- Get 7 Days Free

morningstar.com

Market indexes, u.s. barometer closed, gainers, losers, actives.

- Waste Management 1Q Profit Rises on Pricing Increases | Dow Jones

- Wal-Mart de Mexico 1Q Net Profit Rises 14% on Year | Dow Jones

- Bovespa Index Ends 0.33% Lower at 124740.69 — Data Talk | Dow Jones

- S&P/TSX Composite Index Ends 0.63% Lower at 21873.72 — Data Talk | Dow Jones

- S&P MERVAL Index Ends 3.46% Lower at 1202668.97 — Data Talk | Dow Jones

- IPC Indice de Precios Y Cotizaciones Ends 0.30% Lower at 56463.99 — Data Talk | Dow Jones

- NASDAQ Composite Rises 0.10% to 15712.75 — Data Talk | Dow Jones

- DJIA Falls 0.11% to 38460.92 — Data Talk | Dow Jones

- S&P 500 Rises 0.02% to 5071.63 — Data Talk | Dow Jones

- IBM to Buy HashiCorp in $6.4 Billion Deal | Dow Jones

- What Can Private Funds Offer You?

- A 5-Star Dividend Stock to Buy With a 3.7% Yield

How to Choose an Index Fund

The Oldest Balanced Fund Is Still a Top Choice

- The Best Innovative Companies to Own

The Best Defensive Stocks to Buy

Earnings Season

- GE Aerospace: Fantastic Prospects

- Visa: Growth Holds Steady

- Verizon: Price Increases Drive Solid Wireless Growth

- Truist: Expense Control Is Working

- Zions: Steady Start to 2024

- GM: Strong Start to 2024 Is Encouraging

- AT&T: Network Outage Didn’t Stop Growth

- Is Alphabet Stock a Buy Going Into Earnings?

- Is Eli Lilly Stock a Buy Going Into Earnings?

- Is Microsoft Stock a Buy Going Into Earnings?

- Is Albemarle Stock a Buy Going Into Earnings?

- Read More Company Earnings Updates

From Our Specialists

- Will Earnings From These 10 AI Stocks Live Up to the Hype?

Investing Insights

Financial Literacy Month

- Earth Day 2024: Investing in a Warming Planet

- Must-Know Climate Statistics for Earth Day

5 Cheap Stocks Leading the Low-Carbon Transition

- 4 Climate Votes That Matter This Year

- The Best Sustainable Companies to Own

How to Make Your Voice Heard on Climate Issues

Investing in Times of Climate Change

- Why a Portfolio With Low ESG Risk Can Better Withstand a Market Crisis

- Which Investors Are Taking a Stand on Climate

Investment Ideas

- The Best Companies to Own: 2024 Edition

- 5 Top Dividend Stocks to Buy From the Best Managers

19 Best Healthcare Companies to Invest In

- The Best Financial-Services Companies to Own

- The Best International Companies to Own

Specialists

2 Wide-Moat Stocks Trading at Rare Discounts While growth in this industry slows, the prospects for these well-known brands look attractive. Susan Dziubinski

4 Undervalued Semiconductor Stocks Amid the Nvidia-led AI boom, Infineon and STMicroelectronics are among Morningstar’s top picks. Diana Anghel

19 Best Healthcare Companies to Invest In These companies largely earn their competitive advantage from intangible assets, and their stocks are great choices for an investor’s watchlist. Emelia Fredlick

Personal Finance

TIPS Are on Sale It’s time to buy shares of TIPS funds, not redeem them. John Rekenthaler

The Dangerous Myth of ‘The New Normal’ The odds are against those who believe this time is different. John Rekenthaler

Best Companies of 2024

Best International Companies to Own These companies from various corners of the globe are well positioned for the future. Ruth Saldanha

Best Innovative Companies to Own These companies are expected to benefit from disruptive technologies. Sachin Nagarajan

Best Financial-Services Companies to Own What drives these firms’ competitive advantages varies by industry. Katherine Lynch

Best Sustainable Companies to Own We believe these companies’ strong ESG management practices give them a long-term advantage. Leslie Norton

7 Top-Performing Large-Growth Funds The category’s gains have been led by returns from investments in tech stocks. Kumudini Devalla

These 5 Funds May Be Affected By Broader Company Issues Why falling Parent Pillar ratings are reason for caution. Greg Carlson

Advisor Insights

5 Ways Investors Can Succeed by Knowing Their Limits You don’t know what you don’t know when investing. Jeffrey Ptak

Why Advisors Should Care About Open Banking Advisors will get fuller view of clients’ financial picture. Sheryl Rowling

Retirement Planning

4 Big Fund Downgrades These Morningstar Medalists have gone from great to simply good. Russel Kinnel

Can Converting to a Roth IRA Reduce Future RMDs? Tax and IRA expert Ed Slott says you may want to make this change earlier than you think. Christine Benz

Sustainable Investing

Earth Day 2024: Must-Know Climate Statistics Understand the effects of climate change and how investors are reacting. Susan Zhou

5 Cheap Stocks Leading the Low-Carbon Transition Moderna, Etsy, Illumina, Healthpeak Properties, and PayPal Holdings are trading below their fair value estimates. Muskaan Hemrajani

4 Big Fund Downgrades

7 Top-Performing Large-Growth Funds

These 5 Funds May Be Affected By Broader Company Issues

5 Growth Stocks to Buy From the Best Money Managers

2 Wide-Moat Stocks Trading at Rare Discounts

4 Undervalued Semiconductor Stocks

Active ETFs are Soaring. Should You Invest?

3 Great Value ETFs for 2024

For Most Investors, Single-Stock ETFs Are Best Left Alone

3 Great Emerging-Markets ETFs for 2024

What the Next Bitcoin Halving Means for ETF Investors

This One Tweak Could Improve Your Bond Portfolio in Q2

JPMorgan Core Bond’s Deep Team and Disciplined Approach Earn It an Upgrade

5 Top-Performing Core Bond Funds

A Way to Protect Your Portfolio Against Bond Price Drops

3 Bond Funds for All Yield Seasons

Is a New Age on the Horizon for 401(k) Participants?

What to Know About Health Insurance and Taxes When You Get Married

Do as I Say (Not as I Do)

TIPS Are on Sale

The Dangerous Myth of ‘The New Normal’

Bank of America, Goldman Sachs Urged to Disclose Clean Energy Financing in Proxy Voting

Earth Day 2024: Must-Know Climate Statistics

Financial Advisors

The Advantage of Low Stock Market Expectations

Are You an Investment Historian or a Futurist?

Make These Investing Moves Now for a Better Tax Day in 2025

Best Mutual Fund Investments

Medalist Funds

U.S. Index Funds

Index Medalist Funds

Bond Index Funds

Small Cap Funds

Best Stock Investments

Five Star Stocks

Wide Moat Undervalued Stocks

Core Stock Funds

Wide Moat Stocks

Moats on Sale

Best ETF Investments

Gold Rated ETFs

Medalist ETFs

Core Medalist ETFs

Medalist Bond ETFs

Sector ETFs

Best Bond Investments

Core Bond Funds

High Yield Bonds

Foreign Bond Funds

Sponsor Center

5 Best Free Stock Analysis Tools for Investors

A tremendous amount of free stock research and analysis tools are available online.

Best Free Stock Analysis and Research

Getty Images | iStockphoto

It's best to do your homework before you pull the trigger on a stock option.

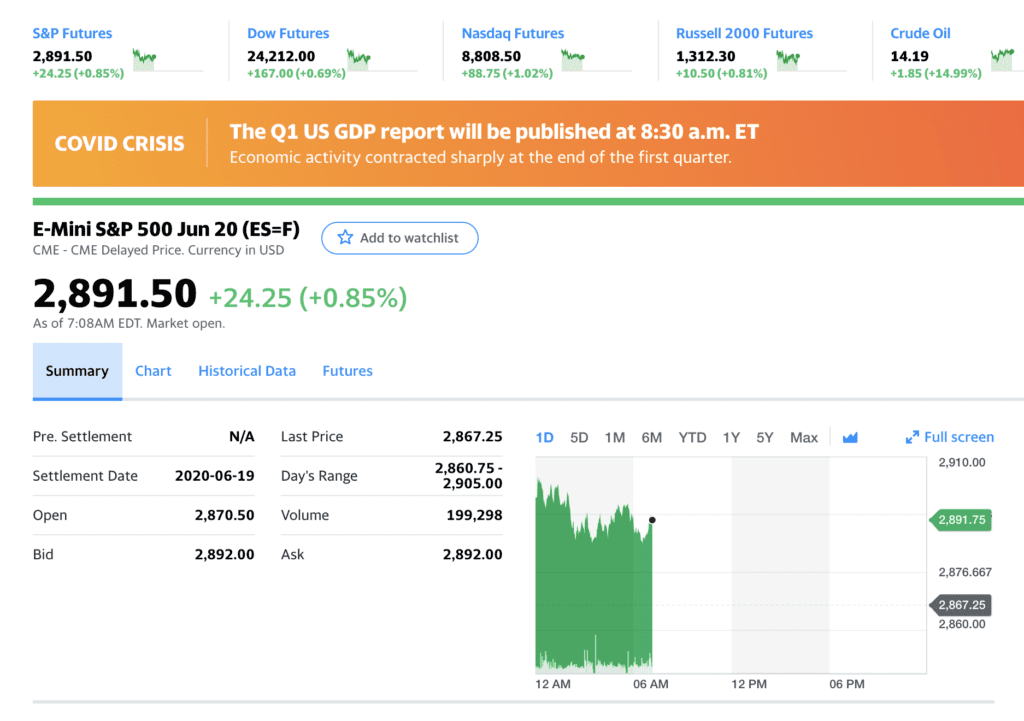

The U.S. stock market is off to a great start in 2024. Through Feb. 23, both the S&P 500 and the Nasdaq-100 are up more than 7% year to date (YTD). The Dow Jones Industrial Average is up nicely as well, though not as dramatically. That well-known index has gained just over 3% YTD.

You may be thinking about taking money off the sidelines and investing in this red-hot market. If you have a long-term time horizon, that's probably a good idea. The equities markets go up and down, but historically, good quality stocks tend to appreciate over time.

Before you pull the trigger on that stock you've got your eye on, you need to do a little homework first. It's smart to review past performance, become familiar with company fundamentals , learn about management and get an independent, third-party opinion before you place a buy order.

The problem is, high-quality stock analysis tools and professional research can be very expensive. Where can a retail investor go for high-level stock research and helpful analysis tools without breaking the bank?

Thankfully, there are plenty of investing resources that any investor can access for free. Here are some of the best places to conduct your equity research at no cost to you:

- Your online broker.

- TradingView.

- Morningstar at the public library.

- S&P Global Market Intelligence.

Your Online Broker

Most brokerage platforms provide their clients with reasonable access to their proprietary equity research as well as valuable analysis tools such as charting and backtesting utilities. Generally, the larger and more established the broker, the better the research. You can expect excellent quality research, tools and advice to be included on platforms like E*Trade, which is owned by Morgan Stanley (ticker: MS ), TD Ameritrade, owned by Charles Schwab Corp. ( SCHW ) and Merrill Edge, owned by Bank of America Corp. ( BAC ), and the online brokerage of Charles Schwab Corp. ( SCHW ), which includes features from the recently acquired TD Ameritrade. Popular online and app-based brokers like Interactive Brokers Group Inc. ( IBKR ) and Robinhood Markets Inc. ( HOOD ) get high marks in this department as well.

Broker-provided research reports are usually only one or two pages long and are well worth reading. You'll also find easy-to-access tools like stock screeners and news feeds as well.

Just log on to your account and look for a tab or button that says "research." Most systems are designed to be highly intuitive and user-friendly. If you run into difficulty accessing their tools or research, just contact customer service via chat, email or phone.

Did you know that a public company's financial filings and virtually all other government-mandated reports are public information and can be accessed by anyone, at any time free of charge? It's true. And it makes the Securities and Exchange Commission (SEC) an excellent free resources for stock research.

The SEC doesn't publish research reports or give opinions on stocks, but through its Electronic Data Gathering, Analysis and Retrieval System, called EDGAR for short, it does catalog and provide free access to every document a public company files with that regulatory agency.

Want to know a stock's revenue, profit, expenses or cash flow for the latest quarter or for the last few decades? Are you curious about the CEO's compensation? It's all on EDGAR for you to download and view, and it's very easy to find. Just navigate over to the SEC's website and click on the "filings" tab. From there, page down to the EDGAR - Search and Access . There you can navigate to a search that works for you, and an incredible wealth of information is available with a few clicks of your mouse.

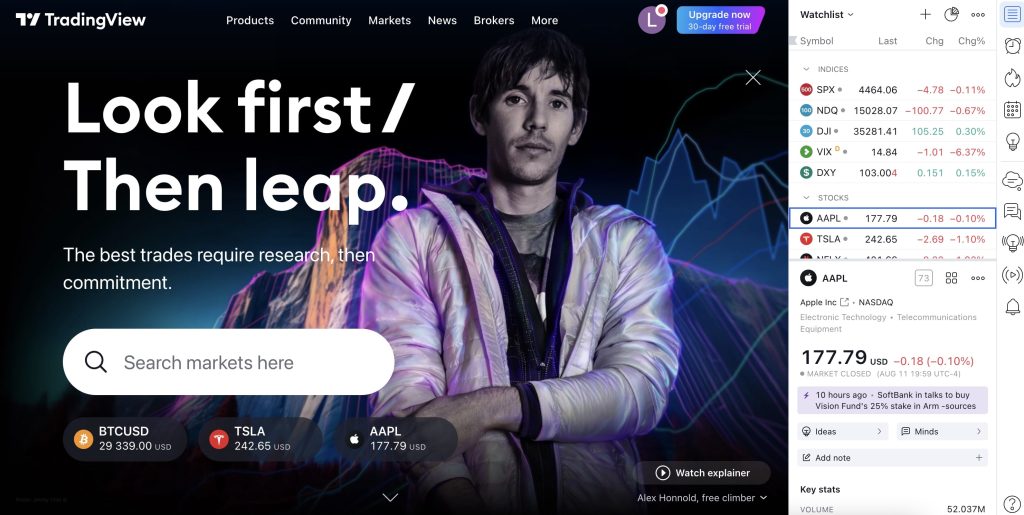

TradingView

There is a category of investment analysis websites broadly called charting platforms. That name, however, is insufficient in light of all they offer and all the free investing tools they provide. With more than 50 million users, TradingView is among the most popular charting and investing platforms on the internet.

TradingView is a comprehensive combination of charting, analysis and research tools. All members have access to breaking news, historical investment data and the site's social network. It offers premium subscriptions for a reasonable fee, but investors can conduct a surprising amount of in-depth research with basic access which is available for free.

You can view customizable charts with multiple layers of pricing, volume and trend data , you can screen stocks by market capitalization, stock market sector and other criteria, and you can develop your own strategies and ideas and test them in various hypothetical situations. Beyond the research capabilities, TradingView offers an opportunity to communicate and learn from other investors on the platform.

It will ask you to open an account by registering with an email and password, but access isn't temporary or on a trial basis. You can use the many free tools for as long as you want and upgrade to premium only when you're ready.

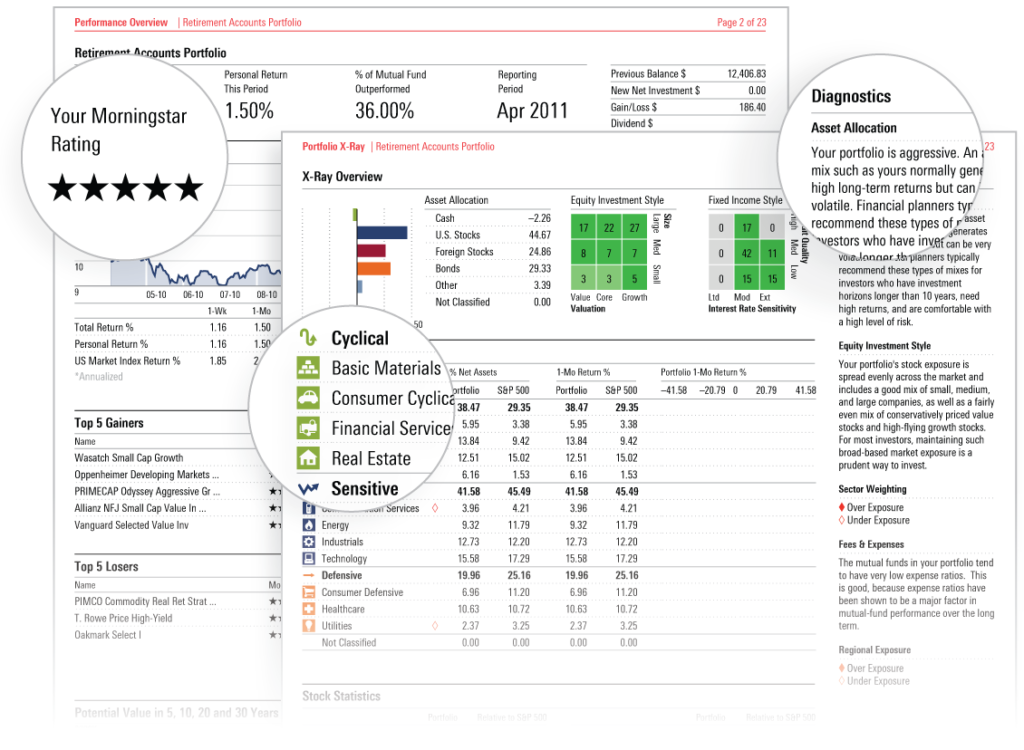

Morningstar at the Public Library

A standard library card can be your key to an incredible amount of free market research. Many public libraries around the country maintain a premium subscription to Morningstar as well as other professional investment research outlets. Like almost all public library resources, Morningstar equity research is free to registered members.

Check with your local or state library system to see if it has Morningstar. While you're at it, look for other subscription-based research companies like CFRA or Zacks. Chances are they will have one or more. Once you've confirmed it has what you're looking for, dust off your old library card – or apply for a new one for free – and start browsing the catalog of investment resources.

In most cases, you won't even have to visit a physical library branch. Modern libraries offer members access to Morningstar online at no additional cost. You can download detailed financial and analyst reports, use the available portfolio and stock screening tools, and benefit from the educational resources Morningstar produces, all for free.

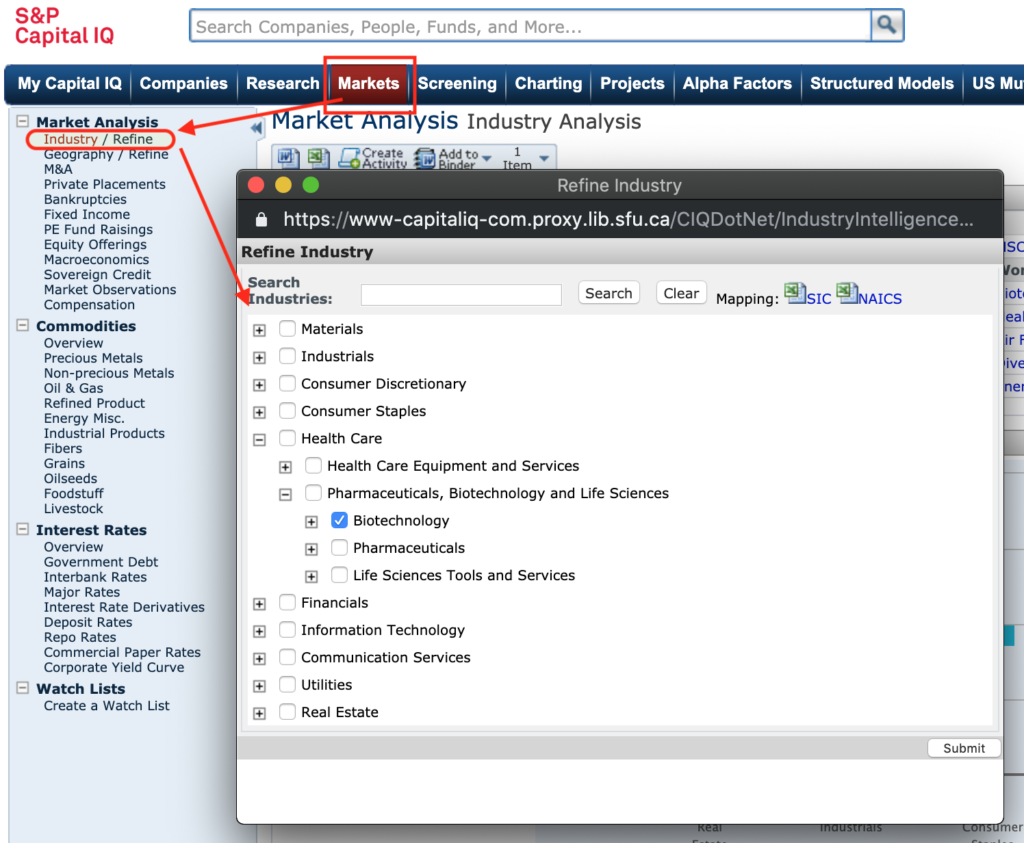

S&P Global Market Intelligence

S&P Global is one of the most respected research firms in the world. Institutional investors pay tens of thousands of dollars a year for premium access to its S&P Capital IQ research and trading platform. Those exorbitant price levels are out of reach for most retail investors but, thankfully, S&P offers many market insights and research online for free.

The Research & Insights page of S&P's website is loaded with articles, posts, notes and news that can be an invaluable resource to the small investor. Some information requires you have an account, but you can create one for free to access those reports. The site is updated several times a week so the data and information is always current.

You'll find sophisticated but accessible market intelligence on sectors from tech to health care and everything in between. The page has a search bar in the upper right corner so you can quickly find exactly what you're looking for.

Click on the "subscribe now" button and you'll be directed to the S&P newsletter subscription hub. There you can sign up for any of dozens of professional quality investment industry newsletters on a wide variety of subjects. Free research will be delivered to your email inbox on a monthly basis at no cost and with no obligation.

Best Long-Term Stocks to Buy Now

Glenn Fydenkevez Feb. 12, 2024

Tags: investing , stock market , money , financial literacy , Morgan Stanley , TD Ameritrade , Charles Schwab , Bank of America , Interactive Brokers Group , Robinhood

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

What to know about sweep accounts.

Brian O'Connell April 24, 2024

Best Charles Schwab Mutual Funds

Tony Dong April 24, 2024

6 Best Airline Stocks to Buy

Coryanne Hicks April 24, 2024

7 Best Long-Term ETFs to Buy and Hold

Jeff Reeves April 24, 2024

7 Best Electric Vehicle ETFs to Buy

Tony Dong April 23, 2024

Best Beginner Investing Books

Julie Pinkerton April 23, 2024

Are There Any Tax-Free Investments?

Marguerita Cheng April 23, 2024

8 Best Defense Stocks to Buy Now

Wayne Duggan April 22, 2024

7 Best Energy ETFs to Buy Now

Tony Dong April 22, 2024

Small-Cap ETFs to Buy for Growth

Glenn Fydenkevez April 22, 2024

7 Best IPOs in 2024

Brian O'Connell April 22, 2024

Oil Stocks Tied to Crude Prices

Wayne Duggan April 19, 2024

7 Best Dividend ETFs to Buy Now

Jeff Reeves April 19, 2024

Could Energy Costs Suppress Bitcoin?

Dmytro Spilka April 19, 2024

Best Tech ETFs to Buy

Coryanne Hicks April 19, 2024

15 Best Dividend Stocks to Buy for 2024

Ian Bezek April 19, 2024

Commodity Stocks to Buy for Dividends

Matt Whittaker April 18, 2024

ETF vs. Index Funds: What to Know

Tony Dong April 18, 2024

Best Actively Managed ETFs

Glenn Fydenkevez April 18, 2024

8 Top Nancy Pelosi Stocks to Buy

Wayne Duggan April 18, 2024

- Customer Service

- Open an Account

- Virtual Assistant

- Portfolio Log In Required

- Account Positions Log In Required

- Account Positions

- Trade Log In Required

- Trading Dashboard Log In Required

- Trading Dashboard

- Active Trader Pro

- Cash Management Log In Required

- Cash Management

- Bill Pay Log In Required

- Security Settings Log In Required

- Security Settings

- Account Features Log In Required

- Account Features

- Documents Log In Required

- Fidelity Alternative Investments Program Log In Required

- Tax Forms & Information

- Retirement Distributions Log In Required

- New Account Checklist Log In Required

- Refer a Friend

- What We Offer

- Build Your Free Plan

- Financial Basics

- Building Savings

- Robo Investing Plus Advice

- Wealth Management

- Find an advisor

- Life Events

- Saving & Investing for a Child

- Charitable Giving

- Life Insurance & Long Term Care Planning

- Wealth Management Insights

- Watchlist Log In Required

- Alerts Log In Required

- Mutual Funds

- Fixed Income, Bonds & CDs

- Markets & Sectors

- Retirement & IRAs

- Spending & Saving

- Investing & Trading

- Direct Indexing

- Sustainable Investing

- Managed Accounts

- 529 College Savings

- Health Savings Accounts

- Life Insurance

- The Fidelity Advantage

- Planning & Advice

- Straightforward Pricing

- Insights & Tools

- Security & Protection

- FDIC & SIPC Coverage

- Marketplace Solutions

- About Fidelity

- Research >

- Stocks >

Investing Insights

Recognia methodology.

Bullish and Bearish Events of the Day provide long/short trading ideas by identifying U.S. stocks that have recently formed a bullish or bearish classic chart pattern. Patterns must have taken at least 35 days to form, which draws out the more significant patterns for intermediate or long-term trend direction. The list is then filtered to include stocks with a minimum $3.00 for bullish and $5.00 for bearish close price; and, a minimum 50,000 trading volume. Most recent patterns are listed first. Patterns on the same date are sorted using Recognia's proprietary quantitative algorithm to draw strong companies to the top, and if further sorting is required (for stocks with the same quantitative analysis result) it is done by trading volume to draw highest volume stocks to the top.

Find out how to use fundamental analysis and technical analysis when evaluating stocks, with the help of the Fidelity Learning Center.

My Research –

Today's events, upcoming webinar events.

Visit the Learning Center Events page for a full list of upcoming webinars.

- Terms of Use |

- Site Map

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Stock Research: How to Do Your Due Diligence in 4 Steps

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Stock research involves investigating a company's financials, leadership team and competition to figure out if you want to invest.

When doing stock research, it's helpful to know terms such as revenue, earnings per share and price-earnings ratio.

A good stock research site can help you find lots of information quickly and may even offer stock analysis.

Stock research is a lot like shopping for a car. You can base a decision solely on technical specs, but it’s also important to consider how the ride feels on the road, the manufacturer’s reputation and whether the color of the interior will camouflage dog hair.

What is stock research?

Stock research is a method of analyzing stocks based on factors such as the company’s financials, leadership team and competition. Stock research helps investors evaluate a stock and decide whether it deserves a spot in their portfolio.

» Looking for a lesson in how to buy stocks instead? We have a full guide to that here .

4 steps to research stocks

One note before we dive in: Stocks are considered long-term investments because they carry quite a bit of risk; you need time to weather any ups and downs and benefit from long-term gains. That means investing in stocks is best for money you won't need in at least the next five years. (Elsewhere we outline better options for short-term savings .)

1. Gather your stock research materials

Start by reviewing the company's financials. This is called quantitative research, and it begins with pulling together a few documents that companies are required to file with the U.S. Securities and Exchange Commission (SEC):

Form 10-K: An annual report that includes key financial statements that have been independently audited. Here you can review a company’s balance sheet, its sources of income and how it handles its cash, and its revenues and expenses.

Form 10-Q: A quarterly update on operations and financial results.

Best stock research websites

The SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) website provides a searchable database of the forms named above. It’s a valuable resource for learning how to research stocks.

Short on time? You’ll find highlights from the above filings and important financial ratios on your brokerage firm ’s website or on major financial news websites. (If you don't have a brokerage account, here's how to open one .) This information will help you compare a company’s performance against other candidates for your investment dollars.

» View our picks: The best online brokers for stock trading

2. Narrow your focus

These financial reports contain a ton of numbers and it's easy to get bogged down. Zero in on the following line items to become familiar with the measurable inner workings of a company:

Revenue: This is the amount of money a company brought in during the specified period. It’s the first thing you’ll see on the income statement, which is why it’s often referred to as the “top line.” Sometimes revenue is broken down into “operating revenue” and “nonoperating revenue.” Operating revenue is most telling because it’s generated from the company’s core business. Nonoperating revenue often comes from one-time business activities, such as selling an asset.

Net income: This “bottom line” figure — so called because it’s listed at the end of the income statement — is the total amount of money a company has made after operating expenses, taxes and depreciation are subtracted from revenue. Revenue is the equivalent of your gross salary, and net income is comparable to what’s left over after you’ve paid taxes and living expenses.

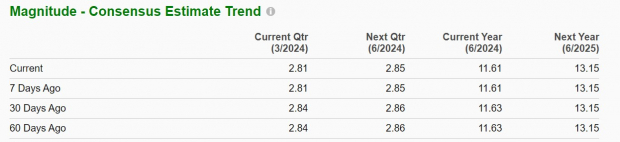

Earnings and earnings per share (EPS). When you divide earnings by the number of shares available to trade, you get earnings per share. This number shows a company’s profitability on a per-share basis, which makes it easier to compare with other companies. When you see earnings per share followed by “(ttm)” that refers to the “trailing twelve months.”

Earnings is far from a perfect financial measurement because it doesn’t tell you how — or how efficiently — the company uses its capital. Some companies take those earnings and reinvest them in the business. Others pay them out to shareholders in the form of dividends.

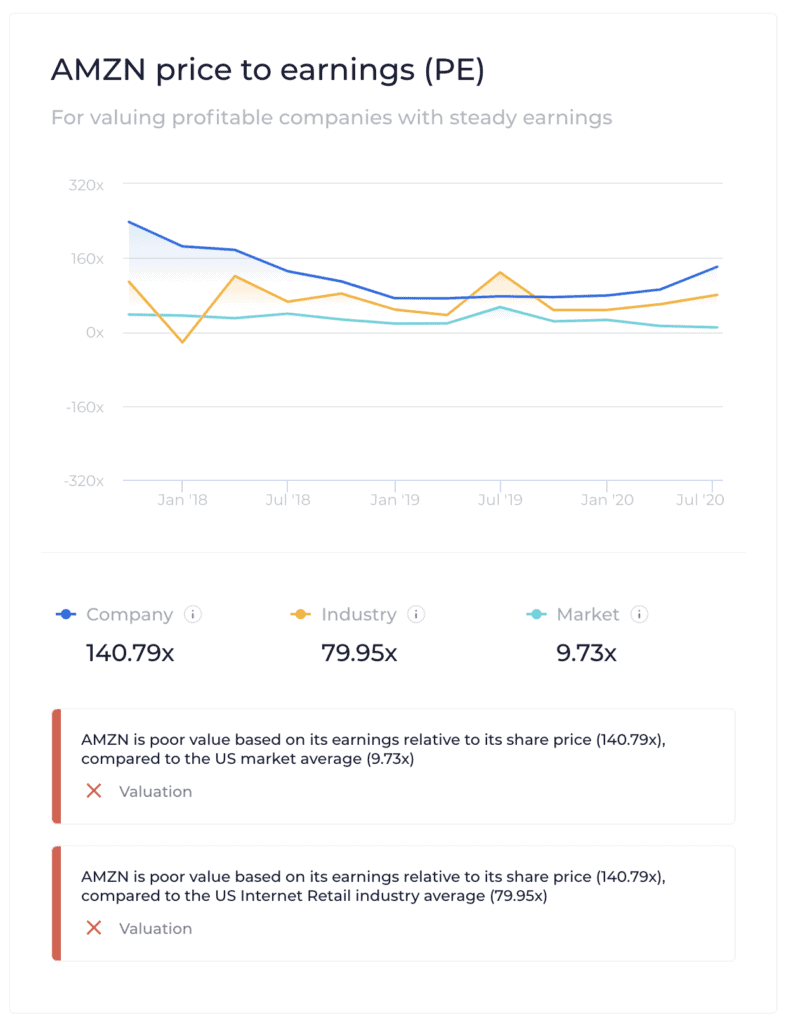

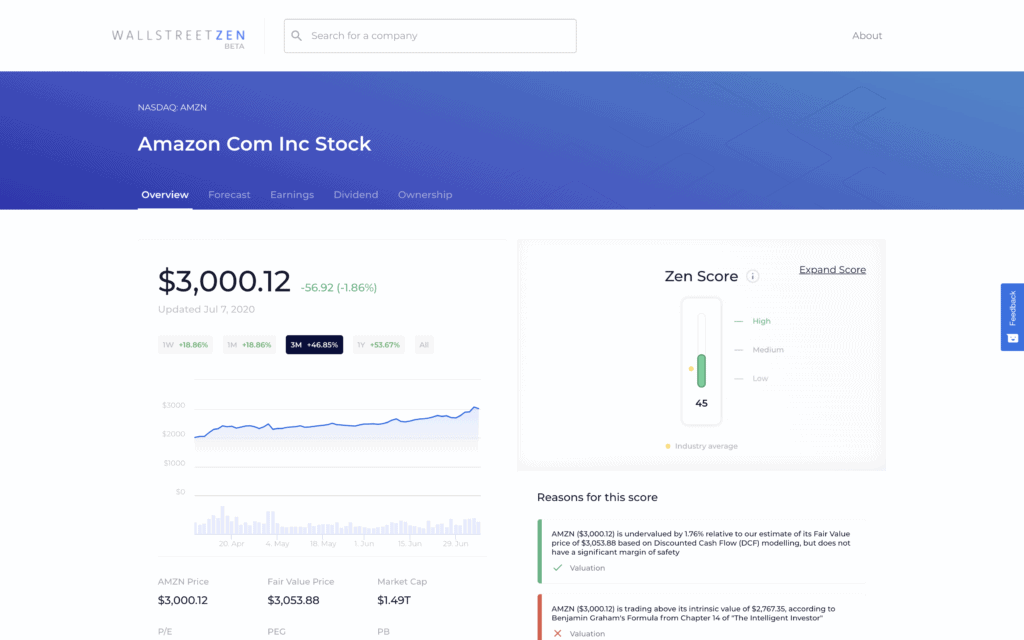

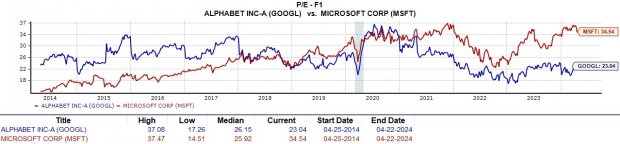

Price-earnings ratio (P/E): Dividing a company’s current stock price by its earnings per share — usually over the last 12 months — gives you a company’s trailing P/E ratio . Dividing the stock price by forecasted earnings from Wall Street analysts gives you the forward P/E. This measure of a stock’s value tells you how much investors are willing to pay to receive $1 of the company’s current earnings.

Keep in mind that the P/E ratio is derived from the potentially flawed earnings per share calculation, and analyst estimates are notoriously focused on the short term. Therefore it’s not a reliable stand-alone metric.

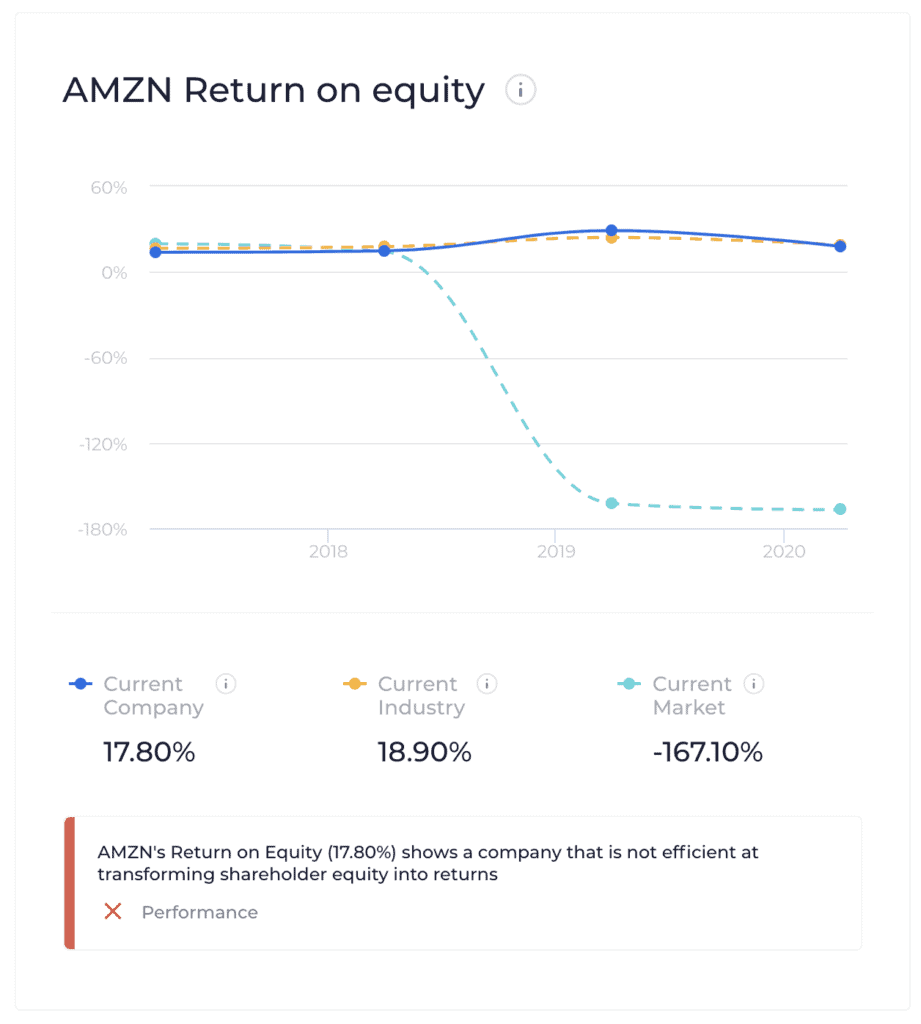

Return on equity (ROE) and return on assets (ROA): Return on equity reveals, in percentage terms, how much profit a company generates with each dollar shareholders have invested. The equity is shareholder equity. Return on assets shows what percentage of its profits the company generates with each dollar of its assets. Each is derived from dividing a company’s annual net income by one of those measures. These percentages also tell you something about how efficient the company is at generating profits.

Here again, beware of the gotchas. A company can artificially boost return on equity by buying back shares to reduce the shareholder equity denominator. Similarly, taking on more debt — say, loans to increase inventory or finance property — increases the amount in assets used to calculate return on assets.

» Want to make sense of stock charts? Learn how to read stock charts and interpret data

3. Turn to qualitative stock research

If quantitative stock research reveals the black-and-white financials of a company’s story, qualitative stock research provides the technicolor details that give you a truer picture of its operations and prospects.

Warren Buffett famously said: “Buy into a company because you want to own it, not because you want the stock to go up.” That’s because when you buy stocks, you purchase a personal stake in a business.

Here are some questions to help you screen your potential business partners:

How does the company make money? Sometimes it’s obvious, such as a clothing retailer whose main business is selling clothes. Sometimes it’s not, such as a fast-food company that derives most of its revenue from selling franchises or an electronics firm that relies on providing consumer financing for growth. A good rule of thumb that’s served Buffett well: Invest in common-sense companies that you truly understand.

Does this company have a competitive advantage? Look for something about the business that makes it difficult to imitate, equal or eclipse. This could be its brand, business model, ability to innovate, research capabilities, patent ownership, operational excellence or superior distribution capabilities, to name a few. The harder it is for competitors to breach the company’s moat, the stronger the competitive advantage.

How good is the management team? A company is only as good as its leaders’ ability to plot a course and steer the enterprise. You can find out a lot about management by reading their words in the transcripts of company conference calls and annual reports. Also research the company’s board of directors, the people representing shareholders in the boardroom. Be wary of boards comprised mainly of company insiders. You want to see a healthy number of independent thinkers who can objectively assess management’s actions.

What could go wrong ? We’re not talking about developments that might affect the company’s stock price in the short-term, but fundamental changes that affect a business’s ability to grow over many years. Identify potential red flags using “what if” scenarios: An important patent expires; the CEO’s successor starts taking the business in a different direction; a viable competitor emerges; new technology usurps the company’s product or service.

4. Put your stock research into context

As you can see, there are endless metrics and ratios investors can use to assess a company’s general financial health and calculate the intrinsic value of its stock. But looking solely at a company's revenue or income from a single year or the management team's most recent decisions paints an incomplete picture.

Before you buy any stock, you want to build a well-informed narrative about the company and what factors make it worthy of a long-term partnership. And to do that, context is key.

For long-term context, pull back the lens of your research to look at historical data. This will give you insight into the company's resilience during tough times, reactions to challenges, and ability to improve its performance and deliver shareholder value over time.

Then look at how the company fits into the big picture by comparing the numbers and key ratios above to industry averages and other companies in the same or similar business. Many brokers offer research tools on their websites. The easiest way to make these comparisons is by using your broker's educational tools, such as a stock screener. (Learn how to use a stock screener .) There are also several free stock screeners available online.

The bottom line on how to research stocks

Stock research is just a matter of gathering the right materials from the right websites, looking at some key numbers (quantitative stock research), asking some important questions (qualitative stock research) and looking at how a company compares to its industry peers — as well as how it compares to itself in years past.

Following these four steps can help you gain a deeper understanding of how to research stocks.

Colloquially, yes — "due diligence" or "DD" is a synonym for stock research.

Some professional investors, such as financial advisors, have a duty to act in their clients' best interest and are legally required take care, or exercise "due diligence," to not harm them financially — for example, by thoroughly researching an investment before buying it on behalf of a client.

Paid subscriptions and tools may streamline the research process, and may have more obscure types of stock data that aren't easy to find for free. But all of the types of data we've discussed in this article, such as SEC filings and valuation metrics, are available for free on websites such as EDGAR and Yahoo Finance .

Some professional investors, such as

financial advisors,

have a duty to act in their clients' best interest and are legally required take care, or exercise "due diligence," to not harm them financially — for example, by thoroughly researching an investment before buying it on behalf of a client.

Paid subscriptions and tools may streamline the research process, and may have more obscure types of stock data that aren't easy to find for free. But all of the types of data we've discussed in this article, such as SEC filings and valuation metrics, are available for free on websites such as

Yahoo Finance

More reading for active investors

Stock Market Outlook

Short Selling: 5 Steps to Shorting a Stock

» Who offers the best research? View our list of the best online brokers for beginners .

On a similar note...

Find a better broker

View NerdWallet's picks for the best brokers.

on Robinhood's website

12 Best Stock Research Tools for 2024

- By Ajay Sharma

- on January 16, 2024

Several new stock research platforms have launched in the last few years. Although most platforms differ in terms of data coverage, geographical coverage, and available tools, the age-old problem remains — interpreting the data provided by the companies and deciding which one is the best suitable for investors. The following stock research tools are at the forefront of solving this problem, in our opinion, by offering a diverse set of features that are user intuitive and aid in generating actionable insights, rather than just spewing raw data.

12 Best Stock Research Tools for 2024:

Business quant.

- Morningstar Premium

S&P Capital IQ

Stockopedia.

- Thomson Reuters Eikon

Benzinga Pro

Looking at stock research tools.

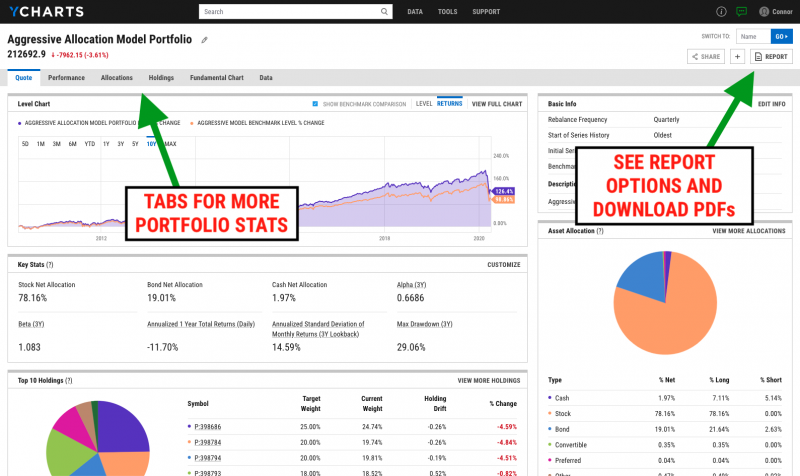

Ycharts was founded back in 2009, and since then, it’s well known for providing an extensive range of data points. They claim to have over 4000 clients who collectively oversee more than $750 billion in assets.

Ycharts provides 7-day free trial for their services,

- Their Standard basic package is priced at $3,600/year and the Professional is priced at $6,000/year

The standard package includes access to the following :

- Fundamental & Technical Charting

- Stock & Fund Screeners

- Live News and Customizable Alerts

- Analyst Estimates & Recommendations

- Dashboard for Monitoring Markets & Securities

Professional and Enterprise packages allow for the user to have access to features such as Charts, Excel Add-In, Integration Support, Model Portfolios, Comp Tables & Timeseries Analysis, Scoring Models, Dedicated Account Manager, Collaboration & Content Sharing Across Users, Tailored Onboarding & Training Program, Firm-wide Excel Model Conversion & Automation, and Consolidated Billing & Account Admin.

That’s us! Business Quant provides financial data, segment financials, KPI data, and powerful analytical tools to help investors research stocks and understand industry trends. We like to think that Business Quant is one of the best stock research tools for making informed investment decisions.

- Key Performance Indicator Data (e.g. AT&T’s subscriber adds, McDonald’s’ restaurant openings, Tesla’s vehicle deliveries by model, etc.),

- Financials by Region, Segment and Other Classifications,

- Industry Data (e.g. market share, shipments by vendor, etc.),

- Non-GAAP metrics from company presentations and filings,

- Stock Screener,

- Sector financials,

- Stock comparisons,

- Stock warnings,

- Stock ratings

- SEC filings

- Insider ownership data

- Institutional ownership data

- 200+ financial items and ratios for thousands for US stocks,

- Financial statements dating back 10+ years,

- Charting and visualization tools,

- Download data in CSV and XLSX formats

Our team of analysts goes through company filings, press releases, investor presentations, and other company documents to compile segment financials, non-GAAP metrics and key performance indicators. This way, you never have to dig through boring company documents and maintain a database of your own. Countless hours saved!

- The basic plan is free of cost, but provides access to limited data.

- The Pro plan is priced at just $19/month, when billed annually.

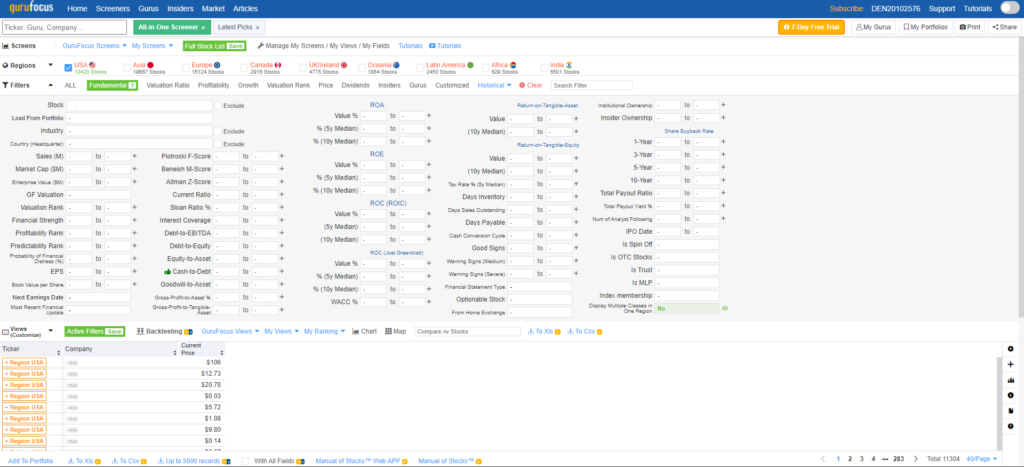

GuruFocus is another comprehensive stock research platform dedicated to value investing. It was founded in 2004, and it follows the principles of Warren Buffett. They believe the most effective way to create wealth is by investing long term and in quality instruments. GuruFocus provides a range of tools to excel at investment. For starters, it tracks 175+ investment gurus – mostly wealth managers and successful individual investors and CEOs and CFOs of various companies — to provide an upper hand on the market and information.

The platform also hosts vital features such as a comprehensive stock screener, discussion forums for investors, financial news, insider trading information, and a range of financial statements, business and valuation ratios. Plus, GuruFocus sports interactive charts, warning signs and data APIs to help investors to make informed investment decisions.

Clients are entitled to 7-day free trials of GuruFocus Premium and PremiumPlus memberships.

For individual investors:

- The price of the Premium membership depends on the geographical market. US market data costs $449/year , while European and Asian market data costs $399/year.

For professional investors:

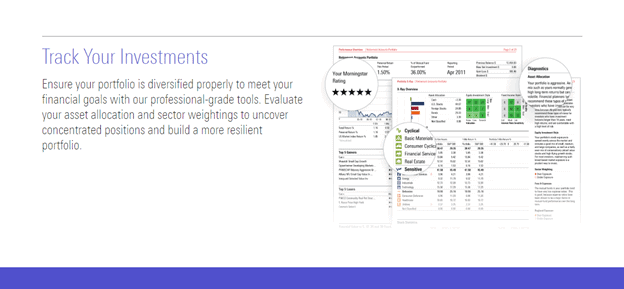

Morningstar Premium

Morningstar offers retail and individual investors access to news, financial data, and research on stocks, bonds, ETFs and mutual fund via its Morningstar Premium subscription product. Unlike other platforms, Morningstar premium does not rely on charts and technical analysis but focuses on fundamental analysis. Morningstar Premium is well suited to investors who prefer investing based on company fundamentals.

Morningstar Premium starts with a 14-day free trial , after which the service costs $29.95 per month or $ 199 per year.

Here are some features of a Morningstar Premium subscription

- Portfolio X-ray

- Fund screeners

- Portfolio manager

- Investment planning

- Personal Capital advisor

- Rating list

S&P Capital IQ is the research division of Standard & Poor. Ever since Capital IQ was acquired by Standard & Poor in 2004, the company has expanded operations in more than 20 countries, and its research terminals now cover almost all major markets. Capital IQ provides financial news, market insights, financial and pricing data, research reports on ETFs, funds, bonds on more than 65,000 public and 15 million private companies across the globe.

Capital IQ’s feature set includes the following:

- Deep company and industry research,

- Industry data,

- Supply chain database,

- Build and maintain models and presentation

- Commodities and futures, macroeconomic, pricing and exchange data

Capital IQ’s feature set is best suited for institutional or professional investors, and its pricing starts at $13,000 per user per year with a minimum of 3 users. This pricing drops to as low as $7,500 per user per year for large teams. But that’s just the starting pricing. There are data and feature add-ons that can quickly inflate the overall cost. It’s one of the most comprehensive and perhaps one of the best stock research tools in the list, provided one has a budget for it.

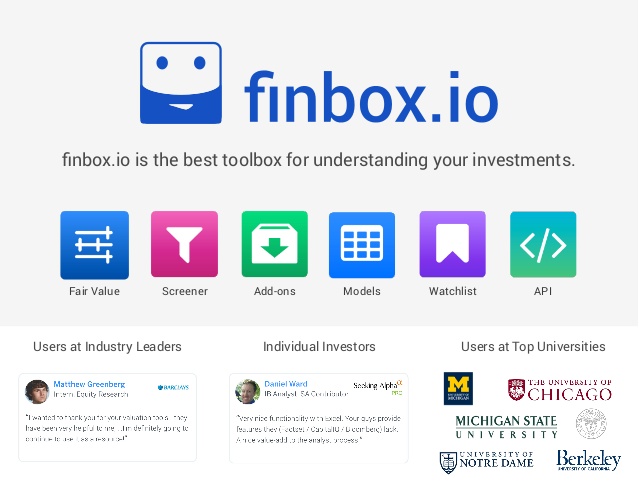

Finbox.comwas founded in 2014. It provides fundamental and financial data for 6 major global markets, including the U.S. The platform serves as a stock market portfolio research and management instrument to help traders improve their investing skills.

What makes Finbox different is it’s financial modelling functionality. Users create their own custom financial model templates, download the recent SEC filings and monitor their returns in a model portfolio.

Finbox’s feature set includes:

- Stock screener

- Ideas (find other portfolios through the search bar)

- Custom model templates

- Financial data for US and 5 other markets

- Educational classroom

Finbox provides a 10-day free trial for $1.

Its pricing starts at $20/month, billed annually for U.S. market data only ; and $66/month when billed annually for global markets .

If you don’t want to commit to an annual plan, Finbox.com also provides monthly plans for $39 and a quarterly plan for $90.

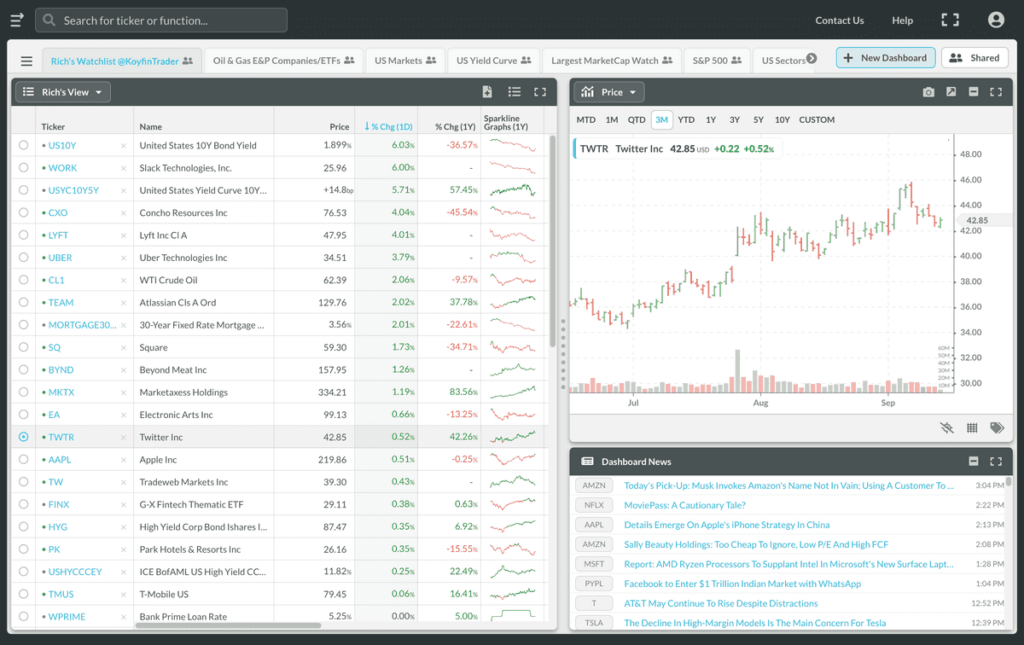

Koyfin was started in 2016 by two former Wall Street veterans. Its plans start from $15/month and go all the way up to $70/month.

The platform provides customizable dashboards and focuses on US markets. It’s similar to a research terminal, except it’s on the web.

Koyfin’s feature set includes:

- Macro Dashboards (macroeconomic, FX and commodity data)

- Financial statements and valuations

- Charting and graphing

- User-customizable dashboards

- Stock pricing data

Stockopedia was launched in 2010. It’s now attracted more than 10,000 subscribers to its platform. The platform provides automated stock ratings and portfolio analysis.

Stockopedia provides services such as

- StockRanks (automated stock ranking)

- Stock screening

- Portfolio tracking and watchlists

- Stock reports

- eBooks, Forums, Stockopedia customization and layout

Stockopedia’s has region-specific pricing:

- United Kingdom – $15/month and $75/year

- Europe (29+ countries including UK) and Developed Asia (5 Asia-Pacific nations) – $55/month and $400/year

- Australasia, United States and Canada – $25/month and $150/year

- India – $30/month and $300/year

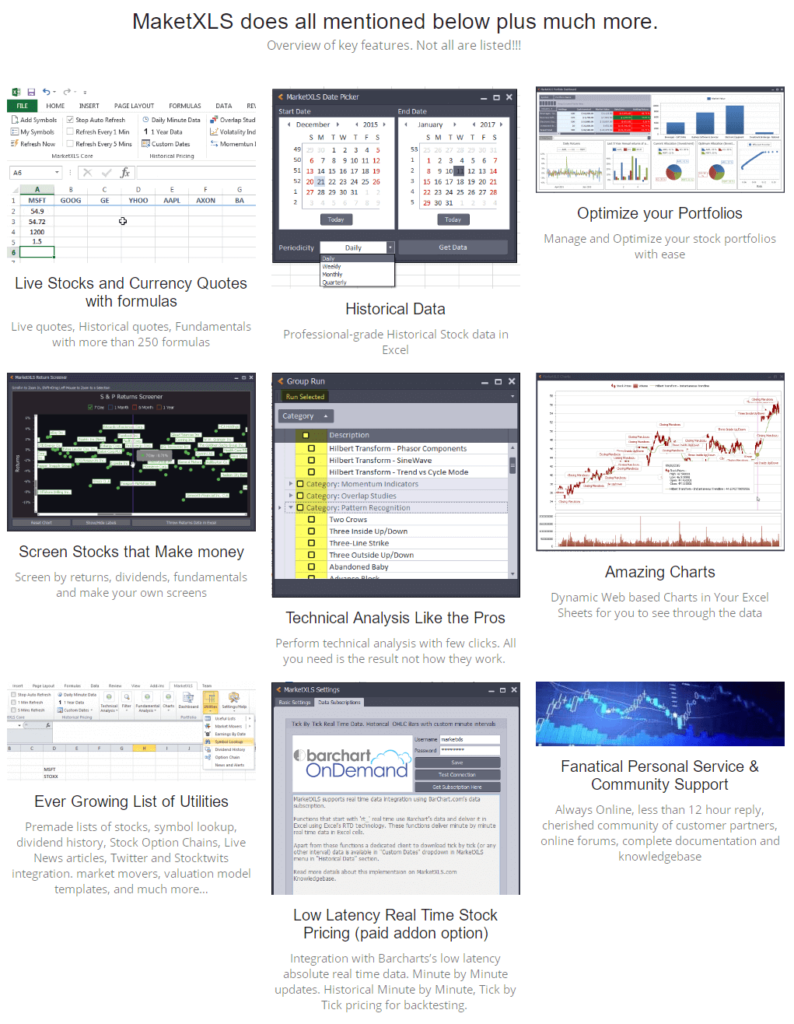

MarketXLS was founded in 2015. It’s an Excel-focused investment research platform. It provides financial, fundamental, and pricing data on stocks, ETFs, options & mutual funds within Microsoft Excel. Users can also screen stocks based on cash flow ratios, balance sheet items, income statement items, along with valuation and business ratios. There are also pattern recognition scans ideal for technical analysts and the option to back-test strategies. MarketXLS is best suited for Excel-oriented investors.

The platform provides coverage on 6 major markets: US, Canada, Australia, Germany and UK.

- Portfolio monitoring,

- Charts and visualization,

- Technical indicator scans,

- Back-testing strategies,

- Social media and market news,

- Options data,

- Watchlists,

MarketXLS provides a 7-days free trail and comes with four different versions of subscription,

- Pro , priced at $420/year ,

- Pro Plus priced at $680/year,

- Pro Plus RT priced at $940/year and

- Premium priced at $1680/year.

Refinitive EIKON

Refinitiv Eikon, launched in 2010, is a full-blown trading and research terminal like Bloomberg and S&P Capital IQ. The platform provides real-time market data, news, fundamental data, research reports, trading, and messaging tools.

It’s an open platform so clients can build and plug into a wide array of APIs and apps to get the information they need, when and how they need it.

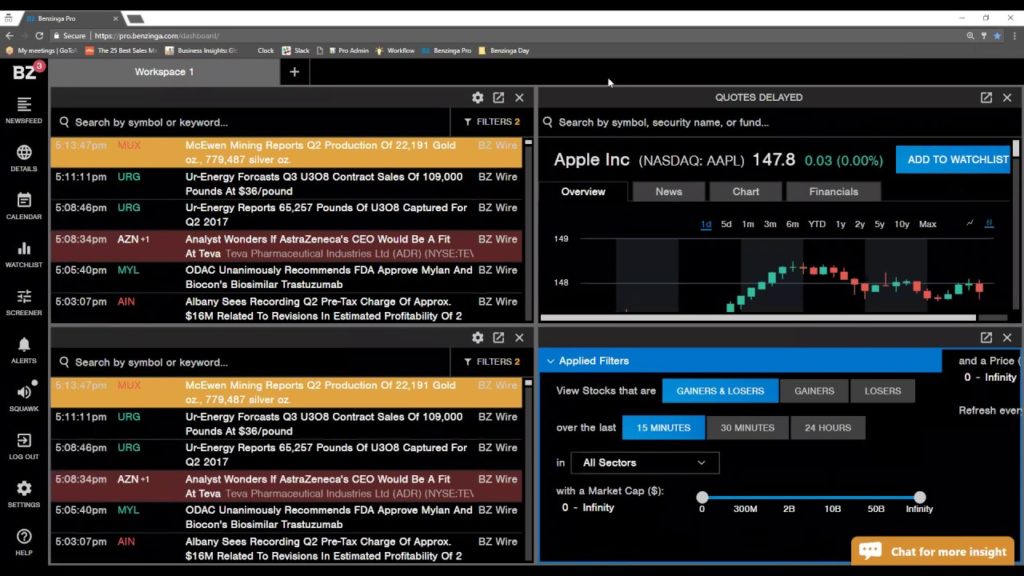

Benzinga Pro is a news-based research platform that was founded in 2010. The platform sets itself apart by providing real-time news for fast pace traders. It also sports other features

Benzinga Pro’s feature set includes:

- Real-time news feed

- Corporate earnings and events calendar

- Charts and visualization tools

- Financial statements and business ratios

- News Desk gives you personal access to a team of analysts

- Benzinga can get exclusive stories to their established brand in financial news

- Option alerts and penny stocks

The platform has two subscription plans available:

- Benzinga Pro Basic costs $99/month paid monthly or $79/month billed annually.

- Benzinga Pro Essential costs $177/month billed monthly and $117/month billed annually.

- Bloomberg Terminal

Bloomberg Terminal was founded 1981, and it’s grown to become one of the most extensive and expensive research terminals across the world. It’s a multi-functional stock research terminal where you can access real-time news, events, analytical tools, view company filings, manage portfolios, conduct research, place trades customize information, access research reports, and chat with other Bloomberg terminal users.

Bloomberg has data on more than 5 million bonds, equities, commodities, currencies, and funds across most major markets. Bloomberg Terminal’s features include:

- Data Visualization

- Research and Financial Analysis

- Charting and Visualization

- Risk Analysis

- Real-time news

- Place orders

- View and annotate documents

- Collaborate with other users

- Set alerts and monitor market news and events

- Events calendar

Bloomberg costs $24,000 per user per year and is apt for institutional investors.

Which Stock Research Tool is for you?

Most of the stock research tools listed on this page have a diverse set of features and datasets that may not overlap with the others in a given price-band. So, a good way to pick the best stock research tool for you would be to start with a budget and create a list of features you want for your research workflow. At this point, taking trials would give you a good indication of which stock research tool fits your criteria the best. This is a better assessment approach than outrightly declaring a winner or a loser from the list.

What do you think is the Best Stock Research Tool for you?

If you think we’ve missed out on a stock research tool, do let us know.

(Image credits: Designed by ijeab / Freepik )

Ajay Sharma

- On October 23, 2020

- Tags: Bloomberg , Capital IQ , Eikon , Finbox , Gurufocus , Investment Research Platforms , Koyfin , MarketXLS , Morningstar Premium , Stock Research Tool , Stockopedia , Ycharts

Segment Financials and KPI Data for US Stocks

- Piyush Arora -

- Investing ·

14 Best Stock Analysis Websites for 2024

- M. Anwitha -

9 Best Stock Screeners for 2024

- Subham Sharma -

13 Best Stock Research Websites for 2024

- Muskan Gupta -

Get 60% Off on Business Quant

- Access all features

- Stock analysis tools

- Company KPI data

- Segment financials

Offer Ends In

Starting from $49 $19/mo..

Granular Financial Intelligence

Get Pro for 60% off

- Access all features immediately

- Datasets updated every day

- Export data in CSV and XLSX formats

Starting from $49 $19 / month

- Free Sign Up

Free Report PDFs

- American Express

- Caterpillar

- Cisco Systems

- Goldman Sachs Group

- Honeywell International

- Johnson & Johnson

- JPMorgan Chase

- Procter & Gamble

- Travelers Companies

- UnitedHealth Group

- Verizon Communications

- Walgreens Boots Alliance

- Walt Disney

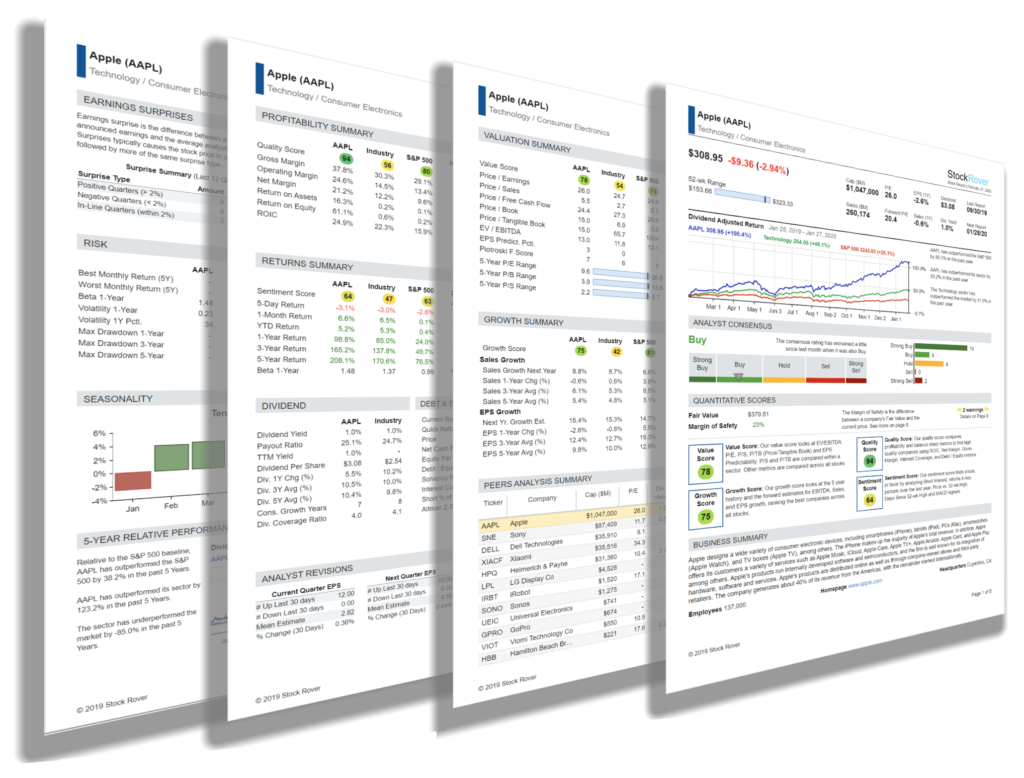

Research Reports

Grab a comprehensive and unbiased report on any of the 7000+ stocks we track with a Research Reports subscription.

As a Research Reports subscriber, you will have unlimited access to our interactive, up-to-the-minute research reports. Research Reports can be viewed interactively in your browser or generated in PDF format.

On the left are examples of Research Reports for the Dow 30. Note the free samples are updated on a weekly basis.

Reports include premium Stock Rover metrics such as Margin of Safety, Fair Value, and our scores. The comprehensive eight page document is structured as follows:

- Key Information (P/E, EPS and Sales Growth)

- Chart vs. Industry and S&P 500

- Analyst Summary Consensus

- Scores, Fair Value and Margin of Safety

- Business Summary

- Peers Analysis

- Profitability

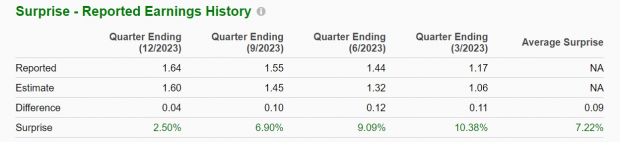

- Earnings Surprises

- Risk Analysis

- Seasonality

- Relative Performance

Ratings vs. Peers

- Financial Strength

- Dividend History

- Upcoming Dividend

- Dividend Rate

- Dividend Statistics

Financial Statement Summary

- Income Statement

- Balance Sheet

Valuation and Profitability History

- 10 Year History of Key Valuation and Profitability Metrics

- Explanation of each Warning for the Stock

- Report Tips

- Updated: February 13, 2024

13 Stock Research Websites & Tools for Undervalued Stocks in 2024

Trying to find your next investment isn’t easy.

There are hundreds (if not thousands) of websites and tools you could use to find information about which stocks to invest in.

However, not all of them are accurate, or even helpful.

Some of them might only cover one data point, others might be missing data points, and some cost thousands of dollars to access.

So in this article, I’m going to share the best stock research websites and tools to help you find hidden gems worth investing in. Including the ones that are free!

Best Stock Research Websites & Tools Summary

Here's the TL;DR

- TradingView is best for charts and advanced metrics.

- Investopedia is best for educational content and simulated trading.

- Ticker Nerd is best for detailed stock reports.

- Simply Wall St is the best visual analysis research platform.

- Quiver Quantitative is best for alternative data points.

- Stock Analysis is best for IPO data and stock forecasts.

- Seeking Alpha is best for investors who want a one-stop shop.

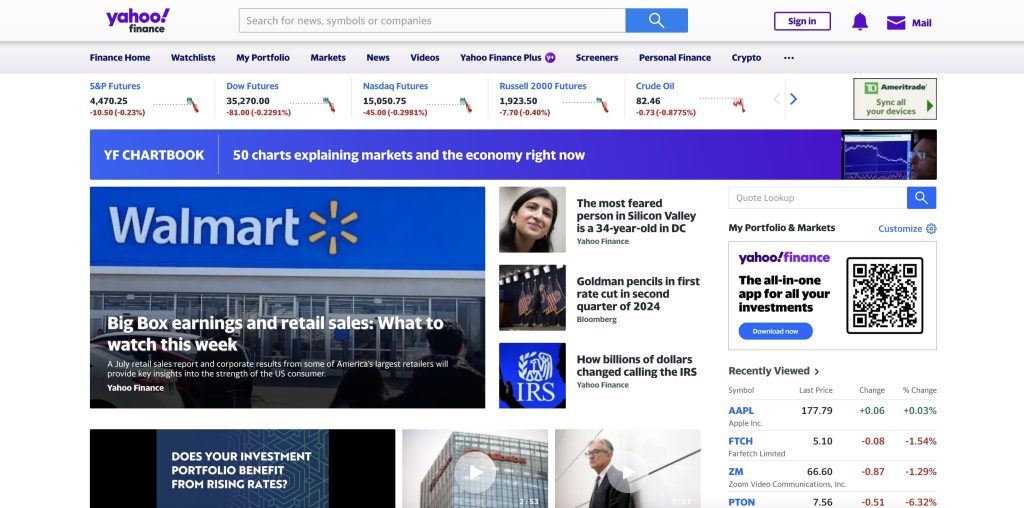

- Yahoo Finance is best for updated company information and news.

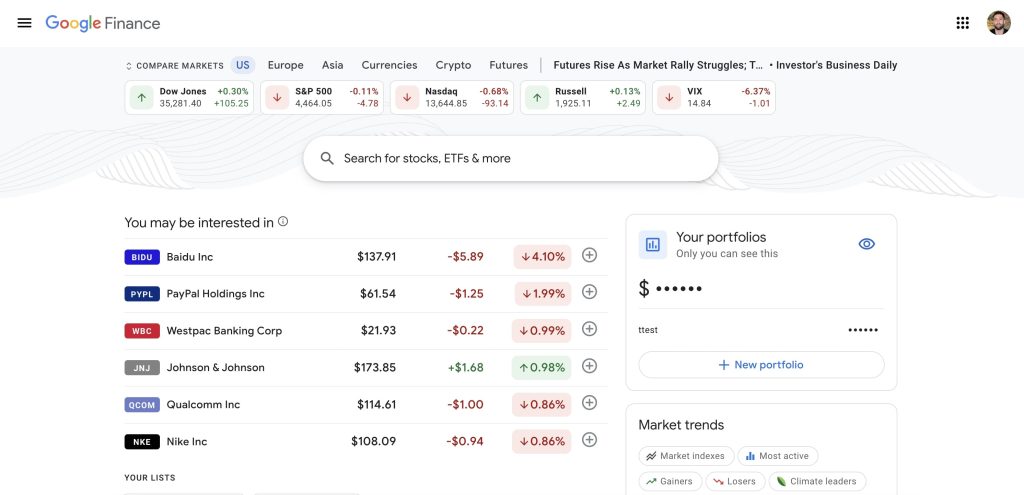

- Google Finance is best for tracking your portfolio performance.

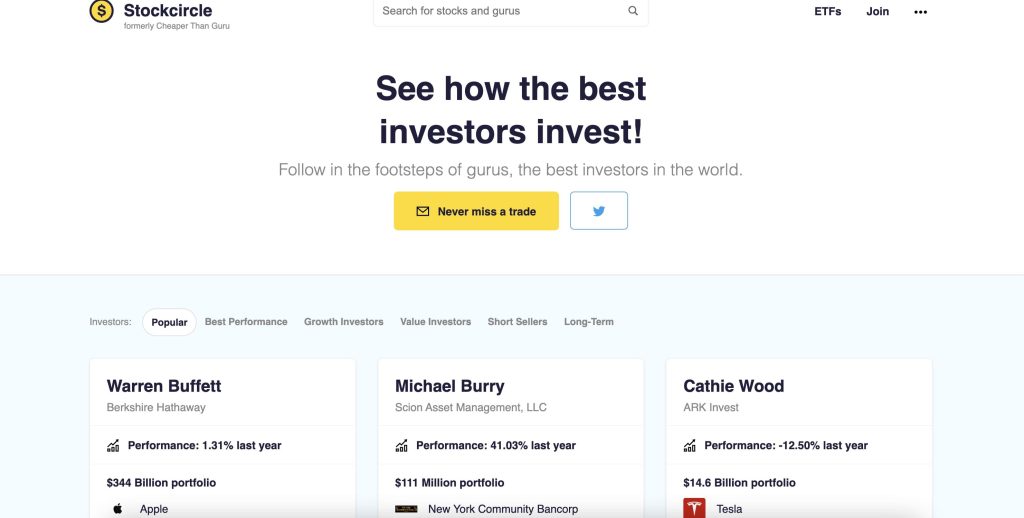

- Stock Circle is best for staying on top of hedge fund trading data.

- MarketWatch is best for news and opinions.

- The Motley Fool is best for reports and opinions.

- Stock Market Guides is best for software-based stock and options

What to look out for when using a stock research website or tool

It’s almost impossible to get an accurate picture of the performance of a stock without using a reliable, complete, and accurate tool. When searching for a website to lean on keep an eye out for these specific factors:

- Data accuracy and reliability: Ensure the platform sources its data from reputable providers (e.g. SEC data and not a third party that gets their data from another third party)

- User interface: Make sure the platform is user-friendly and easy to navigate. You might miss important details or information if it is not.

- Depth and breadth of data: Does the platform only share a few data points or does it share the whole picture? Ensure you have access to multiple data points.

- Historical data: This refers to the ability to access and analyzes historical performance, without this, it’s hard to see the full picture.

- Real-time updates: This is most important for active traders (i.e. day traders) but it’s still important to know that the information presented is updated as frequently as possible.

- Analytical tools: If the platform is technical in nature it should offer a range of analytical tools, such as valuation models, technical analysis charts, and predictive algorithms, to aid in your research.

- Sources: Any credible website or research tool will tell you where the information came from and have no issue linking out so you can validate their claims.

- Alternative data sources: For your research to be complete you might want access to alternative data sources like social media mentions, hedge fund trading data, etc. Ticker Nerd is a great example of combining alternative data sources to give an accurate picture of a company.

- Educational resources: This is especially important for newer investors, platforms that offer tutorials, webinars, articles, and other educational resources can be beneficial.

- Reviews and testimonials: Check reviews and testimonials from other users to gauge the platform's reliability, usability, and overall reputation.

13 best stock research websites and tools based on our first-hand experience

Here are the best stock research websites and tools based on our first-hand experience with them. We use these tools daily to produce our premium reports and provide our members access to the highest quality data and sources.

1. TradingView

TradingView is a popular platform that provides advanced financial visualization tools, including interactive charts for stocks, cryptocurrencies, forex, and other assets. It even offers a social network for traders and investors to share and discuss their insights, strategies, and technical analyses. Additionally, TradingView provides a range of tools for technical analysis, backtesting, and scripting, making it popular among novice traders, experienced traders, and other websites that want to leverage their data.

This is a stock research tool that any investor can find value in. When it comes to getting accurate, up-to-date data I rely on TradingView. Since I prefer to use websites with clean and easy-to-navigate interfaces I rely on TradingView.

- Free version with limited features.

- Pro: $14.95 per month.

- Pro+: $29.95 per month.

- Premium: $59.95 per month.

- All memberships have a free 30-day trial and are cheaper on an annual plan.

🤓 Pro tip: You can customize your graphs to include data points, date ranges, and chart types that best suit your needs. On top of this, you can create detailed alerts with specific triggers and messages.

2. Investopedia

Investopedia is one of the most popular financial education websites on the internet and one of the first investing sites I ever came across. They offer a tonne of articles, tutorials, and resources on finance, investing, and economics. It serves as a comprehensive reference for terms, concepts, and strategies, catering to both beginners and experienced professionals.

Most of their articles are comprehensive, peer-reviewed, and packed with visuals to help you grasp concepts quickly. I would recommend every investor use Investopedia to improve their baseline investing knowledge.

🤓 Pro tip: Investors can use their tools like simulators, quizzes, and courses to further enhance financial literacy and investment skills.

3. Ticker Nerd

Ticker Nerd is our very own stock research website and newsletter space that is growing rapidly. Our reports are transparent, unbiased, trustworthy, packed with hard-to-find data and sources, and easily skimmable. Our team of experts keeps a three to five-year horizon when covering any stock to ensure a long-term upside for members.

Each monthly report shows two undervalued growth stocks that cover hedge fund trading data, Wall St analyst ratings, social media sentiment, and fundamental and technical analysis. So if you’re an investor who appreciates objective, transparent, accurate, and well-rounded information, Ticker Nerd is for you.

- Free newsletter packed with value.

- Premium stocks newsletter: $39.95 per month or $199 per year.

🤓 Pro tip: Take a look at our upcoming IPO pages such as Waymo , Chime , Reddit , and Stripe to see which companies might go public and when.

4. Simply Wall St

Simply Wall St is one of the best stock research websites on the internet. The comprehensive visual analysis platform covers almost every data point on any business you can think of. What I like most about Simply Wall St is how intuitive the visualizations are. It's very easy to get a birds-eye view of a company's performance, along with its relative performance to other similar stocks.

For investors who want to spend time researching the fundamentals of a company and can appreciate in-depth visual reports I highly recommend starting a free trial. With a 4.5 star rating on Trust Pilot and over 6,000,000 investors signed up you trust the platform will provide value.

- Free plan: $0 with access to 5 company reports per month, 1 portfolio, and 1 watchlist.

- Premium: $14 per month for 30 company reports, 3 portfolios with 30 holdings, a stock screener, and 3 watchlists.

- Unlimited: $28 per month for unlimited company reports, 5 portfolios with unlimited holdings, a stock screener, and 5 watchlists.

- All plans are billed yearly.

🤓 Pro tip: Use the snowflake filter to visually create your own personal stock screener.

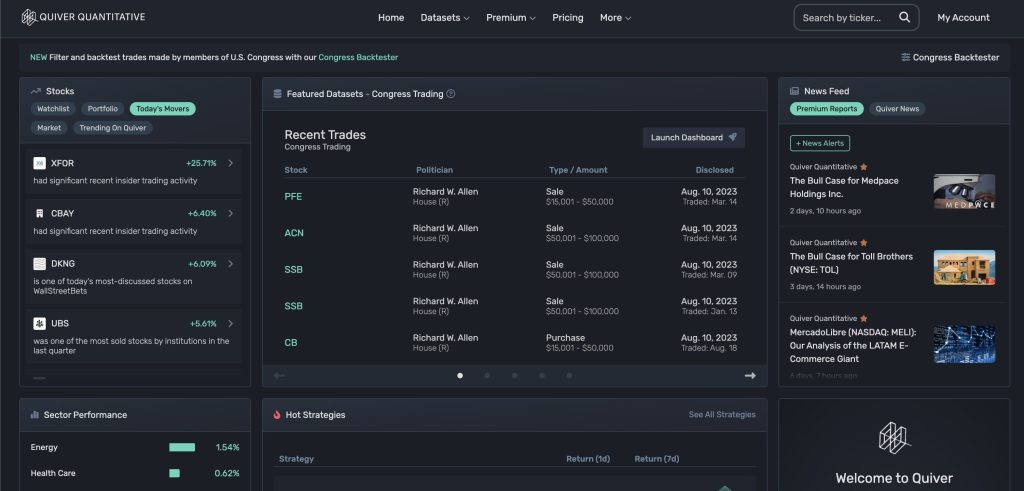

5. Quiver Quantitative

If you like alternative data points then you’ll like Quiver Quantitative. The platform aggregates and visualizes alternative financial data to provide unique insights into the stock market . It sources data from non-traditional datasets, such as political contributions, satellite imagery, and Reddit mentions, to offer a different perspective on market movements and trends. The platform aims to democratize access to alternative data, allowing both retail and institutional investors to make more informed investment decisions.

While I wouldn’t rely solely on this website for your research it’s a great place to come to find additional data points that Google Finance or Trading View simply won’t supply.

- Free forever membership.

- Hobbyist: $20 per month.

- Trader: $30 per month.

- Enterprise: Contact for a quote.

- Annual plans are cheaper.

🤓 Pro tip: If you navigate to an individual stock page you can see whether any new patents have been submitted. This can often be a signal that the company is actively investing in new initiatives and protecting its IP.

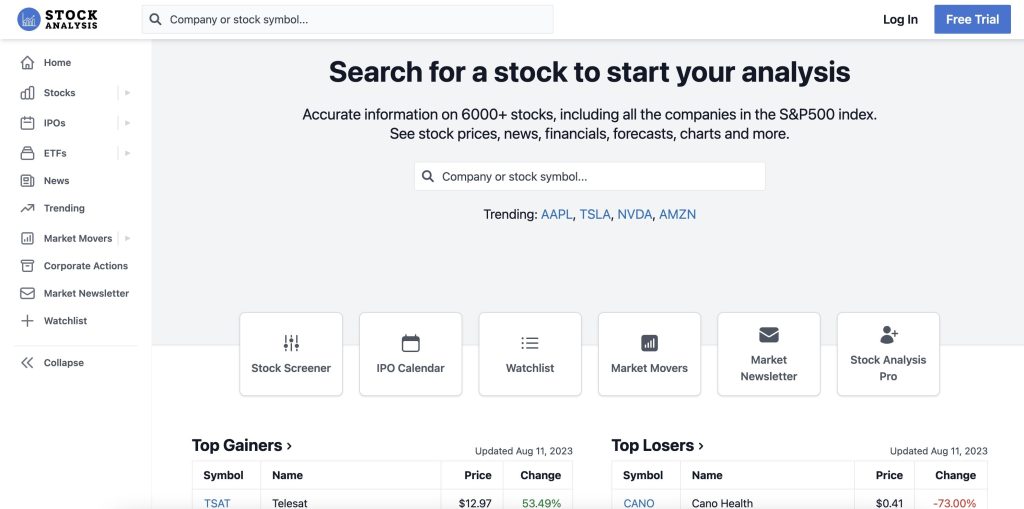

6. Stock Analysis

Stock Analysis is another fantastic site for researching the market. You can find detailed and accurate information on Stocks, IPOs , and ETFs. My favorite feature is the stock price prediction pages which leverage high-quality data sources to identify where a stock price is headed. Their revenue and EPS forecast data are provided by Finnhub which is a reputable data source.

Whilst Stock Analysis is packed with information I find their free daily newsletter to be particularly helpful. It gets me up to speed on what’s happening in the market along with any breaking news or IPOs to keep an eye on.

- Free plan with limited historical data and exports.

- Pro plan for $9.99 per month with access to all tools, data, and 30yrs of historical data.

🤓 Pro tip: Check out the IPO statistics page to find clear macroeconomic trends.

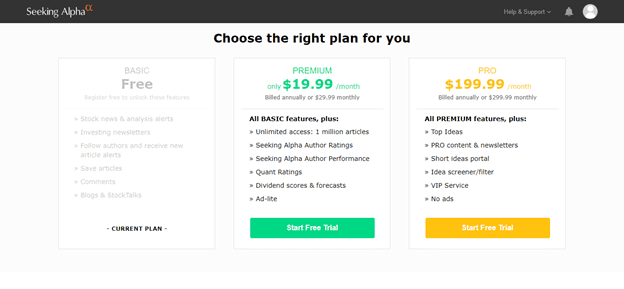

7. Seeking Alpha

Seeking Alpha is one of the most popular and reputable crowd-sourced content platforms for financial markets. Both professionals and amateur analysts share research, opinions, and insights on stocks, sectors, and economic trends. Whilst they offer a newsletter called “Alpha Picks” you can expect a robust investing platform with analyst ratings, quant ratings, news, stock screeners, and additional features to help you stay on top of your portfolio.

Similar to Trading View, you can create your own custom dashboards and alerts to help you stay on top of the market.

- Limited free membership.

- Seeking Alpha Premium: $239 per year with a $4.95 1-month trial.

- Seeking Alpha Alpha Picks: $99 for the first year then $199 per year.

- Seeking Alpha Pro: $2,400 per year.

🤓 Pro tip: If you want to take your investing to the next level consider subscribing to a Premium Investing Group. You’ll be able to access stock picks from Wall St Analysts, economists, and general enthusiasts with good track records.

Read our full Seeking Alpha Review here.

→ Get 50% off your first year with Seeking Alpha Premium & Pro here.

8. Yahoo Finance

Yahoo Finance is a staple in my investment research. I find it to be one of the most reliable and easy-to-navigate platforms. The website provides financial news, data, and commentary on stocks, bonds, commodities, cryptocurrency, and fiat currencies. It offers tools such as stock quotes, historical data, and portfolio management resources, making it a go-to source for both individual and professional investors.

There really isn’t any reason not to use Yahoo Finance in your research since it’s completely free and mostly accurate. Some of the news articles are opinion pieces so I wouldn’t take every single article as gospel.

🤓 Pro tip: Navigate to a company profile (e.g. AAPL – Apple) and click on Profile to see which executives are running the company. From here you can take the name and plug it into Guru Focus to find out whether they’re trading the stock or not.

9. Google Finance

Google Finance is a website and tool offered by Google that provides real-time stock quotes, financial news, and market data. It allows users to track their portfolios, view interactive charts, and access company-specific details and key financial metrics. While it offers a streamlined interface for tracking and analyzing stocks, it's often used in conjunction with other more comprehensive financial platforms.

I like how clean Google Finance is however, they do not have an opinion piece so you will need to look elsewhere to find things like analyst ratings.

🤓 Pro tip: Create a portfolio within Google Finance and add all of your holdings and the purchase date. Google will visually show you the performance of your portfolio with additional metrics to keep you informed.

10. Stock Circle

Stock Circle, formerly known as Cheaper Than Guru, is a website that analyses and presents Hedge Fund and Institutional Investor holdings. You can see exactly which stocks investors like Waren Buffet, Michael Burry, Cathie Wood, and Ray Dalio are bullish on. Stock Circle sources most of its data from IEX Cloud which is another reputable provider of accurate and timely stock data.

On top of the institutional investor holdings, Stock Circle has other interesting data points and metrics. One of my favorite pages is the “Buffett Indicator”, which is a ratio that compares the total market value of all publicly traded stocks (Wilshire 5000) to the gross domestic product (GDP) of the US.

🤓 Pro tip: Use the stock screener to find interesting stocks and then click through to see which institutional investors have positions in the company.

11. MarketWatch

MarketWatch is a major financial news website that provides real-time market data, analysis, and news on stocks, bonds, commodities, and currencies. It offers tools and features such as a stock screener, watchlist, and market trend insights to help investors make informed decisions.

One thing I particularly like is their podcast “Best New Ideas in Money” which is a great educational resource. Most of the investing and stock websites on his list except Investopedia have a lot of market information but lack educational content.

- Free basic membership.

- MarketWatch Digital: $4 for 4 weeks then $19.99 per month.

- Barron’s & MarketWatch Duo: $5 for 4 weeks then $22.99 per month.

🤓 Pro tip: Create an account and start trading using the virtual trading account feature. This will help you become a better investor by simulating various trades.

12. The Motley Fool

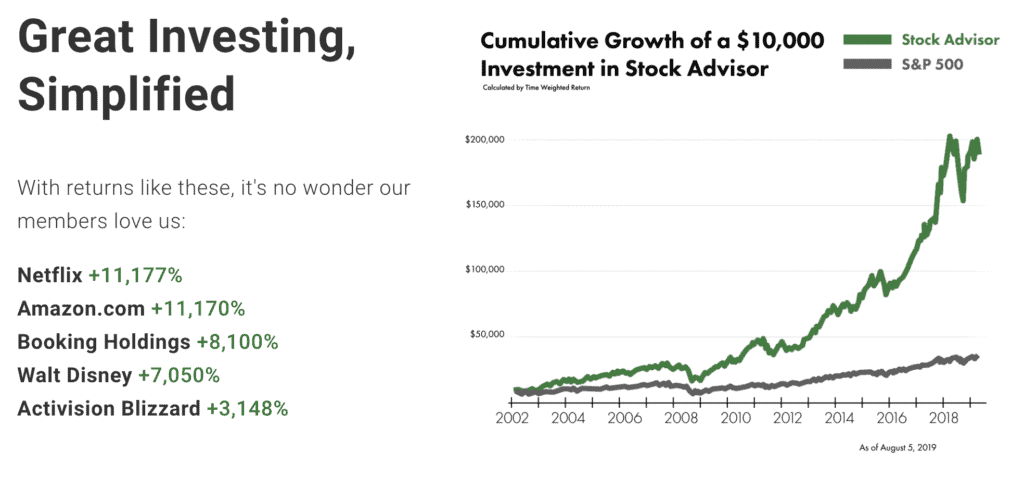

Most stock investors have probably heard of the Motley Fool. They’ve been around for over 25 years and have covered every aspect of the stock market. As far as a stock research website goes they’ve got a lot of experience and are mostly trustworthy.

The only pitfall is that they have over 20 different membership plans which can become overwhelming and difficult to choose from. On top of this, their investment philosophy is quite specific. If you’re looking for a stock picking service then I would recommend Motley Fool, but as a stock research platform, I think there are better options such as Seeking Alpha or Stock Analysis.

Related article: Morningstar vs Motley Fool

- Free to access news stories.

- Motley Fool Stock Advisor: $199 per year.

- Over 25 other membership plans range from $149 per year to $4,999 per year.

🤓 Pro tip: Before signing up for the Motley Fool, I suggest reading their investment philosophy and adhering to the principles so you can get the most out of your membership.

13. Stock Market Guides

Stock Market Guides is a stock-picking service that leverages an algorithm and a back-tested model to make recommendations. Unlike some services, Stock Market Guides is purely a software play.

Most stock and option advisory services that offer trade recommendations don’t tell you exactly how the trade setup has performed historically. This is what distinguished Stock Market Guides from other services. The service is best suited for active traders who want to enter and exit positions daily.

Related article: Best investing newsletters.

- Pre-market stock picks: $49 per month.

- Market hours stock picks: $49 per month.

- Pre-market options picks: $49 per month.

- Market hours options picks: $49 per month.

- Note: you can combine packages.

🤓 Pro tip: Use Stock Market Guides to educate yourself on options trading by watching their videos and then analyzing the positions they recommend.

Other stock research websites that are worth exploring

The websites I mentioned above are a lot more popular, complete, and easy to use. However, there are some other gems I would personally check out if you’re not afraid to dig a bit deeper. These include:

- Finimize (see our review here )

- SEC Website for 13F trading data

- Whale Wisdom for hedge fund trading data

- Morningstar and Bloomberg (for advanced investors)

- Subreddits like r/stocks or r/WallStreetBets for opinions

- ChatGPT with the Boolio Plugin (see the stock prompts here )

Where to from here

Now that you’re equipped with the resources to get started, I suggest taking a look at each website to see which works best for you. Some of the stock research websites and tools will be more advanced than others while some will be free and others will cost thousands of dollars to access.

So it’s important to know what your end goal is and only sign up for a tool (or suite of tools) that aligns.

If this is too overwhelming and time-consuming then consider signing up for a premium service such as Ticker Nerd which does all of the hard work for you.

Frequently Asked Questions (FAQs)

Each website will have different data points and features so it will depend on your use case. TradingView is great for technical analysis, charts, and alters whereas Seeking Alpha is best for getting opinions from Wall Street Analysts and the broader community of investors. No one website is “the best” for stock research. Instead, it is likely going to be a combination of sites and tools that best fit your use case and needs.

I believe Yahoo Finance is the best free stock research website since you can conduct all of your research from the spot. Everything from investing news to financial information on a particular company. It can all be done within Yahoo Finance. Even though there aren’t Wall St Analyst ratings there it still offers real-time stock quotes, financial news, portfolio management resources, and international market data.

Whilst it is almost impossible to accurately predict the stock market you can find stock price prediction on sites like Stock Analysis. If you’re looking for specific stock picks then Ticker Nerd, Motley Fool, and Seeking Alpha Picks are also great options. Note that these sites charge a monthly or yearly fee to access.

When it comes to stock advice be sure to find a service that is reputable, accurate, unbiased, complete, and timely. This is why I highly recommend using Ticker Nerd. I understand this is our very own Investing Newsletter, however, we’ve spent a lot of time and resources creating the most valuable reports on the market. Each report contains two growth stocks and combines data sources from almost every single resource on this list. Not to mention, we’re the only resource on this list that accurately cover the risks of each business.

Related articles

- Best Stock-Picking Services

- Best Investment Newsletters

- Seeking Alpha Review

- Finimize Review

- Tags: review

Luciano Viterale

Please note the team at Ticker Nerd put a lot of effort into personally using and testing the services we review. We may earn an affiliate commission if you buy a product or service through a link on this page, at no additional cost to you. For more information please read our affiliate disclosure .

Other related articles

Li Lu Portfolio – Himalaya Capital Management

Ray Dalio Portfolio – Bridgewater Associates Latest Holdings

Cathie Wood Portfolio from ARK Investment Management

Looking for new stock ideas?

With a Ticker Nerd Premium membership, you’ll get our monthly reports for 12 months AND unlock access to our report archive with 120+ stock deep dives.

You’re only one step away from joining Ticker Nerd and supercharging your portfolio.

We’ll see you inside…

- Stock report each month

- 2 exclusive stocks per report

- Top 10 stocks to buy right now

- Analyst ratings updated monthly

- Instant access to 60+ quality stocks

- Save 80+ hours of research per month

Join 6,503+ savvy investors using Ticker Nerd to save time and find stocks before they blow up.

Join 6,503+ savvy investors.

- How it works

- Affiliate Disclosure

The information that Ticker Nerd provides is general in nature as it has been prepared without taking account of your objectives, financial situation or needs. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Ticker Nerd is for information purposes only. Ticker Nerd is not responsible for any damages or losses that may occur as a result of reliance on this information. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. All content, group, messaging, tweets, newsletter, article, and email created by Ticker Nerd is intended for educational and information purposes only, is not financial, investment, legal or tax advice, and is a restatement, summary or extract of other data and research reports that are widely distributed from sources such as, but not limited to, Bloomberg, Market Watch, Wall Street Journal, Google Finance, and Yahoo Finance. Ticker Nerd is not a registered financial, investment, legal or tax advisor and is not liable for any financial loss you may incur acting on any information provided by Ticker Nerd. By registering, you agree not to hold Ticker Nerd liable at any time or under any circumstances for your decisions, actions, or results.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Stock Market

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Investment Ideas

- Research Reports

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Top research reports for meta platforms, broadcom & verizon.

Tuesday, January 9, 2024 The Zacks Research Daily presents the best research output of our analyst team. Today's Research Daily features new research reports on 16 major stocks, including Meta Platforms, Inc. (META), Broadcom Inc. (AVGO) and Verizon Communications Inc. (VZ). These research reports have been hand-picked from the roughly 70 reports published by our analyst team today. You can see all of today’s research reports here >>> Meta Platform shares have outperformed the Zacks Internet - Software industry over the past six months (+19.7% vs. +9.7%). The company is benefiting from steady user growth across all regions, particularly Asia Pacific. Increased engagement for its offerings like Instagram, WhatsApp, Messenger and Facebook has been a major growth driver. Meta Platform is leveraging AI to recommend Reels content, which is driving traffic on Instagram and Facebook. Its innovative portfolio, which includes Threads, Reels and Llama 2, is likely to aid prospects. Advertising revenues are expected to witness a CAGR of 13% per our model estimate. However, challenging macroeconomic conditions remain a headwind for Meta’s advertising revenues, along with targeting and measurement headwinds due to Apple’s iOS changes. Slow monetization of Reels, along with mounting operating losses at Reality Labs, are concerns. (You can read the full research report on Meta Platforms here >>> ) Shares of Broadcom have outperformed the Zacks Electronics - Semiconductors industry over the past year (+86.1% vs. +77.2%). The company is benefiting from the strong deployment of generative AI which it expects to contribute more than 25% of semiconductor revenues in fiscal 2024. VMware is expected to contribute $12 billion to revenues. Infrastructure software revenues are expected to be $20 billion while semiconductor solutions revenues are expected to increase in the mid to high-single-digit percentage range on a year-over-year basis in fiscal 2024. Broadcom expects networking revenues to grow nearly 30% year over year in fiscal 2024 driven by accelerating deployment of networking connectivity and expansion of AI accelerators in hyperscalers. Wireless revenues are expected to remain stable on a year-over-year basis. However, server storage, broadband, and industrial revenues are expected to decline in fiscal 2024. (You can read the full research report on Broadcom here >>> ) Verizon shares have outperformed the Zacks Wireless National industry over the past year (+2.7% vs. +2.1%). The company is witnessing significant 5G adoption and fixed wireless broadband momentum. It is offering various mix and match pricing in both wireless and home broadband plans which has led to solid client additions. Initiative to change its revenue mix toward emerging growth services like cloud, security and professional services will likely reap long-term benefits. Its mmWave footprint delivers game-changing experiences for the densest parts of the network and offers highly predictable signal waves leading to greater efficiency and less interference for customers. However, lower wireline and wireless equipment revenues are major concerns. In the third quarter of 2023, Verizon registered 78,000 Fios Video net losses, reflecting the ongoing shift from traditional linear video to over-the-top offerings. Macroeconomic challenges are impeding the top line. (You can read the full research report on Verizon here >>> ) Other noteworthy reports we are featuring today include Sanofi (SNY), Starbucks Corporation (SBUX) and MercadoLibre, Inc. (MELI). Director of Research Sheraz Mian Note: Sheraz Mian heads the Zacks Equity Research department and is a well-regarded expert of aggregate earnings. He is frequently quoted in the print and electronic media and publishes the weekly Earnings Trends and Earnings Preview reports. If you want an email notification each time Sheraz publishes a new article, please click here>>>

Today's Must Read

User Growth, Instagram Strength Aids Meta Platforms (META)

Strong Demand for Networking Products Aids Broadcom (AVGO)

Verizon (VZ) Will Likely Benefit from Rapid 5G Deployment

Featured Reports

Dupixent to Remain Sanofi's (SNY) Key Top-Line Driver The Zacks analyst believes Dupixent is a key top-line driver for Sanofi due to its outstanding growth trajectory. Dupixent enjoys strong demand trends across all approved indications and geographies.

Solid Comps Growth Aids Starbucks (SBUX), High Costs Ail Per the Zacks analyst, Starbucks is likely to benefit from robust North America and International sales and sales leverage initiatives and new store growth. However, high costs are a concern.

Solid Data Center Demand Aids Equinix (EQIX) Amid High Rates Per the Zacks analyst, the solid demand for data centers amid growth in digital infrastructure and cloud adoption will benefit Equinix. Yet, a competitive landscape and high interest rates might ail.

Robust Product Sales Aids West Pharmaceuticals' (WST) Prospects Per the Zacks analyst, continued strength in West Pharmaceuticals' proprietary products segment will drive prospects amid uncertainty in global economy which includes recession or slow economic growth