Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning Services

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB-1 Business Plan

- EB-2 NIW Business Plan

- EB-5 Business Plan

- Innovator Founder Visa Business Plan

- Start-Up Visa Business Plan

- Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Plan

- Landlord business plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- Ecommerce business plan

- Online boutique business plan

- Mobile application business plan

- Daycare business plan

- Restaurant business plan

- Food delivery business plan

- Real estate business plan

- Business Continuity Plan

- Pitch Deck Consulting Services

- Financial Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

Loan Officer Business Plan Guide

JUL.05, 2023

1. What are loan officers’ services?

Loan officers serve both home buyers and businesses. When evaluating clients’ eligibility for loans, they carefully assess their credit history and financial status. Additionally, they offer expert guidance in selecting mortgage products that cater to the unique needs of each client. Loan officers collaborate with lenders, streamlining the application process, negotiating terms, and facilitating closing.

2. Executive Summary

Why do you need a business plan for a loan officer business.

A business plan holds immense importance for the success of a Loan Officer business. A comprehensive guide on crafting a loan officer business plan acts as a roadmap leading to operational and financial success for the Loan Officer business. It should identify not only milestones but also the processes and strategies needed to achieve those goals.

The business plan should outline the company’s overall mission and objectives, its financials (including a budget and a pro forma income statement), market analysis, organizational structure, and customer acquisition strategies.

How to write an executive summary for a Loan officer business plan?

The executive summary of a loan officer business plan worksheet provides a comprehensive overview of the entire plan. The provided sentence lists various components of a summary, including the mission, goals, products and services, financial projections, and competitive analysis. It also mentions that the qualifications and experience of the loan officer are highlighted.

The executive summary should prioritize the loan officer’s objectives and strategies for acquiring and fulfilling client requests. It should outline how the loan officer plans to reach these goals effectively while explaining the specific techniques they will utilize.

The executive summary of the commercial loan officer business plan template should provide a concise overview of the products and services offered by the loan officer. Additionally, it should include anticipated financial projections and competitive analysis. This section aims to present an outline of available loans, associated fees, charges, and estimated total revenue for the loan officer’s business.

The executive summary should provide a concise overview of the loan officer’s qualifications and experience. This section briefly highlights the loan officer’s education, professional certifications, and pertinent industry expertise within lending.

3. Company Overview

History of loan officer company.

Loan Officer Company was founded in 2021 to become a top-tier mortgage loan provider. The company offers specialized mortgage loan services to its customers. These services are provided through a team of experienced and knowledgeable loan officers.

Moreover, our organization takes great pride in being a member of esteemed professional associations such as the National Association of Mortgage Professionals , the Mortgage Bankers Association of America, and the National Reverse Mortgage Lenders Association.

Our range of loan products encompasses conventional loans, government-backed loans, jumbo loans, and refinancing. Loan officers undergo ongoing training and must pass a stringent certification process to guarantee exceptional customer service quality.

The company’s main objective is to provide personalized creditworthy loans to every customer. Transparency and fairness are our core principles, ensuring that each customer receives the loan that suits their unique circumstances. Additionally, we prioritize clarity and understanding by guiding customers through the entire loan process from start to finish.

4. Services and pricing

- Conventional Loans: Fixed or adjustable rate mortgages as low as 3.875%, Low or no down payments, Flexible qualification criteria

- Government-Backed Loans: VA, FHA, and USDA loans with competitive rates and flexible qualifications

- Jumbo Loans: Loan limits up to $3.5 million with competitive rates and flexible qualifications

- Refinancing: Lower rates, cash-out options, and the ability to consolidate debt

- Mortgage Consultations: Comprehensive assessment of your financial situation and personalized advice

- Loan Packaging: Comprehensive loan packaging and presentation services to ensure competitive offers

- Loan Servicing: Professional loan servicing that includes payment processing, collections, and customer service

5. Customer Analysis

Customer segmentation.

The customer base for the loan officer business plan example can be segmented as follows:

- Homeowners: This segment comprises existing homeowners looking to obtain or refinance a mortgage loan. They are likely between the ages of 35-55 and have a higher net worth than the average consumer.

- First-time Home Buyers: This segment consists mostly of younger people who are first becoming homeowners. They may have lower credit scores or more limited finances and require more assistance in obtaining a mortgage loan.

- Real Estate Investors: This segment typically consists of experienced investors or business-minded individuals looking to purchase property as an income-generating tool.

- Small Business Owners: Small business owners may be interested in obtaining a commercial loan to purchase a building or expand their business operations.

- Homeowners with Equity: This segment comprises existing homeowners looking to access the built-up equity in their homes to finance a large purchase or investment.

6. SWOT Analysis

- The knowledgeable and experienced loan officer

- Access to data and analytics to better determine loanworthiness

- Established relationships with lenders

- Long-term relationships with customers

Weaknesses:

- Lack of resources, such as access to capital or the ability to hire new loan officers

- Lack of technology to efficiently process and monitor loan applications

Opportunities:

- Expansion into new geographic areas

- Leveraging new technology to increase efficiency and effectiveness in the loan process

- Establishing relationships with new lenders and financial service providers

- Increasing competition in the loan officer business

- Strained lending regulations that may limit loan products or terms

- Changing economic environment and interest rate markets that may inhibit borrower demand

7. Marketing Analysis

The Mortage Broker Business Plan industry is highly competitive, dominated by traditional banks and large financial institutions.

Competitors

The primary competitors of our Payday Loan officer services are other loan officers, mortgage brokers, banks, credit unions, mortgage lenders, and real estate agents. They offer services similar to our company, such as home loans, refinancing options, loan terms and conditions, etc.

Market trends

Recent market trends in the loan officer industry have seen an increase in demand and competition as the US housing market has continued to boom.

Competitive Advantage (USPs)

Our commitment lies in providing a comprehensive loan service, giving us a competitive edge. We dedicate ourselves to understanding the unique needs and financial goals of each client, allowing us to offer personalized loan advice and tailored solutions. Rather than settling for standard options, we go the extra mile to ensure our clients receive the absolute best choices available.

8. Marketing Plan

Create a commercial loan officer business plan marketing plan that includes a mix of promotional strategies and goals, an organizational structure for tracking and measuring effectiveness, and a budget.

Promotions Strategy

The promotional strategy for a loan officer business plan involves several activities, including direct mail advertising, personal contacts and referrals, print media, and social media.

- Direct Mail Advertising: Direct mailers are a great way to reach potential clients and remind existing clients of your services. When preparing a direct mailer, it is important to tailor the message and design to the target market.

- Print Media: Print media provides an effective way to showcase the qualifications of a loan officer and the services provided.

- Social Media: Social media presents a powerful opportunity for businesses to connect with potential clients.

9. Management Team

Organizational structure.

An organizational structure for a loan officer 1-year business plan includes the following components:

- Accounting and Financial Support Team

- Loan Processing Team

- Customer Service Team

- Loan Administration Team

- Compliance and Regulatory Team

- Sales and Marketing Team

10. Financial Plan

Startup costs.

Developing a loan officer Finance Business Plan requires an initial investment of capital. These costs may be broken down into the following categories:

- Technology and Equipment: $2,500

- Legal and Regulatory Fees: $2,500

- Insurance: $2,500

- Licensing: $1,000

- Office Expenses: $2,000

- Marketing and Advertising: $1,000

Total Startup Costs: $11,000

Financial Projections

Assuming a loan officer is loaned out at an average of $250 per hour yearly, the following financial projections may be made:

- Year 1: $60,000

- Year 2: $75,000

- Year 3: $90,000

- Year 1: $25,000

- Year 2: $30,000

- Year 3: $35,000

- Year 1: $35,000

- Year 2: $45,000

- Year 3: $55,000

Funding Ask

Initial funding for the loan officer business plan can be obtained through a variety of sources, including personal savings, friends and family, business loans, or venture capital. Depending on the sources, the owner may need to provide collateral or a personal guarantee.

11. Accelerate Your Loan Officer Business Goals with OGS Capital

Are you a Loan Officer looking to get ahead?

OGS Capital has the expertise to accelerate your business growth. Our team comprises experienced financial and marketing professionals with extensive knowledge in the mortgage and banking sector. They are dedicated to supporting Loan Officers, like yourself, in achieving their business goals.

The OGS Capital team of advisors possesses extensive experience and expertise in the realms of business strategy and management. They have collaborated with a diverse array of companies, ranging from fledgling startups to reputable Fortune 500 corporations.

Our strategy plans are customized to align with the unique goals and objectives of your loan office business. They provide valuable insights and guidance for effectively targeting niche markets and reaching your desired audience. By employing data-driven methods, our plans prioritize actionable insights for your marketing campaigns, optimize spending, and drive sales and revenue growth in a cost-efficient manner.

Whether you’re looking for an effective growth strategy or a comprehensive roadmap to success, the experienced consultants at OGS Capital are on hand to provide the knowledge and expertise to turn your vision into reality.

Are you looking for expert guidance on business growth? Reach out to OGS Capital today to obtain your personalized roadmap towards achieving your goals.

Q. What is the easiest way to finalize a loan officer business plan?

The easiest way to finalize a loan officer business plan is to utilize online resources or templates to customize it to meet your needs. Templates are typically available online for free or at nominal costs and often include sections like a mission statement, financial goals, target audience, risk assessment, and more. Additionally, consider seeking professional help from a financial advisor who can provide additional guidance and advice.

Q. Where can I download the loan officer business plan in PDF format?

You can download a Loan Officer Business Plan Template in PDF format from websites such as SCORE, HubSpot, OGS Capital, and BizPlanBuilder.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Add comment

E-mail is already registered on the site. Please use the Login form or enter another .

You entered an incorrect username or password

Comments (0)

mentioned in the press:

Search the site:

OGScapital website is not supported for your current browser. Please use:

Mortgage Broker Business Plan Template

Written by Dave Lavinsky

Mortgage Broker Business Plan

You’ve come to the right place to create your Mortgage Broker business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Mortgage Broker companies.

Below is a template to help you create each section of your Mortgage Broker business plan.

Executive Summary

Business overview.

Davidson Mortgage, located in Tucson, Arizona, is a new mortgage brokerage specializing in residential mortgages. The company will operate in a professional setting, conveniently located next to several banks in the center of the shopping district. We offer a wide range of services to help our clients get a mortgage, including finding loan options, applying for the loans on the clients’ behalf, and completing all the paperwork. We strive to serve our clients with the utmost empathy to ensure they get the best mortgage for their situation.

Davidson Mortgage is headed by Harold Davidson. He is an MBA graduate from Arizona State University with 20 years of experience working in the finance industry. His passion is to help his clients qualify for their dream homes and provide them with a smooth process from start to finish.

Davidson Mortgage will focus on providing superior service to all of its clients to ensure they get the best mortgage possible. Our services include finding loan options, applying for loans on behalf of customers, and completing closing paperwork. Since customer service is our top priority, we will keep in touch with our clients after they have closed on the mortgage. Furthermore, Harold will create webinars, online courses, and other content to educate his clients and the local community on the mortgage lending process.

Customer Focus

Davidson Mortgage will primarily serve homebuyers interested in properties located in the Tucson, Arizona area. Tucson is a growing city with thousands of residents eager to purchase a new home. We expect our clientele to be equal parts first-time home buyers and existing homeowners.

Management Team

Davidson Mortgage is run by Harold Davidson. Harold has been a licensed mortgage broker for the past 20 years, working for several large firms. However, throughout his career, he desired to have a closer connection with his clients as well as have more flexibility to help them get their dream homes. He started this company in order to achieve those goals. In addition to his valuable experience, Harold also holds an MBA from Arizona State University.

Harold is joined by Bethany Peterson. She will serve as the company’s full-time assistant, who, among other things, will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

Success Factors

Davidson Mortgage is uniquely qualified to succeed due to the following reasons:

- Davidson Mortgage will fill a specific market niche in the growing community we are entering. In addition, we have surveyed local realtors and homebuyers and received extremely positive feedback saying that they would consider making use of our services when launched.

- Our location is in an economically vibrant area where new home sales are on the rise, and turnover in homes and rentals occurs often due to the upward mobility of residents.

- The management team has a track record of success in the mortgage brokerage business.

- The local area is currently underserved and has few independent mortgage brokers offering high customer service to homebuyers.

Financial Highlights

Davidson Mortgage is seeking a total funding of $250,000 of debt capital to open its office. The capital will be used for funding capital expenditures and location build-out, hiring initial employees, marketing expenses, and working capital.

Specifically, these funds will be used as follows:

- Office design/build: $50,000

- Three months of overhead expenses (payroll, rent, utilities): $100,00

- Marketing expenses: $50,000

- Working capital: $50,000

Company Overview

Who is davidson mortgage, davidson mortgage history.

After surveying the local customer base and finding a potential office, Harold Davidson incorporated Davidson Mortgage as an S-Corporation on 1/1/2023.

The business is currently being run out of Harold’s home office, but once the lease on Davidson Mortgage’s office location is finalized, all operations will be run from there.

Since incorporation, Davidson Mortgage has achieved the following milestones:

- Found office space and signed Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired an interior designer for the decor and furniture layout

- Determined equipment and fixture requirements

Davidson Mortgage Services

Industry analysis.

Despite the pandemic hurting several industries, the mortgage brokers industry still performed strong and is projected to continue to do so. Last year, U.S. mortgage brokerages brought in revenues of $11.7 billion and employed 47,000 people. There were just over 12,000 businesses in this market.

However, the mortgage broker industry is highly fragmented, with the top two companies accounting for just over 11% of industry revenue. Furthermore, mortgage interest rates are on the rise, as well as housing prices, preventing many people from buying houses and applying for mortgages. These two factors significantly stunt the industry at present.

Despite these challenges, the industry is still projected to increase moderately throughout the rest of the decade. Though larger firms may dominate revenue and clientele, studies and surveys show that clients don’t necessarily favor working with large firms. Providing excellent service and personal touches throughout the process can help small firms succeed in the industry.

Customer Analysis

Demographic profile of target market.

Davidson Mortgage will primarily serve the residents of Tucson, Arizona. The area we serve has a significant population of people who are searching for their first home, as well as families and individuals who need a new home.

The precise demographics for Tucson, Arizona are:

Customer Segmentation

Davidson Mortgage will primarily target the following customer segments:

- Existing homeowners

- First-time home buyers

Competitive Analysis

Direct and indirect competitors.

Davidson Mortgage will face competition from other companies with similar business profiles. A description of each competitor company is below.

The Loan Store

Established in 2010, The Loan Store originates, finances, and sells mortgage and non-mortgage lending products throughout the United States. It offers a range of consumer credit products, such as home loan products, home equity loans, and unsecured personal loans, as well as home and personal loan servicing. The company claims to be one of the largest private, independent retail mortgage lenders in the U.S. Its current business channels include direct lending, affinity, branch retail, and servicing.

However, agents working with The Loan Store experience high turnover, resulting in little concern for maintaining ongoing relationships with clients. Also, the agents themselves are mixed in quality, ranging from part-time brokers with little experience or sales records to full-time brokers with long-term experience. There is no systematic company method for passing on knowledge from experienced to inexperienced brokers as all are competing with each other, to a certain extent, for commissions.

Direct Loan Connection

Founded in 2006, Direct Loan Connection (DLC) employs licensed mortgage professionals who have access to multiple lending institutions, including banks, credit unions, and trust companies. This access enables the company to offer a vast array of available mortgage products – ranging from first-time homebuyer programs to financing for the self-employed to financing for those with credit blemishes. In addition, to help homebuyers and homeowners, DLC offers commercial mortgages.

Though they are a local leader in the premium end of the market, they refuse to negotiate their broker’s fees and sometimes lose potential clients because of this. Davidson Mortgage’s fees will be far more reasonable.

Supreme Mortgage

Supreme Mortgage specializes in mortgage brokering and is committed to helping homebuyers, and homeowners get the best mortgage with the lowest interest rate. The brokerage works with more than 40 lenders who compete to provide mortgages and who pay Supreme Mortgage’s fee so that clients receive the service free of charge.

Some reviews of Supreme Mortgage point out the low-quality service offered by brokers, who have little training in customer service. Furthermore, Supreme Mortgage does not attempt to maintain long-term relationships with customers who will eventually purchase another home.

Competitive Advantage

Davidson Mortgage enjoys several advantages over its competitors. These advantages include:

- Location: Davidson Mortgage’s location is near the center of town, in the shopping district of the city. It is visible from the street, where many residents shop for both day-to-day and luxury items.

- Client-oriented service: Davidson Mortgage will have a full-time assistant to keep in contact with clients and answer their everyday questions. Harold Davidson realizes the importance of accessibility to his clients and will further keep in touch with his clients through monthly seminars on topics of interest.

- Management: Harold Davidson has been extremely successful working in the mortgage brokerage sector and will be able to use his previous experience to grant his clients detailed insight into the world of home loans. His unique qualifications will serve customers in a much more sophisticated manner than many of Davidson Mortgage’s competitors.

- Relationships: Having lived in the community for 25 years, Harold Davidson knows many of the local leaders, newspapers, and other influencers.

Marketing Plan

Davidson Mortgage will use several strategies to promote its name and develop its brand. By using an integrated marketing strategy, Davidson Mortgage will win clients and develop consistent revenue streams.

Brand & Value Proposition

The Davidson Mortgage brand will focus on the company’s unique value proposition:

- Client-focused residential mortgage brokerage services, where the company’s interests are aligned with the customer

- Service built on long-term relationships and personal attention

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Davidson Mortgage is as follows:

Website/SEO

Davidson Mortgage will invest heavily in developing a professional website that displays all of the features and benefits of working with the mortgage broker. It will also invest heavily in SEO so the brand’s website will appear at the top of search engine results.

Social Media

Davidson Mortgage will invest heavily in a social media advertising campaign. Harold and Bethany will create the company’s social media accounts and invest in ads on all social media platforms. It will use targeted marketing to appeal to the target demographics.

Davidson Mortgage understands that the best promotion comes from satisfied customers. The company will work to partner with local realtors by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

By offering webinars and courses on topics of interest in the office or other locations, Harold Davidson will encourage residents in the community to become comfortable with the expertise and character of Davidson Mortgage. These webinars will generally be offered free of charge as general promotion and for direct networking.

Davidson Mortgage’s pricing will rely on the standard industry rates in order to be perceived as neither a luxury nor a discount broker. The standard rate for brokering a mortgage is 1-2% of the loan amount. By seeking quality clients and maintaining long-term relationships with them, Davidson Mortgage will fend off pressure to discount their rates, even in down markets.

Operations Plan

The following will be the operations plan for Davidson Mortgage.

Operation Functions:

- Harold Davidson is the founder and will operate as the President of the company. He will be in charge of all the general operations and executive functions within the company. Furthermore, until he hires additional staff, he will personally help all clients who agree to utilize the company’s services.

- Harold is assisted by his long-term assistant Bethany Peterson. She will serve as the company’s full-time assistant and will manage the company website, coordinate scheduling, and answer basic client questions. Bethany has experience working with C-level executives and has spent significant time as an administrator.

- As the business grows and Harold takes on more clients, he will hire other mortgage brokers to assist him.

Milestones:

The following are a series of steps that will lead to the company’s long-term success. Davidson Mortgage expects to achieve the following milestones in the next six months:

3/202X Finalize lease agreement

4/202X Design and build out Davidson Mortgage office

5/202X Hire and train initial staff

6/202X Kickoff of promotional campaign

7/202X Reach break-even

8/202X Reach 25 ongoing clients

Financial Plan

Key revenue & costs.

Davidson Mortgage’s revenues will come primarily from the commissions earned from residential mortgage sales.

The major cost drivers for the company will include employee salaries, lease payments, and marketing expenses.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Annual lease: $30,000

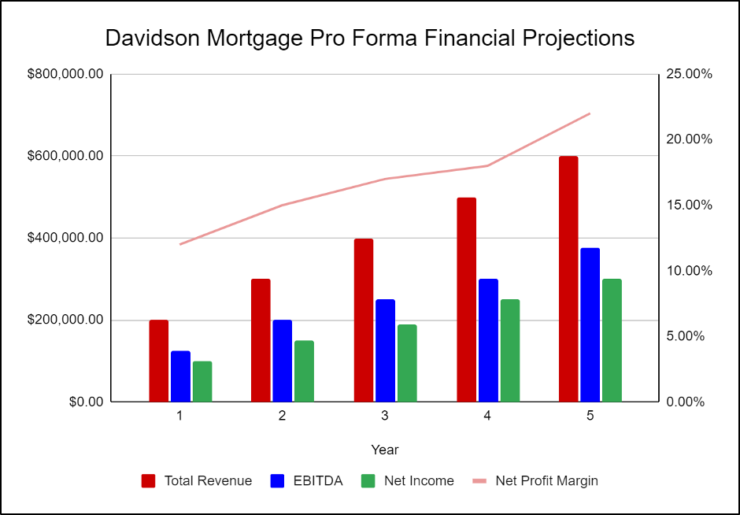

Financial Projections

Income statement, balance sheet, cash flow statement, mortgage broker business plan faqs, what is a mortgage broker business plan.

A mortgage broker business plan is a plan to start and/or grow your mortgage broker business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Mortgage Broker business plan using our Mortgage Broker Business Plan Template here .

What are the Main Types of Mortgage Broker Businesses?

There are a number of different kinds of mortgage broker businesses , some examples include: Retail Mortgage Broker, Business/Corporate Mortgage Broker, or Private Mortgage Brokers.

How Do You Get Funding for Your Mortgage Broker Business Plan?

Mortgage Broker businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Mortgage Broker Business?

Starting a mortgage broker business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Mortgage Broker Business Plan - The first step in starting a business is to create a detailed mortgage broker business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your mortgage broker business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your mortgage broker business is in compliance with local laws.

3. Register Your Mortgage Broker Business - Once you have chosen a legal structure, the next step is to register your mortgage broker business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your mortgage broker business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Mortgage Broker Equipment & Supplies - In order to start your mortgage broker business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your mortgage broker business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful mortgage broker business:

- How to Start a Mortgage Broker Business

IMAGES

COMMENTS

Loan Officer Business Plan. You’ve come to the right place to create your Loan Officer business plan. We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Loan Officer business. You can download the Loan Officer business plan (including a full, customizable financial model)

Develop a business plan; Choose the legal structure; Secure startup funding (if required) Secure a location; Register your company with the IRS; Open a business bank account; Get a business...

The executive summary of a loan officer business plan worksheet provides a comprehensive overview of the entire plan. The provided sentence lists various components of a summary, including the mission, goals, products and services, financial projections, and competitive analysis.

There’s no right or wrong way to write your mortgage broker business plan, but there are some key sections you’ll want to include to make the most of it. A plan that’s tailored to fit your industry acts as a roadmap that can help you structure your business and scale fast.

Written by Dave Lavinsky. Mortgage Broker Business Plan. You’ve come to the right place to create your Mortgage Broker business plan. We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Mortgage Broker companies.