Search Product category Any value Sample Label 1 Sample Label 2 Sample Label 3

Business Plan vs. Financial Plan: What’s The Difference?

- December 16, 2022

- Fundraising

When preparing their business plan, entrepreneurs sometimes get confused between different terms, especially the difference between a business plan and a financial plan.

Whilst a business plan must include a financial plan, these 2 documents are very different and have separate objectives.

In this article we explain you what are a business plan and a financial plan, their objectives and what are the key differences between them.

What is a Business plan?

A business plan is a long document that contains a detailed description of your business and your strategy. Unlike a pitch deck, a business plan is a Word document and often includes 30 up to 100 pages.

We use business plans to communicate information about a business to third-parties. We often use it when a business needs funding. Debt investors (e.g. banks or venture debt investors ) almost always require a business plan as part of a loan application. Instead, equity investors usually ask for a pitch deck .

What should you include in a business plan?

Chances are you will find different definitions online for what you need to include in your business plan. Yet, most interested parties (investors or banks) agree on the different elements that a business plan must include, they are:

- Executive summary : usually a one-pager, this section outlines key information about the company such as a short business overview , operations, location and leadership

- Products and services : a detailed overview of the different products and/or services the company offers including features, benefits to customers and pricing. This section can also include, if relevant, information about the production and manufacturing elements (costs, materials and processes). Also, include here any proprietary technology (e.g. patents) your business might have

- Market analysis : a description of the market including its size and its growth. Here you should also include any information about your competitive environment, especially you position yourself vs. competitors

- Marketing strategy : this section explains how a business acquires and retains its customers. Your acquisition strategy ( inbound or outbound for example) as well as your conversion funnel must be clearly explained. If any, you should include here the different marketing campaigns you are running (e.g. paid ads, offline marketing), their goals and historical performance.

- Financial plan : every business plan must include a financial plan. As explained below, a financial plan is the projection in the future of the 3 financial statements . Usually, a financial plan is a 3- to 5-year forecast , depending on the objective of the business plan and the stage the business is in today.

What is a Financial plan?

As explained above, a financial plan is an element of every business plan.

A financial plan can take different forms (charts, tables) yet should always at least show the projection over a certain period ( 3- to 5-year usually) of the 3 financial statements.

A financial plan should also include some historical data (if any). If you have 3 years of historical financial data, include them in there as well. Indeed, investors will want to see how realistic are your projections .

Also, make it clear what are the key assumptions behind your financial forecasts: projecting the future isn’t easy and we often need to make some assumptions. Yet, the more available sources and data points you have to substantiate your projections, the better. Investors appreciate entrepreneurs who are realistic about their projections and understand the opportunities as well as the potentials risks involved. Whenever possible, use historical data and/or industry benchmarks .

Privacy Overview

Business Plan Development

Masterplans experts will help you create business plans for investor funding, bank/SBA lending and strategic direction

Investor Materials

A professionally designed pitch deck, lean plan, and cash burn overview will assist you in securing Pre-Seed and Seed Round funding

Immigration Business Plans

A USCIS-compliant business plan serves as the foundation for your E-2, L-1A, EB-5 or E-2 visa application

Customized consulting tailored to your startup's unique challenges and goals

Our team-based approach supports your project with personal communication and technical expertise.

Pricing that is competitive and scalable for early-stage business services regardless of industry or stage.

Client testimonials from just a few of the 18,000+ entrepreneurs we've worked with over the last 20 years

Free tools, research, and templates to help with business plans & pitch decks

Understanding The Distinction Between a Business Plan & Business Planning

In the dynamic world of entrepreneurship, our choice of words matters. Our vocabulary can often become a veritable alphabet soup of jargon, acronyms, and those buzzwords (I'm looking at you, "disrupt").

And let's not get started on business cliches – "circle back," "synergy," “deep-dive,” etc.

Yet sometimes, it's worth pausing to consider the words we casually sprinkle around in our business conversations. In a previous article, we explored the differences between strategic and tactical business planning , two related but distinct approaches to guiding a business. Now, we're going to delve into another pair of terms that often get used interchangeably but have unique implications: "business plan" (the noun) and "business planning" (the verb).

The business plan, a noun, is a tactical document. It's typically created for a specific purpose, such as securing a Small Business Administration (SBA) loan . Think of it as a road map – it outlines the route and the destination (in this case, the coveted bank loan). But once you've reached your tactical goal (in this case, getting the loan), it often gets shoved in the glove compartment, forgotten as part of the organization's action plan until the next road trip (i.e., additional funding ).

Business planning is not a static concept, but rather a dynamic verb. It's an ongoing process that necessitates continual adjustments. It's about creating a holistic, interconnected value-creating strategic plan that benefits all stakeholders. This includes attracting top-tier employees, ensuring a return on lending or investment, and making a positive impact on the community, whether online or in real life.

That being said, the customer remains at the heart of this process. Without customers, there are no sales, no revenue, and no value. Everything else is contingent on this key element.

If we were to compare the business plan to a map, then business planning would be the journey. It's a continuous process of making strategic decisions, adapting to new paths, and steering the business towards its goals. Sometimes, it even involves redefining objectives midway.

So, let's do a "deep-dive" (I couldn't resist) into these two terms, examining their application in the real world. Along the way, we'll uncover some tools that can aid us in the ever-evolving process of strategic business planning and the more finite task of crafting a winning business plan.

The Business Plan is a Document

Alright, let's take a closer look at a phrase we've all tossed around: the business plan. Imagine it as the detailed blueprint of your organization's goals, strategies, and tactics. It's like the North Star for your entrepreneurial ship, shedding light on the key questions: what, why, how, and when (speaking of questions, here are some FAQs about the business plan ).

Writing a solid business plan isn't easy , especially if you're just dipping your toes into the world of business planning. But don’t worry; we'll get to that (eventually).

So, let's break it down. What does a business plan document consist of, exactly?

- Executive Summary: Just as it sounds, this is a quick overview of the nitty-gritty that's in the rest of your business plan. It's the introduction to your organization, highlighting your mission statement and serving up the essential details like ownership, location, and structure.

- Company Overview: This is where you will detail your products and/or services, their pricing, and the operational plan. If you're opening a restaurant, this section is where you present your menu, and it's also where you talk about your ingredient sourcing, the type of service you'll provide, and the ambiance you're aiming for.

- Market Analysis Summary: This section demands a comprehensive analysis of your industry, target market, competitors, and your unique selling proposition. Without access to top-notch (and often not free) research tools, it can be challenging to find current industry data. Check out our guide on the best market research tools to get started.

- Strategy and Implementation Summary: Here, you'll lay out your short-term and long-term objectives along with the strategies you'll implement to attract and retain customers. This is where you’ll talk about all the different marketing and sales strategies you'll use to charm your future customers.

- Management Summary: This is your chance to spotlight your company's key personnel. Detail the profiles of your key leaders, their roles, and why they're perfect for it. Don't shy away from acknowledging talent gaps that need to be filled, and do share how you plan to fill them!

- Pro Forma Financials: This is where you get down to the dollars and cents with a detailed five-year revenue forecast along with crucial financial statements like the balance sheet and the profit & loss statement.

A business plan is an essential instrument, not just for securing funding, but also for communicating long-term goals and objectives to key stakeholders. But, while a business plan is essential for many circumstances, it's important to understand its scope and limitations. It's a tactical tool, an important one, but it's not the be-all and end-all of business strategy. Which brings us to our next point of discussion: business planning.

Business Planning is a Process

If we view the business plan as a blueprint, then business planning is the architect. But let's be clear: we're not building just any old house here. We're building the Winchester Mystery House of business. Just as the infamous Winchester House was constantly under construction , with new rooms being added and old ones revamped, so too is your business in a state of perpetual evolution. It's a dynamic, ongoing process, not a one-and-done event.

In the realm of business planning, we're always adding 'rooms' and 'corridors' – new products, services, and market strategies – to our 'house'. And just as Sarah Winchester reputedly consulted spirits in her Séance Room to guide her construction decisions, we consult our customers, market data, and strategic insights to guide our strategy. We're in a constant state of assessing, evolving, executing, and improving.

Business planning touches all corners of your venture. It includes areas such as product development, market research, and strategic management. It's not about predicting the future with absolute certainty – we’re planners, not fortune tellers. It's about setting a course and making calculated decisions, preparing to pivot when circumstances demand it (think global pandemics).

Business planning is not a 'set it and forget it' endeavor. It's akin to being your company's personal fitness coach, nudging it to continually strive for better. Much like physical fitness, if you stop the maintenance, you risk losing your hard-earned progress.

Business Planning Case Study: Solo Stove

Now that summer is here, my Solo Stove stands as a tangible testament to effective business planning.

For those unfamiliar, Solo Stove started with a simple yet innovative product – a smoke-limiting outdoor fire pit that garnered over $1.1 million on Kickstarter in 2016, far exceeding its original objective. Since then, it has expanded its portfolio with products tailored to outdoor enthusiasts. From flame screens and fire tools to color-changing flame additives, each product is designed to fit seamlessly into modern outdoor spaces, exuding a rugged elegance that resonates with their target audience.

This strategic product development, a cornerstone of business planning, has allowed Solo Stove to evolve from a product to a lifestyle brand. By continually listening to their customers, probing their desires and needs, and innovating to meet those needs, they've built a brand that extends beyond the products they sell.

Their strategy also includes a primary "Direct To Consumer" (DTC) revenue model, executed via their e-commerce website. This model, while challenging due to increased customer acquisition costs, offers significant benefits, including higher margins since revenue isn’t split with a retailer or distributor, and direct interaction with the customer.

Through its primary business model, Solo Stove has amassed an email database of over 3.4 million customers . This competitive advantage allows for ongoing evaluation of customer needs, driving product innovation and improvement, and enabling effective marketing that strengthens their mission. The success of this approach is evident in the company's growth: from 2018 to 2020, Solo Stove’s revenue grew from $16 million to $130 million , a 185% CAGR.

While 85% of their revenue comes from online DTC channels, Solo Stove has also enhanced their strategic objectives by partnering with select retailers that align with their reputation, demographic, and commitment to showcasing Solo Brands’ product portfolio and providing superior customer service.

Solo Stove's success underscores how comprehensive business planning fosters regular assessment, constant evolution, and continual improvement. It's more than setting goals – it's about ceaselessly uncovering ways to deliver value to your customers and grow your business.

However, even successful businesses like Solo Stove can explore additional strategic initiatives for growth and diversification, aligning with their strategic direction and operational planning. For instance, a subscription model could provide regular deliveries of products or a service warranty, creating a consistent revenue stream and increasing customer loyalty. Alternatively, a B2B model could involve partnerships with adventure tourism operators, who could purchase Solo Stove products in bulk.

These complementary business models, when integrated into the operational plan, could support the primary DTC model by driving customer acquisition, providing ongoing revenue streams and expanding the customer base. This strategic direction ensures that Solo Stove continues to thrive in a competitive market.

The Interplay between the Business Plan (Noun) and Business Planning (Verb)

In the realm of business strategy, there's an intriguing chicken-and-egg conundrum: which comes first, the business plan or business planning? The answer is both straightforward and complex: they're two sides of the same coin, each indispensable in its own right and yet inextricably linked.

The process of business planning informs and modifies the business plan, just as the business plan provides a strategic foundation for the planning process. This interplay embodies the concept of Model-Based Planning™, where the business model serves as a guide, yet remains flexible to the insights and adaptations borne out of proactive business planning.

Let's revisit the Solo Stove story to elucidate this concept. Their business model, primarily direct-to-consumer, laid the groundwork for their strategy. Yet, it was through continuous business planning – the assessment of customer feedback, market trends, and sales performance – that they were able to refine their model, expand their product portfolio, and enhance their growth objectives. Their business plan wasn't a static document but a living entity, evolving through the insights gleaned from ongoing business planning.

So, how can you harness the power of both the tactical business plan and strategic business planning in your organization? Here are a few guiding principles:

- Embrace Model-Based Planning™: Start with a robust business model that outlines your strategic plan. But remember, this isn't set in stone—it's a guiding framework that will evolve over time as you gain insights from your strategic planning process.

- Make business planning a routine: Regularly review and update your business plan based on your findings from market research, customer feedback, and internal assessments. Use it as a living document that grows and adapts with your business.

- Foster open communication: Keep all stakeholders informed about updates to your business plan and the insights that informed these changes. This promotes alignment and ensures everyone is working towards the same goals.

- Be agile and adaptable: A key part of business planning is being ready to pivot when necessary . Whether it's a global pandemic or a shift in consumer preferences, your ability to respond swiftly and strategically to changing circumstances is crucial for long-term success.

Fanning the Flames: From Planning to Plan

The sparks truly ignite when you understand the symbiotic relationship between tactical business plans, strategic business planning, and the achievement of strategic goals. Crafting a tactical business plan (the noun) requires initial planning (the verb), but then you need to embark on continuous strategic planning (the verb) to review, refine, and realign your strategic business plan (the noun). It's a rhythm of planning, execution, review, and adjustment, all guided by key performance indicators.

Business planning, therefore, isn't a one-off event, but rather an active, ongoing process. A business plan needs constant nurturing and adjustment to stay relevant and guide your organization's path to success. This understanding frames your business plan not as a static document, but as a living, breathing entity, evolving with each step your business takes and each shift in the business landscape. It's a strategic roadmap, continually updated to reflect your organization's objectives and the ever-changing business environment.

How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Understanding Venture Debt vs Venture Capital

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Going Beyond Writing: The Multifaceted Role of Business Plan Consultants

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...

SWTCH by Pigment

Three days of predictions, insights, and advice from leaders in finance, sales, HR, supply chain and more

Register now here

By Dean Sorensen , Founder of IBP Collaborative

Integrated Financial Planning (IFP) and Integrated Business Planning (IBP) mean different things to different people. Primarily because there is no universal definition of what “fully integrated” processes entail. This article presents a maturity model to explain what it means and the capabilities that comprise it.

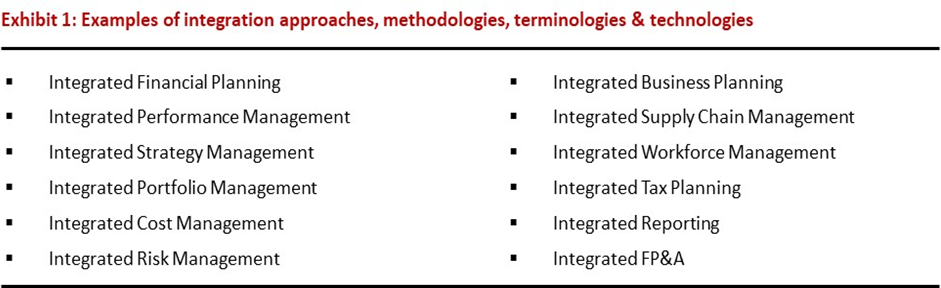

Introduction

What’s the difference between IFP and IBP? And how do IFP and IBP differ from the plethora of integration approaches and terminologies, examples of which are shown in exhibit 1? These questions were posed to me by a Vice President of Finance of a Global Manufacturing Company, hereafter referred to as Bob and GMC respectively.

Why was Bob asking these questions? GMC had made significant investments in planning and performance management (P&PM) methods and tools. Despite these investments, capability gaps remained. GMC was still struggling to achieve the strategic, financial and operational (SFO) management objectives shown in exhibit 2. What Bob didn’t appreciate was that most of his [global manufacturing] peers were also struggling to achieve these interconnected objectives.

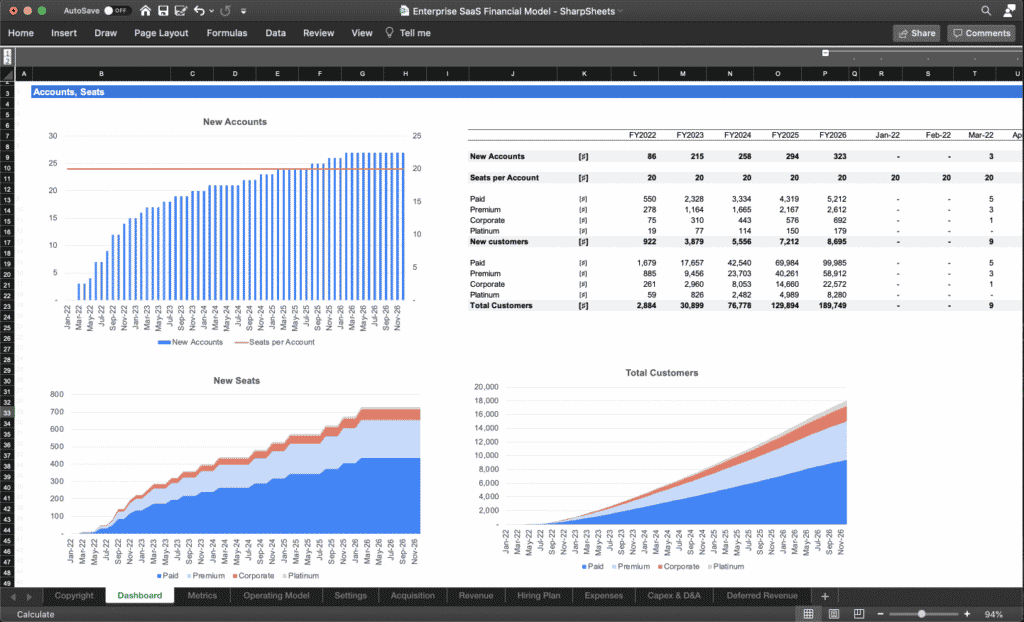

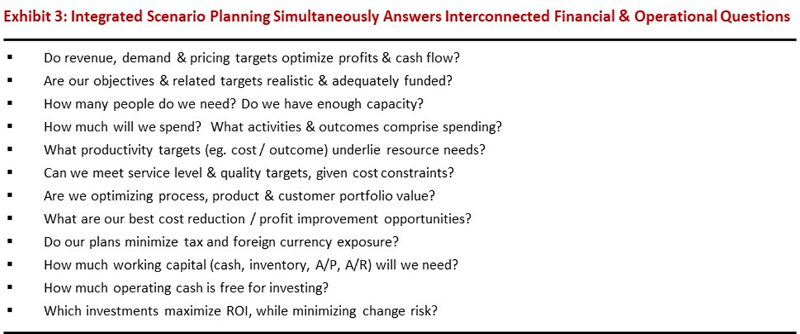

For Bob, the most glaring of these capability gaps was scenario planning. He envisioned an end to end scenario planning process that could answer interconnected questions, like those shown below in exhibit 3. This process would provide the basis to develop and deploy executable plans, while simultaneously optimizing free cash flow and exposing financial and operational risks.

To Bob’s dismay, this vision never materialized. GMC’s rolling forecast process was only loosely connected to IBP and could only support the most basic forms of cash flow [and foreign currency exposure] forecasting.

Bob was frustrated by the situation. GMC had partnered with a large / leading software company (hereafter referred to as LSC) to avoid this very problem. LSC provided both IFP and IBP solutions, albeit by way of separate financial and operational P&PM applications. He assumed that the combination of the two would result in an integrated process that enabled GMC to achieve these objectives.

Questions & Complications

Bob now questioned the validity of this assumption. He wondered how LSC could be classified as a leader (by technology analysts) if they couldn’t support these SFO objectives. In light of this, Bob sought answers to 3 questions. First, what are “fully integrated” processes? Second, are our processes integrated? And third, what capabilities [that GMC could be missing] comprise fully integrated processes?

One factor complicates the ability to answer these questions. There is no universally accepted definition of what constitutes fully integrated P&PM processes and technologies. Which is one reason why terms like IBP and IFP are so liberally used. Another is that technology analysts still use separate maturity models to evaluate financial and operational applications.

There are two limitations of these technology-based maturity models. First, they aren’t industry-specific, so they don’t reflect unique needs of specific industries, like manufacturing. Second, they don’t recognize that SFO objectives [shown in exhibit 2] become highly interconnected as complexity increases. As a result, capability gaps in traditional financial and operational applications are not always exposed.

Question 1: What Are Fully Integrated Processes?

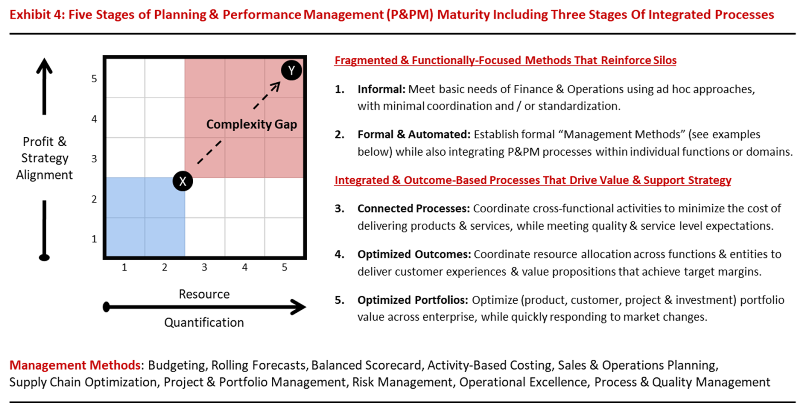

What’s needed is a more business-oriented maturity model. One that describes how integrated SFO process enable the achievement of one overarching business objective. That being, the ability to optimize the value of business outcomes for customers and stakeholders, across functions and entities.

Mature processes support this objective by enabling strategy and cost structures self-adjust to changing market conditions to achieve financial and operational performance targets. Two business capabilities play a central role in supporting such a process. They are explained below and form the framework for the maturity model shown in exhibit 4.

- Resource Quantification : Quickly and accurately quantify opportunities to optimize value [across functions and entities] while translating targets [eg. revenue, price, profit, cost, service and quality) into executable financial and operational plans for the outcomes and business processes that comprise customer value propositions. Further details of this capability are provided in a separate FP&A Trends article entitled “ Driver Based Planning Maturity ”.

- Profit & Strategy Alignment : Establish effective accountability, decision rights and rewards for managing key outcomes and tradeoffs that comprise customer value propositions and enterprise performance, while focusing and motivating people to behave and make decisions that optimize value for the organization as a whole, in both the short and long term. Further details of this capability are provided in a separate FP&A Trends article entitled “ Productivity Management ”.

This model presents five stages of maturity across these two business capabilities. Stages 1 and 2 are the lowest level of maturity and are represented by the blue box in the bottom left corner. A key feature of stage 2 is the introduction of formal management methods and tools, examples of which are shown at the bottom of exhibit 4.

Stages 3 to 5 represent mature forms of integrated [and outcome-based] processes that are represented by the pink box in the top right. The hallmark of these maturity stages is improving the effectiveness of these management methods by embedding them into processes that integrate strategy, finance and operations.

Question 2: Do Our Tools Support Integrated Processes?

This maturity model provides the basis to answer Bob’s second question. The conclusion being that LSC did not support the integrated processes that GMC required, as denoted by Point Y on the chart.. It’s processes were stuck at stage 2, as denoted by Point X. Two primary factors led to this conclusion about gaps in GMC’s processes and tools.

First, LSC did not support mature planning models that could be shared by finance and operations, as defined in the “ Driver-Based Planning Maturity ” article. For example, it lacked a planning model that could support cash flow forecasting, profit-based sales & operations planning and scenario planning. This corresponds to a stage 2 maturity for Resource Quantification.

Second, LSC did not support cross-functional performance management, as defined in the “ Productivity Management ” article. For example, it didn’t support the capabilities defined as matrix planning and tradeoff management, which are stages 3 and 4 capabilities respectively. This corresponds to a stage 2 maturity for Profit & Strategy Alignment.

Bob was somewhat consoled by the fact that global manufacturers often experience this same “complexity gap”. It did much to explain why complex organizations, like GMC, struggled to execute against business objectives requiring superior cross-functional coordination. This includes operational excellence, profitable growth and sustainable cost reduction.

What it also helped Bob to understand is that, in mature processes, there is no distinction between IBP, IFP and other integration terms. There is simply an integrated P&PM process. To Bob, they now sounded like marketing hype that should be met with greater skepticism.

What Capabilities Comprise Fully Integrated Processes?

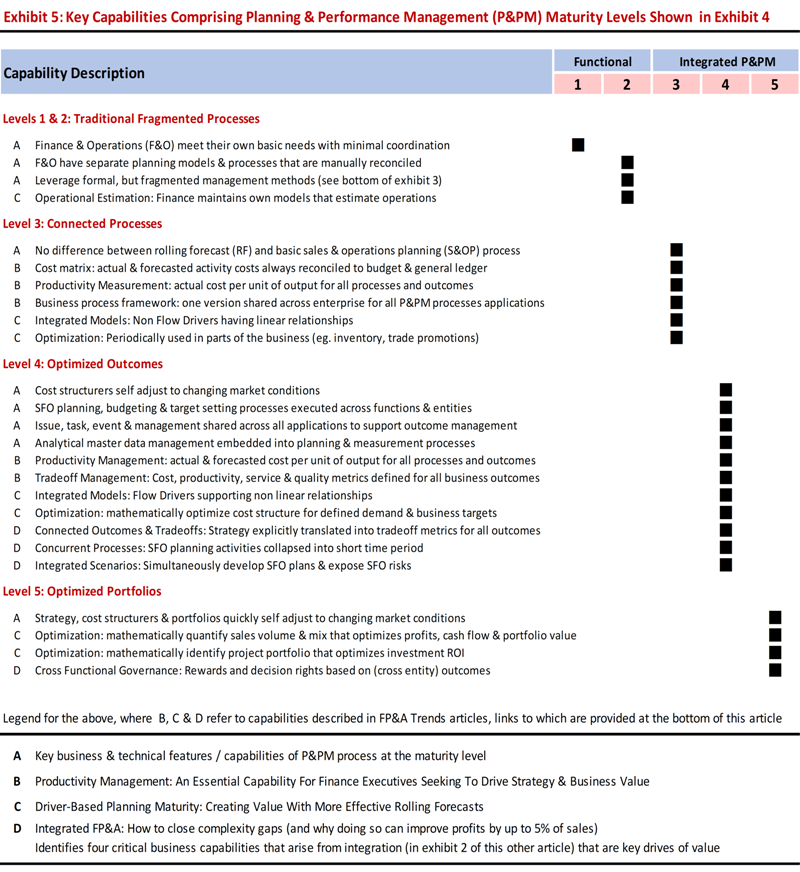

Bob’s third question was aimed at further understanding specific capabilities that comprised the gaps identified in exhibit 2. The capabilities that GMC lacked are identified below in exhibit 4 in the columns denoted as maturity levels 3 to 5.

Details of the capabilities [shown above in exhibit 5] are contained in three separate FP&A Trends articles, links to which are provided at the bottom of this article. Each capability in the exhibit has a letter reference, which is described in the legend at the bottom of the exhibit. Three key insights can be gleaned from this exhibit:

- Specific capabilities [in stages 3 to 5] comprise the gaps of GMC’s processes

- Four of these capabilities [labelled “D”] are the primary gaps because they comprise the others

- The probability is high that these four capabilities are missing from IBP and IFP applications

This last point is of particular note. These four capabilities play a central role in helping global organizations manage complexity. Their absence undermines the ability to manage complexity costs. This is important because [as noted in the “ Integrated FP&A ” article] complexity costs can approach 5% of sales. In this context, these capabilities need to be a key focus of strategically focused finance executives.

Key Takeaways

Bob, like other forward-thinking finance executives, understood the importance of integrating SFO P&PM processes. Especially as a means of coping with complexity. Despite this understanding, GMC still failed to establish mature forms of integrated processes that could support their objectives. Here are four things you can learn from GMC’s experience that will help you to avoid these mistakes:

- Develop a healthy skepticism of IBP, IFP and other solutions, like those in exhibit 1. Many lack the capabilities to support mature forms of integrated processes.

- Employ a holistic approach for developing SFO P&PM processes. As GMC learned, failure to define integrated SFO processes and requirements at the outset, can lead to missed requirements and the capability gaps that they are now coping with.

- Consider the views of technology analysts, but remember that they view technologies from functional perspectives. Not from a process-driven one that brings together SFO perspectives. Without understanding this, their views can lead organizations in the wrong direction.

- Develop a shared understanding of what fully integrated P&PM processes look like, the specific capabilities that comprise them and why they are important for driving strategy and value.

This last point is especially important. Had GMC established such an understanding at the outset of their program, they could have avoided the situation in which they found themselves. In this context, the insights in this article can help to get you started in the right direction.

Related articles

The cost of complexity can be significant – upwards of 5% of sales in global organizations. Forward-thinking...

Mature driver-based planning models are an essential component of effective rolling forecast processes in complex, global...

Managing enterprise productivity is an essential capability for value-focused Finance executives. It provides the basis for...

Subscribe to FP&A Trends Digest

We will regularly update you on the latest trends and developments in FP&A. Take the opportunity to have articles written by finance thought leaders delivered directly to your inbox; watch compelling webinars; connect with like-minded professionals; and become a part of our global community.

Create new account

Financial Tips, Guides & Know-Hows

Home > Finance > What Is Business Financial Planning

What Is Business Financial Planning

Published: November 2, 2023

Discover the importance of business financial planning and how it can optimize your finances. Gain insights into finance strategies and maximize profitability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more )

Table of Contents

Introduction, definition of business financial planning, importance of business financial planning, steps in business financial planning, components of business financial planning, benefits of business financial planning, challenges in business financial planning, considerations in business financial planning.

Welcome to our comprehensive guide on business financial planning. In today’s fast-paced and competitive business landscape, having a solid financial plan is crucial for the success and sustainability of any organization. Whether you are a small start-up or a large corporation, effectively managing your finances is a key factor in achieving profitability, growth, and long-term stability.

Financial planning for businesses involves analyzing the company’s current financial situation, setting realistic financial goals, and developing strategies to achieve those goals. It encompasses various aspects such as budgeting, forecasting, cash flow management, investment planning, risk management, and tax planning.

In this article, we will explore the definition, importance, steps, components, benefits, challenges, and considerations involved in business financial planning. By gaining a deeper understanding of these critical elements, you will be equipped with the necessary knowledge and insights to create a strong financial foundation for your organization.

Financial planning is not just for companies seeking external funding or facing financial difficulties. It is a fundamental process that applies to all businesses, regardless of their size or industry. It allows you to make informed decisions, optimize resource allocation, and seize opportunities as they arise.

Effective financial planning provides you with a roadmap to success, setting a clear direction for your business and helping you stay on track. It enables you to anticipate potential obstacles and devise strategies to overcome them, ensuring smooth operations and sustained profitability.

As we delve deeper into the world of business financial planning, it’s important to remember that every organization’s needs and circumstances are unique. While there are standard principles and best practices, it is essential to tailor your financial plan to align with your specific objectives, challenges, and resources.

Are you ready to embark on this journey of optimizing your business’s financial health? Let’s dive in and explore the exciting world of business financial planning together!

Business financial planning is the process of assessing, organizing, and managing a company’s financial resources to achieve its goals and objectives. It involves analyzing the company’s financial status, setting financial targets, and developing strategies to achieve those targets.

Financial planning also includes creating budgets, forecasting future financial performance, and monitoring cash flow, investments, and expenses. It helps businesses make informed decisions about resource allocation, capital investments, and risk management.

At its core, business financial planning aims to ensure the organization’s financial stability, growth, and long-term success. It provides a roadmap for allocating financial resources effectively, maximizing profitability, and mitigating financial risks.

Business financial planning covers various areas, including:

- Income and expense management: Monitoring and controlling the company’s revenue streams and expenses to achieve financial sustainability.

- Cash flow management: Managing the inflow and outflow of cash to ensure sufficient liquidity for day-to-day operations and future growth.

- Investment planning: Identifying investment opportunities that align with the company’s financial goals and risk tolerance.

- Debt management: Evaluating and managing the company’s debt levels to optimize financial leverage and maintain healthy financial ratios.

- Risk management: Identifying potential risks, such as market volatility or regulatory changes, and implementing strategies to mitigate their impact on the organization’s finances.

- Tax planning: Developing strategies to minimize tax liabilities and ensure compliance with applicable tax laws and regulations.

Business financial planning is an ongoing process that requires regular review and adjustment. As market conditions, financial goals, and business circumstances change, it is crucial to update and adapt the financial plan accordingly to maintain its effectiveness.

The ultimate goal of business financial planning is to optimize the company’s financial performance, enhance shareholder value, and provide a solid foundation for sustainable growth. By proactively managing the company’s finances and making informed decisions, businesses can navigate challenges, seize opportunities, and achieve their desired financial outcomes.

Business financial planning is of utmost importance for organizations of all sizes and industries. It provides a roadmap for success by guiding key financial decisions and ensuring the long-term stability and growth of the business. Here are several reasons why business financial planning is essential:

- Goal Setting and Strategic Alignment: Financial planning helps businesses set clear financial goals and align them with the overall strategic objectives of the organization. By defining specific targets, such as revenue growth or profitability ratios, businesses can track their progress and make informed decisions that drive them closer to accomplishing their goals.

- Resource Optimization: Financial planning allows businesses to plan and allocate their resources effectively. By carefully analyzing income and expenses, businesses can identify areas of inefficiency, eliminate unnecessary costs, and focus resources on initiatives that generate the highest returns. This optimization of resources leads to increased profitability and the preservation of valuable capital.

- Risk Management: One of the key benefits of financial planning is the ability to assess and mitigate risks that may impact the financial health of the business. By performing risk analysis and implementing risk management strategies, businesses can prepare for unforeseen events, such as economic downturns or industry disruptions, and minimize their potential negative impact.

- Cash Flow Management: Effective financial planning enables businesses to manage their cash flow efficiently. By forecasting future cash inflows and outflows, businesses can ensure that they have sufficient liquidity to meet their financial obligations, such as paying suppliers or employees, while also planning for future investments or expansion.

- Financial Decision-Making: Financial planning provides businesses with the necessary information and analysis to make informed financial decisions. Whether it is evaluating investment opportunities, determining pricing strategies, or deciding on financing options, a solid financial plan acts as a guiding framework, ensuring decisions are based on sound financial principles and long-term objectives.

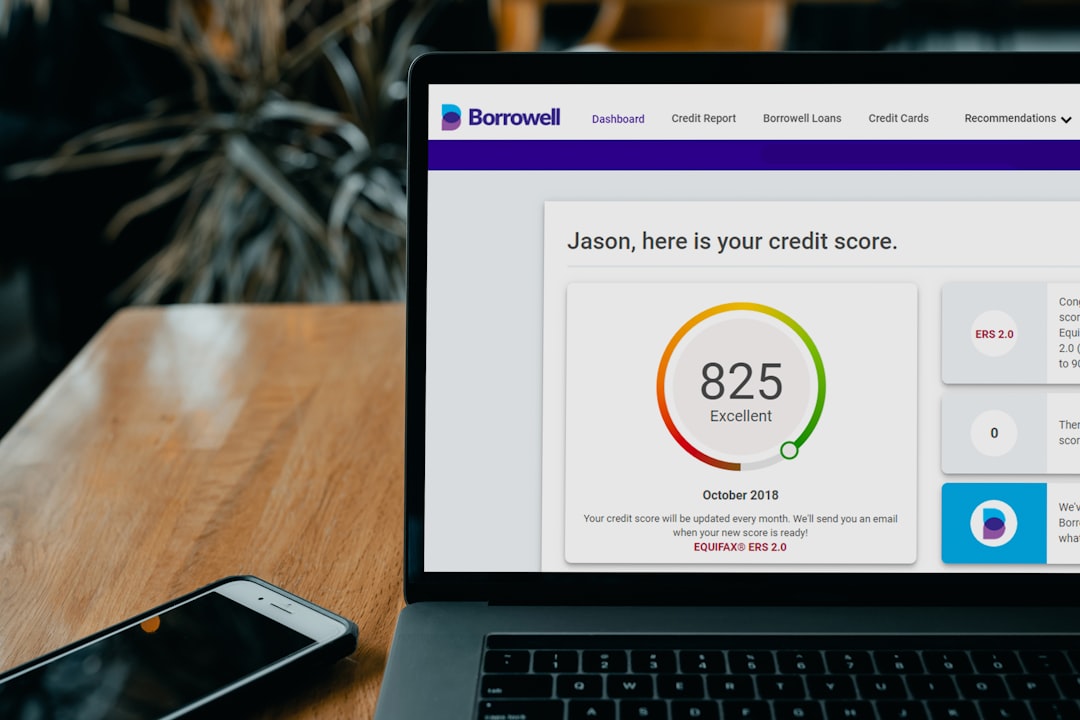

- Stakeholder Confidence: Having a robust financial plan instills confidence in stakeholders, including investors, lenders, and shareholders. It demonstrates that the business is well-managed, financially stable, and capable of delivering on its promises. This, in turn, enhances credibility and attracts potential investors or financing opportunities.

Overall, business financial planning plays a crucial role in setting the direction, optimizing resources, and managing risks for an organization. It provides the foundation for effective financial management and decision-making, enabling businesses to navigate challenges, seize opportunities, and achieve sustainable growth in a competitive market environment.

Effective business financial planning involves a series of steps that help organizations analyze their current financial position, set financial goals, and develop strategies to achieve those goals. While each business’s financial planning process may vary based on their specific needs, here are the general steps to follow:

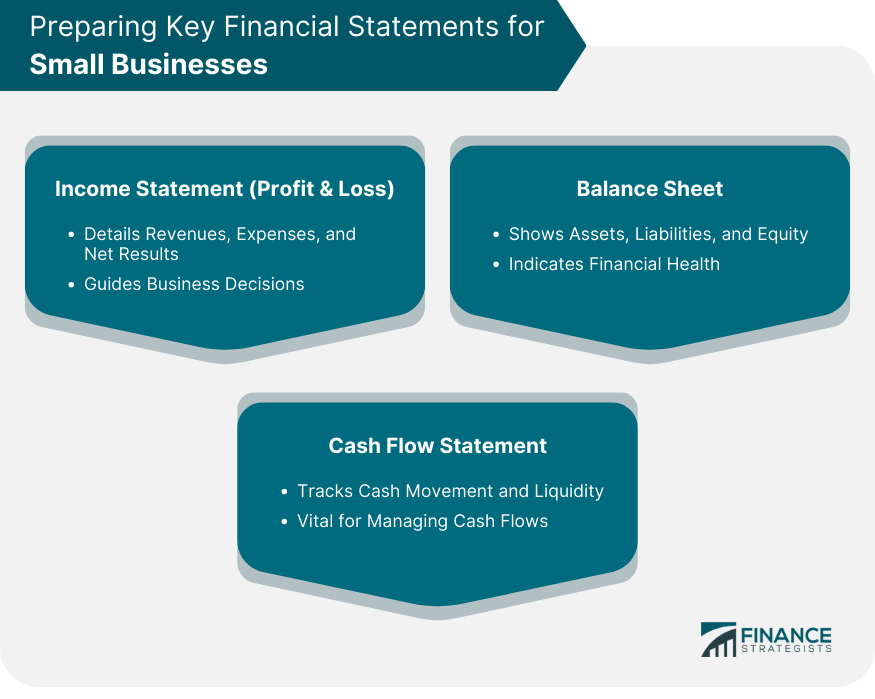

- Assess Current Financial Position: The first step in financial planning is to assess the company’s current financial position. This involves gathering and analyzing financial statements, such as income statements, balance sheets, and cash flow statements, to understand the company’s revenue, expenses, assets, liabilities, and cash flow. It also involves identifying any financial strengths, weaknesses, or areas for improvement.

- Set Financial Goals: Once the current financial position is evaluated, the next step is to set specific financial goals. These goals can include increasing revenue, improving profit margins, reducing costs, increasing cash flow, or achieving a specific return on investment. It is important to ensure that these goals are realistic, measurable, and aligned with the overall strategic objectives of the business.

- Develop a Budget: A budget is a crucial tool in financial planning as it helps to allocate resources and track financial performance. Based on the identified financial goals, businesses create a budget that outlines projected income, expenses, and cash flow for a specific period, typically on an annual basis. The budget should be detailed and comprehensive, accounting for all aspects of the business’s operations.

- Perform Financial Analysis: Financial analysis involves examining historical financial data and using financial ratios to assess the company’s financial health and performance. This analysis helps to identify trends, patterns, and areas of improvement. Key financial ratios to consider include liquidity ratios, profitability ratios, and solvency ratios.

- Create Financial Strategies: With a clear understanding of the current financial position, goals, and budget, businesses can develop strategies to achieve their financial objectives. These strategies may include steps to increase revenue, reduce costs, manage cash flow, optimize investments, and mitigate financial risks. The strategies should be realistic, actionable, and aligned with the overall business strategy.

- Implement and Monitor: Once the financial strategies are defined, it is important to implement them and closely monitor their progress. Regularly reviewing and comparing actual financial performance against the budget and goals helps to identify any deviations or areas requiring adjustments. This monitoring allows for timely decision-making and course correction to stay on track.

- Periodic Review and Adjustments: Financial planning is an ongoing process, and it is essential to periodically review and adjust the financial plan as business conditions change. This includes revisiting financial goals, updating the budget, and adapting strategies to reflect new opportunities or challenges. Regular reviews help businesses stay agile and responsive to the evolving market dynamics.

Following these steps in business financial planning ensures that organizations have a clear understanding of their financial position, set realistic goals, and implement strategies to achieve those goals. It provides a structured approach to financial management and enables businesses to make informed decisions for long-term success and profitability.

Business financial planning encompasses several key components that work together to create a comprehensive and effective financial strategy. These components provide the necessary framework for managing and optimizing the company’s finances. Here are the primary components of business financial planning:

- Financial Goals: Defining clear and specific financial goals is an essential component of business financial planning. Financial goals can include revenue targets, profit margins, cash flow objectives, and return on investment. These goals provide direction and purpose to the financial planning process, guiding decision-making and resource allocation.

- Budgeting: Budgeting is a critical component of financial planning that involves creating a detailed plan for income and expenses. A well-structured budget lays out projected revenue, costs, and investments over a specific period, typically on an annual basis. It helps businesses track their financial performance, allocate resources effectively, and make informed financial decisions.

- Cash Flow Management: Managing cash flow is crucial for the financial health of any business. It involves monitoring and controlling the inflow and outflow of cash to ensure there is enough liquidity to meet ongoing expenses and fund future growth. An effective cash flow management component of financial planning includes forecasting cash flow, optimizing working capital, and implementing strategies to improve cash flow efficiency.

- Financial Analysis: Financial analysis plays a pivotal role in business financial planning. It involves analyzing financial statements, ratios, and other financial data to assess the company’s financial health and performance. Key financial analysis components include liquidity ratios, profitability ratios, and solvency ratios. This analysis helps identify trends, evaluate the company’s financial strengths and weaknesses, and make data-driven financial decisions.

- Investment Planning: Investment planning focuses on identifying investment opportunities that align with the company’s financial goals and risk tolerance. This component involves evaluating potential investments, such as new projects, technology upgrades, or acquisitions, and assessing their potential returns and risks. Effective investment planning allows businesses to allocate resources wisely to maximize profitability and long-term growth.

- Risk Management: Risk management is an integral part of financial planning that involves identifying and mitigating financial risks that can impact the company’s finances. This component includes assessing market risks, legal and regulatory risks, credit risks, and operational risks. Implementing risk management strategies, such as insurance coverage or hedging techniques, helps businesses protect their financial stability and minimize potential losses.

- Tax Planning: Tax planning is an essential component of financial planning that involves developing strategies to minimize tax liabilities while maintaining compliance with tax laws and regulations. This includes understanding tax incentives, deductions, and credits, as well as effectively managing tax reporting and documentation. Effective tax planning ensures businesses optimize their tax positions and maximize after-tax profitability.

By integrating these components into their financial planning process, businesses can create a comprehensive and dynamic strategy that addresses their financial goals, manages cash flow, analyzes performance, minimizes risks, and optimizes investments. Each component contributes to the overall financial health and success of the organization, helping businesses navigate challenges, seize opportunities, and achieve sustainable growth.

Business financial planning offers several significant benefits to organizations of all sizes and industries. It serves as a fundamental tool for managing and optimizing financial resources, making informed decisions, and achieving long-term success. Here are some key benefits of business financial planning:

- Goal Clarity and Focus: Financial planning helps businesses set clear financial goals and objectives. By defining specific targets, businesses can align their efforts and resources towards achieving those goals. It brings clarity and focus to the organization, providing a sense of direction and purpose.

- Resource Optimization: A well-developed financial plan enables businesses to allocate their resources effectively. It helps identify areas of inefficiency, wasteful spending, or underutilization of resources. Through financial planning, organizations can optimize their resource allocation, reduce costs, and maximize profitability.

- Risk Management: Financial planning incorporates risk management strategies that help businesses identify and mitigate potential risks. It enables companies to anticipate and prepare for unforeseen events, such as economic downturns, regulatory changes, or supply chain disruptions. By mitigating risks, businesses can protect their financial stability and minimize potential losses.

- Sustainable Growth: Financial planning is crucial for sustained business growth. It allows organizations to assess their financial position, identify growth opportunities, and develop strategies to capitalize on them. By setting achievable financial goals, businesses can expand their market share, enter new markets, invest in research and development, and drive long-term growth.

- Better Decision-making: Financial planning provides businesses with a solid foundation for making informed decisions. By analyzing financial data, evaluating risk factors, and considering various scenarios, businesses can make strategic decisions that align with their financial goals. This leads to better investment choices, pricing strategies, and capital allocation.

- Improved Cash Flow: Effective financial planning helps businesses manage their cash flow efficiently. It involves forecasting cash inflows and outflows, optimizing working capital, and ensuring sufficient liquidity for day-to-day operations and growth initiatives. Improved cash flow management enables businesses to meet financial obligations, seize opportunities, and maintain financial stability.

- Enhanced Credibility: Financial planning enhances a business’s credibility and reputation with stakeholders, including investors, lenders, and customers. It demonstrates that the organization is well-managed, financially stable, and has a clear vision for the future. This credibility attracts potential investors, lenders, and partners, opening doors to new growth opportunities.

Overall, business financial planning plays a vital role in guiding organizations towards financial success and sustainability. It provides a framework for goal setting, resource optimization, risk management, and decision-making. By implementing effective financial planning strategies, businesses can navigate challenges, seize opportunities, and achieve their desired financial outcomes.

While business financial planning is crucial for success, it is not without its challenges. Organizations must navigate various obstacles to develop and implement effective financial plans. Here are some common challenges in business financial planning:

- Data Accuracy and Availability: Financial planning heavily relies on accurate and up-to-date financial data. However, obtaining reliable and comprehensive data can be a challenge, especially for small businesses or those with inadequate financial reporting systems. Without accurate data, it becomes difficult to perform accurate financial analysis and make informed decisions.

- Uncertain Economic Climate: The ever-changing economic landscape poses a challenge in financial planning. Businesses need to adapt their financial plans to account for economic fluctuations, changes in market trends, and shifts in consumer behavior. Uncertainty, such as recessions, inflation, or global crises, can impact revenue streams, cash flow, and profitability, making financial planning more complex.

- Complexity of Financial Regulations: Compliance with financial regulations is a significant challenge in financial planning. Businesses must stay abreast of constantly evolving regulations, tax laws, and reporting requirements. Failure to comply can result in penalties, legal issues, and reputational damage. Ensuring accuracy and compliance while navigating a complex regulatory environment adds complexity to the financial planning process.

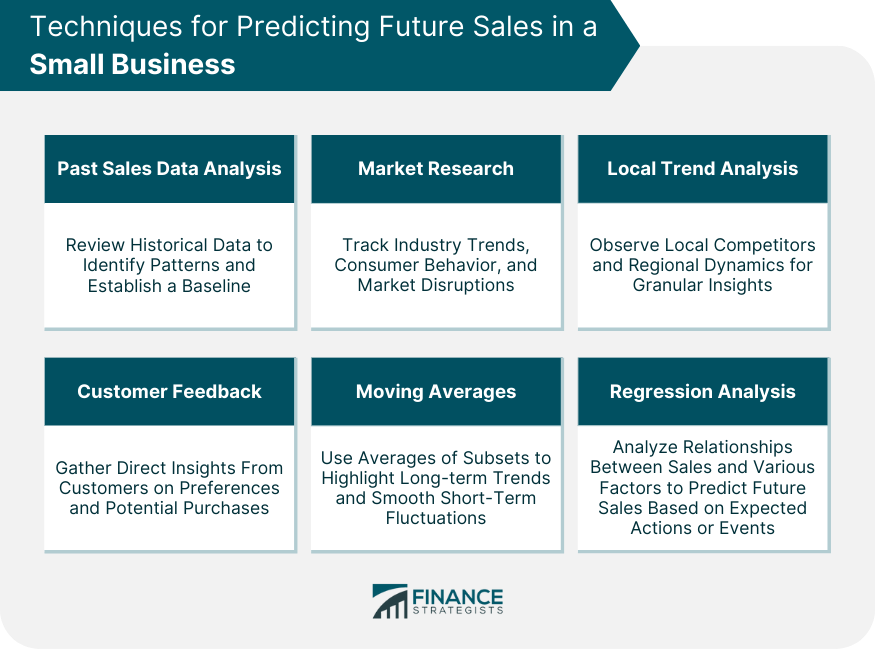

- Difficulty in Forecasting: Forecasting future financial performance is integral to financial planning. However, accurately predicting future events, such as sales growth, market demand, or industry trends, can be challenging. External factors like changing customer preferences or new competitors can impact revenue projections, making it difficult to create realistic financial forecasts.

- Limited Resources: Limited financial and human resources can pose challenges in financial planning. Small businesses often face constraints in hiring dedicated financial professionals or investing in sophisticated financial planning tools. Lack of expertise and resources can hinder the ability to develop and execute robust financial plans.

- Inadequate Communication and Collaboration: Financial planning requires collaboration across different departments and stakeholders within an organization. Ineffective communication and collaboration can lead to misalignment between financial goals, operations, and strategic objectives. It is essential to foster effective communication channels and ensure all stakeholders are involved in the financial planning process.

- External Factors: External factors beyond a business’s control, such as political instability, natural disasters, or shifts in the global economy, can impact financial planning. These unforeseen events can disrupt supply chains, affect customer demand, or create financial instability. Adapting financial plans to mitigate the impact of external factors is a challenge that businesses must navigate.

Despite the challenges, businesses can overcome them by adopting proactive measures. Implementing robust financial systems, investing in accurate data collection and reporting tools, staying informed about regulatory changes, and fostering effective communication can help organizations navigate these challenges and develop resilient financial plans.

When embarking on business financial planning, there are several important considerations to keep in mind. These considerations help ensure that the financial plan is comprehensive, realistic, and tailored to the specific needs of the organization. Here are key factors to consider in business financial planning:

- Business Objectives: Align financial planning with the overall strategic objectives of the business. The financial plan should support and contribute to the achievement of the organization’s goals, whether it is revenue growth, market expansion, profitability, or sustainability.

- Risk Tolerance: Understand the risk tolerance of the business and factor it into the financial plan. Different businesses have varying levels of risk appetite, and the financial plan should account for this. It should include risk management strategies that align with the organization’s risk tolerance and protect against potential financial setbacks.

- Industry and Market Conditions: Consider the specific industry and market conditions in which the business operates. Market trends, customer preferences, competitive landscape, and regulatory environment all impact financial planning. Keeping abreast of industry dynamics helps in making informed financial decisions and formulating realistic financial projections.

- Customer and Supplier Relationships: Analyze the relationships with customers and suppliers to understand their impact on the financial health of the business. Ensure financial planning accounts for any dependencies, credit terms, payment schedules, and potential risks associated with these relationships.

- Technology and Systems: Assess the technology infrastructure and financial systems in place to support financial planning. Evaluate whether the existing systems are capable of providing accurate and timely financial data for analysis. Consider whether any upgrades or investments in technology are needed to enhance financial planning capabilities.

- Competencies and Resources: Evaluate the financial competencies and resources within the organization. Determine if the current finance team has the necessary expertise to develop and execute the financial plan effectively. Identify any gaps and consider training or hiring new talent to strengthen financial planning capabilities.

- Long-term Sustainability: Consider long-term sustainability when creating the financial plan. Beyond short-term goals, it is crucial to analyze the impact of financial decisions on the overall financial health and viability of the business in the long run. Balancing short-term objectives with long-term sustainability is essential for sustained growth and profitability.

- Regulatory Compliance: Stay informed about relevant financial regulations, tax laws, and reporting requirements. Ensure the financial plan complies with all applicable regulations. Consult with legal and financial experts, if necessary, to ensure compliance and mitigate any potential legal or financial risks.

By considering these factors in business financial planning, organizations can develop a comprehensive and tailored financial strategy that addresses their unique circumstances. Regularly reviewing and updating the financial plan in response to changes in these considerations ensures that the plan remains relevant and effective in driving the organization towards its financial goals.

Business financial planning is a crucial process that organizations must undertake to navigate the complex world of finance and achieve their goals. From setting clear financial objectives to creating budgets, managing cash flow, and analyzing financial performance, financial planning forms the foundation for informed decision-making and long-term success.

Throughout this comprehensive guide, we have explored the definition, importance, steps, components, benefits, challenges, and considerations of business financial planning. We have seen how financial planning helps businesses clarify their goals, optimize resources, mitigate risks, and make strategic financial decisions.

By engaging in financial planning, businesses can set the stage for sustainable growth, enhanced profitability, and improved financial stability. It empowers organizations to allocate resources effectively, manage cash flow efficiently, and respond to changes in the economic, market, and regulatory environment.

However, financial planning is not without its challenges. Obtaining accurate data, forecasting future performance, complying with regulations, and managing limited resources are some of the obstacles businesses may face. Despite these challenges, businesses can overcome them through proactive measures such as investing in technology, fostering effective communication, and staying informed about industry trends.

As you embark on your own financial planning journey, remember that flexibility and adaptability are key. Regularly review and update your financial plan, considering factors such as market conditions, customer relationships, and long-term sustainability. By doing so, you can ensure that your financial plan remains relevant and responsive to the evolving needs of your organization.

In conclusion, business financial planning is a dynamic and essential process that enables organizations to effectively manage their financial resources and achieve their strategic objectives. By integrating financial planning into your business strategy, you lay the groundwork for sustainable growth, profitability, and long-term success in today’s competitive business landscape.

How To Start A Financial Planning Business

Our Review on The Credit One Credit Card

20 Quick Tips To Saving Your Way To A Million Dollars

What Are Asset Management Ratios

How Retainers And Draws Work In Money Management

Latest articles.

Understanding XRP’s Role in the Future of Money Transfers

Written By:

Navigating Post-Accident Challenges with Automobile Accident Lawyers

Navigating Disability Benefits Denial in Philadelphia: How a Disability Lawyer Can Help

Preparing for the Unexpected: Building a Robust Insurance Strategy for Your Business

Custom Marketplace Development: Creating Unique Online Shopping Experiences

Related post.

By: • Finance

By: Chelsea • Finance

Please accept our Privacy Policy.

We uses cookies to improve your experience and to show you personalized ads. Please review our privacy policy by clicking here .

- https://livewell.com/finance/what-is-business-financial-planning/

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Run » finance, what is the difference between accounting and financial planning .

Accounting and financial planning both have a role to play in growing your business sustainably.

Accounting and financial planning are two different areas of expertise that many business owners conflate. However, hiring a financial planner to do your accounting isn’t the best idea. These disciplines may overlap in the process of running your business, but you shouldn’t be picking one function over the other. Here’s a quick guide to the different roles accounting and financial planning play in your business.

Accounting and financial management both have to do with managing your business assets, but from different perspectives. “Accounting provides a snapshot of an organization’s financial situation using past and present transactional data, while finance is inherently forward-looking; all value comes from the future,” wrote Harvard Business School Online .

Accounting is primarily concerned with tracking and recording income, expenses, assets, and liabilities. Accountants prepare documents such as income statements and balance sheets that offer a snapshot of the company's financial health at a specific point in time.

Comparatively, financial planning focuses on strategies to achieve long-term financial goals. Small business owners hire financial planners to assess their current financial situations, risk tolerance, and goals. These planners can help a startup determine how much funding to raise, plan for major expenses (like an expansion), or mitigate risks.

[Read more: How to Create a Financial Forecast for a Startup Business Plan ]

Key activities

Accountants and financial planners do very different things on a day-to-day basis. Accountants manage tasks such as bookkeeping , tracking revenue and expenses, financial and internal reporting, auditing, and risk management. “An accountant records, summarizes, analyzes, and creates reports of financial transactions,” wrote Investopedia .

A financial planner is more concerned with funding the business. This role includes activities such as raising capital, corporate strategy, budgeting and forecasting, and overseeing mergers and acquisitions. Financial planning aims to get the best risk-adjusted returns and will track metrics like cash flow, profit margin, and cost of capital.

Accounting is like looking in the rearview mirror to get a clear view of your business’s financial track record. Financial planning takes a view through the windshield, helping you navigate toward your desired financial future.

Measuring financial performance

Speaking of key metrics, accounting and finance have different approaches to measuring financial performance. Accounting uses the accrual method, which records transactions as they are agreed upon rather than when they are completed. This means your business can allow customers to use credit cards or payment plans. The philosophy behind accrual accounting is that revenues and costs will “ smooth out ” over time to show an accurate snapshot of a company’s financial health.

[Read more: Accounting Basics Every New Business Owner Should Learn ]

“Finance rejects that idea, instead believing that the best way to measure economic returns from a company is to calculate the cash it’s able to produce and leverage, which is dependent on when that cash is exchanged—rather than just agreed upon,” wrote Harvard Business School Online .

Finance instead uses metrics like net profit margin to understand business performance.

Tools and skill sets

Accounting teams use tools to establish a record of the company’s finances that can be used in tax audits and reporting. Accounting compiles data in a general ledger, where all transactions across the company’s supply chain, procurement, payments, and other functions are kept in one place. Accountants use accounting software and spreadsheets extensively to record accounts payable and receivable.

Financial planners use the same information for financial projections. Financial teams use historical data generated by accountants with market data and industry trends to chart a path forward. “While a financial planner must be good with numbers and possess a keen understanding of how the markets work, it is arguably more important to have strong sales and networking skills,” wrote Investopedia .

Ultimately, financial planning and accounting are both core functions of a growing business. Accounting is like looking in the rearview mirror to get a clear view of your business’s financial track record. Financial planning takes a view through the windshield, helping you navigate toward your desired financial future.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more finance tips

What is enterprise resource planning, choosing an enterprise resource planning tool for your small business, 10 benefits of erp systems for small businesses.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Business Financial Planning: How to Create Business Financial Plan

- Post author: fincart

- Post published: January 8, 2024

- Post category: Financial Planning

Table of Contents

In this fast and competitive world, the success of a business depends on how prepared they are. Prepared to adapt, to keep up with rivals, to handle the unexpected, and to seize opportunities as they arise. Through Business Financial Planning, businesses can fortify their foundation for success. They can gain insights by making use of their past performance data, their current situation, and trends to make predictions about future performances. They can make efficient use of their resources to maximise profit and wealth to keep all stakeholders happy. Since financial planning is so important for businesses, they hire a business financial consultant to help create a solid financial plan for sustained, long-term growth.

In this blog, let us understand the meaning of business financial planning, how it benefits businesses, how you can create a financial plan for your business, and see how different business financial plans are from individual ones.

What is Business Financial Planning?

With business financial planning, you create the blueprint for your business’s financial future. It details the financial management of your overall business plan. Through it, you decide the allocation of resources, monitor cash flows, decide the budget, manage liabilities, make projections and forecasts, manage risk, and much more, ultimately improving efficiency and achieving your short and long-term business goals. Basically, doing financial planning for business gives you insights to make smart and sustainable decisions. It is a comprehensive approach that ensures that your business not only survives but thrives in the ever-changing market dynamics. It needs to be strong and built on a solid foundation because when you try to grow your business and seek investors or loans, your financial plan will become the bedrock of credibility and confidence.

The importance of financial planning in business

For any business, the Importance of Financial Planning cannot be overstated. It is essential to the success of any business. Here’s why –

- Through financial planning, entrepreneurs gain insights that keep them informed and improve their decision-making.

- A financial plan outlines the business strategies that an entrepreneur will use over the course of the next month, quarter, or financial year.

- Entrepreneurs can use financial plans to assess their past and current situation, the progress of their goals, and their resources. It helps them keep track of their financial performance, identify areas of improvement, and make informed decisions to ensure the optimal allocation of resources for sustained growth and success.

- When the resources are optimally allocated, business owners can increase their profitability and sustainability.

- Financial plans can also help identify risk areas in advance which enables business owners to develop strategies to mitigate them.

- If you are a new business owner or are looking to start a business, it’s important to seek guidance from experts. A business financial planner can make sure you cover every essential component in your plan and ensure it aligns with your business goals.

- Consider the local aspects of your business and ask yourself, “Can a business financial advisor near me help me get started with my financial planning?” With help from a local business financial consultant, you will receive personalised insights tailored to the specific needs and challenges of your new venture while keeping in mind the competition and market trends in your area.

- Explore different business finance consulting services, and leverage the expertise of professionals who can help your business grow and succeed.

Benefits of financial planning for business

A well-crafted business financial plan lays the foundation for stable growth. Let’s list down some ways in which making a financial plan can benefit your business –

1. Cash Flow Management

As the name suggests, cash flow refers to the money coming in and out of your business. Usually, when a business is new, it will spend more money than it will earn, so your expectations about cash flow should be realistic. Through a financial plan, you will be able to forecast and manage cash flows effectively and avoid underflows or overflows.

2. Risk Management

A business faces many different types of financial risks , such as credit risk, liquidity risk, legal risk, operational risk, systematic risk, and market risk. A financial plan helps a business stay prepared for such dangers through forecasts and scenario planning. It will also compel you to create contingencies to tackle unexpected circumstances.

3. Creates Transparency

A financial plan creates transparency among investors, executives, and employees. If you want to hire good employees, they would want to know how stable your business is, and how likely it is to succeed in the future. A good and transparent financial plan attracts investors and high-quality employees.

4. Cost Reduction

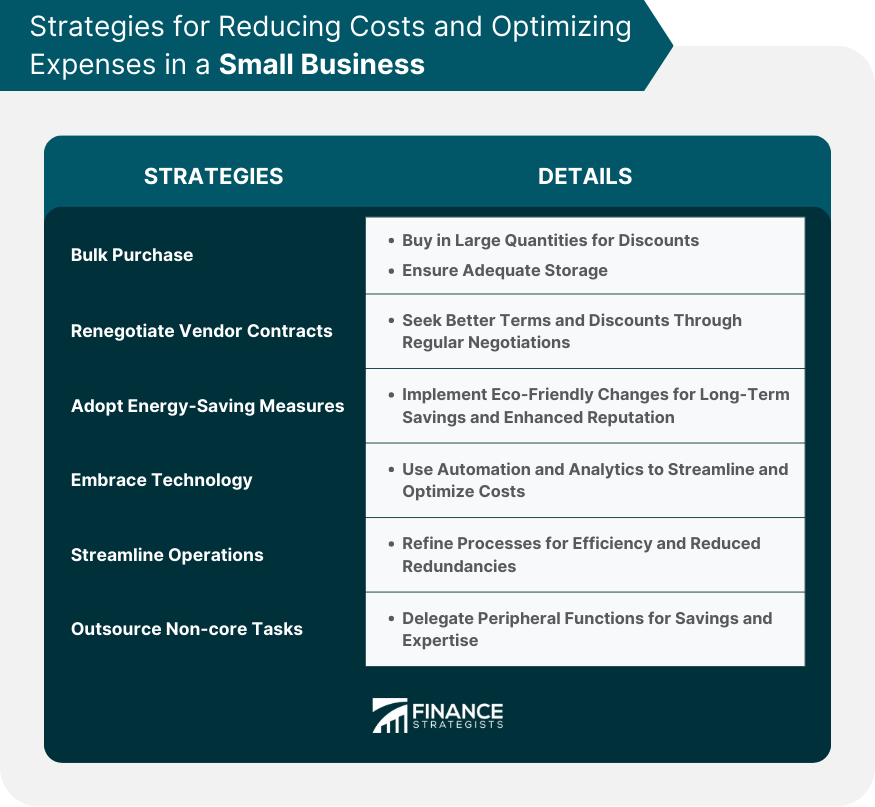

A part of your financial plan is your budget. When you assess your expenses, you will likely find areas where you can make cuts to save more money. Cost cutting will help your bottom line and make sure you utilise your resources more efficiently.

Also Read: What is Cost Reduction Strategy? A complete Guide

5. Funding Opportunities

A solid financial plan enhances your credibility and attracts potential investors. Investors will see how their money will be used and study your past performances. Similarly, if your business needs loans, banks will scrutinise your liabilities and how you’ve managed them. A good financial plan can ensure your business gets all the funding it needs.

6. Crisis Management

Through projections, forecasts, and scenario planning, you will see any financial crisis coming from far away. But there are cases when extremely unexpected events happen, such as the 2008 global economic crisis, or the COVID pandemic. A well-prepared financial plan not only enables you to identify potential crises in advance but also equips you with contingency measures to deal with such events. This includes having a comprehensive risk mitigation strategy, maintaining a sufficient cash reserve, and establishing clear communication to keep stakeholders informed.

7. Professional Guidance

These benefits highlight why businesses invest heavily in business finance consulting services. Seeking guidance from a business financial consultant comes with its own advantages, the first being benefiting from the specialised knowledge and experience of financial professionals. A business financial planner can also tailor your financial plan according to the unique needs and goals of your business, and help you by regularly reviewing and adapting your financial plan to changes in the market.

Steps to Develop a Business Financial Plan

Creating effective financial plans for businesses demands a thoughtful approach, honest assessment, and careful implementation. Understand that this plan is going to be your guide for the future, and how closely and effectively you follow it will determine whether or not you achieve your business goals. Here are three simple steps you can take to start creating a successful business financial plan –

A. Setting Financial Goals:

Start by setting attainable short-term and long-term financial goals that are aligned with your business vision. These objectives should be clear, measurable, and defined with a time horizon. Ask yourself some questions – Where do I want my business to be in the next year or five? Do I plan to expand my business? If so, in how many years? Do I want to hit a specific revenue target to attract investors? Be specific with your questions, as the answers will help you set realistic goals. Establishing such goals will provide a strategic framework and help you focus your financial efforts and resources toward specific milestones, which will ultimately steer your business in the direction you wanted and planned for.

B. Budgeting Techniques

A budget can help you dictate the flow of cash. It is a framework that includes your total income, total expenses, and investments and reserves. Assess your situation and note down all your income and its sources, such as sales income, investments, donors, investors, or other revenue streams. Now take a thorough look at your expenses such as daily operational costs, marketing, advertising, employee salaries, research and development of products, equipment, and technology. Of course, if you want to profit, your revenue should exceed all your expenses. A budget helps with exactly this, and more. It will allow you to allocate resources to different departments efficiently. It is essentially a constraint, and everyone must work within it. When you break down your budget, you’ll find it easy to track and manage it.

Also Read: Understanding Budgeting in Financial Management

C. Forecasting and Projections:

Now you have to create financial projections for different components such as income statements or balance sheets. These take into account the past performance, market trends, expenses you are expecting, and your sales forecast for the next month, quarter, or year. If you own a business that works with a very tight cash flow, you can also consider making a weekly projection.

Financial projections are important as they are shared with stakeholders, and help you navigate uncertainties and make sure that you remain on track toward your business goals. Take a look at your goals and work out how much it will cost you to reach them. Do this for a variety of scenarios – best case, worst case, or likely scenarios. This comprehensive scenario planning will help you stay prepared for any challenges and improve your decision-making.

Other than these steps you should make sure to plan for contingencies. Even though forecasts and projections give you a good idea of where you’re likely headed, they can’t predict the future. The world of finance especially is full of uncertainties, and a business should be prepared for them.

Make sure you have a decently sized cash reserve during slow periods or market downturns. Other things include making sure you have access to quick credit lines and liquid assets. Remember that financial planning doesn’t just stop after you craft the document. It is a continuous process, which means you should monitor and review your plan regularly and accordingly make adjustments.

Individual vs. Business Financial Plans

Here is how a business financial plan differs from that of an individual:

Conclusion:

Every business financial plan should clearly state three things – How the business will make its money, what it needs to do to achieve its goals, and its operational budget. We’ve seen the many benefits of a business financial plan, and how assessment, financial goals, budgeting, and projections can help you craft one. We’ve also seen that financial planning for business is a lot more complex and bigger in scope than individual financial planning. As a business owner, you will be answerable to your investors, employees, banks, and other stakeholders, so your financial plan needs to be transparent and have a solid base.

It would be wise for any business owner to consult with a business financial advisor. This professional guidance can provide valuable insights and expertise while crafting a comprehensive financial plan that is suited to your specific industry, goals, and competition. Their expertise will also help you with other aspects, such as risk management, investment decisions, and your optimising capital structure. By having them by your side, you can make informed decisions, and ensure the financial stability and growth of your business.

You Might Also Like

Gold VS Silver: Which is Better as an Investment?

How to Start Financial Planning in Your 40s?

What Are Some Golden Rules Of Financial Planning/Investment Strategies?

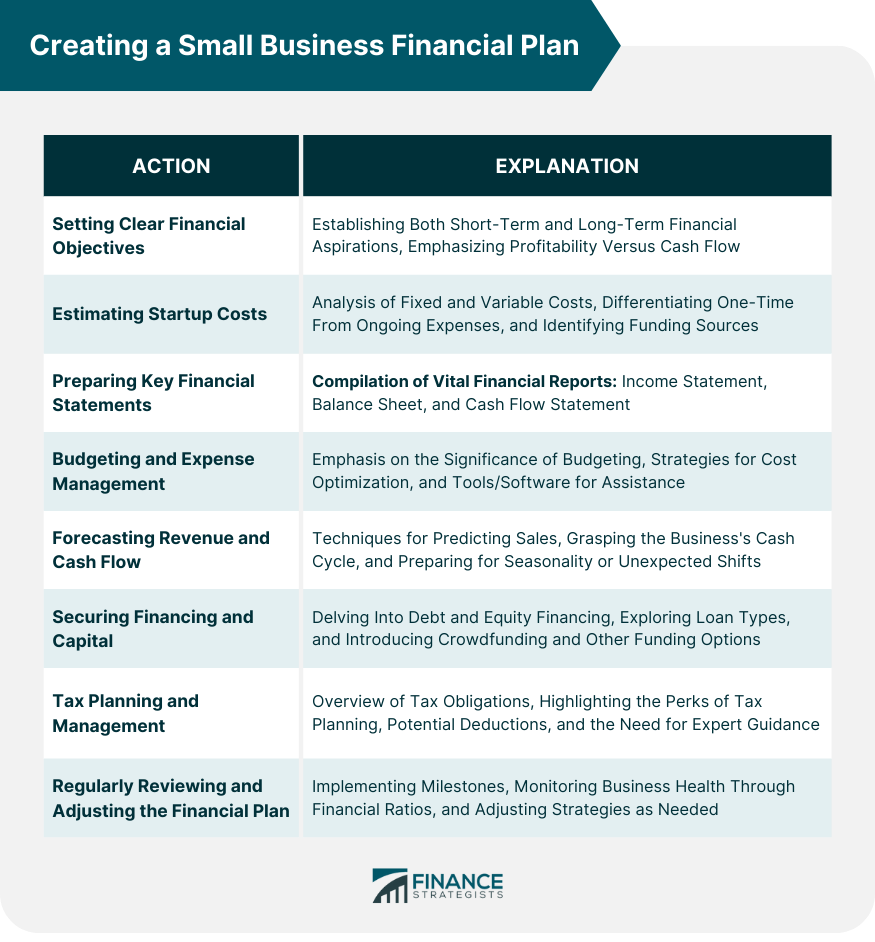

- Creating a Small Business Financial Plan

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 02, 2023

Get Any Financial Question Answered

Table of contents, financial plan overview.

A financial plan is a comprehensive document that charts a business's monetary objectives and the strategies to achieve them. It encapsulates everything from budgeting and forecasting to investments and resource allocation.

For small businesses, a solid financial plan provides direction, helping them navigate economic challenges, capitalize on opportunities, and ensure sustainable growth.

The strength of a financial plan lies in its ability to offer a clear roadmap for businesses.