How much does it cost to start a business?

8 min. read

Updated March 4, 2024

What will it cost to start your business? This is a key question for anyone thinking about starting out on their own. You’ll want to spend some time figuring this out so you know how much money you need to raise and if you can afford to get your business off the ground on your own. Most importantly, you’ll want to figure out how much cash you’re going to need in the bank to keep your business afloat as you grow your sales during the early days of your business.

Typical startup costs can vary depending on whether you’re operating a brick-and-mortar store, online store, or service operation . But a common theme is that launching a successful business requires preparation. And while you may not know exactly what those expenses will be, you can and should begin researching and estimating what it will cost to start your business.

- How to determine your startup costs

Like when developing your business plan , or forecasting your initial sales, it’s a mixture of market research , testing , and informed guessing. Looking at your competitors is a good starting point. Once you feel your initial estimates are in the ballpark, you can start to get more specific by making these three simple lists.

1. Startup expenses

These are expenses that happen before you launch and start bringing in any revenue. Here are some examples:

- Permits and Licenses: Every business needs a license to operate, just like a driver needs one to hit the road. Costs vary depending on your industry and location.

- Legal Fees: Getting your business structure set up (sole proprietorship, LLC, etc.) might involve consulting a lawyer and at least will involve the basic business formation fees.

- Insurance: Accidents happen, and insurance protects your business from unforeseen bumps.

- Marketing and Branding: This is how you spread the word about your product or service. It could involve website creation, business cards, or social media promotion.

- Office Supplies : Pens, paperclips, that all-important stapler – the essentials to keep your business humming.

- Rent/Lease: If you need to rent space for your business before you start selling, include those expenses in your list as well.

2. Startup assets

Next, calculate the total you need to spend on assets to get your business off the ground. Assets are larger purchases that have long-term value. They’re typically significant items that you could resell later if you needed or wanted to. Here are a few examples:

- Equipment: Think ovens for a bakery, cameras for a photography business, or computers for a tech startup.

- Inventory: If you’re selling products, you’ll need to stock up before opening your doors (or your online store).

- Furniture and Decorations: Desks, chairs, that comfy couch in the waiting room – creating a functional and inviting workspace might involve some upfront investment.

- Vehicles: If your business requires a vehicle to deliver your product or service, be sure to account for that purchase here.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Why separate assets and expenses?

There’s a reason that you should separate costs into assets and expenses. Expenses are deductible against income, so they reduce taxable income. Assets, on the other hand, are not deductible against income.

By initially separating the two, you potentially save yourself money on taxes. Additionally, by accurately accounting for expenses, you can avoid overstating your assets on the balance sheet. While typically having more assets is a better look, having assets that are useless or unfounded only bloats your books and potentially makes them inaccurate.

Listing these out separately is good practice when starting a business and leads into the final piece to consider when determining startup costs.

3. Operating Expenses

Finally, figure out what it’s going to cost to keep your doors open until sales can cover expenses. Create a list that estimates monthly expenses, such as:

- Payroll (including your own salary)

- Marketing and advertising

- Loan payments

- Insurance premiums

- Office supplies

- Professional services

- Travel costs

- Shipping and distribution

Then, based on your revenue forecasts , calculate how many months it will take before your sales can cover all those monthly expenses. Multiply that number of months by your monthly operating expenses to determine how much you’re going to need to cover operating expenses as your business starts.

This number is often called “ cash runway ” and is a critical number – you need enough cash to fund those early red ink months. This number is how much cash you need to have in your checking account when you open your doors for business.

Calculating how much startup cash you need

To figure out how much money you need to start your business, add the asset purchases, startup expenses, and operating expenses over your cash runway period. This is your total startup costs, and it’s better to overestimate than underestimate these costs.

It often makes sense to invest the time to build a slightly more detailed starting costs calculation. Assuming you start making some sales and those sales grow over time, your revenue will be able to help pay for some of your operating expenses. Ideally, your sales contribute more and more over time until you become profitable.

To do a more detailed calculation, you’ll want to invest the time in a detailed financial forecast where you can experiment with different scenarios. If you do this, you’ll be able to see how much it will cost to start your business with different revenue growth rates. You’ll also be able to experiment with different funding scenarios and what your business would look like with different types of loans.

- Funding Starting Costs

You can cover starting costs on your own, or through a combination of loans and investments.

Many entrepreneurs decide they want to raise more cash than they need so they’ll have money left over for contingencies. While that makes good sense when you can do it, it is difficult to explain that to investors. Outside investors don’t want to give you more money than you need, because it’s their money.

You may see experts who recommend having anywhere from six months to a year’s worth of expenses covered, with your starting cash. That’s nice in concept and would be great for peace of mind, but it’s rarely practical. And it interferes with your estimates and dilutes their value.

Of course, startup financing isn’t technically part of the starting costs estimate. But in the real world, to get started, you need to estimate the starting costs and determine what startup financing will be necessary to cover them. The type of financing you pursue may alter your startup or ongoing costs in a given period, so it’s important to consider this upfront.

Here are common financing options to consider:

- Investment : What you or someone else puts into the company. It ends up as paid-in capital in the balance sheet . This is the classic concept of business investment, taking ownership in a company, risking money in the hope of gaining money later.

- Accounts payable : Debts that are outstanding or need to be paid after a certain time according to your balance sheet. Generally, this means credit-card debt. This number becomes the starting balance of your balance sheet.

- Current borrowing : Standard debt, borrowing from banks, Small Business Administration , or other current borrowing.

- Other current liabilities : Additional liabilities that don’t have interest charges. This is where you put loans from founders, family members, or friends. We aren’t recommending interest-free loans for financing, by the way, but when they happen, this is where they go.

- Long-term liabilities : Long-term debt or long-term loans.

- Other considerations for estimating startup costs

Pre-launch versus normal operations

With our definition of starting costs, the launch date is the defining point. Rent and payroll expenses before launch are considered startup expenses. The same expenses after launch are considered operating or ongoing expenses. And many companies also incur some payroll expenses before launch — because they need to hire people to train before launch, develop their website, stock shelves, and so forth.

The same defining point affects assets as well. For example, amounts in inventory purchased before launch and available at launch are included in starting assets. Inventory purchased after launch will affect cash flow , and the balance sheet; but isn’t considered part of the starting costs.

So, be sure to accurately define the cutoff for startup costs and operating expenses. Again, by outlining everything within specific categories, this transition should be simple and easy to keep track of.

Your launch month will likely be the start of your business’s fiscal year

The establishment of a standard fiscal year plays a role in your analysis. U.S. tax code allows most businesses to manage taxes based on a fiscal year, which can be any series of 12 months, not necessarily January through December.

It can be convenient to establish the fiscal year as starting the same month that the business launches. In this case, the startup costs and startup funding match the fiscal year—and they happen in the time before the launch and beginning of the first operational fiscal year. The pre-launch transactions are reported as a separate tax year, even if they occur in just a few months, or even one month. So the last month of the pre-launch period is also the last month of the fiscal year.

- Aim for long-term success by estimating startup costs

Make sure you’ve considered every aspect of your business and included related costs. You’ll have a better chance at securing loans, attracting investors, estimating profits, and understanding the cash runway of your business.

The more accurately you layout startup costs and make adjustments as you incur them, the more accurate vision you’ll have for the immediate future of your business.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

5 Min. Read

How to reduce your startup costs

4 Min. Read

Determine how much money you need to start

2 Min. Read

Hidden startup costs you may overlook

What you won’t regret spending money on as a business owner

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Create a Business Budget for Your Small Business

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget estimates future revenue and expenses in detail, so that you can see whether you’re on track to meet financial expectations for the month, quarter or year. Think of your budget as a point of comparison — you run your actual numbers against it to determine if you’re over or under budget.

From there, you can make informed business decisions and pivot accordingly. For example, maybe you find that your expenses are over budget for the quarter, so you may hold off on a large equipment purchase.

Here’s a step-by-step guide for creating a business budget, along with why budgets are crucial to running a successful business.

» MORE: What is accounting? Definition and basics, explained

QuickBooks Online

How does a business budget work?

Budgeting uses past months’ numbers to help you make financially conservative projections for the future and wiser business decisions for the present. If you’ve had a few bad months and predict another slow one, you can prepare to minimize expenses where possible. If business has been booming and you’re bringing in new customers, maybe you invest in buying more inventory to satisfy increased demand.

Creating a business budget from scratch can feel tedious, but you might already have access to tools that can help simplify the process. Your small-business accounting software is a good place to start, since it houses your business’s financial data and may offer basic budgeting reports.

To create a budget in QuickBooks Online , for example, you break down your estimated income and expenses across each area of your business. Then, the software calculates figures like gross profit, net operating income and net income for you.

You can then compare actual versus projected figures side by side by running a Budget vs. Actuals report. Businesses that need more in-depth features, like cash flow forecasting or the ability to use different projection methods, might subscribe to business budgeting software in addition to accounting software.

If your small business doesn’t have access to these features or has simple financials, you can download free small-business budget templates to manually create and track your budget. Regardless of which option you choose, your business will likely benefit from hiring an accountant to help manage your budget, course-correct when the business gets off track, and make sure taxes are being paid correctly.

Why is a business budget important?

A business budget encourages you to look beyond next week and next month to next year, or even the next five years.

Creating a budget can help your business do the following:

Maximize efficiency.

Establish a financial plan that helps your business reach its goals.

Point out leftover funds that you can reinvest.

Predict slow months and keep you out of debt.

Estimate what it will take to become profitable.

Provide a window into the future so you can prepare accordingly.

Creating a business budget will make operating your business easier and more efficient. A business budget can also help ensure you’re spending money in the right places and at the right time to stay out of debt.

How to create a business budget in 6 steps

The longer you’ve been in business, the more data you’ll have to inform your forward-looking budget. If you run a startup, however, you’ll want to do extensive research into typical costs for businesses in your industry, so that you have working estimates for revenue and expenses.

From there, here’s how to put together your business budget:

1. Examine your revenue

One of the first steps in any budgeting exercise is to look at your existing business and find all of your revenue sources. Add all those income sources together to determine how much money comes into your business monthly. It’s important to do this for multiple months and preferably for at least the previous 12 months, provided you have that much data available.

Notice how your business’s monthly income changes over time and try to look for seasonal patterns. Your business might experience a slump after the holidays, for example, or during the summer months. Understanding these seasonal changes will help you prepare for the leaner months and give you time to build a financial cushion.

Then, you can use those historic numbers and trends to make revenue projections for future months. Make sure to calculate for revenue, not profit. Your revenue is the money generated by sales before expenses are deducted. Profit is what remains after expenses are deducted.

2. Subtract fixed costs

The second step for creating a business budget involves adding up all of your historic fixed costs and using them to reliably predict future ones. Fixed costs are those that stay the same no matter how much income your business is generating. They might occur daily, weekly, monthly or yearly, so make sure to get as much data as you can.

Examples of fixed costs within your business might include:

Debt repayment.

Employee salaries.

Depreciation of assets.

Property taxes.

Insurance .

Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

3. Subtract variable expenses

As you compile your fixed costs, you might notice other expenses that aren’t as consistent. Unlike fixed costs, variable expenses change alongside your business’s output or production. Look at how they’ve fluctuated over time in your business, and use that information to estimate future variable costs. These expenses get subtracted from your income, too.

Some examples of variable expenses are:

Hourly employee wages.

Owner’s salary (if it fluctuates with profit).

Raw materials.

Utility costs that change depending on business activity.

During lean months, you’ll probably want to lower your business’s variable expenses. During profitable months when there’s extra income, however, you may increase your spending on variable expenses for the long-term benefit of your business.

4. Set aside a contingency fund for unexpected costs

When you’re creating a business budget, make sure you put aside extra cash and plan for contingencies.

Although you might be tempted to spend surplus income on variable expenses, it’s smart to establish an emergency fund instead, if possible. That way, you’ll be ready when equipment breaks down and needs replacing, or if you have to quickly replace inventory that's damaged unexpectedly.

5. Determine your profit

Add up all of your projected revenue and expenses for each month. Then, subtract expenses from revenue. You may also see the resulting number referred to as net income . If you end up with a positive number, you can expect to make a profit. If not, that’s a loss — and that can be OK, too. Small businesses aren’t necessarily profitable every month, let alone every year. This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on Nerdwallet's secure site

6. Finalize your business budget

Are the resulting profits enough to work with, or is your business overspending? This is your opportunity to set spending and earning goals for each month, quarter and year. These goals should be realistic and achievable. If they don’t line up with your projections, make sure to establish a strategy for making up the difference.

As time goes on, regularly compare your actual numbers to your budget to determine whether your business is meeting those goals, and course correct if necessary.

» MORE: Ways your small business can spend smarter

A business budget projects future revenue and expenses so you can create a smart, realistic spending plan. As the year progresses, comparing your actual numbers against your budget can help you hold your business accountable and make sure it reaches its financial goals.

A business budget includes projected revenue, fixed costs, variable costs and the resulting profits. You can also factor in contingency funds for unforeseen circumstances like equipment failure.

On a similar note...

Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

Business expenses: definition with examples.

Business expenses are ordinary and necessary costs a business incurs in order for it to operate. Businesses need to track and categorize their expenditures because some business expenses can count as tax deductions. Deductible expenses reduce a business’s taxable income, which can result in significant cost savings.

Here’s What We’ll Cover:

What Can You Write off as Business Expenses?

Business expenses examples, can business expenses be carried forward, can i deduct personal expenses for business, types of business expenses, tips for tracking business expenses.

NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide advice in these areas, outside of supporting questions about FreshBooks. If you need income tax advice please contact an accountant in your area.

Tax deductible business expenses are ones that are considered by the Internal Revenue Service (IRS) to be both “ordinary and necessary.”

Ordinary is defined by the IRS as “one that is common and accepted in your trade or business. A necessary expense is “one that is helpful and appropriate for your trade or business.”

Not all expenses a company incurs are tax deductible. Those that are may only qualify for a partial reduction. Some companies will need to ‘ capitalize ’ a business expense.

Capitalizing an expense refers to business assets that a business invests in to generate revenue, but is also one that will depreciate over a number of years (like a building or piece of equipment).

Capitalizing large business expenses means only the depreciation amount of those items for that year will show up on a company’s income statement, unlike regular business expenses which show the full amounts. This will allow a company to accurately assess its profits.

Here are some common business expense examples that may be partially or fully tax deductible:

- Payroll (employees and freelance help)

- Bank fees and interest

- Insurance expenses

- Business vehicles

- Equipment or equipment rental

- Office supplies

- Membership dues (including union or other professional affiliations)

- Commissions & fees

- Business meals

- Business travel expenses

- Employee retirement plans

- Employee education plans

- Employee benefit programs

- Subscriptions

- Equipment rentals

- Advertising and marketing costs

- Office equipment

- Repair and maintenance costs

- Executive compensation

- Employee salaries and wages

- Interest expenses

- Shipping costs

If you operate a small business out of your home, some of your housing costs may be partially deductible:

- Home office space (as long as this is your main place of business)

- Mortgage interest

- Security system

- Property taxes

- Maintenance, repairs or upkeep

- Business phone line (separate from home line)

For example, say your home is 1,000 square feet, and you use 100 square feet (10% of the total square footage) exclusively for your home office. In that case, you can deduct 10% of the above expenses as part of the home office deduction. The remaining 90% are considered personal expenses.

Typically, a company’s business expenses are fully deductible the tax year the purchases were made. If the business expenses missed were considerable and affected a company’s taxes, the company could then choose to file an amended tax return . You have three years from the tax return due date to file an amended return and claim business expenses and get a tax refund.

In addition, business expenses that are considered to be capitalized costs (see above) will be carried forward, but the depreciation amounts will change every year. Capitalizing business expenses is standard for a new company with a lot of expensive start up costs.

No, you cannot claim personal expenses as tax-deductible business expenses. The only exception is if the costs incurred are both personal and business expenses. In that case, you can only deduct the portion of the expense that relates to business purposes.

Let’s give an example. Take John, he’s self-employed and runs his own tax consulting business. He uses his vehicle 50% of the time to visit clients in their homes or at their place of business, and 50% of the time the vehicle is used for family or pleasure. The costs of maintaining and operating the vehicle include both personal and business expenses.

The rules allow John to deduct the business portion of gas, insurance, maintenance, and repairs as deductible expenses. But to back up these business expenses on his taxes he needs to track mileage and the purpose of each trip.

There are three types of business expenses:

Fixed Expenses

A fixed cost is one that does not change or changes only slightly. An example of fixed business expenses would be the monthly rent a business pays on its headquarters.

Variable expenses vary from month to month and are typically a company’s largest expense. Examples of variable business expenses would be payroll for a company with a large amount of freelance personnel, or overtime expenditures.

Periodic expenses are ones that happen infrequently. Periodic business expenses can be hard to plan for, such as money needed for an unexpected machine replacement or repair.

Keeping track of business expenses can be a time-consuming burden for a small business owner. However, there are several ways to make this task easier and more efficient.

The following tips can help you ensure you track business expenses efficiently and effectively:

- Set up a separate business bank account. Open a business checking account and ensure all of your business-related income and expenses run through that account.

- Use business accounting software . Most business owners use accounting software to track business costs. Most modern accounting software can connect to your business bank account to automatically record expenses.

- Keep good records. Document all business spending with receipts and invoices to establish a clear paper trail in case the IRS decides to audit your taxable income.

- Review expenses regularly. It’s important for business owners to review their expenses regularly in order to stay on top of their finances. This allows them to identify areas where they can reduce operating costs to save money, spot tax deductions to lower the company’s tax liability, and make more informed decisions about how to grow their business.

By following these simple steps, business owners will always know where their business money is going, helping them make better decisions in their business and reduce their tax liability.

Janet Berry-Johnson

About the author

Janet Berry-Johnson, CPA, is a freelance writer with over a decade of experience working on both the tax and audit sides of an accounting firm. She’s passionate about helping people make sense of complicated tax and accounting topics. Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. You can learn more about her work at jberryjohnson.com .

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Planning, Startups, Stories

Tim berry on business planning, starting and growing your business, and having a life in the meantime., standard business plan financials: spending budget.

As I continue with my standard business plan financials series, I turn now to developing the spending budget. True, nobody likes budgets, but the budgeting function is one of the most important to management to keep cash in the bank; and we all know it. In standard business plan budgeting, you look for realism and credibility, with educated guesses. And the point of it is setting it down as a standard so you can track it, review it, and revise as needed.

The spending budget is also vital to projected profit and loss and projected cash flow . In the diagram here below of full financials (repeated here from three essential projections posted previously in this series) the spending budget includes both the expenses portion of profit and loss and additional spending that doesn’t show up in profit and loss but does impact the cash flow and balance sheet.

By the way, the word budget, as I use it here, is exactly the same as forecast. The difference between the two is just custom. I could just as easily refer to revenue and spending budgets, or revenue and spending forecasts, as revenue forecast and spending budget. Most people are used to them the way I’m using them, with forecast for revenue and budget for spending.

Also, the difference between Costs and Expenses is significant. In finance and accounting, costs are the direct costs you have in your sales forecast, and expenses are operating expenses like rent, advertising, and payroll. They are not the same thing.

Finally, a special note to our LivePlan users – LivePlan has its own interface to guide you through your spending budget. That’s for a different post. All the concepts you see here are valid, and included with LivePlan – but you don’t have to build them in your spreadsheet.

Three types of spending

There are three common types of spending in a normal business. These are the things you write checks for.

- The first is costs, direct costs, what you spend on what you sell. Those are the costs you have already estimated in your sales forecast.

- The second is your expenses. They are mostly operating expenses, like rent, utilities, advertising, and payroll.

- The third is what you spend to repay debts and purchase assets. I call that “other spending.” These are important financial terms that you have to use correctly; so if you have any doubt, investigate what assets are and how debt repayment is different from interest expense, not an expense, but something that absorbs cash and affects the cash available to the business.

Let’s look first at the most common kind of spending, the operating expenses.

The Expense Budget

Make sure you understand expenses as a technical financial term. Expenses are spending like payroll and rent that aren’t part of direct costs and reduce profits and taxable income. You need to understand that difference if you are going to run a business and manage cash flow. If you have any doubts, please read up on that.

Just as you did for sales forecast and direct costs, try to always project expenses in the same categories you have in your chart of accounts. If your accounting divides marketing expenses into personnel, advertising, and PR, don’t project marketing expenses in your business plan as print, online, and social media. This is important.

Summary of Operating Expenses

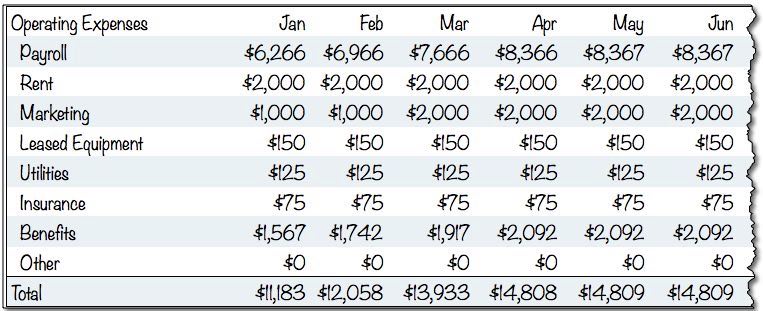

Forecasting your operating expenses is a matter of experience, educated guessing, a bit of research, and common sense. Let’s look at a sample expense budget from the same bicycle business plan I used in the sales forecast section above (with middle columns cut out):

All the numbers are educated guesses. Garrett, the bicycle storeowner, knows the business. As he develops his first lean plan, he has a good idea of what he pays for rent, marketing expenses, leased equipment, and so on. And if you don’t know these numbers, for your business, find out. If you don’t know rents, talk to a broker, see some locations, and estimate what you’ll end up paying. Do the same for utilities, insurance, and leased equipment: Make a good list, call people, and take a good educated guess.

Payroll and Payroll Taxes are Operating Expenses

Payroll, or wages and salaries, or compensation, are worth a list of their own. In the case of the bike shop owner, for payroll, he does a separate list so he can keep track. Payroll is a serious fixed cost and an obligation. Garrett’s summary budget (above) has the one line for payroll but it comes from a separate list. He just takes the total into the budget. ;Here’s the list:

Notice that the totals from the Personnel Plan show up in the expense budget. And if you look closely (it may take a calculator) at the expense row “Payroll Taxes” and compare that amount to the total payroll, you’ll see that it’s an estimate based on 25 percent of payroll. Garrett uses “Payroll Taxes” as a blanket term; it includes what he spends on health insurance and other benefits.

Other spending

This is tricky: standard accounting and financial analysis include only sales, costs, and expenses in the calculation of Profit and Loss . However, in the real world, some of what you spend isn’t included in either costs or expenses. For example, repaying a loan takes money, but doesn’t show up anywhere in the profit and loss. And if you have a product-based business and proper accrual accounting, the money you spend buying inventory doesn’t show up in the profit and loss until that inventory sells. Buying a vehicle or production equipment isn’t tax deductible and isn’t an expense; but it costs money. The rule of thumb is that all expenses are tax deductible, but not all spending is an expense.

What to do? Plan and track your operating expenses for sure. And if you need to handle loan repayments, purchasing assets, distributing profits, owners’ draw, or other spending outside of profit and loss, keep those in your spending budget. Keep track of them. Plan for them.

Understand Starting Costs

Startup costs are a special case that applies to startup businesses only. They are the sum of the assets you need to purchase before you start, plus the expenses you incur before you start. My advice on how to estimate starting costs is coming later, in a separate post.

valuable work sheet and would like to learn in detail

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Search Search Please fill out this field.

- Building Your Business

How To Create Financial Projections for Your Business

Learn how to anticipate your business’s financial performance

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-26at1.24.14PM-16d178cb2ee74d71946d658ab027e210.png)

- Understanding Financial Projections & Forecasting

Why Forecasting Is Critical for Your Business

Key financial statements for forecasting, how to create your financial projections, frequently asked questions (faqs).

Maskot / Getty Images

Just like a weather forecast lets you know that wearing closed-toe shoes will be important for that afternoon downpour later, a good financial forecast allows you to better anticipate financial highs and lows for your business.

Neglecting to compile financial projections for your business may signal to investors that you’re unprepared for the future, which may cause you to lose out on funding opportunities.

Read on to learn more about financial projections, how to compile and use them in a business plan, and why they can be crucial for every business owner.

Key Takeaways

- Financial forecasting is a projection of your business's future revenues and expenses based on comparative data analysis, industry research, and more.

- Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts, which can be attractive to investors.

- Some of the key components to include in a financial projection include a sales projection, break-even analysis, and pro forma balance sheet and income statement.

- A financial projection can not only attract investors, but helps business owners anticipate fixed costs, find a break-even point, and prepare for the unexpected.

Understanding Financial Projections and Forecasting

Financial forecasting is an educated estimate of future revenues and expenses that involves comparative analysis to get a snapshot of what could happen in your business’s future.

This process helps in making predictions about future business performance based on current financial information, industry trends, and economic conditions. Financial forecasting also helps businesses make decisions about investments, financing sources, inventory management, cost control strategies, and even whether to move into another market.

Developing both short- and mid-term projections is usually necessary to help you determine immediate production and personnel needs as well as future resource requirements for raw materials, equipment, and machinery.

Financial projections are a valuable tool for entrepreneurs as they offer insight into a business's ability to generate profit, increase cash flow, and repay debts. They can also be used to make informed decisions about the business’s plans. Creating an accurate, adaptive financial projection for your business offers many benefits, including:

- Attracting investors and convincing them to fund your business

- Anticipating problems before they arise

- Visualizing your small-business objectives and budgets

- Demonstrating how you will repay small-business loans

- Planning for more significant business expenses

- Showing business growth potential

- Helping with proper pricing and production planning

Financial forecasting is essentially predicting the revenue and expenses for a business venture. Whether your business is new or established, forecasting can play a vital role in helping you plan for the future and budget your funds.

Creating financial projections may be a necessary exercise for many businesses, particularly those that do not have sufficient cash flow or need to rely on customer credit to maintain operations. Compiling financial information, knowing your market, and understanding what your potential investors are looking for can enable you to make intelligent decisions about your assets and resources.

The income statement, balance sheet, and statement of cash flow are three key financial reports needed for forecasting that can also provide analysts with crucial information about a business's financial health. Here is a closer look at each.

Income Statement

An income statement, also known as a profit and loss statement or P&L, is a financial document that provides an overview of an organization's revenues, expenses, and net income.

Balance Sheet

The balance sheet is a snapshot of the business's assets and liabilities at a certain point in time. Sometimes referred to as the “financial portrait” of a business, the balance sheet provides an overview of how much money the business has, what it owes, and its net worth.

The assets side of the balance sheet includes what the business owns as well as future ownership items. The other side of the sheet includes liabilities and equity, which represent what it owes or what others owe to the business.

A balance sheet that shows hypothetical calculations and future financial projections is also referred to as a “pro forma” balance sheet.

Cash Flow Statement

A cash flow statement monitors the business’s inflows and outflows—both cash and non-cash. Cash flow is the business’s projected earnings before interest, taxes, depreciation, and amortization ( EBITDA ) minus capital investments.

Here's how to compile your financial projections and fit the results into the three above statements.

A financial projections spreadsheet for your business should include these metrics and figures:

- Sales forecast

- Balance sheet

- Operating expenses

- Payroll expenses (if applicable)

- Amortization and depreciation

- Cash flow statement

- Income statement

- Cost of goods sold (COGS)

- Break-even analysis

Here are key steps to account for creating your financial projections.

Projecting Sales

The first step for a financial forecast starts with projecting your business’s sales, which are typically derived from past revenue as well as industry research. These projections allow businesses to understand what their risks are and how much they will need in terms of staffing, resources, and funding.

Sales forecasts also enable businesses to decide on important levels such as product variety, price points, and inventory capacity.

Income Statement Calculations

A projected income statement shows how much you expect in revenue and profit—as well as your estimated expenses and losses—over a specific time in the future. Like a standard income statement, elements on a projection include revenue, COGS, and expenses that you’ll calculate to determine figures such as the business’s gross profit margin and net income.

If you’re developing a hypothetical, or pro forma, income statement, you can use historical data from previous years’ income statements. You can also do a comparative analysis of two different income statement periods to come up with your figures.

Anticipate Fixed Costs

Fixed business costs are expenses that do not change based on the number of products sold. The best way to anticipate fixed business costs is to research your industry and prepare a budget using actual numbers from competitors in the industry. Anticipating fixed costs ensures your business doesn’t overpay for its needs and balances out its variable costs. A few examples of fixed business costs include:

- Rent or mortgage payments

- Operating expenses (also called selling, general and administrative expenses or SG&A)

- Utility bills

- Insurance premiums

Unfortunately, it might not be possible to predict accurately how much your fixed costs will change in a year due to variables such as inflation, property, and interest rates. It’s best to slightly overestimate fixed costs just in case you need to account for these potential fluctuations.

Find Your Break-Even Point

The break-even point (BEP) is the number at which a business has the same expenses as its revenue. In other words, it occurs when your operations generate enough revenue to cover all of your business’s costs and expenses. The BEP will differ depending on the type of business, market conditions, and other factors.

To find this number, you need to determine two things: your fixed costs and variable costs. Once you have these figures, you can find your BEP using this formula:

Break-even point = fixed expenses ➗ 1 – (variable expenses ➗ sales)

The BEP is an essential consideration for any projection because it is the point at which total revenue from a project equals total cost. This makes it the point of either profit or loss.

Plan for the Unexpected

It is necessary to have the proper financial safeguards in place to prepare for any unanticipated costs. A sudden vehicle repair, a leaky roof, or broken equipment can quickly derail your budget if you aren't prepared. Cash management is a financial management plan that ensures a business has enough cash on hand to maintain operations and meet short-term obligations.

To maintain cash reserves, you can apply for overdraft protection or an overdraft line of credit. Overdraft protection can be set up by a bank or credit card business and provides short-term loans if the account balance falls below zero. On the other hand, a line of credit is an agreement with a lending institution in which they provide you with an unsecured loan at any time until your balance reaches zero again.

How do you make financial projections for startups?

Financial projections for startups can be hard to complete. Historical financial data may not be available. Find someone with financial projections experience to give insight on risks and outcomes.

Consider business forecasting, too, which incorporates assumptions about the exponential growth of your business.

Startups can also benefit from using EBITDA to get a better look at potential cash flow.

What are the benefits associated with forecasting business finances?

Forecasting can be beneficial for businesses in many ways, including:

- Providing better understanding of your business cash flow

- Easing the process of planning and budgeting for the future based on income

- Improving decision-making

- Providing valuable insight into what's in their future

- Making decisions on how to best allocate resources for success

How many years should your financial forecast be?

Your financial forecast should either be projected over a specific time period or projected into perpetuity. There are various methods for determining how long a financial forecasting projection should go out, but many businesses use one to five years as a standard timeframe.

U.S. Small Business Administration. " Market Research and Competitive Analysis ."

Score. " Financial Projections Template ."

36 Business Expense Categories for Small Businesses and Startups

Attention to expense deductions may not play a prominent role in the financial planning process for small businesses and startups—and that may be costing them. Sure, you’re focused on customer service and improving your products and services. But some easy moves could significantly lessen your tax bill.

For example, say you’re putting 250 miles per week on your private vehicle to get products out to customers. It may seem time-consuming to keep a log separating business and personal use, but you’re losing out on close to $600 in deductions. Or maybe you shuttered your office and started running your company from a spare room. As long as the space is exclusively used for business, you can deduct $5 for every square foot, up to $1,500.

Business expenses are the costs of running a company and generating sales. Given that broad mandate, the IRS doesn’t provide a master list of allowable small-business and startup deductions. As long as an expense is “ordinary and necessary” to running a business in your industry, it’s deductible. That makes it well worth the time to organize your spending so your business takes all legitimate write-offs, creates an effective financial plan , pays the proper amount in quarterly taxes—and doesn’t need to sweat an audit.

What Is a Tax-Deductible Business Expense?

Which expenses may be written off varies depending on the nature of your business. Start by reviewing Internal Revenue Service Publication 535 , which discusses the deductibility of common business expenses and general rules for filing your taxes.

Those “ordinary and necessary” expenses must be incurred in an organization motivated by profit. Even if your small business faces financial problems and doesn’t actually generate a profit, the intent needs to be there. Otherwise, the IRS may determine your business is a hobby and disallow expenses.

The IRS also suggests distinguishing usual business expenses from categories that fall under the cost of goods sold (COGs) and capital expenses to ensure accuracy, since some business expenses cannot be deducted in the year they’re incurred.

What Are Business Expense Categories?

By developing expense categories that fit your business and recording and organizing expenditures as you go, you’ll find it easier to get all the deductions you’re due.

You’ll also save significant headaches for your bookkeeper or tax preparer. Speaking of, it’s worth spending time with a financial adviser to understand the types of expenses you can and can’t include in a specific category.

Below is an example small-business expense categories list that applies to most companies, outlining what’s included and how you can qualify for a deduction. Add to this industry-specific categories, such as R&D costs or spending to seek VC funding.

Advertising:

This covers the cost of items and services to directly promote or market your business. Examples include fees paid to advertising or marketing companies to produce promotional materials, billboards, brochures, posters, websites and social media images. You may even deduct spending on a PR campaign.

Continuing education:

This can include courses for continuing education or seminars to stay current on industry trends. Relevant materials, books and registration fees for you and your employees are tax-deductible. You can also deduct payments made to employees to reimburse them for relevant educational expenses.

Credit and collection fees:

Businesses that use accrual basis accounting, where revenue and expenses are recorded when they’re earned or incurred even if no money changes hands at that point, can deduct unpaid invoices as business bad debt. Any fees spent trying to collect on debt, such as hiring an outside company to collect what’s owed, also count. A better bet: Minimize bad debt and increase cash flow by optimizing your billing processes.

Interest paid on business loans, ongoing credit lines and business credit cards are tax-deductible expenses. Bank fees, such as monthly maintenance or overdraft fees, also count.

Dues and subscriptions:

Subscriptions to industry magazines or journals related to your business can be deducted on your taxes. Membership fees include those paid to professional or trade associations that can help promote your business and even to your local Chamber of Commerce.

Employee benefit programs:

Payments made toward benefits such as disability insurance, life insurance, dependent care assistance, health plans for you and your employees and adoption assistance are tax-deductible. Note that this is one area, along with workers’ compensation insurance, where companies tend to spend more than they need to.

Besides that workers’ compensation insurance, you can deduct premiums for business-related insurance, including for liability, malpractice and real estate. Auto insurance premiums on a personal vehicle are a bit more complicated: If you deduct a flat mileage rate, you can’t itemize and must use the actual expense method, where you determine what it actually costs to operate the car for the portion of the overall use of the car that’s business use.

Maintenance and repairs:

Companies that use fleet vehicles as part of their operations can deduct the portion used for business. Deductible expenses include parking fees and gas. Otherwise, you can choose to utilize the standard mileage rate. Additionally, repair and maintenance of other types of equipment and machinery used in your business can also count.

Under actual expenses calculations for vehicles, you may include gas, oil, repairs, tires, insurance, registration fees, licenses and depreciation (or lease payments) prorated to the total business miles driven.

Legal and professional expenses:

These can include fees paid to certified public accountants (CPAs), financial planners, lawyers or other types of professionals.

Office expenses and supplies:

Items such as cleaning products, paper, notebooks, stationery and even snacks and beverages for employees can be deducted as supplies. The expenses category includes costs related to operating your business, such as website hosting and software.

Monthly telecommunications fees in a commercial space can be deducted, as can additional phone lines in a home office as well as cell phone contracts as a subcategory of office expenses.

For a commercial space, utilities such as electricity, internet, sewage and trash pickup fees are fully deductible. For a home office, you can deduct utilities in proportion to how much of your home is used for business.

Postage and shipping:

Stamps, freight and postage fees to mail business-related items, including products to customers and return shipping labels, count. Envelopes and packaging materials are included in office supplies.

Items such as ink cartridges, printers or payments for printing services can be included under this business expense category. Note that if you decide to do some direct-mail marketing, you can deduct the cost of producing the materials here, but postage must be listed separately even if the printer handled mailings.

Any rental payments made to occupy a warehouse for inventory or office space to conduct business are tax deductible. Your business structure —C corporation (C-corp) or S corporation (S-corp)—dictates whether you can pay a reasonable amount to rent property from shareholders.

Salaries and other compensation:

Employee salaries, gross wages, commissions, bonuses and other types of compensation count as tax-deductible expenses. Compensation can even extend to salaries paid to children and spouses, provided payments were made through payroll and those individuals performed services for your business. The amount paid does need to be considered reasonable.

Business-related travel expenses include flights, hotels and meals—but note that only 50% of the cost of meals for employees and customers is deductible. Costs for candidates who are traveling for an interview are deductible. Examples include parking fees and flights.

Costs include cell phone, electricity, internet, sewage and trash pickup fees (for commercial spaces).

Business meals:

You can deduct 50% of qualifying food and drink purchases. It needs to be related to the business, such as work conferences and meals on business trips. As a small business, you can deduct 50% of food and drink purchases that qualify.

Business use of your car:

You may be able to write off costs of maintaining and operating your vehicle if it’s strictly for business use. However, if it’s mixed, you can claim mileage related to the business use.

Moving expenses:

For work-related moving expenses, you may be able to deduct 100% of the costs related to your move. You will need to pass the distance test, such as your new job location being at least 50 miles from your former location.

Depreciation:

These are costs for big ticket items like machinery or a vehicle over its lifetime use, instead of it over one single tax year.

Charitable contributions:

You can deduct charitable contributions made to qualifying organizations—you may need to itemize these deductions.

Child and/or dependent care:

Qualifying costs associated with child or dependent care can be written off, though you’ll need to meet the IRS requirements.

Startup expenses:

Businesses who launched a new venture may be able to deduct up to $5,000 in startup expenses leading up your launch. Examples include marketing and employee training costs.

Mortgage interest:

If you’re purchasing a building or taking out a loan to build or improve your home for business purposes, you may be able to deduct the interest incurred.

Ones, such as bookkeeping software or recurring subscription with SaaS companies, used for business related purposes may be fully tax deductible.

Books and magazine subscriptions:

Magazine, books and journals that are specialized and directly to your business may be tax-deductible. For instance, newspapers may not be, but industry-specific magazines would.

Foreign earned income:

If you have a business based abroad you may be able to leave out any foreign income earned off your tax return, known as foreign earned income exclusion. You’ll need to meet certain requirements such as being under a certain income threshold.

Medical expenses:

Self-employed individuals, who pay for their own medical care expenses or insurance premiums, can deduct these expenses on their tax return. Examples include doctor’s fees and prescription drugs.

Licenses and permits:

Any required licenses and permits can be tax deductible. Examples include building permits and licenses to practice law in your state.

Manufacturing or raw materials:

These are directly related to the cost of goods sold or items and storage paid to sell your products.

Retirement contributions:

Contributing to a tax-advantaged account, such as an IRA or 401k, can reduce your taxable income—a great way for those who are self-employed to save on taxes.

Real estate taxes:

If you have a home office and itemize your taxes, you may be able to deduct some of the taxes you pay.

Client gifts:

Gifts for employees, clients or vendors may be fully tax deductible. For example, you give your employees gift baskets during the holiday season or send gift cards to vendors.

Employee loans:

If you pay an advance to an employee and expect them to pay you back (as in, they didn’t do any extra work to earn this “extra” income), you can deduct this amount. However, any interest paid may count as business income.

Skip the Golf?

If you have employees who frequently travel for business, ensure you follow small-business expense management best practices like making it easy for them to upload the receipts required by the IRS.

3 Steps to Categorize Expenses for Your Small Business or Startup

Poor tax compliance and inconsistent cash flow are among the top 10 financial challenges for small businesses. You can break that mold by being consistent in categorizing expenses. That allows you to see where and how much you’re spending to operate your company while being prepared come tax time.

You’ll also gather insights that will enable you to create a financial statement that adds visibility into profitability and cash flow. These statements are required for audits and are often requested by investors.

Here are three steps to categorize business expenses.

Determine correct categories for your specific business.

Choosing the right categories will depend on your industry. For example, a greeting card business may have dedicated categories for shipping and storage rental, whereas software-as-a-service ( SaaS) companies may have categories for digital services.

Start by identifying the expense categories your business uses the most—that financial statement will help here—and ones that you’ll need to grow. Refer to the list above to get started.

Reconcile and review financial accounts regularly.

Reviewing financial accounts is a good habit that will encourage you to stay on top of your expenditures. Reconciling bank statements can be easily done using accounting software. If you find you’re having challenges, a business-only credit card is a top expense management best practice.

Assign a category to all transactions.