- Search Menu

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Urban Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Literature

- Classical Reception

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Papyrology

- Greek and Roman Archaeology

- Late Antiquity

- Religion in the Ancient World

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Acquisition

- Language Evolution

- Language Reference

- Language Variation

- Language Families

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Modernism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Religion

- Music and Media

- Music and Culture

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Science

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Lifestyle, Home, and Garden

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Politics

- Law and Society

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Neuroanaesthesia

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Clinical Neuroscience

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Medical Ethics

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Security

- Computer Games

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Strategy

- Business Ethics

- Business History

- Business and Government

- Business and Technology

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic Systems

- Economic History

- Economic Methodology

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Natural Disasters (Environment)

- Social Impact of Environmental Issues (Social Science)

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- International Political Economy

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Political Behaviour

- Political Economy

- Political Institutions

- Political Theory

- Politics and Law

- Public Administration

- Public Policy

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Developmental and Physical Disabilities Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

The Oxford Handbook of International Tax Law

Florian Haase, Professor for German, European and International Tax Law and Tax Lawyer, IU International University, Bad Honnef/Rödl & Partner, Hamburg, Germany.

Georg Kofler, Professor of International Tax Law, Vienna University of Economics and Business (WU Vienna), Austria.

- Cite Icon Cite

- Permissions Icon Permissions

International tax law is at a turning point. Increased tax transparency, the tackling of ‘Base Erosion and Profit Shifting’ (BEPS), the reconstruction of the network of bilateral tax treaties, the renewed discussion about a fair and efficient allocation of taxing rights between states in a global, digitalized economy, and the bold push for minimum corporate taxation are some expressions of this shift. This new era also demonstrates the increased influence of international ‘standard setters’ such as the Organisation for Economic Co-operation and Development (OECD), the United Nations, and the European Union. These developments together have the potential to reshape the international tax system. This Handbook provides a comprehensive exploration of these key issues. Part I traces the history of international tax law from its earliest days until the present, including reflections on the developments that have characterized the last one hundred years. Part II places tax law within the broader international context considering how it relates to public and private international law, as well as corporate, trade, and criminal law. Parts III and IV consider key legal principles and issues. Analysis in subsequent Parts places these issues within their European and cross-border contexts providing an assessment of the role of the European Court of Justice, state aid, and cross-border value added tax before Part VII broadens the scope of that analysis, asking how trends in recent major economies and regions have helped shape the current outlook. Finally, Part VIII considers emerging issues and the future of international tax law.

Signed in as

Institutional accounts.

- GoogleCrawler [DO NOT DELETE]

- Google Scholar Indexing

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

Institutional access

- Sign in with a library card Sign in with username/password Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Sign in through your institution

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Sign in with a library card

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

WU International Taxation Research Paper Series - 2021

Speitmann, Raffael (2021) Reputational Risk and Corporate Tax Planning. WU International Taxation Research Paper Series , 2021-11. WU Vienna University of Economics and Business

Shehaj, Pranvera (2021) Corporate Income Tax, IP boxes and the Location of R&D. WU International Taxation Research Paper Series , 2021-10. WU Vienna University of Economics and Business

Edwards, Alexander and Marin, Michael and Wu, Yuchen (2021) Negative Interest Rates and Corporate Tax Behavior in Banks. WU International Taxation Research Paper Series , 2021-09. WU Vienna University of Economics and Business

Wu, Yuchen (2021) Does Tax Return Disclosure Affect Information Asymmetry among Investors?. WU International Taxation Research Paper Series , 2021-08. WU Vienna University of Economics and Business

Diller, Markus and Lorenz, Johannes and Schneider, Thomas Georg and Sureth-Sloane, Caren (2021) Is Consistency the Panacea? Inconsistent or Consistent Tax Transfer Prices with Strategic Taxpayer and Tax Authority Behavior. WU International Taxation Research Paper Series , 2021-05. WU Vienna University of Economics and Business

Petutschnig, Matthias and Resenig, Kristin (2021) Market reactions of multinationals to the OECD BEPS Action Plan. WU International Taxation Research Paper Series , 2021-04. WU Vienna University of Economics and Business

Brezina, Paul and Eberhartinger, Eva and Zieser, Maximilian (2021) Taxpayers’ and Tax Auditors’ Acceptance of Cooperative Automated Tax Audits. WU International Taxation Research Paper Series , 2021-02. Editors: Eva Eberhartinger, Michael Lang, Rupert Sausgruber and Martin Zagler (Vienna University of Economics and Business), and Erich Kirchler (University of Vienna)

Zieser, Maximilian (2021) Perceptions of trust, power and tax compliance motivations among large businesses and their tax auditors. WU International Taxation Research Paper Series , 2021-01. WU Vienna University of Economics and Business

Eberhartinger, Eva and Speitmann, Raffael and Sureth-Sloane, Caren and Wu, Yuchen (2021) How Does Trust Affect Concessionary Behavior in Tax Bargaining?. WU International Taxation Research Paper Series , 2020-15. WU Vienna University of Economics and Business

Flagmeier, Vanessa and Mueller, Jens and Sureth-Sloane, Caren (2021) When Do Firms Highlight Their Effective Tax Rate?. WU International Taxation Research Paper Series , 2020-11. WU Vienna University of Economics and Business

Bornemann, Tobias and Jacob, Martin and Sailer, Mariana (2021) Do Corporate Taxes Affect Executive Compensation?. WU International Taxation Research Paper Series , 2020-09. WU Vienna University of Economics and Business

Eberhartinger, Eva and Zieser, Maximilian (2021) The Effects of Cooperative Compliance on Firms’ Tax Risk, Tax Risk Management and Compliance Costs. WU International Taxation Research Paper Series , 2020-07. WU Vienna University of Economics and Business

Amberger, Harald J. and Robinson, Leslie (2021) The Inital Effect of U.S. Tax Reform on Foreign Acquisitions. WU International Taxation Research Paper Series , 2020-06. WU Vienna University of Economics and Business

Library electronic resources outage May 29th and 30th

Between 9:00 PM EST on Saturday, May 29th and 9:00 PM EST on Sunday, May 30th users will not be able to access resources through the Law Library’s Catalog, the Law Library’s Database List, the Law Library’s Frequently Used Databases List, or the Law Library’s Research Guides. Users can still access databases that require an individual user account (ex. Westlaw, LexisNexis, and Bloomberg Law), or databases listed on the Main Library’s A-Z Database List.

- Georgetown Law Library

- Foreign & International Law

International and Foreign Tax Law Research Guide

Introduction.

- International Tax -- U.S. Law & Practice

- International Tax -- Theoretical & Multi-Jurisdictional Resources

- Foreign & Comparative Tax Law (Jurisdictions Outside the U.S.)

- Secondary Sources: Journal Articles

- Tax Policy: IGO & NGO Resources

- Multilateral Tax Treaties

- Model Bilateral Tax Treaties

- U.S. Bilateral Tax Treaties

- Bilateral Treaties -- U.S. Not a Party

- Comparative Tools

- Summaries & Analyses

- Full Texts & Translations

- Foreign Tax Case Law

- News & Current Awareness Tools

- Other Research Guides & Update History

Key to Icons

- Georgetown only

- On Bloomberg

- More Info (hover)

- Preeminent Treatise

International tax law governs the taxation of income generated by an individual or a business enterprises outside of its home jurisdiction. This research guide focuses on U.S. international tax law and practice . It also covers bilateral tax treaties, foreign tax law (enacted in jurisdictions outside the U.S.), and comparative tax law research across multiple jurisdictions.

Key Resources for International & Foreign Tax Law

- Bloomberg Tax - International U.S. international tax law; U.S. tax treaties; BNA Foreign Income Portfolios (guides to foreign tax law and transfer pricing for select jurisdictions); comparative tools; news and practitioner-oriented journals.

- Checkpoint Treatises & other secondary sources on U.S. international tax law; U.S. tax treaties; foreign tax law in translation. Select "International Tax" as the practice area from the menu on the left.

- IBFD Tax treaties (multiple jurisdictions); summaries of foreign tax law; foreign tax law in translation; case law (multiple jurisdictions); e-books and journal articles; comparative tools. Select "Search" from the menu bar.

- TaxNotes.com * Tax Notes & Tax Notes International (practitioner-oriented news, commentary, and analysis); tax treaties (multiple jurisdictions); summaries of foreign tax law; and tax case law. * First-time users must register for an individual account using their Georgetown email address. To register, open this library catalog record , scroll down to "View Online," and follow the prompts.

- VitalLaw (Wolters Kluwer/CCH , formerly Cheetah) Current and superseded U.S. bilateral tax treaties; current and superseded model tax treaties (U.S., U.N., and OECD); news; articles published in the International Tax Journal . Select "Tax - International" as the practice area.

Research Assistance and Help with Related Topics

If you need assistance with international and foreign tax law research, visit the Research Help page of the Georgetown University Law Library's website. Or contact the Law Library's International and Foreign Law Department by phone (202-662-4195) or by email ( [email protected] ). Georgetown Law Center students may schedule a one-on-one research consultation with a librarian.

For guidance in researching topics related to international and comparative tax law, consult the following Georgetown Law Library research guides: Customs Law Research (U.S.) ; Customs Law Research (International) ; Foreign and Comparative Law Research ; Treaty Research ; U.S. Federal Tax Research .

International & Foreign Tax Law

Questions? Need Help? Contact the International & Foreign Law Dept.

International & foreign legal research (202) 662-4195 request a research consultation , update history.

Created 01/07 (SK) Links Checked 08/08 (RAS) Updated 05/11 (MMS) Revised 2/13 (JZ) Updated 8/13 (JZ) Revised 01/16 (CHB) Updated 01/17 (CHB) Updated 01/19 (CHB)

- Next: Secondary Sources: Treatises & Books >>

- © Georgetown University Law Library. These guides may be used for educational purposes, as long as proper credit is given. These guides may not be sold. Any comments, suggestions, or requests to republish or adapt a guide should be submitted using the Research Guides Comments form . Proper credit includes the statement: Written by, or adapted from, Georgetown Law Library (current as of .....).

- Last Updated: Sep 14, 2023 5:59 PM

- URL: https://guides.ll.georgetown.edu/internationaltaxlawresearch

The Reporter

International Taxation

The ability and evident willingness of taxpayers to relocate activity, to shift taxable income between jurisdictions, and to respond to incentives created by the interaction of domestic and foreign tax rules, mean that the tax policies of other countries obviously must be considered in the formulation of domestic policy. In the current environment, almost every U.S. tax provision influences foreign direct investment (FDI) or provides incentives for international tax avoidance.

Research in the field of public finance reflects a growing awareness of the importance of foreign tax policies; over the last ten years, there have been many new quantitative studies of the impact of taxation in open economies. 1 This research considers how tax policies affect three aspects of economic activity: FDI, international tax avoidance, and economic efficiency.

Foreign Direct Investment

Tax rate differences over time and between countries can be very large, thereby significantly affecting aftertax returns to FDI. By now there is ample evidence that countries with lower tax rates receive much more FDI than do countries with higher tax rates. And, for a given country, FDI is greater in years in which associated tax burdens are lighter. 2 To be sure, there are important complications to this otherwise very simple story. The ability of taxpayers to adjust the financing of FDI, and the repatriation of profits to home countries, also can affect the magnitude of FDI. 3 Furthermore, one of the stumbling blocks confronting efforts to estimate the impact of taxes on FDI is the importance of other nontax considerations -- such as market size and proximity, local factor prices, and local infrastructure -- and the possibility that they are correlated with tax rates.

There have been several efforts to identify the impact of tax rates on FDI in a way that removes as much as possible of the effect of correlated omitted variables. The U.S. Tax Reform Act of 1986 (TRA) provides one such opportunity, since it was a major tax change with important international repercussions, and it affected certain firms and industries differently than it did others. Firm- and industry-level evidence suggests that American companies concentrating in assets not favored by the TRA reacted by increasing their foreign investment after 1986; furthermore, foreign investors in the United States (for whom the TRA provisions had relatively smaller impact) may have concentrated in these more heavily taxed assets in the years after 1986. 4

Mihir Desai and I evaluate the impact of the TRA by comparing its effect on FDI undertaken by joint ventures and FDI undertaken by majority-owned foreign affiliates. 5 The TRA introduced an important distinction between income received from these two foreign sources by requiring Americans to calculate foreign tax credit limits separately for each joint venture. This change greatly reduced the attractiveness of joint ventures, particularly those in low-tax foreign countries. We find that American participation in international joint ventures fell sharply after 1986, while international joint venture activity by non-American firms rose. The drop in American joint ventures was most pronounced in low-tax countries, which is consistent with the incentives created by the TRA. Furthermore, after 1986 American joint ventures used more debt and paid greater royalties to their American parents, reflecting their incentives to economize on dividend payments.

Other types of comparisons offer useful evidence of the effect of taxation on FDI. The distribution between U.S. states of investment from countries that grant foreign tax credits with investment from all other countries provides one such comparison. The ability to apply foreign tax credits against home-country tax liabilities reduces an investor's incentive to avoid high-tax foreign locations. I find that differences in state corporate tax rates of a single percent are associated with differences between the investment shares of foreign-tax-credit investors and the investment shares of all others of 9 to 11 percent. This suggests that state taxes significantly influence the pattern of FDI in the United States. 6

Comparisons between American and foreign FDI in third countries offer a different type of powerful evidence of the impact of taxation. American and foreign tax systems differ in their treatment of foreign income, in particular because most high-income capital-exporting countries grant "tax sparing" for FDI in developing countries, while the United States does not. Tax sparing is the practice of adjusting home country taxation of foreign investment income to permit investors to receive the full benefits of any host country tax reductions. For example, Japanese firms investing in countries with whom Japan has tax sparing agreements are entitled to claim foreign tax credits for income taxes that they would have paid to foreign governments in the absence of tax holidays and other special abatements.

The evidence indicates that the ratio of Japanese FDI to American FDI in countries with whom Japan has tax sparing agreements is roughly double what it is elsewhere. In addition, I find that Japanese firms are subject to 23 percent lower tax rates than are their American counterparts in countries with whom Japan has tax sparing agreements. 7 Similar patterns appear when tax sparing agreements with the United Kingdom are used as instruments for Japanese tax sparing agreements. This evidence suggests that tax sparing influences the level and location of FDI, as well as the willingness of foreign governments to offer tax concessions.

By now there is extensive evidence that the volume and location of FDI is sensitive to its tax treatment. There is even in the literature something of a regularity among estimates: the implied tax elasticity of FDI is in the neighborhood of -0.6. This reveals an impact of taxation on FDI that is strong enough to appear clearly, despite the importance of many other variables that influence FDI. Furthermore, it suggests that international investors cannot use creative financing and other methods so effectively and costlessly that they avoid all taxes on their international income. Nor do governments imposing high tax rates fully compensate foreign investors in indirect ways by providing various forms of infrastructure.

Tax Avoidance

International investors often can reduce their tax liabilities through careful structuring and financing of their investments, use of transactions between related parties located in different countries, and decisions as to when to repatriate profits to parent firms in home countries. These practices often must be coordinated with FDI decisions, but together with FDI appear to be strongly influenced by tax rate differences.

Sophisticated international tax avoidance typically entails reallocating taxable income from countries with high tax rates to countries with low tax rates, and may include changing the timing of income recognition for tax purposes. Many of these methods are quite legal and closely resemble those used by domestic taxpayers. One example is the financing of foreign affiliates, which clearly can affect ultimate tax liabilities. If an American firm finances its foreign subsidiary with equity, then its foreign profits are taxable in the host country, and no U.S. tax is due until profits are repatriated to the United States. The alternative of financing the foreign subsidiary with debt from the parent company would entail lower foreign tax liabilities (since interest payments are deductible) but higher domestic tax liabilities (since interest receipts represent taxable income). Hence, the choice between financing a foreign affiliate with debt or with equity should depend on the difference between home and foreign tax rates, an implication that is quite consistent with the behavior of American multinational firms. Glenn Hubbard and I find that American-owned foreign subsidiaries located in high-tax countries are more likely to pay interest to their American parent companies in 1984 than are subsidiaries in low-tax countries, while the opposite pattern holds for subsidiaries remitting dividends to their American parents. 8

The TRA significantly changed the cost of capital for multinational firms with excess foreign tax credits by effectively limiting the deductibility of interest expenses incurred in the United States. Kenneth Froot and I find that after 1986 American firms with excess foreign tax credits and half of their assets abroad borrowed 5 percent less annually than did firms with deficit foreign tax credits (whose borrowing costs were not affected by the 1986 tax change). 9 A similar provision of the 1986 Act limited the deductibility of R and D expenses incurred in the United States by multinational firms with significant foreign sales and excess foreign tax credits. There, too, the evidence indicates that American firms that were affected by the tax change responded by reducing R and D activity in the United States and replacing it with R and D performed in foreign locations. 10 The estimated unit elasticity of demand for R and D implies that a tax change that increases the cost of performing R and D in the United States by 5 percent thereby reduces the volume of R and D by roughly 5 percent.

Of course, there are other methods of reducing tax obligations in an international environment, and sophisticated taxpayers show themselves to be adept at using such methods. Multinational firms can and do adjust the timing of dividend repatriations from foreign subsidiaries to reduce the associated tax liabilities. Hubbard and I find that only 16 percent of the foreign subsidiaries of American multinational firms paid any dividends to their parent companies in 1984. Subsequent research reports similar findings for other years. 11 American firms incur tax penalties if they pay bribes to foreign government officials or if they participate in unsanctioned international boycotts; the cost of these penalties vary with foreign tax rates, and the evidence indicates that the extent of such behavior is sensitive to its tax cost. 12 Even a multinational firm's country of residence is potentially affected by that country's system of taxing foreign income. There is evidence that the nationality of what are now American firms ultimately may be determined by how the United States imposes its worldwide resident tax system. 13

Tax systems often permit a certain leeway in selecting transfer prices for transactions between related parties located in countries with different tax rates. Taxpayers also typically have incentives to reduce prices charged by affiliates in high-tax countries for goods and services provided to affiliates in low-tax countries. The available evidence suggests that transfer pricing is sensitive to tax rate differences: reported pre-tax profit rates of foreign affiliates are inversely related to local tax rates; 14 royalty payments by foreign affiliates to their American parent companies are positively related to local tax rates; 15 American firms with tax haven affiliates tend to have lower U.S. tax liabilities; 16 and the foreign affiliates of American multinational firms are more likely to run trade surpluses with related parties if they are located in low-tax countries. 17 While it is hardly surprising that taxpayers take steps to reduce their tax liabilities, this evidence is very useful in establishing the revenue impact of such behavior and in suggesting ways in which tax avoidance affects other variables of interest, such as FDI. Far from removing incentives to locate FDI in low-tax countries, the ability to use sophisticated tax avoidance techniques probably enhances the attractiveness of low-tax locations for FDI, since FDI is necessary in order to report earning significant income in a location. 18

Economic Efficiency

Given the potential impact of taxation on the volume and location of FDI, as well as on the other activities of multinational firms, it is clear that the foreign provisions of actual tax systems may be responsible for considerable deadweight loss -- or, to put the same point differently, that more efficient alternatives may be available. Fundamental tax reform proposals often contain provisions concerning foreign income that would simplify and render more efficient the incentives facing American taxpayers, though this is not universally the case. 19 In the category of somewhat more modest reforms, Alberto Giovannini and I consider the potential efficiency gains from implementing corporate taxation based on the residence of shareholders rather than the source of income-generating activity within a community such as the European Union. 20 Yet another efficiency-enhancing alternative is for home countries to permit investors to receive deductions for capital outflows while fully taxing all capital inflows, a possibility that could be implemented even while imposing what is otherwise a traditional income tax. 21

The current U.S. tax treatment of foreign income is often criticized by observers who feel that the combination of foreign tax credits and deferral encourages foreign investment by American companies at the expense of domestic investment. This criticism typically relies on a stylized conceptual framework in which a fixed supply of capital is allocated between countries based on tax considerations. A potentially important, though more subtle, variant of this argument notes that aspects of the tax system that encourage foreign investment may thereby reduce expected payoffs to bondholders in the event of default, making borrowing more expensive and indirectly discouraging domestic investment. 22 In order to evaluate the overall impact of international taxation on the efficiency of resource allocation, however, it is necessary to consider its interaction with other distortionary aspects of the tax system. In such a setting, tax provisions that might otherwise reduce efficiency, such as the ability to defer home-country taxation of unrepatriated foreign profits, actually can enhance efficiency. 23

The interaction of taxation and inflation is responsible for a different kind of inefficiency. In an open economy with a nominal tax system, domestic inflation changes aftertax interest rates at home and abroad, thereby stimulating international capital movement and influencing domestic and foreign tax receipts, saving, and investment. Desai and I find that the efficiency costs of inflation-induced international capital reallocations are typically much larger than those that accompany inflation in closed economies, even if capital is imperfectly mobile internationally. 24

There is extensive evidence of the responsiveness of behavior to international tax rate differences, and this evidence carries important implications for the efficiency of foreign and domestic tax systems. This evidence also enlightens what were once purely domestic issues concerning the determinants of investment, corporate finance, R and D activity, and a host of other economic decisions. The ability to look across countries and firms with widely differing tax situations opens promising new avenues of investigation that may offer useful answers to what continue to be important and open questions.

1. For recent reviews of this literature, along with expanded analysis of many of the studies surveyed here, see J. R. Hines Jr., "Tax Policy and the Activities of Multinational Corporations," in Fiscal Policy: Lessons from Economic Research , A. J. Auerbach, ed. Cambridge: MIT Press, 1997, pp. 401-45; and J. R. Hines Jr., "Lessons from Behavioral Responses to International Taxation," National Tax Journal , 53 (2) (June 1999), pp. 305-22.

2. For evidence that FDI is concentrated in countries with low tax rates, see H. Grubert and J. Mutti, "Taxes, Tariffs, and Transfer Pricing in Multinational Corporate Decisionmaking," Review of Economics and Statistics , 73 (2) (May 1991), pp. 285-93; J. R. Hines Jr. and E. M. Rice, "Fiscal Paradise: Foreign Tax Havens and American Business," Quarterly Journal of Economics ,109 (1) (February 1994), pp. 149-82; and R. Altshuler, H. Grubert, and T. S. Newlon, "Has U.S. Investment Abroad Become More Sensitive to Tax Rates?" NBER Working Paper No. 6383 , January 1998, also in International Taxation and Multinational Activity , J. R. Hines Jr. ed. Chicago: University of Chicago Press, forthcoming. For evidence that FDI is concentrated in years with low tax rates, see D. G. Hartman, "Tax Policy and Foreign Direct Investment in the United States," National Tax Journal , 37 (4) (December 1984), pp. 475-87; M. Boskin and W. G. Gale, "New Results on the Effects of Tax Policy on the International Location of Investment," in The Effects of Taxation on Capital Accumulation, M. Feldstein, ed. Chicago: University of Chicago Press, 1987, pp. 201-19; and J. Slemrod, "Tax Effects on Foreign Direct Investment in the United States: Evidence from a Cross-country Comparison," in Taxation in the Global Economy , A. Razin and J. Slemrod, eds. Chicago: University of Chicago Press, 1990, pp. 79-117.

3. See, for example, the model presented in J. R. Hines Jr., "Credit and Deferral as International Investment Incentives," Journal of Public Economics , 55 (2) (October 1994), pp. 323-47.

4. For firm-level evidence, see D. G. Harris, "The Impact of U.S. Tax Law Revision on Multinational Corporations' Capital Location and Income-shifting Decisions," Journal of Accounting Research , 31 (Supplement) (1993), pp. 111-40. For industry-level evidence, see D. L. Swenson, "The Impact of U.S. Tax Reform on Foreign Direct Investment in the United States," Journal of Public Economics , 54 (2) (June 1994), pp. 243-66; and also A. J. Auerbach and K. Hassett, "Taxation and Foreign Direct Investment in the United States: A Reconsideration of the Evidence," in Studies in International Taxation, A. Giovannini, R. G. Hubbard, and J. Slemrod, eds. Chicago: University of Chicago Press, 1993, pp. 119-44.

5. See M. A. Desai and J. R. Hines Jr., "'Basket' Cases: Tax Incentives and International Joint Venture Participation by American Multinational Firms," Journal of Public Economics , 71 (3) (March 1999), pp. 379-402.

6. See J. R. Hines Jr., "Altered States: Taxes and the Location of Foreign Direct Investment in the United States," American Economic Review , 86 (5) (December 1996), pp. 1076-94.

7. See J. R. Hines Jr., "'Tax Sparing' and Direct Investment in Developing Countries," NBER Working Paper No. 6728 , September 1998, also in International Taxation and Multinational Activity , J. R. Hines Jr. ed. Chicago: University of Chicago Press, forthcoming.

8. J. R. Hines Jr. and R. G. Hubbard, "Coming Home to America: Dividend Repatriations by U.S. Multinationals," in Taxation in the Global Economy , A. Razin and J. Slemrod, eds. Chicago: University of Chicago Press, 1990, pp. 161-200. This pattern appears not to have changed significantly over time, according to evidence reported by H. Grubert, "Tax Planning by Companies and Tax Competition by Governments: Is There Evidence of Changes in Behavior?" in International Taxation and Multinational Activity , J. R. Hines Jr. ed. Chicago: University of Chicago Press, forthcoming. See also J. R. Hines Jr., "Credit and Deferral as International Investment Incentives," Journal of Public Economics , 55 (2) (October 1994), pp. 323-47; and H. Grubert, "Taxes and the Division of Foreign Operating Income Among Royalties, Interest, Dividends, and Retained Earnings," Journal of Public Economics , 68 (2) (May 1998), pp. 269-90.

9. See K. A. Froot and J. R. Hines Jr., "Interest Allocation Rules, Financing Patterns, and the Operations of U.S. Multinationals," in The Effects of Taxation on Multinational Corporations , M. Feldstein, J. R. Hines Jr., and R. G. Hubbard, eds. Chicago: University of Chicago Press, 1995, pp. 277-307.

10. See J. R. Hines Jr., "On the Sensitivity of R and D to Delicate Tax Changes: The Behavior of U.S. Multinationals in the 1980s," in Studies in International Taxation , A. Giovannini, R. G. Hubbard, and J. Slemrod, eds. Chicago: University of Chicago Press, 1993, pp. 149-87; J. R. Hines Jr., "No Place Like Home: Tax Incentives and the Location of R and D by American Multinationals," in Tax Policy and the Economy vol. 8, J. M. Poterba, ed. Cambridge: MIT Press, 1994, pp. 149-82; and J. R. Hines Jr., "International Taxation and Corporate R and D: Evidence and Implications," in Borderline Case: International Tax Policy, Corporate R and D, and Investment , J. M. Poterba, ed. Washington, DC: National Academy Press, 1997, pp. 39-52. Further evidence on the international sensitivity of R and D location to taxation is provided by J. R. Hines Jr., "Taxes, Technology Transfer, and the R and D Activities of Multinational Firms," in The Effects of Taxation on Multinational Corporations , M. Feldstein, J. R. Hines Jr., and R. G. Hubbard, eds. Chicago: University of Chicago Press, 1995, pp. 225-48; and J. R. Hines Jr. and A. B. Jaffe, "International Taxation and the Location of Inventive Activity," in International Taxation and Multinational Activity , J. R. Hines Jr., ed. Chicago: University of Chicago Press, forthcoming.

11. See J. R. Hines Jr. and R. G. Hubbard, "Coming Home to America: Dividend Repatriations by U.S. Multinationals," in Taxation in the Global Economy , A. Razin and J. Slemrod, eds. Chicago: University of Chicago Press, 1990, pp. 161-200; as well as R. Altshuler and T. S. Newlon, "The Effects of U.S. Tax Policy on Income Repatriation Patterns of U.S. Multinational Corporations," in Studies in International Taxation , A. Giovannini, R. G. Hubbard, and J. Slemrod, eds. Chicago: University of Chicago Press, 1993, pp. 77-115; and R. Altshuler, T. S. Newlon, and W. C. Randolph, "Do Repatriation Taxes Matter? Evidence from the Tax Returns of U.S. Multinationals," in The Effects of Taxation on Multinational Corporations , M. Feldstein, J. R. Hines Jr., and R. G. Hubbard, eds. Chicago: University of Chicago Press, 1995, pp. 253-72. For suggestive evidence that the stock market discounts the tax saving associated with contemporaneous deferral, see J. H. Collins, J. R. M. Hand, and D. A. Shackelford, "Valuing Deferral: The Effect of Permanently Reinvested Foreign Earnings on Stock Prices," in International Taxation and Multinational Activity , J. R. Hines Jr. ed. Chicago: University of Chicago Press, forthcoming.

12. See J. R. Hines Jr., "Forbidden Payment: Foreign Bribery and American Business after 1977," NBER Working Paper No. 5266 , September 1995; and J. R. Hines Jr., "Taxed Avoidance: American Participation in Unsanctioned International Boycotts," NBER Working Paper No. 6116 , July 1997.

13. See J. R. Hines Jr., "The Flight Paths of Migratory Corporations," Journal of Accounting, Auditing, and Finance , 6 (4) (Fall 1991), pp. 447-79; and J. H. Collins and D. A. Shackelford, "Corporate Domicile and Average Effective Tax Rates: The Cases of Canada, Japan, the United Kingdom, and the United States," International Tax and Public Finance , 2 (1) (May 1995), pp. 55-83.

14. See J. R. Hines Jr. and E. M. Rice, "Fiscal Paradise: Foreign Tax Havens and American Business," Quarterly Journal of Economics , 109 (1) (February 1994), pp. 149-82; H. Grubert and J. Mutti, "Taxes, Tariffs, and Transfer Pricing in Multinational Corporate Decisionmaking," Review of Economics and Statistics , 73 (2) (May 1991), pp. 285-93; and J. H. Collins, D. Kemsley, and M. Lang, "Cross-jurisdictional Income Shifting and Earnings Valuation," Journal of Accounting Research , 36 (2) (Autumn 1998), pp. 209-29.

15. J. R. Hines Jr., "Taxes, Technology Transfer, and the R and D Activities of Multinational Firms," in The Effects of Taxation on Multinational Corporations , M. Feldstein, J. R. Hines Jr., and R. G. Hubbard, eds. Chicago: University of Chicago Press, 1995, pp. 225-48; and H. Grubert, "Taxes and the Division of Foreign Operating Income Among Royalties, Interest, Dividends, and Retained Earnings," Journal of Public Economics , 68 (2) (May 1998), pp. 269-90.

16. D. Harris, R. Morck, J. Slemrod, and B. Yeung, "Income Shifting in U.S. Multinational Corporations," in Studies in International Taxation , A. Giovannini, R. G. Hubbard, and J. Slemrod eds. Chicago: University of Chicago Press, 1993, pp. 277-302.

17. K. A. Clausing, "The Impact of Transfer Pricing on Intrafirm Trade," NBER Working Paper No. 6688 , August 1998, also in International Taxation and Multinational Activity , J. R. Hines Jr. ed. Chicago: University of Chicago Press, forthcoming.

18. See the model developed in J. R. Hines Jr. and E. M. Rice, "Fiscal Paradise: Foreign Tax Havens and American Business," Quarterly Journal of Economics , 109 (1) (February 1994), pp. 149-82.

19. See J. R. Hines Jr., "Fundamental Tax Reform in an International Setting," in Economics Effects of Fundamental Tax Reforms , H. J. Aaron and W. G. Gale, eds. Washington, DC: Brookings, 1996, pp. 465-502.

20. A. Giovannini and J. R. Hines Jr., "Capital Flight and Tax Competition: Are There Viable Solutions to Both Problems?" in European Financial Integration , A. Giovannini and C. Mayer, eds. Cambridge: Cambridge University Press, 1991, pp. 172-210.

21. See J. R. Hines Jr., "Border Cash-flow Taxation," Mimeo , University of Michigan, 1999.

22. See J. R. Hines Jr., "Investment Ramifications of Distortionary Tax Subsidies," NBER Working Paper No. 6615 , June 1998.

23. See J. R. Hines Jr., "The Case Against Deferral: A Deferential Reconsideration," National Tax Journal , 52 (3) (September 1999), pp. 385-404. In this connection, see also J R. Hines Jr., "Dividends and Profits: Some Unsubtle Foreign Influences," Journal of Finance , 51 (2) (June 1996), pp. 661-89.

24. M. A. Desai and J. R. Hines Jr., "Excess Capital Flows and the Burden of Inflation in Open Economies," in The Costs and Benefits of Price Stability , M. Feldstein, ed. Chicago: University of Chicago Press, 1999, pp. 235-68.

Researchers

More from nber.

NBER periodicals and newsletters may be reproduced freely with appropriate attribution.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

© 2023 National Bureau of Economic Research. Periodical content may be reproduced freely with appropriate attribution.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

- We're Hiring!

- Help Center

International Taxation

- Most Cited Papers

- Most Downloaded Papers

- Newest Papers

- Save to Library

- Last »

- International Tax Law Follow Following

- Tax Treaties Follow Following

- International and European Tax Law Follow Following

- Tax Law Follow Following

- Transfer Pricing Follow Following

- Taxation Follow Following

- Tax Policy Follow Following

- International Tax Policy Follow Following

- Business Taxation Follow Following

- Direito Tributário (Tax Law) Follow Following

Enter the email address you signed up with and we'll email you a reset link.

- Academia.edu Publishing

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

UAE Is Drafting New Research and Development Tax Incentives

By Danish Mehboob

The UAE is planning to provide its first research and development tax incentives to bolster business investment.

The UAE Ministry of Finance started a consultation Friday about R&D incentives that it can provide under its new corporation tax framework that started last year. It is considering direct grants as well as tax incentives such as credits, but notes that credits give businesses predictable outcomes and reduce costs.

- The main design features that the ministry is considering include what businesses, activities, and expenditures should qualify for the incentive. It is also asking about what forms an incentive can take and ...

Learn more about Bloomberg Tax or Log In to keep reading:

Learn about bloomberg tax.

From research to software to news, find what you need to stay ahead.

Already a subscriber?

Log in to keep reading or access research tools.

International Paper Agrees to Buy DS Smith for $7.2 Billion (3)

By Eric Pfanner

International Paper Co. agreed to buy DS Smith Plc for £5.8 billion ($7.2 billion), besting rival suitor Mondi Plc in the battle for the UK packaging company.

The all-stock transaction would create a global leader in packaging, International Paper said in a statement Tuesday. The US company agreed to pay 0.1285 new shares of International Paper for each DS Smith share, or about 415 pence based on the share prices of both companies as of late March, when the US company went public with its interest.

The formal agreement gives International Paper the backing of DS Smith’s board, though Mondi ...

Learn more about Bloomberg Law or Log In to keep reading:

Learn about bloomberg law.

AI-powered legal analytics, workflow tools and premium legal & business news.

Already a subscriber?

Log in to keep reading or access research tools.

Perception of Housing Taxation in the Czech Republic

- Original paper

- Open access

- Published: 16 April 2024

Cite this article

You have full access to this open access article

- Jana Janoušková ORCID: orcid.org/0000-0001-9718-0316 1 &

- Šárka Sobotovičová 1

38 Accesses

Explore all metrics

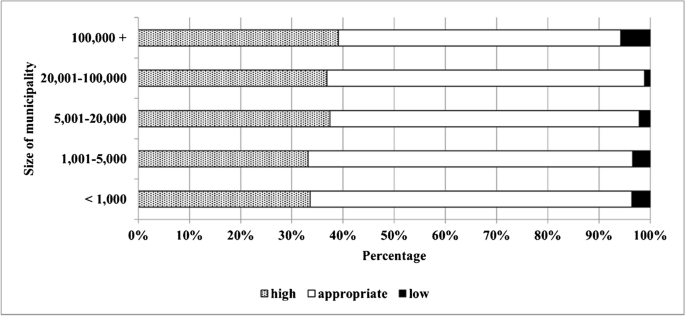

Housing taxation is considered the most obvious tax system inequity. Therefore, this type of taxation should be in line with the benefit principle. This article examines the attitudes of citizens towards residential building taxation in the Czech Republic. The aim of this paper is to evaluate the perception of residential building tax burden by taxpayers who own a house or apartment for housing based on primary research. The research was conducted in the Czech Republic using a questionnaire in 2021 and 2022. Differences in the tax burden perception in relation to improvements in quality of life in a municipality and use of compensation by providing financial benefit in favor of resident citizens are investigated in the context of municipality size. It was found that the majority of respondents in all municipality size categories perceived the tax burden as reasonable. Citizens' positive attitudes towards the taxation of their residential buildings were influenced not only by the quality-of-life improvement in the municipality, but also by the transparency of the municipality's financial management. By compensating for the tax on residential buildings through providing a financial benefit, some municipalities reduced the tax burden for their resident citizens and shifted the tax burden, within the limits of the law, to buildings for business and recreation. The most common forms of financial benefits included reducing or eliminating municipal waste fees.

Similar content being viewed by others

Specifics of Real Estate Taxation in the Czech and Slovak Republics

Šárka Sobotovičová & Jana Janoušková

Effects of Property Rights for Low-Income Housing in South Africa

Effective Public Rental Housing governance: tenants’ perspective from the pilot city Chongqing, China

Juan Yan, Marietta Haffner & Marja Elsinga

Avoid common mistakes on your manuscript.

Introduction

Real estate tax is not a popular tax, but some economists are inclined to believe that the tax is fair based on the principles of benefit and ability to pay (Alm 2013 ; Ihlanfeldt 2013 ). The property tax meets the principle of equitable taxation benefits when it is a price for local public services. Property tax can be a progressive tax if the tax is understood as a tax on capital. Despite being considered a fair tax by economists, property tax has consistently been cited as the least popular tax in surveys (e.g., Cabral and Hoxby, 2012 ) of taxpayers. This is because people are more aware of paying it compared to other taxes.

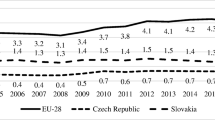

Immovable property tax revenue is negligible in relation to total tax revenue in the majority of the European Union (EU) member states. The share of the immovable property tax was 0.1% to 6.1% of total tax revenues (the EU 27 average was 2.6%) in 2021. In particular, the highest rates were in Greece (6.1%) and 5% in France. The Czech Republic is one of the countries with low immovable property tax revenues (property tax accounts for only 0.5% of total tax revenue) (European Commission 2023 ).

According to an Organization for Economic Co-operation and Development (OECD) study (2021), the Czech Republic is characterized by a large number of small municipalities with up to 2,000 inhabitants (89%). The trend of self-ownership continues and 78.9% of people live in their own home. The property tax burden can influence voters' perceptions and potentially affect electoral results. Municipal governments should carefully consider any property tax increase in terms of what is expected from the revenue increase, and whether it will be consistent with the satisfaction of the citizens who vote for them.

This paper examines citizens’ attitudes towards the taxation of residential buildings in the Czech Republic. The aim of this paper is to evaluate the perception of the residential building tax burden by taxpayers who own a detached or semi-detached house (hereafter house) or apartment for housing based on primary research. Differences between perceptions of the tax burden in relation to quality-of-life improvement in a municipality and the provision of financial benefits to resident citizens are investigated in the context of the size of the municipality.

Literature Review

Discussions about the rationale for the immovable property tax have been ongoing for a long time. Economists are looking for a method of taxation that will be acceptable to citizens and concurrently ensure sufficient tax revenue. Several contentious issues in the context of valuation are related to this tax (Horne and Felsenstein, 2010 ; Presbitero et al., 2014 ; Raslanas et al., 2010 ). These authors addressed the determination of the tax rate and disputes over whether to tax property at all.

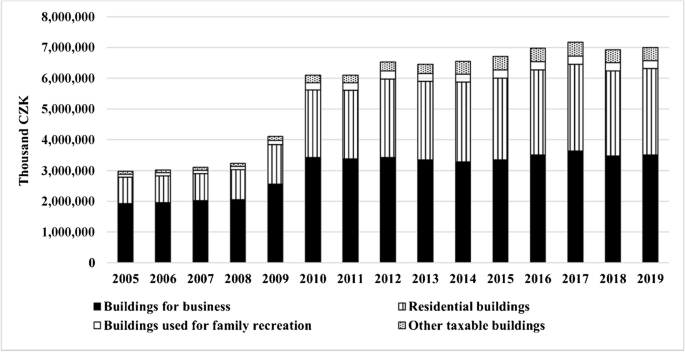

Immovable property taxes were levied in most EU member states (except Malta, Cyprus, Estonia, Hungary, Italy, and Croatia) in 2019. The importance of this taxation increased, in particular, in the Czech Republic, Greece, Spain, Portugal, Slovenia, and Finland. Recurrent property taxes have remained fairly constant in other countries (Barrios et al., 2019 ). Different tax rates are applied to different types of buildings in most EU member states. Residential buildings tend to be taxed at lower rates than buildings for recreation and business (Brunetti and Torricelli, 2017 ). The immovable property tax can be used by local governments to influence revenues in favor of improving quality of life in the community (Bird 2011 ; Haider-Markel 2014 ; Hesse 2021 ; Roubínek et al., 2015 ).

Kono et al. ( 2019 ) also highlighted the importance of immovable property tax revenues for local budgets and discussed the formal application of immovable property tax rates uniformly across locations. The simplicity of this uniformity is seen as an important practical advantage. The immovable property tax rate is formally adjusted according to the characteristics of the building, such as age, purpose of use, and tenure, and also according to the characteristics of the homeowner, such as disability and seniority, in many countries (e.g., France, the United Kingdom (UK), and Sweden). The effective tax rate may deviate from its formal uniform structure due to the assessment and calculation of tax procedures (e.g., in the United States (U.S.)). In addition, a metropolitan area may include several independent tax jurisdictions, so that the tax rate may vary spatially.

Afon ( 2014 ) investigated residents’ perceptions of the immovable property rating in a traditional African city. The study concluded that the tax should be portrayed as charges for services provided and that residents’ present negative perceptions of the tax would change if services were provided to meet minimal residents’ satisfaction. Zdražil and Pernica ( 2018 ) discussed the relationship between immovable property tax increases and the quality of life in a municipality. They pointed out that a tax increase implied the potential for municipal development and the stability of the supply of public services, and did not affect population decline in general.

The immovable property tax burden and its impact on local citizens was discussed by Beal-Hodges et al. ( 2016 ). The authors emphasized the need to consider both income and demographic variables when assessing the immovable property tax burden and its impact on different groups of homeowners. Blaufus et al. ( 2022 ) acknowledged that a tax change can affect voters' perceptions of the tax burden and their decision-making process when it comes to elections. Perceptions of the tax burden may also be affected by factors such as tax complexity, tax significance, tax morale, and fairness.

The motivation for our research was to assess taxpayer perceptions of the tax burden on residential buildings. The research results can be used by municipality governments in the Czech Republic when deciding on immovable property tax increases.

Taxation of Residential Buildings in the Czech Republic

A unitary system that does not reflect the value of the property is used for building taxation in the Czech Republic. The tax base for buildings is the acreage of the built-up area. Tax rates are set by law and differ according to the use of the buildings. The lowest tax rates are set for residential buildings, and the highest ones are applied to business buildings. An increase in the tax rates applies if the building has more than one floor above ground.

Municipalities should have a great deal of power in setting the amount of tax, particularly in the area of residential building taxation. The infrastructure and services must match the composition of the population of the municipality. Municipalities can affect the amount of the tax on residential buildings only by coefficients (corrective and local) in the Czech Republic.

The corrective coefficient takes into account the population size of the municipality. The municipality has the ability to influence the amount of the coefficient by decreasing it by one to three categories or increasing it by one category for each part of the municipality. Therefore, the corrective coefficient can have both a positive and a negative effect on the amount of the tax on residential buildings. When adjusting the corrective coefficients, the aim is usually different from affecting the municipality's revenue. This coefficient is used most often to differentiate between parts of a municipality according to the infrastructure and attractiveness of a given location.

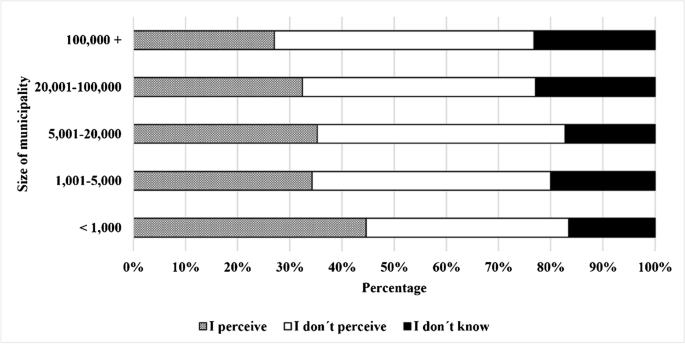

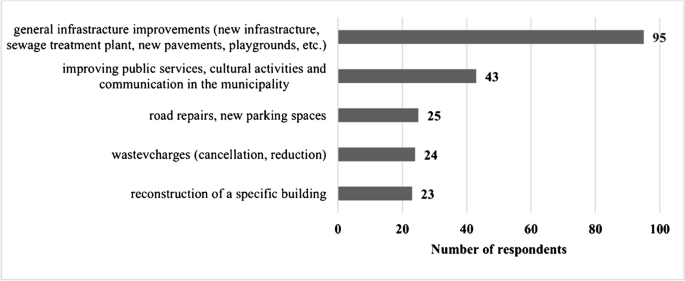

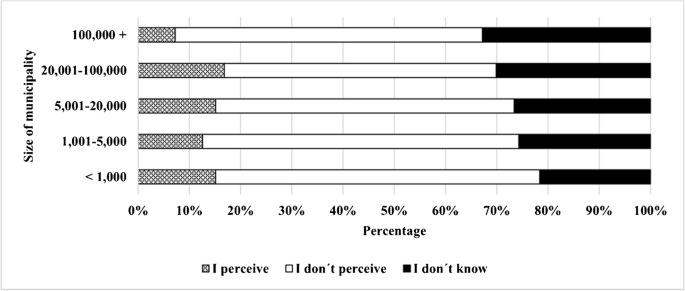

The local coefficient can also be used by municipalities to affect the tax revenues of residential buildings. This coefficient may be set at a value between 1.1 and 5 by the decision of the municipal government. This coefficient can be used both to secure tax revenue in the long term and in cases where the municipality needs non-recurrent resources to finance a necessary investment (Janoušková and Sobotovičová, 2019 ). The local coefficient is the most important tool that municipalities can use to increase immovable property tax revenues. The local coefficient was used by 719 municipalities in 2021 (the Czech Republic has a total of 6,258 municipalities) (FACR 2021 ).