How to write a financial need statement for your scholarship application (with examples!)

So you’re applying for a scholarship that asks you about your financial need. What do you say? How honest or specific should you be? What is TMI? In this article, we break down how to pen an awesome financial need scholarship essay or statement.

What to include in a financial need scholarship essay

Template to structure your financial need scholarship essay, introduction: your basic profile, body: your financial situation and hardships, conclusion: how you would benefit from this scholarship, was this financial need essay for a college financial aid application , now, reuse that same essay to apply for more scholarships, additional resources to help you write your financial need scholarship essay.

Many scholarships and college financial aid awards are “need-based,” given to students whose financial situation requires additional support. That’s why one of the most common college scholarship essays is a statement of financial need. This might be very explicit (“Explain your financial need”), somewhat explicit (“Describe your financial situation”), or quite open-ended (“Explain why you need this scholarship”).

In all cases, scholarship providers want to get a sense of your family’s financial picture: what your family income is, if you personally contribute to it (do you have a job?), and how much additional money you need to attend your target college (your “financial gap”).

If the essay prompt is a bit more open-ended (“Explain how this scholarship would help you”), your essay should probably be a combination of a financial need statement and a career goals / academic goals essay. That’s because you want to show how the award will help you financially and in your academic or career goals.

Usually this statement of financial need is a pretty short scholarship essay (150-300 words), so unlike a college essay or personal statement where you have ample word count to tell anecdotes, you’ll likely need to get right to the point.

Be sure to include:

- If you are an underrepresented group at college, for instance, part of an ethnic minority or the first in your family to go to college

- Any relevant family circumstances, like if your parents are immigrants or refugees, as well as your parents’ occupation and how many children/family members they support financially

- How you are currently paying for college, including what you personally are doing to contribute financially (like working student jobs)

- What financial challenges/difficulties your family is facing, for instance, if a parent recently lost their job

- How you would benefit from the scholarship–including your academic and career goals (if word count allows)

Also remember to write in an optimistic tone. Writing about your financial situation or hardships might not be the most positive thing to share. But you can turn it around with an optimistic tone by writing about how these challenges have taught you resiliency and grit.

Give a short introduction to who you are, highlighting any family characteristics that might make you part of an underrepresented group at college.

“I am a first-generation American and the first in my family to go to college. My family moved from El Salvador to New York when I was seven years old, to escape the violence there.”

Example 2:

“I am from a working-class family in Minnesota. My family never had a lot, but we pooled our efforts together to make ends meet. My parents both worked full-time (my father as a mechanic, my mother as a receptionist at the local gym), while my siblings and I all worked weekend jobs to contribute to the family income.”

Dive into the details. How are you currently planning to pay for college? The idea here is to show that you and your family have made a good-faith effort to earn enough money to pay your tuition, but that it has simply not been enough.

Make sure you describe your parents’ occupation, any savings (like a 529 College Savings Account), and any student jobs. You might also discuss any sudden changes in fortune (e.g. parent fell ill or lost their job) that have ruined your original financial plans.

Example

As immigrants with limited English, my parents have had to accept low-paying jobs. My father is an Uber driver, and my mother is a housekeeper. They earn just enough to pay our rent and put food on the table, so I’ve always known they could not help me pay for college. So I’ve been proactive about earning and saving my own money. Since age 11, I’ve worked odd jobs (like mowing my neighbors’ lawns). At age 16, I started working at the mall after school and on weekends. Through all these jobs, I’ve saved about $3000. But even with my financial aid grants, I need to pay $8000 more per year to go to college.

Bring it home by wrapping up your story. Explain how you plan to use the financial aid if you’re awarded this scholarship. How will you benefit from this award? What will you put the money toward, and how will it help you achieve your academic and/or career goals?

Scholarship review boards want to know that their money will be put to good use, supporting a student who has clear plans for the future, and the motivation and determination to make those plans a reality. This is like a shortened, one-paragraph version of the “Why do you deserve this scholarship?” essay .

Winning $5000 would help me close the financial gap and take less in student loans. This is particularly important for me because I plan to study social work and eventually work in a role to support my community. However, since these jobs are not well paid, repaying significant student loans would be difficult. Your scholarship would allow me to continue down this path, to eventually support my community, without incurring debt I can’t afford.

My plan is to study human biology at UC San Diego, where I have been admitted, and eventually pursue a career as a Nurse-Practitioner. I know that being pre-med will be a real academic challenge, and this scholarship would help me focus on those tough classes, rather than worrying about how to pay for them. The $2000 award would be equivalent to about 150 hours of working at a student job. That’s 150 hours I can instead focus on studying, graduating, and achieving my goals.

Sometimes this financial need statement isn’t for an external scholarship. Instead, it’s for your college financial aid office.

In that case, you’re usually writing this statement for one of two reasons:

- You’re writing an appeal letter , to request additional financial aid, after your original financial aid offer wasn’t enough. In this case, you’ll want to make sure you’re being extra specific about your finances.

- You’re applying for a specific endowed scholarship that considers financial need. In this case, your financial need essay can be quite similar to what we’ve outlined above.

Now that you’ve written a killer financial need scholarship essay, you have one of the most common scholarship essays ready on hand, to submit to other scholarships too.

You can sign up for a free Going Merry account today to get a personalized list of hundreds of scholarships matched to your profile. You can even save essays (like this one!) to reuse in more than one application.

You might also be interested in these other blog posts related to essay writing:

- What’s the right scholarship essay format and structure?

- How to write a winning scholarship essay about your academic goals

- How to write an awesome essay about your career goals

- Recent Posts

- Scholarships for Students in Pennsylvania for 2021 - November 11, 2020

- Counselor Starter Guide: How to Use Going Merry’s Scholarship Platform - September 9, 2020

- How to write a financial need statement for your scholarship application (with examples!) - August 13, 2020

Ready to find scholarships that are a match for you?

- Search All Scholarships

- Exclusive Scholarships

- Easy Scholarships to Apply For

- No Essay Scholarships

- Scholarships for HS Juniors

- Scholarships for HS Seniors

- Scholarships for College Students

- Scholarships for Grad Students

- Scholarships for Women

- Scholarships for Black Students

Scholarships

- Student Loans

- College Admissions

- Financial Aid

- Scholarship Winners

- Scholarship Providers

Apply to vetted scholarship programs in one click

Student-centric advice and objective recommendations.

Higher education has never been more confusing or expensive. Our goal is to help you navigate the very big decisions related to higher ed with objective information and expert advice. Each piece of content on the site is original, based on extensive research, and reviewed by multiple editors, including a subject matter expert. This ensures that all of our content is up-to-date, useful, accurate, and thorough.

Our reviews and recommendations are based on extensive research, testing, and feedback. We may receive commission from links on our website, but that doesn’t affect our editors’ opinions. Our marketing partners don’t review, approve or endorse our editorial content. It’s accurate to the best of our knowledge when posted. You can find a complete list of our partners here .

How to Pay for College (A Step-by-Step Guide)

Will Geiger is the co-founder of Scholarships360 and has a decade of experience in college admissions and financial aid. He is a former Senior Assistant Director of Admissions at Kenyon College where he personally reviewed 10,000 admissions applications and essays. Will also managed the Kenyon College merit scholarship program and served on the financial aid appeals committee. He has also worked as an Associate Director of College Counseling at a high school in New Haven, Connecticut. Will earned his master’s in education from the University of Pennsylvania and received his undergraduate degree in history from Wake Forest University.

Learn about our editorial policies

Bill Jack has over a decade of experience in college admissions and financial aid. Since 2008, he has worked at Colby College, Wesleyan University, University of Maine at Farmington, and Bates College.

Maria Geiger is Director of Content at Scholarships360. She is a former online educational technology instructor and adjunct writing instructor. In addition to education reform, Maria’s interests include viewpoint diversity, blended/flipped learning, digital communication, and integrating media/web tools into the curriculum to better facilitate student engagement. Maria earned both a B.A. and an M.A. in English Literature from Monmouth University, an M. Ed. in Education from Monmouth University, and a Virtual Online Teaching Certificate (VOLT) from the University of Pennsylvania.

Let’s face it: college is one of the most important investments you will make in your life. However, college is an unusually expensive and complicated investment. The complexity stems from the fact that every family may be paying a different amount for college as determined by the EFC or Expected Family Contribution.

It is also a confusing process for students and families because there are so many ways to fund an education. Scholarships, need-based grants, savings, student loans, and work study are just a few of the ways that families and students might pay for college. This is why it’s important to have a plan to pay for college. In this guide, we will talk you through the process of paying for college.

Of course, every family’s financial situation is different, and the cost of college will be different for each. That’s why an important first step to paying for college is figuring out what college will cost for you.

Related: Scholarships360’s free scholarship search engine

Estimating the cost of college

I mentioned earlier that the cost of college will vary from family to family. This is because need-based financial aid is dependent on each family’s financial situation, so the “net cost” of college (after financial aid is factored in) can vary.

Luckily, there is a useful tool called the Net Price Calculator that can help students estimate what a need-based financial aid package might look like at a particular school. You don’t need to be an applicant to complete the Net Price Calculator, so you can feel free to use it well before you are applying for college. In fact, anyone can complete the Net Price Calculator including parents, guardians, and school counselors!

This is a recommended first step for all students and families who want to estimate the net cost of a college education.

Now that you have that figured out, we can dive into the major ways that students will pay for college:

- Savings & Income

Need-based financial aid

Private student loans, other ways to pay for college, savings & income.

According to the most recent Sallie Mae report, savings and income represented 50% of funding from students and parents. This made it the largest single funding source that families reported. Luckily for families, there is a financial vehicle called a 529 plan that provides tax benefits for educational-related savings.

Saving money through a 529 Plan

“ Family contributions” is a fancy phrase for “money that you and your family have saved” and one of the primary ways people pay for college.

One of the best ways to save for college is through a 529 Education Plan . A 529 plan allows families to use money tax-free for education expenses, including college. I t is never too late to start a 529 plan, but a longer period of time will allow you to invest more money and allow your investment to grow.

Learn more: How much money can you put in a 529 Plan?

Need-based financial aid is awarded based on a student’s family financial situation. This means that it can be a very valuable way to pay for college.

Students can apply for need-based financial aid through the Free Application for Federal Student Aid or FAFSA . Some colleges will also ask students to complete additional applications like the CSS Profile .

There are three major types of need-based financial aid that you might receive: grants, loans, and work study. Let’s discuss all three of these options:

Need-based grants

Need-based grants do not need to be repaid and can include institutional grants from specific colleges, as well as grants from the federal government such as the Pell Grant . The upside of need-based grants is that they are essentially free money and will not need to be repaid.

Federal work study is a need-based program through the federal government that allows students to pay for college and educational expenses through a part-time job. Students are responsible for finding their jobs through their school and the amount of money they earn will depend on the specific job, as well as the amount of hours worked. Earnings from work study also do not need to be repaid.

Federal student loans

The third type of need-based financial aid that students can qualify for are federal student loans . Federal student loans include subsidized and unsubsidized Direct Loans , as well as Parent PLUS loans . These student loans generally have more favorable interest rates and more flexible repayment options than other student loans. This generally makes them a better option than private student loans which we will get to later.

Learn more: Top Student Loans for undergraduate and graduate degrees

Tons of companies, non-profits, foundations, and other organizations offer scholarships to students! Similar to college merit scholarships and need-based financial aid, scholarships do not need to be paid back. There are scholarships for lots of different things including writing, volunteering, and athletics.. There are lots of scholarships that are open to students who are freshmen , sophomores , and juniors, as well as seniors in high school.

College merit scholarships

In addition to need-based financial aid, many colleges offer merit scholarships to strong applicants. These merit scholarships are also great, because they don’t need to be paid back. Merit scholarships can range from a few thousand dollars to full tuition, room, and board!

The process of applying for college merit scholarships can vary form college to college. At some colleges, all applicants will be automatically considered for merit scholarship opportunities with their admissions application. At other colleges, students will have to submit a separate merit scholarship application with additional essays. When in doubt, you should check in with the colleges on your list so you an be sure you are properly applying for merit scholarships.

Apply to these scholarships due soon

$10,000 “No Essay” Scholarship

$2,000 Sallie Mae Scholarship

“Get Inspired” TikTok Scholarship

Niche $10,000 “No Essay” Scholarship

“Jump for Joy” InstaScholarship

$25k “Be Bold” No-Essay Scholarship

“College Here I Come” Essay Scholarship for High School Seniors

“Scholar Dollars” Essay Scholarship for Black Students

$2,000 No Essay CollegeVine Scholarship

Private student loans are loans that are offered by private financial companies, as opposed to the government. The best advice is to compare different loan rates and repayment terms. By comparing different options, you will be able to find the best private loan solution for your situation.

Remember that you are responsible for paying back all student loans–both private and federal. As a rule of thumb, you should try to keep your total loan amount at or below your anticipated post-graduate earnings. So if you expect to make $50,000 per year, you should not take out more than $50,000 in total student loans over four years.

The College Scorecard is a tool that can provide useful data about what you can expect to earn as a graduate of a particular college or university. Remember, earnings can vary depending on your major or chosen career pathway, so keep that in mind!

Also see: How much student loan debt is too much?

While income & savings, need-based financial aid, scholarships, and private student loans are the major ways that students pay for college, there are some additional options to consider.

Income Share Agreements are one such funding option where students promise to pay back a portion of future earnings in return for educational funding.

Some colleges also offer in-state tuition to certain out-of-state students . This is another way to potentially save tens of thousands of dollars on college tuition.

- If you are saving money for college, a 529 Plan will allow you to take advantage of certain tax benefits!

- Use the Net Price Calculator to estimate financial aid at all of the colleges on your list. If you are still in the research stage, you should run the Calculator on a few schools to get some benchmarks on college cost

- Apply for need-based financial aid with the FAFSA and CSS Profile (if your college requires the CSS Profile). Remember, that both the FAFSA and the CSS Profile have deadlines that may vary based on your school!

- As a last resort, you can use private student loans or Income Share Agreements to pay for college. We also recommend that students shop around for the best terms and rates for these alternative financing options

Scholarships360 Recommended

When is the 2024-2025 FAFSA Deadline?

Pell Grant Eligibility: Do You Qualify?

Trending Now

What Does My FAFSA EFC Number Mean?

3 reasons to join scholarships360.

- Automatic entry to our $10,000 No-Essay Scholarship

- Personalized matching to thousands of vetted scholarships

- Quick apply for scholarships exclusive to our platform

By the way...Scholarships360 is 100% free!

Choose Your Test

Sat / act prep online guides and tips, how to pay for college: complete guide.

Financial Aid

You did all the work of getting into your dream schools - researching the colleges, visiting campuses, getting great test scores, putting together a polished application - and still have to deal with one major obstacle: paying for college. Few students can pay for a full year at college without some assistance, but almost 2 million students graduate with a bachelor’s degree each year in the US - they must be paying for school somehow, right?

Whether you’re a high school student or a current undergraduate, it’s never too early (or too late) to think about minimizing your college costs to make school more affordable . In this post, I’ll go through everything you need to know about how to pay for college.

I’ll start off by talking about what college actually costs before moving into application strategies, figuring out how much money you need, how much aid you can get, and how much you should actually be paying. We'll cover all the major ways to pay for college that families usually use. At the end, I’ll offer some more creative options for closing the gap between your financial need and your actual cost.

First, How Much Does College Cost?

The first step in understanding how to pay for college is having a good understanding of what your expenses will be .

For the 2014-2015 academic year, the average cost of tuition and fees for one year was:

- $31,231 at private colleges

- $9,139 for state residents at public colleges

- $22,958 for out-of-state residents at public colleges

This is the cost that people typically consider when they think of college expenses. Unfortunately, there’s a lot more to the picture than just tuition costs - there are also hidden or implicit expenses associated with spending a year at college.

These other annual expenses include:

- Room and board - averages $11,188 at private colleges, $8,804 at public colleges

- College textbooks - average cost is about $1,200

- Travel costs - these will vary widely based on the student

- Lab fees and supplies - these will come to about $50 per class if they're not already rolled into fees

- Personal expenses - most students budget about $2,000/year to cover personal costs like toiletries and entertainment

Lumping together all of these expenses (if you can estimate travel and personal expenses) will give you a school’s real sticker price - the Cost of Attendance. It’s pretty easy to get an estimate of a school’s CoA- just google “[school name] cost of attendance.”

While it's important to know a school's CoA, perhaps a more important figure to know is your "net price" - it’s what you pay after all financial aid is taken into account. This is what you actually owe, out of pocket, for a year at school . Want to estimate your net price at a particular school? Just google “[school name] net price calculator” - many schools have tools that will give you an estimate of how much you’ll pay out of pocket. These calculators take financial need and sometimes merit-based factors into account.

Minimizing Costs With Your College Applications

Cutting costs can be as simple as applying to the right schools - make paying for college easier from the beginning.

If you’re applying to colleges with price in mind, your strategy should focus on lowest net price, not necessarily lowest sticker price . Apply broadly so that you can consider as many options as possible. You have nothing to lose by applying to a wide range of schools, aside from application fees. If these fees are an issue, ask your guidance counselor about fee waivers.

Once you've been accepted to schools, you’ll receive official financial aid packages . You can then determine which packages you’re most comfortable with (I'll go through some example financial aid packages at the end of the post).

Once you start looking over different financial aid offers, you might notice that not all types of aid are created equal . Just because a financial aid package will cover all your “unmet need” doesn’t mean that it will do so in a way that you’ll find helpful (for example, an aid offer might offer large high-interest loans). Look over each package carefully to determine how much money you’ll actually pay, both now and in the future .

- Example : A school that offers you 5k in grants and 40k in high-interest loans (45k total) will have you paying much more in the long run than a school that offers you 25k in grants, 10k in low-interest loans, and 5k in high-interest loans (40k total).

In general, grants and scholarships tend to be better aid options than low-interest loans or federal work-study . High-interest loans are the least desirable forms of aid. You don't have to pay back grant or scholarship money, but you do have to pay back your school loans (and high-interest loans cost you more in the long run than low-interest ones).

How Do You Figure Out How Much You Need to Pay for College?

Now may be a good time to whip out your trusty TI-84.

There are a few different steps to figuring out how much aid you’ll need in order to afford college:

1. How Much Will School Cost?

Your total expenses will depend on where you decide to go to school, whether you're living in a dorm, and what sort of travel and personal expenses you'll need to account for. Use the info above and this guide to get a good estimate of what your sticker price will be .

2. What Can You Afford?

Your family’s idea of what you can afford may differ from what schools and the Department of Education think you can afford. To address this discrepancy, I have two strategies to figuring out what your family can contribute to college costs: an "unofficial" (perhaps more realistic) one, and an official one. The unofficial strategy will tell you what your family can reasonably contribute, whereas the official strategy tells you what you may be expected to contribute.

The "Unofficial" Strategy

Sit down with your parents/guardians and crunch some numbers. Schools often expect families to contribute at least 10% of annual income to college costs, even if schools themselves can’t offer enough aid to cover the difference. What would it mean for your family if they had to contribute 10% to your college expenses for four years? What if they were asked to contribute more than 10%?

The "Official" Strategy

Use the FAFSA4caster to estimate your federal aid eligibility. The tool will spit out a number called an EFC, or Expected Family Contribution - this is the figure that the FAFSA4caster has determined your family can afford to pay . The more accurate the info you enter into the FAFSA4caster, the more accurate your EFC will be. When you submit the real FAFSA , the federal government will use the application to determine aid eligibility. Many schools also use the FAFSA to award their own need-based aid.

3. What's the Difference Between What You Can Afford and What You Owe?

The final step in determining how much aid you need is figuring out the difference between your CoA (cost of attendance) and the amount you can comfortably afford. The difference will be the amount that (ideally) you can get covered with financial aid, including grants, loans, and scholarships.

Anything that remains “uncovered” is your responsibility to pay . For example, if a school’s CoA is 50k and you get 20k in grants and 20k in federal subsidized loans , 10k will be your responsibility. You can pay the amount that year, take out private loans or PLuS loans , or a combination thereof.

How Much Financial Aid Can You Get?

Let's figure out how much money you can get your hands on.

Unfortunately, just because you have demonstrated financial need doesn’t mean you can get that need covered at any school you wish to go to. Most college students in the US get some help paying for college, but the amount of money you can get will depend on quite a few different factors. In this section, I'll talk about the main variables that affect how much aid you can get and the different ways to pay for college .

Financial Need

The greater your demonstrated financial need, the more aid you're likely to get. Students with exceptional financial need may be eligible for federal programs like the Pell Grant or Perkins loan . Need-based scholarships, like the Gates Millennium Scholarship program , are also viable funding options. Finally, schools that offer need-based aid will award more funds to students with greater need.

Your Choice of School

Put simply; top-rated schools tend to have more money, which means they can offer more generous financial aid packages. Some schools even claim to cover all unmet financial need.

Whether you attend a public or private college will also affect your net costs. Private schools tend to cost more than public in terms of sticker price, but they tend to have better financial aid programs. Public schools are relatively inexpensive for state residents, but can be very pricey for out-of-state applicants.

The greater your strengths, the more opportunities you'll have for educational funding.

Merit-based institutional aid is often offered in the form of sports scholarships or academic scholarships (for students with high grades or SAT/ACT scores). Not all schools offer merit-based aid, but some do in order to attract high-caliber applicants.

Merit-based scholarships are also good funding options for ambitious students. Many private scholarships give out awards based on GPA, test scores, community service, and leadership experience. Being a high performer in any of these areas will help your college applications, but they’ll also help your scholarship applications.

Ultimately, access to many of these financial opportunities comes down to initiative and personal organization . One of the most important ways initiative comes into play is when it comes to keeping track of (and meeting) deadlines - you won't be able to get any forms of financial aid if you don't have an organized timeline. To give you a bit of a head start, I've compiled important deadlines so that you can maximize your aid opportunities:

- Federal FAFSA deadline - For the 2015-2016 academic year, the federal FAFSA deadline is June 30, 2016. The earlier you apply, the better - you don't want funds for certain programs to run out. For the 2016-2017 academic year, the FAFSA will open January 1, 2016.

- State FAFSA deadline - These deadlines vary be state. If you're interested in qualifying for state funding (you should be interested), check the FAFSA deadline for your state .

- CSS/Financial Aid PROFILE deadline - The PROFILE is an aid applications that some schools use in lieu of (or in addition to) the FAFSA. Deadlines vary by school, so check with the colleges you're applying to if you know you'll have to submit a PROFILE. Check this list of participating schools and programs for more info.

- Scholarship deadlines - Deadlines for different scholarship programs vary widely. If you do plan on applying for scholarships, you may as well go all out and apply to as many as possible. Many scholarships ask for similar things from applicants: a personal statement, transcripts, ACT/SAT scores, letters of rec., etc. Check out our list of top scholarships to get an idea of typical scholarship deadlines.

For more information on applying for financial aid, check out our step-by-step guide .

How Much Should You Pay for College Out-of-Pocket?

How much is too much to pay in cash and loans?

So we've gone through strategies for minimizing costs, determining need, and calculating likely aid. What we haven't covered yet is perhaps the most important question you should ask yourself before committing to a particular school: how much should you pay, both in cash up front and in loans after graduation, for your education? If you have the opportunity to attend one of your target schools or even reach schools, but the financial aid package isn’t as great as you expected, what do you do? Is it worth it to pay more than you can afford to attend that college ?

I can't give you a clear answer to these questions, but I can give you some information that will help you figure them out for yourself :

1. Attending a Better School Leads to Better Networking and Career Opportunities

More prestigious or better-ranked schools often have stronger alumni networks and recruiting events. A diploma from a better school is also a better "signal" to future employers or graduate schools. Ultimately, you may earn more money in the long run if you attend a high-ranking college.

There are a few caveats to keep in mind, however. First, you may not equate a higher salary with success, especially if you don't plan on pursuing a high-earning career. Second, a college degree on its own (regardless of where you go to school) is correlated with higher earnings . Finally, income is probably more strongly associated with your choice of career than it is with your choice of college. For example, students who graduate in math/science fields tend to earn more than other students.

2. Student Loan Debt Can Limit Your Future Choices

Loans often have a grace period (a period of time after graduation where you don’t yet have to make payments), but after this grace period, looming student debt can limit your career options. Things like travel, unpaid internships, or volunteer work may be out of the question if you have to make hefty monthly loan payments. If you have severe financial problems later in life and declare bankruptcy (where all your debts are forgiven - you start with a clean slate, but your credit is destroyed), student loans are essentially non-dischargeable . Even if you face extreme financial hardships through no fault of your own, student debt is notoriously sticky, and usually, won’t be canceled by bankruptcy.

In sum, student debt is a commitment. The more loans you take out, the more your debt will affect the rest of your life choices.

3. Student Loan Debt Can Be Flexible, and Even Forgivable

There are different repayment plan options for recent grads who aren’t making much money, including income-based and graduated repayment plans. You pay more in the long run, but monthly payments are smaller when you’re younger and aren’t making as much money. This affords you a degree of flexibility. Additionally, you usually don’t have to make payments on your loans if you are in graduate school .

Finally, some student loans can be forgiven or canceled if you work in certain public service careers. This means you can pursue a (relatively) low-paying career option without worrying about paying back student debt.

How Do You Determine Your Willingness to Pay?

The right amount to pay out-of-pocket for college will depend on what you’re ultimately comfortable with. Some questions to consider before deciding what you’re okay paying for school, both now (in cash) and in the future (with student loan payments) include:

- Will this school offer you unparalleled networking/professional opportunities, or can you get similar opportunities somewhere less expensive?

- Does this school offer an especially strong program in a field I want to pursue?

- How much do you (realistically) anticipate earning in the 5-10 years after you graduate? Based on your career path, what will you be able to afford in terms of monthly student loan payments?

- Are there ways to cut down personal costs/expenses to lower your cost of attendance? What sacrifices are you willing to make, and what sacrifices are out of the question?

- Can you get a student job to mitigate some of your costs? Would getting a student job negatively impact your studies?

- Last, but not least: how does this amount of debt or expense make you feel? If you anticipate burdened or overwhelmed to the extent that your quality of life is negatively affected, is the expense worth it?

Only you know the answers to these questions. I encourage you to be thoughtful and honest with yourself - the costs and benefits of attending a particular school are long-lasting and far-reaching . Paying for college is an investment in yourself and in your future, but you want the investment to be premeditated and purposeful.

If you’re dead-set on attending a particular school that’s a little pricier than you’d like, read on for tips on making college a bit more affordable.

Creative Ways to Pay for School

There are other ways to get money for college besides federal and institutional financial aid. If you have a bit of time on your hands, these next options could help you make college more affordable.

Scholarships

You can start applying for scholarships any time - you don’t even have to be in high school! Many of the bigger scholarships, though, are targeted towards graduating high school seniors. Before you even apply to colleges, start checking out scholarship options, ideally sometime during your junior year. There are so many scholarship options out there - big and small - that could make a world of a difference.

To start your scholarship search, check out our guides to the top awards for high school juniors and high school seniors .

Student Jobs

This won’t be right for everyone, but a student job can be a practical (and sometimes even fun) way to cover some of your expenses. Students with federal work study awards, in particular, will have plenty of on-campus job options. Ideally, you can get both professional career experience AND some extra cash.

Paying for College: Real-World Examples

Now that we've gone through everything you need to know about paying for college, from cost-minimization strategies to creative cost solutions, we can put everything together to see examples in action. I'll present two different examples to reflect two different, but realistic, situations. For each example, I'll walk through different payment options for each (hypothetical) student.

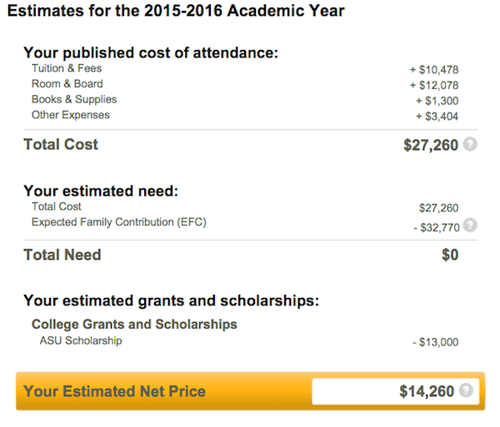

In this example, a high-achieving Arizona student from a relatively wealthy family has received a financial aid offer from Arizona State University . Remember when we went over factors that affect aid? We know that she's applied to an in-state public school, she's high-merit, and she has relatively low financial need . The first two factors will positively affect the amount of aid she receives, whereas the last factor will negatively impact her aid. Here's an idea of what her aid offer would look like:

Her net price - what her family would have to pay out-of-pocket for all expenses - comes to $14,260 for the year. She's responsible for paying this entire amount if she wants to register for classes at ASU. She has a few options when it comes to tackling this expense:

- If her family can afford to do so, they could pay the entire $14,260 for the year. This would be less expensive than taking out loans in the long run because the student wouldn't be responsible for accruing interest charges.

- The student could take out the entire amount in loans. If she did this for all 4 years of college, her debt would come to about $60,000 - more than twice the average amount of US student debt. She may be able to take out some low-interest federal loans to mitigate these costs.

- The student's family could pay some amount in cash, and the student could take out the remaining balance in loans.

- The student could apply for merit-based scholarships, and get part or all of her net price covered. If a balance remains after winning scholarships, the student could pay with cash; she could take out loans, or she could cover the balance with some combination of cash and loans.

- The student could get a student job and pay down some of her net balance while she's in school. It would be very difficult, however, to earn almost 15k/year while shes's also a full-time student - 2-3k would be a reasonable goal.

Keep in mind that if this student were not high-achieving, she likely wouldn't have earned the ASU scholarship. Her net price would have been $27,260 instead of $14,260 - her good grades and ACT/SAT scores saved her $13,000 in her first year of college.

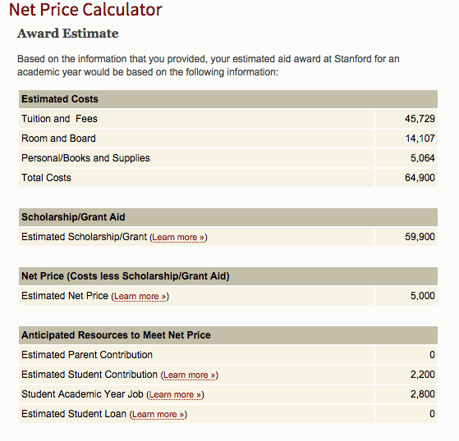

In this example, a high-achieving California student from a relatively low-income family has received a financial aid offer from Stanford University . We know that he's applied to a top private school with a high sticker price but a generous financial aid program, he's high-merit, and he has high financial need. All three factors will positively impact the amount of aid he receives. Here's an idea of what his aid offer would look like:

His net price comes to $5,000 a year, even though the total cost of attendance is a staggering $64,900. He has a few options when it comes to paying this annual expense:

- His family may pay part or all of his net cost. Given that he comes from a lower-income family, however, they may not be able to afford this.

- He could apply for need-based or merit-based scholarships. Even if he got several smaller scholarships, he could cover a significant part (or even all) of this annual cost.

- He could get a student job to cover these expenses. If he got paid work during the summer and the school year, it wouldn't be unmanageable to pay 5k per year.

- He could take out student loans to cover part or all of his expenses. Given that his family is low-income, he would likely qualify for low-interest federal loans. Even if he took out 5k loans for 4 years of college, his student debt at graduation would be lower than that of the average US graduate.

What's Next?

Excited to start budgeting for college? Of course, you're not - it's like the least fun part. Even though it's not exactly thrilling, it doesn't have to be painful. Your first stop should be our clear guide to what college actually costs .

Your next stop should be prepping for financial aid applications. Read our guides to applying for financial aid and submitting a FAFSA .

Ready for something a little more fun? Check out our guides to the top scholarship programs for high school juniors and seniors .

Want to improve your SAT score by 160 points or your ACT score by 4 points? We've written a guide for each test about the top 5 strategies you must be using to have a shot at improving your score. Download it for free now:

Francesca graduated magna cum laude from Harvard and scored in the 99th percentile on the SATs. She's worked with many students on SAT prep and college counseling, and loves helping students capitalize on their strengths.

Student and Parent Forum

Our new student and parent forum, at ExpertHub.PrepScholar.com , allow you to interact with your peers and the PrepScholar staff. See how other students and parents are navigating high school, college, and the college admissions process. Ask questions; get answers.

Ask a Question Below

Have any questions about this article or other topics? Ask below and we'll reply!

Improve With Our Famous Guides

- For All Students

The 5 Strategies You Must Be Using to Improve 160+ SAT Points

How to Get a Perfect 1600, by a Perfect Scorer

Series: How to Get 800 on Each SAT Section:

Score 800 on SAT Math

Score 800 on SAT Reading

Score 800 on SAT Writing

Series: How to Get to 600 on Each SAT Section:

Score 600 on SAT Math

Score 600 on SAT Reading

Score 600 on SAT Writing

Free Complete Official SAT Practice Tests

What SAT Target Score Should You Be Aiming For?

15 Strategies to Improve Your SAT Essay

The 5 Strategies You Must Be Using to Improve 4+ ACT Points

How to Get a Perfect 36 ACT, by a Perfect Scorer

Series: How to Get 36 on Each ACT Section:

36 on ACT English

36 on ACT Math

36 on ACT Reading

36 on ACT Science

Series: How to Get to 24 on Each ACT Section:

24 on ACT English

24 on ACT Math

24 on ACT Reading

24 on ACT Science

What ACT target score should you be aiming for?

ACT Vocabulary You Must Know

ACT Writing: 15 Tips to Raise Your Essay Score

How to Get Into Harvard and the Ivy League

How to Get a Perfect 4.0 GPA

How to Write an Amazing College Essay

What Exactly Are Colleges Looking For?

Is the ACT easier than the SAT? A Comprehensive Guide

Should you retake your SAT or ACT?

When should you take the SAT or ACT?

Stay Informed

Get the latest articles and test prep tips!

Looking for Graduate School Test Prep?

Check out our top-rated graduate blogs here:

GRE Online Prep Blog

GMAT Online Prep Blog

TOEFL Online Prep Blog

Holly R. "I am absolutely overjoyed and cannot thank you enough for helping me!”

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Pay for College: 8 Tips

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When paying for college, some forms of financial aid are better than others.

Money that you don't have to pay back should take priority — like scholarships, grants and fellowships — followed by income from work-study programs, or even employer assistance if you can work while enrolled.

To keep college costs manageable, exhaust free financial aid before taking out student loans when planning how to pay for college.

Student loans from our partners

on Sallie Mae

4.5% - 15.49%

Mid-600's

on College Ave

College Ave

4.07% - 15.48%

4.09% - 15.71%

Low-Mid 600s

12.94% - 14.93%

13.74% - 15.01%

5.24% - 9.99%

5.49% - 12.18%

on Splash Financial

Splash Financial

6.64% - 8.95%

4.07% - 14.49%

5.01% - 14.81%

4.11% - 14.3%

6.5% - 14.83%

1. Fill out the FAFSA

Fill out the Free Application for Federal Student Aid to receive federal aid like grants, work-study opportunities and even federal student loans . You can also qualify for state-level and school-based aid.

Be as thorough as you can when filling out the FAFSA . The federal government uses this to gauge what resources you and your family have to pay for college. For example, if you or your parents saved money in a 529 plan — a state-sponsored tax-advantaged college investment account — you'll be expected to tap into this to cover your costs.

Submit the FAFSA as soon as possible because some colleges award both need- and merit-based money on a first-come, first-served basis. In addition to the FAFSA, some schools also require you to complete the CSS profile to be considered for aid.

» MORE: How many colleges should I apply to?

2. Search for scholarships

You don’t have to wait until you’re a senior in high school to start your scholarship search. In fact, it could pay to start earlier. For example, the Evans Scholars Foundation awards full-ride scholarships to hundreds of golf caddies each year. But you have to be a caddie for at least two years to qualify, which means you’d have to start caddying during your sophomore year in high school at the latest to be eligible by the time you apply at the beginning of your senior year.

Scholarships, unlike student loans, don’t have to be paid back. Thousands are available; use the Department of Labor’s Scholarships Finder to get started. While many scholarships require that you submit the FAFSA, most also have an additional application.

» MORE: How to get a scholarship

3. Choose an affordable school

Paying for college will be easier if you choose a school that’s reasonably priced for you. To avoid straining your bank account, consider starting at a community college or technical or trade school.

» MORE: College enrollment is down, but here's why you should still go

If you opt for a traditional four-year university, research the school's net price — the cost to you after grants and scholarships. This will show you your out-of-pocket cost instead of solely focusing on the sticker price.

For example, if a $28,000-a-year school doesn’t offer you any aid, and a $60,000-a-year college offers you $40,000 in aid, the school with the higher sticker price could be a better option because of it's lower net price.

Schools have net price calculators on their websites to help you estimate the amount you’ll have to pay out of pocket.

» MORE: Why college students take on loans they can't repay

4. Use grants if you qualify

The high school class of 2021 forfeited $3.75 billion in federal Pell Grant money by not completing the FAFSA, according to a study by the National College Attainment Network .

Don’t make that mistake. As long as you submit the FAFSA and renew it each year you’re enrolled in school, you’ll receive Pell money if you’re eligible for it.

In addition to the need-based Pell program, the federal government offers several other types of grants, which also don’t need to be paid back in most cases. Many states have grant programs, too. Use the Education Department's state education contacts and information locator to find the agencies in your state that administer college grants. Then look up and apply to state grant programs you may qualify for.

» MORE: Guide to grants for college

5. Get a work-study job

A college job checks multiple boxes: It provides an income, work experience and potentially valuable connections. The federal work-study program funds part-time jobs for college students with financial need.

To apply for work-study, submit the FAFSA. If you qualify, you’ll see “work-study” listed on your financial aid award. However, just because you’re eligible for work-study doesn’t mean you automatically get that money. You have to find an eligible work-study job on your campus and work enough hours to earn all of the aid you qualify for.

6. Work for an employer that pays for college

Nearly half of employers offer undergraduate or graduate tuition assistance, according to a 2022 survey by the Society for Human Resource Management.

A company can help you afford college by covering a percentage of costs, a flat amount, or even 100% of tuition. For example, you have access to over 75 fully-funded associate and bachelor's degree programs if you work at Chipotle.

Employer tuition assistance programs can come in the form of tuition reimbursement — where you're reimbursed for tuition you already paid — or the company can pay the school directly.

When applying to jobs, research what educational benefits they offer. And if you're already employed, connect with the human resources department to see what is available for you.

» MORE: 11 jobs that will pay for college

7. Take out federal loans if you have to

You don’t have to say yes to all the aid you’re offered — especially student loans. As a rule of thumb, aim for student loan payments that don’t exceed 10% of projected after-tax monthly income your first year out of school.

If you need to borrow to pay for college, take out federal student loans before private ones . Federal loans have benefits that private loans don’t, including access to income-driven repayment plans and loan forgiveness programs .

» MORE: Is college worth it?

8. Borrow private loans as a last resort

If you do need to use private student loans , compare your options before you choose a lender. Shop around to find the lender that offers you the lowest interest rate and the most generous borrower protections, such as flexible repayment plans or the option to put your loans in forbearance if you’re struggling to make payments.

It is also harder to qualify for private loans. Unlike federal loans, most private loans take into account a potential borrower’s credit score and finances. Borrowers with strong finances or those who have a co-signer with strong finances stand to get lower interest rates and more favorable loan terms. There are also private student loans designed for borrowers with poor or no credit .

» MORE: How is a student loan different from a scholarship?

Remember: After you leave school, you’ll have to pay back any money you borrowed. Many student loans — all but federal subsidized loans — accrue interest while you’re in school, which means you’ll have to pay back more than you originally borrowed. You can use a student loan calculator to see how much you'll owe later based on what you borrow now.

On a similar note...

Tips for Writing an Effective Application Essay

How to Write an Effective Essay

Writing an essay for college admission gives you a chance to use your authentic voice and show your personality. It's an excellent opportunity to personalize your application beyond your academic credentials, and a well-written essay can have a positive influence come decision time.

Want to know how to draft an essay for your college application ? Here are some tips to keep in mind when writing.

Tips for Essay Writing

A typical college application essay, also known as a personal statement, is 400-600 words. Although that may seem short, writing about yourself can be challenging. It's not something you want to rush or put off at the last moment. Think of it as a critical piece of the application process. Follow these tips to write an impactful essay that can work in your favor.

1. Start Early.

Few people write well under pressure. Try to complete your first draft a few weeks before you have to turn it in. Many advisers recommend starting as early as the summer before your senior year in high school. That way, you have ample time to think about the prompt and craft the best personal statement possible.

You don't have to work on your essay every day, but you'll want to give yourself time to revise and edit. You may discover that you want to change your topic or think of a better way to frame it. Either way, the sooner you start, the better.

2. Understand the Prompt and Instructions.

Before you begin the writing process, take time to understand what the college wants from you. The worst thing you can do is skim through the instructions and submit a piece that doesn't even fit the bare minimum requirements or address the essay topic. Look at the prompt, consider the required word count, and note any unique details each school wants.

3. Create a Strong Opener.

Students seeking help for their application essays often have trouble getting things started. It's a challenging writing process. Finding the right words to start can be the hardest part.

Spending more time working on your opener is always a good idea. The opening sentence sets the stage for the rest of your piece. The introductory paragraph is what piques the interest of the reader, and it can immediately set your essay apart from the others.

4. Stay on Topic.

One of the most important things to remember is to keep to the essay topic. If you're applying to 10 or more colleges, it's easy to veer off course with so many application essays.

A common mistake many students make is trying to fit previously written essays into the mold of another college's requirements. This seems like a time-saving way to avoid writing new pieces entirely, but it often backfires. The result is usually a final piece that's generic, unfocused, or confusing. Always write a new essay for every application, no matter how long it takes.

5. Think About Your Response.

Don't try to guess what the admissions officials want to read. Your essay will be easier to write─and more exciting to read─if you’re genuinely enthusiastic about your subject. Here’s an example: If all your friends are writing application essays about covid-19, it may be a good idea to avoid that topic, unless during the pandemic you had a vivid, life-changing experience you're burning to share. Whatever topic you choose, avoid canned responses. Be creative.

6. Focus on You.

Essay prompts typically give you plenty of latitude, but panel members expect you to focus on a subject that is personal (although not overly intimate) and particular to you. Admissions counselors say the best essays help them learn something about the candidate that they would never know from reading the rest of the application.

7. Stay True to Your Voice.

Use your usual vocabulary. Avoid fancy language you wouldn't use in real life. Imagine yourself reading this essay aloud to a classroom full of people who have never met you. Keep a confident tone. Be wary of words and phrases that undercut that tone.

8. Be Specific and Factual.

Capitalize on real-life experiences. Your essay may give you the time and space to explain why a particular achievement meant so much to you. But resist the urge to exaggerate and embellish. Admissions counselors read thousands of essays each year. They can easily spot a fake.

9. Edit and Proofread.

When you finish the final draft, run it through the spell checker on your computer. Then don’t read your essay for a few days. You'll be more apt to spot typos and awkward grammar when you reread it. After that, ask a teacher, parent, or college student (preferably an English or communications major) to give it a quick read. While you're at it, double-check your word count.

Writing essays for college admission can be daunting, but it doesn't have to be. A well-crafted essay could be the deciding factor─in your favor. Keep these tips in mind, and you'll have no problem creating memorable pieces for every application.

What is the format of a college application essay?

Generally, essays for college admission follow a simple format that includes an opening paragraph, a lengthier body section, and a closing paragraph. You don't need to include a title, which will only take up extra space. Keep in mind that the exact format can vary from one college application to the next. Read the instructions and prompt for more guidance.

Most online applications will include a text box for your essay. If you're attaching it as a document, however, be sure to use a standard, 12-point font and use 1.5-spaced or double-spaced lines, unless the application specifies different font and spacing.

How do you start an essay?

The goal here is to use an attention grabber. Think of it as a way to reel the reader in and interest an admissions officer in what you have to say. There's no trick on how to start a college application essay. The best way you can approach this task is to flex your creative muscles and think outside the box.

You can start with openers such as relevant quotes, exciting anecdotes, or questions. Either way, the first sentence should be unique and intrigue the reader.

What should an essay include?

Every application essay you write should include details about yourself and past experiences. It's another opportunity to make yourself look like a fantastic applicant. Leverage your experiences. Tell a riveting story that fulfills the prompt.

What shouldn’t be included in an essay?

When writing a college application essay, it's usually best to avoid overly personal details and controversial topics. Although these topics might make for an intriguing essay, they can be tricky to express well. If you’re unsure if a topic is appropriate for your essay, check with your school counselor. An essay for college admission shouldn't include a list of achievements or academic accolades either. Your essay isn’t meant to be a rehashing of information the admissions panel can find elsewhere in your application.

How can you make your essay personal and interesting?

The best way to make your essay interesting is to write about something genuinely important to you. That could be an experience that changed your life or a valuable lesson that had an enormous impact on you. Whatever the case, speak from the heart, and be honest.

Is it OK to discuss mental health in an essay?

Mental health struggles can create challenges you must overcome during your education and could be an opportunity for you to show how you’ve handled challenges and overcome obstacles. If you’re considering writing your essay for college admission on this topic, consider talking to your school counselor or with an English teacher on how to frame the essay.

Related Articles

- How to Find a Job

- Building a Career Network

- Internships

- Volunteer Work

- Creating Your Résumé

- Résumé Examples

- Creating Your Cover Letter

- Job Interview Tips

- Planning for College

- College Planning Timeline

- Taking College Entrance Exams

- Testing Tips

- Choosing a College

- The College Application Process

- Campus Visit Tips

- Writing a College Essay

- College Interview Tips

Paying for College

- Paying for Two-year Colleges & Trade Schools

- Financial Aid Application

- What to Bring to College

- Campus Life: What to Expect

- Types of Military Service

- Enlisting in the Military

- Becoming an Officer

- College Assistance

- Common Military Questions

- Preparing for Basic Training

- Military Benefits

- Military Life

- Glossary: Military Jargon

A big part of college preparation is knowing how you’ll afford tuition. Learn about your options, which include scholarships, financial aid and tuition savings plans. The Military also offers scholarship programs and plans for students to explore (e.g., the Reserve Officers’ Training Corps or ROTC).

Jump to Section

- The cost of college

- Financial aid

- Other ways to pay

The Cost of College

While the total cost of college depends on where you go, how you budget and whether you'll receive financial aid, there are five standard expenses you have to consider:

Source: National Center for Education Statistics

Average cost: $1,216 .

If you're attending a college far from home, travel expenses can be high. If you're attending a college close to home, or if you plan on living off campus and commuting to school, you’ll still need to factor in transportation costs between home and classes.

This is the cost of that morning coffee, late-night pizza and monthly cell phone bill. Personal expenses can add up, especially in pricier metropolitan areas. Average cost: $4,551 per year (2016–2017).

Financial Aid

Financial aid is money given to students to help them pay for college. You can receive financial aid by way of merit or need. Merit-based financial aid is awarded to a student with strong grades or who is good at sports, music or any other special skill. Need-based financial aid is given to a student who shows he or she cannot afford to pay the full cost of college on his or her own. The qualifications for both vary greatly so be sure to check if you qualify.

Both kinds of financial aid can come from a variety of sources: the government, schools, charities or businesses. They also come in various forms:

Loans A loan is money you're expected to pay back later. Loans are widely used because they allow students to pay their own way through college, and they typically have no requirement that they be paid back until one year after graduation (this applies for undergraduate and graduate school).

There are both federal and private loans available to students. Federal loans don't require a credit check, and the government regulates the associated fees and interest rates, which usually means they're lower. There is a limit to how much money a single student may receive. Private loans, however, can be taken in any amount, but they are credit-based and can be denied based on credit score. Either one can be a good choice depending on your circumstances.

Common types of college loans:

Direct PLUS Loan

A grant is money you're not expected to pay back. For this reason, grants are a very sought-after form of financial aid.

Common types of college grants:

Federal Supplemental Educational Opportunity Grant (FSEOG Grant)

Teacher Education Assistance for College and Higher Education Grant (TEACH Grant)

Iraq and Afghanistan Service Grant

Scholarships Scholarships are like grants in that you're not required to pay them back. While scholarships can be given based on either need or merit, they're often awarded for academic performance. Organizations of all types and sizes sponsor scholarships, including colleges and universities themselves, and often all you have to do to be considered for one is submit an application.

Scholarship search (FastWeb)

Work-Study Work-study is a program funded by the federal government that allows students to receive financial aid in exchange for working on campus. When available, work-study can be a convenient form of aid. Students in the program usually work a set number of hours per week on or around campus and are able to schedule their hours around classes.

Free Application for Federal Student Aid (FAFSA) To qualify for financial aid, a very important application is the FAFSA (Free Application for Federal Student Aid), and it's what you should start with first. The FAFSA is a form that provides the federal government with all of your financial information and helps the government determine what kind of financial aid you qualify for. The FAFSA also requires information from your parents or guardian, so make sure you have access to their tax information before you apply.

Another online financial-aid application that's become popular with private colleges and scholarship programs is the CSS PROFILE . The PROFILE is similar to the FAFSA in that it collects your financial information, but it goes more in-depth and costs at least $25 to fill out. However, a limited amount of fee waivers are available to low-income students.

Upon completing the FAFSA or PROFILE, start looking into specific financial-aid opportunities and corresponding payment plans. The different forms of financial aid described above can often be combined with whatever you receive through FAFSA for additional help. With a little determination and research, financial aid can allow students, no matter what their income level is, to meet the costs of college.

Other Ways to Pay

Tuition Savings Plans There are several kinds of savings accounts that can help pay for college. The most popular are 529 plans, legally referred to as “qualified tuition programs.” A 529 plan is an education savings plan designed to help families set aside funds for future college costs. There are two kinds of 529 plans: prepaid tuition plans and education savings plans. All states and the District of Columbia sponsor at least one type of these plans. Check with a parent, grandparent or guardian to see whether they have a 529 plan set up for you and if you can make additional contributions for the remainder of high school.

Military Service Another option to pay for college is serving in the Military for a set amount of time. For decades, Americans have enjoyed educational benefits in return for military service. There are numerous programs designed to help service members receive an education before, during and after their service commitments. From officer training programs to the Post-9/11 GI Bill and on-base educational opportunities, the Military spends millions of dollars annually educating its troops.

Explore more ways to pay for college (Today’s Military)

Reserve Officers’ Training Corps (ROTC) Scholarship The Reserve Officers’ Training Corps (ROTC) program prepares young adults to become military officers while earning a college degree. By committing to a post-college career as an officer, ROTC students receive a scholarship while enrolled in a college or university. ROTC scholarship benefits can vary by college or university , but may include:

- 100% tuition and fees coverage (dependent on merit and grades)

- Room and board (for qualifying cases)

- Personal expenses of $300 to $500 a month, per school year, depending on the cadet’s year in the ROTC program

- $1,200 per year for books

Related Resources

Paying for two-year colleges and trade schools.

Get tips for selecting a school that is covered by financial assistance.

Applying for Financial Aid

Use these tips to ensure your application is correct.

- Search Search Please fill out this field.

- Student Loans

- Paying for College

Should College Be Free? The Pros and Cons

Should college be free? Understand the debate from both sides

:max_bytes(150000):strip_icc():format(webp)/KellyDilworthheadshot-c65b9cbc3b284f138ca937b8969079e6.jpg)

Types of Publicly Funded College Tuition Programs

Pros: why college should be free, cons: why college should not be free, what the free college debate means for students, how to cut your college costs now, frequently asked questions (faqs).

damircudic / Getty Images

Americans have been debating the wisdom of free college for decades, and more than 20 states now offer some type of free college program. But it wasn't until 2021 that a nationwide free college program came close to becoming reality, re-energizing a longstanding debate over whether or not free college is a good idea.

And despite a setback for the free-college advocates, the idea is still in play. The Biden administration's proposal for free community college was scrapped from the American Families Plan in October as the spending bill was being negotiated with Congress.

But close observers say that similar proposals promoting free community college have drawn solid bipartisan support in the past. "Community colleges are one of the relatively few areas where there's support from both Republicans and Democrats," said Tulane economics professor Douglas N. Harris, who has previously consulted with the Biden administration on free college, in an interview with The Balance.

To get a sense of the various arguments for and against free college, as well as the potential impacts on U.S. students and taxpayers, The Balance combed through studies investigating the design and implementation of publicly funded free tuition programs and spoke with several higher education policy experts. Here's what we learned about the current debate over free college in the U.S.—and more about how you can cut your college costs or even get free tuition through existing programs.

Key Takeaways

- Research shows that free tuition programs encourage more students to attend college and increase graduation rates, which creates a better-educated workforce and higher-earning consumers who can help boost the economy.

- Some programs are criticized for not paying students’ non-tuition expenses, for not benefiting students who need assistance most, or for steering students toward community college instead of four-year programs.

- If you want to find out about free programs in your area, the University of Pennsylvania Graduate School of Education has a searchable database. You’ll find the link further down in this article.

Before diving into the weeds of the free college debate, it's important to note that not all free college programs are alike. Most publicly funded tuition assistance programs are restricted to the first two years of study, typically at community colleges. Free college programs also vary widely in the ways they’re designed, funded, and structured:

- Last-dollar tuition-free programs : These programs cover any remaining tuition after a student has used up other financial aid , such as Pell Grants. Most state-run free college programs fall into this category. However, these programs don’t typically help with room and board or other expenses.

- First-dollar tuition-free programs : These programs pay for students' tuition upfront, although they’re much rarer than last-dollar programs. Any remaining financial aid that a student receives can then be applied to other expenses, such as books and fees. The California College Promise Grant is a first-dollar program because it waives enrollment fees for eligible students.

- Debt-free programs : These programs pay for all of a student's college expenses , including room and board, guaranteeing that they can graduate debt-free. But they’re also much less common, likely due to their expense.

Proponents often argue that publicly funded college tuition programs eventually pay for themselves, in part by giving students the tools they need to find better jobs and earn higher incomes than they would with a high school education. The anticipated economic impact, they suggest, should help ease concerns about the costs of public financing education. Here’s a closer look at the arguments for free college programs.

A More Educated Workforce Benefits the Economy

Morley Winograd, President of the Campaign for Free College Tuition, points to the economic and tax benefits that result from the higher wages of college grads. "For government, it means more revenue," said Winograd in an interview with The Balance—the more a person earns, the more they will likely pay in taxes . In addition, "the country's economy gets better because the more skilled the workforce this country has, the better [it’s] able to compete globally." Similarly, local economies benefit from a more highly educated, better-paid workforce because higher earners have more to spend. "That's how the economy grows," Winograd explained, “by increasing disposable income."

According to Harris, the return on a government’s investment in free college can be substantial. "The additional finding of our analysis was that these things seem to consistently pass a cost-benefit analysis," he said. "The benefits seem to be at least double the cost in the long run when we look at the increased college attainment and the earnings that go along with that, relative to the cost and the additional funding and resources that go into them."

Free College Programs Encourage More Students to Attend

Convincing students from underprivileged backgrounds to take a chance on college can be a challenge, particularly when students are worried about overextending themselves financially. But free college programs tend to have more success in persuading students to consider going, said Winograd, in part because they address students' fears that they can't afford higher education . "People who wouldn't otherwise think that they could go to college, or who think the reason they can't is because it's too expensive, [will] stop, pay attention, listen, decide it's an opportunity they want to take advantage of and enroll," he said.

According to Harris, students also appear to like the certainty and simplicity of the free college message. "They didn't want to have to worry that next year they were not going to have enough money to pay their tuition bill," he said. "They don't know what their finances are going to look like a few months down the road, let alone next year, and it takes a while to get a degree. So that matters."

Free college programs can also help send "a clear and tangible message" to students and their families that a college education is attainable for them, said Michelle Dimino, an Education Senior Policy Advisor with Third Way. This kind of messaging is especially important to first-generation and low-income students, she said.

Free College Increases Graduation Rates and Financial Security

Free tuition programs appear to improve students’ chances of completing college. For example, Harris noted that his research found a meaningful link between free college tuition and higher graduation rates. "What we found is that it did increase college graduation at the two-year college level, so more students graduated than otherwise would have."

Free college tuition programs also give people a better shot at living a richer, more comfortable life, say advocates. "It's almost an economic necessity to have some college education," noted Winograd. Similar to the way a high school diploma was viewed as crucial in the 20th century, employees are now learning that they need at least two years of college to compete in a global, information-driven economy. "Free community college is a way of making that happen quickly, effectively and essentially," he explained.

Free community college isn’t a universally popular idea. While many critics point to the potential costs of funding such programs, others identify issues with the effectiveness and fairness of current attempts to cover students’ college tuition. Here’s a closer look at the concerns about free college programs.

It Would Be Too Expensive

The idea of free community college has come under particular fire from critics who worry about the cost of social spending. Since community colleges aren't nearly as expensive as four-year colleges—often costing thousands of dollars a year—critics argue that individuals can often cover their costs using other forms of financial aid . But, they point out, community college costs would quickly add up when paid for in bulk through a free college program: Biden’s proposed free college plan would have cost $49.6 billion in its first year, according to an analysis from Georgetown University Center on Education and the Workforce. Some opponents argue that the funds could be put to better use in other ways, particularly by helping students complete their degrees.

Free College Isn't Really Free