- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for April 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

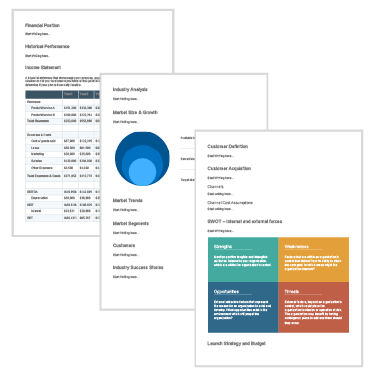

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

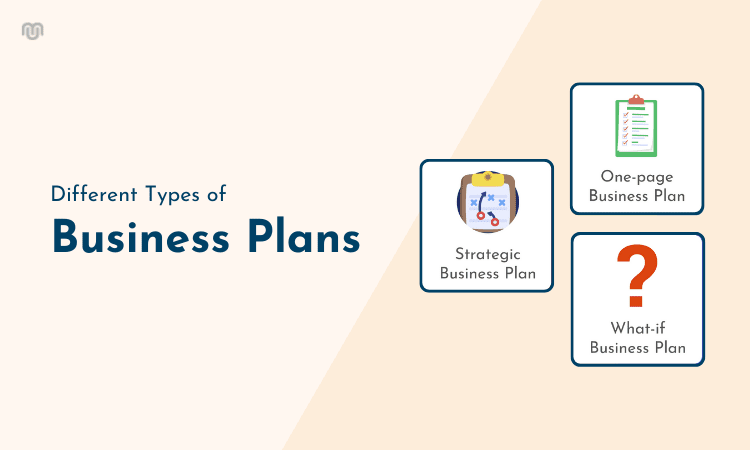

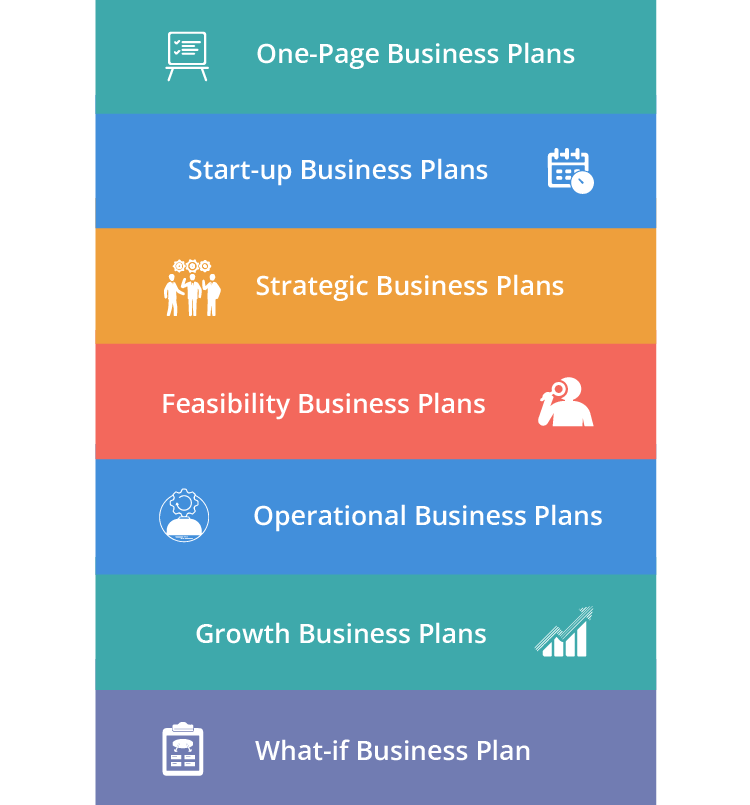

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

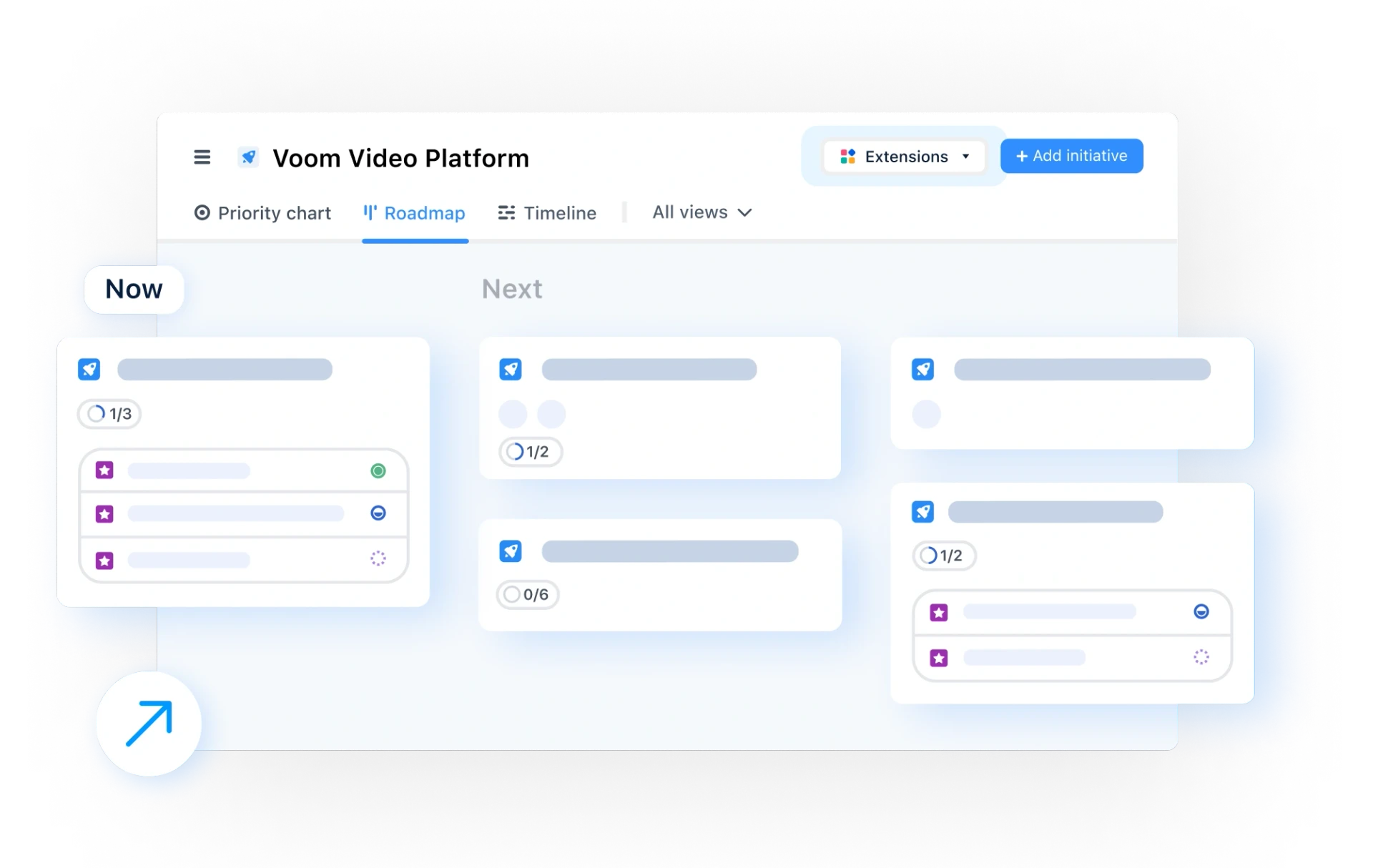

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

- Frequently Asked Questions

- Business Credit Cards

- Talk to Us 1-800-496-1056

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Leave a Reply

Your email address will not be published. Required fields are marked *

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![definition and types of business plan How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![definition and types of business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![definition and types of business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Customers’ Top HubSpot Integrations to Streamline Your Business in 2022

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Top Courses

- Online Degrees

- Find your New Career

- Join for Free

Business Plan: What It Is + How to Write One

Discover what a business plan includes and how writing one can foster your business’s development.

![definition and types of business plan [Featured image] Woman showing a business plan to a man at a desk](https://d3njjcbhbojbot.cloudfront.net/api/utilities/v1/imageproxy/https://images.ctfassets.net/wp1lcwdav1p1/8jaIrEmfb9uCidnAGOr2F/c551eade2b440294787de7afd2acb369/GettyImages-1127726432__1_.jpg?w=1500&h=680&q=60&fit=fill&f=faces&fm=jpg&fl=progressive&auto=format%2Ccompress&dpr=1&w=1000)

What is a business plan?

A business plan is a written document that defines your business goals and the tactics to achieve those goals. A business plan typically explores the competitive landscape of an industry, analyzes a market and different customer segments within it, describes the products and services, lists business strategies for success, and outlines financial planning.

In your research into business plans, you may come across different formats, and you might be wondering which kind will work best for your purposes.

Let’s define two main types of business plans , the traditional business pla n and the lean start-up business plan . Both types can serve as the basis for developing a thriving business, as well as exploring a competitive market analysis, brand strategy , and content strategy in more depth. There are some significant differences to keep in mind [ 1 ]:

The traditional business plan is a long document that explores each component in depth. You can build a traditional business plan to secure funding from lenders or investors.

The lean start-up business plan focuses on the key elements of a business’s development and is shorter than the traditional format. If you don’t plan to seek funding, the lean start-up plan can serve mainly as a document for making business decisions and carrying out tasks.

Now that you have a clear business plan definition , continue reading to begin writing a detailed plan that will guide your journey as an entrepreneur.

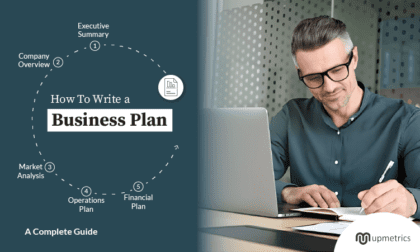

How to write a business plan

In the sections below, you’ll build the following components of your business plan:

Executive summary

Business description

Products and services

Competitor analysis

Marketing plan and sales strategies

Brand strategy

Financial planning

Explore each section to bring fresh inspiration to the surface and reveal new possibilities for developing your business. You may choose to adapt the sections, skip over some, or go deeper into others, depending on which format you’re using. Consider your first draft a foundation for your efforts and one that you can revise, as needed, to account for changes in any area of your business.

Read more: What Is a Marketing Plan? And How to Create One

1. Executive summary

This is a short section that introduces the business plan as a whole to the people who will be reading it, including investors, lenders, or other members of your team. Start with a sentence or two about your business, your goals for developing it, and why it will be successful. If you are seeking funding, summarize the basics of the financial plan.

2. Business description

Use this section to provide detailed information about your company and how it will operate in the marketplace.

Mission statement: What drives your desire to start a business? What purpose are you serving? What do you hope to achieve for your business, the team, your customers?

Revenue streams: From what sources will your business generate revenue? Examples include product sales, service fees, subscriptions, rental fees, license fees, and more.

Leadership: Describe the leaders in your business, their roles and responsibilities, and your vision for building teams to perform various functions, such as graphic design, product development, or sales.

Legal structure: If you’ve incorporated your business or registered it with your state as a legal entity such as an S-corp or LLC, include the legal structure here and the rationale behind this choice.

3. Competitor analysis

This section will include an assessment of potential competitors, their offers, and marketing and sales efforts. For each competitor, explore the following:

Value proposition: What outcome or experience does this brand promise?

Products and services: How does each one solve customer pain points and fulfill desires? What are the price points?

Marketing: Which channels do competitors use to promote? What kind of content does this brand publish on these channels? What messaging does this brand use to communicate value to customers?

Sales: What sales process or buyer’s journey does this brand lead customers through?

Read more: What Is Competitor Analysis? And How to Conduct One

4. Products and services

Use this section to describe everything your business offers to its target market . For every product and service, list the following:

The value proposition or promise to customers, in terms of how they will experience it

How the product serves customers, addresses their pain points, satisfies their desires, and improves their lives

The features or outcomes that make the product better than those of competitors

Your price points and how these compare to competitors

5. Marketing plan and sales strategies

In this section, you’ll draw from thorough market research to describe your target market and how you will reach them.

Who are your ideal customers?

How can you describe this segment according to their demographics (age, ethnicity, income, location, etc.) and psychographics (beliefs, values, aspirations, lifestyle, etc.)?

What are their daily lives like?

What problems and challenges do they experience?

What words, phrases, ideas, and concepts do consumers in your target market use to describe these problems when posting on social media or engaging with your competitors?

What messaging will present your products as the best on the market? How will you differentiate messaging from competitors?

On what marketing channels will you position your products and services?

How will you design a customer journey that delivers a positive experience at every touchpoint and leads customers to a purchase decision?

Read more: Market Analysis: What It Is and How to Conduct One

6. Brand strategy

In this section, you will describe your business’s design, personality, values, voice, and other details that go into delivering a consistent brand experience.

What are the values that define your brand?

What visual elements give your brand a distinctive look and feel?

How will your marketing messaging reflect a distinctive brand voice, including the tone, diction, and sentence-level stylistic choices?

How will your brand look and sound throughout the customer journey?

Define your brand positioning statement. What will inspire your audience to choose your brand over others? What experiences and outcomes will your audience associate with your brand?

Read more: What Is a Brand Strategy? And How to Create One

7. Financial planning

In this section, you will explore your business’s financial future. If you are writing a traditional business plan to seek funding, this section is critical for demonstrating to lenders or investors that you have a strategy for turning your business ideas into profit. For a lean start-up business plan, this section can provide a useful exercise for planning how you will invest resources and generate revenue [ 2 ].

Use any past financials and other sections of this business plan, such as your price points or sales strategies, to begin your financial planning.

How many individual products or service packages do you plan to sell over a specific time period?

List your business expenses, such as subscribing to software or other services, hiring contractors or employees, purchasing physical supplies or equipment, etc.

What is your break-even point, or the amount you have to sell to cover all expenses?

Create a sales forecast for the next three to five years: (No. of units to sell X price for each unit) – (cost per unit X No. of units) = sales forecast

Quantify how much capital you have on hand.

When writing a traditional business plan to secure funding, you may choose to append supporting documents, such as licenses, permits, patents, letters of reference, resumes, product blueprints, brand guidelines, the industry awards you’ve received, and media mentions and appearances.

Business plan key takeaways and best practices

Remember: Creating a business plan is crucial when starting a business. You can use this document to guide your decisions and actions and even seek funding from lenders and investors.

Keep these best practices in mind:

Your business plan should evolve as your business grows. Return to it periodically, such as every quarter or year, to update individual sections or explore new directions your business can take.

Make sure everyone on your team has a copy of the business plan and welcome their input as they perform their roles.

Ask fellow entrepreneurs for feedback on your business plan and look for opportunities to strengthen it, from conducting more market and competitor research to implementing new strategies for success.

Start your business with Coursera

Ready to start your business? Watch this video on the lean approach from the Entrepreneurship Specialization :

Article sources

1. US Small Business Administration. “ Write Your Business Plan , https://www.sba.gov/business-guide/plan-your-business/write-your-business-plan." Accessed April 19, 2022.

2. Inc. " How to Write the Financial Section of a Business Plan , https://www.inc.com/guides/business-plan-financial-section.html." Accessed April 14, 2022.

Keep reading

Coursera staff.

Editorial Team

Coursera’s editorial team is comprised of highly experienced professional editors, writers, and fact...

This content has been made available for informational purposes only. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals.

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

How To Get A Business License In North Dakota (2024)

How To Write An Effective Business Proposal

Best New Hampshire Registered Agent Services Of 2024

Employer Staffing Solutions Group Review 2024: Features, Pricing & More

How To Sell Clothes Online In 2024

2024 SEO Checklist

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Additionally, she is a Columnist at Inc. Magazine.

BUSINESS STRATEGIES

7 types of business plans every entrepreneur should know

- Amanda Bellucco Chatham

- Aug 3, 2023

What’s the difference between a small business that achieves breakthrough growth and one that fizzles quickly after launch? Oftentimes, it’s having a solid business plan.

Business plans provide you with a roadmap that will take you from wantrepreneur to entrepreneur. It will guide nearly every decision you make, from the people you hire and the products or services you offer, to the look and feel of the business website you create.

But did you know that there are many different types of business plans? Some types are best for new businesses looking to attract funding. Others help to define the way your company will operate day-to-day. You can even create a plan that prepares your business for the unexpected.

Read on to learn the seven most common types of business plans and determine which one fits your immediate needs.

What is a business plan?

A business plan is a written document that defines your company’s goals and explains how you will achieve them. Putting this information down on paper brings valuable benefits. It gives you insight into your competitors, helps you develop a unique value proposition and lets you set metrics that will guide you to profitability. It’s also a necessity to obtain funding through banks or investors.

Keep in mind that a business plan isn’t a one-and-done exercise. It’s a living document that you should update regularly as your company evolves. But which type of plan is right for your business?

7 common types of business plans

Startup business plan

Feasibility business plan

One-page business plan

What-if business plan

Growth business plan

Operations business plan

Strategic business plan

01. Startup business plan

The startup business plan is a comprehensive document that will set the foundation for your company’s success. It covers all aspects of a business, including a situation analysis, detailed financial information and a strategic marketing plan.

Startup plans serve two purposes: internally, they provide a step-by-step guide that you and your team can use to start a business and generate results on day one. Externally, they prove the validity of your business concept to banks and investors, whose capital you’ll likely need to make your entrepreneurial dreams a reality.

Elements of a startup business plan should include the following steps:

Executive summary : Write a brief synopsis of your company’s concept, potential audience, product or services, and the amount of funding required.

Company overview: Go into detail about your company’s location and its business goals. Be sure to include your company’s mission statement , which explains the “why” behind your business idea.

Products or services: Explain exactly what your business will offer to its customers. Include detailed descriptions and pricing.

Situation analysis: Use market research to explain the competitive landscape, key demographics and the current status of your industry.

Marketing plan: Discuss the strategies you’ll use to build awareness for your business and attract new customers or clients.

Management bios: Introduce the people who will lead your company. Include bios that detail their industry-specific background.

Financial projections: Be transparent about startup costs, cash flow projections and profit expectations.

Don’t be afraid to go into too much detail—a startup business plan can often run multiple pages long. Investors will expect and appreciate your thoroughness. However, if you have a hot new product idea and need to move fast, you can consider a lean business plan. It’s a popular type of business plan in the tech industry that focuses on creating a minimum viable product first, then scaling the business from there.

02. Feasibility business plan

Let’s say you started a boat rental company five years ago. You’ve steadily grown your business. Now, you want to explore expanding your inventory by renting out jet skis, kayaks and other water sports equipment. Will it be profitable? A feasibility business plan will let you know.

Often called a decision-making plan, a feasibility business plan will help you understand the viability of offering a new product or launching into a new market. These business plans are typically internal and focus on answering two questions: Does the market exist, and will you make a profit from it? You might use a feasibility plan externally, too, if you need funding to support your new product or service.

Because you don’t need to include high-level, strategic information about your company, your feasibility business plan will be much shorter and more focused than a startup business plan. Feasibility plans typically include:

A description of the new product or service you wish to launch

A market analysis using third-party data

The target market , or your ideal customer profile

Any additional technology or personnel needs required

Required capital or funding sources

Predicted return on investment