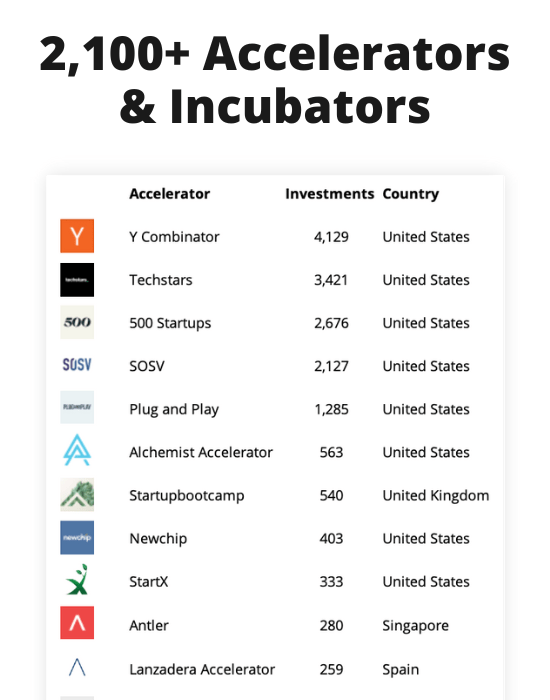

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

17 Failed Indian Startups & Analyses on Why they Failed

Description

Countless startups are being launched every day in India.

Many fail because they did not learn from the success of other companies who've managed to rise above.

We just published this list of 17 failed startups from India with analyses on why they shut down, and interviews with their founders.

17 Failed Startups Founded in India

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the industries, countries, and cities they generally invest in.

Information about their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

Dazo was a food-tech startup based in Bangalore which emerged as a “food on demand” company. Fierce competition and lack of funding led to Dazo's failure.

Details of the startup:

Monica Rastogi, Shashaank Shekhar Singhal

Food & Beverage

Started in:

Nº of employees:

Funding Amount:

Specific cause of failure:

Competition

You can read more about their failure here .

Frankly.me was a Q&A social platform that wasn’t able to raise the necessary round of funding. That is why the CEO of Frankly decided to shut it down.

Abhishek Gupta, Nikunj Jain

Social Media

Lack of PMF

HotelsAroundYou

HotelsAroundYou was an India service centered on last-minute and short stay bookings. They weren't capable of raising more money and had to shut down.

Animesh Chaudhary, Harsha Nallur, Mohsin Dingankar

Koinex was a cryptocurrency exchange platform. India's laws got harsh against cryptocurrencies and the obstacles and little profits led to its shut down.

Aditya Naik, Rahul Raj, Rakesh Yadav

Legal Challenges

Lumos provided the ultimate smart switching tech. After the shutdown, the founders recognized they were not the right team to build a hardware company.

Pritesh Sankhe, Tarkeshwar Singh, Yash Kotak

Software & Hardware

Lack of Experience

PepperTap provided a platform to buy and deliver groceries from local markets. Customers found delivery fees too expensive for their needs, and shut down.

Milind Sharma, Navneet Singh

1,000-5,000

Poor Product

RoomsTonite

RoomsTonite was a last-minute hotel booking app for people traveling to India. They raised $1.5M in funding but the money didn't arrive and they shut down.

Suresh John

Lack of Funds

SchoolGennie

SchoolGennie provided solutions that saved time, reduced costs, and helped make better decisions on schools. But they didn’t test their product-market fit.

Amit Gupta, Pardeep Goyal

Stayzilla, once a thriving homestay network with $33.5M in funding, closed due to unsustainable operational costs and consistent financial losses.

Rupal Yogendra, Sachit Singhi, Sachit Singhi, Yogendra Vasupal

Lack of Focus

Zoomo's goal was to build trust in the Indian used cars market. The buy-and-sell vehicle market was relatively young in India and decided to shut down.

Arnav Kumar, Himangshu Hazarika

Transportation

Bad Business Model

Adleaf Technologies

Back in 2013, Chetan Vashistth founded his first startup business called “Adleaf Technologies”, a blend of programming bootcamps and software solutions. Business was good for a while, but the challenge of multiple bad business decisions paired with failed money management proved to be the business’s demise. In this interview, we will talk about the lessons Chetan learned the hard way.

Chetan Vashistth

Mismanagement of Funds

Autto.in was an on-demand doorstep car service provider, created by Deepak in 2017. Soon after launching, a co-founder joined him and they started marketing the startup, spending a lot of money in customer acquisition. As money burnt, they decided to reach investors, who put them pressure in growing fast. After some months, they decided to shut down.

Deepak Murthy

FreshConnect

Tarun co-founded Freshconnect, an online B2B marketplace for fresh agricultural produce like fruits & vegetables. After making mistakes like lack of focus and bad hiring, they couldn't secure a funding round and eventually got acqui-hired by another company.

Tarun Gupta

Bad Management

InoVVorX was an app development company that both worked for clients and built their own projects. The business did it well for some time, having a team of 25 people, making $300k from their services, and raising $100k. However, their plans on working on their own products (too many of them) meant they started burning all the money and eventually had to shut down.

Maxim Dsouza

$100K-$500K

Jasmeet is an Indian software engineer who a few years ago decided to build new revenue strategies for his business directory and decided to build a job board with a unique offline-online model. But their idea was too ahead to the time and, due to a bad business model, they had to shut down.

Jasmeet Singh

Mishra Motors

Mishra Motors was to be the premier electric sports bike in India. Time and capital were the causes of its collapse.

Naveen Mishra

The Punjab Kitchen

Amit is a hard-core sales professional, who decided to set up a home-made food business with his wife. They started investing $1,200/month to set up the startup and get the first customers. However, once running they had to confront a big problem: the prices of their competitors were much lower. After some pivots, they decided to shut it down.

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

To read this content please select one of the options below:

Please note you do not have access to teaching notes, why do indian startups fail a narrative analysis of key business stakeholders.

Indian Growth and Development Review

ISSN : 1753-8254

Article publication date: 20 April 2023

Issue publication date: 24 July 2023

This paper aims to examine the factors that lead to the failure of startups in India and proposes a ‘Four Dimensional (4D) Strategic Framework’ to drive success.

Design/methodology/approach

This study is exploratory and uses a narrative analysis methodology to analyse the accounts of key startup stakeholders – founders, investors, former employees and consumers; to identify their failure factors. A conveniently selected sample of 165 startups was studied to understand better the reasons for their failure within a thematic framework developed from David Feinleib’s (2012) handbook “Why Startups Fail”.

Results indicate that a dearth of capital or running out of money and inadequate sales and marketing strategy, which leads businesses to fall behind rivals and lose money on each transaction, are the most common factors for startup failure in India.

Originality/value

“Startups” are substantial for emerging economies like India because they fuel technological innovation and economic progress and provide for the modern workforce’s needs and aspirations. However, they seem to be typically unprofitable, with a modest probability of survival. Subsisting studies mainly focus primarily on success factors and very few on why startups fail, with significant disagreement on an appropriate methodology. To the best of the authors’ knowledge, this is the first study that analyses failure factors of Indian startups using narrative analysis of its key stakeholders. It aims to aid the conception of profitable entrepreneurship by reducing the failure frequency in the startup and small business ecology.

- Entrepreneurship

- Failure factors

- Narrative analysis

- Thematic framework

- Success strategy

Goswami, N. , Murti, A.B. and Dwivedi, R. (2023), "Why do Indian startups fail? A narrative analysis of key business stakeholders", Indian Growth and Development Review , Vol. 16 No. 2, pp. 141-157. https://doi.org/10.1108/IGDR-11-2022-0136

Emerald Publishing Limited

Copyright © 2023, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- Take One: Big story of the day

First General Motors, Citibank and now Disney; why do MNCs fail in India?

Exit from the india market by multinationals is often on account of problems in home territory or failure to segment the indian market correctly.

- Most Popular

After studying law I vectored towards journalism by accident and it's the only job I've done since. It's a job that has taken me on a private jet to Jaisalmer - where I wrote India's first feature on fractional ownership of business jets - to the badlands of west UP where India's sugar economy is inextricably now tied to politics. I'm a big fan of new business models and crafty entrepreneurs. Fortunately for me, there are plenty of those in Asia at the moment.

- PI Industries: Focusing on small details to win big

- SBFC Finance: Enabling lending to small businesses

- Explained: Why are gold prices rising?

- DLF, MKJ Enterprises feature prominently in electoral bond list

- With MG, JSW wants to create a "Maruti moment for electric vehicles"

- Podcast: Unilever's Bargain Offer

- Rupa Garments: The Inside Story

- Economic Milestone: Nationalisation of Banks (1969)

- Vini Cosmetics: Smelling good

- Having a CMO in the management makes a huge difference: Hyatt's chief marketing officer

- " class="general-icons icon-sq-whatsapp">

- " class="general-icons icon-sq-googleplus popup">

Related stories

Disney+ Hotstar loses 12.5 million paid subscribers in the quarter ended June

Ford Motors tries to reinvent itself to catch up to Tesla and Elon Musk

How bias towards home-country culture holds back multinationals' growth

- " class="general-icons icon-sq-youtube">

Uncharted Waters: In photos this week

Inside the 2024 elections: Policy complacency risk or is it too optimistic?

Is cost becoming an increasingly determining factor in quitting smoking?

In the world's first Venice to trial day tickets

Why younger workers just can't get ahead

New regulations get European banks interested in crypto services

Clean Power: At 7 GW, India installs highest renewable energy sources in March

Orry's marketing playbook: How a Rs 2500 T-shirt became the hottest party pass

Photo of the day: Taking to the skies

Brand Breakthroughs: Can gen AI make all marketers creative?

It's time to stop hiring for 'fit': Poornima Luthra

'Mrs Jhunjhunwala' to 'Rekha Jhunjhunwala': How the new custodian of wealth is finding her feet

PayPal proposes crypto incentives for eco-friendly Bitcoin mining

Want to be more productive at work? Aim for a state of creative 'flow'

World's top 5 thrilling travel experiences to explore

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Business failures

- Finance and investing

- Corporate finance

- Financial analysis

Kodak's Downfall Wasn't About Technology

- Scott D. Anthony

- Scott Anthony

- July 15, 2016

The Scary Truth About Corporate Survival

- Harvard Business Review

- From the December 2016 Issue

Today's Innovation Can Rise from Yesterday's Failure

- Vijay Govindarajan

- March 29, 2011

Finding Your Company's Second Act

- Larry Downes

- From the January–February 2018 Issue

Why Do So Many Strategies Fail?

- David J. Collis

- From the July–August 2021 Issue

Redefining Failure

- From the September 2010 Issue

Can Zombie Firms Survive Rising Interest Rates?

- Walter Frick

- September 02, 2022

Set Up to Fail: Economist Paul Ormerod on Strategy and Extinction

- Paul Ormerod

- Gardiner Morse

- From the June 2007 Issue

Selection Bias and the Perils of Benchmarking

- Jerker Denrell

- From the April 2005 Issue

Why Start-ups Fail

- Tom Eisenmann

- From the May–June 2021 Issue

Maybe Failure Isn't the Best Teacher

- Lauren Eskreis-Winkler

- Eben Harrell

- From the May–June 2020 Issue

A Tale of Two Business Models

- Harvard Business Publishing

- August 01, 2022

Why CRM Projects Fail and How to Make Them More Successful

- Scott Edinger

- Scott Edinger

- December 20, 2018

The Case for Investing in Underdogs

- Chengwei Liu

- David Maslach

- July 18, 2022

What Drives You Nuts about Failure?

- April 18, 2011

Strategies for Learning from Failure

- Amy C. Edmondson

- From the April 2011 Issue

Here's Why Strategy Chiefs Succeed or Fail

- Jo Whitehead

- Felix Barber

- Rebecca Homkes

- January 19, 2018

How Businesses Have Successfully Pivoted During the Pandemic

- Mauro F Guillén

- July 07, 2020

Why Hard-Nosed Executives Should Care About Management Theory

- Clayton M. Christensen

- Michael E. Raynor

- September 01, 2003

How to Overcome Your Fear of Failure

- Susan Peppercorn

- December 10, 2018

Cooptex: Reinventing Itself

- Tulsi Jayakumar

- June 13, 2017

Ça Va de Soi: A Phoenix Rises from the Ashes of a Failed IT Project - Part B - The Rise

- Simon Bourdeau

- Dragos Vieru

- Amelie Bernier

- September 01, 2016

Schlitterbahn: Tragedy at the Waterpark

- Jonathan Landis

- Kanina Blanchard

- July 14, 2022

Studio Realty

- December 05, 1996

Unleashing Human Magic at Best Buy

- Leonard A. Schlesinger

- Sunil Gupta

- Amram Migdal

- April 08, 2024

Purity Steel Corporation, 2012

- Robert Simons

- Antonio Davila

- March 04, 1997

Lehman Brothers: Too Big to Fail?, Epilogue

- Jack Lysohir

- Emi Nakamura

- Pierre Yared

- September 19, 2016

Project Deutschland: Unpeeling the Onion of a Distressed Real Estate Portfolio

- Nori Gerardo Lietz

- Ricardo Andrade

- March 31, 2016

Quincy Apparel (B)

- Thomas R. Eisenmann

- Lisa Mazzanti

- February 11, 2015

Aikon Medical Devices Co. (A): Strategizing for continuous success

- Frederic Dalsace

- Mala Banerjee

- March 27, 2022

Baroo (A): Pet Concierge

- Susie L. Ma

- August 27, 2019

Deloitte & Touche (A): A Hole in the Pipeline

- Rosabeth Moss Kanter

- Jane Roessner

- September 28, 1999

Wild Oats Markets, Inc.

- Travis Haglock

- John R. Wells

- September 05, 2006

GoPro: The Disruptive Innovator Faces Challenges

- Rishi Dwesar

- Geeta Singh

- July 30, 2018

Successes and Failures of Amazon's Growth Strategies: Causes and Consequences

- W. Chan Kim

- Renee Mauborgne

- Oh Young Koo

- September 25, 2017

Ransomware Attack at Springhill Medical Center

- Suraj Srinivasan

- February 17, 2023

Classtivity: Payal's Pirouette

- Jeffrey J. Bussgang

- Olivia Hull

- January 10, 2017

European Integration: Meeting the Competitiveness Challenge

- Michael E. Porter

- Christian H.M. Ketels

- July 25, 2013

Breaking Bad (the Rules): Argentina Defaults, Inflates (and Grows), 1997-2015

- Rafael Di Tella

- Fernanda Miguel

- December 04, 2013

"Care in Every Drop": Ayala Corporation and Manila Water (B)

- Debora L. Spar

- Paul M. Healy

- Tricia Peralta

- Julia Comeau

- November 27, 2023

Schlitterbahn: Tragedy at the Waterpark, Teaching Note

Ça va de soi: a phoenix rises from the ashes of a failed it project, teaching note, lehman brothers: too big to fail, teaching note.

- December 11, 2018

The Cognitive Shortcut That Clouds Decision-Making

- Jonas De keersmaecker

- Katharina Schmid

- Nadia Brashier

- August 16, 2022

Popular Topics

Partner center.

Tata Nano's Failure To Attract Customers [Tata Nano Case Study]

Devashish Shrivastava

Tata Nano is a compact vehicle that was produced and showcased by Indian automaker Tata Motors , principally in India, as a modest back-engined hatchback expected to speak to current riders of bikes and bikes — with a dispatch cost of Rs 1,00,000 or $2500. Delays during the production line migration from Singur to Sanand, early cases of the Nano bursting into flames, the impression of the vehicle being perilous, and compromise in quality due to cost slicing are some of factors behind Tata's failure to attract Indians.

Here we present the case study of tata motors – nano case and find out why did Tata Nano Failed and never gained traction despite being termed as the 'people's car'.

Tata Motors anticipated creation of 250,000 every year at dispatch. This didn't happen. Only 7591 were sold for the model year 2016-17. In 2017, Tata Motors said assembling would proceed because of Tata's passionate promise to the project. In 2018, Cyrus Mistry, previous Chairman of the Tata Group, called the Tata Nano a venture in progress with China, with a generation overhaul scheduled in May 2018.

Tata Motors' Nano Initiative Initial Effects Of Tata Nano Marketing And Business Strategy Of Tata Nano Why Tata Nano Failed? Tata Nano's Attempted Comeback FAQs

Tata Motors' Nano Initiative

After effectively propelling the ease of Tata Ace truck in 2005, Tata Motors started the advancement of a reasonable vehicle that would speak to the numerous Indians who ride motorcycles . The price tag of this nitty-gritty auto was brought somewhere around getting rid of the most superfluous highlights, diminishing the measure of steel utilized in its development, and depending on ease of Indian labor.

The superfluous highlights include the evacuation of the traveller's side wing mirror, having one wiper sharp edge, having just three fasteners for every wheel, and the expulsion of the fuel filler top from the fuel tank. The presentation of the Nano got much media consideration because of its low cost of Rs. 100,000. The vehicle was promoted as "The People's Car".

Initial Effects Of Tata Nano

A report by the Indian rating office CRISIL figured the Nano would extend the country's vehicle advertising by 65%, in any case, starting late 2012. However, deals in the initial two monetary years after the vehicle's divulging stayed unfaltering at around 70,000 units. Tata still proposed the ability ability to deliver the vehicle in a lot bigger amounts, somewhere in the range of 250,000 every year, if the need arise.

It was foreseen that its 2009 presentation would significantly influence the trade-in vehicle market, and costs dropped 25–30% before the launch. Sales of the Nano's closest rival, the Maruti 800, fell by 20% promptly following the disclosing of the Nano.

It is obscure if the Nano has lastingly affected the costs of and interests for close substitutes. In July 2012, Tata's Group administrator- Ratan Tata , who resigned in January 2014, said that the vehicle had huge potential while conceding that the early open doors were squandered because of starting problems. Due to the business drops, just a solitary unit was delivered in June 2018.

Marketing And Business Strategy Of Tata Nano

India is an organization with a larger part of its populace dwelling as a low pay gathering. Purchasing a vehicle is still a fantasy for many families in India. In the year 2008, Ratan Tata reported the dispatch of its new vehicle, which would be a progressive item in the car division. He called it a 1 Lakh rupee vehicle and the same title was used for promotions .

The fantasy of a middle and even lower white collar class family unit to have their very own vehicle woke up with this declaration from Tata Motors. It was hailed to be cutting edge innovation and was commended by international media. An entirely unexpected story unfurled when the vehicle appeared on the streets.

India Customer's Needs

Ratan Tata's flash for the Nano came when he saw groups of 3-4 individuals utilizing a motorbike for transportation . There are a great many bicycles in India and it has constantly presented well-being worries for the general population. In blend with the poor street conditions in India and conveying a full family on a bike, bikers are subjected to numerous mishaps.

His strategical view drove the concept of a low cost vehicle and chose that the 1 Lakh Rupee sticker price will be appealing to the objective market.

Proclamation

At the point when Tato Nano was declared in the long stretch of January 2008, it was over-advertised to be the vehicle of each Indian. The cost of Nano was pegged at Rs. 1 lakh or $2500 by Ratan Tata, the Chairman of the Tata Group by then of time.

It turned into a fantasy vehicle for each individual having a place with the lower working class and even the lower class. Anyway, the service of the vehicle additionally raised worries about the blockage on streets that the vehicle would acquire as individuals began to utilize it for everyday transportation.

Strategic Plans

TATA Motors fundamentally segmented and focused on the following sections of the Indian population:

- The middle class- Fundamentally the lower white-collar class.

- Upper lower class- Normally the bike clients .

- Family with 3-4 individuals who have inconveniences while going on a 2-wheeler.

Affordability And Family Friendly Usage

Tata Nano being propelled in the Indian market was an opportunity for the normal man of India to fulfill his dream of owning a vehicle. The promotions and media productions featured the passionate remainder that demonstrated the joy of youngsters when they see a vehicle coming to their home, and the joy on the substance of the relatives who delineated a white-collar class gathering.

The battling Indian classes who had a month to month pay of under Rs.6000 every month and comprised more than 110 million families got the chance to dream of purchasing a vehicle. Mr. Ramesh Mangaleswaran, an accomplice of McKinsey and co., anticipated that in Mumbai alone the 2 million individuals who rode a cruiser ordinary would now attempt to lift themselves to purchase a Tata Nano.

It was expected that Tata Nano would make a progressive change in the way of life, uncommonly concerning the substitution of the regular man. It would turn into a face of the Indian lower class, just like the Bajaj Scooter at one time represented the white-collar class.

Why Tata Nano Failed?

Ratan Tata stayed faithful to his obligation and the Indian market saw Nano set on the streets in the long stretch of July 2009. At the start, the deals for the vehicle were high. It then began to decay on every month. There are a few reasons of failure which justify Tata Nano's downfall,

- Failure in marketing the vehicle was the main reason behind Tata Nano's Failure to attract customers .

- TATA nano promotes itself as the least expensive vehicle.

- No one needs to drive the least expensive vehicle.

- Purchasing a vehicle is identified with economic well-being and distinction in the public arena.

- "Cheap" and "lakhtakia" used in Tata Nano's advertising for advancement and showcasing all over India disturbed its image.

- The engine was an issue.

- There was a buzz in the universal media, "What if Nano becomes successful? It would mean an end to the second-hand car market ."

Problems With The Car

- Awful picture of the shoddy vehicle.

- Several cars caught fire. Thus, in spite of its low cost, people refrained from buying it .

- Media channels covering the news related to Tata Nano underestimated the vehicle. In any case, they were correct.

- The car was not fit for sloping territories.

- The motor used to make a great deal of clamor, and individuals even compared it with an auto.

- Insides were dull with inadequate leg space.

- The whole assemblage of Nano was light and prone to damage on even the slightest of knocks.

Other Reasons

- Tata Nano got around 200,000 appointments at first. This made Tata Motors complacent and it didn't bother about new advertising strategies . New publicity procedures were essential to keep the enthusiasm of the individuals unblemished. But it wasn't done. When the main flame episode was accounted for, the ad system then just looked responsive and upgraded rather then focusing on negative attention.

- Nano was viewed as an attraction for individuals who never thought of purchasing a vehicle. It was focused on engine cycle riders, recycled vehicle proprietors, and different families in the lower white collar class gathering. This prompted some degree of opposition. According to the intended interest group, the media and the general public acknowledged Tata Nano as a poor man's vehicle.

- Ratan Tata in his previous question and answer sessions referenced that he wanted to position Tata Nano as a 'reasonable, all climate family vehicle".

- At the point when Nano later raised its cost to conquer the negatives of the principal model, the cost turned out to be a lot higher. The top-end Model of Tata Nano (2014) was cited at an on-street cost of around Rs.2.6 lakhs in Bangalore . This sort of evaluation with the equivalent Nano model which the poor man likewise claimed, confounded the clients..

Tata Nano's Attempted Comeback

In the year 2013 Tata engines re-propelled Tata Nano with new components and publicity efforts. The re-dispatch concentrated on the following:

Focusing on the young people of the nation, the new Nano had extravagant settings like settings and shading blends, for example, ranch side or experience sports . The ads and crusades this time concentrated on the adroitness factor. The emphasis was, "Why not purchase a Nano when it gives everything at a deep discounted?" It additionally featured the rational advantage of Fuel productivity in another manner.

This time, Tata Nano pursued another sort of crusade altogether. They began to support programs on MTV that energized experience sports and stretched out the crusade on National TV.

Like the arrangement Roadies circulated on MTV where the members need to go on a Hero Karizma, they attempted to execute a comparable technique where the members were approached to traverse India in a Tata Nano. This validated the intense with which the vehicle was fabricated.

It concentrated on the passionate parts of a parent, and the car was promoted such that guardians can give their children a Tata Nano as opposed to giving them bicycles; a vehicle is more secure than a bicycle. This would likewise make them brilliant guardians.

Why did Tata Nano failed?

There are a few reasons of failure which justify Tata Nano's downfall,

- Failure in marketing the vehicle was the main reason behind Tata Nano Failure to attract customers.

- Tata Nano promotes itself as the least expensive vehicle.

- There was a buzz in the universal media, "What if Nano becomes successful? It would mean an end to the second-hand car market."

Why did Tata Nano fail to attract customers?

Delays during the production line migration from Singur to Sanand, early cases of the Nano bursting into flames, the impression of the vehicle being perilous, and compromise in quality due to cost slicing are some of factors behind Tata's failure to attract Indians. Also Tata nano promotes itself as the least expensive vehicle. No one needs to drive the least expensive vehicle.

Is Tata Nano still available?

Tata Nano is no longer available in the new car market.

Is Nano car still in production?

No Tata Nano is no longer manufactured.

What went wrong with Tata Nano?

Tata Nano got around 200,000 appointments at first. This made Tata Motors complacent and it didn't bother about new advertising strategies. New publicity procedures were essential to keep the enthusiasm of the individuals unblemished. But it wasn't done. When the main flame episode was accounted for, the ad system then just looked responsive and upgraded rather then focusing on negative attention.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Spy on your Competitors- Adspyder

- Manage your business smoothly- Google Workspace

Behind the Genius: Exploring the Life of Alakh Pandey, the Physics Wallah

“Our aim is to bring about a revolution in education by reaching out to millions of students in a sustainable and affordable way,” says Alakh Pandey, the CEO of “Physics Wallah”. Here is yet another inspiring story of a man whose journey from poverty to prosperity is nothing short of

Top AI Music Generator Tools Making Waves: List of AI-Music Generators

The entire world has been apoplectic over artificial intelligence ever since it was first proposed. Several companies have already begun using AI to replace humans in their specific operations. When it comes to music, AI is essentially a sheet anchor. The module's training on massive datasets allows it to examine

Outlast Labz USA Launches in India, Offering Premium Fitness Supplements

New Delhi (India), April 17: Outlast Labz USA has officially launched its operations in India, aiming to dominate the global market. The USA-born brand, founded in 2020, is set to redefine the nutritional supplement industry in India. At a time when health and wellness are paramount, Outlast Labz is expanding

Bridging Online and Offline: How Finndit Connects Digital Presence to Physical Stores

New Delhi (India), April 17: In today's digital age, the importance to include businesses on local search engines has never been more evident. Finndit stands out as a prime example, functioning not merely as a typical search engine but as a facilitator of community connections. This platform seamlessly integrates user-generated

Why Attend?

- Live Online

- 1,00,000+ people attended since 2009

- Rs 1999 FREE

- Certificate of Participation

- An exclusive Surprise

[Case Study]: Big Brand Failures; Lessons to Learn From

Table of Contents

![[Case Study]: Big Brand Failures; Lessons to Learn From 7 dsim image](https://dsim.in/blog/wp-content/uploads/2017/01/feature-image.jpg)

A good marketing strategy is the most effective way to increase the brand awareness . But, when the marketing strategies go wrong and turn into a marketing failure then it can be the major reason behind the fall of your brand.

Maintaining the brand value and strategy is a challenging journey, even when you reach great heights. Always take the right decision as single marketing blunder can destroy your brand completely.

In this age of rapidly changing technology either you have to adapt the change with time or you fail. Those who refuse to improve become redundant and irrelevant to the industry one day.

This case study talks about how fairly large marketing mistakes of big brands leaded to their devastation. If we come to seek examples there are many, yet here we have picked up 3 known names, Kingfisher, Kodak and Nokia, whose stories are mere enough to let you know the failure reasons.

1) The Rise, Dominance and Fall of Kingfisher

About kingfisher.

![[Case Study]: Big Brand Failures; Lessons to Learn From 8 dsim image](https://dsim.in/blog/wp-content/uploads/2017/01/kingfisher-31.jpg)

In 2003, Kingfisher Airlines Limited was founded by Vijay Malllya as a premium and world-class airline group. The airline was based in Bangalore India and had more than 400 flights per day (Domestic & International). It used to be the most admired name in Asia-Pacific region.

The Rise of Kingfisher Airlines

On its peak time, it was the 2 nd largest airline, in terms of carrying the number of passengers. The quality and comfortable service attracted many passengers in the initial years. And, then the Kingfisher acquired Air Deccan in 2007.

In just 3 years after touching the skies, the first international Bengaluru-London flight in 2008 was launched.

Marketing Strategy

They promoted the brand through all media channels like Radio, Television, Print, Multiplexes, Malls and in their In-flight magazines too.

- In just 2 years, the airlines achieved the aviation market share of 10%.

- During 2007, they had the most aggressive expansion plans of all Indian carriers.

- In June 2007, their influence in the market was increased with the acquisition of 26% shareholding of Air Deccan Airlines.

- During February 2009, more than 900,000 passengers flew with Kingfisher giving it the highest marketing share in India.

How Brand turned into Non-Performing Asset?

- By the end of the March 2008, company was under the debt of INR 934 cr and net losses continued to widen in the following financial year.

- Acquisition of Air Deccan marked the end of Kingfisher Airlines. By the year 2009-10, airlines accumulated the debt of over INR 7,000 cr as the losses continued to pile up. 2010 was the year when it turned into a non-performing asset for banks.

- In 2012, the airlines operations were shut down as the DGCA suspended its flying license.

What Went Wrong?

- Lack of Delegation.

- Low-cost airline aviation airline, Air Deccan was treated as a step-child.

- Unnecessary Burning of Fuel.

![[Case Study]: Big Brand Failures; Lessons to Learn From 9 dsim image](https://dsim.in/blog/wp-content/uploads/2017/01/kingfisher_airlines_chart2.jpg)

The major reason that the brand was grounded was that it wasn’t just into one business and trying hands on more than one business. The founder was taking care of different businesses personally without appointing proper CEOs and couldn’t succeed in doing so. And, it’s pretty obvious that if two brands serve almost the same service, then people would rather prefer the cheaper one.

2) How Kodak couldn’t evolve with time and failed?

About kodak.

![[Case Study]: Big Brand Failures; Lessons to Learn From 10 dsim image](https://dsim.in/blog/wp-content/uploads/2017/01/kodak.jpg)

The American technology company, Kodak, was built on the culture of innovation and change in 1888. The company was invented and marketed by George Eastmen who was a former bank clerk from New York. At that time, it used to be a simple box camera, loaded with 100-exposure roll of film.

Kodak held a dominant position in photographic film in its time. Its tagline “ Kodak Moments ” was so famous that it was used for promoting events.

Marketing Strategy of Kodak

The real genius of founder Eastman lied in his marketing strategy. He launched an advertising campaign which featured children and women operating the camera with a slogan, “ You press the button, we do the rest .”

- In 1935, produced the first mass-market color film in 16 and 8mm.

- Kodak owned the film market with 90% market share in 1970s.

- Created the first digital camera in 1975.

How Kodak Failed?

The first digital camera was designed by a Kodak engineer, Steve Sasson in 1975. It was a filmless photography at that time so they didn’t want to threaten their film business so didn’t do the marketing of the Digital camera. Whereas, other digital companies like Sony, Nikon, Fujifilm took the full advantage of the situation.

Kodak missed the opportunities in the technology, they themselves invented.

- Kodak couldn’t get on the nerve of the modern technology and remained in denial for long about digital photography while all the other brands adapted the change by introducing electronic cameras.

- Even before the digital photography they were failing to keep up as its rivalry Fujifilm started doing a better job than them.

- In January 2012, the big name went bankrupt because of not making the smart move into the digital world fast enough.

- On February 9, 2012, Kodak announced that it will exit the digital image capture business.

![[Case Study]: Big Brand Failures; Lessons to Learn From 11 dsim image](https://dsim.in/blog/wp-content/uploads/2017/01/kodak-stats.jpg)

The Kodak failed due its slowness in transition. The world moved ahead with digital cameras, SD cards and USB cables but the company remained stuck with films. They didn’t know how to respond in time and technology eventually killed the Kodak films.

3) How Nokia got acquired by Microsoft?

About nokia.

![[Case Study]: Big Brand Failures; Lessons to Learn From 12 dsim image](https://dsim.in/blog/wp-content/uploads/2017/01/nokia.jpg)

Nokia Corporation was founded in 1865 in Finland. The company was formally known as Nordic Mobile Telephone (NMT). The company name was changed to Nokia in 1871. They built the first international mobile phone in 1981 and this marked the beginning of the mobile era.

The Rise of Nokia, Connecting People

- Nokia phone was used in 1991 for making the first GSM call.

- In 1992, they launched Nokia 1101, the first GSM handset which became an instant hit.

- In 1988, Nokia became the world leader in mobile phones.

- Nokia’s Marketing share grew to 74% in March 2006 from 61.5%in October 2005.

- In the color phone category, market share jumped to 59.3% from 40.9%.

The Fall of Nokia

Nokia used to own a large portion of market of smartphone before the iPhone came out in market in 2007. Their refusal to change and learn new things lost their survival and this ultimately leaded to their demise.

It used to be the leader in its market whereas Samsung was nowhere to be seen. But, Samsung made the move at the right time and gained the success.

![[Case Study]: Big Brand Failures; Lessons to Learn From 13 dsim image](https://dsim.in/blog/wp-content/uploads/2017/01/nokia-mobile.png)

The pioneer brand failed to respond to the completely changed smartphones with full touchscreen and application based operating system. The years passed and they didn’t keep up with the expectation of people and the consumers shifted.

They remained their focus on the Symbian series. Until 2011, company didn’t make the leap of faith onto the Windows phone and due to their slow response they suffered such demise.

- Nokia got acquired by Microsoft in 2013.

And as we conclude, we look forward to the statement made by Stephen Elop, Nokia’s CEO in his speech when Nokia got acquired by Microsoft that “ we didn’t do anything wrong, but somehow, we lost ”. And, as far as the parameters on which success is measured, he was right somewhere that they didn’t do anything wrong, it’s just that they were unable to adapt the change at the right time and so, lost.

The unwillingness to embrace the needed marketing change when required was probably the main cause that turned these brands down. One needs to think and act holistically for growing the brand with time otherwise, if you don’t change, you will definitely get removed from the competition.

1 thought on “[Case Study]: Big Brand Failures; Lessons to Learn From”

I could not resist commenting. Well written!

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

30 Social Bookmarking Sites to Boost SEO & Drive Traffic

8 Digital Marketing Tips Your Competitors Probably Don’t Know

13 CTA Stats to Quantify Its POWER for BRANDS

DSIM Reviews – See What DSIM’s Awesome Trainees Say about DSIM

[CASE STUDY]: How M.A.C Cosmetics became the world’s leading Makeup Company?

5 Google Penalty Checker tools To Save You

How Narendra Modi Leveraged Social Media to Generate Awareness about his Political Party

How penguin books india used fb to increase awareness and attendance for its flagship spring fever 2013 book festival.

CASE STUDY: How GrabOn started with 6 interns became India’s leading Couponic platform?

Advertisement

A crisis that changed the banking scenario in India: exploring the role of ethics in business

- Published: 28 August 2022

- Volume 11 , pages 7–32, ( 2022 )

Cite this article

- Sushma Nayak ORCID: orcid.org/0000-0001-9645-3095 1 &

- Jyoti Chandiramani ORCID: orcid.org/0000-0002-6766-8975 1

4934 Accesses

3 Citations

1 Altmetric

Explore all metrics

Digital business has marked an era of transformation, but also an unprecedented growth of cyber threats. While digital explosion witnessed by the banking sector since the COVID-19 pandemic has been significant, the level and frequency of cybercrimes have gone up as well. Cybercrime officials attribute it to remote working—people using home computers or laptops with vulnerable online security than office systems; malicious actors relentlessly developing their tactics to find new ways to break into enterprise networks and grasping defence evasion; persons unemployed during the pandemic getting into hacking; cloud and data corruption; digital fatigue causing negligence; etc. This study adopts a case-based approach to explore the importance of business ethics, information sharing and transparency to build an information-driven society by scouting the case of Punjab and Maharashtra Co-operative (PMC) Bank, India. PMC defaulted on payments to its depositors and was placed under Reserve Bank of India’s directions due to financial irregularities and a massive fraud perpetrated by bank officials by orchestrating the bank’s IT systems. The crisis worsened when panic-stricken investors advanced their narrative through fake news peddled via social media channels, resulting in alarm that caused deaths of numerous depositors. It exposed several loopholes in information management in India’s deposit insurance system and steered the policy makers to restructure the same, thus driving the country consistent with its emerging market peers. The study further identifies best practices for aligning employees towards ethical behaviour in a virtual workplace and the pedagogical approaches for information management in the new normal.

Similar content being viewed by others

The Ethical Implications of Using Artificial Intelligence in Auditing

Ivy Munoko, Helen L. Brown-Liburd & Miklos Vasarhelyi

The role of digitalization in business and management: a systematic literature review

Esther Calderon-Monge & Domingo Ribeiro-Soriano

E-Commerce and Consumer Protection in India: The Emerging Trend

Neelam Chawla & Basanta Kumar

Avoid common mistakes on your manuscript.

Introduction

The importance of information management in the banking sector has gained traction among researchers in recent times. Bank depositors place their savings with banks with an assurance to withdraw their funds on demand, based on the nature of contracts. Likewise, banks grant loans of diverse maturities to different borrowers out of the resources received as deposits (Diamond & Dybvig, 1983 ). In this formal arrangement, banks act as intermediaries vested with the responsibility of ensuring disclosure, operational transparency and ethical compliance as an essential practice of corporate governance. Information sharing is important because it propels ethical compliance and market discipline Footnote 1 among banks, and provides all the stakeholders with the information they need to determine if their interests are protected. Retail depositors lack sufficient information about the operational efficiency of their banks and are unable to communicate with fellow depositors, which may impede their ability to collectively guard themselves against potential bank failures.

Before opening an account, banks want possession of copies of various personal documents to know their clients well. However, the depositor never knows how the money mobilised by banks is spent. Bank assets are opaque, illiquid and short of transparency, because most bank loans are typically tailored and confidentially negotiated. Customers are constrained by the information shared by bank managers since financial products are intricate and risky (Tosun, 2020 ). Banks are, thus, at a risk of self-fulfilling panics Footnote 2 due to their illiquid assets (loans, which cannot be recovered from borrowers on demand) and liquid liabilities (deposits, which can be withdrawn by depositors on demand) (Bryant, 1980 ; Diamond & Dybvig, 1983 ; Liu, 2010 ). Lastly, it is assumed that the volatility of one bank might cause a contagion effect, distressing a group of banks or perhaps resulting in a systemic failure altogether.

While banks are inherently volatile due to the nature of the functions they perform (Kang, 2020 ; Santos & Nakane, 2021 ), only few have realised the importance of integrating ethics into their operations. In business, the perspective of ethical concerns has shifted dramatically in the past two decades. If a firm wants to be seen as a truthful affiliate and an esteemed member of the industry, it must exhibit a high degree of ethical compliance and upright conduct (Sroka & Szántó, 2018 ). Nevertheless, the situation gets worse when fraudsters abuse loopholes in banking systems to ride on the coat-tails of critical world events such as the COVID-19 pandemic, and its corresponding speedy digital acceleration driven by community guidelines such as “stay home,” “contactless digital payments” and so forth. Cyber-crime and online data breaches (Patil, 2021 ), unethical lending (Pandey et al., 2019 ), under-reporting non-performing assets Footnote 3 (Agarwala & Agarwala, 2019 ), frauds (Sharma & Sharma, 2018 ; Sood & Bhushan, 2020 ), poor information sharing (Jayadev & Padma, 2020 ) and floppy corporate governance (Agnihotri & Gupta, 2019 ) have been the factors responsible for most bank runs in Asia in general, and India in particular, in recent years. In 2020, when the Philippines was hit hardest by the virus, phishing was estimated to have surged by 302 percent (Mohan, 2022 ). The same year saw online fraud to be the second most common type of offence reported to police in Indonesia; likewise, investment scams had the greatest impact on victims in Singapore, with about USD 52 million defrauded in over 1100 cases (Bose, 2021 ).

During the period 2009–2021, 69,433 cases of bank fraud were reported in India; in the financial year 2021, the central bank of India confirmed that until mid-September, the value of bank frauds amounted to ₹1.38 trillion (Statista, 2021 ). According to the National Crime Record Bureau, the overall number of incidents of online fraud in India was 2093 in 2019, but it jumped to over 4000 in 2020 after the COVID-19 outbreak. It is interesting to note that five cities such as Ahmedabad, Delhi, Hyderabad, Mumbai and Pune, which had 221 incidences of online frauds in 2017, experienced a massive hike to 1746 cases in 2020 (Dey, 2021 ).

“Organized crime has been quick to respond, mounting large scale orchestrated campaigns to defraud banking customers, preying on fear and anxiety related to COVID-19” (KPMG, 2022 , p. 1). The COVID-19 pandemic has wreaked havoc on the banking industry, increasing fears of online frauds and spiralling bad loans—as consumer and business debt levels soar. In early 2022, while India was staring the Omicron-led third wave of COVID-19, the Central Bureau of Investigation registered four major cases of bank fraud involving Bank of India, Union Bank of India, Bank of Baroda and Punjab National Bank for siphoning of funds that resulted in losses worth ₹ 939 crore for the said banks (Financial Express, 2022 ).

A bank is expected to foster public confidence by providing demand-driven services while adhering to ethical practices such as transparency, honest and timely disclosures for customer retention, security and trust. This is likely to lessen the risk of bank runs, Footnote 4 which serves in upholding the security and stability of banks—necessary for consumer protection. Previous studies have rarely investigated how seamless information sharing with the public—by banks, government and regulatory bodies—may moderate the opacity of the bank’s financial performance and inhibit panic runs through informed decisions by the customers. This is particularly important in the current times of risk and uncertainty wherein ethical concerns are perturbing the stakeholders of most businesses, particularly banks.

The present study shall explore the importance of business ethics, information sharing and transparency to build an information-driven society by scouting the case of Punjab and Maharashtra Co-operative (PMC) Bank, India, which defaulted on payments to its depositors and was placed under Reserve Bank of India’s (RBI) Footnote 5 directions due to a massive fraud perpetrated by bank officials. The auditors, too, were deemed lacking in their duties because they failed to notice the bank’s serious infractions. Since the depositors were permitted to withdraw only ₹ 1000 from their accounts (suspension of convertibility) and banking operations were stalled until further directions, there was panic among investors. In fact, “PMC was also India’s first crisis related to a bank which played out on social media” (Kaul, 2020 , p. 256). The crisis worsened when uninformed and panic-stricken investors advanced their narrative through fake news peddled via social media channels, WhatsApp and Twitter, resulting in alarm that caused deaths of numerous depositors.

Based on the aforementioned discussion, the authors of this study shall explore answers to the following questions:

What are the gaps in risk-management systems in India’s banking sector, specifically in the slackly regulated cooperative banks?

What are the best techniques for aligning employees towards ethical behaviour in a virtual workplace, and how should they be assessed?

What are the pedagogical approaches for information management and ethics education in the new normal?

The rest of the paper is as follows. The next segment explores theoretical background, followed by methodology, case study, discussion, directions for future research and conclusion.

Theoretical background

Evolving paradigm of business ethics.

The impact of the COVID-19 pandemic on global health, organisations, economy and society is intensifying relentlessly (Mahmud et al., 2021 ). The current pandemic has compelled businesses to embrace virtual space to a greater extent than earlier. This needs a comprehensive review of business ethics, among other things. An ethical decision is one that is accepted by a larger community because it adheres to moral guidelines (Reynolds, 2006 ). With the bulk of the personnel working online and maybe indefinitely in the future, a paradigm shift in business ethics, values and social responsibilities seems imminent and looming round the corner. Remote employees are expected to be disciplined with the ability to fulfil their duties with minimal supervision. Remote workers must also comprehend the nature of the task they would be undertaking and what it requires for a business to flourish. Finding solutions to reconcile the demands of work and personal life is the main problem of the new work-life model (Aczel et al., 2021 ).

The idea of an organisation’s social responsibility swings between two extremes: one that limits the organisation’s obligation to maximising profit for its shareholders, and another that broadens the organisation’s responsibility to encompass a wide variety of actors with a “stake” in the business (Argandoña, 1998 ). From an ethical standpoint, the stakeholder notion of social responsibility is more engaging for the common good (Argandoña, 1998 ; Di Carlo, 2019 ). “An individual or group is said to have a stake in a corporation if it possesses an interest in the outcome of that corporation” (Weiss, 2021 , p. 153). Stakeholders are persons or groups with whom the organisation intermingles or works together—any entity capable of influencing or being influenced by the organisation’s activities, preferences, strategies, objectives or practices (Gibson, 2000 ). Therefore, a firm is responsible for value creation for all its stakeholders, not just shareholders (Freeman et al., 2018 ). The importance of stakeholder interactions on corporate performance is particularly highlighted by instrumental stakeholder theory (IST), which calls attention to the effects of high-trust, high-cooperation, and high-information-sharing (Jones et al., 2018 ). Although IST is contested by Weitzner and Deutsch ( 2019 ), Harrison et al. ( 2019 ) claim that few firms have the ability to maintain strong economic performance while also treating their stakeholders ethically at all times. Through communal sharing ties, societal welfare can be improved in a Pareto-optimised manner, meaning that shareholders and some stakeholders benefit without any other stakeholders getting worse. Building strong relationships with stakeholders becomes an appealing strategy even for managers who are fixated on bottom-line results.

The importance of business ethics and moral conduct among leaders is evident in light of the recent high-profile ethical scandals (e.g., Enron) and growing expectations for ethical standards in management. Having a strong self-concept as a leader fosters ethical leadership, which is helpful to organisations as it encourages employees to perform well—both in their roles and outside of them (Ahn et al., 2016 ). Ethical frameworks encourage managers to modify salaries to the “efficiency wage” point, which is the best compromise between the interests of shareholders and employees, and hence the best way to sustain stakeholder relationships (Zhong et al., 2015 ).

Business ethics in banks

Banks and financial institutions are transforming digitally at a rapid pace employing new technologies and developing digital business models that are eventually helping them to create and add more value to their organisations. Given the pace at which workforce skills are being enhanced in the digital reality, these institutions are advancing towards a significant dearth of ethical skills. “The ethical peril of unfair contract terms is evident from the abuse of banks’ dominant position relative to bank consumers in dictating contractual terms and conditions, and asymmetrical information that causes significant imbalance of rights and obligations of bank consumers as the weaker contracting parties, placing them at a detriment” (Bakar et al., 2019 , p. 11). The three pillars of ethics in banking are “integrity”, “responsibility” and “affinity”. Integrity is imperative because it helps build the trust that any banking system needs to thrive. Responsibility necessitates contemporary banks to consider the effects of their lending policies. Affinity refers to fresh approaches to bring depositors and borrowers closer than they are in traditional western banking (Cowton, 2002 ). Herzog ( 2017 ) presents a duty-based explanation of professional ethics in banking. According to this viewpoint, bankers have obligations not just to their clients, who traditionally represent the core of their ethical obligations, but also to prevent systemic harm to entire societies. In order to best address these issues, regulation and ethics must be used in conjunction to align roles, rewards and incentives and produce what Parsons refers to as “integrated situations”.

Collins and Kanashiro ( 2021 ) emphasise the importance of ethics in banks by explaining how they follow a practice of secrecy in maintaining cash vaults by informing the branch manager of the first three digits while the assistant manager informed of the remaining three digits. If the managers violate the policy and collude to know all the six digits, they would be fired. Likewise, studies also suggest that employees are less likely to quit their jobs when they believe their organisation is empathetic and accommodating and provides an ethically supportive setting (Jeon & Kwon, 2020 ). A sustainable job performance can be reached by workers only through strong work ethics (Qayyum et al., 2019 ). It is necessary for employees to encourage ethical practice and prevent unethical deeds that can harm the company’s image and performance, particularly with respect to small organisations (Valentine et al., 2018 ). Work ethics contribute to employees’ job performance depending on how much an individual fosters honesty, prudence, quality, self-control and cooperation while discharging their duties (Osibanjo et al., 2018 ). Even so, the banking business is plagued by a variety of ethical problems, including a lack of adequate ethics training, problems with trust and transparency, increased pressure of competition, the complexity of financial operations and the problem of money laundering, among others (Kour, 2020 ).

Ethically responsive education: challenges and way ahead

Business schools have traditionally assumed that executive education is either delivered online or in-person and that online executive education programmes are substandard than in-person programmes (González-Ramírez et al., 2015 ). This is no longer true. Drawing from their experiences during the pandemic, educators and their institutions are shifting to “omnichannel” programme models, where executive learners have a seamless and engaging learning experience across all channels and platforms through which they participate. While ethical practices are important for an enterprise, business schools face numerous hindrances in their efforts to promote ethical standards in their students (Sholihin et al., 2020 ). Virtual technology allows students to learn practical skills without leaving the classroom. Furthermore, moving from a physical class to a virtual setting can give real-time imagery and interface in a simulated world that is extremely close to the real world, allowing students to gain practical insights without having to leave their homes. Simulations give students room to test out their course knowledge and make leadership decisions through the lens of real-life situations—all in the safety of a virtual class. As a result, virtual technology might be one of the learning media to motivate students studying at home during a pandemic (Chuah et al., 2010 ). However, as pointed out by Bhattacharya et al. ( 2022 ), the support that the institution offers during the transition to online learning, faculty acceptance and adoption of the new technology, and adaptation of the teaching and learning pedagogy to the new medium, are factors that determine whether the abrupt shift to online learning is successful in meeting the needs of students with various learning preferences and abilities. The effectiveness of online learning depends largely on how interesting and dynamic the class sessions are designed by getting students to participate in discussions, role plays, browsing online links, engaging in polls, taking quick quizzes, etc.

Methodology

This study draws upon secondary sources and adopts a case-based approach to explore the role of ethics in business in a dynamic world that is gradually shifting towards virtual technology in the milieu of the global pandemic. The advantage of a case study is that it aims to investigate a current occurrence in its natural setting (Yin, 2017 ). In this study, papers dealing with a wide range of diverse themes relating to business ethics were reviewed. Also, relevant press releases by RBI and Deposit Insurance and Credit Guarantee Corporation (DICGC), newspaper accounts, videos, media narratives, annual reports and recast balance sheet of the PMC Bank were examined. Every fact was cross-checked from two different sources in order to establish the accuracy of the case information. Anything that did not meet this criterion was left out of the analysis. The data was gathered over a period of 2 years to track the changes in the work environment—before and during the pandemic—and to closely examine the multifarious developments that occurred ever since the crisis at PMC Bank came to light. Despite the authors’ attempts to speak with the irate PMC Bank customers to solicit their responses and reactions, the latter declined to do so due to the emotional trauma they had already experienced, and the sense of utter helplessness they felt following numerous unsuccessful attempts to knock at the doors of the relevant authorities. As a result, they denied to participate in the survey, a major limitation of this study.

The authors selected the case of PMC Bank as it featured among the top bank frauds in India towards the close of the previous decade (Sengupta, 2022 ). The PMC bank failure exposed several loopholes in information management in India’s deposit insurance system (DIS) Footnote 6 and steered the policy makers to restructuring the same, thus driving the country consistent with its emerging market peers. In March 2020, the Banking Regulation (Amendment) Bill was introduced in the lower house of the Indian Parliament to avoid a PMC Bank–like crisis in the future. While administrative matters would continue to be governed by the Registrar of Cooperatives, the bill aimed to apply banking regulation principles of the RBI to cooperative banks. Additionally, it suggested that cooperative banks be strengthened by raising professionalism, facilitating capital access, enhancing governance and assuring sound banking through the RBI. Following the failure of PMC Bank, the Union Cabinet amended the DIS in India and addressed an enduring concern of the depositors of troubled banks. In 2020, the deposit insurance (DI) cover was raised from ₹ 1 lakh to ₹ 5 lakhs with the approval of Government of India (RBI, 2020 ), and banks were mandated to disclose this information on their respective websites. Since July 2021, the depositors of distressed banks were permitted to withdraw their holdings from the accounts—up to the highest insured amount—within 3 months since a bank was placed under moratorium by the RBI (Kumar, 2021 ). The RBI also got the ball rolling to prevent scams such as the one perpetrated by PMC by enforcing a set of criteria for the hiring of managing directors and chief risk officers in banks; levying fines (for regulatory lapses); calling for higher reporting standards; developing a big data centre that could access data from banks’ systems; and proposing differential deposit insurance premium for banks, contingent on their risk profile. Likewise, the RBI issued new provisioning norms for primary cooperative banks’ inter-bank exposure as well as valuation of their perpetual non-cumulative preference shares and equity warrants, directing them to continue making provisions of 20% for such exposures, in the aftermath of the PMC Bank’s bankruptcy.

The case of Punjab and Maharashtra Co-operative Bank, India

About pmc bank.

The PMC Bank was functioning as a multi-State scheduled primary co-operative bank in India, with its area of operation extending over seven states viz., Andhra Pradesh, Delhi, Goa, Gujarat, Karnataka, Madhya Pradesh and Maharashtra. With a modest beginning in 1984 as a unit bank, the business later expanded over a vast network of 137 branches in less than four decades. Empowered by a mission “to emerge as a strong, vibrant, most preferred premier co-operative bank, committed to excellence in serving the customers, and augmenting the stakeholders’ value through concern, care and competence”, the bank gradually gained the trust of its customers by reaching numerous milestones such as earning the “Scheduled” Footnote 7 status by the RBI and consent to venture into the forex business (PMC Bank, 2021 ). The following years brought laurels to the bank in the form of recognition for “lowest dispute ratio” as well as “work ethics oriented to depositors’ service” by the All-India Bank Depositors’ Association; “Best Bank Award” by diverse State Co-operative Banking Associations; and so forth.

In the early weeks of September 2019, the RBI received information from a whistleblower that the PMC Bank was undertaking fraudulent activities which involved the bank’s board of management (Hafeez, 2019 ). The complaints pointed out that certain loans of PMC should have been classified as non-performing assets (NPAs) but were concealed in the bank’s loan account system. In response to these complaints, the RBI started investigations. On September 23, 2019, RBI placed restrictions on the PMC Bank citing “major financial irregularities, failure of internal control and systems of the bank, and wrong/under-reporting of its exposures under various Off-site Surveillance reports to RBI” (RBI, 2019 ). The RBI acted in quick time and took control of the bank’s operations to assuage any risk of a bank run. To protect the interests of depositors, RBI placed PMC Bank under “Directions” vide Sect. 35-A read with Sect. 56 of the Banking Regulation Act, 1949 (RBI, 2019 ). Subsequently, PMC was refrained from fresh lending, accepting deposits and making investments for six months Footnote 8 (Singh, 2021 ). According to a report by BloombergQuint ( 2019a ), at the heart of the PMC Bank crisis stood the fact that several bank officials manipulated their books and their IT system to conceal the loans given to the real estate developer Housing Development and Infrastructure Limited (HDIL). A primary cooperative bank Footnote 9 could lend up to 15% of its total capital to a single company—a norm violated by PMC (Kaul, 2020 ). The bank’s then Managing Director, in his confession letter to the RBI, claimed that PMC Bank’s exposure to the large corporate group—HDIL—was just about ₹ 2500 crores (Gadgil, 2019 ). However, PMC’s actual exposure to the HDIL group stood at ₹ 6500 crore, accounting for 73% of the aggregate loan book size of ₹ 8880 crore and nearly four times the regulatory cap as of September 19, 2019 (Rebello, 2020 ). The six board members of PMC had approved loans to HDIL, the largest borrower of the bank, by breaching the RBI’s exposure limit not just to HDIL, but also the Uttam Galva Group and Abchal Group (Rajput & Vyas, 2019 ). PMC had extended loans worth ₹565 crores Footnote 10 to Uttam Galva Group—an exposure in excess of the limits set by the RBI (BloombergQuint, 2019b ). There is limited public information on the Abchal Group or its promoters.

Things changed around in 2012–2013 when HDIL started defaulting on the dues owing to cancellation of a slum rehabilitation project near the Mumbai airport—a major setback to the real estate group. Even though the outstanding loans with the group swelled, the bank’s management did not classify them as NPAs, fearing a hit in the balance sheet. They were also apprehensive of reputational loss and facing regulatory action from the RBI. The Economic Offences Wing of Mumbai Police uncovered that the bank’s management had replaced 44 loan accounts of HDIL with over 21,000 fictitious loan accounts—all this in an effort to camouflage defaults by the HDIL group (Ozarkar, 2019 ). PMC bank incurred losses to the tune of ₹ 4355 crores (Seetharaman, 2019 ). Despite these losses, PMC continued to support HDIL owing to the relationship shared between the duo.

The relationship between the PMC Bank and the promoters of HDIL group dated back to the 1980s when the latter had first aided the bank by infusing capital of ₹13 lakh, and also placed a huge sum of deposits for the bank’s revival. Furthermore, when the bank was facing a run on its deposits in 2004, HDIL pumped in ₹ 100 crore to deal with the liquidity crunch that enabled the cash strapped PMC bridge over the crisis. As a result, more than 60% of the bank’s transactions were with the HDIL group. The PMC Bank would charge 18–24% interest from the group accounts and make good profits. Meanwhile, the HDIL group maintained that its banking relations with PMC were clean and the audits presented a true and fair picture (BloombergQuint, 2019b ).

Although HDIL had an impressive record of clearing dues despite certain delays, PMC Bank continued to report the loan accounts as standard assets—albeit they were gradually downgrading to substandard and doubtful categories. All this went unnoticed as statutory auditors were looking at only incremental advances and scrutinised accounts shown by the management (Dalal & Sapkale, 2019 ). Prior to 2015, RBI looked at only the top accounts of the bank. Since loans to HDIL were spread across multiple accounts, they never showed up in the RBI’s inspection. Post 2017, when RBI started looking into the “advances master”, PMC replaced the accounts belonging to the HDIL group with dummy accounts—of small amounts—to escape detection by the regulator (Ozarkar, 2019 ).

The modus operandi

According to a report by BloombergQuint ( 2019a ), experts claim that whenever an auditor or an RBI inspector looks at the books of a bank, they examine the top 50–100 accounts that the bank is exposed to. In the case of PMC Bank, these accounts were masked by holding too many accounts with little funds to avoid any suspicion, by manipulating the bank’s core banking system, officially known as the “core banking solution (CBS) Footnote 11 ”. All bank employees have access to the CBS—from a teller to the branch manager, to loan officers and risk managers—but their access and what they can do with the system is limited to their exact area of function. The CBS is essentially a back-end intelligence software. It provides the analytics for decision-making to the bank staff whenever bankers physically input data. So, the CBS has a “rule-engine” which is controlled by an access-control framework, letting only certain people alter the rules. Usually, every bank appoints an IT administrator for managing the CBS, who is the only person allowed to modify the software. According to forensic experts, whenever there is fraud at a bank, the “rule-engine” is compromised. Therefore, by giving limited access to the rule-engine, other employees—such as those in the credit department or risk management division—have little information of the changes made to the CBS. Thus, by creating 21,000 dummy accounts in bogus names to conceal from the auditors and RBI inspectors, other departments of PMC were perhaps in the dark the whole time the bank was exposed to the HDIL group.

The RBI in its investigation established that out of 1800 bank employees, only 25 employees had access to the loan accounts of the bankrupt real estate developer and its group entities (Hakim, 2019 ). These bank officials assigned specific codes to the accounts belonging to the HDIL group in order to disguise the money in the loan accounts. When the suppression of true accounts became too much for the employees, the management decided to come clean to the RBI. PMC was instructed to recast its balance sheet to present an accurate and honest portrayal of the bank’s assets (PMC Bank, 2019 ). Investigating agencies promptly arrested several bank executives including three top officials of the PMC bank, as well as two promoters of the HDIL group.

Depositors’ backlash

The cap on withdrawals came heavily on depositors, particularly those who held all their savings with the PMC Bank. The deposit withdrawal restrictions sparked off a massive public outcry as customers were unable to pay their bills. Ironically, the bank that clients had trusted to keep their money safe had now become the source of their woes. It was difficult to survive on minimal amounts. Businesspersons reported how their business operations had stalled, leaving them to survive on loans from relatives and friends. Several account holders could not access savings, much needed to meet their medical needs. Likewise, deaths due to cardiac ailments and suicide were reported. Footnote 12 Distressed depositors held protests outside the PMC Bank and the RBI quarters to permit withdrawals of their lifetime savings. During the same time, numerous WhatsApp videos started circulating among the aggrieved depositors and the news fired up on mainstream and social media (Kaul, 2020 ). Poor lending norms and questionable governance had afflicted the banking system, in part due to professional incompetence to assess project viability, and in part due to the political economy that permits, even nurtures, credit to privileged parties (partisanship). A fake news that went viral on online platforms was the speculation that the government was proposing to close nine public sector banks. This raised qualms about the systemic stability of banking in India, which compelled the RBI to issue a press release that no such plan was in the offing. “PMC Bank is too tiny to pose a systemic threat, but a small, dead canary in a coalmine is still a large warning sign” (Mukherjee, 2019 ).

In response to people’s anxiety and backlash, the RBI raised the withdrawal limits for PMC depositors from time to time, as illustrated in Table 1 . Deposit withdrawals were permitted to ₹ 1 lakh in exceptional situations such as wedding, education, livelihood, and other adversities. At the same time, in February 2020, the DICGC Footnote 13 was authorised to raise the deposit insurance coverage for a bank depositor, from ₹ 1 lakh to ₹ 5 lakh per depositor—an amendment brought into force after 27 years—since the previous one was initiated in 1993 (Nayak, 2020 ).

Simultaneously, depositors of insolvent or stressed banks that were placed under a central bank moratorium were entitled to recover their funds (up to ₹ 5 lakh) within 90 days of the commencement of the moratorium. The 90-day span would be split into two periods of 45 days. The RBI mandated: “The stressed bank on whom restriction is placed is expected to collate all information regarding the number of claimants and claim amount and inform DICGC about it within the first 45 days. Within the next 45 days, DICGC is mandated to process the claim and make payment to each eligible depositor” (Motiani, 2021 ). However, customers of PMC Bank were exempted from receiving ₹ 5 lakh in the first lot as the bank was under the resolution process.

Following the PMC debacle, the RBI strengthened its control by necessitating primary cooperative banks to submit quarterly reports of individual loan exposures above ₹ 5 crore to the Central Repository on Information on Large Credits (The Economic Times, 2020 ). The RBI established a big data centre to retrieve data from banks’ systems. The data centre would aid in the prevention of scams such as the one perpetrated by PMC Bank, in which data was camouflaged through the use of phoney accounts (ETBFSI, 2021 ).

The PMC bank takeover

In the second half of 2021, nearly 2 years after the PMC scam had come to light, Centrum Finance Services Footnote 14 was given “in-principle” approval by the RBI to establish a small finance bank that would take over the scam-plagued PMC Bank. Two distinct entities—the Centrum and BharatPe Footnote 15 syndicate (with 51:49 stake)—were collectively permitted to acquire the PMC Bank. Accordingly, Centrum and Resilient Innovation Private Limited (a BharatPe enterprise) were authorised to set up a small finance bank—which would hold the assets and liabilities of the PMC Bank (Panda & Lele, 2021 ). In October 2021, the Unity Small Finance Bank (USFB) got licence from the RBI and started its operations in record time with an equity capital of ₹ 1100 crore (Banerjea, 2022 ). The RBI came up with a draft plan for the merger of the beleaguered PMC Bank with the new entity, USFB. Depositors could claim up to ₹ 5 lakhs over a 3- to 10-year period, according to the proposal. They could receive up to ₹ 50,000 after 3 years, ₹ 1 lakh after 4 years, ₹ 3 lakh after 5 years, and ₹ 5.50 lakh after 10 years (The Economic Times, 2021 ). On January 25, 2022, the amalgamation of PMC Bank with USFB officially came into force. All the branches of PMC Bank would operate as branches of USFB, ensuring job security and stability to the employees of the merged entity, alongside consistent services to the clients. Since the draft amalgamation plan was opposed by an umbrella body of cooperative societies, the lead bank—USFB—came up with a press release: “96 percent of depositors, have deposits up to Rs 5 lakhs, will be paid upfront (subject to completion of the requirements as per DICGC rules). These depositors can choose to either withdraw or retain this amount with Unity Bank; or make additional deposits, and take advantage of the attractive interest rate up to 7%, being offered on savings accounts” (CNBC, 2022 ). Thus, the long-drawn-out scandal that stretched over 2 years ended up with the PMC takeover by USFB that was enforced in the larger interests of all the stakeholders.

The ethical stance