Financial Advisor Business Plan Template

Written by Dave Lavinsky

Over the past 20+ years, we have helped over 9,000 entrepreneurs create business plans to start and grow their financial advisor and financial planning businesses. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a financial advisor business plan template step-by-step so you can create your plan today.

Download our Ultimate Financial Advisor Business Plan Template here >

What Is a Business Plan?

A business plan provides a snapshot of your financial advisor business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan

If you’re looking to start a financial advisor business or grow your existing financial advisor business you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your financial planning business in order to improve your chances of success. Your financial advisor business plan is a living document that should be updated annually as your company grows and changes.

Source of Funding for Financial Planning Businesses

With regards to funding, the main sources of funding for a financial advisor are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding, or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of financial advisor business you are operating and the status; for example, are you a startup, do you have a financial advisor business that you would like to grow, or are you operating a chain of financial planning businesses.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the financial advisor business industry. Discuss the type of financial planning business you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of financial advisor business you are operating.

For example, you might operate one of the following types:

- Financial Planning for Consumers : this type of financial advisor provides services such as retirement planning and investment management for individuals.

- Financial Management Consulting : this type of financial advisor business typically serves businesses and governments, providing portfolio management services.

In addition to explaining the type of financial advisor business you operate, the Company Analysis section of your financial planner business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new store openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the financial advisor business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the financial advisor business industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, if there was a trend towards cryptocurrency investment, it would be helpful to ensure your plan calls for continuing education in alternative investments.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your financial advisor business plan:

- How big is the financial advisor business (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your financial advisor business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your financial planning business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: families, high net worth individuals (HNWIs), baby boomers, businesses, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of financial advisor business you operate. Clearly baby boomers would want different pricing and product options, and would respond to different marketing promotions than high net worth individuals.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve. Because most financial advisor businesses primarily serve customers living in their same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Financial Advisor Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Financial Advisor Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other financial advisor businesses.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes independent advisory firms, commercial banks, investment banks, insurance companies, broker-dealers, discount brokerages or self-managing one’s finances and investments. You need to mention such competition to show you understand that not everyone who seeks financial advice engages the services of a financial advisor.

With regards to direct competition, you want to detail the other financial advisor businesses with which you compete. Most likely, your direct competitors will be financial advisor businesses located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What products and services do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior services?

- Will you provide products/services that your competitors don’t offer?

- Will you make it easier or faster for customers to engage your services?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. Your financial advisor marketing plan should include the following:

Product : in the product section you should reiterate the type of financial advisor business that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to financial advice, will you offer trust services or brokering and dealing?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the products and services you offer and their prices.

Place : Place refers to the location of your financial advisor business. Document your location and mention how the location will impact your success.

Promotions : the final part of your financial advisor business marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Pay per click advertising

- Reaching out to local bloggers and websites

- Social media advertising

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your financial advisory such as serving customers, procuring supplies, keeping the office clean, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to serve your 100th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

Management Team

To demonstrate your financial advisor business’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your team members have direct experience in the financial advisor business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in financial advisor businesses and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement : an income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you serve 50 accounts at a time, or 100? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets : While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your financial advisor business, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement : Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a financial advisor business:

- Office location build-out including design fees, construction, etc.

- Cost of equipment like computer hardware and software, office equipment, etc.

- Cost of required licenses (e.g., FINRA fees)

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office design blueprint or location lease, etc.

Additional Financial Advisor Business Plan Tips

When writing a business plan for a financial advisor practice, take great pains to avoid these three mistakes which each give funders reason to set the plan aside or stop returning your calls.

Resting on Your Laurels

Your financial experience that prepares you to be an advisor is certainly important to explain in your business plan, but this isn’t enough. You have to go beyond explaining the experience you bring to the table to explain how you will market and operate a business with that experience serving as a cornerstone. Without a plan for how the business will run, readers cannot truly judge how you expect the business to succeed.

Ignoring Competition

Writing that there is no competition for the customers you want in the location you will operate is a huge mistake in a business plan. There are always competitors, even if the competition is Fortune magazine or the Motley Fool website. At a minimum, clients have the option of finding financial advice in these inexpensive sources rather than working with you. The competitive analysis section of your plan must recognize the challenge you face in proving your practice’s worth beyond these competitors, at the very least.

Not Connecting the Dots

The business plan is a type of logic puzzle. When put together, it connects opportunity to means to methods to results. Think through the logic of whether the means you present (your experience, team, location, etc.) are adequate to take advantage of the opportunity. Consider whether the operations and marketing methods you propose make sense for the means. Look at whether the results you project are reasonable given these methods. If you don’t think through these steps, your readers will find gaps in your logic and turn down funding for your plan, even if each component sounds perfectly fine on its own. The plan must work as a cohesive whole to be fundable.

Financial Advisor Business Plan Summary

Putting together a business plan for your financial advisor business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the financial advisor business, your competition and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful financial advisor business.

Download Our Financial Advisor Business Plan PDF

You can download our financial advisor business plan PDF here . This is a business plan template you can use in PDF format.

Financial Advisor Business Plan FAQs

What is the easiest way to complete my financial advisor business plan.

Growthink's Ultimate Financial Advisor Business Plan Template allows you to quickly and easily complete your Financial Advisor Business Plan.

Where Can I Download a Financial Advisor Business Plan PDF?

You can download our financial advisor business plan PDF template here . This is a business plan template you can use in PDF format.

Don’t you wish there was a faster, easier way to finish your Financial Advisor business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan writers can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Financial Advisor Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Financial Advisor Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Financial Advisor Business Plan

You’ve come to the right place to create your financial advisor business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their financial advisor businesses. Our financial advisor business plan template will help you create your business plan, ensuring that you have all the necessary elements to make your financial advisor business a success.

To write a successful financial advisor business plan, you will first need to decide what type of financial advisor services you will offer. Will you be working with small businesses? Or are your target customers individuals saving for retirement?

You will need to gather information about your business and the financial advisor industry. This type of information includes business goals, customer demographics, market research, and financial statements.

Below are links to each section of a financial advisor business plan example:

Next Section: Executive Summary >

Financial Advisor Business Plan FAQs

What is a financial advisor business plan.

A financial advisor business plan is a plan to start and/or grow your financial advisor business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your financial advisor business plan using our Financial Advisor Business Plan Template here .

What Are the Main Types of Financial Advisor Companies?

There are different types of financial advisor firms . The most common kinds are the investment advisors, broker-dealers and brokers, certified financial planners, financial consultants, wealth advisors, and portfolio, investment, and asset managers. There are also digital platforms that provide automated, algorithm-driven investment services with little to no human supervision called robo-advisors.

What Are the Main Sources of Revenues & Expenses for Financial Advisors?

Financial advisors make money on client fees for financial planning services. These are usually charged on an hourly basis or as a percentage of client assets under management. Another source of income are commissions for certain financial transactions, such as the sale of insurance products or the buying and selling of securities.

The key expenses are salaries and wages, and office space rent.

How to Start a Financial Advisor Business?

Starting a financial advisor business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

- Write A Financial Advisor Business Plan - The first step in starting a business is to create a detailed business plan that outlines all aspects of the venture. This should include market research on the financial industry and potential target market size, information on the services and/or products you will offer, marketing strategies, pricing details, competitive analysis and a solid financial forecast.

- Choose Your Legal Structure - It's important to select an appropriate legal entity for your business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your financial advisor business is in compliance with local laws.

- Register Your Business - Once you have chosen a legal structure, the next step is to register your financial advisor business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

- Identify Financing Options - It’s likely that you’ll need some capital to start your business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

- Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

- Hire Employees - There are several ways to find qualified employees and a top notch management team, including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

- Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your business. Marketing efforts includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising to reach your target audience.

Learn more about how to start a Financial Advisor business:

- How to Start a Financial Advisor Business

How Do You Get Funding for Your Financial Advisor Business Plan?

Financial advisor businesses are typically funded through small business loans, personal savings, credit card financing and angel investors.

A financial advisor's business plan should include a detailed financial plan to secure any type of potential investor. This is true for all types of financial advisor business plans including a financial planner business plan and a wealth management business plan.

Where Can I Get a Financial Advisor Business Plan PDF?

You can download our free financial advisor business plan template PDF here. This is a sample financial advisor business plan template you can use in PDF format.

Advancing Knowledge in Financial Planning

- Close Search

- Live Webinars

- Financial Planning Value Summit

- Digital Marketing Summit

- Business Solutions

- Advicer Manifesto

- AdvisorTech

- FinTech Map

- AdvisorTech Directory

- Master Conference List

- Best Of Posts

- CFP Scholarships

- FAS Resources

- How To Contribute

- Financial Advisor Success

- Kitces & Carl

- Apply/Recommend Guest

- Client Trust & Communication

- Conferences

- Debt & Liabilities

- Estate Planning

- General Planning

- Human Capital

- Industry News

- Investments

- Personal/Career Development

- Planning Profession

- Practice Management

- Regulation & Compliance

- Retirement Planning

- Technology & Advisor FinTech

- Weekend Reading

- CE Eligible

- Nerd’s Eye View

Please contact your Firm's Group Admin

IAR CE is only available if your organization contracts with Kitces.com for the credit. Please contact your firm's group administrator to enable this feature. If you do not know who your group administrator is you may contact [email protected]

Want CE Credit for reading articles like this?

Essential requirements in crafting a one-page financial advisor business plan.

August 17, 2015 07:01 am 21 Comments CATEGORY: Practice Management

Executive Summary

In a world where most advisory firms are relatively small businesses, having a formal business plan is a remarkably rare occurrence. For most advisors, they can “keep track” of the business in their head, making the process of creating a formal business plan on paper to seem unnecessary.

Yet the reality is that crafting a business plan is about more than just setting some business goals to pursue. Like financial planning, the process of thinking through the plan is still valuable, regardless of whether the final document at the end gets put to use. In fact, for many advisory firms, a simple “one-page” financial advisor business plan may be the best output of the business planning process – a single-page document with concrete goals to which the advisor can hold himself/herself accountable.

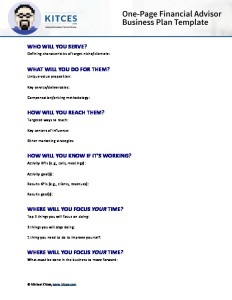

So what should the (one-page) financial advisor business plan actually cover? As the included sample template shows, there are six key areas to define for the business: who will it serve, what will you do for them, how will you reach them, how will you know if it’s working, where will you focus your time, and what must you do to strengthen (or build) the foundation to make it possible? Ideally, this should be accompanied by a second page to the business plan, which includes a budget or financial projection of the key revenue and expense areas of the business, to affirm that it is a financially viable plan (and what the financial goals really are!).

And in fact, because one of the virtues of a financial advisor business plan is the accountability it can create, advisors should not only craft the plan, but share it – with coaches and colleagues, and even with prospective or current clients. Doing so becomes an opportunity to not only to get feedback and constructive criticism about the goals, but in the process of articulating a clear plan for the business, the vetting process can also be a means to talk about the business and who it will serve, creating referral opportunities in the process!

Author: Michael Kitces

Michael Kitces is Head of Planning Strategy at Buckingham Strategic Wealth , which provides an evidence-based approach to private wealth management for near- and current retirees, and Buckingham Strategic Partners , a turnkey wealth management services provider supporting thousands of independent financial advisors through the scaling phase of growth.

In addition, he is a co-founder of the XY Planning Network , AdvicePay , fpPathfinder , and New Planner Recruiting , the former Practitioner Editor of the Journal of Financial Planning, the host of the Financial Advisor Success podcast, and the publisher of the popular financial planning industry blog Nerd’s Eye View through his website Kitces.com , dedicated to advancing knowledge in financial planning. In 2010, Michael was recognized with one of the FPA’s “Heart of Financial Planning” awards for his dedication and work in advancing the profession.

Why A Business Plan Matters For Financial Advisors

There’s no end to the number of articles and even entire books that have been written about how to craft a business plan , yet in practice I find that remarkably few financial advisors have ever created any kind of formal (written or unwritten) business plan. Given that the overwhelming majority of financial advisors essentially operate as solo practitioners or small partnerships, this perhaps isn’t entirely surprising – when you can keep track of the entire business in your head in the first place, is there really much value to going through a formal process of crafting a financial advisor business plan?

Having been a part of the creation and growth of numerous businesses , I have to admit that my answer to “does a[n individual] financial advisor really need a business plan?” is a resounding yes . But not because you’re just trying to figure out what the basics of your business will be, which you may well have “figured out” in your head (or as the business grows, perhaps figured out in conversations with your partner). The reason a business plan matters is all about focus , and the ability to keep focus in proceeding towards your core objectives, and accountable to achieving them, even in a dynamic real-world environment full of distractions.

Click To Tweet

As the famous military saying goes, “ no battle plan ever survives contact with the enemy ”, because the outcomes of battle contact itself change the context, and it’s almost impossible to predict what exactly will come next. Nonetheless, crafting a battle plan in advance is a standard for military leadership. Because even if the plan will change as it’s being executed, having a clearly articulated objective allows everyone, even (and especially) in the heat of battle, to keep progressing towards a common agreed-upon goal. In other words, the objective stated in the battle plan provides a common point of focus for everyone to move towards, even as the (battle) landscape shifts around them. And the business plan serves the exact same role within a business.

Essential Elements Required In A Financial Advisor Business Plan

Because the reality is that in business – as in battle? – the real world will not likely conform perfectly to an extensively crafted business (or battle) plan written in advance, I am not a fan of crafting an extensively detailed business plan, especially for new advisors just getting started, or even a ‘typical’ solo advisory firm. While it’s valuable to think through all the elements in depth – the process of thinking through a business plan is part of what helps to crystallize the key goals to work towards – as with financial planning itself, the process of planning can actually be more valuable than “the plan” that is written out at the end .

Accordingly, for most financial advisors trying to figure out how to write a business plan, I’m an advocate of crafting a form of “one-page business plan” that captures the essential elements of the business, and provides direction about where to focus, especially focus the time of the advisor-owner in particular. In other words, the purpose for a financial advisor business plan is simply to give clear marching orders towards a clear objective, with clear metrics about what is trying to be achieved along the way, so you know where to focus your own time and energy!

Of course, the reality is that what constitutes the most important goals for an advisory firm – as well as the challenges it must surmount – will vary a lot, depending not just on the nature of the firm, but simply on its size, scope, and business stage. Financial advisors just getting started launching a new RIA face very different business and growth issues than a solo advisor who has been operating for several years but now hit a “wall” in the business , and the challenges of a solo advisor are different than those of a larger firm with multiple partners who need to find alignment in their common business goals. Nonetheless, the core essential elements that any business plan is required to cover are remarkably similar.

Requirements For An Effective Financial Advisor Business Plan

While there are many areas that can potentially be covered, the six core elements that must be considered as the template for a financial advisor business plan are:

6 Required Elements Of A (One Page) Business Plan For Financial Advisors 1) Who will you serve? This is the most basic question of all, but more complex than it may seem at first. The easy answer is “anyone who will pay me”, but in practice I find that one of the most common reasons a new advisor fails is that their initial outreach is so unfocused, there’s absolutely no possibility to gain any momentum over time. In the past, when you could cold-call your way to success by just trying to pump your products on every person who answered the phone until you found a buyer, this might have been feasible. But if you want to get paid for your advice itself, you need to be able to demonstrate your expertise. And since you can’t possibly be an expert at everything for everyone, you have to pick someone for whom you will become a bona fide specialist (which also provides crucial differentiation from other advisors the potential client might choose to work with instead ). In other words, you need to choose what type of niche clientele you’re going to target to differentiate yourself. And notably, this problem isn’t unique to new advisors; many established advisors ultimately hit a wall in their business, in part because it’s so time-consuming trying to be everything to everyone, that they reach their personal capacity in serving clients earlier than they ‘should’. Focusing on a particular clientele – to the point that you can anticipate all of their problems and issues in advance – allows the business to be radically more efficient. So who, really , do you want to serve? 2) What will you do for them? Once you’ve chosen who you will serve, the next task is to figure out what you will actually do for them – in other words, what services will you deliver. The reason it’s necessary to first figure out who you will serve, is that the nature of your target niche clientele may well dictate what kind of services you’re going to provide them; in fact, part of the process of identifying and refining your niche in the first place should be to interview a number of people in your niche , and really find out what they want and need that’s important to them (not just the standard ‘comprehensive financial plan’ that too many advisors deliver in the same undifferentiated manner ). For instance, if you’re really serious about targeting retirees, you might not only provide comprehensive financial planning, but investment management services (for their retirement portfolios), a specific retirement income distribution strategy, assistance with long-term care insurance, and guidance on enrolling in Medicare and making decisions about the timing of when to start Social Security benefits . On the other hand, if you hope to work with entrepreneurs, you might need to form relationships with attorneys and accountants who can help facilitate creating new business entities, and your business model should probably be on a retainer basis, as charging for assets under management may be difficult (as entrepreneurs tend to plow their dollars back into their businesses!). If your goal is to work with new doctors, on the other hand, your advice will probably focus more on career guidance, working down a potential mountain of student debt, and cash flow/budgeting strategies. Ultimately, these adjustments will help to formulate the ongoing client service calendar you might craft to articulate what you’ll do with clients (especially if you plan to work with them on an ongoing basis), and the exact business model of how you’ll get paid (Insurance commissions? Investment commissions? AUM fees? Annual retainers? Monthly retainers ? Hourly fees?). 3) How will you reach them? Once you’ve decided who you want to reach, and what you will do for them, it’s time to figure out how you will reach them – in other words, what will be your process for finding prospective clients you might be able to work with? If you’re targeting a particular niche, who are the centers of influence you want to build relationships with? What publications do they read, where you could write? What conferences do they attend, where you might speak? What organizations are they involved with, where you might also volunteer and get involved? If you’re going to utilize an inbound marketing digital strategy as an advisor , what are the topics you can write about that would draw interest and organic search traffic, and what giveaway will you provide in order to get them to sign up for your mailing list so you can continue to drip market to them? In today’s competitive world, it’s not enough to just launch a firm, hang your (virtual) shingle, and wait for people to walk in off the street or call your office. You need to have a plan about how you will get out there to get started! 4) How will you know if it’s working? Once you’ve set a goal for who you want to serve, what you want to do for them, and how you will reach them, it’s time to figure out how to measure whether it’s working. The caveat for most financial advisory businesses, though, is that measuring outcomes is tough because of the small sample size – in a world where you might have to reach out to dozens of strangers just to find a dozen prospects, and then meet with all those prospects just to get a client or two, it’s hard to tell whether a strategy that nets one extra client in a quarter was really a “better strategy” or just random good luck that won’t repeat. As a result, in practice it’s often better to measure activity than results , especially as a newer advisory firm. In other words, if you think you’ll have to meet 10 Centers Of Influence (COIs) to get introductions to 30 prospects to get 3 clients, then measure whether you’re meeting your activity goals of 10 COIs and 30 prospect meetings, and not necessarily whether you got 2, 3, or 4 clients out of the last stint of efforts. Not that you shouldn’t ultimately have results-oriented goals of clients and revenue as well, but activity is often the easier and more salient item to measure, whether it’s phone calls made, articles written, subscribers added to your drip marketing list, prospect meetings, COI introductions, or something else. So when you’re defining the goals of your business plan, be certain you’re setting both goals for the results you want to achieve, and the key performance indicator (KPI) measures you want to evaluate to regarding your activities along the way? 5) Where will you focus your time in the business? When an advisory firm is getting started, the role of the advisor-as-business-owner is to do “everything” – as the saying goes, you’re both the chief cook and the bottle washer . However, the reality is that the quickest way to failure in an advisory firm is to get so caught up on doing “everything” that you fail to focus on the essential activities necessary to really move the business forward (that’s the whole reason for having a plan to define what those activities are, and a measure to determine whether you’re succeeding at them!). Though in truth, the challenge of needing to focus where you spend your time in the business never ends – as a business grows and evolves, so too does the role of the advisor-owner as the leader, which often means that wherever you spent your time and effort to get your business to this point is not where you need to focus it to keep moving forward from here. From gathering clients as an advisor to learning to transition clients to another advisor, from being responsible for the firm’s business development to hiring a marketing manager, from making investment decisions and executing trades to hiring an investment analyst and trader. By making a proactive decision about where you will spend your time, and also deliberately deciding what you will stop doing, it also becomes feasible to determine what other resources you may need to support you, in order to ensure you’re always spending your time focused on whatever is your highest and best use. In addition, the process can also reveal gaps where you may need to invest into and improve yourself, to take on the responsibilities you haven’t in the past but need to excel at to move forward from here. 6) How must you strengthen the foundation? The point of this section is not about what you must do to achieve the goals you’ve set, but what else needs to be done in the business in order to maximize your ability to make those business goals a reality. In other words, if you’re going to focus your time on its highest and best use in the business, what foundation to you need to support you to make that happen? If you’re a startup advisory firm, what business entity do you need to create, what are the tools/technology you’ll need to launch your firm , and what licensing/registrations must you complete? Will you operate with a ‘traditional’ office or from a home office , or run an entirely virtual “location-independent” advisory firm ? What are the expenses you’re budgeting to operate the business? If you’re an advisor who’s hit a growth wall , what are the essential hire(s) you’ll make in the near future where/how else will you reinvest to get over the wall and keep moving forward? At the most basic level, the key point here is that if you’re going to execute on this business plan to move the business forward from here, you need a sound foundation to build upon – so what do you need to do to shore up your foundation, so you can keep building? But remember, the goal here is to do what is necessary to move forward, not everything ; as with so much in the business, waiting until perfection may mean nothing gets done at all.

Creating A Budget And Financial Projections For Your Advisory Business

In addition to crafting a (one-page) financial planner business plan, the second step to your business planning process should be crafting a budget or financial projection for your business for the upcoming year (or possibly out 2-3 years).

Key areas to cover in budget projections for a financial advisory firm are:

Revenue - What are the revenue source(s) of your business, and realistically what revenue can you grow in the coming year(s)? - If you have several types of revenue, what are you goals and targets for each? How many hourly clients? How much in retainers? How much in AUM fees? What commission-based products do you plan to sell, and in what amounts? Expenses - What are the core expenses to operate the business on an ongoing basis? (E.g., ongoing salary or office space overhead, core technology you need to operate the business, etc.) - What are the one-time expenses you may need to contend with this year? (Whether start-up expenses to launch your advisory firm , new hires to add, significant one-time projects to complete, etc.)

An ongoing advisory firm may project out for the next 1-3 years, while a newer advisors firm may even prefer a more granular month-by-month budget projection to have regular targets to assess.

Ultimately, the purpose of the budgeting process here is two-fold. The first reason for doing so is simply to have an understanding of the prospective expenses to operate the business, so you can understand if you do hit your goals, what the potential income and profits of the business will be (and/or whether you need to make any changes, if the business projections aren’t viable!). The second reason is that by setting a budget, for both expenses and revenue, you not only set targets for what you will spend in the business to track on track, but you have revenue goals to be held accountable to in trying to assess whether the business is succeeding as planned.

Vetting Your Business Plan By Soliciting Constructive Criticism And Feedback

The last essential step of crafting an effective financial planner business plan is to vet it – by soliciting feedback and constructive criticism about the gaps and holes. Are there aspects of the financial projections that seem unrealistic? Is the target of who the business will serve narrow and specific enough to be differentiated, such that the person you’re talking to would clearly know who is appropriate to refer to you? Are the services that will be offered truly unique and relevant to that target clientele, and priced in a manner that’s realistically affordable and valuable to them?

In terms of who should help to vet your financial advisor business plan, most seem to get their plan vetted by talking to a business coach or consultant to assess the plan. While that’s certainly a reasonable path, another option is actually to take the business plan to fellow advisors to vet, particularly if you’re part of an advisor study (or “mastermind”) group ; the reason is that not only do fellow advisors have an intimate understanding of the business and potential challenges, but if their target clientele is different than yours, it becomes an opportunity to explain what you do and create the potential for future referrals! In other words, “asking for advice on your business plan” also becomes a great opportunity to “tell you about who I work with in my business that you could refer to me” as well! (In fact, one of the great virtues of a clearly defined niche practice as an advisor is that you can generate referrals from other advisors who have a different niche than yours !)

Similarly, the reality is that another great potential source for feedback about your business plan are Centers of Influence already in your niche in the first place. While you might not share with your potential clients the details of your business financial projections (which is why I advocate that those be separate from the one-page business plan), the essential aspects of the business plan – who you will serve, what you will provide them, how you will charge, and how you will try to reach them – is an area that the target clientele themselves may be best positioned to provide constructive feedback. And in the process, once again you’ll effectively be explaining exactly what your niche business does to target clientele who could either do business with you directly, or refer business to you , even as you’re asking for their advice about how to make the business better (to serve people just like them!). So whether it’s people you’re not yet doing business with but want to, or an existing client advisory board with whom you want to go deeper, vetting your plan with prospective and current clients is an excellent opportunity to talk about and promote your business, even as you’re going through the process of refining it and making it better!

And notably, the other benefit of vetting your business plan with others – whether it’s a coach, colleague, prospects, or clients – is that the process of talking through the business plan and goals with them also implicitly commits to them that you plan to act on the plan and really do what’s there. In turn, what this means is that once you’ve publicly and openly committed to the business plan with them, it’s now fair game for them to ask you how it’s going, and whether you’re achieving the goals you set forth for yourself in the plan – an essential point of accountability to help you ensure that you’re following through on and executing the business plan you’ve created!

So what do you think? Have you ever created a formal business plan for yourself? If you have, what worked for you – a longer plan, or a shorter one? If you haven’t created a business plan for yourself, why not? Do you think the kind of one-page financial advisor business plan template articulated here would help? Have you checked out our financial advisor business plan sample template for yourself? Do you have a financial advisor business plan example you're willing to share in the comments below?

- About Michael

- Career Opportunities

- Permissions / Reprints

- Disclosures / Disclaimers

- Privacy Policy

- Terms of Use

Showcase YOUR Expertise

How To Contribute Submit Podcast Guest Submit Guest Webinar Submit Guest Post Submit Summit Guest Presentation

Stay In Touch

General Inquiries: [email protected]

Members Assistance: [email protected]

All Other Questions, Or Reach Michael Directly:

This browser is no longer supported by Microsoft and may have performance, security, or missing functionality issues. For the best experience using Kitces.com we recommend using one of the following browsers.

- Microsoft Edge

- Mozilla Firefox

- Google Chrome

- Safari for Mac

Friend's Email Address

Your Email Address

IMAGES

VIDEO

COMMENTS

Financial Advisor Business Plan Template [Updated 2024] Financial Advisor Business Plan Template. Written by Dave Lavinsky. Over the past 20+ years, we have helped over 9,000 entrepreneurs create business plans to start and grow their financial advisor and financial planning businesses. On this page, we will first give you some background ...

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their financial advisor businesses. Our financial advisor business plan template will help you create your business plan, ensuring that you have all the necessary elements to make your financial advisor business a success.

Michael Kitces is Head of Planning Strategy at Buckingham Strategic Wealth, which provides an evidence-based approach to private wealth management for near- and current retirees, and Buckingham Strategic Partners, a turnkey wealth management services provider supporting thousands of independent financial advisors through the scaling phase of growth.