Here's what you need to know about the global economy in 10 articles from the Forum

How will today's economic shifts shape your life? The economy explained in 10 stories from the World Economic Forum. Image: Unsplash/Jay Clark

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Tom Crowfoot

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} Geo-economics is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, geo-economics.

Listen to the article

- This round-up explores 10 articles from the World Economic Forum on key economic terms and theories.

- As the effects of inflation are felt around the world, these articles will help you understand the driving forces behind the global economy and the impacts on your finances.

1. How to prepare for a new economic reality and protect the most vulnerable - experts explain

The Forum's latest Chief Economists Outlook Report suggests a global recession is "somewhat likely". The OECD in its recent report similarly warned that recent indicators have "taken a turn for the worse".

Saadia Zahidi, Managing Director at the Forum, highlights “growing inequality between and within countries” as the “ongoing legacy of COVID-19, war and uncoordinated policy action”.

Find out what four chief economists think needs to be done to shield the most vulnerable.

2. Here’s how rising global interest rates could impact your life

With inflation on the rise globally, central banks are using interest rates — the amount you are charged for borrowing money — to try and slow rising prices. As mortgage and credit card repayments increase, rising levels of inflation are forcing central banks to take urgent action.

Learn more about interest rates and their impact on your finances.

3. Explainer: What is a recession?

The National Bureau of Economic Research defines the event as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when the economy reaches its trough.”

Read more about recessions and their warning signs.

4. What are foreign currency reserves and can they help combat the global economic crisis?

Foreign currency or exchange reserves, otherwise known as forex reserves, are made up of cash and other assets such as gold that are held by central banks or other financial institutions such as the International Monetary Fund (IMF).

From maintaining liquidity in economic crises to diversifying a country's financial portfolio, discover why these reserves are so important.

5. What are central bank digital currencies?

Digital currency is electronic, rather than physical money. Central bank digital currency is “a risk-free form of money that is guaranteed by the state”, according to the European Central Bank.

More than 100 countries are now exploring central bank digital currencies, find out why .

The World Economic Forum’s Centre for the Fourth Industrial Revolution Network has built a global community of central banks, international organizations and leading blockchain experts to identify and leverage innovations in distributed ledger technologies (DLT) that could help usher in a new age for the global banking system.

We are now helping central banks build, pilot and scale innovative policy frameworks for guiding the implementation of DLT, with a focus on central bank digital currencies (CBDCs) . DLT has widespread implications for the financial and monetary systems of tomorrow, but decisions about its use require input from multiple sectors in order to realize the technology’s full potential.

“Over the next four years, we should expect to see many central banks decide whether they will use blockchain and distributed ledger technologies to improve their processes and economic welfare. Given the systemic importance of central bank processes, and the relative freshness of blockchain technology, banks must carefully consider all known and unknown risks to implementation.”

Our Central Banks in the Age of Blockchain community is an initiative of the Platform for Shaping the Future of Technology Governance: Blockchain and Digital Assets.

Read more about our impact , and learn how you can join this first-of-its-kind initiative.

6. What is the gig economy and what's the deal for gig workers?

The “gig economy involves the exchange of labour for money between individuals or companies via digital platforms that actively facilitate matching between providers and customers, on a short-term and payment-by-task basis,” according to the UK government.

Despite the benefit of freedom that the gig economy provides to workers, “issues such as benefits, income-security measures, and training and credentials offer room for policy-makers to provide solutions", according to a McKinsey Global Institute report.

Read more on the gig economy and the challenges its workers face.

7. GDP is no longer an accurate measure of growth. So what can take its place?

Many economists feel GDP is an outdated measure of economic wellbeing, with even its inventor, US economist Simon Kuznets , advocating for a new measure. Therefore, in the Forum's 2021 report on post-COVID recovery it has proposed a scorecard made up of four dimensions that need to be brought into balance: prosperity, the planet, people and the role of institutions.

Explore how the Forum envisions a post-COVID economic recovery.

8. What happens if a country defaults on its debts?

A default happens when governments are not able to – or don’t want to – meet some or all of their debt payments to creditors. This situation isn't uncommon, with 147 governments having defaulted on debts since 1960 . Credit rating agencies rate a debtor's ability to repay debt, so when countries have a poor credit rating, it’s hard for them to raise debt.

Learn more about government debt.

9. Explainer: What is a yield curve and why does it matter right now?

A yield curve refers to the representation on a graph of the yield – or the return investors can expect – on bonds that mature at different times. “A yield curve can be used to help gauge the direction of the economy,” according to Fidelity Investments. Therefore, yield curves are often used as a visual representation of bond investors’ feelings about risk .

Read more about yield curves and why they are so relevant right now.

10. What is a bear market?

A bear market occurs when a market experiences prolonged price declines. Bear markets are often associated with declines in an overall market or index – such as the S&P 500 – but they can also be associated with recessions. The causes of bear markets can range from pandemics to wars.

Discover more about bear markets.

More on economics from Agenda

Have you read, here's how 10 of the largest economies are tackling inflation, japan has the lowest inflation of all major economies but will continue feeling the pressure. here's why, can the economy grow for ever, don't miss any update on this topic.

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Geo-economics .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

IMF says global economy 'remains remarkably resilient', and other economics news

April 19, 2024

The latest from the IMF on the global economy, and other economics stories to read

April 12, 2024

These 6 countries are using space technology to build their digital capabilities. Here’s how

Simon Torkington

April 8, 2024

Eurozone inflation, Asian factory activity and other economics news to read

April 5, 2024

China's industrial profits grow, and other economics stories to read this week

March 28, 2024

Bank of Japan ends negative interest rate era, and other economic stories to read this week

March 22, 2024

Penn State University Libraries

Pl sc 412: international political economy (world campus).

- Getting Started

- Exploring Topics

- Search Strategies Exercise

- Journal Articles

- Data Sources

- Specialized Sources

Term Paper Overview

- You will write a term paper on a relevant topic of interest to you. The basic idea is for you to apply a theory or small set of theories to an issue in international political economy to drive predictions regarding the likely course of events over the next 5-10 or 10- 20 years. You will work on the paper in stages and be graded on your work over the course of the semester. After submitting a rough draft, you will review another student’s paper and get peer feedback on your draft.

Term Paper Stages

1. Research Paper Topic : You will write a short paragraph outlining the general topic of your research paper. General topics include, but are not limited to, trade relations, hegemony, the exchange rate, development and globalization. You will then describe the specific subtopic you are interested in. If, for example, your general topic is globalization, some subtopics might be sweatshops or the effect of globalization on the environment.

2. Research Question: You will write one short paragraph that first presents your initial research question. Make sure that your research question asks what factors, variables, or conditions affect some aspect of your subtopic and focuses on cause-and-effect relationships.

- You should avoid descriptive and prescriptive questions. The former leads to research papers that simply describe a process or an event, while the latter results in research papers that tell us what we can or should do to change, fix, or prevent some undesirable situation.

- For example, if your subtopic is the effect of globalization on the environment under the general topic of the globalization, an appropriate research question might be “under what conditions will countries cooperate to reduce pollution?” Inappropriate research questions might be “which states are the biggest polluters?” and “what should be done to reduce pollution?”

3. Bibliography: You will submit a preliminary bibliography that should consist primarily of scholarly works associated with your research topic, such as books, journal articles, and other published studies that have been subjected to peer review. University presses, as well as many other reputable publishers, produce peer-reviewed books.

- American Political Science Review

- American Journal of Political Science

- International Organization

- International Studies Quarterly

- World Politics International

- Journal of Political Economy

- Your bibliography must follow the guidelines found in the American Political Science Association’s Style Manual for Political Science. (See the Citations page of this guide for link.)

4. Theory Overview : The reading you do will allow you to become acquainted with different theories (or "models" as they are often called) about the phenomenon that you’re interested in. Review the most prominent or compelling theories. If there are competing theories, highlight their distinguishing factors.

5. Thesis Statement : You will write one or two sentences that represent your thesis statement. This thesis statement should be a concise summary of your research paper’s argument or analysis. In other words, the thesis statement summarizes your findings, your predictions and your argument. It is “the punch line” of your paper and what follows fills out and supports this statement.

6. Detailed Outline : You will provide a detailed outline of the various sections of your research paper. These sections may include, but are not limited to, the introduction (including your thesis statement), theory review, analysis, and conclusions.

7. Rough Draft : You will submit a rough draft of your research paper for peer review. This draft does not have to be perfect. It simply represents your first attempt to put your thoughts in final form. However, the more work you put into this rough draft, the more likely it is that you will receive useful feedback from the peer review. You will get full credit for submitting the draft. (I will not be grading content at this point.) If you do not submit the rough draft you WILL NOT get any credit for completing a peer review.

8. Peer Review: You will provide constructive feedback on one classmate’s rough draft. Using track changes and the insertion of comments, offer as much constructive criticism on your classmate’s paper as possible. Constructive criticism is criticism that is intended to improve the paper and often identifies solutions to problems in a positive and productive way. You might want to think about this peer review as a valuable opportunity to improve your own writing; as you edit and comment upon your classmate's work, you might discover things that you should or should not do in future essays and research papers. You will not get credit for this portion if you do not submit a rough draft yourself.

9. Final Paper: Your final paper must be between 6-8 pages in length, double-spaced with 12-point Times New Roman font and 1-inch margins. Your paper must also include proper parenthetical citations and bibliography, following the guidelines found in the American Political Science Association’s Style Manual for Political Science. (See the Citations page of this guide for link.) Please upload your paper in Word (or Pages), not pdf.

- << Previous: Getting Started

- Next: Exploring Topics >>

- Last Updated: Mar 25, 2024 10:59 AM

- URL: https://guides.libraries.psu.edu/WorldCampus/PLSC412

The Global Economic Outlook During the COVID-19 Pandemic: A Changed World

An empty highway in Dubai during the coronavirus pandemic. Above the highway, a sign reads "Stay Safe, Stay Home." © Mo Azizi/Shutterstock

The COVID-19 pandemic has spread with alarming speed, infecting millions and bringing economic activity to a near-standstill as countries imposed tight restrictions on movement to halt the spread of the virus. As the health and human toll grows, the economic damage is already evident and represents the largest economic shock the world has experienced in decades.

The June 2020 Global Economic Prospects describes both the immediate and near-term outlook for the impact of the pandemic and the long-term damage it has dealt to prospects for growth. The baseline forecast envisions a 5.2 percent contraction in global GDP in 2020, using market exchange rate weights—the deepest global recession in decades, despite the extraordinary efforts of governments to counter the downturn with fiscal and monetary policy support. Over the longer horizon, the deep recessions triggered by the pandemic are expected to leave lasting scars through lower investment, an erosion of human capital through lost work and schooling, and fragmentation of global trade and supply linkages.

The crisis highlights the need for urgent action to cushion the pandemic’s health and economic consequences, protect vulnerable populations, and set the stage for a lasting recovery. For emerging market and developing countries, many of which face daunting vulnerabilities, it is critical to strengthen public health systems, address the challenges posed by informality, and implement reforms that will support strong and sustainable growth once the health crisis abates.

Historic contraction of per capita income

The pandemic is expected to plunge most countries into recession in 2020, with per capita income contracting in the largest fraction of countries globally since 1870. Advanced economies are projected to shrink 7 percent. That weakness will spill over to the outlook for emerging market and developing economies, who are forecast to contract by 2.5 percent as they cope with their own domestic outbreaks of the virus. This would represent the weakest showing by this group of economies in at least sixty years.

Every region is subject to substantial growth downgrades. East Asia and the Pacific will grow by a scant 0.5%. South Asia will contract by 2.7%, Sub-Saharan Africa by 2.8%, Middle East and North Africa by 4.2%, Europe and Central Asia by 4.7%, and Latin America by 7.2%. These downturns are expected to reverse years of progress toward development goals and tip tens of millions of people back into extreme poverty.

Emerging market and developing economies will be buffeted by economic headwinds from multiple quarters: pressure on weak health care systems, loss of trade and tourism, dwindling remittances, subdued capital flows, and tight financial conditions amid mounting debt. Exporters of energy or industrial commodities will be particularly hard hit. The pandemic and efforts to contain it have triggered an unprecedented collapse in oil demand and a crash in oil prices. Demand for metals and transport-related commodities such as rubber and platinum used for vehicle parts has also tumbled. While agriculture markets are well supplied globally, trade restrictions and supply chain disruptions could yet raise food security issues in some places.

A possibility of even worse outcomes

Even this bleak outlook is subject to great uncertainty and significant downside risks. The forecast assumes that the pandemic recedes in such a way that domestic mitigation measures can be lifted by mid-year in advanced economies and later in developing countries, that adverse global spillovers ease during the second half of 2020, and that widespread financial crises are avoided. This scenario would envision global growth reviving, albeit modestly, to 4.2% in 2021.

However, this view may be optimistic. Should COVID-19 outbreaks persist, should restrictions on movement be extended or reintroduced, or should disruptions to economic activity be prolonged, the recession could be deeper. Businesses might find it hard to service debt, heightened risk aversion could lead to climbing borrowing costs, and bankruptcies and defaults could result in financial crises in many countries. Under this downside scenario, global growth could shrink by almost 8% in 2020.

Looking at the speed with which the crisis has overtaken the global economy may provide a clue to how deep the recession will be. The sharp pace of global growth forecast downgrades points to the possibility of yet further downward revisions and the need for additional action by policymakers in coming months to support economic activity.

A particularly concerning aspect of the outlook is the humanitarian and economic toll the global recession will take on economies with extensive informal sectors that make up an estimated one-third of the GDP and about 70% of total employment in emerging market and developing economies. Policymakers must consider innovative measures to deliver income support to these workers and credit support to these businesses.

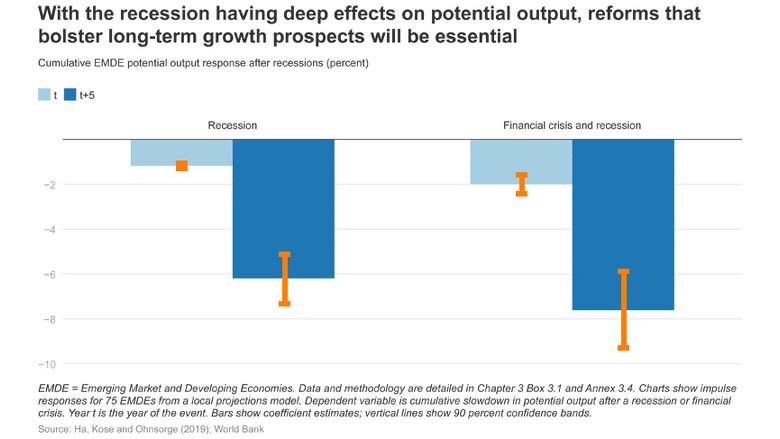

Long-term damage to potential output, productivity growth

The June 2020 Global Economic Prospects looks beyond the near-term outlook to what may be lingering repercussions of the deep global recession: setbacks to potential output—the level of output an economy can achieve at full capacity and full employment—and labor productivity. Efforts to contain COVID-19 in emerging and developing economies, including low-income economies with limited health care capacity, could precipitate deeper and longer recessions—exacerbating a multi-decade trend of slowing potential growth and productivity growth. Many emerging and developing economies were already experiencing weaker growth before this crisis; the shock of COVID-19 now makes the challenges these economies face even harder.

Another important feature of the current landscape is the historic collapse in oil demand and oil prices. Low oil prices are likely to provide, at best, temporary initial support to growth once restrictions to economic activity are lifted. However, even after demand recovers, adverse impacts on energy exporters may outweigh any benefits to activity in energy importers. Low oil prices offer an opportunity to oil producers to diversify their economies. In addition, the recent oil price plunge may provide further momentum to undertake energy subsidy reforms and deepen them once the immediate health crisis subsides.

In the face of this disquieting outlook, the immediate priority for policymakers is to address the health crisis and contain the short-term economic damage. Over the longer term, authorities need to undertake comprehensive reform programs to improve the fundamental drivers of economic growth once the crisis lifts.

Policies to rebuild both in the short and long-term entail strengthening health services and putting in place targeted stimulus measures to help reignite growth , including support for the private sector and getting money directly to people. During the mitigation period, countries should focus on sustaining economic activity with support for households, firms and essential services.

Global coordination and cooperation—of the measures needed to slow the spread of the pandemic, and of the economic actions needed to alleviate the economic damage, including international support—provide the greatest chance of achieving public health goals and enabling a robust global recovery.

- Global Economic Prospects

- Press release

- Download the report

- Download all data (Excel)

- Download charts (zip)

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

Essays on a 21st century multilateralism that works for all

- Download the full report

Subscribe to Global Connection

Brahima sangafowa coulibaly , brahima sangafowa coulibaly vice president and director - global economy and development , senior fellow - global economy and development @bsangafowacoul kemal derviş , kemal derviş senior fellow amar bhattacharya , amar bhattacharya senior fellow - global economy and development , center for sustainable development homi kharas , homi kharas senior fellow - global economy and development , center for sustainable development john w. mcarthur , john w. mcarthur director - center for sustainable development , senior fellow - global economy and development @mcarthur amrita narlikar , amrita narlikar president - german institute for global and area studies @amritanarlikar josé antonio ocampo , josé antonio ocampo professor of professional practice in international and public affairs - columbia university, co-director of the economic and political development concentration - school of international and public affairs @josea_ocampo eswar prasad , eswar prasad senior fellow - global economy and development @eswarsprasad elizabeth sidiropoulos , elizabeth sidiropoulos chief executive - south african institute of international affairs dennis j. snower , dennis j. snower nonresident senior fellow - global economy and development @djsnower vera songwe , and vera songwe nonresident senior fellow - global economy and development , africa growth initiative @songwevera nathalie tocci nathalie tocci director - istituto affari internazionali, honorary professor - university of tübingen, visiting professor - harvard kennedy school @nathalietocci.

February 16, 2022

Edited by Brahima S. Coulibaly and Kemal Derviş, this collection of essays builds upon a 2021 global “experts” survey on multilateralism . While not an exhaustive list, the topics addressed here comprise some of the most pressing issues for international cooperation in the years ahead, as identified by both the survey respondents and the essay authors. The editors’ overview follows here.

By Brahima S. Coulibaly and Kemal Derviş

Introduction.

There is no general agreement on what shape the “world order” will take in the years and decades ahead. What is certain, however, is that humanity will have to deal with huge and in many ways unprecedented transformations and challenges, such as the digitalization of economies and societies, climate change and mitigation, pandemic preparedness, extreme income and wealth concentration, 1 and new types of “weapons” associated with dual-use technologies.

There are great opportunities for improved well-being associated with many of these challenges. Digitalization and artificial intelligence (AI) could result in tremendous increases in productivity, and the green transformation necessitated by climate change could constitute the greatest economic, social, and business opportunity since the industrial revolution. 2 However, failure to adequately address some of these challenges, notably climate change, could lead to immense economic and social damage; it could add to the existing pressures caused by mass migration resulting from the imbalance between geographic concentrations of populations and economic opportunities. Furthermore, digitalization could exacerbate inequalities and lead to mass surveillance of societies led by autocrats. In turn, some of the “weapons” that may be developed with new technologies could lead to a scale of destruction of the planet tantamount to nuclear weapons. The U.N. Secretary-General António Guterres starts his new agenda-setting report by stating “humanity faces a stark and urgent choice: a breakdown or a breakthrough.” 3 Multilateral cooperation is therefore needed more than ever to both fully realize the potential benefits of these shifting trends and minimize the dangers that accompany them.

The Global Economy and Development Program at the Brookings Institution conducted a global “experts” survey on multilateralism in the Spring of 2021 as part of a project on the future of global governance. 4 The topics addressed in this compilation of essays do not attempt to cover all challenges faced by multilateralism, but they reflect issues considered most important by the survey respondents, as well as the authors of these essays. Together, they address some of the most pressing questions and needs for international cooperation in the years ahead.

Read the rest of the overview in the full report

Overview Brahima S. Coulibaly and Kemal Derviş

1. multilateralism and dynamic divergence in the global economy eswar prasad and vera songwe, 2. global governance: balancing power and equitable representation kemal derviş and josé antonio ocampo, 3. regional cooperation: a necessary complement to global multilateralism brahima s. coulibaly and elizabeth sidiropoulos, 4. multilateralism and climate change: providing a global public good and following an ethical imperative amar bhattacharya and kemal derviş, 5. from vertical funds to purpose-driven funds: a new approach to multilateralism homi kharas, john w. mcarthur, and dennis snower, 6. liberal democratic values and the future of multilateral cooperation kemal derviş and nathalie tocci, 7. multilateralism, liberal values, and the global south amrita narlikar.

Related Content

Kemal Derviş, Sebastian Strauss

August 9, 2021

- Between 1995 and 2021 the top 1 percent of the global population captured 38 percent of the increase in wealth. See “World Inequality Report 2022.” https://wir2022.wid.world/www-site/uploads/2021/12/Summary_WorldInequalityReport2022_English.pdf .

- Nicholas Stern. “G7 leadership for sustainable, resilient, and inclusive economic recovery and growth.” https://www.lse.ac.uk/granthaminstitute/wp-content/uploads/2021/06/G7_leadership_for_sustainable_resilient_and_inclusive_economic_recovery_and_growth_full_report.pdf .

- United Nations. “Summary of Our Common Agenda Report.” https://www.un.org/en/content/common-agenda-report/summary.shtml .

- Dervis and Strauss, 2021. Responses contained in this survey.

Multilateral Development Organizations

Diplomacy & Multilateralism

Global Economy and Development

Homi Kharas, Charlotte Rivard

April 16, 2024

Pedro Conceição

April 3, 2024

Kerllen Costa

March 28, 2024

The Truly Global Economy Essay

Introduction, globalization, a truly global economy, globalization theories, political and financial instabilities, ways in which people are still connecting despite economic crisis, factors affecting globalization, reference list.

Many people have had different questions regarding globalization, some asking whether it is the integration of economic, social, political and cultural systems across the world or the dominance of the developed countries in making decisions at the expense of the poor regions.

Others have questioned whether it can contribute to the economic growth, prosperity or the democratic freedom or it is a force for devastation of the environment and exploitation of the developing countries. This paper handles what a truly global economy is with emphasis on the consequences of the current economic crisis.

Globalization refers to all aspects that seek to increase not only the connectivity but also the interdependence of the world’s markets. The main factor that has led to the increase in globalization is the technological advancement that allows people to freely move communicate and trade internationally. It is the interconnectedness of production, communication and technologies all over the world. It involves both cultural and economic activities.

Additionally, it is said to be such a diverse, deep-rooted force that not even the current massive economic crisis can break it down or permanently destroy it. Many argue that globalization has brought about increased opportunities for everybody in the world, irrespective of their social backgrounds.

The rich and poor actively participate in globalization. On the other hand, others who are against globalization claim that it has deprived some people in terms of resources, as they cannot compete with the rest of the world. “Globalization raises new challenges for governance, especially vis-vis the roles of government, workers, and citizens in the new economic order” (Ashford, 2004, pp.52). The differential success of regulation regimes affects the progress of globalization within many nations around the globe.

Introduction of global markets has lead to many changes. One of the major changes is the harmonization of principles. This has been a success through the integration of ILO conventions and international environmental agreements. Many nations are reluctant in surrendering their overall autonomy since they are afraid of the possible negative impacts of the possible economic integration.

Nations around the world began to globalize their economies towards the end of the eighteenth century as major discoveries on geography started influencing everyday’s business life. During this time, the economic interests as well as the advancements in technologies could not stand to integrate the world’s economies.

Community wars and political instabilities have made the economic integration process and creation of a unified market place more unrealistic. This has caused the world economy to continue with the strengthening of integration. It is also being taken to the oblivion further by the differences in national developments that have proved to be increasing on a daily basis. As far as technology is concerned, many countries are lagging behind and have no characteristics of a global economy.

Countries that have large populations and provinces have a continual disparity in terms of economic and technological developments. For instance, in Bangladesh, the large populaces have never made a telephone call. The gap between the rich and the poor continue to widen. However, the companies in different regions and continents have integrated and made it a reality.

This does not mean that it is a truly global economy because globalization does not revolve around trade only. Countries such as Myanmar are working hand in hand with developed countries causing global economic harmonization. This creates GMP. A truly global economy requires a complete economic integration of the the various aspects of the national economy.

Several terms bring out several aspects of the term globalization in different ways and contexts. Globalization has been like an extension of modernization. The instability in capitalism and traditional sovereignty has sparked reaction against reason. According to the World Polity theory, globalization is about culture.

By the end of the twentieth century, world culture had crystallized and become part of the world society: a common heritage. Even so, it has not been able to claim global consensus. The main reason behind this is that different communities in different geographical locations differ in their interpretations of some aspects such as the rights each community in globalization.

This definitely makes it hard for the world to attain a homogenous state of economy. According to Meyer, “A polity system is a system of creating value through the collective conferral of authority” (1980, pp. 52). The players in the system happen to be “entities constructed and motivated by enveloping frames” (Boli and Thomas, 1997, pp.22).

This is why the nations have adopted analogous constitutional forms as well as educational systems among others. The international non-governmental organizations also play a big role in world citizenship. Some ample room is created for innovation while in pursuit of similar goals by the states thus causing intense competition. The competition as part of the world’s cultural standards causes reactions that later demands putting things right. This will continue for as long as the world lives.

Thirdly, there is so much pressure on survival brought about by the capitalists. According to Robertson “globalization is the compression of the world and the intensification of consciousness as a whole” (1992, pp.8).

By the end of the twentieth century, the world was in chaos as more people were being exposed to the need to live independently in such of sovereignty. According to the World System theory, globalization is a process by which the world’s system eventually becomes harmonized around the globe. It maintains that globalization is not a new phenomenon.

Wallerstein argues “the current ideological celebration of the so-called globalization is in reality the swan song of our historical system” (1998, pp.32). It started with the Europeans whose desire for feudalism provoked technological innovations and developments of market institutions in the quest for production. This made it even easier to reach the other parts of the world. Military strength and a good transportation system made it easier to establish economic ties with other nations.

The peripheral areas provided raw materials while the semi-periphery regions had little if not zero benefit. It reached its geographic limit with the extension of capitalist market. Even with this, there was no way to change the situation because polarization of the system had taken place. Crisis arose that could not be solved by exploitation of new markets and there could never be a more equal or democratic world. The periods of innovation had a negative impact to the economy.

Businesses experienced a reduction of profits, an aspect led to not only recession but also economic stagnation. It is clear that even with the theories, globalization actualization in its full capacity is an issue that seems to be at its peak though it is still in the process of winning many participants-nations.

The increased economic interaction between different nations has led to the propagation of a different and deep-rooted political change. This has been evident in that most of the poor or rather third world countries have become more dependent of the developed countries for everything. In addition, economic power has shifted from the nation-state to multinational corporations.

This is characterized by circulation of technologies, practices as well as ideas. “The intensification of worldwide social relations which link distant localities in such a way that local happenings are shaped by events occurring many miles away and vice versa” (Anthony, 1990, pp.64).

With the current technological advancement, people are in a position to buy goods from the internet. They do not interact with the suppliers or the sellers but can only interact with the delivery personnel. Banking has also facilitated virtual interactions between the parties involved. The other casualties of this kind of a process have been a decline in national governments failure to direct and have an impact in their economies.

A good example could be Japan whose economic shifts can be felt in countries all over the entire universe because of the interconnectivity. The lack of influence in the national governments does not mean that they are gone completely but in essence they remain “pivotal institutions especially in terms of creating the conditions for effective international governance” (Hirst and Thompson, 1996, pp.170).

Multinational corporations are literal beneficiaries of globalization. The car manufacturing companies for instance go global in search of the parts required for the assembling of the same. According to Hirst and Thompson,

International businesses are still largely confined to their home territory in terms of their overall business activities, they remain heavily ‘nationally embedded’ and continue to be multinational rather than transnational corporations (1996, pp.98).

The impact of this globalization on the local communities is evident. The multinationals can influence local communities in many ways. First, in order for them to operate, they establish operations that include sales and services in the regions that will eventually offer cheap labor and resources as required.

This can bring wealth to the areas that the multinationals have elected; for instance, people can choose to work at the plant, on the one hand, or to be unemployment, on the other hand.

This is because incase of relocation, the locals who had been offering services as workers would be rendered jobless, and this could be devastating. In most cases, the public spaces like the parks are eroded with their activities. Social places become privatized and commercialized leaving the locals with no social grounds. Everything eventually becomes expensive and inaccessible for the locals.

Globalization is well thought-out to be a line in the sphere where the economic world is developing irremediably as well as irreversibly. Financial globalization presents a very high degree of development, especially within the financial markets. Technological changes in communication and data processing have made globalization to be identified as the irrefutable proof of huge capital movement achieved.

Nonetheless, a global financial industry has not been established yet. The current financial crisis around the globe is a major barrier to the advancement of the process of globalization especially to the developing nations. Though it has been of great help to not only the developing but also developed countries by alleviating their poverty levels, it is very vulnerable to terrible and costly backlashes, as history has shown.

The constantly changing global economy and market are challenges for all nations. The deteriorating economy poses a challenge to issues such as employment, occupational health and safety as well as people’s wages among others. (Ashford 2008, pp. 304). To achieve an affluent global economy, it is necessary for all nations to be aware of their rights to take part in the world trade and use the advantages of the innovations (Ashford 2004).

Nothing good comes on a silver platter and to achieve globalization in the vast continent has been a great achievement even with its failures. The failures that have brought about dysfunctional globalization as some view it, has been brought about by political and financial instabilities.

Many countries have outstretched to their limits in an attempt to adapt to globalization but ended up being exhausted especially in cases of financially driven globalization. These mainly are the developing countries whose financial status fails to handle their capital city’s economy and operations. Technical advances are the sole drivers for the upswing that causes many of the institutions to foster ways to adjust with some ending up being poorer than before. Protectionism became a key consequence in many of the countries.

This is why the G-20 summit of November 2008 in Washington produced some reverberating denunciations of countries and nations being protective of their possessions. This did not last long before measures regarding protectionism were implemented in many of the countries like China. This at some point brought about a misconception of the end of globalization because globalization is not just about international trade and investment, which the countries were shielding.

It is true that trade has plunged and financial flows drastically fallen and to some extent may not recover any time soon unless the main economic pillars are reignited. Although international trade plays a pivotal role in globalization, there other factors that are essential in enhancing the full realization of the process in developing an affluent global economy.

All over the world, people are still connecting despite economical crisis threatening the countries. Internet connectivity is a key boost in the advancement of the great relationships among the people in the world.

Social sites, like MySpace, Twitter, Facebook, have enabled communication to be cheaper and accessible even in the most of the remote areas one can ever think of. People from North islands can relate with people from Africa. E-bay also allows people to transact irrespective of their geographical locations. Their international activities could be bolstered regardless the current economic crisis.

As witnessed all over the world, the global charities might bring people together in one way or another. This is so because many countries are in need and none seems to be isolated to live on its own without ever mingling with the others. Amazingly enough, the ability of a national government to protect its economy and society from outside influences has no strong roots recently.

The current wave of globalization has proven to have unprecedented impacts, and this explains the reason why it is hard to tame and curb external influences. The internet allows Vietnam to trade their handicrafts in Europe without travelling there. The cultural, political, social, economic as well as military components have been quantified, so it is a matter of time before a qualitative change takes place.

Nevertheless, even with the financial crisis still going on, nations from all over the world are interconnected. Globalization has multiplied the number of problems that have made it hard for any country to solve them on its own. These problems include such issues as financial problems, climate changes, terrorism that has interconnected the East African countries with America in one way or another to curb the menace.

Pandemics like HIV/AIDS have brought together countries looking for cure, nuclear proliferations, among others. With the current global crisis, global governance will increase respectively. Countries in East and Central Africa have signed partnership deals to enable them to transport and export their products like oil through Kenya from South Sudan.

One of the major factors that affect globalization is the barriers associated with immigration. Some countries have imposed trade-impairing policies besides taking strict measures to curb immigration. Such an approach will work for a while, but the financial support will fail after a while.

The world culture theory also called the Homogenism theory acts in unison with these findings concerning globalization being there no matter what happens. The theory marks differences in cultural homogenization and sees globalization broadly being the increasing uniformity of cultures all over the world, instead of just viewing it from an economical perspective.

Transformational theory is handled in these findings as well. The theory focuses on the global forces that increase the powers of the nation-state. It maintains thinking globally as people or nations act locally, as well as maintaining diversity in the face of economic forces that encourage uniformity.

In conclusion, globalization presents both the opportunities and risks to every nation that indulges in it, especially the African nations. In most developing countries especially those in Africa, globalization presents certain risks. For instance, one of the possible impacts of globalization is the increase in political costs as well as the social tensions that come with (Ikeme 1999).

Owing to this, the economic state of most developing nations may end up being strained to levels beyond their abilities or rather resources. This translates to economic redundancy in such nations, which will have a negative impact on the global economy as well. It is no doubt that globalization has tremendous potential benefits for any developing country.

The bigest “challenge is to realize the potential benefits without incurring huge offsetting costs in loss of the ecological basis for development and in the increase of inequality and impoverishment of the public” (Ikeme 1999). Developing country should, therefore cease to see globalization as a result but as a means to the end. The end is sustainable wellbeing for everyone.

The chance is created by the opportunity that the fender-bender of the two approaches towards globalization and sustainable progress will cause a new stage of human development, “which offers up-to-the-minute opportunities for the re-negotiation, and re-juggling of the world economic configuration” (Ikeme 1999). Both the developing and developed nations have equal opportunities to participate in the globalization of the word’s economy.

However, their contribution is dictated by their economic stability. To do this, they must set free from all the stereotypes on frameworks for development that the Western powers have created in favor of their origin. To be competitive in the global economy, the nations should invest their natural capital in their economy. They should also train their locals and ensure that foreigner does not have too big share in the development of their economy.

Thus, making sure that local companies are owned by the locals themselves ensures that profits are reinvested in the country as well as innovations in technology are never imported but developed in their own homeland. Following this way, they will make quick leaps in attaining the global goal and they will benefit from it just like the rest of the developed countries.

Globalization is to stay and the countries that will be the most successful in the next near future will be the ready to take all the obligatory informed decisions of their endeavors and in light of their goals irrespective of the misinformed guidance from the development experts. The so-called experts and giants in the economy have little business in enhancing the locals of other nations to remain superior and relevant.

However, once the rest take up the task upon them to educate and take their country to the next level, the superiors will have no business with it. Unless this hard but fruitful task is yoked in the locals of the developing countries, the economic giants will always mingle in their affairs with no tangible returns witnessed. They should engage the global economy on the own terms and not using the preset order by the developed country. Until then, they will always have a way to elude them.

Ashford, NA 2004, “Sustainable Development and Globalization: New Challenges and Opportunities for Work Organization”, in C Nova-Kaltsouni & M Kassotakis (eds.) Promoting New Forms of Work Organization and Other Cooperative Arrangements for Competitiveness and Employability , National and Kapodistrian University of Athens, Athens, pp. 50-61.

Ashford, NA 2008, “Environmental Regulation, Globalization, and Innovation,” in KP Gallagher (ed.), Handbook on Trade and the Environment, Chettendam and Northampton, Virginia, USA, pp. 296-307.

Boli, J. and Thomas, G., 1997. World Culture in the World Polity. American Sociological Review, 62(2), pp.171-190.

Ikeme, J 1999, ‘Sustainable development, globalisation and Africa: Plugging the holes’, Africa Economic Analysis . Web.

Hirst, P & Thompson, G 1996, Globalization in question: The international economy

Meyer, W., Boli, J., Thomas, G. and Francisco O., 1997. World Society and the Nation-State. American Journal of Sociology, 103(1), pp.144-181.

Robertson, R., 1992. Globalization: Social Theory and Global Culture. London: Sage.

Wallerstein, I., 1998. Utopistics: Or, Historical Choices of the Twenty-First Century. New York: The New Press.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, December 26). The Truly Global Economy. https://ivypanda.com/essays/the-global-economy/

"The Truly Global Economy." IvyPanda , 26 Dec. 2023, ivypanda.com/essays/the-global-economy/.

IvyPanda . (2023) 'The Truly Global Economy'. 26 December.

IvyPanda . 2023. "The Truly Global Economy." December 26, 2023. https://ivypanda.com/essays/the-global-economy/.

1. IvyPanda . "The Truly Global Economy." December 26, 2023. https://ivypanda.com/essays/the-global-economy/.

Bibliography

IvyPanda . "The Truly Global Economy." December 26, 2023. https://ivypanda.com/essays/the-global-economy/.

- International Monetary Fund and Financial Instability

- Multinational Companies

- Cryptocurrency and Its Instability Issues

- Banking Instability During the Global Financial Crisis

- Globalization's Effects on the UAE Development

- Instability in Leadership in "Red Azalea"

- Effect of the Political instability on Haiti's development

- How Systematic Shocks Affect the Financial Instability?

- The Buckling Instability in Arteries

- Truly Just Society and John Rawls's Principles

- The Peculiarities of Housing Crisis in the USA

- The Rational Optimist: How Prosperity Evolves by Matt Ridley

- How a Country like Greece Can Find the Way out Of Recession

- Economy of China: Relationship with South Korea and the United States

- Blood Diamond from Sierra Leone

Advertisement

Supported by

I.M.F. Sees Steady Growth but Warns of Rising Protectionism

The International Monetary Fund offered an upbeat economic outlook but said that new trade barriers and escalating wars could worsen inflation.

- Share full article

By Alan Rappeport

Alan Rappeport covers the Treasury Department and is reporting on the spring meetings of the I.M.F. and World Bank in Washington this week.

The global economy is approaching a soft landing after several years of geopolitical and economic turmoil, the International Monetary Fund said on Tuesday. But it warned that risks remain, including stubborn inflation, the threat of escalating global conflicts and rising protectionism.

In its latest World Economic Outlook report, the I.M.F. projected global output to hold steady at 3.2 percent in 2024, unchanged from 2023. Although the pace of the expansion is tepid by historical standards, the I.M.F. said that global economic activity had been surprisingly resilient given that central banks aggressively raised interest rates to tame inflation and wars in Ukraine and the Middle East further disrupt supply chains.

The forecasts came as policymakers from around the world began arriving in Washington for the spring meetings of the International Monetary Fund and the World Bank. The outlook is brighter from just a year ago, when the I.M.F. was warning of underlying “turbulence” and a multitude of risks.

Although the world economy has proved to be durable over the past year, defying predictions of a recession, there are lingering concerns that price pressures have not been sufficiently contained and that new trade barriers will be erected amid anxiety over a recent surge of cheap Chinese exports.

“Somewhat worryingly, progress toward inflation targets has somewhat stalled since the beginning of the year,” Pierre-Olivier Gourinchas, the I.M.F.’s chief economist, wrote in an essay that accompanied the report. “Oil prices have been rising recently in part due to geopolitical tensions and services inflation remains stubbornly high.”

He added: “Further trade restrictions on Chinese exports could also push up goods inflation.”

The gathering is taking place at a time of growing tension between the United States and China over a surge of Chinese green energy products, such as electric vehicles, lithium batteries and solar panels, that are flooding global markets. Treasury Secretary Janet L. Yellen returned last week from a trip to China , where she told her counterparts that Beijing’s industrial policy was harming American workers. She warned that the United States could pursue trade restrictions to protect investments in America’s solar and electric vehicle industries.

The United States and China agreed to hold additional talks on “balanced growth.” On Tuesday afternoon, Ms. Yellen convened a meeting of the U.S.-China Financial Working Group and the Economic Working Group at the Treasury Department.

During her visit to China, Ms. Yellen suggested that tariffs on Chinese exports of green energy products were “on the table.” The Biden administration is weighing changes to tariffs that the Trump administration imposed on more than $300 billion worth of Chinese goods. The European Union has been pursuing its own trade restrictions on China, and fears over China’s growing dominance over clean energy production could lead to a new wave of protectionism globally.

On Tuesday, Ms. Yellen pointed out that the United States economy was defying expectations of weakness from a year ago, describing the labor market as “remarkably healthy” and noting that inflation had come down significantly from its peak.

I.M.F. officials have been wary about “fragmentation” in recent years, as economies gravitate to trading blocs with aligned political interests. The report on Tuesday warned that further restrictions on trade and investment could fuel more inflation and weigh on economies.

“Tariff increases could trigger retaliatory responses, raise costs, and harm both business profitability and consumer well-being,” the report said.

Ms. Yellen said on Tuesday that the I.M.F. is not sufficiently focused on the problem of Chinese overcapacity, arguing that China’s subsidies of its green energy sectors were creating an uneven playing field.

“With these subsidies, the amount of capacity exceeds global demand, and what it’s likely to be even over the next decade,” Ms. Yellen said. “When the markets weaken, prices fall and it’s our firms who go out of business, and those that are our allied countries. Chinese firms continue to receive support so that they remain.”

Officials from the Group of 7 nations and the Group of 20 will hold separate discussions on the sidelines of the meetings, which officially begin on Wednesday, on a variety of pressing issues including the fallout from the war in Gaza and Russia’s war in Ukraine.

Biden administration officials, including Ms. Yellen, are expected to meet senior Ukrainian officials as they try to build international support to provide more aid to Ukraine. The Treasury secretary will also continue to make the case for using Russia’s frozen central bank assets as a lifeline for Ukraine’s economy.

The meetings are taking place at a fragile time for the global economy, which has been battered in recent years by a pandemic and war. The world’s top financial officials will be discussing ways to maintain economic stability during a year when elections around the world could herald dramatic policy changes.

The I.M.F. report broadly described its growth outlook for the global economy as “stable but slow,” with much of the resilience powered by the strength of the United States, where growth is expected to increase from 2.5 percent in 2023 to 2.7 percent in 2024.

Output in the euro area remains sluggish, with growth increasing from 0.4 percent in 2023 to 0.8 percent this year.

China’s economy is expected to grow at a rate of 4.6 percent in 2024, down from 5.2 percent in 2023. But on Tuesday, China’s statistics agency reported stronger-than-expected growth in the first quarter, with the economy expanding at a 6.6 percent annual rate, as the country turned to manufacturing and exports to counter a downturn in the property market.

Efforts by central banks to contain price increases by raising interest rates have begun to tame inflation. The I.M.F. predicts that global headline inflation will decline from an annual average rate of 6.8 percent in 2023 to 5.9 percent in 2024 and 4.5 percent next year. But the slowdown is not happening at the same rate in every country and some places are further along in taming price increases than others. The I.M.F. said that a scenario where interest rates need to remain higher for a longer period of time could put added stress on housing markets and the financial sector,

The fight against inflation in the United States has begun to stall. While prices are rising more slowly than they had been, they are still higher than the 2 percent that the Federal Reserve targets. In March, the Consumer Price Index climbed by 3.8 percent on an annual basis after stripping out food and fuel prices, raising doubts among economists about whether the Fed will start cutting interest rates this year.

The most prominent threat to the inflation outlook is the possibility that regional conflicts could cause food and energy prices to spike. The I.M.F. said that an escalation of the conflict in Gaza, additional attacks on ships in the Red Sea and additional volatility associated with Russia’s war in Ukraine all represent wild cards that could disrupt supply chains and derail the world economy’s progress.

“Such geopolitical shocks could complicate the ongoing disinflation process and delay central bank policy easing, with negative effects on global economic growth,” the I.M.F. said.

Alan Rappeport is an economic policy reporter, based in Washington. He covers the Treasury Department and writes about taxes, trade and fiscal matters. More about Alan Rappeport

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend Print delivery

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

Term Paper on Global Economic Crisis | Economics

Here is a term paper on ‘Global Economic Crisis’. Find paragraphs, long and short term papers on ‘Global Economic Crisis’ especially written for school and college students.

Term Paper # 1. Introduction to Global Economic Crisis:

When the world economy crumbled in 1930, there was a clear writing on the wall that the market- based capitalistic economic system failed to work in the critical situations like recession and slump.

The over-enthusiastic advocates of market capitalism refused to learn that fundamental lesson and resurrected it again and again, sometimes in the garb of Brettonwoods system, sometimes in the form of the Reagan-Thatcher model that favoured finance over domestic manufacturing, and sometimes through the dispensations of the WTO.

The purpose here is not to debunk the market capitalism but to underline the fact that it is not always self-regulating and self-correcting. This system has certain rules of the game. When those rules do not apply, the system too becomes unworkable. The profit expectations were over-optimistic in 2007 such that the academic community failed largely to anticipate the impending disaster. They ignored the prophetic words of J.M. Keynes, “It is of the nature of the organised investment markets… that, when disillusion falls upon an over-optimistic and over-bought market, it should fall with a sudden and catastrophic force.”

ADVERTISEMENTS:

Only Nouriel Roubini of New York University did make forecast about it on Sept. 7, 2006 before an audience of economists at the I.M.F. meet. He unraveled correctly the contours of the financial meltdown in the United States and its global repercussions.

A person laughed at him and dismissed his assertions as devoid of mathematical models and was labelled as Dr. Doom. By the fall of 2007, Roubini stood fully vindicated, when the U.S. economy was faced with sub-prime mortgage crisis, bankruptcies, fall in hedge funds, crash at stock markets, impeding housing bust and increasing unemployment. Both Federal Reserve System and the U.S. administration had started making panicky interventions in the economic system by that time.

Term Paper # 2. United States and Economic Crisis:

The economic recession is generally defined as two consecutive quarters of declining activities. The Business Cycle Dating Committee of the National Bureau of Economic Research in the U.S.A. specified its own criteria for the determination of downturn. It stated, a recession is a significant decline in economic activity spread across the economy lasting more than a few months, normally visible in production, employment, real income and other indicators upto mid-2007.

This problem was not anticipated as the economy grew at a 0.2 percent rate in the fourth quarter of that year followed by the rates of growth of 0.8 percent and 2.8 percent respectively in the first and second quarters of 2008, while in the third quarter of that year, the real GDP growth dropped by 0.5 percent, there was stunning contraction of real GDP at the rate of 0.3 percent in the fourth quarter of 2008. It was then declared officially that the United States had entered into recession in December 2007.

The deepening of economic crisis in world’s largest economy was bound to have widespread repercussions upon the economies of all developed and developing countries of the world.

The most elementary question is what led to the global economic crisis first in the United States and subsequently in other countries of the world.

The causes of the economic meltdown in the U.S. economy were as under:

(i) The U.S. economy was confronted with sub-prime mortgage scandal in 2007-08. The FRS in the United States had kept the interest rates too low and for too long. The financial institutions bundled together goods, housing and other categories of loans. The rating agencies accorded high rating to these loan packages as they were being paid by those who were supposed to be rated by them. The packages of mortgages and other complex financial products were sold by one bank or financial institutions to another.

The house price bubble created by low interest got burst and the prices of housing units started declining. The depreciating values of the packages of mortgages made the banks to demand money back from their borrowers. This resulted in a severe liquidity and banking crisis. The U.S. administration had to offer bail-out packages to such financial giants as Bear Sterns, Freddie Mac and Fannie Mae. Then came the collapse of the three biggest financial players like Lehman Brothers Merrill Lynch and AIC.

The US economy received a stunning blow on June 1, 2009, when century-old giant automaker General Motors filed for bankruptcy. The relief of $ 20 billion provided by the administration to it could not help its revival. The collapse of this mighty firm employing 2, 44, 500 people worldwide and selling 8.35 million cars and trucks in about 140 countries was bound to have further grave effects on the U.S. economy.

The severity of the economic crisis was reflected by the fact that the United States witnessed 25 bank failures in 2008. Over the previous eight years (2000-08), 52 banks had collapsed. The financial meltdown continued unabated as 16 banks collapsed in the first two months of 2009. It was more than half of total bank collapses in 2008. The criticality of financial turmoil was evident because even the bail-out package of over 700 billion dollars adopted by the government had failed to stem the tide of financial collapse.

(ii) Another factor behind the recent crisis in the U.S. economy was the decline in domestic manufacturing. There was the predominance of manufacturing over finance in that country even upto 1960’s. But decline in American manufacturing saddled the economy not only with almost permanent negative balance of trade but also with a business community which was less and less concerned with the productive capacities in that country.

The globalisation of manufacturing left little room for the United States to revert to the levels of manufacturing that it was having in the good old days. The trend of decline in industrial output continued even after the largest economy of the world slid into recession in December 2007. In March 2009, the industrial output fell by 1.5 percent. It was nearly 13 percent below its level in March 2008 and it was the lowest since December 1998.

(iii) The retention of low rates of interest for creating investment stimulus resulted in the low rate of saving in the US economy. It meant that rest of the world came to hold a large part of capital in that country. As a consequence, the economy became more susceptible to the speculative international movements of capital. The keeping of interest rates too low for too long led to the housing bubble with all its consequences.

(iv) The collapse of a series of large financial institutions led to much speculative activity and excessive risk-taking in a frantic search for super profits at the Wall Street. Excessive selling activity in the stock market resulted in a crash and the Wall Street hit the levels below 8000 mark in November, 2008. Such a low level had not been seen since March 2003.

The worsening of the financial crisis in the United States economy during 2008-09 was on account of the following factors:

(i) The growth rate in the U.S. economy continued to plummet. In the third and fourth quarters of 2008, the real GDP in that country dropped 0.5 and 6.3 percent respectively. The staggering contraction in GDP was primarily due to negative contributions from exports, personal consumption expenditures and equipments and softwares among others. According to the Organisation for Economic Co-operation and Development (OECD), the United States economy was projected to shrink as much as 0.9 percent in 2009.

(ii) The financial meltdown was having serious adverse consequences due to the collapse of housing market, escalation of food and energy prices and the decline in industries like automobiles, steel, engineering, chemicals and many more. The ailing economy shed over 2.6 million jobs over the course of 2008, the most since 1945.

The job losses in November and December 2008 were of the order of 5.84 lakh and 5.24 lakh respectively. The rate of unemployment mounted to 7.2 percent in December 2008 which was the highest since January 1993. This jobs hemorrhage was likely to push up the unemployment rate from 9.0 to 9.5 percent in 2009 as the firms on a very wide front were engaged in lowering their cost structures through job reductions.

(iii) The increasing intensity of job losses resulted in cut in consumer spending in the United States at a rate which is, according to the Commerce Department Report, was the steepest in 28 years. Unless the support packages were directed to reverse the steep fall in consumer spending, the economy it was feared would remain sluggish.

(iv) The financial meltdown in the United States had continued despite the relief packages. Upto May 2009, there had been a collapse of 36 banks which was more than total bank collapses (25) in 2008 and was more than half of the total number of bank failures (68) in the previous nine years. This indicated that the severity of financial crisis could not be mitigated even by the close of May 2009.

The US financial companies were too big to fail and these failures would continue to generate tremors not only in the US economy but also in the other countries of world, unless effective regulatory mechanisms were put in place.

(v) The continued drift of the US economy was obvious on account of around fall in the investment activity. Owing to the fall in consumer spending, failure of banks, accumulation of excess capacity in several industrial sectors, decline in exports and failure of the revival of demand for housing units, the business confidence had been badly shattered despite lowest ever rates of interest as everyone was suspect in the eyes of others.

Even the mega relief package amounting to $ 7.8 trillion seemed inadequate to revive the investment demand. Investment worth $ 3 trillion was to be directed to buy stocks, corporate debts and mortgages.

An amount $ 3.1 trillion was meant for guaranteeing the corporate bonds, money market funds and money in specified deposit accounts. The liquidity crunch was still being felt by the investing companies. They were not yet ready to give their investment policies the benefit of doubt.

Although the US Fed had assured that it would print whatever notes would be required, yet the drift in investment continued. Even after the liquidity crunch was over, the companies still required some time to readjust their balance sheets and start improving their profit-loss situation.

It indicated that the downturn would persist through 2009 and further. Four out of every five investors believed that the United States as well as the other developed countries would continue to be gripped by the recession even beyond 2009. The investors remained embedded in a defensive asset allocation mindset. There was impending fear of deflation that perhaps kept them on the sideline.

(vi) The revival of demand in the US economy was not in sight on account of deteriorating conditions related to exports. The contraction of domestic manufacturing sectors, increasing excess capacities in industries, the declining overseas demand and appreciation of dollar had caused a collapse in the US exports. The growing protectionist tendencies in the US economy were likely to reduce demand for imports from abroad and the resultant contraction also in the US exports.

(vii) Another factor leading to worsening of economic crisis had been the strengthening of the US dollar since September 2008 along with other principal currencies. It resulted in a decline in US exports and inflows of capital from abroad which was being employed essentially for restructuring of assets of the weakening financial institutions.

(viii) In the prevailing bleak situation only possible engine of growth seemed to be the increased volumes of federal and local government spending. Once the stimulus packages would get expended, the federal deficits would shrink and even that engine of growth would slow down. Only hope for recovery in that eventuality, according to Christina Romer, would rest on export growth.

The countries of Europe, Japan, China, India and several other countries would also strive to step up their exports. It is impossible for all the big economies to improve their trade balance simultaneously. They are bound to resort to import restraints, dumping of products and manipulation of exchange rates. The world would witness a high degree of volatility in trade and financial flows, uncertainty and speculation.

In view of the conditions existing in the US economy at present, it is too early to congratulate the over-optimistic Fed experts for banishing the crisis through their scholarly prescriptions. The crisis is likely to remain with the US economy even beyond 2010.

Term Paper # 3. Economic Crisis and Other Countries:

The financial meltdown started in the United States in 2007. It soon took Britain into its fold. Thereafter, it engulfed the countries of European Union, Japan and emerging economies in Asia, Africa and Latin America.

The global sweep of the recession was described by Strauss-Kahn, the managing director of the IMF in these words, “Continued deleveraging by world financial institutions combined with a collapse in consumer demand and business confidence is depressing domestic demand across the globe, while world trade is falling at an alarming rate and commodity prices have tumbled.”

The depressing economic conditions in different parts of the globe and policy prescriptions applied by various countries to grapple with that crisis are discussed below:

(i) Britain:

Like the United States, the financial meltdown started in 2007, was not anticipated even by the British economists. The recession befell the British economy almost as early as the United States got engulfed into it. The meltdown in Britain too was precipitated by weakening of financial institutions, serious instability in equity market and crash of prices of housing units.

The data continued to get worse as the government revenues plunged, exports dwindled down and unemployment continued to mount up. In March 2009, the retail price index saw a negative growth of 0.4 percent. It was evident that Britain had slipped into deflation for the first time in nearly 50 years.

It was estimated by OECD that the British economy would contract by 3.7 percent which would be the worst since 1931. According to a private think tank, the number of jobless workers would exceed 3 million by the end of 2010. In order to grapple with the crisis, Britain announced £ 20 billion fiscal boost including a 2.5 point cut in the value added tax. In order to encourage a large credit flow, the policy of low interest rates was initiated. In February 2009, the Bank of England slashed its base rate to the lowest level of 1.0 percent.

This was the lowest level since the creation of Bank of England in 1694. Evidently, there was the element of desperation in that action. Having realized, like the United States, that initial rescue package did not work, Britain announced in January 2009 a second rescue plan which involved a cost of £ 100 billion or more. It included measures like raising the stake of the government in the Royal Bank of Scotland from 58 percent to 77 percent and provision of government insurance against big losses on toxic assets of the banks. The British Prime