- Noatum Group

- Get to know us

- Our Leadership

- Recognition and awards

- Our history

- Certifications

- Maritime Containers

- Air Containers

- Conversion Tables

- Dangerous goods labels

- Goods tariff code

Freight Management

- Contract Logistics / Warehouse & Distribution

- Customs services

- International Supply Chain Management

- Project cargo logistics

- Reefer Logistics

Automotive & Aerospace

Chemical industry, construction.

- Consumer Electronics

- Industrial Manufacturing

Oil and Gas

- Pharma & Healthcare

Renewable Energy

Case studies.

- Location & Contact

- Maritime containers

- Air containers

- Get a quote

Home / Case Studies

Case Study – Air transport services for mining industry

Our client needed to transport a total of 8 cable reels of 23 tons each from Shanghai. The challenge was to make the shipment in the shortest possible time with reasonable costs.

Case Study – Air Charter for Healthcare

The start of the Covid-19 vaccination campaign was imminent and our client needed regular shipments of syringes from China, where the factory was located, to Peru so they could ensure the vaccination campaign ran smoothly.

Case study – Air charter for the mining sector

Our client needed to urgently ship two conveyor belts from Santiago de Chile to Lima. These conveyor belts are used to move the mineral extracted from the mine into the storage area. Due to their size and weight, more than 60 tonnes, it was necessary to study in detail what would be the best transport solution to deliver in the shortest possible time.

Case Study – Automotive logistics

To create a cost saving solutions with enhanced service levels, whilst maintaining existing structures and warehouse facilities.

Case Study – Retail logistics: LG Harris

When understanding the LG Harris supply chain requirements, Noatum Logistics quickly identified that their buying terms were CIF (cost, insurance, freight) across the majority of their supply base. This prevented shipment visibility for LG Harris until the goods arrived into port. Accounting for over 1,000 TEU per annum was a major headache. The supply chain model was completely reactive with little or no reporting or key-performance-indicator (KPI) management. This created high demurrage charges, inbound-inventory and stock-control challenges at the LG Harris distribution centre (DC) located in the Midlands (UK).

Case Study – Personal care logistics

The customer felt its supply chain was working fine. No pain, no need to change! However, having worked with Noatum Logistics in the past, and experienced improved operations, the new leader was willing to let us review the company’s pricing and route information on outbound shipments to the United States, Japan, Taiwan, Malaysia and Australia.

Case Study – Outdoor retailer logistics

The retailer faced major challenges with days-in-inventory and capacity at its distribution center (DC). Days-in-inventory time continued to increase over the prior five years The single distribution center experienced overly high storage levels, delays with unloading railcars and shipping containers, and an overall worsening in port-to-DC transit times (hovering around 40 days).

Case Study – Oil & Gas industry

With each unit weighing approximately 32,000 pounds, the company faced high shipping costs for the pumping units sourced from China.

Case Study – Oil and Gas logistics

The customer suspected they were being overcharged for shipping. They were not using freight forwarders, instead allowing manufacturers to arrange for the ocean-freight shipping of the oilfield equipment from China to Canada. Cargo was shipped using fixed load plans with no optimization for larger batches.

Case Study – Mining logistics

An initial assignment was for the movement of Autoclave and Flash Vessel pieces from their manufacturing plant, located 30 miles inland from the Shanghai port, to the mining project 90 miles east of Lima, Peru. The equipment pieces were over size and over weight, requiring special loading/unloading procedures; ocean, rail and ground transportation; and infrastructure modifications.

Case Study – High Tech logistics

With a significant segment of the semiconductor wafer foundry base moving to Asia, our customer decided to relocate operations closer to their end user. Our customer opened an equipment integration facility in Singapore near their customer who provides wafer fabrication equipment. Unfortunately, this move created an increase in real estate and labor costs, thus denying our customer the warehouse space to stage components for assembly and integration.

Case Study – Pharma&Healthcare logistics

Sourcing product from Korea, the customer initially used Noatum Logistics to assist with international freight forwarding and the custom clearance process for shipments to the U.S. As the customer grew their customer base and product offering, it was apparent their outsourced warehouse solution in the U.S. could not keep up with their needs. The end customers’ orders frequently required special packing, rush deliveries, and special project handling, straining the customer’s inventory management practices.

Case Study – Fashion industry logistics: Gant

Capitalise on the retail expertise and capabilities of Noatum Logistics, including our robust warehouse management technologies and local capacity. The benefits of greater inventory visibility and control would cascade into other supply chain functions including transportation, warehousing, distribution and customer service.

Case Study – Consumer Electronics logistics

A leading manufacturer of cell phone accessories was in a crisis. Issues with an overseas partner completely shut down their supply chain. They needed a new logistics services provider to quickly step in and get shipments moving. The manufacturer also recognized the need to rethink its supply chain to gain better control over vendors, reduce costs and achieve more efficient handling of orders.

Case Study – Apparel retailer logistics

A retail client of Noatum Logistics for international freight forwarding services sought additional assistance for improving control over its global supply chain. The client recognized that greater visibility to purchase orders and shipments would lead to better purchasing, transportation and distribution decisions.

Case Study – Industrial Manufacturing logistics

Our customer is a leading multinational manufacturer of automobiles and agricultural machinery. The company entered the U.S. market in 2000; since 2002, Noatum Logistics has handled the company’s customs brokerage at Noatum Logistics’ Houston branch.

Case Study – Fashion industry logistics

Founded in 1920, New Era Cap Company is an American headwear company headquartered in Buffalo, New York. Best known for being the official on-field cap for Major League Baseball, the official sideline cap for the National Football League, and the official on-court cap for the National Basketball Association.

Case Study – High tech firm

The customer, a global provider of secure IP/Ethernet switching solutions, sources products from South China and Taiwan for sales in the United States. They identified cost containment objectives and wanted to improve the overall performance of their supply chain.

Logistics Services

- Freight management

Logistics Solutions

Key industries.

- Automotive Logistics

- Chemicals Logistics

- Construction Logistics

- Fashion Logistics

- Food Logistics

- Furniture Logistics

- Mining Logistics

- Oil and Gas Logistics

- Retail Logistics

- Renewable Energy Logistics

- Case studies

Noatum Logistics is a company of Noatum group

Reach out: [email protected] Whistleblowing: Online portal

© Copyright 2024. All Rights Reserved.

- Livro de reclamaçoes

- Privacy Policy

- Legal warning

- Cookies Policy

- All our business are subject to Noatum Logistics USA LLC Terms & Conditions

Select your country

- Browse All Articles

- Newsletter Sign-Up

Logistics →

- 25 Apr 2023

How SHEIN and Temu Conquered Fast Fashion—and Forged a New Business Model

The platforms SHEIN and Temu match consumer demand and factory output, bringing Chinese production to the rest of the world. The companies have remade fast fashion, but their pioneering approach has the potential to go far beyond retail, says John Deighton.

- 18 Oct 2022

- Cold Call Podcast

Chewy.com’s Make-or-Break Logistics Dilemma

In late 2013, Ryan Cohen, cofounder and then-CEO of online pet products retailer Chewy.com, was facing a decision that could determine his company’s future. Should he stay with a third-party logistics provider (3PL) for all of Chewy.com’s e-commerce fulfillment or take that function in house? Cohen was convinced that achieving scale would be essential to making the business work and he worried that the company’s current 3PL may not be able to scale with Chewy.com’s projected growth or maintain the company’s performance standards for service quality and fulfillment. But neither he nor his cofounders had any experience managing logistics, and the company’s board members were pressuring him to leave order fulfillment to the 3PL. They worried that any changes could destabilize the existing 3PL relationship and endanger the viability of the fast-growing business. What should Cohen do? Senior Lecturer Jeffrey Rayport discusses the options in his case, “Chewy.com (A).”

- 12 Jul 2022

Can the Foodservice Distribution Industry Recover from the Pandemic?

At the height of the pandemic in 2020, US Foods struggled, as restaurant and school closures reduced demand for foodservice distribution. The situation improved after the return of indoor dining and in-person learning, but an industry-wide shortage of truck drivers and warehouse staff hampered the foodservice distributor’s post-pandemic recovery. That left CEO Pietro Satriano to determine the best strategy to attract and retain essential workers, even as he was tasked with expanding the wholesale grocery store chain (CHEF’STORE) that US Foods launched during the pandemic lockdown. Harvard Business School Professor David E. Bell explores how post-pandemic supply chain challenges continue to affect the foodservice distribution industry in his case, “US Foods: Driving Post-Pandemic Success?”

- 05 Jul 2022

- What Do You Think?

Have We Seen the Peak of Just-in-Time Inventory Management?

Toyota and other companies have harnessed just-in-time inventory management to cut logistics costs and boost service. That is, until COVID-19 roiled global supply chains. Will we ever get back to the days of tighter inventory control? asks James Heskett. Open for comment; 0 Comments.

- 19 Oct 2021

- Research & Ideas

Fed Up Workers and Supply Woes: What's Next for Dollar Stores?

Willy Shih discusses how higher costs, shipping delays, and worker shortages are putting the dollar store business model to the test ahead of the critical holiday shopping season. Open for comment; 0 Comments.

- 26 Mar 2014

How Electronic Patient Records Can Slow Doctor Productivity

Electronic health records are sweeping through the medical field, but some doctors report a disturbing side effect. Instead of becoming more efficient, some practices are becoming less so. Robert Huckman's research explains why. Open for comment; 0 Comments.

- 11 Nov 2013

- Working Paper Summaries

Increased Speed Equals Increased Wait: The Impact of a Reduction in Emergency Department Ultrasound Order Processing Time

This study of ultrasound test orders in hospital emergency departments (EDs) shows that, paradoxically, increasing capacity in a service setting may not alleviate congestion, and can actually increase it due to increased resource use. Specifically, the study finds that reducing the time it takes to order an ultrasound counter intuitively increases patient throughput time as a result of increased ultrasound use without a corresponding increase in quality of care. Furthermore, the authors show that in the complex, interconnected system or hospitals, changes in resource capacity affects not only the patients who receive the additional resources, but also other patients who share the resource, in this case, radiology. These results highlight how demand can be influenced by capacity due to behavioral responses to changes in resource availability, and that this change in demand has far reaching effects on multiple types of patients. Interestingly, the increased ultrasound ordering capacity was achieved by removing what appeared to be a "wasteful" step in the process. However, the results suggest that the step may not have been wasteful as it reduced inefficient ultrasound orders. In healthcare, these results are very important as they provide an explanation for some of the ever-increasing costs: reducing congestion through increased capacity results in even more congestion due to higher resource use. Overall, the study suggests an operations-based solution of increasing the cost/difficulty of ordering discretionary but sometimes low-efficacy treatments to address the rise in healthcare spending. Therefore, to improve hospital performance it could be optimal to put into place "inefficiencies" to become more efficient. Key concepts include: A process improvement can inadvertently cause an increase in demand for a service as well as associated shared resources, which results in congestion, counter intuitively decreasing overall system performance. While individual patients and physicians may benefit from the reduced processing time, there can be unintended consequences for overall system performance. Closed for comment; 0 Comments.

- 25 Jan 2013

Why a Harvard Finance Instructor Went to the Kumbh Mela

Every 12 years, millions of Hindu pilgrims travel to the Indian city of Allahabad for the Kumbh Mela, the largest public gathering in the world. In this first-person account, Senior Lecturer John Macomber shares his first impressions and explains what he's doing there. Closed for comment; 0 Comments.

- 07 Aug 2012

Off and Running: Professors Comment on Olympics

The most difficult challenge at The Olympics is the behind-the-scenes efforts to actually get them up and running. Is it worth it? HBS professors Stephen A. Greyser, John D. Macomber, and John T. Gourville offer insights into the business behind the games. Open for comment; 0 Comments.

- 19 Oct 2010

The Impact of Supply Learning on Customer Demand: Model and Estimation Methodology

"Supply learning" is the process by which customers predict a company's ability to fulfill product orders in the future using information about how well the company fulfilled orders in the past. A new paper investigates how and whether a customer's assumptions about future supplier performance will affect the likelihood that the customer will order from that supplier in the future. Research, based on data from apparel manufacturer Hugo Boss, was conducted by Nathan Craig and Ananth Raman of Harvard Business School, and Nicole DeHoratius of the University of Portland. Key concepts include: Two key measures of supplier performance include "consistency", which is the likelihood that a company will continue to keep items in stock and meet demand, and "recovery", which is the likelihood that a company will deliver on time in spite of past stock-outs. Improvements in consistency and recovery are associated with increases in orders from retail customers. Increasing the level of service may lead to an increase in orders, even when the service level is already nearly perfect. Closed for comment; 0 Comments.

- 19 Jul 2010

How Mercadona Fixes Retail’s ’Last 10 Yards’ Problem

Spanish supermarket chain Mercadona offers aggressive pricing, yet high-touch customer service and above-average employee wages. What's its secret? The operations between loading dock and the customer's hands, says HBS professor Zeynep Ton. Key concepts include: The last 10 yards of the supply chain lies between the store's loading dock and the customer's hands. Poor operational decisions create unnecessary complications that lead to quality problems and lower labor productivity and, in general, make life hard for retail employees. Adopting Mercadona's approach requires a long-term view and a leader with a strong backbone. Closed for comment; 0 Comments.

- 12 Jul 2010

Rocket Science Retailing: A Practical Guide

How can retailers make the most of cutting-edge developments and emerging technologies? Book excerpt plus Q&A with HBS professor Ananth Raman, coauthor with Wharton professor Marshall Fisher of The New Science of Retailing: How Analytics Are Transforming the Supply Chain and Improving Performance. Key concepts include: Retailers can better identify and exploit hidden opportunities in the data they generate. Integrating new analytics within retail organizations is not easy. Raman outlines the typical barriers and a path to overcome them. Incentives must be aligned within organizations and in the supply chain. The first step is to identify the behavior you want to induce. To attract and retain the best employees, successful retailers empower them in specific ways. Closed for comment; 0 Comments.

- 05 Jul 2006

The Motion Picture Industry: Critical Issues in Practice, Current Research & New Research Directions

This paper reviews research and trends in three key areas of movie making: production, distribution, and exhibition. In the production process, the authors recommend risk management and portfolio management for studios, and explore talent compensation issues. Distribution trends show that box-office performance will increasingly depend on a small number of blockbusters, advertising spending will rise (but will cross different types of media), and the timing of releases (and DVDs) will become a bigger issue. As for exhibiting movies, trends show that more sophisticated exhibitors will emerge, contractual changes between distributor and exhibitors will change, and strategies for tickets prices may be reevaluated. Key concepts include: Business tools such as quantitative and qualitative research and market research should be applied to the decision-making process at earlier stages of development. Technological developments will continue to have unknown effects on every stage of the movie-making value chain (production, distribution, exhibition, consumption). Closed for comment; 0 Comments.

- 20 Dec 2004

How an Order Views Your Company

HBS Professors Benson Shapiro and Kash Rangan bring us up to date on their pioneering research that helped ignite today’s intense focus on the customer. The key? Know your order cycle management. Closed for comment; 0 Comments.

- 15 Apr 2002

In the Virtual Dressing Room Returns Are A Real Problem

That little red number looked smashing onscreen, but the puce caftan the delivery guy brought is just one more casualty of the online shopping battle. HBS professor Jan Hammond researches what the textile and apparel industries can do to curtail returns. Closed for comment; 0 Comments.

- 26 Nov 2001

How Toyota Turns Workers Into Problem Solvers

Toyota's reputation for sustaining high product quality is legendary. But the company's methods are not secret. So why can't other carmakers match Toyota's track record? HBS professor Steven Spear says it's all about problem solving. Closed for comment; 0 Comments.

- 19 Nov 2001

Wrapping Your Alliances In a World Wide Web

HBS professor Andrew McAfee researches how the Internet affects manufacturing and productivity and how business can team up to get the most out of technology. Closed for comment; 0 Comments.

- 22 Jan 2001

Control Your Inventory in a World of Lean Retailing

"Manufacturers of consumer goods are in the hot seat these days," the authors of this Harvard Business Review article remind readers. But there is no need to surrender to escalating costs of inventories. In this excerpt, they describe one new way to help lower inventory costs. Closed for comment; 0 Comments.

- 12 Oct 1999

Decoding the DNA of the Toyota Production System

How can one production operation be both rigidly scripted and enormously flexible? In this summary of an article from the Harvard Business Review, HBS Professors H. Kent Bowen and Steven Spear disclose the secret to Toyota's production success. The company's operations can be seen as a continuous series of controlled experiments: whenever Toyota defines a specification, it is establishing a hypothesis that is then tested through action. The workers, who have internalized this scientific-method approach, are stimulated to respond to problems as they appear; using data from the strictly defined experiment, they are able to adapt fluidly to changing circumstances. Closed for comment; 0 Comments.

Rapid Response: Inside the Retailing Revolution

A simple bar code scan at your local department store today launches a whirlwind of action: data is transmitted about the color, the size, and the style of the item to forecasters and production planners; distributors and suppliers are informed of the demand and the possible need to restock. All in the blink of an electronic eye. It wasn’t always this way, though. HBS Professor Janice Hammond has focused her recent research on the transformation of the apparel and textile industries from the classic, limited model to the new lean inventories and flexible manufacturing capabilities. Closed for comment; 0 Comments.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

It’s Time to Rethink Your Global Logistics

- Willy C. Shih

- Adrien Foucault

The pandemic has overloaded companies’ usual shipping networks.

The initial supply and demand shocks caused by the pandemic were followed by an import surge as suppliers tried to replenish inventories, which threw normal transportation operations into turmoil. In the United States, this has included a lack of freight-handling capacity at Los Angeles and Long Beach ports, overloaded U.S. intermodal rail networks, and a lack of containers. But alternatives to established logistics networks exist. It’s time for companies to take advantage of them.

Over the last three decades, companies have established wide-ranging global supply chains that have taken advantage of steadily improving scale economies in global logistics. Efficient and reliable ocean and air cargo have linked low-cost manufacturing hubs across Asia with major markets in the United States and Europe. Much of this global sourcing was driven by the cost savings reaped through labor arbitrage, cost savings that were so dramatic that it more than covered the expense associated with moving products across vast distances to markets, or the extra cost of carrying inventory in long pipelines.

- Willy C. Shih is a Baker Foundation Professor of Management Practice at Harvard Business School.

- Adrien Foucault is an MBA student at Harvard Business School and has worked at maritime transport company CMA CGM.

Partner Center

Case Studies in Carbon-Efficient Logistics

Logistics is a leading source of carbon. Nearly 6 percent of the greenhouse gases generated by humans come from the flow of products to consumers. Reducing these emissions takes more than setting goals; it requires clear, measurable initiatives that hit sustainability targets while delivering lower costs and higher service levels.

Sponsored by Environmental Defense Fund (EDF), Dr. Edgar E Blanco Research Director of the Carbon-Efficient Supply Chains Research Project at the MIT Center for Transportation & Logistics, worked alongside three US companies to help them quantify the carbon footprint of some of their logistics initiatives. The goal was to document the projects, and illustrate to other companies that it is possible to reduce cost and become more environmentally friendly.

In this case study we present two Ocean Spray initiatives – distribution network redesign and intermodal shift from road to rail – that in combination led to a 20% reduction in transportation CO2 emissions, while achieving comparable cost savings across the transportation network.

Shifting to Rail – A Collaborative Approach

Ocean Spray, CSX (the rail operator), and fruit shipping companies partnered in order to enable Ocean Spray to ship more products intermodally from its New Jersey distribution center to the company's Florida facility. Prior to the collaboration, these boxcars were returning empty to the Florida region. Shipments that shifted to intermodal generated 65% less emissions while saving over 40% of transportation costs.

Distribution Network Redesign

Ocean Spray added new manufacturing and distribution capabilities in Florida to support the company’s growing customer base. To fully and effectively utilize these additions, Ocean Spray conducted a national network re-design project to determine which customers will receive product from the new location. Ocean Spray projected that over 17% of the total shipments will be served from the new facility.

Read the full Ocean Spray case study here .

In this case study, we analyzed the inbound shipping operations of Caterpillar’s North American large mining truck facility to determine – based on weight, packaging, routing, and scheduling – opportunities to streamline shipping protocols, and thus reduce carbon emissions associated with the supply chain. When combined, the streamlined shipping and packaging efforts could reduce Caterpillar’s overall carbon emissions by 340-730 tonnes of CO2 per year.

Switching Shipment Packaging from Steel to Light-Weight Plastic

At present, Caterpillar uses steel containers to transport parts. Caterpillar has been working for the past four years to phase out these steel containers and replace them with plastic containers, which weigh considerably less.

Analyzing Inbound Shipments to Identify Potential Consolidation

To construct the very large vehicles used in the mining industry, parts are shipped from all over the globe for assembly at Caterpillar’s manufacturing facility in Decatur, Illinois. We analyzed historical shipment data to identify areas where shipments could be consolidated to save fuel and reduce vehicle CO2 emissions. More specifically, we analyzed:

Read the full Caterpillar case study here .

Boise Inc. has launched two initiatives to improve its logistics operations and environmental performance. The Carload Direct Initiative is shifting product transport to rail, and the Three-Tier Pallet Initiative is increasing railcar utilization. Both initiatives have resulted in a combined 62-72% reduction in the company’s CO2 emissions, as well as cost savings on those shipments.

Reducing CO2 Emissions Through Carload Direct

Traditionally, manufacturers use trucks, or a mix of trucks and rail, to transport their products to customers. As trucks produce greater emissions than trains, a logical way to reduce emissions is to minimize the use of trucks and maximize the use of rail. Boise coordinated with its customers to promote rail transport so that product could be sent directly from the manufacturing plant to the customer’s warehouse. The transition from using a mix of truck and rail to exclusively rail eliminated more than 2,600 tons of C02; the equivalent of saving over 264,000 gallons of fuel consumed by road vehicles.

Optimizing Railcar Utilization with Three-Tier Pallets

Prior to this project, railcars were loaded two pallets high, leaving a space from the top of the second pallet to the roof of the railcar, thus under-utilizing the full capacity of the railcar. Boise redesigned its pallets and loading structure by creating a half-pallet, which allowed the company to rethink pallet stacking and maximize shipping capacities for its loads. These redesigns maximized carloads by reducing the number of shipments required to deliver product. Using just 930 railcars in 2011 reduced the company’s C02 emissions by 190 tons, which is equal to the C02 emissions from 21,637 gallons of fuel consumed by road vehicles.

Read the full Boise case study here .

Hear directly from Dr. Edgar Blanco, from MIT CTL, joined by EDF’s Jason Mathers, Ross Corthell from Boise, Kristine Young from Ocean Spray, and Zena Onstott from Caterpillar as they share their insights from these case studies on this webinar .

To find out more about the case studies, contact Dr. Edgar E. Blanco , Research Director, Carbon Efficient Supply Chains Research Project, MIT CTL, and co-founder of the LEAP consortium.

The Carbon Efficient Supply Chains Research Project is addressing three challenges: how to measure the carbon footprint of a supply chain, developing strategies for reducing supply chain carbon emissions, and communicating carbon footprints to consumers and stakeholders. Further information is available here .

The Leaders in Environmental Assessment and Performance (LEAP) consortium is a vehicle for organizations to leverage MIT’s knowledge and resources as well as the lessons learned from corporate environmental efforts. LEAP is a joint initiative between MIT CTL and the MIT Material Systems Laboratory. Further information is available here .

Case Studies

Learn more about how omni logistics can help you..

Read some of our global case studies that give you a first hand look at how Omni Logistics has helped other companies succeed. Expect the best in comprehensive supply chain solutions. We’re ALL IN for our clients.

CASE STUDIES

Critical on-time delivery for international retail stores., increasing performance and reducing fines., regaining visibility to sustain in-stock performance., meeting the needs of a growing security technology company., a unique logistics solution for a unique electronics challenge., supply chain problem solving with life-giving results., are you ready to part of an all in team.

Please enter the following information:

Mach1 is now Omni Logistics

Mach 1 is now Omni Logistics! We look forward to offering a wide range of solutions and capabilities as part of the Omni team. You will now be redirected to the Omni Logistics website.

Schedule a 15 Minute Call

Privacy overview.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these cookies on your website.

- © 2013

Basics — Exercises — Case Studies

- Harald Gleissner 0 ,

- J. Christian Femerling 1

Berlin School of Economics and Law, Berlin, Germany

You can also search for this author in PubMed Google Scholar

Investa Holding GmbH, Eschborn, Germany

- Offers a broad range of exercises and case studies

- Written by authors with outstanding logistics industry practice and teaching experience

- Suitable complementary case study book is available

- Includes supplementary material: sn.pub/extras

Part of the book series: Springer Texts in Business and Economics (STBE)

1.74m Accesses

24 Citations

12 Altmetric

- Table of contents

About this book

Authors and affiliations, about the authors, bibliographic information.

- Publish with us

Buying options

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Other ways to access

This is a preview of subscription content, log in via an institution to check for access.

Table of contents (14 chapters)

Front matter, introduction.

- Harald Gleissner, J. Christian Femerling

The Principles of Logistics

Logistics systems, logistical infrastructure, transport systems and logistics services, warehousing, handling, and picking systems, inventory, stock and provisioning management, logistics network planning, it in logistics, investment and financing in logistics.

- Logistics Controlling

Business Models and Industry Solutions

Outline solutions to case studies, back matter.

Logistics is the ideal book for Bachelor students of logistics, providing a solid foundation as well as a practical guide. In modular and clear form, it explains key concepts, principles, and practices of logistics. Learning objectives as well as several case studies are integrated into each chapter.

It features chapters on Principles of Logistics; Logistics Systems; Transport Systems and Logistics Services; Warehousing, Handling and Picking Systems; Inventory, Stock and Provisioning Management; Logistics Network Planning; IT in Logistics; and Logistics Controlling.

In addition, the second fully updated German edition has been extended by the chapters Logistics Infrastructure and Investment and Financing in Logistics.

“This book offers, in a very clear and concise manner, access to fundamental management topics of modern logistics. Well-chosen case studies serve to illustrate best practice solutions.”

Professor Peter Klaus, member of Logistics Hall of Fame

”This new textbook facilitates a comprehensive and easy-to-grasp insight into the complex subject area of logistics. The authors have succeeded in presenting a good mix of theoretical foundation and practical application. Due to its clear structure and extensive range of topics, this book is highly suitable not only for students, but also for practitioners.”

Bernhard Simon, Managing Director, DACHSER GmbH & Co. KG

- Supply Chain Management

- Transport Systems

- Warehousing

- Engineering Economics

Harald Gleissner

J. Christian Femerling

Book Title : Logistics

Book Subtitle : Basics — Exercises — Case Studies

Authors : Harald Gleissner, J. Christian Femerling

Series Title : Springer Texts in Business and Economics

DOI : https://doi.org/10.1007/978-3-319-01769-3

Publisher : Springer Cham

eBook Packages : Business and Economics , Business and Management (R0)

Copyright Information : Springer Nature Switzerland AG 2013

Hardcover ISBN : 978-3-319-01768-6 Published: 19 February 2014

Softcover ISBN : 978-3-319-34743-1 Published: 03 September 2016

eBook ISBN : 978-3-319-01769-3 Published: 11 February 2014

Series ISSN : 2192-4333

Series E-ISSN : 2192-4341

Edition Number : 1

Number of Pages : XXI, 311

Number of Illustrations : 156 b/w illustrations

Topics : Operations Management , Engineering Economics, Organization, Logistics, Marketing , Organization

Policies and ethics

- Find a journal

- Track your research

Heart of Efficiency: 3 Logistics Case Studies that Show the Love

- February 13, 2024

This article dives into three compelling logistics case studies showcasing how MercuryGate enhances transportation management for three of our clients.

As we unwrap these stories, you’ll discover success stories conveying how logistics technology creates harmony in your complex supply chain.

Logistics Case Study #1: Using Analytics to Drive Operational Efficiency

- Significant Improvement in Timestamp Accuracy : Transitioning to MercuryGate’s platform increased timestamp accuracy from 60% to 89%.

- Increased On-Time Delivery Metrics : MercuryGate’s data-driven insights allowed more precise analysis of driver performance and operational procedures, leading to more efficient and accurate service delivery.

- Elevated Customer Service Ratings : MercuryGate’s solutions significantly increased customer service ratings — especially for on-time delivery.

Our SaaS video case study, available here , exemplifies how data-driven insights can lead to significant operational improvements and heightened customer experiences.

Logistics Case Study #2: Super Users Achieve TMS Eminence & Partner for Success

- Embracing Future-Ready Technology : By aligning with MercuryGate, this customer effectively evaluates and integrates various vendors, such as third-party payers or transportation tracking software, fostering a more comprehensive logistics solution.

- Combating Fraud with Advanced Logistics Technology : MercuryGate worked with this logistics provider to develop dynamic logic and validation workflows, ensuring carriers meet stringent criteria and safeguarding customer interests.

- Innovative Collaboration and Forward Thinking : The partnership’s focus on innovation and anticipating future needs led to significant advancements. By looking forward and not just relying on past builds, we push the boundaries of logistics technology.

This logistics case study is one of continuous improvement and adaptation. It illustrates how a deep understanding of each partner’s capabilities and needs can lead to remarkable success. Our customer’s transformation underlines the importance of embracing logistics technology to stay ahead in the dynamic world of transportation management. Watch the complete case study here .

Logistics Case Study #3: Navigating Intermodal Transportation

- Integration with Third-Party Providers : MercuryGate’s platform facilitated integration, including rates and schedules, bid creation to execution, and tracking and tracing equipment on the rails, enhancing overall operational efficiency.

- Streamlined Billing Capabilities : MercuryGate’s SaaS logistics technology platform solves billing complexities associated with boxcar movements, demonstrating its versatility and adaptability to stringent intermodal billing requirements.

This collaboration is comparable to finding the perfect Valentine, where the “matchmaking” of technology with logistics needs dramatically increased efficiency. Watch the video case study here .

Calculate your potential Saving While Using an enterprise TMS

Mercurygate’s impact: a story of innovation and partnership.

In conclusion, to commemorate Valentine’s Day, let’s celebrate the partnerships, innovations, and technological advancements that transform logistics. If these stories of transformation inspire you, imagine what MercuryGate can do for your business. Schedule a demo and take the first step toward becoming our next success story in logistics innovation.

And add one more delighted customer to our list of logistics case studies to find out how we help Facil improve transportation visibility. Download it today and find out how much this MercuryGate user loves our solutions.

Subscribe To The MercuryGate Blog

Related resources, baltimore bridge disaster: supply chain impacts & solutions.

Achieving Supply Chain Sustainability Success

Maximizing Efficiency in Carrier Claims Management

Import Compliance Deep Dive: Tackling Tough Questions in Global Trade

More Resources

Find out why our logistics technology users feel the love

Case Studies: How AI Consulting Has Helped Logistics Companies Succeed

According to McKinsey , the successful implementation of AI has helped businesses improve logistics costs by 15%, inventory levels by 35%, and service levels by 65%. AI consulting for logistics businesses brings a number of benefits, but RTS Labs has taken it a step further by delivering tangible results through its tailored AI consulting services.

In this blog, we’ll explore real case studies showcasing how RTS Labs has empowered logistics companies to succeed through the strategic application of AI. From optimizing supply chain operations to enhancing last-mile delivery efficiency, these case studies offer valuable insights into the transformative power of AI consulting in the logistics industry.

Case Study 1: Streamlining Supply Chain Operations

Client: swift logistics.

Problem Swift Logistics, a leading transportation and logistics company, faced challenges in optimizing its supply chain operations. The company struggled with inefficient route planning, resulting in increased fuel costs, longer delivery times, and reduced overall productivity. Additionally, manual inventory management processes led to inaccuracies and stockouts, impacting customer satisfaction.

Solution RTS Labs conducted a comprehensive analysis of Swift Logistics’ supply chain processes and implemented AI-driven solutions to address the identified challenges. Leveraging predictive analytics and machine learning algorithms, RTS Labs developed a dynamic route optimization system that factored in real-time traffic data, delivery constraints, and customer preferences. Additionally, AI-powered inventory management systems were deployed to forecast demand accurately and optimize stock levels in warehouses and distribution centers.

- Reduced Fuel Consumption by 20%: Streamlining delivery routes led to a significant 20% decrease in fuel usage, cutting operational costs and promoting environmental sustainability.

- Shortened Delivery Times by 30%: Optimal route planning resulted in a notable 30% improvement in delivery efficiency, enhancing customer satisfaction and maintaining a competitive edge.

- Minimize Stock Outs by 40%: Accurate demand forecasting reduced stockouts by 40%, ensuring shelves were consistently stocked, fulfilling orders promptly, and preventing lost sales opportunities.

- Achieved Cost Savings and Improved Profitability: These optimizations led to substantial cost savings and improved profitability, validating the transformative impact of AI on Swift Logistics’ operations.

Testimonial “ Teaming up with RTS Labs has completely transformed how we run our supply chain. Thanks to their AI-powered solutions, our route planning is more efficient than ever, and we’re nailing inventory management with pinpoint accuracy. Now, our deliveries are quicker, our shelves are stocked just right, and our customers couldn’t be happier. RTS Labs gets us – they know the ins and outs of logistics, and their customized solutions are game-changers. ” – John Kavinsky, CEO of Swift Logistics

Case Study 2: Enhancing Last-Mile Delivery Efficiency

Client: express fulfillment.

Problem Express Fulfillment, a fast-growing e-commerce fulfillment provider, struggled to meet the increasing demand for same-day and next-day deliveries. The company faced challenges in optimizing last-mile delivery routes, resulting in missed delivery windows, higher transportation costs, and customer dissatisfaction. Additionally, manual order processing and scheduling processes led to inefficiencies and delays in order fulfillment.

Solution RTS Labs collaborated with Express Fulfillment to implement AI-driven solutions to enhance last-mile delivery efficiency. Using advanced predictive analytics and route optimization algorithms, RTS Labs developed a real-time delivery scheduling system that optimized delivery routes based on factors such as order volume, delivery windows, and traffic conditions. Furthermore, AI-powered chatbots were deployed to automate order processing and customer communication, improving operational efficiency and reducing turnaround times.

- 25% Reduction in Transportation Costs: The real-time delivery scheduling system optimized routes, leading to a 25% decrease in transportation costs.

- 40% Improvement in On-Time Delivery Rates: With optimized routes and better scheduling, on-time delivery rates improved by 40%, enhancing customer satisfaction.

- 50% Reduction in Order Processing Times: AI-powered chatbots streamlined order processing, reducing processing times by 50% and improving operational efficiency.

Testimonial “ Our partnership with RTS Labs has been transformative. Their AI solutions have optimized our delivery operations, resulting in significant cost savings and improved customer satisfaction. With streamlined processes and better scheduling, we’ve been able to meet growing demand and scale our business effectively. ” – Emily Johnson, COO of Express Fulfillment

Case Study 3: Optimizing Warehouse Operations

Client: global logistics solutions.

Problem Global Logistics Solutions, a multinational logistics provider, faced challenges in optimizing warehouse operations to accommodate seasonal peaks and fluctuating demand patterns. Manual picking and packing processes resulted in bottlenecks, leading to longer order fulfillment times and increased labor costs. Inefficient space utilization within warehouses compounded the issue, limiting storage capacity and hindering throughput. Moreover, manual inventory tracking methods led to inaccuracies, stockouts, and delays in replenishment.

Solution To address these challenges, RTS Labs proposed tailored AI-driven solutions. They developed a customized automated picking and packing system, integrating machine learning algorithms and robotics technology to optimize order fulfillment processes. This system dynamically adjusted resource allocation based on real-time demand forecasts and historical data analysis, ensuring efficient utilization of labor and warehouse space. Additionally, AI-powered inventory management systems were implemented for precise inventory tracking and proactive replenishment, enabling seamless operations and reducing stockout occurrences.

- 50% Reduction in Order Fulfillment Time: The automated picking and packing system halved order fulfillment times, enhancing operational efficiency.

- 30% Decrease in Labor Costs: By automating processes and optimizing resource allocation, labor costs decreased by 30%, leading to substantial savings.

- 60% Increase in Storage Capacity Utilization: AI-driven space optimization strategies increased storage capacity utilization by 60%, maximizing warehouse throughput and efficiency.

Testimonial “ Our journey with RTS Labs has been nothing short of transformative for our warehouse operations. Their tailored AI solutions have completely revolutionized how we work, bringing remarkable improvements in efficiency and accuracy. Thanks to their expertise and commitment, we’ve not only met but exceeded our goals, delighting our customers while driving down costs. RTS Labs has truly been a game-changer for us. ” – Sarah Parker, Director of Operations at Global Logistics Solutions.

Case Study 4: Compliance Monitoring and Risk Management

Client: secure logistics inc..

Problem Secure Logistics Inc., specializing in secure transportation services, faced a pressing challenge in ensuring compliance with stringent regulatory standards while effectively managing operational risks. The company struggled with manual compliance monitoring processes, leading to inconsistencies in adherence to security protocols and an increased likelihood of security breaches. With the transportation sector’s ever-evolving regulatory landscape, Secure Logistics Inc. needed a robust solution to automate compliance monitoring and mitigate potential risks to maintain the integrity of its operations.

Solution Recognizing the critical need for a tailored solution, RTS Labs developed an advanced AI-driven compliance monitoring and risk management system for Secure Logistics Inc. Leveraging sophisticated machine learning algorithms, the system ingested data from security checkpoints, vehicle inspections, and incident reports in real time. This data was then analyzed to identify patterns, anomalies, and potential compliance issues swiftly and accurately.

- Improved Compliance by 30%: The AI-driven system enabled Secure Logistics Inc. to achieve a 30% improvement in compliance with regulatory standards by automating the monitoring of security protocols and ensuring consistent adherence across all operations.

- Reduced Security Incidents by 25%: By proactively identifying and mitigating potential risks in real-time, Secure Logistics Inc. experienced a significant reduction in the frequency of security incidents, enhancing the safety and security of its transportation services.

- Enhanced Operational Security: The implementation of RTS Labs’ AI solution not only bolstered compliance and mitigated risks but also contributed to overall operational security.

Testimonial “ RTS Labs’ AI solution transformed our security operations. With automated compliance checks and risk management, we’ve improved regulatory adherence and minimized security incidents. Their expertise has strengthened our operations, ensuring we deliver secure transportation services effectively. ” – Mark Johnson, Security Director at Secure Logistics Inc.

Case Study 5: Optimizing Cold Chain Logistics for Pharmaceutical Shipments

Client: frostcargo pharmaceuticals.

Problem FrostCargo Pharmaceuticals, a specialized logistics provider for temperature-sensitive pharmaceutical products, faced a unique challenge in maintaining the integrity of its cold chain during transportation. With stringent temperature requirements and regulatory compliance standards, they struggled to ensure consistent temperature control across their supply chain, leading to occasional product spoilage and compliance issues.

Solution RTS Labs collaborated closely with FrostCargo Pharmaceuticals to develop a tailored AI-driven solution to optimize cold chain logistics. Leveraging advanced temperature monitoring sensors and predictive analytics, RTS Labs designed a real-time temperature control system that continuously monitored temperature variations during transit. The system utilized machine learning algorithms to analyze historical temperature data, predict potential deviations, and trigger proactive interventions to maintain optimal storage conditions.

- 99% Temperature Compliance: The AI-driven temperature control system achieved a remarkable 99% compliance rate, ensuring pharmaceutical products remained within the specified temperature range throughout transit.

- Elimination of Product Spoilage: By addressing temperature fluctuations, FrostCargo Pharmaceuticals eliminated product spoilage incidents, preserving the quality and efficacy of pharmaceutical shipments.

- Enhanced Regulatory Compliance: The implementation of the AI solution enabled FrostCargo Pharmaceuticals to meet and exceed regulatory compliance standards, enhancing trust and credibility among clients and regulatory authorities.

Testimonials “ Their AI solution completely transformed how we manage our cold chain logistics. Now, with real-time temperature monitoring and predictive analytics, we’ve waved goodbye to worrying about spoiled products. Thanks to their deep understanding of pharmaceutical logistics, our service quality has skyrocketed, putting us ahead of the pack in the market. ” – Emily Chen, Logistics Manager at FrostCargo Pharmaceuticals

Case Study 6: Improving Cross-Border Freight Management

Client: globaltrans freight solutions.

Problem GlobalTrans Freight Solutions, a company specializing in cross-border freight transportation, faced significant challenges in managing customs clearance processes efficiently. The complexity of international regulations and the manual nature of paperwork led to delays at border crossings, increased transit times, and heightened operational costs. Additionally, inconsistent communication with customs authorities and lack of real-time visibility into shipment status further compounded the problem.

Solution RTS Labs collaborated with GlobalTrans Freight Solutions to develop an AI-driven customs clearance and border management system. Leveraging machine learning algorithms and natural language processing (NLP), the system automated the classification of goods, streamlined documentation processes, and facilitated communication with customs authorities. Furthermore, real-time tracking and monitoring capabilities were integrated to provide end-to-end visibility into the status of shipments, enabling proactive management of border crossings.

- 50% Reduction in Custom Clearance Duration: Cut customs clearance times in half, leading to faster transit of goods across borders.

- 30% Reduction in Transit Time: Reduced transit times by 30%, enabling quicker deliveries and improved customer satisfaction.

- 40% Reduction in Operational Costs: Achieved a substantial 40% reduction in operational costs associated with border delays and penalties, resulting in significant cost savings.

Testimonial “ Thanks to the AI consulting team at RTS Labs, we’ve been able to tackle our toughest logistics challenges with confidence. Their expertise and dedication have truly made a difference in our operations. We couldn’t have achieved our goals without their invaluable support and guidance. ” – Sarah Rodriguez, CEO of GlobalTrans Freight Solutions

Wrapping Up

These case studies offer a clear picture of the transformative power of AI consulting in the logistics sector. They underline the vital role played by RTS Labs in helping companies navigate complex challenges and achieve remarkable improvements in their operations.

The message is crystal clear: AI consulting is no longer a luxury but a necessity for logistics businesses striving to stay competitive in today’s fast-paced world. With RTS Labs at the helm, companies can harness the full potential of AI to streamline processes, enhance efficiency, and drive success.

Ready to revolutionize your logistics operations with AI consulting? Let RTS Labs be your trusted partner in driving efficiency, optimizing processes, and unlocking new possibilities.

Reach out to us if you'd like to be featured on our podcast.

Transform your last mile with personalized, actionable insights in just seven minutes. Take our Assessment >

Meet us in-person or virtually at these events, locus exclusive webinar series, upcoming roundtable discussions, locus in the news, watch our videos, infographics.

- Case Studies

- Whitepapers

Partner With Us to Solve Your Logistics Problems

How to eliminate human dependency in Retail/FMCG Sales Beat Planning

Streamlining the FMCG Distribution Supply Chain with a Comprehensive TMS Solution

How can FMCG players utilize sales reps more effectively

How to optimize various legs of the FMCG supply chain?

How Locus Enhanced End-to-End Operational Efficiency for this Indonesian Manufacturing Giant

Optimizing Indonesia’s Growing Cold Chain Businesses

Enabling unparalleled on-site customer service at scale

How to increase operational efficiencies in E-commerce

How to increase visibility for on-demand pharma companies?

Enabling customer satisfaction through smart logistics in E-grocery

How to reduce manual shipment processes for courier services?

Delve into the world of logistics here.

The Logistics of Furniture Retail

Holiday Season Trends That Will Shape the Retail Supply Chain Industry

A Look at the Future of Grocery Retail in North America

A Comprehensive Guide to Effective Returns Management

Buying vs. Building Logistics Software: How to Choose?

Evolution of Healthcare Supply Chain and the Importance of Logistics Tech

The Future is Now: Why Transportation Management Systems are Indispensable to Growth in Logistics

Last-mile Delivery: Finding the Right Balance

Hope Comes In the Form of AI for Big-Box Stores

Transform your wholesale distribution supply chain with logistics tech

How to Optimize Your Business Using Territory Planning

Optimize Cannabis Delivery Operations

Digital Twins — Transforming the Supply Chain

Micro-Fulfillment Centers are Shaping Up the Future of E-Grocery Deliveries

The Final Frontier: Designing an optimal cold chain network to distribute the COVID-19 Vaccine

Captive vs Outsourced Fleet: Math behind Transportation and Distribution

How to Keep the Promise of Same-Day Grocery Delivery Amidst COVID-19

Post-Pandemic Sustainability: What lies ahead of the Supply Chain Industry

The Role of AI-powered Logistics in E-commerce 4.0

COVID-19 and Supply Chain: Disruptions and Actions

Artificial Intelligence: The solution for supply chain problems in the Engineering Industry

How Locus automated logistics operations for Indonesia’s leading E-commerce player

How Locus is managing customer-preferred time windows for its clients

Multi-Echelon SupplyChain Inventory Optimization – A mathematical perspective

How Locus filled the gaps in the supply chain of Southeast Asia’s largest e-commerce player

FMCG Insight Report II

The Future Of Sales Transformation : Dynamic PJP

Locus’ Guide To Omnichannel Fulfilment

FMCG Sales Beat - Insight Report

Why Businesses need Route Optimization?

Long reads on logistics and technology.

Big and Bulky Retail Shipments - Seamless Delivery Regardless of Size

The Retail Playbook For Thriving in an Omnichannel World

Middle East Bottled Water Manufacturers: Last-mile Delivery Strategies

Revolutionizing Every Mile: A New Era in the Paint Industry

Efficient Shipping Solution to Automate Your Carrier Selection

Establish Your Right To Win: The Definitive CEP Playbook for Profitability

Why You Should Choose Carbon Neutral Shipping Today

Here's How ONDC Will Create a Level-Playing Field for Businesses

How a Dispatch Management Platform Optimizes Your Last-mile

Locus' Guide to Quick Commerce Fulfillment

![case study for logistics industry [E-book] The Complete Guide to Same-Day Delivery](https://locus.sh/assets/img/resources/ebook/same-day-delivery.jpg)

[E-book] The Complete Guide to Same-Day Delivery

The New Fulfillment Models in Logistics

Supply Chain Sustainability and Profitability with Green Logistics

Direct to Consumer- The trend of the future

Home Services in 2020 and the Changing Role of Logistics

Unlock Infinite Possibilities in your Supply Chain with AI

Omnichannel Retail Fulfillment and the Role of Logistics

Food Delivery: The Past, Present, and Future

Change is the Only Constant in Last-mile Delivery

The History, Evolution and Future of Reverse Logistics

White Glove Services: A Necessity in the Post-Pandemic World?

Evolution of Vehicle Routing and Scheduling

Convert your logistics operations to a revenue generator.

By clicking submit, you are providing us with your consent to communicate via email or phone

I would also like to subscribe to the Exclusive Newsletters, Content & Event invitations and notifications by Locus in related areas. You can refer to our Privacy Policy .

Market (Europe - English)

- United States

Top Searches

- Real Time Visibility

Case Studies

Freight sourcing.

Sonepar plugs into a new era of freight matching with Transporeon Freight Procurement

How Transporeon is helping Limagrain Europe achieve its field of dreams

Transporeon improving Amica’s logistics processes

Pirelli: Managing Complexity in Freight Procurement

Benetton Group: Comparability of offers and transparency

AB InBev brews up double-digit spot freight savings with Transporeon Autonomous Procurement

RPM Logistics Deploys Autonomous Truckload Procurement

ZF Friedrichshafen: Easy handling of complex logistics tenders

Transport Execution

Ritex Logistics' journey to operational excellence with Transport Assignment solutions

Transporeon solutions help Essity reach 1bn people every day

Barilla Group achieves 99% carrier allocation success

Duracell: Managing Parcel, FTL and LTL shipments on one Transportation Management Platform

Acerinox: Globalization with a single tool

How we helped DHL to innovate at a crucial time

Facil chooses Transport Operations to streamline transportation flows

How Pfeifer is putting logistics efficiency at the root of their business

Flowing with success: Acqua Vera

Girteka Logistics: Developing relationships between business partners

H.Essers: Finding price-competitive capacity and speeding up the average time to carrier acceptance with Freight Matching

Barilla: Digitalization is the secret ingredient that keeps your pasta fresh

Perfect transport partners with the Transporeon Transportation Management Platform

How Burgo Group digitises its logistics

How K+S achieves efficient end-to-end processes and carrier connectivity with Transporeon and Visibility Hub

Dock & Yard Management

ArcelorMittal Hamburg: Improving time management and streamlining processes in logistics

Metro Logistics: Digitisation ensures transparency in the incoming goods department

How GEBA Trans is improving its customer service offering with Transporeon’s Visibility Hub

How Nestlé is using Transporeon Visibility Hub to manage supply chain disruptions

Saint Gobain Isover: Rapidly scalable visibility solution with high levels of automation

Sustainability

IKEA Supply Chain Operations & Girteka Logistics: You can’t manage what you can’t measure

Schneider Electric: Unlocking greater visibility into the market

Freight Audit & Payment

Top 50 Fortune 500 FMCG company saves big with Freight Audit solution

Interested in our solutions?

Get in touch with us to learn more!

Our solutions for your transport and logistic needs

Visibility Hub

- Reduce check calls and automate processes.

- Increase performance and customer satisfaction.

- Reduce wait and dwell times with more accurate ETAs.

- Increase your on-time performance and avoid penalties

- Reduce CO2 emissions and empty mileage.

Freight Audit and Payment Hub

- Pre-fill and validate fields from the Transporeon platform.

- Easily transfer documents to ERP systems via the interface.

- All relevant parties maintain access to the latest versions of all documents.

- Get automatic reminders and notifications for requirements documents.

- Instantaneous and traceable digital transmission of all documents.

Transport Execution Hub

Attachment Services

- Pre-fill and validate fields from the Transporeon platform

- Easily transfer documents to ERP systems via the interface

- All relevant parties maintain access to the latest versions of all documents

- Get automatic reminders and notifications for requirements documents

- Instantaneous and traceable digital transmission of all documents

Freight Sourcing Hub

Autonomous Procurement

- Automates procurement using data and behavioural science.

- Analyses how carriers make pricing decisions.

- Achieves requested capacity at lower freight rates for road transports.

- Fully automated process of predicting, framing offers, and concluding assignments.

- Entirely carrier specific and automated process.

Best Carrier

- Access the spot market more easily.

- Cut transaction costs by up to 19%.

- React quickly to market fluctuations.

- Improve process efficiency with better integrations.

- Cloud-based system provides real-time transparency.

Sustainability Hub

Carbon Visibility

- Precise measuring & reporting on logistics emission.

- Across entire supply chain and all transport modes.

- Based on the highest market standards covering the total emissions (Well-to-Wheel).

- Enables operations to move to Net Zero logistics.

Carrier Premium Account

- Apply for suitable calls for bids with one click and win new customers.

- Make your business known on the platform and in the service provider database.

- Clear distribution of competencies and tasks between Head Office and Branch Office.

- Optimize internal processes through additional functions and reports.

Dock & Yard Management Hub

Digital Transport Documents

- Paperless management of the consignment note through all involved parties

- Easy usage due to conveniently comment and signing of the eCMR on a mobile device

- Provide the eCMR in real time via Transporeon platform plus additional communication channels

Platform Capabilities

ERP Interfaces

- Integrate the Transporeon platform into your ERP system using the ERP interfaces.

- Stay within your ERP system while using the full-service power of the integrated Transporeon platform.

Event Management

- Track transports from collection to end-point delivery with digital event management.

- Events can be defined and provided to customer needs.

- View actual delivery status and trigger subsequent processes.

- Reliable information about time of arrival for all parties.

- Enable proactive reactions or automated platform based mitigation tasks.

Extended Yard Management powered by Peripass

- Reduce manual efforts by digitising the registration process.

- Save on reception costs and reduce waiting times.

- Keep an overview of your site and how capacity is used.

- Shorten lead times, increase volumes and reduce waiting costs by 85%.

- Get a real-time overview of all trucks, containers, trailers etc on site.

- Centralise and digitise the operations of shunters, forklift and truck drivers and security personnel on site.

Freight Audit & Payment Hub

Freight Audit

- Full visibility of process, data and carrier performance.

- Logistics should no longer deal with invoicing.

- Underbilling is reported.

- Receives alerts about rejection/approval.

- Cost allocation of freight audit costs are automated.

Freight Matching

- Maximize profitability and productivity by equipping your teams to utilize available capacity opportunities within your trusted network, faster.

- Enable your carriers to realize their full potential by matching with the loads that are right for them.

- Manage your carrier relationships with more transparency from increased number of data points.

- Stay in control of your shipments and provide end-to-end visibility to your customers, and eradicate check calls.

- Reduce manual effort, and increase accuracy with full digitalization.

Freight Procurement

- Smart purchasing strategy.

- Achieve optimum freight rates.

- Reduce administrative effort and costs.

- Find suitable partners worldwide.

- Audit-proof the tendering process.

Procurement Advisory

- Save up to 19% on freight costs.

- Save 30% on administrative effort with e-sourcing.

- Use only quality-approved data for tender processes and RFQ events.

- Ensure 100% compliance with tendering processes.

Freight Settlement

- Save time by resolving billing issues before the invoice is sent.

- Simplified control of individual invoice items.

- All settlement transactions are displayed in their entirety to provide complete transparency.

- Company-wide and standardized coordination process.

- Can be also used as stand-alone-solution also compatible with other products.

Insights Hub

Market Insights

- Monitor the contractually agreed rates between shippers, logistic service providers, and the spot market.

- Use important "indirect" indicators to illustrate the capacity situation on any given lane or market.

- Define the lanes and metrics that you want to monitor.

- Get a clear overview of the biggest market changes and top movers.

Strategic Benchmarking

- Persistent freight cost savings with up to 8% with our state of art benchmarking approach.

- Get the most comprehensive overview of all markets and for all modes.

- Profit from insights into latest market developments & forecasts.

- Get a deeper understanding of rate developments & costs drivers.

- Receive regular information with market overviews, developments, cost drivers.

No-Touch Order

- Automated shipment execution processes.

- Fewer empty runs.

- Cut process costs by up to 30%.

Rate Management

- All freight rates and freight contracts in one centralized database.

- Rate query engine factors in multiple currencies, surcharges and total chargeable cost per available carrier.

- Optimization of inquiry processes and better usage of internal resources.

- Fully integrated process of assigning transports and management of rates in an organization.

- Centralized interfaces and import/export functions.

Real Time Workflow

- Less labor-intensive solution due to electronic workflows and paperless management of transport documents.

- Integration of drivers into the digital workflow.

- Immediate updates about status changes and shipping stages of the goods to be delivered.

- Photographic documentation of transport damage and proof of cargo safety.

Real-Time Yard Management

- Improve overall visibility and ability to predict changes.

- Combine yard, transport, and warehouse management.

- Automate arrivals, check-ins, and call-offs.

- Avoid costs and fees caused by idle and inefficient processes.

- Monitor, measure, and improve KPIs.

Time Slot Management for Retail

- Increase handling capacity by up to 20%

- Reduce driver wait times by up to 40%

- Shorten loading times by up to 60 minutes

- Audit and legal security

- Completely documented processes

- The SAP Add Ons integrates all Transporeon functionalities without a need for interfaces or middleware into the SAP ERP system.

- Benefit from the Transporeon UX within your standard SAP system.

Market Intelligence & Benchmarking

Supply Chain Advisory

- Know-How from more than 1,700 supply chain projects and 25+ years of experience

- Gain full global network transparency

- Achieve cost savings through supply chain optimization

- Support for all phases, from conception to implementation into your supply chain

- Deep knowledge of all modes of transport

- Specialized Benchmarks with proven Market Intelligence methodology

- be_ixf; php_sdk; php_sdk_1.4.26

- https://ziplinelogistics.com/why-zipline/case-studies/

Zipline Logistics acquires Summit Eleven [read more]

Why Zipline

Logistics case studies.

Zipline Logistics prioritizes YOUR bottom line. We are experts in retail logistics and exclusively service CPG brands shipping into retail. This means we’re a logistics solutions provider — not just a rate and a truck — and we genuinely care about and invest in CPG brands’ success.

Check out the Zipline love stories below for examples of challenges our customers have faced and the results we’ve driven alongside them.

“Zipline has eliminated all of these issues for Isik”

Shipper: Isik Organic, a leading grower, manufacturer, and exporter of organic dried fruits & nuts and frozen fruits and headquartered in Turkey.

Challenge: During the height of the COVID-19 pandemic, I sik was dealing with carriers arriving late to delivery appointments, products being damaged while in transit, and keeping t ransportation costs within budget .

Results: Over the course of the first two years working together, Zipline has eliminated virtually all of these issues for Isik. Their OTIF has improved and their transportation costs have gone down considerably.

See Full Logistics Case Study

T. Marzetti Dramatically Increases OTIF

Shipper : T. Marzetti, a leading specialty foods company headquartered in Columbus, Ohio.

Challenge: T. Marzetti was struggling to meet delivery deadlines and as a result, experiencing heavy retail compliance fines and damaged relationships with their retail partners.

Results : T. Marzetti’s OTIF score was in the mid-80’s when they started working with Zipline. One year later, their OTIF score was up to 94%. Before Zipline, Marzetti felt alone in putting out fires and educating their partners on the impacts of not meeting retail expectations. Whereas with Zipline, these issues were immediately met with proactive communication that led to quick solutions.

“What Make Zipline Different is the People”

Shipper: Be Well Nutrition, Inc., known for its ICONIC PROTEIN line of beverages, powders, and coffee.

Challenge: The relationship between Zipline Logistics and Mariah Nguyen, COO of Be Well Nutrition, Inc. , began about ten years ago when Nguyen was working for Vita Coco. Nguyen enjoyed Zipline’s people and service so much that she carried the relationship to the next four companies she worked with.

Results: ICONIC PROTEIN, Be Well’s line of protein beverages, powders, and coffee , has relied on Zipline as its exclusive transportation broker since 2018. Zipline manages both procurement of ingredients and LTL & FTL customer order fulfillment. Zipline has offered this client a competitive advantage through in depth freight analyses, resulting in both time and cost savings.

True Logistics Partnership

Shippers: Premium drink mixer company, Fever Tree; and importer, distributor and brand representative for premium biscuit/snack manufacturers, Brand Passport.

Challenge: Both Fever Tree and Brand Passport needed a logistics service provider that could meet a wide range of transportation needs while identifying new supply chain efficiencies and showcasing true partnership.

Results: Zipline Logistics went above and beyond to provide knowledge, data, and recommendations that helped streamline operations for Fever Tree and Brand Passport. Invested in customer success, Zipline fully managed orders, optimizing along the way and involving the customer on an exception-management basis. Zipline built trust, provided peace of mind, and helped both brands solve for their logistics challenges.

3PL Partnership and Service

Shipper: Global producer of coconut products, Vita Coco

Challenge: Vita Coco required a logistics partner that instilled total confidence and enabled it to focus on its brand, not transportation. Navigating a fast-growth market segment, they needed a 3PL that could scale alongside them and provide ongoing supply chain consultation.

Results: Zipline Logistics has successfully grown together with Vita Coco, expanding to meet domestic transportation and drayage needs. Vita Coco now cuts down on overhead costs by funneling logistics through its customer service department, relying on Zipline Logistics to properly handle transportation and identify new optimization and savings opportunities.

Zipline Love Stories: Specialized 3PL Adds Value to Multibillion-Dollar Retailers

Challenge: The shoe company was challenged by it’s tiny storefronts in bustling metropolitan areas, which required multiple perfectly timed deliveries per week. The specialty retailer needed consistent manpower transporting expensive, valuable, time sensitive, and extremely high volume shipments from ports to distribution centers.

Results: Zipline played a major role in helping the shoe brand skyrocket. Since entrusting us with nearly 100% of their domestic freight over the last three years, their revenue nearly doubled as they explosively expanded from four stores to 30+. After six years of business with the specialty retailer, Zipline has moved 17,000+ loads at 96% on-time delivery rate. Since partnering with us, we have seen their revenue grow by close to $3.5 Billion.

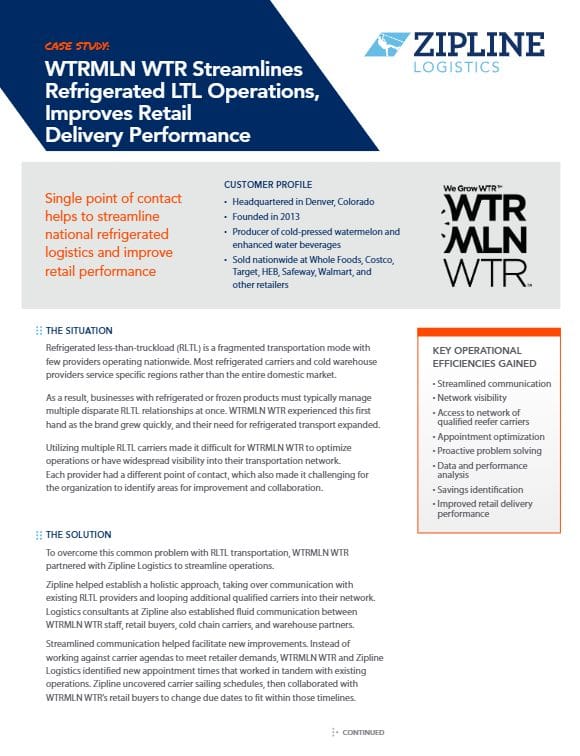

WTRMLN WTR Streamlines Refrigerated LTL Operations

Challenge : WTRMLN WTR grew quickly and expanded its sales across the United States. Because the brand’s product is temperature-sensitive, it required refrigerated shipping to fulfill its growing orders. Temp-controlled shipping is fragmented with few providers operating nationwide. WTRMLN WTR needed to manage relationships with several disparate regional providers at once.

Results: By working with Zipline, WTRMLN WTR gained new visibility into their operations adding transparency into their supply chain and uncovering beneficial consolidation opportunities, scheduling improvements, and network reconfiguration.

Download Logistics Case Study

Consolidation and Managed Transportation Solution

Shipper: Global producer of pork snack products, Evans Food Group

Challenge : Evans Food Group was charged with identifying proactive ways to cut costs and improve efficiencies throughout its supply chain. Goals were set to minimize use of LTL, lower landed costs, increase overall production efficiency, improve dock utilization, and allow for more flexibility.

Results: Solution consultants at Zipline Logistics developed an on-site order consolidation program that successfully reduced LTL utilization and lowered landed costs per pallet by 20%. Adoption of a managed transportation solution and EDI order tendering technology also enabled Evans Food Group to greatly improve internal efficiencies and gain more visibility into its supply chain.

Beverage Transportation Specialists

Shipper: Emerging enhanced-water brand, Hoist

Challenge: As a growing beverage brand, Hoist needed to scale its transportation strategy and engage a logistics partner that could provide guidance on how to meet retailer demands.

Results: Hoist leveraged Zipline Logistics’ beverage transportation expertise to meet retailer requirements, cut transportation costs, and grow its network. By engaging an experienced 3PL partner, Hoist no longer had to worry about scheduling product pick-ups or deliveries and could instead focus on growing its brand.

Improving On-Time Delivery by 17%

Challenge: The company grew extremely fast and struggled to consistently meet retail compliance standards due to a complex national footprint.