే అవకాశం ఉంది. కళ్యాణ్ రామ్ మామగా బ్రహ్మాజీ పంచ్ డైలాగ్స్ తో వినోదాన్ని పంచాడు. మిగిలిన పాత్రధారులందరూ తమ పాత్రలకు తగిన న్యాయం చేశారు. జిబ్రాన్ నేపథ్య సంగీతం సన్నివేశాలను బాగా ఎలివేట్ చేసింది. సౌందర్ రాజన్ సినిమాటోగ్రఫీ ఈ మూవీకి మెయిన్ ఎసెట్. యాక్షన్ కొరియోగ్రఫీ కూడా థ్రిల్లింగ్ గా ఉంది. అయితే కథలో తగిన దమ్ములేకపోవడం, కథనం ఆసక్తిని కలిగించకపోవడంతో సాధారణ ప్రేక్షకులను ‘అమిగోస్’ ఊహించిన స్థాయిలో మెప్పించలేకపోయింది. యాక్షన్ మూవీ లవర్స్ కు, నందమూరి ఫ్యాన్స్ మాత్రం సంతృప్తి చెందే అవకాశం ఉంది.

రేటింగ్: 2.75 / 5

ప్లస్ పాయింట్స్

కళ్యాణ్ రామ్ త్రిపాత్రాభినయం

జిబ్రాన్ రీరికార్డింగ్

యాక్షన్ సీక్వెన్స్

ప్రొడక్షన్ వాల్యూస్

మైనెస్ పాయింట్స్

బలహీనమైన కథ

ఆసక్తికలిగించని కథనం

ట్యాగ్ లైన్: డోపెల్ గ్యాంగర్!

ntv తెలుగు వాట్సాప్ ఛానల్ ని ఫాలో అవ్వండి

- Amigos Movie Review

- Amigos Review

- Amigos Telugu Movie

- Amigos Telugu Movie Review

- ashika ranganath

Related News

Related articles, తాజావార్తలు, bc janardhan reddy: అరుంధతి కోటపై టీడీపీ జెండా ఎగరడం ఖాయం.., shocking video: బైకర్పై దూసుకెళ్లిన బస్సు.. పట్టించుకోని బాటసారులు.. వీడియో వైరల్, vamshi paidipally: బాలీవుడ్ స్టార్ హీరోను పట్టేసిన పైడిపల్లి.. దిల్ రాజు నిర్మాణంలో సినిమా, israel: హిజ్బుల్లాపై విరుచుకుపడిన ఇజ్రాయిల్ ఆర్మీ.. 40 టెర్రర్ టార్గెట్లు ధ్వంసం.., revanth reddy: అసెంబ్లీ చర్చలకు రాని దద్దమ్మలు 4 గంటలు మీడిలో కూర్చున్నారు.

ట్రెండింగ్

Pooja hegde: సినిమాల్లేక ప్రేమలో మునిగి తేలుతున్న పూజ.. బాయ్ ఫ్రెండ్ ను చూశారా, hariharaveeramallu: హరిహరవీరమల్లు అప్డేట్ వచ్చేస్తుంది.. రెడీగా ఉండండమ్మా.., ntr : ఎన్టీఆర్ పెట్టుకున్న ఈ వాచ్ ధర ఎంతో తెలుసా..టైగర్ తో మామూలుగా ఉండదు.., ugadi 2024: ఉగాది పండుగను ఎందుకు జరుపుకుంటారో తెలుసా, ice cafe: 14 వేల అడుగుల ఎత్తులో ఐస్ కేఫ్ నిర్మాణం.. ఎక్కడో తెలుసా...

- Movie Schedules

- OTT and TV News

Most Viewed Articles

- Jai Hanuman’s new poster launched; Film to release in IMAX 3D

- OTT movies and series releasing this week

- Not Vijay, but this versatile actor is the initial choice for Ghilli

- Shah Rukh Khan to play a don in King?

- Rajinikanth’s Coolie glimpse gets mixed reactions

- COVID days back for Tollywood; Industry facing content shortage

- NBK109: Bobby Deol joins the sets of Balakrishna and Bobby’s film

- Pushpa 2: First single to be out at this time?

- Actress Aparna Das ties the knot with Manjummel Boys actor Deepak Parambol

- Here is the list of most awaited South Indian films for 2024

Recent Posts

- Photos : Beautiful Tanya Ravichandran

- “గేమ్ చేంజర్” ప్లాన్ లోనే “దేవర” ట్రీట్ కూడా?

- Latest Photos : Iswarya Menon

- Nithiin’s Thammudu – Makers canning a huge action sequence with 8 crores budget

- Glamorous Pics : Rakul Preet Singh

- Latest Photos : Samyuktha Menon

IMAGES

VIDEO

COMMENTS

Amigos is undoubtedly one of the best performances by Kalyan Ram. The actor is ruthless as Michael, innocent as Manjunath, and shows subtleness as Siddharth. The film has a few interesting moments and the proceedings are a bit fast in the second half.

కానీ ఈ సినిమా పూర్తి స్థాయిలో ఆకట్టుకోదు. 123telugu.com Rating: 2.75/5. Reviewed by 123telugu Team. Click Here For English Review. Amigos Telugu Movie Review, Nandamuri Kalyan Ram, Ashika Ranganath, Brahmaji, Sapthagiri, Amigos Movie Review, Amigos Movie Review, Nandamuri ...

Review: After the success of Bhimbisara, Kalyan Ram's Amigos is a brave experimental step. Building on the concept of doppelgangers, director Rajendra Reddy weaves a thriller and makes use of the acting prowess of Kalyan Ram. The actor seems home, playing different shades and doing a fine job. Shades of his character in Bimbisara could be ...

We have to sit through—in this case, endure—the whole film to reach there. Cast: Nandamuri Kalyan Ram, Ashika Ranganath, Brahmaji. Director: Rajender Reddy. The film directed, directed by Rajender Reddy, has a thrilling idea at its core. Siddharth (he's the hero of the story, let's call him the 'good guy' for better understanding ...

Published on Feb 8, 2023 1:00 pm IST. Kalyan Ram's Amigos is arriving in theaters this Friday. The film has an interesting concept of doppelgangers and is directed by debutant Rajendra Reddy. T Produced by Mythri Movie Makers, Sandalwood beauty Ashika Ranganath plays the love interest of Kalyan Ram. Kollywood music director Ghibran is scoring ...

ఇప్పుడు అదో కోవలో ప్రేక్షకుల ముందుకు వచ్చిన చిత్రం 'అమిగోస్' (Amigos Telugu Movie). అమిగోస్ అంటే ఫ్రెండ్స్ అని అర్ధం. మరి ఈ ముగ్గురి ఫ్రెండ్స్ ...

Amigos Movie Review : నందమూరి కళ్యాణ్ రామ్ అనగానే మనకు గుర్తొచ్చేది మూడే ...

Amigos is a 2023 Indian Telugu-language action thriller film directed by Rajendra Reddy and produced by Mythri Movie Makers.The film features Nandamuri Kalyan Ram in a triple role, while Ashika Ranganath, Brahmaji, Saptagiri, Jayaprakash, Satyam Rajesh, Raghu Karumanchi and Ravi Prakash appear in supporting roles.The music was composed by Ghibran, while the cinematography and editing were ...

Cast: Nandamuri Kalyan Ram, Ashika Ranganath, Nithin Prasanna Director: Rajendra Reddy Producers: Mythri Movie Makers Nanadmuri Kalyan Ram is one of those rare actors who tries to experiment with each and every movie. The young actor who is riding high after the sensational blockbuster of Bimbisara has come out with a thriller Amigos, a never tried experimental movie in Telugu.

'Amigos' movie review: Interesting idea undone by lacklustre narration Kalyan Ram enacts three roles in this story of doppelgangers that never rises above tried and tested tropes February 10 ...

Amigos Movie Live Updates, Kalyan Ram, Ashika Ranganath, Amigos Movie Live Updates, Amigos telugu movie review, Amigos telugu premiers talk, Amigos Movie Live Updates

Amigos Review. Published at: Fri 10th Feb 2023 11:44 AM IST. Director: Rajendra Reddy. Producer: Naveen Yerneni and Y Ravi Shankar. Release Date: Fri 10th Feb 2023. Actors: Nandamuri Kalyan Ram, Ashika Ranganath, Brahmaji, Sapthagiri & Others. Amigos Movie Rating: 2.5 / 5.

Amigos Movie Live Updates, Amigos Movie Live Updates, Amigos telugu movie review, Amigos telugu premiers talk,Amigos Movie Live Updates

అనేది తెలుసుకునే ముందు ఈ సినిమా కథేంటో చూద్దాం. (Amigos Review) కథేంటంటే: సిద్ధార్థ్ (కల్యాణ్రామ్) ( Kalyan Ram )ది హైదరాబాద్. తండ్రి ...

The first half of the film drags a lot and the second half is also not incredible, to be able to save the movie. The placement of songs is not right in the film, and the overall execution of the concept felt lackluster in the end. The director could have made his screenplay more interesting and racy, which would have made the film a lot better.

Amigos Movie Review & Showtimes: Find details of Amigos along with its showtimes, movie review, trailer, teaser, full video songs, showtimes and cast. Nandamuri Kalyanram,Ashika Ranganath are ...

Amigos: Directed by Rajendra Reddy. With Brahmaji, Nithin Prasanna, Nandamuri Kalyan Ram, Ashika Ranganath. Three nearly-identical men become fast friends after meeting via an online doppelgänger-finding app. It's all fun and games until one of them turns out to be a notorious fugitive.

All the issues with Amigos can be traced to its weak and predictable screenplay. Amigos opens with its climactic scene. We see two bruised Kalyan Rams facing off each other on a dark night. One of ...

Review : Amigos - Interesting concept, middling narration. Telugu cinema news, Movie reviews, OTT News, OTT Release dates, Latest Movie reviews in Telugu, telugu movie reviews, Box office collections.

Amigos Review: Dull Doppelganger. In the wake of Bimbisara's massive success, Kalyan Ram's movies became all the rage. The trailer for "Amigos" has piqued interest thanks to the intriguing premise of a doppelganger. Let's find out its merits and demerits. Siddharth (played by Kalyan Ram) is immediately smitten with Ishika (played by Ashika ...

Amigos Telugu Movie Review: రివ్యూ: అమిగోస్ రిలీజ్: 10-02-2023 నటీనటులు: కళ్యాణ్ రామ్ ...

Video : Cheli Kasiresthunna Song - Love Guru (Vijay Antony, Mirnalini Ravi) April 16, 2024

Posts Tagged 'Amigos Movie Review'. Review : Amigos - Interesting concept, middling narration. Telugu cinema news, Movie reviews, OTT News, OTT Release dates, Latest Movie reviews in Telugu, telugu movie reviews, Box office collections.