Financial Services Case Interview: 4 Tips on How to Pass

- Last Updated December, 2021

A good case structure will get through any consulting case interview question. But some industries have specific issues that make it a lot easier to pass the case if you know what to expect. Financial services case interviews are like that.

Government regulation of financial institutions, their corporate structure, and business models are quite different from other industries, so it’s good to brush up on the financial services industry before facing a case.

In this article, we’ll discuss:

- Differences between financial services firms and other firms.

- Common types of financial services case interviews.

- A financial services case example.

- 4 Tips on acing your financial services case interview.

Let’s get started!

Differences Between Financial Services Firms & Other Firms

Financial services case interview example, common types of financial services case interviews.

5 Tips On Acing Your Financial Services Case Interview

Financial services firms don’t make cars or serve hamburgers to customers to generate revenue the way an auto company or a fast-food restaurant does. Instead, they provide retail customers (individual consumers – people like you and me) and businesses with loans, deposit accounts, or insurance policies. Or they help them invest their money in stocks, bonds, or other financial instruments.

Corporate Structure

There are many different types of financial institutions and they exist both on paper (e.g., online banks) and in actual brick-and-mortar form (e.g., retail bank branches with ATMs). Typical financial institutions include:

- Commercial banks (provide business loans, home mortgage loans, and savings/checking accounts)

- Investment banks and securities firms (help people buy and sell stocks and bonds and help companies issue them)

- Insurance companies (provide insurance for homes, cars, business risk, health, etc.)

- Mutual funds and pension funds (manage retirement savings or savings for other goals, e.g., education, health, etc., by investing it in stocks, bonds, and other assets)

- Microfinance companies (provide small loans to populations underserved by traditional financial institutions)

Businesses that “make stuff” have a factory where parts go in one end and cars or hamburgers go out the other. Financial institutions, on the other hand, have people who handle the bank accounts, stocks purchases/sales, or insurance products that they provide, and all the investment decisions and paperwork that go with that service.

Business Model

Unlike other sectors, the financial services industry’s business model is largely based on interest, fees, and premiums. Don’t get bogged down by the variety of products and services that a financial institution has to offer. You only need to remember:

- Key income sources: interest earned by selling retail and corporate loans, premiums earned on insurance policies, fees earned on financial advisory (e.g., stockbroking) or on deposit accounts, etc.

- Key costs: interest paid on deposits from retail investors and corporates, insurance claims/payouts, branch operations, manpower, SG&A, etc.

Always confirm and validate the drivers of revenue and cost with your interviewer before jumping to solving any financial services case.

Regulation and Risk

A well-functioning financial system is vital for the economy, businesses, and consumers. When a financial institution fails, it can create problems for the wider economy as the 2007-2009 financial crisis showed us. Financial services firms, therefore, attract high levels of scrutiny and oversight.

Government regulation helps make sure that these institutions have good management so they don’t make bad investments or become too risky. They require that financial institutions hold “shock absorbers” (i.e., capital) to help deal with bad investments. Each country has its own set of norms and regulations that create the framework and operating model for financial institutions.

In a financial services case, therefore, it’s always important to include regulation as a category in your issue tree. You can check with your interviewer on which aspects of financial regulation and risk are relevant to ensure that ideas you brainstorm in the case won’t break laws. Aligning on this upfront increases your credibility with the interviewer, but regulation is not typically the focus of the case.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

Financial services cases can include revenue growth, cost reduction, or new product introduction like they would for any other industry. They can also include managing the “back office” where financial account information is maintained or stock and bond trades are cleared.

Here are some financial services case interview examples:

- Disconsa – A McKinsey case on developing better financial service offerings for a not-for-profit entity serving remote Mexican communities.

- Internet Bank – An L.E.K. case on product diversification for a large insurance company in Europe.

- Big Bucks Bank – A Deloitte case on technology transformation for a large US-based bank.

- Bank of Zurich – A Deloitte case on developing a strategy to structure the organization’s data program.

We’ve also curated a list of case examples , to help you hone your business problem-solving skills. Head to Our Ultimate Guide to Case Interview Prep to learn what a case interview is and its various stages (i.e., opening, structure, analysis, and conclusion). The best way to get smarter about answering financial services case interview questions is to master this general four-part approach first and then apply financial services specifics as appropriate.

Let’s dive into a financial services case example.

Case Question

“Your client is Go-for-Growth bank, a large bank in a frontier market that wants to rapidly build its agent network to grow revenue for its payment and banking business. How should they go about it?”

First, repeat the main information in the prompt to the interviewer to make sure you got it right, and ask clarifying questions. If you don’t know what a frontier market is or who banking agents are, ask your interviewer.

Frontier market is a classification made by Standard & Poors, a financial rating agency, that’s used to classify less advanced economies in the developing world, e.g., Vietnam, Kenya, Nigeria, Cambodia, etc.

A banking agent is a retail or a postal outlet contracted out by a financial institution (in this case Go-for-Growth bank) to process clients’ transactions. Typically, in less advanced economies, the population has little access to banks but significantly higher interaction with establishments such as pharmacies, grocery stores, post offices, and beauty salons. The agents help the banks get new customers and typically make money on commissions.

Take a moment to develop your own hypothesis for the Go-for-Growth bank case.

Financial Services Case Hypothesis

Your hypothesis could be that a banking agent is a cost-efficient way for the bank to acquire customers and distribute financial products vs. having to set up their own branches across the country (including paying rent for office space and hiring staff in each location).

Next, validate your understanding of the bank’s business model, corporate structure, and applicable regulations. Here, the bank is a traditional commercial bank that wants to add agents as a channel to acquire retail customers and sell traditional financial products and services (e.g., loans, deposits, etc.) Building an agent network is allowed within the regulatory framework of the country.

A great candidate would also establish:

- The purpose of agent acquisition: “Why agents?” “Why now?” and “What is the size of the opportunity (or market) that the bank is chasing?” Here, the interviewer can confirm your hypothesis about agents being cost-efficient vs. Go-for-Growth Bank having to set up brick-and-mortar establishments.

- The size of the opportunity: Establishing an agent network is a big undertaking so it’s worth ensuring the opportunity size is big enough to justify the cost. In this case, the total opportunity size is $3 billion given the country is largely underpenetrated with only 10-20% of the total population of 100+ million having access to financial services, so the opportunity is worth it. (Note that to make this a short case or one that would be appropriate for undergrad summer interns, sizing the market could be the sole focus.)

- The client’s key success metrics : “What does success look like to Go-for-Growth Bank?” Here, you should clarify the target network size and the target timeframe to meet the client’s growth target. Say, your interviewer adds that they want to scale up to a size of 200,000 agents in 2 years to achieve the topline impact of $3+ billion.

You’d now ask for a minute to lay down your thoughts so that you can build your structure.

Take a moment to think about how you would structure this case before reading ahead. That will give you a sense of what business issues come naturally to you in a financial services case and where you need to push your thinking further.

Here’s a sample case structure:

- Which services/revenue streams should Go-for-Growth Bank market via the agents and to which end customers?

- Which of the existing products and services are most profitable?

- Which products and services don’t need extensive training for agents to sell?

- Which products and services best meet the needs of the customers who agents serve (e.g., payments and basic deposit accounts and loans, not more sophisticated financial products).

- Is there a segmentation of customers who should be targeted by the agents?

- Will the bank need to tweak their products to make them profitable to customers acquired through the agent network? (An A+ answer would note that clients with low incomes or lumpy earnings might need bank accounts with lower minimums.)

- Is there opportunity for cross-sell/ up-sell of products to customers?

- How to reach the agents? (sales force/feet on the ground vs. email campaign)

- How to get them interested in becoming a channel partner? Will one-time, up-front incentives be required?

- What is the process to get them on board?

- What cut can be given to the agents (so the bank continues to be profitable)?

- What will be meaningful for the agents?

- Can gamification reward schemes be introduced?

- Would certification or co-branding, such as a sticker to display the agent’s affiliation with Go-for-Growth Bank, appeal to potential agents?

- What banking products can be sold to the agents?

- Can the agents be offered discounted pricing on the products?

- What is the up-front effort/cost to acquire agents?

- What is the expected revenue or profit uplift per agent to the bank?

- How much should each agent sell annually/monthly to continue being profitable to the bank?

- What are the recurring costs to maintain the agent network?

- Which metrics should be used for tracking performance?

- Can low performers be segmented further based on their potential?

- What will be the plan of action for consistent low-performing agents?

- Which training(s) and products’ brochures should be offered to agents to keep the customer conversion rate high?

- How can we create a community within the agent network to provide product information updates and support agency retention (such as Facebook or WhatsApp groups)?

- How can we set up the right operating model for providing cash to agents as needed?

- How can we make sure the agents have the right processes in place to ensure Go-for-Growth Bank’s cash is safeguarded?

This structure is quite exhaustive. Don’t worry if you didn’t have every bullet point in your structure. In practice, since you only have about 2 minutes to lay this out, you don’t need to write full questions on your piece of paper but only a couple of keywords for each bucket and each sub-bucket.

We recommend going through our article on Issue Trees to learn more about how to create a case structure.

After you lay out your case structure, your interviewer would prompt you to brainstorm which agents to acquire and which products and services to sell, so if you’ve already alluded to it in your structure, that gives you a headstart.

Here, your interviewer would hand you a few exhibits that detail population density by region, classification of the retail stores with metrics on annual revenue, footfall, etc., a list of Go-for-Growth Bank’s products and the associated profitability of each product, and the results of a survey that details the wishlist of financial services and products by underserved consumers and small businesses.

On brainstorming ideas, you’ll be rated on both your structure and your creativity. Make sure to always articulate the logic behind your ideas, using your past experience, analogies, or your general knowledge.

Ideas for Increasing Go-for-Growth Bank’s Revenue

- Target the agents that receive the highest customer footfall (grocery stores) AND/OR agents that are well-versed in handling legal/administrative documentation (postal outlets). Let’s assume the bank can cover 60% of the untapped population by acquiring grocery stores and postal outlets as agents in the Tier 2 cities.

- Sell products that are profitable to the bank and at the same time relevant to the customers (payment transfer, insurance products, working capital loans, home loans, etc.)

- Onboard agents as customers first to establish other customers’ trust in the bank’s products. Given it’s a less advanced economy where customers rely on heavy interactions with retail stores for information on financial products, word-of-mouth from the agent will establish trust upfront and lead to longer lifetime value (LTV) for the bank.

Ideas on Incentives for Agents

- Provide commission to agents of 0.15% on each insurance/loan product.

- Organize monthly or quarterly leagues with leaderboards to recognize top performers, e.g., highest transaction value, highest growth, highest customer acquisition, etc.

- Leverage social media to build an agent community via Facebook or WhatsApp groups. These groups can create engagement and serve as an efficient mode of communication, allowing the bank to solicit agent referrals and publish leaderboards.

- Introduce friendly competitions like “Best shop-front display” to increase the visibility of Go-for-Growth Bank’s products.

- Test if affiliation with the Bank’s brand in the country is a motivator for agents.

You could classify “high performers” as agents with transaction volume and transaction value in the top 10%. Agent’s potential information (e.g., footfall, turnover, location potential) can also be collected to have a more nuanced segmentation for tracking and governance purposes.

Running the Numbers on Go-for-Growth’s Agent Strategy

Finally, you should consider pressure testing the unit economics of each agent to ensure the bank’s targets are met. To do this, you’ll need to leverage the information you were provided during the opening of the case as well as make some assumptions. A quick way to round this up would be:

- Total # of customers = % of population targeted * Annual conversion rate per agent = 60% of population targeted * 10% conversion rate = 60% * (80% [% of population currently underserved by financial institutions] * 100 million [total population]) * 10% [conversion rate]= 4.8 million customers

- Revenue per customer = Avg # of banking products sold per customer * Annual price per product = 1.5 avg # of products * $500 price 1 = $750 annual revenue per customer.

1 Based on data from interviewer.

- Therefore, Topline impact = 4.8 million * $750 = $3600 million = $3.6 billion (validated as this meets the $3+ billion target)

Keep drawing on the interviewer to test the assumptions and/or ask for industry benchmarks on conversion rates, average number of products, prices, etc. to make your analysis rigorous.

A great candidate would also establish bottom line impact for the bank:

- Total bottom line opportunity = Topline opportunity * Profit margin = $3.6 billion * (5-7% profit margin – 0.15% cut to agents) = $175 to $250 million.

“Go-for-Growth Bank’s CEO walks into the team room and asks you about your findings. What do you tell her?”

You should lead with your recommendation to the client and detail the key reasons supporting that recommendation. Then, mention any risks to consider which might impact the outcome and the next steps that you’d suggest to double down on the analysis. There is no need to repeat everything you covered during the case: be succinct and stick to the key arguments.

What would you say? Give it a try before reading ahead.

“We recommend acquiring the grocery stores and postal outlets in the Tier-2 cities as agents for the bank to help sell loan and insurance products at a profit margin of 5-7% to retail and small business clients with a 0.15% cut to the agents. This way, we cover 60%+ of the underpenetrated population with our highest profitability products and provide an additional source of income to the agents at no additional cost to them. The high perceived value in being affiliated with the Go-for-Growth Bank brand will attract agent interest. This will allow us to add $3 billion to the top line and $175-$250 million to the bottom line annually.

One concern we’d like to address next is whether competitors could potentially take away our first-mover advantage by luring away agents with better commissions, especially in densely populous areas. We should address this potential problem with contract terms and incentives in our agent agreements.”

Congrats, you made it through your first financial services case interview!

4 Tips On Acing Your Financial Services Case Interview

1. validate corporate structure and business model.

Always remember to validate the corporate structure and business model of the financial institution in your financial services case interview. You don’t want to end up confusing a commercial bank with an investment bank!

As a candidate, you’re not expected to know everything. Therefore, ask as many questions as possible to understand what you’re really dealing with. For instance, you could say, “Hey, I’m not familiar with the corporate structure and the business model of a pension fund, could you please explain that to me so I can start to understand the drivers of value for the business a bit better.”

2. Align on the Success Metrics

To be able to reach your destination, you must know what the destination is. This is especially relevant in the financial services case interview, where there could be dozens of metrics that can be solved for. Therefore, it’s critical to align on the North Star with your interviewer so you can solve for the target the client cares most about.

3. Apply First-Principles Thinking to Structure the Case

To navigate through a financial services case interview, you need to think on your toes. Chances are the corporate structure, business model, regulatory environment, and risk aspects will be unfamiliar to you. Instead of feeling bogged down by these nuances, take a big picture lens and apply first-principles thinking to structure the case.

You may not know the industry terms such as “net interest margin” or “dividend-adjusted return,” but you can always ask the first-principles question on “What drives value for the business?” and engage with your interviewer to identify the underlying sources of value.

Demonstrating intellectual curiosity in financial services cases will hold you in good stead. Start with “Why?” then get to the “What?” and only then solve for “How?”

4. Remain Calm and Confident

It’s easy to lose nerve when you’re out of your comfort zone. If financial services case interviews tend to throw you off, practice staying calm while solving the case. During your practice, monitor yourself for signs of nervousness. Pause, take a deep breath, smile, and then continue solving the case. The more practice you put in, the calmer your nerves will become. Also, include elements such as reading financial news, financial statements, etc., into your case prep so that you become familiar with industry terminologies. Incorporating these habits into your holistic practice will boost your confidence naturally.

– – – – –

In this article, we’ve covered:

- Key differences between financial services firms and other firms,

- Common types of financial services case interviews,

- A financial services case interview example, and

- 4 tips on acing your financial services case interview.

Still have questions?

If you have more questions about financial services case interviews, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for consulting case interviews found the following pages helpful:

- Our Ultimate Guide to Case Interview Prep

- Issue Trees

- Market-sizing Case Interview

- Supply Chain Case Interview

Help with Case Study Interview Prep

Thanks for turning to My Consulting Offer for advice on case study interview prep. My Consulting Offer has helped almost 85% of the people we’ve worked with to get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how Julien was able to get his offer from Capital One.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

- Contact us now!

- Listen Live

- Team Members

- Buy Vendor Booth!

Finance Case Study Example | Finance Interview Technical Questions

Written by abc audio all rights reserved on february 23, 2022.

My Communities: ► Email list: http://bit.ly/joinericnewsletter ► Discord: https://discord.gg/gHghhVcW3S

Related Financial Modeling Videos: ► Finance Interview Prep Series | Crush Your Interview: http://bit.ly/fin_intervw_prep ► Build a 3 Statement Financial Model: https://youtu.be/xlXDZyZ9azk ► Demystifying the Cash Flow Statement: https://youtu.be/BS6_RsuqzwE ____________________________________________

One of the quickest and most common ways to evaluate candidates for analyst roles is to give them a finance case study during an interview. Case studies force us to both crunch the numbers quantitatively to demonstrate our knowledge but also think about the big picture and make recommendations – they are a lot of fun!

For these reasons, they are common in technical finance interviews, university projects, MBA programs, etc.

In this video, I help you solve a finance interview case study for a software platform that is considering a revenue share partnership with another company – this is the type of case study would be common at a FAANG or big tech company.

All case studies start the same way – they present you with a set of facts during some pivotal moment at a company where they are trying to decide whether they want to do some new thing (be it internally, or externally).

Regardless of the specifics – all case studies in finance are effectively asking you to do the same thing – build a simple income statement, differentiate COGS vs. OPEX expenses, calculate the depreciation for a CAPEX investment, and evaluate cash vs. accrual accounting payback period.

At the end, you are expected to synthesize your analysis into an open-ended recommendation about what the company should do.

Now that you understand the basic format of finance case studies, let’s walk through this example where I help you develop a framework of ideas to analyze situations with.

1:04 finance case study model setup (all case studies are basically asking the same info) 3:55 building the income statement & analyzing margins 10:50 calculating depreciation schedule for CAPEX 16:15 cash flow analysis & payback period vs. p&l 18:12 key quantitative metrics for making a case study recommendation 21:10 key qualitative metrics for making a case study recommendation 24:36 my finance case study recommendation

By the end of this video, you will understand how to approach finance case studies, crunch the numbers, and make recommendations in your future interviews – I guarantee it!

If you have questions – please leave a comment below and I’ll try to help. Cheers!

► Subscribe for more finance videos: https://bit.ly/EricAndrewsSubscribe

#financecasestudy #financeinterviews #saas

The post Finance Case Study Example | Finance Interview Technical Questions appeared first on Correct Success .

ABC Audio All Rights Reserved

Reader's opinions

Leave a reply.

You must be logged in to post a comment.

You may also like

Start your new year and journey with occc.

Luck Wilson

January 3, 2024

Expand the Child Tax Credit

December 18, 2022

6 surprising ways to use your on-property credits at hotels

December 17, 2022

Continue reading

Βδκδβo¥ζ daily is live.

Previous post

2022 nfl free agency: russell wilson, matt ryan among eight star players who should be traded this offseason.

Current track

35 Case Interviews Examples from MBB / Big Four Firms

Studying case interview examples is one of the first steps in preparing for the management consulting recruitment process. If you don’t want to spend hours searching the web, this article presents a comprehensive and convenient list for you – with 35 example cases, 16 case books, along with a case video accompanied by detailed feedback on tips and techniques.

A clear understanding of “what is a case interview” is essential for effective use of these examples. I suggest reading our Case Interview 101 guide, if you haven’t done so.

McKinsey case interview examples

Mckinsey practice cases.

- Diconsa Case

- Electro-Light Case

- GlobaPharm Case

- National Education Case

What should I know about McKinsey Case interviews?

At McKinsey, case interviews often follow the interviewer-led format , where the interviewer asks you multiple questions for you to answer with short pitches.

How do you nail these cases? Since the questions can be grouped into predictable types, an efficient approach is to master each question type. However, do that after you’ve mastered the case interview fundamentals!

For a detailed guide on interviewer-led cases, check out our article on McKinsey Case Interview .

BCG & Bain case interview examples

Bcg practice cases.

- BCG – Written Case – Chateau Boomerang

Bain practice cases

- Bain – Coffee Shop Co.

- Bain – Fashion Co.

- Bain – Mock Interview – Associate Consultant

- Bain – Mock Interview – Consultant

What should I know about BCG & Bain case interviews?

Unlike McKinsey, BCG and Bain case interviews typically follow the candidate-led format – which is the opposite of interviewer-led, with the candidate driving the case progress by actively breaking down problems in their own way.

The key to acing candidate-led cases is to master the case interview fundamental concepts as well as the frameworks.

Some BCG and Bain offices also utilize written case interviews – you have to go through a pile of data slides, select the most relevant ones to answer a set of interviewer questions, then deliver those answers in a presentation.

For a detailed guide on candidate-led cases, check out our article on BCG & Bain Case Interview .

Deloitte case interview examples

Deloitte practice cases.

Undergrad Cases

- Human Capital – Technology Institute

- Human Capital – Agency V

- Strategy – Federal Benefits Provider

- Strategy – Extreme Athletes

- Technology – Green Apron

- Technology – Big Bucks Bank

- Technology – Top Engine

- Technology – Finance Agency

Advanced Cases

- Human Capital – Civil Cargo Bureau

- Human Capital – Capital Airlines

- Strategy – Club Co

- Strategy – Health Agency

- Technology – Waste Management

- Technology – Bank of Zurich

- Technology – Galaxy Fitness

What should I know about Deloitte case interviews?

Case interviews at Deloitte also lean towards the candidate-led format like BCG and Bain.

The Deloitte consultant recruitment process also features group case interviews , which not only test analytical skills but also place a great deal on interpersonal handling.

Accenture case interview examples

Accenture divides its cases into three types with very cool-sounding names.

Sorted in descending order of popularity, they are:

These are similar to candidate-led cases at Bain and BCG. albeit shorter – the key is to develop a suitable framework and ask the right questions to extract data from the interviewer.

These are similar to the market-sizing and guesstimate questions asked in interviewer-led cases – demonstrate your calculations in structured, clear-cut, logical steps and you’ll nail the case.

These cases have you sort through a deluge of data to draw solutions; however, this type of case is rare.

Capital One case interview examples

Capital One is the odd one on this list – it is a bank-holding company. Nonetheless, this being one of the biggest banks in America, it’s interesting to see how its cases differ from the consulting ones.

Having gone through Capital One’s guide to its cases, I can’t help but notice the less-MECE structure of the sample answers. Additionally, there seems to be a greater focus on the numbers.

Nonetheless, having a solid knowledge of the basics of case interviews will not hurt you – if anything, your presentation will be much more in-depth, comprehensive, and understandable!

See Capital One Business Analyst Case Interview for an example case and answers.

Other firms case interview examples

Besides the leading ones, we have some examples from other major consulting firms as well.

- Oliver Wyman – Wumbleworld

- Oliver Wyman – Aqualine

- LEK – Cinema

- LEK – Market Sizing

- Kearney – Promotional Planning

- OC&C – Imported Spirits

- OC&C – Leisure Clubs

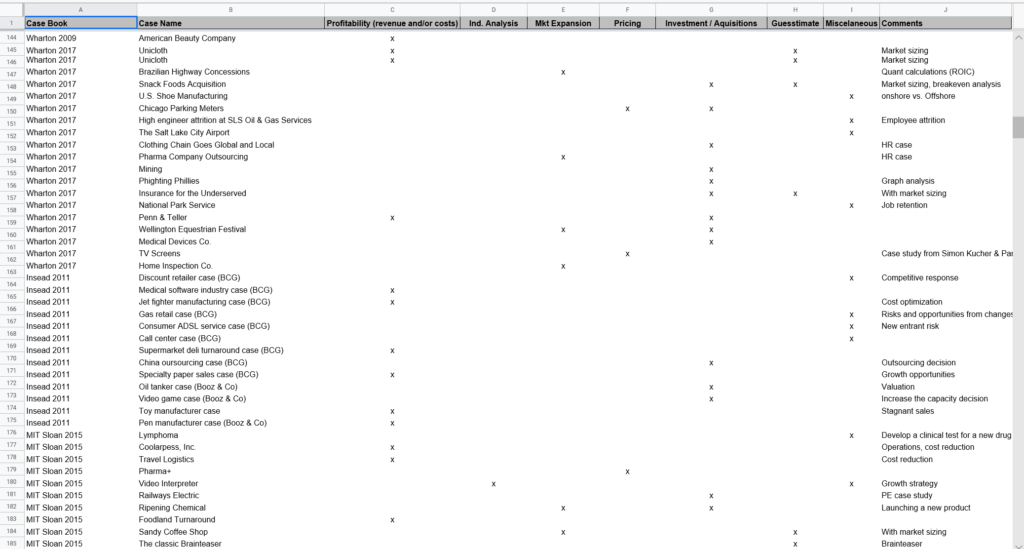

Consulting clubs case books

In addition to official cases, here are a few case books you can use as learning materials.

Do keep in mind: don’t base your study on frameworks and individual case types, but master the fundamentals so you can tackle any kind of case.

- Wharton Consulting Club Case Book

- Tuck Consulting Club Case Book

- MIT Sloan Consulting Club Case Book

- LBS Consulting Club Case Book

- Kellogg Consulting Club Case Book

- INSEAD Consulting Club Case Book

- Harvard Consulting Club Case Book

- ESADE Consulting Club Case Book

- Darden Consulting Club Case Book

- Berkeley Consulting Club Case Book

- Notre-Dame Consulting Club Case Book

- Illinois Consulting Club Case Book

- Columbia Consulting Club Case Book

- Duke Consulting Club Case Book

- Ross Consulting Club Case Book

- Kearney Case Book

Case interview example – Case video

The limitation of most official case interview examples is that they are either too short and vague, or in text format, or both.

To solve that problem for you, we’ve extracted a 30-minute-long, feedback-rich case sample from our Case Interview End-to-End Secrets Program .

This is a candidate-led, profitability case on an internet music broadcasting company called Pandora.

In 30 minutes, this candidate demonstrates the exact kind of shortcoming that most candidates suffer during real case interviews – they come in with sharp business senses, then hurt their own chances with inadequate techniques.

Here are seven notable areas where the candidate (and you) can improve:

Thanking Throughout the case, as especially in the opening, he should have shown more appreciation for the time the interviewer spent with him.

Structured opening The candidate’s opening of the case feels unstructured. He could have improved it by not mixing the playback and clarification parts. You can learn to nail the case in a 3-minute start through this video on How to Open Any Case Perfectly .

Explicitness A lot of the candidate’s thought process remains in his head; in a case interview, it’s better to be as explicit as possible – draw your issue tree out and point to it as you speak; state your hypothesis when you move into a branch; when you receive data, acknowledge it out loud.

Avoiding silence The silence in his case performance is too long, including his timeout and various gaps in his speech; either ask for timeout (and keep it as short as possible) or think out loud to fill those gaps.

Proactivity The candidate relies too much on the interviewer (e.g: asking for data when it can easily be calculated); you don’t want to appear lazy before your interviewer, so avoid this.

Avoiding repeating mistakes Making one mistake twice is a big no-no in consulting interviews; one key part of the consulting skill set is the ability to learn, and repeating your mistakes (especially if the interviewer has pointed it out) makes you look like someone who doesn’t learn.

Note-taking Given the mistakes this candidate makes, he’s probably not taking his notes well. I can show you how to get it right if you watch this video on Case Interview Note-Taking .

Nonetheless, there are three good points you can learn from the candidate:

The candidate sums up what he’s covered and announces his upcoming approach at the start and at key points in the case – this is a very good habit that gives you a sense of direction and shows that you’re an organized person.

The candidate performs a “reality check” on whether his actions match the issue tree; in a case interview it’s easy to lose track of what you’re doing, so remember to do this every once in a while.

The candidate prompts the interviewer to give out more data than he asked for; if anything, this actually matches a habit of real consultants, and if you’re lucky, your interviewer may actually give out important pieces you haven’t thought of.

These are only part of the “ninja tips” taught In our Case Interview E2E Secrets Program – besides the math and business intuition for long-term development, a key feature is the instant-result tips and techniques for case interviews.

Once you’ve mastered them, you can nail any case they throw at you!

For more “quality” practice, let’s have a mock case interview with former consultants from McKinsey, BCG, Bain, Oliver Wyman, Strategy& and many other consulting firms. They will help you identify your problem areas and give you actionable feedback, making your preparation much easier and faster.

Hi! This is Kim and welcome to another performance in the Tips & Techniques part of our amazing End-to-end program. You are about to hear a really interesting performance.

There is a common Myth that Profitability cases are easier. Well, for beginners, that’s may make sense, but I would argue that Profitability cases can be really tricky and candidates without good foundation will make about the same level of mistakes regardless of type of cases given.

The profitability case we are about to watch will show that. It’s a very unconventional

Profitability. It started out like a typical one but getting more and more tricky toward the end.

The candidate is fairly good in term of business intuition, but the Tips & Techniques aspect needs a lot of fine tune! Now let’s go ahead and get started!

It’s actually a little better to playback the case information and ask clarifications. The candidate does not distinguish between the two and do both at a same time. Also, the candidate was asking these clarifications in an unorganized and unstructured fashion. This is not something terrible, but could have been better, especially when this is the very first part of the case, where the crucial first impression is being formed.

My pitch would sound like this:

“That’s a very interesting problem and I am happy to get the chance to solve it. First of all let me tell you my understanding of the case context and key objectives. Then I would like to ask a few clarifying questions regarding a few terminology and concepts. Both of these are to make sure that I will be solving the right problem.

So here is my understanding of the case: The client is ABC. Here are some DEF facts about the situation we just talked about. And the key case question is XYZ.

Does that correctly and adequately summarize the case?”

Once the interviewer confirms, I would move to the clarification part as follows: “Now I would like to ask a few clarification questions. There are three of them: No 1, … No 2, … and No 3, …”

You may see above pitch as obvious but that’s a perfect example of how you should open any cases. Every details matters. We will point out those details in just a second. But before we do that, it’s actually very helpful if you can go back, listen carefully to the above pitch, and try to point out the great components yourselves. Only after that, go back to this point and learn it all together.

Alright, let’s break down the perfect opening.

First of all, you hear me say: “That’s a very interesting problem and I am happy to get a chance to solve it”. This seems trivial but very beneficial in multiple ways:

1. I bought myself a couple of seconds to calm down and get focused. 2. By nature, we as human unconsciously like those who give us compliments. Nothing better than opening the case with a modest compliment to the interviewer.

And (c) I showed my great attitude towards the case, which the interviewer would assume is the same for real future consulting business problems.

You should do that in your interviews too. Say it and accompany it with the best smile you can give. It shows that you are not afraid of any problems. In fact, you love them and you are always ready for them.

Secondly, I did what I refer to as the “map habit”, which is to always say what you are about to do and then do it. Just like somebody in the car showing the drivers the route before cruising on the road. The driver would love it. This is where I said: “Let me tell you my understanding of the case context and key objectives. Then ABC…”.

Third, right at the beginning of the case, I try to be crystal clear and easy to follow. I don’t let the interviewer confused between playing the case vs. asking clarification questions. I distinguish between the two really carefully. This habit probably doesn’t change the outcome of how the case goes that much, but it certainly significantly changes the impression the interviewer has of me.

Fourth, in playing back the case, each person would have a different way to re-phrase. But there are three buckets to always include:

1. Who is the client 2. The facts regarding the client and the situation and (c) The key question and the objective of the case.

Fifth, after playing the case context and objectives, I pause for a second and ALIGN with the interviewer: “Does it correctly and adequately summarize the case?”. This is a habit that every consulting manager loves for young consultants to do. Nobody wants first-year folks to spend weeks of passion and hard-work building an excel model that the team can’t use. This habit is extensively taught at McKinsey, Bain and BCG, so therefore interviewers would love somebody that exhibits this habit often in case interview.

Lastly, when asking clarification questions, you hear me number them very carefully to create the strong impression that I am very organized and structured. I said I have three clarifying questions. Then I number them as I go through each. No.1, No.2, and No.3.

Sometimes, during interviews it’s hard to know exactly how many items you are going to get. One way is to take timeout often to carefully plan your pitch. If this is not possible in certain situations, you may skip telling how many items you have; but you should definitely still number your question: No.1, No.2; and so on.

Just a moment ago, the candidate actually exhibited a good habit. After going through his clarification questions, the candidate ended by asking the “is there anything else” question. In this case, I actually give out an important piece of data.

Though this is not very common as not every interviewer is that generous in giving out data. But this is a habit management consultants have to have every day when talking to experts, clients, or key stakeholders. The key is to get the most data and insights out of every interview and this is the type of open-ended question every consultant asks several times a day.

To show of this habit in a case interview is very good!

There are three things I would like you to pay attention to:

First, it took the candidate up to 72 seconds to “gather his thoughts”. This is a little too long in a case interview. I intentionally leave the 72 seconds of silence in the recording so you get an idea of how long that is in real situations. But it’s worth-noting here is not only that. While in some very complicated and weird cases, it’s ok to take that long to really think and gather ideas. In this case, the approach as proposed by the candidate is very simple. For this very approach, I think no more than 15 to 20 seconds should be used.

No.2, with that said, I have told I really like the fact that this candidate exhibits the “map” habit. Before going straight to the approach he draws the overall approach first.

No.3. You also see here that the candidate tried to align the approach with me by asking my thoughts on it. As I just said on the previous comment, this is a great habit to have. Not only does it help reduce chance of going into the wrong direction in case interviews, but it also creates a good impression. Consulting interviewers love people doing it often!

Here we see a not-really-bad response that for sure could be much better. The candidate was going into the first branch of the analysis which is Revenue. I would fix this in 3 aspects:

First, even though we just talked about the overall approach, it’s still better to briefly set up the issue tree first then clearly note that you are going into one branch.

Second, this is not a must, but I always try to make my hypothesis as explicitly clear as possible. Here the candidate just implicitly made a hypothesis that the problem is on the revenue side. The best way to show our hypothesis-driven mindset is to explicitly say it.

Third, you hear this a ton of times in our End-to-End program but I am going to repeat it again and again. It is better to show the habit of aligning here too. Don’t just go into revenue, before doing that, give the interviewer a chance to agree or to actually guide you to Cost.

So, summarizing the above insights, my pitch would sound something like this:

“So as we just discussed, a profit problem is either caused by revenue or by cost. Unless you would like to go into cost first, let’s hypothesize that the problem is on revenue side. I would like to look deeper into Revenue. Do we have any data on the revenue?”

And while saying this, you should literally draw an issue tree and point to each as you speak.

There is an interesting case interview tip I want to point out here. Notice how the candidate responds after receiving two data points from me. He went straight into the next question without at least acknowledging the data received and also without briefly analyzing it.

I am glad that the candidate makes this mistakes… well, not glad for him but for the greater audience of this program. I would like to introduce to you the perfect habit of what you should react and do every time you have any piece of data during case interviews. So three things you need to do:

Step 1: Say … that’s an interesting piece of data. This helps the interviewer acknowledge that you have received and understand the data. This also buys you a little time. And furthermore, it’s always a good thing to give out modest compliments to the interviewer.

Step 2: Describe the data, how it looks, is there any special noteworthy trend? In this case, we should point out that revenue actually grew by more than 50%.

Also notice here that I immediately quantified the difference in specific quantitative measurement (in this case, percentage). Saying revenue went up is good, but it’s great to be able to say revenue went up by more than 50%.

Step 3: Link the trend identified back to the original case question and the hypothesis you have. Does it prove, disprove, or open up new investigation to really test the hypothesis? In this case, this data piece actually opened up new investigating areas to test the hypothesis that the bottleneck is within revenue.

My sample pitch for this step 3 would sound like this: “It’s interesting that revenue went up quite a bit. However, to be able to fully reject our hypothesis on the revenue, I would like to compare our revenue to that of the competitors as well.”

Then only at this point, after going through 3 steps above, I ask for the competitors’ revenue like the candidate did.

Notice here that I ended up asking the same question the candidate did. This shows that the candidate does have a good intuition and thought process. It’s just that he did all of these implicitly on his head.

In consulting case interview, it’s always good to do everything as explicitly as possible. Not only is it easier to follow but it helps show your great thought process.

… the rest of the transcript is available in our End To End Case Interview

Learn the Secrets to Case Interview!

Join countless other successful candidates around the world with our Case Interview End-to-End Secrets Program ! 10 example cases with 100+ real-time feedbacks on tips and techniques, 50+ exercises on business intuition and 1300+ questions for math practice!

Scoring in the McKinsey PSG/Digital Assessment

The scoring mechanism in the McKinsey Digital Assessment

Related product

/filters:quality(75)//case_thumb/1669783363736_case_interview_end_to_end_secrets_program.png)

Case Interview End-to-End Secrets Program

Elevate your case interview skills with a well-rounded preparation package

Preparing for case interviews is a hard task when you only have 1 week, so the first part you need to learn during this time is fundamentals of case interview

Case interview in consulting is difficult with the passing rate is around 10%. This is because big consulting firms keep an extremely high recruitment standard

A case interview is where candidates is asked to solve a business problem. They are used by consulting firms to evaluate problem-solving skill & soft skills

Case interviews: what finance concepts do I need to know?

Consultants use a wide range of financial concepts on their projects. Case interviews reflect real life examples and you will therefore come across financial concepts when you interview. These concepts range from fairly basic (E.g.: fixed costs) to more advanced (E.g.: return on investment).

The difficulty is that there is an endless list of financial concepts you could learn. But you do not have time to learn and master all of them and doing so should not be the objective of your preparation.

When you prepare for case interviews , you therefore need to ask yourself the following key question: What are the financial concepts I need to master to ace case interviews?

Click here to practise 1-on-1 with MBB ex-interviewers

The answer depends on the position you are applying for. In this blog post, we assume that you are interviewing for a general consultant, associate or manager role at a typical strategy firm (E.g.: McKinsey, BCG, Bain, etc). If you apply specifically to the financial services practice of the firms above, you will need to know more advanced financial concepts than we list below. But for general positions, here is the list of financial concepts you need to master:

- Fixed and variable costs

More advanced

- Return on investment

- Payback period

There is a very small chance that you might come across more exotic financial concepts in your case interviews. But in these cases you will not be expected to know the concept at hand. Instead, your interviewer will expect you to ask clarifying questions about the concept and will help you understand it.

There are three reasons why you do not need to know more financial concepts than the ones listed above:

- First, in our experience, these concepts will enable you to tackle 99% of the cases you will come across in your interviews

- Second, learning more concepts than this would be very time consuming. Instead you should use your time practicing on real case interviews

- Third, consultants themselves usually do not know more financial concepts than the ones we have listed. As a consequence if a more advanced concept is required for your case it is almost certain that your interviewer will help you understand it

Let us now define the concepts you need to know one by one.

We’ve already defined some basic financial concepts the video below. While McKinsey no longer uses the PST, these concepts are still useful to review.

Revenues, sales, or turnover (the three terms are synonyms) are the total amount of money that the company receives from customers by selling its products.

Let’s take an example. Imagine you work for an airline, such as British Airways. You sell plane tickets to your customers. The total amount of money you collect from customers in exchange for plane tickets (and any additional services you provide) is your company’s revenues.

There are two main ways you could be asked to calculate revenues for a company:

You might be given the number of products the company sold (the volume) and the average price of the products. From this, you can obtain revenues using the following formula: Revenues = Volume x Average Price.

Alternatively, you could be given the total sales in an industry (total market sales), and the share of the industry’s revenues represented by the company (the market share). The company’s sales would then be given by: Revenues = Total Market Sales x Market Share.

Either way, remember that revenues or sales are measured in terms of money (Dollar, Pound Sterling, Euro, etc.).

Costs, or expenses, are the total amount of money that the company pays to its various suppliers. In the case of the airline above, this will be the money that the company pays for fuel, leasing airplanes, the salaries of the crew, as well as expenses such as the cost of running their headquarters, their website, or even taxes and interest on loans.

As you can see, the term ‘costs’ covers many different items. Companies will be interested in tracking costs closely.

Fixed and variable costs: Businesses incur two types of costs. Variable costs are the costs that increase with higher sales or higher production. Fixed costs are the costs that would have to be paid regardless of how much is produced. In other words, variable costs change with the level of business activity, while fixed costs don’t.

Let’s imagine you are the CEO of a handbag manufacturer. The cost of the material you use to manufacture the bags is a variable cost: the more bags you produce, the more leather you will need. If one day you produce no handbag, then you don’t have to pay for any extra material. By contrast, the rent you pay for the store has to be paid every month, regardless of whether you sell or produce any bags that month.

As you may already appreciate, the distinction between fixed and variable costs is not always straightforward. For instance, labour costs can be either fixed or variable. As a CEO, your salary is a fixed cost as it will be paid independently of how many bags the company produces. However, during periods of peak production you might hire extra workers at your factory and their salary will therefore be a variable cost.

Even though these difficulties might arise, your interviewer will always allow you to determine easily from the context which cost is fixed and which is variable.

The most important relationship in business analysis is probably the following:

Profits = Revenues – Costs

Profits, also known as net income or net earnings, represents the money left to the owners or managers of the business after all expenses have been paid. Many questions in case interviews revolve around whether or not a company is profitable and what it should do to become more profitable.

Profits are always calculated over a certain period of time – either a quarter or a full year. If you are given fixed and variable costs, you would first have to calculate total costs over the period of time studied, before being able to calculate profits. For instance, in our handbag manufacturing example you would take all fixed costs for one year and add all variable costs for the production of that year to calculate total costs. Annual profits would then be given by subtracting total costs from annual revenues.

Given this definition of profits, there are two ways companies can increase their profits: increase revenues, or decrease costs. You can also see why it might not always be completely straightforward to compare the performance of two companies: one might have higher revenues but higher costs than the other.

4. Return on investment

Return on investment (ROI), or return on capital invested (ROCI), measures how much profits are generated by $100 invested in a given project or business. Let’s say you set up a lemonade stand with an initial investment of $1,000 to pay for a stand, a lemon press, etc. Let’s now assume that you sell $500 worth of lemonade throughout the year and that you incurred $400 in costs to make those sales (E.g.: lemons, sugar, electricity, etc). Your profit for the year is $100 and your return on investment is $100 / $1,000 = 10%.

The formula for return on investment is therefore given by:

Return on investment = Profits over given period / Initial investment

Returns on investment are expressed in percentages and calculated over a given period of time, usually one year. But nothing prevents you from calculating a daily or monthly return on investment. To do so, you just need to divide a day’s worth of profits or a month’s worth of profits by the initial investment. For a given project, profits made in a day are lower than profits made in a month or year, and the daily return on investment is therefore lower. In our example, assuming we make $100 / 365 = $0.27 of profits in a day, the daily return on investment is $0.27 / $1,000 = 0.027% which is lower than 10%.

Let’s focus on the initial investment part of the equation. In your case interviews , you will most likely have to calculate ROIs when a company is investing in a new project. Here, the initial investment will be the upfront expenses the company needs to make to start the business. For instance, if the company wants to start producing cars, building the car factory will be the main initial investment. Similarly, if the company wants to start a supermarket, the main initial investment will be the building, fridges and shelves to set up the supermarket (assuming it buys the building). Initial investments are typically only incurred once, at the beginning of the project.

Finally, there are two ways to increase ROIs: growing profits or decreasing the initial investment. Sometimes, the return on investment for a project will be negative. This indicates that profits are negative and that the project is losing money.

5. Payback period

Payback period measures how much time it takes to earn back your initial investment. In our lemonade stand example, it takes 10 years of profits at $100 per year to pay back the initial investment of $1,000. The payback period is 10 years.

The formula for payback period is therefore given by:

Payback period = Initial investment / Profits over a given period

Payback periods are usually expressed in years by dividing the initial investment by the profits per year . But notice that they can also be expressed in days or months too simply by dividing the initial investment by the profits per day or the profits per month .

Finally, notice that the payback period is simply the inverse of the return on investment. In our lemonade stand example, the yearly return on investment was 10%. To calculate the payback period we could have simply done 1 / 10% = 10 years. Again, in some cases the payback period will be negative which indicates negative profits and that the project is losing money.

Mock interviews

The best way to improve at case interviews is to practise interviewing out loud, and you can do that in three main ways:

- Interview yourself (out loud)

- Practise interviewing with friends or family

- Practise interviewing with ex-interviewers

Practising by yourself is a great way to get started, and can help you get more comfortable with the flow of a case interview. However, this type of practice won’t prepare you for realistic interview conditions.

After getting some practice on your own, you should find someone who can do a mock interview with you, like a friend or family member.

We’d also recommend that you practise 1-1 with ex-interviewers from top consulting firms . This is the best way to replicate the conditions of a real case interview, and to get feedback from someone who understands the process extremely well.

Click here to book your mock case interview.

- Internships

- Career Advice

Interview Questions: The Financial Case Interview

Published: Mar 10, 2009

Case interviews aren't just for consultants any more. Many investment banks give questions that could, under other circumstances, be called case interviews--they often involve both strategy and quantitative know-how. The best way to prepare for any interview is to prepare. Here is one such question.

What is a company that you follow closely? Is it a good investment?

Tell your interviewer you would look at various criteria to determine if it's a worthwhile investment, including:

- Earnings growth: Determine how fast the company's earnings are expected to grow, looking at the following factors (among others): the company's historic growth rate; earnings growth rates of other companies in the industry; growth rate of the market the company services; analyst estimates; and perhaps building your own financial model in Excel to test various assumptions.

- Industry analysis: Evaluate the industry the company is in to determine whether this is an attractive industry in which to invest. Look at factors including: how rapidly the industry is growing; whether the industry is consolidating; how intense the competition is among competitors; whether market players have pricing power; and whether products are considered commodities.

- Competitive advantages: Evaluate whether the company has any competitive advantages over its competition, such as patents, exclusive contracts, a differentiated product, brand equity, a lower cost structure, or superior management.

- Valuation: Given its prospects, is the company a good value? You would compare the company's expected earnings growth to various valuation measures, like price-to-earnings ratio, price-to-sales ratio, and price-to-book-value. You would also compare these valuation measures to other companies in the industry to determine whether the company is relatively expensive or relatively affordable.

- Portfolio considerations: Finally, you would want to determine whether an investment in the company fits well with your overall portfolio and objectives. You would want to ask questions like: Does the company help diversify risk in your portfolio? Does the company meet your portfolio's risk profile?

The Tesla Financial Analyst Interview Guide

Walk through the Tesla financial analyst interview process and learn how I landed a job with Tesla’s FP&A Business Operations team.

Introduction

In this article, Michael (former FP&A and Business Operations Analyst at Tesla), will walk you through the steps he took to land a full-time analyst role at Tesla. This guide will cover the various stages of the interview process alongside general notes, tips, and sample interview questions and answers.

#1 Passing the Resume Screen

Tesla received 3 million job applications in all of 2021. This may sound a bit daunting, but there are several different things that you can do to squeeze past this first obstacle.

Clean Up Your Resume

First, you need to clean up your resume and tailor all of your experiences to best fit the financial analyst role or whichever role you are applying for.

Tesla is an innovative, technology-driven company that likes seeing people use data to make logical business decisions. Keep this in mind when tuning up the bullets in your resume.

When writing the experience section of your resume, you should make sure to start each bullet with an action verb. This will help cut down the excess “fluff” in your resume and make it easier for recruiters to understand your previous tasks and experiences.

Sample Action Verbs:

- More Action Verbs

In addition to using action verbs, you should quantify your resume as much as possible so that you clearly state how you added value to your previous companies. For example, you can change “Reduced product line wait time” to “Reduced product line wait time by 3 seconds resulting in a 15% increase in production efficiency.”

For more details and tips, check out our other article on how to write the perfect resume .

Try to Obtain an Employee Referral

With thousands of applications flowing into Tesla each day, an employee referral would certainly help bring your resume to the top of the stack.

Now if you don’t have any existing friends or connections that work at Tesla, you can try to use LinkedIn and cold emails to contact an existing employee to ask for a quick phone call.

When scrolling through your LinkedIn network, try to look for your school alumni and ideally people who work on the finance team or the team that you are applying to. The goal is to hop on a phone call with your connection so that you can learn more about the working roles at Tesla and demonstrate a genuine interest in the company.

For those looking to better their chances of a referral, we recommend you check out our article on Networking Cold Email Templates.

#2 Phone Screen

If you make it past the resume screen, then congratulations, you’ve made it past the largest cutting stage of the application process.

Following the resume screen, you’ll likely have to hop on a call with one recruiter and one or two finance managers. These calls are quite straightforward and very behavioral-focused. Although they seem quite simple, it will be important to give off a good impression and to make your interviewers believe that you will be a good fit on one of their teams.

Preparation Tip: Read Up on Tesla News

- Spend an hour reading online articles on Tesla. Finance-oriented publications like CNBC , The Financial Times , and Bloomberg are great places to start.

- Watch YouTube videos on recent company stories. Tesla has its own channel and Rob Maurer also runs a very informative YouTube channel called the Tesla Daily .

- Read Tesla’s 10-K annual report. Every public company is required to post a publicly available 10-K company report . I’d recommend taking a look at the section on “Risk Factors” and “Management Opportunities, Challenges, and Risks.” (These sections are perfect for coming up with interesting follow-up questions that you can ask your interviewer).

Sample Questions & Answers

The following should give you an idea of the types of questions that you may be asked in these phone screen interviews.

Q: Why do you want to work for Tesla?

Sample Answer:

“Tesla seems to be a very dynamic and innovative company. With this in mind, I figured that this type of work exposure, particularly at the junior level, would be extremely rewarding as I would be forced to learn many things in a rapid environment. Although this may seem daunting for some, I’ve always been the type to throw myself into challenging situations to force myself to figure things out. Tesla has made tremendous progress since its first factory opening in Fremont, California and I’d simply love to take part in its massive global mission.”

Q: Where do you see yourself in 5 years?

“It’s hard to answer that question specifically as 5 years is quite a long time. What I can say is that I would like to spend the first few years of my analyst career learning the little details and all the ins and outs of the business. Then, after building up my fundamentals and overall experience, I would like to transition into a role that would allow me to make thoughtful and impactful business decisions.”

Q: What do you like to do outside of work and school?

“I really enjoy going fishing when I have some free time over the weekend. Although it seems like fishing is a relatively relaxed activity, I actually really enjoy the strategic side of a fishing operation. Whether it's looking a weather and wave height reports or researching specific species and testing different baits and fishing equipment, I actually really enjoy the process of testing out different theories to find what works best for me.”

#3 Excel Case Study Interview

If you make it past the phone screen stage, you’ll likely move on to an Excel case study interview. To prepare for this Excel case study test, I recommend you make sure you are comfortable with basic Excel skills and finance fundamentals.

Excel: In my case study, I ended up using simple formulas like SUMIFS and VLOOKUPS and I didn’t have to use pivot tables or macros. That said it certainly wouldn’t hurt to learn pivot tables and other Excel functions as they’ll likely switch up the case studies every now and then.

Finance: The Excel case study (at least when interviewing for the financial analyst role) is very much finance oriented. At a minimum, make sure you understand the ins and outs of an income statement so that you can comfortably solve for gross and net profit margins, EBITDA, etc.

General Tip: They will likely ask you for your insights or recommendations given the figures and data available. If certain figures or assumptions seem a bit high, perhaps you could recommend the analyst to speak with the manufacturing team or distribution team for more details on mandatory vs optional expenses (this makes it seem like you are familiar with real work scenarios).

If you’re interested in learning more about how you can best prepare for your interviews, consider checking out our Excel for Business & Finance Course and our Complete Finance & Valuation Course . These two courses should help you comfortably tackle finance interviews at the most competitive corporations and investment banks!

#4 Final Round: 4-5 Back-to-Back 30-Minute Interviews

If you make it past the Excel case study test, you’ll likely have an opportunity to take part in a final round interview consisting of 4-5 back-to-back 30-minute interviews with members from various finance teams.

These interviews will consist of mostly technical and brain teaser questions. With this in mind, you should expect to open up Excel during the interview to share your screen and walk through mini case studies and teaser problems.

General Tip: Once you find a reasonable solution, don’t just stop at the numerical answer. The interviewer wants to see how you can connect the data to actionable business ideas. You’ll usually want to make some surface-level assumptions to arrive at a figure, then tell your interviewer the types of follow-up questions you would ask if you had more time to work on this in a real business setting.

You should also expect a couple of behavioral questions at the end of the interview alongside an opportunity to ask the interviewer general questions.

The following should give you an idea of the types of problem-solving questions that you might be asked in the final round of interviews.

Q: Tell me 3 different methods that you could use to price a Tesla car entering a new market?

- You can use a competitive pricing model. Simply put, you can look up the prices of competing cars in the new market and price the Tesla car within a certain range of its competitors (maybe plus or minus 5%). It will also be interesting to factor in any potential tax benefits that some countries give to electric vehicle consumers as that could give Teslas a big pricing edge over traditional combustion engine vehicles.

- You can use a cost-based pricing model. In this method, you can add up all the costs required to manufacture and distribute a vehicle. Then you can apply a percentage premium to that cost basis to arrive at the consumer-facing price. Perhaps you could use some industry-standard or comparable markup figure to determine the percentage premium to use.

- You could create a model based on customer income. In this method, you could start by looking at all of the existing markets, and create a ratio using the Tesla prices in those markets relative to the median family income in that area. Once you have that ratio, you can apply it to your new market by finding the median family income in the new area.

Q: Identify the bottleneck of the car manufacturing line given XYZ data

This question will likely require you to use simple math to figure out which stage in the production line is taking up the most time. Once you figure out the bottleneck, the interviewer might ask you a follow-up question modifying the figures of the original scenario.

For example, your interviewer might say: “If you were presented with the opportunity to invest $X amount of dollars to cut down the bottleneck time by 25%, would you proceed with the project?”

To approach this problem, you would likely have to calculate how much more product you would be able to produce and the dollar value of that additional product. From there, you could calculate the payback period or essentially how long it would take for the additional profits to cover the cost of the initial investment.

#5 Job Offer!

If you make it past the final round of interviews, congratulations, you’ll likely receive an email and a call from the HR team.

If you don’t get the job offer, don’t worry and keep your chin up. It’s already quite an accomplishment to make it to the final round of interviewers. Even if you don’t end up at Tesla, you can still apply to many other great companies like Apple, Amazon, Visa, and more.

If you're fishing around for a new job, consider signing up for our weekly newsletter for more career news and interesting job opportunities that we find at fortune 500 companies across the globe.

Additional Resources

If you’re looking to better prepare your technical skills for any competitive business or finance interviews, consider checking out our courses using the get started button below!

Other Articles You Might Find Useful

- Interview With a Tesla Financial Analyst

- Goldman Sachs Interview Process

- Investment Banking Target Schools

- Accounting Internships

- Goldman Sachs Interview Questions

Building a cash flow statement from scratch using a company income statement and balance sheet is one of the most fundamental finance exercises commonly used to test interns and full-time professionals at elite level finance firms.

Test hyperlink

Dolor enim eu tortor urna sed duis nulla. Aliquam vestibulum, nulla odio nisl vitae. In aliquet pellentesque aenean hac vestibulum turpis mi bibendum diam. Tempor integer aliquam in vitae malesuada fringilla.

Elit nisi in eleifend sed nisi. Pulvinar at orci, proin imperdiet commodo consectetur convallis risus. Sed condimentum enim dignissim adipiscing faucibus consequat, urna. Viverra purus et erat auctor aliquam. Risus, volutpat vulputate posuere purus sit congue convallis aliquet. Arcu id augue ut feugiat donec porttitor neque. Mauris, neque ultricies eu vestibulum, bibendum quam lorem id. Dolor lacus, eget nunc lectus in tellus, pharetra, porttitor.

- Test Bullet List 1

- Test Bullet List 2

- Test Bullet List 3

"Ipsum sit mattis nulla quam nulla. Gravida id gravida ac enim mauris id. Non pellentesque congue eget consectetur turpis. Sapien, dictum molestie sem tempor. Diam elit, orci, tincidunt aenean tempus."

Tristique odio senectus nam posuere ornare leo metus, ultricies. Blandit duis ultricies vulputate morbi feugiat cras placerat elit. Aliquam tellus lorem sed ac. Montes, sed mattis pellentesque suscipit accumsan. Cursus viverra aenean magna risus elementum faucibus molestie pellentesque. Arcu ultricies sed mauris vestibulum.

Morbi sed imperdiet in ipsum, adipiscing elit dui lectus. Tellus id scelerisque est ultricies ultricies. Duis est sit sed leo nisl, blandit elit sagittis. Quisque tristique consequat quam sed. Nisl at scelerisque amet nulla purus habitasse.

Nunc sed faucibus bibendum feugiat sed interdum. Ipsum egestas condimentum mi massa. In tincidunt pharetra consectetur sed duis facilisis metus. Etiam egestas in nec sed et. Quis lobortis at sit dictum eget nibh tortor commodo cursus.

Odio felis sagittis, morbi feugiat tortor vitae feugiat fusce aliquet. Nam elementum urna nisi aliquet erat dolor enim. Ornare id morbi eget ipsum. Aliquam senectus neque ut id eget consectetur dictum. Donec posuere pharetra odio consequat scelerisque et, nunc tortor. Nulla adipiscing erat a erat. Condimentum lorem posuere gravida enim posuere cursus diam.

Ready to Level Up Your Career?

Learn the practical skills used at Fortune 500 companies across the globe.

- Undergraduates

- Ph.Ds & Postdocs

- Prospective Students & Guests

- What is a Community?

- Student Athletes

- First Generation and/or Low Income Students

- International Students

- LGBTQ Students

- Students of Color

- Students with Disabilities

- Student Veterans

- Exploring Careers

- Advertising, Marketing & PR

- Finance, Insurance & Real Estate

- General Management & Leadership Development Programs

- Law & Legal Services

- Startups, Entrepreneurship & Freelance Work

- Environment, Sustainability & Energy

- Media & Communications

- Policy & Think Tanks

- Engineering

- Healthcare, Biotech & Global Public Health

- Life & Physical Sciences

- Programming & Data Science

- Graduate School

- Health Professions

- Business School

- Meet with OCS

- Student Organizations Workshop Request

- OCS Podcast Series

- Office of Fellowships

- Navigating AI in the Job Search Process

- Cover Letters & Correspondence

- Job Market Insights

- Professional Conduct & Etiquette

- Professional Online Identity

- Interview Preparation

- Resource Database

- Yale Career Link

- Jobs, Internships & Other Experiences

- Gap Year & Short-Term Opportunities

- Planning an International Internship

- Funding Your Experience

- Career Fairs/Networking Events

- On-Campus Recruiting

- Job Offers & Salary Negotiation

- Informational Interviewing

- Peer Networking Lists

- Building Your LinkedIn Profile

- YC First Destinations

- YC Four-Year Out

- GSAS Program Statistics

- Statistics & Reports

- Contact OCS

- OCS Mission & Policies

- Additional Yale Career Offices

5 Key Case Interview Questions

- Share This: Share 5 Key Case Interview Questions on Facebook Share 5 Key Case Interview Questions on LinkedIn Share 5 Key Case Interview Questions on X

There are types of case study interview questions that you’ll run across more frequently than others. Once you start recognizing these patterns, you will be able to create frameworks more accurately and efficiently. In this article, Management Consulted provides case study interview questions and answers for the top 5 most common business problems presented during case study interview questions. See a breakdown of the 5 key case interview questions and answers here

Office of Career Strategy

Visiting yale.

Career in Consulting

280 Free Case Interview Examples

Do you want to get access to over 280 free case interview examples (with answers)?

If you have interviews planned at McKinsey , The Boston Consulting Group , or any other consulting firm, you are probably looking for case interview examples.

So, to help you prepare, I have compiled a list of 280 free case interview examples:

- Over 30 free case interview examples (+ interview prep tips) from the websites of top consulting firms

- More than 250 free case interview examples from top business school case books

Moreover, you’ll get my take on which case studies you will likely have in interviews.

In short, the resources listed hereafter will be very helpful if you are starting out or have already made good progress in preparing for your case interviews.

One last word : check out this free case-cracking course to learn how to crack the most recent types of case questions consulting firms use in actual interviews.

Let’s get started!

Table of Contents

Get the latest data about salaries in consulting, mckinsey: tips and case interview examples.