- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Survey Research: Definition, Examples and Methods

Survey Research is a quantitative research method used for collecting data from a set of respondents. It has been perhaps one of the most used methodologies in the industry for several years due to the multiple benefits and advantages that it has when collecting and analyzing data.

LEARN ABOUT: Behavioral Research

In this article, you will learn everything about survey research, such as types, methods, and examples.

Survey Research Definition

Survey Research is defined as the process of conducting research using surveys that researchers send to survey respondents. The data collected from surveys is then statistically analyzed to draw meaningful research conclusions. In the 21st century, every organization’s eager to understand what their customers think about their products or services and make better business decisions. Researchers can conduct research in multiple ways, but surveys are proven to be one of the most effective and trustworthy research methods. An online survey is a method for extracting information about a significant business matter from an individual or a group of individuals. It consists of structured survey questions that motivate the participants to respond. Creditable survey research can give these businesses access to a vast information bank. Organizations in media, other companies, and even governments rely on survey research to obtain accurate data.

The traditional definition of survey research is a quantitative method for collecting information from a pool of respondents by asking multiple survey questions. This research type includes the recruitment of individuals collection, and analysis of data. It’s useful for researchers who aim to communicate new features or trends to their respondents.

LEARN ABOUT: Level of Analysis Generally, it’s the primary step towards obtaining quick information about mainstream topics and conducting more rigorous and detailed quantitative research methods like surveys/polls or qualitative research methods like focus groups/on-call interviews can follow. There are many situations where researchers can conduct research using a blend of both qualitative and quantitative strategies.

LEARN ABOUT: Survey Sampling

Survey Research Methods

Survey research methods can be derived based on two critical factors: Survey research tool and time involved in conducting research. There are three main survey research methods, divided based on the medium of conducting survey research:

- Online/ Email: Online survey research is one of the most popular survey research methods today. The survey cost involved in online survey research is extremely minimal, and the responses gathered are highly accurate.

- Phone: Survey research conducted over the telephone ( CATI survey ) can be useful in collecting data from a more extensive section of the target population. There are chances that the money invested in phone surveys will be higher than other mediums, and the time required will be higher.

- Face-to-face: Researchers conduct face-to-face in-depth interviews in situations where there is a complicated problem to solve. The response rate for this method is the highest, but it can be costly.

Further, based on the time taken, survey research can be classified into two methods:

- Longitudinal survey research: Longitudinal survey research involves conducting survey research over a continuum of time and spread across years and decades. The data collected using this survey research method from one time period to another is qualitative or quantitative. Respondent behavior, preferences, and attitudes are continuously observed over time to analyze reasons for a change in behavior or preferences. For example, suppose a researcher intends to learn about the eating habits of teenagers. In that case, he/she will follow a sample of teenagers over a considerable period to ensure that the collected information is reliable. Often, cross-sectional survey research follows a longitudinal study .

- Cross-sectional survey research: Researchers conduct a cross-sectional survey to collect insights from a target audience at a particular time interval. This survey research method is implemented in various sectors such as retail, education, healthcare, SME businesses, etc. Cross-sectional studies can either be descriptive or analytical. It is quick and helps researchers collect information in a brief period. Researchers rely on the cross-sectional survey research method in situations where descriptive analysis of a subject is required.

Survey research also is bifurcated according to the sampling methods used to form samples for research: Probability and Non-probability sampling. Every individual in a population should be considered equally to be a part of the survey research sample. Probability sampling is a sampling method in which the researcher chooses the elements based on probability theory. The are various probability research methods, such as simple random sampling , systematic sampling, cluster sampling, stratified random sampling, etc. Non-probability sampling is a sampling method where the researcher uses his/her knowledge and experience to form samples.

LEARN ABOUT: Survey Sample Sizes

The various non-probability sampling techniques are :

- Convenience sampling

- Snowball sampling

- Consecutive sampling

- Judgemental sampling

- Quota sampling

Process of implementing survey research methods:

- Decide survey questions: Brainstorm and put together valid survey questions that are grammatically and logically appropriate. Understanding the objective and expected outcomes of the survey helps a lot. There are many surveys where details of responses are not as important as gaining insights about what customers prefer from the provided options. In such situations, a researcher can include multiple-choice questions or closed-ended questions . Whereas, if researchers need to obtain details about specific issues, they can consist of open-ended questions in the questionnaire. Ideally, the surveys should include a smart balance of open-ended and closed-ended questions. Use survey questions like Likert Scale , Semantic Scale, Net Promoter Score question, etc., to avoid fence-sitting.

LEARN ABOUT: System Usability Scale

- Finalize a target audience: Send out relevant surveys as per the target audience and filter out irrelevant questions as per the requirement. The survey research will be instrumental in case the target population decides on a sample. This way, results can be according to the desired market and be generalized to the entire population.

LEARN ABOUT: Testimonial Questions

- Send out surveys via decided mediums: Distribute the surveys to the target audience and patiently wait for the feedback and comments- this is the most crucial step of the survey research. The survey needs to be scheduled, keeping in mind the nature of the target audience and its regions. Surveys can be conducted via email, embedded in a website, shared via social media, etc., to gain maximum responses.

- Analyze survey results: Analyze the feedback in real-time and identify patterns in the responses which might lead to a much-needed breakthrough for your organization. GAP, TURF Analysis , Conjoint analysis, Cross tabulation, and many such survey feedback analysis methods can be used to spot and shed light on respondent behavior. Researchers can use the results to implement corrective measures to improve customer/employee satisfaction.

Reasons to conduct survey research

The most crucial and integral reason for conducting market research using surveys is that you can collect answers regarding specific, essential questions. You can ask these questions in multiple survey formats as per the target audience and the intent of the survey. Before designing a study, every organization must figure out the objective of carrying this out so that the study can be structured, planned, and executed to perfection.

LEARN ABOUT: Research Process Steps

Questions that need to be on your mind while designing a survey are:

- What is the primary aim of conducting the survey?

- How do you plan to utilize the collected survey data?

- What type of decisions do you plan to take based on the points mentioned above?

There are three critical reasons why an organization must conduct survey research.

- Understand respondent behavior to get solutions to your queries: If you’ve carefully curated a survey, the respondents will provide insights about what they like about your organization as well as suggestions for improvement. To motivate them to respond, you must be very vocal about how secure their responses will be and how you will utilize the answers. This will push them to be 100% honest about their feedback, opinions, and comments. Online surveys or mobile surveys have proved their privacy, and due to this, more and more respondents feel free to put forth their feedback through these mediums.

- Present a medium for discussion: A survey can be the perfect platform for respondents to provide criticism or applause for an organization. Important topics like product quality or quality of customer service etc., can be put on the table for discussion. A way you can do it is by including open-ended questions where the respondents can write their thoughts. This will make it easy for you to correlate your survey to what you intend to do with your product or service.

- Strategy for never-ending improvements: An organization can establish the target audience’s attributes from the pilot phase of survey research . Researchers can use the criticism and feedback received from this survey to improve the product/services. Once the company successfully makes the improvements, it can send out another survey to measure the change in feedback keeping the pilot phase the benchmark. By doing this activity, the organization can track what was effectively improved and what still needs improvement.

Survey Research Scales

There are four main scales for the measurement of variables:

- Nominal Scale: A nominal scale associates numbers with variables for mere naming or labeling, and the numbers usually have no other relevance. It is the most basic of the four levels of measurement.

- Ordinal Scale: The ordinal scale has an innate order within the variables along with labels. It establishes the rank between the variables of a scale but not the difference value between the variables.

- Interval Scale: The interval scale is a step ahead in comparison to the other two scales. Along with establishing a rank and name of variables, the scale also makes known the difference between the two variables. The only drawback is that there is no fixed start point of the scale, i.e., the actual zero value is absent.

- Ratio Scale: The ratio scale is the most advanced measurement scale, which has variables that are labeled in order and have a calculated difference between variables. In addition to what interval scale orders, this scale has a fixed starting point, i.e., the actual zero value is present.

Benefits of survey research

In case survey research is used for all the right purposes and is implemented properly, marketers can benefit by gaining useful, trustworthy data that they can use to better the ROI of the organization.

Other benefits of survey research are:

- Minimum investment: Mobile surveys and online surveys have minimal finance invested per respondent. Even with the gifts and other incentives provided to the people who participate in the study, online surveys are extremely economical compared to paper-based surveys.

- Versatile sources for response collection: You can conduct surveys via various mediums like online and mobile surveys. You can further classify them into qualitative mediums like focus groups , and interviews and quantitative mediums like customer-centric surveys. Due to the offline survey response collection option, researchers can conduct surveys in remote areas with limited internet connectivity. This can make data collection and analysis more convenient and extensive.

- Reliable for respondents: Surveys are extremely secure as the respondent details and responses are kept safeguarded. This anonymity makes respondents answer the survey questions candidly and with absolute honesty. An organization seeking to receive explicit responses for its survey research must mention that it will be confidential.

Survey research design

Researchers implement a survey research design in cases where there is a limited cost involved and there is a need to access details easily. This method is often used by small and large organizations to understand and analyze new trends, market demands, and opinions. Collecting information through tactfully designed survey research can be much more effective and productive than a casually conducted survey.

There are five stages of survey research design:

- Decide an aim of the research: There can be multiple reasons for a researcher to conduct a survey, but they need to decide a purpose for the research. This is the primary stage of survey research as it can mold the entire path of a survey, impacting its results.

- Filter the sample from target population: Who to target? is an essential question that a researcher should answer and keep in mind while conducting research. The precision of the results is driven by who the members of a sample are and how useful their opinions are. The quality of respondents in a sample is essential for the results received for research and not the quantity. If a researcher seeks to understand whether a product feature will work well with their target market, he/she can conduct survey research with a group of market experts for that product or technology.

- Zero-in on a survey method: Many qualitative and quantitative research methods can be discussed and decided. Focus groups, online interviews, surveys, polls, questionnaires, etc. can be carried out with a pre-decided sample of individuals.

- Design the questionnaire: What will the content of the survey be? A researcher is required to answer this question to be able to design it effectively. What will the content of the cover letter be? Or what are the survey questions of this questionnaire? Understand the target market thoroughly to create a questionnaire that targets a sample to gain insights about a survey research topic.

- Send out surveys and analyze results: Once the researcher decides on which questions to include in a study, they can send it across to the selected sample . Answers obtained from this survey can be analyzed to make product-related or marketing-related decisions.

Survey examples: 10 tips to design the perfect research survey

Picking the right survey design can be the key to gaining the information you need to make crucial decisions for all your research. It is essential to choose the right topic, choose the right question types, and pick a corresponding design. If this is your first time creating a survey, it can seem like an intimidating task. But with QuestionPro, each step of the process is made simple and easy.

Below are 10 Tips To Design The Perfect Research Survey:

- Set your SMART goals: Before conducting any market research or creating a particular plan, set your SMART Goals . What is that you want to achieve with the survey? How will you measure it promptly, and what are the results you are expecting?

- Choose the right questions: Designing a survey can be a tricky task. Asking the right questions may help you get the answers you are looking for and ease the task of analyzing. So, always choose those specific questions – relevant to your research.

- Begin your survey with a generalized question: Preferably, start your survey with a general question to understand whether the respondent uses the product or not. That also provides an excellent base and intro for your survey.

- Enhance your survey: Choose the best, most relevant, 15-20 questions. Frame each question as a different question type based on the kind of answer you would like to gather from each. Create a survey using different types of questions such as multiple-choice, rating scale, open-ended, etc. Look at more survey examples and four measurement scales every researcher should remember.

- Prepare yes/no questions: You may also want to use yes/no questions to separate people or branch them into groups of those who “have purchased” and those who “have not yet purchased” your products or services. Once you separate them, you can ask them different questions.

- Test all electronic devices: It becomes effortless to distribute your surveys if respondents can answer them on different electronic devices like mobiles, tablets, etc. Once you have created your survey, it’s time to TEST. You can also make any corrections if needed at this stage.

- Distribute your survey: Once your survey is ready, it is time to share and distribute it to the right audience. You can share handouts and share them via email, social media, and other industry-related offline/online communities.

- Collect and analyze responses: After distributing your survey, it is time to gather all responses. Make sure you store your results in a particular document or an Excel sheet with all the necessary categories mentioned so that you don’t lose your data. Remember, this is the most crucial stage. Segregate your responses based on demographics, psychographics, and behavior. This is because, as a researcher, you must know where your responses are coming from. It will help you to analyze, predict decisions, and help write the summary report.

- Prepare your summary report: Now is the time to share your analysis. At this stage, you should mention all the responses gathered from a survey in a fixed format. Also, the reader/customer must get clarity about your goal, which you were trying to gain from the study. Questions such as – whether the product or service has been used/preferred or not. Do respondents prefer some other product to another? Any recommendations?

Having a tool that helps you carry out all the necessary steps to carry out this type of study is a vital part of any project. At QuestionPro, we have helped more than 10,000 clients around the world to carry out data collection in a simple and effective way, in addition to offering a wide range of solutions to take advantage of this data in the best possible way.

From dashboards, advanced analysis tools, automation, and dedicated functions, in QuestionPro, you will find everything you need to execute your research projects effectively. Uncover insights that matter the most!

MORE LIKE THIS

Customer Communication Tool: Types, Methods, Uses, & Tools

Apr 23, 2024

Top 12 Sentiment Analysis Tools for Understanding Emotions

QuestionPro BI: From Research Data to Actionable Dashboards

Apr 22, 2024

21 Best Customer Experience Management Software in 2024

Other categories.

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Employee Exit Interviews

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Market Research

- Artificial Intelligence

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- What is a survey?

- Survey Research

Try Qualtrics for free

What is survey research.

15 min read Find out everything you need to know about survey research, from what it is and how it works to the different methods and tools you can use to ensure you’re successful.

Survey research is the process of collecting data from a predefined group (e.g. customers or potential customers) with the ultimate goal of uncovering insights about your products, services, or brand overall .

As a quantitative data collection method, survey research can provide you with a goldmine of information that can inform crucial business and product decisions. But survey research needs careful planning and execution to get the results you want.

So if you’re thinking about using surveys to carry out research, read on.

Get started with our free survey maker tool

Types of survey research

Calling these methods ‘survey research’ slightly underplays the complexity of this type of information gathering. From the expertise required to carry out each activity to the analysis of the data and its eventual application, a considerable amount of effort is required.

As for how you can carry out your research, there are several options to choose from — face-to-face interviews, telephone surveys, focus groups (though more interviews than surveys), online surveys , and panel surveys.

Typically, the survey method you choose will largely be guided by who you want to survey, the size of your sample , your budget, and the type of information you’re hoping to gather.

Here are a few of the most-used survey types:

Face-to-face interviews

Before technology made it possible to conduct research using online surveys, telephone, and mail were the most popular methods for survey research. However face-to-face interviews were considered the gold standard — the only reason they weren’t as popular was due to their highly prohibitive costs.

When it came to face-to-face interviews, organizations would use highly trained researchers who knew when to probe or follow up on vague or problematic answers. They also knew when to offer assistance to respondents when they seemed to be struggling. The result was that these interviewers could get sample members to participate and engage in surveys in the most effective way possible, leading to higher response rates and better quality data.

Telephone surveys

While phone surveys have been popular in the past, particularly for measuring general consumer behavior or beliefs, response rates have been declining since the 1990s .

Phone surveys are usually conducted using a random dialing system and software that a researcher can use to record responses.

This method is beneficial when you want to survey a large population but don’t have the resources to conduct face-to-face research surveys or run focus groups, or want to ask multiple-choice and open-ended questions .

The downsides are they can: take a long time to complete depending on the response rate, and you may have to do a lot of cold-calling to get the information you need.

You also run the risk of respondents not being completely honest . Instead, they’ll answer your survey questions quickly just to get off the phone.

Focus groups (interviews — not surveys)

Focus groups are a separate qualitative methodology rather than surveys — even though they’re often bunched together. They’re normally used for survey pretesting and designing , but they’re also a great way to generate opinions and data from a diverse range of people.

Focus groups involve putting a cohort of demographically or socially diverse people in a room with a moderator and engaging them in a discussion on a particular topic, such as your product, brand, or service.

They remain a highly popular method for market research , but they’re expensive and require a lot of administration to conduct and analyze the data properly.

You also run the risk of more dominant members of the group taking over the discussion and swaying the opinions of other people — potentially providing you with unreliable data.

Online surveys

Online surveys have become one of the most popular survey methods due to being cost-effective, enabling researchers to accurately survey a large population quickly.

Online surveys can essentially be used by anyone for any research purpose – we’ve all seen the increasing popularity of polls on social media (although these are not scientific).

Using an online survey allows you to ask a series of different question types and collect data instantly that’s easy to analyze with the right software.

There are also several methods for running and distributing online surveys that allow you to get your questionnaire in front of a large population at a fraction of the cost of face-to-face interviews or focus groups.

This is particularly true when it comes to mobile surveys as most people with a smartphone can access them online.

However, you have to be aware of the potential dangers of using online surveys, particularly when it comes to the survey respondents. The biggest risk is because online surveys require access to a computer or mobile device to complete, they could exclude elderly members of the population who don’t have access to the technology — or don’t know how to use it.

It could also exclude those from poorer socio-economic backgrounds who can’t afford a computer or consistent internet access. This could mean the data collected is more biased towards a certain group and can lead to less accurate data when you’re looking for a representative population sample.

When it comes to surveys, every voice matters.

Find out how to create more inclusive and representative surveys for your research.

Panel surveys

A panel survey involves recruiting respondents who have specifically signed up to answer questionnaires and who are put on a list by a research company. This could be a workforce of a small company or a major subset of a national population. Usually, these groups are carefully selected so that they represent a sample of your target population — giving you balance across criteria such as age, gender, background, and so on.

Panel surveys give you access to the respondents you need and are usually provided by the research company in question. As a result, it’s much easier to get access to the right audiences as you just need to tell the research company your criteria. They’ll then determine the right panels to use to answer your questionnaire.

However, there are downsides. The main one being that if the research company offers its panels incentives, e.g. discounts, coupons, money — respondents may answer a lot of questionnaires just for the benefits.

This might mean they rush through your survey without providing considered and truthful answers. As a consequence, this can damage the credibility of your data and potentially ruin your analyses.

What are the benefits of using survey research?

Depending on the research method you use, there are lots of benefits to conducting survey research for data collection. Here, we cover a few:

1. They’re relatively easy to do

Most research surveys are easy to set up, administer and analyze. As long as the planning and survey design is thorough and you target the right audience , the data collection is usually straightforward regardless of which survey type you use.

2. They can be cost effective

Survey research can be relatively cheap depending on the type of survey you use.

Generally, qualitative research methods that require access to people in person or over the phone are more expensive and require more administration.

Online surveys or mobile surveys are often more cost-effective for market research and can give you access to the global population for a fraction of the cost.

3. You can collect data from a large sample

Again, depending on the type of survey, you can obtain survey results from an entire population at a relatively low price. You can also administer a large variety of survey types to fit the project you’re running.

4. You can use survey software to analyze results immediately

Using survey software, you can use advanced statistical analysis techniques to gain insights into your responses immediately.

Analysis can be conducted using a variety of parameters to determine the validity and reliability of your survey data at scale.

5. Surveys can collect any type of data

While most people view surveys as a quantitative research method, they can just as easily be adapted to gain qualitative information by simply including open-ended questions or conducting interviews face to face.

How to measure concepts with survey questions

While surveys are a great way to obtain data, that data on its own is useless unless it can be analyzed and developed into actionable insights.

The easiest, and most effective way to measure survey results, is to use a dedicated research tool that puts all of your survey results into one place.

When it comes to survey measurement, there are four measurement types to be aware of that will determine how you treat your different survey results:

Nominal scale

With a nominal scale , you can only keep track of how many respondents chose each option from a question, and which response generated the most selections.

An example of this would be simply asking a responder to choose a product or brand from a list.

You could find out which brand was chosen the most but have no insight as to why.

Ordinal scale

Ordinal scales are used to judge an order of preference. They do provide some level of quantitative value because you’re asking responders to choose a preference of one option over another.

Ratio scale

Ratio scales can be used to judge the order and difference between responses. For example, asking respondents how much they spend on their weekly shopping on average.

Interval scale

In an interval scale, values are lined up in order with a meaningful difference between the two values — for example, measuring temperature or measuring a credit score between one value and another.

Step by step: How to conduct surveys and collect data

Conducting a survey and collecting data is relatively straightforward, but it does require some careful planning and design to ensure it results in reliable data.

Step 1 – Define your objectives

What do you want to learn from the survey? How is the data going to help you? Having a hypothesis or series of assumptions about survey responses will allow you to create the right questions to test them.

Step 2 – Create your survey questions

Once you’ve got your hypotheses or assumptions, write out the questions you need answering to test your theories or beliefs. Be wary about framing questions that could lead respondents or inadvertently create biased responses .

Step 3 – Choose your question types

Your survey should include a variety of question types and should aim to obtain quantitative data with some qualitative responses from open-ended questions. Using a mix of questions (simple Yes/ No, multiple-choice, rank in order, etc) not only increases the reliability of your data but also reduces survey fatigue and respondents simply answering questions quickly without thinking.

Find out how to create a survey that’s easy to engage with

Step 4 – Test your questions

Before sending your questionnaire out, you should test it (e.g. have a random internal group do the survey) and carry out A/B tests to ensure you’ll gain accurate responses.

Step 5 – Choose your target and send out the survey

Depending on your objectives, you might want to target the general population with your survey or a specific segment of the population. Once you’ve narrowed down who you want to target, it’s time to send out the survey.

After you’ve deployed the survey, keep an eye on the response rate to ensure you’re getting the number you expected. If your response rate is low, you might need to send the survey out to a second group to obtain a large enough sample — or do some troubleshooting to work out why your response rates are so low. This could be down to your questions, delivery method, selected sample, or otherwise.

Step 6 – Analyze results and draw conclusions

Once you’ve got your results back, it’s time for the fun part.

Break down your survey responses using the parameters you’ve set in your objectives and analyze the data to compare to your original assumptions. At this stage, a research tool or software can make the analysis a lot easier — and that’s somewhere Qualtrics can help.

Get reliable insights with survey software from Qualtrics

Gaining feedback from customers and leads is critical for any business, data gathered from surveys can prove invaluable for understanding your products and your market position, and with survey software from Qualtrics, it couldn’t be easier.

Used by more than 13,000 brands and supporting more than 1 billion surveys a year, Qualtrics empowers everyone in your organization to gather insights and take action. No coding required — and your data is housed in one system.

Get feedback from more than 125 sources on a single platform and view and measure your data in one place to create actionable insights and gain a deeper understanding of your target customers .

Automatically run complex text and statistical analysis to uncover exactly what your survey data is telling you, so you can react in real-time and make smarter decisions.

We can help you with survey management, too. From designing your survey and finding your target respondents to getting your survey in the field and reporting back on the results, we can help you every step of the way.

And for expert market researchers and survey designers, Qualtrics features custom programming to give you total flexibility over question types, survey design, embedded data, and other variables.

No matter what type of survey you want to run, what target audience you want to reach, or what assumptions you want to test or answers you want to uncover, we’ll help you design, deploy and analyze your survey with our team of experts.

Ready to find out more about Qualtrics CoreXM?

Get started with our free survey maker tool today

Related resources

Survey bias types 24 min read, post event survey questions 10 min read, best survey software 16 min read, close-ended questions 7 min read, survey vs questionnaire 12 min read, response bias 13 min read, double barreled question 11 min read, request demo.

Ready to learn more about Qualtrics?

- Privacy Policy

Home » Survey Research – Types, Methods, Examples

Survey Research – Types, Methods, Examples

Table of Contents

Survey Research

Definition:

Survey Research is a quantitative research method that involves collecting standardized data from a sample of individuals or groups through the use of structured questionnaires or interviews. The data collected is then analyzed statistically to identify patterns and relationships between variables, and to draw conclusions about the population being studied.

Survey research can be used to answer a variety of questions, including:

- What are people’s opinions about a certain topic?

- What are people’s experiences with a certain product or service?

- What are people’s beliefs about a certain issue?

Survey Research Methods

Survey Research Methods are as follows:

- Telephone surveys: A survey research method where questions are administered to respondents over the phone, often used in market research or political polling.

- Face-to-face surveys: A survey research method where questions are administered to respondents in person, often used in social or health research.

- Mail surveys: A survey research method where questionnaires are sent to respondents through mail, often used in customer satisfaction or opinion surveys.

- Online surveys: A survey research method where questions are administered to respondents through online platforms, often used in market research or customer feedback.

- Email surveys: A survey research method where questionnaires are sent to respondents through email, often used in customer satisfaction or opinion surveys.

- Mixed-mode surveys: A survey research method that combines two or more survey modes, often used to increase response rates or reach diverse populations.

- Computer-assisted surveys: A survey research method that uses computer technology to administer or collect survey data, often used in large-scale surveys or data collection.

- Interactive voice response surveys: A survey research method where respondents answer questions through a touch-tone telephone system, often used in automated customer satisfaction or opinion surveys.

- Mobile surveys: A survey research method where questions are administered to respondents through mobile devices, often used in market research or customer feedback.

- Group-administered surveys: A survey research method where questions are administered to a group of respondents simultaneously, often used in education or training evaluation.

- Web-intercept surveys: A survey research method where questions are administered to website visitors, often used in website or user experience research.

- In-app surveys: A survey research method where questions are administered to users of a mobile application, often used in mobile app or user experience research.

- Social media surveys: A survey research method where questions are administered to respondents through social media platforms, often used in social media or brand awareness research.

- SMS surveys: A survey research method where questions are administered to respondents through text messaging, often used in customer feedback or opinion surveys.

- IVR surveys: A survey research method where questions are administered to respondents through an interactive voice response system, often used in automated customer feedback or opinion surveys.

- Mixed-method surveys: A survey research method that combines both qualitative and quantitative data collection methods, often used in exploratory or mixed-method research.

- Drop-off surveys: A survey research method where respondents are provided with a survey questionnaire and asked to return it at a later time or through a designated drop-off location.

- Intercept surveys: A survey research method where respondents are approached in public places and asked to participate in a survey, often used in market research or customer feedback.

- Hybrid surveys: A survey research method that combines two or more survey modes, data sources, or research methods, often used in complex or multi-dimensional research questions.

Types of Survey Research

There are several types of survey research that can be used to collect data from a sample of individuals or groups. following are Types of Survey Research:

- Cross-sectional survey: A type of survey research that gathers data from a sample of individuals at a specific point in time, providing a snapshot of the population being studied.

- Longitudinal survey: A type of survey research that gathers data from the same sample of individuals over an extended period of time, allowing researchers to track changes or trends in the population being studied.

- Panel survey: A type of longitudinal survey research that tracks the same sample of individuals over time, typically collecting data at multiple points in time.

- Epidemiological survey: A type of survey research that studies the distribution and determinants of health and disease in a population, often used to identify risk factors and inform public health interventions.

- Observational survey: A type of survey research that collects data through direct observation of individuals or groups, often used in behavioral or social research.

- Correlational survey: A type of survey research that measures the degree of association or relationship between two or more variables, often used to identify patterns or trends in data.

- Experimental survey: A type of survey research that involves manipulating one or more variables to observe the effect on an outcome, often used to test causal hypotheses.

- Descriptive survey: A type of survey research that describes the characteristics or attributes of a population or phenomenon, often used in exploratory research or to summarize existing data.

- Diagnostic survey: A type of survey research that assesses the current state or condition of an individual or system, often used in health or organizational research.

- Explanatory survey: A type of survey research that seeks to explain or understand the causes or mechanisms behind a phenomenon, often used in social or psychological research.

- Process evaluation survey: A type of survey research that measures the implementation and outcomes of a program or intervention, often used in program evaluation or quality improvement.

- Impact evaluation survey: A type of survey research that assesses the effectiveness or impact of a program or intervention, often used to inform policy or decision-making.

- Customer satisfaction survey: A type of survey research that measures the satisfaction or dissatisfaction of customers with a product, service, or experience, often used in marketing or customer service research.

- Market research survey: A type of survey research that collects data on consumer preferences, behaviors, or attitudes, often used in market research or product development.

- Public opinion survey: A type of survey research that measures the attitudes, beliefs, or opinions of a population on a specific issue or topic, often used in political or social research.

- Behavioral survey: A type of survey research that measures actual behavior or actions of individuals, often used in health or social research.

- Attitude survey: A type of survey research that measures the attitudes, beliefs, or opinions of individuals, often used in social or psychological research.

- Opinion poll: A type of survey research that measures the opinions or preferences of a population on a specific issue or topic, often used in political or media research.

- Ad hoc survey: A type of survey research that is conducted for a specific purpose or research question, often used in exploratory research or to answer a specific research question.

Types Based on Methodology

Based on Methodology Survey are divided into two Types:

Quantitative Survey Research

Qualitative survey research.

Quantitative survey research is a method of collecting numerical data from a sample of participants through the use of standardized surveys or questionnaires. The purpose of quantitative survey research is to gather empirical evidence that can be analyzed statistically to draw conclusions about a particular population or phenomenon.

In quantitative survey research, the questions are structured and pre-determined, often utilizing closed-ended questions, where participants are given a limited set of response options to choose from. This approach allows for efficient data collection and analysis, as well as the ability to generalize the findings to a larger population.

Quantitative survey research is often used in market research, social sciences, public health, and other fields where numerical data is needed to make informed decisions and recommendations.

Qualitative survey research is a method of collecting non-numerical data from a sample of participants through the use of open-ended questions or semi-structured interviews. The purpose of qualitative survey research is to gain a deeper understanding of the experiences, perceptions, and attitudes of participants towards a particular phenomenon or topic.

In qualitative survey research, the questions are open-ended, allowing participants to share their thoughts and experiences in their own words. This approach allows for a rich and nuanced understanding of the topic being studied, and can provide insights that are difficult to capture through quantitative methods alone.

Qualitative survey research is often used in social sciences, education, psychology, and other fields where a deeper understanding of human experiences and perceptions is needed to inform policy, practice, or theory.

Data Analysis Methods

There are several Survey Research Data Analysis Methods that researchers may use, including:

- Descriptive statistics: This method is used to summarize and describe the basic features of the survey data, such as the mean, median, mode, and standard deviation. These statistics can help researchers understand the distribution of responses and identify any trends or patterns.

- Inferential statistics: This method is used to make inferences about the larger population based on the data collected in the survey. Common inferential statistical methods include hypothesis testing, regression analysis, and correlation analysis.

- Factor analysis: This method is used to identify underlying factors or dimensions in the survey data. This can help researchers simplify the data and identify patterns and relationships that may not be immediately apparent.

- Cluster analysis: This method is used to group similar respondents together based on their survey responses. This can help researchers identify subgroups within the larger population and understand how different groups may differ in their attitudes, behaviors, or preferences.

- Structural equation modeling: This method is used to test complex relationships between variables in the survey data. It can help researchers understand how different variables may be related to one another and how they may influence one another.

- Content analysis: This method is used to analyze open-ended responses in the survey data. Researchers may use software to identify themes or categories in the responses, or they may manually review and code the responses.

- Text mining: This method is used to analyze text-based survey data, such as responses to open-ended questions. Researchers may use software to identify patterns and themes in the text, or they may manually review and code the text.

Applications of Survey Research

Here are some common applications of survey research:

- Market Research: Companies use survey research to gather insights about customer needs, preferences, and behavior. These insights are used to create marketing strategies and develop new products.

- Public Opinion Research: Governments and political parties use survey research to understand public opinion on various issues. This information is used to develop policies and make decisions.

- Social Research: Survey research is used in social research to study social trends, attitudes, and behavior. Researchers use survey data to explore topics such as education, health, and social inequality.

- Academic Research: Survey research is used in academic research to study various phenomena. Researchers use survey data to test theories, explore relationships between variables, and draw conclusions.

- Customer Satisfaction Research: Companies use survey research to gather information about customer satisfaction with their products and services. This information is used to improve customer experience and retention.

- Employee Surveys: Employers use survey research to gather feedback from employees about their job satisfaction, working conditions, and organizational culture. This information is used to improve employee retention and productivity.

- Health Research: Survey research is used in health research to study topics such as disease prevalence, health behaviors, and healthcare access. Researchers use survey data to develop interventions and improve healthcare outcomes.

Examples of Survey Research

Here are some real-time examples of survey research:

- COVID-19 Pandemic Surveys: Since the outbreak of the COVID-19 pandemic, surveys have been conducted to gather information about public attitudes, behaviors, and perceptions related to the pandemic. Governments and healthcare organizations have used this data to develop public health strategies and messaging.

- Political Polls During Elections: During election seasons, surveys are used to measure public opinion on political candidates, policies, and issues in real-time. This information is used by political parties to develop campaign strategies and make decisions.

- Customer Feedback Surveys: Companies often use real-time customer feedback surveys to gather insights about customer experience and satisfaction. This information is used to improve products and services quickly.

- Event Surveys: Organizers of events such as conferences and trade shows often use surveys to gather feedback from attendees in real-time. This information can be used to improve future events and make adjustments during the current event.

- Website and App Surveys: Website and app owners use surveys to gather real-time feedback from users about the functionality, user experience, and overall satisfaction with their platforms. This feedback can be used to improve the user experience and retain customers.

- Employee Pulse Surveys: Employers use real-time pulse surveys to gather feedback from employees about their work experience and overall job satisfaction. This feedback is used to make changes in real-time to improve employee retention and productivity.

Survey Sample

Purpose of survey research.

The purpose of survey research is to gather data and insights from a representative sample of individuals. Survey research allows researchers to collect data quickly and efficiently from a large number of people, making it a valuable tool for understanding attitudes, behaviors, and preferences.

Here are some common purposes of survey research:

- Descriptive Research: Survey research is often used to describe characteristics of a population or a phenomenon. For example, a survey could be used to describe the characteristics of a particular demographic group, such as age, gender, or income.

- Exploratory Research: Survey research can be used to explore new topics or areas of research. Exploratory surveys are often used to generate hypotheses or identify potential relationships between variables.

- Explanatory Research: Survey research can be used to explain relationships between variables. For example, a survey could be used to determine whether there is a relationship between educational attainment and income.

- Evaluation Research: Survey research can be used to evaluate the effectiveness of a program or intervention. For example, a survey could be used to evaluate the impact of a health education program on behavior change.

- Monitoring Research: Survey research can be used to monitor trends or changes over time. For example, a survey could be used to monitor changes in attitudes towards climate change or political candidates over time.

When to use Survey Research

there are certain circumstances where survey research is particularly appropriate. Here are some situations where survey research may be useful:

- When the research question involves attitudes, beliefs, or opinions: Survey research is particularly useful for understanding attitudes, beliefs, and opinions on a particular topic. For example, a survey could be used to understand public opinion on a political issue.

- When the research question involves behaviors or experiences: Survey research can also be useful for understanding behaviors and experiences. For example, a survey could be used to understand the prevalence of a particular health behavior.

- When a large sample size is needed: Survey research allows researchers to collect data from a large number of people quickly and efficiently. This makes it a useful method when a large sample size is needed to ensure statistical validity.

- When the research question is time-sensitive: Survey research can be conducted quickly, which makes it a useful method when the research question is time-sensitive. For example, a survey could be used to understand public opinion on a breaking news story.

- When the research question involves a geographically dispersed population: Survey research can be conducted online, which makes it a useful method when the population of interest is geographically dispersed.

How to Conduct Survey Research

Conducting survey research involves several steps that need to be carefully planned and executed. Here is a general overview of the process:

- Define the research question: The first step in conducting survey research is to clearly define the research question. The research question should be specific, measurable, and relevant to the population of interest.

- Develop a survey instrument : The next step is to develop a survey instrument. This can be done using various methods, such as online survey tools or paper surveys. The survey instrument should be designed to elicit the information needed to answer the research question, and should be pre-tested with a small sample of individuals.

- Select a sample : The sample is the group of individuals who will be invited to participate in the survey. The sample should be representative of the population of interest, and the size of the sample should be sufficient to ensure statistical validity.

- Administer the survey: The survey can be administered in various ways, such as online, by mail, or in person. The method of administration should be chosen based on the population of interest and the research question.

- Analyze the data: Once the survey data is collected, it needs to be analyzed. This involves summarizing the data using statistical methods, such as frequency distributions or regression analysis.

- Draw conclusions: The final step is to draw conclusions based on the data analysis. This involves interpreting the results and answering the research question.

Advantages of Survey Research

There are several advantages to using survey research, including:

- Efficient data collection: Survey research allows researchers to collect data quickly and efficiently from a large number of people. This makes it a useful method for gathering information on a wide range of topics.

- Standardized data collection: Surveys are typically standardized, which means that all participants receive the same questions in the same order. This ensures that the data collected is consistent and reliable.

- Cost-effective: Surveys can be conducted online, by mail, or in person, which makes them a cost-effective method of data collection.

- Anonymity: Participants can remain anonymous when responding to a survey. This can encourage participants to be more honest and open in their responses.

- Easy comparison: Surveys allow for easy comparison of data between different groups or over time. This makes it possible to identify trends and patterns in the data.

- Versatility: Surveys can be used to collect data on a wide range of topics, including attitudes, beliefs, behaviors, and preferences.

Limitations of Survey Research

Here are some of the main limitations of survey research:

- Limited depth: Surveys are typically designed to collect quantitative data, which means that they do not provide much depth or detail about people’s experiences or opinions. This can limit the insights that can be gained from the data.

- Potential for bias: Surveys can be affected by various biases, including selection bias, response bias, and social desirability bias. These biases can distort the results and make them less accurate.

- L imited validity: Surveys are only as valid as the questions they ask. If the questions are poorly designed or ambiguous, the results may not accurately reflect the respondents’ attitudes or behaviors.

- Limited generalizability : Survey results are only generalizable to the population from which the sample was drawn. If the sample is not representative of the population, the results may not be generalizable to the larger population.

- Limited ability to capture context: Surveys typically do not capture the context in which attitudes or behaviors occur. This can make it difficult to understand the reasons behind the responses.

- Limited ability to capture complex phenomena: Surveys are not well-suited to capture complex phenomena, such as emotions or the dynamics of interpersonal relationships.

Following is an example of a Survey Sample:

Welcome to our Survey Research Page! We value your opinions and appreciate your participation in this survey. Please answer the questions below as honestly and thoroughly as possible.

1. What is your age?

- A) Under 18

- G) 65 or older

2. What is your highest level of education completed?

- A) Less than high school

- B) High school or equivalent

- C) Some college or technical school

- D) Bachelor’s degree

- E) Graduate or professional degree

3. What is your current employment status?

- A) Employed full-time

- B) Employed part-time

- C) Self-employed

- D) Unemployed

4. How often do you use the internet per day?

- A) Less than 1 hour

- B) 1-3 hours

- C) 3-5 hours

- D) 5-7 hours

- E) More than 7 hours

5. How often do you engage in social media per day?

6. Have you ever participated in a survey research study before?

7. If you have participated in a survey research study before, how was your experience?

- A) Excellent

- E) Very poor

8. What are some of the topics that you would be interested in participating in a survey research study about?

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

9. How often would you be willing to participate in survey research studies?

- A) Once a week

- B) Once a month

- C) Once every 6 months

- D) Once a year

10. Any additional comments or suggestions?

Thank you for taking the time to complete this survey. Your feedback is important to us and will help us improve our survey research efforts.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Questionnaire – Definition, Types, and Examples

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

A Comprehensive Guide to Survey Research Methodologies

For decades, researchers and businesses have used survey research to produce statistical data and explore ideas. The survey process is simple, ask questions and analyze the responses to make decisions. Data is what makes the difference between a valid and invalid statement and as the American statistician, W. Edwards Deming said:

“Without data, you’re just another person with an opinion.” - W. Edwards Deming

In this article, we will discuss what survey research is, its brief history, types, common uses, benefits, and the step-by-step process of designing a survey.

What is Survey Research

A survey is a research method that is used to collect data from a group of respondents in order to gain insights and information regarding a particular subject. It’s an excellent method to gather opinions and understand how and why people feel a certain way about different situations and contexts.

Brief History of Survey Research

Survey research may have its roots in the American and English “social surveys” conducted around the turn of the 20th century. The surveys were mainly conducted by researchers and reformers to document the extent of social issues such as poverty. ( 1 ) Despite being a relatively young field to many scientific domains, survey research has experienced three stages of development ( 2 ):

- First Era (1930-1960)

- Second Era (1960-1990)

- Third Era (1990 onwards)

Over the years, survey research adapted to the changing times and technologies. By exploiting the latest technologies, researchers can gain access to the right population from anywhere in the world, analyze the data like never before, and extract useful information.

Survey Research Methods & Types

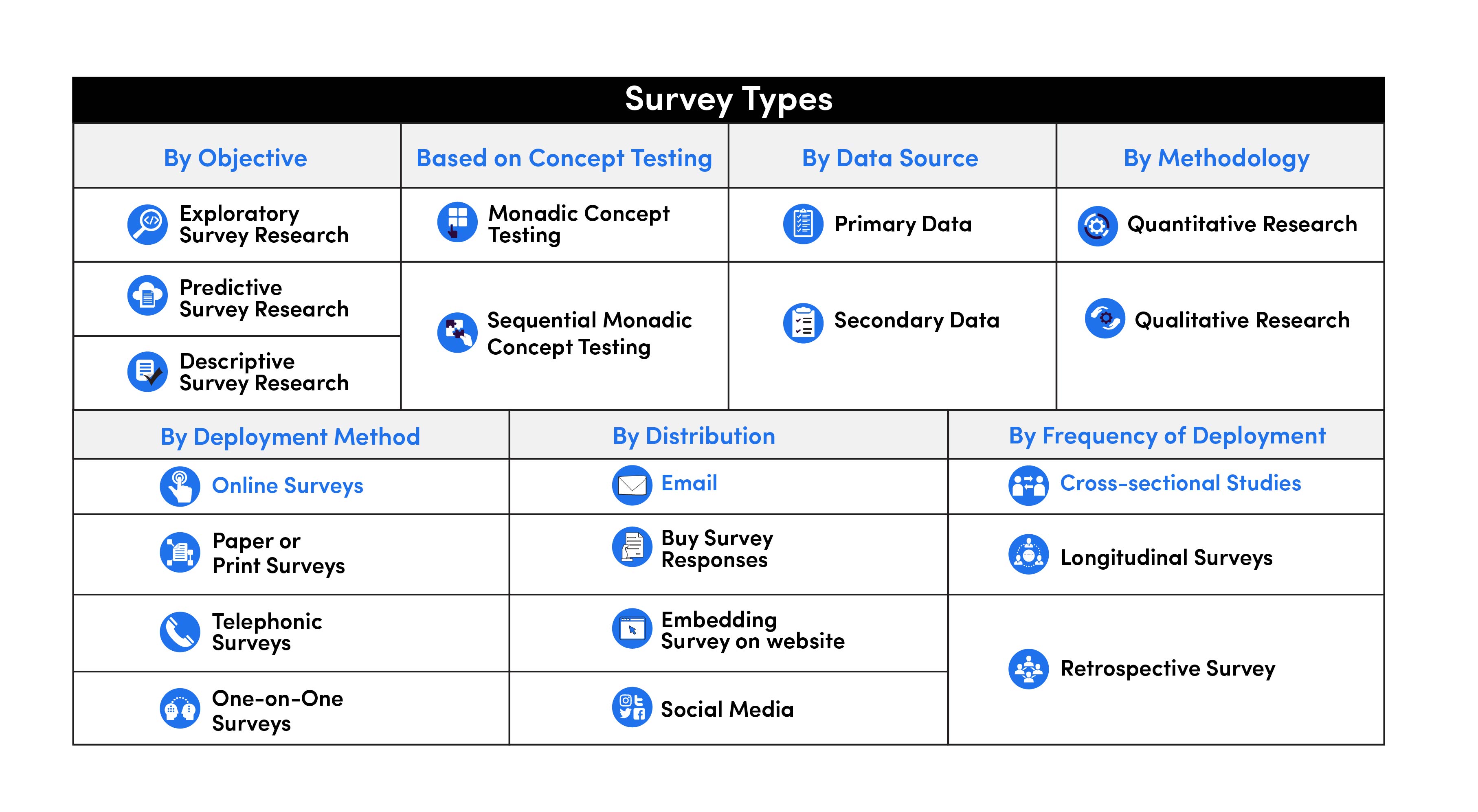

Survey research can be classified into seven categories based on objective, data sources, methodology, deployment method, and frequency of deployment.

Surveys based on Objective

Exploratory survey research.

Exploratory survey research is aimed at diving deeper into research subjects and finding out more about their context. It’s important for marketing or business strategy and the focus is to discover ideas and insights instead of gathering statistical data.

Generally, exploratory survey research is composed of open-ended questions that allow respondents to express their thoughts and perspectives. The final responses present information from various sources that can lead to fresh initiatives.

Predictive Survey Research

Predictive survey research is also called causal survey research. It’s preplanned, structured, and quantitative in nature. It’s often referred to as conclusive research as it tries to explain the cause-and-effect relationship between different variables. The objective is to understand which variables are causes and which are effects and the nature of the relationship between both variables.

Descriptive Survey Research

Descriptive survey research is largely observational and is ideal for gathering numeric data. Due to its quantitative nature, it’s often compared to exploratory survey research. The difference between the two is that descriptive research is structured and pre-planned.

The idea behind descriptive research is to describe the mindset and opinion of a particular group of people on a given subject. The questions are every day multiple choices and users must choose from predefined categories. With predefined choices, you don’t get unique insights, rather, statistically inferable data.

Survey Research Types based on Concept Testing

Monadic concept testing.

Monadic testing is a survey research methodology in which the respondents are split into multiple groups and ask each group questions about a separate concept in isolation. Generally, monadic surveys are hyper-focused on a particular concept and shorter in duration. The important thing in monadic surveys is to avoid getting off-topic or exhausting the respondents with too many questions.

Sequential Monadic Concept Testing

Another approach to monadic testing is sequential monadic testing. In sequential monadic surveys, groups of respondents are surveyed in isolation. However, instead of surveying three groups on three different concepts, the researchers survey the same groups of people on three distinct concepts one after another. In a sequential monadic survey, at least two topics are included (in random order), and the same questions are asked for each concept to eliminate bias.

Based on Data Source

Primary data.

Data obtained directly from the source or target population is referred to as primary survey data. When it comes to primary data collection, researchers usually devise a set of questions and invite people with knowledge of the subject to respond. The main sources of primary data are interviews, questionnaires, surveys, and observation methods.

Compared to secondary data, primary data is gathered from first-hand sources and is more reliable. However, the process of primary data collection is both costly and time-consuming.

Secondary Data

Survey research is generally used to collect first-hand information from a respondent. However, surveys can also be designed to collect and process secondary data. It’s collected from third-party sources or primary sources in the past.

This type of data is usually generic, readily available, and cheaper than primary data collection. Some common sources of secondary data are books, data collected from older surveys, online data, and data from government archives. Beware that you might compromise the validity of your findings if you end up with irrelevant or inflated data.

Based on Research Method

Quantitative research.

Quantitative research is a popular research methodology that is used to collect numeric data in a systematic investigation. It’s frequently used in research contexts where statistical data is required, such as sciences or social sciences. Quantitative research methods include polls, systematic observations, and face-to-face interviews.

Qualitative Research

Qualitative research is a research methodology where you collect non-numeric data from research participants. In this context, the participants are not restricted to a specific system and provide open-ended information. Some common qualitative research methods include focus groups, one-on-one interviews, observations, and case studies.

Based on Deployment Method

Online surveys.

With technology advancing rapidly, the most popular method of survey research is an online survey. With the internet, you can not only reach a broader audience but also design and customize a survey and deploy it from anywhere. Online surveys have outperformed offline survey methods as they are less expensive and allow researchers to easily collect and analyze data from a large sample.

Paper or Print Surveys

As the name suggests, paper or print surveys use the traditional paper and pencil approach to collect data. Before the invention of computers, paper surveys were the survey method of choice.

Though many would assume that surveys are no longer conducted on paper, it's still a reliable method of collecting information during field research and data collection. However, unlike online surveys, paper surveys are expensive and require extra human resources.

Telephonic Surveys

Telephonic surveys are conducted over telephones where a researcher asks a series of questions to the respondent on the other end. Contacting respondents over a telephone requires less effort, human resources, and is less expensive.

What makes telephonic surveys debatable is that people are often reluctant in giving information over a phone call. Additionally, the success of such surveys depends largely on whether people are willing to invest their time on a phone call answering questions.

One-on-one Surveys

One-on-one surveys also known as face-to-face surveys are interviews where the researcher and respondent. Interacting directly with the respondent introduces the human factor into the survey.

Face-to-face interviews are useful when the researcher wants to discuss something personal with the respondent. The response rates in such surveys are always higher as the interview is being conducted in person. However, these surveys are quite expensive and the success of these depends on the knowledge and experience of the researcher.

Based on Distribution

The easiest and most common way of conducting online surveys is sending out an email. Sending out surveys via emails has a higher response rate as your target audience already knows about your brand and is likely to engage.

Buy Survey Responses

Purchasing survey responses also yields higher responses as the responders signed up for the survey. Businesses often purchase survey samples to conduct extensive research. Here, the target audience is often pre-screened to check if they're qualified to take part in the research.

Embedding Survey on a Website

Embedding surveys on a website is another excellent way to collect information. It allows your website visitors to take part in a survey without ever leaving the website and can be done while a person is entering or exiting the website.

Post the Survey on Social Media

Social media is an excellent medium to reach abroad range of audiences. You can publish your survey as a link on social media and people who are following the brand can take part and answer questions.

Based on Frequency of Deployment

Cross-sectional studies.

Cross-sectional studies are administered to a small sample from a large population within a short period of time. This provides researchers a peek into what the respondents are thinking at a given time. The surveys are usually short, precise, and specific to a particular situation.

Longitudinal Surveys

Longitudinal surveys are an extension of cross-sectional studies where researchers make an observation and collect data over extended periods of time. This type of survey can be further divided into three types:

- Trend surveys are employed to allow researchers to understand the change in the thought process of the respondents over some time.

- Panel surveys are administered to the same group of people over multiple years. These are usually expensive and researchers must stick to their panel to gather unbiased opinions.

- In cohort surveys, researchers identify a specific category of people and regularly survey them. Unlike panel surveys, the same people do not need to take part over the years, but each individual must fall into the researcher’s primary interest category.

Retrospective Survey

Retrospective surveys allow researchers to ask questions to gather data about past events and beliefs of the respondents. Since retrospective surveys also require years of data, they are similar to the longitudinal survey, except retrospective surveys are shorter and less expensive.

Why Should You Conduct Research Surveys?

“In God we trust. All others must bring data” - W. Edwards Deming

In the information age, survey research is of utmost importance and essential for understanding the opinion of your target population. Whether you’re launching a new product or conducting a social survey, the tool can be used to collect specific information from a defined set of respondents. The data collected via surveys can be further used by organizations to make informed decisions.

Furthermore, compared to other research methods, surveys are relatively inexpensive even if you’re giving out incentives. Compared to the older methods such as telephonic or paper surveys, online surveys have a smaller cost and the number of responses is higher.

What makes surveys useful is that they describe the characteristics of a large population. With a larger sample size , you can rely on getting more accurate results. However, you also need honest and open answers for accurate results. Since surveys are also anonymous and the responses remain confidential, respondents provide candid and accurate answers.

Common Uses of a Survey

Surveys are widely used in many sectors, but the most common uses of the survey research include:

- Market research : surveying a potential market to understand customer needs, preferences, and market demand.

- Customer Satisfaction: finding out your customer’s opinions about your services, products, or companies .

- Social research: investigating the characteristics and experiences of various social groups.

- Health research: collecting data about patients’ symptoms and treatments.

- Politics: evaluating public opinion regarding policies and political parties.

- Psychology: exploring personality traits, behaviors, and preferences.

6 Steps to Conduct Survey Research

An organization, person, or company conducts a survey when they need the information to make a decision but have insufficient data on hand. Following are six simple steps that can help you design a great survey.

Step 1: Objective of the Survey

The first step in survey research is defining an objective. The objective helps you define your target population and samples. The target population is the specific group of people you want to collect data from and since it’s rarely possible to survey the entire population, we target a specific sample from it. Defining a survey objective also benefits your respondents by helping them understand the reason behind the survey.

Step 2: Number of Questions

The number of questions or the size of the survey depends on the survey objective. However, it’s important to ensure that there are no redundant queries and the questions are in a logical order. Rephrased and repeated questions in a survey are almost as frustrating as in real life. For a higher completion rate, keep the questionnaire small so that the respondents stay engaged to the very end. The ideal length of an interview is less than 15 minutes. ( 2 )

Step 3: Language and Voice of Questions

While designing a survey, you may feel compelled to use fancy language. However, remember that difficult language is associated with higher survey dropout rates. You need to speak to the respondent in a clear, concise, and neutral manner, and ask simple questions. If your survey respondents are bilingual, then adding an option to translate your questions into another language can also prove beneficial.

Step 4: Type of Questions

In a survey, you can include any type of questions and even both closed-ended or open-ended questions. However, opt for the question types that are the easiest to understand for the respondents, and offer the most value. For example, compared to open-ended questions, people prefer to answer close-ended questions such as MCQs (multiple choice questions)and NPS (net promoter score) questions.

Step 5: User Experience

Designing a great survey is about more than just questions. A lot of researchers underestimate the importance of user experience and how it affects their response and completion rates. An inconsistent, difficult-to-navigate survey with technical errors and poor color choice is unappealing for the respondents. Make sure that your survey is easy to navigate for everyone and if you’re using rating scales, they remain consistent throughout the research study.

Additionally, don’t forget to design a good survey experience for both mobile and desktop users. According to Pew Research Center, nearly half of the smartphone users access the internet mainly from their mobile phones and 14 percent of American adults are smartphone-only internet users. ( 3 )

Step 6: Survey Logic

Last but not least, logic is another critical aspect of the survey design. If the survey logic is flawed, respondents may not continue in the right direction. Make sure to test the logic to ensure that selecting one answer leads to the next logical question instead of a series of unrelated queries.

How to Effectively Use Survey Research with Starlight Analytics

Designing and conducting a survey is almost as much science as it is an art. To craft great survey research, you need technical skills, consider the psychological elements, and have a broad understanding of marketing.

The ultimate goal of the survey is to ask the right questions in the right manner to acquire the right results.

Bringing a new product to the market is a long process and requires a lot of research and analysis. In your journey to gather information or ideas for your business, Starlight Analytics can be an excellent guide. Starlight Analytics' product concept testing helps you measure your product's market demand and refine product features and benefits so you can launch with confidence. The process starts with custom research to design the survey according to your needs, execute the survey, and deliver the key insights on time.

- Survey research in the United States: roots and emergence, 1890-1960 https://searchworks.stanford.edu/view/10733873

- How to create a survey questionnaire that gets great responses https://luc.id/knowledgehub/how-to-create-a-survey-questionnaire-that-gets-great-responses/

- Internet/broadband fact sheet https://www.pewresearch.org/internet/fact-sheet/internet-broadband/