How to Create Business Places in SAP Hana

Define business places in sap s/4hana.

In this SAP tutorial, you will learn how to create a business place that is needed for your company. You can create business places in SAP S4Hana by using the following navigation

- SAP IMG Path: SPRO > SAP Reference IMG > Cross Application Components > General Application Functions > Business Place > Define Business Places

Configuration Steps:

Step 1: Follow the IMG Menu Path and execute the IMG activity “Define Business Places”

Step 2 : On the “Determine Work Area: Entry” screen, enter your company code and press enter to continue.

Step 3: On the change view “Business Places” overview screen , click on “ New Entries “ for the creation of a new business place in SAP Hana.

Note: If business places already exist, click on business places and update the address and GSTIN details.

Step 4: On the new entries of the business places creation screen, update the required details like

- Business Place ID and Description

- GST Tax registration number.

Step 5 : Click on the “ Address ” icon and update the complete address details for the new business place.

After maintaining all the required details, click on the save button and save the newly created business place in the SAP Hana system.

- Talk to our counsellor, call/whatsapp on +91 7262000918

- Eamil: [email protected]

- Download brochure

- SAP FICO S/4HANA

- SAP TRM S/4HANA

- SAP TM S/4HANA

- SAP SUCCESSFACTORS

- SAP SD S/4HANA

- SAP MM S/4HANA

- SAP PP S/4HANA

- SAP PS S/4HANA

- SAP CO S/4HANA

- SAP ABAP S/4HANA

- SAP BW S/4HANA

- SAP BOBI on S/4HANA

- SAP BODS on S/4HANA

- SAP S/4HANA ADMIN

- Snowflake Data Cloud

- SalesForce Developer

- AWS Solution Architect

- Data Analyst

- Data Science

- Digital Marketing

- Full Stack JAVA

- Web Development

- Batch Schedule

- Blog – SAP FICO

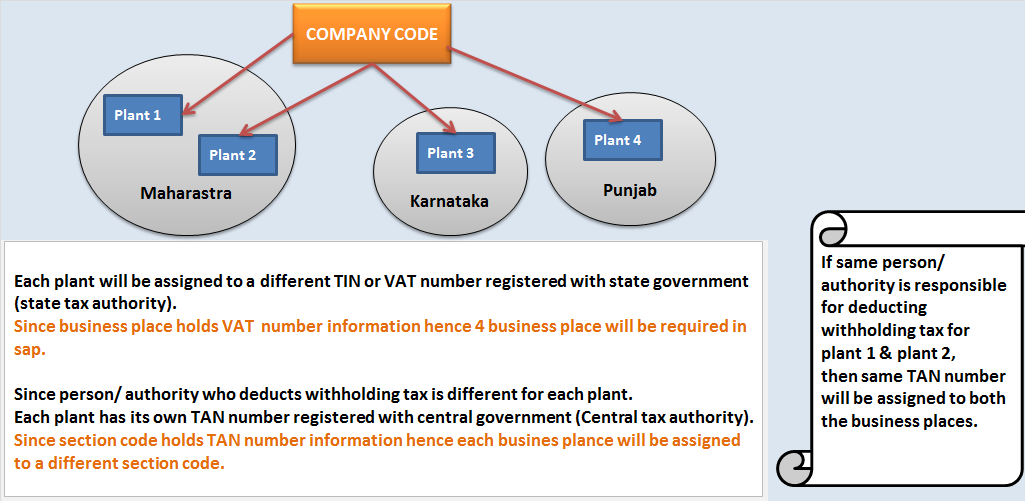

Business place & Section code in sap

Certain counties (India, Brazil, Philippines, South Korea, Taiwan & Thailand) require tax reporting at level below company code.

Let’s take the example of India:

TIN number needed for VAT

VAT (tax on purchase and sales of product within state) reporting is done at state level. Company has to collect & file VAT returns to state tax authority (state tax authority is below central tax authority).

- Whichever person/authority in the company is liable to collect & file VAT returns has to obtain VAT registration number or Tax identification number (TIN) from state tax authority.

- One person/ authority (responsible for filing VAT returns) cannot have more than one TIN number. Hence different person/ authority responsible for collecting & filing VAT returns need to have its own TIN number.

- If same person/authority is responsible for collecting & filing VAT returns for multiple plants then VAT can be applied on transactions done in all those plants under single TIN number. Whenever a VAT applicable transaction is done, VAT amount is applied (calculated & recorded) under the TIN number obtained from state tax authority. (TIN number is assigned by state tax authority to each person/authority responsible for collecting & filing VAT).

Example: You got to restaurant and order food. The bill that you receive has VAT amount applied and a VAT number is also written on the bill. The VAT number (TIN) is basically identification number assigned to restaurant by state tax authority for the purpose of collecting & filing VAT with state government for transactions done within state.

TAN number needed for withholding tax Withholding tax reporting is done at central level. Company has to file withholding tax returns to central tax authority.

- Whenever person/authority makes a payment and if as per income tax act 1961 withholding tax is applicable on the payment then it’s the liability of payer to deduct withholding tax from payment to payee. Person/ authority that is liable for collecting & filling withholding tax has to obtain TAN number from central tax authority.

- One person/ authority (responsible for collecting & filling withholding tax returns) cannot have more than one TAN number. Hence different person/ authority responsible for collecting & filing withholding tax returns need to have its own TAN number.

- If same person/authority is responsible for collecting & filing withholding tax returns for multiple plants then withholding tax can be applied on transactions done in all those plants under single TAN number.

Example: Employer deducts tax (tax at source) from employee’s salary on behalf of central tax authority. Later on employer has to remit the deducted tax and file withholding tax returns with central tax authority under the TAN number.

TAN (Tax Deduction & Collection Account Number) is assigned by central tax authority to the employer.

Now let’s apply above concept and understand why we need Business place and Section code in sap

Different place of business will have different person/ authority responsible for collecting & filling VAT returns with state tax authority. Hence each person/authority has to obtain is own TIN number from state tax authority.

In sap, place of business is represented as business place. Business place captures TIN number.

Plant is assigned to a business place, whenever transaction is posted software picks the business place from plant involved in the transaction and hence fetches the TIN number as well.

For transactions where software is not able to determine business place, business place information is entered manually.

Different place of business will have different person/ authority responsible for collecting & filling withholding tax returns with central tax authority. Hence each person/authority has to obtain is own TAN number from central tax authority.

In sap, each business place is mapped to a section code. Section code captures TAN number.

Plant is assigned to a business place and business place is mapped with section code , whenever transaction is posted software picks the business place from plant involved in the transaction and hence fetches the TAN number as well.

Below example to help you apply the above concepts and understand better

GL ACCOUNTING

- What is SAP FICO ?What business requirement is fulfilled in this module?

- What is enterprise structure in sap fico?

- What is GL account? What is account group? What is operational chart of accounts?

- What is the need of country chart of account or alternate chart of account? How country chart of account helps fulfill a business requirement?

- What is the need for group chart of account? How group chart of account helps in consolidation of financial data?

- What is non leading ledger in sap fico?

- What is company code global settings? What global parameter is assigned to company code?

- What is fiscal year variant? Why fiscal year variant is assigned to company code?

- What is posting period variant? Why posting period variant is assigned to company code?

- What is field status variant? What is field status group?

- What is document type in sap? Explain the purpose of document type?

- Document date vs Posting date vs Entry date vs Translation date. Explain

- What is posting key? what is the use of posting key?

- Document header & line items capture information of business transaction.

- Everything about currency & exchange rate in sap.

- Foreign currency valuation in sap. Explain with example

- Retained earnings account helps in year end balance carry forward. Explain

- What is the significance of tolerance groups in sap?

- What parameters are maintained in GL master and how does it impact in document posting?

ACCOUNTS PAYABLE

- What is meant by accounts payable in sap?

- Understanding procure to pay (PTP) cycle and accounting document at each step.

- Understanding MM FI integration in very simple terms.

- Purchase order price determination in SAP. Explained in very simple words.

- House bank, Bank key, Account ID in SAP

- What configuration (FBZP) needed for executing F110 in sap ?

ACCOUNTS RECEIVABLE

- How sap overcomes challenges in accounts receivable process?

- What is customer reconciliation account?

- Understanding order to cash cycle in sap.

- Understanding SD FI integration in very simple terms.

- What is lock box? How lockbox helps in collection from customers?

TAX ACCOUNTING

- How sap helps in tax accounting?

- Tax configuration in sap: Tax procedure, Tax code & Tax jurisdiction code

- Concept of tax jurisdiction code & tax jurisdiction structure

- Significance of “Tax category & Posting without tax allowed” in GL master.

- Tax base amount and Discount base amount

- Assigning tax code V0 & A0 for non taxable transaction?

- Deductible input tax vs non deductible input tax

WITHHOLDING TAX

- Withholding tax in sap explained with example.

- How sap overcomes challenges in managing withholding tax?

- Withholding at the time of invoice or payment

- Withholding tax configuration in sap

- Business place & Section code in sap

- Withholding tax certificate numbering in sap

- Withholding tax report for filling tax returns

ASSET ACCOUNTING

- How sap helps in asset accounting?

- What is meant by asset accounting?

- What is the use of asset class?

- What is the use of depreciation key in asset accounting?

- Depreciation area and Chart of depreciation in sap.

- Derived depreciation area VS real depreciation area?

- Understanding asset accounting configuration needed in sap

- GL account determination for posting asset transaction

- Asset transaction and corresponding accounting document?

- How depreciation is posted in sap?

SAP CONTROLLING

- Understanding the concept of standard cost and how it’s done in SAP?

- Understanding everything about production order from finance point of view. What documents are posted in SAP at different stages of production process?

- Understanding configuration needed for handling WIP in SAP?

We upskill students and make them job ready. Providing high quality practical training in emerging IT technologies. Committed to help students move ahead in career.

Quick Links

- SAP Course – Your Gateway to IT Success

- Mastering IT Opportunities_ The Power of Online Training

Office 305, 3rd Floor Royal Tranquil, Konkane Chowk Pimple Saudagar, Pune Maharastra - 411027

[email protected], +91 7262000918.

© Copyright 2022 TECH CONCEPT HUB. All rights reserved. Powered By Gatitaa, Pune, MH, India

WhatsApp us

- +91-9556432150

- [email protected]

Business Area in SAP – A Detailed Overview & Set of Questions

Published by pradeep on october 22, 2022 october 22, 2022, business area in sap.

The Business Area in SAP is the highest organizational cost structure unit. You can specify it either as per Functional lines, Product lines or as per responsibilities assigned region-wise.

Below are some quick questions that may help you understand this term better. you can also read them to prepare for your SAP FICO job interviews .

A Business Area in SAP corresponds to specific business segments of a company and may cut across different Company Codes (Product Lines). They can further represent various responsibility areas, such as Branch Units, plant engineering, automotive, etc. Also, its configuration is optional (not mandatory).

‘0001- Plant engineering

‘0002- Automotive

Use of Business Area in SAP

Business areas we primarily use to facilitate external segment reporting across company codes , covering the company’s main areas of operation (product lines, subsidiaries).

Assign Balance Sheet Items

You can assign all balance sheet items, such as fixed assets, receivables , payables, material stock, and the entire P/L statement directly to business areas. You should assign banks’ capital and taxes only manually (indirectly) to business areas, not directly for this reason. Although, it is impossible to create legally-required financial statements, tax, and tax reports at the business areas level. Balance sheets and P/L statements at the business area level only are suitable for use in internal reporting.

Create a Balance sheet and P & L

To be able to create a balance sheet and P/L statement, we need to update the data for each business area in the transaction figures in the general ledger. Therefore, we have two different procedures to do this.

Procedure 1

When posting the original document, the system supplies the business area with the proper information.

You create a customer invoice. The system can allocate the sales revenue to exactly one business area. The receivables inherit this business area.

When we make an adjustment posting in the general ledger in a second step, the system changes the business area used in the original posting to the correct value. Particularly when we didn’t enter the initial value. This may sometimes distribute the posting to several business areas.

Procedure 2

You create a customer invoice. The system must allocate the sales revenue to several business areas. We post the receivables without a business area and make a transfer posting for the receivable in a second step.

After splitting

Business area in sap general ledger accounting, automatic/manual assignment.

You cannot directly assign G/L account master data to a business area. You must enter the business area either manually or derive from that entered in the CO account assignment object.

Though we have certain business transactions for which automatic procedures exist. These analyze documents/ transaction figures in the system and use them to create new documents (Foreign Currency valuation). Subsequently, they assign the line items generated to the business areas entered in the documents/transaction figures that were read.

Business Area in SAP Asset Accounting

This section describes the role played by the “business area” organizational unit within Asset Accounting .

Automatic/Manual Account Assignment

The system allocates Assets to a single business area in its master record. Further, it automatically posts every posting to an asset balances sheet account in that business area. Consequently, the business area for an asset is passed on to all line items connected with the asset. Therefore, you do not need to make a manual assignment to a business area at any point.

Asset Dr -UN1- 5000

Vendor Cr- UN1-5000

Depreciation

The asset balance is reduced by the depreciation amount in the value adjustment (accumulated depreciation) account with the business area of the asset. Also, the expense line items receive the business area of that asset.

Asset Retirement (Scrapping)

Here the system clears the asset amount and any existing depreciation with the business area of the asset. It assigns the asset’s business area to the expenses line item.

Business Area in Accounts Receivable and Accounts Payable

This segment describes the role played by the “Business area “organizational unit within the Accounts Payable and Accounts Receivable systems.

You cannot allocate customer or vendor master records to a business area. Thus, you usually determine the business area from the business area allocated to the related G/L account posting and do not need to enter it manually.

The business area for G/L account items has to be either manually entered or derived from the SAP CO allocation object that you enter.

How Business Area in SAP works for an invoice?

In an invoice, the customer/vendor item takes the business area of the expenses or revenue postings. If the business area has been entered in the document, it is copied into the line item automatically.

However, if there is more than one business area in the document, the customer/vendor items remain unallocated. Also, a transfer posting is made at a later date to the receivables or payable account.

Furthermore, the system checks that any business area entered in the customer/vendor item is the same as that in the offsetting G/L account item and issues an error message if this is not the case.

In customizing, you can set the status of this message or even suppress it from display entirely.

Noteworthy, the taxes are always posted without a business area. Subsequently, at a later date, the system makes a transfer posting from the tax account to the business areas allocated to the revenue or expenses account.

Business Area in SAP for Payment

For customer/vendor items in payment documents, the procedure is the same as it is for the items in the invoice that they clear. Therefore, these items take the business area from the invoice.

Cash discount and exchange rate difference postings take their business area from the customer/vendor item they originated from. If this item was posted without a business area and then later has one specified via a transfer posting in the general ledger. You must make this allocation yourself retroactively for both the cash discount and exchange rate difference posting.

Bank items are currently posted without a business area (unless one is entered manually). There is also no standard function that allocates the bank items to the business area of the cleared customer/vendor items.

Business Area for Down payment

The system cannot automatically derive the business area of the underlying item with down payments since the invoice that belongs to the down payment is not entered until later.

The business area in the customer/vendor item from the invoice is therefore not entered automatically and has to be entered manually.

The bank item is currently posted without a business area. There is no standard function that allocates the bank item to the business areas of the customer/vendor items.

Business Area in SAP Cost Accounting

Automatic/ manual account assignment.

Account assignment objects in Cost Accounting are allocated to a single business area in the master record. When you post to an account assignment object in Cost Accounting, the system automatically determines the business area. You do not have to assign the posting to the business area manually.

Assessment, Distribution, Activity Allocation

Costs that have initially been allocated to an allocation object in Cost Accounting (default cost center) and therefore also to a default business area are later broken down by certain distribution keys to final recipients (such as cost centers). The allocation object is then relieved of the costs.

Business Area in SAP Material Management

Materials are assigned to a business area based on the combination of division and plant. Every time a material is posted, the relevant material stock account is automatically assigned to the business area belonging to that account.

The business area from the other line items is either (depending on the business transaction in question) derived from the account assignment object posted in Cost Accounting or from the material involved. You do not need to manually assign a business area.

Initial Entry of Stock Balances Goods/Invoices Received

The notable thing about the business transactions being examined here is that they generate a posting record that makes a posting to the material stock account (or the account representing this account) and whose offsetting posting has no business area in it. In this case, the offsetting item takes the business area from the material.

Additional, automatically-generated items that are directly linked to a certain material (price differences, exchange rate differences, freight charges) are also assigned to the same business area as the material.

The payable (vendor) is only allocated to a business area if there is one specified for the material. If more than one is specified in the invoice, the payable is posted without a business area.

Goods Receipt

Invoice receipt

Some Important Questions related to Business Area in SAP

How to draw financial statements in a business area in sap.

We draw Financial statements per business area for internal reporting purposes. It will help if you put a “tick mark in the check box in the configuration against the company for which you want to enable business area financial statements.

When we post transactions in SAP FI we can assign the same to a Business Area so that the system captures the values per business area for internal financial statements.

Can we attach “Business Area” to a Transaction by not assigning the same in a posting?

Yes, you can derive the business area from other account assignments, for example, cost center and Asset Master. We need to define the business area in the master record of Cost Center & Asset Master.

How to post Cross-Company Code Business Area posting?

Using a Cross Company code transaction, one should be able to post to different Business Areas cutting across various Company Codes. Also, any number of Business Area-Company code combinations are possible.

Why do you need to know this?

Though the Business Area in SAP is an optional setting in FICO or S/4HANA Finance , it is essential for a consultant to have good knowledge. This is because a company may demand it in their plant or business to configure. Secondly, it is part of the Cost Structure which is a must-have skill for SAP Functional-consultants. Hence, this is when you must possess relevant skills to work on it.

Additionally, you may have questions on business areas in SAP Finance Interviews . You should have a good configuration knowledge of the business area in SAP in order to perform the task that your client delegated.

Visit Course Page: SAP S4 HANA FICO Training

Related Posts

Tax on Sale Purchase in SAP S/4HANA

SAP S/4 HANA covers the business processes like Procure-to-Pay, Order-to-Cash and record-to-report. To understand the functioning of tax on sale purchase in SAP we need to know all tax-relevant steps within the end-to-end scenarios. Additionally, Read more…

SAP New GL Activation & Migration Process

SAP New GL Activation and Migration From Classic GL During a new installation, the New G/L accounting in the standard system is set to active. While the use of classic General Ledger is theoretically also Read more…

SAP Order to Cash & its Process Flow

SAP Order-To-Cash The SAP order to cash process is used for processing the business’s sales orders for goods and services. It manages the company’s receivables and accumulates the relevant payments from its customers. This is Read more…

/support/notes/service/sap_logo.png)

3304445 - Message F5A190 - "Enter a business place under "Basic data"" is raised in VF02/01

When creating or transferring a billing document to FI side, message F5A190 - "Enter a business place under "Basic data"" is raised.

Environment

- Sales And Distribution (SD)

- Logistics Execution (LE)

- SAP R/3 Enterprise 4.7

- SAP ERP Central Component

- SAP Enhancement package for SAP ERP

- SAP Enhancement package for SAP ERP, version for SAP HANA

VBRK-BUPLA, BUPLA, XACCIT-BUPLA, business place, F5A190, "Enter a business place under "Basic data"", "Enter a business place", VF01, VF02, billing document, accounting document, accounting, FI, VBRK, IDBUPLA_ACTIVE. , KBA , SD-BIL-IV , Processing Billing Documents , SD-BIL-CA , Account Assignment , Problem

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

- TutorialKart

- SAP Tutorials

- Salesforce Admin

- Salesforce Developer

- Visualforce

- Informatica

- Kafka Tutorial

- Spark Tutorial

- Tomcat Tutorial

- Python Tkinter

Programming

- Bash Script

- Julia Tutorial

- CouchDB Tutorial

- MongoDB Tutorial

- PostgreSQL Tutorial

- Android Compose

- Flutter Tutorial

- Kotlin Android

Web & Server

- Selenium Java

- SAP MM - Home

- SAP MM Tutorial

- SAP MM Enterprise Structure

- Define Plant in SAP

- Define Company Code

- Assign Plant to Company Code

- Define Purchasing Organization in SAP

- Maintain Storage Location in SAP

- Define Purchasing Group in SAP

- ADVERTISEMENT

- Assign Company code to Company

- Assign Purchasing Organization to Company code

- Assing Purchasing Organization to Plant

- Assing Standard Purchasing Organization to Plant

- SAP MM - Material Master Data

- What is material master

- Attributes for material type

- Create material types

- Number range interval for material type

- Define material groups

- Company code for material management

- Create material master record

- Purchase Info record

- Maintain Plant parameters

- SAP MM - Vendor Material Master Data

- SAP MM - Vendor account groups

- SAP MM - Number ranges for Vendor accounts

- SAP MM - Assign number ranges to vendor accounts

- SAP MM - Sundry Creditors Account

- SAP MM - Vendor master record

- SAP MM - Quotation

- SAP MM - Number ranges for RFQ

- SAP MM - Document types for RFQ

- SAP MM - Screen Layout at Document Level

- SAP MM - Maintain Quotation Components

- SAP MM - Text types for RFQ/ Quotations

- SAP MM - Purchase Requistion (PR)

- SAP MM - Number ranges for PR

- SAP MM - Document types for PR

- SAP MM - Define Processing time for PR

- SAP MM - Setup authorization check for G/L account

- SAP MM TCodes

- ❯ SAP MM Tutorial

- ❯ Assign Plant to Company Code

SAP MM How to Assign Plant to Company Code

In this SAP MM tutorial , you will learn how to assign plant to company code in SAP step by step using transaction code “OX18”.

How to assign plant to company code in SAP

The link between plant and company code in SAP is established through the assignment of plant to company code. A plant can only belong to one company code.

Configuration

Step 1 : – Execute t-code “OX18” in command field from SAP easy access screen.

Step 2 : – On change view “Assignment plant – company code” overview screen, choose new entries button for assignment of company code to plant in SAP.

Step 3 : – On new entries overview added entries screen, update the following details.

- CoCd : – Update the company code “TK01”.

- Plnt : – Update the plant key “TKBL” for assigning to company code.

After maintaining all the required details, choose save icon and save the configured assignment details in SAP. Now you are prompted for customizing request number, choose request and save the configured data.

Successfully we have assigned plant to company code in SAP MM.

Popular Courses by TutorialKart

App developement, web development, online tools.

Business place Table in SAP

- IDBUPLA_ACTIVE Table for Activate Business Place per country Table Type : TRANSP Package : ID-FI Module : CA-GTF-CSC

- IDVKBUR_BUPLA Table for Assignment of Business Place to Sales Office Table Type : TRANSP Package : ID-SD-CN Module : SD

- J_1BBRANCH Table for Business Place Table Type : TRANSP Package : ID-FI Module : CA-GTF-CSC

- J_1BNFE_CUST2 Table for NF-e: System Configuration per Business Place Table Type : TRANSP Package : J1BA Module : CRM-LOC-BR

- J_1BNFE_CUST3 Table for NF-e: System Configuration per Business Place Table Type : TRANSP Package : J1BA Module : CRM-LOC-BR

- J_1I_BUPLA_SECCO Table for Maps Business Place to Section code for TCS Table Type : TRANSP Package : J1IN Module : FI-LOC

- OFIC_CMPCD_BUSPL Table for Customizing Orgfinder: Company Code and Business Place Table Type : TRANSP Package : CRM_OFI_APPLICATION Module : CRM-BF-OFI

- T7FI11 Table for Place of business related info (Finland) Table Type : TRANSP Package : PB44 Module : PA-PA-FI

- T7KRBP Table for Business Place KR Table Type : TRANSP Package : PB41 Module : PA-PA-KR

- AXT_PLACE_LOCK_D Table for Dummy table for AXT place lock Table Type : TRANSP Package : AXT_MODEL Module : CA-GTF-EEW

- AXT_REG_TPLACE Table for Technical place for table extensibility Table Type : TRANSP Package : AXT_MODEL_REGISTRY Module : CA-GTF-EEW

- CIAP_C_NO_QUO_BP Table for Table for customizing of quotas quantity by CCode / B Place Table Type : TRANSP Package : INT_TMF_CIAP Module : FI-LOC

- CNV_20551_OBJCVT Table for Objecttypes for which a re-conversion shall take place Table Type : TRANSP Package : CNV_20551 Module : CA-GTF-BS

- CPEC_CONVPLACE Table for CPE Conversion Place Table Type : TRANSP Package : CPE_BASIS Module : CA-GTF-CPE

- CPEC_CONVPLACE_T Table for CPE Conversion Place: Description Table Type : TRANSP Package : CPE_BASIS Module : CA-GTF-CPE

- CRMC_ACT_MSA Table for Activity Journals: Table for place holder fields for MSA Table Type : TRANSP Package : CRM_ACTIVITY_H Module : CRM-BTX-ACT

- CRMC_ACT_MSA_T Table for Activity: Text table for MSA place holders Table Type : TRANSP Package : CRM_ACTIVITY_H Module : CRM-BTX-ACT

- EEW_WZCF_PLACE Table for Extension Place Table Type : TRANSP Package : EEW_WIZARD Module : CA-GTF-EEW

- EEW_WZCF_PLACELN Table for Link Subobjects to Extension Place Table Type : TRANSP Package : EEW_WIZARD Module : CA-GTF-EEW

- GRPCRTAPAHI Table for GRPCRTA Parameter History place holder Table Type : TRANSP Package : GRPCRTA_MAIN Module : GRC-PCE

- J_1BNF_PLANTS Table for Plants of same Bus. Place for which Nota Fiscal is created Table Type : TRANSP Package : J1BA Module : CRM-LOC-BR

- OIREBLSTPL Table for SSR PC: Black List Storage Place Table Type : TRANSP Package : OIR_E Module : IS-OIL-DS-SSR

- OIREBLSTPLT Table for SSR PC: Black List Storage Place Texts (IS-Oil SSR) Table Type : TRANSP Package : OIR_E Module : IS-OIL-DS-SSR

- P01EL_DBAB Table for Data Module Alternative Place of Employment of ELENA Notif. Table Type : TRANSP Package : P01S Module : PY-DE-NT-NI

- SMOFINICUS Table for Decision if data distribution from CRM shall take place Table Type : TRANSP Package : SMOF Module : CRM-MW-ADP

- T5C2P_LOCCD Table for Withholding Tax Geneva: Place of Residence Municipality Table Type : TRANSP Package : PC02 Module : PY-CH

- T5ED1 Table for Place type Table Type : TRANSP Package : PB04 Module : PA-PA-ES

- T5ED1T Table for Place type Table Type : TRANSP Package : PB04 Module : PA-PA-ES

- T5F4UM Table for "Declared unit" modifier by Soc.Prot.Agy(OPS)/Place of Work Table Type : TRANSP Package : PB06 Module : PA-PA-FR

- T5ITND Table for Place of work table Table Type : TRANSP Package : PB15 Module : PA-PA-IT

- T5M1A Table for Place of Employment Keys for Tax Information S74 DK Table Type : TRANSP Package : PB09 Module : PA-PA-DK

- T5M1B Table for Place of Employment Keys for DA Statistics DK Table Type : TRANSP Package : PB09 Module : PA-PA-DK

- T5M1C Table for Place of Employment Keys for DS Statistics DK Table Type : TRANSP Package : PB09 Module : PA-PA-DK

- T5MF0 Table for FA Place of Employment (Employer Association Financ.Sector) Table Type : TRANSP Package : PB09 Module : PA-PA-DK

- T706_ABWH Table for Absence Types from Place of Work (PS; Separation Allowance) Table Type : TRANSP Package : PTRAPS Module : FI-TV-COS

- TFK056C Table for Clearing reasons for which no interest calc. takes place Table Type : TRANSP Package : FKKB Module : FI-CA

- /BEV3/CHCLTLOABR Table for Link type/place for data transfer in settlement record Table Type : TRANSP Package : /BEV3/CH Module : SD-SLS-PLL-OBS

- /SAPSLL/CUCPRO Table for GTS: Place into a Customs Status Table Type : TRANSP Package : /SAPSLL/CORE_LEGAL Module : SLL-LEG

- /SAPSLL/CUCPROT Table for GTS: Place into a Customs Status - Description Table Type : TRANSP Package : /SAPSLL/LEGAL_CUS_LOCALIZATION Module : SLL-LEG

- BP2000 Table for BP: Business Partner - Business Partner - Relationship Table Type : TRANSP Package : FBPAR Module : CA-FS-BP

- CDBC_BUPA_BUSTYP Table for Business Partner: Business Type (Korea) Table Type : TRANSP Package : CDB Module : CRM-MSA

- CRMC_BUPA_BUSTYP Table for Business Partner: Business Type (Korea) Table Type : TRANSP Package : CRM_LOC_KOREA Module : CRM-LOC

- CRMC_FS_PROC_OBJ Table for Assign Business Object Types to Business Processes Table Type : TRANSP Package : CRM_FS_DCL_CUSTOMIZING Module : CRM-IFS-BF

- CRMD_TM_IACT_BP Table for Business context information: one order and business partner Table Type : TRANSP Package : CRM_CIC_CLM_BO Module : CRM-CIC-CAM

- CRMM_BABR Table for Business Partner - Business Agreement Rule (Header) Table Type : TRANSP Package : CRM_BUPA_FRG0130 Module : CRM-MD-BP-BAG

- CRMM_BABR_H Table for Business Partner - Business Agreement Rule Table Type : TRANSP Package : CRM_BUPA_FRG0130 Module : CRM-MD-BP-BAG

- CRMM_BUAG Table for Business Partner: Business Agreement Set (Header) Table Type : TRANSP Package : CRM_BUPA_FRG0130 Module : CRM-MD-BP-BAG

- CRMM_BUAG_H Table for Business Partner: Business Agreement Set Table Type : TRANSP Package : CRM_BUPA_FRG0130 Module : CRM-MD-BP-BAG

- CRMM_BUAG_L_FICA Table for Business Agreement Set - Business Partner - Allocation Table Type : TRANSP Package : CRM_BUPA_FRG0130 Module : CRM-MD-BP-BAG

- CRMM_BUT_FRG0060 Table for Business Partner Business Hours Table Type : TRANSP Package : BUPA_HOURS Module : AP-MD-BP

- CRMM_BUT_FRG0061 Table for Business Partner Business Hours Interval Table Type : TRANSP Package : BUPA_HOURS Module : AP-MD-BP

- BUPLA Table Data element for Business Place

- J_1BBRANC_ Table Data element for Business Place

- TTET_BUSINESS_PLACE Table Data element for Business Place

- IDACTIVE Table Data element for Business Place Active for Country

- J_1BINDUS2 Table Data element for Business Place CFOP Category

- J_1BCGCBRA Table Data element for CNPJ Business Place

- J_1BPARID Table Data element for Partner ID (Customer, Vendor, Business Place)

- J_1B_CNPJ_BUPLA Table Data element for CNPJ Number of Business Place

- J_1B_STAINS_BUPLA Table Data element for State Tax Number (IE) of Business Place

- J_1B_STAIST_BUPLA Table Data element for State Tax Number (IE) of Business Place (SubTrib)

- J_1B_CNAE_BUPLA Table Data element for CNAE Code of Business Place

- J_1B_CRT_BUPLA Table Data element for Tax Regimen Code (CRT) of Business Place

Business place related terms

Definitions.

SAP is the short form of Systems, Applications & Products in Data Processing. It is one of the largest business process related software. This software focused on business processes on ERP & CRM.

Like most other software, SAP also using database tables to store the data. In SAP thousands of tables are there to store different data. A table contains several fields and some of the fields will be key fields.

Popular Table Searches

Latest table searches.

SAP SuccessFactors First Half 2024 Release: Make Every Employee a Success Story

Success can take many forms. It’s achieving AI-driven results faster and smarter. It’s unlocking more meaningful and aspirational career development experiences. It’s empowering employees and managers through simple HR-related tasks in the flow of work, freeing up more productive time across the organization.

And for you and your business, you can tell all those success stories – and more – with the SAP SuccessFactors HCM suite and our first half 2024 release.

As your organization and employees begin to embrace AI, HR has the opportunity to drive new levels of employee productivity, engagement, and growth. SAP SuccessFactors HCM can give you everything you need – the global foundation, skills framework, people-first experiences, and purpose-built AI capabilities – to help take HR to the next level. With the SAP SuccessFactors first half 2024 release, we are delivering more than 250 innovative features and enhancements.

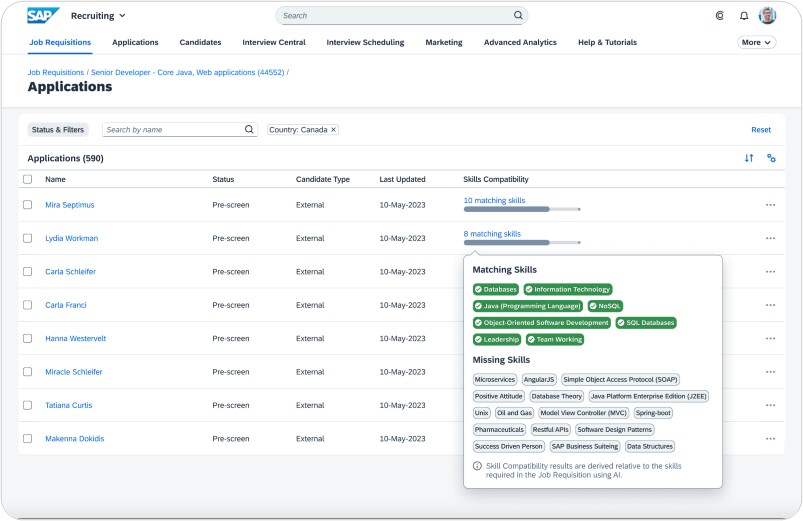

SAP Business AI

In 1H 2024, we are thrilled to introduce more than 25 new AI capabilities to enable better employee experiences and new levels of productivity.

Among these capabilities include the ability for applicants to provide skills during the application process. This can enable recruiters to see a skills compatibility for each applicant based on matching the applicant’s skills and the job requisition, helping improve applicant screening and time to hire. Furthermore, personalization in SAP SuccessFactors Opportunity Marketplace is enhanced with new AI-driven recommendation categories, “Ignite Your Role” and “Reach Your Aspirations.” These guided experiences can enable employees to proactively take steps to reach their development goals.

Generative AI continues to be embedded across the SAP SuccessFactors HCM suite, including new capabilities to help employees create ready-made performance and development goals and AI-assisted writing to help improve the quality, clarity, and conciseness of writing across a variety of areas within SAP SuccessFactors solutions.

Further, with this release, insights based on an employee’s compensation and job history are available to help support managers in having effective and well-informed compensation discussions.

We have also added more than 15 new Joule capabilities in this release to help both managers and employees get work done in a conversational way, such as creating or changing a position, creating spot awards, clocking in and out, and viewing pay statements as well as time capabilities like requesting time off, checking leave balances, and syncing holidays to Outlook calendars while managers can review and approve time off. Further, employees can now clock in and out using Joule, Microsoft Teams, or the SAP SuccessFactors Mobile app.

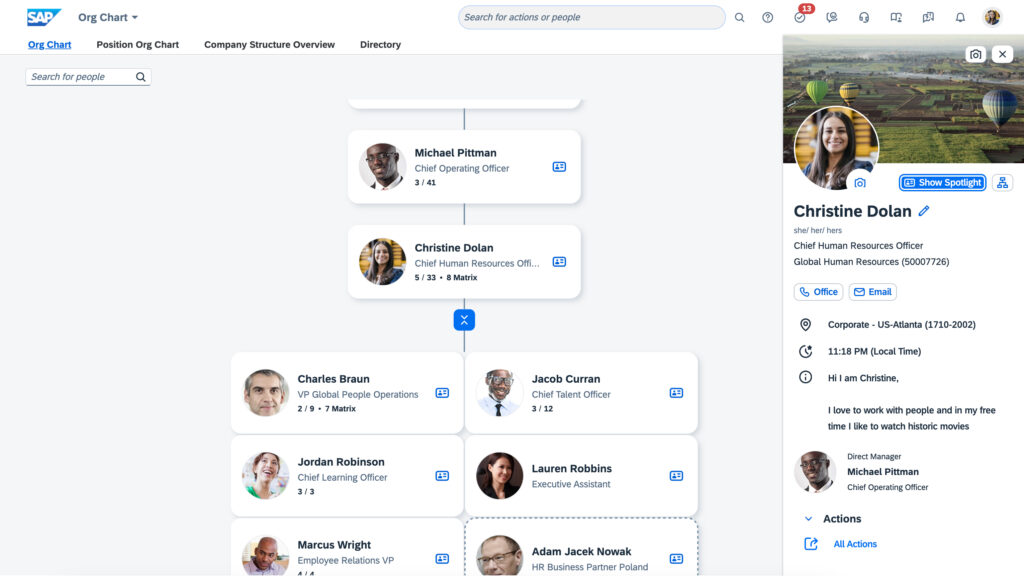

SAP SuccessFactors Employee Central

We are excited to unveil two new people profile experiences – the profile preview and the spotlight view. The profile preview can provide a snapshot of key areas of the employee profile, including job, manager, location, and contact details, to quickly view and connect with others. Additionally, the spotlight view can showcase employee skills and competencies, mentoring and target roles, and other relevant personal and organizational information.

We are also introducing a new org chart experience with a refreshed look and feel. Available on desktop and mobile, users can explore their organizational structure with improved expand and collapse capabilities, which helps provide full accessibility to an employee’s profile preview, with an option to open the new spotlight view.

Customers can now automatically process new hires from SAP SuccessFactors Recruiting and SAP SuccessFactors Onboarding into SAP SuccessFactors Employee Central. This capability helps further reduce the time to hire, which is especially important with mass, seasonal, and high-volume hiring.

SAP SuccessFactors Employee Central Global Benefits

With this release, we are pleased to introduce a new benefits enrollment experience for insurance, savings, and pension benefit types. Available on both desktop and mobile, the guided experience for benefits elections can give employees increased convenience with improved navigation and increased confidence with side-by-side plan comparisons and embedded instructional text. Additionally, employees can update dependent information and manage beneficiaries directly from the benefits enrollment process, which helps further streamline the enrollment experience.

SAP SuccessFactors Time Tracking

We are thrilled to share the launch of a new time sheet experience that integrates the latest version of My Timesheet in SAP S/4HANA with SAP SuccessFactors. Employees can now record time for payroll, as well as against activities and cost objects, from a single time sheet across applications. This helps organizations leverage real-time connectivity between HR and finance operations to keep track of employee activity and labor costs and to pay employees accurately and on time.

Additionally, a new monthly calendar view for time sheets can give employees and managers a complete picture of recorded time over a month. Users can drill down into specific days and submit or approve time for pay periods beyond a week, such as biweekly or monthly.

For managers, a new time approval center helps simplify approvals with a centralized dashboard highlighting anomalies for swift resolution. Managers can monitor team working hours effectively, helping to ensure accurate and timely payroll processing.

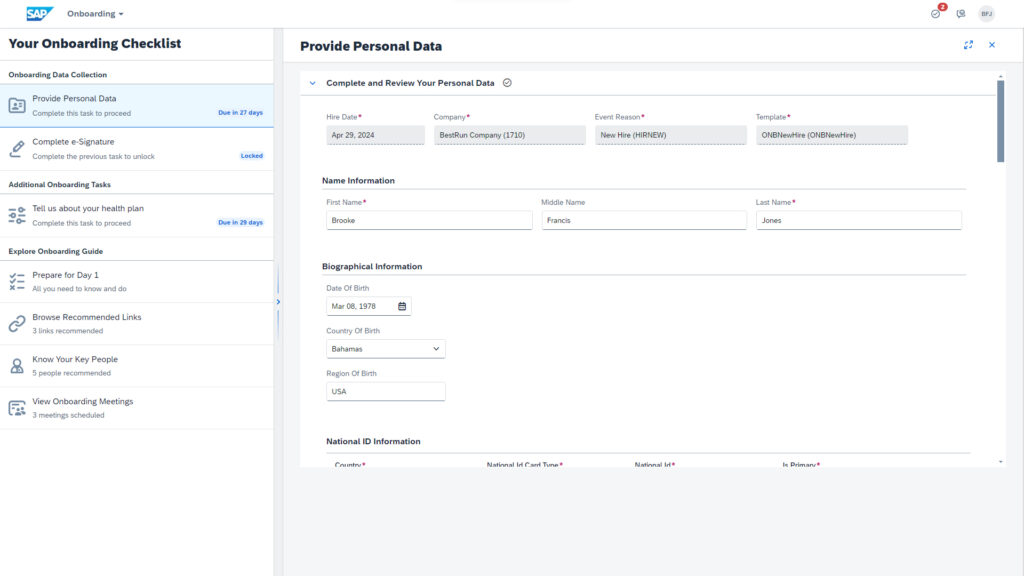

SAP SuccessFactors Onboarding

With enhancements to the onboarding journey experience, new hires can now use the new Your Onboarding Checklist page to reference and complete all tasks – onboarding data collection, compliance tasks, additional onboarding tasks, and exploring the onboarding guide – from one place with a single view. Available for new hires, rehires, internal hires, and employees with global assignments, this improved experience can save time for onboarding participants while helping to ensure productivity from the start.

And that’s only a fraction of all the innovations we’re bringing to customers in 1H 2024. There’s much more in the release, including new and exciting updates in:

- Generative AI and Joule capabilities

- SAP SuccessFactors Opportunity Marketplace

- SAP SuccessFactors Compensation

- SAP SuccessFactors Succession & Development

- SAP SuccessFactors Incentive Management

- SAP SuccessFactors Work Zone

Read the SAP SuccessFactors first half 2024 release highlights brochure and watch the 1H 2024 release highlights video to find out more.

Bianka Woelke is group vice president of Application Product Management at SAP.

SAP SuccessFactors Strategy for Building Future-Ready Workforces

SAP SuccessFactors Employee Central Grows to 6,000 Customers

SAP SuccessFactors Employee Central Payroll Natively Supports 50 Locales

Asking the better questions that unlock new answers to the working world's most complex issues.

Trending topics

AI insights

EY Center for Board Matters

EY podcasts

EY webcasts

Operations leaders

Technology leaders

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

EY.ai - A unifying platform

Strategy, transaction and transformation consulting

Technology transformation

Tax function operations

Climate change and sustainability services

EY Ecosystems

EY Nexus: business transformation platform

Discover how EY insights and services are helping to reframe the future of your industry.

Case studies

How Mojo Fertility is helping more men conceive

26-Sep-2023 Lisa Lindström

Strategy and Transactions

How a cosmetics giant’s transformation strategy is unlocking value

13-Sep-2023 Nobuko Kobayashi

How a global biopharma became a leader in ethical AI

15-Aug-2023 Catriona Campbell

We bring together extraordinary people, like you, to build a better working world.

Experienced professionals

EY-Parthenon careers

Student and entry level programs

Talent community

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

Press release

EY announces launch of artificial intelligence platform EY.ai following US$1.4b investment

13-Sep-2023 Rachel Lloyd

EY reports record global revenue results of just under US$50b

Doris Hsu from Taiwan named EY World Entrepreneur Of The Year™ 2023

09-Jun-2023 Lauren Mosery

No results have been found

Recent Searches

How do you steady the course of your IPO journey in a changing landscape?

EY Global IPO Trends Q1 2024 provides insights, facts and figures on the IPO market and implications for companies planning to go public. Learn more.

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

Artificial Intelligence

EY.ai - a unifying platform

Select your location

close expand_more

Three in four businesses failing to manage talent mobility effectively, as demand for international work experience soars

Press contact

EY Global Media Relations and Social Media Associate Director – Tax and Assurance

- Send e-mail to Emile Abu-Shakra

- Open LinkedIn profile of Emile Abu-Shakra

Related topics

- EY survey shows 75% of employers do not have fully developed mobility functions vital for meeting modern business and talent demands.

- Companies could be neglecting a crucial opportunity to retain key talent – 64% say international assignments would encourage them to consider staying in current job.

- 71% of firms say mobility risks and scope have increased over past two years, but many don’t have policies in place to manage them.

Companies around the world could be at risk of losing out in the race for talent and driving business resilience because they are failing to mobilize their workforce effectively and create opportunities for flexible work experiences, according to the EY 2024 Mobility Reimagined Survey .

The survey canvassed the views of 1,059 mobility professionals across 21 countries on the benefits and challenges organizations can face when developing and building mobility strategies and functions.

It found that only one in four employers surveyed (25%) have a fully developed mobility function, with three-quarters (75%) failing to take advantage of a truly mobile and agile workforce.

Mobility strategy now central to talent attraction and retention

This is despite the fact that almost two-thirds (64%) of employee respondents around the world say they’re more likely to stay with their current employer after a long-term cross-border assignment, while (92%) believe such experiences can be “life-changing” and 89% say international mobility is essential for business continuity and resilience, edging up from 74% last year.

Gerard Osei-Bonsu , EY Global People Advisory Services Tax Leader, says:

“From economic volatility and geopolitical crises to talent shortages and rapidly changing employee demands, companies are having to navigate an unprecedented number of complex challenges.

“If organizations want to survive and thrive in this new working environment, they need to attract and retain top talent. Having an effective international mobility function and program in place is critical to creating a dynamic and empowered workforce.”

Organizations ill-prepared to deal with cross-border risks

Despite the significant benefits that mobility programs bring to companies, many are facing a growing number of risks and challenges when establishing international mobility functions. Seven in ten respondents (71%) say cross-border mobility risks – including tax/regulatory and data privacy risks – have increased over the last two years, mostly due to the pandemic and ongoing geopolitical and economic challenges, which saw employees move around the world and work in separate jurisdictions, heightening corporate exposure to tax, regulatory issues and diverse employment laws.

Worryingly, many organizations are not fully prepared to manage all the risks they face. For example, while 84% of employer respondents recognize data privacy risks from hybrid mobility arrangements, just 55% have policies in place to mitigate them — a moderate improvement from last year’s 47%. Similarly, although 87% of employer respondents are aware of cybersecurity risks, just 46% have policies to address them – down from 51% last year.

In addition, 46% of companies responding use a centralized mobility operating model, which is often siloed from the rest of the business, creating a raft of communication, collaboration, and technology-related challenges.

Successful organizations accelerate mobility with five key drivers

Nevertheless, many companies are taking action where it is needed. More than eight in 10 employer respondents (82%) have developed a policy or approach for hybrid mobility, up from 76% in 2023.

There is also clear recognition that mobility is growing in importance. Eight in 10 employer respondents (80%) say they plan to increase investment in mobility technology over the next five years, up from 67% in 2023. Two-thirds (66%) of respondents believe the scope of the mobility function will grow over the next three years.

The survey identifies five key drivers that are crucial to the development of a successful mobility function:

- Strategic alignment: Organizations should align their mobility strategy to broader organizational strategy.

- Talent linkage: An organization’s mobility strategy should be used for talent acquisition and development.

- Digital focus: Organizations should have investment and maturity in the automation and digitization of mobility processes.

- Flexibility: Organizations should be embedding flexibility in the selection of program benefits.

- External expertise: Organizations should be co-sourcing or outsourcing selected mobility processes for greater efficiency.

Maureen Flood , EY Global Mobility Reimagined Leader, says:

“It’s clear that businesses do understand the value of international mobility, not least for the impact it can have on the workforce and wider business resilience. With robust polices in place to address risks, the right level of investment, and by ensuring that the function isn’t siloed, mobility can propel businesses forward and help them face the many challenges that the future surely holds. When organizations adopt an evolved mobility approach, they reap much greater rewards.”

EY exists to build a better working world, helping create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws. For more information about our organization, please visit ey.com.

This news release has been issued by EYGM Limited, a member of the global EY organization that also does not provide any services to clients.

About the survey

The EY 2024 Mobility Reimagined Survey was conducted in January 2024 and received responses from 1,059 employees and employers from 21 countries.

To take a, CPE accredited, deeper dive into the survey results, please visit and register here: Welcome - EY 2024 Mobility Reimagined Conference (cvent.com)

Related news

EY launches OpsChain Contract Manager solution to support secure private business agreements on public Ethereum

LONDON, April 17, 2024 – The EY organization today announces the launch of EY OpsChain Contract Manager (OCM), a transformative blockchain-enabled solution for contract management. EY OCM helps enterprises to execute complex business agreements, supporting confidentiality, helping improve time efficiency, and achieving cost reduction, with automatic adherence to the agreed terms.

EY and Saïd Business School study reveals that leaders prioritizing a human-centered approach to transformation turning points are up to 12x more successful

LONDON,16 April 2024. The EY organization’s latest research with Saïd Business School, at the University of Oxford, reveals new insights into what happens when a transformation program’s leadership believes a transformation has or will go off-course and intervenes with the intent of improving its performance (turning points).

Extreme E and EY publish Season 3 report, recording 8.2% carbon footprint reduction as female-male performance gap continues to narrow

LONDON, 9 APRIL 2024. Extreme E has published its third Sustainability Report, compiled, and produced in collaboration with EY. Continuing to race the series’ ODYSSEY 21 off-road electric vehicles and leveraging solar and green hydrogen energy, the report reveals that the racing series maintained its carbon-neutral status and reduced its overall carbon footprint by 8.2%.

Major shift in global IPO market share from the past five years

London, 28 March 2024. The year kicked off on a cautiously optimistic note, marked by a selective thaw following a quieter period. The Americas and EMEIA IPO markets had a bright start in 2024, increasing global proceeds. However, the Asia-Pacific region started on a weak note, weighing down the overall global volume.

EY announces 18 women entrepreneurs selected for the EY Entrepreneurial Winning Women™ Asia-Pacific class of 2024

HONG KONG, 27 MARCH 2024 — The EY organization today announces the details of 18 female entrepreneurs selected for the EY Entrepreneurial Winning Women™ Asia-Pacific class of 2024 — a bespoke executive program that identifies and champions a select group of high-potential entrepreneurs who have built profitable companies and provides them with connections and resources needed to unlock their potential and sustainably scale their companies.

EY announces acceleration of client AI Business Model adoption with NVIDIA AI

LONDON, 20 March 2024. The EY organization today announces Ernst & Young LLP (EY US) will help clients implement and accelerate their artificial intelligence (AI) journeys using NVIDIA’s industry-leading technology and solutions.

- Connect with us

- Our locations

- Legal and privacy

- Open Facebook profile

- Open X profile

- Open LinkedIn profile

- Open Youtube profile

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

IMAGES

VIDEO

COMMENTS

The following steps would take you through the configuration steps for the business place for a particular scenario. This document is written mainly to explain the purpose of business place concept towards having different number ranges for the outgoing documents. · Defining (Assigning to Company Code) the Business Place.

SAP Help Portal

Step 1: Follow the IMG Menu Path and execute the IMG activity "Define Business Places". Step 2: On the "Determine Work Area: Entry" screen, enter your company code and press enter to continue. Step 3: On the change view "Business Places" overview screen, click on "New Entries" for the creation of a new business place in SAP Hana.

The business place is used in countries that by law require returns for taxes on sales/purchases to be submitted at a level below the company code. For this reason, companies have to register each business place with the tax authorities as the unit responsible for tax reporting. In some countries, the business place is also used to assign ...

A company subsidiary. Each business place registers separately with its district tax office and is assigned a separate VAT registration number. Business Place in SAP - Everything you need to know about Business Place; definition, explanation, tcodes, tables, wiki, relevant SAP documents, PDFs, and useful links.

Dear All, where we can assing the Business Place witht the Plant. I have gone through the SDN also there was a path Cross Application Components à General Application Functions à Business Place--> Assign plant to business place.. Is there any FI or MM path to assign the Business Place to Plant.

In sap, place of business is represented as business place. Business place captures TIN number. Plant is assigned to a business place, whenever transaction is posted software picks the business place from plant involved in the transaction and hence fetches the TIN number as well. For transactions where software is not able to determine business ...

SPRO, Assign Business Places to Sites, T001W, T001K, T005, plant , KBA , XX-CSC-XX , Please use FI-LOC-I18 for I18N and cross-country issues , Problem About this page This is a preview of a SAP Knowledge Base Article.

SAP Community is moving in January 2024! Hereâ s what you need to know to prepare. Home; Community; Ask a Question; ... Search Questions and Answers . 0. Former Member . Mar 02, 2011 at 04:58 AM Assignment of Business place to Plant. 4080 Views. Follow RSS Feed Hi, Can you please tell me where is option for assignment of Business place to ...

A Business Area in SAP corresponds to specific business segments of a company and may cut across different Company Codes (Product Lines). They can further represent various responsibility areas, such as Branch Units, plant engineering, automotive, etc. Also, its configuration is optional (not mandatory). Example,

When creating or transferring a billing document to FI side, message F5A190 - "Enter a business place under "Basic data"" is raised. SAP Knowledge Base Article - Preview 3304445 - Message F5A190 - "Enter a business place under "Basic data"" is raised in VF02/01

IDVKBUR_BUPLA Fields, Structure, and DDIC. IDVKBUR_BUPLA is a standard Sales and Distribution Transparent Table in SAP SD application, which stores Assignment of Business Place to Sales Office data. You can use the transaction code SE16 to view the data in this table, and SE11 TCode for the table structure and definition.

Step 1 : - Execute t-code "OX18" in command field from SAP easy access screen. ADVERTISEMENT. Step 2 : - On change view "Assignment plant - company code" overview screen, choose new entries button for assignment of company code to plant in SAP. Step 3 : - On new entries overview added entries screen, update the following details.

Business Place Tables in SAP. Search. SAP Database Tables; business place; Tables Related Searches # TABLE Description Application Table Type; 1 : BKPF: Accounting Document Header ... Assignment of business place to Sales Office SD - Sales and Distribution: Transparent Table 50 : OFIC_CMPCD_BUSPL:

A table contains several fields and some of the fields will be key fields. List of Business place tables in SAP. IDBUPLA_ACTIVE for Activate Business Place per country. IDVKBUR_BUPLA for Assignment of Business Place to Sales Office. J_1BBRANCH for Business Place. J_1BNFE_CUST2 for NF-e: System Configuration per Business Place.

Hi everyone, My client currently uses business entities as the account assignment object in SAP ECC and intends to continue using them in S/4HANA. However, the universal allocation feature does not support this object ("business entity"). As a result, they will need to resort to classic transactions...

Hello, We have such issue that when we record the class this action moves the item with another active class from the users learning assignments. Description: 1) We created an item: English course and added classes for multiply sessions (one session is in spring and second is in autumn each year, on...

I've created some course assignments on specific objects to specific groups of users, but I only want the Demo, Practice and Test modes visible. But even after deactivating those modes in the Course Assignment, they still show up.

SAP Business AI. In 1H 2024, we are thrilled to introduce more than 25 new AI capabilities to enable better employee experiences and new levels of productivity. ... and exploring the onboarding guide - from one place with a single view. Available for new hires, rehires, internal hires, and employees with global assignments, this improved ...

Companies could be neglecting a crucial opportunity to retain key talent - 64% say international assignments would encourage them to consider staying in current job. 71% of firms say mobility risks and scope have increased over past two years, but many don't have policies in place to manage them.