Sustainable livelihoods - supply chain strategy

UK Stores. Last updated 06/01/2022

Introduction

Customers want the peace of mind that the products they buy from us are sourced with respect for the people who help make them.

None of us – including customers, suppliers, investors or governments worldwide – want to see people living in poverty, and we’re proud that the jobs our business creates can, in the right environments, allow people to improve their circumstances. Everyone, as a minimum, should have access and be able to afford the basic needs required for themselves and their family to prosper.

However, in many parts of the world, having a job does not guarantee a decent living. 8% of the world’s workers and their families were estimated still to be living in extreme poverty (using UN definitions) in 2018[1]. In some countries and sectors, legal minimum wages are set at levels that leave families unable to afford all their basic needs such as food, education, healthcare and decent accommodation.

Around three-quarters of the world’s extreme poor live in rural areas, with most dependent on agriculture for their livelihoods[2]. Smallholder farmers – for example in cocoa, coffee, rice – often rely on the income from their harvest to support the family throughout the year.

Receiving decent wages and incomes is an essential part of achieving sustainable livelihoods and therefore a primary focus of this strategy and our work.

The starting point for our work on wages is to ensure that everyone is paid in accordance with their contracts of employment, for all hours they work, that the wages are legally compliant and that there are no unfair deductions. Through our sourcing of certified products, such as Rainforest Alliance, we are also supporting farmers to adopt more efficient farming practices, which can reduce costs and improve incomes.

But to go even further we have developed this Sustainable Livelihoods Strategy. It recognises that, in some supply chains, wages and incomes are too low and demonstrates our commitment to supporting workers and small-scale farmers in our supply chains to increase their resilience and prosperity. Only by working together with suppliers, NGOs, governments, unions and the wider industry can we increase incomes and reduce poverty on a sustainable basis.

Sustainable Livelihoods is one of four pillars of our Human Rights Strategy.

Our work on sustainable livelihoods focuses on products and ingredients where both poverty is most severe and where we can make the most impact. By identifying the overlap between the UN Multi-dimension Poverty Index , our supply chains and where there is already other stakeholder support to leverage our action for the greatest impact, we have identified six priority product supply chains.

For three of these product supply chains our focus is on ensuring employed workers earn a decent wage; bananas, tea and clothing factories. Whereas for cocoa, rice and coffee supply chains we need to look more broadly and, as well as supporting small-scale farmers to increase their income, we need to understand what community support and infrastructure is needed for them to become more resilient and prosper.

While we have identified these six priority products, we recognise that enabling environments change and continue to review other commodities. For example, in 2021 we explored potential living wage projects in horticulture and Thai prawn supply chains as collaborative proposals and initiatives have started to emerge. In 2022 we will continue to engage and review these proposals as part of our Sustainable Livelihoods Strategy.

Our approach within each of our priority supply chains is defined by three pillars:

We are reviewing our purchasing practices to ensure they support producers to pay living wages to workers and for smallholder farmers to receive a fair income. This includes looking at how we can ensure quoted prices reflect the costs of sustainable and ethical production, and how our relationships with suppliers support positive change.

In 2021, we reviewed our purchasing practices with banana producers and made new commitments to pay the living wage gap to banana producers (equivalent to the volumes we source) through a new partial open book purchasing model. Following extensive producer and stakeholder consultation we published these new commitments on living wage at the end of 2021. You can read more here .

Also in 2021, as part of our membership of Action Collaboration Transformation (ACT) , we undertook a purchasing practice survey with garment primary suppliers and Tesco Clothing colleagues. The aim was to assess where suppliers and colleagues felt we were performing well in terms of our purchasing practices, and where we had opportunity for improvement. An action plan has been created based on the results with a key element including internal training to enable improvement on areas identified.

In addition to our own work on purchasing practices, we continue to collaborate with certification and standard setting organisations, such as the Rainforest Alliance, to review the role they can play in improving wages and incomes.

2. Transform

By working with stakeholders, including unions, governments, NGOs and other businesses, we are identifying potential ways to measure wage gaps and increase wages and incomes. We will pilot solutions in collaboration with our partners and share learnings.

For example, in 2019 we joined the IDH Steering Committee for the Salary Matrix and helped to pilot this tool for producers in some of our banana and tea supply chains. The tool defines a consistent method that could be used across different industries and supply chains to assess current wages at a site and compare this to a living wage benchmark.

We are using this tool to work with our suppliers to gain greater visibility of living wage gaps so that we can jointly create timebound actions plans to improve wages.

We are committed to supporting workers and small-scale farmers to organise collectively and this is a key part of our approach. We believe effective worker representation and farmer organisations are essential for workers and farmers to better negotiate wages or the price of their product.

Worker representation has been part of our human rights strategy for many years. In Latin America in particular we closely monitor sites to ensure workers are able to democratically elect their representatives to worker committees and/or Health and Safety Committees. As well as our own direct monitoring, audits assess if workers are aware of who their representatives are and if they are satisfied with their effectiveness. As part of our work on living wages, suppliers will be expected to engage worker representatives in the development of wage improvement plans. We will also be engaging certification and other standard setting organisations to emphasise the importance of worker representation as part of wage improvement strategies and develop guidance for both suppliers and worker representatives.

As part of this Sustainable Livelihoods Strategy we will be exploring what actions we can take to specifically support small-scale farmers. We will focus on understanding the distribution of value in supply chains, what is required to increase income for small-scale farmers and how we can support farmers to organise collectively.

3. Advocate

We need to work with other stakeholders to ensure a level playing field across whole industries and to have a long-lasting positive impact. By convening and engaging others, including governments, we can find systemic solutions that will impact all workers or producers across a whole industry or country.

For example, in recent years we have lobbied for minimum wage increases in Bangladesh and, as signatories of the ACT initiative , have participated in discussions to encourage wage increases with manufacturing associations and governments in Cambodia and Myanmar.

Targets and ambitions

Outlined below are some of the targets we have set and actions we are taking in each of our priority supply chains. As we are in the early stages of implementing this strategy, we will be adding to this list as we continue to develop product specific action plans.

- Continue to support workers in the Malawi tea industry by funding alternative income generating activities and initiatives. For example, supporting Village Saving and Loans Associations, and the ‘seeds for kitchen gardens’ initiative.

- Work with Ethical Tea Partnership, Global Tea Coalition and other key stakeholders to develop a timebound industry commitment and action plan to living wages in key producing countries including Malawi, Kenya and India.

- As of January 2022, Tesco commits to paying the living wage gap to banana producers (equivalent to the volumes we source).

- Ensure that producers have in place a timebound commitment to pay all workers a living wage.

- Reward suppliers who continue to make progress on closing living wage gaps with higher volumes as part of a balanced scorecard.

- Our ambition is that from January 2024, we will only source from banana producers who pay a living wage to all workers no matter the volumes sourced by Tesco.

- Explore opportunities with our suppliers to support the uptake of the Sustainable Rice Standard by farmers in key sourcing regions.

- With WWF UK, develop a proposal for a UK retail collaborative working group on sustainable rice and potential joint commitment supporting the uptake of the Sustainable Rice Platform (SRP) standard.

- As members of the Retail Cocoa Collaboration, continue to engage global traders of cocoa on their efforts to increase farmers’ incomes.

- Explore ways to obtain better visibility of the gaps between farmer incomes and living incomes, and understand how this links to the broader distribution of value along our cocoa supply chains.

- Following the results of the purchasing practices survey, implement an action plan including internal training to address improvement areas.

- Work with suppliers and IndustriAll to facilitate workers negotiating wages towards a living wage.

We commit to reporting on progress regularly; sharing examples of where there are living wage gaps, the steps we have taken to reduce gaps as well as any learnings.

For the latest updates and information on particular supply chains, view our product specific webpages:

[1] https://www.un.org/sustainabledevelopment/poverty/

[2] http://www.fao.org/sustainable-development-goals/goals/goal-1/en/

The powerful impact of Tesco’s supply chain: A closer look

Tesco , the British multinational retailer, has established itself as one of the world’s leading grocery retailers. Behind its success lies a robust and efficient supply chain that ensures products are available to customers in a timely and cost-effective manner. Tesco’s supply chain is a complex network that encompasses sourcing, manufacturing, distribution, and retail operations. This article takes a closer look at the powerful impact of Tesco’s supply chain and how it has contributed to the company’s success.

Importance of a well-functioning supply chain

A well-functioning supply chain is crucial for any organization, and Tesco is no exception. A reliable supply chain ensures that products are delivered to the right place, at the right time, and in the right quantity. This enables Tesco to meet customer demand efficiently and effectively. Additionally, a well-functioning supply chain helps Tesco minimize costs, reduce waste, and optimize inventory management. These factors contribute to Tesco’s ability to offer competitive prices to its customers and maintain a profitable business.

The scale and complexity of Tesco’s supply chain

Tesco’s supply chain operates on a massive scale, serving millions of customers across the globe. With over 7,000 stores in various countries, Tesco sources products from thousands of suppliers worldwide. Coordinating the movement of goods from suppliers to distribution centers and ultimately to stores requires careful planning and execution. The complexity of Tesco’s supply chain is further magnified by the diverse range of products it offers, including fresh produce, groceries, clothing, and household items. Managing such a vast and diverse supply chain links is no small feat, but Tesco has developed systems and processes to ensure smooth operations.

Above: Tesco’s supply chain network first 100 based on news announcements data

Tesco’s supply chain sustainability efforts

In recent years, sustainability has become a top priority for businesses, and Tesco is no exception. Tesco has implemented various initiatives to make its supply chain more sustainable. One such initiative is the reduction of carbon emissions by optimizing transportation routes and using more fuel-efficient vehicles. Tesco also works closely with its suppliers to promote sustainable practices, such as responsible sourcing and waste reduction. By incorporating sustainability into its supply chain, Tesco not only reduces its environmental impact but also strengthens its reputation as a socially responsible retailer.

Challenges faced by Tesco’s supply chain

Despite its success, Tesco’s supply chain faces several challenges. One of the major challenges is ensuring product availability while minimizing waste. Tesco needs to strike a delicate balance between maintaining adequate inventory levels to meet customer demand and avoiding excess stock that may go to waste. Additionally, managing a global supply chain introduces complexities such as transportation logistics, customs regulations, and cultural differences. These challenges require Tesco to continuously adapt and innovate its supply chain management strategies.

Issues and controversies surrounding Tesco’s supply chain

Like any large corporation, Tesco has faced its share of supply chain issues and controversies. In the past, there have been allegations of labour rights violations and unethical sourcing practices within Tesco’s supply chain. These incidents have highlighted the importance of transparency and accountability in supply chain management. Tesco has taken steps to address these issues by implementing stricter supplier standards and conducting regular audits to ensure compliance. The company recognizes the need to maintain a responsible and ethical supply chain and continues to improve its practices.

Tesco has also been accused of sourcing products from suppliers who engage in unethical practices, such as deforestation and water pollution. In 2014, the company was criticized for sourcing palm oil from plantations that were destroying rainforests in Indonesia. Tesco responded by committing to sourcing 100% of its palm oil from sustainable sources by 2020.

The John West tuna scandal forced Tesco to remove unsustainable products from their shelves, and many praised Tesco for their leadership in doing so. They were then later found to be selling their own brand and Princes tuna from unsustainable MSC certified fisheries. Last year, they joined a partnership platform to promote sustainable fisheries and protecting the ocean, following audits of its seafood sourcing.

Additional examples of criticisms of Tesco’s supply chain:

The use of pesticides and other chemicals that harm the environmen t.

The production of waste that ends up in landfills and waterways.

The use of unsustainable packaging materials.

The lack of transparency about the working conditions of Tesco’s suppliers.

Addressing Tesco’s supply chain criticisms

Tesco has responded to these criticisms by investing in more sustainable practices, such as reducing its use of pesticides and packaging materials , and increasing its use of renewable energy. The company has also committed to publishing more information about its supply chain, including the names and locations of its suppliers.

However, Tesco’s critics argue that the company has not done enough to address these issues. They argue that Tesco should be doing more to verify that its suppliers are complying with its ethical standards, and that the company should be more transparent about the environmental impact of its supply chain.

The debate over Tesco’s supply chain is likely to continue. The company is under pressure from its shareholders, customers, and environmental and labour rights groups to improve its practices. Tesco is committed to doing better, but it faces a number of challenges in doing so.

These incidents have highlighted the challenges of ensuring ethical and sustainable practices throughout a complex supply chain. Tesco’s experiences serve as a reminder of the importance of transparency and accountability in supply chain management. The company has taken steps to address these issues, but it continues to face scrutiny from environmental and labour rights groups.

Tesco’s influence over its suppliers

Tesco has a significant influence over its suppliers when it comes to sustainability practices. As one of the largest supermarket chains in the world, Tesco has the power to set sustainability standards for its suppliers and to enforce those standards through its purchasing power. The company has implemented a number of initiatives to promote sustainability in its supply chain, including:

- Sustainable sourcing standards: Tesco has set ambitious sustainability goals for its own-brand and branded products, including reducing its carbon emissions by 50% by 2030 and sourcing 100% of its own-brand products from sustainable sources by 2025. These goals have been communicated to Tesco’s suppliers, who are expected to help the company achieve them.

- Supplier audits: Tesco conducts regular audits of its suppliers to assess their compliance with its sustainability standards. These audits cover a wide range of issues, including the use of sustainable packaging materials, water conservation, and energy efficiency.

- Supplier training: Tesco provides training to its suppliers on sustainability best practices. This training helps suppliers to understand Tesco’s sustainability standards and to develop the skills and knowledge they need to meet those standards.

- Sustainability scorecards: Tesco tracks the progress of its suppliers in meeting its sustainability goals. This information is used to inform Tesco’s purchasing decisions and to identify suppliers that need additional support.

Tesco’s influence over its suppliers in terms of sustainability is likely to continue to grow in the future. As customers become more demanding of sustainable products and as governments introduce stricter regulations on sustainability, Tesco will need to continue to push its suppliers to adopt more sustainable practices.

Here are some specific examples of how Tesco has used its influence to promote sustainability in its supply chain:

- In 2014, Tesco stopped buying palm oil from suppliers who were destroying rainforests in Indonesia.

- In 2020, Tesco committed to sourcing 100% of its seafood from sustainable fisheries.

- In 2022, Tesco launched a new initiative to reduce food waste by 50% by 2030.

Tesco’s efforts to promote sustainability in its supply chain have been praised by environmental groups. For example, Greenpeace ranked Tesco 6th out of the 10 supermarkets that were analysed for its sustainability efforts. Overall, Tesco is a leader in the use of its influence to promote sustainability in its supply chain. The company has made significant progress in recent years, but it still has more work to do.

Tesco’s supply chain impacts: Final thoughts

Tesco’s supply chain is a powerful force that has propelled the company to the status of one of the world’s leading grocery retailers. Its ability to efficiently source, manufacture, distribute, and retail products to millions of customers across the globe is a testament to its robust supply chain infrastructure. The company’s emphasis on sustainability and ethical sourcing has further strengthened its reputation and set a benchmark for other retailers to follow.

Despite its remarkable achievements, Tesco’s supply chain continues to face challenges, particularly in ensuring the protection of the environment and upholding labor standards. The company has taken steps to address these issues, but it must remain vigilant and committed to continuous improvement. By leveraging its influence over its suppliers and embracing transparency , Tesco can further enhance its supply chain performance and maintain its position as a leading global innovator in grocery retail.

Request data on Tesco’s supply chain

Ready to delve deeper into Tesco’s intricate supply chain networks? Uncover nuanced data and gain unparalleled insights and supply chain transparency with our data. Elevate your understanding of Tesco’s operations, sustainability initiatives, and challenges. Request bespoke data tailored to your specific inquiries and navigate the complex web of one of the world’s retail giants by filling out the form below.

Get in touch

- Supply chain monitoring

- Trading & investment insights

- Greenwashing framework

- Invest in us

- Data or comment for media

- Something else - please let us know

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How Disruption Accelerated Digital Supply Chain Transformation

Sponsor content from GEP.

In 2020, when the pandemic erupted, Tesco—a leading British retailer of groceries and general merchandise—was staring at challenges it had never seen.

Having been designated an “essential” retailer, Tesco saw a huge rush to its stores while other outlets were temporarily closed. And as customers chose to buy from the safety of their homes, demand for online shopping grew at an unprecedented rate.

Tesco responded by more than doubling its capacity for online orders, to more than 1.5 million a week. To support this increase, it opened an urban fulfillment center—a small automated warehouse—within each store. The retailer plans to add several more fulfillment centers in the next 12 months to boost its online delivery capabilities.

Tesco’s online sales have increased by 77% since the pandemic began. The retailer could have easily missed this growth opportunity and taken a big hit on revenue, but it rose to the challenge by testing several approaches to modernizing its omnichannel retail operation and enhancing its digital sales capabilities.

Tesco, of course, isn’t the only enterprise that responded to the pandemic by pivoting to combat supply-chain disruption. Many enterprises accelerated the digitalization of their customer and supply-chain interactions by as much as three to four years.

It wasn’t only about turning retail space into warehouses to accommodate a broken supply chain. As traditional retail channels weakened, iconic brands, including Nike, added or expanded their online direct-to-consumer sales. Nike’s digital sales grew 79% after its brick-and-mortar stores shuttered in 2020.

A B2B Push from Inside Out

The e-commerce rush wasn’t limited to retailers. Many business-to-business (B2B) sales and interactions pivoted to e-commerce as well.

The pandemic catalyzed digital transformation at many global enterprises. Over 69% of leaders said social and economic disruption were accelerating their digital business initiatives, a 2020 board of directors survey by Gartner revealed. Many said their business changed more in the first few months of the outbreak than it had in the previous decade.

The push for digital has come from the inside out. Technology has helped internal teams rally to support customers and partners during the lockdown, free of the inertia and change-management issues often associated with such programs.

Even with an accelerated pace of digital transformation, enterprises have a long way to go. A recent Harvard Business Review Analytic Services and GEP study showed that more than 72% of companies believed their key supply chain capabilities—supply planning, demand planning , supplier risk management, warehousing and logistics, procurement, and inventory management—to be digitally immature.

The Time for Digital Transformation Is Now

New technologies can provide comprehensive supply-chain visibility with real-time data and intelligence to help companies make timely and effective decisions based on shifting market dynamics.

Artificial intelligence (AI), internet of things (IoT), predictive analytics, and other transformative technologies can help enterprises respond to sudden shifts in demand and supply trends, and plan for such shifts in advance.

Enterprises must prioritize their digital supply-chain investments in three key areas: visibility, planning, and collaboration. They must look at upgrading or replacing their legacy enterprise resource planning (ERP) and supply-chain systems with next-generation cloud-based supply-chain platforms designed to support rapid innovation. Effective supply-chain collaboration , both within and outside the enterprise, is critical for increased agility and resilience. Over 66% of companies in the Harvard Business Review Analytic Services and GEP study said they will be focusing on improving collaboration.

While investing in the right technology is critical for supply-chain transformation, enterprises must also focus on helping their workforce become more digital-savvy. More than 50% of companies plan to invest in training to improve their employees’ skills in using digital tools. The key, however, is to look for technology solutions that have intuitive design and interfaces and don’t have a steep learning curve.

Disruptions like the pandemic are no longer rare and unpredictable “black swan” events. The high threat of natural disasters, political unrest, economic crises, and pandemics will continue, so enterprises must build the capabilities they need to mitigate such disruptions.

Enterprises that had developed strong digital capabilities in advance of the pandemic were better able to cope with the disruption with agility and resilience than those that hadn’t.

Now is the time for enterprises to assess their digital readiness and start investing—or accelerating their investments—in digital supply-chain transformation . A supply-chain digital-maturity assessment can help your organization identify gaps and improvement areas.

To learn how GEP’s comprehensive portfolio of software, strategy, and managed services can help your enterprise build an agile, intelligent, and resilient supply chain, visit gep.com .

Technology and Operations Management

Mba student perspectives.

- Assignments

- Assignment: Digitization Challenge

Tesco: A digital transformation

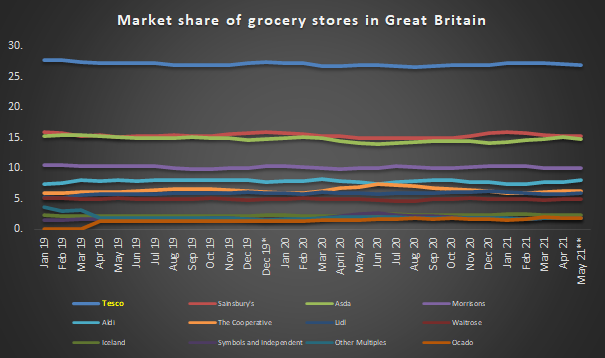

Tesco is the leading grocer in the UK, accounting for 25% of all grocery sales offline and 43% of all grocery sales online [1]. In the last 15 years, Tesco has digitally transformed their customer experience, business model and operating model through investments in a state-of-the-art website with click-and-collect functionality, a digitalized in-store experience and a data-driven customer loyalty platform.

How is Tesco using technology to differentiate their Business and Operating Model?

Tesco has continually been investing in technology to develop an omnichannel customer experience and to maintain a competitive edge in an increasingly digitized UK grocery landscape. Three technological advancements that have created opportunities, as well as some challenges, for Tesco have been:

- Moving from ‘bricks and mortar’ to ‘bricks and clicks’ with the emergence of Tesco Direct, an online grocery platform with ‘click-and-collect’ functionality

In the early 2000s, the UK was prime for online grocery shopping and home delivery due to high technology adoption rates and areas of high population density. In 2000, Tesco was quick to respond to this opportunity, adapting their business model by establishing an online grocery channel, ‘Tesco Direct’ (Exhibit 1) [2]. By 2006, online sales were rapidly growing (CAGR of 23%) and in order to meet fulfilment demands, Tesco augmented their operating model by investing in ‘grocery dotcom centres’ [3], warehouses solely for online order fulfilment purposes equipped with innovative ‘goods to person’ picking technology (Exhibit 2) [4]. In 2011, to offer further convenience to customers and to improve business model profitability through lowering home delivery costs, Tesco led the competitive pack by offering an omnichannel ‘click and collect’ function, whereby customers placed orders online and collected bagged groceries at a collection point of their choice. Despite revenue upside, the shift to a ‘bricks and clicks’ omnichannel offering came with challenges for Tesco’s operating model: heavy investment in development of an online platform, investment in ‘grocery dotcom centres’ (approximately £1.5-3.5M per warehouse) [5], investment in a home delivery labour force and supply chain ordering difficulties due to inaccurate forecasting of online grocery orders given a lack of historical data.

Exhibit 1: Tesco Direct online website [2]

Pathways to Just Digital Future

Exhibit 2: State of the art goods-to-person picking technology [6]

- Implementation of a digitalized in-store experience

To improve the efficiency of Tesco’s operating model, Tesco invested in digital in-store initiatives. ‘Scan as you shop’ handheld devices (Exhibit 3) and self-check-out stations (Exhibit 4) were placed adjacent to the usual employee manned check-out stations to provide customers with the technology to perform the check-out function without involvement from Tesco employees [7]. From a business and operating model perspective, this results in efficiency cost savings as fewer employees are required to perform manual check-out [7]. However, self-checkout has not come without challenges – the lack of employee supervision has led to significant levels of fraud for Tesco (approximately ~£8M per year) [8]. Tesco is combating this thievery through digital receipt technology and specialized cameras at self-checkout stations to alert staff real-time to ‘irregular’ customer scanning activity [8].

Exhibit 3: Scan as you shop handheld device [9]

Exhibit 4: Self Service Checkout [10]

In addition, in-store video cameras, such as the ‘broccoli cam’ (Exhibit 5), detect when fruit and vegetable trays in the fresh foods aisles are depleted, sending instant messages to the shop-floor employees for immediate replenishment [7]. Electronic shelf-edge labels (Exhibit 6) circumvent the need for Tesco employees to change 5-10 million paper labels monthly, freeing up valuable employee time to focus on serving customers [7, 11]. Moreover, electronic shelf-edge labels allow for instantaneous price-changes throughout a given day, allowing Tesco to implement promotional prices at a moment’s notice. Finally, employees are equipped with portable smart badges which, upon scanning an item, provide employees with information on stock levels and further product details, allowing shop floor employees to answer customer queries live [7].

Exhibit 6: Electronic shelf edge labels [7]

- Development of Tesco Clubcard – a sophisticated data-driven customer loyalty scheme

The Tesco Clubcard loyalty scheme tags a unique customer ID to every purchase, resulting in the amalgamation of millions of customer purchasing data points [13]. Tesco leverages big data analytics and algorithms to adapt the supply chain and product offering to purchasing trends, predict future customer purchasing habits and generate personalized online and offline discounts [14]. This has created opportunities for Tesco’s business and operating model as approximately 16.5 million customers subscribe to Clubcard in the UK, driving greater customer lifetime value and loyalty through repeat purchases due to personalized discounts and allowing greater accuracy into forecasting customer demand by region and product category [5]. What additional steps Tesco should consider implementing?

Moving forward, Tesco needs to leverage smartphone technology to digitally innovate the in-store customer experience by equipping customers with knowledge and personalization in-store. For example, the existing Tesco App could be expanded provide a functionality to help customers locate specific items within superstores and to replace the ‘scan as you shop’ handheld devices for a seamless digital experience using digital wallets. This could create an operating model opportunity by further decreasing in-store headcount and costs. Finally, Tesco could overcome the difficulties users face scanning barcodes in self-checkout machines by utilizing innovative Toshiba technology which no longer requires barcodes [15].

[766 words excluding exhibits]

References:

[1] Planet Retail, www1.planetretail.net/, accessed November 2016

[2] Tesco Direct website, http://www.tesco.com/groceries/ , accessed November 2016

[3] ‘Tesco goes into the darkness’, Retail Gazette, http://www.retailgazette.co.uk/blog/2014/01/42030-tesco-goes-into-the-darkness , accessed November 2016 [4] ‘Insight supermarkets dark stores’, The Guardian, https://www.theguardian.com/business/shortcuts/2014/jan/07/inside-supermarkets-dark-stores-online-shopping , accessed November 2016 [5] Tesco annual report, https://www.tescoplc.com/media/264194/annual-report-2016.pdf , accessed November 2016

[6] Tesco ‘goods to person’ picking image, http://www.expo21xx.com/material_handling/13440_st3_conveyor_elevator/default.htm , accessed November 2016~ [7] In-store innovation at Tesco, Tesco PLC presentation by CIO Mike McNamara, https://www.youtube.com/watch?v=noa4SmYhjTA , accessed November 2016 [8] ‘Tesco trials digital receipts and self scanner tech that aims to reduce theft; Marketing Week, https://www.marketingweek.com/2016/10/21/tesco-trials-digital-receipts-and-self-scanner-tech-that-aims-to-reduce-theft/ , accessed November 2016 [9] Tesco scan as you shop image, http://www.tesco.com/scan-as-you-shop/i/diagram.png , accessed November 2016

[10] Tesco self-check out image, https://www.engadget.com/2015/07/30/tesco-automated-checkout-voice/ , accessed November 2016

[11] ‘Tesco is back’, Forbes, http://www.forbes.com/sites/kevinomarah/2016/04/14/tesco-is-back/#5839eaca1c64 , accessed November 2016

[13] ‘Clubcard built the Tesco of today but it could be time to ditch it’, The Telegraph, http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/10577685/Clubcard-built-the-Tesco-of-today-but-it-could-be-time-to-ditch-it.html , accessed November 2016 [14] ‘Tesco: how one supermarket came to dominate’, BBC News, http://www.bbc.com/news/magazine-23988795 , accessed November 2016 [15] ‘New Toshiba supermarket scanner does away with need for bar codes’, Digital Trends, http://www.digitaltrends.com/cool-tech/new-toshiba-supermarket-scanner-does-away-with-need-for-bar-codes/ , accessed November 2016

Student comments on Tesco: A digital transformation

I completely agree with the idea of Tesco using technology to enhance the customer’s experience in the store. I also think that Tesco’s biggest advantage is the vast trove of data it is now collecting on shoppers through its mobile app and loyalty program. There are benefits to both the brand and consumer of Tesco having this data.

On the consumer side, Tesco can use this to enhance the customer experience, as you mentioned above. For example, since Tesco knows what a shopper has purchased, and how frequently, on average, either that shopper or similar shoppers replace a specific item, Tesco could use this to remind shoppers to buy something that they may be running low on. They can also use this to delight shoppers by suggest recipes using things they’ve purchased or offering savings on things they might want to try. They will need to handle this carefully as to not venture into “creepy” territory.

On the brand side, Tesco can unite the data from the POS and mobile device to understand which products a shopper was considering, but did not ultimately purchase. This information is extremely valuable to brands and can help them target shoppers in a way that maximizes their spend.

Thanks for a great post! It’s interesting to see how advanced Tesco is compared to US grocery retailers, especially with its online delivery platform. I think the biggest advantage for Tesco here is the data they have been able to collect with its loyalty program. I agree with Katherine that the next step is creating personalized communication at the customer level to enhance the customer experience and increase traffic in stores. My concern here is Tesco’s ability to retain strong margins. Grocery retailers already face low margins, and I’m curious to know how these investments have impacted its performance.

Wow – this is so interesting. I had no idea that Tesco was doing so much…I especially love the Broccoli cam!

One concern I have is how whether consumers actually value all these additional digital applications. A Harvard Business Review article from 2014 (“Tesco’s Downfall is a Warning to Data-Driven Retailers” [1]) discussed Tesco’s declining performance despite all the investments they had recently made in digital technology and data analysis. They quoted a Telegraph article which said “…judging by correspondence from Telegraph readers and disillusioned shoppers, one of the reasons that consumers are turning to [discounters] Aldi and Lidl is that they feel they are simple and free of gimmicks. Shoppers are questioning whether loyalty cards, such as Clubcard, are more helpful to the supermarket than they are to the shopper.”

As a consumer I would agree…although the products discussed above sound interesting…how much do value do they really provide for myself as a shopper?

[1] https://hbr.org/2014/10/tescos-downfall-is-a-warning-to-data-driven-retailers

Great read CC! It’s amazing to know that a 100-year-old retailer such as Tesco has been investing capital and innovating to stay competitive in the digital age. I loved the simple yet far-reaching functionalities of the innovations you mentioned, especially ‘the broccoli cam’ and the electronic shelf labels.

It is well known that Clubcard was pivotal in establishing Tesco as a dominant player in UK [1] but it might be time to update the way it works. With the advent of smartphones, most consumers have their loyalty programs on their phones, with easy real time access to their benefits and rewards. Customers are also happier

Tesco also has a huge potential in updating its supply chain through digital initiatives. More and more firms are relying on technologies such as Sensors & geolocation, robotics, big data and cloud services to gain supply chain efficiencies and cost savings. [2] Things are clearly working in Tesco’s favor as they enjoy fastest growth in three years as Aldi and Lidl slow [3]. Hope they realize the huge potential that digitization has to offer and keep evolving

[1] http://www.telegraph.co.uk/finance/newsbysector/retailandconsumer/10577685/Clubcard-built-the-Tesco-of-today-but-it-could-be-time-to-ditch-it.html

[2] https://www.atkearney.com/documents/10192/6500433/Digital+Supply+Chains.pdf/a12fffe7-a022-4ab3-a37c-b4fb986088f0

[3] http://www.telegraph.co.uk/business/2016/11/15/tesco-enjoys-fastest-growth-in-three-years-as-aldi-and-lidl-slow/

Leave a comment Cancel reply

You must be logged in to post a comment.

Product details

TESCO – British Retailer that redefined Grocery Shopping

The first time I visited a ‘Tesco Extra’ store was at midnight, making an emergency run for next morning’s breakfast. The store seemed to occupy the area of an entire football field in Ashby-De-La-Zouch, UK. Even at an ungodly hour, Tesco was well-lit with visiting customers.

Inside, there were never-ending aisles lined up with groceries, food items, clothing, electronics, and whatnot. It was easy to lose way and lose track of time in the colossal supermarket.

I thought to myself that this would be the only store of its kind in the county, but I was wrong.

Tesco has 4008 stores across the UK and Republic of Ireland , with 7005+ stores and franchises across the world. In Europe, Tesco has established itself in Hungary, Slovakia, Czech Republic, Poland and Turkey. In Asia it has stores in Thailand, South Korea, Malaysia, Japan and China.

TESCO is much more than a chain of supermarkets selling a million products. It’s a giant conglomerate, spanning across so many verticals. It’s the equivalent of one of the FAANG companies but in the Grocery & Retail sector. It becomes imperative for business enthusiasts like you and me to understand the business model of this retail giant called Tesco.

It’s considered a part of the ‘Big Four’ supermarkets alongside ASDA, Sainsbury’s, and Morrison’s in Europe.

The Birth of Supermarkets in Britain

Founded in 1919 by a war veteran – Jack Cohen , Tesco began as a grocery stall in the East End of London, making a profit of £1 on sales of £4 on day one. Tesco’s first store was launched in 1929, selling dry goods & its own brand of Tesco Tea. A hundred more Tesco stores were opened in the next 10 years.

With 100+ mom-and-pop stores in Britain, Jack wanted to expand his product range. He traveled to the US in 1946 and noticed the self-service system, where customers would select different products on the shop floor and finally checkout at a counter. Jack brought this concept back to Britain, giving birth to Tesco Supermarkets and changing the face of British Shopping. His motto was to “stack ‘em high, and sell ‘em low (cheap).”

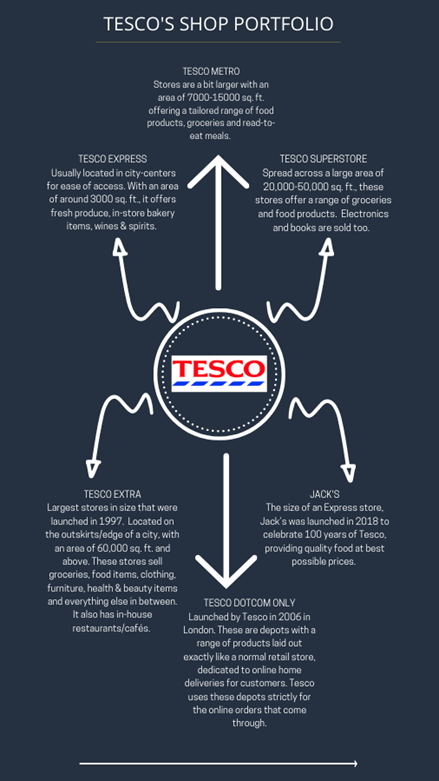

Tesco has a wide range of supermarkets depending upon their size, range of products, and location. This also helps regulate their Supply Chain to reduce wastage.

Tesco Business Model is based on various verticals

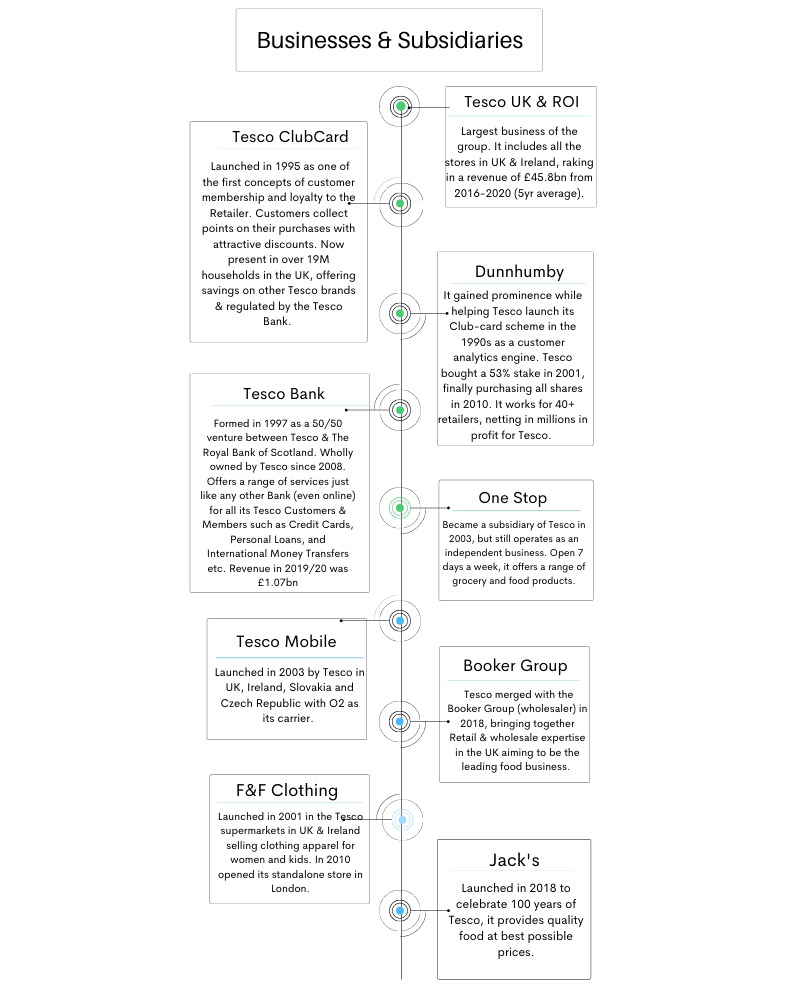

Tesco has deep-rooted its businesses in the European market so well, it’s difficult to miss out on the Tesco hoarding anywhere. Its Businesses and subsidiaries are:

A glimpse into the Complex Supply Chain

A supply chain is one of the critical aspects of the business model of a giant retailer like Tesco. Tesco has its priorities set when it comes to procuring products from different parts of the world:

- Use expertise to offer a better range of products at reasonable prices

- Use economies of scale to buy more for less

- Leverage and maintain relations with global branded suppliers

- Grow the brand

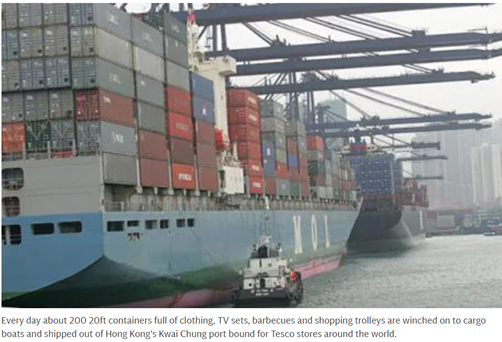

It procures goods from over 44 countries, majorly China. A stock of up to 90,000 different products (30% are food & beverages) is transferred via the global sourcing office located in Hong Kong. Keeping wholesalers out of the loop, Tesco procures directly from suppliers. The conglomerate has developed and maintained long-lasting relations with suppliers’ world over—the main ones being General Mills, Kellogg, Mars, and Princes.

Tesco has set up a separate division to regulate its supply chain, “the machine behind the machine” – Tesco International Sourcing (TIS). It can be compared to the East India Company of the 18 th -19 th Century, catering to only one customer – Tesco.

TIS is connected to over 1000+ suppliers across 1200+ factories . It’s responsible for over 50,000 Tesco product lines in terms of quality control, sourcing, production, designing, timely delivery, and sorting trading/customs documentation.

All activities are coordinated centrally at TIS, with just 533 staff members. These staff members undergo rigorous training to detect & analyze Supplier-violations and conduct Auditing.

Tesco coordinates with TIS on a daily basis to procure products in the following ways:

- The local team uses customer insights to create a Product Brief (new or modified) specified for each region.

- TIS analyzes the product brief and develops a Product Sourcing Plan depending upon – stores that need this product and figuring out minimum transport time and cost, as per the region.

- The Plan is executed, and specific demands are handed out to Suppliers all over the world. Expert TIS Buyers make sure the best deal is made.

- Inbound logistics are consolidated at specific Tesco Depot to receive the product efficiently from Suppliers.

- Local teams then make sure the product is distributed to different Tesco stores from the Depots.

Tesco adding eCommerce to the mainstream business model

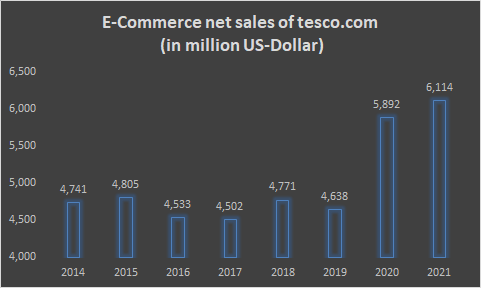

Being in the Top 50 retailers globally as of 2021 , Tesco’s annual revenue worldwide in 2020 was £58.09B , a 9.1% decline from 2019 (due to the Pandemic & disposing of its Asia operations , to focus on the core business in Europe).

It shifted from Brick & Mortar to Brick & Click stores. The Click+Collect functionality on its website accounts for 43% of E-grocery sales in the UK. The Click+Collect concept enables customers to place their orders online and collect their orders a few hours later at the nearest Tesco Depot. Tesco created these specialized Depots for online orders only.

Despite shutting down most its mall operations, Tesco survived 2020 through its online retail store Tesco.com , with double the orders. Its E-commerce net sales had shot up by 31% from 2019-2021.

A Global Operations & Technology Center in Bengaluru was also set up in 2004. This center serves as the backbone of distribution operations for Tesco worldwide. Its business functions are- Finance, Property, Distribution Operations, Customers & Product. The employees at this Center are Engineers, Analysts, Designers, and Architects.

Tesco’s Marketing Strategy

Tesco has always believed in acquiring loyal customers and regaining stakeholders’ trust. It aims to reach customers from all financial backgrounds. So it launched 2 of its own sub-brands – Tesco finest for the affluent customers and Tesco Everyday Value for the rest of the crowd.

Tesco also launched the Club Card in 1995 as a Membership card, to maintain customer loyalty and keep them coming back. The Card operates on a point-based system with discounts on products, & other subsidiaries like double data on Tesco Mobile. With 5 Million subscribers in the first year , Tesco finally overtook its competitor – Sainsbury’s to become No.1 in the UK.

The Club-card strategy was used to obtain customer data and observe buying habits. This data was analyzed, allowing Tesco to put the right products on shelves while eliminating unpopular ones. Tesco realized that the Club Card isn’t just a quick fix & temporary promotional tool; it’s a promotion in itself. This made the Tesco Club Card unique and long-lasting.

Tesco also realized that spending Billions on traditional marketing efforts and maintaining a ‘one-size-fits-all’ brand image wouldn’t work. It decided to hyper-target specific customers and to earn their trust. For starters, thousands of head-office staff and senior executives were sent to work in stores – to demonstrate how Tesco values its customer. Customization became key for its new marketing strategy; sending out discounts on birthdays via Emails and campaigning from door-to-door.

Tesco also made a partial shift to Digital Marketing which costs much lesser and has a wider outreach. It created well-tailored profiles on all social media platforms. On Twitter, it has more than 15 accounts, separate for each of its business units. The online customer care account on Twitter is active 24-7.

All supermarkets commonly advertised themselves to have quality products at a reasonable cost; Tesco wanted to differentiate itself as a unique brand. It introduced step-by-step Recipes prepared from ingredients available at any Tesco store, with Chef Jamie Oliver as its Health Ambassador . Tesco Food and its variety of recipes were a massive hit. Later on, the monthly Tesco Magazine as a food & lifestyle magazine was also launched, with 4.65Million readers worldwide.

The beginning of the pandemic in March 2020 left people apprehensive about visiting a physical store to buy groceries. To deal with customers’ concerns, Tesco came up with an instructional advertisement in April ‘20. With crisp instructions similar to that of an in-flight safety video, this ad showed customers how to physically shop and behave at Tesco stores. It was considered to be the most effective advertising and communications campaign of 2020 as per YouGov BrandIndex .

Competition

Tesco’s earliest competitor has been Sainsbury’s since the 70s. The Tesco Club Card strategy in 1995 helped it overtake Sainsbury’s to become the No.1 Retailer in the UK, but not for long. The ‘Big Four’ supermarkets in Europe have been in close competition throughout the years. Tesco has acquired a 28% majority stake in the UK market.

The horse meat and accounting scandals were a real setback for Tesco, letting competitors take over the European market. The newest German entrants – Aldi and Lidl had caught customers’ attention and market share in a short span of time.

With a combined market share of 12%, these German retailers posed a threat to Tesco. So much so that Tesco began the ‘ Aldi Price Match ’ campaign to curb the growth of the German discounter and win back customers. Tesco started price-matching thousands of its products with that of Aldi, offering better quality and branded products at Aldi’s prices.

Tesco has a majority market share in Britain, with Sainsbury’s and ASDA in tow:

Tesco Adding Sustainability to its business model – The Little Helps Plan

It’s a well-known fact that giant conglomerate retailers are one of the major causes of rapid climate change and increasing carbon footprints. Tesco realized its impact on the planet and launched the Little Helps Plan as a core part of business in 2017. This plan serves as a framework to attain long-term sustainability. Its four Pillars – People, Products, Planet, and Places are aligned with the UN’s Sustainable Development Goals.

Until now, the Plan has enabled Tesco to:

- Permanently remove 1 Billion pieces of plastic from its packaging

- Redistribute 82% of unsold food, safe for human consumption

- Remove 52Billion unnecessary calories from foods sold

Apart from this, it also aims to increase sales of Plant-Based Meat alternatives by 300% by 2025. At present, it has 350 plant-based meat alternatives on the shelf.

Apart from partnering with various other organizations, Tesco entered a 4-year partnership with World Wide Fund for Nature (WWF) to address one of the biggest causes of wildlife loss – the global food system. It aims to eliminate deforestation from products, promote recyclable/compostable packaging and minimize food waste.

Tesco is one of the few successful retailers in the world, with a compelling history. Tesco has overcome numerous issues across its supply chain, faced global criticism, and still stands undeterred in the European market with its rock-solid business model. It has always adapted to its unpredictable consumers and continues to do so while caring for the planet.

The business is healthy. We said we would rebuild the relationship with the brand and consumers; you will see that in every measure of customer satisfaction we do that. The business is healthy, vibrant and there is a lot of optimism of what we can do going forward. CEO Dave Lewis, who took over Tesco in 2014 (during the struggle years) & stepped down in September 2020

-AMAZONPOLLY-ONLYWORDS-START-

Also, check out our most loved stories below

Why did Michelin, a tire company, decide to rate restaurants?

Is ‘Michelin Star’ by the same Michelin that sells tires, yes, it is! But Why? How a tire company evaluations became most coveted in the culinary industry?

Johnnie Walker – The legend that keeps walking!

Johnnie Walker is a 200 years old brand but it is still going strong with its marketing strategies and bold attitude to challenge the conventional norms.

Starbucks prices products on value not cost. Why?

In value-based pricing, products are price based on the perceived value instead of cost. Starbucks has mastered the art of value-based pricing. How?

Nike doesn’t sell shoes. It sells an idea!!

Nike has built one of the most powerful brands in the world through its benefit based marketing strategy. What is this strategy and how Nike has used it?

Domino’s is not a pizza delivery company. What is it then?

How one step towards digital transformation completely changed the brand perception of Domino’s from a pizza delivery company to a technology company?

BlackRock, the story of the world’s largest shadow bank

BlackRock has $7.9 trillion worth of Asset Under Management which is equal to 91 sovereign wealth funds managed. What made it unknown but a massive banker?

Why does Tesla’s Zero Dollar Budget Marketing Strategy work?

Touted as the most valuable car company in the world, Tesla firmly sticks to its zero dollar marketing. Then what is Tesla’s marketing strategy?

The Nokia Saga – Rise, Fall and Return

Nokia is a perfect case study of a business that once invincible but failed to maintain leadership as it did not innovate as fast as its competitors did!

Yahoo! The story of strategic mistakes

Yahoo’s story or case study is full of strategic mistakes. From wrong to missed acquisitions, wrong CEOs, the list is endless. No matter how great the product was!!

Apple – A Unique Take on Social Media Strategy

Apple’s social media strategy is extremely unusual. In this piece, we connect Apple’s unique and successful take on social media to its core values.

-AMAZONPOLLY-ONLYWORDS-END-

An Engineering grad, currently working in the fields of Big Data & Business Intelligence. Apart from being immersed in Tech, I love writing and exploring the business world with a focus on Strategy Consulting. An ardent reader of Sci-Fi, Mystery, and thriller novels. On my days off, I would spend time swimming, sketching, or planning my next trip to an unexplored location!

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Impact of COVID-19 on Supply Chain Management: A Case Study of Tesco

Added on 2023-06-10

About This Document

Added on 2023-06-10

End of preview

Want to access all the pages? Upload your documents or become a member.

Business and Management: Contemporary Research, ALDI Case Study, Business Ethics, Class Discussion, and Portfolio Collation lg ...

Investigating international supply chain vulnerabilities and knowledge-based view theory lg ..., circular flow of income and the impact of covid-19 on uk smes lg ..., impact of covid-19 on construction sector: a case study of morgan sindall group lg ..., repercussions of war on global economy lg ..., contemporary research on business and management lg ....

- Anthesis Group

- Anthesis España

- Anthesis Catalunya

- Anthesis France

- Anthesis Deutschland

- Anthesis Italia

- Anthesis Suomi

- Anthesis Sverige

- Anthesis Brasil

- Anthesis Middle East & Africa

- Anthesis Australia

Developing Sustainability-linked Supply Chain Finance Product for Tesco

Tesco was eager to identify novel levers that could be deployed to help incentivise and reward suppliers to take action to deliver on Tesco’s updated supply chain carbon reduction targets and Net Zero emissions across its entire value chain by 2050.

Anthesis has supported Tesco to design the methodology that determines how suppliers’ sustainability credentials are assessed and incentivised suppliers to set emission targets.

- Supply Chain Sustainability

We are delighted to be able to offer thousands of suppliers access to market-leading supply chain finance linked to sustainability. This programme not only provides suppliers with a real incentive to set science-based emissions reduction targets, it will help embed sustainability goals throughout our supply chain and support the UK in realising its climate change targets.” Ashwin Prasad – Tesco Chief Product Officer

Anthesis has been a trusted advisor to Tesco for over seven years and has been supporting the company by embedding its sustainability goals within its supply chain as part of the Tesco Supplier Network platform. As an industry leader, Tesco was eager to identify novel levers that could be deployed to help incentivise and reward suppliers to take action to deliver on Tesco’s updated supply chain carbon reduction targets (aligned to a 1.5°C pathway) and Net Zero emissions across its entire value chain by 2050.

In partnership with Tesco and their finance partner, Santander, Anthesis supported the development of UK retail’s first sustainability-linked supply chain finance product. The voluntary programme saw Tesco suppliers offered preferential financing rates based on their disclosure of greenhouse gas emissions, setting reduction targets, and delivering reductions. Anthesis led the development of the methodology by which suppliers are assessed. In addition, Anthesis was the implementation partner for the programme, independently reviewing each supplier’s application to the programme.

In line with Tesco’s science-based climate targets and goal to achieve net zero in the UK by 2035, the supply chain finance programme encourages suppliers to work with Tesco to address the most urgent environmental issue, climate change.

Tesco has taken a leadership position as the first UK retailer to offer preferential funding rates linked to suppliers’ sustainability performance. Suppliers that successfully engaged with the programme have been able to access funding at costs below the market rate. Moreover, the programme has incentivised many suppliers to measure their greenhouse gas (GHG) emissions for the first time, set GHG reduction targets in line with Tesco’s goals, establish Net Zero ambitions, and deliver emission reductions.

Anthesis has supported Tesco to design the methodology that determines how suppliers’ sustainability credentials are assessed. In addition, the team assisted with collecting and reviewing supplier data, as well as supporting Tesco with the continued evolution of the initiative over time – in line with the retailer’s sustainability goals.

Anthesis has been working with Tesco since 2014 to advance its supply chain sustainability agenda. This has included developing and delivering the Tesco Supplier Network, Tesco’s online supplier collaboration platform, which gives over 10,000 suppliers and producers access to guidance materials to improve sustainability.

We are the world’s leading purpose driven, digitally enabled, science-based activator. And always welcome inquiries and partnerships to drive positive change together.

Information Age

Insight and Analysis for the CTO

Tesco saves millions with supply chain analytics

Tesco's partnership with retail analytics provider Dunnhumby is held up as the textbook case study for customer data analysis.

But in the last five years, the retail giant has also been applying sophisticated analysis to its supply chain data. And by identifying opportunities to cut waste, to optimise promotions and to match stock to fluctuations in demand, Tesco's supply chain analytics function has saved the company many millions of pounds.

In 2006, an executive from Tesco Direct, the company's online retail division, moved over to the supply chain department. He spotted an opportunity to run a small sales forecasting project, and persuaded one of the company's directors to give him some budget.

The project saved the company £16 million in one year. "That project built the engagement with the business," says Duncan Apthorp, supply chain systems development programme manager at Tesco.

Since then, Tesco's supply chain analytics team has grown from five people to 50. It is staffed mainly by science and engineering graduates, who Tesco trains up in retail expertise and SQL programming skills and who mostly use mathematics application Matlab to conduct their analysis.

The team's biggest wins so far include a statistical model that predicts the impact of the weather on customer buying behaviour. By comparing historical weather data with sales records in its 3,000 plus stores, Tesco can now adjust its stock levels based on the weather forecast, so its stores do not run out of the goods people want.

There are goods that sell more when the weather is hot, such as barbecue meat, and goods that sell more when is cold, such as cat litter (cats are less likely to leave the house in the winter, Tesco has found). There are other products that sell when it is hold or cold, such as firelighters, but when it is in the middle.

It is not simply a matter increasing or decreasing stock as the temperature rises and falls, however – context matters too. What is considered a hot day in Glasgow may be nothing special in Brighton.

And people are more likely to break out the barbecue when a sunny day follows a prolonged cold spell. "By adding this effect to model," Apthorp says, "we reduced out of stock for good weather products by a factor of four.

"That means there is a 97% change of customers who come into the store finding what they want, whereas other supermarkets might not have it."

The weather modelling project took around five people a couple of years to develop. So far, Apthorp says, it has saved Tesco £6 million.

Discounts and promotions

An even bigger win has come from analysing discounts and promotions. Tesco runs 1,000s of promotions every day, and needs to predict how popular they will be in make it has enough – but not too much – stock to meet demand.

Until recently, it was up to each store's stock controller to estimate how popular each promotion would on a daily basis. But with so many promotions running at any one time, the accuracy of their predictions was understandably limited.

The supply chain analytics team took all the data Tesco had about its historical promotions, and built a detailed predictive model. This pulled in all manner of variables, including the positioning of a discounted product in a store and what other offers were operating at the same time.

That has revealed some interesting insights. For example, a "buy one, get one free" offer works better than a 50% discount for non-perishable goods, such as a cooking sauces, but the reverse is true for fruit and vegetables.

To push these insights out into the stores, the supply chain analytics team built a web-based workflow system that allow stock controllers to access a sales uplift forecast for their specific store, and use it to plan their orders.

This system, Apthorp says, has allowed Tesco to take £50 million-worth of stock out of its depots.

All of this was possible, he explains, because Tesco sorted out its data infrastructure 15 years ago, when it implemented a Teradata enterprise data warehouse alongside its IBM mainframe.

As it happens, though, the supply chain analytics team recently bought its own Teradata data warehouse, which replicates the primary data set, which Apthorp says has increase the frequency and complexity of the analyses it can do.

Now Tesco is helping its non-UK divisions build the same infrastructure so they can start analyse their supply chains in as much detail. Unfortunately, Apthorp says, not all them have their data in such good order as its UK division.

"In one European market, we asked them where their data is," he recalls. "They said, some of it's in Excel, and some of it's sitting under this desk'."

Pete Swabey

Pete was Editor of Information Age and head of technology research for Vitesse Media plc from 2005 to 2013, before moving on to be Senior Editor and then Editorial Director at The Economist Intelligence... More by Pete Swabey

Related Topics

Related stories.

Data Analytics & Data Science

Observability – everything you need to know

Morgan Mclean, Director of Product Management at cybersecurity leader, Splunk, tells Information Age about all things observability

Partner Content

Why data isn’t the answer to everything

Splunk's James Hodge explains the problem with using data (and AI) in helping you make key business decisions

Anna Jordan

Cloud & Edge Computing

Two-thirds of UKI firms struggling with data insight costs

Research from SAS has revealed widespread struggles faced by businesses in the UK and Ireland to drive value from data insights

Aaron Hurst

Qlik completes acquisition of Talend

Global data integration and analytics provider Qlik has acquired data management vendor Talend, to bolster automated delivery of business insights

What generative AI means for business analytics

Jim Goodnight, founder and CEO of SAS Institute, tells Information Age his thoughts on the impact generative AI will have on business analytics

Dom Walbanke

Tesco Change Management Case Study

Change is a necessary part of any business’s growth and success. However, managing change can be a challenging task, especially for a company as large as Tesco.

The UK-based retail giant faced numerous challenges during its journey of growth, including increasing competition, changing consumer preferences, and economic uncertainties.

To overcome these challenges, Tesco embarked on a change management journey that transformed the company and enabled it to become one of the world’s largest retailers.

In this blog post, we will delve into Tesco’s change management case study, discussing the strategies the company employed to manage change, the challenges it faced, and the results and achievements of the change management program.

We will also examine the lessons learned from Tesco’s success story and provide insights into best practices for effective change management

Background of Tesco

Tesco is a British multinational retailer that was founded in 1919 by Jack Cohen. Initially, the company started as a market stall in London’s East End, selling surplus groceries from a stall.

In the 1920s, the company expanded its business by opening its first store in Burnt Oak, North London.

The company went public in 1947 and continued to expand its business throughout the UK in the following years.

By the 1990s, Tesco had become the largest supermarket chain in the UK.

However, despite its success, Tesco faced several challenges in the early 2000s. Increasing competition from discount retailers such as Aldi and Lidl, changing consumer preferences, and economic uncertainties had a significant impact on the company’s growth.

Tesco’s sales started to decline, and the company’s market share was shrinking. To address these challenges, Tesco’s management team realized the need for a change management program that would transform the company and enable it to regain its position as a market leader.

History and growth of Tesco

Tesco’s success story began in the early 20th century when Jack Cohen, the founder of Tesco, started selling groceries from a stall in London’s East End. By the 1920s, Cohen had established his first store in Burnt Oak, North London, under the name Tesco.

The name “Tesco” was derived from the initials of TE Stockwell, a supplier of tea to Cohen, and the first two letters of Cohen’s surname.

In the following years, Tesco continued to expand its business by acquiring other retailers and opening new stores throughout the UK.

By the 1970s, the company had become one of the largest supermarket chains in the UK. In the 1980s, Tesco introduced new products and services, including Tesco Metro stores, Tesco Express, and Tesco Clubcard, which enabled the company to enhance customer loyalty and increase sales.

In the 1990s, Tesco’s growth continued, and the company expanded its business beyond the UK by entering new international markets such as Poland, Hungary, and the Czech Republic. By the early 2000s, Tesco had become the largest supermarket chain in the UK, with over 2,500 stores worldwide.

However, the company faced several challenges in the early 2000s, including increasing competition, changing consumer preferences, and economic uncertainties, which had a significant impact on the company’s growth. Tesco’s management realized the need for a change management program that would transform the company and enable it to regain its position as a market leader.

Key Reasons of making changes at Tesco

There were several key reasons for the changes at Tesco, including:

- Increasing competition : The rise of discount retailers such as Aldi and Lidl had a significant impact on Tesco’s market share and profitability. These retailers offered lower-priced alternatives, which attracted customers away from Tesco’s stores.

- Changing consumer preferences: Consumer preferences were shifting towards healthier and more sustainable products, which Tesco was slow to respond to. This led to a decline in sales and customer loyalty.

- Economic uncertainties: The global economic recession of the late 2000s had a significant impact on Tesco’s financial performance. Consumers were more price-sensitive, and there was increased pressure on retailers to reduce prices.

- Internal issues: Tesco’s rapid expansion had resulted in organizational complexity, which made decision-making slow and inefficient. There were also issues with employee morale and engagement, which impacted the company’s ability to deliver high-quality customer service.

Steps taken by Tesco to implement change management

To address the external and internal challenges, Tesco’s management team realized the need for a change management program that would transform the company and enable it to regain its position as a market leader. The changes that were implemented included a focus on cost reduction, improving customer service, and enhancing employee engagement.

To implement the change management strategy, Tesco took several steps, including:

- Leadership commitment: The company’s senior leadership team was fully committed to the change management program and provided clear direction and support throughout the process.

- Communication : Tesco developed a comprehensive communication plan to ensure that all employees understood the rationale for the changes and their role in implementing them. The plan included regular updates, town hall meetings, and training sessions.

- Cost reduction: Tesco implemented a cost reduction program to improve efficiency and profitability. The company reduced its product lines, renegotiated supplier contracts, and streamlined its supply chain.

- Customer focus: Tesco implemented a new customer service strategy, which included improving the quality of its products, enhancing the in-store experience, and increasing customer engagement through loyalty programs and personalized marketing.

- Employee engagement: Tesco recognized the importance of employee engagement in delivering high-quality customer service. The company implemented initiatives to improve employee morale, including training programs, recognition schemes, and improved working conditions.

- Technology: Tesco invested in new technologies to improve its operations and enhance the customer experience. This included the introduction of self-checkout machines, mobile payment options, and online shopping platforms.

- Measurement and feedback: Tesco established metrics to measure the success of the change management program and solicited feedback from employees and customers to identify areas for improvement.

Positive outcomes and results of change management by Tesco

The change management program implemented by Tesco resulted in several positive outcomes and results, including:

- Increased profitability: Tesco’s cost reduction program resulted in improved profitability, with the company’s profits increasing by 28% in the first half of 2017.

- Enhanced customer experience: Tesco’s focus on improving the customer experience led to increased customer satisfaction and loyalty. The company’s customer satisfaction ratings improved significantly, and it was named the UK’s top supermarket for customer service by consumer watchdog Which? in 2018.

- Improved employee engagement: Tesco’s initiatives to improve employee engagement resulted in increased employee morale and motivation. The company’s employee engagement scores improved significantly, and it was recognized as one of the UK’s top employers in 2019.

- Streamlined operations: Tesco’s focus on improving efficiency and reducing complexity resulted in streamlined operations and faster decision-making. The company was able to reduce its product lines and negotiate more favorable supplier contracts, resulting in improved margins.

- Strong financial performance: Tesco’s change management program helped the company recover from a period of declining sales and market share. The company’s financial performance improved significantly, with revenue increasing by 11.5% and profits increasing by 34.2% in 2018.

Final Words

Tesco’s change management program is an excellent example of how a company can successfully transform itself in response to external challenges and changing market conditions. The program was comprehensive and multi-faceted, addressing the company’s challenges from multiple angles. Tesco’s leadership commitment, communication strategy, and focus on cost reduction, customer service, and employee engagement were all critical factors in the program’s success.

The positive outcomes and results of the program demonstrate the importance of change management in driving organizational success. Tesco was able to recover from a period of declining sales and market share, and become a more efficient, customer-focused, and profitable organization. The lessons learned from Tesco’s change management program are applicable to businesses of all sizes and industries, highlighting the need for organizations to remain agile and responsive to changing market conditions.

About The Author

Tahir Abbas

Related posts.

How to Motivates Employees During Layoffs

30 60 90 Day Plan for Business Development Manager – Explained

Change Advisory Board Process Flow – Explained

- International edition

- Australia edition

- Europe edition

The Guardian view on Tesco and supply chains: landmark case shines a light

Rising prices dominate the news, but Burmese workers taking the supermarket to court are a reminder that cheap goods come at a cost

“T hat period was a time I was in hell” is how one woman describes her two years working for VK Garments (VKG) in Thailand. Hla Hla Tey, who at 54 has struggled to find work since losing her job and now lives in a monastery, is among 130 former workers who are bringing a landmark case against Tesco in the UK. The supermarket giant stands accused of negligence and unjust enrichment on the basis of events at a clothing factory making F&F brand jeans in Mae Sot, a city at the Myanmar border, between 2017 and 2020. The area is described as a wild west of the global garment industry, with western retailers and their subcontractors drawn by the promise of cheap labour supplied by Burmese migrants.

Attention at the moment is rightly focused on the adverse effects of rising prices . Particularly in the run-up to Christmas, the UK public is accustomed to being reminded about the financial and other difficulties faced by people who are less fortunate than themselves. But the harmful impact of downward cost pressures must not be forgotten, even if those harms take place thousands of miles away. The demand for cheap goods, including new fashions, continues to lead to the exploitation of workers around the world, as employers vie with one another to fulfil orders as cheaply as they can.

Tesco says that the jeans made by VKG in Mae Sot were sold in Thailand, not Britain. But the relationship between the supermarket and its Thai branch, Ek-Chai (which has since been sold), VKG and an auditor, Intertek, is part of a system developed by retailers that enables them to outsource risks as well as well as keep costs down. Following earlier scandals over dangerous and exploitative working conditions, the most dramatic of which was the Rana Plaza factory collapse in Bangladesh in 2013, retailers have in some cases opted to extend supply chains further, placing more intermediaries between themselves and the people making the clothes they sell.