Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Case Study on Journal Entries Requirements

Accounting entries are supposed to be made in accordance with the internationally recognized accounting standards. If an error is made, the income statement and the balance sheet at the end of the financial year will show incorrect balances. Accountants should be keen to note any cases of errors in the records made. If an error is recognized in the records, the accountant should correct immediately before posting the balances in the balance sheets and income statements.

Related Papers

Niamh M. Brennan

A multiple choice questionnaire (MCQ) style examination typically consists of 20/30 short statements, each of which is followed by a number of alternative answers. Only one answer is strictly correct. This allows the examiner to mark candidates' responses in an objective rather than subjective fashion. This style of examination question has recently been adopted by the Institute of Chartered Accountants in Ireland and is also used in third level institutions. MCQs have a number of advantages over traditional examination formats. First, they allow the examiner to ask questions on every topic on the syllabus and thus test the candidates range of knowledge. Perhaps more importantly, correction of answers is entirely objective and comparatively easy. Large numbers of scripts can be objectively tested in a short space of time. Objective tests can also be an effective teaching tool. The topics covered in each chapter are logically sequenced so that as the student progresses through the chapter they build up their knowledge and skills in relation to that topic. In addition, the book emphasises problem areas and attempts to help students avoid common mistakes in financial accounting. Thus the tutor can indicate the correct solution and also explain or seek responses as to why other plausible answers are incorrect to the given statement. Such a process should ensure greater understanding of the topic under discussion. This book is suitable for students taking introductory financial accounting examinations of the professional accountancy bodies, third level accounting students or other students studying introductory financial accounting courses. The three revision examinations at the end of this book are reproduced with the kind permission of the Institute of Chartered Accountants in Ireland.

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Journal Entries

Home › Accounting › Accounting Cycle › Journal Entries

- What is a Journal Entry?

1. Identify Transactions

2. analyze transactions, 3. journalizing transactions, common journal entry questions.

Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. For example, when the company spends cash to purchase a new vehicle, the cash account is decreased or credited and the vehicle account is increased or debited.

How to Make a Journal Entry

Here are the steps to making an accounting journal entry.

There are generally three steps to making a journal entry. First, the business transaction has to be identified. Obviously, if you don’t know a transaction occurred, you can’t record one. Using our vehicle example above, you must identify what transaction took place. In this case, the company purchased a vehicle. This means a new asset must be added to the accounting equation.

After an event is identified to have an economic impact on the accounting equation, the business event must be analyzed to see how the transaction changed the accounting equation. When the company purchased the vehicle, it spent cash and received a vehicle. Both of these accounts are asset accounts, so the overall accounting equation didn’t change. Total assets increased and decreased by the same amount, but an economic transaction still took place because the cash was essentially transferred into a vehicle.

After the business event is identified and analyzed, it can be recorded. Journal entries use debits and credits to record the changes of the accounting equation in the general journal. Traditional journal entry format dictates that debited accounts are listed before credited accounts. Each journal entry is also accompanied by the transaction date, title, and description of the event. Here is an example of how the vehicle purchase would be recorded.

Since there are so many different types of business transactions, accountants usually categorize them and record them in separate journal to help keep track of business events. For instance, cash was used to purchase this vehicle, so this transaction would most likely be recorded in the cash disbursements journal. There are numerous other journals like the sales journal, purchases journal, and accounts receivable journal.

We are following Paul around for the first year as he starts his guitar store called Paul’s Guitar Shop, Inc. Here are the events that take place.

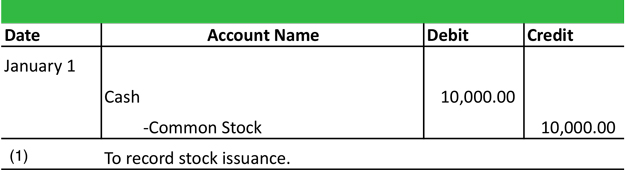

Entry #1 — Paul forms the corporation by purchasing 10,000 shares of $1 par stock.

Entry #2 — Paul finds a nice retail storefront in the local mall and signs a lease for $500 a month.

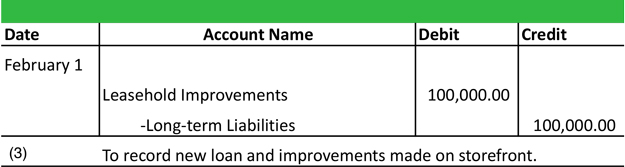

Entry #3 — PGS takes out a bank loan to renovate the new store location for $100,000 and agrees to pay $1,000 a month. He spends all of the money on improving and updating the store’s fixtures and looks.

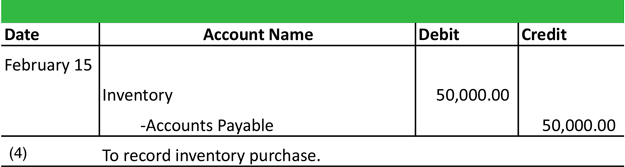

Entry #4 — PGS purchases $50,000 worth of inventory to sell to customers on account with its vendors. He agrees to pay $1,000 a month.

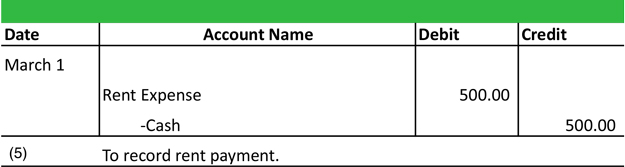

Entry #5 — PGS’s first rent payment is due.

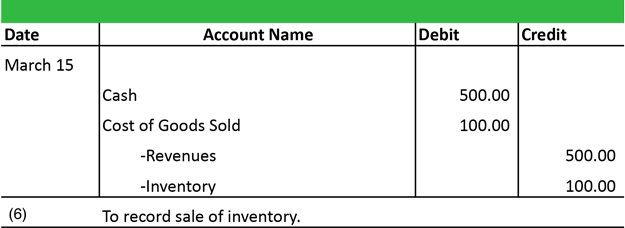

Entry #6 — PGS has a grand opening and makes it first sale. It sells a guitar for $500 that cost $100.

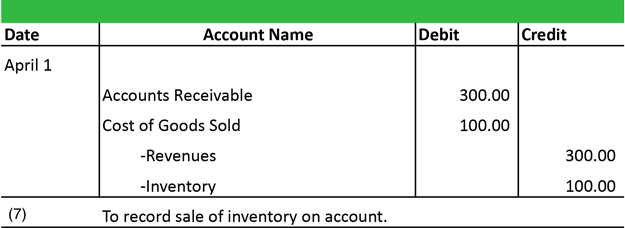

Entry #7 — PGS sells another guitar to a customer on account for $300. The cost of this guitar was $100.

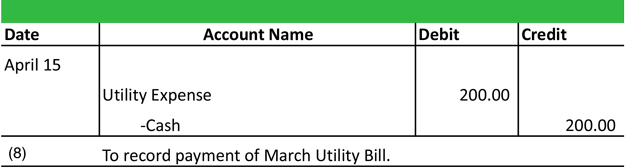

Entry #8 — PGS pays electric bill for $200.

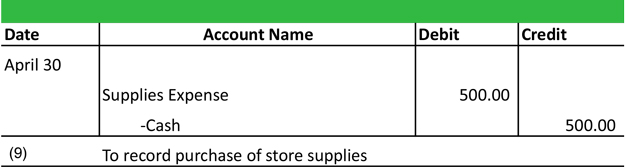

Entry #9 — PGS purchases supplies to use around the store.

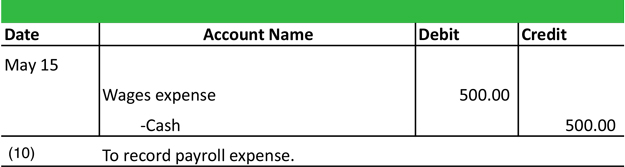

Entry #10 — Paul is getting so busy that he decides to hire an employee for $500 a week. Pay makes his first payroll payment.

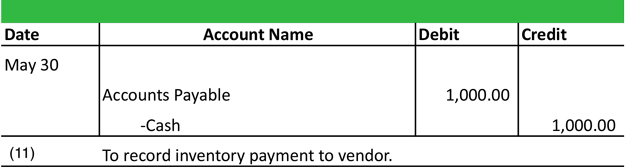

Entry #11 — PGS’s first vendor inventory payment is due of $1,000.

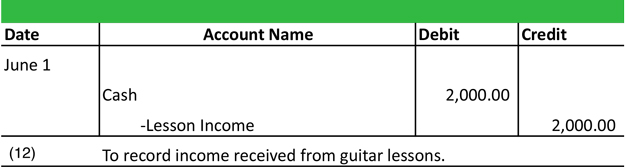

Entry #12 — Paul starts giving guitar lessons and receives $2,000 in lesson income.

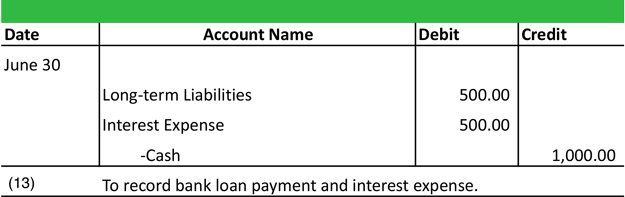

Entry #13 — PGS’s first bank loan payment is due.

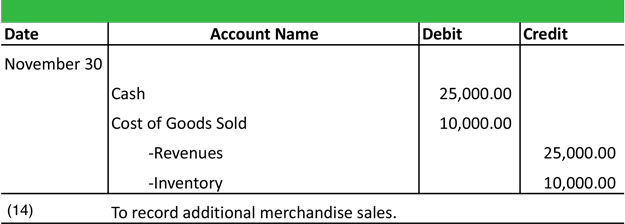

Entry #14 — PGS has more cash sales of $25,000 with cost of goods of $10,000.

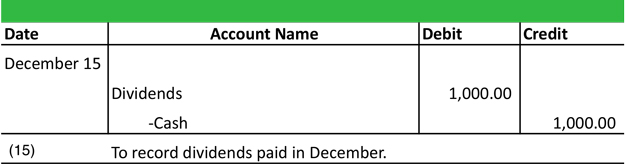

Entry #15 — In lieu of paying himself, Paul decides to declare a $1,000 dividend for the year.

Now that these transactions are recorded in their journals, they must be posted to the T-accounts or ledger accounts in the next step of the accounting cycle .

Here is an additional list of the most common business transactions and the journal entry examples to go with them.

- Depreciation Expense Entry

- Accumulated Depreciation Entry

- Accrued Expense Entry

What is a manual Journal Entry?

Manual journal entries were used before modern, computerized accounting systems were invented. The entries above would be manually written in a journal throughout the year as business transactions occurred. These entries would then be totaled at the end of the period and transferred to the ledger. Today, accounting systems do this automatically with computer systems.

What is a general journal entry in accounting?

An accounting journal entry is the written record of a business transaction in a double entry accounting system. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event.

What is the purpose of a journal and ledger?

The purpose of an accounting journal is record business transactions and keep a record of all the company’s financial events that take place during the year. An accounting ledger, on the other hand, is a listing of all accounts in the accounting system along with their balances.

What is the purpose of a journal entry?

A journal entry records financial transactions that a business engages in throughout the accounting period. These entries are initially used to create ledgers and trial balances. Eventually, they are used to create a full set of financial statements of the company.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Financial Statement Prep

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post Closing Trial Balance

- Reversing Entries

- Financial Statements

- Financial Ratios

- Introduction to Accounting Skills for Managers

- Key Accounting Concepts

- Accounting Business Transactions and the Accounting Equation

Accounting Skills - Case Study

- Rules of Debit and Credit

- Maintaining Accounting Records

- Cheat Sheet - Accounting for Common Business Transactions

Accounting Case Study - Journal Entries

- Accounting Case Study - General Ledger and Trial Balance

We had started our case study for explaining accounting concepts. You can view the case study introduction at the following link:

In this part, we present the journal entries for the transactions at Web Design Inc. We have prepared a PDF document containing the transactions and their respective journal entries.

These can be viewed below:

Lesson Resources

Free guides - getting started with r and python.

Enter your name and email address below and we will email you the guides for R programming and Python .

Take the Next Step in Your Data Career

Join our membership for lifetime unlimited access to all our data analytics and data science learning content and resources.

- +91-6239911499

- [email protected]

- UGC NET Paper 1

Journal, Ledger & Trial Balance (Financial Accounting) – Practical Problems and Solutions

Journal, Ledger and Trial Balance (Financial Accounting)

In this article, we will discuss the basic concepts of financial accounting i.e. journal, ledger, and trial balance as per financial accounting rules. In this topic, we also cover how to prepare journal, ledger, and trial balance with practical problems and solutions.

Types of Journal

There are two types of the journal in financial accounting:

- General Journal : General Journal is one in which a small business entity records all the day to day business transactions

- Special Journal : In the case of big business houses, the journal is classified into different books called as special journals. Transactions are recorded in these special journals on the basis of their nature. These books are also known as subsidiary books . It includes cash book, purchase day book, sales day book, bills receivable book, bills payable book, return inward book, return outward book and journal proper.The journal proper is used for entering infrequent transactions such as opening entries, closing entries and rectification entries.

Journalizing Process

The process of recording transactions in the journal is called Journalizing . The transactions are recorded in the journal in the manner of their occurrence along with a suitable explanation, called ‘ Narration ‘ which supports the entry.

The steps involved in the process of Journalizing in financial accounting are as under:

- Identification of Accounts : The first and foremost step in any given transaction is to identify the accounts which are being affected with it.

- Recognition of Account type : Once the accounts are identified, the type of account is ascertained, i.e. whether it is a personal account, real account or nominal account.

- Applying the golden rules of accounting : The rules of debit and credit, i.e. the golden rules of accounting are to be applied to the accounts which are affected by the transactions.

The debit and credit sides of the journal must be equal. There are some transactions in which you will find there are more than one debit for a single credit, more than one credit for a single debit or multiple debits and credits for an entry. Such entries are called as a compound journal entry . Nevertheless, the aggregate amount of debit and credit in an entry must tally.

Format of Journal

- Date : In this column, we mention the date of the transaction along with the month in which the transaction took place. The year is indicated at the top only once and not repeated with every date.

- Particulars : This column indicates the accounts which are affected, i.e. debited or credited, by the transaction. In the very first line, we write the account which is debited and then in the extreme right of the same line and column we write Dr. which indicates Debit.In the next line, after leaving some space, we write the account which is credited starting with the preposition ‘to’. A small narration for the respective transaction is given in the third line which explains the entry in the brackets, and it starts with the word ‘being’.

- Voucher Number : In this column, we enter the number written on the voucher of the concerned transaction.

- L.F. or Ledger Folio : As we know that transactions entered in the journal are then taken to the Ledger, in their respective accounts. In this column, the page number concerning the entry in the ledger is mentioned.

- Dr. Amount : The amount to be debited for a particular entry is written in the same line, where the debited account is indicated.

- Cr. Amount : The amount to be credited for a particular entry is written in the same line, where the concerned credited account is written.

All the columns are to be filled at the time of recording the transaction in the journal, except the ledger folio column which is filled when the transaction is posted to the ledger.

The journal entries may extend to multiple pages, and so both the two columns are totalled at the end of each page, with the word Total c/f , i.e. carried forward. Further, at the beginning of the next page, the amounts in debit and credit columns in the previous page is written with the words Total b/f , i.e. brought forward. Finally, on the last page of the entry, the Grand Total is written, and the columns are totaled.

Topic: Journal, ledger, and Trial balance (CONTINUE…)

Types of accounts.

To understand the Golden Rules of Financial Accounting we must first understand the types of accounts.

There are three types of accounts:

- Real Account

- Personal Account

- Nominal Account

A Real Account is a general ledger account relating to Assets and Liabilities other than people accounts. These are accounts that don’t close at year-end and are carried forward.

A Personal Account is a General ledger account connected to all persons like individuals, firms, and associations.

A Nominal account is a General ledger account pertaining to all income, expenses, losses, and gains.

Golden rules of accounting

Looking at the nature of all the accounts, the financial accounting rules have been devised. For each account, there is a set of Golden Rules and hence there are three Golden Rules of Accounting.

Illustration

An entity named Orange Ltd. has the following financial accounting transactions.

- It deposits Rs.10,000 into Bank

- It buys goods worth Rs.50,000 from Apple Ltd.

- It sells goods worth Rs.35,000 to Melon Ltd.

- It pays Rs.12,000 as Rent for its premises

- It earns Rs.3,000 as interest on bank account.

First of all, let us identify the accounts involved in these transactions and classify them into the different types of accounts:

Now applying the golden rules of Financial Accounting to each of the transactions we will get the following journal entries :

- Deposit Rs.10,000 in Bank

Both Bank and Cash are real accounts and so the Golden rule is:

- Debit what comes into the business

- Credit what goes out from the business

So the entry will be:

- Purchase goods worth Rs.50,000 from Apple Ltd.

The Purchase Account is a Nominal account and the Creditors Account is a Personal account.

Applying Golden Rule for Nominal account and Personal account:

- Debit the expense or loss

- Credit the giver

The entry will be:

- Sale of goods worth Rs.35,000 to Melon Ltd.

The sale account is a Nominal account and the Debtors Account is a Personal account.

Hence the Golden Rule to be applied is:

- Debit the receiver

- Credit the income or gain

Thus the entry will be:

- Pays Rs.12,000 as rent

Rent is a Nominal account and Bank is a real account.

The Golden Rule to be applied is:

- Credit what goes out of business

The entry thus will be:

- Earn Rs.3,000 as interest on Bank Account

Interest and Bank are Nominal account and Real Account.

The Golden rule to be applied is:

Hence the entry will be:

Topic: Journal, ledger, and Trial balance – Financial Accounting (CONTINUE…)

Format of ledger.

When the debit and credit items are transferred from a journal to the specific ledger accounts, the process is called as Posting. The rules with respect to the ledger posting are discussed as under:

- Individual accounts are to be opened in ledger books for each group, i.e. purchases, sales, cash etc. and the entries from the journal are posted to their account.

- It should be kept in mind that the account name used in the ledger should be the same used in the journal.

- In the date column, we enter the date of the transaction.

- While posting the entries in the debit side, we add the prefix ‘To’ with the concerned accounts posted in the particulars column and the prefix ‘by’ is used with the accounts entered in the particulars column of the credit part.

- When it comes to posting the entries, the accounts debited in the journal are to be debited in the ledger, however, reference is given to the concerned credit account.

- The accounts are balanced at the end of each month or the financial year. And to do so both sides are totaled first and then the difference between the two sides is ascertained. This difference is called the balance, which is added to the side which falls short. When the credit side is greater than the debit side, it is called a credit balance which is indicated as ‘To balance c/d’.On the other hand, when the debit side is in excess of the credit side it is termed as debit balance, which is indicated as ‘By balance c/d’. Here, the word c/d refers to carried down. Similarly while opening the account for the next month or period. The balance on the debit balance is taken to the debit side as ‘To Balance b/d’ and vice versa. The word ‘b/d’ expands to brought down.

- In the folio column, we will enter the page number of the journal from which entry is posted to the ledger.

- The amount column is filled with the respective amount against the entry.

Subdivision of Ledger

- Debtors Ledger : Debtors are the persons to whom goods are sold. So, it includes the accounts of individual trade debtors of the entity are covered in this category.

- Creditors Ledger : Creditors are the persons or firm from whom we purchase the goods. So, it encompasses the accounts of individual trade creditors of the business enterprise.

- Cash Book : It is the book that contains all the cash and bank transactions.

- Nominal Ledger : The ledger accounts relating to incomes such as Sales A/c, Rent received A/c, Commission earned A/c, Interest received A/c, etc. and expenses such as Wages A/c, Salaries A/c, Purchases A/c, Electricity A/c. Rent Paid A/c, Commission Paid A/c, etc. are covered in this category.

- Private Ledge r: The ledger in which entries concerned with assets and liabilities are entered is called Private Ledger.

3. TRIAL BALANCE

The statement which is prepared at a particular date with the ledger account balances to test the arithmetical accuracy of the ledger accounts and also to facilitate the preparation of financial statements is called a trial balance.

It is to be noted that trial balance is not an account; it is a mere statement.

A trial balance contains the columns – serial number of ledger accounts,

If a trial balance agrees i.e. a total of debit money column and a total of credit money column are equal, it proves that the ledger accounts are arithmetically accurate.

The famous writer R.N. Carter says;

A trial balance is a schedule or a list of balances both debit and credit extracted from the accounts in the ledger and including the cash and bank balances from the cash book.

According to J.R. Batliboi,

A trial balance may be defined as a statement of debit and credit balances extracted from the ledger with a view to testing the arithmetical accuracy of the books.

Characteristics of Trial Balance

It appears from the definitions of trial balance that the trial balance contains the following features;

- The trial balance is neither an account nor a part of it. It is a statement containing all balances of ledger accounts.

- It is not recorded in any book of account. The trial balance is prepared in a separate sheet of paper.

- The trial balance is prepared with the balances of accounts at the end of a particular accounting period. A trial balance is prepared before the preparation of financial statements at the end of the accounting period.

- The statement contains all kinds of accounts, irrespective of their classifications, such as assets liabilities, income-expenses, etc. It helps to test the arithmetical accuracy of accounts.

Objects of Trial Balance

Although trial balance is not an account, it is prepared to fulfill the following objects;

- The main object of the trial balance is to prove the arithmetical accuracy of accounts.

- It is prepared to check whether the debit and credit accounts of each transaction have been recorded properly.

- For the convenient preparation of financial statements, the trial balance is prepared to bring debit and credit ledger balances together.

- To proof the accurate balancing of a ledger account.

- To detect mistakes in the process of accounts, if any.

- To provide information to the proper authority in time.

- To compare the balances of various ledger accounts of the current year with those of the previous year.

Why do both Sides of Trial Balance Agree

According to a double-entry system every transaction is recorded in a journal debiting one account and crediting the other for the same amount of money with an explanation.

At the time of posting of the transaction from journal to ledger debit account of the journal is debited in the same account and the credit account of the journal is credited in the same account in the ledger.

As a result, a total of the debit balance of ledger accounts becomes equal to the total credit balance of ledger accounts.

Therefore, According to double-entry principle;

If all correctly drawn ledger accord balance is recorded in trial balance in debit and credit money columns properly, the totals of both columns of trial balance become equal.

Preparing Trial Balance From Journal and Ledger (How To)

To prepare a trial balance, first, we need to know to make sure the transactions are journalized and have been posted to ledgers.

The final balance from the ledger needs to be properly placed on the debit and credit column while preparing the trial balance, to make sure the accounting process is correct.

How to Prepare a Trial Balance

Business transactions are first recorded in the journal and thereafter these are posted in the ledger under different heads of accounts.

It may be mentioned that transactions may directly be posted in the ledger accounts without recording them in the journal.

At the end of a particular accounting period, a trial balance is prepared in a separate sheet of prescribed form recording debit ledger balance, in the debit column and credit ledger balances in the credit money column.

Besides ledger balances, cash balance, and bank balance of cash book of that particular date are also included in the trial balance.

Thereafter the total of debit and credit money columns of a trial balance is calculated. The agreement of trial balance is the conclusive evidence of the accuracy of the ledger and trial balance.

The format for Preparing Trial Balance

A short description of the format of the trial balance is given below:

- Titles: In the middle of the format name of the company, the trial balance and date of preparation are written.

- Accounts serial number: In this column, the serial numbers of ledger accounts are written.

- Account Titles: The serial number of that account of the ledger which has been written in the first column, the full title of that account is written in this column. For example, Capital account, Furniture account, Cash account etc.

- Ledger Folio: The number of the ledger page from where ledger balances are brought is written in this column.

- Debit balance: All debit balances of ledger accounts are written in this column.

- Credit balance: All credit balances of ledger accounts are written in this column.

Ledger Account Balance and Trial Balance

Rules for recording debit ledger account balances and credit ledger account balances in debit money column and credit money column of trial balance in absence of ledger account:

Important to remember:

- Opening cash and bank balance are not shown in the trial balance as these are included in closing cash and bank balances.

- Closing stock is not shown in the trial balance because this remains included with opening stock and purchase of the accounting year. But if opening stock and purchase remain absent in trial balance and the adjusted purchase is shown in the trial balance, in that case, the closing stock is shown in the debit money column of the trial balance.

PRACTICAL PROBLEM AND SOLUTIONS

Record the following transactions in the Journal and post them into the ledger and prepare a Trial Balance

Topic: Journal, ledger, and Trial balance – Financial Accounting (CONTINUE…)

General Ledger [Books of Mr. Neel]

Trial Balance [Modern Method]

Problem – 2

Enter the following transactions in the Journal and post them into the ledger and from the information obtained prepare a Trail Balance.

General Ledger [Books of Mrs. Roy]

Trial Balance [Modern Method]

FOR MORE Books / Notes / Study Material VISIT OUR BOOKSTORE-Click Here

Share this:.

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to email a link to a friend (Opens in new window)

You may also Interested in:

Dr. Gaurav Jangra

Dr. Gaurav has a doctorate in management, a NET & JRF in commerce and management, an MBA, and a M.COM. Gaining a satisfaction career of more than 10 years in research and Teaching as an Associate professor. He published more than 20 textbooks and 15 research papers.

Leave a Reply Cancel reply

Recently active members.

Popular Tags

Easy Notes 4U Academy is an Online Teaching & Learning Educational Portal for Competitive Exams.

- Our Founder

- Our Teachers

- Our Members

Important Links

- Account details

- Mohali, SAS Nagar, Chandigarh

Copyright © 2024. Easy Notes 4U Academy. Developed by iTech Web Solutions

- Refund Returns

- Data Deletion

You must be logged in to post a comment.

Insert/edit link

Enter the destination URL

Or link to existing content

This site uses cookies to store information on your computer. Some are essential to make our site work; others help us improve the user experience. By using the site, you consent to the placement of these cookies. Read our privacy policy to learn more.

- MANAGEMENT ACCOUNTING

Mastering accounting for business combinations

Mergers and acquisitions present challenges that finance can overcome by staying involved with the deal and preparing in advance of the closing..

- Management Accounting

- Accounting & Reporting

- FASB Financial Accounting & Reporting

- Managerial Financial Accounting & Reporting

When accountants face the prospect of a business combination, there will be many challenges to prepare for in the deal and the accounting for it.

One of the first challenges is the strategic decision - making about whether the deal is right from a business perspective.

"Statistically, acquisitions aren't successful a high percentage of the time," said Aaron Saito, CPA, CGMA, Capital Accounting controller at Intel Corp. "It's like a baseball batting average, where .300 to .400 is outstanding. If you're at this percentage for M&A, you're beating the average," he said.

There are deal activities usually led by those outside of finance, such as finding the right target, performing due diligence, setting the price, drafting a purchase agreement, and working with professionals to close the transaction.

"Much of the complexity in acquisitions results from stresses around negotiating the deal structure, like funding arrangements, tax considerations, and continuation or dismissal of the acquired entity's employees," said Susan Callahan, CPA, Ford Motor Co.'s director, Americas Accounting and Global Policy. "These are in addition to the technical complexity of financial reporting."

FASB' s RULES

FASB ASC Topic 805, Business Combinations , is a specialized accounting area that has evolved over the years and continues to be the subject of simplification initiatives by FASB. It is complex and may require CPAs to face new issues and apply certain accounting principles for the first time (see the sidebar, "Accounting Quick Tips," below).

"Unless you work for a company that is a serial acquirer, you are not applying acquisition accounting day to day, like you are other GAAP areas like revenue recognition and inventory accounting," said Greg McGahan, CPA, a partner at PwC. "Most companies only do one acquisition every couple of years, as it is only one path of a company's growth agenda. You may have to crack the books open and deal with a new accounting model, to refresh what you remember but also to keep up with the changes," he said.

To help accountants better anticipate and prepare for the challenges in business combinations, here are some things to consider.

INVOLVEMENT WITH THE DEAL

Since finance may not be leading the acquisition process, it is critical that it has a seat at the table and a strong partnership with the business development team throughout the transaction life cycle. In that way, finance will understand the deal's rationale, critical contract terms, and where the value drivers are.

"In a typical case, the business development group has done their due diligence, analyzed the target, developed the price, and determined the value drivers. Then the deal is closed, and the torch is passed to finance to do the acquisition accounting," McGahan said.

He said that if there is a lack of communication with the deal team, and finance doesn't understand the value drivers — such as a business that was acquired for a customer list or a platform that was too difficult to build internally — it will be much harder to apply acquisition accounting and properly value assets acquired and liabilities assumed.

Saito agreed that it is very important to understand the accounting ramifications upfront. "Once the ink is dry on the contract, you don't have options," he said. "And it's not easy to read purchase contracts. They can be 400 to 500 pages long, so it's easy for even the best accountants to miss something."

Finance needs to ensure that it does not get left out of the due - diligence process, because it can add value to the negotiations and help determine the best accounting and tax outcomes.

"Being part of due diligence can help finance understand the business being acquired and uncover areas where things can go wrong. Otherwise, you may not know what you don't know," said Linnae Latessa, CPA, corporate controller and chief accounting officer of USI Insurance Services.

Finance can reduce risks and avoid surprises by advising the due - diligence team against doing things in the transaction based on the potential financial impacts post - close , Saito said.

UNDERSTANDING GAAP

Accounting for business combinations is complex and requires considering a number of areas, including the following:

- Identifying business combination transactions.

- Identifying the acquirer.

- Determining the acquisition date.

- Measuring the consideration transferred.

- Recognizing and measuring the identifiable assets acquired and liabilities assumed, and any noncontrolling interests in the acquiree.

- Recognizing and measuring goodwill for a gain from a bargain purchase.

Topic 805 provides guidance on the accounting and reporting for business combinations to be accounted for under the transition method.

One of the biggest challenges in applying acquisition accounting is the requirement to estimate the fair value of assets acquired and liabilities assumed. Valuation is challenging and requires a lot of judgment, which needs to be supported. Irrespective of whether the valuation is performed internally within a company or by an outside third party, finance needs to be aware of fair value accounting requirements and involved in the valuation process.

"Fair value using the concept of what 'market participants' do in arm's - length transactions may be a foreign concept," said Saito. Also, things may need to go on the balance sheet that were never valued before, like internally developed intangibles, intellectual property, know - how , and brands.

Valuation is frequently based on cash flow models. "Does the company have cash flow models? If so, how do you adjust them to reflect market participant assumptions? Where are the cash flows associated with the valuation? How do you translate deal price of '10X EBITDA' into cash flows?" asked Saito.

Some companies may perform the valuation themselves internally. If they do, it is important for finance to have the necessary expertise and to work with the external auditors to make sure the documentation and support that finance develops for the acquisition accounting is adequate for the auditors' needs.

Many companies use third - party valuation firms for their fair value estimates. Latessa recommended that transactions over a determined dollar value have an outside valuation. If a third - party valuation firm is used, management must be comfortable with the outcome of its activities.

"The valuation firm works from the assumptions the company provides, such as revenues used to value trademarks, and specific customer revenues and attrition rates to value customer intangibles," said McGahan. "At the end of the day, the financial statements are the company's responsibility. Mistakes in valuation in the financial statements are on your watch."

McGahan also advised that successful companies have an integrated approach to the valuation process, which includes the business development team and finance. The valuation experts should be given the deal's model assumptions (discount rates, internal rate of return, hurdle rates, and cost of capital) and the final version of the deal model to use, and everyone on the team should review the valuation output for reasonableness.

"Work with a good quality valuation firm, ask a lot of questions, and understand how they come up with the values," Latessa said. "They know how to run models, but conceptually does the answer make sense? Should 50% of the deal value have gone to the customer list? They should be able to explain why it makes sense."

The amount attributed to goodwill should also be reasonable in relation to the purchase price.

"It's the residual, but accountants should be able to validate it," McGahan said. "If 40% of the purchase price is allocated to goodwill, does that make sense based on the deal or value drivers? Things like future customers, platform, and company - specific synergies all go to goodwill."

This approach will pay dividends in the end, especially since valuation is an area of high audit concern. Because of the prevalence of merger activity in recent years and the many subjective judgments and estimates involved in the business combination process, the PCAOB highlighted its concern about valuation risk in its August 2017 Staff Inspection Brief. The PCAOB also recently issued two new standards that affect auditing of valuations: Amendments to Auditing Standards for Auditor's Use of the Work of Specialists and Auditing Accounting Estimates, Including Fair Value Measurements, and Amendments to PCAOB Auditing Standards .

CHANGES TO GAAP

The fair value challenges aren't the only things that make business combination accounting complex. FASB is continuing to work on initiatives to simplify this area and improve comparability. In 2017, FASB issued guidance that clarified the definition of a business. FASB also has several projects on its agenda that may impact business combinations, including subsequent accounting for goodwill and accounting for certain identifiable intangible assets, as well as improving the accounting for business and asset acquisitions. The experts interviewed for this article all agreed that these efforts have been helpful and made things better operationally.

FASB has also developed private company alternatives related to accounting for business combinations (see " Private Company GAAP Alternatives: It's Not Too Late ," page 32). However, the practical expedients for private companies should be used only if the company's financial statements stay in the private domain and the banks will accept this format. McGahan advised: "Most companies doing acquisitions will need to access capital markets to raise money, so financial statements may need to be SEC - compliant ."

Financial statement disclosures for business combinations can be extensive, especially for larger transactions.

"The critical assumptions regarding opening day balance sheet values are important for financial statement users," said McGahan. "They need transparent disclosure of significant acquisition accounting assumptions and estimates that are not [derived based on] observable inputs, including how they were developed."

For SEC registrants, operating segments may change based on how the new business will be managed going forward. In addition to the financial statements, there are also management's discussion and analysis (MD&A) and description of business sections to develop and prepare within filing deadlines.

Latessa recommended that accountants look at disclosures of other companies that have done acquisitions, along with networking with peers and others in their network or industry to ask if they have had the same issues that may need to be disclosed. She also recommended getting the auditors comfortable with disclosures in advance, getting their guidance on the requirements, and asking them what their other clients have disclosed in specific situations.

AFTER THE TRANSACTION CLOSES

After the business combination closes, accountants must contend with financial reporting challenges. "You can't just mush the results of the target in with the existing business," said Saito. " Post - close , it's disruptive."

Hopefully, there have been operational discussions in advance about how the new business will be managed, whether as a stand - alone or integrated business. "There may also be challenges with 'operationalizing' the acquisition accounting after day one," McGahan said, "like whether to track acquisition accounting at the parent or push down to a subsidiary, and how to deal with international transactions' foreign currency and deferred tax issues."

The closing process may become very challenging. Accounting policies and practices may be different and may have to be conformed. This may be an opportunity to evaluate existing accounting methods and make changes. There can also be timing issues if the acquired company takes longer to close its books.

If there are different ledgers and enterprise resource planning systems, automatic consolidation may not be possible and manual processes may have to be used. There will likely be system integration issues, especially if the acquired company is smaller and uses QuickBooks. System conversions will require additional reconciliations and verification of data. McGahan recommended that companies' due diligence include IT due diligence upfront to understand the target's IT and financial reporting and plan for it. "The best companies have dedicated teams to integrate IT post - closing to get the target on the same systems," he said.

"The two companies' accounting and finance departments need to form a partnership," said Saito. "Workflows may need to change, and change doesn't happen overnight."

Latessa agreed. "You may need to retrain the acquired company's people," she said. "This results in operational risks that can manifest themselves in the financial statements, so you need to be diligent in reviewing the financial statements when there are new employees involved." She has also experienced situations where the finance staff did not transfer to the acquiring company, so legacy knowledge and experience were lost. She said that in cases where a company buys a portion of another company, the acquired company's accounting may have been done at the corporate level, and it can take six months to a year for the acquirer to understand the business it bought.

Since post - close accounting is difficult, GAAP allows up to a year post - acquisition to finalize acquisition accounting and measurement period adjustments. But in some cases, there may only be 30 to 60 days to do a working capital true - up .

"The further away from the close date it is, the harder it is to remember, and people get busy with other things," Saito said.

Material adjustments to the acquisition accounting made too late can be considered errors as well as deficiencies of internal controls that could require financial reporting disclosure. Saito suggested that acquisition accounting be run like a project, with finance as the project manager, providing all involved departments a calendar of key dates and activities up to the earnings release so that everyone is aware of what has to be done and who has to review it.

Beyond the book close, reporting needs to be in place, including metrics and dashboards for management about the acquired business. A cash flow process should be developed to support the business after the close.

This requires planning in advance. "CFOs and boards of directors do not like surprises," Saito said. "Management needs to be aligned with finance upfront about what to expect."

INTERNAL CONTROLS

To address the issues related to business combinations, it is critical that companies implement internal controls over the integration process. "From my experience, the post - combination accounting is less an issue than is the integration of the acquired entity. Challenges associated with integrating a new company are often dependent on size and scale, but the acquirer may need to consider new systems, processes, and, most importantly, controls," Callahan said.

Another big challenge relates to the controls over the business combination process itself, especially in a company where this may not happen often.

"How robust your process is depends on the frequency of acquisitions. The harder part is that if they are infrequent, you may not know what you should be looking for," Saito said.

McGahan agreed: "Companies have spent their time and effort to develop controls around ongoing daily processes but may not have robust controls for business combinations and struggle with what these are. There is a set of specific controls and procedures that should be in place ... But companies don't spend sufficient time developing these if they are only doing a few transactions."

Post - acquisition , until there is one integrated process with combined controls, companies may struggle to comply with internal control frameworks and Sarbanes - Oxley (SOX) requirements.

"You will have to do more to get your auditors through their test work," Latessa said. "There may be extra work and cost for them to look at both companies' processes, sample sizes will likely be higher, and they will have to do more substantive work."

Under SOX Section 404, public companies must include an internal control report with management's assertions about the effectiveness of the company's internal control over financial reporting, and their auditors must attest to its effectiveness. There are SOX implications relating to the acquirer's internal controls over the acquisition accounting and financial statement consolidation processes, along with the acquired company's own internal controls over financial reporting. If it is not possible for the acquiring company to complete its assessment of internal control over financial reporting of the acquired entity between the acquisition date and the acquirer's year end, in order to assess and report on its own internal controls over financial reporting on a consolidated basis under SOX Section 404(b), there is a relief period of one year from the date of the acquisition during which it may exclude the acquisition from its assessment. Despite this relief, necessary controls should be designed and implemented as quickly as possible.

Another internal control issue is documentation. "If I think about controls that need to be in place, in my experience, substantively companies are doing the work that they need to do. They are not doing big transactions blindly, they have talked to their boards, and management time has been spent," McGahan said. "They do have support for what they've done, but they don't have the documentation all in one place. One of the biggest challenges auditors have is that companies have to go back and pull together documentation around what they've done so that auditors are able to reperform the control."

A company that is doing a material acquisition may wish to talk to its auditors in advance about what controls might be needed, Saito suggested. "This helps with the audit and also gets management comfortable that they have the right controls in place," he said. "No one wants to have an internal control issue down the line."

Accounting quick tips

These simple ideas can aid in M&A reporting. The following general advice can help organizations skillfully handle business combination accounting:

- “Plan, plan, plan,” and communicate upfront and throughout.

- Be proactive rather than reactive. You will have more time to think about, prioritize, and address the issues.

- Finance should be involved in the deal from the beginning and play a key role throughout the process to reduce surprises.

- Timelines and deadlines should be set for the integration of processes and people.

- Experience helps. As you go through more of these transactions, everyone on the team will be better educated about what finance needs to do.

- Reach out to your auditors as a resource, even if you are only thinking about doing a transaction, and be transparent with them if you do.

- Early in the process involve valuation specialists (whether internal or external) who will value assets acquired and liabilities assumed.

About the author

Maria L. Murphy, CPA , is a freelance writer based in North Carolina.

To comment on this article or to suggest an idea for another article, contact Ken Tysiac, the JofA 's editorial director, at [email protected] or 919-402-2112.

AICPA resources

- " After the Merger: Creating a Culture of Success ," JofA , Dec. 2018

- " Not-for-Profits Teaming Up to Fulfill Missions ," JofA , Nov. 2018

- " Tax Compliance After M&As ," JofA , Dec. 2017

Publication

Editor's note: The AICPA is developing a Business Combinations accounting and valuation guide that is expected to be released for feedback in 2020.

CPE self-study

- Advanced Income Tax Accounting — Tax Staff Essentials (#157834, online access)

- CEIV for Finance Professionals: CEIV Education and CEIV Exam (#158530-CEIVLQN, education bundle; #16-XAM-CEIVLQN, CEIV exam). The Certified in Entity and Intangible Valuations (CEIV) credential program is designed to enhance credential holders' commitment to enhancing audit quality, consistency, and transparency in fair value measurements for financial reporting purposes.

For more information or to make a purchase, go to aicpastore.com or call the Institute at 888-777-7077.

Where to find April’s flipbook issue

The Journal of Accountancy is now completely digital.

SPONSORED REPORT

Manage the talent, hand off the HR headaches

Recruiting. Onboarding. Payroll administration. Compliance. Benefits management. These are just a few of the HR functions accounting firms must provide to stay competitive in the talent game.

FEATURED ARTICLE

2023 tax software survey

CPAs assess how their return preparation products performed.

- Accountancy

- Business Studies

- Commercial Law

- Organisational Behaviour

- Human Resource Management

- Entrepreneurship

- CBSE Class 11 Accountancy Notes

Chapter 1: Introduction to Accounting

- Introduction to Accounting

- Types and Users of Accounting Information

- Difference between Bookkeeping and Accounting

- Accounting: Objectives, Characteristics, Advantages, Disadvantages and Role of Accounting

- Basic Accounting Terms

- Difference between Accounting and Accountancy

Chapter 2: Theory Base of Accounting

- Accounting Standards : Need, Benefits, Limitations and Applicability

- IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles)

- Difference between Cash Basis and Accrual Basis of Accounting

- Accounting Concepts

- Systems and Basis of Accounting | Single and Double Entry System

Chapter 3: Recording of Business Transactions

- Accounting Voucher: Format & Types of Vouchers

- Accounting Equation: Meaning, Format, Effect and Rule of Posting

- Accounting Equation | Increase in Assets and Capitals both and Increase in Assets and Liability both

- Accounting Equation | Decrease in Assets and Capital both and Decrease in Asset and Liability both

- Accounting Equation|Decrease in Capital and Increase in the Liability, Decrease in Liability and Increase in the Capital and Increase and Decrease in Assets

- Accounting Equation|Sale of Goods and Calculation of Net Worth (Owner's Equity) Or Capital

- Journal Entries

- Journal Entry Questions and Solutions

- Rules of Journal Entry

- Cash Book: Meaning, Types, and Example

- Purchase Book : Meaning, Format, and Example

- Sales Book: Meaning, Format and Example

- Purchase Return Book : Meaning, Format, and Example

- Sales Return Book: Meaning, Format, and Example

- Journal Proper: Meaning, Format and Examples

Chapter 4: Bank Reconciliation Statement

- Bank Reconciliation Statement (BRS) | Full Form of BRS and Need of BRS

- Difference between Bank Statement and Bank Reconciliation Statement

- Preparation of BRS without correcting Cash Book

- Preparation of Bank Reconciliation Statement with Amended Cash Book

Chapter 5: Depreciation, Provisions, and Reserves

- Depreciation: Features, Causes, Factors and Need

- Methods of charging Depreciation

- Straight Line Method of Charging Depreciation

- Written Down Value (WDV) Method of Depreciation

- Difference between Straight Line and Written Down Value Method of calculating Depreciation

- Provisions in Accounting - Meaning, Accounting Treatment, and Example

- Reserves in Accounting: Meaning, Accounting Treatment, Importance, and Example

- Difference between Provisions and Reserves

- Reserves and its Types

- Difference between Capital Reserve and Revenue Reserve

Chapter 6: Trial Balance and Rectification of Errors

- Trial Balance: Meaning, Objectives, Preparation, Format, and Example

- Types of Errors in Trial Balance

- Detection and Rectification of Errors in Trial Balance

- Suspense Account : Meaning, Journal Entry & Format

Chapter 7: Bills of Exchange

- Bills of Exchange: Meaning, Features, Parties, and Advantages

- Promissory Note: Features and Parties

- Difference between Bills of Exchange and Promissory Note

- Important Terms in Bills of Exchange

- Accounting Treatment of Bills of Exchange

Chapter 1: Financial Statements

- Financial Statements : Meaning, Objectives, Types and Format

- Financial Statement with Adjustments

- Financial Statement with Adjustments ( Journal Entries )

- Financial Statement with Adjustment with Examples-I

- Financial Statement with Adjustment with Examples-II

- Financial Statement with Adjustment with Examples-III

- Financial Statement with Adjustment with Examples-V

- Financial Statement with Adjustment-Loss of Insured Goods & Assets (All three cases)

- Stakeholders and their Information Requirements

- Capital Expenditure | Meaning, Example and Accounting Treatment

- Trading and Profit and Loss Account: Opening Journal Entries

- Operating Profit (EBIT): Meaning, Formula and Example

- Balance Sheet: Meaning, Format, Need and Objectives

- How to prepare a Balance Sheet?

A Journal is a book in which all the transactions of a business are recorded for the first time. The process of recording transactions in the journal is called Journalising and recorded transactions are called Journal Entries.

Every transaction affects two accounts, one is debited and the other one is credited. ‘Debit’ (Dr.) and ‘Credit’ (Cr,) are the two terms or signs used to denote the financial effect of any transaction. The word ‘journal’ has been derived from the French word ‘JOUR’ meaning daily records. Journal Book is maintained to have prime records for small firms. After preparing the journal book, the transactions are then posted to Ledger.

Steps to be followed to record business transactions in a journal are:

- Ascertain the accounts related to a particular transaction.

- Find the nature of the related account.

- Ascertain the rule of debit and credit, applicable to the related account.

- Record the date of the transaction in the ‘Date Column’.

- Write the name of the account to be debited in the particulars column along with the abbreviation ‘Dr.’ and the amount to be debited in the debit amount column.

- Write the name of the account to be credited in the next line starting with ‘To’ and the amount to be credited in the credit amount column.

- Write a brief explanation of the transaction as narration.

- Draw a line across the entire particulars column to separate one journal entry from the other.

Table of Content

- Capital Account

- Drawings Account

- Expenses Paid

- Income Received

- Transactions

- Depreciation

- Amount Paid or Received in Full/Final Settlement

- Compound or Composite Journal Entry

- Opening Journal Entry

- Banking Transactions

- Bad Debts Recovered

- Loss of Insured Goods/Assets

- Outstanding Expenses

- Prepaid or Unexpired or Advance Expenses

- Income Due or Accrued Income

- Income Received in Advance or Unearned Income

- Life Insurance Premium

- Employee’s Life Insurance Premium

- Interest on Capital

- Interest on Drawings

- Use of Goods in Business

- Expenditure on Assets (Erection or Installation)

- Expenses on Purchase of Goods

- Outstanding Salary

- Prepaid Insurance

- Commission Received

- Salaries Paid

- Deferred Revenue

1. Capital Account

The amount invested in the business whether in the means of cash or kind by the proprietor or owner of the business is called capital. The capital account will be credited, and the cash or assets brought in will be debited.

Journal Entry:

Capital Account Journal Entry with Examples

2. Drawings Account :

Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings. The Drawings account will be debited, and the cash or goods withdrawn will be debited.

Journal Entry:

Drawings Account Journal Entry with Examples

3. Expenses Paid :

Any amount spent in order to purchase or sell goods or services that generates revenue in the business is called expenses. The Cash Account will be decreased with the amount paid as expenses, so it will be credited and Expenses will be debited.

Expenses Paid Journal Entry with Examples

4. Income Received :

Any monetary benefit arising from the business can be termed as income. The Cash Account will be increased with the amount received as income, so it will be debited and Income Account will be credited.

Income Received Journal Entry with Examples

5. Goods :

Goods are those items in which a business deals. In other words, goods are the commodities that are purchased and sold in a business on a daily basis. Goods are denoted as ‘Purchases A/c’ when goods are purchased, and ‘Sales A/c’ when they are sold.

Goods Account is classified into five different accounts for the purpose of passing journal entries:

A. Purchases Account: When goods are purchased in cash or credit, donated, lost, or withdrawn for personal use, in all these cases, goods are denoted as Purchases A/c.

- Goods purchased for cash

- Goods Donated

- Goods are withdrawn for personal use

- Goods lost by fire

B. Sales Account: When goods are sold, then it is represented as Sales A/c.

C. Purchase Return or Return Outwards Account: When purchased goods are returned to the supplier, it is denoted as Purchase Return A/c or Return Outwards A/c.

D. Sales Return or Return Inwards Account: When goods sold are returned by the customers, it is termed as Sales Return or Return Inwards A/c.

E. Stock: The left over unsold goods at the end of a financial year is represented through stock. Closing Stock is the valuation of goods leftover at the end of a financial year, and Opening Stock is the valuation of goods an enterprise has at the beginning of a financial year.

Goods Journal Entry with Examples

6. Transactions :

Transactions related to the purchase and sale of goods can be of two types, Cash or Credit.

A. Cash Transactions: Cash transactions are those transactions in which payment is made or received in cash at the time of purchase or sale of goods. Cash transactions can be identified by-

- When the Name of the Party and Cash both are given in the transaction;

- When only Cash is given in the transaction;

- When the Name of the Party and Cash both are not given.

B. Credit Transactions: Credit transactions are those transactions in which payment is not made or received at the time of purchase or sale of goods. Credit transactions can be identified by:

- When only the Name of the Party is given in the transaction.

Cash & Credit Transactions Journal Entry with Examples

7. Assets :

Assets (Machinery, Building, Land, etc.) can also be purchased or sold in cash or on credit. It is not represented through Purchases, but with the name of the Asset.

Journal Entry: (When Assets are Purchased)

Journal Entry: (When Assets are Sold)

Assets Journal Entry with Examples

8. Depreciation :

Depreciation is the decrease in the value of assets due to use or normal wear and tear.

Depreciation Account Journal Entry with Examples

9. Discount :

A discount is a concession in the selling price of a product offered by a seller to its customers. According to nature, there are two types of discount:

A. Discount Allowed

B. Discount Received

A. Discount Allowed: When at the time of sales or receiving cash, any concession is given to the customers, it is called discount allowed.

B. Discount Received: When at the time of purchase or paying cash, any concession is received from the seller, it is called discount received.

According to the business point of view, there are two types of Discount:

A. Trade Discount

B. Cash Discount

A. Trade Discount: The discount provided by the seller to its customers at a fixed percentage on the listed price mostly on bulk purchases is called a trade discount. Trade discount is not shown separately in the journal entry.

B. Cash Discount: A Cash discount is offered to those customers who make quick payments or payment is made by them within a fixed period.

Discount Journal Entry with Examples

10. Amount Paid or Received in Full/Final Settlement :

A business may allow or receive a discount at the time of full and final settlement of the accounts of debtors or creditors.

Amount Paid or Received in Full/Final Settlement Journal Entry with Examples

11. Compound or Composite Journal Entry :

When certain transactions of the same nature happen on the same date, it is preferred to pass a single journal entry instead of passing two or more entries.

Compound or Composite Journal Entry with Examples

12. Opening Journal Entry :

After closing all the books at the end of a financial year, every business starts its new books at the beginning of each year. Closing balances of all the accounts are carried forward to the new year as opening balances. As it is the first entry in the new financial year, it is called Opening Journal Entry.

Opening Journal Entry with Examples

13. Bad Debts :

When the goods are sold to customers on credit, there can be a situation where a few of them fail to pay the amount due to them because of insolvency or any other reason, the amount that remains unrecovered is called Bad Debts.

Bad Debts Journal Entry with Examples

14. Banking Transactions :

All businesses make many transactions with the bank in their day-to-day activity. Journal Entries related to banking transactions are as follows:

1. When cash is deposited in the bank:

2. When cash is withdrawn from the bank:

3. When cash is withdrawn from the bank for personal use:

4. When the cheque, drafts, etc. received from the customers are not sent to the bank for collection on the same date and deposited at the bank on any other day or endorsed to any other party.

A. When any cheque is received and not sent to the bank for collection:

B. When the above cheque was sent to the bank for collection:

C. If the above cheque was endorsed in favour of any other party:

5. When the cheque, drafts, etc., received from the customers are sent to the bank for collection on the same date:

6. When a customer directly deposits any amount in the firm’s bank account:

7. When a cheque previously deposited into the bank gets dishonoured:

Banking Transactions Journal Entry with Examples

8. Payment is received through cheque and a discount is allowed.

A. When a cheque is received from a customer and a discount is allowed to him (Cheque is deposited into the bank on the same day):

B. If the above cheque gets dishonoured:

Journal Entry:

9. When payment is made through cheque:

10. When expenses are paid through cheque:

11. When interest is charged by the bank:

12. When interest is allowed by the bank:

13. When a bank charges any amount for the services rendered:

15. Bad Debts Recovered :

When the amount that is earlier written as bad debts is now recovered, it is called bad debts recovered.

Bad Debts Recovered Journal Entry with Examples

16. Loss of Insured Goods/Assets :

Sometimes insured goods are lost by fire, theft, or any other reason. There can be three cases related to the loss of insured goods or assets.

A. Claim does not get accepted by the Insurance Company:

B. Insurance Company partly accepted the claim:

C. Insurance Company fully accepted the claim:

For receiving the claim money:

Loss of Insured Goods/Assets Journal Entry with Examples

17. Loan Taken :

A business can take an amount of money as a loan from a bank or any outsider. In return, the business has to pay interest.

A. Loan is taken from a bank or person:

B. Interest charged by the bank or person and then paid:

There can be a situation where the interest is charged first and then paid. There will be two Journal Entries in this case.

i. Journal Entry: (On charging of interest)

ii. Journal Entry: (On payment of interest)

C. Interest paid to bank/person on the loan:

In this case, only a single entry is passed because interest is directly paid.

Loan Taken Journal Entry with Examples

18. Loan Given :

Businesses can also provide loans to any person or entity.

A. Loan is given to a person:

B. Interest charged and then received on loan given:

There can be a situation where the interest is charged first and then received. There will be two Journal Entries in this case.

ii. Journal Entry: (On receiving of interest)

C. Interest received on loan given:

In this case, only a single entry is passed because interest is directly received.

Loan Given Journal Entry with Examples

19. Outstanding Expenses :

Outstanding expenses are those expenses that are related to the same accounting period in which accounts are being made but are not yet paid.

Outstanding Expenses Journal Entry with Examples

20. Prepaid or Unexpired or Advance Expenses :

Such expenses which are concerned with the next financial year, but have been paid in the current year are called prepaid expenses.

Prepaid Expenses Journal Entry with Examples

21. Income Due or Accrued Income :

An income that has been earned, but not yet received in the current financial year is called Accrued Income.

Accrued Income Journal Entry with Examples

22. Income Received in Advance or Unearned Income :

An income that has not been earned yet, but has been received in advance is called Unearned Income.

Next year, unearned commission will be adjusted as:

Income Received in Advance Journal Entry with Examples

23. Income Tax :

Income Tax is paid by the business on the profit earned during the year. Income Tax is a personal liability of the proprietor. The journal entry will be:

A. Payment of Income Tax:

B. Refund of Income Tax:

Income Tax Journal Entry with Examples

24. Life Insurance Premium :

Sometimes, Life Insurance Premium is paid by the business on the behalf of the proprietor.

Life Insurance Premium Journal Entry with Examples

25. Employee’s Life Insurance Premium :

Businesses purchase life insurance for their employees too.

Employee’s Life Insurance Premium Journal Entry with Examples

26. Interest on Capital :

The proprietor can charge interest on the amount invested by him/her in the business as capital, which is shown as Interest on Capital.

Interest on Capital Journal Entry with Examples

27. Interest on Drawings :

The amount withdrawn from the capital by the proprietor for personal use is called drawings. Businesses can charge interest on the amount of drawings.

Interest on Drawings Journal Entry with Examples

28. Use of Goods in Business :

Sometimes goods of a business are used in the business itself. If this happens, those goods are considered assets by the business.

Use of Goods in Business Journal Entry with Examples

29. Expenditure on Assets (Erection or Installation) :

Any expenditure incurred in the erection or installation of any building or machinery or any type of asset is considered to be capital expenditure and debited under the name of the particular asset.

Expenditure on Assets Journal Entry with Examples

30. Expenses on Purchase of Goods :

Purchasing process involves a number of steps starting from placing an order and ending with the delivery of goods. Apart from the cost incurred in purchasing the goods, any additional expenses like Carriage, Import Duty, etc is also paid. Any expenses incurred during the purchase of goods will be shown separately unlike an expenditure on assets.

Expenses on Purchase of Goods Journal Entry with Examples

31. Outstanding Salary :

Outstanding Salary is a liability for the firm. Outstanding salary journal entry is passed to record the salary that is due concerning the employees but not yet paid. When salary is not paid on time, it is shown under the Liabilities side of the balance as an ‘Outstanding Salary’ which means it has now become the liability of the firm to pay salaries.

Outstanding Salary Journal Entry with Examples

32. Prepaid Insurance :

Prepaid Insurance is the amount of insurance premium that the company pays in one financial year, and avails its benefit in some other financial year, generally in the upcoming financial year. Prepaid Insurance journal entry is passed to record the amount paid as advance for the insurance. Prepaid insurance is treated as the asset of the firm and is recorded under the Asset side of the balance sheet. Insurance premium is generally paid by the company on behalf of its employees.

Prepaid Insurance Journal Entry with Examples

33. Commission Received :

Commission received is the amount that an individual receives in exchange for the services offered by him/her. It is a kind of monetary remuneration that is said to be the asset of the individual/company. Commission received journal entry is passed in order to show the amount that an individual/a company received in exchange for their services as commission.

Commission Received Journal Entry with Examples

34. Cash Sales :

When goods/services are sold for cash, the transactions are known as Cash Sales, i.e., when the customer pays in terms of cash in exchange for goods and services, cash sales occur. Cash sales journal entry is passed to show the sales transactions that have been settled in cash. There are mainly two types of cash sales:

- Sale of goods in cash

- Sale of an asset for cash

1. For the Sale of Goods in Cash: Sale of goods (in cash) is an income, so the balance of the cash account (debit balance) increases, and the balance of the sales account (credit balance) decreases.

2. For the Sale of an Asset for Cash – For the sale of an asset in cash, the balance of the cash account (debit balance) increases due to the inflow of cash, and the balance of the asset account will decrease due to the outflow of the asset.

Cash Sales Journal Entry with Examples

35. Provisions :

A Provision in accounting is generally some set aside profits to be used under specific contingencies. They are the reserves that are being made for specific situations and are to be compulsorily used in those conditions only. A provision is seen as an upcoming liability and should not be treated as savings. Provisions journal entry is passed to show the amount set aside by the firm to meet contingencies.

Provision Journal Entry with Examples

36. Rent Paid :

Sometimes a business does not own any specific type of property, plant, and/or machinery. They take the required asset on rent and pay the pre-specified installment for the asset in terms of cash or cheques. Rent paid journal entry is passed in order to record the necessary rent payments against rented assets. Rent is an expense for business and thus has a debit balance.

Rent is generally:

- Paid every month

- Has fixed installment

- Recurring in nature

- Shown under the head of ‘Office Rent’ or ‘Factory Rent’

Rent Paid Journal Entry with Examples

37. Salaries Paid :

Salaries are the monetary remunerations the business gives to its employees in exchange for their services. Salaries Paid journal entry is passed to record the salary payments to employees by the business. Salaries are treated as an expense in the books of business, so when the salary is paid, the Salary account gets debited and the cash/bank A/c gets credited.

1. When Salary is Due:

2. When Salary is Paid:

Salaries Paid Journal Entry with Examples

38. Deferred Revenue :

Deferred Revenue is the income received in exchange for goods that are yet to be delivered. Deferred Revenue is also known as Unearned Income or Unearned Revenue. Deferred revenue journal entry is passed to record the advance payments received for goods and services. In this case, the balance for cash/bank (debit balance) increases due to the inflow of income, and the balance for deferred revenue (credit balance) i.e. liability increases.

Deferred Revenue Journal Entry with Examples

For more journal entries on GST, kindly refer to:

Gst (goods and services tax), please login to comment..., similar reads.

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

Please briefly explain why you feel this question should be reported.

Please briefly explain why you feel this answer should be reported.

Please briefly explain why you feel this user should be reported.

AccountingQA

Search Your Accounting Question..

I need 20 journal entries with ledger and trial balance?

You must login to add an answer.

Username or email *

Ledger is known as the book of final entry. It is the book where the transactions related to a specific account are posted. This posting of transactions is done from journal entries.

The posting of journal entries into the ledger is performed in the following way:

The journal entry of cash sales is :

Here, Cash A/c is debited to Sales A/c. So, in the Cash A/c ledger, posting will be made on the debit side as “To Sales A/c”

In the Sales A/c ledger, the posting will be made on the credit as “By Cash A/c” because Sales A/c is credited to Cash A/c

For creating ledgers, journal entries are a prerequisite.

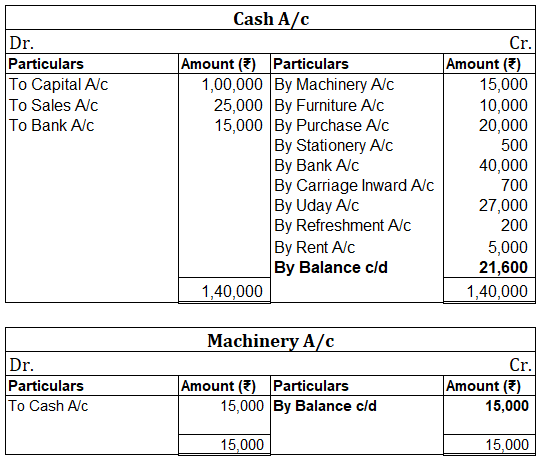

Now, the ledgers to be created as per the journal entries made above are as follows:

- Capital A/c

- Furniture A/c

- Machinery A/c

- Purchase a/c

- Matt A/c (Debtor)

- Uday A/c (Creditor)

- Purchase Return A/c

- Stationery A/c

- Carriage Inward A/c

- Refreshment A/c

- Shyam A/c (Debtor)

- Ram A/c (Creditor)

- Suri A/c (Debtor)

- Discount Received A/c

The account ledgers are as follows:

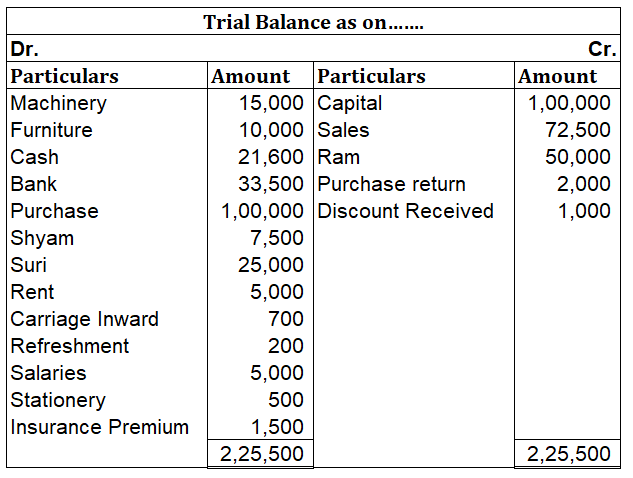

Trial Balance

A trial balance is a statement that is prepared to check the arithmetical accuracy of books of accounts.

In this statement, the total of all accounts having debit balance and the total of all accounts having credit balance is computed. If the total of debit and credit matches, then it can be said that the books of accounts are arithmetically accurate.

Here also we have prepared the trial balance by computing the total of accounts having debit balances and the total of accounts having credit balances

The debit column total and credit column total are matching. Hence, we can say that the books of accounts we have prepared are arithmetically accurate.

Note: Matt A/c and Uday A/c have not appeared in the trial balance because they do not have any carrying balance.

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share on WhatsApp

Related Questions

- What are some examples of deferred revenue expenses?

- Are brands intangible assets?

- What comes in debit side of Realisation account?

- What is recorded in the Realisation account?

- What is not included in Realisation account?

- What is recorded on the credit side of a Realisation account?

- Can accounts payable have a debit balance?

- Most Visited

- Most Active

- Write an Answer

- Badges & Points

- Request New Category

- Send a Suggestion

Most Helping Users

- 50,286 Points

AbhishekBatabyal

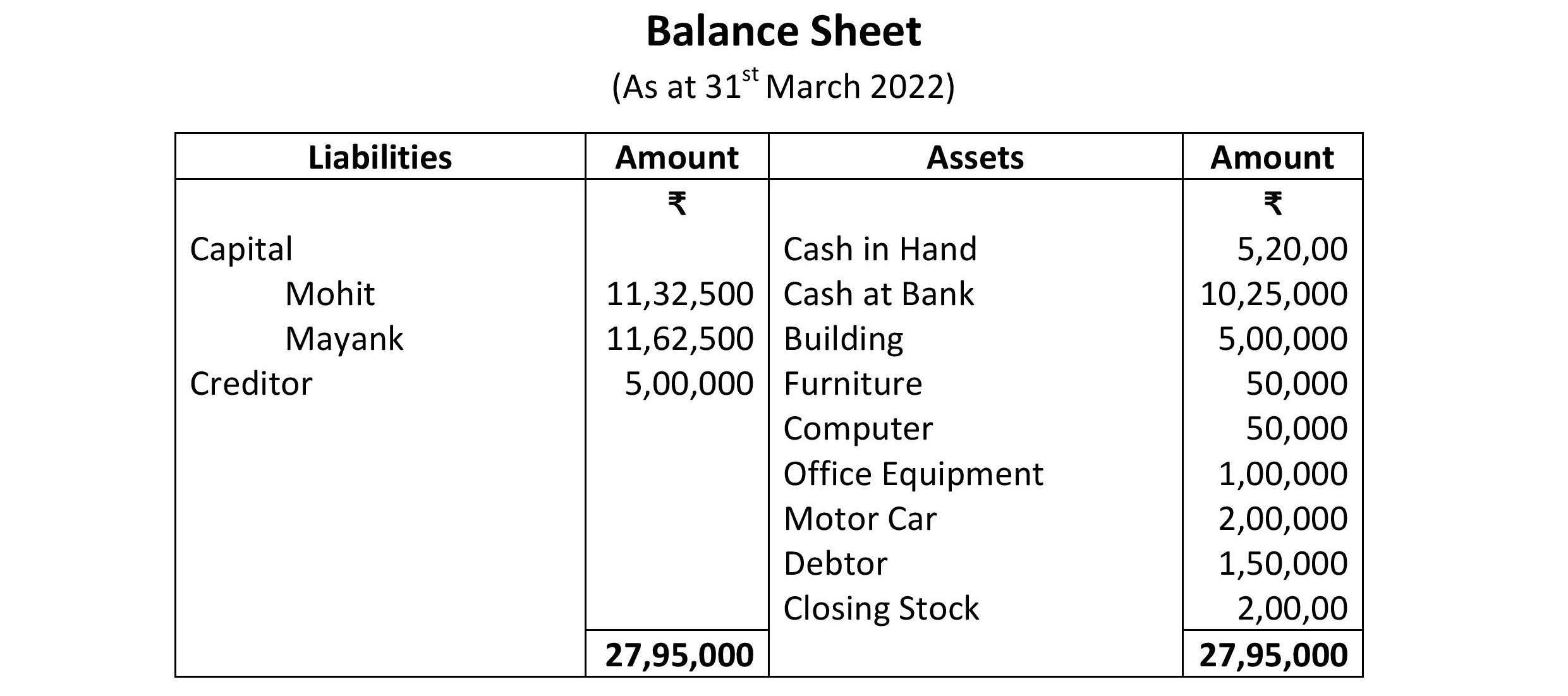

Preparation of Journal, Ledger, Trial balance and Financial Statements of a partnership firm on the basis of a case study- 15 Transactions

Table of Contents

Preparation of Journal, Ledger, Trial balance, and Financial Statements of a partnership firm on the basis of a case study:

- Partnership Deed

- 15 transactions

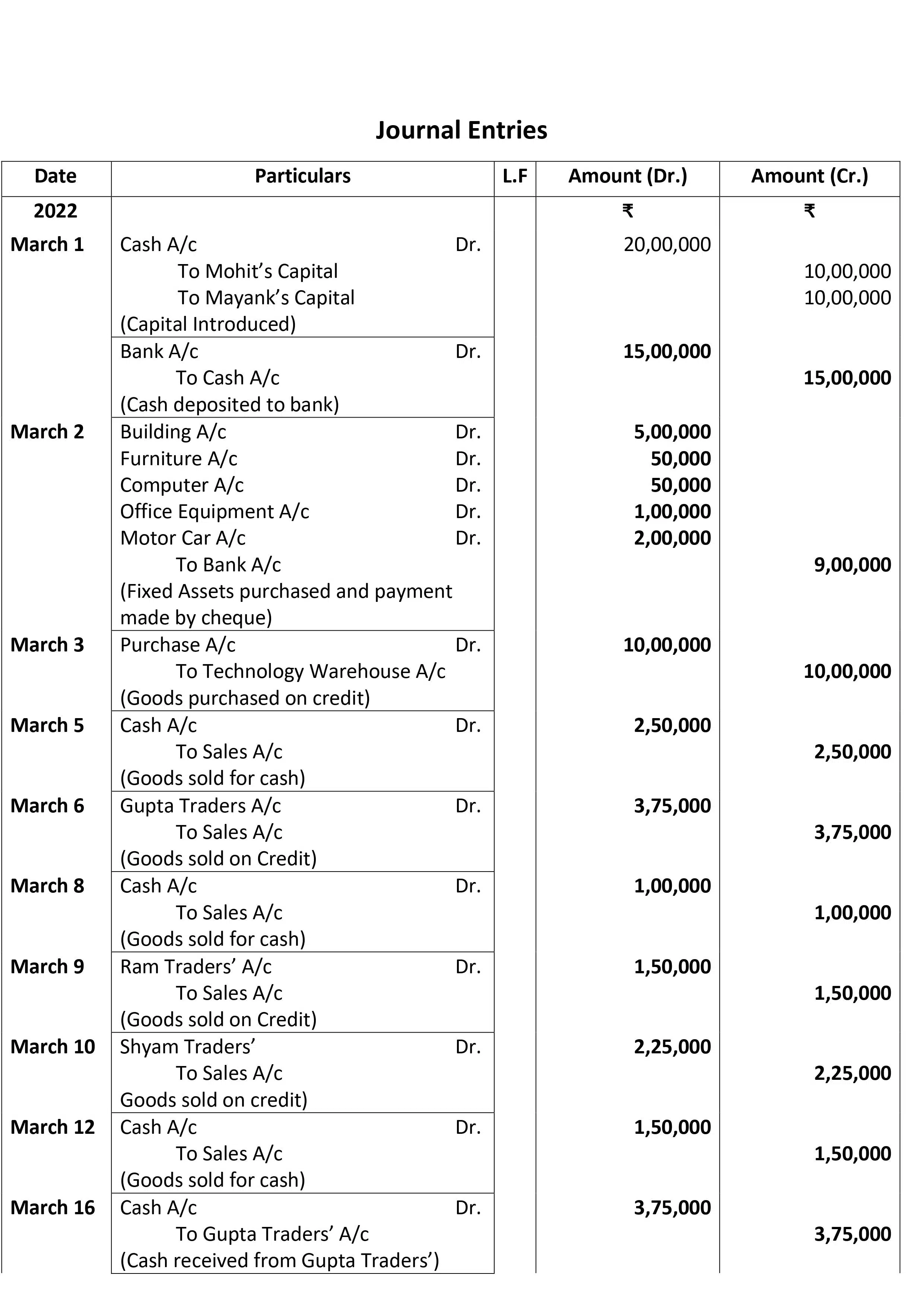

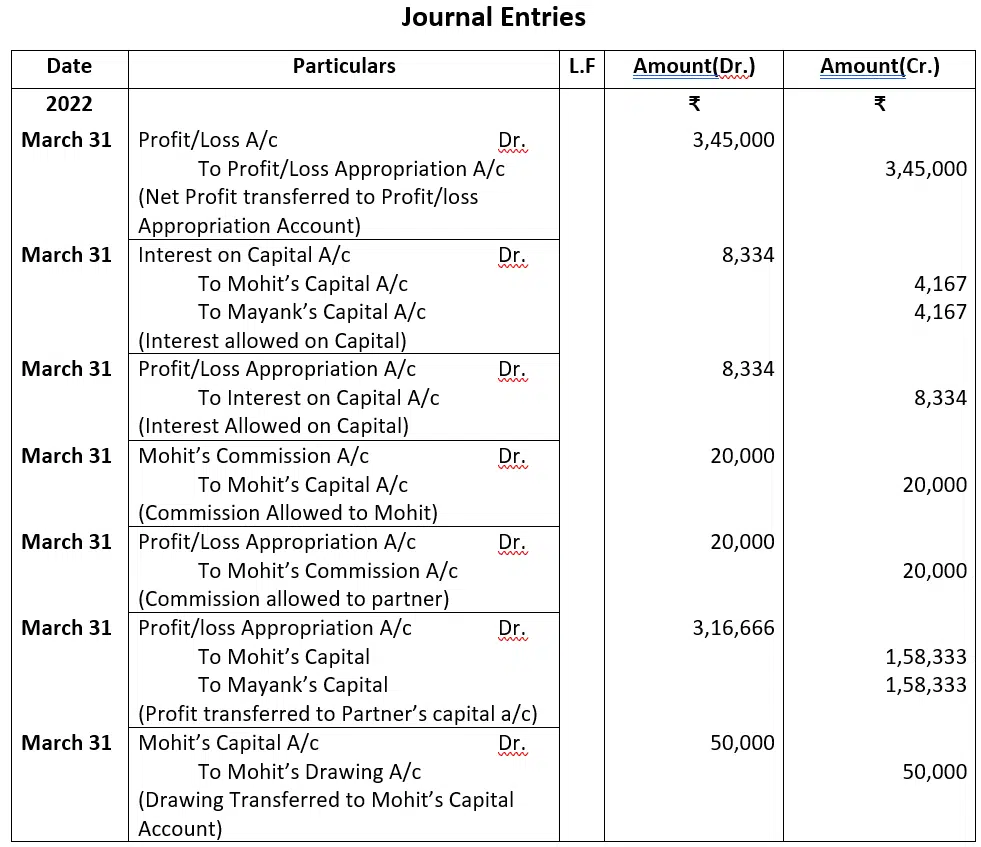

- Journal Entries

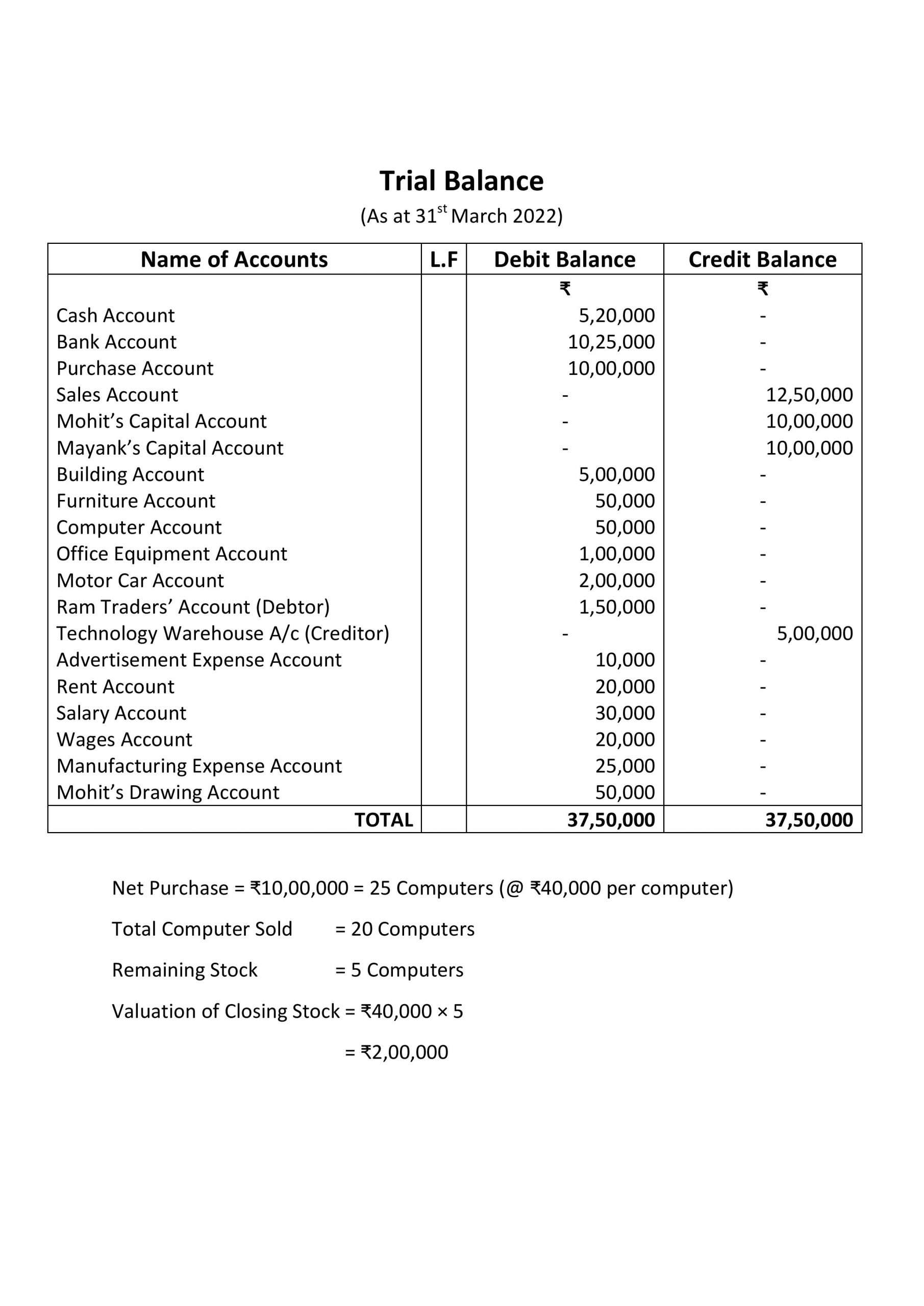

- Trial Balance

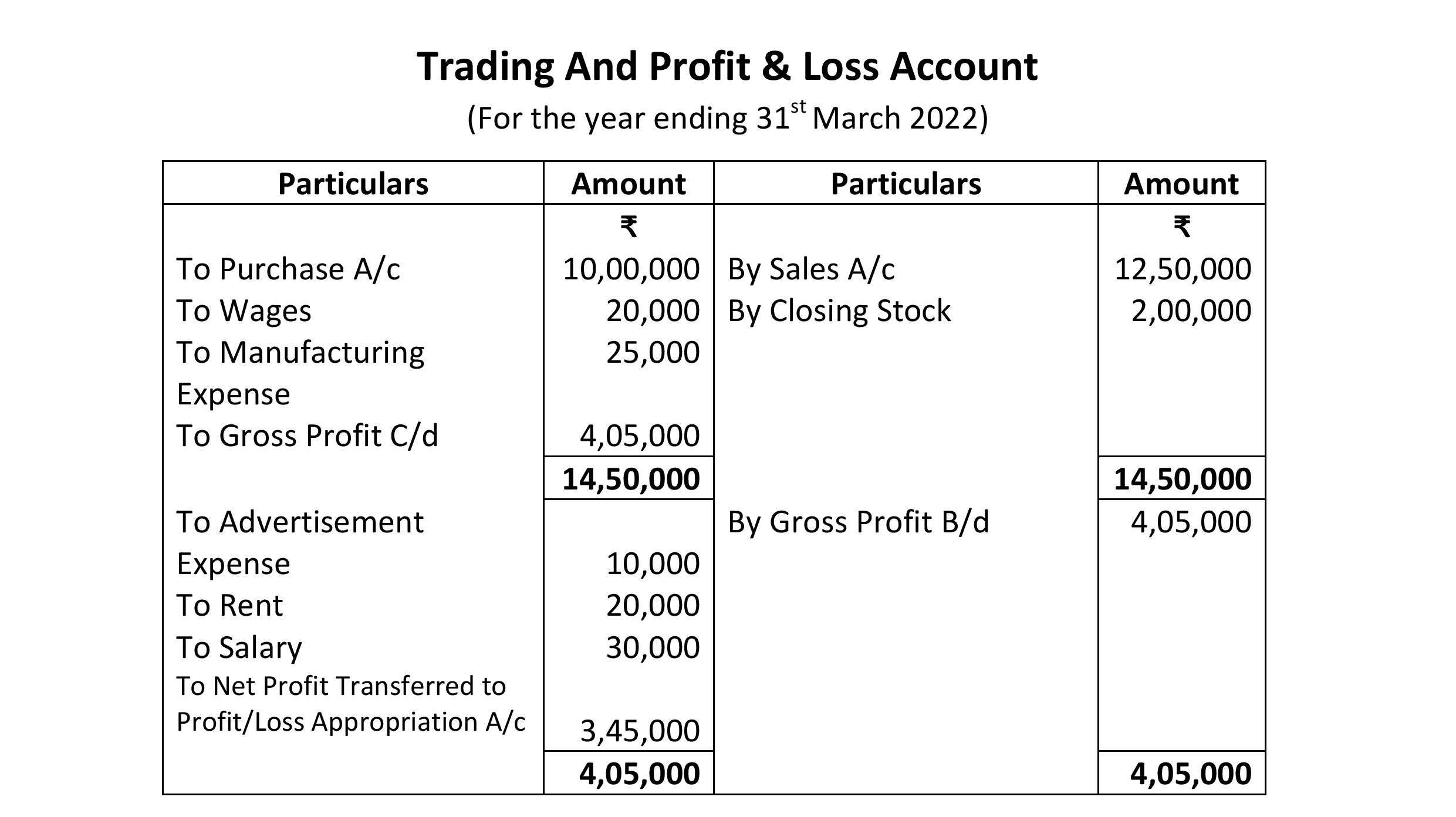

- Trading and Profit and Loss Account

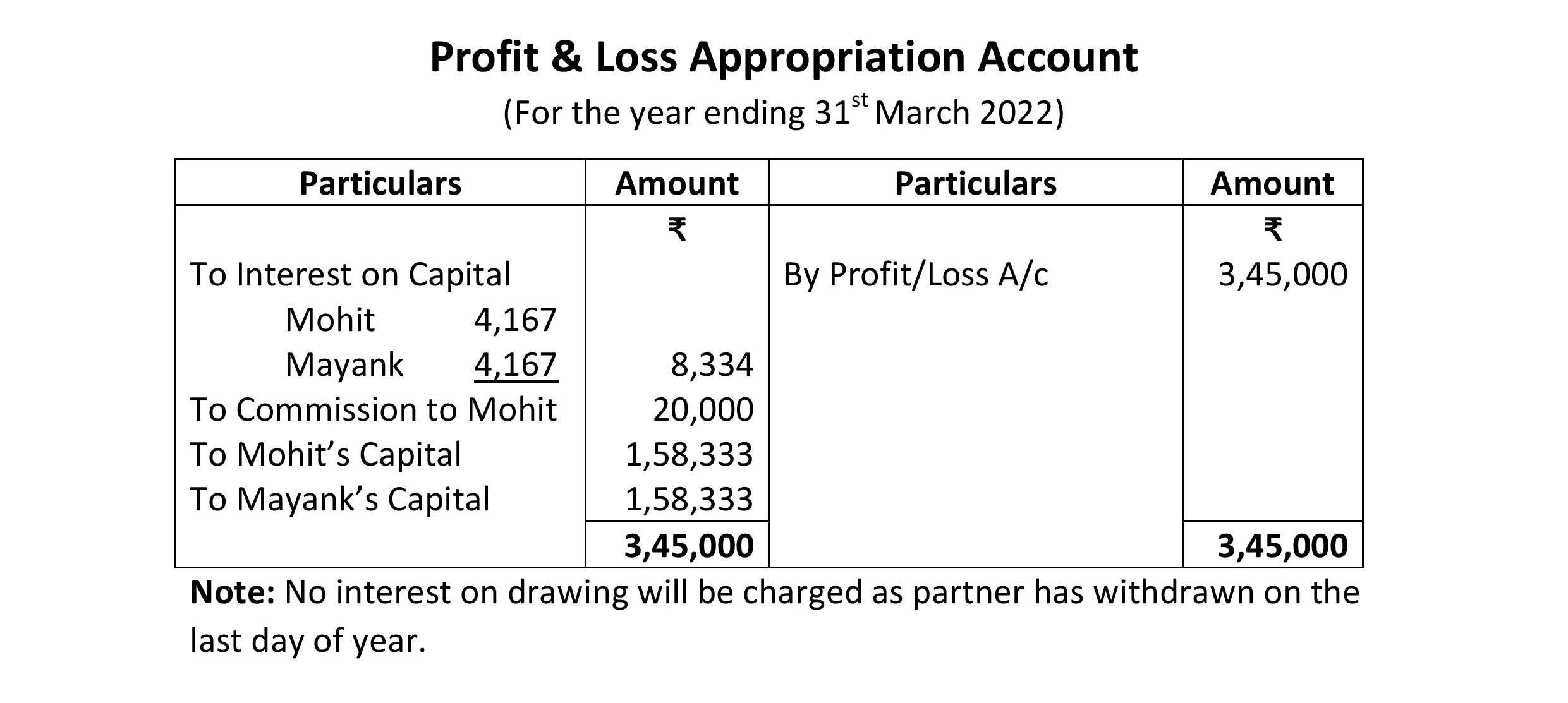

- Profit and Loss Appropriation

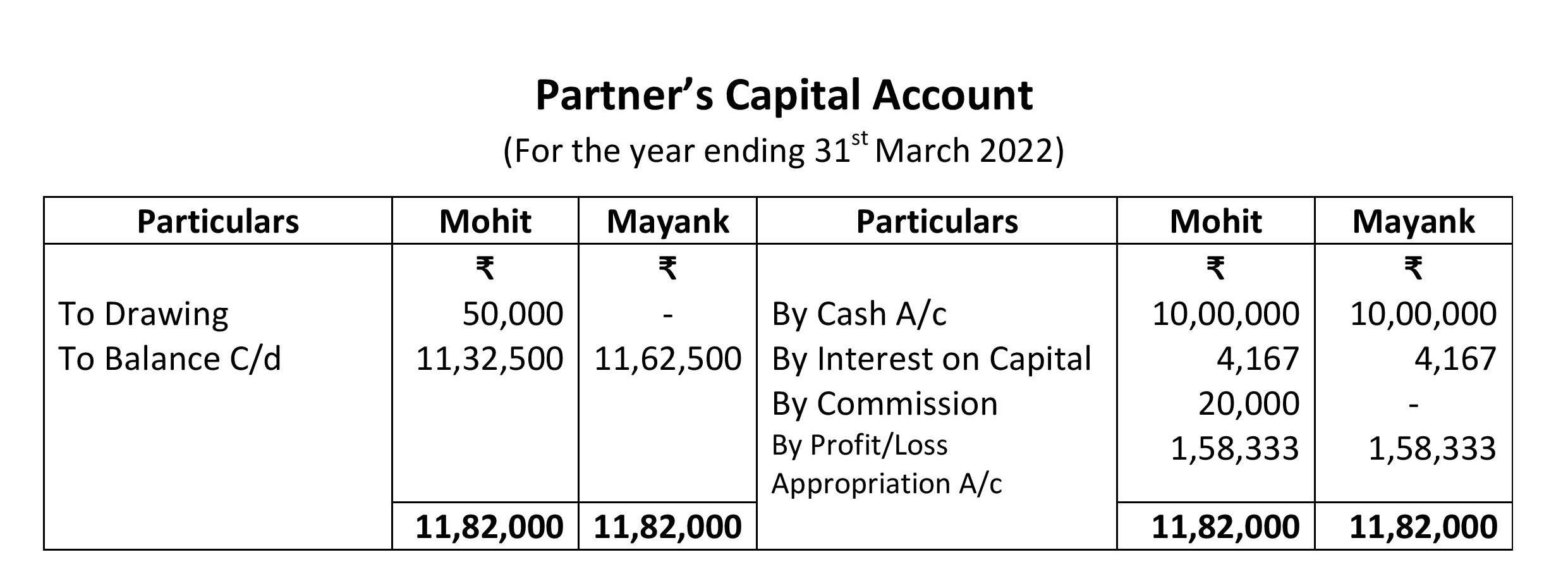

- Partner’s Capital Account

- Balance Sheet

Partnership Deed:

A partnership Deed is a written agreement among the partners for managing the affairs of a partnership firm Business.

Definition of partnership Deed