How to Master the Fine Art of Business Planning and Budgeting

Updated on: 5 January 2023

Starting a business is a challenging thing: you have to work hard and do your best to ensure its success. However, the work doesn’t end even when your business actually becomes operational. You still have to do so much more to ensure that it will keep on track.

Of course, it could be hard, especially for the beginners. It seems that you have to keep an eye on so many things and focus on so many urgent tasks every day that there isn’t any time left for business planning and budgeting. However, it is very important to find that time, because business planning and budgeting are actually one of the most important things for business success.

Why so? Because a plan allows you to get a better understanding of how you see your business, how you want to develop it, and so on. When you create a plan, you set targets that you want to achieve as well as define the ways of evaluating the success of your business.

Basically, planning gives you all the necessary tools that you can use to improve your business in the nearest future. However, this happens only when planning is done correctly.

What to Include in Your Annual Plan?

If you want to create a perfect business plan, you have to know what has to be included in it and how big it will be. Of course, there are no strict limitations to a size of a business plan as each business is different. However, if you are doing it for the first time, I recommend starting with a yearly plan: it is not too big and not too short.

A good annual plan has to include the following things:

- an executive summary

- a list of products and services you offer (or plan to offer this year)

- a detailed description of your target market

- a financial plan

- a marketing plan as well as a sales plan

- milestones and metrics

- a description of your management team

In order to write it in the best way possible, you need to spend some time thinking about the current status of your company as well as how it should look like by the end of the year. Describe your target market, think about the goals that have to be achieved this year, about the products and services that have to be launched.

Visualize the information to make it easier for you to see the whole picture (this is especially important for those, who don’t have much experience in planning). You can use charts, and different diagram types such as mind maps to visualize and organize your ideas and plans.

Try choosing a few main goals for your company and add them to the annual plan being as specific as possible: for example, if you want to increase your earnings, you should specify by how much (10%, 15%, etc.). It’s also good to think about the obstacles you might face and come up with some ways to minimize the potential risks that could occur.

Remember that while a business plan has to be specific and detailed when you write it, it shouldn’t remain static by the end of the year. No business is predictable enough for this to happen: you should understand it and prepare to act quickly, adding changes to a business plan if something unexpected happens.

Business Planning Cycle

As I said, typical business planning isn’t a static thing – actually, it’s a cycle that usually looks like this:

- You take some time to evaluate the effectiveness of your business. In order to do so, you should compare its current performance with the last year’s one – or with targets set earlier this year.

- Then you have to think about opportunities that might appear as well as the threats you might face.

- Remember about both successes and failures your business experienced throughout last year. Analyze them and think what can be done to repeat/avoid them.

- Think of the main business goals you would like to achieve and be sure to add them to the new annual plan (or edit the old one according to them).

- Create a budget.

- Come up with budget targets.

- Complete the plan.

- Be sure to review it regularly (every month, every three months, etc.), making changes if necessary.

Repeat the whole cycle.

Business Planning and Budgeting

When a business is still small and growing, it might seem unnecessary to plan its budget. However, it’s crucial if you want to avoid financial risks and be able to invest in opportunities when they appear.

Moreover, with the rapid growth of your business, you might find yourself in a situation where you aren’t able to control all the money anymore. Expansion of the business usually includes the creation of different departments responsible for different things – and each of these departments needs to have its own budget.

As you see, the bigger your business becomes, the more complicated it gets. While it’s okay to not control every cent by yourself, it is still up to you to make sure that your business keeps growing instead of becoming unprofitable. That’s why it’s so important to create a budget plan that allows you to understand the exact income your business brings by the end of the month and the amount of it, you are able to save or spend on different things.

It is important to remember that a business plan is not a forecast in any way. It doesn’t predict how much money you’ll make by the end of the year. Instead, it’s a tool for ensuring that your business will remain profitable even after covering all the necessary expenses.

Moreover, a business plan also ensures that you’ll have the opportunity to invest money into future projects, fund everything that has to be funded this year, and meet all of the business objectives.

Benefits of a Business Budget

The whole budget planning has a lot of benefits:

It allows you to evaluate the success of your business: when you know exactly how much profit your business gave you at the beginning of the year, you are able to compare it with the profit by the end of the year, understanding whether your financial goals have been met or not.

It allows managing money effectively: for example, if you save money for predicted one-time spends, you won’t be caught by surprise by them.

It helps identify the problems before they actually happen: for example, if you evaluate your budget and see that the income left after covering all the expenses is quite small, you’ll understand that you need to make more profit this year.

It helps make smarter decisions, by only investing money that you can afford to invest.

It allows you to manage your business more effectively, allocating more resources to the projects that need them the most.

It helps in increasing staff motivation.

Basically, when you have a budget plan ready, you have your back covered.

How to Create a Budget?

There are so many articles written on how to create a perfect business budget, but most of them narrow down to these 5 simple things:

- Evaluate your sources of income. You have to find out how much money your business brings on a daily basis in order to understand how much money you can afford to invest and spend.

- Make a list of your fixed expenses. These ones repeat every month and their amount doesn’t change. Some people forget to exclude the sum needed to cover these expenses from the monthly income, but it’s important to do so in order to get a clear understanding of your budget.

- Don’t forget about variable expenses. These ones don’t have a fixed price but still have to be paid every month. Come up with an approximate sum you’ll have to pay and include it in your budget.

- Predict your one-time expenses. Every business needs them from time to time, but if you plan your budget forgetting about these expenses, spending money on them could affect it greatly and not in a positive way.

- When you list all the income and expense sources, it’s time to pull them all together. Evaluate how much money you’ll have each month after you cover all these expenses. Then think of what part of that sum you could afford to invest into something.

While a whole process of budget creation might seem too complicated, you still should find time to do it. It’s totally worth the effort – moreover, such a plan could help you not only throughout the next month but also throughout the next year (if your expense and income sources won’t change much).

Of course, it’s still important to review it from time to time, making changes when necessary. However, the review process won’t be as complicated as the creation of a budget plan from scratch.

Key Steps in Drawing up a Budget

If you’ve never created a budget plan before, you could make some budgeting mistakes . However, when it comes to financial planning, the smallest mistake could have a negative impact. The following tips can help you easily avoid most mistakes, making your budget plan more realistic.

- Try to take it slow

The more time you spend on budgeting, the better it is for you. It’s hard to create a flawless budget plan quickly: there’s a big chance you might miss something. That’s why it’s vital to make sure that you’ve listed all the sources of your income and expenses, and are prepared well.

- You can use last year’s data

Last year’s data could help you see the whole picture better: you can compare it with this year’s data, finding out whether your income has increased or decreased. However, you should use it only for comparing and as a guide. You have new goals and resources this year, and the environment you’re working in has changed too, so your current planning and strategies should differ from the ones you used last year.

- Make sure that a budget is realistic

The most important thing about a budget plan is that it has to cover not only predictable expenses but also less predictable ones. Of course, making predictions is hard but using previous data along with some other business plans as examples could make the whole process easier.

A budget also has to be detailed: the information it contains has to allow you to monitor all the key details of your business, be it sales, costs, and so on. You could also use some accounting software for more effective management.

- It’s okay to involve people

If your business is big enough, you probably have some employees responsible for a part of the financial operations. It’s good to involve them in a budget creation process too, using their knowledge and experience to predict some expenses, for example. If the people you involve are experienced enough, the combination of their professionalism and your knowledge will make a budget more realistic and effective.

- Visualizing helps

Various charts and diagrams are so popular in business for a reason: they allow tracking your incomes and expenses easily. For example, you can create one chart based on your plan and another chart based on an actual budget and compare them during planned revisions to see whether your budget plan works just as expected or not.

As I mentioned above, it’s easier to control finances when you are running a small business. Such business needs only one budget that is created for a certain period – in most cases, for a year. Larger businesses, however, require something else. They have various departments, so it is better to create several budgets at once, tailoring each of them to a certain department’s needs.

Don’t Forget to Review!

I’ve already mentioned that a review is an important process of every business planning and budgeting. No matter how good your plan is, it is impossible to predict everything with 100 percent accuracy. Your business will grow and the environment around it will change, so the quicker you’ll react to such changes, the better it is for you.

That’s why you should schedule budget reviews from time to time. I recommend starting with reviewing it every month and then switching to a more comfortable schedule. Every month review can help you notice the flaws of your plan (which is especially important if you don’t have much experience in this kind of thing) as well as understand how stable your business is.

If you see that you don’t have to make changes often, you could start reviewing your plan every three or six months (however, I recommend doing it more often).

You can use various common diagrams to help you . The best thing about diagrams is that they help visualize data well, which is very important when you need to see the whole picture more clearly – and this happens often during budget planning. For example, a diagram or a chart of your company’s income can show you how much your finances have grown during a certain period. Moreover, if you notice certain downfalls in a chart (that aren’t predicted), you’ll be able to react to it quickly, fixing things that went wrong.

What do you need to consider during the whole review process? First, your actual income. Probably it will be different each month: every business has its own peak sales periods and drop sales ones, and you have to find them and remember them for more effective planning next year. It is important to check whether the income matches the one you predicted or not: if not, you have to find out why it happened.

Second, you have to evaluate your actual expenses. See if they differ from your budget, how much do they affect it, why they exceed your expectations (if they do), and so on.

Probably the best thing about reviewing is that it allows you to react to all the unexpected situations quickly, saving your business from the potential troubles and downfalls. So be sure not to skip it.

As you see, writing a business plan is a complex process. You have to be very attentive, to plan everything, starting with your goals and ending with your expenses, to consider so many things and to involve other people in planning if possible. Moreover, you also have to learn all the time, reviewing your plans, making changes, finding the ways to react to unexpected situations.

But while this might look like a tough thing to do, it is very convenient for everyone who wants to manage their business successfully. The planning takes a lot off your shoulders and makes the whole business running process easier. You are able to evaluate the effectiveness of your business by looking at the monthly income increase, at the goals you wanted to achieve, and so on. You are also able to predict the potential downfalls of your business and to use the tools you have to minimize all the risks.

You are able to evaluate the effectiveness of your business by looking at the monthly income increase, at the goals you wanted to achieve, and so on. You are also able to predict the potential downfalls of your business and to use the tools you have to minimize all the risks.

I hope that this guide will help you create strong and realistic budget and business plans, and successfully implement them in running your business. If you have some tips on business and budget planning that you want to share, please do so in the comment section below!

Author’s Bio:

Kevin Nelson started his career as a research analyst and has changed his sphere of activity to writing services and content marketing. Apart from writing, he spends a lot of time reading psychology and management literature searching for the keystones of motivation ideas. Feel free to connect with him on Facebook , Twitter , Google+ , Linkedin .

Join over thousands of organizations that use Creately to brainstorm, plan, analyze, and execute their projects successfully.

More Related Articles

Leave a comment Cancel reply

Please enter an answer in digits: ten − 2 =

Download our all-new eBook for tips on 50 powerful Business Diagrams for Strategic Planning.

How Cube works

Sync data, gain insights, and analyze business performance right in Excel, Google Sheets, or the Cube platform.

Built with world-class security and controls from day one.

Cube meets you where you work—your spreadsheets. Get started quickly with a fast implementation and short time to value.

Developer Center

Cube's API empowers teams to connect and transform their data seamlessly.

Integrations

Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more.

Break free from clunky financial analysis tools. Say hello to a flexible, scalable FP&A solution.

See Cube in action

Centralized Data Management

Automatically structure your data so it aligns with how you do business and ensure it fits with your existing models.

Reporting & Analytics

Easily collaborate with stakeholders, build reports and dashboards with greater flexibility, and keep everyone on the same page.

Planning & Modeling

Accelerate your planning cycle time and budgeting process to be prepared for what's next.

.png)

Creating a high-impact finance function

Get secrets from 7 leading finance experts.

Download the ebook

Business Services

Real Estate

Financial Services

Manufacturing

Learn how Veryable unwound a complex spreadsheet stack

Essential reading for forward-thinking FP&A leaders.

Customer Stories

Discover how finance teams across all industries streamline their FP&A with Cube.

Featured Customers

BlueWind Medical reduced company spend by over $100k with Cube

Edge Fitness Clubs cuts reporting time by 50% & saves $300,000 annually

Join our exclusive, free Slack community for strategic finance professionals like you.

Join the community

Content Library

Discover books, articles, webinars, and more to grow your finance career and skills.

Find the Excel, Google Sheets, and Google Slide templates you need here.

Discover expert tips and best practices to up-level your FP&A and finance function.

Need your finance and FP&A fix? Sign up for our bi-weekly newsletter from former serial CFO turned CEO of Cube, Christina Ross.

Help Center

Make the most of Cube or dig into the weeds on platform best practices.

Creating a High-impact Finance Function

Secrets from 7 leading finance experts.

Get the guide

We're on a mission to help every company hit their numbers. Learn more about our values, culture, and the Cube team.

Grow your career at Cube. Check out open roles and be part of the team driving the future of FP&A.

Got questions or feedback for Cube? Reach out and let's chat.

In the news

Curious what we're up to? Check out the latest announcements, news, and stories here.

A newsletter for finance—by finance

Sign up for our bi-weekly newsletter from 3x serial CFO turned CEO of Cube, Christina Ross.

Subscribe now

Updated: September 29, 2023 |

What’s the difference between a plan, a budget, and a forecast?

Jake Ballinger is an experienced SEO and content manager with deep expertise in FP&A and finance topics. He speaks 9 languages and lives in NYC.

“Remind me, what’s the difference between the plan and the forecast?” is something we often hear from executives looking for clarity.

While a company’s plan, budget, and financial forecast are often discussed in the boardroom, these terms’ functions are not always precise.

Finance leaders commonly use the three terms in conjunction with one another, allowing each model to inform the others.

So...are they interchangeable? No.

In fact, financial forecasting, budgeting , and planning each serve a unique purpose. A plan serves as the foundation, a budget guides how to allocate cash, and a forecast projects the financial future of the business.

CFOs understand that each is a standalone piece of the company’s financial puzzle.

Jake Ballinger

FP&A Writer, Cube Software

Financial planning: explained

Budgeting: explained, forecasting: explained.

Plan vs. budget vs. forecast

Get out of the data entry weeds and into the strategy.

Sign up for The Finance Fix

Sign up for our bi-weekly newsletter from serial CFO and CEO of Cube, Christina Ross.

Generally, a financial “plan” aims to define the financial direction and vision of the organization within the context of a broader business plan.

Leaders ask themselves how the business will stack up in the next 1, 5, or even 10 years. The “plan” answers that question by outlining the company’s operational and financial objectives. Executives build out teams and infrastructure based on this plan and the defined goals.

Colloquially, the “plan” is sometimes used interchangeably with the most recent budget or forecast, and can be broadly considered the budget or forecast that is the most likely “version of truth”.

Because of the long-term nature of a financial plan, it allows for more flexibility and creativity. In the case of a financial plan (versus a budget, for example), the means are less important than the end. Ultimately, a good financial plan provides a top-down operational framework to explore various scenarios.

Because an organization's future is undefined, financial planning is a perpetual process. Despite this, a plan is more static—more of a roadmap than a document updated daily. The plan relies on historical performance data and subjective financial analysis, so it can never be fully accurate.

Businesses, but most commonly, the Finance team, compile a budget to determine how the company will spend its capital during the next period—a month or quarter, but typically a fiscal year.

The budget’s primary goal is determining what resources to allocate to each part of the company, from salaries to office supplies. The focus of a budget revolves around cash position, including expected revenues and expenses, to create specific financial goals for the foreseeable future.

Most businesses create a budget annually and implement it from the start of the fiscal year. The budget is also commonly considered “unmovable” and is used to gauge performance of actuals or forecast data versus the planned budget.

A thorough budget offers clear guidance on how a company should be spending its resources by providing a line item for any expense imaginable. Budgets also create accountability for departmental spending because overages are apparent and gaps in appropriate funding become clear as the year unrolls.

Teams should review the budget regularly and compare it with actuals, making each department responsible for any variances that occur.

A budget aligns expectation with reality when it comes to revenue and expenses.

Budgeting can be a difficult process because of the kind of involvement it takes across departments, including meetings and negotiations with department leaders to determine the amount of cash they will need to accomplish business goals over the budget. Since budgets are generally made to last an entire year, a budget might constrain necessary spending (or saving) if any unexpected situations in cash flow arise.

Essentially, expense allowances are built not to exceed budget limits, while income projections are the minimum needed to balance the budget. Financial analysts need to calculate the variances between the two figures to evaluate the budget's efficacy and the organization's fiscal health.

A forecast is a financial snapshot of the future as it is best understood today. When creating a forecast , teams must examine possible financial outcomes based on the most up-to-date drivers and assumptions . The result is a view of how the business is trending so that the leaders can determine whether or not adjustments should be made to the existing budgets or plans.

For example, the budget might assume that the business will hit a $10M revenue target, but the forecast shows that the business is on target to only achieve $8M. Given the difference between the forecast and the budget, the business might adjust the variable costs associated with lower revenue, while simultaneously adjusting the expense plan in order to hit cash targets.

A company’s financial forecast is updated regularly, such as monthly or quarterly. The forecast’s undefined nature allows it to be used for both short- and long-term projections and adapt to recent performance data. In this way, executives can make changes in real-time, adjusting their operations, such as production, marketing approach, and staffing.

Forecasting can be a time-consuming process that not all businesses are able to stay on top of regularly. Because of this, many businesses update their forecast data periodically, such as quarterly or biannually. It’s considered a best practice to build a rolling (ongoing) forecast to make these adjustments in real-time.

Conclusion: Plan vs. budget vs. forecast

All three terms reflect expectations and estimates of financial objectives. Financial planning lays the foundation for budgeting, suggesting that a financial plan must precede the budget so that company leaders have an idea of what they are budgeting for. Meanwhile, a forecast projects how far over or under expectations a company may be.

A financial plan is a strategic, long-term tool, while a budget is tactical and short-term. A financial forecast is an updated reflection of the future. In a way, the forecast bridges the gap between the business plan and the budget.

The most financially disciplined businesses leverage all three tools in planning and operations. Financial modeling software like Cube can help companies build multiple plan scenario types, including budgets, forecasts, and even what-ifs, in a way that allows leaders to visualize data, analyze past performance, and calculate how decisions may affect future goals.

Want to see how Cube can accelerate your financial planning? Get a demo today.

Related Articles

Feel the burn: a guide to gross burn vs. net burn

How to create & use pro forma statements

Burn multiple: a quick & simple guide

A How-To Guide for Creating a Business Budget

Amanda Smith

Reviewed by

September 23, 2022

This article is Tax Professional approved

Most business owners know how important a business budget is when it comes to managing expenses and planning for the future—but in a challenging economic environment like the one we’ve been experiencing, your business budget takes on even greater significance.

With inflation running rampant and the possibility of a recession looming, business owners need to be able to forecast their cash flow, manage their expenses, and plan for the future. Creating a detailed business budget is the first step.

Whether you want to revamp your budgeting method, or you’ve never created a business budget before, this guide will walk you through the process.

I am the text that will be copied.

What is a business budget?

A budget is a detailed plan that outlines where you’ll spend your money monthly or annually.

You give every dollar a “job,” based on what you think is the best use of your business funds, and then go back and compare your plan with reality to see how you did.

A budget will help you:

- Forecast what money you expect to earn

- Plan where to spend that revenue

- See the difference between your plan and reality

What makes a good budget?

The best budgets are simple and flexible. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.

Every good budget should include seven components:

1. Your estimated revenue

This is the amount you expect to make from the sale of goods or services. It’s all of the cash you bring in the door, regardless of what you spent to get there. This is the first line on your budget. It can be based on last year’s numbers or (if you’re a startup ), based on industry averages.

2. Your fixed costs

These are all your regular, consistent costs that don’t change according to how much you make—things like rent, insurance, utilities, bank fees, accounting and legal services, and equipment leasing.

Further reading: Fixed Costs (Everything You Need to Know)

3. Your variable costs

These change according to production or sales volume and are closely related to “ costs of goods sold ,” i.e., anything related to the production or purchase of the product your business sells. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. Other variable costs can include sales commission, credit card fees, and travel. A clear budget plan outlines what you expect to spend on all these costs.

The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs. Make sure you file your different salary costs in the correct area of your budget.

Further reading: Variable Costs (A Simple Guide)

4. Your one-off costs

One-off costs fall outside the usual work your business does. These are startup costs like moving offices, equipment, furniture, and software, as well as other costs related to launch and research.

5. Your cash flow

Cash flow is all money traveling into and out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

6. Your profit

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold. If the difference between revenue and expenses (aka “ profit margins ”) aren’t where you’d like them to be, you need to rethink your cost of goods sold and consider raising prices .

Or, if you think you can’t squeeze any more profit margin out of your business, consider boosting the Advertising and Promotions line in your budget to increase total sales.

7. A budget calculator

A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

In your spreadsheet, create a summary page with a row for each of the budget categories above. This is the framework of your basic budget. Then, next to each category, list the total amount you’ve budgeted. Finally, create another column to the right—when the time period ends, use it to record the actual amounts spent in each category. This gives you a snapshot of your budget that’s easy to find without diving into layers of crowded spreadsheets.

See the sample below.

Pro tip: link the totals on the summary page to the original sums in your other budget tabs . That way when you update any figures, your budget summary gets updated at the same time. The result: your very own budget calculator.

You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered. From there, you can customize a rough budget for your own industry.

Small business budgets for different types of company

While every good budget has the same framework, you’ll need to think about the unique budgeting quirks of your industry and business type.

Seasonal businesses

If your business has a busy season and a slow season, budgeting is doubly important.

Because your business isn’t consistent each month, a budget gives you a good view of past and present data to predict future cash flow . Forecasting in this way helps you spot annual trends, see how much money you need to get you through the slow months, and look for opportunities to cut costs to offset the low season. You can use your slow season to plan for the next year, negotiate with vendors, and build customer loyalty through engagement.

Don’t assume the same thing will happen every year, though. Just like any budget, forecasting is a process that evolves. So start with what you know, and if you don’t know something—like what kind of unexpected costs might pop up next quarter— just give it your best guess . Better to set aside money for an emergency that doesn’t happen than to be blindsided.

Ecommerce businesses

The main budgeting factor for ecommerce is shipping. Shipping costs (and potential import duties) can have a huge impact.

Do you have space in your budget to cover shipping to customers? If not, do you have an alternative strategy that’s in line with your budget—like flat rate shipping or real-time shipping quotes for customers? Packaging can affect shipping rates, so factor that into your cost of goods sold too. While you’re at it, consider any international warehousing costs and duties.

You’ll also want to create the best online shopping experience for your customers, so make sure you include a good web hosting service, web design, product photography, advertising, blogging, and social media in your budget.

Inventory businesses

If you need to stock up on inventory to meet demand, factor this into your cost of goods sold. Use the previous year’s sales or industry benchmarks to take a best guess at the amount of inventory you need. A little upfront research will help ensure you’re getting the best prices from your vendors and shipping the right amount to satisfy need, mitigate shipping costs, and fit within your budget.

The volume of inventory might affect your pricing. For example, if you order more stock, your cost per unit will be lower, but your overall spend will be higher. Make sure this is factored into your budget and pricing, and that the volume ordered isn’t greater than actual product demand.

You may also need to include the cost of storage solutions or disposal of leftover stock.

Custom order businesses

When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate.

Budgeting is tricky for startups—you rarely have an existing model to use. Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on.

This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. This business startup budget guide from The Balance is a great start.

Service businesses

If you don’t have a physical product, focus on projected sales, revenue, salaries, and consultant costs. Figures in these industries—whether accounting, legal services, creative, or insurance—can vary greatly, which means budgets need flexibility. These figures are reliant on the number of people required to provide the service, the cost of their time, and fluctuating customer demand.

Small business budgeting templates

A business budget template can be as simple as a table or as complex as a multi-page spreadsheet. Just make sure you’re creating something that you’ll actually use.

Create your budget yearly—a 12-month budget is standard fare—with quarterly or monthly updates and check-ins to ensure you’re on track.

Here are some of our favorite templates for you to plug into and get rolling.

- The Balance has a clear table template that lists every budget item, the budgeted amount, the actual amount, and the difference between the two. Use this one if you’re looking to keep it simple.

- Capterra has both monthly and annual breakdowns in their Excel download. It’s straightforward, thorough, and fairly foolproof.

- Google Sheets has plenty of budget templates hiding right under your nose. They’re easy to use, and they translate your figures into clear tables and charts on a concise, visual summary page.

- Smartsheet has multiple resources for small businesses, including 12-month budget spreadsheets, department budget templates, projection templates, project-by-project templates, and startup templates. These templates are ideal if you’re looking for a little more detail.

- Scott’s Marketplace is a blog for small businesses. Their budget template comes with step-by-step instructions that make it dead simple for anyone.

- Vertex42 focuses on Excel spreadsheets and offers templates for both product-based and service-based businesses, as well as a business startup costs template for anyone launching a new business.

Budgeting + bookkeeping = a match made in heaven

Making a budget is kind of like dreaming: it’s mostly pretend. But when you can start pulling on accurate historical financials to plan the upcoming year, and when you can check your budget against real numbers, that’s when budgets start to become useful.

The only way to get accurate financial data is through consistent bookkeeping.

Don’t have a regular bookkeeping process down pat? Check out our free guide, Bookkeeping Basics for Entrepreneurs . We’ll walk you through everything you need to know to get going yourself, for free.

If you need a bit more help, get in touch with us. Bookkeeping isn’t for everyone, especially when you’re also trying to stay on top of a growing business—but at Bench, bookkeeping is what we do best.

Related Posts

What Are Operating Expenses? (With Examples)

Understanding operating expenses can help you keep tabs on how efficiently your small business generates revenue. Here’s what you need to know.

4 Methods to Get Your Business Value

Learn how to put a price on your business, and how to judge the value of a business you want to buy.

The Best Apps for Managing Receipts

Drowning in paper receipts? Or worse: are you worried you’ve lost all of your receipts? It might be time to invest in a receipt scanning app. Here’s what we recommend.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

The Complete Guide To Business Budgeting and Budget Management

Running a business without a budget opens oneself up to a host of financial problems, including failure. But what is a business budget and what does budgeting mean?

At its core, a business budget lets companies know how much money they have, how much they’ve spent, and how much they need for future initiatives. With budgeting, business owners can stay out of debt, reduce costs, earn profits, and make decisions aimed at growing their business. This is true for both large and small businesses.

This article takes a deep dive into business budgets, types of budgets, the meaning of budgeting and why it is essential business practice.

What is a business budget?

A budget is a detailed, formal spending plan for a business for a specified time period (a month, quarter, or year). It is a forward-looking document estimating a company’s expenses and revenue within that period. A budget provides the necessary information for a business to fund and fulfil its commitments and make a profit while making sure it has money left over for unexpected expenses and future ventures.

Components of a budget

Understanding a business budget requires a clear understanding of its components:

This is the projected income from sales, investments, or other sources. This estimate is usually based on past financial records or, in the case of a new business, from the revenue of rival companies. While estimating revenue, it is important to take note of lean periods when business and revenue are down and factor in a financial cushion to tide over them.

2. Expenses

This component is split into:

- Fixed costs , or expenses that remain constant, such as rent, lease, utilities, salaries, insurance, legal and accounting fees.

- Variable costs , or production-dependent fluctuating expenses, such as raw material prices, labour costs, packaging charges, shipping and transportation fees.

- One-time expenses , such as money spent on a new building, furniture, equipment, software, or product patent.

This is what is left after subtracting estimated costs from revenue. Profit is key to making investment decisions.

4. Cash flow

This is money that flows in (income) and out (expenses) of a business and helps companies predict future earnings. It is important to know not only how much money is coming in or going out but also when (peak and lean seasons) to make the right projections.

Some people might confuse a business budget with a cash flow statement because both track how money travels in and out of a company. The difference is that a cash flow statement is a summary of the movement of money while a budget serves a greater purpose as a tool for decision-making.

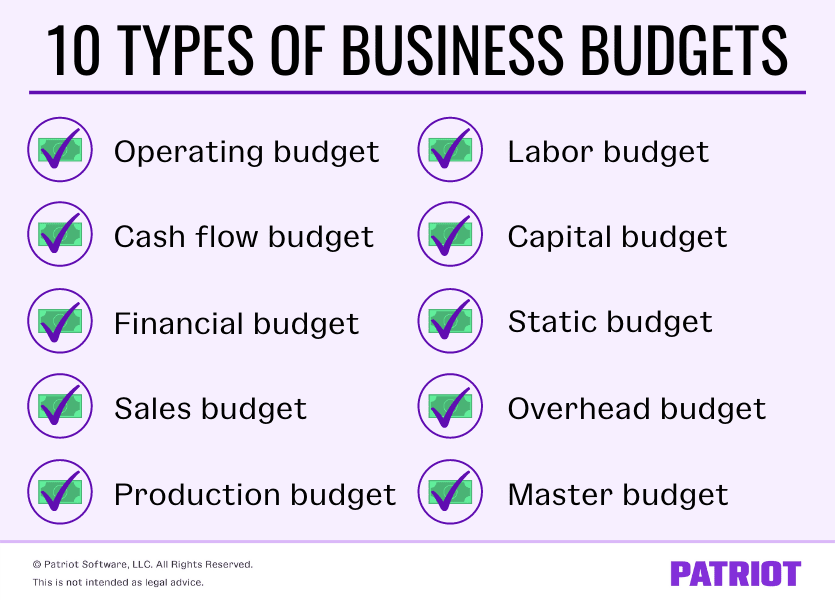

Types of budgets

There are different types of budgets in use, depending on the size, resources, and market position of businesses. A company typically has a Master Budget , which presents a broad overview of its finances. Within the Master Budget are multiple lower-level budgets.

Budgets might be specific to a department, subsidiary, or project. Depending on the time frame, they can also be long-term or short-term. Annual budgets are the norm but many companies also have monthly and quarterly budgets. Similarly, a business can use a long-term budget to plan financial goals three, five, or even 10 years down the line.

Then there are static and flexible budgets. With fixed revenue and expense estimates, a static budget isn’t affected by ups and downs in sales. It is mostly used by organisations with fixed funds, such as government agencies and non-profits. A flexible budget, on the other hand, adjusts to changes in production and sales volumes or external economic factors. It is ideal for businesses that are new or seasonal or have varying income.

What does budgeting mean?

A search online will result in various budgeting meanings. But to put it simply, budgeting is the process of preparing and using a budget. It is also called budget management or spend management . Budgeting means analysing data specific to the business as well as historical and current market trends to make informed business decisions. These decisions can range from the marketing strategies to be deployed for a venture to plans to expand the business into overseas markets. For small businesses, intelligent budgeting helps them use their modest financial resources to make the most of a business opportunity.

Five stages of budget management

1. financial analysis.

Budget planners must have keen analytical skills to ensure projections are accurate and goals realistic. By researching company records and market conditions, they must accurately determine the company’s financial health and use that knowledge to make good business decisions.

2. Financial forecasting

Financial forecasting helps companies predict their performance in a pre-determined future by providing valuable insights into, say, areas where they might incur extra expenses or where investments should be added or removed altogether.

3. Budget preparation

At this stage, a company determines its revenue, expenses, and profit, breaking these down by month, quarter, and year. It also sets goals and takes important decisions (such as identifying high-priority goals and projects that require maximum funding). It is good practice to set aside an emergency fund to account for unexpected challenges.

4. Budget implementation

Many businesses fail to do this as they find their budgets restrictive. However, they must remember that a budget improves financial control. If a company struggles to implement its budget despite having the will to do so, it might be because the spend management plan has shortcomings that need to be examined.

5. Budget evaluation

Companies mustn’t forget to go back to their budgets periodically to check if the actual numbers match the projections. This will lead to necessary revisions and keep the budget relevant. Regular reviews also ensure budgets change with the way a business evolves.

Components of a growing company’s budget

At the top is the Master Budget, which has two components, the Operating Budget and the Financial Budget. These, in turn, are broken down into sub-budgets:

1. Operating Budget

It presents an overview of a company’s projected income for a period, usually up to a year. Its objective is to set financial goals and check the results. An operating budget can be created every month or quarter and relies on the following sub-budgets:

Sales Budget

It lists the expected product units, per unit price, and total revenue expected from their sale. To arrive at these estimates, budget planners depend primarily on feedback from salespeople and to a lesser extent on other information sources such as the state of the economy and pricing policies. The Sales Budget – also called a Sales Forecast or Revenue Budget – is the first step in preparing the Master Budget.

Production Budget

The next step is to determine the number of product units to be produced, taking into account the number of units already in stock and the final number that is needed. This is the only budget to be stated in unit terms instead of dollar terms. Companies use the Production Budget to adjust production levels.

Direct Materials Purchases Budget

Next comes the materials purchase budget, which states how much additional raw material is required to produce the projected number of items and how much this will cost.

Direct Labour Budget

Production requires manpower and the labour budget specifies the number of work hours and workers required and their cost.

Overhead Budget

Excluding direct materials and direct labour expenses, the Overhead Budget accounts for all other production-related costs – for use of machinery, equipment and factory premises; for indirect materials such as machine parts and safety devices for workers; for indirect labour such as supervisors and security wages; and compliance charges related to government regulations on safety, emissions, and hazardous material.

Administrative Expenses Budget

It details the administrative expenses related to the production and sale of goods, such as employee salaries and benefits, taxes, expenses associated with buying office supplies and hiring professional advisors and consultants, and so on.

Ending Finished Goods Inventory Budget

It helps set the per unit product price based on material, labour, and overhead costs.

Cost of Goods Sold Budget

This budget details direct expenses incurred on producing a company’s goods. It includes direct costs for raw materials and labour and excludes indirect expenses such as those associated with distributing the goods or hiring sales personnel to sell them.

Budgeted Income Statement

Combining information provided in the eight sub-budgets, this is a statement of a company’s net income – the earnings left after deducting the cost of goods sold, other expenses, taxes, and interests – for the budget period.

2. Financial Budget

The second component of the Master Budget, the Financial Budget serves as a strategic plan for managing a company’s assets, liabilities, income, expenses, cash flow, and investments. It helps companies arrive at their net profit (earnings minus operating costs, taxes, and interest) at the end of the budgeting process. The Financial Budget is mostly used by larger firms to carry out long-term plans, but it can be invaluable to small and growing businesses as it presents a clear view of their financial resources, which can greatly help in decision-making. Like the Operating Budget, the Financial Budget is split into sub-budgets:

Capital Expenditures Budget

It is a list of expenses incurred on the purchase and maintenance of fixed assets such as machinery, equipment, and plants. Most small and growing businesses don’t own their own factories and, therefore, have conservative capital expenditures. A typical Capital Expenditures Budget for a growing business might include money spent on buying software or leasing equipment.

Cash Budget

This is of special interest to small and medium businesses, which typically operate on cash. Usually prepared on a monthly basis, a Cash Budget tells companies how much money they have (net working capital) at the month-end. They also pinpoint areas where the company might be overspending or underspending.

Budgeted Balance Sheet

A statement of expected assets and liabilities at the end of the budget period. It is drawn from information provided in the Capital Expenditures, Cash, and Operating Budgets.

Additionally, many growing businesses have department-specific budgets such as an IT budget (hardware, software, personnel, outsourcing costs), HR budget (recruitment, training, learning and development, salaries and benefits), and a marketing budget (advertising, social media, and website development).

Develop your business budget with our monthly budget Excel template

Now that we’ve covered the components of a business budget, learn to make one for your small business. This monthly budget Excel template is the perfect place to start. Input your own data into the budget template to turn it into a customised spend plan for your future endeavours, whether it is increasing sales or launching a new product. Need a marketing budget template on the double? This easy-to-use Excel template can be your guide to creating the perfect business budget.

5 budgeting benefits for small businesses

1. meeting financial goals.

All companies have financial goals – from cutting costs to increasing investments. Attaining its financial goals means a company has succeeded. But without a budget, it might not know if these goals were fulfilled at all. Another way budgeting helps businesses set and achieve goals is by replacing guesswork with accurate information and insights, maybe about opportunities waiting to be explored that they didn’t know about.

2. Ready for emergencies

In business as in life, one must plan for the unexpected. Budgeting does just that. Take the Covid-19 pandemic, which saw scores of businesses shut shop. Those that survived probably had a little fund cushion to fall back on. As previously mentioned, setting aside a contingency fund is crucial in budget management. It can help companies tide over emergencies like economic recessions and even the general unpredictability of running a small business.

3. Planning ahead

Running a business without a budget is like flying blind. Not knowing where its money is coming from or going can make companies incapable of making long-term commitments to customers/suppliers or taking advantage of opportunities. It can also deal a death blow to expansion dreams. Surely, no small business wants to stay small forever.

4. Being debt-free

With few financial resources, small companies rely on external funding to keep the business running. Failure to pay their debts can lead to loss of reputation and shut down funding avenues. To avoid this fate, businesses must meet monthly or quarterly repayment obligations and set these in their budget management plans.

5. Better decision-making

To make any business decision, an organisation needs to know how much money it can allocate for that purpose. For instance, can it afford to offer employees a raise or hire advisors to improve productivity? With the clarity a budget provides, such decisions aren’t that difficult to make. From wise allocation of resources to knowing the right time to scale up operations, small businesses have much to gain from the improved decision-making budgeting brings.

5 risks of not having a budget

1. spending money you don’t have.

Budgets help businesses forecast spending, keep up with payments, manage cash flow smoothly, and inject efficiency into expense management (employee-initiated expenses). Without a budget, a company might be spending money it doesn’t have, resulting in debt and worse.

2. Denial of funding

Banks and other financial institutions won’t lend to a company unless it has a budget detailing where the funds will be invested and how revenue will be raised to repay the debt. For the same reason, investors won’t put their money in a business unless they see a spend management document. For small businesses, a lack of funding doesn’t just put the lid on expansion plans. It could very well put the survival of the business on the line.

3. Poor product pricing

Companies price their products on the basis of what they need to spend to produce them. Without the accurate cost estimates budgeting provides, they might not be setting optimal prices for profitable products. Or, they might be wasting their resources on products with insignificant profit margins.

4. Failed commitments and unhappy clients

Without proper spend management, small businesses may run out of funds and fail to deliver on their commitments, leading to unhappy clients who won’t think twice before moving to more competent rivals. Such a loss of reputation can be permanently damaging for small companies and start-ups.

5. Helpless in changing conditions

Doing business is fraught with challenges and changes. It isn’t possible to predict every change but a budget gives businesses the flexibility to adjust quickly – perhaps, by cutting costs in the face of a sudden dip in sales. On the other hand, the absence of a budget makes businesses less agile and incapable of adapting to change.

How budgeting works – the methods

Are you a start-up, a small business, or a large corporation? The size of a business is one of many factors determining what budgeting methodology works best for you. Others include spend patterns, sales performances, and scale of resources.

- Incremental budgeting: This involves adjusting your previous budget by an increment or percentage to arrive at your current budget. It suits established businesses with historical data and companies whose funding patterns aren’t subject to sudden changes. Incremental budgeting is easy, uncomplicated, and common practice. But it can promote unnecessary spending and doesn’t account for external factors (changing market conditions).

- Zero-based budgeting: Here, a business creates a fresh budget from scratch, assuming it begins at zero. Each dollar requested must therefore be justified. Zero-based budgeting is ideal for companies of all sizes, but particularly for those that want to focus on specific goals. It ensures resources are allocated efficiently and unnecessary expenses curbed. However, the process can be time-consuming.

- Value proposition budgeting: This method lies midway between incremental and zero-based budgeting. It determines whether the value created from a product for the company and its stakeholders, including customers, justifies the cost of producing it. By helping companies prioritise products with high customer value, it helps reduce unnecessary expenses. As such, it is considered a good fit for small businesses.

- Activity-based budgeting: It analyses activities – any activity that incurs a cost – to predict expenses. With activity-based budgeting, companies can pinpoint where each dollar goes, making it easier to cut costs where feasible and predict how much profit can be earned. On the flip side, this type of budgeting is time-consuming, expensive, and requires expert analysts. It is commonly used by large companies with considerable revenue.

- Cash flow budgeting: As the name suggests, this method estimates how much cash flows in and out of a business over a specific period. This insight helps businesses use allocated funds wisely, ensuring there is enough to maintain day-to-day operations and also a little left over at the end of the budget period. Cash flow budgeting is suitable for all businesses, but it might be difficult for companies with thin profit margins.

- Surplus budgeting: This comes into play when the estimated revenue exceeds total expenditure, resulting in a surplus. Surplus budgeting helps companies make prudent use of this surplus – for example, should it be used to grow the business or put aside for use during an emergency?

Budgeting methods can also vary according to the type of accounting used:

- Cash accounting: This method records income only after it has been received in the company bank account and expenses after the money has left the account.

- Accrual accounting: Here, revenue is recorded when it is earned, not when it enters the bank account. Similarly, expenses are recorded when they are billed, not when money leaves the account.

Principles of successful budgeting

To come up with a well-thought-out budget, business owners must stand by these principles:

Be realistic

Set goals that can be reasonably achieved. Similarly, make sure the company doesn’t overestimate its projected income. Inaccurate projections not only cause operational problems but also harm a company’s credibility.

Be flexible

Running a business can be unpredictable and budgets should be built to adapt to changing conditions. Whether it is an unexpected spike in raw material prices or a sudden shortage of shipping containers (which much of the world witnessed in 2021), make sure your budget has the elbow room to account for the unexpected. Again, earmarking savings for an emergency fund should be a golden rule of budgeting, if it isn’t already.

Be accurate

A budget must be accurate when it comes to tracking expenses – especially purchases made in cash, which are often the biggest source of budget leaks. A budget that doesn’t account for every dollar will present a distorted expenditure estimate, which can endanger the entire budgeting process.

Be inclusive

When a company holds its employees responsible for results, it should also include them in budget preparation and seek their opinion at the goal-setting stage. By incorporating their work experience and knowledge in the budget, employers can significantly increase their chances of success and boost their commitment to work.

Hold regular reviews

Weekly, monthly, quarterly or yearly, a company’s financial goals and budgets must be revisited periodically to ensure the results match the projections. The review process should be standardised and a team set aside for it. Evaluations require manpower, time, and effort, but they are the only way to ensure the budget is fulfilling its function.

Be a budgeting pro with Aspire

Budgeting for business can be difficult, but Aspire can help you take effective control of your company spend. In tune with the industry best practices stated in this article, our budgeting solutions include:

- Spend limits and notifications to prevent overspending

- Real-time visibility into all company expenses

- Delegation of budget owners within teams for better accountability

- Automated receipt reminders, seamless uploading, and easily available transaction records

- Integrated accounting software for error-free transactions

- Interest-free credit for all those times you need ready cash.

Click here to get started or to speak with an expert.

Download this article as an e-book: The Complete Guide to Business Budgeting and Budget Management

Frequently Asked Questions

How to create a business budget

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Small business loans

- • Bad credit loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Our writers and editors used an in-house natural language generation platform to assist with portions of this article, allowing them to focus on adding information that is uniquely helpful. The article was reviewed, fact-checked and edited by our editorial staff prior to publication.

Key takeaways

- A business budget is a financial plan that helps estimate a company's revenue and expenses, making it an essential tool for small businesses

- The steps to creating a business budget include choosing budget and accounting software, listing expenses and forecasting revenue

- If a business finds itself in a budget deficit, strategies such as cutting costs, negotiating with suppliers and diversifying revenue streams can help

As a small business owner, keeping your finances organized through a business budget is crucial to running a successful company.

Business budgeting involves creating a financial plan that estimates future revenue and expenses to make informed financial decisions, which can ultimately move the needle on your business’s financial goals and help it grow in profitability.

What is a business budget?

A business budget is a financial plan that outlines the company’s current revenue and expenses. The budget also forecasts expected revenue that can be used for future business activities, such as purchasing equipment. It sets targets for your business’s revenue, expenses and profit and helps you determine if you’ll have more money coming in than you pay out.

A business budget is an essential tool that helps you make wise business decisions. Without it, it’s difficult to gauge your business’s financial health.

What is the difference between a cash flow statement and a business budget?

A cash flow statement (CFS) is a financial document that summarizes the movement of cash coming in and going out of a company. The CFS gauges how effectively a company manages its finances, including how it manages debt responsibilities and funds day-to-day operations.

It’s similar to a business budget in that you can see expenses and revenue. But while a budget gives a moment-in-time snapshot of your business’s financial performance compared to forecasts, the cash flow statement focuses on the actual inflows and outflows of money through your business.

Follow these steps to ensure a well-developed budget, from understanding your expenses to generating revenue and adjusting expenses to balance the budget.

1. Choose a budget and accounting software

First, you’ll want to store your expense and revenue information with accounting software to help you track your numbers and generate reports. Some software may also help you assign categories to the transactions, identify tax deductions and file taxes. Quickbooks is an example of accounting software.

Some business bank accounts also have accounting software built in, helping you stay organized by keeping your accounting and banking in one place.

2. List your business expenses

The next step in creating a small business budget is to list all your business expenses. Here are the types of expenses you want to include in your budget:

- Fixed expenses: Fixed expenses cost a fixed amount monthly or within the assessed period. Those costs include rent, insurance, salaries and loan payments.

- Variable expenses: Variable expenses can change monthly or over time, making them trickier to budget. This might include materials, direct labor, utility bills or marketing expenses.

- Annual or one-time costs: Some costs only occur a few times per year, while others you’ll only pay for as needed, such as buying new equipment. You still want to budget for these expenses by allocating a portion of your weekly or monthly budget toward one-time expenses.

- Contingency funds: Unexpected business costs can throw a wrench in your budget if not planned for. Such costs could include emergency repairs, necessary equipment purchases, sudden tax increases or unforeseen legal fees. To plan for these costs, you can create a contingency or emergency fund that’s separate from your operational budget.

- Maintenance costs: To allocate funds for maintenance costs, begin by including regular inspections and maintenance in your budget. Then, make sure to leave room for changes and unexpected maintenance costs.

3. Forecast your revenue

To estimate your future revenue, start by deciding on a timeline for your forecast. A good place to start is the previous 12 months. Your accounting software may also include revenue forecasting as one of its features, which can automate this step for you.

The timeline and your recent past growth can help you understand how much revenue you’ll generate in the future. Consider external factors that could drive revenue growth, such as planned business activities like expansion, marketing campaigns or new product launches.

You’ll also want to think about anything that might slow your growth. Many businesses experience seasonal fluctuations, which can impact your budget if you don’t plan for it. To account for these changes, list the minimum expenses required to keep your business running. Use your financial statements to understand these costs, and consider averaging out irregular expenses over the year to avoid surprises.

Ideally, your business should build a cash reserve during profitable periods to cover expenses during slower seasons. If necessary, consider various financing options, such as a business credit card or line of credit, that you can draw from to manage cash flow during peak or off times.

4. Calculate your profits

The next step in creating a business budget is to calculate your business profits. You can look at your total profits by calculating revenue minus expenses. That way, you see how much money you have to work with, called your working capital .

You should also understand your profit margins for each of your products and services, which can help you set prices or decide whether to offer a new product or service.

How to calculate your profit margins

To find out your gross profit margin, you’ll first need to calculate the gross profit. To calculate your business’s gross profit, subtract the cost of goods sold (COGS) from your total revenue. COGS includes all the expenses related to producing your products and services.

Once you have the gross profit, use the gross profit margin formula: (Revenue – COGS) / Revenue x 100. This will give you a percentage that shows how much profit you gain from that particular product after accounting for the product’s costs.

5. Make a strategy for your working capital

Knowing what to do with extra revenue, which is your working capital, is crucial for managing your business finances and growth. Here’s how to get started with a financial strategy that propels your business goals forward:

- Set spending limits for different categories in your budget. When listing your expenses, you should have set a dollar amount for each category. You can estimate this by a monthly average or a general forecasted amount.

- Set realistic short- and long-term goals. These goals will motivate you to stick to your budget and guide your spending decisions.

- Compare your actual spending with your net income and priorities. Look at the areas you’re spending and consider whether you need to reallocate money to different categories. Consider separating expenses into business needs and extras.

- Adjust your budget and actual spending. Adjust your spending to ensure you do not overspend and can allocate money towards your goals. If you need to cut spending, consider the categories that are extras, such as types of marketing that you don’t know will generate a return on investment.

6. Review your budget and forecasts regularly

Finally, review your budget regularly. By frequently checking in on your budget, you can identify any discrepancies between your planned and actual expenses and adjust accordingly. This allows you to proactively handle any financial issues that may arise rather than reacting to them after they’ve become a problem.

Regular reviews also allow you to refine your budgeting process and improve its accuracy over time. Keep in mind that your budget is not set in stone but rather a tool to guide your financial decisions and help you achieve your business goals.

What to do if you have a deficit in your business budget

Finding a deficit in your small business budget can be alarming, but there are several strategies you can employ to handle this situation.

- Do a cash flow analysis. Begin by doing a cash flow analysis to review what your business is earning and spending money on. Identify potential problems and adjust the budget as needed to prevent overspending.

- Cut nonessential business costs. Cutting spending may involve eliminating nonessential costs and transferring funds from other categories to overspent categories. Your goal is a balanced or profitable budget.

- Negotiate with suppliers. Be transparent in your communications with suppliers and explain your quality standards and why you’re seeking cost reduction. Explore options for cost reduction that do not compromise quality, such as process improvements or ordering in larger quantities.

- Create a lean business model. By removing anything that doesn’t benefit your customer, your business can potentially save time and resources. Lean business models focus on continually improving processes and customer experience without adding additional resources, time or funds.

- Add revenue and diversify revenue streams. Raising revenue requires a realistic plan with measurable goals to increase sales and overall business income. You can also consider other products and services you could offer that would make your business profitable.

- Use financing to cover temporary gaps. Applying for a small business loan can help pay bills during an unplanned shortfall. Since this will add an expense to your budget, make sure you can handle the loan repayments and your regular expenses.

- Plan for a deficit. In some cases, a planned budget deficit might be a strategic decision, such as investing in new opportunities that promise long-term benefits.

Bottom line

Having a well-developed business budget is crucial for making informed decisions. You can effectively manage your small business’s finances by tracking and analyzing your business’s inflows and outflows, forecasting your expected revenue and adjusting your budget to stay balanced.

Even in the face of a budget deficit, there are various strategies you can use to keep your business profitable, including negotiating costs with your suppliers, assessing your business operations and offering new products and services.

With a solid business budget in place, you can confidently navigate financial challenges and drive long-term success for your small business.

Frequently asked questions

What are the benefits of a business budget, what are the components of a business budget, how do you calculate fixed and variable costs in a business budget.

Related Articles

How to finance a small business for the holidays

Average cost of starting a small business

How to bootstrap your small business

How to start a small business

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

What Is a Business Budget?

Definition & Examples of a Business Budget

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

How a Business Budget Works

Do i need a business budget, example of a business budget template.

A business budget estimates an organization's revenue and expenses over a specific period of time.

Learn more about how a business budget works and get an example of one.

A business budget provides an accurate picture of expenditures and revenues and should drive important business decisions such as whether to increase marketing, cut expenses, hire staff, purchase equipment, and improve efficiencies in other ways. It also outlines your organization's financial and operational goals, so it may be thought of as an action plan that helps you allocate resources, evaluate performances, and formulate plans.

The basic process of planning a budget involves listing your business's fixed and variable costs on a monthly basis and then deciding on the allocation of funds to reflect goals.

Businesses often use special types of budgets to assess specific areas of operation. A cash flow budget, for example, projects your business's cash inflows and outflows over a certain period of time. Its main use is to predict your business's ability to take in more cash than it pays out.

Most businesses have fixed costs that are independent of sales revenue, such as:

- Building or office eases or mortgage costs