Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

The importance of business plan: 5 key reasons.

A key part of any business is its business plan. They can help define the goals of your business and help it reach success. A good business plan can also help you develop an adequate marketing strategy. There are a number of reasons all business owners need business plans, keep reading to learn more!

Here’s What We’ll Cover:

What Is a Business Plan?

5 reasons you need a well-written business plan, how do i make a business plan, key takeaways.

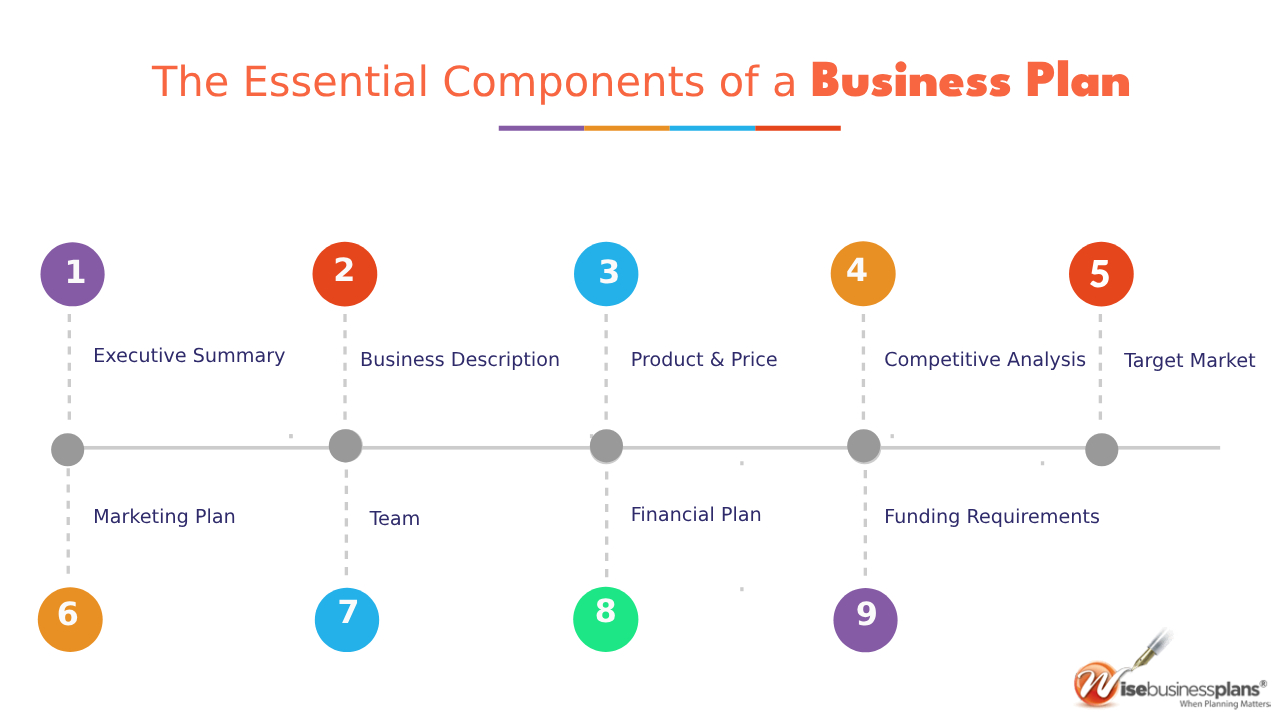

A business plan contains detailed information that can help determine its success. Some of this information can include the following:

- Market analysis

- Cash flow projection

- Competitive analysis

- Financial statements and financial projections

- An operating plan

A solid business plan is a good way to attract potential investors. It can also help you display to business partners that you have a successful business growing. In a competitive landscape, a formal business plan is your key to success.

Check out all of the biggest reasons you need a good business plan below.

1. To Secure Funding

Whether you’re seeking funding from a venture capitalist or a bank, you’ll need a business plan. Business plans are the foundation of a business. They tell the parties that you’re seeking funding from whether or not you’re worth investing in. If you need any sort of outside financing, you’ll need a good business plan to secure it.

2. Set and Communicate Goals

A business plan gives you a tangible way of reviewing your business goals. Business plans revolve around the present and the future. When you establish your goals and put them in writing, you’re more likely to reach them. A strong business plan includes these goals, and allows you to communicate them to investors and employees alike.

3. Prove Viability in the Market

While many businesses are born from passion, not many will last without an effective business plan. While a business concept may seem sound, things may change once the specifics are written down. Often, people who attempt to start a business without a plan will fail. This is because they don’t take into account all of the planning and funds needed to get a business off of the ground.

Market research is a large part of the business planning process. It lets you review your potential customers, as well as the competition, in your field. By understanding both you can set price points for products or services. Sometimes, it may not make sense to start a business based on the existing competition. Other times, market research can guide you to effective marketing strategies that others lack. To have a successful business, it has to be viable. A business plan will help you determine that.

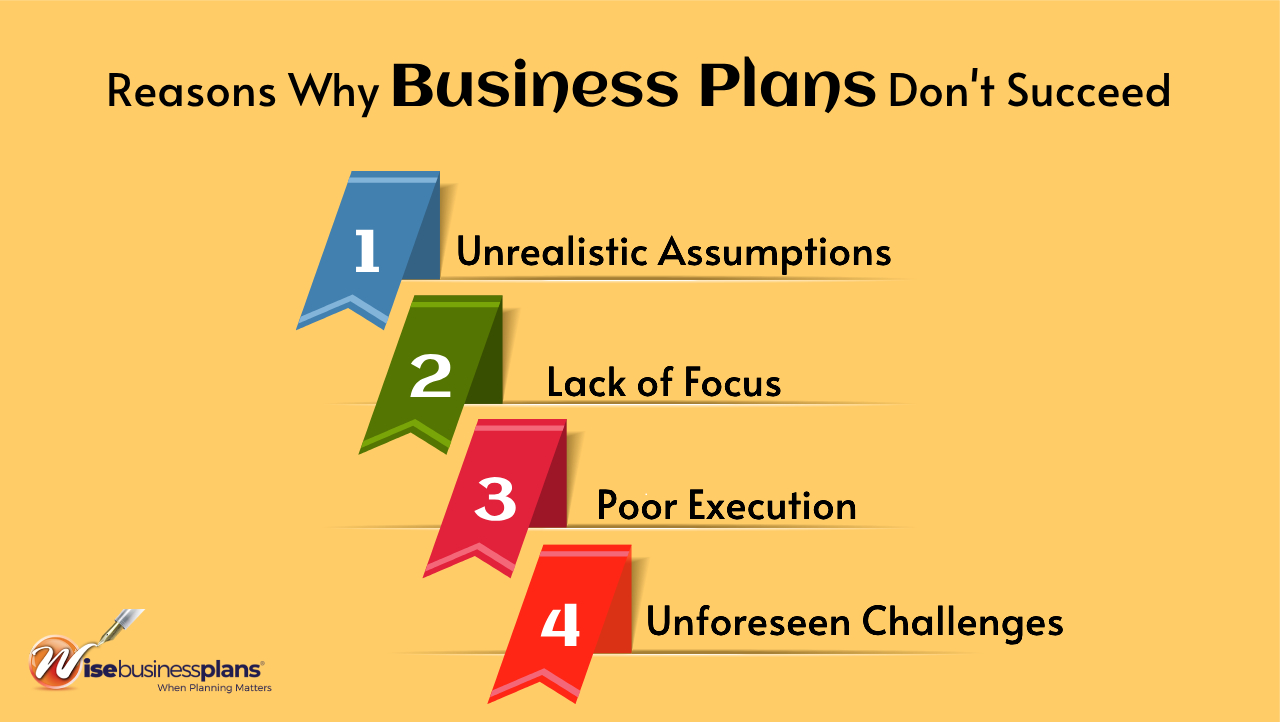

4. They Help Owners Avoid Failure

Far too often, small businesses fail. Many times, this is due to the lack of a strong business plan. There are many reasons that small businesses fail, most of which can be avoided by developing a business plan. Some of them are listed below, which can be avoided by having a business plan:

- The market doesn’t need the business’s product or service

- The business didn’t take into account the amount of capital needed

- The market is oversaturated

- The prices set by the business are too high, pushing potential customers away

Any good business plan includes information to help business owners avoid these issues.

5. Business Plans Reduce Risk

Related to the last reason, business plans help reduce risk. A well-thought-out business plan helps reduce risky decisions. They help business owners make informed decisions based on the research they conduct. Any business owner can tell you that the most important part of their job is making critical decisions. A business plan that factors in all possible situations helps make those decisions.

Luckily, there are plenty of tools available to help you create a business plan. A simple search can lead you to helpful tools, like a business plan template . These are helpful, as they let you fill in the information as you go. Many of them provide basic instructions on how to create the business plan, as well.

If you plan on starting a business, you’ll need a business plan. They’re good for a vast number of things. Business plans help owners make informed decisions, as well as set goals and secure funding. Don’t put off putting together your business plan!

If you’re in the planning stages of your business, be sure to check out our resource hub . We have plenty of valuable resources and articles for you when you’re just getting started. Check it out today!

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Sign up for our newsletter for product updates, new blog posts, and the chance to be featured in our Small Business Spotlight!

The importance of a business plan

Business plans are like road maps: it’s possible to travel without one, but that will only increase the odds of getting lost along the way.

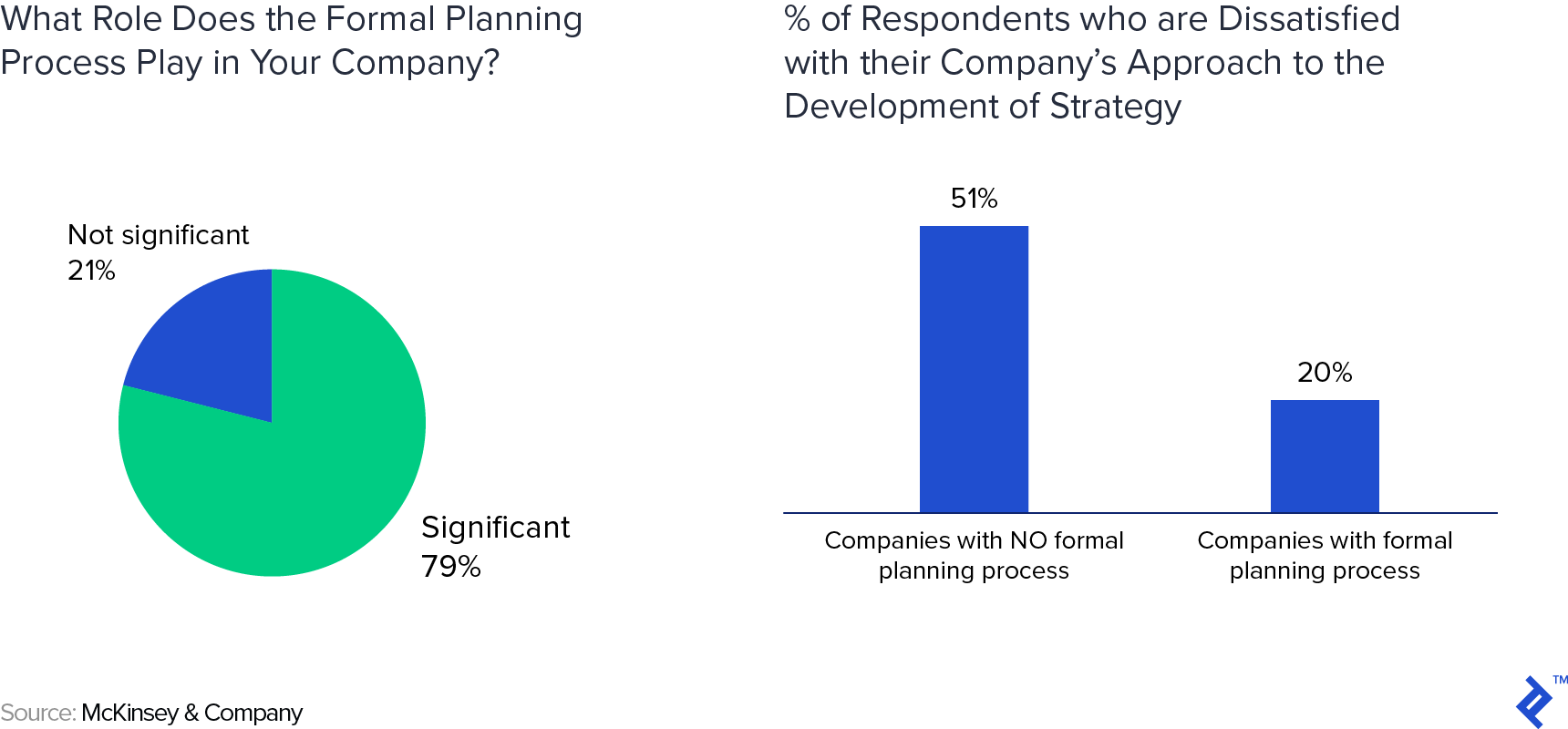

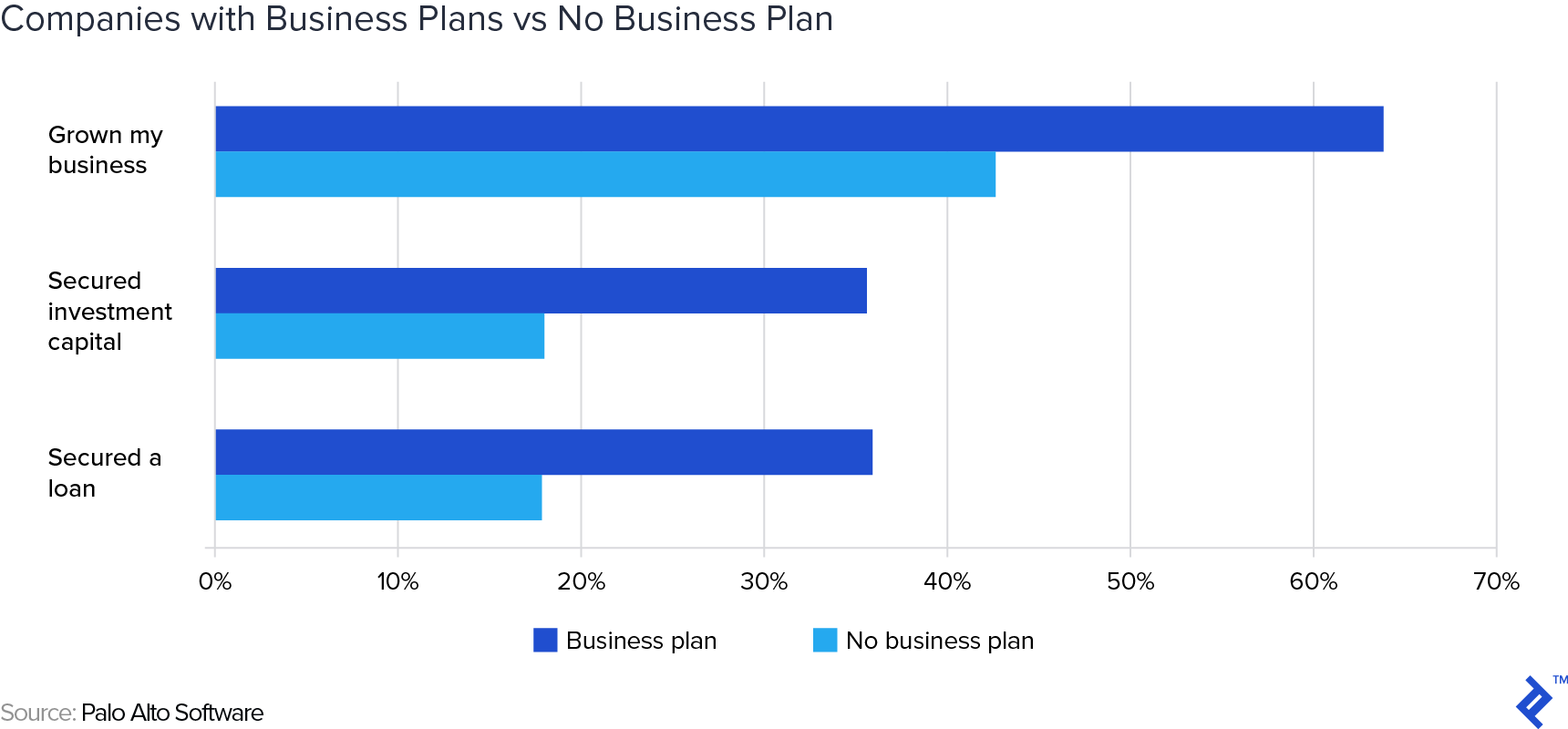

Owners with a business plan see growth 30% faster than those without one, and 71% of the fast-growing companies have business plans . Before we get into the thick of it, let’s define and go over what a business plan actually is.

What is a business plan?

A business plan is a 15-20 page document that outlines how you will achieve your business objectives and includes information about your product, marketing strategies, and finances. You should create one when you’re starting a new business and keep updating it as your business grows.

Rather than putting yourself in a position where you may have to stop and ask for directions or even circle back and start over, small business owners often use business plans to help guide them. That’s because they help them see the bigger picture, plan ahead, make important decisions, and improve the overall likelihood of success.

Why is a business plan important?

A well-written business plan is an important tool because it gives entrepreneurs and small business owners, as well as their employees, the ability to lay out their goals and track their progress as their business begins to grow. Business planning should be the first thing done when starting a new business. Business plans are also important for attracting investors so they can determine if your business is on the right path and worth putting money into.

Business plans typically include detailed information that can help improve your business’s chances of success, like:

- A market analysis : gathering information about factors and conditions that affect your industry

- Competitive analysis : evaluating the strengths and weaknesses of your competitors

- Customer segmentation : divide your customers into different groups based on specific characteristics to improve your marketing

- Marketing: using your research to advertise your business

- Logistics and operations plans : planning and executing the most efficient production process

- Cash flow projection : being prepared for how much money is going into and out of your business

- An overall path to long-term growth

10 reasons why you need a business plan

I know what you’re thinking: “Do I really need a business plan? It sounds like a lot of work, plus I heard they’re outdated and I like figuring things out as I go...”.

The answer is: yes, you really do need a business plan! As entrepreneur Kevin J. Donaldson said, “Going into business without a business plan is like going on a mountain trek without a map or GPS support—you’ll eventually get lost and starve! Though it may sound tedious and time-consuming, business plans are critical to starting your business and setting yourself up for success.

To outline the importance of business plans and make the process sound less daunting, here are 10 reasons why you need one for your small business.

1. To help you with critical decisions

The primary importance of a business plan is that they help you make better decisions. Entrepreneurship is often an endless exercise in decision making and crisis management. Sitting down and considering all the ramifications of any given decision is a luxury that small businesses can’t always afford. That’s where a business plan comes in.

Building a business plan allows you to determine the answer to some of the most critical business decisions ahead of time.

Creating a robust business plan is a forcing function—you have to sit down and think about major components of your business before you get started, like your marketing strategy and what products you’ll sell. You answer many tough questions before they arise. And thinking deeply about your core strategies can also help you understand how those decisions will impact your broader strategy.

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

Send invoices, get paid, track expenses, pay your team, and balance your books with our financial management software.

2. To iron out the kinks

Putting together a business plan requires entrepreneurs to ask themselves a lot of hard questions and take the time to come up with well-researched and insightful answers. Even if the document itself were to disappear as soon as it’s completed, the practice of writing it helps to articulate your vision in realistic terms and better determine if there are any gaps in your strategy.

3. To avoid the big mistakes

Only about half of small businesses are still around to celebrate their fifth birthday . While there are many reasons why small businesses fail, many of the most common are purposefully addressed in business plans.

According to data from CB Insights , some of the most common reasons businesses fail include:

- No market need : No one wants what you’re selling.

- Lack of capital : Cash flow issues or businesses simply run out of money.

- Inadequate team : This underscores the importance of hiring the right people to help you run your business.

- Stiff competition : It’s tough to generate a steady profit when you have a lot of competitors in your space.

- Pricing : Some entrepreneurs price their products or services too high or too low—both scenarios can be a recipe for disaster.

The exercise of creating a business plan can help you avoid these major mistakes. Whether it’s cash flow forecasts or a product-market fit analysis , every piece of a business plan can help spot some of those potentially critical mistakes before they arise. For example, don’t be afraid to scrap an idea you really loved if it turns out there’s no market need. Be honest with yourself!

Get a jumpstart on your business plan by creating your own cash flow projection .

4. To prove the viability of the business

Many businesses are created out of passion, and while passion can be a great motivator, it’s not a great proof point.

Planning out exactly how you’re going to turn that vision into a successful business is perhaps the most important step between concept and reality. Business plans can help you confirm that your grand idea makes sound business sense.

A critical component of your business plan is the market research section. Market research can offer deep insight into your customers, your competitors, and your chosen industry. Not only can it enlighten entrepreneurs who are starting up a new business, but it can also better inform existing businesses on activities like marketing, advertising, and releasing new products or services.

Want to prove there’s a market gap? Here’s how you can get started with market research.

5. To set better objectives and benchmarks

Without a business plan, objectives often become arbitrary, without much rhyme or reason behind them. Having a business plan can help make those benchmarks more intentional and consequential. They can also help keep you accountable to your long-term vision and strategy, and gain insights into how your strategy is (or isn’t) coming together over time.

6. To communicate objectives and benchmarks

Whether you’re managing a team of 100 or a team of two, you can’t always be there to make every decision yourself. Think of the business plan like a substitute teacher, ready to answer questions any time there’s an absence. Let your staff know that when in doubt, they can always consult the business plan to understand the next steps in the event that they can’t get an answer from you directly.

Sharing your business plan with team members also helps ensure that all members are aligned with what you’re doing, why, and share the same understanding of long-term objectives.

7. To provide a guide for service providers

Small businesses typically employ contractors , freelancers, and other professionals to help them with tasks like accounting , marketing, legal assistance, and as consultants. Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, while ensuring everyone is on the same page.

8. To secure financing

Did you know you’re 2.5x more likely to get funded if you have a business plan?If you’re planning on pitching to venture capitalists, borrowing from a bank, or are considering selling your company in the future, you’re likely going to need a business plan. After all, anyone that’s interested in putting money into your company is going to want to know it’s in good hands and that it’s viable in the long run. Business plans are the most effective ways of proving that and are typically a requirement for anyone seeking outside financing.

Learn what you need to get a small business loan.

9. To better understand the broader landscape

No business is an island, and while you might have a strong handle on everything happening under your own roof, it’s equally important to understand the market terrain as well. Writing a business plan can go a long way in helping you better understand your competition and the market you’re operating in more broadly, illuminate consumer trends and preferences, potential disruptions and other insights that aren’t always plainly visible.

10. To reduce risk

Entrepreneurship is a risky business, but that risk becomes significantly more manageable once tested against a well-crafted business plan. Drawing up revenue and expense projections, devising logistics and operational plans, and understanding the market and competitive landscape can all help reduce the risk factor from an inherently precarious way to make a living. Having a business plan allows you to leave less up to chance, make better decisions, and enjoy the clearest possible view of the future of your company.

Understanding the importance of a business plan

Now that you have a solid grasp on the “why” behind business plans, you can confidently move forward with creating your own.

Remember that a business plan will grow and evolve along with your business, so it’s an important part of your whole journey—not just the beginning.

Related Posts

Now that you’ve read up on the purpose of a business plan, check out our guide to help you get started.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

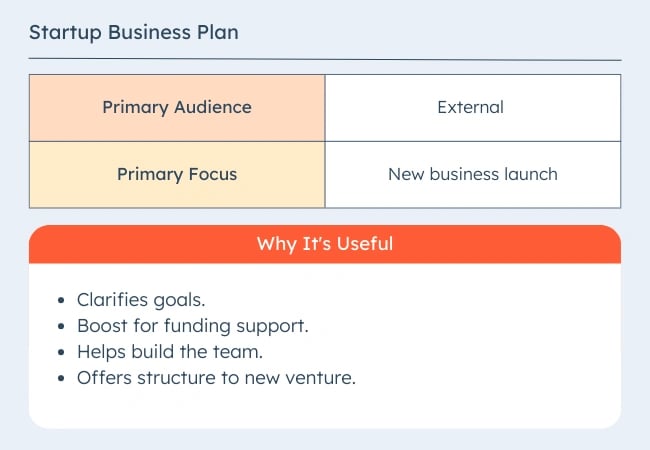

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

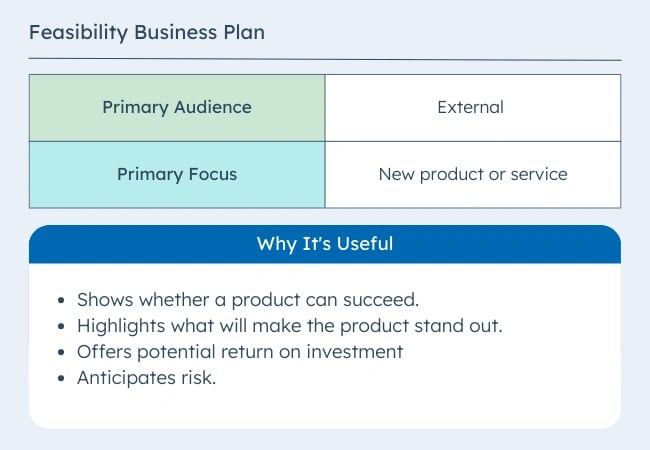

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

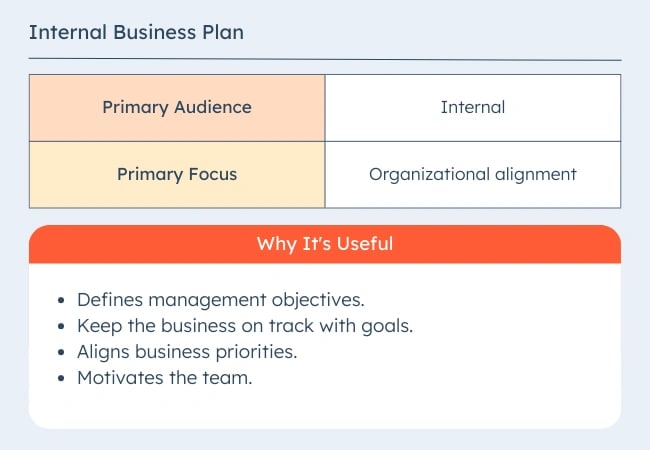

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

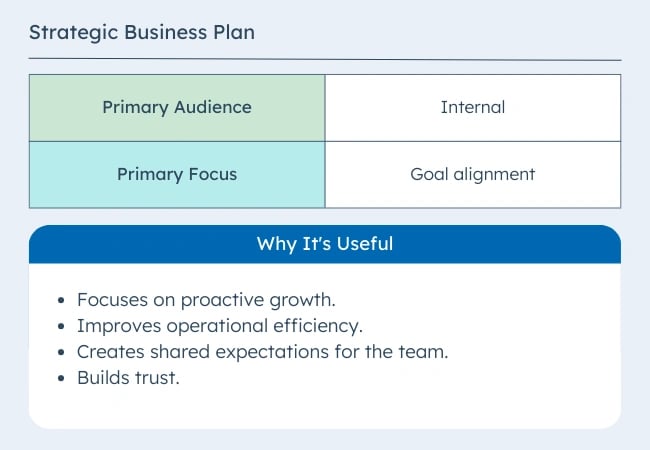

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

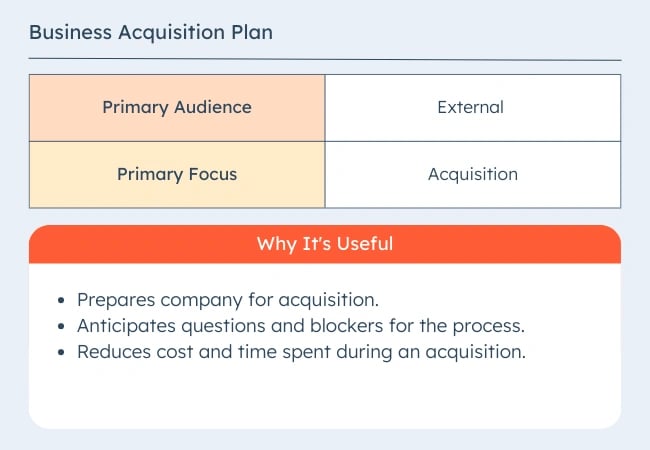

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![significance of business plan How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

19 Best Sample Business Plans & Examples to Help You Write Your Own

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![significance of business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![significance of business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Transition to growth mode

with LivePlan Get 40% off now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

What is a Business Plan? Definition and Resources

9 min. read

Updated March 4, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

If you’re stuck, start with a one-page business plan and check out our collection of over 550 business plan examples for inspiration. They’re broken out over dozens of industries—you can even copy and paste sections into your plan and rewrite them with information specific to your business.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

12 Min. Read

How to Write a Food Truck Business Plan (2024 + Template)

10 Min. Read

How to Create a Convincing Problem and Solution Statement

8 Min. Read

How to Format a Business Plan in 8 Simple Steps

6 Min. Read

How to Do a SWOT Analysis for Better Strategic Planning

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

Tax Season Savings

Get 40% off LivePlan

The #1 rated business plan software

Transform Tax Season into Growth Season

Discover the world’s #1 plan building software

The Undeniable Importance of a Business Plan

We often hear about business plans in the context of early-stage companies; however, constructing excellent business plans is difficult and time-consuming, so many entrepreneurs avoid them. But, is this a mistake?

While most people may be aware of the “soft” arguments for and against writing a business plan, in this article, a Toptal Finance Expert takes a data-driven approach to addressing the debate. In it, he finds strong evidence to support the notion that writing an excellent business plan is time well spent.

By Sean Heberling

Sean has analyzed 10,000+ companies, built complex models, and helped facilitate $1+ billion in investment transactions.

PREVIOUSLY AT

Executive Summary

- Individuals who write business plans are 2.5x as likely to start businesses.

- Business planning improves corporate executive satisfaction with corporate strategy development.

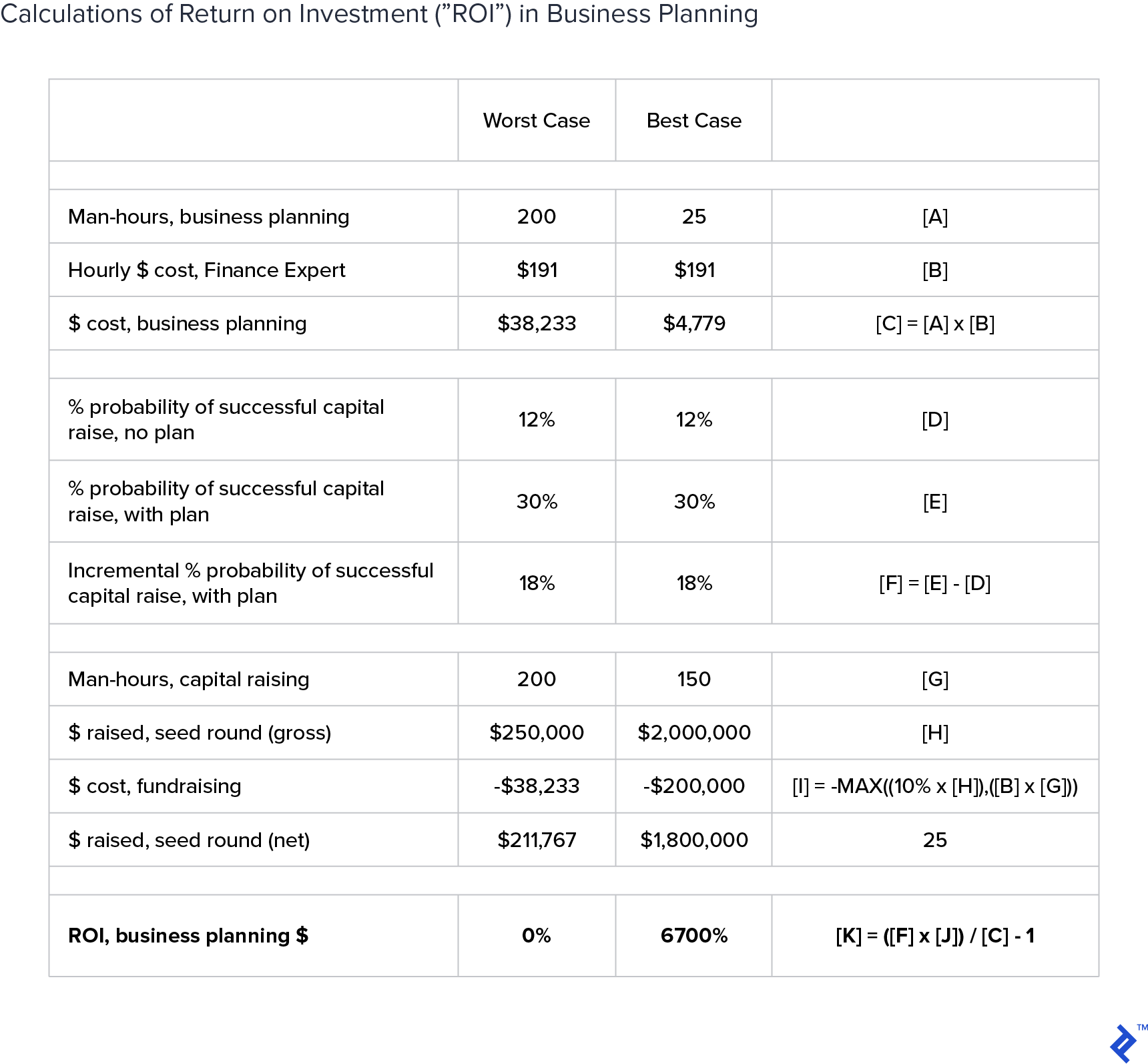

- Angels and venture capitalists value business plans and their [financial models](https://www.toptal.com/finance/tutorials/what-is-a-financial-model).

- Companies who complete business plans are 2.5x as likely to get funded.

- Even if a small-scale early-stage venture seeking just $250,000 in capital spent almost $40,000 on business planning and another almost $40,000 on capital raising, it should still expect to "break even" on a probability-weighted basis.

- Larger early-stage ventures enjoy extraordinary probability-weighted returns on investment from business planning. Because the target net capital so greatly exceeds the money spent on business planning, the prospective ROI is huge.

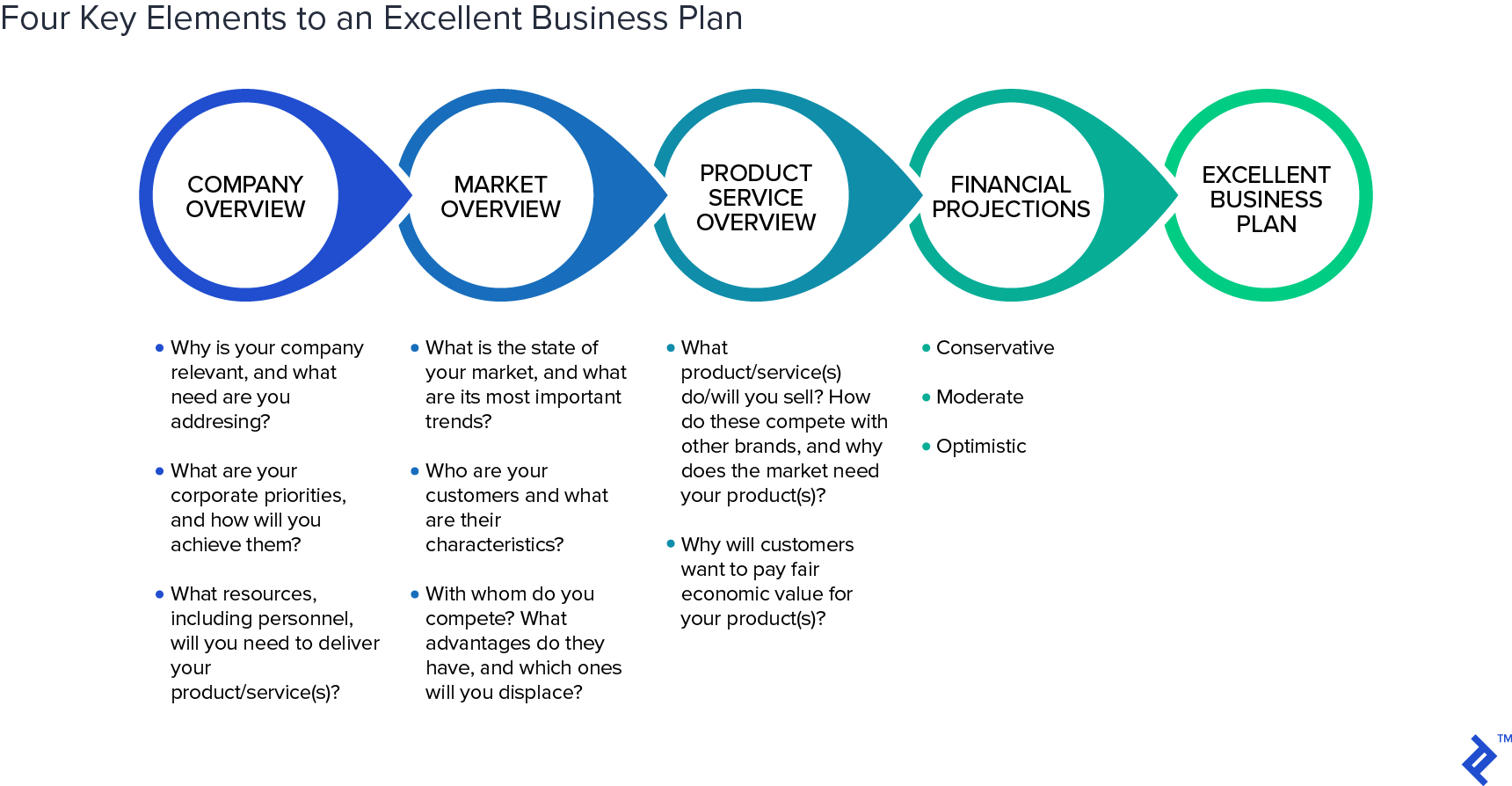

- Company Overview: An explanation of why your company is relevant and the need you are addressing.

- Market Overview: A description of the state of your market and its important trends, a detailed description of your customers, and a description of your current competitors and their advantages.

- Product/Service Overview: A description of your product(s), how they compete with other brands, why they are needed, and why customers will pay a fair economic value for it.

- Financial Projections: Three thorough financial plans with conservative, moderate, and optimistic assumptions.

- The process of writing forces the author to ask introspectively how they reached their conclusions and each of the sub-conclusions along the way because they must explain their logic to a cynical reader.

- The written author needs to support all conclusions with facts and logic to prove that they are not "making it up" or relying upon popular "myths."

- Outlined reports and outlined business plans are not generally subject to the same level of reader scrutiny.

We often hear about business plans in the context of early-stage companies , but constructing excellent business plans is difficult and time-consuming, so many entrepreneurs avoid them. That’s a mistake, as there is strong evidence demonstrating that business plans generate positive returns on time and money invested .

The business world has long debated the importance of business plans, and most involved understand the “soft” arguments. However, this article delves into the data to conclude that writing an excellent business plan is time well spent. I developed a similar view over my 20+ year financial career , during which I have analyzed well over 10,000 different types of companies. I have noticed that while a business plan may not be required for a venture to become successful, having one does seem to greatly improve the probability of successful outcomes.

Expert Opinions Support the Value of Business Planning

Expert opinions support the four following conclusions:

- Angels and venture capitalists value business plans and their financial models.

Individuals Who Write Business Plans Are 2.5x More Likely to Become Entrepreneurs