- Remember me Not recommended on shared computers

Forgot your password?

- Collections

DEBT BUYER MUST PROVE ASSIGNMENT

By Guest Informed, December 16, 2011 in Collections

- Start new topic

Recommended Posts

Guest informed.

“Debt Buyer Sentenced For Fraud Conviction,” Collections & Credit Risk (November 19, 2009) (quoting Dan Cofall of NorAm Capital Holdings). Other problems have included debtors settling with one creditor and then being sued by another who allegedly purchased the debt (Smith v. Mallick, 514 F.3d 48 (D.C.Cir. 2008)), disputes between debt buyers over who owns which account when buyers have purchased partial portfolios (Wood v. M&J Recovery LLC, CV 05-5564, 2007 U.S. Dist. LEXIS 24157 (E.D.N.Y., April 2, 2007) (dispute over who owned the 1/5th of a portfolio that included the debtor’s account), or debt buyers attempting to collect monies in excess of the balance of a previously settled debt (Overcash v. United Abstract Group, Inc., 549 F. Supp. 2d 193 (N.D.N.Y. 2008)).

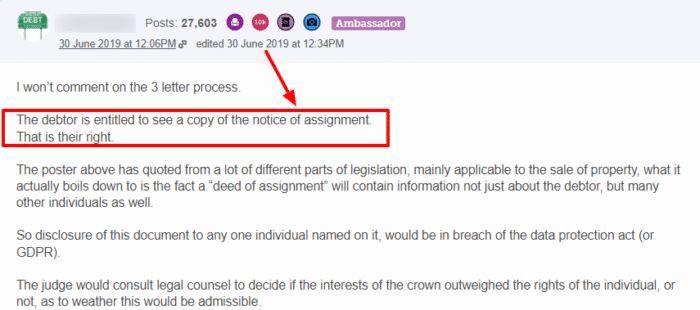

In a string of cases refusing to grant judgment to debt buyers based on confusion over ownership, the New York courts have succinctly summarized the issue:

Because multiple creditors may make collection efforts for the same underlying debt even after assignment… failure to give notice of an assignment may result in the debtor having to pay the same debt more than once or ignoring a notice because the debtor believes he or she has previously settled the claim.

MBNA Am. Bank v. Nelson, 15 Misc. 3rd 1148, 841 N.Y.S. 2d 846 (N.Y. 2007). The problem of establishing ownership, according to the MBNA court, deals squarely with the core issue of standing, i.e., the ability to even bring the case into court:

It is imperative that an assignee establish its standing before a court, since "lack of standing renders the litigation a nullity." It is the "assignee's burden to prove the assignment" and "an assignee must tender proof of assignment of a particular account or, if there were an oral assignment, evidence of consideration paid and delivery of the assignment." Such assignment must clearly establish that Respondent's account was included in the assignment. A general assignment of accounts will not satisfy this standard and the full chain of valid assignments must be provided, beginning with the assignor where the debt originated and concluding with the Petitioner. . . .

This problem has come to the forefront because Issuers, Debt Buyers and the ARM industry face a set of “perfect storm” circumstances. High debt volume, high default and a long economic downturn have resulted in heightened scrutiny of the industries as well as increased regulations and awareness about deficiencies that exist in proving account level ownership. This in turn creates enormous hurdles in proving the fundamental basis of a lawsuit: standing, which in turn leads to substantial enterprise wide regulatory actions and legal action exposure, higher costs, reduced efficiencies, and lower recovery rates.

The response by regulators, judges and lawmakers has been to increase the burden of verification significantly for the debt owner, making the cost and effort to collect on purchased debt inordinately high absent proof of ownership. At least one municipality, five states and one set of local court rules now require additional proof from debt owners to verify their ownership of accounts in collection suits or otherwise subject debt buyers to requirements formerly restricted to collection agencies:

Jurisdiction

Law or Rule

Requirements

New York City Council

Local Rule No. 15 (amending NY Admin. Code 20489) and implementing rules from Department of Consumer Affairs

Subjects debt buyers to same requirements as collection agencies; requires for purchased debt a record of the name and address of the seller, date of purchase and amount of debt at time of purchase

New York State

Consumer Credit Fairness Act (CCFA)

Proof of debt must include name of original creditor and all assignees

Debt buyers added to this Act—requires written agreement evidencing assignment of debt, recording of assignments

Circuit Court of Cook County,

Local rule 10.9

Debt buyer suits shall include “Legallysufficient documentation for each transfer or assignment of the account, including documents identifying the specific account”

North Carolina

Changes to N.C. G.S. 58-70-150)

Subjects debt buyers to debt collector laws; require debt buyers to provide documents proving ownership of accounts

House Bill No. 2996 (pending)

Debt buyers must attach to complaint a copy of the assignment establishing that the person is the owner of the debt, and “if debt has been assigned more than once, then each assignment or other writing evidencing transfer of ownership must be attached to establish an unbroken chain of ownership”

Changes to Tennessee Code Annotated 60-20102(3)

Subjects debt buyers to debt collector laws, requiring debt buyers to provide documents proving ownership of accounts under TCA 60-20-127(a)

In addition, numerous courts have ruled that debt buyers lacked standing to proceed with suits or claims against debtors, where the debt buyer was unable to prove a chain of title to the account. See Unifund CCR Partners v. Cavender, 14 Fla. L. Weekly Supp. 975b (Orange County, July 20, 2007); MBNA Am. Bank v. Nelson, 15 Misc. 3rd 1148, 841 N.Y.S. 2d 846 (N.Y. 2007); In re Leverett, 378 B.R. 793, 800

v. 12011***********************

********************************************************

Debt buyers added to this Act—requires written agreement evidencing assignment of debt, recording of assignments)

Nana...This is interesting "recording of assignments"...

does this mean that a Debt Buyer must record THE ASSIGNMENT WITH A COUNTY COURT RECORDER ?

Link to comment

Share on other sites.

- Existing user? Sign In

- Unread Content

- All Activity

- My Activity Streams

- Content I Started

- Leaderboard

- Online Users

- Create New...

Important Information

We have placed cookies on your device to help make this website better. You can adjust your cookie settings , otherwise we'll assume you're okay to continue.. For more information, please see our Privacy Policy and Terms of Use .

What Does a Debt Collector Have to Prove in Court?

Sarah Edwards | March 06, 2023

Legal Expert Sarah Edwards, BS

Sarah Edwards is a professional researcher and writer specializing in legal content. An Emerson College alumna, she holds a Bachelor of Science in Communication from the prestigious Boston institution.

Edited by Hannah Locklear

Editor at SoloSuit Hannah Locklear, BA

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Summary: A creditor is the company or organization that originally owns your debt, while a debt collector is someone who collects the debt on their behalf or purchases the debt account from the creditor. In order to win a court case, a debt collector must prove that they have proper ownership of the debt, that you actually owe the debt, and that the amount they claim you owe is correct.

Have you recently been sued by a debt collector? If so, you’re likely wondering what your options are.

You can pay the debt or arrange a payment plan before your court date, attempt to defend yourself before the judge, or avoid the issue entirely and let the chips fall where they may.

Many try to pay off or settle the debt before the court date, but it’s not a viable option if you don’t have the money available. If you avoid responding to the lawsuit, the judge will likely grant a default judgment to your creditor.

The judgment will allow your creditor to garnish your wages or pursue the money in other ways, like freezing your bank account.

While judgments no longer appear on your credit report, they impact your life. An employer or creditor who runs a more intensive background check on you will likely come across your judgment since it appears in public records. If this happens, they may be less likely to hire you or approve you for a loan.

The final option to deal with a lawsuit for debt is to defend yourself in court .

Going to court to argue against a creditor may sound fruitless, especially if you know you owe the money. However, if you put the appropriate effort into defending yourself, you may be pleasantly surprised with the results.

What happens after a creditor or debt collector sues me?

You’ll receive a court Summons and Complaint (also known as Petition in some states) if a creditor or debt collector decides to sue you. These are the court documents that initiate a lawsuit. They may come in the mail, or a court officer may deliver it to your door. Once you receive the Summons and Complaint, you’ll have around 14-35 days to respond , depending on where you live. Your response is necessary if you intend to argue against your creditor.

In your response, list your reasons why the court should rule in your favor. Each reason is a defense in your case.

For instance, you may argue that the statute of limitations has passed or that you were the victim of identity theft. Other potential defenses include the lack of a business relationship between you and the debt collector or proof that you have already satisfied the debt through other means.

SoloSuit can help you draft and file an Answer to a lawsuit in a matter of minutes. Learn more about how to respond to a debt lawsuit in this video:

Will the court review my response?

Yes, the court and the opposing side will have a chance to view your response before the trial.

Once the creditor or debt collector has your response, they will likely prepare their defense against it. However, if your defense is adequate, they may move to dismiss the case or come to a settlement agreement with you.

There are three potential outcomes to your lawsuit, should you decide to defend it. The court may find your defense lacking and decide to issue a judgment against you, your creditor may attempt to settle the matter with you privately, or the court may dismiss your case.

There is a difference between a creditor and debt collector

It’s important to understand the difference between your original creditor and a debt collector. The creditor is the company or agency that offered you the original loan or line of credit. This could be a bank, credit card company, lender, etc. So, your creditor owns your debt from the beginning.

On the other hand, a debt collector is usually hired by a creditor to collect the debt on their behalf. This could be a third-party debt collection agency or some creditors have internal collections departments.

Keep in mind that some debt collectors are also debt buyers. They may have purchased an old debt of yours from your creditor at a discounted rate, and now they’re trying to get you to pay off the full amount.

What does the creditor have to prove in a debt lawsuit?

A creditor must prove three basic facts in court to win their case. These facts include:

- The creditor owns your debt.

- You are the individual who owes the debt.

- The amount you owe is accurate.

The burden of proof of all three facts rests with the plaintiff who sues you—or in this case, your creditor.

What does a debt collector have to prove in court?

Similarly, a debt collector must prove the following facts to win their case in court:

- The debt collection agency owns your debt and has the legal right to sue.

- You owe the debt.

- The amount they claim you owe is accurate.

If the debt collector purchased your old debt account from your creditor, they must show proof that the account was properly transferred to their ownership, giving them the legal right to sue for it.

How do debt collectors show proof of ownership of my debt?

An original creditor will produce the credit agreement you initially signed to prove ownership. For example, a credit card lender may provide your initial credit application and acceptance of the loan.

Things get dicier when the original creditor has sold the loan to a debt collection agency. If the debt collector sues you, they must prove that they purchased your debt from your creditor. Generally, they do so by providing a copy of the purchase agreement.

If the debt collection agency resells your account to another debt collector, the chain of ownership grows. The final debt collector who decides to sue you for a debt must produce evidence of all debt repurchases.

As you can imagine, new debt collectors may have difficulty proving they own your debt, especially if various companies have transferred it throughout the years.

How can a creditor establish that I owe the debt?

Establishing that you are the individual who owes the debt is another objective the debt collector or creditor must overcome.

It’s generally easier for first-party creditors to prove you owe a debt. They simply produce the original credit agreement that shows your name and identifying information, like your address and Social Security number.

However, when a first-party creditor sells your account to a debt collection agency, it’s easy for personal information to get lost in the shuffle. Debt collection agencies often purchase thousands of overdue accounts at once. During the purchase, they may mix up account details or receive information from the original creditor that isn’t accurate.

If your account transfers hands multiple times, essential information like your account number and contact details may be lost. Mixed-up account information works in your favor, as the debt collector won’t be able to prove the debt is yours.

You may also have an adequate defense to your lawsuit if someone stole your identity to create the account or if the account belongs to another family member and you were simply an authorized user.

Can a debt collector prove that the amount I owe is accurate?

In a debt lawsuit, the creditor must prove the accuracy of the amount due to them. Previous account statements and complete sets of monthly bills help establish a full accounting of your debts.

Suppose that a debt collector purchases your account from a first-party creditor. In that case, they will need to identify any new charges for interest or processing that they have added to the amount you owe.

When you receive notification of a debt lawsuit, you should ask for an immediate accounting of the amount the plaintiff is suing you for. If you note any mistakes in the amount due, you can record them for your defense.

Is my defense likely to be successful?

Whatever reasons you decide to use in your defense, make sure you can prove them. Your ability to successfully defend yourself in a debt lawsuit will rest upon the validity of your claims and the evidence you present.

If you use defenses you can’t prove, a judge will likely see through them. If they believe your claims are without merit, they’ll probably issue a judgment against you.

The more evidence you can provide to support your claims, the better.

For instance, if you claim the statute of limitations expired, provide copies of the last transaction in the account. If you believe you are the victim of identity theft, file a complaint with the FTC and your local authorities.

If you have previously settled the debt, produce copies of your receipts or a canceled check.

The more information a judge has concerning your defense, the more likely they will decide the case in your favor.

Can I settle a debt before it goes to court?

Yes, settling a debt before going to court is entirely possible. To do so, simply contact the plaintiff before the court date and attempt to work out a payment plan or a payoff amount.

When you contact the entity suing you, let them know you are willing to work out a payment arrangement to avoid going to court. Frequently, debt collectors prefer to work out their claims with debtors instead of proceeding with a court case.

Going to court requires collectors to take time away from their regular duties to meet with a judge. The outcome of a court case isn’t guaranteed; they may show up only to find that a judge dismisses their case or issues a finding on your behalf.

On top of that, many debt collectors are debt buyers who purchased your debt for as little as 4% of its original amount. This means that, if you offer to pay off even just 50% of the debt amount, the collector will still make a huge profit. Therefore, debt collectors are usually willing to settle for less.

If you attempt to settle your debt without going to court , make sure you have your defenses ready. Explain why the defense applies to your case.

It’s helpful to get someone on the phone with authority to decide on your offer. Otherwise, you may spend time explaining the situation to someone whose responsibilities mainly concern customer service.

Settle with SoloSettle

Before offering to settle the debt, make sure you have an amount in mind that you can afford to pay. If the creditor accepts your offer, you’ll likely need to pay the amount on the spot.

Suppose that you don’t have the financial means to make a lump-sum payment. Try to negotiate a payment plan. Sometimes creditors and debt collectors will agree to a payment plan rather than going to court for a judgment, especially if they believe collecting money from you all at once will be difficult.

Start the settlement process with the help of SoloSettle.

To learn more about how to reach a settlement with your creditor or debt collector, check out this video:

What happens if a creditor refuses to settle before court?

If your creditor doesn’t want to accept a settlement or payment plan, you’ll need to move forward with defending yourself before the judge. Make sure to gather all evidence for your defense and be prepared to answer questions in court.

In most cases, you can defend yourself in a small claims debt lawsuit on your own. However, if your case involves significant amounts of money, you may be better off seeking the assistance of a qualified attorney.

What is SoloSuit?

SoloSuit makes it easy to fight debt collectors.

You can use SoloSuit to respond to a debt lawsuit, to send letters to collectors, and even to settle a debt.

SoloSuit's Answer service is a step-by-step web-app that asks you all the necessary questions to complete your Answer. Upon completion, we'll have an attorney review your document and we'll file it for you.

Respond with SoloSuit

"First time getting sued by a debt collector and I was searching all over YouTube and ran across SoloSuit, so I decided to buy their services with their attorney reviewed documentation which cost extra but it was well worth it! SoloSuit sent the documentation to the parties and to the court which saved me time from having to go to court and in a few weeks the case got dismissed!" – James

We have answers. Join our community of over 40,000 people.

You can ask your questions on the SoloSuit forum and the community will help you out. Whether you need help now or are just looking for support, we're here for you.

>>Read the FastCompany article: Debt Lawsuits Are Complicated: This Website Makes Them Simpler To Navigate

>>Read the NPR story on SoloSuit. (We can help you in all 50 states.)

How to answer a summons for debt collection in your state

Here's a list of guides for other states.

All 50 states .

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Guides on how to beat every debt collector

Being sued by a different debt collector? Were making guides on how to beat each one.

- Absolute Resolutions Investments LLC

- Accredited Collection Services

- Alliance One

- Amcol Clmbia

- American Recovery Service

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Autovest LLC

- Cavalry SPV I LLC

- Cerastes LLC

- Covington Credit

- Crown Asset Management

- CTC Debt Collector

- Cypress Financial Recoveries

- Delanor Kemper & Associates

- Eagle Loan of Ohio

- Estate Information Services

- FIA Card Services

- Forster & Garbus

- Freshview Solutions

- Fulton Friedman & Gullace LLP

- Harvest Credit Management

- Howard Lee Schiff

- Hudson & Keyse LLC

- Integras Capital Recovery LLC

- Javitch Block

- Jefferson Capital Systems LLC

- LVNV Funding

- Mannbracken

- Mariner Finance

- Michael J Adams PC

- Michael J Scott

- Midland Funding LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Mountain Land Collections

- MRS Associates

- National Collegiate Trust

- Nationstar Foreclosure

- Northstar Capital Acquisition

- NRC Collection Agency

- OneMain Financial

- Palisades Collection LLC

- Pallida LLC

- Paragon Revenue Group

- Pinnacle Collections Agency

- Portfolio Recovery Associates

- Provest Law

- Reunion Student Loan Finance Corporation

- Revenue Group

- Regents and Associates

- Salander Enterprises LLC

- Second Round Sub LLC

- Security Credit Services

- Sherman Financial Group

- Suttell and Hammer

- Transworld Systems

- Tulsa Teachers Credit Union

- UCB Collection

- Velo Law Office

- Velocity Investments

- Waypoint Resource Group

- Weinberg and Associates

- Wolpoff & Abramson

Win against credit card companies

Is your credit card company suing you? Learn how you can beat each one.

- Bank of America

- Capital One

- Credit One Bank

- PayPal Synchrony Card

- SYNCB/PPEXTR

- Synchrony Bank

- Target National Bank

- Wells Fargo

Going to Court for Credit Card Debt — Key Tips

How to Negotiate Credit Card Debts

How to Settle a Credit Card Debt Lawsuit — Ultimate Guide

Get answers to these FAQs

Need more info on statutes of limitations? Read our 50-state guide.

Why do debt collectors block their phone numbers?

How long do debt collectors take to respond to debt validation letters?

What are the biggest debt collector companies in the US?

Is Zombie Debt Still a Problem in 2019?

SoloSuit FAQ

If a car is repossessed, do I still owe the debt?

Is Portfolio Recovery Associates Legit?

Is There a Judgment Against Me Without my Knowledge?

Should I File Bankruptcy Before or After a Judgment?

What is a default judgment?— What do I do?

Summoned to Court for Medical Bills — What Do I Do?

What Happens If Someone Sues You and You Have No Money?

What Happens If You Never Answer Debt Collectors?

What Happens When a Debt Is Sold to a Collection Agency

What is a Stipulated Judgment?

What is the Deadline for a Defendants Answer to Avoid a Default Judgment?

Can a Judgement Creditor Take my Car?

Can I Settle a Debt After Being Served?

Can I Stop Wage Garnishment?

Can You Appeal a Default Judgement?

Do I Need a Debt Collection Defense Attorney?

Do I Need a Payday Loans Lawyer?

Do student loans go away after 7 years? — Student Loan Debt Guide

Am I Responsible for My Spouses Medical Debt?

Should I Marry Someone With Debt?

Can a Debt Collector Leave a Voicemail?

How Does Debt Assignment Work?

What Happens If a Defendant Does Not Pay a Judgment?

Can You Serve Someone with a Collections Lawsuit at Their Work?

What Is a Warrant in Debt?

How Many Times Can a Judgment be Renewed in Oklahoma?

Can an Eviction Be Reversed?

Does Debt Consolidation Have Risks?

What Happens If You Avoid Getting Served Court Papers?

Does Student Debt Die With You?

Can Debt Collectors Call You at Work in Texas?

How Much Do You Have to Be in Debt to File for Chapter 7?

What Is the Statute of Limitations on Debt in Washington?

How Long Does a Judgment Last?

Can Private Disability Payments Be Garnished?

Can Debt Collectors Call From Local Numbers?

Does the Fair Credit Reporting Act Work in Florida?

The Truth: Should You Never Pay a Debt Collection Agency?

Should You Communicate with a Debt Collector in Writing or by Telephone?

Do I Need a Debt Negotiator?

What Happens After a Motion for Default Is Filed?

Can a Process Server Leave a Summons Taped to My Door?

Learn More With These Additional Resources:

Need help managing your finances? Check out these resources.

How to Make a Debt Validation Letter - The Ultimate Guide

How to Make a Motion to Compel Arbitration Without an Attorney

How to Stop Wage Garnishment — Everything You Need to Know

How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

Defending Yourself in Court Against a Debt Collector

Tips on you can to file an FDCPA lawsuit against a debt collection agency

Advice on how to answer a summons for debt collection.

Effective strategies for how to get back on track after a debt lawsuit

New Hampshire Statute of Limitations on Debt

Sample Cease and Desist Letter Against Debt Collectors

The Ultimate Guide to Responding to a Debt Collection Lawsuit in Utah

West Virginia Statute of Limitations on Debt

What debt collectors cannot do — FDCPA explained

Defending Yourself in Court Against Debt Collector

How to Liquidate Debt

Arkansas Statute of Limitations on Debt

Youre Drowning in Debt — Heres How to Swim

Help! Im Being Sued by My Debt Collector

How to Make a Motion to Vacate Judgment

How to Answer Summons for Debt Collection in Vermont

North Dakota Statute of Limitations on Debt

ClearPoint Debt Management Review

Indiana Statute of Limitations on Debt

Oregon Eviction Laws - What They Say

CuraDebt Debt Settlement Review

How to Write a Re-Aging Debt Letter

How to Appear in Court by Phone

How to Use the Doctrine of Unclean Hands

Debt Consolidation in Eugene, Oregon

Summoned to Court for Medical Bills? What to Do Next

How to Make a Debt Settlement Agreement

Received a 3-Day Eviction Notice? Heres What to Do

How to Answer a Lawsuit for Debt Collection

Tips for Leaving the Country With Unpaid Credit Card Debt

Kansas Statute of Limitations on Debt Collection

How to File in Small Claims Court in Iowa

How to File a Civil Answer in Kings County Supreme Court

Roseland Associates Debt Consolidation Review

How to Stop a Garnishment

Debt Eraser Review

Do Debt Collectors Ever Give Up?

Can They Garnish Your Wages for Credit Card Debt?

How Often Do Credit Card Companies Sue for Non-Payment?

How Long Does a Judgement Last?

How Long Before a Creditor Can Garnish Wages?

How to Beat a Bill Collector in Court

It only takes 15 minutes. And 50% of our customers' cases have been dismissed in the past.

"Finding yourself on the wrong side of the law unexpectedly is kinda scary. I started researching on YouTube and found SoloSuit's channel. The videos were so helpful, easy to understand and encouraging. When I reached out to SoloSuit they were on it. Very professional, impeccably prompt. Thanks for the service!" – Heather

Not sued yet? Use our Debt Validation Letter.

Our Debt Validation Letter is the best way to respond to a collection letter. Many debt collectors will simply give up after receiving it.

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Search our site

Assignment Of Debt Agreement

Jump to Section

What is an assignment of debt agreement.

An assignment of debt agreement is a legal document between a debtor and creditor that outlines the repayment terms. An assignment of debt agreement can be used as an alternative to bankruptcy, but several requirements must be met for it to work.

In addition, if obligations are not met under a debt agreement, it might still be necessary to file for bankruptcy later on. Therefore, consulting with an attorney specializing in debt agreements is always recommended before entering into one of these contracts.

Assignment Of Debt Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 5 exhibit1024f10qsbmay04.htm EXHIBIT 10.24 , Viewed December 20, 2021, View Source on SEC .

Who Helps With Assignment Of Debt Agreements?

Lawyers with backgrounds working on assignment of debt agreements work with clients to help. Do you need help with an assignment of debt agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignment of debt agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

Meet some of our Assignment Of Debt Agreement Lawyers

Ferraro Law Firm was founded by Dean C. Ferraro. Dean earned his Bachelor's Degree from California State Polytechnic University, Pomona ("Cal Poly Pomona") in 1992 and his J.D. Degree from the University of Mississippi School of Law ("Ole Miss") in 1996. He is licensed to practice law in the State Courts of Colorado, Tennessee, and California. Dean is also admitted to practice before the United States District Courts of Colorado (District of Colorado), California (Central District), and Tennessee (Eastern District). Shortly after earning his law license and working for a private law firm, Dean joined the District Attorney's office, where he worked for five successful years as one of the leading prosecuting attorneys in the State of Tennessee. After seven years of practicing law in Tennessee, Dean moved back to his birth state and practiced law in California from 2003-2015. In 2015, Dean moved with his family to Colorado, practicing law in beautiful Castle Rock, where he is recognized as a highly-effective attorney, well-versed in many areas of law. Dean's career has entailed practicing multiple areas of law, including civil litigation with a large law firm, prosecuting criminal cases as an Assistant District Attorney, In-House Counsel for Safeco Insurance, and as the founding member of an online law group that helped thousands of people get affordable legal services. Pursuing his passion for helping others, Dean now utilizes his legal and entrepreneurial experience to help his clients in their personal and business lives. Dean is also a bestselling author of two legal thrillers, Murder in Santa Barbara and Murder in Vail. He currently is working on his next legal thriller, The Grove Conspiracy, set to be published in 2023.

Jason is a self-starting, go-getting lawyer who takes a pragmatic approach to helping his clients. He co-founded Fortify Law because he was not satisfied with the traditional approach to providing legal services. He firmly believes that legal costs should be predictable, transparent and value-driven. Jason’s entrepreneurial mindset enables him to better understand his clients’ needs. His first taste of entrepreneurship came from an early age when he helped manage his family’s small free range cattle farm. Every morning, before school, he would deliver hay to a herd of 50 hungry cows. In addition, he was responsible for sweeping "the shop" at his parent's 40-employee HVAC business. Before becoming a lawyer, he clerked at the Lewis & Clark Small Business Legal Clinic where he handled a diverse range of legal issues including establishing new businesses, registering trademarks, and drafting contracts. He also spent time working with the in-house team at adidas® where, among other things, he reviewed and negotiated complex agreements and created training materials for employees. He also previously worked with Meriwether Group, a Portland-based business consulting firm focused on accelerating the growth of disruptive consumer brands and facilitating founder exits. These experiences have enabled Jason to not only understand the unique legal hurdles that can threaten a business, but also help position them for growth. Jason's practice focuses on Business and Intellectual Property Law, including: -Reviewing and negotiating contracts -Resolving internal corporate disputes -Creating employment and HR policies -Registering and protecting intellectual property -Forming new businesses and subsidiaries -Facilitating Business mergers, acquisitions, and exit strategies -Conducting international business transactions In his free time, Jason is an adventure junkie and gear-head. He especially enjoys backpacking, kayaking, and snowboarding. He is also a technology enthusiast, craft beer connoisseur, and avid soccer player.

Maigan is a registered nurse and attorney with tech law experience, specifically in Web3, including NFTs. Maigan acted as general counsel for a NFT platform for two years and speaks and understands smart contracts. As a registered nurse, Maigan is in a unique position to understand health law issues and graduated with a concentration in health law distinction. Maigan is happy to help you create a business entity, draft and negotiate contracts and agreements, apply for trademarks, draft terms of service and privacy notices, draft terms of sale for NFT drops, draft web3 licenses, and act as a consultant for other attorneys looking for someone who understands web3 and NFTs. Maigan speaks conversational Spanish.

Founder David W. Weygandt, the Singing Lawyer, is passionate about helping families and businesses stay in tune with what they care about and avoid conflict. When injustice has been done, David is proud to stand up to the modern Goliath and vindicate your rights on your behalf. David lives and practices law in The Woodlands, Texas, and assists clients all across Texas.

Attorney Nicole B. Phillips is a northwestern Iowa native and devotes her practice to the area of Family Law. She is an experienced trial attorney with over 12 years of family law experience. Nicole graduated from The University of South Dakota with a degree in Criminal Justice, and attended Oklahoma City University School of Law to obtain her law degree. Prior to establishing Phillips Law Firm, P.C., Nicole built her first successful law practice in Oklahoma City, Oklahoma, where she focused on Family Law, Estate Planning and Personal Injury Law, and her second successful law practice in Sherman, Texas, focusing primarily on Family Law. Nicole has one daughter, Arabella. In addition to enjoying time with her daughter, Nicole enjoys reading, family dinners, traveling, spending time with friends, and game nights.

Ari is a transactional attorney with substantial experience serving clients in regulated industries. He has worked extensively with companies in regulated state cannabis markets on developing governance documents (LLC operating agreements, corporate bylaws, etc...), as well as drafting and negotiating all manner of business and real estate contracts.

I'm a knowledgable and experienced New York licensed attorney with strong contract drafting and negotiation skills, a sophisticated business acumen, and a background working in entertainment and technology law.

Find the best lawyer for your project

How it works.

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt Agreement lawyers by city

- Austin Assignment Of Debt Agreement Lawyers

- Boston Assignment Of Debt Agreement Lawyers

- Chicago Assignment Of Debt Agreement Lawyers

- Dallas Assignment Of Debt Agreement Lawyers

- Denver Assignment Of Debt Agreement Lawyers

- Houston Assignment Of Debt Agreement Lawyers

- Los Angeles Assignment Of Debt Agreement Lawyers

- New York Assignment Of Debt Agreement Lawyers

- Phoenix Assignment Of Debt Agreement Lawyers

- San Diego Assignment Of Debt Agreement Lawyers

- Tampa Assignment Of Debt Agreement Lawyers

related contracts

- Accredited Investor Questionnaire

- Adverse Action Notice

- Bridge Loan

- Bridge Loan Contract

- Collateral Assignment

- Commercial Loan

- Convertible Bonds

- Convertible Note

- Convertible Preferred Stock

- Cumulative Preferred Stock

other helpful articles

- How much does it cost to draft a contract?

- Do Contract Lawyers Use Templates?

- How do Contract Lawyers charge?

- Business Contract Lawyers: How Can They Help?

- What to look for when hiring a lawyer

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

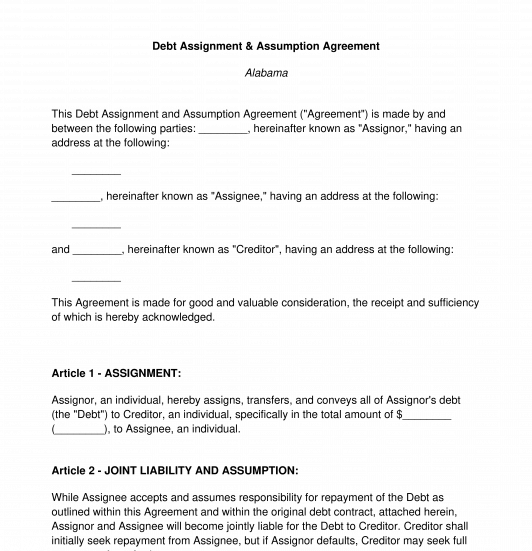

Debt Assignment and Assumption Agreement

Rating: 4.7 - 23 votes

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Agreement to Assign Debt, Agreement to Assume Debt, Assignment and Assumption of Debt, Assumption and Assignment of Debt Agreement, Debt Assignment Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

- Search Search Please fill out this field.

- Managing Your Debt

Sample Debt Validation Letter for Debt Collectors

Use this letter to dispute a debt collection you're unsure of

:max_bytes(150000):strip_icc():format(webp)/bio_LaToyaIrby-d7b87e77d6c441e5a61deecedbb3861a.png)

The Right To Request Validation

How to write a debt validation letter.

- The Debt Collector's Response to Your Validation Request

Frequently Asked Questions (FAQs)

How long does a collector have to respond to a debt validation letter, when should i request debt validation.

The Balance / Theresa Chiechi

Not every debt collector who contacts you is attempting to collect a legitimate debt. Sometimes debt collectors scam consumers into paying debts that aren't real or perhaps have already been paid.

Federal law gives you the right to request a debt collector provide proof that you owe a debt . It's the best way to ensure that you're not paying a debt you don't owe or a debt that the collector isn't authorized to collect on.

The debt validation request is time sensitive. You must make your request in writing within 30 days of the debt collector's initial contact with you. If you wait more than 30 days, your validation request may not be covered under debt collection law.

Your rights are not protected if you make your debt validation request over the phone. Don't worry if you don't know what to say in a letter; there's one below that you can use as a template.

Once you send a request for proof, also called a debt validation letter, the collector must stop collection efforts until they've sent sufficient proof of the debt. It means they cannot call you, send you letters, or list the debt on your credit report.

In the letter, reference the date of the initial contact and the method, for example, "a phone call received from your agency on April 25, 2019." You also need to provide a statement that you're requesting validation of the debt. Do not admit to owing the debt or make any reference to payment.

Send your letter via certified mail, so you have proof of when the letter was mailed and received.

Debt Validation Letter Example

Re: Account Number This letter is sent in response to [a letter/phone call] I received on [date you received the letter/call]. I am requesting that you provide verification of this debt. Please send the following information:

- The name and address of the original creditor, the account number, and the amount owed.

- Verification that there is a valid basis for claiming I am required to pay the current amount owed.

- Details about the age and amount of the debt including a copy of the last billing statement from the original creditor; a detailed explanation of any interest added or payments made since the last billing statement and the legal authorization for this interest; the date the original creditor claims this debt became delinquent.

- Whether this debt is within the statute of limitations and how that was determined.

Please also forward details about your authority to collect this debt: whether you are licensed in my state and if so provide the date of the license, name on the license, license number, and the license number, and the name, address, and telephone number of the state agency issuing the license. If you are contacting me from outside my state, provide the licensing information from your state as well. Sincerely, Your Name

The Debt Collector's Response to Your Validation Request

If the debt collector does not send you proof of the debt, any future collection efforts are in violation of the Fair Debt Collection Practices Act . Note that your account may be assigned or sold to a new debt collection agency. In that case, your validation request from the previous collection agency does not apply.

Otherwise, if the debt collector does send proof, determine whether or not the debt is within the statute of limitations, and then decide how you want to proceed. Paying the debt , takes care of the obligation for good. You may be able to negotiate a settlement for less than the full balance due. Finally, if the debt is outside the statute of limitations for your state, you can ignore the debt if you have no interest in paying it, but keep in mind that collection efforts can continue indefinitely.

The law does not specify a time window for a debt collector to respond to a debt validation letter. However, the collector must cease collection activities until it responds to your letter and provides proof that you owe the debt.

If you are unsure whether a debt is valid, you should submit a debt validation letter immediately. By law, you have 30 days to request validation after you receive a collections request. If you wait longer than this, the debt collector is not obligated to respond to your request.

Federal Trade Commission. " Fake Debt Collectors ."

Federal Trade Commission. " Fair Debt Collection Practices Act ," Pages 11-12.

Consumer Financial Protection Bureau. " What Information Does a Debt Collector Have to Give Me About the Debt? "

State of California Department of Justice. " Debt Collectors - Disputing a Debt ."

Minnesota Attorney General's Office. " Debt Buyers ."

Consumer Financial Protection Bureau. " What Is a Statue of Limitations On a Debt? "

Consumer Financial Protection Bureau. " What Is the Best Way to Negotiate a Settlement With a Debt Collector? "

Client Login

The Crawshaw Law Firm

Client login, practice areas, texas debt defense, assigned debt defense.

1. Assignments Generally

- What is an assignment – An assignment is “the transferring to another of one’s rights or property interest.”

- to constitute a valid assignment there must be a perfect transaction between the parties, intended to vest in the assignee a present right in the thing assigned.” Mitchell v. Scott, 14 S.W.2d 916, 917 (Tex. Civ. App. 1928)

2. Challenging an Assignment

a. To set up a challenge to being sued by a company who claims to have purchased the debt from your original creditor you must challenge the actual assignment. This is generally governed by Texas Rule of Civil Procedure 93(8).

- i. Texas Rule of Civil Procedure 93 says what types of pleadings must be sworn to in order to properly bring them into issue in court. Regarding assignments – Tex. R. Civ. P. 93(8) says:

- 1. A denial of the genuineness of the indorsement or assignment of a written instrument upon which suit is brought by an indorsee or assignee and in the absence of such a sworn plea, the indorsement or assignment thereof shall be held as fully proved. The denial required by this subdivision of the rule may be made upon information and belief. Tex. R. Civ. P. 93(8).

b. If you are being sued by an assignee (the person or company who bought the debt from the original creditor/assignor) you must raise the denial of the assignment to protect yourself. If you do not you are prevented from stating that the person/company suing is not actually the assignee.

3. Why Hire a Lawyer

a. Hiring a lawyer to defend you on debt claims brought by an assignee takes the burden off you.

b. Lawyers know to ask the assignee questions in discovery like the following:

- How much did you pay for the debt;

- Send us the actual original assignment contract between your original creditor and the assignee (the company suing you).

- Lawyers know when it is appropriate to file a Motion to Compel when the company suing you does not answer the discovery requests on time.

c. Many times the Plaintiff suing you as an assignee will not want to answer these questions and will dismiss the suit. Other times they will settle with you for a lot less. Of course, it all depends on the particular case.

d. Bottom line – many times hiring a lawyer to defend you can save you more money than you will have paid a lawyer. Plus, hiring a lawyer to advise you on how best to settle provides certainty and peace of mind knowing that a case is closed correctly – even if the case is not dismissed.

4. What Companies/Assignees has the Crawshaw Law Firm had dismiss cases?

a. TD AUTO FINANCE f/k/a Chrysler Financial

b. CAVALRY SPV I, LLC as Assignee of Sychrony Bank/Walmart

c. TROY CAPITAL, LLC

(210) 595-1553

(210) 879-7064 – Text Only

321 S. Flores St

San Antonio, TX 78204

P.O. Box 32845

Phoenix, AZ 85064

Request Consultation

© 2021 The Crawshaw Law Firm, PLLC. All Rights Reserved.

The Basics of Defending Creditor Lawsuits

This guide provides general information for New Yorkers who are facing debt collection lawsuits in the New York City civil courts. It does not apply to courts outside the state of New York. It is not a substitute for obtaining legal advice in your individual case.

Can a creditor sue me if I owe credit?

Yes. In fact, these days it is quite common for creditors to file lawsuits to collect debts. In New York, the creditor typically files the lawsuit in the county where you live.

What is a debt buyer?

A “debt buyer” is a company that specializes in buying and collecting old debts. If you fail to repay a debt, your creditor might sell it to a debt buyer. The debt buyer will then try to collect the debt from you. This practice is legal. Debts are often bought and sold more than once.

Can a debt buyer sue me if I owe a debt?

Yes. If your creditor has sold your debt to a debt buyer, the debt buyer can sue you to collect the debt. This practice is legal.

If I am sued by a creditor or debt buyer, do I need a lawyer?

In an ideal world, every defendant in a debt collection lawsuit would be represented by a lawyer. Practically speaking, however, most low income New Yorkers who have been sued over a debt will be unable to obtain free legal representation. And hiring a private attorney will often cost almost as much, if not more than, the debt itself. Unfortunately, most low income New Yorkers have no choice but to represent themselves in court.

You should not ignore a debt collection lawsuit because you cannot find a lawyer. Hundreds of low income New Yorkers defend themselves in debt collection cases every single day, and many do so successfully. Luckily, a debt collection case is relatively simple and straightforward as compared to other kinds of legal problems. Debt collection attorneys often rely on the fact that unrepresented defendants do not know their rights. Fight back by educating yourself about your case! Read the information in these pages to familiarize yourself with the court process and the issues you will face as a pro se defendant (“pro se” means “without a lawyer”). If possible, consult with the NYC Financial Justice Hotline or another attorney to obtain individualized advice about potential defenses you may have. In our experience, a little information goes an incredibly long way.

What is a plaintiff?

A plaintiff is the party who files the lawsuit. If a creditor or debt buyer files a lawsuit against you, the creditor or debt buyer is the plaintiff.

What is a defendant?

A defendant is the party who is sued by the plaintiff. If a creditor or debt buyer files a lawsuit against you, you are the defendant.

What is a summons?

A summons is your official notification that you have been sued. It tells you how and where to appear in order to defend the case. For more information, see How to Read a Civil Court Summons (PDF). A summons is usually accompanied by a complaint.

What is a complaint?

A complaint explains why you have been sued. It contains the facts and the legal claims that are the basis for the lawsuit. In debt collection cases, the complaint is often very short and may provide very little information.

What is an answer?

An answer is an official written response to a complaint. In your answer, you should write all the defenses that you want to raise in the case.

What is a counter-claim?

A counter-claim is a claim that you have against the plaintiff. The plaintiff may owe you money, or the plaintiff may have violated your rights or caused you some other kind of harm for which you want to recover money damages. You always have the right to file a counter-claim against the plaintiff along with your answer.

What should I do if I receive a summons and complaint?

DO NOT IGNORE IT. You should always respond to a summons and complaint. The correct way to respond is to go to the clerk’s office at the address provided on the summons and tell the clerk that you want to file an answer. The clerk will give you an answer form and can help you to complete it. For more detailed assistance filing your answer, contact the NYC Financial Justice Hotline at 212-925-4929, or click here to request assistance.

Is there a time limit for filing an answer?

Yes. If you were served with the summons and complaint in person, you must file your answer within 20 DAYS . “In person” means that a process server came to your home or place of business and gave the papers to you personally. If you were served with the summons and complaint in some other way, you have 30 DAYS to file your answer.

What if the time for filing my answer has already expired?

You should try to file an answer anyway. As long as there is no judgment against you, the court will usually accept a late answer.

What should I write in my answer?

Your answer should contain all the defenses that you want to raise in your case. For more information, see Common Defenses to Creditor Lawsuits or call the NYC Financial Justice Hotline at 212-925-4929 (or click here to request assistance).

If you are rushed for time and do not know what to write, just check the box labelled “general denial.” You can always amend your answer later. However, please note that if you want to raise a defense of improper service, you MUST do so in your initial answer, or you will not be able to do so at all.

What will happen if I ignore the summons?

If you ignore the summons, the plaintiff will almost certainly ask the court to award a judgment against you. This kind of judgment is called a “default judgment.” A default judgment usually awards the plaintiff everything that it asked for in the complaint, plus interest and court costs. The judgment will appear on your credit report, and it can stay there for up to twenty years if not satisfied. The judgment also gives the plaintiff the right to try to collect money from you by freezing your bank account or garnishing your wages. You can avoid a default judgment by filing an answer and appearing in court.

What happens after I file an answer?

After you file an answer, the court will notify you of your first court date. Your first court date could be anywhere from 1 month to 9 months after you file your answer, depending on where you live. It is very important that you attend this court date. If you fail to attend the court date, the court will award a default judgment against you.

What is the “burden of proof”?

The ‘burden of proof” is the responsibility to provide evidence in support of a legal claim.

Who has the burden of proof in a debt collection case?

The plaintiff — the creditor or debt buyer — ALWAYS has the burden of proof in a debt collection case. This means that the plaintiff has to come up with evidence to prove to the court that (1) the plaintiff has the right to sue you; (2) the debt is yours; and (3) you owe the exact amount of money that the plaintiff claims you owe. You do not have to prove that you do not owe the money. Rather, the plaintiff has to prove that you DO owe the money.

What kind of evidence does the plaintiff need to present in order to meet its burden of proof?

If you admit that the plaintiff’s allegations are correct, the plaintiff can rely on your admission to win the case. But if you challenge the plaintiff’s right to sue you, the existence of the debt, or the amount of the debt, the plaintiff must provide the following evidence to the court:

- Proof that the plaintiff has the right to sue you. In the case of a debt buyer, the debt buyer must prove that it owns your debt by showing the court the contract of sale. This contract is called an “assignment.” The assignment must mention your debt specifically. If your debt has been bought and sold multiple times, the debt buyer must present a chain of assignments that goes all the way back to your original creditor.

- Proof that the debt is yours. Usually, this means an original contract with your signature.

- Proof that the amount demanded in the lawsuit is correct. Usually, this means a complete set of bills or account statements. In the case of a credit card, the plaintiff also has to prove that each and every charge on the card was authorized.

All of this proof must come in a specific format, or else it is considered “hearsay,” not admissible in court. If the plaintiff fails to meet its burden of proof by coming up with admissible evidence of your debt, the court must dismiss the case.

How can the burden of proof help me get a better outcome in my case?

The plaintiff has to present quite a lot of evidence in order to meet its burden of proof. This evidence is often difficult or expensive for the plaintiff to produce. If your debt is old, or if it has been bought and sold multiple times, evidence of your debt may not exist at all. It is almost always much easier and cheaper for the plaintiff to negotiate a settlement with you than to come up with all the evidence needed to meet the burden of proof. That is why the plaintiff will nearly always want you to agree to a settlement.

More Information

How to Read a Civil Court Summons (PDF)

Common Defenses to Creditor Lawsuits

Preparing for Your Court Date

Negotiating A Settlement Agreement in Court

Vacating a Default Judgment

Frozen Bank Accounts

Wage Garnishment

What is Exempt from Debt Collection?

Helpful Links and Resources

LawHelp/NY : attorney referrals and information for pro se litigants

National Association of Consumer Advocates : national database of consumer lawyers

New York City Civil Court : information about representing yourself in court, including contact information and court forms

eCourts : information about cases filed in New York courts

Laws of New York : complete text of New York laws

Disclaimer: This site provides general information for consumers and links to other sources of information. This site does not provide legal advice, which you can only get from an attorney. New Economy Project has no control over the information on linked sites.

Copyright ©2007 by the Neighborhood Economic Development Advocacy Project, Inc.

All Rights Reserved

§ 9-406. DISCHARGE OF ACCOUNT DEBTOR; NOTIFICATION OF ASSIGNMENT; IDENTIFICATION AND PROOF OF ASSIGNMENT; RESTRICTIONS ON ASSIGNMENT OF ACCOUNTS, CHATTEL PAPER, PAYMENT INTANGIBLES, AND PROMISSORY NOTES INEFFECTIVE.

(a) [Discharge of account debtor; effect of notification.]

Subject to subsections (b) through (i), an account debtor on an account , chattel paper , or a payment intangible may discharge its obligation by paying the assignor until, but not after, the account debtor receives a notification, authenticated by the assignor or the assignee, that the amount due or to become due has been assigned and that payment is to be made to the assignee. After receipt of the notification, the account debtor may discharge its obligation by paying the assignee and may not discharge the obligation by paying the assignor.

(b) [When notification ineffective.]

Subject to subsection (h), notification is ineffective under subsection (a):

(1) if it does not reasonably identify the rights assigned;

(2) to the extent that an agreement between an account debtor and a seller of a payment intangible limits the account debtor's duty to pay a person other than the seller and the limitation is effective under law other than this article; or

(3) at the option of an account debtor, if the notification notifies the account debtor to make less than the full amount of any installment or other periodic payment to the assignee, even if:

(A) only a portion of the account , chattel paper , or payment intangible has been assigned to that assignee;

(B) a portion has been assigned to another assignee; or

(C) the account debtor knows that the assignment to that assignee is limited.

(c) [Proof of assignment.]

Subject to subsection (h), if requested by the account debtor , an assignee shall seasonably furnish reasonable proof that the assignment has been made. Unless the assignee complies, the account debtor may discharge its obligation by paying the assignor, even if the account debtor has received a notification under subsection (a).

(d) [Term restricting assignment generally ineffective.]

Except as otherwise provided in subsection (e) and Sections 2A-303 and 9-407 , and subject to subsection (h), a term in an agreement between an account debtor and an assignor or in a promissory note is ineffective to the extent that it:

(1) prohibits, restricts, or requires the consent of the account debtor or person obligated on the promissory note to the assignment or transfer of, or the creation, attachment, perfection, or enforcement of a security interest in, the account , chattel paper , payment intangible , or promissory note; or

(2) provides that the assignment or transfer or the creation, attachment, perfection, or enforcement of the security interest may give rise to a default, breach, right of recoupment, claim, defense, termination, right of termination, or remedy under the account , chattel paper , payment intangible , or promissory note .

(e) [Inapplicability of subsection (d) to certain sales.]

Subsection (d) does not apply to the sale of a payment intangible or promissory note .

(f) [Legal restrictions on assignment generally ineffective.]

Except as otherwise provided in Sections 2A-303 and 9-407 and subject to subsections (h)and (i), a rule of law, statute, or regulation that prohibits, restricts, or requires the consent of a government, governmental body or official, or account debtor to the assignment or transfer of, or creation of a security interest in, an account or chattel paper is ineffective to the extent that the rule of law, statute, or regulation:

(1) prohibits, restricts, or requires the consent of the government, governmental body or official, or account debtor to the assignment or transfer of, or the creation, attachment, perfection, or enforcement of a security interest in the account or chattel paper ; or

(2) provides that the creation, attachment, perfection, or enforcement of the security interest may give rise to a default, breach, right of recoupment, claim, defense, termination, right of termination, or remedy under the account or chattel paper .

(g) [Subsection (b)(3) not waivable.]

Subject to subsection (h), an account debtor may not waive or vary its option under subsection (b)(3).

(h) [Rule for individual under other law.]

This section is subject to law other than this article which establishes a different rule for an account debtor who is an individual and who incurred the obligation primarily for personal, family, or household purposes.

(i) [Inapplicability to health-care-insurance receivable.]

This section does not apply to an assignment of a health-care-insurance receivable .

(j) [Section prevails over specified inconsistent law.]

This section prevails over any inconsistent provisions of the following statutes, rules, and regulations:

[List here any statutes, rules, and regulations containing provisions inconsistent with this section.]

- [email protected]

- (845) 232-0202

Why Do Debt Buyers Have Trouble Proving Their Cases?

The law offices of robert j. nahoum, p.c. – a new york consumer protection law firm.

By:Â Robert J. Nahoum

The Problem:

There is an industry out there of companies who buy up portfolios of old consumer debts like credit cards and medical bills for pennies on the dollar. These debt buyers then try to collect those debts from consumers using tactics that often violate federal debt collection laws. Too often, debt buyers sue consumers in court without sufficient evidence to prove the existence of the debt or the debt buyers’ standing to collect it.

In a debt collection lawsuit, the Plaintiff (the party bringing the lawsuit) always has the burden to prove that the defendant (the party being sued) is responsible for the debt. To meet this burden, a debt buyer must prove that: (1) it has the right to sue you; (2) the debt is yours; and (3) you owe the amount for which you were sued. It is never the burden of the Defendant to prove that he or she does not owe the debt.

- What Must the Debt Buyer Do to Prove It Owns Your Debt?

To prove that a debt buyer owns your debt, it generally must prove how it came to acquire it. The sale of a debt from one creditor to another is memorialized through an “assignment†in which the original creditor “assigns†ownership (and the right to collect the debt) to a new creditor. To be valid, the assignment must sufficiently identify your particular debt.

Often, debts are sold and resold over and over again to a number of subsequent debt buyers. When this happens, the debt buyer must prove each and every assignment by showing a “chain of title†reaching all the way back in history to the original creditor. Again, each assignment must sufficiently identify your particular debt.

- How Must a Debt Buyer Prove That the Debt Belongs to Me?

To prove that a particular debt is attributable to you, the debt buyer must prove the establishment of that debt. This usually means producing a contract such as a credit card agreement. Depending on the theory under which you have been sued, a debt buyer may also try to prove that the debt belongs to you by showing copies of bills to which you never allegedly objected.

- How Must a Debt Buyer Prove That the Amount for Which I was Sued is Correct?

To prove that the amount they sued you for is correct, the debt buyer must show a complete accounting of the charges they claim you made. This generally includes a full set of bills and account statements.

To meet its burden, the proof submitted by the debt buyer must be based on “personal knowledgeâ€. Personal knowledge means that the person offering the evidence on behalf of the debt buyer must be a witness to the event shown in a particular document. For example, if credit card bills are offered into evidence on behalf of the debt buyer, the person offering the evidence must have personal knowledge of how the information in the credit card bill got there, how it is generated and how it is maintained. That person must have personal knowledge of the computer system and how it operates. If this person does not have such personal knowledge, the evidence is “hearsay†and it cannot be used.

What You Should Do:

The first step is to actually fight back. Do not ignore the lawsuit because if you do, you will end up with a default judgment . Don’t make it this easy on the debt buyer especially when it is already so hard for them to prove their case.

Next, you must use the debt buyers’ burden of proof to your advantage. The many things the debt buyer has to prove with personal knowledge are burdensome and costly. Also, the way consumer accounts are “assigned†is virtually 100% electronic. That is, your account information is sent from one creditor to another through nothing more than a spreadsheet. When push comes to shove, a debt buyer might occasionally be able to produce copies of the bills and possibly even a contract. However, usually nobody working for the debt buyer has “personal knowledge†of those documents and so that may not be admissible in evidence.

Use this advantage to either win your case or negotiate a favorable settlement . If you do settle, be on the lookout for dirty little debt collector secrets and don’t be taken advantage of.

If you need help settling or defending a debt collection law suit contact us today to see what we can do for you.

The Law Offices of Robert J. Nahoum, P.C (845) 232-0202 web:Â www.nahoumlaw.com email:Â [email protected]

Related posts:

What is an Assignment of Debt?

By Sej Lamba

Updated on 26 February 2024 Reading time: 5 minutes

This article meets our strict editorial principles. Our lawyers, experienced writers and legally trained editorial team put every effort into ensuring the information published on our website is accurate. We encourage you to seek independent legal advice. Learn more .

When Could an Assignment of Debt Happen?

Key issues on assignment of debt, drafting the correct documentation, giving notice, key takeaways.

Debts are increasingly common in today’s financial climate, and unfortunately, many people struggle to repay what they owe. Debts owed can be sold to third parties and a lot of companies in the UK purchase debts. However, this can be complicated as specific legal formalities apply when assigning debts. This article will explain some of the critical issues around the assignment of debt.

Debt collection can be a complex process. There are various reasons as to why debt is assigned. For example, a company owed debt may want to avoid putting in time and effort to chase it or want to take legal action to recover it.

To picture a scenario, imagine this:

- Joe Bloggs gets a brand-new shiny credit card. Joe purchases lots of nice things for his family with the credit card. Usually, he can keep up with payments as he keeps track of them and earns enough to pay them back;

- suddenly, Joe has an injury and cannot work anymore. He has to give up his job and now can’t afford to pay the credit card company back;

- Joe ignores various letters chasing the debt and hopes the problem will disappear. Ultimately, after months, the credit card company gives up and sells Joe’s debt to a debt collection agency.

So, in summary – after the debt sale, Joe now owes money to a different company.

In practice, debt assignments can be complex, and the parties must follow the relevant legal rules and draft the correct documentation.

An assignment of debt essentially transfers the debt from one party (the assignor) to a third party (an assignee).

In practice, this will mean the original debtor (e.g. Joe Bloggs) will now owe the debt to a new third-party creditor (e.g. the debt collection business). Therefore, in the scenario above, Joe must now repay the debt to the third-party debt collection business.

This process can be complex. There have been several legal cases in the courts where this process has given rise to disputes.

There are two different types of assignment of debt – a legal assignment of debt and an equitable assignment of debt.

In simple terms:

- a legal assignment of debt will transfer the right for enforcement of the debt; and

- an equitable assignment of debt will transfer only the benefit of the debt without the right to enforce it.

Let us explore each type below.

Legal Assignment of Debt

If the assignment complies with specific legal requirements under the Law of Property Act 1925, it will be a ‘legal assignment’. This means that the assignee will be the new owner of the debt.

A legal assignment requires various formalities to be effective. For example, it must:

- be in writing and signed by the assignor;

- the debtor must be given written notice of the assignment;

- be absolute with no conditions attached to it;

- relate to the whole of the debt and not just part of it; and

- not be a charge.

After the transfer of the debt, the assignor can sue the debtor in its own name.

Equitable Assignment of Debt