Top 50 Accountant Interview Questions and Answers (Examples Included)

Mike Simpson 0 Comments

By Mike Simpson

Updated 6/11/2022.

When you’re trying to land a new accounting position, the accounting interview questions you’ll face can be doozies. While you’re going to see some classic ones – like the infamous “ Tell me about yourself ” – you’re also going to have to tackle some surprising ones.

Luckily, preparing for the unexpected isn’t as challenging as you’d think. If you want to bend those accounting interview questions to your will, here’s how to make that happen.

How to Answer Accounting Interview Questions

Before we dig into the actual accountant interview questions you’ll tee off against, let’s spend a moment on something that’s equally important. You need to know how to answer these questions properly, particularly because you could face stiff competition.

Overall, there are 1.32 million people working in accounting jobs in the US, so at least a few of the other candidates likely have strong skills. So, how do you make sure you get these questions right? By embracing a winning strategy.

To begin, consider what the hiring manager is trying to find. Trust us; they have a perfect candidate in mind. What you need to do is position yourself as close to that ideal as possible while ensuring you remain genuine and honest.

While every accounting role can be a bit different, much of what the hiring managers want to find is the same. They are looking for critical thinkers with superior math skills and strong communicators with prior experience using key pieces of software. Candidates with time management and organizational skills are always going to be favored, as well as those who can work well as part of a team but also handle their responsibilities independently. Having an understanding of relevant laws and regulations is also critical.

IMPORTANT: These are skills and qualities that are usually desirable in an accountant. But as we often discuss on this blog, you need to find out what skills and qualities your specific company/firm is looking for. The best way to do this is by going over your accountant job description with a fine-tooth comb.

Now that you have a solid idea of what the hiring manager is looking for, you have to find a way to convey those details during your interview. Plus, you have to find opportunities that let you stand out from the competition, particularly since most will have credentials similar to yours.

Usually, behavioral interview questions are where you’ll have a chance to shine. But these frequently seem like the trickiest ones to answer. You have to discuss your past experience or how you think you’d act if you encountered various scenarios. Technically, there is no right or wrong answer. However, that doesn’t mean some responses aren’t better than others.

Nailing behavioral interview questions typically requires a two-step approach. First, it’s time for the STAR method . With that approach, you can turn your interview answers into compelling stories, making them tons more engaging than your typical response.

But you can’t stop there. If you want your response to stand out like the north star in the sky, take it up a notch with the Tailoring Method . With that, you can personalize your answers and speak to the company’s or hiring manager’s needs. You are highlighting your capabilities in a way that brings them value, and that’s critical if you want to make a genuine connection.

In fact we we wanted to let you know that we created an amazing free cheat sheet that will give you word-for-word answers for some of the toughest interview questions you are going to face in your upcoming interview. After all, hiring managers will often ask you more generalized interview questions!

Click below to get your free PDF now:

Get Our Job Interview Questions & Answers Cheat Sheet!

FREE BONUS PDF CHEAT SHEET: Get our " Job Interview Questions & Answers PDF Cheat Sheet " that gives you " word-word sample answers to the most common job interview questions you'll face at your next interview .

CLICK HERE TO GET THE JOB INTERVIEW QUESTIONS CHEAT SHEET

Top 3 Accounting Interview Questions

Now that you have a strategy to answer accounting interview questions, you might be feeling pretty pumped. Having a great approach feels good, no doubt about it. But that doesn’t mean a few examples won’t help.

Here are the top 3 accounting interview questions you’ll probably face and tips for answering them.

1. How do you track incoming accounting legislation and regulatory changes?

Laws and regulations that impact the accounting world change surprisingly often. With this question, the hiring manager is trying to ensure that you do your part to stay up-to-date on the latest happenings.

EXAMPLE ANSWER:

“I’ve found that using a multi-faceted approach allows me to track upcoming accounting legislation and regulatory changes effectively. First, I subscribe to several industry publications and am also a member of a professional organization that sends out newsletters regarding these topics. Second, I follow thought leaders, publications, and specific regulatory bodies on social media, all of which help me stay informed.

“Finally, I created Google Alerts that include keywords relating to these topics. That way, I receive a notification when an article is posted that aligns with the criteria, helping me catch breaking news stories quickly.”

2. How would you explain a complex accounting concept to someone who isn’t as familiar with the field or the terminology?

In many cases, accounting professionals need to convey complex concepts to stakeholders that don’t work in accounting. As a result, the hiring manager wants to know that you can do so effectively.

“Generally, I find the best approach is to use analogies if a term isn’t widely used outside of the world of accounting. I try to relate it to a topic that may feel familiar to them. For example, I may describe a ledger as a record-keeping system that’s not unlike a database, as most people are familiar with databases, at least conceptually.

“For topics that don’t translate well into other areas of expertise, I may also use examples. In my past role, I created samples of many common forms and reports that featured descriptions and definitions for various terms. That allowed me to provide handouts to those who could benefit from the information.”

3. Errors can be detrimental in accounting. How do you reduce the chance that you’ll make a mistake?

As the question suggests, making mistakes in an accounting role leads to trouble. Here, the hiring manager wants to know that you are diligent about avoiding mistakes and can check your own work with ease.

“I use a multi-step approach to help reduce my chances of making an error when inputting financial information. First, I always double-check any entries. Usually, that only takes a moment, and it allows me to catch the vast majority of typos before I complete the given task.

“Second, many accounting solutions have built-in checks that I make sure to take advantage of when there’s an opportunity. Finally, I always review any outputs caused by the information I added, as incorrect numbers may lead to calculation results that are clearly incorrect, signaling to me that there’s a mistake I need to address immediately.”

47 More Accountant Interview Questions

Here are 47 more interview questions for accountants you’ll likely cross paths with:

- How would you define the role of an accountant?

- Which skills do you think are essential for accountants?

- What accounting software solutions are you familiar with?

- Can you describe an accounting process that you helped develop or improve?

- Tell me about a time you were able to reduce the cost of a critical process or procedure?

- Can you tell me about a time when you had to work with a particularly difficult client? How did you handle the situation?

- Describe a past experience where you were faced with an incredibly tight deadline. What did you do to make sure you could hand over the deliverable on time?

- Tell me about a time when you had to discuss a complex accounting concept with someone who wasn’t familiar with it. How did you make sure they understood?

- Please define and describe the three kinds of financial statements and what they contain.

- If you spot an error in another accounting professional’s work, what do you do?

- Can you tell me about a time when you made a mistake? What did you do once it was spotted?

- What is the difference between public and private accounting?

- What impact do you think AI and automation will have on accounting?

- Do you have prior experience with ERP systems? If so, which ones?

- Describe one of the biggest challenges in the accounting field and how you strive to overcome it.

- Please describe your experience with Microsoft Excel.

- Why did you choose accounting as a career?

- What is the difference between accounts payable and accounts receivable?

- Do you have any certifications? Do you plan to get any in the near future?

- When tax season arrives, are you open to working long hours?

- Which accounting skill do you like using the most? What about the least?

- Describe your experience with developing business metrics.

- Can you tell me about a time you and another accountant did not see eye to eye? How did you handle the situation?

- In your previous positions, what processes have you used to estimate bad debt?

- Describe your auditing and fraud analysis experience.

- What are two types of special journals?

- With double-ledger accounting, what ledger elements need to be equal?

- What is the minimum number of ledgers a company needs if it has four bank accounts for payment processing?

- Why is fraud easier to perpetrate with journal entries instead of ledgers?

- What role do you think blockchain will play in the future of the accounting field?

- Why is compliance vital in accounting?

- Describe your business metrics monitoring experience.

- How does a major equipment purchase impact a company’s financial statements?

- How can accounting professionals benefit from big data knowledge?

- Describe the difference between accounting and auditing.

- How do you determine the reliability of accounting information that’s given to you by an outside party?

- How do you stay on top of emerging trends in accounting?

- Do you believe you work best when you’re on-site, or is remote work a better fit?

- What attracted you to this firm?

- Did you learn anything unexpected while studying accounting in college?

- If you weren’t working in accounting, what field would you pursue instead?

- What about accounting do you enjoy most?

- Do you dislike anything about accounting?

- If you saw a colleague intentionally alter a client’s books to reflect inaccurate information, what would you do?

- What kind of management style helps you stay motivated?

- Which do you prefer, formal training or a mentor/mentee approach to learning?

- If you had a chance to acquire any accounting skill that you don’t currently have, what would it be and why?

5 Good Questions to Ask at the End of an Accounting Interview

As your interview begins to draw to a close, you should get a chance to ask the hiring manager a few questions. Make sure you are ready for this. It’s a great opportunity to learn more about the job and if it’s actually right for you.

Plus, as Indeed puts it, “Having your questions prepared shows the interviewer that you researched the company and the position.” That makes you seem more enthusiastic about the role, and that matters.

If you can’t figure out what to ask, here are some questions that can work in most situations.

- Can you describe a typical day in this accounting role?

- How will this accounting job change over the next 12 months? What about three years?

- What trait do you think is essential for those who want to succeed in this accounting role?

- Are there any major accounting projects on the horizon?

- How many accounts/clients will this role support?

Putting It All Together

Ultimately, landing an accountant interview is exciting, but it’s also okay to be a bit nervous about what’s to come. A new job usually means taking a step forward in your career, and that can be a lot of pressure, particularly with the types of interview questions for an accountant you’ll usually face.

But, by making use of the tips above and reviewing the accounting interview questions, you can be ready. You’ll have a strategy that showcases you as an amazing candidate, allowing you to demonstrate to the hiring manager why you’ll be a great addition to their team.

FREE : Job Interview Questions & Answers PDF Cheat Sheet!

Download our " Job Interview Questions & Answers PDF Cheat Sheet " that gives you word-for-word sample answers to some of the most common interview questions including:

- What Is Your Greatest Weakness?

- What Is Your Greatest Strength?

- Tell Me About Yourself

- Why Should We Hire You?

Click Here To Get The Job Interview Questions & Answers Cheat Sheet

Co-Founder and CEO of TheInterviewGuys.com. Mike is a job interview and career expert and the head writer at TheInterviewGuys.com.

His advice and insights have been shared and featured by publications such as Forbes , Entrepreneur , CNBC and more as well as educational institutions such as the University of Michigan , Penn State , Northeastern and others.

Learn more about The Interview Guys on our About Us page .

About The Author

Mike simpson.

Co-Founder and CEO of TheInterviewGuys.com. Mike is a job interview and career expert and the head writer at TheInterviewGuys.com. His advice and insights have been shared and featured by publications such as Forbes , Entrepreneur , CNBC and more as well as educational institutions such as the University of Michigan , Penn State , Northeastern and others. Learn more about The Interview Guys on our About Us page .

Copyright © 2024 · TheInterviewguys.com · All Rights Reserved

- Our Products

- Case Studies

- Interview Questions

- Jobs Articles

- Members Login

15 Accounting Problem Solving Interview Questions and Answers

Prepare for the types of questions you are likely to be asked when interviewing for a position where Accounting Problem Solving skills will be used.

When it comes to interviews, accounting problem solving questions are designed to test your ability to find creative solutions to real-world challenges. While there is no one right answer to these types of questions, the best way to prepare is to practice brainstorming and thinking on your feet.

To help you ace your next interview, we’ve compiled a list of sample accounting problem solving questions and answers. These questions will test your knowledge of basic accounting principles as well as your ability to think critically and come up with innovative solutions.

- You are a senior accountant and you have been assigned to work on the budget for a new project. What steps would you take in order to complete this task?

- You are training an intern on how to perform accounting tasks. How would you go about doing that?

- You need to provide financial information to your team but you are short staffed and don’t have time to do it yourself. What would you do?

- You are working as part of a small accounting firm and need to improve internal processes. Where should you start?

- A client is having trouble understanding their bill. How would you help them understand what they owe?

- Your boss has asked you to cut costs by 10% but still maintain the same level of quality. How would you go about achieving this goal?

- A CFO wants to know why expenses went over budget last quarter. How would you explain this using data?

- An employee used company credit cards to purchase personal items. What would you do?

- The bookkeeper accidentally recorded some transactions twice. What should be done to correct this issue?

- A client needs a refund for services rendered but can’t find any record of payment. How would you handle this situation?

- There were several rows missing from your bank statement. How will you account for this error?

- You discovered errors in the books that would affect the balance sheet. What approach would you take to fix this problem?

- A customer doesn’t want to pay their invoice because they think there are mistakes. How will you resolve this conflict?

- A vendor claims they didn’t receive payment for goods provided. How would you investigate this claim?

- A client has requested additional documentation regarding payments made to vendors. How would you obtain this information?

1. You are a senior accountant and you have been assigned to work on the budget for a new project. What steps would you take in order to complete this task?

This question is a great way to assess your analytical skills and how you prioritize tasks. When answering this question, it can be helpful to list the steps you would take in order to complete this task.

Example: “I would first gather all of the information I need for the budget, including the current financial status of the company, the amount of money needed for the project and any other relevant information. Then, I would create a spreadsheet with all of the information I gathered and calculate the total cost of the project. After that, I would compare the projected costs to the actual costs to ensure they are accurate.”

2. You are training an intern on how to perform accounting tasks. How would you go about doing that?

This question is a great way to assess your teaching skills and how you would train others on the job. When answering this question, it can be helpful to describe what you would do step-by-step in training an intern or new employee.

Example: “I would first explain the basics of accounting by showing them how to use the software we use at our company. I would then have them perform tasks like entering data into spreadsheets and reconciling accounts. After they are comfortable with these basic tasks, I would give them more complex assignments that require them to apply their knowledge.”

3. You need to provide financial information to your team but you are short staffed and don’t have time to do it yourself. What would you do?

This question is an opportunity to show your leadership skills and ability to delegate tasks. In your answer, explain how you would communicate the information to your team in a timely manner while also ensuring that it’s accurate.

Example: “I would first make sure I had all of the financial data needed for my presentation. Then, I would create a spreadsheet with the relevant information and send it to each member of my team so they could review it before our meeting. This way, everyone has access to the same information at the same time and can ask me questions if they need clarification.”

4. You are working as part of a small accounting firm and need to improve internal processes. Where should you start?

This question is a great way to assess your problem-solving skills and ability to work as part of a team. When answering this question, it can be helpful to highlight the steps you would take when starting any project or task.

Example: “I would start by identifying what processes need improvement. I would then create a list of all current accounting procedures and compare them to industry standards. After that, I would analyze each process and determine which ones are most important for our company. Finally, I would implement new procedures based on my analysis.”

5. A client is having trouble understanding their bill. How would you help them understand what they owe?

This question can help interviewers understand your customer service skills and ability to explain complex information in a way that’s easy for clients to understand. Use examples from previous experience where you helped clients understand their bills or invoices.

Example: “I once had a client who was confused about why they were being charged late fees when they paid their bill on time. I explained the billing cycle to them, which included how long it took for the company to process payments before crediting accounts. They understood after that explanation and didn’t have any more questions.”

6. Your boss has asked you to cut costs by 10% but still maintain the same level of quality. How would you go about achieving this goal?

This question is a great way to test your analytical skills and ability to work under pressure. When answering this question, it can be helpful to provide an example of how you would go about achieving the goal while still maintaining quality.

Example: “I would first look at our current budget and see where we could cut costs without affecting the level of service we provide. I would then implement those changes and monitor them closely for any errors or issues that may arise. If there are no problems with the new system after three months, I would recommend making the cuts permanent.”

7. A CFO wants to know why expenses went over budget last quarter. How would you explain this using data?

This question is a great way to test your ability to communicate with others in the accounting department. It also shows how you can use data to explain complex financial processes.

Example: “I would first look at the budget and compare it to actual expenses for that quarter. I would then break down each expense category, looking for any outliers or areas where we spent more than usual. If there were no major changes in spending habits, I would check if there was an error in our calculations or if we had overlooked something.”

8. An employee used company credit cards to purchase personal items. What would you do?

This question can help an interviewer understand how you would handle a challenging situation in the workplace. Use your answer to highlight your problem-solving skills and ability to make tough decisions.

Example: “I would first meet with the employee to discuss their actions and determine why they used company credit cards for personal purchases. I would then speak with my manager about what happened, and we would decide on a course of action together. Depending on the severity of the situation, we may choose to terminate the employee or give them another chance by issuing a warning. If it’s a minor offense, I would likely issue a warning and require them to reimburse the company.”

9. The bookkeeper accidentally recorded some transactions twice. What should be done to correct this issue?

This question is a great way to test your accounting problem-solving skills. It also shows the interviewer that you can work independently and make decisions on your own. In your answer, explain how you would fix this mistake.

Example: “I would first check if there are any transactions missing from the ledger. If not, I would go through each transaction twice and delete it from the system. Then, I would record the correct amount of money in the account.”

10. A client needs a refund for services rendered but can’t find any record of payment. How would you handle this situation?

This question can help an interviewer assess your problem-solving skills and ability to work with clients. Use examples from past experiences where you helped a client resolve this issue.

Example: “I once had a client who needed a refund for services rendered but couldn’t find any record of payment. I asked the client if they remembered what method of payment they used, and they said it was a check. I then looked through all of our records for checks that were never cashed and found one that matched the amount owed by my client. I contacted the company that issued the check and explained the situation. They agreed to send a new check to my client.”

11. There were several rows missing from your bank statement. How will you account for this error?

This question is a great way to test your accounting skills and how you use them. It also shows the interviewer that you can recognize errors in financial documents and correct them quickly.

Example: “I would first check my math, as this is usually where I find mistakes. If there are no mathematical errors, then I will contact my bank for more information on the missing rows. Once I have all of the necessary information, I will create new rows for the missing data and enter it into the spreadsheet.”

12. You discovered errors in the books that would affect the balance sheet. What approach would you take to fix this problem?

This question is a great way to test your problem-solving skills and ability to work with others. Your answer should show that you can be honest, communicate effectively and collaborate with others.

Example: “I would first meet with the accounting manager to discuss my findings. I would then explain how the errors affected the balance sheet and what steps we could take to fix it. If there was enough time before the end of the fiscal year, I would make sure all transactions were recorded correctly. If not, I would record any adjustments needed in the next quarter’s financial statements.”

13. A customer doesn’t want to pay their invoice because they think there are mistakes. How will you resolve this conflict?

This question is a great way to test your customer service skills. It also allows the interviewer to see how you would handle conflict with clients and other stakeholders. In your answer, try to show that you can be empathetic while still maintaining professionalism.

Example: “I understand that this situation must be frustrating for my client. I would first ask them if they have any questions about their invoice. If they say no, I will explain why we are asking for payment. If they still don’t want to pay, I will offer to send them an itemized list of what they owe us so they can verify it themselves.”

14. A vendor claims they didn’t receive payment for goods provided. How would you investigate this claim?

This question can help interviewers assess your ability to investigate and resolve accounting errors. Use examples from past experiences where you investigated vendor claims or other types of errors in payment processing.

Example: “I would first check the company’s bank statements for any payments made to that vendor. If I find no record of a payment, I will contact the person responsible for making the payment to verify whether it was processed. If they confirm that the payment was never made, I will work with them to determine what happened and how we can prevent this type of error in the future.”

15. A client has requested additional documentation regarding payments made to vendors. How would you obtain this information?

Interviewers may ask you to provide examples of how you would complete a task or process in your previous role. This question can help them understand the steps you take and whether you have experience with similar processes.

Example: “I would first check our accounting software for any payments made to vendors that haven’t been recorded yet. If I don’t find any, I would contact each vendor to confirm if we’ve paid them. If we haven’t, I would record the payment as an expense and enter it into our system. If we have already paid the vendor, I would send my client documentation confirming this.”

15 Intrapersonal Communication Interview Questions and Answers

15 mathematical interview questions and answers, you may also be interested in..., 25 car salesman interview questions and answers, 25 data science consultant interview questions and answers, 17 maintenance coordinator interview questions and answers, 20 jacobs interview questions and answers.

Accountant Interview Questions

The most important interview questions for Accountants, and how to answer them

Getting Started as a Accountant

- What is a Accountant

- How to Become

- Certifications

- Tools & Software

- LinkedIn Guide

- Interview Questions

- Work-Life Balance

- Professional Goals

- Resume Examples

- Cover Letter Examples

Interviewing as a Accountant

Types of questions to expect in a accountant interview, technical proficiency questions, behavioral questions, scenario-based and problem-solving questions, communication and interpersonal questions, culture fit and motivation questions, preparing for a accountant interview, how to do interview prep as an accountant.

- Review Accounting Principles and Standards: Ensure you have a solid grasp of key accounting principles and standards such as GAAP or IFRS, depending on the region. Be prepared to discuss how you apply these standards in your work.

- Understand the Company's Financial Context: Research the company's financial health, industry position, and any recent financial news. This will allow you to speak knowledgeably about how your skills can benefit their specific financial situation.

- Prepare for Technical Questions: Be ready to answer technical questions that may test your knowledge of financial reporting, tax laws, auditing processes, or accounting software you may be required to use.

- Practice Behavioral Questions: Reflect on your past experiences and prepare to discuss them in the context of behavioral interview questions. Focus on situations that highlight your analytical skills, attention to detail, and ethical decision-making.

- Brush Up on Excel and Other Relevant Software: Accountants often need to be proficient in Excel and various accounting software. Make sure you're familiar with the most common functions and any specific platforms mentioned in the job description.

- Prepare Your Own Questions: Develop insightful questions to ask the interviewer about the company's accounting processes, challenges they face, and the expectations for the role. This shows your proactive approach and interest in the position.

- Mock Interviews: Practice with a mentor, friend, or colleague to get comfortable with responding to questions and to receive feedback on your answers and demeanor.

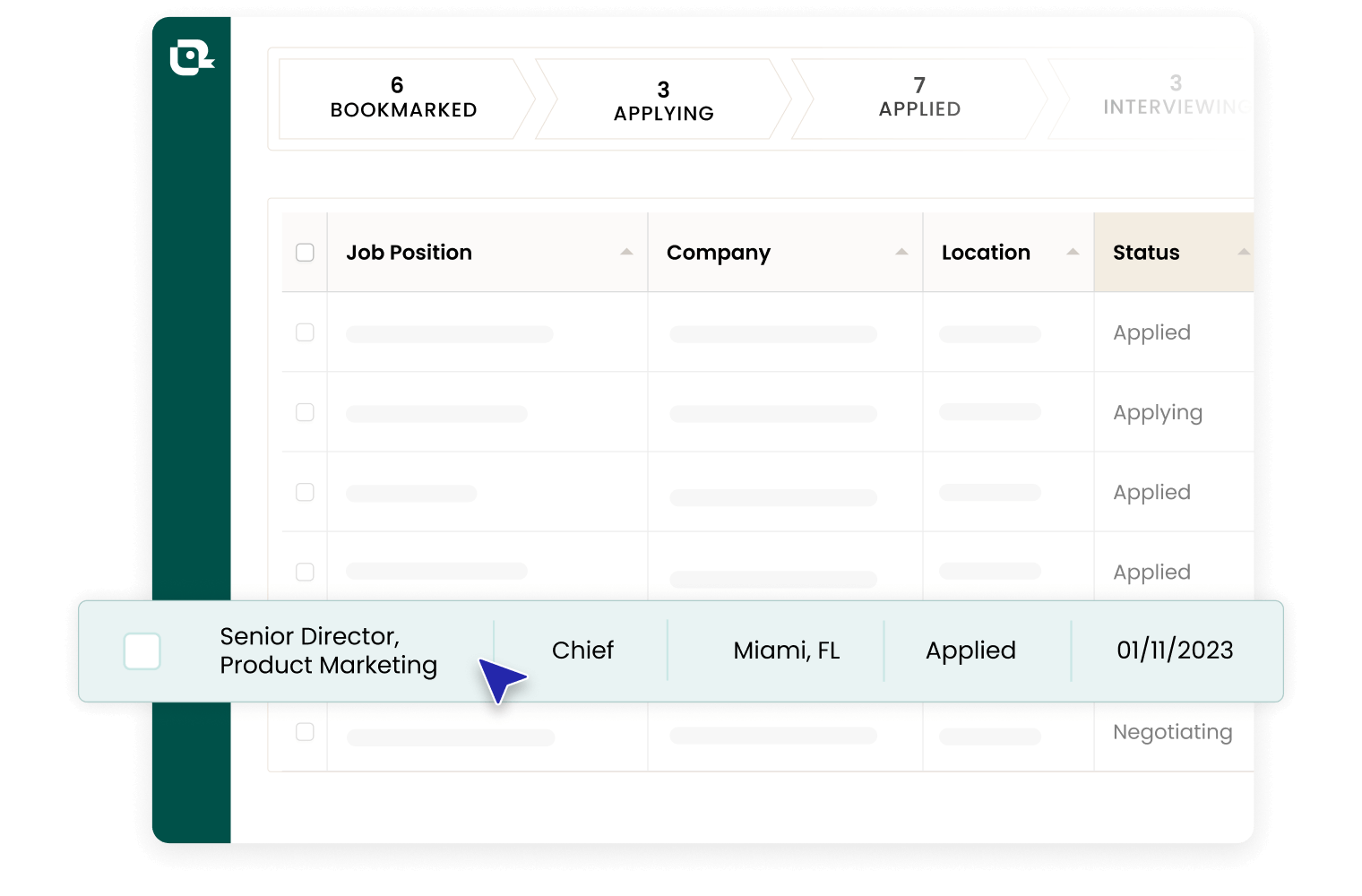

Stay Organized with Interview Tracking

Accountant Interview Questions and Answers

"how do you ensure accuracy and compliance in your accounting work", how to answer it, example answer, "can you describe a time when you identified a significant error in the financial statements and how you addressed it", "what accounting software are you familiar with, and how have you utilized its features in your work", "how do you manage tight deadlines, especially during the end-of-month or end-of-year closing", "explain the concept of accrual accounting and how it differs from cash basis accounting.", "how do you approach the reconciliation of accounts", "can you discuss a time when you had to explain complex financial information to a non-financial audience", "what steps do you take to stay updated with changes in accounting standards and tax laws", which questions should you ask in a accountant interview, good questions to ask the interviewer, "can you explain the typical client portfolio i would be handling, and how the firm supports accountants in managing their responsibilities", "what accounting software and systems does the firm currently use, and what is the training process for these tools", "how does the company approach professional development and continuing education for its accounting staff", "can you describe the performance review process and how success is measured for accountants here", what does a good accountant candidate look like, technical proficiency, attention to detail, strategic thinking, integrity and ethics, communication skills, adaptability and continuous learning, problem-solving skills, interview faqs for accountants, what is the most common interview question for accountants, what's the best way to discuss past failures or challenges in a accountant interview, how can i effectively showcase problem-solving skills in a accountant interview.

Accountant Job Title Guide

Related Interview Guides

Driving financial success by overseeing accurate, efficient accounting operations

Ensuring financial accuracy and compliance, safeguarding business integrity and growth

Balancing financial accuracy with efficiency, ensuring fiscal health and transparency

Navigating complex tax landscapes, ensuring compliance while maximizing savings

Steering financial success with strategic oversight, ensuring fiscal integrity and growth

Driving financial strategies, analyzing market trends for business profitability

Start Your Accountant Career with Teal

Interview Questions

Comprehensive Interview Guide: 60+ Professions Explored in Detail

15 Most Common Accountant Interview Questions and Answers

By Pete Martin

Published: October 21, 2023

In an accountant interview, you can anticipate both technical and behavioral questions that help assess your skill set, knowledge, and work ethic . Technical questions will delve into your ability to perform tasks relevant to the role, such as reconciling bank statements, preparing financial reports, and ensuring compliance with tax laws. On the other hand, behavioral questions enable the interviewer to gauge your interpersonal skills, problem-solving abilities, and how you handle workplace challenges.

By knowing what to expect and preparing thoughtful, comprehensive answers to these questions, you’ll be better positioned to showcase your expertise and prove that you are the right candidate for the job.

Qualities and Skills Hiring Managers Look for in Accountants

As an aspiring accountant, it’s crucial to be aware of the qualities and skills hiring managers look for in candidates . By focusing on these areas, you can improve your chances of landing that accounting role you desire. Here are some key skills and qualities you should hone:

- Accounting Experience and CPA Certification

Having relevant accounting experience and being a Certified Public Accountant (CPA) will give you an edge over the competition. This demonstrates your dedication to the field and your expertise in accounting principles.

- Analytical Thinking

Accountants need to analyze and interpret financial data to make informed decisions. Sharpen your analytical thinking by practicing problem-solving exercises and staying up-to-date with industry trends.

- Math Skills

Proficiency in basic and advanced mathematical concepts is a must for accountants. Ensure you have a strong foundation in mathematics, as it will help you in various accounting tasks such as financial analysis and budgeting.

- Attention to Detail

In the world of accounting, every digit counts. Your ability to thoroughly review financial documents and identify any discrepancies is vital for maintaining accurate records.

- Time Management and Efficiency

Accounting can be time-sensitive, with strict deadlines for filing taxes and financial reports. By improving your time management skills, you’ll be able to work efficiently and complete tasks on time, which is an attribute hiring managers value.

- Organizational Skills

Staying organized will help you manage multiple tasks simultaneously and ensure accuracy in your work. Develop a system for organizing documents, tracking deadlines, and staying on top of client communication.

Focus on cultivating these skills and qualities as you prepare for your accountant interviews. By showcasing your expertise in these areas, you’ll increase your chances of being the ideal candidate for your desired accounting role.

15 Most Common Interview Questions and Answers

In this section, we will discuss 15 common accountant interview questions and provide sample answers to help you prepare. Remember to tailor your answers to your specific experiences and the company you are interviewing with.

1. Can you tell us about yourself and your background in accounting?

This question is asked to gain an understanding of the candidate’s professional background and experience in accounting. It allows the interviewer to assess the candidate’s qualifications and determine if they have the necessary skills and knowledge for the position they are applying for.

- Briefly mention your education and work experience.

Don’t

- Share unrelated personal hobbies or interests.

Sample Answer :

“I have a bachelor’s degree in accounting from XYZ University and have been working as a staff accountant for the past four years at a mid-sized public accounting firm. This experience has allowed me to master financial reporting, tax compliance, and auditing.”

2. What motivates you to pursue a career in accounting, and what made you apply to our company?

This is asked to understand the candidate’s motivation to work in the accounting field and their interest in the company they are applying to. It is used to give an insight into the candidates motivation for the sector, and their knowledge about the company itself.

- Highlight your passion for the field and research about the company.

- Focus solely on salary or job stability.

“I have always been passionate about analyzing financial data and helping businesses make informed decisions. Your company excels in providing top-notch accounting services, and I am eager to contribute my skills to your stellar team”.

3. How do you handle stress and tight deadlines in a work environment?

This question helps determine how the candidate handles pressure and if they can work effectively under tight deadlines. It allows the interviewer to assess the candidate’s ability to manage their workload and prioritize tasks.

- Showcase your time management and prioritization skills.

- Ignore the importance of taking breaks to maintain productivity.

“I utilize a task management system to prioritize my daily workload and set realistic deadlines, ensuring that my time is focused on high-priority tasks. When necessary, I am willing to put in extra hours to meet deadlines and ask for help from my coworkers when needed.”

4. Can you provide an example of a time when you had to work with a difficult team member, and how did you resolve the conflict?

Here the candidate’s ability to work collaboratively with others and handle conflicts in the workplace is being assessed. It also allows the interviewer to determine if the candidate has good communication and problem-solving skills.

- Demonstrate your ability to communicate and collaborate effectively.

- Blame or criticize the team member.

Sample Answer:

“I once had a team member who was hesitant to share important information, which hindered our project’s progress. I scheduled a one-on-one meeting to discuss the issue, highlighting the importance of collaboration in successful project completion. With open communication, we were able to resolve the issue and work more effectively as a team.”

5. Where do you see yourself in five years, and how do you plan to grow within our company?

Interviewers want to know the candidate’s long-term career goals and their interest in growing within the company. Interviewer’s can also assess if the candidate is a good fit for the company culture and values.

- Project realistic career growth and alignment with the company’s goals.

- Make it seem like you are using the job as a temporary stepping stone.

“In five years, I see myself taking on more responsibility as a senior accountant, contributing to more complex projects and mentoring junior staff. I plan to continue learning and expanding my skillset by attending professional development courses and staying informed about changes in accounting standards.”

6. Do you have your CPA?

Having the correct certification is critical, and this ascertains the candidate’s expertise. If the candidate does not have their CPA, it does not necessarily mean that they are not qualified for the role . In this case, the interviewer may ask additional questions to assess the candidate’s qualifications and suitability for the role.

- Mention your current CPA status and future plans for certification.

- Exaggerate or lie about your progress.

“Yes, I have my CPA certification. I believe that obtaining this certification has helped me to develop a deeper understanding of accounting principles and has given me the knowledge and skills necessary to excel in my career. It has also allowed me to stay up-to-date with changes in tax laws and accounting regulations, which is important in ensuring that financial statements are accurate and compliant.”

7. How do you organize and prioritize your daily tasks?

This question helps establish the candidate’s time management skills and ability to prioritize tasks effectively. It allows the interviewer to assess if the candidate can handle multiple tasks and meet deadlines.

- Share specific time-management techniques that work for you.

- Ignore the role of teamwork and collaboration in task prioritization.

“I use a variety of tools and techniques to organize and prioritize my daily tasks. I start by creating a to-do list and then prioritize it based on urgency and importance. I also use a calendar to schedule my tasks and set reminders for important deadlines. Additionally, I make sure to communicate regularly with my team and stakeholders to ensure that everyone is on the same page and that we are working towards a common goal. I also make sure to take breaks when necessary to recharge and maintain my focus.”

8. What accounting software are you familiar with, and how proficient are you with these tools?

Accountant need to be proficient with a range of different software. This question helps the interviewer understand your technical skills and proficiency with the different types.

- List software you have used and the functions you have performed.

- Overstate your proficiency with software you are not familiar with.

“I am familiar with a variety of accounting software, including QuickBooks, Sage, and Xero. I am proficient in using these tools to manage financial data, prepare reports, and perform other accounting tasks. For example, I have used QuickBooks to manage accounts payable and receivable, reconcile bank statements, and generate financial statements. I am also comfortable learning new software and adapting to new technologies as needed.”

9. Can you describe a time when you identified a discrepancy or error in financial statements and how you addressed it?

Attention to detail and problem-solving skills are two of the most fundamental skills accountants must possess. This question allows the interviewer to determine how the candidate uses them.

- Emphasize your attention to detail and problem-solving skills.

- Downplay the importance of resolving errors.

“I once discovered a material misstatement in a client’s income statement during a routine review. I promptly notified my manager, and together, we traced the error, corrected the financial statements, and implemented additional internal controls to prevent similar issues in the future.”

10. How do you stay up-to-date with changes in tax laws and accounting regulations?

This question is asked to assess the candidate’s commitment to professional development and their ability to adapt to changes in the field. It allows the interviewer to determine if the candidate has a proactive approach to staying informed about changes in the industry.

- Discuss specific resources you use to stay informed.

- Treat professional development as an afterthought.

“I regularly attend industry seminars and webinars, read accounting publications, and follow experts on social media to stay current with updates in regulations and best accounting practices.”

11. Can you explain the importance of internal controls in an organization, and provide an example of a control you’ve helped implement or improve?

This allows the interviewer to determine if the candidate has experience in ensuring financial integrity and minimizing risk. The importance of internal controls should not be underestimated and this question assesses the candidates attitude towards them.

- Emphasize the benefits of internal controls and your experience.

- Overlook the challenges in implementing them.

“Internal controls are crucial in preventing fraud, ensuring accurate financial records, and promoting operational efficiency. I have assisted in strengthening segregation of duties by implementing a dual-approval process for high-value transactions.”

12. How have you handled a situation where you had to explain complex financial information to a non-financial audience?

Communicating financial information to stakeholders who may not have a financial background is an important part of the job. This question helps the interviewer understand your communication skills and ability to explain complex information in a clear and understandable way.

- Show your strong communication skills and ability to simplify complex concepts.

- Fail to consider the audience’s requirements when relaying information.

“I had to present a quarterly financial report at a board meeting, so I prepared easy-to-understand visual aids and focused on the key financial indicators to effectively communicate the financial performance to non-financial board members.”

13. What role do you believe accountants play in the strategic decision-making process within an organization?

This helps the interviewer understand your understanding of the role of accountants in an organization and your ability to contribute to strategic decision-making.

- Highlight the importance of financial insight in decision-making.

- Diminish the role other departments play in the process.

“Accountants provide crucial financial analysis to inform decision-makers, enabling them to optimize resource allocation and make well-informed decisions that align with the organization’s objectives.”

14. How do you approach the process of creating and monitoring budgets, and what strategies do you employ to ensure their effectiveness?

Here the interview can assess the candidate’s budgeting skills and ability to monitor financial performance. It allows them to determine if the candidate has experience in creating and managing budgets effectively.

- Detail your experiences with budgeting and methodology.

- Ignore the importance of adapting budgets as circumstances change.

“I collaborate with department managers to create realistic budgets based on historical data and projected changes. To ensure their effectiveness, I update and monitor actual expenditures against the budget periodically and communicate with stakeholders to adjust as needed.”

15. Can you discuss your experience with financial audits, and how you have prepared or assisted in these processes?

This question helps the interviewer understand your experience with financial audits and your ability to assist in these processes. The candidate should discuss any challenges they faced during the audit process and how they overcame them. This could include issues such as discrepancies in financial records, difficult stakeholders, or complex accounting standards.

- Demonstrate your understanding of audit procedures and the value they bring.

- Neglect the importance of communication and collaboration during audits.

“I have been involved in several financial audits, where I prepared financial documents, liaised with auditors, and addressed any findings. I have found that clear communication and proactive collaboration with auditors are essential for a successful audit experience.”

And here are a few final tips to help get you over the line:

Do some research on the company you are interviewing with to gain a better understanding of their values, mission, and culture . This will help you tailor your responses to their specific needs and demonstrate your interest in the organization.

Review your resume and experience to identify key achievements and skills that are relevant to the position. Be prepared to provide specific examples of how you have applied these skills in your previous roles.

Practicing your responses will free up precious brain power to ensure you put your best foot forward in the rest of the interview. You can practice with a friend or family member, or record yourself answering the questions and review your responses.

Prepare a list of questions to ask the interviewer about the company, the role, and their expectations . This will demonstrate your interest in the position and help you gain a better understanding of what the job entails.

By following these steps (and the strategies above), you can walk into your interview safe in the knowledge that you have prepared as best you can.

And, hopefully, when you walk out, it will be with your dream job secured!

About the Author

Read more articles by Pete Martin

Continue Reading

15 Most Common Pharmacist Interview Questions and Answers

15 most common paralegal interview questions and answers, top 30+ funny interview questions and answers, 60 hardest interview questions and answers, 100+ best ice breaker questions to ask candidates, top 20 situational interview questions (& sample answers), 15 most common physical therapist interview questions and answers, 15 most common project manager interview questions and answers.

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Career Sherpa

Guide for Lifetime Career Navigation

- Search this site...

47 Accounting Interview Questions You Must Prepare For

July 20, 2023 by Hannah Morgan

If you’re applying for an accounting position and want to improve your chance of getting hired, you need to be ready to answer a number of questions.

This comprehensive list of accounting interview questions will help you prepare and make a great impression.

1. Have you ever created your own process for accounting?

Accounting is an important role within a company, and many are looking for innovators. Employers want people who can actively improve existing accounting processes. A question like this lets interviewers see if you have the creative mind and problem-solving skills to address the company’s issues.

Reflect on your experience and provide details on the processes you created. Highlight how they benefited your past employers. If you don’t have a direct example, you can talk about how you changed and improved processes to improve efficiency.

2. Can you provide an example of a complex accounting issue you resolved and how you went about it?

This accounting interview question is all about testing your problem-solving skills. To be a successful accountant, you have to navigate complex challenges regularly. Your response is an opportunity to prove that you aren’t afraid of hurdles and have the innate skills to overcome anything.

Provide real-world examples whenever possible. Explain the problem, explain what you did, and emphasize the positive outcome that came after.

3. Can you give an example of a time when you delivered outstanding customer service to a client?

Most people think that accounting is all about technical skills and knowledge. While those are big factors to your success, you must also provide great customer service. This question is about showing that you know how to interact with clients while taking care of their needs. Keep in mind, sometimes we have internal customers too.

Consider your greatest customer service moments and discuss when you went above and beyond to meet a client’s needs.

4. What attracted you to our accounting firm?

Here’s a question you’ll hear regardless of the position you’re trying to get. Employers want to know why you want a job at their firm. Your answer unveils your motivations and shows that you’ve done your research.

Before your interview, learn as much as you can about the company. Find a few key talking points that initially compelled you to comply. It can be the company’s mission, its approach to accounting, etc.

5. Can you share your experience in developing or tracking business metrics?

As an accountant, you’ll work with businesses to track many key metrics. That can include monitoring gross margins or tracking the cost of bringing in new customers, and knowing how to monitor those metrics is essential.

Hiring managers ask this accounting interview question to gauge your understanding of these critical skills. They want to know that you clearly understand business metrics and will have no problem completing the relevant work.

6. In terms of accounting software, do you place more importance on cost or functionality?

There are many types of accounting software available. The best way to answer this question is to emphasize that cost doesn’t always reflect functionality and efficiency. While you may have your preferences, hiring managers want to hear answers that emphasize both cost and functionality.

For example, you can talk about the importance of finding software that fits your budget and meets your business’s core needs.

7. What methods do you employ to evaluate the reliability of financial data you receive?

An accounting interview question like this gives interviewers more insight into your standards. Higher performance standards are always preferred!

Think about how you evaluate financial data. You may have processes to reduce errors and maintain good quality control. Whatever the case, talk about it and emphasize the importance of reliability.

Your goal is to show great attention to detail and care about accuracy.

8. How would you define working capital?

This question appears simple, but it’s something interviewers ask to gauge your understanding of accounting. It’s a simple definition, but you can provide examples to put your knowledge on full display.

In short, working capital refers to the money a business has available to use on day-to-day expenses. It’s the company’s overall assets minus its current liabilities.

9. How would you distinguish between auditing and accounting?

Here’s another interview question for accountants that lets you show your understanding of this industry. While accounting and auditing are both important, they are two different processes.

Accounting is a continuous process that involves keeping track of transactions and preparing financial statements. Auditing comes after. It’s a periodic process that involves critically examining financial statements to verify accuracy.

10. Have you ever mentored another accountant?

There’s no better way to improve your own skills than by mentoring others. Employers love to hear that candidates have some mentoring experience. Not only does it usually mean their skills are excellent, but it also shows that they know how to work with others.

Talk about previous mentorship experiences and lean into what you did to help the person who shadowed you. If you don’t have any experience, be honest. You can discuss a moment when someone mentored you.

11. Can you explain the key differences between cash and accrual accounting?

These forms of accounting differ in what you include for financial statements and monitoring processes.

With accrual accounting, you include funds the company hasn’t yet received. A business could accept deferred payments. When you do accrual accounting, you include everything owed to the company, even if they receive it later.

Cash accounting doesn’t include those deferred payments. It’s not counted as revenue until the company has the cash on hand.

12. Tell me about a time when you fostered teamwork and cooperation in the workplace?

Teamwork is important in the accounting world. Hiring managers ask this question to learn more about how you work with others and what you do to foster collaboration.

Reflect on past experiences and provide a real example. You can discuss what steps you take to include others, how you improve communication among team members, the importance of active listening, etc.

13. How do you work to minimize human error?

Like the question about financial data reliability, this one helps employers gauge your attention to detail. In accounting, human errors can be detrimental.

The best way to respond is to highlight your organizational skills and understanding of internal controls. You can discuss Generally Accepted Accounting Principles (GAAPs) and go over your steps to reduce errors as much as possible.

14. How would you gauge if a company can meet its short-term obligations?

Here’s another question that gauges your skills and accounting knowledge.

The best way to determine if a company can meet its short-term obligations is to look at its working capital. Also known as the current ratio, you find the figure dividing the company’s current assets by its current liabilities.

15. Can you explain the difference between public and private accounting?

Interviewers may ask this question to ensure that you understand what different types of work entail and what responsibilities you may have. The best way to respond to this accounting interview question is to define these two terms and provide examples of how they differ.

Private accounting refers to when an accountant works for a single company. You can discuss responsibilities, such as implementing accounting processes, evaluating spending, etc.

Public accounting is when you work with multiple businesses and individuals. In this case, your responsibilities could include providing auditing services, preparing financial statements, etc.

16. When purchasing equipment for a company, how do the three financial statements get affected?

This question lets employers gain more insight into your understanding of financial statements. When a company purchases new equipment, the three statements affected are cash flow statements, balance sheets, and income statements.

Interviewers may make this question more complex by including thresholds, such as time of acquisition and financing factors.

17. What are the five common errors in accounting? Have you committed any of these errors? If so, what did you learn from the experience?

The five common errors in accounting include:

- Entering line items into the wrong account

- Considering income as an expense or vice versa

- Transposing numbers

- Omitting a digit or decimal point

- Duplication and missed entries

You can be honest about whether or not you’ve made these mistakes. But if you talk about those mistakes, discuss what you learned and how you’ve stopped yourself from making them again.

18. Do you possess any unique accounting qualifications or skills?

There are many accounting specializations and unique qualifications available. If you have any of them, employers want to learn about them!

Added qualifications can improve your chances of getting a job. That’s especially true if they’re relevant to the role. If you don’t have any extra qualifications, you can discuss the steps you’re taking to get them in the future.

19. Why is fraud more likely to occur with a journal entry compared to a ledger?

An accounting interview question like this helps hiring managers test a candidate’s knowledge and skills around fraud analysis.

Journal entries have fewer controls than ledgers. An official ledger has controls that detect issues like human error and fraud. Because journals lack those protections, it’s easier for someone to commit fraud.

20. How do you stay current on the latest accounting laws and regulations?

Accounting laws and regulations are ever-changing. To remain successful in this field, you must stay abreast of what’s current. No employer wants to hire an accountant who isn’t updated on laws and regulations.

You can talk about attending regular conferences or subscribing to professional publications. Memberships in professional organizations are also a plus.

21. Which accounting software platforms do you have experience with?

There’s no right or wrong answer to this question. Several accounting platforms exist. Whether you prefer Quickbooks or Hyperion, you can talk about what you enjoy most from those platforms.

The most important thing is to emphasize that you’re adaptable and willing to learn. The employer may have its preferred software, and you must show that you can learn quickly without hiccups.

22. What tactics did you use in your past roles to detect fraud and ensure security?

Fraud detection is crucial in accounting. With this question, interviewers aim to learn more about what you do to ensure security. It’s about proving your attention to detail and ensuring you take steps to prevent fraud.

The best way to respond is to go over your methods. Provide examples and offer proof of how your tactics work.

23. Can you share some challenges you faced while leading others through an analysis project?

Leading a team through a complex analysis project isn’t easy. However, worthy candidates can lead a team effectively and use many strategies to handle tough challenges.

When you answer this accounting interview question, provide real examples. Be comprehensive in your response, detailing what you did to handle the situation. Interviewers want more insight into your thought processes, so focus on your critical thinking and problem-solving capabilities.

24. Which ERP systems are you familiar with?

Enterprise resource planning (ERP) systems are what companies use to manage their business operations.

Don’t be vague with your response. Talk about the systems you have experience using. Be specific with your answer.

Hiring managers want to learn about what you’re comfortable using so that they can understand how much training you’ll need to utilize existing ERP systems if offered the job.

25. Can you discuss how you managed to lower a company’s operating expenses in the past?

Knowing how to lower a company’s operating expenses is a valuable skill. Any way you can save your clients money and boost the bottom line is worth discussing.

Like other questions, this one is about problem-solving and creative thinking. Refer to real scenarios from your work history. Discuss what you did and how your work made a difference.

26. Could you explain the primary types of financial statements?

Questions like this gauge your accounting knowledge. You can use many types of financial statements, and what’s best will depend on the company.

Common financial statements include a balance sheet. Balance sheets outline current assets, liabilities, and shareholder equity. There are also cash flow statements detailing where a company’s money comes from.

Finally, you can bring up income statements. They detail expenses and revenue.

27. Explain the difference between deferred revenue and accounts receivable.

Deferred revenue refers to money a company receives before providing its product or service. For example, a customer may prepay for something. However, the company hasn’t fulfilled its part of the exchange.

Accounts receivable are the opposite. It’s when a company provides its product or service, but the customer hasn’t paid yet. It’s considered accounts receivable until the customer fulfills their invoice.

28. What three soft skills do you believe are essential for an accountant to have?

There are many soft skills an accountant needs. Interviewers ask this question to learn more about what you bring to this position and what you believe is most important to the job.

You can discuss skills like time management, attention to detail, communication, problem-solving, etc. The best approach is to respond with the skills you have, allowing you to show how you demonstrate the skills you need to succeed.

29. What does PP&E represent, and how is it recorded?

Here’s another interview question for accountants that helps employers understand your core knowledge.

PP&E stands for property, plant, and equipment. It’s an acronym that refers to physical assets.

Typically, you’d record PP&E on a balance sheet while accounting for factors like depreciation and added capital.

30. How do you manage stress?

Accounting can be a stressful job. Hiring managers ask about stress management to ensure you have what it takes to navigate the challenges of the job without losing your cool.

There’s no right or wrong answer, but you must discuss what steps you take to ensure that stress doesn’t affect your performance and productivity.

31. How do you handle tight deadlines?

When an interviewer asks this question, they want to know about your time management skills! Accounting can involve many distinct tasks with strict deadlines.

Your response should cover your approach to time management and task prioritization. Provide real examples that show how your techniques benefit you and your past employers.

32. Have you obtained your CPA?

A certified public accountant (CPA) license isn’t always required. However, it can give a competitive edge because it proves you have specific competencies.

If you don’t have your CPA, be honest. You can discuss your plans to get your CPA. You can also bring up other credentials, such as a CFA, CMA and more.

33. Can you identify a major challenge that individuals in the accounting profession often face?

Accounting interview questions like this assess your knowledge of the current accounting landscape. A solid response covers common challenges, proving that you understand what hurdles you’ll need to overcome if given the job.

Consider reading recent accounting publications. You can solve existing problems, such as staying current with changing regulations and utilizing emerging technologies.

34. Can you share a recent challenge you encountered and what you did to overcome it?

This question complements the previous one. Like many other questions during your interview, this one aims to shed light on your ability to overcome challenges and solve problems.

Refer to a real scenario you recently experienced. Detail the issues at hand, discuss how you approached them, and end with a positive outcome. You can also refer to the lessons you learned and how you’ve avoided similar challenges since.

35. What is the accounting equation?

If you can’t answer this question confidently, it’ll be a major red flag for hiring managers. The accounting equation relates to the balance sheet and is an important foundation for this industry.

The accounting equation shows how a company’s liabilities and equity relates to its assets.

36. If a company processes payments through three bank accounts, what is the minimum number of ledgers it requires?

When an interviewer asks this question, they’re testing your knowledge of ledgers. It’s an opportunity to show that you understand how bank accounts relate to the lines of business.

Each bank account should have three ledgers for proper accounting and reconciliation. That means you’d have a total of nine ledgers to cover the three accounts.

37. Can you mention a few prevalent budget methods and their main features?

There are several budgeting methods you can use. Some of the most common include incremental budgeting, activity-based budgeting, zero-based budgeting, and value proposition budgeting.

The best way to answer this accounting interview question is to focus on the methods you’re most familiar with. Talk about their advantages and disadvantages, and provide examples of how you’ve used them to your and your past employer’s benefit.

38. What methods do you use to manage and prioritize your day-to-day tasks?

Here’s another question centered around time management. Hiring managers want to learn about how you approach your day. They want insight into how you manage your time, meet deadlines, and prioritize tasks to get everything done efficiently.

You can discuss various time management techniques. Focus on the ones you utilize most and how they work to your advantage.

39. What are the four types of special journals?

The four main types of special journals include:

- Sales journals

- Purchase journals

- Cash disbursement journals

- Cash receipt journals

When interviewers ask this question, they’re gauging your knowledge and testing your ability to stay organized and identify journaling mistakes.

40. In double-entry accounting, what components of a ledger should balance out?

This is a relatively easy accounting question that interviewers often use to ensure that you have a basic understanding of the job. If you can’t answer it, you’ll likely get taken out of the running.

To balance out, the total of debits and credits for a transaction need to be equal on the ledger.

41. Can you explain EBITDA and its relevance in accounting?

EBITDA is an acronym for “earnings before interest, taxes, depreciation, and amortization.” EBITDA is an important measure of an entity’s financial health. It provides insight into how a company earns money.

Like other basic knowledge questions, interviewers may ask about EBITDA as an early “qualifier” question. Explain the concept thoroughly to make a good impression.

42. What do you believe are the top attributes of an effective accountant?

You could talk about many skills, but hiring managers want to hear what you think is most important to success. A question like this unveils considerable information about your approach and motivations.

Think about what skills and attributes contribute most to your success. They can be hard or soft skills, but you must explain why those attributes matter.

43. Tell me about yourself.

This question can catch you off guard. While it seems simple and irrelevant, hiring managers use it to gauge your fit into the company.

It’s about seeing if you fit into the company culture and can succeed in this environment. The best approach is to focus on your work experience. Talk about your qualifications and what types of work environments you thrive in. This tell me about yourself question should align with the job you are interviewing for and be under two minutes long.

Of course, research the company before your interview to ensure that your answer aligns with the organization.

44. Can you differentiate between accounts receivable and accounts payable?

Another knowledge-based question, interviewers ask this to gauge your core understanding of accounting.

Accounts receivable are assets. It’s what a company receives in exchange for a product or service.

Accounts payable are liabilities. It’s what a company owes to another entity for products or services. For example, accounts payable could include rent payments for the office, software the team uses, office supplies, etc.

45. In what circumstances would you capitalize an expenditure instead of expensing it?

Generally, it’s best to capitalize a purchase if the company plans to use it over a long period of time. For example, buying new equipment the organization will use for years should be capitalized.

On the other hand, expensing a purchase is best if the company plans to consume it immediately. Examples of those purchases include employee salaries, office supplies, etc.

46. Could you describe an occasion where you exceeded expectations at work?

Employers love it when employers go above and beyond. Of course, it’s not about squeezing as much work out of a person as possible. Instead, it shows you’re dedicated to your job and willing to go above and beyond to ensure success.

Provide examples of when you went outside your scope of work to handle a problem. That could be staying late to take care of tight deadlines or doing extra work to ensure security on financial statements. Whatever the case, explain the situation and lean into what good came out of it.

47. Which accounting duties do you find to be the easiest? Which tasks are more challenging for you?

Accounting interview questions like this are similar to those about your strengths and weaknesses. Everyone has areas where they excel and areas where they’re looking to improve.

Be honest about both. Talk about your strengths and provide examples of how you thrive doing certain work.

When discussing weaknesses, reflect on why those challenges are so difficult to overcome. Most importantly, discuss the steps you’re taking to improve and show that you don’t shy away from the hurdles that come your way.

Now that you’re familiar with the most important accounting interview questions, the next step is to start practicing your answers. Work through this list and identify any questions that trip you up so you can develop a perfect response!

If you do this, your chance of getting hired will skyrocket.

Hannah Morgan speaks and writes about job search and career strategies. She founded CareerSherpa.net to educate professionals on how to maneuver through today’s job search process. Hannah was nominated as a LinkedIn Top Voice in Job Search and Careers and is a regular contributor to US News & World Report. She has been quoted by media outlets, including Forbes, USA Today, Money Magazine, Huffington Post, as well as many other publications. She is also author of The Infographic Resume and co-author of Social Networking for Business Success .

- Interviewing

- Career Management

- Social Media

- Summary Sunday

- Products & Services

NEVER MISS A POST!

Don’t miss out on the latest tips and tricks for a successful job search! By subscribing, you’ll get a weekly digest of modern job hunting trends. Whether you’re just starting your career or looking to take it to the next level, my newsletter has everything you need to succeed. Join the community today and stay ahead of the game!

SIGN UP HERE!

- More Networks

Would you like a 4 day work week?

15 Accountant Interview Questions with Sample Answers (2023)

7 sep, 2023.

- Interview Questions

Dive into our curated list of Accountant interview questions complete with expert insights and sample answers. Equip yourself with the knowledge to impress and stand out in your next interview.

1. could you discuss a time when you helped reduce costs at a previous company.

When preparing for this question, reflect on a specific instance where you were able to identify inefficiencies or unnecessary expenditure in a company's books. The interviewer wants to understand your capacity for critically assessing financial data for the benefit of the company.

In my previous role, I noticed that the company was consistently exceeding its budget in a few areas. Upon closer examination, I found that we were using premium services where cost-effective alternatives would serve the purpose. I brought this to the attention of management and, after careful consideration, we switched to more economical options, saving the company approximately 20% annually.

2. How have you maximized tax deductions for a corporation?

This question assesses your understanding and application of tax laws. Interviewees should demonstrate their ability to apply these laws effectively, and provide specific examples of how they maximized tax deductions.

I once worked with a company that was not fully leveraging tax credit opportunities. After a thorough review of their financials, I introduced them to a few underutilized tax credits related to their industry. This resulted in significant tax savings for the company.

3. How do you ensure accuracy when preparing and reviewing financial statements?

Accuracy is fundamental in accounting, and the interviewer wants to gauge how you achieve this in your work. Provide specific methods or systems you use to ensure accuracy in your work.

I follow a methodical process when preparing and reviewing financial statements. This includes double-checking my work, using reliable accounting tools, and periodically cross-referencing with original documentation. This multi-level review process helps ensure accuracy in the financial statements I prepare.

4. Describe a complex financial project you have managed. What was the outcome?

This question allows you to showcase your project management skills in a financial context. Be sure to discuss the complexity of the project, your role, and the results achieved.

I managed a complex project involving the financial integration of two merging companies. It involved reconciling numerous accounts, aligning financial strategies and ensuring regulatory compliance. Despite its complexity, we successfully completed the project on time and within budget, achieving a seamless financial integration.

5. How have you adapted to changes in financial regulations?

Accounting is a field subject to frequent changes in financial regulations. The interviewer wants to understand your adaptability and how you keep abreast of these changes.

I regularly follow industry news and attend webinars and workshops to keep updated with changes in financial regulations. For instance, when the tax law changes came into effect, I attended several seminars to understand the implications, ensuring I could efficiently implement these changes in our work.

6. Can you discuss a time when you had to explain financial information to non-financial staff?

The ability to communicate financial information to non-financial staff is a critical skill for Accountant s. The interviewer wants to see how you simplify complex information for wider understanding.

I once had to explain the financial implications of a proposed project to the marketing team. I broke down the cost components and highlighted the impact on the company's bottom line. This helped them understand and make informed decisions on their marketing strategies.