- The Hut Group

- Investor Conference Presentation Decks

Stay in the loop

Presentations.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

The hut group shares crash plunge after investor presentation.

October 12, 2021 — 12:45 pm EDT

Written by Abhinav Ramnarayan and Julien Ponthus for ->

By Abhinav Ramnarayan and Julien Ponthus

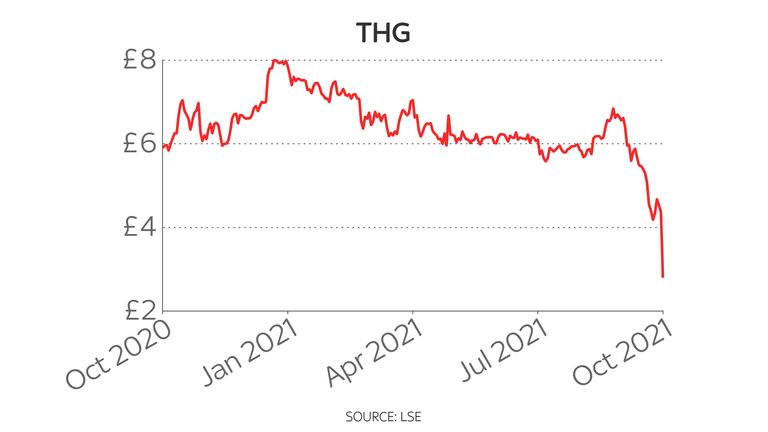

LONDON, Oct 12 (Reuters) - Softbank-backed online retailer THG THG.L lost over a third of its value on Tuesday after it held a presentation for investors that had been intended to reassure the market it could reverse a recent share price slide.

The stock fell suddenly in late afternoon and closed down 34.75% at 285 pence. The stock has now lost close to 60% since September, having listed last year when it sold shares at 500 pence each.

No clear single trigger for the sudden selloff was apparent and the company didn't immediately reply to a request for comment.

"What I think has prompted the selloff is a number of different factors," said Susannah Streeter, an analyst at Hargreaves Lansdown.

She listed profit warnings in the online retail sector, rising interest yields denting the appeal of growth companies and the planned spin off of THG's beauty arm.

"There are reports as well that a number of different institutional investors have sold shares," she added.

THG was expected to detail plans for its e-commerce services business, THG Ingenuity, and lay out its ESG strategy at Tuesday's capital market day.

But it ended the day as the top loser on the London Stock Exchange after recording its worst ever day in its one-year trading history.

THG last year completed what at the time was the biggest London stock market debut by market cap since Royal Mail RMG.L in 2013. The deal netted the company 920 million pounds while shareholders, led by founder Matthew Moulding and private equity group KKR KKR.N shared gross proceeds of 961 million pounds.

KKR sold its entire shareholding in the listing.

The company listed on the standard segment of the London Stock Exchange as the founder retained enhanced shareholding rights, thus barring it from a premium listing and access to the FTSE indices.

Several companies that listed in London at high valuations on the back of their online platform credentials have struggled in recent weeks, with iconic boot brand Dr Martens DOCS.L and online card retailer Moonpig MOONM.L both trading well below their list price.

In May, THG raised $1 billion in new equity, including $730 million from Japan's Softbank Group 9984.T . It also said it planned to spin off its THG Ingenuity platform into a separate company, and that Softbank had an option to inject a further $1.6 billion into Ingenuity once that was done.

(Reporting by Julien Ponthus and Abhinav Ramnarayan; Editing by Rachel Armstrong)

(( [email protected] ; 02075426189; Reuters Messaging: [email protected] ))

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

THG shares plunge after investor presentation

- Medium Text

The Technology Roundup newsletter brings the latest news and trends straight to your inbox. Sign up here.

Reporting by Julien Ponthus and Abhinav Ramnarayan; Editing by Rachel Armstrong

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Technology Chevron

Xiaomi's SU7 orders reach 70,000, EV business to stay focused on China

China's Xiaomi has secured locked-in orders for more than 70,000 of its SU7 electric cars as of Saturday and the company intends to keep its automotive business "100% focused" on the Chinese market for the next three years, founder Lei Jun said on Tuesday.

- Work & Careers

- Life & Arts

Hut Group lifts revenue forecast as UK retail winners emerge

- Hut Group lifts revenue forecast as UK retail winners emerge on x (opens in a new window)

- Hut Group lifts revenue forecast as UK retail winners emerge on facebook (opens in a new window)

- Hut Group lifts revenue forecast as UK retail winners emerge on linkedin (opens in a new window)

- Hut Group lifts revenue forecast as UK retail winners emerge on whatsapp (opens in a new window)

Jonathan Eley

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The Hut Group, the online retailer that floated on the stock market in September, has upgraded its revenue forecasts after sales rose more than 50 per cent in the final months of last year.

The Manchester-based group, founded by Matthew Moulding, said trading in its fourth quarter was ahead of the forecasts it made little more than a month ago .

Sales in the final three months of 2020 were £559m, 51 per cent higher than a year earlier, and ahead of a previous estimate of 40 to 45 per cent growth. The company also increased forecasts for 2021, though this largely reflected the acquisition of Dermstore last month

Shares in The Hut Group have risen almost 60 per cent since its initial public offering, and its market value, at £7.6bn, is well above the threshold required to trigger large incentive payments to a number of staff, including Mr Moulding. The company runs beauty websites Lookfantastic and Glossybox and also has own-label health and nutrition businesses, such as Myprotein.

Growth was particularly strong at The Hut Group’s online beauty business, where revenues rose 66 per cent to £298m.

The company’s announcement was one of a flurry of trading updates on Tuesday that showed many UK retailers continuing to prosper despite the alarming resurgence of coronavirus in the UK.

Very Group, the credit-based online retailer owned by the Barclay brothers, reported strong growth over the period that encompassed Black Friday and Christmas. Retail sales rose 18 per cent as consumers loaded up on homewares and electronics.

There was also upbeat commentary from DIY conglomerate Kingfisher and Warhammer owner Games Workshop, both of which have large store estates.

Kingfisher said it expected full-year adjusted pre-tax profit of about £740m, a 6 per cent increase on current estimates . Sales in the quarter to January 9 were up 16.9 per cent.

Games Workshop said half-year pre-tax profit rose more than 50 per cent to £91.6m, which was hailed by its chief executive as “a cracking performance”.

Although these retailers are very different, they have all benefited from consumers being barred from eating out or going on holiday for large parts of the year.

Henry Birch, chief executive of Very, said shoppers’ initial alarm over the impact of Covid-19 on their finances had eased. “We offered payment holidays to our credit customers but only 3 per cent took them up — and that’s now down to 1 per cent,” he said. Instead, they had been paying off loans.

He pointed to home furnishings as an example of the greater acceptance of ecommerce. “People are becoming more comfortable buying big home items online,” he said.

Adam Cochrane, retail analyst at Citigroup, said the pile up of savings caused by working from home and the closures of leisure and hospitality had been unprecedented.

“The savings ratio was up over 25 per cent during the second quarter and stayed at 16 to 17 per cent in the third. The only time it’s got near those levels in the past was during the early 1990s recession,” he said.

Proportionately more people are buying as opposed to just browsing. “We have seen that in a reduced returns rate . . . shoppers have definitely become more purposeful,” said Mr Birch.

Mr Cochrane agreed that financially robust retailers had been much better placed to react to the pandemic’s challenges.

“The online demand was there and companies that had the flexibility to move quickly were able to exploit it,” he said.

Retailers’ share prices, hit hard when the first UK lockdown was announced in March last year, have rebounded strongly. Kingfisher is up 36 per cent over the past year; Games Workshop’s market value is almost £4bn.

That is prompting more interest in flotations; cards and gifts group Moonpig said on Tuesday it would follow footwear brand Dr Martens on to the stock market.

“We’re a profitable 20-year-old business with a real record. We’re ready to be a public company,” said Moonpig’s chief executive, Nickyl Raithatha.

The big unknown is where the proportion of online sales will settle. Mr Raithatha said he was confident Moonpig — which is benefiting as people send cards instead of attending parties — would emerge from the pandemic “larger and stronger than we were coming into it”.

“There will be some kind of reversion to the norm. But we will have a significantly larger customer base and more reach.”

Promoted Content

Follow the topics in this article.

- UK retail results Add to myFT

- Personal & Household Goods Add to myFT

- Corporate earnings and results Add to myFT

- Coronavirus economic impact Add to myFT

- THG PLC Add to myFT

International Edition

Why The Hut Group looks set to remain in the doghouse with some investors

Founder Matthew Moulding seemed to have seen off the sceptics when the group went public last year but now analysts and commentators are putting it under the microscope - and do not like what they have found.

Business presenter @iankingsky

Wednesday 13 October 2021 14:17, UK

The flotation of The Hut Group - now rechristened THG - in September last year was the biggest of 2020 on the London Stock Exchange.

At the time, it spurred a great deal of optimism , coming as it did in the middle of a period in which the UK was grappling with COVID-19.

It also raised hopes that the London stock market could be as much of a crucible for technology stocks as its counterparts in the United States and continental Europe.

Fuelling that was the fact that, despite several eyebrow-raising features about the company's listing, the shares got off to a day one premium.

Those features included the fact that Matthew Moulding, the founder, was both chairman and chief executive of the company - an arrangement usually frowned upon in UK listed companies.

Some investors disliked an incentive scheme under which Mr Moulding stood to make as much as £700m and also the fact that he had a controversial "founder's share" that gave him the ability to block takeover bids for the next three years.

More from Business

Government borrowing higher than forecast as doubts raised over pre-election tax cuts

Supermarket price war leads to fall in grocery inflation

FTSE 100 hits new record high helped by five-month low for pound

Such arrangements are commonplace in the tech-friendly US markets but not in the UK.

For a while, Mr Moulding appeared to have seen off the sceptics.

Shares of THG, which came to market at 500p each, soared to 658p on debut and went on to hit the dizzy heights of 837.8p each in January this year.

Shortly afterwards, in May, Mr Moulding announced that Softbank, the specialist Japanese tech investor famous in this country for its takeover of chip designer Arm Holdings in late 2016, was investing $730m (£537m) as part of a $1bn (£735m) fund-raising.

That announcement was accompanied by news that Softbank had been awarded an option to buy 19.9% of THG Ingenuity, the part of THG that provides integrated ecommerce and logistics services for customers such as Gillette, Homebase and Nintendo, in an arrangement that valued Ingenuity at £4.5bn.

That option, as things stand, looks unlikely to be exercised any time soon.

Shares of THG, since peaking in January, have lost two-thirds of their value.

The entire business is now valued less than £3.5bn.

So what has gone wrong?

According to THG itself, nothing with the business itself.

It pointed out today in a stock exchange announcement that, since the flotation, it had "consistently delivered ahead of its targets set at the time of the IPO [initial public offering] and recently reported a strong first half performance across all divisions, with group revenue of £958.8m, up 44.7% year on year".

The statement went on: "The group also has a very strong liquidity position as it enters its peak trading season, with available cash as at 30 September 2021 of £700.0m across long dated 3-5 year facilities."

The share price tells a different story.

Some investors have clearly been rattled by trading updates from a number of other online retailers, among them AO World, Boohoo and ASOS , that have pointed to supply chain issues and labour shortages.

Analysts naturally assume THG will not have gone unaffected if its peers have been hit.

But that is only part of the explanation for the share price reverse.

The more fundamental issue is that a number of analysts and commentators have been putting parts of THG under the microscope and have not liked what they have seen.

A number of short-sellers (those investors who borrow shares in a business, sell them and then buy them back later to return to the lender after the share price has fallen) have targeted the business, arguing that it was previously over-valued by the market, being valued more as a tech company than an online retailer.

It was suggested that the valuation could not be justified in the absence of greater transparency about THG Ingenuity.

Others, who had always had it in for the company because of its unconventional approach to corporate governance, were happy to join in the selling frenzy.

In order to tackle the criticism, THG on Tuesday held a presentation to investors and analysts, who were promised more detail about THG Ingenuity.

Unfortunately for the company, the selling intensified, causing the shares to lose a third of their value on the day.

Mr Moulding himself told the Daily Mail after the share price reverse: "It has not been a great day, that's for sure."

THG, in its statement today, insisted it "knows of no notifiable reason for the material share price movement, and that no material new information was disclosed at the [presentation]".

That may be the problem.

A lot of investors are still none the wiser about THG Ingenuity, for example, how much it charges clients, as well as the websites THG itself owns.

More detail in particular is sought about the global technology partnership arrangement THG Ingenuity signed in April last year with Nestlé which, at the time, was described by Mr Moulding as "a major endorsement for THG Ingenuity's unique and comprehensive offering".

Until more clarity is provided around some of these issues, THG is likely to remain in the doghouse with a portion of its shareholders, with wider implications for London as a location for high profile tech IPOs.

Today's Digital Daily

site categories

Parent item expand the sub menu, retailers were cautiously optimistic with stable budgets at 2024 watches and wonders, nancy gonzalez sentenced to 18 months in prison, ftc sues to block tapestry’s $8.5b takeover of capri, u.s. private equity giants are circling the hut group.

THG has become the latest British company after Ted Baker to attract institutional bargain hunters.

Bureau Chief, London

- Share this article on Facebook

- Share this article on X

- Share this article on Flipboard

- Share this article on Pin It

- Share this article on Tumblr

- Share this article on Reddit

- Share this article on LinkedIn

- Share this article on WhatsApp

- Share this article on Email

- Print this article

- Share this article on Talk

LONDON — Ted Baker isn’t the only British company that’s attracting private equity bargain hunters.

The Hut Group , which has seen its share price plummet 83 percent in the past year, has also received “indicative proposals from numerous parties in recent weeks,” according to the company’s cofounder and chief executive officer Matthew Moulding .

Moulding told investors earlier this week during THG ’s full-year results presentation that he and the board knocked back all of the offers as they don’t reflect the value of the company.

“The board has concluded that each and every proposal to date has been unacceptable, failing to reflect the fair value of the group, and confirms that THG is not currently in receipt of any approaches,” he said.

Moulding did not elaborate on who the suitors were, what price they offered, or even how serious those offers were.

Related Articles

Ted baker partners with brooklyn botanic garden on capsule, ted baker to shut 15 stores in u.k., cut 245 jobs.

According to British press reports, the top suitors are American private equity giants Leonard Green & Partners; Advent International, and Clayton, Dubilier & Rice. They have not commented on the speculation, nor has anyone made a formal offer.

THG shares are currently trading at 1.09 pounds.

Beauty industry sources confirmed that THG is a very attractive target given the share price decline, the governance challenges it has been experiencing of late and the potential for growth.

THG landed on the London Stock Exchange with a blockbuster initial public offering in September 2020, but the share price began to fall after questions arose about cofounder Moulding ’s powerful role and oversight.

Until recently he was chairman, chief executive officer and in possession of a “golden share,” which gives him special veto powers and the ability to block takeover attempts. In addition — via a series of complex deals — Moulding is also THG’s main landlord through a separate investment company.

Moulding has since ceded the role of chairman to former ITV boss Charles Allen, and has said he plans to give up his golden share. He remains CEO.

Adding to THG’s woes, analysts have also questioned the value of the company’s Ingenuity platform, which licenses end-to-end e-commerce solutions to brand owners, provides various other digital services and undertakes beauty product development and manufacturing for third parties.

Earlier this week, THG said full-year revenue in fiscal 2021 was 2.2 billion pounds, up from 1.6 billion pounds in 2020. Adjusted EBITDA was up 6.6 percent to 161 million pounds. THG added it was expecting “strong” revenue growth in 2022, ranging from 22 to 25 percent.

In the meantime, Ted Baker , which also saw its share price plummet due partly to governance issues , continues to field offers after putting itself up for sale earlier this month.

As reported, Sycamore Partners has confirmed it is taking part in the formal sales process after having made a series of unsuccessful bids for Ted Baker earlier this year.

Sign up for WWD news straight to your inbox every day

Ethan Hawke, Maya Hawke & Laura Linney Talk ‘Wildcat’

WWD and Women's Wear Daily are part of Penske Media Corporation. © 2024 Fairchild Publishing, LLC. All Rights Reserved.

Fashion Expand fashion menu

- Fashion Trends

- Fashion Features

- Fashion Scoops

- Designer & Luxury

- Ready-To-Wear

- Accessories

Business Expand business menu

- Government & Trade

- Mergers & Acquisitions

- Marketing & Promotion

- Human Resources

- Business Features

- Real Estate

Beauty Expand beauty menu

- Beauty Features

Men's Expand mens menu

- Mens Accessories

- Mens Clothing Furnishings

- Mens Designer Luxury

- Mens Lifestyle

- Mens Retail Business

- Mens Sportswear

- Mens Fashion

Runway Expand runway menu

- Men’s Fall 2024

- Pre-Fall 2024

- Spring Ready-to-Wear 2024

- Fall Couture 2023

- Resort 2024

Denim Expand denim menu

Sustainability expand sustainability menu.

- Environment

- Social Impact

Home/Design Expand home-design menu

- Interior Design

- Architecture

WWD Weekend Expand wwd-weekend menu

Events expand events menu, eye expand eye menu.

- Celebrity Real Estate

Shop Expand shop menu

More expand more menu.

- Fairchild Live

- RetailRx Community

Verify it's you

Please log in.

- International edition

- Australia edition

- Europe edition

THG chief Matt Moulding gives up ‘golden’ share

Retail group says Moulding has ‘transferred’ share that had given him power to veto hostile takeovers

Matt Moulding, the founder and chief executive of the online retail platform THG, has given up his “golden” share allowing him to block any attempt to takeover the company, months after he was due to surrender it .

THG – formerly known as The Hut Group and the owner of retail sites LookFantastic, Glossybox, Zavvi and Coggles – first pledged to cancel Moulding’s controlling share in October 2021, after a disastrous investor presentation triggered a 35% one-day crash in its share price .

Before its annual investor meeting on Wednesday, THG said Moulding had “transferred” his special share that had given him power to veto hostile takeovers. The share will be cancelled by the company.

Moulding’s “golden” share had long been contentious, and the company had originally said it would be cancelled during 2022, “in furtherance of good corporate governance”.

The move came as Manchester-based THG, which also owns the MyProtein brand, forecast an increase in first-half profits thanks to a strong performance from the nutrition part of its business.

The company is now predicting adjusted pre-tax profit of between £44m and £47m for the first half, compared with £32.3m a year earlier.

THG’s shares rose 2% to 75p in early trading on Wednesday – but about 90% has been wiped off the company’s market value since it first listed in London in September 2020.

The 2021 announcement that Moulding would relinquish his controlling share was intended to pave the way for THG to apply to switch from a standard stock market listing to a premium one, as is usual.

THG said it still intended to move to a premium stock market listing, but added that the timing was dependent on the final outcome of the review by the financial watchdog, the Financial Conduct Authority, on reform of the listing regime.

The online retail platform said its nutrition division, which sells products including protein shakes, had had a “particularly strong start to the year”, adding that commodity prices would continue to ease, boosting its profit margins in the second half of the year.

THG said it expected to see sales of beauty products and makeup to increase in the second half, as beauty brands once again increased their production.

after newsletter promotion

The company, co-founded in 2004 by Matt Moulding and fellow former Phones4u executive John Gallemore, initially became an investor favourite after floating in London at an opening valuation of £5.4bn.

However, amid continued underperformance, the market value has fallen below £1bn, to about £950m, and shares were recently knocked by THG’s announcement that it was ending talks about a possible takeover bid by Apollo.

The company said last month the private equity company’s offer provided “inadequate valuations” of the retail platform.

Online health and beauty firm THG in talks to buy freesheet City AM

THG shares fall after failed takeover talks with Apollo

Kelso Group ups stake in THG and calls for spinoff of nutrition business

Boss of THG quotes Alanis Morissette as he slams ‘negative press’

THG shares soar on takeover move amid spate of private equity bids for UK firms

Now would be a good moment for the chair of THG to find his voice

More pain for online retailer THG as top insurer reduces cover

THG shares rise after SoftBank sells stake to Moulding and Qatar

Most viewed.

Subscribe Sign In Register

Moscow: Without Limits

As moscow booms, its convention and meeting venues are playing catch-up.

- Copy Link copied

As Moscow booms, its convention and meeting venues are playing catch-up by Edith Hall Friedheim In October 2006, a total of about 40,000 high-profile politicians, businessmen and show-business celebrities, most of them Russian, attended the four-day Millionaire Fair at Moscow’s Crocus City Exhibition Center to buy diamond-encrusted telephones and other indulgences most provincial Russians can only dream of. Dizzy from the wealth the oil boom has brought, a nouveau riche Russian elite are making up for decades of deprivation, creating lives ever and ever more bespredel (without limits). Tourism might be driving St. Petersburg’s economy, but Moscow is a commercial boomtown where entire neighborhoods of drab Soviet architecture are being replaced with smart shopping centers, nightclubs and glass-and-steel office buildings that tower above the rest of the city.

The area around Krasnaya Presnya, once a working-class quarter, has the greatest political and financial concentration, housing the White House, World Trade Center, Expocenter and other corporate megaliths. Originally the idea for a major trade center was initiated by Armand Hammer, who began doing business with the USSR in the 1920s and knew every Communist leader from Lenin to Gorbachev. Launched in 1980, along with its adjacent Mezhdunarodnaya Hotel, the first WTC was replaced in 2004 with a 21-story World Trade Center II, built between the original complex and a new Expocenter.

There’s no shortage of convention facilities in Moscow, but when it comes to claims of “state-of-the-art technology,” caveat emptor: What Westerners consider state-of-the-art can fall frustratingly short in other parts of the world. Of the three major meetings venues near Moscow’s fairgrounds, the World Trade Center (12 Krasnopresnenskaya Embankment (nab.), tel. 495-258-1212; www.wtcmoscow.ru) claims its 1,500-person capacity Congress Hall is the city’s largest and best equipped multi-purpose facility, no more, no less. The venue’s 28 adaptable function halls on two floors boast several thousand square feet of floor space and such support services as simultaneous translation, audio-visual equipment, overhead projector and screen, flipcharts and markers, and microphones. (These or similar services are provided by most Moscow business and hotel centers.)

The Manezh Exhibition Center (1 Manezhnaia St., tel. 095-292-4459;) has an unbeatable location near the Kremlin and a fascinating history that dates back to 1817, when the original building—now virtually replaced because of a deadly fire in 2004—was a riding school where Tolstoy had his first lessons.

The Mezhdunarodnaya Hotel, the “Mezh” to expats (12 Krasnopresnenskaya Embankment, tel. 095-258-2122; www.wtcmoscow.ru) has the advantage of sharing both the World Trade Center’s address and its 1,500-seat Congress Hall. And nearby, Expocenter (14 Krasnopresnenskaya Embankment, tel. 495-255-3733; www.expocentr.ru) has added a 600-seat Expo-Congress facility to attract the conference market. Although the fairgrounds in particular, and Krasnaya Presnya, its neighboring Fili, and the southern districts in general, can hardly be considered ideal starting points for exploring Moscow on foot, they do encompass Tolstoy’s House, the former Russian Parliament building, Victory Park and Moscow State University, all worth a visit.

Crocus City International Exhibition Center (4 Krasnogorsk, tel. 495-727-2598; www.eng.crocusexpo.ru) is one of Moscow’s most ambitious developments, part of a $28 million Crocus Expo complex that includes a marina, yacht club, helicopter pad, entertainment center, luxury shopping mall and up-market restaurants—Disneyland redux. As such, it managed to snare the 2006 Millionaire Club trade show for the second consecutive year. 900 delegates can convene in 226,042 square feet of floor space when the four conference halls of Pavilion 1 are combined. The Food Court in the same pavilion can dish up more than 1,000 Russian-style portions of blini and beef stroganoff at one time.

If the sleek, low-slung Crocus City complex defines “new” Russian architecture, the All-Russia Exhibition Center (Vserossiysky Vystavochny Center, tel. 495-544-3400; www.vvcentre.ru ) screams “Stalin Baroque” in all its excess. Ornate, monumental in size and scope—with 70 fountains, about 70 pavilions and wide promenades, the VVTs, as it is called today, was created by the Soviet government in 1939, enlarged during the 1950s to better glorify Soviet Republics, and finally left to fend for itself after the collapse of Communism. The current trade-fair-cum-shopping-center is as much a tourist attraction as a center of commerce. Closer to central Moscow the well-established Sokolniki Culture and Exhibition Center (1 Sokolnicheskiy Val, Pav. 4, tel. 495-995-0595; www.exposokol.com/eng) offers 13 function halls in 301,390 square feet of indoor space.

Every city in Russia has a Gostiny Dvor, a central covered market. Moscow’s, in Red Square (3 Varvarka St., tel. 095-298-5549; www.mitf.ru/eng) has undergone centuries of modification since it was first covered in brick in 1590 and later transformed in neoclassical style with Corinthian columns and arcades. In 1995 it gained a glass roof and its Atrium morphed into one of the city’s most fashionable exhibition venues.

Moscow may seem overwhelming at first, but its historic nucleus—Red Square and the Kremlin—is compact enough to see on foot. Heading any list of must-sees: Lenin’s Mausoleum, St. Basil’s Cathedral, the GUM department store and the Kremlin itself, which houses among other tsarist treasures Catherine the Great’s diamond-studded coronation crown and a collection of Fabergé eggs.

As to restaurants in central city, One Red Square (tel. 095-925-3600)— enter via the History Museum—features a menu culled from 200 years of traditional Russian recipes; it’s inexpensive for its location, and the cuisine is highly rated. Bosco, in the GUM department store (tel. 095-929-3182), is a cross between an Italian café and a Russian tearoom. What could be a better combination than cappuccino and views of the sun setting over St. Basil’s at dusk? Even Pushkin would approve of Café Pushkin (tel. 095-229-5590/91), a restored 19th-century mansion where the in-crowd dines on blini and black caviar. The café isn’t really a café at all, except for its ground-level bar open 24 hours. Upstairs the cuisine is strictly haute, with prices to match. But Café Pushkin is one of Moscow’s finest restaurants, and worth the splurge.

While most major Moscow hotels house conference facilities, the largest and best-equipped are not necessarily in the top properties or most central locations. One businessman recently praised the President’s “five-star conference rooms” while deriding its “four-star accommodations.” And the colossal, recently revamped 1970s Cosmos Hotel garners fewer than five stars in guidebooks, but its convention facilities are among Moscow’s most sophisticated. Conversely, the Mezhdunarodnaya, sharing the World Trade Center’s 1,500-seat Congress Hall and other business amenities, is a true five-star hotel in every respect except location; anyone looking for nightlife will find it inconvenient. And speaking of nightlife, local restaurants and nightclubs open, close, and change their addresses so often that hotel guests should consult their concierge desks for recommendations.

In Russian hotel ratings, stars are not as important as when a property was built or completely upgraded. Generally location determines price; the closer the property to the center of town, the more expensive. According to Natasha Bloom, Sales Executive with the Russian Travel Group, Moscow’s average $347 room rate qualifies it as the world’s most expensive city for lodging (especially in November, prime convention time), outdistancing New York and London. Yet there are bargains to be had.

The colossal (almost 1,800 rooms) Soviet-era Cosmos Hotel (150 Mira Prospect, tel. 095-234-1000; www.hotelcosmos.ru.) doesn’t have the five-star prestige of Moscow’s Marriotts or Méridiens, but it boasts one of the city’s most comprehensive convention and conferences venues, including a 1,000-seat congress/concert/ cinema hall, and multiple conference and exhibition halls. All this and an exhaustive Web site, albeit last updated in 1998, make it a standout in its class.

When easy access to Red Square and the Kremlin counts, it’s reassuring to book the brands with cache: Marriott, Hyatt, Kempinski. As the latest in Moscow’s inventory of elite central-city hotels, the ultra-deluxe Ararat Park Hyatt (4 Neglinnaya St., tel. 095-783-1234; www.moscow.park. hyatt.com) offers almost 4,000 square feet of business space in its well-staffed, 180-seat ballroom and smaller meeting rooms. Nearly everything is within walking distance, including the best restaurants. Its bar is also the crème de la crème of Moscow night spots.

As typically European in style and décor as the Ararat is modern, the Baltschug Kempinski (1 Baltschug St., tel. 095-230-6500; www.kempinski-commoscow.ru) has an unprepossessing façade and terrific views of the Kremlin and St. Basil’s Cathedral. Up to 180 people can rendezvous in two adequate-sized meeting rooms or sit down to dinner in an atrium that serves up to 230.

Marriott’s five-star flagship Grand (26 Tverskaya St., tel. 095-937-0000; www.marriott.com), the same company’s five-star Aurora Royal (11/20 Petrovska St., tel. 095-937-1000; www.marriott.com), and the slightly lower-end but enormous Renaissance (18/1 Olympijskij Avenue, tel. 095-931-9000; www.renaissancehotels .com) handle groups of up to 600 in as many as 28,000 square feet of floor space (Renaissance).

Less expensive than the Marriotts, the elegant Art Nouveau Metropol (1/4 Theater Passage, tel. 095-927-6000; www.metropol-moscow.ru), dating from 1903, is no slouch when it comes to celebrity guests, having hosted Leo Tolstoy, G.B. Shaw and JFK during its hundred-year history. Clients convene either in the main conference hall holding just under 300 people, or in five smaller rooms, ranging in capacity from 50 at a round table, to 150 in an amphitheater setup.

Another 19th-century landmark—somehow it also survived Stalin’s demolition of countless relics of the Russian “bourgeoisie"—the National Hotel, now Le Royal Méridien National (14/1 Okhatny Rd., tel. 095-258-7000; www.national.ru) was Lenin’s home in 1918. Refurbished during the 1990s, it now vies with the Metropol as Moscow’s grande dame, boasting views of the Kremlin its rival can’t match. The National’s 14 banquet halls and conference rooms service as many as 170 people.

Finally, the President (24 Bolshaya Yakimanka, tel. 095-239-3800; www. president-hotel.ru), once a pied-à-terre for high-ranking Soviet officials, and the Golden Ring (5 Smolenskaya Square, tel. 095-725-0100; www.hotel-goldenring.ru) are updated vintage Soviet, and both offer a full range of facilities.

GETTING THERE

Aeroflot (nonstop) From NY (JFK): business class $2,799–$4,798; economy class $459–$2,194 From Los Angeles: business class 3,599–$5,758; economy class $739–$2,638

AeroSvit (via Kiev) From NY (JFK): business class $1,859–$2,290 economy class $284–$1,444 From Los Angeles: AeroSvit only flies from NY. Buying a separate roundtrip from LA–NY on another carrier would be cheaper than buying its published interline fares

Air France (via Paris) From NY (JFK or Newark): business class $2,863–$6,674; economy class $383–$3,974 From Los Angeles: business class $3,300–$8,455; economy class $506–$5,564

Delta Airlines From NY (JFK nonstop): business class $2,943–$8,034; economy class $413–$4,054 From Los Angeles (via JFK): business class $3,300–$9,540; economy class $579–$5,564 Lufthansa (via Frankfurt or Munich) From NY(JFK or Newark): business class $2,863–$7,058; economy class $589–$4,046 From Los Angeles: business class $3,300–$8,838; economy class $779–$5,564

REG - Dillistone Group PLC - Notice of Results & Investor Presentation

22 April 2024

Dillistone Group Plc

("Dillistone", the "Company" or the "Group")

Notice of Results & Investor Presentation

Dillistone Group Plc, the AIM quoted supplier of software and services for recruiters, expects to announce results for the 12 months ended 31 December 2023 on Thursday 25 April 2024.

Investor Presentation: 3pm on Tuesday 30 April 2024

Jason Starr, Chief Executive, and Ian Mackin, Finance Director, will hold an investor presentation to review the results and prospects at 3pm on Tuesday 30 April 2024.

The presentation will be hosted through the digital platform Investor Meet Company. Investors can sign up to Investor Meet Company and add to meet Dillistone Group Plc via the following link https://www.investormeetcompany.com/dillistone-group-plc/register-investor. For those investors who have already registered and added to meet the Company, they will automatically be invited.

Questions can be submitted pre-event to [email protected] or in real time during the presentation via the "Ask a Question" function.

Notes to Editors:

Dillistone Group Plc is a leader in the supply and support of software and services to the recruitment industry. Dillistone operates through the Ikiru People (www.IkiruPeople.com) brand.

The Group develops, markets and supports the Talentis, FileFinder, Infinity, Mid-Office, ISV and GatedTalent products.

Dillistone was admitted to AIM, a market operated by the London Stock Exchange plc, in June 2006.

Learn about our products:

Talentis Software: https://www.talentis.global/recruitment-software/

Voyager Software: https://www.voyagersoftware.com

GatedTalent Executive Jobs: https://www.talentis.global/all-jobs

RNS may use your IP address to confirm compliance with the terms and conditions, to analyse how you engage with the information contained in this communication, and to share such analysis on an anonymised basis with others as part of our commercial services. For further information about how RNS and the London Stock Exchange use the personal data you provide us, please see our Privacy Policy. END NORUKRURSOUSAAR

Expedia Rewards is now One Key™

Elektrostal, visit elektrostal, check elektrostal hotel availability, popular places to visit.

- Electrostal History and Art Museum

You can spend time exploring the galleries in Electrostal History and Art Museum in Elektrostal. Take in the museums while you're in the area.

- Cities near Elektrostal

- Places of interest

- Yuri Gagarin Cosmonaut Training Center

- Peter the Great Military Academy

- Central Museum of the Air Forces at Monino

- History of Russian Scarfs and Shawls Museum

- Balashikha Arena

- Balashikha Museum of History and Local Lore

- Bykovo Manor

- Pekhorka Park

- Malenky Puppet Theater

- Drama Theatre BOOM

- Ramenskii History and Art Museum

- Noginsk Museum and Exhibition Center

- Pavlovsky Posad Museum of Art and History

- Saturn Stadium

- Fairy Tale Children's Model Puppet Theater

- Fifth House Gallery

- Church of Vladimir

- Likino Dulevo Museum of Local Lore

- Malakhovka Museum of History and Culture

- Orekhovo Zuevsky City Exhibition Hall

- Phone: +90 (212) 875 19 08

- E-Mail: [email protected]

- Company Profile

- Company Policy

- Mission and Vision

- Certificates

- Aluminium Windows

- Aluminium Doors

- Aluminium Sliding Elements

- Aluminium Curtain Walls

- Aluminium Skylight Elements

- Aluminium Frames for Safety and Security

- Aluminium Conservatories

- Metal Panel Sheet Claddings

- Aluminium Entrance Frames

- Glass Structures

- Complementary Items

- Lightweight Steel Structures

- Human Resources OPEN

Project Description

Project name:, year of construction:, items to be completed:.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Investment Ideas

- Research Reports

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance transfer cards

- Cash-back cards

- Rewards cards

- Travel cards

- Personal Loans

- Student Loans

- Car Insurance

- Options 101

- Good Buy or Goodbye

- Options Pit

- Yahoo Finance Invest

- EV Deep Dive

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Recording of lhv group's 23 april investor webinar.

To give an overview of the 2024 Q1 financial results, LHV Group organised an investor meeting webinar on 23 April. An overview of the company's progress was given by Madis Toomsalu, Chairman of the Management Board of LHV Group and Meelis Paakspuu, CFO of LHV Group.

The live coverage was followed by 35 participants, the live feed of the presentation was broadcast over Zoom.

Recording of the investor meeting (in Estonian) is available at: https://youtu.be/Ngt7yh6aHAs .

Presentation (in English): https://www.lhv.ee/assets/files/investor/LHV_Group_Presentation_2024-Q1-EN.pdf .

Priit Rum Communications Manager Phone: +372 502 0786 Email: [email protected]

IMAGES

VIDEO

COMMENTS

Presentation. Webcast. THG Annual Report 2022. 03/05/2023. THG Annual Report 2021. 09/05/2022. THG Annual Report 2020. ... Group. Our Business Model. Our Purpose, Vision & Values. Our Strategy. Five-Year Record. Businesses. THG Beauty. ... Questions regarding Investor Relations can be emailed to [email protected] or by clicking the ...

Tel: +44 (0) 20 7250 1446. Victoria Palmer-Moore/Nick Dibden/Nick Hayns. [email protected]. THG PLC. Viki Tahmasebi. [email protected]. The Company confirms that the Annual Report & Accounts for the financial year ended 31 December 2022 ("2022 Annual Report") have today been posted, or otherwise made available, to the Company's ...

The Hut Group; Investor Conference Presentation Decks; Download PDF See More The Hut Group. Investor Conference Presentation Decks. Explore Topics Beauty. Manufacturing. Recent decks by The Hut Group Results April 2022 Investor Day October 2021 ...

The Hut Group shares crash plunge after investor presentation. Softbank-backed online retailer THG lost over a third of its value on Tuesday after it held a presentation for investors that had ...

The stock fell suddenly in late afternoon and closed down 34.75% at 285 pence. The stock has now lost close to 60% since September, having listed last year when it sold shares at 500 pence each.

THG, formerly known as The Hut Group, became London's biggest IPO in five years in September 2020, ... Following THG's investor presentation in October 2021, a Numis employee sent clients a ...

The retailer, formerly known as The Hut Group, which is run by its founder Matt Moulding, held a capital markets day, where it shared its 2030 sustainability strategy with investors.

of the Group and a significant undertaking that was completed on track and on time. The Board believes that this separation provides material optionality and flexibility for our key trading Divisions to enter into future strategic partnerships, generating value accretion for all shareholders. As you will see from our published accounts

The Hut Group, the online retailer that floated on the stock market in September, has upgraded its revenue forecasts after sales rose more than 50 per cent in the final months of last year. The ...

The flotation of The Hut Group - now rechristened THG - in September last year was the biggest of 2020 on the London Stock Exchange. ... THG on Tuesday held a presentation to investors and ...

Moulding told investors earlier this week during THG's full-year results presentation that he and the board knocked back all of the offers as they don't reflect the value of the company.

First published on Tue 12 Jan 2021 06.12 EST. The Hut Group, the recently floated online retail company run by billionaire Matthew Moulding, has upgraded its profit forecasts after strong sales at ...

THG - formerly known as The Hut Group and the owner of retail sites LookFantastic, ... after a disastrous investor presentation triggered a 35% one-day crash in its share price. ...

catalogue.thehutgroup.com

This progress has continued into 2020, with in excess of £200m of long-term contracted technology revenues secured in the first quarter of 2020. Highlights & Progress in 2019 ANNUAL REPORT 2019ANNUAL REPORT 2019. Example progression of a recent new Ingenuity client. 2018 Launch Revenue 2020 Forecast Revenue. £11m £0.3m.

Hut 8 Reports Operating and Financial Results for 2021 ... group and in doing so, have become the only company in North America to both mine digital assets while ... where necessary to conform with current period presentation. As At (CAD thousands) December 31, 2021 December 31, 2020 Financial position Cash $ 140,127 $ 2,816 Total digital ...

Everything related to the Swedish Embracer Group Members Online ... Investor presentation, 22 April 2024 Share Add a Comment. Be the first to comment Nobody's responded to this post yet. Add your thoughts and get the conversation going. Top 29% Rank by size . More posts you may like ...

In 1938, it was granted town status. [citation needed]Administrative and municipal status. Within the framework of administrative divisions, it is incorporated as Elektrostal City Under Oblast Jurisdiction—an administrative unit with the status equal to that of the districts. As a municipal division, Elektrostal City Under Oblast Jurisdiction is incorporated as Elektrostal Urban Okrug.

Unum Group 2024 Outlook Meeting. January 31, 2024. View this Presentation.

The presentation is open to all existing and potential shareholders. Questions can be submitted pre-event via your Investor Meet Company dashboard up until 29 April 2024, 09:00 BST or at any time during the live presentation. Investors can sign up to Investor Meet Company for free and add to meet Kooth plc via:

As Moscow booms, its convention and meeting venues are playing catch-up by Edith Hall Friedheim In October 2006, a total of about 40,000 high-profile politicians, businessmen and show-business ...

Investors. News & Results. Regulatory News. Results & Presentations. Financial Calendar. Our Purpose. THG at a Glance. Sustainability. Governance. Board of Directors. ... THG announces a new 10-year partnership with expanding beauty and fragrance group. Read more. All Group News. Financial | 21-04-2022.

Dillistone Group Plc, the AIM quoted supplier of software and services for recruiters, expects to announce results for the 12 months ended 31 December 2023 on Thursday 25 April 2024. Investor Presentation: 3pm on Tuesday 30 April 2024. Jason Starr, Chief Executive, and Ian Mackin, Finance Director, will hold an investor presentation to review ...

At Omnicom Group Inc., we promise to treat your data with respect and will not share your information with any third party. You can unsubscribe to any of the investor alerts you are subscribed to by visiting the 'unsubscribe' section below. If you experience any issues with this process, please contact us for further assistance.

Cities near Elektrostal. Places of interest. Pavlovskiy Posad Noginsk. Travel guide resource for your visit to Elektrostal. Discover the best of Elektrostal so you can plan your trip right.

Adres: BOSB Mermerciler San. Sitesi 4. Cadde No: 7 34520, Beylikdüzü / İstanbul / TÜRKİYE

To give an overview of the 2024 Q1 financial results, LHV Group organised an investor meeting webinar on 23 April. An overview of the company's progress was given by Madis Toomsalu, Chairman of ...

To give an overview of the 2024 Q1 financial results, LHV Group organised an investor meeting webinar on 23 April. An overview of the company's progress was given by Madis Toomsalu, Chairman of ...