- Assignment Clause

Get free proposals from vetted lawyers in our marketplace.

Contract Clauses

- Acceleration Clause

- Arbitration Clause

- Cancellation Clause

- Choice of Law Clause

- Confidentiality Clause

- Consideration Clause

- Definitions Clause

- Dispute Resolution Clause

- Entire Agreement Clause

- Escalation Clause

- Exclusivity Clause

- Exculpatory Clause

- Force Majeure Clause

- Governing Law Clause

- Indemnification Clause

- Indemnity Clause

- Insurance Clause

- Integration Clause

- Merger Clause

- Non-Competition Clause

- Non-Disparagement Clause

- Non-Exclusivity Clause

- Non-Solicitation Clause

- Privacy Clause

- Release Clause

- Severability Clause

- Subordination Clause

- Subrogation Clause

- Survival Clause

- Termination Clause

- Time of Essence Clause

Jump to Section

Assignment clause defined.

Assignment clauses are legally binding provisions in contracts that give a party the chance to engage in a transfer of ownership or assign their contractual obligations and rights to a different contracting party.

In other words, an assignment clause can reassign contracts to another party. They can commonly be seen in contracts related to business purchases.

Here’s an article about assignment clauses.

Assignment Clause Explained

Assignment contracts are helpful when you need to maintain an ongoing obligation regardless of ownership. Some agreements have limitations or prohibitions on assignments, while other parties can freely enter into them.

Here’s another article about assignment clauses.

Purpose of Assignment Clause

The purpose of assignment clauses is to establish the terms around transferring contractual obligations. The Uniform Commercial Code (UCC) permits the enforceability of assignment clauses.

Assignment Clause Examples

Examples of assignment clauses include:

- Example 1 . A business closing or a change of control occurs

- Example 2 . New services providers taking over existing customer contracts

- Example 3 . Unique real estate obligations transferring to a new property owner as a condition of sale

- Example 4 . Many mergers and acquisitions transactions, such as insurance companies taking over customer policies during a merger

Here’s an article about the different types of assignment clauses.

Assignment Clause Samples

Sample 1 – sales contract.

Assignment; Survival . Neither party shall assign all or any portion of the Contract without the other party’s prior written consent, which consent shall not be unreasonably withheld; provided, however, that either party may, without such consent, assign this Agreement, in whole or in part, in connection with the transfer or sale of all or substantially all of the assets or business of such Party relating to the product(s) to which this Agreement relates. The Contract shall bind and inure to the benefit of the successors and permitted assigns of the respective parties. Any assignment or transfer not in accordance with this Contract shall be void. In order that the parties may fully exercise their rights and perform their obligations arising under the Contract, any provisions of the Contract that are required to ensure such exercise or performance (including any obligation accrued as of the termination date) shall survive the termination of the Contract.

Reference :

Security Exchange Commission - Edgar Database, EX-10.29 3 dex1029.htm SALES CONTRACT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1492426/000119312510226984/dex1029.htm >.

Sample 2 – Purchase and Sale Agreement

Assignment . Purchaser shall not assign this Agreement or any interest therein to any Person, without the prior written consent of Seller, which consent may be withheld in Seller’s sole discretion. Notwithstanding the foregoing, upon prior written notice to Seller, Purchaser may designate any Affiliate as its nominee to receive title to the Property, or assign all of its right, title and interest in this Agreement to any Affiliate of Purchaser by providing written notice to Seller no later than five (5) Business Days prior to the Closing; provided, however, that (a) such Affiliate remains an Affiliate of Purchaser, (b) Purchaser shall not be released from any of its liabilities and obligations under this Agreement by reason of such designation or assignment, (c) such designation or assignment shall not be effective until Purchaser has provided Seller with a fully executed copy of such designation or assignment and assumption instrument, which shall (i) provide that Purchaser and such designee or assignee shall be jointly and severally liable for all liabilities and obligations of Purchaser under this Agreement, (ii) provide that Purchaser and its designee or assignee agree to pay any additional transfer tax as a result of such designation or assignment, (iii) include a representation and warranty in favor of Seller that all representations and warranties made by Purchaser in this Agreement are true and correct with respect to such designee or assignee as of the date of such designation or assignment, and will be true and correct as of the Closing, and (iv) otherwise be in form and substance satisfactory to Seller and (d) such Assignee is approved by Manager as an assignee of the Management Agreement under Article X of the Management Agreement. For purposes of this Section 16.4, “Affiliate” shall include any direct or indirect member or shareholder of the Person in question, in addition to any Person that would be deemed an Affiliate pursuant to the definition of “Affiliate” under Section 1.1 hereof and not by way of limitation of such definition.

Security Exchange Commission - Edgar Database, EX-10.8 3 dex108.htm PURCHASE AND SALE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1490985/000119312510160407/dex108.htm >.

Sample 3 – Share Purchase Agreement

Assignment . Neither this Agreement nor any right or obligation hereunder may be assigned by any Party without the prior written consent of the other Parties, and any attempted assignment without the required consents shall be void.

Security Exchange Commission - Edgar Database, EX-4.12 3 dex412.htm SHARE PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1329394/000119312507148404/dex412.htm >.

Sample 4 – Asset Purchase Agreement

Assignment . This Agreement and any of the rights, interests, or obligations incurred hereunder, in part or as a whole, at any time after the Closing, are freely assignable by Buyer. This Agreement and any of the rights, interests, or obligations incurred hereunder, in part or as a whole, are assignable by Seller only upon the prior written consent of Buyer, which consent shall not be unreasonably withheld. This Agreement will be binding upon, inure to the benefit of and be enforceable by the parties and their respective successors and permitted assigns.

Security Exchange Commission - Edgar Database, EX-2.1 2 dex21.htm ASSET PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1428669/000119312510013625/dex21.htm >.

Sample 5 – Asset Purchase Agreement

Assignment; Binding Effect; Severability

This Agreement may not be assigned by any party hereto without the other party’s written consent; provided, that Buyer may transfer or assign in whole or in part to one or more Buyer Designee its right to purchase all or a portion of the Purchased Assets, but no such transfer or assignment will relieve Buyer of its obligations hereunder. This Agreement shall be binding upon and inure to the benefit of and be enforceable by the successors, legal representatives and permitted assigns of each party hereto. The provisions of this Agreement are severable, and in the event that any one or more provisions are deemed illegal or unenforceable the remaining provisions shall remain in full force and effect unless the deletion of such provision shall cause this Agreement to become materially adverse to either party, in which event the parties shall use reasonable commercial efforts to arrive at an accommodation that best preserves for the parties the benefits and obligations of the offending provision.

Security Exchange Commission - Edgar Database, EX-2.4 2 dex24.htm ASSET PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1002047/000119312511171858/dex24.htm >.

Common Contracts with Assignment Clauses

Common contracts with assignment clauses include:

- Real estate contracts

- Sales contract

- Asset purchase agreement

- Purchase and sale agreement

- Bill of sale

- Assignment and transaction financing agreement

Assignment Clause FAQs

Assignment clauses are powerful when used correctly. Check out the assignment clause FAQs below to learn more:

What is an assignment clause in real estate?

Assignment clauses in real estate transfer legal obligations from one owner to another party. They also allow house flippers to engage in a contract negotiation with a seller and then assign the real estate to the buyer while collecting a fee for their services. Real estate lawyers assist in the drafting of assignment clauses in real estate transactions.

What does no assignment clause mean?

No assignment clauses prohibit the transfer or assignment of contract obligations from one part to another.

What’s the purpose of the transfer and assignment clause in the purchase agreement?

The purpose of the transfer and assignment clause in the purchase agreement is to protect all involved parties’ rights and ensure that assignments are not to be unreasonably withheld. Contract lawyers can help you avoid legal mistakes when drafting your business contracts’ transfer and assignment clauses.

Meet some of our Lawyers

I build legal solutions which create extraordinary value for my clients. I am a partner in Alliance Law Firm International PLLC in Washington. My specialties include tax, wealth management, estates, corporations/business, venture capital, private equity, and natural resources. Prior to practicing law, I had a decade-long career in international private equity and investment banking. I have worked on building and managing companies in technology, energy, materials, retail, and natural resources. I am licensed to practice in the District of Columbia and Pennsylvania. I have degrees from the Georgetown University Law Center (JD) and the Yale School of Management (MBA).

Prior to becoming an attorney, Mr. Dimitry Alexander Kaplun had been involved with many industries and professions, and helped manage, create, and advise a wide range of businesses around the world. While at Drexel University as a computer science major, he became an NASD licensed representative and was employed by Fortune 100 insurance companies, including Prudential, AIG, and NY Life, first specializing in financial investments for life and annuity products, and then expanding his expertise to mutual finds, stocks, environmental insurance, and real property. Due to his technical expertise and a clear understanding of business rules, he was soon brought on board to help assist those companies with coding their interface for the Y2K switch. Soon after switching his major to business, Mr. Kaplun worked for a telecommunication service company first in quality assurance and then as a database programmer and developer, with sole and exclusive responsibilities for a multitude of warehouses located around the continental United States. Working on-site and from the company headquarters, he was responsible for streamlining processes for internal departments while fulfilling the quickly changing needs to the company clients, most notably Verizon Wireless. Mr. Kaplun opened his practice in 2008. Prior to starting his practice, he worked as a paralegal instructor for Prism Career Institute, creating the lesson plans for the whole program and focusing his instruction on substantive and procedural laws for general practitioners. Mr. Kaplun also worked as an associate for The Law Office of Keith Owen Campbell PC, focusing on Family and Matrimonial Law, and assisted the law firm of Jeffrey Neu and Associates in securities research as well as various contact and sales agreements, mainly online reseller agreements. He currently focuses his energy on representing individuals and companies in liability insulation, contracts and business agreements, and other legal concerns that crop up in the regular operation of doing business.

Muhammad Yar L.

I am Muhammad, a legal counsel, technology law advisor, and corporate and commercial law expert, licensed to practice in New York State. I graduated from University of London and Georgetown Law Center and have about 7 years of experience in corporate and commercial law. As a As a technology law advisor, I possess deep insights into SaaS agreements, master service agreements, master subscription agreements, and SaaS Agreements, among others.

Alexandra I.

I am a licensed attorney in California specializing in consumer contract law. My areas of expertise include contract law and employment law, including independent contractor compliance, work-for-hire compliance and general corporate law. I appreciate getting to know my clients and enjoy providing legal guidance, whether they are large corporations, young start-ups about to take off, or just one person in need of legal advice. Some of my recent work has included the drafting of corporate purchase and sale agreements, independent contractor agreements, nondisclosure agreements, and software as a service (SaaS) agreements. I am well-versed in intellectual property law and have successfully obtained trademarks for former clients. My passion for learning, reading and writing has proved advantageous in my practice. I complete continuing education courses to stay current on industry best practices. I take great satisfaction in offering precise and helpful legal advice free from fancy terminology. I look forward to discussing your particular needs and supporting you in achieving your objectives. Please get in touch to learn more about my approach and see whether we are a good fit.

I am a Silicon Valley tech lawyer with over 13 years of in-house experience and additional years in BigLaw. I provide tech licensing, data privacy, employment, international expansion, go to market, and other corporate and commercial legal services to clients in software, SaaS, bio-tech, cryptocurrency, financing, and construction business. I currently run my own practice concentrating on transactional, commercial, corporate or employment matters. Prior to starting my own practice, I joined as the first in-house counsel to lead the global legal strategy to bring tech products to market, increase revenue, decrease exposure to risk, and raise venture funding for HashiCorp Inc., currently an unicorn technology company with evaluation over $5 billion and venture funding over $350 million; Sysdig Inc., a technology company with venture funding of $195 million; and Anaplan Inc., currently a publicly traded company on the US Stock Market. Furthermore, I acted as in-house counsel advising leading technology enterprise companies such as HP, VMware, and Genentech and currently act as member of strategic advisory boards to several technology companies located globally

I'm a tenants rights attorney based (and licensed) in New York. My expertise includes filing complaints and responsive pleadings as well as reviewing leases and contracts and motion practice.

Find the best lawyer for your project

Contract lawyers by city.

- Atlanta Contract Lawyers

- Austin Contract Lawyers

- Boston Contract Lawyers

- Chicago Contract Lawyers

- Dallas Contract Lawyers

- Denver Contract Lawyers

- Fort Lauderdale Contract Lawyers

- Houston Contract Lawyers

- Las Vegas Contract Lawyers

- Los Angeles Contract Lawyers

- Memphis Contract Lawyers

- Miami Contract Lawyers

- New York Contract Lawyers

- Oklahoma City Contract Lawyers

- Orlando Contract Lawyers

- Philadelphia Contract Lawyers

- Phoenix Contract Lawyers

- Richmond Contract Lawyers

- Salt Lake City Contract Lawyers

- San Antonio Contract Lawyers

- San Diego Contract Lawyers

- San Francisco Contract Lawyers

- Seattle Contract Lawyers

- Tampa Contract Lawyers

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Find lawyers and attorneys by city

- Trade Finance

- Letters of Credit

- Trade Insurance & Risk

- Shipping & Logistics

- Sustainable Trade Finance

- Incoterms® Rules 2020

- Research & Data

- Conferences

- Purchase Order Finance

- Stock Finance

- Structured Commodity Finance

- Receivables Finance

- Supply Chain Finance

- Bonds and Guarantees

- Find Finance Products

- Get Trade Finance

- Incoterms® 2020

- Letters of Credit (LCs)

UCP 600 and Letters of Credit | Trade Finance Global 2024 Guide

Ucp600 and letters of credit, ucp 600 (uniform customs & practice for documentary credits) - what does ucp 600 mean, ucp 600 and the letter of credit.

The Uniform Customs & Practice for Documentary Credits (UCP 600) is a set of rules agreed by the International Chamber of Commerce, which apply to finance institutions which issue Letters of Credit – financial instruments helping companies finance trade. Many banks and lenders are subject to this regulation, which aims to standardise international trade, reduce the risks of trading goods and services, and govern trade.

The UCP 600 (“Uniform Customs & Practice for Documentary Credits”) is the official publication which is issued by the International Chamber of Commerce (ICC). It is a set of 39 articles on issuing and using Letters of Credit, which applies to 175 countries around the world, constituting some $1 trillion USD of trade per year.

What’s the purpose of UCP 600?

The UCP 600 replaced the UCP 500 on the 1st July 2007. It was brought about to standardise a set of rules aiming to benefit all parties during a trade finance transaction. UCP 600 was created by industry experts, and mandated by the Banking Commission, rather than through legislation. The first UCP was created in 1933 and has been revised by the ICC up to the point of the UCP 600.

Is the UCP 600 legally binding?

The UCP 600 rules are voluntarily incorporated into contracts and have to be specifically outlined in trade finance contracts in order to apply. They also allow flexibility for the international parties involved.

An accompaniment to the UCP 600 is the International Standard Banking Practice for the Examination of Documents under Documentary Credits (ISBP), ICC Publication 745. It assists with understanding whether a document complies with the terms of Letters of Credit.

Credits that are issued and governed by UCP 600 will be interpreted in line with the entire set of 39 articles contained in UCP 600. However, exceptions to the rules can be made by express modification or exclusion.

The UCP 600 are the most successful rules ever developed in relation to trade and most Letters of Credit are subject to them. At the recent ICC UK Winter Trade Finance Conference , there was a special programme which addressed the UCP 600. This looked at recent developments in industry practice and ICC policy, as well as a review of the latest Banking Commission Opinions.

Part 1 - What is a Letter of Credit and what are the benefits to its users?

Summary of the ucp 600.

Here are a few of the key elements which make up the UCP 600:

- Definition of key terms which are prevalent in international trade (e.g. honouring [of payments], applicants, banking days, presentation)

- How international trade documents (Letters of Credit) can be signed and acknowledged by all parties

- The difference between documents, goods and services (and which parties deal with these)

- Which parts of a Letter of Credit are negotiable and non-negotiable

- How credit works, and how payment is made

- How banks can communicate the confirmation of goods (teletransmission)

- Transportation of the goods, modes of transport, and who bears responsibility

- How to deal with discrepancies, waivers and giving notice

- The provision of original documents or electronic copies

- Bills of Lading

- Insurance and covering the cost of goods

- Loss of shipping documents in transit

Will the UCP 600 be revised?

At Trade Finance Global, many people ask whether the UCP 600 will be revised. The UCP 600 is a set of rules developed by the International Chamber of Commerce on the issuance and governance of Letters of Credit, which account for a significant proportion of global trade finance transactions.

The UCP 600 has taken over 3 years to develop

When looking at the UCP 600, it is important to look at the market environment and general notes about the current guidelines. It is general consensus that UCP 600 will not be revised any time soon. Some of the reasons for this and general notes about the UCP are outlined below:

- there was a 14 year gap between UCP 500 and UCP 600;

- The consulting group was established with 41 members from 26 countries, who held meetings on over 15 occasions

- Over 5000 comments were received and reviewed once the first draft of the UCP 600 came about, being unanimously approved in October 2006

- UCP 600 is doing relatively well and works most of the time, there have been a low number of disputes, usually centred around some ambiguous wording that could not be agreed when the UCP 600 was drafted;

The big question is, if it were to be revised,

- who would draft it and who in the market has the expertise to do so;

- revision would take time and be at a high cost;

- there is a lot of regulatory uncertainty in the market and policy would need to be drafted before any advancement of the documents;

- it is unknown what will happen to various sanctions that are operating in the market;

- the ISBP is used to clarify points and there are further opinions that do the same; and

- the system will never be perfect as there will always need to be compromise – it covers over 150 trading countries and needs to reflect the commercial and legal realities.

Part 2 - Explanation of the UCP 600 rules and history of UCP

Part 3 - evolution of ucp 600 rules – will we see ucp 700 rules.

Trade Finance Global interviewed Pradeep Taneja, Managing Director of Taneja Global Trade Consulting, Bahrain and Co-Chairman and Board member of ICC Bahrain to learn more about Letters of Credit. To read this inteview, click here .

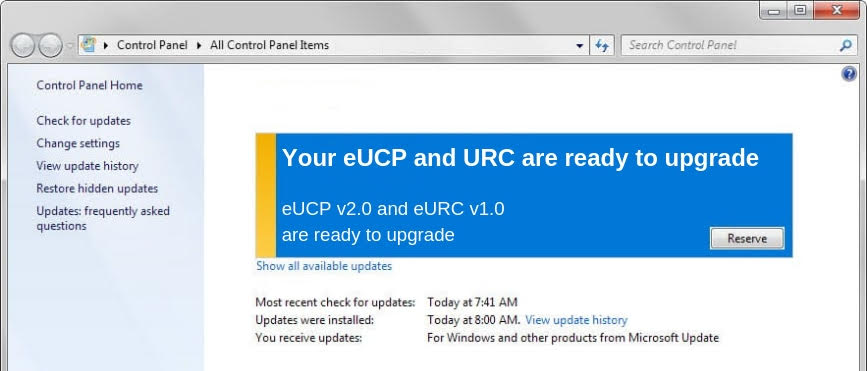

Electronic UCP (eUCP)

In 2019, the International Chamber of Commerce also released an updated supplement for the electronic rules (eRules) of the Uniform Customs & Practice for Documentary Credits. TFG covered the key changes for V2.0 of the eUCP rules, which can be found here .

Summary of the Key Articles in the ICC UCP 600

Articles 1 – 5 – General Provisions and Definitions

Articles 6 – 13 – Liabilities and Responsibilities

Articles 14 – Examination of Documents

Article 15 – 17 – Examination of Documents

Articles 18 – 28 – Documents

Articles 29 – 33 – Miscellaneous Provisions

Articles 34 – 37 – Disclaimers

Articles 38 – 39 – Transferable Credit & Assignment

What’s the difference between UCP 600 and UCP 500?

The UCP 500, was revised in 1993, a process which reviewed and overhauled opinions, decisions, URR525, ISP98 and eUCP.

Seven key articles were amended.

In comparison to UCP 500,

- New terminology added, concepts & wording introduced

- Reorganisation of the rules

- Substantive & cosmetic changes

- Improved clarity, yet created new ambiguity

Download our UCP600 Infographic (Free UCP PDF 2020)

UCP600 PDF Infographic:

NEXT >> Problems with Letters of Credit

Part 4 - 3 tips for using UCP 600 rules in Letters of Credit

What about the eucp.

ICC Update on UCP

Recently, the ICC updated eUCP 600 rules (eRules), to accelerate the digitilisation of trade finance. Trade Finance Global have published the updates on the eRules for ‘eUCP 600’, which are supplementary rules to these UCP 600 rules. Find out more here .

Videos you might like

Download our free Letters of Credit guide by filling in the form below:

1 | Introduction to the Letter of Credit 2 | Types of Credit 3 | UCP 600 and the Letter of Credit 4 | UCP 600 – Ultimate Guide 5 | Benefits of Letters of Credit 6 | Handling Document Discrepancies 7 | Restricted Letters of Credit 8 | Letters of Credit vs Bank Guarantees 9 | Standby Letters of Credit 10 | Sight Letters of Credit 11 | eUCP Explained 12 | URC 522 and eURC 13 | SWIFT Messaging Types 14 | Research 15 | BAFT & TFG Guide 16 | Parties Involved 17 | Letters of Credit Rules 18 | ISBP 821 19 | Financial Crime, Fraud and Sanctions 20 | Presentation of Documents 21 | Dispute Resolution 22 | Digitalisation and the Future

Access trade, receivables and supply chain finance

Speak to our trade finance team, messaging types, want to learn more about trade finance download our free guides.

Latest News- UCP 600 and Letters of Credit

Ifc and dbs launch $500m facility to promote trade flows in emerging markets, international standby practices (isp98): 25 years later, baft and tfg launch a comprehensive letter of credit guide, generative ai and llms in trade finance: believe the hype (well, most of it), the role of ucp in standby letters of credit transactions, understanding letters of credit & the ucp 600 rules in nigeria, standby letters of credit (sblc): top tips and best practice for corporates, navigating commodity trade finance: a comprehensive guide for borrowers, 11 swift messaging types (mts), what they do, and how they are used in trade finance (mt700, mt707, mt710, mt700…), video | sustainability in mena: first abu dhabi bank’s approach to sustainable trade finance, trade finance global: a year in review – 2023 recap, citi announces collaboration with traydstream to streamline document services, kuvera resources v j.p. morgan chase: certainty of payment vs risks of breaching sanctions under letters of credit, three levels of iso 20022 usage: steps to harmonise trade finance transactions , 14 key trade documents and data elements for cross-border trade: inside the icc’s ktdde report, afreximbank’s programme to support lcs reaches 80% of africa’s banks, contour collapses: what does this mean for digital trade finance, bridging trade gaps: how adb’s trade finance programme mitigates commercial risk, lloyds bank introduces digital solution for direct guarantees and standby letters of credit, the future of digital trade finance: an in-depth q&a with surecomp, latest insights from ucp 600 & letters of credit, learn more about letters of credit.

2015 | TFG Excellence Awards

2016 | TFG Currency Awards

2016 | TFG Product Awards

2016 | tfg recruitment awards, 2016 | tfg shipping awards.

2017 | TFG International Trade Awards

2018 | TFG International Trade Awards

2019 | TFG International Trade Awards

2020 | TFG International Trade Awards

2022 | TFG International Trade Awards

2023 | TFG Trade, Treasury & Payments Awards

2023 export finance guide, 2024 trade finance research.

A complete guide to the Incoterms® 2020 Rules (International Commerce Terms)

AB Svensk Exportkredit (SEK) | Export Credit Agency (ECA) in Sweden

Accelerate – Apply | Trade Finance Global

About the Author

Deepesh Patel is Editorial Director at Trade Finance Global (TFG). In this role, Deepesh leads efforts in developing TFG’s brand, relationships and strategic direction in key markets, including the UK, US, Singapore, Dubai and Hong Kong.

Deepesh regularly chairs and speaks at international industry events with the WTO, BCR, Excred, TXF, The Economist and Reuters, as well as industry associations including ICC, FCI, ITFA, ICISA and BAFT.

Deepesh is the host of the ‘Trade Finance Talks’ podcast and ‘Trade Finance Talks TV’. He is co-author of ‘Blockchain for Trade: A Reality Check’ with the ICC and the WTO, alongside other industry research.

In addition to his work at TFG, Deepesh is a Strategic Advisor for WOA, and works closely with ITFA. He also sits on the Fintech Working Group of the Standardised Trust.

Prior to TFG, Deepesh worked at Travelex where he was responsible for the cards business and the Travelex Money app in Europe, NAM, UK and Brazil. Deepesh is Chair of Governors and co-opted LA Governor of the Wyvern Federation, which has responsibility for 5 primary schools in South London.

§ 5-114. Assignment of Proceeds.

(a) In this section, "proceeds of a letter of credit" means the cash, check, accepted draft, or other item of value paid or delivered upon honor or giving of value by the issuer or any nominated person under the letter of credit . The term does not include a beneficiary's drawing rights or documents presented by the beneficiary.

(b) A beneficiary may assign its right to part or all of the proceeds of a letter of credit. The beneficiary may do so before presentation as a present assignment of its right to receive proceeds contingent upon its compliance with the terms and conditions of the letter of credit .

(c) An issuer or nominated person need not recognize an assignment of proceeds of a letter of credit until it consents to the assignment.

(d) An issuer or nominated person has no obligation to give or withhold its consent to an assignment of proceeds of a letter of credit, but consent may not be unreasonably withheld if the assignee possesses and exhibits the letter of credit and presentation of the letter of credit is a condition to honor .

(e) Rights of a transferee beneficiary or nominated person are independent of the beneficiary's assignment of the proceeds of a letter of credit and are superior to the assignee's right to the proceeds.

(f) Neither the rights recognized by this section between an assignee and an issuer , transferee beneficiary , or nominated person nor the issuer's or nominated person's payment of proceeds to an assignee or a third person affect the rights between the assignee and any person other than the issuer, transferee beneficiary, or nominated person. The mode of creating and perfecting a security interest in or granting an assignment of a beneficiary's rights to proceeds is governed by Article 9 or other law. Against persons other than the issuer, transferee beneficiary, or nominated person, the rights and obligations arising upon the creation of a security interest or other assignment of a beneficiary's right to proceeds and its perfection are governed by Article 9 or other law.

- Search Search Please fill out this field.

What Is a Transferable Letter of Credit?

How transferable letters of credit work, obtaining a transferable letter of credit, transferable letter of credit vs. confirmed letter of credit, the bottom line.

- Credit & Debt

- Definitions N - Z

What Is a Transferable Letter of Credit? Definition & Advantages

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

A transferable letter of credit is a letter of credit that allows the first beneficiary to transfer some or all of the credit to another party, creating a secondary beneficiary. The party that initially accepts the transferable letter of credit from the bank is referred to as the first, or primary, beneficiary, while the party that applied for the letter of credit is the applicant. A transferable letter of credit is often used in business deals to ensure payment to a supplier or manufacturer and is an alternative to making an advance payment .

Key Takeaways

- A transferable letter of credit permits an initial beneficiary to transfer some or all of the credit they are due to another party.

- Transferable letters of credit are used in certain business deals to ensure that payment is made to a supplier or manufacturer.

- The parties involved in a transferable letter of credit, in addition to the bank, are the applicant (the buyer of goods or services), the first beneficiary (such as a retailer or broker), and the second beneficiary (such as a supplier or manufacturer).

A letter of credit is a document provided by a bank, guaranteeing that a seller will receive the money a buyer has promised to pay it for goods or services in a particular transaction. If the buyer fails to do so, the bank can become responsible for paying.

For example, sellers of manufactured goods often require a letter of credit guaranteeing that they will receive the money they are due—on time and for the full, correct amount—before proceeding to fill a customer's order. The buyer applies to a bank to obtain the letter of credit and pays a fee to compensate the bank for the risk it is taking.

Letters of credit are often used in transactions between importers and exporters. As the U.S. Department of Commerce explains, "Letters of credit (LCs) are one of the most secure instruments available to international traders.... An LC is useful when reliable credit information about a foreign buyer is difficult to obtain, but the exporter is satisfied with the creditworthiness of the buyer's foreign bank. An LC also protects the buyer since no payment obligation arises until the goods have been shipped as promised."

A transferable letter of credit includes an additional provision making some or all of the credit that the bank is guaranteeing transferable to another party, known as the secondary beneficiary. The secondary beneficiary might, for example, be a supplier that the seller (the first beneficiary) is relying on to provide the goods that they are selling. In this type of arrangement, the first beneficiary is serving as a sort of middleman between the supplier and the buyer. There can be more than one secondary beneficiary.

Transferable letters of credit, like other credit letters, are used in both domestic and international commerce.

Letters of credit are available from many banks, particularly those with an international presence.

The approval process for letters of credit, both transferable and non-transferable, is similar to applying for a bank loan. The buyer must submit a credit application , including details on their income, assets, and existing debts, as well as the transaction itself. The bank will analyze that information as part of its underwriting process . Underwriting is the procedure banks follow to assess how much risk a particular borrower poses and make a decision on whether to extend them credit—and, if so, at what cost.

With a letter of credit, the borrower isn't taking an actual loan. Instead, the letter of credit guarantees that the bank is willing to issue a loan for a specified amount to the borrower if one is needed to cover the payment promised to the seller.

A transferable letter of credit can be a more convenient option for a buyer than a confirmed letter of credit . That's because the buyer is only required to deal with one bank for a transferable letter of credit.

With a confirmed letter of credit, however, the buyer must obtain two letters of credit, with the second letter guaranteeing the first one. Confirmed letters of credit can be required by a seller in the event that the first bank defaults on repayment. The second bank will typically be a bank that the seller is familiar with. Confirmed letters are common in international trade and may involve banks in more than one country.

What Is a Commercial Letter of Credit?

With a commercial letter of credit, the bank makes payment directly to the beneficiary (typically the seller in a transaction) by releasing the buyer's funds when the beneficiary has fulfilled its obligations. This contrasts with a standby letters of credit , in which the bank pays the seller directly only if the buyer fails to do so.

What Is a Back-to-Back Letter of Credit?

A back-to-back letter of credit refers to two separate letters of credit issued for the same transaction when a middleman is involved. The buyer will provide a letter of credit to the middleman (such as a re-seller or broker), assuring them that they'll be paid. Based on the first letter, the middleman can then provide a separate letter of credit to their supplier (such as a manufacturer). The two letters ensure that all parties get paid.

What Is a Revolving Letter of Credit?

A revolving letter of credit is one that provides a sum of credit that can be used over a series of transactions. It is often useful when a buyer and seller (such as an importer and an exporter) have an ongoing relationship. With a revolving letter of credit, the buyer doesn't have to get a new letter of credit each time.

What Is a Credit Facility?

A credit facility refers to a loan made to a borrower who can then access the funds as needed rather than all at once. Revolving credit is one example of a credit facility.

What Does a Letter of Credit Cost?

Banks typically charge a percentage of the amount of money they are guaranteeing for a letter of credit, but the fee can also vary based on the applicant's creditworthiness. A review of lender websites shows fees generally ranging from about 0.75% to 2%.

Letters of credit are an important tool in business transactions between buyers and sellers, especially if the parties are in different countries or have not had a long relationship and built up trust. Transferable letters assure both sellers and their suppliers that they will be paid for their goods and services if they deliver as promised. Buyers must pay for letters of credit, but they often facilitate deals that wouldn't be possible otherwise.

Export-Import Bank of the United States. " How Does a Letter of Credit Work and What Is It? "

U.S. Department of Commerce International Trade Administration. " Trade Finance Guide: A Quick Reference for U.S. Exporters ," Page 4.

U.S. Department of Commerce International Trade Administration. " Trade Finance Guide: A Quick Reference for U.S. Exporters ," Page 8.

Cornell Law School Legal Information Institute. " Credit Facility ."

:max_bytes(150000):strip_icc():format(webp)/what-are-different-types-letters-credit.asp-final-2f56c5a984a44a86817b362522bfe9e6.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

International Trade Finance pp 59–94 Cite as

Letters of Credit: Types

- Tarsem Bhogal 2 &

- Arun Trivedi 2

- First Online: 02 October 2019

1506 Accesses

Part of the book series: Finance and Capital Markets Series ((FCMS))

Let us understand letter of credit and its various types with the help of a grid as in Fig. 7.1.

This is a preview of subscription content, log in via an institution .

Buying options

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Author information

Authors and affiliations.

Tarsem Bhogal & Arun Trivedi

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2019 The Author(s)

About this chapter

Cite this chapter.

Bhogal, T., Trivedi, A. (2019). Letters of Credit: Types. In: International Trade Finance. Finance and Capital Markets Series. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-24540-5_7

Download citation

DOI : https://doi.org/10.1007/978-3-030-24540-5_7

Published : 02 October 2019

Publisher Name : Palgrave Macmillan, Cham

Print ISBN : 978-3-030-24539-9

Online ISBN : 978-3-030-24540-5

eBook Packages : Economics and Finance Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Practical Law

Standard documents and clauses with drafting notes: Finance

Practical law uk help and information notes 8-202-3067 (approx. 17 pages), introduction, term sheets.

- Term sheet: bilateral

- Term sheet: bilateral acquisition finance facilities

- Term sheet: syndicated

- Term sheet: syndicated acquisition finance facilities

- Term sheet: syndicated term loan, pre-export finance facility

Commitment letters

- Commitment letter: arranging and underwriting mandate

- Commitment letter: arranging mandate

- Commitment letter: joint arranging and underwriting mandate

- Commitment letter: joint arranging mandate

- Material adverse change clause (including market MAC wording) for a mandate letter

Facility agreements

- Facility agreement

- Facility agreement: intra-group

- Facility agreement: loan from a director or shareholder

- Facility agreement: management buyouts

- Facility agreement: short-form

- On-demand facility agreement: intra-group

- Overdraft facility agreement

Additional clauses

- Capitalised interest and commitment fees provisions

- Facility agreements: anti-corruption provisions: Facility agreement provisions

- Financial covenants: capital expenditure restriction

- Material adverse change (MAC) provisions for a facility agreement

- Profit share provisions

- Revolving facility agreement provisions

Corporate authorisations and assurances

- Board minutes: borrower approving facility agreement

- Board minutes: borrower approving facility agreement and debenture

- Board resolutions: Borrower ratifying facility agreement

- Board resolutions: Borrower ratifying facility agreement and debenture

- Board minutes: declarations of interest

- Director's certificate

- Director's certificate: short form for use with amendment or amendment and restatement agreement

- Legal opinion: Officer's certificate

- Solvency certificate

Amendment, assignment and novation

- Amendment agreement

- Amendment and restatement agreement

- Amendment and waiver letters: Agent confirmation

- Amendment letter

- Amendment request: borrower to lender

- Assignment of loan

- Novation of loan

- Waiver clause

Subordination

- Intercreditor deed for secured debt

- Intercreditor deed for unsecured debt

Retention accounts

- Retention account: escrow letter: asset acquisitions

- Retention account: instructions to escrow bank: acquisitions

- Loan note certificate (share consideration)

)

- Loan note instrument (share consideration)

Other documents

- Condition precedent waiver letter

- Conditions precedent satisfaction letter: lender's lawyers to the lender

- Conditions precedent satisfaction letter: lender to borrower

- Confidentiality agreement: lending

- Consent letter

- Consent request: borrower to lender

- Consent request: borrower to lender (new borrowing and security with new lender)

- Demand for loan repayment

- Drawdown request

- Effective date letter: lender to borrower

- Financial covenants: facility agreement

- Legal opinion: English borrower foreign law governed unsecured bilateral facility agreement

- Legal opinion: English borrower secured bilateral loan facility

- Legal opinion: English borrower unsecured bilateral loan facility

- Legal opinion: Foreign borrower unsecured bilateral loan facility

- Legal opinion from non-English lawyer: English company and foreign law documents

- Legal opinion from non-English lawyer: foreign company and English law documents

- Legal opinion from non-English lawyer: foreign company and foreign law document

- Legal opinion: Immunity

- Process agent letter

- Promissory note

- Reservation of rights letter: facility agreement

- Restatement date letter: lender to borrower

- Undertaking to hold completion monies

- Waiver and consent letter

- Waiver and consent request: borrower to lender

- Waiver letter

- Waiver request: borrower to lender

Guarantees and bonds

)

- Guarantee and indemnity: payment obligation

- ABI model form of guarantee bond

- Advance payment bond

- Bond: default performance bond for a construction project

- On demand performance bond

- Standby letter of credit

- Board minutes: guarantor approving guarantee and indemnity

- Comfort letter - binding

- Comfort letter - non-binding

- Deed of consent: guarantor consent to amendments of the guaranteed obligations

)

- Etridge letter confirming independent advice about mortgage

- Written resolution of members under Companies Act 2006 (approving a guarantee)

Security and quasi security

- Debenture: all monies wording

- Debenture: third party security wording

- Legal mortgage: all monies wording

- Legal mortgage over property from a company securing specific monies (own liabilities)

- Mortgage agreement with individual borrower: residential property, not by way of business

- Supplemental legal mortgage

- Third party legal mortgage over property from a company securing specific liabilities

- Mortgage of shares

- Mortgage of shares: Mortgage of certificated shares and securities

- Mortgage of shares: Mortgage of shares and securities held in CREST

Other assets

- Mortgage of chattels

- Mortgage of patents

- Security assignment of contractual rights

- Charge over bank account

- Charge over shares

- Charge over shares: Charge over certificated shares and securities

- Charge over shares: Charge over shares and securities held in CREST

Registration of charges

- Covering letter to be sent to Companies House with form MR01 (company incorporated in England and Wales)

- Covering letter to be sent with Form MG01 (for a company incorporated in England and Wales)

- Board minutes: third party security provider approving third party security document

- Comfort letter - non binding

- Written resolution of members under Companies Act 2006 (amending articles where share security is taken)

- Written resolution of members under Companies Act 2006 (approving third party security)

Priority and subordination

- Deed of priority

- Deed of priority: mutual consultation obligation on enforcement

- Deed of confirmation: existing security

- Deed of indemnity: appointment of non-administrative receivers

)

- Deed of substituted security

)

- Notice and acknowledgement of security interest over insurance policy

- Undertaking to hold a deed of release

- Undertaking to hold title deeds

Acquisition finance

- Board minutes: borrower completion minutes for an acquisition finance transaction (bilateral)

- Undertaking to stamp stock transfer form

Asset finance

- Ship finance facility provisions: conditions precedent

- Ship finance facility provisions: definitions

- Ship finance facility provisions: events of default

Debt capital markets

Emtn programme.

- EMTN dealer confirmation

- EMTN deed of covenant

- EMTN procedures memorandum

- EMTN trust deed

Corporate authorisations

- Board minutes: bond issue

- Board minutes: ECP programme establishment

- Board minutes: EMTN programme drawdown

- Board minutes: EMTN programme establishment

- Board minutes: EMTN programme updates and amendments

Derivatives

- Notice of default and early termination under ISDA® Master Agreement

- Notice of early termination amount under ISDA® Master Agreement

- Notice of failure to pay or deliver under ISDA® Master Agreement

Project finance

- Project finance facility provisions: conditions precedent

- Project finance facility provisions: definitions

- Project finance facility provisions: covenants (information, budget preparation, reporting and access undertakings)

- Project finance facility provisions: covenants (operational undertakings)

- Project finance facility provisions: events of default

- Project finance facility provisions: representations and warranties

Real estate finance

- Certificate confirming works completed and request for payment

- Conditions precedent: real estate finance

- Consent request: borrower to lender (variations to development documents)

- Development (construction) finance provisions: facility agreement

- Duty of care agreement

- Events of default: real estate finance

- Financial covenants: real estate finance

Restructuring and insolvency

Structured finance.

- True sale legal opinion

Trade finance

Performance bonds.

- On demand bid bond

Letters of credit and standby credit

- Letter of credit

- Irrevocable documentary credit application form

- Standard clause for payment for goods by letter of credit

Jurisdiction and governing law

- Governing law

- Jurisdiction

General boilerplate

- Assignment and other dealings

- Boilerplate agreement

- Boilerplate agreement: short form

- Ordinary power of attorney: specific power

- Public sector boilerplate provisions

Execution formalities

- Execution formalities: administrative receivers

- Execution formalities: administrators

- Execution formalities: attorneys under a power of attorney

- Execution formalities: charities

- Execution formalities: Companies Act companies

- Execution formalities: Companies Act companies: pre-1 October 2009

- Execution formalities: individuals

- Execution formalities: limited liability partnerships: pre-1 October 2009

- Execution formalities: limited liability partnerships: 1 October 2009

- Execution formalities: limited partnerships formed under the Limited Partnerships Act 1907

- Execution formalities: liquidators

- Execution formalities: non-Companies Act corporations

- Execution formalities: other receivers

- Execution formalities: overseas companies

- Execution formalities: partnerships

- Execution formalities: private trusts

Company administration

- Consent to short notice of a general meeting

- Notice of general meeting: listed company

- Notice of general meeting: unlisted company

- Proxy form: listed company

- Proxy form: unlisted company

- Resolution (board): approval of form and sending of a written resolution of members

- Resolution (member): altering a company's objects or articles of association

- Skeleton board minutes (transactional)

- Skeleton print of resolutions passed at a general meeting (including an AGM)

- United Kingdom

21 February 2023

Letter of Credit [LC] Explained with Process & Example

There are several uncertainties that arise when buyers and sellers across the globe engage in maritime trade operations. Some of these uncertainties revolve around delayed payments, slow deliveries, and financing-related issues, among others. The sheer distances involved in international trade, different laws and regulations, and changing political landscape are just some of the reasons for sellers needing a guarantee of payment when they deliver goods through the maritime route to their sellers. Letters of credit were introduced to address this by adding a third party like a financial institution into the transaction to mitigate credit risks for exporters.

- What is a Letter of Credit?

A letter of credit or LC is a written document issued by the importer’s bank (opening bank) on importer’s behalf. Through its issuance, the exporter is assured that the issuing bank will make a payment to the exporter for the international trade conducted between both the parties.

The importer is the applicant of the LC, while the exporter is the beneficiary. In an LC, the issuing bank promises to pay the mentioned amount as per the agreed timeline and against specified documents.

A guiding principle of an LC is that the issuing bank will make the payment based solely on the documents presented, and they are not required to physically ensure the shipping of the goods. If the documents presented are in accord with the terms and conditions of the LC, the bank has no reason to deny the payment.

- Why is Letter of Credit important?

A letter of credit is beneficial for both the parties as it assures the seller that he will receive his funds upon fulfillment of terms of the trade agreement and the buyer can portray his creditworthiness and negotiate longer payment terms, by having a bank back the trade transaction.

- Features / Characteristics of letter of credit

A letter of credit is identified by certain principles. These principles remain the same for all kinds of letters of credit. The main characteristics of letters of credit are as follows:

Negotiability

A letter of credit is a transactional deal, under which the terms can be modified/changed at the parties assent. In order to be negotiable, a letter of credit should include an unconditional promise of payment upon demand or at a particular point in time.

Revocability

A letter of credit can be revocable or irrevocable. Since a revocable letter of credit cannot be confirmed, the duty to pay can be revoked at any point of time. In an irrevocable letter of credit, all the parties hold power, it cannot be changed/modified without the agreed consent of all the people.

Transfer and Assignment

A letter of credit can be transferred, also the beneficiary has the right to transfer/assign the LC. The LC will remain effective no matter how many times the beneficiary assigns/transfers the LC.

Sight & Time Drafts

The beneficiary will only receive the payment upon maturity of letter of credit from the issuing bank when he presents all the drafts & the necessary documents.

- Documents required for a Letter of Credit

- Shipping Bill of Lading

- Airway Bill

- Commercial Invoice

- Insurance Certificate

- Certificate of Origin

- Packing List

- Certificate of Inspection

- How does Letter of Credit Work?

LC is an arrangement whereby the issuing bank can act on the request and instruction of the applicant (importer) or on their own behalf. Under an LC arrangement, the issuing bank can make a payment to (or to the order of) the beneficiary (that is, the exporter). Alternatively, the issuing bank can accept the bills of exchange or draft that are drawn by the exporter. The issuing bank can also authorize advising or nominated banks to pay or accept bills of exchange.

Fee and charges payable for an LC

There are various fees and reimbursements involved when it comes to LC. In most cases, the payment under the letter of credit is managed by all parties. The fees charged by banks may include:

Opening charges, including the commitment fees, charged upfront, and the usance fee that is charged for the agreed tenure of the LC.

Retirement charges are payable at the end of the LC period. They include an advising fee charged by the advising bank, reimbursements payable by the applicant to the bank against foreign law-related obligations, the confirming bank’s fee, and bank charges payable to the issuing bank.

Parties involved in an LC

Main parties involved:

Applicant An applicant (buyer) is a person who requests his bank to issue a letter of credit.

Beneficiary A beneficiary is basically the seller who receives his payment under the process.

Issuing bank The issuing bank (also called an opening bank) is responsible for issuing the letter of credit at the request of the buyer.

Advising bank The advising bank is responsible for the transfer of documents to the issuing bank on behalf of the exporter and is generally located in the country of the exporter.

Other parties involved in an LC arrangement:

Confirming bank The confirming bank provides an additional guarantee to the undertaking of the issuing bank. It comes into the picture when the exporter is not satisfied with the assurance of the issuing bank.

Negotiating bank The negotiating bank negotiates the documents related to the LC submitted by the exporter. It makes payments to the exporter, subject to the completeness of the documents, and claims reimbursement under the credit.

(Note:- Negotiating bank can either be a separate bank or an advising bank)

Reimbursing bank The reimbursing bank is where the paying account is set up by the issuing bank. The reimbursing bank honors the claim that settles the negotiation/acceptance/payment coming in through the negotiating bank.

Second Beneficiary The second beneficiary is one who can represent the original beneficiary in their absence. In such an eventuality, the exporter’s credit gets transferred to the second beneficiary, subject to the terms of the transfer.

What is the process of getting an LC?

The process of getting an LC consists of four primary steps, which are enlisted here:

Step 1 - Issuance of LC

After the parties to the trade agree on the contract and the use of LC, the importer applies to the issuing bank to issue an LC in favor of the exporter. The LC is sent by the issuing bank to the advising bank. The latter is generally based in the exporter’s country and may even be the exporter’s bank. The advising bank (confirming bank) verifies the authenticity of the LC and forwards it to the exporter.

Step 2 - Shipping of goods

After receipt of the LC, the exporter is expected to verify the same to their satisfaction and initiate the goods shipping process.

Step 3 - Providing Documents to the confirming bank

After the goods are shipped, the exporter (either on their own or through the freight forwarders ) presents the documents to the advising/confirming bank.

Step 4 - Settlement of payment from importer and possession of goods

The bank, in turn, sends them to the issuing bank and the amount is paid, accepted, or negotiated, as the case may be. The issuing bank verifies the documents and obtains payment from the importer. It sends the documents to the importer, who uses them to get possession of the shipped goods.

What is an example of an LC?

Suppose Mr. A (an India based exporter) has a sales contract with Mr. B (an importer from Australia) for delivering a batch of medical equipment to the latter. Both parties being unknown to each other, decide to go for an LC arrangement. Company B applies for a letter of credit with a bank in Australia. The document assures Mr. A of the payment in exchange for the shipment of the cargo. From this point on, this is how a letter of credit transaction would unveil between Mr. A & Mr. B:-

- Mr. B (buyer) goes to their bank, that is, the issuing bank or opening bank, and requests to issue an LC.

- The issuing bank further processes the LC to the advising bank (A's India-based bank).

- The advising bank checks the authenticity of the LC and sends it to Mr. A.

- Now Mr. A will ship the goods.

- Furthermore, they will send specific trade documents, including the bill of lading, to the negotiating bank.

- The negotiating bank will make sure that all requirements are fulfilled and make the payment to Mr. A.

- Additionally, the negotiating bank will send all the necessary documents, including the bill of lading, to the issuing bank.

- The issuing bank will send these documents to Mr. B (Buyer) to confirm their authenticity.

- After the confirmation of shipment, Company B completes the payment to Company A in India.

- And the issuing bank will pass on the funds to the negotiating bank.

- If Company B is not able to furnish the required funds, their issuing bank completes payment on their behalf.

To understand the process clearly refer to this image:

- Letter of credit Sample Format

- Types of Letter of Credit

Following are the most commonly used or known types of letter of credit:-

- Revocable Letter of Credit

- Irrevocable Letter of Credit

- Confirmed Letter of Credit

- Unconfirmed Letter of Credit

- LC at Sight

- Usance LC or Deferred Payment LC

- Back to Back LC

- Transferable Letter of Credit

- Un-transferable Letter of Credit

- Standby Letter of Credit

- Freely Negotiable Letter of Credit

- Revolving Letter of Credit

- Red Clause LC

- Green Clause LC

To understand each type in detail read the article, Types of letter of credit used in International Trade .

What is the application process for an LC?

Importers have to follow a specific procedure to follow for the application of LCs. The process is listed here:

- After a sales agreement is created and signed between the importer and the exporter, the importer applies to their bank to draft a letter of credit in favor of the exporter.

- The issuing bank (importer’s bank) creates a letter of credit that matches the terms and conditions of the sales agreement before sending it to the exporter’s bank.

- The exporter and their bank need to evaluate the creditworthiness of the issuing bank. After doing so and verifying the letter of credit, the exporter’s bank approves and sends the document to the importer.

- After that, the exporter manufactures and ships the goods as per the agreed timeline. A shipping line or freight forwarder assists with the delivery of goods.

- Along with the goods, the exporter also submits documents to their bank for compliance with the sales agreement.

- After approval, the exporter’s bank then sends these complying documents to the issuing bank.

- Once the documents are reviewed, the issuing bank releases the payment to the exporter and sends the documents to the importer to collect the shipment.

What are the Benefits of an LC?

A letter of credit is beneficial for both parties as it assures the seller that they will receive their funds upon fulfillment of the terms of the trade agreement, while the buyer can portray his creditworthiness and negotiate longer payment terms by having a bank back the trade transaction.

Letters of credit have several benefits for both the importer and the exporter. The primary benefit for the importer is being able to control their cash flow by avoiding prepayment for goods. Meanwhile, the chief advantage for exporters is a reduction in manufacturing risk and credit risk. Ultimately, since the trade deals are often international, there are factors like location, distance, laws, and regulations of the involved countries that need to be taken into account. The following are advantages of a letter of credit explained in detail.

LC reduces the risk of late-paying or non-paying importers There might be instances when the importer changes or cancels their order while the exporter has already manufactured and shipped the goods. The importers could also refuse payment for the delivered shipments due to a complaint about the goods. In such circumstances, a letter of credit will ensure that the exporter or seller of the goods receives their payment from the issuing bank. This document also safeguards if the importer goes into bankruptcy.

LC helps importers prove their creditworthiness Small to midsize businesses do not have vast reserves of capital for managing payments for raw materials, equipment, or any other supplies. When they are in a contract to manufacture a product and send it to their client within a small window, they cannot wait around to free up capital for buying supplies. This is where letters of credit come to their rescue. A letter of credit helps them with important purchases and serves as proof to the exporter that they will fulfill the payment obligations, thus avoiding any transaction and manufacturing delays.

LCs help exporters with managing their cash flow more efficiently A letter of credit also ensures that payment is received on time for the exporters or sellers. This is especially important if there is a huge period of time between the delivery of goods and payment for them. Ensuring timely payments through the letter of credit will go a long way in helping the exporters manage their cash flow. Furthermore, sellers can obtain financing between the shipment of goods and receipt of payment, which can provide an additional cash boost in the short term.

- Bank guarantee vs letter of credit

A Bank guarantee is a commercial instrument. It is an assurance given by the bank for a non-performing activity. If any activity fails, the bank guarantees to pay the dues. There are 3 parties involved in the bank guarantee process i.e the applicant, the beneficiary and the banker.

Whereas, a Letter of Credit is a commitment document. It is an assurance given by the bank or any other financial institution for a performing activity. It guarantees that the payment will be made by the importer subjected to conditions mentioned in the LC. There are 4 parties involved in the letter of credit i.e the exporter, the importer, issuing bank and the advising bank (confirming bank).

Things to consider before getting an LC

A key point that exporters need to remind themselves of is the need to submit documents in strict compliance with the terms and conditions of the LC. Any sort of non-adherence with the LC can lead to non-payment or delay and disputes in payment.

The issuing bank should be a bank of robust reputation and have the strength and stability to honor the LC when required.

Another point that must be clarified before availing of an LC is to settle the responsibility of cost-bearing. Allotting costs to the exporter will escalate the cost of recovery. The cost of an LC is often more than that of other modes of export payment. So, apart from the allotment of costs, the cost-benefit of an LC compared to other options must also be considered.

FAQs on Letter of Credit

1. is letter of credit safe.

Yes. Letter of Credit is a safe mode of payment widely used for international trade transactions.

2. How much does it cost for a letter of credit?

Letters of credit normally cost 1% of the amount covered in the contract. But the cost may vary from 0.25% to 2% depending on various other factors.

3. Can a letter of credit be cancelled?

In most cases letters of credit are irrevocable and cannot be cancelled without the agreed consent of all parties.

4. Can a letter of credit be discounted?

A letter of credit can be discounted. While getting an LC discounted the supplier or holde of LC should verify whether the issuing bank is on the approved list of banks, with the discounting bank. Once the LC is approved, the discounting bank releases the funds after charging a certain amount as premium.

5. Is a letter of credit a not negotiable instrument?

A letter of credit is said to be a negotiable instrument, as the bank has dealings with the documents and not the goods the transaction can be transferred with the assent of the parties.

6. Are letters of credit contingent liability?

It would totally depend on future circumstances. For instance, if a buyer is not in a condition to make the payment to the bank then the bank has to bear the cost and make the arrangement on behalf of the buyer.

7. A letter of credit is with recourse or without recourse?

A 'without recourse' letter of credit to the beneficiary is a confirmed LC. Whereas an unconfirmed or negotiable letter of credit is 'with recourse' to the beneficiary.

8. Who is responsible for letters of credit?

The issuing bank takes up the responsibility to complete the payment if the importer fails to do so. If it is a confirmed letter of credit, then the confirming bank has the responsibility to ensure payment if the issuing bank and importers fail to make the payment.

The Uniform Customs and Practice for Documentary Credits (UCP) describes the legal framework for all letters of credit. The current version is UCP600 which stipulates that all letters will be irrevocable until specified.

- Deemed Exports | Meaning, Eligibility, and Benefits

- Demurrage - Meaning & Charges in Shipping

- How to calculate CBM in Shipping?

- What is Trade Finance and How Does it Works?

- Line of Credit | Meaning, Interest Rate, Uses & more

Siddhi Parekh

Finance manager at drip capital.

Table of Content

- Letter of Credit - Process

- Letter of Credit with Example

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used in accordance with and for the purposes set out in our Privacy Policy and acknowledge that your have read, understood and consented to all terms and conditions therein.

Connect with us!

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

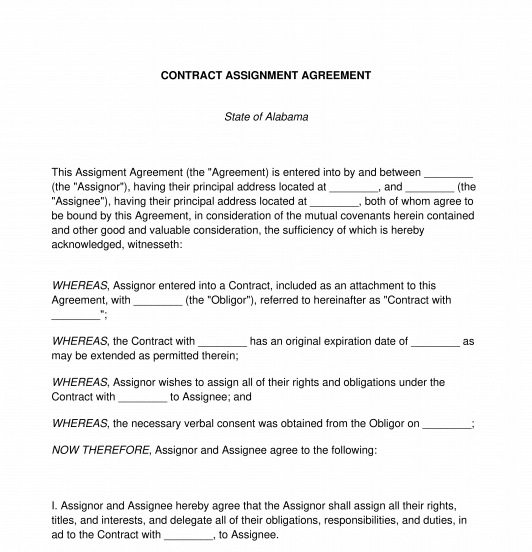

Contract Assignment Agreement

Rating: 4.8 - 105 votes

This Contract Assignment Agreement document is used to transfer rights and responsibilities under an original contract from one Party, known as the Assignor, to another, known as the Assignee. The Assignor who was a Party to the original contract can use this document to assign their rights under the original contract to the Assignee, as well as delegating their duties under the original contract to that Assignee. For example, a nanny who as contracted with a family to watch their children but is no longer able to due to a move could assign their rights and responsibilities under the original service contract to a new childcare provider.

How to use this document

Prior to using this document, the original contract is consulted to be sure that an assignment is not prohibited and that any necessary permissions from the other Party to the original contract, known as the Obligor, have been obtained. Once this has been done, the document can be used. The Agreement contains important information such as the identities of all parties to the Agreement, the expiration date (if any) of the original contract, whether the original contract requires the Obligor's consent before assigning rights and, if so, the form of consent that the Assignor obtained and when, and which state's laws will govern the interpretation of the Agreement.

If the Agreement involves the transfer of land from one Party to another , the document will include information about where the property is located, as well as space for the document to be recorded in the county's official records, and a notary page customized for the land's location so that the document can be notarized.

Once the document has been completed, it is signed, dated, and copies are given to all concerned parties , including the Assignor, the Assignee, and the Obligor. If the Agreement concerns the transfer of land, the Agreement is then notarized and taken to be recorded so that there is an official record that the property was transferred.

Applicable law

The assignment of contracts that involve the provision of services is governed by common law in the " Second Restatement of Contracts " (the "Restatement"). The Restatement is a non-binding authority in all of U.S common law in the area of contracts and commercial transactions. Though the Restatement is non-binding, it is frequently cited by courts in explaining their reasoning in interpreting contractual disputes.

The assignment of contracts for sale of goods is governed by the Uniform Commercial Code (the "UCC") in § 2-209 Modification, Rescission and Waiver .

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Assignment Agreement, Assignment of Contract Agreement, Contract Assignment, Assignment of Contract Contract, Contract Transfer Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Meeting Notice

- Other downloadable templates of legal documents

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Assignment Agreement

Assignment Agreement Template

Use our assignment agreement to transfer contractual obligations.

Updated February 1, 2024 Reviewed by Brooke Davis

An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the “assignor”) to another (the “assignee”). You can use it to reassign debt, real estate, intellectual property, leases, insurance policies, and government contracts.

What Is an Assignment Agreement?

What to include in an assignment agreement, how to assign a contract, how to write an assignment agreement, assignment agreement sample.

Partnership Interest

An assignment agreement effectively transfers the rights and obligations of a person or entity under an initial contract to another. The original party is the assignor, and the assignee takes on the contract’s duties and benefits.

It’s often a requirement to let the other party in the original deal know the contract is being transferred. It’s essential to create this form thoughtfully, as a poorly written assignment agreement may leave the assignor obligated to certain aspects of the deal.

The most common use of an assignment agreement occurs when the assignor no longer can or wants to continue with a contract. Instead of leaving the initial party or breaking the agreement, the assignor can transfer the contract to another individual or entity.

For example, imagine a small residential trash collection service plans to close its operations. Before it closes, the business brokers a deal to send its accounts to a curbside pickup company providing similar services. After notifying account holders, the latter company continues the service while receiving payment.

Create a thorough assignment agreement by including the following information:

- Effective Date: The document must indicate when the transfer of rights and obligations occurs.

- Parties: Include the full name and address of the assignor, assignee, and obligor (if required).

- Assignment: Provide details that identify the original contract being assigned.

- Third-Party Approval: If the initial contract requires the approval of the obligor, note the date the approval was received.

- Signatures: Both parties must sign and date the printed assignment contract template once completed. If a notary is required, wait until you are in the presence of the official and present identification before signing. Failure to do so may result in having to redo the assignment contract.

Review the Contract Terms

Carefully review the terms of the existing contract. Some contracts may have specific provisions regarding assignment. Check for any restrictions or requirements related to assigning the contract.

Check for Anti-Assignment Clauses

Some contracts include anti-assignment clauses that prohibit or restrict the ability to assign the contract without the consent of the other party. If there’s such a clause, you may need the consent of the original parties to proceed.