13 AUD CPA Exam Tips: Study Tips & Topics for 2022

Passing the Uniform CPA Examination is a must if you want to become a licensed certified public accountant. As most people in the profession will tell you, the exam is a significant undertaking, comprising four four-hour sections. The Auditing and Attestation (AUD) section — considered one of the two most difficult parts of the CPA exam — focuses on the information and skills an entry-level CPA typically needs to perform audits, attestations and reviews, to name a few areas. This exam doesn't test technical financial accounting principles, but instead concentrates on ethics, professional conduct, planning, execution and documentation of audit and attestation services, as outlined in professional standards and by governing bodies.

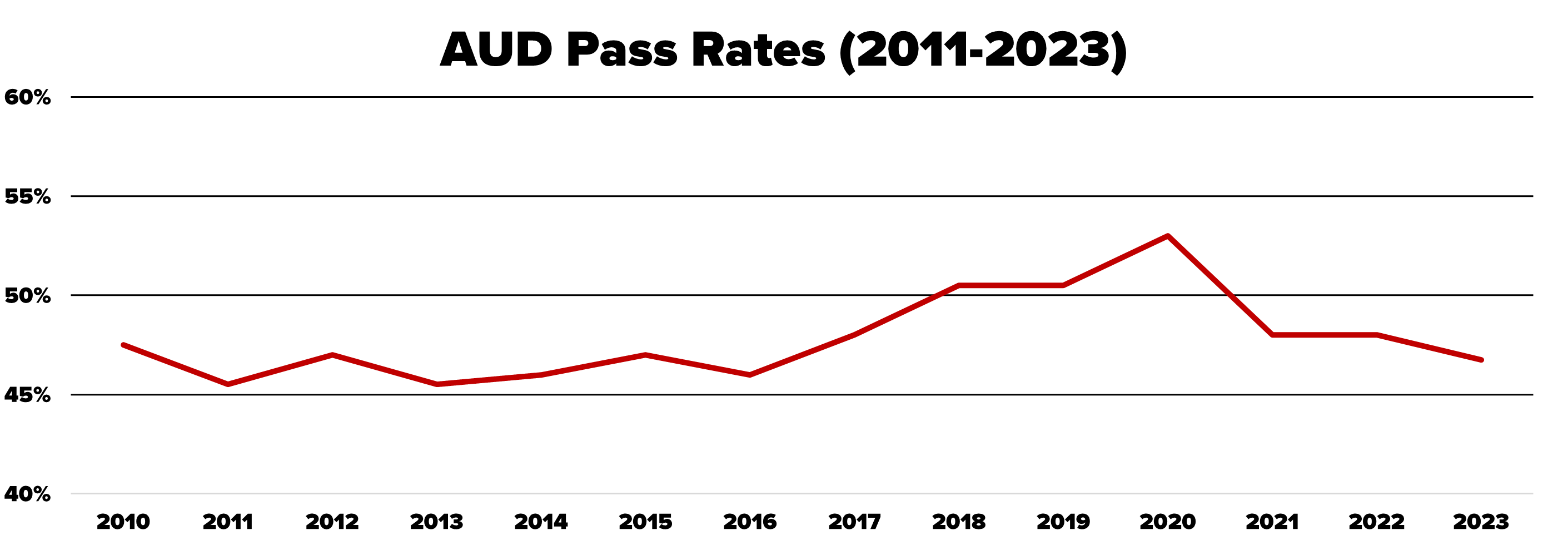

Last year, just 49% of test-takers passed the AUD exam, according to the American Institute of Certified Public Accountants (AICPA). The following AUD exam overview and 13 exam tips can help you be one of those who celebrate when scores are released.

How Long Does It Take to Study for the AUD CPA?

Several estimates suggest that it takes about 100 hours to study for the AUD section of the CPA exam. CPA candidates who are already working as auditors — a typical entry-level position for recent accounting graduates — may need less study time because they should be familiar with the material covered, such as professional standards and opinion templates. Additionally, they may find the application of concepts and the task-based simulation questions easier, based on their day-to-day experience.

For those who are not in an audit-related job, AUD often requires extra study time. It's not an extensively covered topic; most accredited college accounting programs spend less than 10 credit hours on auditing as part of the 150-hour curriculum. It's also unlike more typical, numbers-heavy accounting courses. A long gap in time between taking a few auditing classes in college and taking the exam may also mean extra study time is advisable.

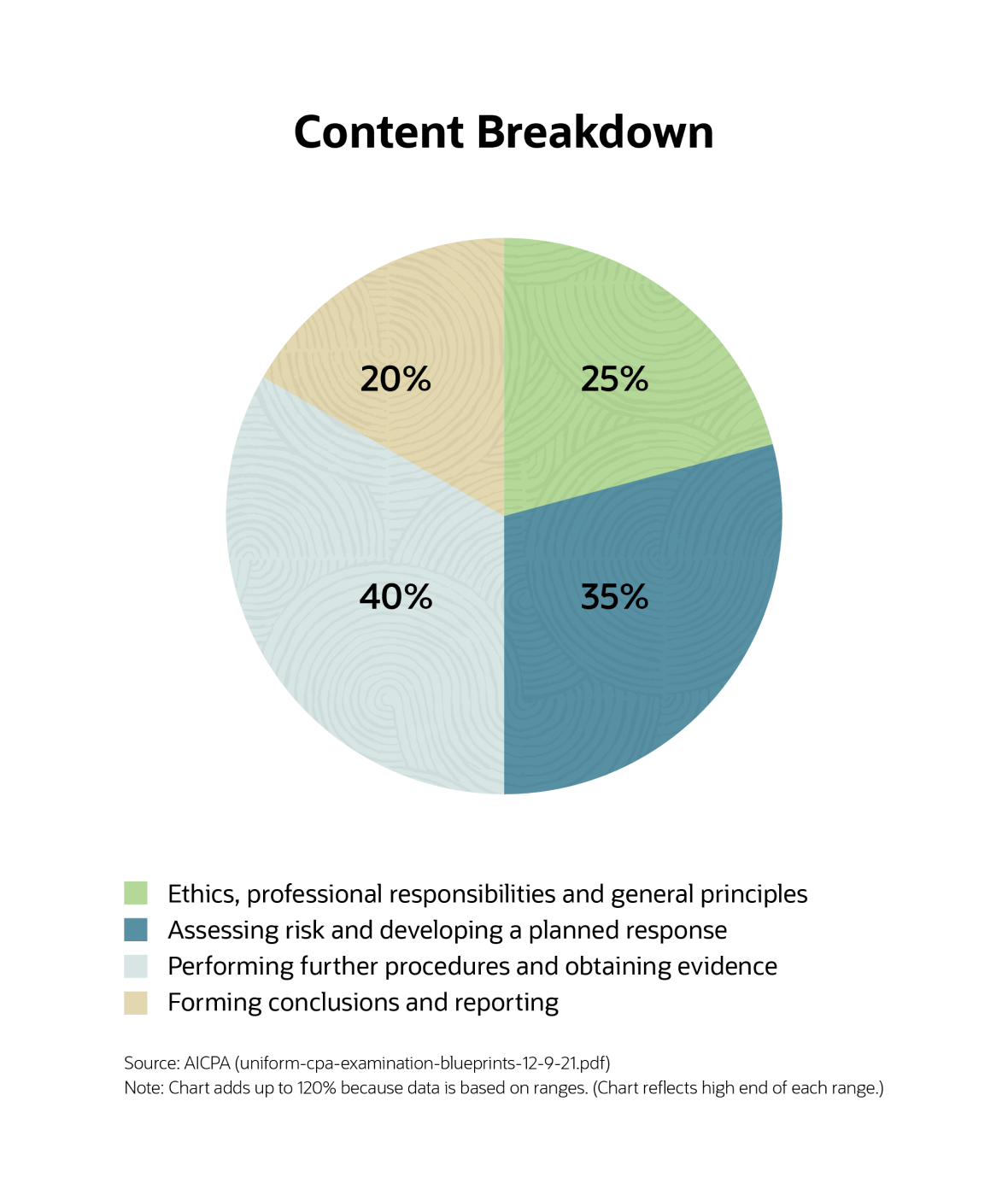

A helpful starting point in preparing for the CPA exam is to understand which content areas to study and how much of the exam focuses on each one. The following AICPA chart can guide you.

How Do I Pass the AUD?

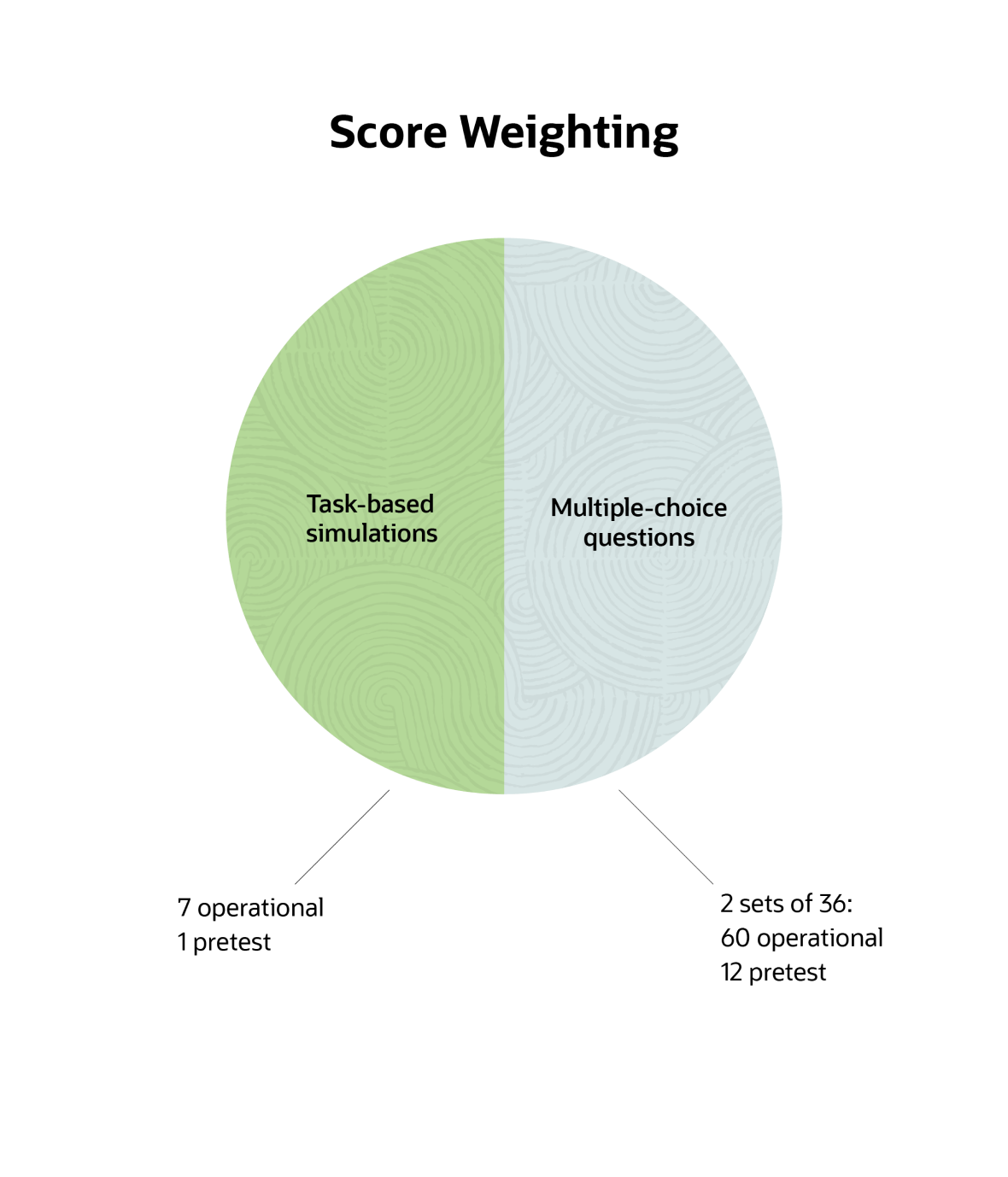

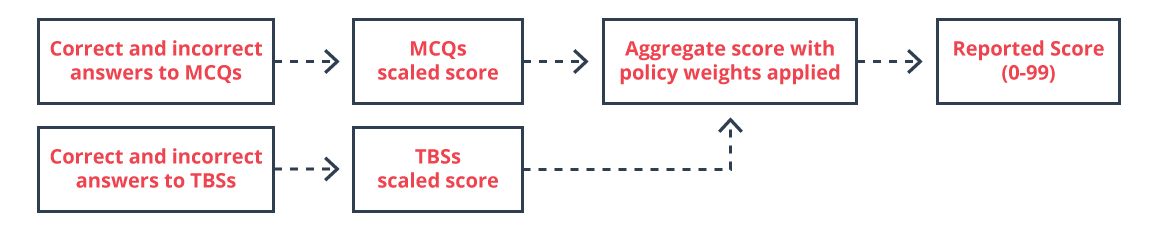

You must score 75 points to pass the AUD section of the CPA exam. Points are earned for correct answers to multiple-choice questions and task-based simulations. You don't lose points for incorrect answers. The AUD exam is designed to evenly weight points between the multiple-choice questions and the task-based simulations.

The passing threshold of 75 isn't the same as getting 75% of the questions correct because each question has a different point value depending on its level of difficulty; you won't know these values. One difficult question answered correctly may be worth more points than several medium-difficulty questions. Because of this weighting, the AUD exam is not curved.

The AUD exam is given on computers at testing centers and uses a multistage, dynamic testing approach for the multiple-choice sections. This means that the level of difficulty for the second set of multiple-choice questions is based on how well you do in the first set. If you do well on the first section, which contains questions of medium difficulty, you will be given difficult questions in the second multiple-choice section. Otherwise, your second section will contain additional questions of medium difficulty, which means you'll need to answer more of them correctly because each one is weighted lower. Likely, you won't be able to tell which second section you were served.

It's also noteworthy that only operational, or "real," questions accumulate points. The AUD exam mixes pretest questions — those being evaluated for future exams — with operational questions in every section. You won't know which questions are operational and which are pretest. Of the 72 multiple-choice questions, 12 are pretest, and of the eight task-based questions, one is pretest. In other words, the 75 points needed to pass are based on 60 multiple-choice questions and seven task-based questions.

AUD CPA Exam Sections

The four-hour AUD exam has five sections, called testlets. Testers can take a 15-minute break between testlets 3 and 4, without cutting into their overall time to complete the exam. The first two testlets are the multistaged, multiple-choice sections, each containing 36 questions. Testlets 3, 4 and 5 are task-based simulations. Testlet 3 has two task-based simulations, and testlets 4 and 5 each have three, for a total of eight.

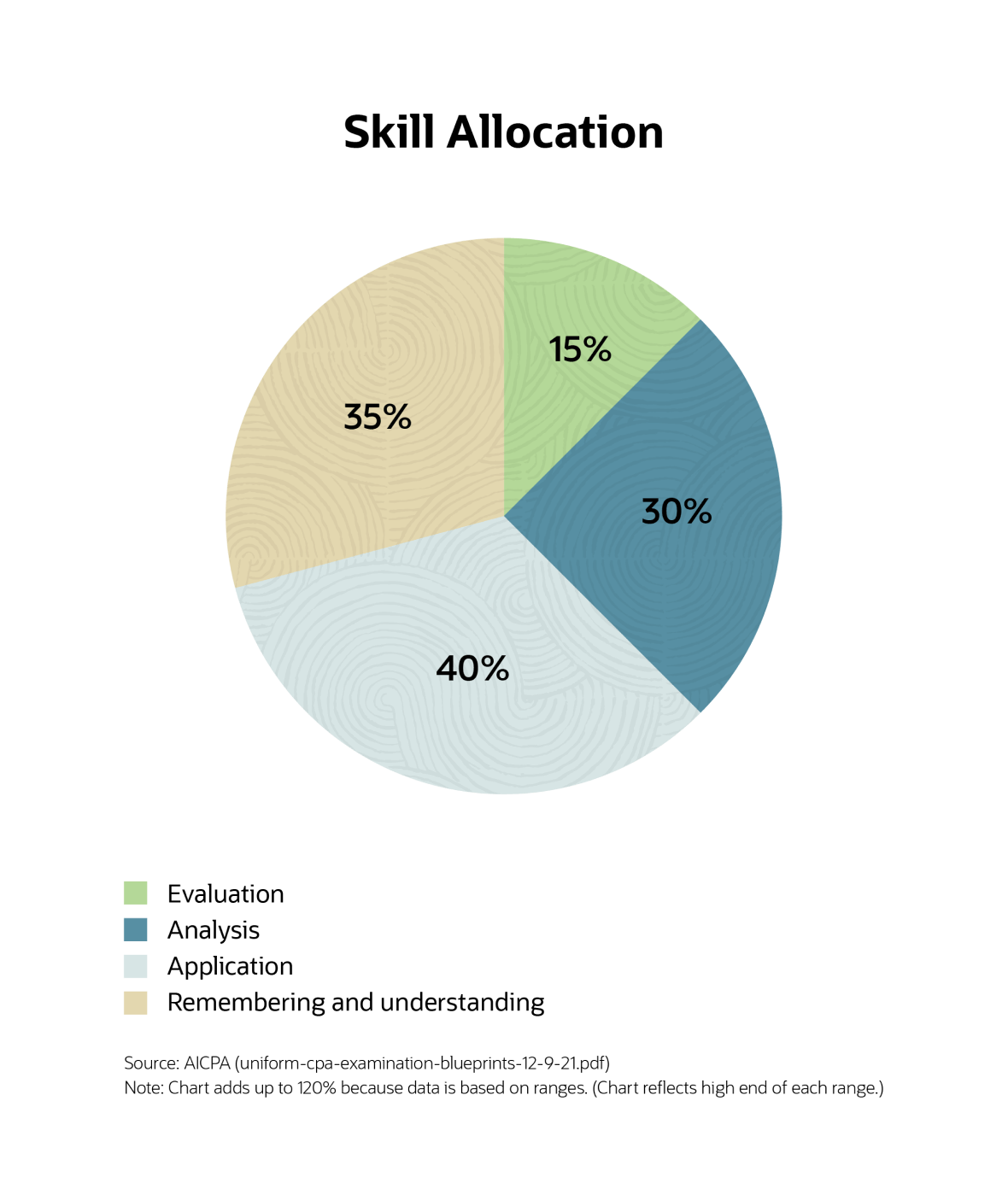

The five sections of the AUD exam are designed to assess different skills that the profession has determined necessary for new CPAs. The exam concentrates on the following four skills, listed in ascending order of complexity:

- Remembering and understanding: Comprehension of general audit knowledge, such as rules, tasks and templates, is the most basic skill.

- Application: Demonstrating appropriate use of auditing techniques, use of technology and sampling techniques, and proper documentation of day-to-day tasks show a higher level of understanding.

- Analysis: This skill includes uncovering data interrelationships, understanding cause and effect of accounting processes and identifying evidence to support conclusions.

- Evaluation: Assessing problems and determining proper courses of action based on evidence, judgment and appropriate levels of professional skepticism is considered the highest skill level. AUD is the only CPA exam that tests for this.

The 72 multiple-choice questions are mostly straightforward and mainly geared toward assessing your remembering and application skills. These skills involve understanding and memorizing principles and standards, but they can also extend to knowing when and how to apply them. Content areas include ethics, professional responsibilities and auditing standards. They also include reporting requirements and comparisons of the several types of service engagements.

Task-based simulations can be thought of as condensed case studies. Each task-based simulation usually incorporates several questions and may require reading provided documents and applying data from them, researching reference literature and using spreadsheets. Typical forms of AUD task-based questions are document reviews, free-response numerical calculations, journal-entry creation/correction, problem-resolution option lists and research exercises. Task-based questions test your analysis and evaluation skills by requiring assessment and synthesis of information from multiple sources to form an evaluative decision that may also require some judgment. While these questions may sound intimidating, keep in mind that you can receive partial credit on the task-based simulations, which contributes to the 75-point threshold needed to pass.

13 AUD CPA Exam Study Tips to Know

The following 13 study tips were curated from several industry sources and interviews with licensed CPAs, including an Elijah Sells Award winner, an honor bestowed upon those with an average composite score over 95.5 for all four sections of the CPA exam, taken in a single sitting.

Practice test-question pacing.

Although there are no official time restrictions on any of the testlets, good time management can help keep you moving along because, don't forget, you have four hours to complete them all. A rule of thumb is to allot 1.25 minutes to each multiple-choice question (for a total of 90 minutes) and 18 minutes per task-based simulation (for a total of 144 minutes).

Double-check multiple-choice questions before submitting.

Testlets 1 and 2 can't be reopened or changed once they're submitted, even if you have time left after submitting all five testlets. Therefore, it's important to check your answers carefully before hitting the submit button.

Take note of word clues.

AUD questions may include certain terminology that points to a specific set of requirements. For example, the "issuer" and "non-issuer" entity types should trigger different rules in your mind. Additionally, terms such as "auditor," "accountant" and "practitioner" can be clues for the type of engagement being tested. Another tip: Avoid answers with universal terminology like "all" or "never," because this is hardly ever the case in real life.

Take a professional review course.

Many CPA review courses are available that can help provide you with a good framework for studying. The courses cater to different styles and methods of learning — auditory, visual, online, in-person — so do some homework to find one that fits best.

Time the test strategically.

Make a plan for completing the four sections of the CPA exam within the allowed 18-month window. Each section is administered four times per year. Plan to take the AUD section closest to the completion of auditing classes or after being hired as an auditor. Depending on your state's eligibility requirements, you may be able to sit for the exam prior to college graduation.

Don't cram.

It is nearly impossible to cram for the AUD CPA exam. Consider a 10- to 12-week time frame to properly prepare while maintaining a life balance.

Memorize the audit reports.

There's just no way around this. Expect many extremely specific questions about the unqualified audit opinion and all its variations. These can be easily scored points when committed to memory.

Master the AICPA Code of Professional Conduct.

This is fodder for a hotbed of potential questions on the AUD exam, aimed at probing your ethical and professional responsibilities as a CPA. The AICPA provides a helpful, plain-English resource to assist with studying.

Take practice tests.

One of the best ways to study is by taking practice tests. Taking past exams can help increase familiarity with the way questions are structured and with timing. The AICPA offers downloadable past exams on its website, and professional review courses offer practice tests with an interface similar to the exam.

Thoroughly study the perennial "favorite" topics.

If there's anything "predictable" about the AUD exam, it's that it will cover the following topics. Focus on memorizing the real-life applications of:

- Internal controls.

- Physical inventory counting.

- Materiality.

- Engagement letters.

- Sampling methods.

- Search for unrecorded liabilities.

Don't skimp on studying task-based simulations.

It's easy to bang away at past multiple-choice questions, but now that task-based simulations are weighted evenly, it's important to weight your study emphasis equally as well. This was not always the case, so beware of outdated advice from those who took the AUD exam before 2021.

Practice using the research database.

One type of task-based simulation on the AUD exam involves researching authoritative reference guidance for a given situation. Become familiar with the database so you can more easily find the best information. The Authoritative Research database is free for six months once you're approved to sit for the exam.

Know what to skip.

A few things won't be on the AUD exam, so don't waste your precious study time on them. According to the AICPA, the AUD exam does not use the written-communication type of task-based simulation. Additionally, the Board of Examiners uses a detailed schedule for determining when new or updated pronouncements — statements, standards, interpretations and other financial reporting guidelines — are eligible to be included on the CPA exam, so that should guide your study time, too. The schedule depends on the source, such as the Financial Accounting Standards Board (FASB), IRS or federal law. Auditing standards have been especially active, so it's a good tip to check here for any changes when making a study plan.

The AUD exam is considered one of the hardest parts of the overall CPA exam. Understanding the content, format and goals of the assessment are a good first step in tackling this exam. Several additional factors can help make the 75-point passing grade more achievable, especially the 13 exam tips included here.

#1 Cloud Accounting Software

AUD CPA Exam FAQs

How long does it take to study for the aud cpa.

Estimates from several sources suggest that it takes about 100 hours to study for the AUD section of the CPA exam. This estimate can change, based on whether the candidate has auditing work experience and the amount of time that has passed since finishing a college auditing class.

Which CPA exam is the hardest?

The AUD exam is considered one of the two most difficult parts of the CPA exam, with a 49% passing rate in 2021, according to the American Institute of Certified Public Accountants. The Financial Accounting and Reporting (FAR) exam had the lowest passing rate, at 45%.

How many testlets are in AUD?

There are five sections, called testlets, in the four-hour AUD exam. Testlets 1 and 2 are multistaged, multiple-choice sections, each containing 36 questions. Testlets 3, 4 and 5 are task-based simulations. Testlet 3 has two task-based simulations, and testlets 4 and 5 each have three, for a total of eight.

Is 75 passing on the CPA exam?

In order to pass the AUD exam, a candidate must score 75 points. Points are earned for correct answers to multiple-choice questions and task-based simulations. The passing threshold of 75 is not the same as getting 75% of the questions correct; each question has a different point value depending on its level of difficulty.

Fixed Price vs. Cost Plus: Which Is Better?

A construction project is about to begin. How much will it cost? Whether the exact amount is known at the project's outset will depend on the type of contract the contractor and…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

Tips for Answering CPA Audit Exam Questions

The Auditing and Attestation (AUD) test is one of the 4 CPA sections (along with REG , FAR , and BEC ). Typically, this test is often the most difficult for CPA candidates who have not worked in the financial accounting industry. That’s because AUD concepts are best explained by auditing examples and professional responsibilities learned in the field.

This article will explain the format of the AUD test, outline key CPA review tips to help you answer AUD questions, and provide some common test topics.

If you’re studying for the AUD test, read on. Whether you’ve worked in the accounting industry or not, you can use these tips to pass the AUD test. Truthfully, AUD doesn’t need to be the hardest CPA exam section if you study the following:

See the Top CPA Review Courses

- 1. Becker CPA Review Course ◄◄ Endorsed by Big 4 Accounting Firms + Save $1,140

- 2. Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- 3. Gleim CPA Study Materials ◄◄ Largest CPA Test Bank

CPA Audit Exam Format

The CPA Exam includes four tests and candidates have four hours to take each one. As the AICPA explains: “ Each of the four exam sections is broken down into five smaller sections called testlets. These testlets feature multiple-choice questions (MCQs) and task-based simulations (TBSs).”

The AICPA also points out that “You will receive at least one research question (research-oriented TBS) in the AUD, FAR and REG sections. To complete them, you will have to search the related authoritative literature and find an appropriate reference.”

Consequently, successful candidates must practice answering multiple-choice questions and task-based simulations, which provide several paragraphs of information for the reader. Therefore, to pass the AUD test, you need to develop the ability to answer these different types of questions.

Learn More About The CPA Exam

- How To Become A CPA

- CPA Exam Stats and Facts

- Best Order To Take CPA Exam

- Motivational Songs For Studying

Audit CPA Exam Tips

The differences between qualified and unqualified audit opinions are heavily tested on the AUD exam. Hence, successful CPA candidates must understand these concepts in order to provide the correct answers to the most difficult questions.

Understanding the purpose of an audit

Here is the key phrase in an unqualified audit opinion, according to the fourth standard of reporting:

“The auditor’s standard report states that the financial statements present fairly, in all material respects, an entity’s financial position, results of operations, and cash flows in conformity with generally accepted accounting principles.”

In plain language, an unqualified audit opinion states that no material exceptions were noted during the audit. Material, in this case, means that the auditor did not find any errors that were large enough to influence a financial statement reader.

Here’s an example: Assume that a construction company lists $3 million in fixed assets (machinery and equipment). A $500 error may not matter to a financial statement reader, but a $100,000 mistake in the fixed asset balance might concern the reader.

Ultimately, materiality is a matter of judgment, and an unqualified opinion states that the financial statements are free of any material errors.

Reviewing other types of audit opinions

The best way to understand other types of audit opinions is to review what the accounting profession requires an auditor to do when forming conclusions. Here’s another quote from the fourth standard:

“The auditor must either express an opinion regarding the financial statements, taken as a whole, or state that an opinion cannot be expressed, in the auditor’s report. When the auditor cannot express an overall opinion, the auditor should state the reasons therefor in the auditor’s report. In all cases where an auditor’s name is associated with financial statements, the auditor should clearly indicate the character of the auditor’s work, if any, and the degree of responsibility the auditor is taking, in the auditor’s report.”

If you break the statement down, you’ll note some important differences:

- Disclaimer : In some cases, an auditor cannot express an opinion on the financial statements, and the auditor issues a disclaimer of opinion. The most common reason for a disclaimer is that the company records are incomplete. Ultimately, this prevents the auditor from obtaining evidence and performing key audit procedures.

- Explanatory language : Some audits require the CPA firm to add an explanatory paragraph to explain a particular issue. If there is doubt about the company’s ability to continue as a going concern, the auditor must add an explanatory paragraph assessing risk. Here’s an example: A business that is losing market share, experiencing a sharp decrease in sales, and operating at a substantial loss may not be able to continue operating for much longer.

- Qualified opinion : You can think of this report as an “except for” opinion. This is because the report states that: “except for the effects of the matter to which the qualification relates,” the financial statements are fairly stated. If, for example, the financial statements use an inventory valuation method that is a departure from generally accepted accounting principles (GAAP), the auditor would qualify the opinion.

To summarize, you can separate unqualified opinions from “everything else”, which include the exceptions listed above.

Finally, the fourth statement explains that: “An adverse opinion states that the financial statements do not present fairly the financial position, results of operations, or cash flows of the entity in conformity with generally accepted accounting principles.”

This is the most damaging opinion to a company, because the auditor is stating that the financial statements misrepresent the true financial condition of the business.

In particular terms, nearly all audit reports are unqualified opinions. Both company management and the auditors work to put accounting systems in place that produce accurate financial statements that follow GAAP.

Issuing any other type of opinion can be damaging to a company’s reputation and future prospects, and most companies do what they can to avoid the issue.

[uam_ad id=”7978″]

Get Discounts On CPA Review Courses!

Cpa audit exam questions.

Here are some other common topics on the AUD test:

Situations that require explanatory language

There are additional situations that require the auditor to add an explanatory paragraph. These topics appear on most AUD tests:

- Work of another auditor : Obviously, a financial statement reader needs to know if more than one auditor performed test work. If, for example, another auditor performed a physical inspection to confirm the existence of fixed assets, an explanatory paragraph is added to the opinion.

- Change in accounting principle : If accounting principles are not consistently applied from one year to the next, the financial statement reader cannot compare financial results and identify trends. In other words, the reader needs an “apples to apples” set of financial statements to make comparisons between years. If the company changes from the FIFO to the LIFO inventory valuation method, for example, the change must be disclosed.

- Error corrections : In spite of the best efforts by company management and the auditor, mistakes sometimes occur. Therefore, if the company corrects a prior period error, the correction requires an explanatory paragraph.

If you’re uncertain about whether or not an issue requires an explanatory paragraph, think about the financial statement reader. Does the reader need to know about the issue to fully understand the financial statements? Keep this concept in mind as you answer these questions.

Scope limitation

This term appears on every AUD test. It means that the auditor wasn’t able to perform sufficient test work to audit a particular account balance.

Think of an inventory balance as an example:

Auditors want to perform an inventory count as close to the balance sheet date of the audit as possible. An inventory count compares each inventory item in the accounting records to the physical item stored in a warehouse or a retail location.

By counting inventory on or near the balance sheet date, the auditor is minimizing the potential change in the inventory balance that is being counted.

However, if the auditor was not allowed to perform the physical count near the balance sheet date, the auditor might conclude that the count was insufficient to confirm the existence of the inventory account balance. This is referred to as a scope limitation.

Scope limitations require the auditor to perform other procedures to audit the balance, and the CPA firm may need to add an explanatory paragraph to the report.

Find Useful Examples

As mentioned above, the best way to understand AUD test topics is by using examples from the field. As you study and find auditing examples that are clear to you, keep the examples for future reference. By the end of your test preparation, you should have a full set of examples that help you understand AUD concepts.

Use these tips to study for the AUD test and pass the CPA exam!

COMPARE THE BEST CPA REVIEW COURSES

Frequently Asked Questions about AUD CPA

How do i study for audit cpa exam.

To ensure that you have the highest possible score on the Auditing and Attestation portion of the CPA exam, you’ll want to focus on studying questions and lectures based on the auditing process. Fortunately, many excellent CPA prep courses organize their study materials in a way that makes this much easier to accomplish.

Is audit CPA exam hard?

Although it isn’t considered the hardest portion of the CPA exam, many test takers have said that the AUD section is fairly difficult. According to the AICPA’s data on pass rates for 2019, it has the second-lowest pass rate out of all 4 CPA exam sections.

How many hours should you study for audit CPA?

If you plan on devoting an appropriate amount of time to your entire CPA exam study schedule (300-400 hours), you’re going to want to devote a decent amount of this time to the AUD section due to its low pass rate. Anywhere between 75 and 100 hours should be appropriate.

How many questions are on the CPA audit exam?

According to the AICPA’s exam blueprint , the AUD exam is made up of 72 multiple-choice questions (MCQs) and 8 task-based simulations (TBS). These sections are both worth 50% of your final score.

Related Posts

Recent Posts

- How Hard is the CPA Exam?

- CPE Course Discounts

- CMA Exam Study Material Discounts

Additional Links

- Best CPA Review Courses

- How to Pass the CPA Exam 10-Step Plan

- Enrolled Agent vs. CPA

- Policies and Disclosures

- Terms of Service

- Editorial Policy

- Advertise With Us

- Premium Pro

- Traditional

- Mega Test Bank

- Help Me Pass Program

- Why Gleim CPA

- Gleim vs Surgent CPA Review: 100+ Hrs Research Boiled Down

- Compare Adaptive Platforms

- CPA Customer Reviews

- Try Our Course!

- Practice Questions

- Webinars and Videos

- Learning Resource Center

- How to Choose Your CPA Exam Discipline

- Free Exam Guide PDF

- CPA Exam Pass Rates

- CPA Exam Changes

- CPA Salary Report

AUD CPA Exam Section Guide

All about the Auditing and Attestation (AUD) CPA Exam Section

The Auditing and Attestation (AUD) CPA Exam section tests your knowledge of the entire audit process, as well as preparation, compilation, and review engagements and other non-attestation services. It also tests ethics, so you will have to become familiar with the AICPA Code of Professional Conduct .

How do I pass AUD?

To pass AUD, you’ll need to study diligently and take a lot of practice quizzes. The AUD section of the exam will be mostly conceptual: asking you to apply your judgment to questions about best practices, ethics, and proper procedure. So you’ll need to be able to comfortably put yourself in the shoes of an auditor in the field.

This guide will equip you with all of the information you need to prepare for the AUD section of the exam. If you’re already studying, check out some of our free webinars and videos or make use of our free test-bank of AUD questions . You’ll also find here some study tips specifically for AUD.

• How do I pass AUD?

• What if I don’t have any auditing experience?

• AUD pass rates

CPA AUD Exam format

• CPA AUD testing process

• CPA AUD question types

Why does the AICPA include pre-test questions on the AUD exam?

How is cpa aud graded.

• What is a CPA passing score?

• Is the CPA Exam curved?

• Can I receive partial credit on Task-Based Simulations (TBSs)?

CPA AUD Exam content

• When do new pronouncements appear on the CPA Exam?

Skill levels tested on AUD

• When should I take AUD?

AUD CPA Exam time management How do I prepare for AUD?

• What is the best way to study for the AUD CPA Exam section?

• Helpful CPA Exam prep tips

What if I don’t have any auditing experience?

Many accountants and accounting students don’t have any first-hand auditing experience when they decide to sit for the CPA Exam, so if this describes you, you’re not alone! Current auditors will have a head start, but it’s nothing that can’t be overcome with determined, disciplined studying.

Find a review course and stick to a study schedule , and you can be comfortably prepared to pass AUD in 10-12 weeks.

AUD pass rates

The AUD section tends to be on the upper end of the scale as far as CPA Exam difficulty is concerned, with pass rates hovering around 48%. FAR had the lowest average pass rate at almost 45%. While the REG section historically tended to hover around 50%, in 2021 it jumped to almost 60%, REG’s pass rate continues to rise. These percentages shift a bit from year to year, but the CPA Exam sections’ relative difficulties historically have followed this trend.

Take a more detailed look at CPA Exam pass rates , including seasonal trends.

Remember, statistics are useful, but they can’t tell you what your performance will be. You aren’t locked in at a 50% chance to pass! The more you apply yourself to your studies (and the more practice exams you take), the more your outlook improves.

For more information about how the CPA Exam has evolved over time and what’s new this year, visit our CPA Exam Changes page.

CPA AUD Exam Format

The AUD CPA Exam section consists of five testlets: two testlets of multiple-choice questions (MCQs) and three testlets of task-based simulations (TBSs). The MCQ portion of AUD accounts for 50% of your CPA Exam score, and the TBS portion accounts for the other 50%.

AUD Format Breakdown

Testlet 1 39 MCQs Testlet 2 39 MCQs

Total MCQs: 78 | Scoring: 50%

Testlet 3 2 TBSs Testlet 4 3 TBSs Testlet 5 2 TBSs

Total TBSs: 7 | Scoring: 50%

Testing Time 4 hours + 15 min break

CPA AUD question types

Most AUD testlets include operational and pre-test questions. Operational questions count toward your total exam score and pre-test questions do not. That said, the questions are indistinguishable from one another, so don’t waste any valuable testing time trying to decide whether you can afford to skip a question!

The AICPA looks to continuously evolve and improve the CPA Exam. Pre-test questions are potential future exam questions the AICPA is trying out by inserting them among real exam questions on AUD and other CPA Exam sections. This lets it study how suitable the questions will be for future use.

The AICPA already knows what topics the operational questions test and how difficult they are, so it can analyze candidate performance on pretest questions with the operational questions serving as a sort of control. While no one likes to be a guinea pig for experiments—especially on an exam this difficult —keep in mind that your score on these questions will not count.

The pre-test questions that meet the AICPA’s standards are included as operational questions on later iterations of the exam. This pre-test period is also used to assign a difficulty level to questions for grading purposes, and questions continue to undergo statistical analysis based on the live exam.

THE GLEIM SOLUTION

Pre-test questions may be more difficult than operational questions, but because you can’t tell which is which, it’s best to answer all questions as best you can. If it helps, whenever you encounter a really difficult question and aren’t sure of your answer, just tell yourself it’s probably a pre-test question and keep moving!

Computers grade all CPA MCQ and TBS testlets. Your score is scaled according to the difficulty of the MCQs you answered correctly and the credit you receive on the TBSs. (See more on how the CPA Exam is scored .)

What is a CPA AUD passing score?

The passing score for all CPA Exam sections is 75 points or higher .

This does not necessarily mean you need to answer 75% of questions correctly.

Difficult questions are worth more points, so a strong performance on the first MCQ testlet can give you an opportunity to earn even more points in the second MCQ testlet. Difficult questions are also more time-consuming, so you’ll need to practice a time-management strategy to optimize your score.

Is the CPA Exam curved?

The CPA Exam is not curved in the same way as other exams you might have come across in your accounting studies. Instead of adjusting your score based on how your cohort does, the AICPA uses question weights. These weights are assigned based on how candidates fared with the questions on previous exams. So your score is impacted by the performance of past test takers, not current ones.

It’s worth repeating here that your score is not a percent. You don’t have to get 75% of the questions right—you just need a score of 75. If you think you’re borderline passing, you’re probably fine. A 65% may in fact be 75 points after it’s scaled.

Can I receive partial credit on AUD Task-Based Simulations (TBSs)?

Yes, you can receive partial credit on TBSs! Never leave any part of a question blank on AUD (or other sections for that matter), and always double-check to make sure you’ve answered all parts of a question. No two TBSs are the same. They can have wildly different formatting and require you to input your answer in different ways, so stay sharp.

What if I have a question about AUD scoring that wasn’t answered here?

For more information on how your AUD section will be scored, please check out our guide to CPA Exam scoring . You can also see the AICPA’s FAQs or contact one of our Personal Counselors . We’re always here to help!

AUD covers every part of the audit process. The AUD section will test engagements in accordance with professional standards and/or regulations by the:

- American Institute of CPAs (AICPA)

- Public Company Accounting Oversight Board (PCAOB)

- U.S. Government Accountability Office (GAO)

- Office of Management and Budget (OMB)

- U.S. Department of Labor (DOL)

Candidates are expected to demonstrate knowledge and skills related to:

- Audits of issuer and nonissuer entities

- Attestation engagements for issuer and nonissuer entities

- Preparation, compilation, and review engagements for nonissuer entities

- Reviews of interim financial information for issuer entities

The subject matter is divided into four major content areas.

The AICPA publishes CPA Exam Blueprints that specify exactly what a CPA needs to know, all the way down to specific tasks. It’s good to look over the higher-level concepts to get a broad idea of what you should be taking away from your studies, but the Blueprints aren’t really useful for candidates in making a study plan. The Blueprints are incredibly detailed (they break down even further than above), and if you were to go through them on your own, you’d likely spend just as much time figuring out what to study and how much time to devote to each topic as you would actually preparing for the exam .

Our recommendation is to let a CPA Exam review course provider do the bulk of the work for you. All major providers have teams of experts that dig into each Blueprint update, taking the guesswork out of studying. (Learn more about choosing the right review course for you .)

When do new pronouncements appear on the CPA Exam?

With the introduction of Continuous Testing , new accounting and auditing pronouncements may be tested the later of (1) the calendar quarter beginning after the pronouncement’s earliest mandatory effective date or (2) the first calendar quarter beginning six months after the pronouncement’s issuance date.

Changes in uniform acts are eligible to be tested in the calendar quarter beginning one year after their adoption by a simple majority of the jurisdictions.

For all other subjects covered by the CPA Exam, changes are eligible to be tested the later of (1) the first calendar quarter beginning after the earliest mandatory effective date or (2) six months after the issuance date.

Once a new pronouncement is testable, questions testing the old pronouncement will be removed.

Gleim CPA Review Courses are automatically updated to reflect the latest material that could appear on an exam.

The AUD section of the CPA Exam isn’t easy, and one factor contributing to CPA Exam difficulty is the fact that the exam assesses candidates at four different levels of skill. The pass rate for AUD hovers around 50%, so it’s important to make sure you have a firm grasp of the subject matter.

Skill Level 1

WEIGHT: 30-40%

REMEMBERING: This tests pure memorization.

UNDERSTANDING: This tests the ability to understand memorized principles.

Skill Level 2

WEIGHT: 30-40%

APPLICATION: This tests the ability to apply memorized principles to a given situation.

Skill Level 3

WEIGHT: 15-25%

ANALYSIS: This tests the ability to use multiple concepts together and apply them to a given situation.

Skill Level 4

WEIGHT: 5-15%

EVALUATION: This tests the ability to evaluate information using multiple concepts to reach a conclusion.

AUD is the only exam section to test at the Evaluation level of higher order skills, and much of it is testable at the Application and Analysis levels. It’s especially important before you sit for AUD to make sure that you fully understand the core concepts. On the Task-Based Simulations (TBSs), simply choosing the right answer is not sufficient. You must be able to explain and support why your answer is correct.

When should I take AUD?

Most people do not consider AUD as hard as FAR, and the pass rates below support that general consensus. However, AUD can still be a challenging section—it may give you questions that require financial accounting knowledge, and without that knowledge, you may find it difficult to attest to whether a financial statement is presented fairly.

If you have recently studied auditing in college or been working as an auditor, you may be equipped to take AUD first.

If you are not in either of these situations, we recommend you schedule AUD after FAR.

AUD CPA Exam Time Management

MCQs 1.25 minutes each

TBSs 18 minutes each

It will take a lot of practice to be able to answer questions quickly, especially because most AUD questions are conceptual. But as you learn the material and complete more sample questions, you’ll build mastery of the topics and your speed will improve.

- If you are able to answer a question faster without risking misreading it, do it! That way, you’ll have a little extra time to spend on more difficult questions.

- If you encounter a difficult question and you haven’t settled on an answer in two minutes, make an educated guess, flag the question, and move on. If you have time later, you can return to it during your review.

- The best strategy is to work at a pace that allows you to read and respond to every single question.

As you can see, this system allots six minutes to use at your discretion. You can spend it on your MCQ and TBS answers. Just remember, you can’t revisit any previously submitted testlets, so only use the banked time if you need it.

How do I prepare for AUD?

AUD is a difficult exam section, but it’s not impossible to pass.

The Gleim Premium CPA Review course can help you pass AUD on your first attempt. Our course covers the exam content better than any other and always contains the most up-to-date information. Our SmartAdaptTM technology constantly adjusts to help shore up any weak areas, which helps maximize your study time. It also features cumulative review questions to promote maximum retention of AUD topics—repetition over regular intervals is one of the study techniques proven to increase recall.

The AUD questions you’ll see in Gleim CPA Review are just as challenging and realistic as those on the actual exam, and by the time you complete our Final Review, you’ll be completely prepared and confident for exam day!

Want to see if you’re eligible to take the CPA Exam? Learn more about CPA Exam requirements today.

What is the best way to study for the AUD CPA Exam section?

1. Use real-life experience to understand the audit process.

The core audit process is a significant part of the of AUD CPA Exam section, so you should understand it thoroughly. Even though the auditing process itself is pretty straightforward, having an accurate image in your mind of how auditors complete the audit process and the kinds of questions on their minds can greatly enhance your comprehension.

Spend a day in the life of an auditor. Ask an auditor to walk you through how they would go about completing a typical audit. Then, compare the scenarios in the exam questions to your knowledge of what auditors do in real life.

2. Get a firm grasp on the audit report.

The AUD section of the CPA Exam expects you to be thoroughly acquainted with the audit report, which includes several kinds of opinions that deviate in their content and layout. Familiarity with the audit report is essential because you could be asked to modify or replace part of an opinion in a document review simulation (DSR) . Or, in a multiple-choice question , you may be asked to select which kind of opinion is expressed.

Because of how the exam tests the audit report, the most efficient way to study for AUD is to first memorize the main audit report, which is the unmodified opinion, and then learn differences between the other opinions and the distinct sections that need to be included for each.

Gleim CPA Review has an entire Study Unit dedicated to discussing the audit report and how it changes according to the type of opinion expressed. You can preview our audit report coverage by signing up for a free CPA demo .

3. Shore up your knowledge of internal control.

The principles of internal control will remain relevant to your accounting career long after you pass the CPA Exam, so you can’t really over-prepare for this topic. If you aren’t sure what to spend time reviewing, you could always run through internal control once more.

If you use a Gleim Review System, our SmartAdapt™ technology will help you figure out what to study to maximize retention and strengthen any weak areas.

4. Memorize, but in the context of the big picture.

The areas of accounting AUD involve a variety of steps, standards, and procedures, and memorizing this information can be helpful.

But rote memorization alone won’t earn you a passing score. Instead, you should memorize steps within the context of the big picture: what is the purpose of an audit, and what issues are specific audit steps meant to address? AUD tests at the Analysis and Evaluation levels of knowledge, so you have to master the topics comfortably in order to pass this CPA Exam section.

5. Work on techniques for coming up with the right answer.

In order to thoroughly challenge you, the CPA Exam offers more than one answer choice that may seem correct. You must carefully scrutinize the choices in order to determine the best possible answer. To find the best possible answer, try to quickly rule out answers containing absolutes. The words “all,” “never,” “always,” and “none” can indicate an incorrect answer choice because such extreme consistency is usually not realistic in the context of an audit report.

There is more you can do. We’ve got an entire section dedicated to increasing your odds of selecting the right answer .

Looking for more helpful CPA Exam prep tips?

If you’re looking for a start-to-finish CPA Exam walk-through, check out our free CPA Exam Guide for more information! This free PDF contains our top tips for scheduling, studying, and sitting for the CPA Exam.

Visit our CPA Exam Resource Center to view our latest CPA Salary Report , confirm that you meet CPA Exam requirements , and more.

GLEIM HAS HELPED CPA CANDIDATES PASS OVER 1 MILLION CPA EXAMS

15-25% Ethics, Professional Responsibilities and General Principles

- Nature and scope

- Ethics, independence and professional conduct

- Terms of engagement for audit and non-audit engagements

- Requirements for engagements documentation

- Communication with management and those charged with governance

- A firm’s system of quality control, including quality control at the engagement level

25-35% Assessing Risk and Developing a Planned Response

- Planning an engagement

- Understanding an entity and its environment

- Understanding an entity’s control environment and business processes, including information technology (IT) systems

- Assessing risks due to fraud, including discussions among the engagement team about the risk of material misstatement due to fraud or error

- Identifying and assessing the risk of material misstatement, whether due to error or fraud, and planning further procedures responsive to identified risks

- Materiality

- Planning for and using the work of others

- Specific areas of engagement risk

10-20% Forming Conclusions and Reporting

- Reports on auditing engagements

- Reports on attestation engagements

- Accounting and review service engagements

- Reporting on compliance

- Other reporting considerations

30-40% Performing Further Procedures and Obtaining Evidence

- Sufficient appropriate evidence

- General procedures to obtain sufficient appropriate evidence

- Specific procedures to obtain sufficient appropriate evidence

- Specific matters that require special consideration

- Misstatements and Internal Control Deficiencies

- Misstatements and internal control deficiencies

- Written representations

- Subsequent events and subsequently discovered facts

- Becker CPA Review

- Surgent CPA Review

- Gleim CPA Review

- Wiley CPA Review

- CPA Exam Requirements

- CPA Exam Application

- CPA Exam Sections

- How’s the CPA Exam Scored?

- Best CPA Course Support

- CPA Exam Score Release Dates

- Big 4 Accounting Firm Salaries

- Discounts & Coupons

Top 11 Audit CPA Exam Tips

Use these CPA Audit exam tips to better understand how to navigate the most difficult questions and topics and pass your upcoming exam!

See the Top CPA Review Courses

- 1.Becker CPA Review Course ◄◄ Endorsed by Big 4 Accounting Firms + Save $1,140

- 2.Surgent CPA Prep Course ◄◄ Best Technology

- 3. Wiley CPA Review Course ◄◄ Best Instructor Support

Adjusting entry

The accrual method of accounting requires companies to use the matching principle, which matches revenue earned with the expenses incurred to produce the revenue. This rule applies, regardless of the timing of cash inflow and outflows.

When you see questions on adjusting entries, remember that the entry requires one balance sheet and one income statement account. Assume, for example, that you owe $3,000 in payroll for the last week of December, and that payroll will not be paid until January 5th of the following year. Here is the adjusting entry:

December 31st Debit wage expense $3,000 Credit accrued wages payable $3,000 (To post wage expense on 12/31)

Wage expense is an income statement account, and accrued wages payable is a balance sheet account.

Here is the entry when the wages are paid on January 5th:

January 5th Debit accrued wages payable $3,000 Credit cash $3,000 (To pay wages on 1/5)

Related Blog Posts & Resources

- Reduce Your CPA Study Time by 116 Hours!

- Which CPA Exam Section Do I Take First?

- Deep Dive: 35 CPA Exam Statistics [Infographic]

- CPA Exam Final Review Strategy

Asset valuation

Most assets are valued at historical cost, or the purchase price of the asset. Accounting principles use historical cost, because the purchase price can be easily confirmed. Fair market value and other methods are not widely used to value assets.

Audit opinions and fraud

An audit opinion states whether or not the financial statements are free of material misstatement. Because an audit opinion does not state that the financial statements are free of all errors, the auditor can perform test work on a sample basis. CPAs use statistics to determine the required sample size, and the results of the sample can be applied to the entire population tested.

Here’s the deal:

Performing an audit may not uncover fraud, which is defined as willful intent to deceive. Fraud is particularly difficult to uncover if two or more employees collude and work together to avoid internal controls.

If a business suspects that a fraud has occurred, the firm may engage a CPA to test every transaction in a particular account, in order to uncover fraud.

Confirmations

Every AUD exam includes questions regarding confirmations, and confirming information with a third party is considered more reliable the documentation provided by the client. An auditor may send confirmations to a bank to confirm an account balance, or send confirms to customers who have a large balance in accounts receivable.

Engagement letter

The engagement letter is a written agreement between the client and the CPA firm performing the audit, and some components of the engagement letter may be confusing to exam candidates.

An auditor uses judgment when selecting the audit procedures to be performed, and there is not one set of procedures performed for every audit. The client is responsible for implementing a system of internal controls, but the auditor must comment on any internal control weaknesses noted during the audit. Finally, the financial statements are the responsibility of management, and not the auditor.

Inventory count

The best way to confirm the existence of inventory is to perform a physical count, and most auditors require that a count take place before issuing an unqualified audit opinion.

If you haven’t participated in a physical inventory count, some aspects of the count may not be familiar to you. Here are some important components of an inventory count.

- Access during the count: No inventory can move in or out of the area where inventory is stored during the count. Inventory counts typically take place in a warehouse or retail shop, and the access to the location should be restricted during the count. This ensures that the count is performed using the most recent inventory listing from the accounting system.

- Obsolete inventory: Keep an eye out for obsolete inventory, or items that have been in inventory for a long time and are not selling. Obsolete inventory should be expensed by writing off the value of the inventory to cost of goods sold. Every inventory audit program requires the auditor to ask company managers about obsolete inventory.

- All tags collected: Every physical inventory item is tagged, and the tag lists the number of items, a product description, and the cost of the items tagged. If you’re a sporting goods retailer, for example, you might carry a box of 50 baseball gloves in inventory. All inventory tags generated from the accounting system must be placed on inventory and checked during an inventory count.

The AUD test includes several questions on inventory counts, so make sure that you study enough to understand these concepts well.

Materiality

Materiality is defined as a dollar amount that is large enough to be relevant to a financial statement reader, and there is not a set dollar amount that is considered material for every audit. The most important aspect of materiality is a misstatement of net income, because net income is a key metric used to value a company.

But here’s the kicker:

During audit planning, the audit staff will decide on a level of tolerable misstatement for each account balance. If, for example, the balance of accounts receivable is $2 million, the auditor may decide that any misstatement greater than $500 is material, which means an adjusted entry should be posted.

Sales and receivables

When an auditor performs an analytical review, the accountant compares balances in the financial statement to see if the relationships are reasonable. This analysis includes a review of trends from one year to the next. It’s very likely that you’ll see questions on the relationship between credit sales and receivables.

Credit sales are transactions that are not immediately paid in cash, and credit sales increase the accounts receivable balance. If your firm increases credit sales to new customers, you may find that new customers don’t pay as quickly as your existing client base.

What’s the bottom line?

If the accounts receivable balance grows at a faster percentage rate than credit sales, you may not be able to generate enough cash to operate each month. Growing credit sales by 10% will increase profits, but if the accounts receivable balance grows by 30%, if may create a cash shortage.

Sampling is defined as applying an audit procedure to less than 100% of the items in a population. Keep in mind, however, that if exceptions are found as samples are tested, the auditor will expand the audit work by testing more items.

Assume, for example, that an auditor pulls a sample of client checks with a dollar amount of $1,000 or more. The client’s internal controls require two signatures on every check of $1,000 or more, and the auditor selects 50 checks for test work. If the auditor reviews checks that do not have two signatures, the sample size will be expanded. An auditor cannot rely on a sample that contains errors, because the same error rate may apply to the entire population.

Search for unrecorded liabilities

Auditors plan the engagement so that each account in the balance sheet is audited, and auditors are concerned about overstatement of asset accounts and liability accounts that are understated. This auditing concept is based on the balance sheet formula:

Assets – liabilities = equity

If an asset account, such as accounts receivable, increases, the firm’s equity balance also increases. On the other hand, a decrease in accounts payable (a liability account) also increases equity. The auditor’s goal is to audit each balance sheet account, to ensure that each account is materially correct.

The search of unrecorded liabilities is a procedure that confirms accounts payable. The auditor scans large checks written shortly after the fiscal year end and reviews the accounts payable detail. An auditor wants to see if the check is paying a liability that was posted to accounts payable.

Assume, for example, that a company has a December 31st fiscal year end. A $5,000 check paid to a vendor on January 10th was not listed on the December 31st accounts payable detail. If the client was incurred the expense before year-end, the $5,000 should be added to accounts payable by posted an adjusting entry.

Segregation of duties

Segregation of duties is a concept that applies to many audit procedures, and every accountant must understand this topic. This concept is the only way to reduce the risk of fraud, particularly fraud committed by workers within a business.

You might be wondering:

How can I protect my firm from fraud? To protect yourself, make sure that you understand the three types of duties that must be segregated among different employees:

- Physical custody of assets : One worker should have physical custody of assets, such as the checkbook, or the keys to the warehouse.

- Authorization : A second person, usually the owner, should have authority to move assets. An authorized check signer, for example, has the ability to move cash by signing a check.

- Recordkeeping : If possible, a third worker should be responsible for posting accounting activity. That would include the task of reconciling the bank accounts, for example.

Ideally, three separate people should handle these duties. The Audit CPA exam asks many questions on this topic, so make sure that you’re clear about segregation of duties.

Invest In Your Audit CPA Exam Prep

The AUD exam can be difficult, particularly if you haven’t worked as an auditor for a CPA firm. While this test does not have as many calculations as other sections of the CPA exam, you still need to invest a great deal of time to study for it.

Bryce Welker is a regular contributor to Forbes, Inc.com, YEC and Business Insider. After graduating from San Diego State University he went on to earn his Certified Public Accountant license and created CrushTheCPAexam.com to share his knowledge and experience to help other accountants become CPAs too. Bryce was named one of Accounting Today’s “Accountants To Watch” among other accolades. As Seen On Forbes

Related Posts

Practice with accessible CPA Exam Sample Tests

For sample test users who require assistance, the links below are accessible with Job Access With Speech (JAWS®) or ZoomText® Magnifier/Reader screen readers. You must use a Google Chrome web browser to access the links.

NOTE: The sample test requires an HD monitor. If you do not have an HD monitor, you will have to adjust the format of your screen size by clicking (CTRL +) in order to see the entire page and have the full functionality of the test.

Obsolete sample test content is periodically updated in conjunction with other changes. The content on this sample test is current as of July 1, 2023.

Sample test for JAWS® or ZoomText® Magnifier/Readers users:

CPA Exam Sample Test You will need to use your own copy of Microsoft® Excel

Here’s what’s next

Explore more of our great resources below.

What did you think of this?

Every bit of feedback you provide will help us improve your experience

Mentioned in this article

Related content.

This site is brought to you by the Association of International Certified Professional Accountants, the global voice of the accounting and finance profession, founded by the American Institute of CPAs and The Chartered Institute of Management Accountants.

CA Do Not Sell or Share My Personal Information

Audit Research question

- Creator Topic

would you please tell me how to study for this part of the text ? Because now that there is not search bottom i do not how to memorize this .

FAR 05/24/16 73 07/27/2016 reg 07.07.2016

- Author Replies

Where are you getting that information? I took Aud Q2 (new changes) and it had the search capability. Unless something changed, I think it's still there.

What prep are you using? Both Becker and Ninja have decent simulators for the research questions .

Also – aicpa.org has actual sample tests with a good representation of the real environment that you can use for practice.

Here's a strategy I shared for research questions.

Step 1: analyze the question – what exact word or short phrase (2 to 3 words) do you need to research? Step 2: go to the “advanced” tab and search “exact terms” (I forget the exact wording they use) but there's an “all words” and I believe “exclude words” and I think even exact phrase. I think the “all words” one is the best. Step 3: There should be a reasonable number of results that you can now scan through. If not, then step 4. Step 4: If there were too many results – think of a refining word in the question and add that. Step 5: If there were no results, think of your search words and think of synonyms to those words that may appear in a codified doc.

wou thanks to the lord then i do not find the search botton in the simulation at aicpa . I passed far so i am familiar with this question en the last version

Yeah nothing has changed with the research question. They are still easy points.

Just to clarify – I think we are talking about the same thing – the search button is “Authoritative Literature” at which point you can get to the search area. Then you can get to Advanced Search from there.

- You must be logged in to reply to this topic.

Don't have a login? Click here to register.

© 2024. All rights reserved.

Terms & Conditions | Sitemap | DOJO Login

Get Your Free CPA Notes

- If it's IN the NINJA Notes it's ON the exam!

- They boil down key concepts to manageable sizes that are easily consumed AND remembered.

- Read them, read them again, rewrite them, and pass & enjoy your life!

- Have you taken this exam section before? * Select One: Sat Before First Time

- When do you plan to take the CPA Exam? * Select One: 1 Month 2 Months 3 Months 4-6 Months 7-12 Months I have no idea

- What Is Your Primary CPA Material? * Select One: Becker Gleim NINJA Roger Surgent WileyCPAexcel Yaeger Other

- Please Tell Us about Your Current CPA Exam Status.

- What is your AUD Exam Status * Select one Need to Pass Passed Currently Studying

- What is your BEC Exam Status * Select one Need to Pass Passed Currently Studying

- What is your FAR Exam Status * Select one Need to Pass Passed Currently Studying

- What is your REG Exam Status * Select one Need to Pass Passed Currently Studying

- What is your BAR Exam Status * Select one Need to Pass Passed Currently Studying

- What is your ISC Exam Status * Select one Need to Pass Passed Currently Studying

- What is your TCP Exam Status * Select one Need to Pass Passed Currently Studying

- Email This field is for validation purposes and should be left unchanged.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Final Exam Review for Research Methodology (RES301)

Research Methodology final exam review

Related Papers

Dr. John Karanja , JOHN KARANJA, PhD

research proposal is a comprehensive plan for a research project. It is a written description of a research plan that has to be undertaken. It determines the specific areas of research, states the purpose, scope, methodology, overall organization and limitations of the study. It also estimates its requirements for equipment (if necessary), finance and possible personnel.

pinky marie mendi gallano

Rebekka Tunombili

Rengganis Ernia

Dr RUKUNDO Levi, PhD

Dewi Nurbaeti Widianingsih

Nidhi Mishra

Fundamental_of_Research_Methods and Statisti

Hadi Pranoto

RELATED PAPERS

Izvestiya TINRO

Lisa Eisner

Sibirskiy psikhologicheskiy zhurnal

D. Leontiev

Revista Facultad de Ciencias de la Salud UDES

Osmany Blanco

International Journal of Environmental Research and Public Health

Maria Pilar Astier Peña

Girlhood Studies

Judith Inggs

Egyptian Journal of Medical Human Genetics

HUMAIRA BINTE RAIHAN 1712388647

Bulletin of Volcanology

Boris Behncke

Archives of Disease in Childhood

Kerryn Saunders

Bioorganic & Medicinal Chemistry Letters

Jurnal Teknik Elektro Uniba (JTE UNIBA)

rizky alexander

The Journal of Physical Chemistry Letters

Khem Acharya

British Journal of General Practice

Roger Gadsby

František Tihlařík

Transactions of the Indian Institute of Metals

Saida Shaik

Ian Blenkharn

Electrochemistry Communications

Archive for Rational Mechanics and Analysis

Jan Kristensen

Journal of Student Research

Kah Ying Choo

Value in Health

Caroline ANFRAY

Journal of Health Sciences

Kenan Kadić

Acta Chemica Scandinavica

(생명시스템대학 시스템생물학) 이태호

Cecilia Gavazzi

Lenin Lemus

The EMBO Journal

Gerard Grosveld

Gravitation and Cosmology

Valerian Yurov

See More Documents Like This

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

- Starting the research process

- 10 Research Question Examples to Guide Your Research Project

10 Research Question Examples to Guide your Research Project

Published on October 30, 2022 by Shona McCombes . Revised on October 19, 2023.

The research question is one of the most important parts of your research paper , thesis or dissertation . It’s important to spend some time assessing and refining your question before you get started.

The exact form of your question will depend on a few things, such as the length of your project, the type of research you’re conducting, the topic , and the research problem . However, all research questions should be focused, specific, and relevant to a timely social or scholarly issue.

Once you’ve read our guide on how to write a research question , you can use these examples to craft your own.

Note that the design of your research question can depend on what method you are pursuing. Here are a few options for qualitative, quantitative, and statistical research questions.

Other interesting articles

If you want to know more about the research process , methodology , research bias , or statistics , make sure to check out some of our other articles with explanations and examples.

Methodology

- Sampling methods

- Simple random sampling

- Stratified sampling

- Cluster sampling

- Likert scales

- Reproducibility

Statistics

- Null hypothesis

- Statistical power

- Probability distribution

- Effect size

- Poisson distribution

Research bias

- Optimism bias

- Cognitive bias

- Implicit bias

- Hawthorne effect

- Anchoring bias

- Explicit bias

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

McCombes, S. (2023, October 19). 10 Research Question Examples to Guide your Research Project. Scribbr. Retrieved April 2, 2024, from https://www.scribbr.com/research-process/research-question-examples/

Is this article helpful?

Shona McCombes

Other students also liked, writing strong research questions | criteria & examples, how to choose a dissertation topic | 8 steps to follow, evaluating sources | methods & examples, what is your plagiarism score.

- Bihar Board

SRM University

Ap inter results.

- AP Board Results 2024

- UP Board Result 2024

- CBSE Board Result 2024

- MP Board Result 2024

- Rajasthan Board Result 2024

- Shiv Khera Special

- Education News

- Web Stories

- Current Affairs

- नए भारत का नया उत्तर प्रदेश

- School & Boards

- College Admission

- Govt Jobs Alert & Prep

- GK & Aptitude

- CBSE Class 12

CBSE Class 12 Computer Science Paper Analysis 2024: Exam Review, Student Feedback and Expert View

Cbse class 12 computer science paper analysis 2024: in this article, students can find cbse class 12 computer science exam analysis 2024 and get to know about the overall difficulty level of the paper. also, find students reactions on cbse 12th computer science exam 2024. .

CBSE Class 12 Computer Science Exam Paper Analysis 2024: The Central Board of Secondary Education (CBSE) Board Exam 2024 has now come to an end on April 2, 2024. Today, CBSE had scheduled Class 12 Computer Science Exam 2024 and with the completion of this exam, CBSE Board Exams 2024 has been successfully ended. All the students who have appeared for today’s exam can check the CBSE Class 12 Computer Science exam analysis 2024. As a part of the analysis, students will get to know about the overall difficulty level of the question paper, section-wise challenges faced by students, types of questions asked in the exam, paper pattern followed, and a lot more. Also, get to know the students’ reactions on today’s CBSE 12th Computer Science question paper 2024 along with experts’ opinion on the same.

CBSE Class 12 Computer Science Exam 2024 Key Highlights

Cbse class 12 computer science paper review 2024.

- The CBSE Class 12 Computer Science Question Paper 2024 was moderate

- It would fall under easy to moderate category

- The programming questions were moderately challenging

- MCQs were a combination of easy and tricky ones

- Very short answer type questions, short answer type questions, long answer type questions were also a good mix of easy and tricky questions.

CBSE Class 12 Computer Science Paper Review 2024: Students’ Reactions

- Challenging Areas in Computer Science Questions: The entire paper was a combination of mixed questions

- Type of Questions asked in Today’s Computer Science Exam: MCQs, Very short answer type questions, short answer type questions, long answer type questions, Programming based questions

- Section-wise Class 12 Computer Science Exam Review: Section A was average, B and C were easy, Section D was moderately hard

CBSE Class 12 Computer Science Paper Analysis 2024 - Experts' Review

- Experts have agreed to students’ reaction on the paper. They have said that the question paper was moderate

- The paper was completely based on the format of the sample paper

- There was no out-of-syllabus question. Everything was asked from within the curriculum laid down by the board.

- MCQs were a good mix of easy and tricky questions

- Programming based questions were also quite easy

- Overall, the paper was quite doable

CBSE Class 12 Computer Science Question Paper 2024

Cbse class 12 computer science answer key 2024.

Check the CBSE Class 12 Computer Science answer key 2024 here and verify your answers from the article link attached above.

Also Check:

CBSE Class 12 Syllabus 2023-2024 (All Subjects)

CBSE Class 12 Sample Paper 2023-2024 (All Subjects)

CBSE Class 12 Practice Papers 2023-2024

NCERT Solutions for Class 12 (All Subjects and Chapters)

Important Questions for Class 12 Board Exam 2024 (All Subjects)

Get here latest School , CBSE and Govt Jobs notification in English and Hindi for Sarkari Naukari and Sarkari Result . Download the Jagran Josh Sarkari Naukri App . Check Board Result 2024 for Class 10 and Class 12 like CBSE Board Result , UP Board Result , Bihar Board Result , MP Board Result , Rajasthan Board Result and Other States Boards.

- ssc.digialm.com Answer Key 2024

- CGPSC Mains Exam 2024

- SSC GD Answer Key 2024

- AIASL Executive Recruitment 2024

- NTA NITTT Result 2024

- APPSC Group 2 Result 2024

- SSC JE Syllabus 2024

- TN SET Application Form 2024

- BPSC Head Master 2024 Last Date Extended

- UGC NET Notification 2024

Trending Categories

Latest education news.

Today’s IPL Match (4 April) - GT vs PBKS: Team Squad, Match Time, Where to Watch Live and Stadium

What exactly is the Havana syndrome?

Who Won Yesterday IPL Match: DC vs KKR, Match 16, Check All Details and Latest Points Table

Jagran Josh Education Awards 2024: Educational Leaders, Teachers, Students honoured for their Remarkable Innovations to Solve Real-world Problems

Highest Team Scores of All Time in IPL (2008 - 2024): Most Runs in an Innings Totals

Optical Illusion IQ Test: Only 1% High IQ Genius Can Find The COACHMAN Hidden In This 18th Century Picture. 13 Seconds Left!

Picture Puzzle IQ Test: You Are Highly Attentive If You Can Spot The Pencil In 12 Seconds!

SSC GD Answer Key 2024 OUT: Direct Link Active, Download Constable Response Sheet PDF on ssc.gov.in

SSC GD Constable Answer Key 2024 Out: Link Active on ssc.gov.in

SSC GD Answer Key 2024 Released at ssc.gov.in: Download Link Here, Submit Objection

Assam CEE 2024 Registration Ends Today, Check Eligibility Criteria Here

Optical Illusion Vision Test: Find the cat in the picture in 3 seconds!

nbe.edu.in NEET MDS Result 2024 Declared, NTA Released Official PDF and Cutt Marks at natboard.edu.in, Check More Details

Picture Puzzle IQ Test: Find the mistake in the village picture in 5 seconds!

AIMA MAT May 2024 Session Dates Out, Check Schedule Here

JNTUA Result OUT on jntua.ac.in, Download UG and PG Semester Marksheet

JEE Main 2024 Important and Scoring Chapters: Check Subject Wise Weightage & Topics

JNTUA Manabadi Result 2024 OUT at jntua.ac.in; Direct Link to Download UG and PG Marksheet

SSC GD Constable Answer Key 2024: जीडी कांस्टेबल उत्तर कुंजी लिंक ssc.digialm.com पर एक्टिव, इस Direct Link से डाउनलोड करें रिपॉन्सशीट

ISC Class 12 Syllabus 2024-25: Download Class 12th Syllabus PDF

I tried the new Google. Its answers are worse.

Google’s ai-‘supercharged’ search generative experience, or sge, sometimes makes up facts, misinterprets questions and picks low-quality sources — even after nearly 11 months of public testing..

Have you heard about the new Google ? They “ supercharged ” it with artificial intelligence. Somehow, that also made it dumber.

With the regular old Google, I can ask, “What’s Mark Zuckerberg’s net worth?” and a reasonable answer pops up: “169.8 billion USD.”

Now let’s ask the same question with the “experimental” new version of Google search. Its AI responds: Zuckerberg’s net worth is “$46.24 per hour, or $96,169 per year. This is equivalent to $8,014 per month, $1,849 per week, and $230.6 million per day.”

Um, none of those numbers add up.

Google acting dumb matters because its AI is headed to your searches sooner or later . The company has already been testing this new Google — dubbed Search Generative Experience, or SGE — with volunteers for nearly 11 months, and recently started showing AI answers in the main Google results even for people who have not opted in to the test .

Should you trust that AI?

The new Google can do some useful things. But as you’ll see, it sometimes also makes up facts, misinterprets questions, delivers out-of-date information and just generally blathers on. Even worse, researchers are finding the AI often elevates lower-quality sites as reliable sources of information.

Normally, I wouldn’t review a product that isn’t finished. But this test of Google’s future has been going on for nearly a year, and the choices being made now will influence how billions of people get information. At stake is also a core idea behind the current AI frenzy: that the tech can replace the need to research things ourselves by just giving us answers. If a company with the money and computing power of Google can’t make it work, who can?

SGE merges the search engine you know with the capabilities of a chatbot. On top of traditional results, SGE writes out direct answers to queries, interspersed with links to dig deeper.

Geoffrey A. Fowler

SGE is a response to the reality that some people, including me, are starting to turn to AI like ChatGPT for more complex questions or when we don’t feel like reading a bunch of different sites. Onely , a search optimization firm, estimates that using SGE can make a user’s overall research journey 10 to 20 times shorter by assembling pros and cons, prices and other information into one place.

An all-knowing answer bot sounds useful given our shrinking attention spans. But Google has a lot to work out. We expect searches to be fast, yet Google’s AI answers take a painful second or two to generate. Google has to balance the already fragile economy of the web, where its AI answers can steal traffic from publishers who do the expensive and hard work of actually researching things.

And most of all, the new Google has to deliver on the promise that it can consistently and correctly answer our questions. That’s where I focused my testing — and kept finding examples where the AI-supercharged Google did worse than its predecessor.

Putting Google’s AI answers to the test

Often when you’re Googling, what you really want is a short bit of information or a link. On a day-to-day basis, the new Google is often annoying because its AI is so darned chatty.

A goofy example: “What do Transformers eat?”

The AI answer told me that fictional robots don’t really need to eat or drink, though they need some kind of fuel. Meanwhile, old Google had the one-word answer I was looking for: Energon. (It’s a kind of magical fuel.) You got that answer from new Google only by scrolling down the page.

This doesn’t just happen with alien robots. When SE Ranking, a firm dedicated to search engine optimization, tested SGE with 100,000 keyword queries, it found the average answer it generated was 3,485 characters — or roughly a third as long as this column. One of Google’s challenges is figuring out when its AI is better off just keeping quiet; sometimes, SGE asks you to press a “generate” button before it will write out an answer.

Most of all, when we search, we expect correct information. Google claims SGE has a leg up on ChatGPT because its knowledge is up-to-date.

Yet I found the new Google still struggled with recent affairs. Three days after the most recent Academy Awards, I searched for “Oscars 2024.” It told me the Oscars were still to come and listed some nominees.

And nothing undermined my trust in Google’s AI answers more than watching it confidently make stuff up.

That includes facts about yours truly. I asked it about an award-winning series I wrote for The Washington Post, and it attributed it to some stranger — and then gave a link to some other website.

Then there was the time SGE all too happily made up information about something that doesn’t even exist. I asked about a San Francisco restaurant called Danny’s Dan Dan Noodles, and it told me it has “crazy wait times” and described its food.

The problem is that this is an imaginary shop I named after my favorite Chinese dish. Google’s AI had no problem inventing information about it.