How Dell’s strategy transformed it from a doomed player to leading the data revolution

Table of contents, here’s what you’ll learn from dell's strategy study:.

- How to sustain your company’s growth beyond its initial success.

- How a sober bet for the future fuels your conviction to win.

- How to think long-term and not sacrifice your future for short-term benefits.

Dell Technologies is a multinational technology company that designs, develops, and sells a wide range of products and services, including personal computers (PCs), servers, data storage devices, network switches, software, and cloud solutions.

The general public owns 58% of Dell Technologies, while private equity firms and institutions own the rest. Michael Dell is the founder, chairman, and current CEO.

Dell's market share and key statistics:

- Brand value of $26,5 billion

- Net Worth of $28.7 billion as of Jan 13, 2023

- Annual revenue of $105.3 billion for 2022

- Total number of employees: 133.000

- Total assets worldwide: $93 billion in 2022

{{cta('e9abffcd-5522-40c9-be83-0e844633a49a')}}

Humble beginnings: How did Dell start?

The story of every company starts with the story of its founder.

Usually, a great company has a great founder story behind it. And Dell Technologies certainly has one. Michael Dell’s story goes hand in hand with the story of the company he founded. By understanding the story of Michael, we can understand the company’s initial advantages and opportunities it pursued.

And like every great tech company story, Dell’s story starts in a college dorm room.

From stamps to startups: Michael Dell's early years and the birth of Dell

Michael Dell founded the company in college, but his entrepreneurial journey started much earlier.

He had an early interest in technology and business, and by the age of 12, he was already buying and selling stamps and coins to make extra money. As a teenager, he worked summer jobs where he learned by trial and error how demand and supply worked, how to be efficient, how to segment the market, and determine the most profitable persona to sell.

By the time he graduated from high school, he had saved up enough money to buy his own BMW and his first personal computer, an Apple and later an IBM.

But he was curious about the inner workings of these machines and, to his parents' horror, he took them apart, learning about the different components and how they worked together. He soon made a crucial discovery. IBM DIDN’T manufacture its own parts. Instead, it sourced them from other companies. This sparked an idea in Michael's mind - he could build his own PCs using the same components but at a lower cost and higher quality.

That idea didn’t come out of the blue.

Michael Dell was constantly educating himself on computers, how to build them, how they worked, and how to code. He followed all computer magazines at the time and attended every event in his neighborhood to network and learn the latest about the industry. In high school, he was already an expert, modifying his own PC and, once the word spread, customizing the PCs of professionals.

His first customers were friends and acquaintances who were impressed by his knowledge and expertise. Michael quickly realized that there was a demand for customized computers that were not available in the market. He began assembling machines with increased storage capacity and memory at a fraction of the cost of buying from big brands like IBM.

Doctors and lawyers were among his early customers, and word-of-mouth about Michael's high-quality and affordable PCs spread quickly.

He eliminated the middleman by buying components directly and assembling the machines himself, which allowed him to offer lower prices and better performance. By the end of his first year in college, Michael had a vendor's license, he was winning bids against established companies in the industry, and he incorporated his first company, “ Dell Computer Corporation .”

Dell’s direct-to-consumer strategy & how its corporate culture was formed

The company was growing frightfully fast, forcing the team to constantly change and evolve its processes.

Before the company had its second birthday, they had moved to bigger offices three times to accommodate its increased inventory, growing telephone needs, and physical or electronic systems. However, the company was still a high-risk venture and had a small capacity for expensive mistakes.

In those early days, the challenges Dell faced formed its processes and the core traits of its culture that are present to this day:

- Practicality and reduced bureaucracy. They did some things unconventionally, like having salespeople set up their own computers. That way, they gained first-hand knowledge of the technology and the customer’s pain problems (customers and salespeople were uneducated on the technology, so they shared the same problems).

- A “can-do” and “I’ll-pitch-in” attitude. Employees took substantial liberties with their “responsibilities.” Engineers would help with the overloaded manufacturing line, everyone would answer phone calls, salespeople would fulfill orders while taking new ones, etc.

- A sense of making a difference. Money was tight, so Dell employees wouldn’t mind solving secondary “needs” with cheap solutions like using cardboard boxes to throw their trash because they didn’t have trash cans.

- Direct relationships with the customers. Maybe one of the most important aspects of Dell’s culture and strategy. The company was talking at the same time with prospects and current customers on the phone. That way, it got first-hand feedback on what the market was currently asking for and was enjoying or not enjoying. That gave birth to Dell’s “Direct Model.”

The company went to great lengths to build and maintain the direct model because it was one of its most important sources of competitive advantage. Where other companies had to guess what to build next, Dell was already on it because their customers were telling them.

There were clear advantages to the Direct model:

- Closed feedback loop. Dell was talking directly to prospects – no dealer costs – and had no need for inventory. Lower costs = lower prices = more customers. And with every new customer, Dell had another finger on the pulse of the market.

- A single salesforce. Focused solely on the end customer. There was no need to have salespeople to sell to dealers and then additional salespeople to sell to the customer.

- Specialization in sales. Dell sold to large corporations, and smaller customers, like SMBs, educational institutions, and individual consumers. But selling to these two different buyers, large corporations and SMBs, was incomparable. So, the company had different salespeople for different customer segments and thus offering the best customer support and experience.

But the model wasn’t without its disadvantages:

- The model wasn’t irreplicable. Dell was making IBM-compatible PCs and selling them directly to customers. This model wasn’t hard to replicate, and the market’s conditions favored the birth of competitors with the same model.

- Lack of credibility. It’s hard to make a $5,000 sale when the customer has never heard of you and you lack a physical store.

- Incompatibility. Dell’s PC had to be compatible with IBM’s. But they had multiple suppliers for their components and sometimes those components were incompatible. Designing high-quality machines that were outperforming and compatible with IBM’s was a challenge.

But these disadvantages didn’t stop the team. The company doubled down on customer support and service and developed a strong reputation around them. It advertised a 30-day money-back guarantee and educated its suppliers to make components based on Dell designs. They even started their first R&D attempts that gave them a 12-MHz that was faster than IBM’s latest model, cheaper, and got them on the cover of the most prestigious magazine in the industry, the PC Week .

Dell’s strategy was so effective that phone calls started coming in, urging them to accept capital and go public.

Only three years after the company’s birth in a college dorm room, Dell went public, raising $30 million with a market valuation of $85 million.

Key Takeaway #1: Build a coherent strategy beyond your initial differentiator to sustain growth

Most companies enjoy initial success due to an untapped opportunity in the market, from addressing a niche market to exploiting the weaknesses of major players.

But no company succeeds at growing beyond the limits of the initial opportunity if it doesn’t evolve and expand its competitive advantage. So when evaluating your next move, ask yourself:

- What is our current competitive advantage?

- How easily can our competition replicate it?

- How can we make it harder (if we can)?

- How can we expand our capabilities to strengthen our current competitive advantage?

- How can we develop new competitive advantages?

- What are the market trends and how can we adapt/take advantage of them before others?

The occasional bold move doesn’t hurt, either.

Recommended reading: 6 Competitive Analysis Frameworks: How to Leave Your Competition In the Dust

How Dell’s privatization led to a strategic triumph

In the first decade of the new millennium, the PC business was growing rapidly.

Computing power followed Moore’s Law and innovation cycles in hardware were less than 12 months long. At the same time, a new generation of software was spreading and the World Wide Web was expanding globally. Being a part of a growing industry, like the PC business back then, was lucrative. So naturally, many companies did well.

Dell was one of them. In 2000, the company became the world’s largest seller of PCs, having enjoyed a decade of skyrocketing sales.

However, in 2011, things changed. The PC global sales reached their peak and the next year was the first of an 8-year streak of decline that lasted until the pandemic hit.

That decline impacted Dell severely.

Navigating decline: Dell's strategy for a shrinking market

Dell was in deep trouble at the start of the previous decade:

- It had lost its position as a top PC seller in the US to its main competitor, HP.

- It came third in the global PC market share, behind HP and ACER.

Many believed that it was a dying company that would perish like Kodak or Motorola.

The PC market was shrinking and some experts were saying it was the beginning of its end. Dell was expected to be among the first casualties. The truth was that the PC industry wasn’t dying, but it was evolving – it was losing some of its traits and gaining new ones. The difference is subtle but also key. In a competitive arena, every alert player is aware of the market changes: declining sales, emerging trends, and other important facts. But how each player interprets them determines whether they’ll formulate a winning strategy or not.

The more substantial the changes, the more important the interpretation.

In 2012, the fact was that the PC business was declining. Every major player could see it with a single glance at their balance sheet. In Dell's case, the decline was even direr since its PC sales were down by double digits. The company desperately needed to turn things around. And only a bold strategic move could do that.

The company tried to bounce back up with some obvious but desperate moves:

- The introduction of the Streak “phablet.” An embarrassing attempt at creating a new product category between tablets and smartphones. Its design was bulky and its Android software unsuitable for the device, while its purpose was unclear to the consumer.

- Making Windows 8 its default operating system. Dell and Microsoft have been longtime partners, to the benefit of both companies. Unfortunately, their growing interdependence meant that when one failed, it dragged the other one down. Windows 8 failure dragged down Dell and further decreased its PC market share.

- Attempts to enter the tablet and smartphone markets: the “Venue” debacle. Dell was always viewed as a PC company, not a technology company, making it harder to expand to new categories. Its first smartphone, the Venue , ran on Windows Mobile and it never got any traction. As a result, the company abandoned the categories and, even today, it has less than negligible presence in these markets.

But where people saw a vulnerable company, Michael Dell saw an opportunity.

He had an assumption, a vision attached to it, and a plan to make it a reality. But he had no way to execute it with the company’s organizational structure at the time.

The obstacles to implementing Dell's competitive strategy

Dell’s strategy was to go on the offensive. He wanted the company to be highly aggressive by:

- Becoming competitive in the PC business again.

- Expanding its services and software solutions.

- Increasing its sales capacity.

Dell aimed to achieve these goals by investing heavily in R&D, gaining tighter control over its PC and server prices, and expanding its sales workforce. The idea was to fund new business capabilities in the software and services space from Dell's PC segment. That was a bold plan that involved a lot of changes and, thus, a lot of risks.

Dell’s strategy was essentially a business transformation proposal.

And although a lot of public companies have successfully gone through a transformation, none did it in such a short period of time without sacrificing the short-term faith of its shareholders. And that was exactly the problem.

The strategy was inherently risky – like every good strategy is – as it promised capital expenditure and an immediate decrease in profitability due to increased operating expenses. Things shareholders hate. And if shareholders aren’t happy with the company’s near-term returns, they start selling their shares, and the company loses its value and a good portion of its funding capabilities.

Short-term risk = lower share prices = less funding for the company

Thus, the strategy was impossible to execute without the support of the shareholders. So the company had only two options: gain the support of the shareholders or go private.

Dell chose to go private.

Dell's game-changing decision was based on a strategic bet

For a gigantic public company with a market cap of nearly $20 billion, going private is a tough decision and a complicated process.

But it was an unavoidable preliminary for the successful execution of Michael Dell’s plan. And the first step was to convince the board of the necessity of the transformation. After announcing his idea, the board started discussions with experts to evaluate the move, i.e. top consulting agencies and other independent third parties.

JP Morgan , Boston Consulting Group, Evercore, and Debevoise were some of the names involved. And they all shared the same view:

- The PC is dying.

- Funding a business transformation from a declining business is a bad idea (despite such successful attempts from IBM and BMW in the past).

The experts had a lot of facts and strong arguments to support their case. However, all of them were based on a single assumption: tablets and smartphones will replace the dying PC . The growth in those categories would entail a decline in the PC business. They believed the PC was about to be cannibalized.

Dell’s CEO disagreed. What was his assumption?

He believed that tablets and smartphones wouldn’t take away from PCs but rather add to it. He believed that the PC’s central role in productivity and business wasn’t going to be dethroned by the new shiny toys. People would buy and use tablets and smartphones, but PCs would remain their primary productivity tool.

And he would bet Dell’s future on it.

But he had to convince the board of directors first. At the start, conversations were happening in secret and things were moving slowly but steadily. But when the idea was leaked, two new problems presented themselves.

The first was Carl Icahn, who contested for the ownership of Dell. Carl Icahn is a self-proclaimed “activist investor” but others call him a “corporate raider.” The closer the go-private initiative was to happen, the more Carl Icahn fought for it. And he used every improper tool and method he could muster. The battle that followed between Carl and Michael delayed the deal and almost derailed it.

The second was Dell’s customers’ hesitation in doing business with the company. The rumors about the go-private initiative left the customers wondering about the future of Dell and doubted whether any kind of investment in it was worth it. They were suspending purchases and all Dell’s leadership could say was, “We don’t comment on rumors and speculations.”

The press had also concluded that the go-private initiative was a declaration of Michael Dell’s incompetence and a desperate attempt to keep Wall Street’s eyes away from its demise.

History would prove them wrong and crown Michael Dell victorious.

A new chapter: How Dell's go-private move set the stage for future success

The deal happened.

In February 2013, Michael Dell and the investment firm of Silver Lake took Dell private in a leveraged buyout of $24.4 billion, at $13.65 a share.

Despite all the time that passed until Dell could fully execute its strategy, the company didn’t remain idle. It had made several calculated moves to significantly reduce its dependence on the declining PC market before the deal conversations ever happened.

From 2007 to 2012, Dell spent north of $12.40 billion in key acquisitions to increase its enterprise software and hardware solutions, including cloud data storage and management. The acquisitions focused on areas like:

- Data storage

- Systems management

- Data management in healthcare

- Cutting edge software

The company had already started severing the connection between its financial health and its PC market share many years ahead of its privatization.

But after the buyout, it went all in. Speed and agility became its prominent advantages. Dell became, nearly overnight, a hungry, quick, and ready-to-attack-its-prey jackal. Whenever a new opportunity arose and people asked for resources to pursue it, leadership committed double the resources and said, "Go faster!"

For example, SMBs (small and medium businesses) presented a gigantic opportunity. So the company increased its sales workforce, retrained its existing salespeople, and hit endless SMB doors. They would enter a business selling their low-margin PCs and simultaneously become their trusted advisor on all things tech. Then they sold their whole portfolio of solutions.

And the morale of employees was off the charts. Leadership kept their promises on the changes and provided all the support their people needed to execute the plan.

In addition, people started viewing PC and smartphones as complementary, just as Dell expected.

Was Michael Dell’s bet a good one? Well…

45% of Dell’s revenue was generated from PC sales, but 80% or more of its profits were generated by its new solutions. Eight years after the privatization, the value of their equity had increased more than 625% and their enterprise value reached $100 billion.

We’re pretty confident that’s a yes.

Key Takeaway #2: Successful strategic bets require a sober conviction

Markets change and evolve all the time. The difference between players that emerge prosperous and those that struggle to fit in the new order of things isn’t the unique access to data.

No. Every alert player in your competitive zone has more or less the same access to market trends and changes. The difference lies in what you envision the future to be. That’s your bet.

That’s what a winning corporate strategy needs. And because bets are inherently risky, you require two things to place a successful bet:

- Sobriety to envision what the future of your industry will look like.

- Conviction to pursue that vision relentlessly.

Steering towards success: Dell's current strategy and the EMC merger

Michael Dell had foreseen the evolution of the technology industry since the 2000s.

Not the specifics, but the trend of PCs and hardware becoming less relevant – or at least less profitable – and software, the cloud, and back-end taking the front seat. He realized (from very early on) that servers and storage management would become a huge concern for large enterprises building (or upgrading) their IT infrastructure.

Dell anticipated the market’s needs by making a simple observation: the quantity of data in the world expanded exponentially and the traditional way of data management would require server performance that wasn’t physically possible to achieve. But he knew there was a solution underway: virtualization – software that mimics the computer, creating virtual mainframes within the physical mainframe.

That’s why the company had started investing in these technologies since 2001.

Achieving synergy: Dell's competitive strategy and the merger with EMC and VMware

Dell, EMC, and VMware are three major players in the technology industry with distinct but complementary offerings.

EMC had a successful product in networked information storage systems, i.e. a database management system for enterprises.

VMware was pioneering in virtualization, allowing users to run multiple operating systems on the same device.

Dell had an established distribution network and a series of back-end solutions that could expand and fit well with the former technologies.

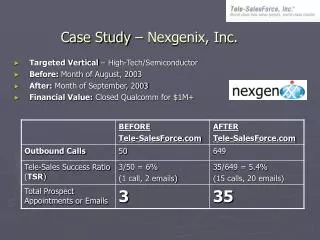

The relationship between these three companies started in 2001. Dell and EMC entered a strategic alliance to rule a market of $100 billion worth by 2005.

%20(1).jpg)

For EMC, the alliance was a one-stone-three-birds initiative. First, it offered a lucrative distribution channel to customers their competitors were already targeting. Second, it ensured Dell wouldn’t partner with a competitor. And third, it reduced its supply costs for components.

For Dell, it also had a threefold benefit. First, It added high-performing products to a rapidly growing business. Second, it gave it an important customer – EMC was using Dell’s servers. And third, it allowed Dell to infiltrate deeper into enterprise data centers.

A strategic alliance that gave both Dell and EMC a competitive edge.

Then EMC bought VMware. That gave the company massive capabilities around cloud infrastructure services ending up being a very lucrative move. Dell, which had invested in VMware back in 2002, saw a massive opportunity to acquire the new EMC.

So Dell and EMC first began discussions of a potential partnership back in 2008, but the idea was ultimately shelved due to the financial crisis. However, in 2014, Dell revisited the idea as both companies had grown and become leaders in their respective industries.

Dell saw the potential for a merger as the two companies' services would bring significant value to their customers when combined. EMC's CEO, Joe Tucci, agreed with this assessment, but they still had to convince EMC's board. EMC was publicly held while Dell was private, and as soon as the idea was on the table, Dell found itself competing with two other interested parties, Cisco Systems and HP. In fact, HP nearly succeeded in acquiring EMC.

It failed due to a financial disagreement. So Dell jumped on the opportunity.

By then, EMC had grown tremendously and had eliminated any short- to mid-term potential start-up disruptors by acquiring them. EMC’s three businesses were uniquely complementary to Dell’s solutions:

- EMC Information structure , a leader in the data storage system market.

- VMware , the undisputed leader in virtualization.

- Pivotal , a start-up with a platform to develop cloud software.

However, the acquisition was a tough process. EMC had grown to a market cap of over $60 billion. It was impossible for Dell to fund an acquisition. Instead, the two companies merged.

The merger happened through a complex but effective financial plan, and the synergies created by the combined company increased revenue significantly. A year after the merger was initiated, the added revenue was well above expectations. This allowed Dell to pay down a significant portion of its debt and improve its financial standing and investment rating. The success of the merger led the company to simplify its structure and align the interests of the stakeholders of the three companies.

In 2018, Dell went public again as a very different entity than its first IPO, uniquely equipped to lead the 5-S sectors: services, software, storage, servers, and security.

What is Dell’s business strategy’s primary focus today?

Dell aspires to become a leading player in the data era by providing a wide range of solutions, products, and services.

Excluding VMware, Dell is divided into two main business segments supported by its financial subsidiary:

- The Infrastructure Solutions Group ISG helps customers with their digital transformation by providing multi-cloud and big data solutions that are built on modern data center infrastructure. These solutions are designed to work in multi-cloud environments and can handle workloads in public and private clouds as well as on-premise.

- The Client Solutions Group CSG focuses on providing solutions for clients such as laptops, desktops, and other end-user devices.

- Dell Financial Services DFS supports Dell businesses by providing financial options and services to customers according to the company’s flexible consumption models. Through DFS, the company tries to tailor its financial options to each customer’s way of consuming Dell’s solutions.

Dell's core offerings include servers, storage solutions, virtualization software, and networking solutions. The company is constantly investing in research and development, sales and other key areas to improve its products and solutions and to drive long-term growth.

Its primary strategic priorities are:

- Improving and modernizing its current offerings in the markets it operates in.

- Expanding into new growth areas such as Edge computing, telecommunications, data management, and as-a-service consumption models.

And its plan involves several key initiatives :

- Developing its flexible consumption models and as-a-Service options to customers to meet their financial needs and expectations.

- Building momentum in recurring revenue streams through multi-year agreements.

- Investing in R&D to develop scalable technology solutions and incorporating AI and machine-learning technology. Since its Fiscal year 2020, the R&D budget is consistently at least $2.5 billion. Most of it goes towards developing the software that powers its solutions.

- Collaborating with a global network of technology companies for product development and integration of new technologies.

- Investing in early-stage, privately-held companies through Dell Technologies Capital.

Although Dell has a coherent strategy to achieve its objectives, competition isn’t idle nor trivial in the core competitive arenas. The company faces a significant risk that includes:

- Failure to achieve intended benefits regarding the VMware spin-off.

- Competition providing products and services that are cheaper and perform better.

- Delays in products, components, or software deliveries from single-source or limited-source suppliers.

- Inability to effectively execute its business strategy (transitioning sales capabilities, expanding solutions capabilities through acquisitions, etc.) and implement its cost efficiency measures.

The technological advances are rapid, and players are in a constant race to innovate not only on the technologies they provide but on their business models and all of their services and solutions. Emerging players and strategic relationships between competitors could easily shift the competitive landscape before the company finds a way to react.

Key Takeaway #3: When making transformational decisions, prioritize thinking long-term

A major acquisition, or a merger, between industry leaders is a bet on the industry’s future.

If you believe in the bet long-term, don’t sacrifice a good move for short-term returns, as HP did with EMC. Instead, do your due diligence in the consideration phase:

- Consider real alternatives.

- Understand deeply how the capabilities of both companies will be improved.

- Validate your assumptions with current market needs and trends.

- Move faster than the competition.

Why is Dell so successful?

One of the key reasons Dell has been so successful is Michael Dell’s intuition and strategic instinct.

He demonstrated a consistent ability to take an accurate pulse of the market, make a winning bet and chase it relentlessly by performing a business transformation. Additionally, Dell never lost one of its core strategic strengths: building strong relationships with its customers by providing excellent customer support and tailored solutions to meet their unique needs. The company has also been successful in streamlining its operations and supply chain, which has allowed it to offer competitive prices and high-quality products.

Dell puts the customer first and makes strategic pivots with perfect timing.

How Dell’s vision guides its steps

According to Dell’s annual report, its vision is:

“To become the most essential technology company for the data era. We seek to address our customers’ evolving needs and their broader digital

transformation objectives as they embrace today’s hybrid multi-cloud environment.”

And their two strategic priorities, growing core offerings and pursuing new opportunities, are their roadmap to achieving it.

Growth by numbers

- Skip to content.

- Jump to Page Footer.

Foreign Investment in 2024: Fueling Global Growth in Tight Markets

Join us as we share crucial insights into the anticipated shifts and emerging trends that will define the funding ecosystem in 2024.

Case study: Dell—Distribution and supply chain innovation

Read the highlights

- Cutting out the middleman can work very well.

- Forgoing the retail route can increase customer value.

- Re-examine & improve efficiency for process/operations.

- Use sales data and customer feedback to get ahead of the curve.

In 1983, 18-year-old Michael Dell left college to work full-time for the company he founded as a freshman, providing hard-drive upgrades to corporate customers. In a year’s time, Dell’s venture had $6 million in annual sales. In 1985, Dell changed his strategy to begin offering built-to-order computers. That year, the company generated $70 million in sales. Five years later, revenues had climbed to $500 million, and by the end of 2000, Dell’s revenues had topped an astounding $25 billion. The meteoric rise of Dell Computers was largely due to innovations in supply chain and manufacturing, but also due to the implementation of a novel distribution strategy. By carefully analyzing and making strategic changes in the personal computer value chain, and by seizing on emerging market trends, Dell Inc. grew to dominate the PC market in less time than it takes many companies to launch their first product.

No more middleman: Dell started out as a direct seller, first using a mail-order system, and then taking advantage of the Internet to develop an online sales platform. Well before use of the Internet went mainstream, Dell had begun integrating online order status updates and technical support into their customer-facing operations. By 1997, Dell’s Internet sales had reached an average of $4 million per day . While most other PCs were sold preconfigured and pre-assembled in retail stores, Dell offered superior customer choice in system configuration at a deeply discounted price, due to the cost-savings associated with cutting out the retail middleman. This move away from the traditional distribution model for PC sales played a large role in Dell’s formidable early growth. Additionally, an important side-benefit of the Internet-based direct sales model was that it generated a wealth of market data the company used to efficiently forecast demand trends and carry out effective segmentation strategies. This data drove the company’s product development efforts and allowed Dell to profit from information on the value drivers in each of its key customer segments.

Virtual integration: On the manufacturing side, the company pursued an aggressive strategy of “virtual integration.” Dell required a highly reliable supply of top-quality PC components, but management did not want to integrate backward to become its own parts manufacturer. Instead, the company sought to develop long-term relationships with select, name-brand PC component manufacturers. Dell also required its key suppliers to establish inventory hubs near its own assembly plants. This allowed the company to communicate with supplier inventory hubs in real time for the delivery of a precise number of required components on short notice. This “just-in-time,” low-inventory strategy reduced the time it took for Dell to bring new PC models to market and resulted in significant cost advantages over the traditional stored-inventory method. This was particularly powerful in a market where old inventory quickly fell into obsolescence. Dell openly shared its production schedules, sales forecasts and plans for new products with its suppliers. This strategic closeness with supplier partners allowed Dell to reap the benefits of vertical integration, without requiring the company to invest billions setting up its own manufacturing operations in-house.

Innovation on the assembly floor: In 1997, Dell reorganized its assembly processes. Rather than having long assembly lines with each worker repeatedly performing a single task, Dell instituted “manufacturing cells.” These “cells” grouped workers together around a workstation where they assembled entire PCs according to customer specifications. Cell manufacturing doubled the company’s manufacturing productivity per square foot of assembly space, and reduced assembly times by 75%. Dell combined operational and process innovation with a revolutionary distribution model to generate tremendous cost-savings and unprecedented customer value in the PC market. The following are some key lessons from the story of Dell’s incredible rise:

1. Disintermediation (cutting out the middleman): Deleting a player in the distribution chain is a risky move, but can result in a substantial reduction in operating costs and dramatically improved margins. Some companies that have surged ahead after they eliminated an element in the traditional industry distribution chain include:

- Expedia (the online travel site that can beat the rates of almost any travel agency, while giving customers more choice and more detailed information on their vacation destination)

- ModCloth (a trendy virtual boutique with no bricks-and-mortar retail outlets to drive up costs)

- PropertyGuys.com (offers a DIY kit for homeowners who want to sell their houses themselves)

- iTunes (an online music purchasing platform that won’t have you sifting through a jumble of jewel cases at your local HMV)

- Amazon.com (an online sales platform that allows small-scale buyers and sellers to access a broad audience without the need for an expensive storefront or a custom website)

- Netflix (the no-late-fees online video rental company that will ship your chosen video rentals right to your door)

2. Enhancing customer value: Forgoing the retail route allowed Dell to simultaneously improve margins while offering consumers a better price on their PCs. This move also gave customers a chance to configure PCs according to their specific computing needs. The dramatic improvement in customer value that resulted from Dell’s unique distribution strategy propelled the company to a leading market position.

3. Process and operations innovation: Michael Dell recognized that “the way things had always been done” wasn’t the best or most efficient way to run things at his company. There are countless examples where someone took a new look at a company process and realized that there was a much better way to get things done. It is always worth re-examining process-based work to see if a change could improve efficiency. This is equally true whether you’re a company of five or 500.

4. Let data do the driving: Harnessing the easily accessible sales and customer feedback data that resulted from online sales allowed Dell to stay ahead of the demand curve in the rapidly evolving PC market. Similarly, sales and feedback data were helpful in discovering new ways to enhance customer value in each of Dell’s key customer segments. Whether your company is large or small, it is essential to keep tabs on metrics that could reveal emerging trends, changing attitudes, and other important opportunities for your company.

See additional learning materials for distribution .

Summary: Dell combined operational and process innovation with a revolutionary distribution model to generate tremendous cost-savings and unprecedented customer value in the PC market.

Read next: customer discovery: identifying effective distribution channels for your startup.

Strickland, T. (1999). Strategic Management, Concepts and Cases . McGraw Hill College Division: New York.

Customer discovery: Identifying effective distribution channels for your startup

Should startups build distribution channels or sell products directly, sign up for our monthly startup resources newsletter about building high-growth companies..

- Enter your email *

You may unsubscribe at any time. To find out more, please visit our Privacy Policy .

- Search Menu

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical Literature

- Classical Reception

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Papyrology

- Greek and Roman Archaeology

- Greek and Roman Epigraphy

- Greek and Roman Law

- Late Antiquity

- Religion in the Ancient World

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Evolution

- Language Reference

- Language Variation

- Language Families

- Language Acquisition

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Modernism)

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Media

- Music and Culture

- Music and Religion

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Science

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Lifestyle, Home, and Garden

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Society

- Law and Politics

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Neuroanaesthesia

- Clinical Neuroscience

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Medical Ethics

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Games

- Computer Security

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Ethics

- Business History

Business Strategy

- Business and Technology

- Business and Government

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic History

- Economic Methodology

- Economic Systems

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Natural Disasters (Environment)

- Social Impact of Environmental Issues (Social Science)

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- International Political Economy

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Behaviour

- Political Economy

- Political Institutions

- Political Theory

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Politics and Law

- Public Policy

- Public Administration

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Developmental and Physical Disabilities Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

- < Previous chapter

- Next chapter >

24 Dell: The Business Case for a Sustainable Supply Chain

- Published: March 2021

- Cite Icon Cite

- Permissions Icon Permissions

The computer manufacturer Dell runs the world’s largest electronics take-back programme. It has recovered more than 800,000 tonnes of electronics since 2008. In the case of individual consumers it partners with freight companies in retrieving equipment from consumers’ homes and partners with Goodwill, a not-for-profit organization that seeks to make people independent through education and training, in running 2,000 locations across the United States where consumers can drop off any brand of used electronics. The article points to the commercial as well as the environmental savings resulting from the recycling programme and describes the process by which Dell has been able to achieve this.

Introduction

Dell is one of the world’s largest computer manufacturers and technology companies. The company sells a wide range of IT hardware, software products, and services for enterprise, government, small business, and consumer markets. 1 As a privately held company, Dell has the freedom to pursue a longer time horizon and to commit to changing how it uses its resources. The principle of efficiency is central to the Dell business model and informs the company’s approach to resources, sourcing, and waste management.

Pain Points in the Ecosystem

Dell’s commitment to efficiency has prompted the company to take on the timely challenge of improving e-waste disposal throughout its business.

E-waste, that is, discarded electrical and electronic equipment, is the world’s fastest-growing waste stream. 2 Rapid technology innovation and ever-shortening product lifespans are contributing to the increase of e-waste. 3 According to a United Nations’ University report, the amount of global e-waste reached 41.8 million tonnes in 2014. 4 To compound matters, e-waste has a low overall recycling rate, which means that unwanted equipment remains unused.

Responsible e-waste disposal is not only important from an environmental perspective, but also makes good economic sense. 5 Vast amounts of gold, for example, exit the economy due to low recycling rates, but increasingly there is an opportunity to recapture that value, as a tonne of computer motherboards contains more gold in it than a tonne of gold ore. In terms of scale, the material value of global e-waste was estimated to be €48 billion in 2014 alone. 6 This underutilized resource has a vast ‘untapped potential to create a more sustainable, efficient product ecosystem’. 7

The circular economy takes the traditional, linear model of ‘take, make, and dispose’—which moves products from design to factory to consumer to landfill—and bends it into a more efficient closed-loop ecosystem. Unwanted used electronics can be taken back for refurbishment and then resold on the secondary market. Products beyond repair, or those that are no longer economical to repair, are recycled to allow for precious and scarce materials to be recovered. Recycled content can either be incorporated into the design and manufacturing of new products or sold for others to use.

Research shows that approximately 30 per cent of consumers have technology products lying around the house unused, and half of consumers are unsure about what to do with their old electronics. 8 According to Dell, similar situations exist with businesses warehousing old equipment. Take-back options make it easy for a wide variety of customers to dispose of their old electronic products in a responsible manner. This measure ensures that unwanted electronics get reused or, if at the end of life, properly recycled.

Plastic is one of the most useful and important materials in modern society. It is popular in computers due to its durability, ease of fabrication into complex shapes, and electrical insulation qualities. 9 However, plastic recycling remains challenging and, as a result, the material constitutes a major contributor to landfills and to nonpoint source pollution—pollution from many different sources. The production of traditional plastics also uses a substantial amount of fossil fuels. Manufacturing plastics from fuel is resource intensive, requires large amounts of energy, and releases relatively high levels of CO 2 emissions in the process. Recent research has shown that our current use of plastics will become unsustainable if we do not take steps to improve recycling and reduce plastics’ usage.

Using secondary, recycled plastic as feedstock for new computers presents one possible solution. With the fast pace of innovation and product upgrades in the ICT sector, recycled content can reduce the environmental toll of manufacturing with virgin materials. The circular economy and the development of secondary raw material markets are high on the European agenda. Nevertheless, it remains challenging to find a sufficient supply of high-quality post-consumer recycled plastics that meets the technical, economic, and aesthetic requirements of ICT products manufacturers. 10

In response, Dell is taking steps towards creating a ‘circular’ supply chain (see also Interface, Chapter 25 ). In addition to environmental concerns, the increased volatility in commodities and growing pressure on resources have alerted Dell to the business necessity of rethinking materials and energy use. 11 In 2013, Dell committed to putting a total of 50 million pounds weight of recycled materials back into its products by 2020. The company reached this goal at the beginning of 2017 and is continuing to scale its efforts.

For Dell, sourcing post-consumer recycled plastics from the market and building a new, stable closed-loop supply chain for plastics from used electronics collected through take-back programmes present viable and affordable alternatives to using virgin materials. Rather than focusing exclusively on individual challenges, Dell has taken steps to approach their supply chain from a broader, systemic perspective. Most recently, this has included expanding its efforts to also address precious metals, such as gold. Jennifer Allison, director of supply chain sustainability at Dell, summarizes the company’s current business strategy:

We’re talking about systems—not just products, programmes, or initiatives. Looking at the whole system is when change begins to make a significant difference. Technology is a great tool for measuring and analysing systems, understanding processes, and identifying inefficiencies. 12

In this way, Dell takes a whole ecosystem view of its product life cycles. This approach is transforming the design of products and services. Dell’s life-cycle approach aims to keep viable products and parts in circulation for longer periods of time. It also harnesses global efforts to reuse, refurbish, and resell products and parts to extend their lifetimes and to recycle them at the end of life.

Product design emphasizes ease of repair and recyclability from the beginning. Dell also looks continuously for ways to incorporate sustainable materials, such as recycled plastic and reclaimed carbon fibre, into products and packaging. 13

The Take-Back Programme

Dell has the world’s largest electronics take-back programme, which spans more than seventy-five countries and territories. The programme has recovered approximately 800,000 tonnes of electronics since 2008. For commercial customers, Dell offers a full-spectrum of logistics and disposal capabilities via the Asset Resale and Recycling Service. Current capabilities include data security, on-site shredding, recycling, and full traceability reporting. Dell also makes it easy for individual consumers to recycle by partnering with freight companies to provide free mail-back recycling of Dell-branded equipment. In many countries, the programme will even pick up used equipment from a customer’s home. 14

Another programme designed to make the recovery of obsolete electronics easier and more accessible is the Dell Reconnect Partnership with Goodwill, a not-for-profit organization committed to helping people become independent through education and training. The Reconnect Programme allows people to drop off any brand of used electronics to more than two thousand participating Goodwill locations across the United States. Dell Reconnect accepts any brand of computer equipment in any condition from consumers and provides free recycling services.

Dell returns all proceeds to Goodwill in order to help support Goodwill’s mission of putting people to work. 15 By participating in this initiative, customers simultaneously help protect the environment, benefit the community, and receive a receipt for tax purposes. In this way, the programme helps both the customers and the business.

The donated equipment has value as a whole system, as parts, and sometimes as raw materials such as metals, plastics, and glass. 16 If the equipment can be refurbished, Goodwill sells it. If not, the end-of-life product is sent to Wistron, one of Dell’s recycling partners, for asset recovery in the United States. Metals such as tin, gold, 17 and tungsten are re-sold in the commodities market. To complete the closed loop, plastics are sorted and shipped to China, turned into pellets, and mixed with virgin plastics for use in new Dell products. 18

Closed-Loop Recycled Plastic Supply Chain

Dell’s 2020 ‘Legacy of Good’ sustainability plan set the goal of incorporating 50 million pounds weight of post-consumer recycled-content plastics and other sustainable materials into Dell products by 2020. 19 Dell met this target ahead of schedule in early 2017.

It started with the launch of Dell’s closed-loop recycled plastics supply chain in 2014. Since then, the company has used more than 9,750 tonnes of closed-loop plastics in over 125 products. These products include flat-panel monitors, desktops, and all-in-one computers.

Run in conjunction with various supply chain partners, the programme consists of collecting, recycling, and using e-waste to make new Dell products. 20 It begins with sorting plastics out of the various take-back streams, further processing them, and then sending them to a manufacturing partner in Asia. The plastics are then melted down and moulded into new parts and computer components, thereby creating a closed-loop system. The whole process—from the time the equipment is received for recycling to the time the plastics are back in a customer’s hands as part of a new product—takes just under six months. The closed-loop system also provides businesses with a price more stable than the cost of virgin materials, which fluctuates with the price of oil. It also reduces the company’s dependence on those environmentally costly virgin materials. Furthermore, by reusing plastics already in circulation, Dell cuts down on e-waste, reduces carbon emissions, and helps drive a circular economy for IT. The closed-loop process yields an 11 per cent lower carbon footprint than a process using virgin materials, 21 and creates products that are better for the environment, which is increasingly what Dell customers demand. 22 Dell was also the first PC manufacturer (January 2018) to use recycled gold from e-waste in its products. Working with the data analyst TruCost, it found that this closed-loop process can cause 99 per cent less environmental damage and avoid $1.6 million in natural capital costs per kilogram processed (US$3.68 million for the pilot project alone) when compared to gold mining. The same study showed closed-loop process can avoid 41 times the social impacts of gold mining.

Dell’s leadership in recovering and reusing plastic from used computers constitutes an important step in moving the larger electronics industry towards a circular economy. Louise Koch, corporate sustainability director in EMEA for Dell, describes the impetus for initiating a closed-loop system:

Dell’s programme is driven by both an effort to improve efficiency—a principle that goes back to its founding ethos and business model—as well as a commitment to reducing environmental impact. 23

The use of closed-loop plastics may create a demand for plastic from used computers and thereby increase the level of plastic recycling from electronics. This, in turn, generates new jobs and opportunities for those in the nascent industry, all while staying true to Dell’s founding principles.

Challenges in Moving to a Closed-Loop Recycling System

In moving from the traditional take–make–dispose linear supply chain to a circular supply chain, Dell has had to overcome a number of hurdles.

One of the biggest challenges that Dell faced with the closed-loop recycling was identifying which types of plastic can be incorporated back into new products. As Scott O’Connell, director of environmental affairs for Dell, puts it, ‘When dealing with plastics, getting the properties equivalent or better to virgin materials isn’t easy…But this is a challenge we’ve been able to overcome with engineering know-how.’ 24 Dell worked with partners to test different approaches. Testing revealed that, due to mechanical and aesthetic considerations, a blend of recycled-content with virgin plastic produces the best outcomes.

Another challenge involves establishing a reliable closed-loop supply chain. As O’Connell describes, ‘We had to make sure that we had sufficient volume of product coming in to be able to yield enough plastics to put into a mainstream Dell product.’ 25 Supply of products and plastic derives from Dell’s own sources, which adds a greater degree of insight and security. However, for the closed-loop recycling to work and scale, Dell needs security of supply, which can be difficult to attain with fluctuating numbers of products collected through take-back. Shrinking form factors—the fact that there is less plastic per item recycled as electronics become smaller—further complicate the situation. Hence Dell needs to continue to drive increasing participation in take-back programmes, while at the same time exploring other means of acquiring recycled-content materials.

Transporting materials poses an additional challenge. Dell customers are all over the world, which means that take-back initiatives must accommodate the global scale. While Dell has a small closed-loop plastics supply chain in Europe already and is exploring ways to scale in other geographies, materials need to be collected in sufficiently large amounts to make shipping to a centralized processor worth the economic and environmental costs. This involves logistics, regulations, and other considerations. In some cases, even the definition of the material being moved can affect the viability of closed-loop efforts: is recycled plastic labelled as waste or a raw material, for example?

The final challenge for Dell is to demonstrate the benefits of closed-loop recycling to customers. Ultimately, the products look and perform exactly the same as those made from virgin materials. Dell must communicate the value proposition to customers by highlighting the amount of recycled content in the final product, the closed-loop nature of the materials, and the benefits to the customers’ own sustainability goals.

Performance

Since 2008, Dell has taken back more than 1.76 billion pounds (nearly 800,000 tonnes) of used electronics and since mid-2014, when Dell launched the closed-loop plastic recycling programme, it has created nearly 5,000 tonnes of plastics from recycled computer parts. Dell has saved more than $1.8 million from this process, and the carbon footprint of circular plastics is 11 per cent smaller than that associated with the manufacture of virgin plastics. Dell now uses circular plastics in approximately 125 products across millions of units globally.

Together with TruCost, Dell has completed an evaluation to understand the gains from moving away from virgin plastics. One of the most useful ways for companies to assess the risks associated with new initiatives is to quantify the environmental impacts generated by their activities—internal operations, upstream supply chain, and downstream product use and disposal—and then convert those impacts into monetary values. 26 The monetary value helps identify the value not captured in traditional financial markets and incorporates these considerations into decision-making. 27

Findings showed that Dell’s closed-loop plastic has a 44 per cent ($1.3 million annually) greater environmental benefit than virgin ABS plastic. 28 In particular, increased computer recycling lessened environmental impacts. The research found that recovering and recycling the used plastics from computers minimized ‘human health and ecotoxicity impacts’ and reduced the overall emission of hazardous substances. 29

Dell has also begun to incorporate social impact metrics into its valuation framework. 30 Emergent strategies such as analysing activities for their use of social and human capital are likely to be an area for further refinement and application in the future. 31 At present, Dell is combining both environmental and social impact metrics into its process in order to help tackle the challenge of responsible e-waste disposal.