- My Shodhganga

- Receive email updates

- Edit Profile

Shodhganga : a reservoir of Indian theses @ INFLIBNET

- Shodhganga@INFLIBNET

- Jamia Milia Islamia University

- Centre for Management Studies

Items in Shodhganga are licensed under Creative Commons Licence Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0).

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

THE IMPACT OF E-BANKING ON BANK PERFORMANCE

This is a final year project on E-Banking and how it's going to affect the bank performance in United Arab Emirates.

Related Papers

Review of Professional Management- A Journal of New Delhi Institute of Management

Garima Verma

ahmedmooge mooge

Impact of E-Banking on Traditional Banking Services

Anar Quliyev

Now a day's due to the emerging world economy, e-commerce and e-business became increasingly a necessary component of business strategy and a powerful catalyst for economic growth. The integration of information and communications technology in business has revolutionized relationships within organizations and those between and among organizations and individuals. The new information technology for the financial services industry and in particular the further development of the banking industry is becoming an important factor. As well as according to health recommendations, one of the most effective ways to contain the current COVID-19 epidemic is to avoid personal contact. This means reducing the movement of people and increasing the time they spend at home as much as possible. In line with these indications, most banks in the affected countries have reduced the opening hours of their branches and they recommend their customers use online banking. At the same time, the adoption of e-banking provides a framework to assess the factors taken. With the emergence of the global economy, e-business has increasingly become a necessary component of business strategy and a powerful catalyst for economic growth. Online-banking has become popular because of its convenience and flexibility, and also transaction related benefits like speed, efficiency, accessibility, etc. It also provides easy transfer, faster operation, lower cost and time-saving. Results from this study indicate that a number of advantages to electronic banking is a service of the Azerbaijanian banking sector, at the same time, research shows that the banking sector in Azerbaijan submitted by customers regarding electronic banking do have enough information.

Journal of Public Administration and Governance

Syed Tauqeer Ahmad

The proliferation and penetration of internet has opened new horizons and scenarios for the retail banking industry. The retail banks are now providing their products and services through the electronic medium; e-banking. E-banking is considered to have a substantial impact on banks’ performance. The aim of this paper is to examine the impact of e-banking on the profitability of Pakistani banks, in particular. This paper covers twelve banks across Pakistan. The study is qualitative in nature which examines different objectives which determine the performance of banks mainly in terms of profitability. It also discusses the effect of customers’ literacy on provision of services from banks’ perspective. It also discusses the basic motive of banks to adopt e-banking services. The study is done through taking interviews from the managers of these banks.The results show that e-banking has increased the profitability of banks, it has enabled the banks to meet their costs and earn profits e...

ramit shetty

IAEME PUBLICATION

IAEME Publication

Electronic Banking has become the heart of banking sector, while banking industry is the heart of every robust economy. E-banking has revolutionized the lives of all individuals of present times and is considered to be a wave of information revolution after the agricultural and industrial revolution Internet banking, mobile banking, Automated Teller Machine, electronic funds transfer, and smart cards etc. are the services provided by banks under Electronic Banking. Through this research paper, an attempt has been made at examining the impact of electronic banking on the performance of Banks. Electronic Banking has resulted in reduction in transaction costs, increased productivity, increase in volume of deposits, increase in net operation margin and reduction of operational costs of the banks, thereby improving the efficiency in the banking operations. Through this paper, it has been found that Electronic Banking has tremendously improved the performance of banks.

ASUE ESELEM Valence

This research study seeks to measure the impact of e-banking on commercial banking operations. With our case study being UBA Bank Cameroon, we will set out to examine the relationship between e-banking services and the profitability of the banking institution and also to identify the difference between those who use E-banking Services and Counter Service. We will use the T-test model and a simple correlation model to establish a relationship between e-banking services and the profitability of the banking institution whilst also establishing the difference between customers who use e-banking services and customers who use the counter service. In conducting this research, we will use both primary and secondary data. Furthermore, quantitative and descriptive methods of analysis will be adopted to examine the impact of e-banking services on the profitability of the banking institution.

2010 Fourth International Conference on Digital Society

A. I Al-Aqeel

Mohammed Abba

The resultant of technological innovation has been the transformation in operational dimension of banks over some decades. Internet technology has brought about a paradigm shift in banking operations to the extent that banks embrace internet technology to enhance effective and extensive delivery of wide range of value added products and services. However, the fact that e-banking is fast gaining acceptance in Nigerian banking sector does not assuredly signify improved bank performance nor would conspicuous use of internet as a delivery channels make it economically viable, productive or profitable. Whether progression is made in the use of internet technology (e-banking) or not, there should be parameter to empirically assess its impact over specified period of adoption. Consequently, the study examined the impact of electronic banking on banks’ performance in Nigeria. Panel data comprised annual audited financial statements of eight banks that have adopted e-) and retained their bra...

International Journal of Scientific Engineering and Technology

Oyewole S Oginni

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Electronic banking adoption in Ethiopia: an empirical investigation

- Original Article

- Published: 09 August 2021

- Volume 1 , article number 112 , ( 2021 )

Cite this article

- Pankaj Tiwari ORCID: orcid.org/0000-0003-2401-184X 1

716 Accesses

Explore all metrics

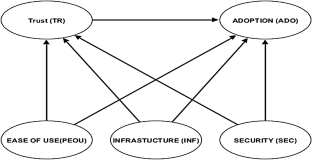

The bank has always been a very intense business, especially in the last few decades when information technology had a strong influence on the banking sector. This research followed almost the same pattern, particularly by examining the factors influencing information technology adoption. However, little work has been done to identify these factors in electronic banking services in developing African Countries. The purpose of this research was to analyze the variables that influence adoption in Commercial Bank of Ethiopia. The researcher has used factors perceived ease of use, infrastructure, security, trust, and e-banking adoption. The data were collected from 179 respondents of CBE. This study uses the structural equation model based on least partial square analysis. The results show that customer trust mediates between the perceived ease of use, infrastructure, security, and e-banking adoption. The practical result of this research is the provision of information and knowledge to the Ethiopian Commercial Bank, which is the financial backbone of this country. Further, combining Trust in technology will improve confidence in Ethiopian banking sector. Hence, the government should make more efforts to sustain and improve e-banking through technology-driven innovation in the banking sector.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Source: Davis ( 1989 ), Lee and Turban ( 2001 ), Kolodinsky et al. ( 2004 )

Similar content being viewed by others

Factors influencing adoption of e-payment systems: an empirical study on iranian customers.

Maryam Barkhordari, Zahra Nourollah, … Mohammad S. Ahangar

Intention Bank Customers’ Use of İnternet-Based Banking Services

Internet banking adoption in a developing country: an empirical study in vietnam.

Feng-Teng Lin, Hsin-Ying Wu & Thi Nguyet Nga Tran

Data availability

All data generated or analysed during this study are included in this published article.

Abugamea GH (2016) Banking sector development and economic growth in palestine; 1995–2014. Int J Econ Finance Stud 8(2):117–128

Google Scholar

Abukhzam M, Lee A (2010) Factors affecting bank staff attitude towards E-banking adoption in Libya. Electron J Inf Syst Dev Ctries 42(1):1–15

Article Google Scholar

Adams DA, Nelson RR, Todd PA (1992) Perceived usefulness, ease of use, and usage of information technology: a replication. MIS Q 16(2):227–247. https://doi.org/10.2307/249577,JSTOR249577

Adamson I, Chan K, Handford D (2003) Relationship marketing: customer commitment and trust as a strategy for the smaller Hong Kong corporate banking sector. Int J Bank Mark 21(6/7):347–358. https://doi.org/10.1108/02652320310498492

Agarwal R, Prasad J (1998) A conceptual and operational definition of personal innovativeness in the domain of information technology. Inf Syst Res 9(2):204–215

Ajzen I, Fishbein M (1980) Understanding attitudes and predicting social behavior. Prentice-Hall, Englewood Cliffs

Al-Ajam AS, Md Nor K (2015) Challenges of adoption of internet banking service in Yemen. Int J Bank Mark 33(2):178–194. https://doi.org/10.1108/ijbm-01-2013-0001

Alalwan AA, Rana NP, Dwivedi YK, Lal B, Williams MD (2015) Adoption of mobile banking in Jordan: exploring demographic differences on customers’ perceptions. In: Conference on e-Business, e-Services and e-Society. Springer, Cham, pp 13–23

Aldás-Manzano J, Lassala-Navarré C, Ruiz-Mafé C, Sanz-Blas S (2009) Key drivers of internet banking services use. Online Inf Rev 33(4):672–695. https://doi.org/10.1108/14684520910985675

Al-Qeisi KI (2009) Analyzing the Use of UTAUT Model in Explaining an Online Behaviour. Internet Banking Adoption. Ph.D. Dissertation, Brunel University.

Alsaghier H, Ford M, Nguyen A, Hexel R (2011) Conceptualising citizen’s trust in e-government: application of Q methodology. Leadi Issues in E-Gov 1(2011):204

Al-Sharafi MA, Arshah RA, Herzallah FA, Alajmi Q (2017) The effect of perceived ease of use and usefulness oncustomers intention to use online banking services: the mediating role of perceived trust. Int J Innov Comput 7(1). https://doi.org/10.11113/ijic.v7n1.139

Al-Smadi M (2012) Factors affecting adoption of electronic banking: an analysis of the perspectives of banks’ customers. Int J Bus Soc Sci 3:294–309

Alwan HA, Al-Zubi AI (2016) Determinants of internet banking adoption among customers of commercial banks: an empirical study in the Jordanian banking sector. Int J Bus Manag 11(3):95

Alzahrani L, Al-Karaghouli W, Weerakkody V (2017) Analysing the critical factors influencing trust in e-government adoption from citizens’ perspective: a systematic review and a conceptual framework. Int Bus Rev 26(1):164–175

Ameme BK (2015) The impact of customer demographic variables on the adoption and use of internet banking in developing economies. J Internet Bank Commer 20(2):1

Amin M, Rezaei S, Abolghasemi M (2014) User satisfaction with mobile websites: the impact of perceived usefulness (PU), perceived ease of use(PEOU) and trust. Nankai Bus Rev Int 5(3):258–274. https://doi.org/10.1108/nbri-01-2014-0005

Abba Ari AA, Ngangmo OK, Titouna C, Thiare O, Kolyang Mohamadou A., Gueroui AM (2020) Enabling privacy and security in Cloud of Things: Architecture, applications, security & privacy challenges. Appl Comput Inform 2634–1964. https://doi.org/10.1016/j.aci.2019.11.005

Attuquayefio S, Addo H (2014) Using the UTAUT model to analyze students’ ICT adoption. International Journal of Education and Development using ICT, 10(3), Open Campus, The University of the West Indies, West Indies. Retrieved August 2, 2021 from https://www.learntechlib.org/p/148478/

Kemal Avkiran N (1994) Developing an Instrument to Measure Customer Service Quality in Branch Banking. Int J Bank Mark 12(6):10–18. https://doi.org/10.1108/02652329410063223

Awang Z (2012) Structural equation modeling using AMOS graphic. Penerbit Universiti Teknologi MARA

Bagozzi RP (2007) The legacy of the technology acceptance model and a proposal for a paradigm shift. J Assoc Inf Syst 8(4):244–254. https://doi.org/10.17705/1jais.00122

Bakkabulindi FEK (2014) A call for return to Rogers’ innovation diffusion theory. Makerere J High Educ 6(1):55–85

Basri WS, Alandejani JA, Almadani FM (2018) ICT Adoption Impact on Students’ Academic Performance: Evidence from Saudi Universities. Edu Res Inter 2018:1–9. https://doi.org/10.1155/2018/1240197

Belanger F, Hiller JS, Smith WJ (2002) Trustworthiness in electronic commerce: the role of privacy, security, and site attributes. J Strateg Inf Syst 11(3–4):245–270

Bergdahl N, Nouri J, Fors U (2020) Disengagement, engagement and digital skills in technology-enhanced learning. Educ Inf Technol 25(2):957–983

Berry LL (2002) Relationship marketing of services perspectives from 1983 and 2000. J Relatsh Mark 1(1):59–77. https://doi.org/10.1300/j366v01n01_05.ISSN1533-2667

Blut M, Wang C (2020) Technology readiness: a meta-analysis of conceptualizations of the construct and its impact on technology usage. J Acad Mark Sci 48(4):649–669

Boateng H, Adam DR, Okoe AF, Anning-Dorson T (2016a) Assessing the determinants of internet banking adoption intentions: a social cognitive theory perspective. Comput Hum Behav 65:468–478

Boateng R, Mbrokoh AS, Boateng L, Senyo PK, Ansong E (2016b) Determinants of e-learning adoption among students of developing countries. Intern J Inform Learn Tech 33(4):248–262. https://doi.org/10.1108/ijilt-02-2016-0008

Bojang I, Medvedev MA, Spasov KB, Matvevnina AI (2017) Determinants of trust in B2C e-commerce and their relationship with consumeronline trust. AIP Conference Proceedings. Published. https://doi.org/10.1063/1.5013938

Bollen KA, Stine RA (1992) Bootstrapping goodness-of-fit measures in structural equation models. Sociol Methods Res 21(2):205–229

Bucko J, Kakalejčík L, Ferencová M (2018) Online shopping: factors that affect consumer purchasing behaviour. Cogent Bus Manag 5(1):1535751

Bülbül D (2013) Determinants of trust in banking networks. J Econ Behav Organ 85:236–248

Cavoukian A, Stoianov A (2007) Biometric encryption. Biom Technol Today 15(3):11

Chellappa RK, Pavlou PA (2002) Perceived information security, financial liability and consumer trust in electronic commerce transaction. Logist Inf Manag 15(5/6):358–368

Chen Y, He W (2013) Security risks and protection in online learning: a survey. Int Rev Res Open Distrib Learn 14(5):108–127

Cheng TE, Lam DY, Yeung AC (2006) Adoption of internet banking: an empirical study in Hong Kong. Decis Support Syst 42(3):1558–1572

Chin WW (1998) Issues and opinions on structural equation modeling. MIS Q 22(1):7–26

Chin WW, Dibbern J (2010) An introduction to a permutation based procedure for multi-group PLS analysis: results of tests of differences on simulated data and a cross cultural analysis of the sourcing of information system services between Germany and the USA. In: Handbook of partial least squares. Springer, Berlin, pp 171–193

Chiu JL, Bool NC, Chiu CL (2017) Challenges and factors influencing initial trust and behavioral intention to use mobile banking services in the Philippines. Asia Pac J Innov Entrep Commer Trans Logist Inf Manag 15(5/6):358–368

Compeau D, Higgins C (1995) Application of social cognitive theory to training for computer skills. Inf Syst Res 6(2):118–143

Curran JM, Meuter ML (2005) Self-service technology adoption: comparing three technologies. J Serv Mark 19(2):103–113. https://doi.org/10.1108/08876040510591411

Darling-Hammond L, Flook L, Cook-Harvey C, Barron B, Osher D (2020) Implications for educational practice of the science of learning and development. Appl Dev Sci 24(2):97–140

Davis FD (1989) Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Quarterly 13(3):319. https://doi.org/10.2307/249008

Davis FD, Bagozzi RP, Warshaw PR (1989) User acceptance of computer technology: a comparison of two theoretical models. Manag Sci 35(8):982–1003

Dijkstra TK, Henseler J (2015) Consistent partial least squares path modeling. MIS Q 39(2):297–316

Dimitriadis S, Kyrezis N (2011) The effect of trust, channel technology, and transaction type on the adoption of self-service bank channels. Serv Ind J 31(8):1293–1310

Dixit N, Saroj K (1970) Acceptance of e-banking among adult customers: an empirical investigation in India. J Internet Bank Commer 15(2):1–17

Du Preez R, Visser E, Janse Van Noordwyk H (2008) Store image: scale development Part 2. SA J Ind Psychol 34(2):59–68

Ezzi SW (2014) A theoretical model for internet banking: beyond perceived usefulness and ease of use. Arch Bus Res 2(2):31–46

Fekadu GW (2009) Electronic Banking in Ethiopia: Practices. SSRN Electronic Journal. Published, Opportunites and Challenges. https://doi.org/10.2139/ssrn.1492006

Featherman MS, Miyazaki AD, Sprott DE (2010) Reducing online privacy risk to facilitate e-service adoption: the influence of perceived ease of use and corporate credibility. J Serv Mark 24(3):219–229. https://doi.org/10.1108/08876041011040622

Filieri R, Alguezaui S, McLeay F (2015) Why do travelers trust TripAdvisor? Antecedents of trust towards consumer-generated media and its influence on recommendation adoption and word of mouth. Tour Manag 51:174–185

Flavián C, Guinalíu M (2006) Consumer trust, perceived security and privacy policy. Ind Manag Data Syst 106(5):601–620. https://doi.org/10.1108/02635570610666403

Fornell C, Larcker DF (1981) Structural Equation Models with Unobservable Variables and Measurement Error: Algebra and Statistics. J Mark Res 18(3):382–388. https://doi.org/10.1177/00222437810180031

Gefen D, Straub D (2005) A Practical Guide To Factorial Validity Using PLS-Graph: Tutorial And Annotated Example. Commun Assoc. Inf Syst 16:Published https://doi.org/10.17705/1cais.01605

Gefen D, Karahanna E, Straub DW (2003) Trust and TAM in online shopping: an integrated model. MIS Q 27(1):51–90

Gikandi JW, Bloor C (2010) Adoption and effectiveness of electronic banking in Kenya. Electron Commer Res Appl 9(4):277–282

Gillett AG (2016) Multiple relationships with multiple stakeholders: the scope of relationship marketing for public services. J Serv Res 16(2):1–28

Gliem JA, Gliem RR (2003) Calculation, interpreting and reporting Cronbach’s alpha reliability coefficient for Likert-type scales. Midwest Research to Practice Conference in Adult, Continuing and Community Education, Columbus, OH, p 82–88

Grabner-Kräuter S, Faullant R (2008) Consumer acceptance of internet banking: the influence of internet trust.Int. J Bank Mark 26(7):483–504. https://doi.org/10.1108/02652320810913855

Hair JF Jr, Black WC, Babin BJ, Andersen RE, Tatham RL (2010) Multivariate data analysis, 7th edn. Prentice Hall, Upper Saddle River, NJ

Han J, Park CM (2017) Case study on adoption of new technology for innovation: perspective of institutional and corporate entrepreneurship. Asia Pacific Journal of Innovation and Entrepreneurship

Henseler J, Ringle CM, Sinkovics RR (2009) The use of partial least squares path modeling in international marketing, Sinkovics RR, Ghauri PN (eds) New Challenges to International Marketing (Advances in International Marketing, vol. 20), Emerald Group Publishing Limited, Bingley, p 277–319. https://doi.org/10.1108/S1474-7979

Henseler J, Ringle CM, Sarstedt M (2016) Testing measurement invariance of composites using partial least squares. Int Mark Rev 33(3):405–431. https://doi.org/10.1108/imr-09-2014-0304

Ho GW (2017) Examining perceptions and attitudes: a review of Likert-type scales versus Qmethodology. West J Nurs Res 39(5):674–689

Holden RJ, Karsh BT (2010) The technology acceptance model: its past and its future in health care. J Biomed Inform 43(1):159–172

Hu LT, Bentler PM (1998) Fit indices in covariance structure modeling: sensitivity to underparameterized model misspecification. Psychol Methods 3(4):424

Hu LT, Bentler PM (1999) Cutoff criteria for fit indexes in covariance structure analysis: conventional criteria versus new alternatives. Struct Equ Model 6(1):1–55

Ismail MA, Osman MA (1970) Factors influencing the adoption of e-banking in Sudan: perceptions of retail banking clients. J Internet Bank Commer 17(3):1–12

Izogo EE, Nnaemeka OC, Onuoha AO, Ezema KS (2012) Impact of demographic variables on consumers’ adoption of e-banking in Nigeria: an empirical investigation. Eur J Bus Manag 4(17):27–39

Jha S, Ye C (2016) The impact of demographic variables on perception of importance and continued usage of Facebook in the US. Glob Bus Rev 17(1):1–15

Jiang Z, Chan J, Tan BC, Chua WS (2010) Effects of interactivity on website involvement and purchase intention. J Assoc Inf Syst 11(1):1

Joewono TB, Effendi BA, Gultom HS, Rajagukguk RP (2017) Influence of personal banking behaviour on the usage of the electronic card for toll road payment. Transp Res Procedia 25:4454–4471

Karahanna E, Straub DW (1999) The psychological origins of perceived usefulness and ease-of-use. Inf Manag 35(4):237–250

Keramati A, Taeb R, Larijani AM (2010) The adoption of mobile payment: a descriptive study on Iranian customers. Int J Electron Cust Relatsh Manag 4(3):264–279

Kesharwani A, Singh Bisht S (2012) The impact of trust and perceived risk on internet banking adoption in India. Int J Bank Mark 30(4):303–322. https://doi.org/10.1108/02652321211236923

Khare A, Dixit S, Chaudhary R, Kochhar P, Mishra S (2012) Customer behavior toward online insurance services in India. J Database Mark Cust Strategy Manag 19(2):120–133

Kim Y, Crowston K (2011) Technology adoption and use theory review for studying scientists’ continued use of cyber-infrastructure. Proc Am Soc Inf Sci Technol 48(1):1–10

Kim C, Tao W, Shin N, Kim KS (2010) An empirical study of customers’ perceptions of security and trust in e-payment systems. Electron Commer Res Appl 9(1):84–95

Kish L (1983) Data collection for details over space and time. In: Tommy Wright (ed) Statistical methods and the improvement of data quality. Academic Press, p 73–84

Koller M (1988) Risk as a determinant of trust. Basic Appl Soc Psychol 9(4):265–276

Kolodinsky JM, Hogarth JM, Hilgert MA (2004) The adoption of electronic banking technologies by US consumers. Int J Bank Mark 22(4):238–259. https://doi.org/10.1108/02652320410542536

Kotler P, Keller KL (2006) Marketing Management 12e. Upper Saddle River, New. L. Little, Attitudes towards technology use in public zones: the influence of external factors on ATM use, CHI '03 extended abstracts on human factors in computing systems, ACM, Ft. Lauderdale, Florida, USA, 2003

Lallmahamood M (1970) An Examination of individual perceived security and privacy of the internet in malaysia and the influence of this on their intention to use e-commerce: using an extension of the technology acceptance model. J Internet Bank Commer 12(3):1–26

Lee TH, Hsu FY (2013) Examining how attending motivation and satisfaction affects the loyalty for attendees at aboriginal festivals. Int J Tour Res 15(1):18–34

Lee MK, Turban E (2001) A trust model for consumer internet shopping. Int J Electron Commer 6(1):75–91

Little L (2003) Attitudes towards technology use in public zones. CHI ’03 Extended Abstracts on Human Factors in Computing Systems - CHI ’03. Published. https://doi.org/10.1145/765891.766110

Ma Q, Liu L (2004) The technology acceptance model: a meta-analysis of empirical findings. J Organ End User Comput (JOEUC) 16(1):59–72

Ma YJ, Gam HJ, Banning J (2017) Perceived ease of use and usefulness of sustainability labels on apparel products: application of the technology acceptance model. Fash Text 4(1):3

Maitlo GM, Kazi ZH, Khaskheley A, Shaikh FM (2015) Factors that influence the adoption of online banking services in Hyderabad. Int J Econ Manag Sci 4(1):1–10

Martins C, Oliveira T, Popovič A (2014) Understanding the Internet banking adoption: a unified theory of acceptance and use of technology and perceived risk application. Int J Inf Manag 34(1):1–13

Martyn H, Gallant LM (2012) Over 50 and wired: Web-based stakeholder communication. First Monday 17(6): https://doi.org/10.5210/fm.v17i6.3449

Mathieson K (1991) Predicting user intentions: comparing the technology acceptance model with the theory of planned behavior. Inf Syst Res 2(3):173–191

Meziane F, Kasiran MK (2008) Evaluating trust in electronic commerce: a study based on the information provided on merchants’ websites. J Oper Res Soc 59(4):464–472

Milkias P (2006) Haile Selassie, western education, and political revolution in Ethiopia. Cambria Press, New York

Mingaine L (2013) Challenges encountered by principals during implementation of ICT in public secondary schools. Kenya J Sociol Res 4(2):1

Morgan RM, Hunt SD (1994) The commitment-trust theory of relationship marketing. J Mark 58(3):20–38

Muñoz-Leiva F, Luque MT, Sánchez-Fernández J (2010) How to improve trust toward electronic banking? Online Inf Rev 34:907–934. https://doi.org/10.1108/14684521011099405

Nasir MA, Wu J, Yago M, Li H (2015) Influence of psychographics and risk perception on internet banking adoption: Current state of affairs in Britain. Int J Econ Fin Issues 5(2):461–468

Ndou V (2004) E-Government for developing countries: opportunities and challenges. Electron J Inf Syst Dev Ctries 18(1):1–24

Ndubisi NO (2007) Customers’ perceptions and intention to adopt Internet banking: the moderation effect of computer self-efficacy. AI & Soc 21(3):315–327

Novaes SZ, de Araújo JB (2012) Small companies innovations in emerging countries: E-business adoption and its business model. J Technol Manag Innov 7(2):102–116

Novoa E (2018) UNCTAD Youth addressing data challenges in a digital economy. Report written by Eugenia Novoa (Speaker), SiddheshKapote (Speaker) Ebba Engstrom (Speaker), Jose Alvarez (Speaker) and Smriti Sonam (Special Rapporteur). Images provided by AFI Changemakers and UNCTAD Youth Summit Delegates

Odat AM (2012) E-Government in developing countries: Framework of challenges and opportunities. 2012 International conference for Internet technology and secured transactions. IEEE, pp 578–582

Oney E, Oksuzoglu GG, Hussain RW (2017) The determinants of electronic payment systems usage from consumers’ perspective. Econ Res Ekonomskaistraživanja 30(1):394–415

Paletta FC, Dias NVJ (2008) Information technology and communication and best practices in it lifecycle management. J Technol Manag Innov 3(4):80–94

Palmer A, Huo Q (2013) A study of trust over time within a social network mediated environment. J Mark Manag 29(15–16):1816–1833

Pikkarainen T, Pikkarainen K, Karjaluoto H, Pahnila S (2004) Consumer acceptance of online banking: an extension of the technology acceptance model. Internet Res 14(3):224–235. https://doi.org/10.1108/10662240410542652

Poon W (2007) Users’ adoption of e‐banking services: the Malaysian perspective. J Bus Indust Market 23(1):59–69. https://doi.org/10.1108/08858620810841498

Prager R (2001) “The effects of ATM surcharges on small banking organizations”, review of industrial organization, 18: 161–173. rReview of Network Economics, vol. 2, Issue 2–June 2003 158 Saloner, G. and A. Shepard (1995) “adoption of technologies with network effects: an empirical examination of the adoption of automated teller machines. RAND J Econ 26:479–501

Rempel JK, Zanna MP (1985) Trust in close relationships. J Pers Soc Psychol 49(1):95–112

Rogers E (1983) The Diffusion of Innovation. Free Press, New York

Sareen M (2015) Perceived security as trust indicator in adoption of internet banking in a developing country: an empirical study. Int J Strateg Inf Technol Appl (IJSITA) 6(3):35–49

Sarstedt M, Ringle CM, Henseler J, Hair JF (2014) On the emancipation of PLS-SEM: A commentary on Rigdon (2012). Long range plann 47(3):154-160.

Sathasivam A, Wijetunga D (2017) Trust as a mediator of the relationship between perceived online deception and online purchase intention. Annual Research Symposiums. 599 http://hdl.handle.net/70130/4575

Shah M, Clarke S (2009) E-banking management: Issues. Solutions and strategies. Information science reference, Hershey, pp 1–3

Book Google Scholar

Shen YC, Huang CY, Chu CH, Hsu CT (2010) A benefit–cost perspective of the consumer adoption of the mobile banking system. Behav Inf Technol 29(5):497–511

Smith KJ, Davy JA, Rosenberg DL, Haight GT (2002) A structural modeling investigation of the influence of demographic and attitudinal factors and in-class deterrents on cheating behavior among accounting majors. J Acc Educ 20(1):45–65

Stoiciu A (2011) The role of e-Governance in bridging the digital divide. UN Chron 48(3):37–39

Suh B, Han I (2002) Effect of trust on customer acceptance of Internet banking. Electron Commer Res Appl 1(3–4):247–263

Takele Y, Sira Z (2013) Analysis of factors influencing customers ‘intention to the adoption of e-banking service channels in Bahir Dar city: An integration of TAM. TPB AND PR. European Scientific Journal 9(13):

Tarhini A, El-Masri M, Ali M, Serrano A (2016) Extending the UTAUT model to understand the customers’ acceptance and use of internet banking in Lebanon. Inf Technol People 29(4):830–849. https://doi.org/10.1108/itp-02-2014-0034

Tyler K, Stanley E (2007) The role of trust in financial services business relationships. J Serv Mark 21(5):334–344. https://doi.org/10.1108/08876040710773642

United Nations (2016) Sustainable development goals report 2016. UN

US Federal Trade Commission, & United States of America (2011) Protecting personal information: a guide for business

Venkatesh Thong Xu (2012) Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Quarterly 36(1):157. https://doi.org/10.2307/41410412

von Schomberg L, Blok V (2019) Technology in the Age of Innovation: Responsible Innovation as a New Subdomain Within the Philosophy of Technology. Philos Technol 34(2):309–323. https://doi.org/10.1007/s13347-019-00386-3

Vukovića M, Pivac S, Kundid D (2019) Technology acceptance model for the internet banking acceptance in split. Bus Syst Res Sci 10(2):124–140

Walker R, Johnson L (2006) Why consumers use and do not use technology-enabled services. J Serv Mark 20(2):125–135

Wang Y, Wang Y, Lin H, Tang T (2003) Determinants of user acceptance of Internet banking: an empirical study. Int J Serv Ind Manag 14(5):501–519. https://doi.org/10.1108/09564230310500192

Weber RH (2010) Internet of things-new security and privacy challenges. Comput Law Secur Rev 26(1):23–30

Worku G (1970) Electronic-banking in Ethiopia-practices, opportunities and challenges. J Internet Bank Commer 15(2):1–8

Xie Q, Song W, Peng X, Shabbir M (2017) Predictors for e-government adoption: integrating TAM. TPB, trust and perceived risk, The Electronic Library 35(1):2–20. https://doi.org/10.1108/EL-08-2015-0141

Yousafzai SY (2012) A literature review of theoretical models of Internet banking adoption at the individual level. J Financ Serv Mark 17(3):215–226

Yousafzai S, Pallister J, Foxall G (2009) Multi-dimensional role of trust in Internet banking adoption. Serv Ind J 29(5):591–605

Yousafzai SY, Foxall G, Pallister JG (2010) Explaining internet banking behavior: theory of reasoned action, theory of planned behavior, or technology acceptance model. J Appl Soc Psychol 40(5):1172–1202

Zainal H, Bakar AA, Saad RAJ (2016) Reputation, satisfaction of zakat distribution, and service quality as determinant of stakeholder trust in zakat institutions. Int J Econ Financ Issues 6(7S):72–76

Zeithaml V, Bitner MJ (2004) Services marketing: focus across the firm. Marketing 68(1):24–27

Zhang W (2010) E-government information security: challenges and recommendations. 2010 International conference on computer application and system modeling (ICCASM). IEEE, pp. V15-11–V15-14

Ziegeldorf JH, Morchon OG, Wehrle K (2014) Privacy in the internet of things: threats and challenges. Secur Commun Netw 7(12):2728–2742

Download references

This research received no specific grant from any funding agency in the public, commercial, or not-for-profit sectors.

Author information

Authors and affiliations.

Ethiopian Civil Service University, CMC Road, PO BOX 5648, Addis Ababa, Ethiopia

Pankaj Tiwari

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Pankaj Tiwari .

Ethics declarations

Conflict of interest.

All the authors announces that there is no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

Reprints and permissions

About this article

Tiwari, P. Electronic banking adoption in Ethiopia: an empirical investigation. SN Bus Econ 1 , 112 (2021). https://doi.org/10.1007/s43546-021-00114-0

Download citation

Received : 29 October 2020

Accepted : 19 July 2021

Published : 09 August 2021

DOI : https://doi.org/10.1007/s43546-021-00114-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Perceived ease of use

- Infrastructure

- E-banking adoption

Advertisement

- Find a journal

- Publish with us

- Track your research

IMAGES

VIDEO

COMMENTS

Thesis PDF Available. ... (33.1%) respondents state that service worst before e-banking channels. 33 (22.8%) stated that service was bad. The findings are figure 14 below.

The rapid expansion of Electronic banking Systems throughout the world, forces the banking industry to implement and improve E-Banking Service qualities. E-banking is one of the most recent phenomenon in the financial services organizations. This method was established in the mid-1990s, there after it becomes more important (Allen L &Rai, 1996).

Page | ii CERTIFICATE This is to certify that the dissertation report titled "An Analysis on E-Banking Services" is a bonafide work carried out by Mr. Rohan Tanwar & Mr. Lakshya Singh of Master of Business Administration (Business Analytics) 2018-20 and submitted to University School of Management and Entrepreneurship, Delhi Technological University, Bawana

1 Accounting Department, College of Business Administration, University of Hail, Hail, Kingdom of Saudi Arabia. *Corresponding author: E-mail: hajeratame [email protected]; Chapter 4. Print ISBN: 978 ...

Impact of e banking service quality on customer satisfaction a comparative study of private and public sector banks ... Banking and banking-India Business Finance Customer relations-India Economics and Business Internet banking-India Management Studies-Thesis Social Sciences: University: ... Description Size Format ; 10.chapter 3.pdf: Attached ...

The process of this master thesis writing is a wonderful learning experience in our academic life which is filled with challenges and rewards. The completion of the ... to broadly develop more E-banking products and to do extensive customer education

However, arrival of technology has an impact on Internet banking and transforms from a traditional banking system to a very useful innovation technology. The purpose of this study is to analyze factors that have influenced users to use Internet banking in doing financial transaction. This study uses content analysis on the previous literatures.

The banking sector has adopted digital ways to provide the best service to consumers to increase loyalty. The current study examines the influence of e-banking mobile application quality factors ...

If the ICT infrastructure at the Commercial Bank of Ethiopia (CBE) is improved by one SD and keeping other variables constant, the adoption rate in e-banking will increase by 3% (roughly). The indirect efect rela-tionship INF—> ADO (γ = 0.0636 and p = 0.0319) is significant.

Sagatchi 2006). E-banking is considered the foundation of e-commerce and number of industries and businesses that are moving toward e-banking is increasing rapidly. E-banking refers to financial activities that involve use of electronic technology ranging from the now ubiquitous automatic teller machines (ATMs), to other services such as direct

1.5 Research methodology used in this thesis 6 1.6 Context of study: Pakistan 8 1.7 Structure of the Thesis 10 CHAPTER TWO: Literature Review 2.1 Introduction 12 2.2 Theoretical Models Used in Technology Acceptance and Usage 13 2.2.1 Theory of Reasoned Action 14 2.2.2 Theory of Planned Behaviour 16

1.1.1 Electronic Banking E-banking can be classified into three basic types. These include Internet banking, Smart card banking and Mobile/telephone banking. Internet banking: This is a type of e-banking service where customers' instructions are taken and attended to through the internet. Internet banking offers customers the

A thesis submitted to the School of Graduate Studies of St Mary University in partial ... (Chang, 2003). This implies that, e-banking has occasioned in efficiency in service provision in the banking sector because customers can perform business from one side of the country to another and from both long and short distance.

Historically, the launching of the first Automated Teller Machine (ATM) in Finland marked the start of a new banking channel, which made Finland the leading country in E-Banking, before it became widely used in any other developed and developing countries (H. Sharma, 2011).More recently, E-Banking, or the distribution of financial services via electronic systems, has spread among customers due ...

The thesis considers customer security in a major European bank Bank X. The action research focus is to strengthen the processes and the overall solution for online Bank customers which experience a significant growth and increase in use. There seem to be a common misperception between the internal staff of the bank and its

It is certified that thesis entitled E-banking and Impact on financial performance in Nepalese Commercial Bank submitted by Eluna Pun is an original piece of research work carried out by the candidate under my supervision. Literary presentation is satisfactory and the thesis is in a form suitable for publication. Work evinces the

1. Introduction. E-banking can be simply defined to mean a process where banks create a platform for its customers to generally access information and to transact businesses electronically through an electronic device without necessarily being present at the bank (Annin et al., Citation 2013).Electronic banking enhances the development of the financial system in general and the banking ...

The goal was to provide a clear understanding of e-banking on the impact it has had on their performance. 3.4 Framework The proposed framework is a fusion of three independent research streams: online transaction, system congestion, staff skills, customer guideline, and modern technology such as communication skills.

Online banking , also known as internet banking, e-banking or virtual banking, is. an electronic payment system that enables customers of a bank or other financial institution to. conduct a range ...

E-banking had provided a variety of services that eases the life of people by enabling customers to carry out financial services through technology devices (Pradhan, 2019). Despite this, awareness among the citizens is still low. (Daily Express, 2021) stated that a customer spent two and a half hours performing financial ...

Virtual banking includes all non- traditional and electronic means of banking such as ATM, Phone Banking, Internet Banking (IB), Credit Cards and Debit Cards etc. A special feature of virtual banking is the physical absence of the person seeking banking services at the premises and out of premises even abroad. The sophisticated and

The electronic novelty in the banking sector dates to 1970. Since then, the computerization of financial institutions has gained momentum. Since 1980, with the introduction of ATMs, easy financial transactions have been a visible light for customers (Prager 2001).Internet and communication technology (ICT)-based e-banking has improved in recent years following the introduction of electronic ...

Andreea-Daniela Moraru et al. E-banking and Customer Satisfaction with Banking Services 9 STRATEGIC MANAGEMENT, Vol. 23 (2018), No. 3, pp. 003-009 National Bank of Romania - A nnual reports for ...

If you suspect fraud, waste, or abuse of public money in Tennessee, call the Comptroller's toll-free hotline at 800.232.5454, or file a report online at: tncot.cc/fraud. Follow us on X/Twitter @TNCOT and Instagram @tncot. Media contact: John Dunn, Director of Communications, 615.401.7755 or [email protected]. Related Links: TSU Forensic ...