We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on Government

Rising Cost Of College Tuition In US Argumentative Essay Sample

Type of paper: Argumentative Essay

Topic: Government , United States , Literature , Taxes , Education , Politics , Banking , Students

Words: 2000

Published: 12/06/2019

ORDER PAPER LIKE THIS

Introduction

Every segment of the American economy is under pressure and college education has not been left behind. The cost of college education has risen sharply in the recent past and a big percentage of American College students risk being left out of college education if the cost rises further. The increase in costs has come forth in spite of the excruciating cost-cutting done by colleges on every activity in the institutions. The increase in tuition fee actually outperformed the overall inflation rate.

The increase in cost of college education in US could eventually put college education out of reach for most Americans (National Center for Public Policy and Higher Education Report, 2011). This problem could also affect the global competitiveness of the United States. According to the National Center for Public Policy and Higher Education Report issued in December 2008, :College tuition and fees adjusted for inflation rose 439% from 1982 to 2007.” This figure was higher than the corresponding increased in medical care, housing and food. During the same period, the median family income rose by 147%. This problem is driving a large number of college students away from students as the costs are increasingly becoming unbearable. The government therefore needs to move with speed in order to rectify this problem before it gets out of hand.

The cost of college education for a year rose by 6% in 2006, surpassing wages, inflation and finacial aid. The cost of obtaining a degree is actually rising even faster since many students are taking longer to graduate. Students who are supposed to be taking 4 years, are taking an average of six years to complete their studies. They are therefore forced to pay for tuition fees for six years instead of the four years that they were supposed to take. If the prices continue rising at the current rate, students who do not receive any grant will have to pay about $115,000 to reach graduation day. University officials are saying that they are raising the sticker prices so as to counterbalance the eductions in the subsidies that the government provide for higher education. the grants that most of the universities are receiving to date is the same to the amount that they used to receive about five years ago. Therefore in order for the institutions to balance the increase in salaries, wages, cost of energy and other operating costs, they have to increase the cost of tuition fees so that they can bridge the gap. The costs of running the universities are also increasig faster than even the consumer price index.

Many colleges are also experiencing pressure from the parents and the students to carry out upgrading process for most of their systems and facilities. Colleges that do not improve on their facilities are left out of business. Some students prefer attending colleges that offer better services even at a higher cost. Therefore some colleges are forced to improve on their facilities but this also comes with a corresponding increase in the amount of fees being offered for the facilities since this is the main source of funding for the institutions.

Posible Solutions to the Problem of Rising Cost of College Education

With the rising cost of tuition fees, students are increasingly realizing that grants and loans are not always sufficient for covering all the costs involved in the provision of college education. The problem that is worrying most students is that as the cost of tuition increases, the federal grants are being decreased. This has forced many students who cannot take up additional grants to take up more loans or find other sources of funding their education or drop out of college. One of the solutions that can help in solving this problem is students taking up two year courses. Most colleges that offer two-year courses do not have dorm facilities. This eventually puts the cost of getting degrees from such colleges relatively lower as compared to other colleges with a four-year program where students also stay in campus. The government should encourage the establishment of two year colleges like Georgia Perimeter College and Atlanta Metropolitan College which have a relatively lower cost.

Easing students’ loan interest rates can also help in reducing the cost of education. The law makers should also think of slowing down the relentless rise in the cost of college education. Most colleges increase their fees at will and this has contributed towards the sharp increase in the cost of college education. If the law makers can vote to stop the colleges from random increment in the cost of college education, then the cost of college education will definitely go down.

Provision of federal aid can also help in reducing the cost of education. However, if the aid is provided but there are no strict measures to keep this in check, the colleges are likely to increase their costs even further. Therefore, the aid should be provided with an accompanying condition aimed at controlling the cost charged by the colleges on the students.

The state should improve on their support for the colleges as inflation increases. Since the cost of running the colleges has greatly increased and the rate of inflation also increased sharply, the colleges require more funds to run. The government should improve on the amount of resources that they set for the colleges so that they can be able to hit a balance. This will prevent the colleges from passing the extra costs to the students.

Annotated bibliography

1. Sandra Block, Rising costs make climb to higher education steeper. USA TODAY December 2007

This article examines the rising cost of education, the causes and the remedies that can be taken in order to caution the public against the ever rising cost of college education. According to the author, the amount of federal aid has declined thus forcing more students to borrow. She states that an increase in the amount of federal aid can make the colleges increase their fees even further. However, in order to control the problem of the escalating cost of college education, she proposes that the government should increase their funding to the colleges so that it can help them cope up with the increasing rate of inflation. With this the costs will not be passed to the students thus making the cost of college education to remain constant or even reduce further.

Sandra Block is a personal finance columnist with USA today who contributes every Tuesday on the column. She has a wealth of knowledge and experience in US financial matters. She has also done a thorough analysis on the effects of inflation to the American economy and brings with her a wealth of information with her contributions.

2. Cheyanne Hunter, Solutions to the rising cost of college tuition Atlanta Continuing Education Examiner, April 29, 2011

This article analyses the factors behind the increasing cost of college education. The author takes us through a thorough analysis of the situation and how it started. She also manages to sufficiently demonstrate the imbalance that exists between the rise in the cost of college education and the rise in the amount of income different families get. According to the author, the cost of college education has risen by over 35% in the past five years. The government has not done much in order to protect the students and their parents from the ever rising cost of education without any corresponding relief from the government. She proposes that students can help get a solution through attending colleges that do not offer dorm facilities and seeking accommodation elsewhere. This is mostly common with two year degree program colleges. She also proposes that the government should try to increase their funding to the colleges so that the colleges can run those institutions effectively without asking the students to pay more.

The author graduated from Georgia State University with a major in Sociology. She has dedicated her time to writing informative and helpful topics. She has done a series of research dealing with the welfare of individuals.

3. Fred Lucas. Analysts: Obama Student Loan Policies Ignore the Real Problem – College Costs October 25, 2011

This article examines the improvements and the measures that have been taken by the US president in order to caution the public against the escalating costs of college education. According to the author, the policies put forth by the US president are not addressing the real problem but instead ignoring the real problem. He states that the actions that have been taken by the administration like rolling out new student loan relief has not targeted the main problem. He proposes that in order for the public to help solve the situation and eventually reduce the stress that they undergo in the process of paying for college education, they can put greater focus on online courses thus reducing the overall cost of obtaining college degrees. This can be done by encouraging the state Universities to put more contents online and eventually reducing the burden.

4. David Leto, Florida colleges are going to cost more, Fort Lauderdale Personal Finance Examiner

This article takes a case study on Florida and outlines the reasons behind Florida colleges costing more than other states in the US. The universities assert that the increment is needed so as to cover the budget cuts so that the colleges can continue to run efficiently. The increment in cost of the colleges is blamed on inflation and the increase in the cost of running the institutions. The author adds that in order for the colleges to remain in business they have to increase their fees. However, in order to control further increases or even reduce the cost, the government needs to improve its funding to the institutions so that they can continue to offer quality services to their students.

5. John L. Rury; Education and Social Change: Themes in the History of American Schooling; Lawrence Erlbaum Associates. 2002.

This book examines the sources of funding college education in the US. Most students in the US are not able to finance their education. Therefore they rely mostly on grants and loans from the government and other financial institutions. The author argues that the rate of inflation has been on the rise in the recent past and this has resulted into many students undergoing a lot of stress as it comes with a corresponding increase in the cost of college education. The government should increase the amount of grants that they offer to the public colleges so that they can cope up with the increasing rate of inflation. This will help in reducing the amount of fees charged by the colleges as this has been one of the main reasons that they use for increasing their tuition fees.

Work cited List

1. Cheyanne Hunter, Solutions to the rising cost of college tuition Atlanta Continuing Education Examiner, April 29, 2011 2. David Leto, Florida colleges are going to cost more, Fort Lauderdale Personal Finance Examiner, 2011 3. Fred Lucas. Analysts: Obama Student Loan Policies Ignore the Real Problem – College Costs, October 25, 2011 4. John L. Rury; Education and Social Change: Themes in the History of American Schooling; Lawrence Erlbaum Associates. 2002. 5. Sandra Block, Rising costs make climb to higher education steeper. USA TODAY, December 2007

Cite this page

Share with friends using:

Removal Request

Finished papers: 1576

This paper is created by writer with

ID 251808046

If you want your paper to be:

Well-researched, fact-checked, and accurate

Original, fresh, based on current data

Eloquently written and immaculately formatted

275 words = 1 page double-spaced

Get your papers done by pros!

Other Pages

Foragers essays, polygalacturonase essays, enlighten essays, road accidents essays, sustainable tourism essays, politano essays, devi essays, bomb threat essays, kuehn essays, moral discourse essays, coinage essays, blueprints essays, twenty percent essays, setups essays, minus essays, american soil essays, debit card essays, concussions essays, neuroimaging essays, hazan essays, fluorescent essays, fluorescence essays, mice essays, acetabularia essays, rosa essays, totemism essays, fredrich essays, microorganism essays, leadership research paper example, good example of all politics is personal essay, good my pen course work example, good example of essay on ancient mesoamerican art a formalist analysis of two sculptures, example of essay on sheen software case study, sample essay on data collection, hirschis social bond control theory research paper, fall risk in the elderly essay example, correctional corruption essays examples, free supply chain management report example, relating college essays, obtaining college essays, human resources college essays.

Password recovery email has been sent to [email protected]

Use your new password to log in

You are not register!

By clicking Register, you agree to our Terms of Service and that you have read our Privacy Policy .

Now you can download documents directly to your device!

Check your email! An email with your password has already been sent to you! Now you can download documents directly to your device.

or Use the QR code to Save this Paper to Your Phone

The sample is NOT original!

Short on a deadline?

Don't waste time. Get help with 11% off using code - GETWOWED

No, thanks! I'm fine with missing my deadline

Inflation affects the price of everything—including a college education

Subscribe to the brown center on education policy newsletter, phillip levine phillip levine nonresident senior fellow - economic studies , center for economic security and opportunity @phil_wellesley.

February 28, 2023

Inflation affects the price of everything we buy these days, and a college education is no different. But everyone pays the same price for eggs. Not everyone pays the same price for college. The availability of need-based financial aid means that those who can afford more pay more and those with fewer financial resources pay less.

As college prices rise with inflation, everyone will likely pay more, but will that burden be shared equally? In the current environment, there is reason to believe that price increases may be greater for those who can afford it the least. Such an outcome would be unfortunate given the role that higher education plays in promoting social mobility .

Sticker price vs. net price: Who pays what?

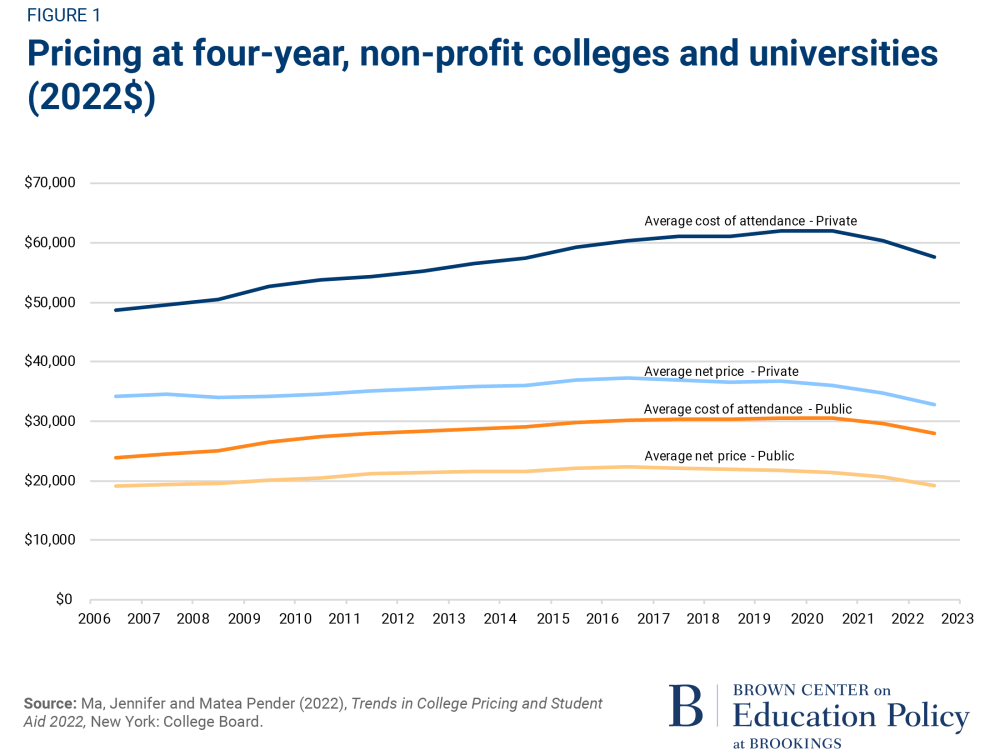

Even before the latest bout of inflation, public attention has focused on the “skyrocketing” cost of a college education. It almost tripled between 1979-80 and 2020-21 at four-year public and private institutions even after accounting for inflation over the period. The pace of growth has slowed, though. Between 2006-07 and 2019-20, the full cost of attendance jumped 27% at both types of institutions

But most students pay less than the full cost of attendance , sometimes labeled the “sticker price.” They receive some form of financial aid, reducing their price. The resulting amount they actually pay is labeled the “net price,” which equals the sticker price less grant-based aid. The only students who pay the full sticker price are those who are not eligible for financial aid. They mainly come from higher-income families.

Tracking net prices over time provides a different picture of the trend in college costs. Overall average net prices have risen at a considerably more modest pace. Between 2006-07 and 2019-20, they rose by 13% and 7% at public and private four-year institutions, respectively. But the average net price for all students includes those who receive financial aid and those who pay full price. We know that the latter group has experienced larger price increases. This means that the rate of increase in net prices for those who receive financial aid has to be lower than this national average.

How recent inflation affects college revenue

Then inflation hit in the wake of the pandemic. Academic year inflation, from July to June, hit 5.3% and 8.5% in 2020-21 and 2021-22, respectively. But institutions adopted moderate price increases, and some froze tuition . This was partly due to the lingering effects of COVID-19 recovery and partly due to public pressure regarding “skyrocketing” college costs (though this pressure may have been misplaced; see above).

After accounting for inflation, college prices are now dropping. In the last three years, the cost of attendance and average net price at public and private four-year institutions have actually fallen by around 10%. This is good news for students, both those with higher and lower incomes.

That trend may not continue, though. Lessons learned from the experience of the Great Recession may be relevant here. Inflation was low, and even negative at points, during the recession. But institutions struggled to make ends meet. Public institutions lost state funding and endowments at private institutions shrank. But a college’s bills need to be paid. To replace lost revenue, institutions raised sticker prices and cut financial aid , increasing net prices as a consequence.

In today’s environment, institutions again find themselves in a situation where their revenue is restricted, but this time it is because their prices have not kept pace with inflation. Federal COVID-19 stimulus funding provided to states and directly to students helped bridge the gap in the past couple of years, but those funds are no longer available.

Inflation’s impact on college costs may not be equally shared

That leaves revenue from students as a primary source of support to fill in gaps moving forward. But how much students pay differs by family finances. The public’s focus on the sticker price, the amount paid by higher-income families, makes it difficult to increase those much. Increasing costs by, say, 8% would be received very poorly. Several public institutions continue to freeze tuition in nominal dollars, which will amount to a significant drop in real revenue in a high-inflation environment.

These limits on the ability to increase tuition at a level large enough to keep pace with inflation will place higher education institutions in an even more difficult financial position. Of course, the handful with vast resources will work around this problem in the short term. Their finances are influenced by large endowments, making them less susceptible to these problems. Most institutions, though, will struggle.

What are the alternative approaches institutions can take to overcome the revenue shortfall? They certainly can reduce costs, scale back maintenance and renovations, and/or cut academic programs, for instance. Doing so, though, is difficult and perhaps even counterproductive. Those changes are also noticed and garner public criticism. It may also reduce their ability to attract students who pay full price.

To make ends meet, there is an easier alternative for them–cut financial aid. Public understanding of college costs after factoring in financial aid is so limited, nobody will notice. Despite its harmful effects, it is a much easier policy to adopt.

In fact, research supports the assertion that higher sticker prices and greater availability of financial aid go hand in hand. One study finds that public institutions provide more financial aid when they increase their sticker price (in real terms). They have greater resources available to do so. The opposite is likely to be true as well. When colleges are limited in their ability to raise sticker prices, they may resort to reducing the amount of financial aid available.

Beware of limiting access to higher education

All of this leads to the question of which students should be the focus in discussions of college costs. Traditionally, we highlight the price paid by higher-income students who pay the sticker price. That is the easiest number to know. And it would be better for these students if they could receive a quality education at a lower price.

But what about students from lower-income families? They are likely to be considerably more price sensitive. A higher price for them may mean the difference between attending college or not , the type of college that they attend , and the amount of debt they encounter if they do attend. Providing them with a price they can afford enables them to take advantage of the economic opportunity that a college education offers. The price they pay is the more important number to know, though it is obscured from public view.

In a high-inflation world, we risk missing the trees for the forest in our discussion of college pricing. It is unclear how long inflation will continue above traditional levels, but if it persists, it may limit college access. Restricting growth in sticker prices to maintain college affordability will benefit affluent students while possibly making college less affordable for those lower-income students for whom costs matter most. We should not lose sight of the goal of maintaining college access for those students as an integral component of the social mobility that we desire.

Related Content

Kaylee T. Matheny, Amanda Lu, Eric P. Bettinger, Gregory S. Kienzl

July 7, 2022

Zachary Mabel, Michael D. Hurwitz, Jessica Howell, Greg Perfetto

August 22, 2022

Sophie Eldridge, Danny Klinenberg, Dick Startz

September 27, 2022

Economic Indicators

Governance Studies

Brown Center on Education Policy

Harry J. Holzer

December 21, 2023

Anne Case, Janice C. Eberly, Carol Graham, Jón Steinsson

October 12, 2023

Pam Harder, Greg Wright

February 1, 2023

Sorry, we did not find any matching results.

We frequently add data and we're interested in what would be useful to people. If you have a specific recommendation, you can reach us at [email protected] .

We are in the process of adding data at the state and local level. Sign up on our mailing list here to be the first to know when it is available.

Search tips:

• Check your spelling

• Try other search terms

• Use fewer words

The price of college is rising faster than wages for people with degrees

Between 2000 and 2019, the price the average college student paid for tuition, fees, and room and board increased 59%.

Updated on Tue, May 18, 2021 by the USAFacts Team

How much does college cost?

The average college student paid $24,623 for tuition, fees, and room and board for a year of school in 2019, according to data from the National Center for Education Statistics . That is an increase of 59% compared to 2000, when the inflation-adjusted price was $15,485. Wages have not kept pace. Between 2000 and 2020, the Bureau of Labor Statistics reports that inflation-adjusted median weekly earnings for people with a bachelor’s degree rose 5%.

Tuition for the average student across all types of institutions has risen faster than tuition for students at four-year or two-year colleges, where prices have increased 53% and 42%, respectively. Part of the rise in attendance cost is a shift towards four-year colleges.

The price the average college student pays for a year of school has risen 59% since 2000.

Four-year institutions are more expensive than two-year ones. The price of attending a year of courses at a two-year school was about 40% of attending a four-year one in 2019. More students attending four-year institutions rather than two-year schools would increase the price of college for the average person even if costs at both types of institutions remained stable.

The percentage of people with a college degree is growing across the board. But increases have been greatest for degrees that require four years or more of college, according to the Census Bureau’s Current Population Survey (CPS) data on highest level of education earned. Between 2000 and 2020, the share of Americans with an associate degree increased by three percentage points, from 8% to 11%. The percentage of Americans with a bachelor’s degree rose twice as much, from 17% to 23%. The share of Americans with an advanced degree rose five percentage points, from 9% to 14%.

It is more common than ever for Americans to have a bachelor’s degree or higher.

Slow wage growth comes as bachelor’s degrees are becoming more common in non-professional occupations..

Professionals like scientists, engineers, and teachers continue to be the likeliest to have a bachelor’s degree or higher — at a rate of 80%, according to CPS data. That has changed little compared to 2000, when it was 79%.

Bachelor’s degrees are becoming more frequent in non-professional occupations.

The share of non-professional positions with a four-year degree or higher increased since 2000. The greatest percentage point increase in people with four-year degrees or more was for technicians, where the rate doubled from 18% to 36%. The rate for management-related positions like accountants, agents, and people working in personnel and HR rose over 17 percentage points, from about 54% to 71%. People working as police and firefighters, administrative support personnel, salespeople, and managers each became over 13 percentage points more likely to hold a four-year college degree. The likelihood of someone working in cleaning, food, childcare, or other services having a four-year degree or higher rose 10 percentage points to 17%.

People with at least a bachelor’s degree have the highest wages and more job security.

Wages have risen 5% for people with bachelor’s degrees and 5.5% for people with advanced degrees. While that lags behind the rise in tuition, it is higher than the 3% wage growth for people with a high school diploma or equivalent and the 0.1% growth for people with some college or an associate degree.

Wages for people with bachelor’s degrees have risen 5% since 2000, compared to 0.1% for people with some college or an associate degree.

Wage growth for people with bachelor’s degrees is less than the 14% increase in wages for people who never graduated high school. People with bachelor’s degrees still make double the median wages per week than those without a high school diploma.

People with bachelor’s degrees or higher also fared better at keeping jobs or getting new ones during the pandemic . The group’s total employment fell 6% in April 2020 and has almost returned to pre-pandemic job levels as of March. The number of people working remained down 7% for people with some college or an associate degree, 9% for high school graduates, and 10% for people without a high school diploma or equivalent.

People with bachelor’s degrees have almost recovered to pre-pandemic employment levels.

How cost-effective is a college degree.

Comparing tuition costs to wage earnings in 2019 dollars can give a sense of the financial benefits of a college degree. An employed person with a bachelor’s degree earned an average of $392 more a week compared to a person with some college or an associate degree in 2019. Those holding a bachelor’s degree earned $502 more per week than a person with a high school diploma.

A person who started school at a four-year institution in the fall of 2015 and graduated in the spring of 2019 would have spent on average about $111,547 on their education, adjusted for inflation. The average American with a bachelor’s degree would earn back the cost of their college education in additional earnings in about four and a quarter years of work with their starting wage compared to someone with a high school diploma. This does not include potential earnings lost by being a student rather than working for four years.

The cost of college for a 2000 graduate was $71,533 when inflation-adjusted to 2019 dollars. That person’s starting wage would average $690 more per week than a person with a high school diploma. Class of 2000 graduates’ starting wages would meet the cost of college in about two years, less than half the time of the class of 2019.

This analysis does not consider the impact of student loans on college students . For those holding student loans, the cost of monthly payments and the interest accrued is an additional financial impact of attending college. Student loan debt, both federal and otherwise, hits lower-income families the hardest. Among households with student loans in the bottom 20% of income earners in 2019, median debt was $15,000 — or 92% of their median income. The US reported $1.6 trillion in federal student loan debt in 2020, almost triple the amount of debt in 2007.

Read more about the state of education at The State of the Union in Numbers and get the data directly in your inbox by signing up for our newsletter.

Correction: A previous version of this piece mislabeled the year in the headline of the first chart as 2019 rather than 2000.

Data shown for rate of bachelor's degrees or higher among occupational groupings is based on the IPUMS-standardized variable OCC90LY. The professional specialty category includes engineers, math and computer scientists, natural scientists, health practitioners, therapists, teachers, librarians, social scientists, social, recreation, and religious workers, lawyers and judges, and writers, artists, entertainers, and athletes. For more information, see the link to the IPUMS CPS data.

Explore more of USAFacts

Related articles, which states have the highest and lowest adult literacy rates.

Virtual school, mask mandates and lost learning: COVID-19's impact on K-12 schools

How often do teacher strikes happen?

Who are the nation’s 4 million teachers?

Related Data

College enrollment

18.99 million

College enrollment rate

College graduation rate at two-year institutions, within three years of start

College graduation rate at four-year institutions, within six years of start

Data delivered to your inbox.

Keep up with the latest data and most popular content.

SIGN UP FOR THE NEWSLETTER

Strategies for Increasing School Fees in your School

Adesola Adedoyin

Running a school costs a lot of money, and these costs only keep increasing yearly. School businesses are almost like private businesses; they receive less financial support from the government, and as such, requires the school owners to spend from the little they have. To meet up with some of the school's goals or to raise the school's standard, school owners increase their school fees occasionally. This way, they can provide more quality services to the students and staff and also improve the school environment.

School fees increment is usually a contentious issue between parents and school owners, especially for parents who do not earn much. The list of things parents pay for every term for their children is usually a burden to some parents, and the thought of having to pay more can sometimes lead to anger or disagreements from the parents. While you may need to increase your school fees as a school owner, you would not want to upset parents in the process. How then do you go about this?

Below are some strategies you can adopt for increasing school fees in your school. These strategies were birthed from a conversation with some school owners a few days ago, and might be helpful for your school:

- Draw out a plan for school fees increment: Many parents get furious when they hear you're increasing your school fees too often. A more considerable way to increase school fees is by drawing out a plan. For instance, you can decide to increase school fees every three or four years, as it suits your school structure best. You can also choose a certain percentage for the increment, maybe 10% or 15% every three or four years. This way, it remains consistent and parents can prepare ahead for it, rather than being caught unawares.

- Carry the parents along: Parents like being involved in every part of the school's activities and development as it concerns their children too. The reason for setting up a PTA in your school is to communicate effectively to parents about developments in your school. This can be a good way to inform parents about school fees increment and the need for it. Otherwise, you can send out emails or messages to them conveying the information. You should inform parents about the decision 6-8 months before you begin to implement it. Every parent wants the best for their children, and if you're looking to improve your school to serve students with the best services you can render, then there should be no reason why parents will disagree with you. Don't let important information catch them unawares; carry them along and make them see reasons too.

- Create a convenient payment strategy for parents: School fees increment always comes as a big blow for parents; especially the low-income earners. One way to calm parents when raising this topic with them is to also provide solutions that are suitable to them. It's not usually convenient for some parents to pay huge sums of money at once. So, you can recommend a two-part payment strategy for paying school fees. This can either be 50% at the beginning of the term and the remaining 50% at the middle of the term. It can also be a 60/40% payment; however it suits your school structure. This way, parents are more encouraged to pay quickly and conveniently.

Parents do not love having to pay higher school fees, but it remains that schools often need to implement school fee increment regardless. There are several strategies for doing this, and your school's structure should be considered closely when determining which strategy works best.

Read this next

8 Financial Statements School Owners Should Have at their Fingertips

Mar 11, 2021.

In a digital world where most transactions are done and saved online, how do you get access to your fina...

Should Students be Given Assignments on Mid-Term Breaks?

Mar 4, 2021.

Mid-term holidays, whether 1 week or 3-days are meant to be an opportunity for students to rest, unwind...

Home — Essay Samples — Education — College Tuition — Is The Cost Of College Too High: Argumentative Analysis

Is The Cost of College Too High: Argumentative Analysis

- Categories: College Tuition

About this sample

Words: 1110 |

Published: Sep 5, 2023

Words: 1110 | Pages: 2 | 6 min read

Table of contents

Introduction, the cost of college, the value of a college degree, the rising cost of tuition and fees, the impact of student loan debt on graduates, the economic benefits of a college degree, the non-financial benefits of a college degree.

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Verified writer

- Expert in: Education

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

2 pages / 761 words

3 pages / 1460 words

3 pages / 1182 words

1 pages / 472 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on College Tuition

Anyone who has ever attended college or thought about attending college has noticed that participating in any sort of higher education is costly. Many families are able to put their kids through school with the help of student [...]

Should college be free? Argumentative essay on this issue is worth writing. Yes, some students, parents, and educators say that it is completely wrong for a person to attend public schools for free and now have them pay for [...]

Recently, politicians all across the United States have debated over the topic of whether college should be free or not. Although it sounds like an incredible idea, it definitely has its flaws. There are a variety of issues [...]

There are several ways on how students can pay their college funds, those ways are discussed below: Students should apply as many scholarships and grants as possible. The money paid by the scholarships go [...]

The debate on whether college education should be free is a heated one, with both sides coming up with convincing arguments in support of their opinion. There exist many varied perspectives with divergent views on the matter. [...]

Thinks about your college experience, are you still paying student loans, did you go to college at all, or did college put a financial burden on your parents and loved ones? If you did not grow up in the 1% of wealthy families [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Announcing a Tuition Increase: Write a Benefit-Based Letter

School Heads //

September 21, 2016

Typically, those involved in setting and announcing tuitions fear that parents will complain and rebel at any increase. Will you lose families? Will there be angry telephone calls and demands for meetings? Will there be negative feedback on social media? You need not worry if you plan your announcement in a way that highlights your reasonable cause for raising tuition— the benefits for the students.

Announce tuition in a letter to current parents, with a tuition chart. You will also want to create and attach the data sheet referenced in the letter. The letter should be signed by the person who has the most “clout” with constituents—you, the School Head.

The letter is your opportunity to give the rationale behind the tuition increase. Recognize that everyone expects schools to need to raise tuitions each year (and you should!). When you understand the way parents think about your school, you can draft a letter that not only states the price, but reinforces the value they get for their tuition “investment.”

Simply remind parents that to stay even, your tuition income for the 12 months (ending in June of next year) must account for inflation. In addition, share with them the 2%+ rule on “disguised” inflation. These factors alone mean that to stay current in 3% inflation, you must recast your tuition figure(s) by a minimum of 5%. Emphasize the term “recasting.” This is what you are doing: converting “old” dollars into “new.”

There is no need to apologize for new tuition figures. Don’t include statements like, “We are sorry to inform you ....” Give parents the essential parts of the data you used to set next year’s tuition. Stress that if the quality of your school’s program is compromised, their children lose.

If you are going to increase tuition beyond the recasting, let parents know why the added funds are needed. Tell them, for example, that you have recast tuition by 5% and have added 2% largely to increase teacher salaries. Distinguish between the need for recasting and the reasons behind any increase.

Consider the following tips as you develop your own letter.

- Personalize the letter by using the parents’ names—first names, if this fits your school’s culture. A “Dear Parent” salutation diminishes your relationship with them. The parent needs to know that this letter is for her or him as an individual and that you care about the family.

- Ensure the tuition you charge is part of a plan, and the plan is transparent to your constituents. How you present this document publicly is a function of your own culture, but it should be accessible, e.g., through your website.

- Tell parents about your school’s finances, without belaboring the point. For many schools, tuition does not cover the operating costs—and the projected increase will not change that fact. If your school does cover 100% of its expenses with hard income (tuition, fees, and other billed items, this shows your exceptional stewardship.

- Sell the value of the tuition increase. Even where you anticipate nothing new, stress the ability of tuition to provide the best possible faculty, program that delivers the mission, and various opportunities for the child to grow. Where tuition provides funds over and above covering inflation, you can really get excited about what’s new and upcoming. What can parents and their children look forward to, and how will they benefit?

- Explain how most students at the school will benefit. Parents have more sympathy for expenses that benefit other children at the school, even if those funds do not directly benefit their child.

- Let parents know that financial aid available, even if they don’t need it. Indicate that any family that finds the increase to be a true burden is invited to apply for financial aid. In doing so, you reinforce for parents that you do not intend tuition to be a barrier to remaining at the school. This sense of “belonging”—the message that the school is concerned about supporting must be addressed in this letter. (You may also want to send a variation of the announcement letter to families currently receiving financial aid.)

- In the final paragraph, portray confidence and address the stability and viability going into the future. This should not be a “schmooze” statement. Focus on how the increase in tuition helps the faculty, staff and Board better serve families, and how it ensures a stronger future for the school.

- Create an enclosure or attachment setting out the tuition new rates. For schools with a single, schoolwide tuition, that figure can be included in the first paragraph. However, if there are any complicating factors at all—e.g., division- or grade-level pricing, payment plans, half-day options—don’t incorporate myriad numbers or tables in the letter.

The enrollment form should not go with the tuition announcement letter. That document should follow two to four weeks later so the discussion about money has a chance to die down and parents can make their re-enrollment decision based on value, not price.

Additional ISM resources: The Source for School Heads Vol. 9 No. 2 Cutting Tuition is Not the Answer—Keep Your School Accessible

Additional ISM resources for Gold Consortium members: I&P Vol. 38 No. 14 Erroneous Premises Employed in Tuition Setting I&P Vol. 40 No. 2 Consolidate and Coordinate Your Parent Communications I&P Vol. 40 No. 7 The Dynamics of Flattened Tuition Gradients: Endowments and Other Revenue Won’t Help

Share this article: | |

PROFESSIONAL DEVELOPMENT FOR PRIVATE SCHOOL LEADERS

Explore ISM’s 40+ professional development events.

Develop new skills, gain confidence in your role, and lead with clarity. Be mentored by leaders who are experts in their field, many currently working in private schools today. Get hands-on experience, network with fellow school leaders, and walk away with an action plan you can use the minute you return to campus.

SEE ALL EVENTS

Upcoming Events

1/29/2024 — 1/31/2024

Strategic Financial Planning: A Comprehensive Approach

Status: Open

More Events

IMAGES

COMMENTS

The increase in tuition fee actually outperformed the overall inflation rate. The increase in cost of college education in US could eventually put college education out of reach for . most Americans (National Center for Public Policy and Higher Education Report, 2011). This problem could also affect the global competitiveness of the United States.

Tuition is an increasingly important revenue source. After adjusting for inflation, the average undergraduate tuition, fees, room and board has more than doubled since 1964, from $10,040 to $23,835 in 2018. Tuition has recently grown the fastest at public and private non-profit institutions, for which tuition has gone up 65% and 50% ...

How recent inflation affects college revenue. Then inflation hit in the wake of the pandemic. Academic year inflation, from July to June, hit 5.3% and 8.5% in 2020-21 and 2021-22, respectively ...

The average college student paid $24,623 for tuition, fees, and room and board for a year of school in 2019, according to data from the National Center for Education Statistics. That is an increase of 59% compared to 2000, when the inflation-adjusted price was $15,485. Wages have not kept pace. Between 2000 and 2020, the Bureau of Labor ...

That’s a 250% increase over four decades. For private schools - The average total cost went from $16,213 in 1975 to $43,921 in 2015. That’s a 271% increase over four decades. Your next question, naturally, might be why we’ve seen such a rapid increase in the cost of a college education in the US over the past 40 years.

A more considerable way to increase school fees is by drawing out a plan. For instance, you can decide to increase school fees every three or four years, as it suits your school structure best. You can also choose a certain percentage for the increment, maybe 10% or 15% every three or four years. This way, it remains consistent and parents can ...

Introduction. The cost of pursuing a college education in the United States has increased dramatically over the past few decades. According to data from the National Center for Education Statistics, the average annual cost of tuition, fees, and room and board at a public 4-year university for the 2021-2022 school year was $22,700, nearly triple the inflation-adjusted cost from 20 years prior.

The brackets with their corresponding benefits are as follows: * Bracket A (income of over PhP1,000,000 annually) students pay the full tuition fee at PhP1,500 per unit * Bracket B (income of PhP500,001 to PhP1,000,000 annually) students pay only the base tuition at PhP1,000 per unit.

only a high school diploma, graduating with a bachelor’s degree is associated with an increase of 66 percent in lifetime earnings (U.S. Department of Education, 2020). Even so, there is the looming concern of higher college prices rising even more rapidly than inflation rates. A variety of scholars

Tell parents about your school’s finances, without belaboring the point. For many schools, tuition does not cover the operating costs—and the projected increase will not change that fact. If your school does cover 100% of its expenses with hard income (tuition, fees, and other billed items, this shows your exceptional stewardship.