Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Private Equity Interviews 101: How to Win Offers

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Private equity interviews can be challenging, but for most candidates, winning interviews is much tougher than succeeding in those interviews.

You do not need to be a math genius or a gifted speaker; you just need to understand the recruiting process and basic arithmetic.

Still, there is more to PE interviews than “2 + 2 = 4,” so let’s take a detailed look at the process:

How to Network and Win Private Equity Interviews

The Private Equity recruiting process differs dramatically depending on your current job and location.

Here are the two extremes:

- Investment Banking Analyst at a Bulge Bracket or Elite Boutique in New York: The process will be highly structured, and interviews will finish at warp speed. In some ways, your bank, group, and academic background matter more than your skill set or deal experience. This one is known as the “on-cycle” process.

- Non-Banker in Another Part of the U.S. or World: The process will be far less structured, it may extend over many months, and your skill set and deal/client experience will matter a lot more. This one is known as the “off-cycle” process.

If you’re in between these categories, the process will also be in between these extremes.

For example, if you’re at a smaller bank in NY, you may complete some on-cycle interviews, but you will almost certainly also go through the off-cycle process at smaller firms.

If you’re in London, there will also be a mix of on-cycle and off-cycle processes, but they tend to start later and move more slowly than the ones in NY.

We have covered PE recruiting previously ( overall process and what to expect in the on-cycle process ), so I am not going to repeat everything here.

Interviews in both on-cycle and off-cycle processes test similar topics , but the importance of each topic varies.

The timing of interviews and start dates, assuming you win offers, also differs.

The Overall Private Equity Interview Process

Regardless of whether you recruit in on-cycle or off-cycle processes, or a combination of both, almost all PE interviews have the following characteristics in common:

- Multiple Rounds: You’ll almost always go through at least 2-3 rounds of interviews (and sometimes many more!) where you speak with junior to senior professionals at the firm.

- Topics Tested: You’ll have to answer fit/background questions, technical questions, deal/client experience questions, questions about the firm’s strategies and portfolio, market/industry questions, and complete case studies and modeling tests.

The differences are as follows:

- Timing and Time Frame: If you’re at a BB/EB bank in NY, and you interview with mega-funds, the process starts and finishes within several months of your start date at the bank (!), and it moves up earlier each year. Interviews at the largest firms start and finish in 24-48 hours, with upper-middle-market and middle-market firms beginning after that.

By contrast, interviews start later at smaller PE firms, and the entire process may last for several weeks up to several months.

- Importance of Topics Tested: At large funds and in the on-cycle process, you need to complete modeling tests quickly and accurately and spin your pitches and early-stage deals into sounding like real deals; at smaller funds and in off-cycle interviews, the reasoning behind your case studies/modeling tests and your real experience with clients and deals matter more.

Firm-specific knowledge and fitting your investment recommendations to the firm’s strategies are also more important.

- Start Date: You interview far in advance if you complete the on-cycle process, and if you win an offer, you might start 1.5 – 2.0 years later. With the off-cycle process, you start right away or soon after you win the offer.

Private Equity Interview Topics

There is not necessarily a correlation between the stage of interviews and the topics that will come up.

You could easily get technical questions early on, and you’ll receive fit/background and deal experience questions throughout the process.

Case studies and modeling tests tend to come up later in the process because PE firms don’t want to spend time administering them until you’ve proven yourself in previous rounds.

However, there are exceptions even to that rule: For example, many funds in London start the process with modeling tests because there’s no point interviewing if you can’t model.

Here’s what to expect on each major topic:

Fit/Background Questions: “Why Private Equity?”

The usual questions about “ Why private equity ,” your story , your strengths/weaknesses , and ability to work in a team will come up, and you need answers for them.

We have covered these in previous articles, so I’ve linked to them above rather than repeating the tips here.

Since on-cycle recruiting takes place at warp speed, you’ll have to draw on your internship experience to come up with stories for these questions, and you’ll have to act as if PE was your goal all along.

By contrast, if you’re interviewing for off-cycle roles, you can use more of your current work experience to answer these questions.

While these questions will always come up, they tend to be less important than in IB interviews because:

- In on-cycle processes, it’s tough to differentiate yourself – everyone else also did multiple finance internships and just started their IB roles.

- They care more about your deal experience, whether real or exaggerated, in both types of interviews.

Technical Questions For PE

The topics here are similar to the ones in IB interviews: Accounting, equity value and enterprise value , valuation/DCF, merger models, and LBO models.

If you’re in banking, you should know these topics like the back of your hand.

And if you’re not in banking, you need to learn these topics ASAP because firms will not be forgiving.

There are a few differences compared with banking interviews:

- Technical questions tend to be framed in the context of your deal experience – instead of asking generic questions about the WACC formula , they might ask how you calculated it in one specific deal.

- More critical thinking is required. Instead of asking you to walk through the financial statements when Depreciation changes, they might describe companies with different business models and ask how the financial statements and valuation would differ.

- They focus more on LBO models, quick IRR math , and your ability to judge deals quickly.

Most interviewers use technical questions to weed out candidates , so poor technical knowledge will hurt your chances, but exceptional knowledge won’t necessarily get you an offer.

Talking About Deal/Client Experience

This category is huge, and it presents different challenges depending on your background.

If you’re an Analyst at a large bank in New York, and you’re going through on-cycle recruiting, the key challenge will be spinning your pitches and early-stage deals into sounding like actual deals.

If you’re at a smaller bank, and you’re going through off-cycle recruiting, the key challenge will be demonstrating your ability to lead, manage, and close deals .

And if you’re not in investment banking, the key challenge will be spinning your experience into sounding like IB-style deals.

Regardless of your category, you’ll need to know the numbers for each deal or project you present, and you’ll need a strong “investor’s view” of each one.

That’s quite a bit to memorize, so you should plan to present, at most, 2-3 deals or projects.

You can create an outline for each one with these points:

- The company’s industry, approximate revenue/EBITDA, and multiples (or, for non-deals, estimated costs and benefits).

- Whether or not you would invest in the company’s equity/debt or acquire it (or, for non-deals, whether or not you’d pursue the project).

- The qualitative and quantitative factors that support your view.

- The key risk factors and how you might mitigate them.

If you just started working, pick 1-2 of your pitches and pretend that they have progressed beyond pitches into early-stage deals.

Use Capital IQ or Internet research to generate potential buyers or investors, and use the company-provided pitch materials to come up with your projections for the potential stumbling blocks in the transaction.

For your investment recommendation, imagine that each deal is a potential LBO, and build a quick, simple model to determine the rough numbers, such as the IRR in the baseline and downside cases.

For the risk factors, reverse each model assumption (such as the company’s revenue growth and margins) and explain why your numbers might be wrong.

If you’re in the second or third categories above – you need to show evidence of managing/closing deals or evidence of working on IB-style deals – you should still follow these steps.

But you need to highlight your unique contributions to each deal, such as a mistake you found, a suggestion you made that helped move the financing forward, or a buyer you thought of that ended up making an offer for the seller.

If you’re coming in with non-IB experience, such as internal consulting , still use the same framework but point out how each project you worked on was like a deal.

You had to win buy-in from different parties, get information from groups at the company, and justify your proposals by pointing to the numbers and qualitative factors and addressing the risk factors.

Firm Knowledge

Understanding the firm’s investment strategies, portfolio, and exits is very important at smaller firms and in off-cycle processes, and less important in on-cycle interviews at mega-funds.

If you have Capital IQ access, use it to look up the firm.

If not, go to the firm’s website and do extensive Google searches to find the information.

Finding this information should not be difficult, but the tricky point is that firms won’t necessarily evaluate your knowledge by directly asking about it.

Instead, if they give you a take-home case study, they might judge your responses based on how well your investment thesis lines up with theirs.

For example, if the firm makes offline retailers more efficient via cost cuts and store divestitures, you should not present an investment thesis based on overseas expansion or roll-ups of smaller stores.

If they ask for an investor’s view of one of your deals, they might judge your answer based on your ability to frame the deal from their point of view.

For example, if the firm completes roll-ups in fragmented industries, you should not look at a standard M&A deal you worked on and say that you’d acquire the company because the IRR is between XX% and YY% in all scenarios.

Instead, you should point out that with several roll-ups, the IRR would be between XX% and YY%, and even in a downside case without these roll-ups, the IRR would still be at least ZZ%, so you’d pursue the deal.

Market/Industry

In theory, private equity firms should care about your ability to find promising markets or industries.

In practice, open-ended questions such as “Which industry would you invest in?” are unlikely to come up in traditional PE interviews.

If they do come up, they’ll be in response to your deal discussions, and the interviewer will ask you to explain the upsides and downsides of your company’s industry.

These questions are more likely in growth equity and venture capital interviews, so you shouldn’t spend too much time on them if your goal is traditional PE (for more on these fields, see our coverage of venture capital interview questions and the venture capital case study ).

And even if you are interviewing for growth equity or VC roles, you can save time by linking your industry recommendations to your deal experience.

Case Studies and Modeling Tests

You will almost always have to complete a case study or modeling test in PE interviews, but the types of tests span a wide range.

Here are the six most common ones, ranked by rough frequency:

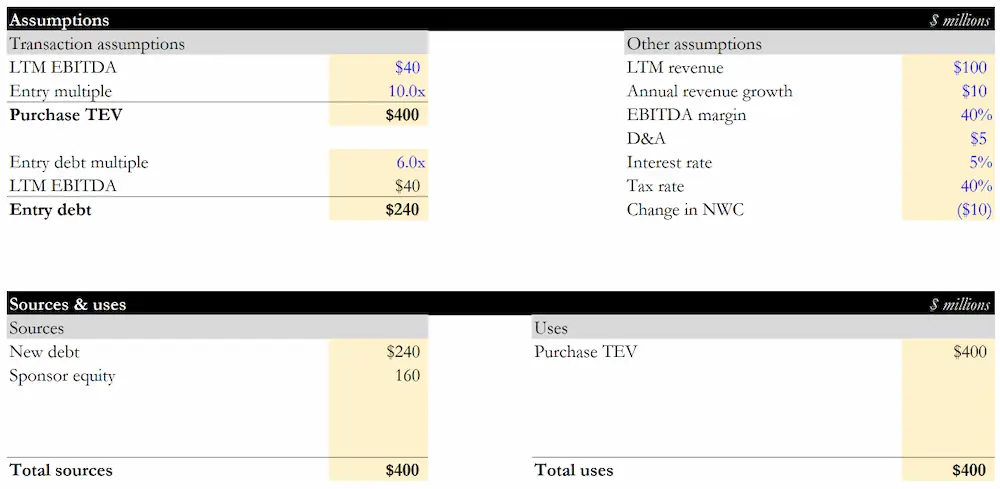

Type #1: “Mental” Paper LBO

This one is closer to an extended technical question than a traditional case study.

To answer these questions, you need to know how to approximate IRR, and you need practice doing the mental math.

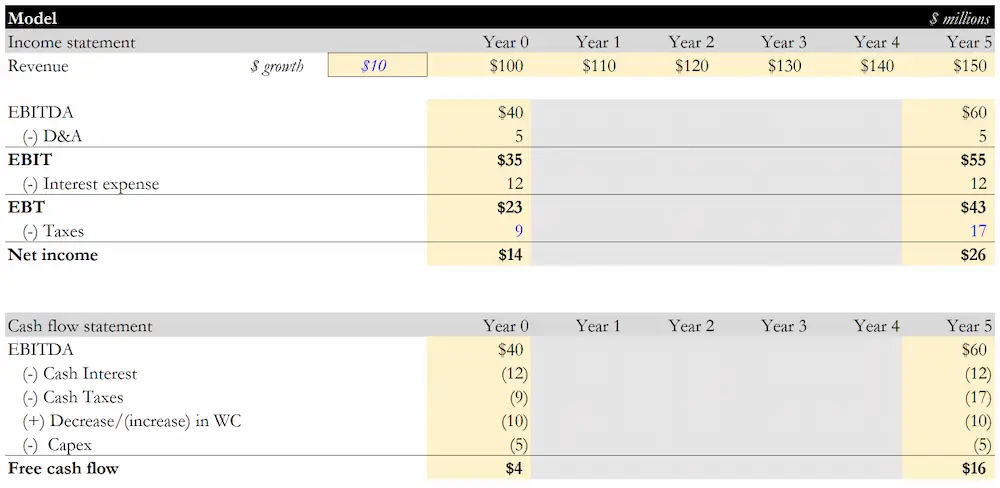

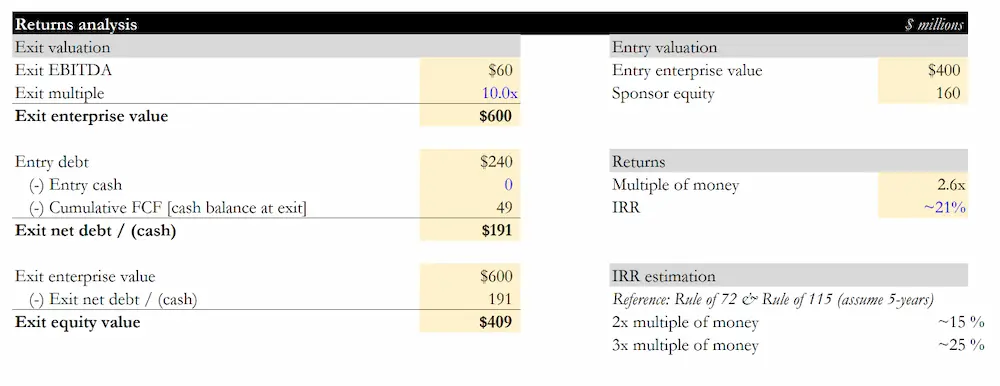

The interviewer might ask something like, “A PE firm acquires a $150 EBITDA company for a 10x multiple using 60% Debt. The company’s EBITDA increases to $200 by Year 3, $225 by Year 4, and $250 by Year 5, and it pays off all its Debt by Year 3.

The PE firm sells its stake evenly over Years 3 – 5 at a 10x EBITDA multiple. What’s the approximate IRR?”

Here, the Purchase Enterprise Value is $1.5 billion, and the PE firm contributes 40% * $1.5 billion = $600 million of Investor Equity.

The “average” amount of proceeds is $225 * 10 = $2,250, and the “average” Exit Year is Year 4 (no need to do the full math – think about the numbers – and all the Debt is gone).

So, the PE firm earns $2,250 / $600 = 3.75x over 4 years. Earning 3x in 3 years is a ~45% IRR, so we’d expect the IRR of a 3.75x multiple in 4 years to be a bit less than that.

To approximate a 4x scenario, we could take 300%, divide by 4 years, and multiply by ~55% to account for compounding.

That’s ~41%, and the actual IRR should be a bit lower because it’s a 3.75x multiple rather than a 4.00x multiple.

In Excel, the IRR is just under 40%.

Type #2: Written Paper LBO

The idea is similar, but the numbers are more involved because you can write them down, and you might have 30 minutes to come up with an answer.

You can get a full example of a paper LBO test, including the detailed solutions, here .

You can also check out our simple LBO model tutorial to understand the ropes.

With these case studies, you need to start with the end in mind (i.e., what multiple do you need for an IRR of XX%) and round heavily so you can do the math.

Type #3: 1-3-Hour On-Site or Emailed LBO Model

These case studies are the most common in on-cycle interviews because PE firms want to finish quickly.

And the best way to do that is to give all the candidates the same partially-completed template and ask them to finish it.

You may have to build the model from scratch, but it’s not that likely because doing so defeats the purpose of this test: efficiency.

You’ll almost always receive several pages of instructions and an Excel file, and you’ll have to answer a few questions at the end.

The complexity varies; if it’s a 1-hour test, you probably won’t even build a full 3-statement model .

They might also ask you to use a cash-free debt-free basis or a working capital adjustment to tweak the Sources & Uses slightly.

If it is a 3-hour test, a 3-statement model is more likely (the other parts of the model will be simpler in this case).

Here’s a free example of a timed LBO modeling test ; we have many other examples in the IB Interview Guide and Core Financial Modeling course .

IB Interview Guide

Land investment banking offers with 578+ pages of detailed tutorials, templates and sample answers, quizzes, and 17 Excel-based case studies.

Type #4: Take-Home LBO Model and Presentation

These case studies are open-ended, and in most cases, you will not get a template to complete.

The most common prompts are:

- Build a model and make an investment recommendation for Portfolio Company X, Former Portfolio Company Y, or Potential Portfolio Company Z.

- Pick any company you’re interested in, build a model, and make an investment recommendation.

With these case studies, you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model.

You might have 3-7 days to complete this type of case study and present your findings.

You might be tempted to use that time to build a complex LBO model, but that’s a mistake for three reasons:

- The smaller firms that give open-ended case studies tend not to use that much financial engineering.

- No one will have time to review or appreciate your work.

- Your time would be better spent on industry research and coming up with a sold investment thesis, risk factors, and mitigants.

If you want an example of an open-ended exam like this, see our private equity case study article and follow the video walkthrough or article text.

Your model could be shorter, and your presentation could certainly be shorter, but this is a good example of what to target if you have more time/resources.

Type #5: 3-Statement/Growth Equity Model

At operationally-focused PE firms, growth equity firms, and PE firms in emerging markets such as Brazil , 3-statement projection modeling tests are more common.

The Atlassian case study is a good example of this one, but I would change a few parts of it (we ignored Equity Value vs. Enterprise Value for simplicity, but that was a poor decision).

Also, you’ll never have to answer as many detailed questions as we did in that example.

If you think about it, a 3-statement model is just an LBO model without debt repayment – and the returns are based on multiple expansion, EBITDA growth, and cash generation rather than debt paydown .

You can easily practice these case studies by picking companies you’re interested in, downloading their statements, projecting them, and calculating the IRR and multiples.

Type #6: Consulting-Style Case Study

Finally, at some operationally-focused PE firms, you could also get management consulting-style case studies, where the goal is to advise a company on an expansion strategy, a cost-cutting initiative, or pricing for a new product.

We do not teach this type of case study, so check out consulting-related sites for examples and exercises.

And keep in mind that this one is only relevant at certain types of firms; you’re highly unlikely to receive a consulting-style case study in standard PE interviews.

A Final Word On Case Studies

I’ve devoted a lot of space to case studies, but they are not as important as you might think.

In on-cycle processes, they tend to be a “check the checkbox” item: Interviewers use them to verify that you can model, but you won’t stand out by using fancy Excel tricks.

Arguably, they matter more in off-cycle interviews since you can present unique ideas more easily and demonstrate your communication skills in the process .

What NOT to Worry About In PE Interviews

The topics above may seem overwhelming, so it’s worth pointing out what you do not need to know for interviews.

First, skip super-complex models.

As a specific example, the LBO models on Macabacus are overkill; they’re way too complicated for interviews or even the job itself.

You should aim for Excel files with 100-300 rows, not 1,000+ rows, and skip points like circular references unless they specifically ask for them (for more, see our tutorial on how to remove circular references in Excel )

Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm.

Finally, you don’t need to know about the history of the private equity industry or much about PE fund economics beyond the basics.

Your time is better spent learning about a firm’s specific strategy and portfolio.

PE Interview X-Factor(s)

Besides the topics above, competitive tension can make a huge difference in interviews.

If you tell Firm X that you’ve already received an offer from Firm Y, Firm X will immediately become far more likely to give you an offer as well.

Even at the networking stage, competitive tension helps because you always want to tell recruiters that you’re also speaking with Similar Firms A, B, and C.

Also, leverage your group alumni and the 2 nd and 3 rd -year Analysts.

You can read endless articles online about interview prep, but nothing beats real-life conversations with others who have been through the process.

These alumni and older Analysts will also have example case studies they completed, and they can explain how to spin your deal experience effectively.

PE Interview Preparation

The #1 mistake in PE interviews is to focus excessively on modeling tests and technical questions and neglect your deal discussions.

You can avoid this, or at least resist the temptation, by turning your deals into case studies.

If you follow my advice to create simplified LBO models for your deals, you can combine the two topics and get modeling practice while you’re preparing your “investor’s views.”

If you’re working full-time in banking, use your downtime in between tasks to do this , outline your story , and review technical questions.

If you only have 10-15-minute intervals of downtime, break case studies into smaller chunks and aim to finish a specific part in each period.

Finally, start preparing before your full-time job begins .

You’ll have far more time before you start working, and you should use that time to tip the odds in your favor.

The Ugly Truth About PE Interviews

You can read articles like this one, memorize PE interview guides, and get help from dozens of bank/group alumni, but much of the process is still outside of your control.

For example, if you’re in a group like ECM or DCM , it will be tough to win on-cycle interviews at large firms and convert them into offers no matter what you do.

If the mega-funds decide to kick off recruiting one day after you start your full-time job in August, and you’re not prepared, too bad.

If you went to a non-target school and earned a 3.5 GPA, you’ll be at a disadvantage next to candidates from Princeton with 3.9 GPAs no matter what you do.

So, start early and prepare as much as you can… but if you don’t receive an offer, don’t assume it’s because you made a major mistake.

So You Get An Offer: What Next?

If you do receive an offer, you could accept it on the spot, or, if you’re speaking with other firms, you could shop it around and use it to win offers elsewhere.

If you’re not in active discussions with other firms, you’re crazy if you do not accept the offer right away.

If You Get No Offer: What Next?

If you don’t get an offer, follow up with your interviewers, ask for feedback, and ask for referrals to other firms that might be hiring.

If you did reasonably well but came up short in a few areas, you could easily get referrals elsewhere .

If you did not receive an offer because of something that you cannot fix, such as your undergraduate GPA or your previous work experience, you might have to consider other options, such as a Master’s, MBA, or another job first.

But if it was something fixable, you could take another pass at recruiting or keep networking with smaller firms.

To PE Or Not to PE?

That is the question.

And the answer is that if you have the right background, you understand the process, and you start preparing far in advance, you can get into the industry and win a private equity career .

And if not, there are other options, even if you’re an older candidate .

You may not reach the promised land, but at least you can blame it on someone else.

Additional Reading

You might be interested in:

- The Search Fund Internship: Perfect Pathway into Investment Banking and Private Equity Roles?

- Private Equity Analyst Roles: The Best Way to Skip Investment Banking?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

49 thoughts on “ Private Equity Interviews 101: How to Win Offers ”

Brian, What about personality tests? What is their importance in the overall hiring process eg if you get them as the last stage?

They’re not that important, and even if you do get them, you can’t really “prepare” in any reasonable way (barring a brain transplant to replace your personality and make it more suitable for the firm). It’s also highly unusual to get one in the final stage – a firm doing that is probably just paranoid that you are secretly a serial killer and they want to rule out that possibility.

Hey- for the Fromageries Bel case study, can’t quite make sense of the Tier 4 management incentive returns, what’s the calculation for each tier? Would think it’s Tier 2 less tier 1 * tier 1 marginal profit

Tier 4 is based on a percentage of all profits *above* a 2.5x equity multiple. Each tier below it is based on a percentage of profits between specific multiples, which correspond to specific EUR proceeds amounts.

I have an accounting background (CPA & several years removed from school) and a small amount of finance experience through internships. I’m interviewing for a PE analyst position and managed to get through the first round of interviews. The firm itself doesnt just hire guys with a few years of banking, their team is very diverse with some backgrounds similar to mine.

The first round interview was a mix of technical questions plus a lot about myself and my experience. No behavioral questions. The first round was with an associate for 30 minutes, the second round is an hour with a partner. I managed to answer a lot of the questions about LBO models and what types of companies are good LBO candidates. Thanks to your website for that.

Any advice for a second round interview for a guy like me who doesnt have deal making experience or much experience in finance? Will the subsequent interviews after the first round be more technical-based questions? Or do they lean more on technical questions in round 1 to weed out candidates?

They will usually become more fit-based if they’ve already asked a lot of technical questions in earlier rounds. I would focus on your story and answers to the Why PE / Why This Firm / Are you sure you want to switch?-type questions.

Is it likely too difficult to access the on-cycle process from the CLT office of an In-Between-a-Bank that it would make more sense to focus one’s energy on the MM/LMM? Is the new era of Zoom making geography/distance less of a factor or is the perceived prestige of NY still an obstacle?

Location is somewhat less of a factor now, but it still matters, and working from home will not continue indefinitely into the future. It will be very difficult to participate in on-cycle recruiting at the mega-funds if you’re working in Charlotte at Wells Fargo if that’s your question, but plenty of MM funds are realistic.

What are some of the larger funds that you would consider realistic?

There are dozens of funds out there (it’s not like bulge bracket banks or mega-fund PE firms where there’s only a defined set of 5-10), so I can’t really give you a specific answer. My recommendation would be to look up people who worked at WF on LinkedIn and see the types of funds they are now working at.

I remember I saw a video of yours (might have been YouTube) where you explained the PE process. You talked about do pe firms really add value and then you went over how when a pe firm buys a company, they do a little “trick” where they create a shell company to acquire the target so the debt isn’t on the pe firms books. I’ve been looking all over for this video. Do you know which video I’m referring to?

Yes, that is no longer in video form. It’s still in the written LBO guide but the video from the old course was removed because it was way too long and boring for a video and was better explained in text.

Hi Brian, can you elaborate more on ‘Understanding the firm’s investment strategies, portfolio, and exits’ when you talk about smaller firm and off-cycle processes, simliar point came up under *Type 5*: you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model. What exactly should I pay attention on? I felt funds I checked their investment strategy descirption are pretty broad, and they invest in various type of deals, say even in one industry, they do different purchase range. Also, when talking about growth equity, you mentioned you can practice case by picking companies you’re interested in, downloading their statements, projecting them. What if they are not public companies, how can I get those information? Are you recommending only those companies with 20F available? Or can you just elaborate more on how can I follow your instruction? Thanks

All you can do is go off their website and possibly a Capital IQ description if you have access. See if they focus on growth, leverage for mature companies, operational improvements, or add-on acquisitions and pick something that fits one of those.

You can pick public companies for growth equity or find a public company that is similar to a private one the firm has.

Hey Brian! I have an interview with a family office for a private equity analyst position. The firm is small and not much about it online. I haven’t had much time to prepare as it was not an interview I was expecting. What would you say the most important elements to focus on are for the interview considering the time constraint? I am an undergrad, third year, second internship. (first internship was for a large construction/developer as project coordinator, not finance based)

Focus on your story, the firm’s portfolio companies and strategies, and a few investment ideas you have for specific sectors. Technical questions are fine, but you probably won’t have much time to prepare at the last minute.

How would PE interviews / Technical questions look like for straight out of undergrad PE role look like

e.g Blackstone internships, Goldman Merchant Banking internships etc

Similar to IB ones, with a focus on LBOs?

Largely the same, but less emphasis on deal experience and deal-related questions at the undergraduate level. They may ask slightly more questions on LBOs, but at the undergrad level, they assume you know very little, so questions will span a wide range of topics.

Have you written or seen similar articles on PE operating partner interviews?

No, sorry. There’s hardly any information on that level of interview online because you can’t really make an interview guide or other product to prepare for it, and most people at that level would need 1-on-1 coaching more than a guide. My guess is that they will focus almost exclusively on your past experience turning around and growing businesses and assess how well you can do it for their portfolio companies. They’re not going to give you LBO modeling tests or case studies.

“Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm”

Could you please elaborate on this? Almost every IB interview includes brain teasers so I am wondering why a PE interview shouldn’t?

Brain teasers are not that common in IB interviews in most regions unless you count any math/accounting/finance question as a brain teaser. They are far more common in S&T, quant fund, and prop trading interviews.

The point of this statement is that it’s OK if an occasional brain teaser comes up, but if the interviewer asks you brain teasers for 30 minutes, which have exactly 0% correlation to the real work in PE, you should leave because it’s a sign that the people working at the firm are idiots who don’t know how to conduct proper interviews or test candidates.

This is helpful. I find myself at a fix, I do not think I have had the right exposure, although in a BB I support teams with standard materials in a particular industry group in M&A. However I have interviews with a top global PE next month. Any guidance on how should I prepare for it ?

Thanks in advance

Follow everything in this article… practice spinning/discussing your deals… practice LBO questions and simple case studies.

Brian – thank you for your concise and candid remarks. do you have any insights or advice for someone with 5yrs of BB ECM & DCM experience now at a top full-time MBA program looking to break in?

It’s going to be very difficult if you just have capital markets experience and you’re already in business school. You should probably move to an M&A or strong industry team at a large bank (BB or EB) after business school and then go into private equity from there. It’s tough, but still easier than trying to move into PE directly out of an MBA program with only capital markets experience.

My next interview will highly likely involve a statement/growth equity modeling case. I tried to find the Atlassian Case interview but i am unable to open the link.

Would it be possible to share an example case or more information on that topic?

Many thanks,

The Atlassian case study is all we have. I don’t know why you can’t open the files, but I just tried and they seemed to work. Maybe try again or use a different browser.

Hi M&I team,

I have an opportunity to interview for an Analyst level opening at a boutique PE fund. This is a shop that has just started operations so I am directly communicating with the Partner. I doubt they have any structured recruitment process at this stage of their existence. He asked me to send some written work (memos and spreadsheets) on any public listed co that demonstrates my understanding of investing (basic balance sheet analysis, ratio analysis, valuation multiples).

So I am just wondering what to do? Should I work on projections and prepare a DCF model or do something simpler? I’d really appreciate your guidance on this.

Thanks again for the amazing work you’ll have been doing!

Yes, just create simple projections, a simple valuation/DCF, and maybe a simple LBO model since it is a PE fund that intends to buy and sell companies.

Could you provide some advice for preparing interviews for principal investing role ?

Thank you in advance Laura

We don’t really focus on that, but the articles on private equity and funds of funds on this site might be helpful.

Just wanted to say thank you! After reading everything on this site including all the CV and interview material I have managed to transition from a second year engineering undergrad with no prior experience/spring weeks/insight days, into an intern at Aviva Investors (UK buy side) within the space of one year.

The information you have posted is invaluable and “breaking in” is definitely doable with the right mindset and appetite for rejections!

Thanks again.

Thanks! Congrats on your internship offer.

Hi Brian/Nicole – Im an Economics student from the UK in 3rd year out of a 4 year course at a semi-target college, with 2 finance internships done up until now(not FO). I plan on doing a Msc Finance when I finish and eventually break into IB or Sales/Trading (I know I still haven’t decided which one I really want more). Through a family friend I have an offer to do a short internship this summer in NY in a post-trade regulatory commission. As this isn’t actually sitting at a trading desk experience, or anything related to IB should I decide to go down that road, would this add genuine value to my CV ? How are internships in regulatory commissions looked at for students looking to break into sales/trading? Surely even having any NY Finance experience on the CV will add more substance over here in London when going for internships compared to the majority of UK students who don’t? Appreciate any advice on this matter, Thanks!

I don’t think it would help much because you already have 2 non-FO internships, and a regulatory internship would be yet another non-FO internship. If it’s your best option, you can take it, but you would be better off getting something closer to a real front-office role.

Hey Brian. I am graduating after this semester going into Management consulting (Deliote, AT Kearny, Accenture)but I’m hoping to make a switch into either IB or PE after a couple years. I have one search fund internship which was enough to get me a few 1st and second round ib/pe FT interviews but no offers.My plan is to get into the best online MSF program I can and switch into Finance once I’m done. Do you think, given how close I was to getting in my 1st try, a high GPA from a reputable MSF and good experience in consulting will be enough or should I try to somehow get an IB internship before I apply?

I think you will probably need another internship just before the MSF starts or while it is in progress, not necessarily in IB, but something closer to it. Otherwise you’ll get a lot of questions about why you went from the search fund to consulting.

Thanks. As far as my story is concerned, is it better to do another finance internship before consulting so it’s search fund->ib->consulting->MSF (or MBA not sure)? I only ask because I may be able to get on some m&a projects with the consulting firm and my story could be when exposed to those deals, I realized how big my passion for finance was and that’s when I decided to get my MSF and switch to IB.

No, I think that would make less sense because then you would have to explain why you went from IB to consulting… and are now trying to go back to IB. Saying that you got exposed to M&A deals during the consulting experience would be a better story (and you would still ideally pair it with a transaction-related internship before/during the MSF).

Got it, thanks!

Probably missing something here, but for the first example, where does the 300% and 55% come from?

300% = 4x multiple. If compounding did not exist, we could just say 300% / 4 = 75% annual return. Because of compounding, however, the actual return does not need to be 75% per year in order for us to earn 300% by the end of 4 years. Instead, it can be a fair amount less than that, and we’ll still end up with 300% at the end.

To estimate the impact of compounding, you can multiply this 300% / 4 figure by a “compounding factor,” which varies based on the multiple and time period, but which is around 55% for a 4x return over a standard holding period.

Do you mind explaining how you can estimate a “compounding factor” such as with the 55% here?

There’s no easy-to-calculate-using-mental-math way to get this for all scenarios, but you can memorize quick rules of thumb (based on actual numbers and looking at the ratios) for 3 and 5-year periods and extrapolate from there. I don’t really think it’s worth doing that in-depth, though, because you just have to be roughly correct with these answers.

Do you think you will do a hedge fund interview guide similar to the one you have here?

Potentially, yes, but it’s much harder to give general guidelines for HF interviews because they’re completely dependent on your investment pitches. Also, interest in HFs has declined over the years (we no longer receive as many questions about them).

On that mental paper LBO question, how is the company able to pay off 900 of debt by year 3? It sounds like proceeds from the sale will have to be used in order to fully pay off the debt because EBITDA alone only adds up to 525, and that’s assuming there’s no interest.

Favorable working capital… NOLs… asset sales… the Konami code or other cheat codes. The point is not the numbers but the thought process.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Ace Your Private Equity Interviews

Our Interview Guide has 120+ pages of LBO instruction, deal discussions, LBO practice tests, personal pitch templates, and more.

How to prepare for the case study in a private equity interview

If you're interviewing for a job in a private equity firm , then you will almost certainly come across a case study. Be warned: recruiters say this is the hardest part of the private equity interview process and how you handle it will decide whether you land the job.

“The case study is the most decisive part of the interview process because it’s the closest you get to doing the job," says Gail McManus of Private Equity Recruitment. It's purpose is to make you answer one question: 'Would you invest in this company?'

In most cases, you'll be given a 'Confidential Information Memorandum' (CIM) relating to a company the private equity fund could invest in. You'll be expected to a) value the company, and b) put together an investment proposal - or not. Often, you'll be allowed to take the CIM away to prepare your proposal at home.

“The case study is still the most decisive element of the recruitment process because it’s the closest you get to actually doing the job. Candidates can win or lose based on how they perform on case study. People who are OK in the interview can land the job by showing the quality of their thinking, ” says McManus. “You need to show that you can think, and think like an investor.”

"The end decision [on whether to invest] is not important," says one private equity professional who's been through the process. "The important thing is to show your thinking/logic behind answer."

Preparing for a PE case study has distinctive challenges for consultants and bankers. If you're a consultant, you need to, "make a big effort to mix your strategic toolkit with financial analysis. You need to prove that you can go from a strategic conclusion to a finance conclusion," says one PE professional. Make sure you're totally familiar with the way an LBO model works.

If you're a banker, you need to, "make a big effort to develop your strategic thinking," says the same PE associate. The fund you're interviewing with will want to see that you can think like an investor, not just a financier. "Reaching financial conclusions is not enough. You need to argue why certain industry is good, and why you have a competitive advantage or not. Things can look good on paper, but things can change from a day to another. As a PE investor, hence as a case solver, you need to highlight and discuss risks, and whether you are ready or not to underwrite them."

Kadeem Houson, partner at KEA consultants, which specialises in hiring junior to mid-level PE professionals, says: “If you’re a banker you’re expected to have great technical skills so you need to demonstrate you can think commercially about the numbers you plugged in. Conversely, a consultant who is good at blue sky thinking might be pressed more on their understanding of the model. Neither is better or worse – just be conscious of your blank spots.”

A good business versus a good investment

For McManus, one of the most important things to consider when looking at the case study is to understand the difference between a good business and a good investment. The difference between a good business and a good investment is the price. So you might have a great business but if you have to pay hugely for it it might not be a great business. Conversely you can have a so-so business but if you get it a good price it might make a great investment. “

McManus says as well as understanding the difference between a good business and a good investment, it’s important to focus on where the added value lies. This has become a critical element for private equity firms to consider as competition for assets has become even more fierce, given the amount of dry powder that funds now have at their disposal through a wide array of funds. “Because of the competition for transactions generally you have to overpay to win a deal. So in the case study it’s really important you think about where the value creation opportunity lies in this business and what the exit would be,” says McManus.

She advises candidates to be brave and state a specific price, provided you can demonstrate how you’ve arrived at your answer.

Another private equity professional says you shouldn't go out on a limb, though, and you should appear cautious: "Keep all assumptions conservative at all times so as not to raise difficult questions. Always highlight risks, downsides as well as upsides."

Research the fund – find the angle

One private equity professional says that understanding why an investment might suit a particular firm could prove to be a plus. Prior to the case study, check whether the fund favours a particular industry sector, so that when it comes to the case study, you can add that to the investment thesis. “This enables you to showcase you have read up on the firm’s strategy/unique characteristics Something that would make it more likely for the fund you’re interviewing with winning the deal in what’s a very competitive market, said the PE source, who said this knowledge made him stand out.

However, the primary purpose of the case study is to test the quality of your thinking - it is not to test you on your knowledge of the fund. “Knowing about the fund will tick an extra box, but the case study is about focusing on the three most critical things that will drive the investment decision,” says McManus.

You need to think through these questions and issues:

We spoke to another private equity professional who's helpfully prepared a checklist of points to think about when you're faced with the case study. "It's a cheat sheet for some of my friends," he says.

When you're faced with a case study, he says you need to think in terms of: the industry, the company, the revenues, the costs, the competition, growth prospects, due dliligence, and the transaction itself.

The questions from his checklist are below. There's some overlap, but they're about as thorough as you can get.

When you're considering the industry, you need to think about:

- What the company does. What are its key products and markets? What's the main source of demand for its products?

- What are the key drivers in that industry?

- Who are the market participants? How intense is the competition?

- Is the industry cyclical? Where are we in the cycle?

- Which outside factors might influence the industry (eg. government, climate, terrorism)?

When you're considering the company, you need to think about:

- Its position in the industry

- Its growth profile

- Its operational leverage (cost structure)

- Its margins (are they sustainable/improvable)?

- Its fixed costs from capex and R&D

- Its working capital requirements

- Its management

- The minimum amount of cash needed to run the business

When you're considering the revenues, you need to think about:

- What's driving them

- Where the growth is coming from

- How diverse the revenues are

- How stable the revenues are (are they cyclical?)

- How much of the revenues are coming from associates and joint ventures

- What's the working capital requirement? - How long before revenues are booked and received?

When you're considering the costs, you need to think about:

- The diversity of suppliers

- The operational gearing (What's the fixed cost vs. the variable cost?)

- The exposure to commodity prices

- The capex/R&D requirements

- The pension funding

- The labour force (is it unionized?)

- The ability of the company to pass on price increases to customers

- The selling, general and administrative expenses (SG&A). - Can they be reduced?

When you're considering the competition, you need to think about:

- Industry concentration

- Buyer power

- Supplier power

- Brand power

- Economies of scale/network economies/minimum efficient scale

- Substitutes

- Input access

When you're considering the growth prospects, you need to think about:

- Scalability

- Change of asset usage (Leasehold vs. freehold, could manufacturing take place in China?)

- Disposals

- How to achieve efficiencies

- Limitations of current management

When you're considering the due diligence, you need to think about:

- Change of control clauses

- Environmental and legal liabilities

- The power of pension schemes and unions

- The effectiveness of IT and operations systems

When you're considering the transaction, you need to think about:

- Your LBO model

- The basis for your valuation (have you used a Sum of The Parts (SOTP) valuation or another method - why?)

- The company's ability to raise debt

- The exit opportunities from the investment

- The synergies with other companies in the PE fund's portfolio

- The best timing for the transaction

BUT: keep things simple.

While this checklist is important as an input and a way to approach the task, w hen it comes to presenting the information, quality beats quantity. McManus says: “The main reason why people aren’t successful in case studies is that they say too much. What you’ve got to focus on is what’s critical, what makes a difference. It’s not about quantity, it’s about quality of thinking. If you do 30 strengths and weaknesses it might only be three that matter. It’s not the analysis that matters, but what’s important from that analysis. What’s critical to the investment thesis. Most firms tend to use the same case study so they can start to see what a good answer looks like.”

Houson agrees that picking out the most important elements in the case study are more important than spending too much time on an elaborate model. “You don’t necessarily need to demonstrate such technical prowess when it comes to building the model. But you need to be comfortable about being challenged around the business case. Frankly it’s better to go for a simple answer which sparks a really interesting conversation rather than something that is purely judged from a technical standpoint. The model is meant to inform the discussion, not be the discussion itself.”

Softer factors such as interpersonal skills are also important because if the case study is the closest thing you’ll get to doing the job, then it’s also a measure of how you might behave in a live situation. McManus says: “This is what it will be like having a conversation at 11am with your boss having been given the information memorandum the day before. Not only are the interviewers looking at how you approach the case study, but they’re also looking at whether they want to have this conversation with you every Tuesday morning at 11am.”

The exercise usually takes around four hours if you include the modelling aspect, so there is time pressure. “Top tips are to practice how to think in a way that is simple, but fit for purpose. Think about how to work quickly. The ability to work under pressure is still important,” says Houson.

But some firms will allow you do complete the CIM over the weekend. In that case on one private equity professional says you should get someone who already works in PE to check it over for you. He also advises getting friends who've been through case study interviews before to put you through some mock questions on your presentation.

But McManus says this can lead to spending too much time and favours the shorter method. “It’s fairer and you can illustrate the quality of your thinking over a short space of time.”

The case study is conducted online, and because of Covid, so too are many of the follow-up discussions, so it’s worth thinking about how to present yourself on zoom or Teams. “Although a lot of these case studies over the last couple of years have been done remotely, in many ways that’s even more reason to try to bring out a bit of engagement and personality with the people you’re talking to."

“ There’s never a right or wrong answer. Rather it’s showing your thinking and they like to have that discussion with you. It’s the nearest you get to doing the job. And that cuts both ways – if you don’t like the case study, you won't like doing the job. “

Contact: [email protected] in the first instance. Whatsapp/Signal/Telegram also available (Telegram: @SarahButcher)

Bear with us if you leave a comment at the bottom of this article: all our comments are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it may take a while for your comment to appear. Eventually it will – unless it’s offensive or libelous (in which case it won’t.

Photo by Adam Kring on Unsplash

Sign up to Morning Coffee!

The essential daily roundup of news and analysis read by everyone from senior bankers and traders to new recruits.

Boost your career

"My daughter is very unhappy with her Goldman Sachs bonus"

Reflections of a banking MD: "20 years of 70-90 hour weeks; six million air miles"

Edward Ruff, 40 year-old Citigroup MD accused of shouting at juniors, had a rough start

Multiple banks cutting jobs after 'lowest bonuses for a decade'

Goldman Sachs' potential next CEO has 5 children & a wife who's best friends with Gwyneth

Deutsche Bank rates traders live in fear of their great leader leaving

Franck Dargent, the French banker who sent allegedly indecent messages, lost everything

High frequency trading firms are hiring video game CEOs and ex-UBS directors

Ex-JPMorgan product VP in fintech critiques the bank's newest innovation

Morning Coffee: Goldman Sachs' ex-Partner's unofficial guide to surviving the grind of banking jobs. Sam Bankman-Fried's "life of delusion" laid bare

Related articles

How to move from banking to private equity, by a former associate at Goldman Sachs

The banks with the best and worst working hours

Private equity pay: where the money has been made

Standard Chartered's changes include a warning on how not to advance your career

- How To Prepare For A Private...

How To Prepare For A Private Equity Case Study Interview

Over the last couple of weeks, hiring within private equity funds has certainly slowed down. However, there are some funds that are continuing with their hiring plans and where possible looking at starting candidates remotely. Therefore, if you are a candidate looking to make a move to the buy-side, one thing is for certain; the number of jobs available has reduced and your competition has increased for the available jobs.

Most candidates who are looking to move to the buy-side are worried about the case study rounds of the interview process. It is also the stage where you commit the most amount of your time and will form a significant part of the firms hiring decision on your application.

As a result, I thought I would share some useful tips for the case study round for candidates still interviewing or looking to resume their search once the COVID-19 crisis is behind us.

Make a decision.

Candidates are sometimes too concerned with making the wrong suggestion to invest or not, some even avoid deciding all together or decide with several caveats. This is not going to work. There is no harm in highlighting a key risk, or at least you should think of the risks for when you are questioned on the investment. Decide, have an opinion and show logic behind that opinion. The last point is crucial. You will feel under pressure, perhaps run out of time and might not get everything right. But what you have done, it needs to make sense. I had one client that said they don’t mind if a candidate doesn’t finish a case study, if what they have done shows their thinking is along the right path. Some candidates under pressure and running out of time have guessed, made poor assumptions and both are hard to justify. Use your common sense. It’s important to state, whilst some firms don’t mind if the case study is not finished, all will expect you have got far enough to form an investment decision.

Modeling isn’t everything.

Looking for a job in private equity without solid LBO modeling skills is probably not going to work. A fund doesn’t have time to train you in basic modeling, so you need to make sure you have practised this. However, in case studies I have known candidates spend too long on the modeling section and over complicate this aspect, to the point that it impacts their ability to finish the case study. The model should guide your investment recommendation, but you will have to analyse several topics in detail that the model doesn’t show. Which ultimately will make the decision to invest or not. A candidate who produces an excellent model but has not thought out their investment decision and isn’t succinct in their presentation is unlikely to get the job. Leave yourself time to think how you are going to articulate your decision. Funds want concise, structured and logical recommendations. Some funds will forgive slight errors in your modeling work if the rest of the interview goes well.

Investor mindset.

Following on from how modeling isn’t everything, you need to be able to demonstrate you have an investor mindset. Most candidates for a Private Equity role will be coming from M&A teams in Investment Banks, where the work usually stops once the acquisition is complete and it’s onto the next deal. Private Equity is all about the long term and how that business is going to perform over typically a 3-5-year period and ultimately how the fund is going to get their exit from that investment. You need to demonstrate you have considered factors which are going to impact the business performance during that period (management team, customer base, competitors, location etc)

Think of the firm.

Just because an investment in the case study could appear attractive from a return’s perspective, think of the firm you are interviewing for and does it fit into their investment strategy. Research their current investments and if you are interviewing for a sector specific fund, make sure you understand key ratios and multiples used in that sector. I had a candidate interview for a special situations fund and whilst the case study from a technical perspective went well, they felt the candidate lacked genuine enthusiasm for special situations and it came across as this is one of many different avenues the candidate is considering. This will not be enough in most circumstances.

So, if you are currently going through an interview process with a fund, I hope the above is helpful for preparing for case studies. If you have any future questions about how to prepare for the case study in a private equity interview, contact our team for more information.

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- What’s included

- Value & Prices

PRIVATE EQUITY INTERVIEW

Master private equity interviews from elite pros.

7 modules with countless real-life interview cases and questions to help you on the buy-side and start making over $250,000/yr.

- Elite Modeling Program (6 Courses)

- Foundations Program (4 Courses)

- Advanced Industry Modeling (10 Courses)

- 20+ Course Certifications

- Entry Level Interview Courses

- Advanced Interview Courses

- Interview Database Access (32,543 Questions)

- Salary Database Access (53,254 Data Points)

- Skip WSO Academy Waitlist

Course Overview

To make sure you are one of the 1% of PE applicants that gets the job, this course contains 15+ hours of LBO modeling tests, detailed information about the industry, interview Q&As, and networking tips. By the end of this, you will know how to build connections and ace interviews!

Who is this Course for?

Motivated investment bankers, consultants, and MBA students looking to break into private equity

Professionals looking to prepare for the recruiting process and transition to a career in private equity

Key Outcomes

Show your mastery in lbo modeling tests.

In this course, you will master the theory and practical skills behind the different LBO modeling tests required to ace your private equity interview.

Unlocking the Door to Private Equity Success

After completing the Private Equity Interview Course, you'll have a strong edge over other candidates in landing a position in private equity.

Boost Your Confidence and Earnings Potential

Once you finish this course, you'll feel more confident in your private equity interviews, which will increase your odds of a move to the buy-side and earning a higher salary.

This course has helped our students and young professionals land and thrive at positions across all top Private Equity firms, including:

WHAT’S INCLUDED

A step-by-step course to help you ace your private equity interviews.

Module 1: Interview Questions

In this module, we cover three crucial question categories: Technical, Fit, and Brainteasers. This module also includes our proprietary Flashcards feature to gain access to 30,000+ interview questions filtered by firm, group, and much more.

Module 2: LBO Modeling Tests

In this module, we'll help you master all the types of LBO modeling tests that you can expect in your PE interviews. We take you in-depth through multiple LBO modeling tests to ensure you get the reps in to excel at them.

Module 3: Case Studies

We teach you how to create an LBO model using the information provided (such as an annual report and due diligence reports) in an interview and present the outcome in a PowerPoint presentation and ace the case study portion of your interview.

Module 4: Interview Process Support Materials

In this module, we teach you various important concepts (such as the various kinds of debts and valuation methods) to help you show your interviewers that you have in-depth knowledge of the private equity industry.

Module 5: Recruiting Overview

In this section, we are going to talk about the different career paths that you can pursue within private equity. Whether you're starting with an undergraduate degree or planning to pursue an MBA and beyond, there are exciting paths to explore.

Module 6: PE Deal Lifecycle

In this module, you'll discover the intricacies of a PE deal lifecycle. From the standard deal process to deal selection, deal funnel, and deal lifecycle, this module content equips you with the knowledge to excel in the dynamic world of private equity.

Module 7: PE Industry Backdrop

In this module, we focus on how the PE industry evolved and developed over time. We also take a closer look at the industry's structure, including the various types of PE firms, and examine the different types of PE deals that shape this sector.

Course Bonuses

Exclusive bonuses (worth $500+) for free, bonus #1: full wso company database.

12 Month Access to 24,681+ interview insights, 51,233+ exclusive salary and bonus datapoints + 20,127 company reviews...

Bonus #2: WSO Video Library

50+ hours of PE-specific videos: webinars, sample deals, 10+ PPT & Excel Templates, 5+ Networking Templates and more...

Don’t Take Our Word For It

Hear from our students.

Wall Street Oasis has trained over 63,000 students at elite corporate and educational institutions for over a decade.

Certificates

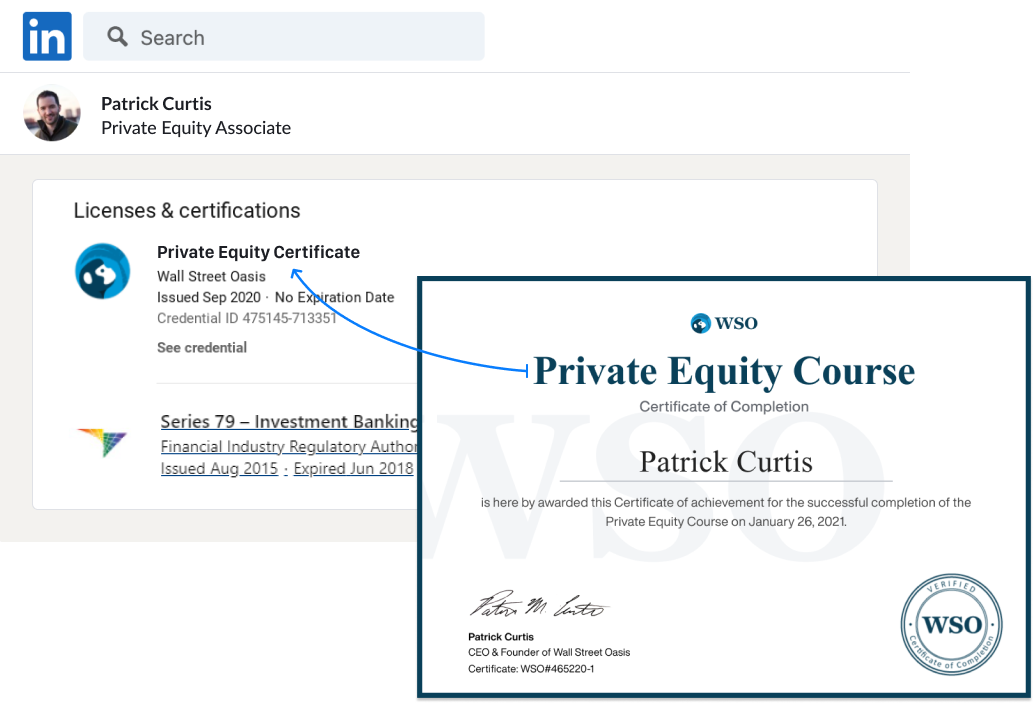

Get the private equity interview course certification.

After completing the course, all students will be granted the WSO Private Equity Interview Course Certification. Use this certificate as a signal to employers that you have the knowledge required to add value to your team immediately.

Demonstrate that you have put in the work outside of university courses to master LBO models and understand the private equity industry in depth. Easily share to LinkedIn and other social media sites to highlight your skills and strengthen your profile as a candidate.

Course Benefits

How much is the private equity interview course worth, consider this your first investment in a long career....

After all, you've likely already spent tens of thousands of dollars on college (and perhaps tens of thousands more on an MBA)...

When you start your coveted finance job, you'll be making well over $200,000.. .

...over $350,000 if you have an MBA...

And that's just the beginning of a long and very lucrative career that could easily net you millions...

Member Benefits

How much is the wso all access worth.

When you start your coveted finance job, you'll be making well over $100,000.. .

...over $200,000 if you have an MBA...

Even at thousands of dollars and your ROI would still be huge…

At a fraction of that price, the ROI is even better... When you do the math, it's a no brainer. And that doesn't include the time you'd have to spend figuring all of this out and the hours of sleep these courses will save you.

Even if you used the free info online, you'd still have to find it, organize it, vet it and test it to get it to work. That would take months… and at that point, you may have missed your window.

The WSO Private Equity Interview Course gives you everything you need to be super-efficient and get ready for your Private Equity interview… quickly and easily.

But we're not going to charge you thousands...

We won't even ask for half of that..., get unlimited lifetime access to the private equity interview course for, this offer (+bonuses) is limited-time only, 12 month money-back guarantee.

Your investment is protected by our 12-Month Risk-Free Guarantee -- easily the most generous in the market.

If, for any reason (or no reason), you don't think the WSO Private Equity Interview Course is right for you, just do the following within 365 days of your enrollment:

- Email [email protected] letting us know

We'll refund every penny. No questions asked . We bear the risk and will eat the transaction fees because we're that confident you'll love it.

Unlimited Access To The Private Equity Interview Course

...and pe deals process course, lbo course, and 22+ courses, company database (100k+ datapoints), and much more.

- Interview Prep Guides

- Private Equity Interview Course

What else is Included? Everything.

All WSO Courses, All WSO Data to Help You Gain an Edge

Course Reviews

Here’s what professionals like you think of the course., answers to popular questions.

No, you don't need an MBA to land a Private Equity job. In fact, if you don't have private equity experience prior to an MBA, it becomes even more difficult to break in since there are fewer seats for post-MBAs.

Yes, although PE firms used to recruit strictly from IB, they have opened up recruiting for consultants over the past decade. However, you'd have to work a lot harder to make up for the gaps in your IB/MBB experience.

Yes, most PE funds want to see your thought process as an investor. They want to learn how you think and if you are able to ask the proper questions when given some details on a potential investment opportunity. You need to be well prepared to answer these types of questions since they are very common and where most candidates slip up. Our interview course has all this covered along with several cheat sheets you can use to ace this section of the interview.

No, they are not. Private equity interviews are more than just LBOs and case studies. The problem is that most candidates now prepare well for these technical tests and ace them. Hence, interviewers go the extra mile to test you on a lot more than just technical skills. Some test you on your knowledge of the industry, while others throw in brain teasers and mental math.

Any other questions?

We’re here to help.

We're confident you'll love the program and happy to answer any questions you have! E-mail [email protected] at any time and we'll get back to you within a few hours.

©2005-2024 Wall Street Oasis. All Rights Reserved.

- Terms of Service

- Privacy Policy

S T R E E T OF W A L L S

Private equity interview, private equity recruiting process.

The lion’s share of the recruiting process for pre-MBA private equity associates truly begins in the first year of standard investment banking and consulting analyst programs. This may surprise some people, but the recruiting cycle is very structured, even though it can start at a moment’s notice (depending upon when the leading firms in the space begin their process). Prospective private equity candidates must be ready for the process early in their investment banking analyst programs in order to be successful in landing a private equity job. That said, recruiting for some other PE jobs will take place year-round. Thus if you happen to miss the main recruiting process for PE jobs, you’re a leg down, but not out. You may still be able to find available opportunities. This chapter will detail this timeline more thoroughly.

The pre-MBA recruiting process for PE positions is truly unique. After banking, exiting to a position as a private equity associate is very prestigious, and PE firms want to make sure that they don’t miss the most qualified applicants. You’ll need to be prepared for the process to start at any time. Once one of the leading PE firms begins its search for the incoming associate class for its firm, the rest of the firms will generally start recruiting directly afterward. For the majority of the firms, the entire recruiting process will be finished within several months once the leading firms start recruiting.

This “leader and followers” pre-MBA recruiting process is primarily driven by the “megafunds” (KKR, TPG, Blackstone, etc.). When they decide to start the recruiting process, most of the other large PE firms, with associate classes ranging from 8-15 professionals per year, will then launch their processes right away. The middle market/smaller PE firms will typically follow shortly after that.

Note that venture capital firms and smaller private equity firms will typically recruit outside of this standard recruiting cycle, and thus the notes above about the process tend not to apply to them. That said, overall most hiring for next year’s summer start dates will be completed by July or August—nearly a full year in advance!

The competition for these jobs is very tough. You’re going to be up against a large pool of talented, driven investment bankers, and will be working against a tight timeline. Therefore it’s very important that you plan out your process well ahead of time.

Even before the official private equity process begins, the initial step for pre-MBA recruits is to meet with headhunters. They are essentially the “gatekeepers” for the interviews with most firms. Headhunters will contact a pre-MBA candidate in the first year of his/her analyst program (up to three months in advance of the start of the recruiting season).

For post-MBA candidates, note that the recruiting process is a bit different. These candidates can rely a bit more heavily on their graduate schools’ career centers, since most PE firms will go directly to MBA program candidates to begin recruiting them. In this respect, post-MBA recruiting is more predictable and standard, as it conforms to the overall MBA student recruiting timeline.

The typical recruiting cycles for pre-MBA and post-MBA associate positions are illustrated below:

For pre-MBA candidates, after the headhunter interview the candidates go on to meet with the private equity firms directly. The overall process is a lot faster and more intense than investment banking. Candidates in this process truly need to be prepared for anything and everything. The recruiting process can be over very rapidly! A specific firm’s interview process can range from days to weeks, depending on the market conditions, how many firms are recruiting at the same time, and how quickly the firm in question finds prospective associates it wants to hire and who want to work for them.

Some investment banking analysts recruiting for PE firm jobs have encountered first-round interviews called “super-days,” where they meet with 8-10 people in one day and receive full-time offers at the end of the day. If this occurs, the PE firm will expect the candidate to accept (or reject) the offer within a few days! In other cases, the process is a bit slower, with several rounds of interviews spread out over a couple of weeks.

The traditional components of a private equity recruiting process include the standard behavioral and technical interviews conducted by junior PE associates—this part of the process is similar to investment banking recruiting. Where the process differs is in two primary places: the testing for investing acumen, and the testing for superior and LBO-specific technical ability.

Testing for investing acumen can come in the form of a broad 20-minute, consulting-like case study, or a detailed 3-5 hour investing exercise wherein the candidate has to research a company, go through the company’s filings, and write an investment memo on the sample target company. Unlike in a hedge fund recruiting process, PE associate candidates will very rarely be asked to pitch an investment idea. Instead, they may be asked what characteristics they would look for in a good LBO candidate.

LBO-specific technical ability screenings can come in the form of a financial modeling test, such as a paper LBO (in which the candidate must do LBO math in his/her head or on a piece of paper), or in a several-hour modeling test wherein the candidate has access to a computer and Microsoft Excel. Different firms like to administer this portion of the interview process differently, so for example, some will have modeling tests at the beginning of their process, while others may have it as the last stage of the process.

Therefore, you need to be prepared for every possibility if you hope to maximize your chance of landing a private equity associate position successfully. That said, don’t be afraid. The following sections and chapters in this guide will help you navigate the recruiting cycle and also help to prepare you for the modeling tests.

Initial Preparations: Before Headhunter Recruiting Starts

Given the short timeframe of the recruiting process, investment banking and consulting analysts need to be as prepared as possible for the process to start. In addition, no one knows exactly when the recruiting process is going to start until it does!

The first thing to do, then, is to make sure you’re interested in private equity. If so, make sure you understand the industry thoroughly, and know what the firms in the industry are going to be looking for in a good candidate.

The key thing that private equity firms look for is that the candidate is skilled at thinking like an investor rather than just being capable of performing the tasks needed for deal execution, which would mean being skilled at operating like an investment banker . Remember, private equity involves making successful investments rather than cranking out many transaction closings. For the banker, the firm’s revenue and profit are not affected by the post-transaction performance of the clients. In private equity, the firm’s success is heavily dependent upon how the client/target performs after the transaction is completed. Therefore, a successful PE associate will need to be able to help his colleagues make successful transaction decisions.

If this does not sound like something you’re interested in doing, then PE is probably not the right destination for you. If it is, then you will need to know how to best position yourself and market yourself to the interviewer with all of this in mind. Start thinking like an investor now, if you’re not already doing so—it will pay huge dividends for you when the PE recruiting process begins.

- Prepare and know your resume inside and out.

- Mega/large fund or middle market fund?

- Investment style (buyout, growth capital, etc.)?

- Culture and lifestyle: Do you prefer small or larger deal teams?

- Geographic location of PE firm or fund: What are your top three preferred city locations?

- Think about the focus of the position offered: Generalist vs. industry-focused? Do you prefer to concentrate on many industries or specifically on one industry?

- Use headhunters/recruiters: Many firms hire exclusively through recruiters even if you have personal contacts at a particular firm. Schedule screening interviews early with the top recruiters as their capacity for candidates is limited. Make a good first impression.

- Prepare to interview extensively by practicing with others. A typical interview process will last 3 to 5 rounds (including the headhunter) with most rounds consisting of numerous individual interviews. Because the competition will be very strong, intense preparation in this phase of the recruiting process will be crucial.

- Be able to talk through the stages and return drivers of an LBO model.

- Prepare by reading up on the relevant industry/industries and learning about what opportunities may be available there, or what transactions are taking place there.

- Modeling tests range from 4-hour computer based tests to “LBO on paper” exams. Be prepared to excel at all of them.

Private Equity Headhunter Interview