How can we help?

- 19 December 2022

- Commercial Real Estate

Commercial Rent Deposits – A brief overview

What is a rent deposit.

A rent deposit is money provided by a tenant to its landlord as security for payment of the rent and performance of the tenant’s covenants contained in the lease. A rent deposit deed will specify the circumstances in which the landlord can draw on this money and the conditions that must be satisfied for the deposit to be repaid to the tenant.

Landlords like rent deposits because they are easily accessible sources of money that can be drawn upon as soon as the tenant is in breach of a relevant covenant in the lease. Court action is not required to recover the debt or enforce performance of the obligation. Tenants are not generally too keen on rent deposits as they lock up capital, often for a lengthy period.

When will a rent deposit be taken?

A rent deposit will be put in place on the grant of a lease or on assignment of an existing lease. If the landlord does require a rent deposit it will usually be for one of the following reasons;-

- The tenant’s covenant is weak and therefore unsatisfactory to the landlord without some additional comfort

- The tenant may be an overseas company with few, if any, UK assets

- The tenant is a new business and so is unable to provide evidence of its past good behaviour as a tenant.

As many tenants will not want to lock up the capital required to fund it, the possible alternatives include;-

- A bank guarantee or bond

- A parent company guarantee

- A guarantee from a director

- A letter of credit from a bank

All of these alternatives have potential disadvantages, for example both the bank guarantee or bond and a letter of credit will require a payment to the bank from the tenant to secure the payment and the value of a guarantee will depend upon the strength of the party providing the guarantee.

Points to be considered when negotiating a rent deposit deed

How much should the landlord require .

There is no prescribed level and no statutory constraints on the size of the sum. However, the amount put down usually reflects the rent payable under the lease, the likely period that it would take for the landlord to re-let the property and the landlord’s perception of the risk that the tenant poses.

Rent deposits are generally equivalent to between 6 & 12 months’ rent due under the lease. The amount is usually related to the yearly rent payable but may also include insurance rent and service charges.

VAT on rent deposits is often a contentious point a deposit in respect of the sum representing the amount of VAT that will be payable is often a contentious point. The parties may not consider VAT when negotiating the amount. VAT is not payable on the sum deposited with the landlord as a supply is not being made at that time, but once the landlord draws on deposit as a result of tenant’s default and if the landlord has exercised the option to tax, VAT will be payable on the amount drawn down.

Accordingly, where the landlord has exercised the option to tax or is likely to do so, the negotiated deposit should be an amount that includes a sum equivalent to the VAT that will be payable if the tenant is in default.

Simon Ralphs

View profile

Email Simon

+44 20 7539 8049

A rent deposit is money provided by a tenant to its landlord as security for payment of the rent and performance of the tenant’s covenants contained in the lease.

When will the rent deposit be returned to the tenant?

It will generally be returnable in the following circumstances;-

- Assignment under the lease in accordance with the lease. (On such an occasion the landlord may, if appropriate, want to require a new rent deposit from the assignee.)

- Expiry of the lease term without any holding over under the landlord and tenant Act 1954

- Early termination of the lease by agreement (such as by way of surrender or exercise of an option to break). Early termination by agreement would exclude forfeiture and disclaimer

The landlord may also agree to return the rent deposit if the tenant demonstrates that its financial position has sufficiently improved to render the rent deposit unnecessary to reassure the landlord that it will meet its financial obligations under the lease. Examples of this trigger are the “net profit” test where the net profits of the tenant are shown to equal or exceed a multiple (usually 3 times) of the rents reserved by the lease for up to 3 years and the “net assets” test where the net assets of the tenant are equal to a multiple (often 5 times) of the rents reserved by the lease.

Tax on rent deposits

Sdlt on the rent deposit.

In the past, rent deposits did not form part of the “consideration” on the grant or assignment of a lease so no SDLT was charged on. However, the Finance (No.2) Act 2005 contains provisions to enable SDLT to be charged on premiums that are disguised as rent deposits.

Under these statutory provisions, rent deposits are held to be “consideration” for the purpose of the grant or assignment of a lease (and therefore potentially liable for SDLT) unless the rent deposit is less than twice the highest amount of annual rent payable in any 12 month period in the first 5 years of the term or, in the case of an assignment, in the first 5 years of the term remaining outstanding at the date of the assignment.

It is argued by some advisors that these provisions only apply to the type of the rent deposit structure where the tenant actually transfers ownership of the deposit monies to the landlord. However, most rent deposits are drafted to provide that the money is held by the landlord but owned by the tenant.

VAT ON RENT DEPOSIT MONIES

Where a landlord has opted to pay VAT, VAT is payable on the annual rent. As mentioned above, it is therefore usual where the option has been exercised, for the landlord to ask that the money deposited incorporates a figure equivalent to the VAT on the rent deposit to ensure that the landlord will be able to claim the full amount due if the tenant fails to pay rent.

VAT is not actually payable when the money is put on deposit, since the landlord is making no supply at that date. It is only if and when the Landlord makes a deduction from the deposit monies that a taxable supply is made that is liable to VAT.

No VAT invoice is required when a rent deposit deed is entered into if a sum equivalent to VAT is paid.

Further information

This article contains some initial points to be considered in relation to rent deposit deeds. These documents are often drafted in a complex way and questions will arise on each form of rent deposit deed used for example whether a landlord can draw against a rent deposit if a corporate tenant becomes insolvent, and what happens when the landlord sells its interest in the property.

If you have any queries on any of these points or the point referred in this note or any other matters relating to rent deposit deeds please contact our Commercial Real Estate team.

About this article

- Subject Commercial Rent Deposits – A brief overview

- Author Simon Ralphs

- Expertise Commercial Real Estate

- Published 19 December 2022

Disclaimer This information is for guidance purposes only and should not be regarded as a substitute for taking legal advice. Please refer to the full General Notices on our website.

Read, listen and watch our latest insights

- 10 April 2024

New Guidance: Confidence to Recruit

The new Government guide in collaboration with the CIPD aims to give employers the confidence to recruit its workforce from a wider range of people including those who may have been overlooked in the past as a problem rather than an asset.

- 03 April 2024

FAQ’s on the new Carer’s Leave Act

Beginning on 6 April 2024, the Carer’s Leave Act comes into force, meaning carers are now entitled to request 1 week’s unpaid leave to care for their dependants.

- 02 April 2024

- Construction

UK housebuilders investigated over suspected exchanges of anti-competitive information

In 2022 the CMA was called upon by the Secretary of State for the Department for Levelling Up, Housing & Communities to conduct a study into the housebuilding sector and provide recommendations on how the sector can operate as efficiently as possible

- 28 March 2024

- Corporate and M&A

Legal perspectives on ESG and director duties

In today’s rapidly changing business landscape, the concept of ESG factors has emerged as a guiding framework for companies seeking to thrive in the long term.

- 27 March 2024

5 key considerations when taking on a lease of a pub property

Taking on a pub property can be both exciting and daunting. Here are 5 key considerations that pub tenants should consider when taking on this new venture.

- 26 March 2024

Navigating Neuroinclusion: A Guide for Employers

Over the past few years, we have seen a marked rise in awareness of neurodiversity, as well as campaigns for awareness and inclusion in the workplace for neurodiverse employees.

Home » News & publications » Latest news » Why commercial rent deposits are not quite so simple

Why commercial rent deposits are not quite so simple

Posted: 28/08/2019

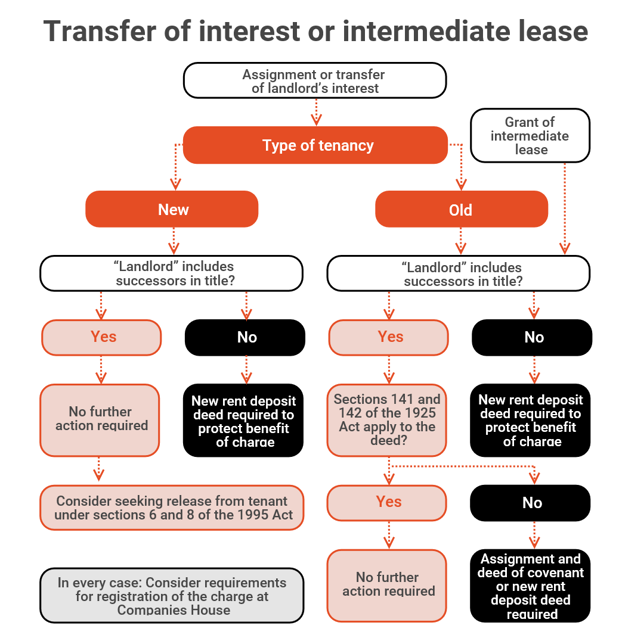

In today’s insecure commercial lettings market, it is becoming increasingly common for landlords to take a significant rent deposit when granting a new lease and to enforce their rights under the rent deposit deed. This is putting the drafting and enforcement of rent deposit deeds under scrutiny. How do the parties to a rent deposit deed protect their positions when the landlord assigns the reversion to the lease? In this article, we assume that the rent deposit account is in the landlord’s name and that the tenant’s interest in the account - and the monies in it - are charged to the landlord.

What happens when:

- The landlord transfers or assigns its interest?

- The landlord grants an intermediate lease?

Transfer or assignment: new tenancies

A rent deposit deed that relates to a “new” tenancy is a “collateral agreement” to the tenancy, as defined in section 28(1) of the Landlord and Tenant (Covenants) Act 1995 (the 1995 Act). Covenants contained in collateral agreements are “covenants” for the purposes of the 1995 Act.

Section 3(3) of the 1995 Act says that, where a landlord transfers or assigns its interest, the transferee or assignee will become bound by the landlord’s covenants whether they are covenants contained in the tenancy or in the rent deposit deed (except where they are stipulated to be personal) and will become entitled to the benefit of the tenant’s covenants. This is a statutory exception to the established principle that the burden of a contract cannot be assigned. In these circumstances, the covenants contained in the rent deposit deed are enforceable by and against the new landlord.

Transferring the charge

The charge on the rent deposit account does not fall within the definition of a “covenant” under the 1995 Act. A charge is not a “term, condition or obligation”; it is an encumbrance on the asset that is subject to the charge and gives the landlord the right to appropriate the charged property.

The fact that the benefit and burden of the rent deposit deed covenants have transferred to the landlord’s successor by virtue of the 1995 Act does not mean that the benefit of the charge has also been transferred. If the parties do not take further action, the beneficiary of the charge may be the old landlord even though he is no longer able to enforce the covenants under the deed.

Defining the “landlord”

If the deed is personal to the named landlord, a new rent deposit deed containing a new charge is required. A new charge will create a chargee/chargor relationship between the new landlord and the tenant. Without a new charge, although the new landlord can enforce the tenant’s covenants in the deed, it will be an unsecured creditor with no priority in a tenant insolvency.

The central purpose of a rent deposit deed is to protect the landlord in the case of tenant insolvency. In a worst-case scenario, a new landlord may find that the deposit is entirely swallowed up by the creditors ranking above it, resulting in the total loss of its security.

It is common for rent deposit deeds to define the “landlord” to include successors in title, so that the tenant’s charge of its interest in the deposit account is to the current and all future landlords. The benefit of the charge will automatically transfer when the landlord transfers or assigns its interest.

Release under the 1995 Act

Under section 6 of the 1995 Act, the outgoing landlord will remain liable for the landlord’s covenants in the rent deposit deed until it obtains a release from the tenant.

The landlord is released if it serves notice on the tenant telling the tenant of the proposed assignment and requesting that it is released from the landlord’s covenants and:

- the tenant does not serve a written notice objecting to the release within four weeks of service of the landlord’s notice;

- the tenant serves such a notice but the court makes a declaration that it is reasonable for the covenants to be released; or

- the tenant serves written notice consenting to the release (and withdrawing any prior notice objecting to it, if applicable).

If this procedure is not followed, a landlord remains liable for the performance of the landlord covenants. However, owing to complications arising if some (but not all) tenants release the landlord, it may not be appropriate in every case to seek such a release.

If a rent deposit deed to a “new” tenancy incorporates the landlord’s successors in title, no action needs to be taken. Where appropriate, a landlord should consider following the procedure in section 8 of the 1995 Act to release its liability to the tenant.

If the deed does not incorporate successors in title, a new rent deposit deed will need to be entered into between the tenant and the landlord’s successor. The covenants will be extinguished and the successor will offer new covenants.

Transfer or assignment: old tenancies

One of two different sets of rules will govern:

Sections 141 and 142 of the Law of Property Act 1925

If the lease and/or the rent deposit deed define covenants given in the rent deposit deed as lease covenants, then sections 141 and 142 of the Law of Property Act 1925 (the 1925 Act) apply. As lease covenants they are enforceable by and against the landlord’s successor in title automatically. To pass on the benefit of the charge automatically, the charge must be drafted to refer to successors in title.

Common law rules

If the covenants in the rent deposit deed are not lease covenants, the common law rules for the assignment of contractual obligations and privity of contract apply.

The benefit of a contract may be assigned. The assignment must be absolute, in writing and signed by the assignor, and notice of the assignment must be given to the tenant.

The burdens of a contract may not be assigned. When the rent deposit deed relates to an “old” tenancy, the parties must create privity of contract between the new landlord and the tenant. Two methods are available:

- Assignment from old landlord to new landlord and deed of covenant from new landlord to tenant: The assignment can be completed within the suite of sale documents, and the deed of covenant can be entered into unilaterally by the new landlord on completion. If the deed does not incorporate successors within the definition of the “landlord”, the benefit of the charge will not transfer.

- Novation of the rent deposit deed: The new landlord and the tenant enter into a new rent deposit deed on identical terms to the previous deed. This could be dealt with as a condition subsequent, so as not to interfere with time pressures or confidentiality obligations relating to a sale. Consideration should be given as to whether the tenant may not comply or may delay and to which party should bear the tenant’s costs. A prudent landlord should ensure that the tenant is in a financial position to give the new charge before completing the new deed.

Grant of an intermediate lease

The 1995 Act does not apply where the landlord grants an intermediate lease of the property. The granting of a new lease is not an “assignment” and the intermediate tenant is not treated as stepping into the landlord’s shoes.

The grant of an intermediate lease may qualify as a disposition of the reversionary estate immediately expectant on the determination of the term of the lease to which the rent deposit deed relates. The provisions of sections 141 and 142 of the 1925 Act may apply as above and, if they do not, the common law rules apply.

Registration

Charges created by companies on or before 5 April 2013 had to be registered at Companies House within 21 days of the date of execution or they are void. If the charge created by a rent deposit deed is not registered, a tenant’s insolvency practitioner will assert that the charge is void and the landlord is an unsecured creditor.

The landlord has two options:

- Argue that the charge did not require registration at Companies House.

- Enter into a new rent deposit deed with the tenant.

Charges created on or after 6 April 2013 are not required to be registered at Companies House.

In summary, rent deposit deeds should be given appropriate consideration both during the drafting process and during due diligence relating to the disposition of the landlord’s interest.

This article was first published in Estates Gazette in June 2019.

Giorgia Mayes

Email Giorgia +44 (0)1223 465425

Related expertise

- Real estate litigation

- Real estate investors

- Property entrepreneurs

Share the article

Useful links

- Legal notice

- Privacy policy

- Cookie policy

- Accessibility

- Complaints procedure

- Quality statement

- Modern slavery statement

- Environmental statement

Contact an office

- London (Head office) +44 (0)20 7457 3000

- Basingstoke +44 (0)1256 407100

- Birmingham +44 (0)121 312 2560

- Cambridge +44 (0)1223 465465

- Guildford +44 (0)1483 791800

- Oxford +44 (0)1865 722106

- Reading +44 (0)118 982 2640

- Madrid +34 91 781 6670

- Paris +33 1 44 34 24 80

- Piraeus +30 210 361 4840

- Singapore +65 6438 4497

- Aviation and aerospace

- Energy and natural resources

- Financial services

- Insurance and reinsurance

- Life sciences

- Media and creative industries

- Private wealth

- Real estate

- Sustainability

Services for Business

- Banking and finance

- Commercial dispute resolution

- Construction and infrastructure

- Data protection and privacy

- Immigration

- Intellectual property

- International trade

- IT and telecommunications

- Marine, trade and energy

- Regulatory compliance

- Restructuring and insolvency

Services for Individuals

- Clinical negligence

- Contentious probate and trust disputes

- Court of Protection and deputyships

- Holiday accident claims

- Personal injury

- Private client and tax

- Residential property and conveyancing

© 2024 Penningtons Manches Cooper LLP. All rights reserved. Website design by Frontmedia / Dynamic Pear

Penningtons Manches Cooper LLP

Penningtons Manches Cooper LLP is a limited liability partnership registered in England and Wales with registered number OC311575 and is authorised and regulated by the Solicitors Regulation Authority under number 419867.

Deed of assignment of rent deposit(s) | Practical Law

Deed of assignment of rent deposit(s)

Practical law uk standard document 6-520-2981 (approx. 13 pages).

- Practical Law

On an assignment can a landlord retain a rent deposit from the assignor tenant?

Practical law resource id a-005-8542 (approx. 2 pages).

- Landlord and Tenant

Electrostal History and Art Museum

Most Recent: Reviews ordered by most recent publish date in descending order.

Detailed Reviews: Reviews ordered by recency and descriptiveness of user-identified themes such as wait time, length of visit, general tips, and location information.

Electrostal History and Art Museum - All You Need to Know BEFORE You Go (2024)

- (0.19 mi) Elektrostal Hotel

- (1.21 mi) Yakor Hotel

- (1.27 mi) Mini Hotel Banifatsiy

- (1.18 mi) Elemash

- (1.36 mi) Hotel Djaz

- (0.07 mi) Prima Bolshogo

- (0.13 mi) Makecoffee

- (0.25 mi) Amsterdam Moments

- (0.25 mi) Pechka

- (0.26 mi) Mazhor

IMAGES

VIDEO

COMMENTS

An Assignment of Rents ("AOR") is used to grant the lender on a transaction a security interest in existing and future leases, rents, issues, or profits generated by the secured property, including cash proceeds, in the event a borrower defaults on their loan. The lender can use the AOR to step in and directly collect rental payments made ...

A rent deposit deed will specify the circumstances in which the landlord can draw on this money and the conditions that must be satisfied for the deposit to be repaid to the tenant. ... Assignment under the lease in accordance with the lease. (On such an occasion the landlord may, if appropriate, want to require a new rent deposit from the ...

Transfer or assignment: new tenancies. A rent deposit deed that relates to a "new" tenancy is a "collateral agreement" to the tenancy, as defined in section 28(1) of the Landlord and Tenant (Covenants) Act 1995 (the 1995 Act). Covenants contained in collateral agreements are "covenants" for the purposes of the 1995 Act.

A rent deposit is a sum of money (usually equalling between 6 and 12 months' gross rent) paid by the tenant and accessible by the landlord in circumstances agreed between the parties. The circumstances are usually non-payment of rent or breach of tenant covenants. The document setting out the rent deposit agreement is usually a rent deposit deed.

A rent deposit is a sum of money that is deposited by a tenant when it takes a lease of premises as security against the non-payment of rent and other breaches of the lease. The money is held on the terms of the rent deposit deed. Rent deposit agreements usually cover 'any' default or breach by the tenant, and not just rent arrears.

Transfer or assignment: new tenancies. A rent deposit deed that relates to a "new" tenancy is a "collateral agreement" to the tenancy, as defined in section 28(1) of the Landlord and ...

by Practical Law Property. Maintained • , England, Wales. A deed for use when acting on the sale of a reversionary interest in a property subject to occupational leases, where a tenant (or more than one) has entered into a Rent Deposit Deed.

The deed of Assignment for Rent Deposits outlines the terms and conditions of the assignment of a rental property lease. It provides a legally binding agreement between the landlord, the original tenant, and the new tenant. This deed serves to transfer the rights and obligations of the original tenant to the new tenant, including the ...

Assignment and Subletting: The deed may address the impact of any assignment or subletting of the lease on the deposit, including the transfer of the deposit to a new tenant. It is common for tenants to seek independent legal advice before entering a rent deposit deed.

What is the process for dealing with a rent deposit deed on the assignment of a lease? What documentation is required? Send to Email address * Open Help options for Email Address. You can send the message to up to 4 other recipients. Separate each address with a semi-colon (;) Example: [email protected]; [email protected]

A rent deposit is a sum of money a commercial landlord may request a tenant pay them at the start of a lease. This sum will protect the landlord and act as a form of security should the tenant fail to uphold any lease provision, such as non-payment of rent. You should outline the details of a rent deposit in a rent deposit deed.

The deed of Assignment for Rent Deposits outlines the terms and conditions of the assignment of a rental property lease. It provides a legally binding agreement between the landlord, the original tenant, and the new tenant. This deed serves to transfer the rights and obligations of the original tenant to the new tenant, including the ...

In practice, this will usually be between 3 and 6 months' rent. Remember to place the deposit in a separate bank account. Under this Rent Deposit Deed, you should place the rent deposit in an interest-earning UK deposit account that is in the name of the landlord. Even while kept by the landlord, the deposit is still the commercial tenant's ...

Our Customer Support team are on hand 24 hours a day to help with queries: +44 345 600 9355. Contact customer support Opens in a new window. End of Document. Resource ID a-005-8542. Can a Landlord, on the assignment of a lease by a Tenant, opt to retain the assignor's Rent Deposit as well as requiring the incoming Tenant to sign a 6 months rent ...

Many rent deposit deeds will contain provisions dealing with a change of landlord. Such provisions will typically allow the landlord to assign the benefit of the deed to the buyer on a sale of the landlord's reversionary interest, subject to the buyer covenanting with the tenant (with effect from the date of the assignment of the reversion) to:

An assignment of rent is a binding contract between a lender and a borrower stipulating that in the event the borrower defaults on the mortgage, the lender will be entitled to collect any rent payments made by a tenant occupying the property. If the lender is aware that the borrower intends to use the mortgaged property as a rental property ...

Sample Clauses. Assignment of rent deposit. Pursuant to a deed of assignment of rent deposit deed made on the date hereof between the Landlord (1) and the Tenant (2), the Tenant has assigned to the Landlord all its rights and interests in the Rent Deposit Deed. As soon as practicable following the date hereof and upon receipt from the Landlord ...

Find company research, competitor information, contact details & financial data for AVANGARD, OOO of Elektrostal, Moscow region. Get the latest business insights from Dun & Bradstreet.

Find company research, competitor information, contact details & financial data for MZ LLC of Elektrostal, Moscow region. Get the latest business insights from Dun & Bradstreet.

Compare from agencies. Compare car suppliers to unlock big savings, and package your flight, hotel, and car to save even more. One Key members save 10% or more on select hotels, cars, activities and vacation rentals. Enjoy maximum flexibility with penalty-free cancellation on most car rentals.

LexisNexis Webinars . Offering minimal impact on your working day, covering the hottest topics and bringing the industry's experts to you whenever and wherever you choose, LexisNexis ® Webinars offer the ideal solution for your training needs.

Art MuseumsHistory Museums. Write a review. Full view. All photos (22) Suggest edits to improve what we show. Improve this listing. The area. Nikolaeva ul., d. 30A, Elektrostal 144003 Russia. Reach out directly.