47 case interview examples (from McKinsey, BCG, Bain, etc.)

One of the best ways to prepare for case interviews at firms like McKinsey, BCG, or Bain, is by studying case interview examples.

There are a lot of free sample cases out there, but it's really hard to know where to start. So in this article, we have listed all the best free case examples available, in one place.

The below list of resources includes interactive case interview samples provided by consulting firms, video case interview demonstrations, case books, and materials developed by the team here at IGotAnOffer. Let's continue to the list.

- McKinsey examples

- BCG examples

- Bain examples

- Deloitte examples

- Other firms' examples

- Case books from consulting clubs

- Case interview preparation

Click here to practise 1-on-1 with MBB ex-interviewers

1. mckinsey case interview examples.

- Beautify case interview (McKinsey website)

- Diconsa case interview (McKinsey website)

- Electro-light case interview (McKinsey website)

- GlobaPharm case interview (McKinsey website)

- National Education case interview (McKinsey website)

- Talbot Trucks case interview (McKinsey website)

- Shops Corporation case interview (McKinsey website)

- Conservation Forever case interview (McKinsey website)

- McKinsey case interview guide (by IGotAnOffer)

- McKinsey live case interview extract (by IGotAnOffer) - See below

2. BCG case interview examples

- Foods Inc and GenCo case samples (BCG website)

- Chateau Boomerang written case interview (BCG website)

- BCG case interview guide (by IGotAnOffer)

- Written cases guide (by IGotAnOffer)

- BCG live case interview with notes (by IGotAnOffer)

- BCG mock case interview with ex-BCG associate director - Public sector case (by IGotAnOffer)

- BCG mock case interview: Revenue problem case (by IGotAnOffer) - See below

3. Bain case interview examples

- CoffeeCo practice case (Bain website)

- FashionCo practice case (Bain website)

- Associate Consultant mock interview video (Bain website)

- Consultant mock interview video (Bain website)

- Written case interview tips (Bain website)

- Bain case interview guide (by IGotAnOffer)

- Bain case mock interview with ex-Bain manager (below)

4. Deloitte case interview examples

- Engagement Strategy practice case (Deloitte website)

- Recreation Unlimited practice case (Deloitte website)

- Strategic Vision practice case (Deloitte website)

- Retail Strategy practice case (Deloitte website)

- Finance Strategy practice case (Deloitte website)

- Talent Management practice case (Deloitte website)

- Enterprise Resource Management practice case (Deloitte website)

- Footloose written case (by Deloitte)

- Deloitte case interview guide (by IGotAnOffer)

5. Accenture case interview examples

- Case interview workbook (by Accenture)

- Accenture case interview guide (by IGotAnOffer)

6. OC&C case interview examples

- Leisure Club case example (by OC&C)

- Imported Spirits case example (by OC&C)

7. Oliver Wyman case interview examples

- Wumbleworld case sample (Oliver Wyman website)

- Aqualine case sample (Oliver Wyman website)

- Oliver Wyman case interview guide (by IGotAnOffer)

8. A.T. Kearney case interview examples

- Promotion planning case question (A.T. Kearney website)

- Consulting case book and examples (by A.T. Kearney)

- AT Kearney case interview guide (by IGotAnOffer)

9. Strategy& / PWC case interview examples

- Presentation overview with sample questions (by Strategy& / PWC)

- Strategy& / PWC case interview guide (by IGotAnOffer)

10. L.E.K. Consulting case interview examples

- Case interview example video walkthrough (L.E.K. website)

- Market sizing case example video walkthrough (L.E.K. website)

11. Roland Berger case interview examples

- Transit oriented development case webinar part 1 (Roland Berger website)

- Transit oriented development case webinar part 2 (Roland Berger website)

- 3D printed hip implants case webinar part 1 (Roland Berger website)

- 3D printed hip implants case webinar part 2 (Roland Berger website)

- Roland Berger case interview guide (by IGotAnOffer)

12. Capital One case interview examples

- Case interview example video walkthrough (Capital One website)

- Capital One case interview guide (by IGotAnOffer)

13. Consulting clubs case interview examples

- Berkeley case book (2006)

- Columbia case book (2006)

- Darden case book (2012)

- Darden case book (2018)

- Duke case book (2010)

- Duke case book (2014)

- ESADE case book (2011)

- Goizueta case book (2006)

- Illinois case book (2015)

- LBS case book (2006)

- MIT case book (2001)

- Notre Dame case book (2017)

- Ross case book (2010)

- Wharton case book (2010)

Practice with experts

Using case interview examples is a key part of your interview preparation, but it isn’t enough.

At some point you’ll want to practise with friends or family who can give some useful feedback. However, if you really want the best possible preparation for your case interview, you'll also want to work with ex-consultants who have experience running interviews at McKinsey, Bain, BCG, etc.

If you know anyone who fits that description, fantastic! But for most of us, it's tough to find the right connections to make this happen. And it might also be difficult to practice multiple hours with that person unless you know them really well.

Here's the good news. We've already made the connections for you. We’ve created a coaching service where you can do mock case interviews 1-on-1 with ex-interviewers from MBB firms . Start scheduling sessions today!

The IGotAnOffer team

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Must-Have Financial Case Study Examples with Samples and Templates

Mayuri Gangwal

Case studies are valuable tools for understanding the real-world applications of financial concepts and strategies. They provide insights into practical scenarios, showcasing the decision-making processes and outcomes in various financial situations. Whether you are a student, professional, entrepreneur, having access to well-crafted financial case study templates can be immensely beneficial in developing a deeper understanding of financial principles and honing your analytical skills.

SlideTeam’s premium PPT templates help you grasp complex financial concepts like investment analysis, financial planning, risk management, etc. Each case study offers a unique scenario, presenting a problem or challenge that requires thoughtful analysis and strategic decision-making.

By using these content-ready slides, you can enhance your problem-solving abilities, learn from real-world success stories and mistakes, and gain valuable insights into the intricacies of financial decision-making. The included samples and templates are practical tools for structuring your case studies, enabling you to apply your knowledge and skills to different financial scenarios.

Whether preparing for exams, a professional seeking to broaden your financial expertise, or an entrepreneur looking to make informed business decisions, these financial case study examples, samples, and templates are indispensable resources to elevate your financial understanding and make well-informed decisions in your personal or professional life.

Financial Case Study Templates

Template 1: financial case study environment business solution problems.

Introducing our ready to use template designed to elevate your content and make you look like a presentation pro. With a wide range of PPT slides covering various topics, this deck encompasses all the core areas of your business needs.

The deck focuses on Financial Case Study Environment Business Solution Problems, offering professionally designed templates that combine suitable graphics and relevant content. With eight slides, thoughtfully crafted to enhance your message and captivate your audience.

Don't miss out on this opportunity to impress your audience with visually stunning slides and compelling content. Click the download button and access our pre-designed PPT presentation and take your presentations to the next level. We also have templates to propose a business case if you aim for a higher company turnover.

Download Now

Template 2: Case Study for Financial Management PowerPoint Template

Introducing our captivating case study template designed to provide an environment conducive to productive discussions and effective decision-making. This template is perfect for showcasing real-life examples and analyzing financial management scenarios visually engagingly.

With its three-stage process, this template simplifies complex concepts and guides your audience through the essential components of a comprehensive business case study. It enables you to present your findings, solutions, and recommendations.

Whether you are analyzing past financial performances, identifying challenges , or proposing solutions, this template provides a flexible framework for organizing and presenting your ideas. You can also elevate your financial management presentations with our marketing Case Study for Financial Management PowerPoint Template . Download it now and unlock a wealth of possibilities to engage your audience, foster integration, and showcase your expertise in financial management.

Download Now

Conclusion

Financial case studies are invaluable tools for understanding real-world financial scenarios and developing practical solutions. By examining concrete examples, individuals and organizations can gain insights into financial challenges, apply analytical techniques, and make informed decisions.

This article has highlighted the importance of collecting financial case study examples and accompanying samples and templates as valuable resources for learning and applying financial principles in various contexts. These resources can serve as guides for conducting comprehensive analyses, formulating recommendations, and ultimately achieving financial success.

FAQs on Financial Case Study

What is a case study in finance.

A case study in finance is an in-depth analysis of a specific financial situation, company, investment, or financial strategy. It involves examining real-world scenarios, often based on actual events, to understand and evaluate the financial implications, decision-making processes, and outcomes.

In finance, case studies are commonly used as a teaching and learning tool to assess and explore complex financial issues in academic and professional settings. They provide a practical approach to understanding financial theories, concepts, and practices by applying them to real-life situations.

A finance case study typically involves the following elements:

- Background: The case study begins by presenting relevant information about the company, industry, or financial situation under examination. This includes details about the organization's financial statements, market conditions, competitive landscape, and other pertinent background information.

- Problem or Challenge: The case study outlines the specific financial problem or challenge that needs to be addressed. This could be related to financial analysis, investment decisions, capital budgeting, risk management, financial restructuring, or any other financial aspect of the organization.

- Data Analysis: The case study analyzes financial data, such as income statements, balance sheets, cash flow statements, and key financial ratios. Various financial analysis tools and techniques, such as ratio analysis, discounted cash flow analysis, or valuation models, may be used to evaluate the situation.

- Alternatives and Solutions: Based on the analysis, different alternatives or solutions are identified to address the financial problem or challenge. These could include recommendations for financial strategies, investment decisions, capital allocation, cost reduction measures, or other relevant actions.

- Decision-Making and Implementation: The case study explores the decision-making process, considering risk, return, financial feasibility, and strategic considerations. It also discusses the potential implementation of the recommended solution and the expected outcomes.

- Lessons Learned: The case study concludes by discussing the lessons learned from the financial situation or decision-making process. This may involve reflections on successful strategies, potential pitfalls, and broader implications for financial management and decision-making in similar contexts.

How do you write a financial case study?

Writing a financial case study involves analyzing a real or hypothetical financial situation or problem and presenting a detailed examination of the facts, analysis, and potential solutions. Here is a step-by-step guide on how to write a financial case study:

- Identify the purpose and scope: Clearly define the purpose of the case study and the specific financial issue you want to address. Determine the scope of the study, including the period, entities involved, and relevant financial data.

- Gather information: Collect all relevant financial data and supporting documents related to the case. This may include financial statements, transaction records, market data, industry reports, and any other information necessary for the analysis.

- Describe the background: Provide an overview of the company or individual involved in the case study. Include relevant details such as the company's history, industry , size, key stakeholders, and any recent events or developments that may have a financial impact.

- State the problem or objective: Clearly define the financial problem or objective that needs to be addressed. Identify the key challenges or issues the company or individual faces and explain why they are essential.

- Conduct financial analysis: Analyze the financial data and apply appropriate financial analysis techniques to evaluate the situation. This may involve calculating financial ratios, conducting trend analysis, performing a discounted cash flow analysis, or any other relevant method to gain insights into the financial performance and position of the entity.

- Present findings: Summarize the results of the financial analysis clearly and concisely. Highlight key findings, trends, and any significant financial situation factors. Use graphs, charts, or tables to present data effectively.

- Discuss alternative solutions: Propose different options or strategies to address the financial problem or achieve the objective. Determine the advantages and drawbacks of each solution and provide supporting evidence or calculations to justify your recommendations.

- Make recommendations: Make clear and actionable recommendations based on analyzing and evaluating the alternative solutions. Support your recommendations with logical reasoning and explain how they can improve the financial situation or achieve the desired outcome.

- Provide a conclusion: Summarize the main points of the case study and restate the recommendations. Highlight any potential risks or challenges associated with implementing the proposed solutions.

- Include references and citations: If you have used external sources or references, provide proper citations to give credit to the authors and avoid duplicity or redundancy.

- Edit and proofread: Review the case study for clarity, coherence, and accuracy. Check for any grammatical or spelling errors. Ensure that the document is well-structured and easy to understand.

What is finance study?

Finance study refers to the field of knowledge and an academic discipline that focuses on managing, creating, and allocating financial resources. It involves studying various aspects of financial systems, instruments, markets, and institutions. Finance encompasses the theory and practice of managing money, investments, and financial decision-making.

The study of finance covers a wide range of topics, including:

- Corporate Finance: This area focuses on financial decisions and strategies within corporations. It includes capital budgeting, investment analysis, financial planning, risk management, and corporate valuation.

- Investments: This field examines allocating money to different financial assets including, stocks, mutual funds, real estate, and other derivatives. It involves analyzing risk and return, portfolio management, asset pricing models, and investment strategies.

- Financial Institutions and Markets: This area explores the functioning of financial institutions (such as banks, insurance companies, and investment firms) and financial markets (such as stock markets, bond markets, and foreign exchange markets). It involves studying the role of these institutions and markets in facilitating the flow of funds, managing risks, and pricing financial assets.

- International Finance: This branch focuses on financial transactions and relationships between countries and across borders. It covers foreign exchange rates, international investment, multinational corporations, and global financial markets.

- Personal Finance: This area focuses on individual or household financial management. It involves budgeting, saving, investing, retirement planning, taxation, and managing personal debt.

Related posts:

- How Financial Management Templates Can Make a Money Master Out of You

- Top 5 Capital Budgeting Templates with Samples and Examples

- The Ultimate Spokes Diagram Templates to Enhance Business Presentation

- Top 5 One-page Quarterly Report Templates with Examples and Samples

Liked this blog? Please recommend us

Top 5 Daily Appointment Templates with Samples and Examples

Top 5 Portfolio Project Status Report Templates with Examples and Samples

2 thoughts on “must-have financial case study examples with samples and templates”.

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

- Development

Financial Analyst Interview Case Study

Don't miss, where to watch the meghan markle oprah interview, when are medical school interviews, how to prepare for java coding interview, questions for an exit interview, cyber security engineer interview questions, how to watch oprah’s interview with harry and meghan, react js programming interview questions, how to prepare for a recruiter position interview, let your experience speak for itself.

Although it is an interview, the case interview is not intended to be a time to discuss your resume. Regardless of your prior experience with the subject of your case, focus on using the unique insights you have and applying them to the problem, rather than discussing your work experience at length.

Nina summarized the difference by saying, Dont use the case to highlight your resume, but do draw in your experience as a human. You will have an opportunity to discuss previous work experience in other types of interviewslike our Behavioral or Job Fit interviews. You can still demonstrate skills from your previous experience through your practical work on the case. General life experience and common sense can be immensely helpful in case interviews as well.

What Would You Say Is Your Greatest Strength That Could Benefit Your Career As A Financial Analyst

Example:”I believe that discipline is my greatest strength that I could apply to a financial analyst position. For example, when I am reviewing company financial records and documentation, I focus on that task alone until I complete it. I am able to avoid procrastination and other time-wasting activities because I am geared toward accomplishing the end goal.”

Related: 39 Strengths and Weaknesses To Discuss in a Job Interview

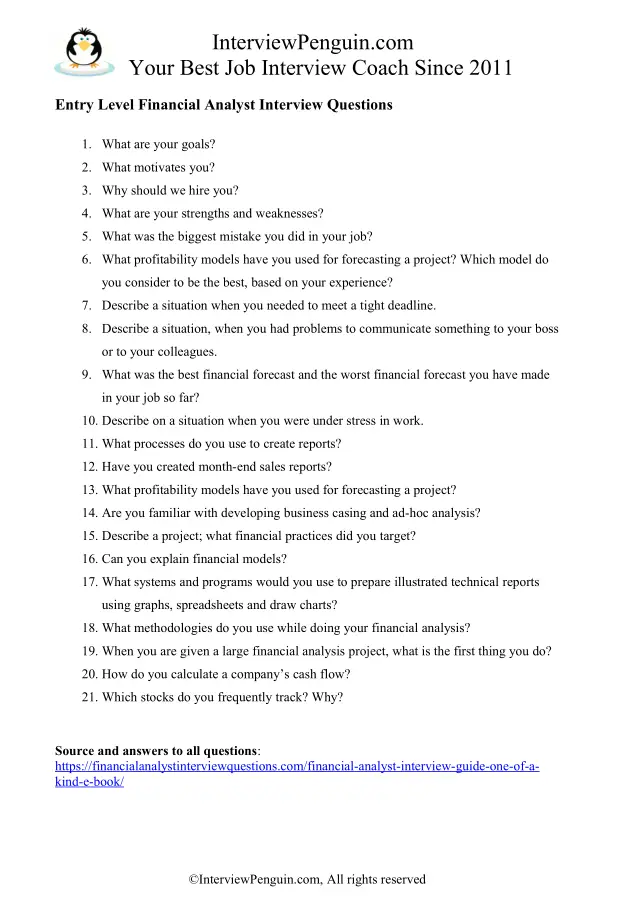

What Processes Do You Use To Create Financial Analysis Reports

Reporting is generally a big part of a financial analysts job, and the reporting required will depend on the role. If youre interviewing for a sales organization, for instance, you might be creating monthly, quarterly, or annual sales reports. In your answer, theyll be looking for technical skills as well as collaboration skills, communication, organization, follow-through, and time management.

Don’t Miss: Good Interview Questions To Ask Production Workers

What Do You Think Is The Best Metric For Analyzing A Company’s Stock

This question tests a candidate’s risk assessment knowledge. An excellent candidate would explain their strategy for measuring a stock’s performance. What to look for in an answer:

- Knowledge of the best metrics for analyzing stock

- Understanding of risk assessment strategies

- Critical-thinking skills

“The price-earnings to growth ratio is a good metric for analyzing a company’s stock performance. If the value is greater than one, the stock is overvalued. Otherwise, it’s undervalued or fairly priced. In my experience, the PEG metric gives more insight into a company’s financial health. It considers the projected earnings growth.”

The Amazon Fldp Interview

This interview consists of four face-to-face interviews, each is 45 minutes, and usually, there are no breaks in between . The interview questions are primarily behavioral and focus on .

Since these are Amazon’s core principles and you’ve applied for a leadership development program, they will expect you to base your answers on them .

Additionally, the interviewers will dive deep into your answers and analyze every detail you provide. Therefore, try to stay very consistent with your answers.

Many candidates mention that one particular interviewer was different from the others. This interviewer is there for a reason, and they are called Amazon Bar Raisers .

The Amazon Bar Raisers are skilled evaluators that are not part of the hiring department. Their central role is to provide authentic and reliable opinions on whether you should get hired or not. For that, they use several tactics designed to throw you off and test your leadership skills and resilience.

The best way to handle them is by maintaining your composure, keeping your answers and explanations tight, and sticking to Amazon’s leadership principles.

Also Check: What Is An Exit Interview For A Job

Imagine You Found Inconsistencies In A Company’s Financial Reports How Would You Handle The Situation

This question helps you understand how a financial analyst would respond to an ethical dilemma or potential issue. What to look for in an answer:

- Desire to follow and enforce ethical business practises

- Honesty and moral values

“At my last job, I was analyzing a startup’s financial records. I found that the cash inflow didn’t quite add up to the company’s cash outflow. There was no explanation for the imbalance from the records I had. I first double-checked before notifying my finance manager of the situation. She later contacted the business owner. I pay keen attention to details and always act ethically when dealing with customers, employers, or my colleagues.”

Technical Questions For Pe

The topics here are similar to the ones in IB interviews: Accounting, equity value and enterprise value , valuation/DCF, merger models, and LBO models.

If youre in banking, you should know these topics like the back of your hand.

And if youre not in banking, you need to learn these topics ASAP because firms will not be forgiving.

There are a few differences compared with banking interviews:

- Technical questions tend to be framed in the context of your deal experience instead of asking generic questions about WACC, they might ask how you calculated it in one specific deal.

- More critical thinking is required. Instead of asking you to walk through the financial statements when Depreciation changes, they might describe companies with different business models and ask how the financial statements and valuation would differ.

- They focus more on LBO models, quick IRR math , and your ability to judge deals quickly.

Most interviewers use technical questions to weed out candidates , so poor technical knowledge will hurt your chances, but exceptional knowledge wont necessarily get you an offer.

Recommended Reading: How To Sight An Interview

How Would The Income Statement Change If A Company’s Debts Increased

An interviewer asks this question to assess how prepared you are for a financial analyst position and whether you have the correct expertise to perform well. Your answer should directly address how company debt affects an income statement.

Example:”If a company’s debts increased, this would decrease the net income listed in a company’s income statement.”

Related: Math Interview Questions

If You Could Only Choose One Profitability Model To Forecast Your Projects Which Would It Be And Why

This is another question that interviewers use to gauge your knowledge of industry terminology. When you give your answer, specify a model and explain your reasoning for choosing it.

Example:”I would usually choosea profitability model that reflected the type of business I was forecasting, but if I had to choose one for all of my projects, I would use the financial model because a company’s finances are constantly fluctuating.”

Related: What Is the Difference Between Profitability and Profit?

Recommended Reading: What Questions To Ask A Ux Designer In An Interview

Private Equity Interviews : How To Win Offers

If you’re new here, please click here to get my FREE 57-page investment banking recruiting guide – plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Private equity interviews can be challenging, but for most candidates, winning interviews is much tougher than succeeding in those interviews.

You do not need to be a math genius or a gifted speaker you just need to understand the recruiting process and basic arithmetic.

Still, there is more to PE interviews than 2 + 2 = 4, so lets take a detailed look at the process:

How Many Food Stores Do You Think There Are In Singapore

This is another guess or market-sizing question. Answering this question may necessitate you answering questions to get statistical information, which you can then use to estimate a number that most answers the question. To answer this type of question, you can ask clarifying queries, create a structured process for deriving the answer, estimate with round numbers and ground your estimations with existing facts.

Recommended Reading: How To Succeed In An Interview

What Are The Most Common Financial Modeling Interview Questions

In this Financial Modeling Interview guide, weve compiled a list of the most common and frequently asked financial modeling interview questions. This guide is perfect for anyone interviewing for a financial analyst job or any other role requiring knowledge in the field as it helps you prepare for the most critical questions relating to financial modeling concepts and application.

Alongside with this comprehensive guide to financial modeling interview questions , you may also be interested in exploring The Analyst Trifecta CFIs guide on how to be a great financial analyst.

Fp& a Interview Questions With Answers:

Walk me through the three financial statements.

The balance sheet shows a companys assets, liabilities, and shareholders equity, and is a snapshot in time. The income statement outlines the companys revenues and expenses over a period of time . The cash flow statement shows the cash flows from operating, investing, and financing activities over a period of time. The three financial statements all fit together to show a picture of the companys financial health.

How does an inventory write-down affect the three statements?

This can be one of the more challenging FP& A interview questions. Here is the answer: On the balance sheet, the asset account of inventory is reduced by the amount of the write-down, and so is shareholders equity. The income statement is hit with an expense in either COGS or a separate line item for the amount of the write-down, reducing net income. On the cash flow statement, the write-down is added back to Cash from Operations, as its a non-cash expense, but must not be double-counted in the changes of non-cash working capital.

How do you record PP& E and why is this important?

There are essentially four areas to consider when accounting for PP& E on the balance sheet: initial purchase, depreciation, additions , and dispositions. In addition to these four, you may also have to consider revaluation. For many businesses, PP& E is the main capital asset that generates revenue, profitability, and cash flow.

What does it take to be a great FP& A analyst?

Don’t Miss: What Questions To Expect In An Exit Interview

Validate Corporate Structure And Business Model

Always remember to validate the corporate structure and business model of the financial institution in your financial services case interview. You dont want to end up confusing a commercial bank with an investment bank!

As a candidate, youre not expected to know everything. Therefore, ask as many questions as possible to understand what youre really dealing with. For instance, you could say, Hey, Im not familiar with the corporate structure and the business model of a pension fund, could you please explain that to me so I can start to understand the drivers of value for the business a bit better.

What Employers Are Looking For

Microsoft Excel is a comprehensive tool that allows businesses to record, track, and analyze data essential for measuring company performance, maximizing return on investment, and defining goals when used to its fullest potential. A new employee who can comfortably navigate Excel is prepared to immediately contribute by producing meaningful, data-driven spreadsheets, reports, and graphs to best serve company needs.

Assessing a job candidates Microsoft Excel proficiency is an important step in making the right hire. The Beginners Microsoft Excel skills test is helpful in learning if a job candidate understands how to manipulate the many functions, tools, and formulas of Excel to present extensive information, identify key trends, or calculate financial and numerical data.

Microsoft Excel assessment test helps predict a job candidates ability to:

- Enter sales figures and properly apply formulas to generate sales totals by date, representative, product or region.

- Conditionally format cells with the goal of highlighting specific dates, values, or ranges.

- Create bar graphs and pie charts from large datasets to illustrate critical company data, performance metrics, and outlook.

Recommended Reading: How To Reject Applicant After Interview

Complexity Levels Of Excel Employment Assessment Tests

Microsoft Excel harbor very basic calculations to very advanced data processing and analysis that requires in-depth knowledge of every tools of Excel. Depending on the position candidate is applying for you are likely to face a pre-employment Excel test with varying level of difficulty. Microsoft Excel Employment Assessment tests can be categorized into at least three levels of difficulty:

How Would You Describe Your Ability To Work With Others

Financial analysts often need to work with portfolio managers, financial managers, and accountants. This question evaluates whether a candidate is a team player. Their answer would give you insights into which team or groups to place a financial analyst. What to look for in an answer:

- Teamwork and collabouration skills

- Strong interpersonal and communication skills

- Motivated to reach a shared goal for clients and your organisation

“I work well with other finance and accounting professionals to reach a shared goal. In my last job, my manager grouped me with two senior and four junior financial analysts. Our goal was to analyse investment opportunities for a top bank in Ontario. Working with experienced professionals helped develop my analytical skills. I also improved my leadership skills by working with junior financial analysts.”

You May Like: What Questions To Ask In An Executive Assistant Interview

Putting It All Together

Ultimately, learning that you get to come in for a financial analyst interview is always exciting. While youre probably going to be at least a teeny bit nervous, that doesnt mean you cant shine.

Just use the tips above and spend time reviewing the financial analyst interview questions. That way, you can create engaging, thorough, and relevant answers that will help you stand out in the eyes of the hiring manager. After all, you are an exceptional candidate. Now, all you have to do is show it.

And as always, good luck!

Ideas On Incentives For Agents

- Provide commission to agents of 0.15% on each insurance/loan product.

- Non-financial

- Organize monthly or quarterly leagues with leaderboards to recognize top performers, e.g., highest transaction value, highest growth, highest customer acquisition, etc.

- Leverage social media to build an agent community via Facebook or WhatsApp groups. These groups can create engagement and serve as an efficient mode of communication, allowing the bank to solicit agent referrals and publish leaderboards.

- Introduce friendly competitions like Best shop-front display to increase the visibility of Go-for-Growth Banks products.

- Test if affiliation with the Banks brand in the country is a motivator for agents.

You could classify high performers as agents with transaction volume and transaction value in the top 10%. Agents potential information can also be collected to have a more nuanced segmentation for tracking and governance purposes.

Don’t Miss: How To Prepare For Analyst Interview

Tips For Performing Well At Investment Banking Case Studies

While working on the investment banking case studies.

- Make a concrete decision and base your recommendations on logical reasons.

- Use a structured approach to tackle the problem.

- Focus on the most important issues prevalent in the case.

- Understand the case and questions carefully before interpreting and think twice before finalizing the problems decision.

- Do not panic if the solution to the case is not obvious.

- For modeling case studies, format the excel and PowerPoint professionally.

- Prepare the type of questions you may be asked during your presentation.

- Assess all the relevant factors and possible problems, but keep in mind your resources.

- The solutions you provide should be realistic and be aware of the implications of the organizations under study.

- Have strong logical reasons behind every statement you make and cater to the cases critical issues at the beginning.

- Having specific knowledge regarding the industry under study is unnecessary, but it would be an added advantage.

- When preparing, focus on reading deal news and practice as many scenarios as possible.

While presenting your Investment Banking Case study

While answering the questions, what qualities do capital one case interviews assess.

Capital One case interviews assess four main qualities:

Logical, structured thinking : Capital One looks for candidates that are organized and methodical problem solvers.

- Can you structure complex problems in a clear, simple way?

- Can you use logic and reason to make appropriate conclusions?

Quantitative skills : Capital One looks for candidates that have strong analytical skills to solve complex business problems and make important business decisions

- Can you read and interpret data well?

- Can you perform math computations smoothly and accurately?

- Can you conduct the right analyses to draw the right conclusions?

Communication skills : Capital One looks for candidates that can communicate in a clear, concise, and persuasive way.

- Can you communicate in a clear and concise way?

- Are you articulate and persuasive in what you are saying?

Business judgment : Capital One looks for candidates with strong business instincts that help them make the right decisions and develop the right recommendations.

- Do you have a basic understanding of fundamental business concepts?

- Do your conclusions and recommendations make sense from a business perspective?

Read Also: How To Prepare For A Phone Job Interview

How To Answer Financial Analyst Interview Questions

Alright, before we talk about the interview questions and examples, lets take a step back. Knowing how to answer is at least as important as seeing samples, if not more so. By having a winning strategy by your side, you can handle the unexpected, and that can make a world of difference.

So, what do you need to do?

Well, step one in a winning strategy is always the same its research. Usually, hiring managers have a perfect candidate in mind before they meet a single applicant. If you can figure out who that person is and what they bring to the table, you can showcase the skills and traits you have that align with it.

Certain skills and traits are going to be givens. You need to have an analytical mindset , math skills , and an understanding of micro and macroeconomics , for example. However, that isnt going to be all the hiring manager is looking for. If you want to get the full picture, you need to do some digging.

Start by reviewing the financial analyst job description . There, youll find a list of all of the must-have skills, traits, and other credentials. If a capability is listed there, theres a good chance youll face financial analyst interview questions about it.

But you also want to go further. If you take a trip to the company website, you can find its mission and values statements. Those provide you with a ton of insights about the organizations goals, priorities, and even its culture.

More articles

30 60 90 day plan example for interview, follow up email to set up interview, motivational interviewing 3rd edition ebook, popular articles, how to follow up after an interview, how to prepare for facebook software engineer interview.

© 2021 InterviewProTips.com

- Terms and Conditions

- Privacy Policy

Popular Category

- Questions 581

- Prepare 281

- Exclusive 270

- Trending 268

- Editor Picks 257

Editor Picks

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Technical Skills

- Accounting Articles

Financial Statements Examples – Amazon Case Study

Financial Statements are informational records detailing a company’s business activities over a period.

Austin has been working with Ernst & Young for over four years, starting as a senior consultant before being promoted to a manager. At EY, he focuses on strategy, process and operations improvement, and business transformation consulting services focused on health provider, payer, and public health organizations. Austin specializes in the health industry but supports clients across multiple industries.

Austin has a Bachelor of Science in Engineering and a Masters of Business Administration in Strategy, Management and Organization, both from the University of Michigan.

- What Are Financial Statements?

Amazon’s Balance Sheet

Amazon’s income statement, amazon’s cash flow statement, usage of financial statements, amazon case study faqs, what are financial statements.

Investors need financial statements to gain a full understanding of how a company operates in relation to competitors. In the case of Amazon , profitability metrics used to analyze most businesses cannot be used to compare the company to businesses in the same sector.

Amazon remains low in profitability continuously to reinvest in growing operations and new business opportunities. Instead, investors can point to the metrics signified in Amazon’s cash flow statement to demonstrate growth in revenue generation over the long term.

There are three main types of financial statements, all of which provide a current or potential investor with a different viewpoint of a company’s financials. These include the following below.

Balance Sheet

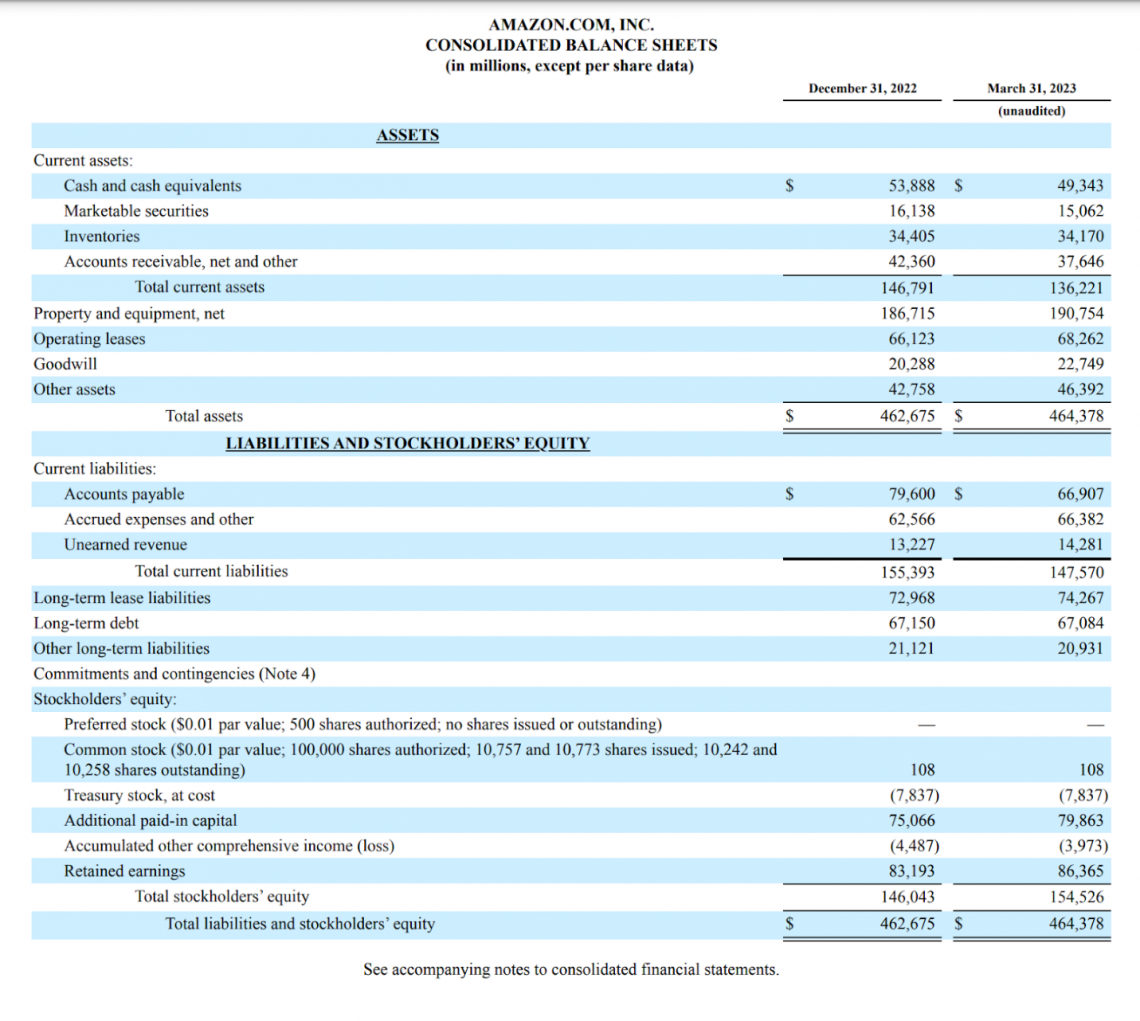

The balance sheet represents a company’s total assets, liabilities, and shareholder ’s equity at a certain time.

Assets are all items owned by a company with tangible or intangible value, while liabilities are all debts a company must repay in the future.

Shareholders' equity is simply calculated by subtracting total assets from total liabilities. This represents the book value of a business.

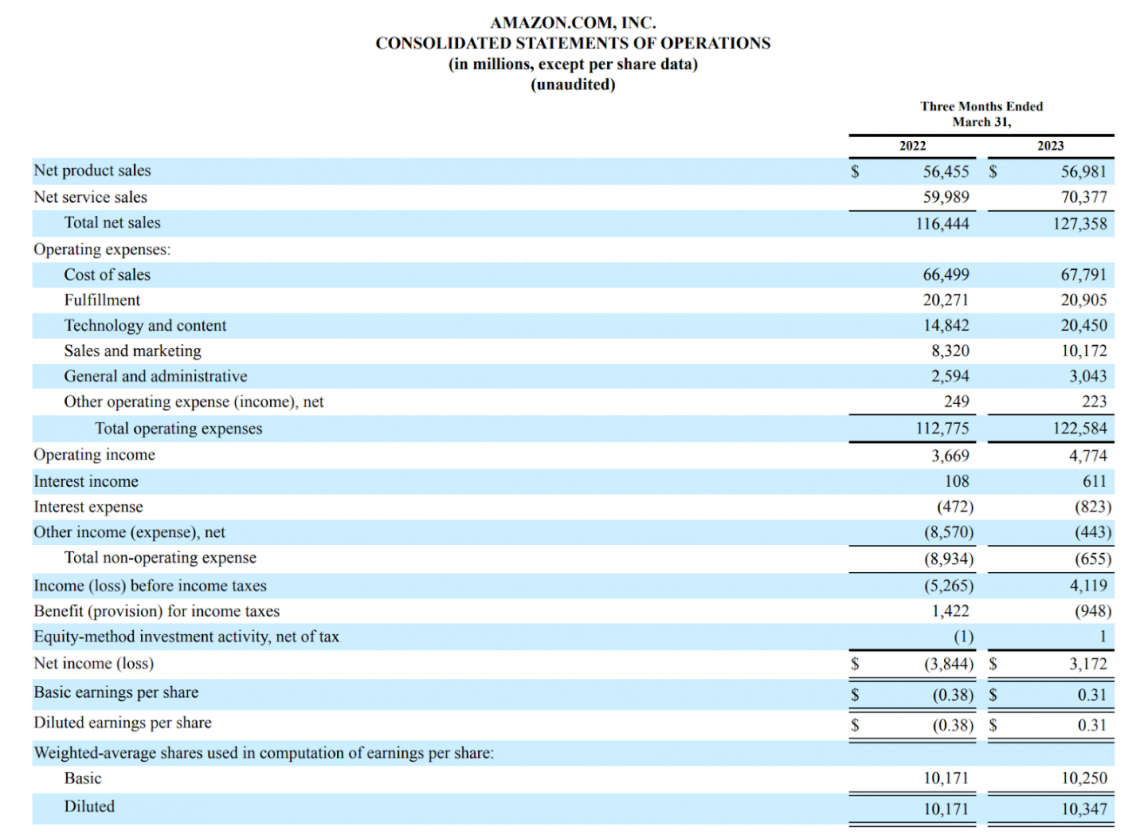

Income Statement

The income statement represents a company’s total generated income minus expenses over a specified range of time. This can be 3 months in a quarterly report or a year in an annual report .

Revenue includes the total money a company makes over a set time.

This includes operating revenue from business activities and non-operating revenue, such as interest from a company bank account.

Expenses include the total amount of money spent by a company over time. These can be grouped into two separate categories, Primary expenses occur from generating revenue, and secondary expenses appear from debt financing and selling off held assets.

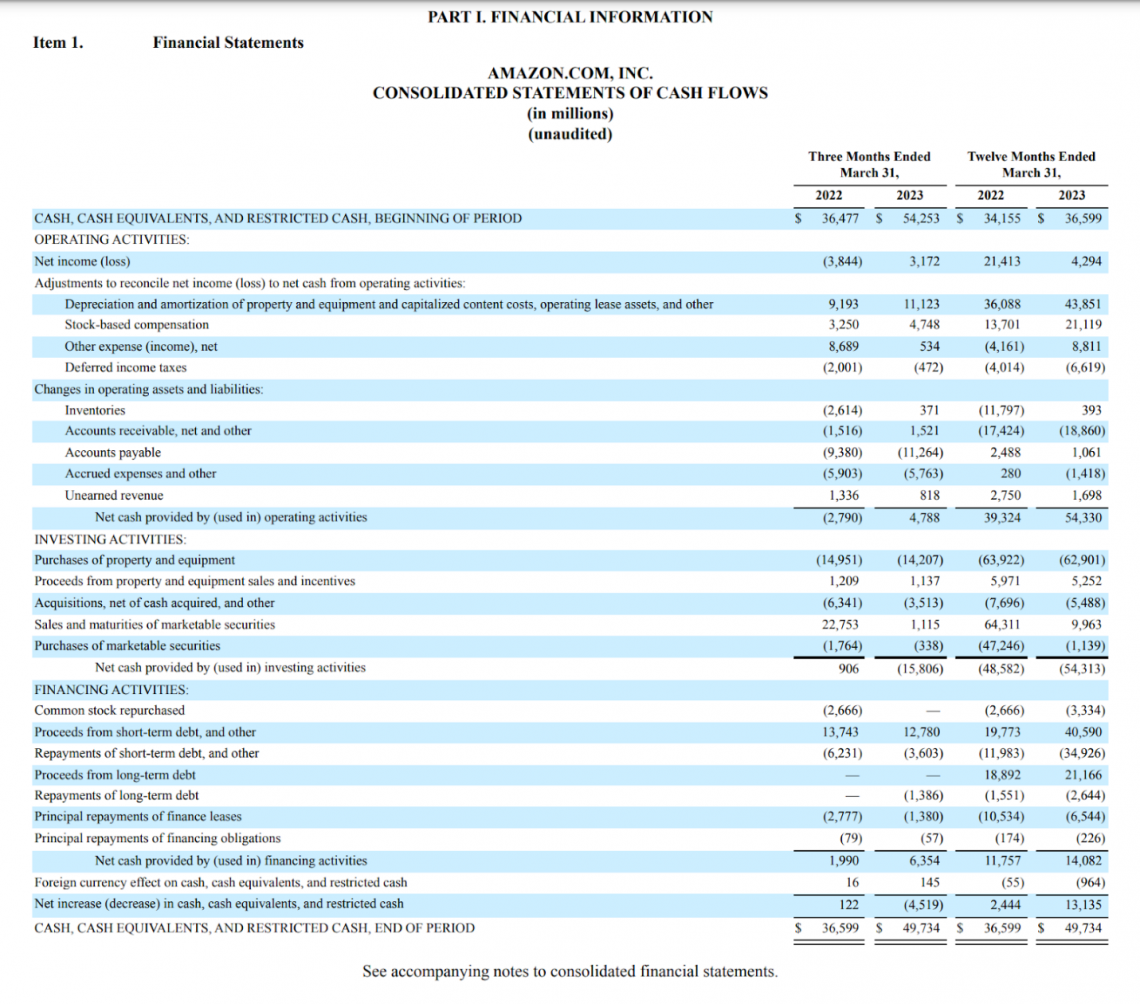

Cash Flow Statement

The cash flow statement represents a company’s total cash inflows and outflows over a specified time range, similar to the income statement. Cash in a business can come from operating, investing, or financing activities.

Operating activities are events in which the business produces or spends money to sell its products or services. This would be income from the sales of goods or services or interest payments and expenses such as wages and rent payments for company facilities.

Investing activities include selling or purchasing assets, which can include investing in business equipment or purchasing short-term securities. Financing activities include the payment of loans and the issuance of dividends or stock repurchases.

Key Takeaways

- Financial statements have information relevant for investors to understand the operations and profitability of a business over a specified time.

- Fundamental analysis typically focuses on the main three financial statements: the balance sheet, income statement, and cash flow statement.

- Although analyzing business financials can provide an unaltered outlook into the operations of a business, the numbers don’t always demonstrate the full story, and investors should always conduct thorough due diligence beyond pure statistics.

- Investors must ensure all of a company's financial statements are analyzed before forming a thesis, as inconsistencies in one sheet may be caused by an unusual one-time expense or dictated by a global measure out of the company’s control (ex., COVID-19).

Now that we have a general understanding of the financial statements, we can begin to take a look at Amazon’s most recent quarterly filing.

Company filings can be found by using EDGAR (database of regulatory filings for investors by the SEC) or from Amazon’s investor relations website.

Before we begin analyzing this sheet, it is important to take note of the statement just below the title, indicating that the data is being displayed in millions.

This can throw off newcomers, who may be very confused upon seeing Amazon’s revenue is $53,888. Amazon’s quarterly revenue is indeed $53.8 billion as calculated in millions.

When looking at Amazon’s assets, it is important to note the difference between current and total assets. Current assets are categorized separately due to the expectation that they can be converted to cash within the fiscal year.

Current assets can be used in the current ratio to analyze Amazon’s ability to pay off its short-term obligations. The current ratio formula is:

Current Ratio = Current Assets / Current Liabilities

Amazon’s current ratio sits at 0.92, which is below the e-commerce industry average of 2.09 as of March 2023 (Source: Macrotrends ).

This could mean that Amazon is potentially overvalued compared to competitors, but this is only one metric and should ultimately be all of an investment decision, especially considering the capital-intensive nature of Amazon’s business model.

It is also important to understand all of the vocabulary used to detail items in Amazon’s balance sheet. Some of the major items’ definitions can be found below:

Assets are classified as follows.

- Cash and cash equivalents: Assets of high liquidity, such as certificates of deposit or treasury bonds.

- Marketable securities: Liquid securities can be sold in the public market, such as stock in another company or corporate bonds.

- Accounts receivable (A/R): Money owed to the company that has not been received yet, such as from items previously bought on credit.

- Inventories: Unsold finished or unfinished products from a company that has yet to be sold.

- Property and equipment (PP&E): Assets owned by a company that is used for business activities. It may include factory assets or other types of real estate.

- Operating leases: Assets rented by a business for operational purposes. Calculated as the net present value on the balance sheet.

- Goodwill: Calculates intangible assets that cannot be sold or directly measured, such as customer reputation and loyalty.

Liabilities are of the following types.

- Accounts payable (A/P): Obligations accrued through business activities that must be paid off shortly.

- Accrued expenses: Current liabilities for a business that must be paid in the next 12 months.

- Unearned revenue: This represents revenue earned by a business that has not yet received. Prevents profits from being overstated for a specific period.

- Long-term debt: Debts in which payments are required over 12 months.

- Lease liabilities: Payment obligations of a lease taken out by a company.

- Stockholders’ equity: Net worth of a business/asset value to shareholders.

- Retained earnings: Net profit remaining for a company after all liabilities are paid.

Amazon’s next statement in its quarterly filing is the income statement. The income statement is useful for comparing a company’s growth over time and matching it up against competitors in the same or different sectors.

An essential factor to note when looking at a company’s income statement is whether its revenue and net income are consistently growing year over year. Investors should also be aware of Wall Street expectations, as they can heavily influence the business’s share price.

Many important ratios are used when analyzing a company’s income statement. Some of the most notable ones include:

- EV/EBITDA = (Market Capitalization + Debt - Cash) / (Revenue - Cost of Goods Sold - Operating Expenses)

- Gross Margin = (Revenue - Cost of Goods Sold) / Revenue

- Operating Margin = Operating Income / Revenue

- Net Margin = Net Income / Revenue

- Return on Equity (ROE) = Net Income / Average Shareholder Equity (End Value + Beginning Value / 2)

- Earnings Per Share = Net Income / Shares Outstanding

Let’s use these ratios to conduct a comparables analysis between Amazon and eBay, a company at a much lower valuation relative to the e-commerce giant. Here are their ratios side-by-side, as of Amazon’s Q1 2023 and eBay’s Q1 2023 filings:

* = EV/EBITDA ratios sourced from finbox.com , March 2023 trailing twelve months (TTM)

Looking at these statistics on paper, it is clear to see that Amazon seems overvalued compared to eBay due to lower margins, negative earnings per share, and an EV/EBITDA multiple over three times as high as the business.

However, pure stats on an income statement cannot fully justify purchasing one company or another. The statement merely shows what a company is doing without a corporate spin.

One thing to note that is unique about Amazon’s business model is how the company invests huge amounts of capital into R&D and technology to expand its operations continuously.

Their numbers don’t account for the massive cash flows and growth opportunities that the business takes advantage of.

When conducting fundamental analysis, an investor must consider all aspects of a business beyond the financial statements, including comparing business models to competitors and setting benchmarks encompassing the overall sector.

Amazon’s cash flow statement is where the company begins to shine compared to its competitors in the online commerce sector. The company has consistently increased cash flow from operating activities and constantly returns value to shareholders in the form of capital appreciation.

It is notable for focusing on what the company is doing inside of its cash flow statements to get a better picture of why its income or stock price is trending a certain way.

For example, an explosive drop in net income in an otherwise stable company could be due to mismanagement or hampered growth but is most likely due to M&A activity charged in a quarter that may be skewing the numbers. The cash flow statement clears this up.

Compared to 2022, Amazon has increased its annual cash from operating activities by over 38% from the previous year based on a 12-month rolling basis.

This increase has also resulted in an 11.7% increase in investment expenditures, which should allow Amazon to continue growing faster than similar companies.

In comparison, according to eBay’s most recent 10-K filing , the company generated an 82% growth in operating cash flow (OCF), however, this stat can be very misleading due to the company’s lack of investment in processes such as R&D and SG&A.

In 2022, the company reported $92M in investing activities, representing only 26% of operating cash flows. Amazon reported over $37.6B in investing activities representing approximately 88% of its OCF.

The income statement can misrepresent how well a company is doing, as while eBay has a higher net income, Amazon strategically reinvests its cash flows into R&D and other expenses to produce more over time continuously.

What makes the cash flow statement so essential to fundamental analysis is the fact that it is tough to manipulate its numbers through financial engineering or clever accounting.

The statement purely shows precisely where all of the money a company makes is being used. Many investors use the cash flow statement to tell the true financial health of a business, as profits can often not be indicative of a growth company's value.

The stock price of a company can easily be swayed by sentiment or the market cycle , and the income statement can be skewed through large one-time transactions or large amounts of financed revenue. The amount of money in the possession of a company is very hard to adjust.

Amazon currently has much better growth prospects than eBay and thus sells at a higher premium in the open market , but you wouldn’t understand why unless you took in the full picture of the company.

Everything You Need To Master Valuation Modeling

To Help You Thrive in the Most Prestigious Jobs on Wall Street.

Financial statements are excellent tools to learn more about a business in terms of an overall market or sector of operation. Using financial statements to determine the current value of a business is essential for understanding a company’s stock price.

Along with the ratios mentioned, analysts often form their methodologies over time to focus on companies that are strong in specific financial circumstances.

Tools such as stock screeners can sort millions of companies by certain factors. For instance, some investors may seek defensive companies with consistent dividend growth over long periods, while others may seek growth companies with the most innovative new technology.

Investors should keep all of this information in mind, as well as pay attention to the reports of analysts with varied performance outlooks. It is essential to seek out the opinions of multiple sources before establishing an opinion on a business.

Looking at reports from analysts specializing in the industry can also ensure that your expectations are reasonable compared to industry experts.

If your thesis results in Amazon growing its revenues by 20% a year while analysts across the country are only expecting growth in the range of 5-7%, it could be a sign that you may have overlooked a key factor in your due diligence .

The overall goal of using financial statements is to fully understand the company you are investing in to justify a position. Although your views may slightly differ from experts, quality due diligence can result in somewhat varied outcomes based on an investor’s outlook for the future.

Using EBITDA instead of net income strips away the capital structure and taxation of a business to analyze the pure earnings potential of a business. This is more practical for investors to see the general trajectory of a company’s income over time.

For example, companies may decide on completing a merger or acquiring another company. This will require a company to report its current and acquired assets on its balance sheet .

Over time, these assets must be recorded as expenses through the use of depreciation, which is the process of deducting from gross revenue to account for the decreasing value of company plant assets.

If these assets increase in value over time, this could decrease revenues over time not due to company performance but because of increased prices for equipment outside of the company’s control.

Without looking at EBITDA, company financials may paint a completely different picture with the use of net income that may or may not be justified at all.

ROE is an important metric to distinguish how good a company is at generating profits with investor capital compared to its share price and competitors. It is yet another indicator used to analyze the trajectory of a business over time.

Using ROE can also demonstrate how much financing a company requires to generate its revenue and if investors are really getting a great return for the amount of money shareholders contribute.

A startup that has recently gone public on the stock exchange may have a very low to negative ROE compared to an established company. Still, the startup may have the margins and growth to justify its valuation .

Much like every financial ratio, ROE doesn’t demonstrate the entire story of a business, and the full picture of a business must be considered to decide on an equity investment.

To proliferate and take market share from competitors , Amazon undercuts prices on many products to decrease competition and remain the top player in the industry.

Amazon, like many other companies recently since the pandemic, has also faced significant increases in operating expenses , thus lowering operating and net margins in the short term. Once Amazon begins to slow expansion, these margins are expected to rise.

Amazon’s net income is very low for many of the same reasons. The company is profitable yet is constantly reinvesting into new businesses and products to further grow cash flows for future expenditures.

Amazon investors are not focused on income but rather on its ability to continuously grow in the long term. Growth companies like Amazon do not issue dividends because they believe that the money is better reinvested in business operations.

Everything You Need To Master Financial Statement Modeling

To Help you Thrive in the Most Prestigious Jobs on Wall Street.

Researched and Authored by Tanner Hertz | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

- Accounting Conservatism

- Accounting Equation

- Accounting Ratios

- Three Financial Statements in FP&A

- Working Capital Cycle

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

Introduction: Ratio analysis is a powerful tool in financial analysis, providing insights into a company's performance. This guide will explore the applicati

Finance Health

Ratio Analysis

Invest Decision

Real Life Case

Invest Strategy

Business Metric

Finance Data

Exploring Ratio Analysis Through Real-Life Case Studies

Dec 4, 2023 6:54 AM - Parth Sanghvi

Image credit: Austin Distel

Introduction:.

Ratio analysis is a powerful tool in financial analysis, providing insights into a company's performance. This guide will explore the application of ratio analysis through diverse case studies, showcasing its significance and practical implications in decision-making.

Understanding Ratio Analysis:

Ratio analysis involves the examination of various financial ratios to evaluate a company's financial health, performance, and operational efficiency. Key ratios include liquidity, profitability, solvency, and efficiency ratios.

Importance of Case Studies in Ratio Analysis:

Real-life case studies offer practical demonstrations of how ratio analysis influences decision-making and provides actionable insights for investors, analysts, and businesses.

Case Study Examples:

Liquidity Ratio Impact on Small Business:

- Analyzing the current ratio and quick ratio of a small business to assess its ability to meet short-term obligations during a cash crunch.

Profitability Ratios in Tech Companies:

- Comparing net profit margin and ROE among tech giants to identify profitability leaders in the industry.

Solvency Ratio Impact in the Retail Sector:

- Analyzing debt-to-equity ratios in the retail sector during economic downturns to evaluate resilience and risk management strategies.

Efficiency Ratios and Manufacturing Operations:

- Assessing inventory turnover ratios and receivables turnover ratios in manufacturing firms to streamline operational efficiency.

Valuation Ratios in Investment Decisions:

- Using P/E ratios and P/B ratios to make informed investment decisions in different sectors based on market sentiment.

Lessons Learned from Case Studies:

Holistic Evaluation: How combining multiple ratios provides a comprehensive view of a company's performance.

Industry Benchmarking: The significance of benchmarking ratios against industry averages for accurate comparative analysis.

Impact on Decision-making: How ratio analysis influences investment, strategic, and operational decisions.

Leveraging Insights from Ratio Analysis:

Continuous Monitoring: Regularly reviewing ratios to detect trends and identify areas needing improvement.

Predictive Analysis: Using historical data from ratios to forecast future performance and trends.

Conclusion:

Ratio analysis case studies provide actionable insights and practical applications for businesses and investors. Learning from these real-life examples empowers stakeholders to make informed decisions based on a thorough understanding of financial ratios.

Other Blogs

Sep 11, 2023 - Rajnish Katharotiya

Industry Analysis with Python

During this post we are going to perform an industry analysis with Python. We will build, analyse and compare all stocks operating within an industry. To do so, we will pick an industry and get all important financial metrics for companies operating in that industry. Then, we will use a couple of fi...

P/E Ratios Using Normalized Earnings

Price to Earnings is one of the key metrics use to value companies using multiples. The P/E ratio and other multiples are relative valuation metrics and they cannot be looked at in isolation. One of the problems with the P/E metric is the fact that if we are in the peak of a business cycle, earni...

Portfolio Risk and Returns with Python

Would you like to know how your portfolio is performing and how much risk you are taking? In this post, you will learn how to measure portfolio risk and calculate portfolio returns using Python. We will see step by step how to calculate the risk and returns of a portfolio containing four stocks Appl...

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Financial analysis

- Finance and investing

- Corporate finance

3 Strategies for Managing Your Profit-Drain Customers

- Jonathan Byrnes

- September 08, 2021

Strategic Analysis for More Profitable Acquisitions

- Alfred Rappaport

- From the July 1979 Issue

To Increase Sales, Get Customers to Commit a Little at a Time

- David Hoffeld

- Frank V. Cespedes

- July 20, 2016

Today’s Options for Tomorrow’s Growth

- W. Carl Kester

- From the March 1984 Issue

How Much Should a Corporation Earn?

- John J. Scanlon

- From the January 1967 Issue

Do You Know Your Cost of Capital?

- Michael T. Jacobs

- Anil Shivdasani

- From the July–August 2012 Issue

Data Scientists Don't Scale

- Stuart Frankel

- May 22, 2015

The Value of Customer Experience, Quantified

- Peter Kriss

- August 01, 2014

Are You Paying Too Much for That Acquisition?

- Robert G. Eccles

- Kersten L. Lanes

- Thomas C. Wilson

- From the July–August 1999 Issue

Using APV: A Better Tool for Valuing Operations

- Timothy A. Luehrman

- From the May–June 1997 Issue

Does the Market Know Your Company’s Real Worth?

- James McNeill Stancill

- From the September 1982 Issue

Sustainable Business Went Mainstream in 2021

- Andrew Winston

- December 27, 2021

KPIs Aren't Just About Assessing Past Performance

- Graham Kenny

- September 23, 2021

How to Talk to Your CFO About Sustainability

- Tensie Whelan

- Elyse Douglas

- From the January–February 2021 Issue

The Balanced Scorecard: Measures That Drive Performance

- Robert S. Kaplan

- David P. Norton

- From the July–August 2005 Issue

The Best-Performing CEOs in the World 2017

- Harvard Business Review

- From the November–December 2017 Issue

6 Ways CEOs Can Prove They Care About More Than Shareholder Value

- John Elkington

- Richard Roberts

- September 02, 2019

The Data: Where Long-Termism Pays Off

- Dominic Barton

- James Manyika

- Sarah Keohane Williamson

- From the May–June 2017 Issue

Innovation Killers: How Financial Tools Destroy Your Capacity to Do New Things

- Clayton M. Christensen

- Stephen P. Kaufman

- From the January 2008 Issue

The Capitalist's Dilemma

- Derek C.M. van Bever

- From the June 2014 Issue

Van Nuys Community Hospital

- David W. Young

- March 25, 2013

Carbostar: To sell or not to sell? That is the question

- Norma Consuelo Ortiz

- Carlos Jaramillo

- Emilio Cardona

- May 25, 2022

Identifying Firm Capital Structure

- January 24, 2011

WLIM: SCALING UP A WEALTH MANAGEMENT BOUTIQUE

- Benoit Leleux

- Federica Fasoli

- Kathrin Lutz

- Cristian Neamtu

- October 04, 2020

Growth Investing at Totem Point

- Suraj Srinivasan

- Charles C.Y. Wang

- Jonah S. Goldberg

- March 13, 2019

The Farm Winery

- Madhav V. Rajan

- Jaclyn C. Foroughi

- October 15, 2014

Financial Analytics Toolkit: Cash Flow Projections

- Marc Lipson

- September 24, 2019

Valuation of AirThread Connections

- Erik Stafford

- Joel L. Heilprin

- March 01, 2011

Clarkson Lumber Co.

- Thomas R. Piper

- September 19, 1996

Ahold versus Tesco--Analyzing Performance

- Penelope Rossano

- September 18, 2012

Environmental Impact-Driven Private Equity Decisions at Ambienta (B)

- Atalay Atasu

- Benjamin Kessler

- November 13, 2022

Note on the Financial Perspective: What Should Entrepreneurs Know?

- William A. Sahlman

- September 04, 1992

Coca-Cola Co. (B)

- David F. Hawkins

- November 19, 1999

Mercury Athletic: Valuing the Opportunity

- September 18, 2009

Budweiser APAC Spinoff (B): The Financial Strategy for Localization

- Shimin Chen

- David Hendrik Erkens

- July 04, 2022

The Confectionery Business

- Arlette Beltran

- Claudia Haro

- November 21, 2020

Portfolio Selection and the Capital Asset Pricing Model

Baupost group: finding a margin of safety in london real estate.

- Adi Sunderam

- Luis M. Viceira

- Shawn O'Brien

- Franklin Muanankese

- May 30, 2018

Financial Statement Analysis

- November 30, 1994

Gupta Media: Performance Marketing in the Digital Age

- V. Kasturi Rangan

- Courtney Han

- October 10, 2019

Healthineers: A Strategic IPO, Student Spreadsheet

- Robert S. Harris

- May 16, 2019

greeNEWit: Financing the Next Level, Teaching Note

- Susan V. White

- Karen Hallows

- March 01, 2016

Popular Topics

Partner center.

- Browse All Articles

- Newsletter Sign-Up

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 Sep 2023

- Research & Ideas

How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, Diversify

Financial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?

- 17 Aug 2023

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 17 Jul 2023

Money Isn’t Everything: The Dos and Don’ts of Motivating Employees

Dangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.

- 20 Jun 2023

- Cold Call Podcast

Elon Musk’s Twitter Takeover: Lessons in Strategic Change

In late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 27 Apr 2023

Equity Bank CEO James Mwangi: Transforming Lives with Access to Credit

James Mwangi, CEO of Equity Bank, has transformed lives and livelihoods throughout East and Central Africa by giving impoverished people access to banking accounts and micro loans. He’s been so successful that in 2020 Forbes coined the term “the Mwangi Model.” But can we really have both purpose and profit in a firm? Harvard Business School professor Caroline Elkins, who has spent decades studying Africa, explores how this model has become one that business leaders are seeking to replicate throughout the world in her case, “A Marshall Plan for Africa': James Mwangi and Equity Group Holdings.” As part of a new first-year MBA course at Harvard Business School, this case examines the central question: what is the social purpose of the firm?

- 25 Apr 2023

Using Design Thinking to Invent a Low-Cost Prosthesis for Land Mine Victims

Bhagwan Mahaveer Viklang Sahayata Samiti (BMVSS) is an Indian nonprofit famous for creating low-cost prosthetics, like the Jaipur Foot and the Stanford-Jaipur Knee. Known for its patient-centric culture and its focus on innovation, BMVSS has assisted more than one million people, including many land mine survivors. How can founder D.R. Mehta devise a strategy that will ensure the financial sustainability of BMVSS while sustaining its human impact well into the future? Harvard Business School Dean Srikant Datar discusses the importance of design thinking in ensuring a culture of innovation in his case, “BMVSS: Changing Lives, One Jaipur Limb at a Time.”

- 18 Apr 2023

What Happens When Banks Ditch Coal: The Impact Is 'More Than Anyone Thought'

Bank divestment policies that target coal reduced carbon dioxide emissions, says research by Boris Vallée and Daniel Green. Could the finance industry do even more to confront climate change?

The Best Person to Lead Your Company Doesn't Work There—Yet

Recruiting new executive talent to revive portfolio companies has helped private equity funds outperform major stock indexes, says research by Paul Gompers. Why don't more public companies go beyond their senior executives when looking for top leaders?

- 11 Apr 2023

A Rose by Any Other Name: Supply Chains and Carbon Emissions in the Flower Industry

Headquartered in Kitengela, Kenya, Sian Flowers exports roses to Europe. Because cut flowers have a limited shelf life and consumers want them to retain their appearance for as long as possible, Sian and its distributors used international air cargo to transport them to Amsterdam, where they were sold at auction and trucked to markets across Europe. But when the Covid-19 pandemic caused huge increases in shipping costs, Sian launched experiments to ship roses by ocean using refrigerated containers. The company reduced its costs and cut its carbon emissions, but is a flower that travels halfway around the world truly a “low-carbon rose”? Harvard Business School professors Willy Shih and Mike Toffel debate these questions and more in their case, “Sian Flowers: Fresher by Sea?”

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

- 23 Mar 2023

As Climate Fears Mount, More Investors Turn to 'ESG' Funds Despite Few Rules

Regulations and ratings remain murky, but that's not deterring climate-conscious investors from paying more for funds with an ESG label. Research by Mark Egan and Malcolm Baker sizes up the premium these funds command. Is it time for more standards in impact investing?

- 14 Mar 2023

What Does the Failure of Silicon Valley Bank Say About the State of Finance?

Silicon Valley Bank wasn't ready for the Fed's interest rate hikes, but that's only part of the story. Victoria Ivashina and Erik Stafford probe the complex factors that led to the second-biggest bank failure ever.

- 13 Mar 2023

What Would It Take to Unlock Microfinance's Full Potential?

Microfinance has been seen as a vehicle for economic mobility in developing countries, but the results have been mixed. Research by Natalia Rigol and Ben Roth probes how different lending approaches might serve entrepreneurs better.

- 16 Feb 2023

ESG Activists Met the Moment at ExxonMobil, But Did They Succeed?

Engine No. 1, a small hedge fund on a mission to confront climate change, managed to do the impossible: Get dissident members on ExxonMobil's board. But lasting social impact has proved more elusive. Case studies by Mark Kramer, Shawn Cole, and Vikram Gandhi look at the complexities of shareholder activism.

- 07 Feb 2023

Supervisor of Sandwiches? More Companies Inflate Titles to Avoid Extra Pay

What does an assistant manager of bingo actually manage? Increasingly, companies are falsely classifying hourly workers as managers to avoid paying an estimated $4 billion a year in overtime, says research by Lauren Cohen.

- Search Search Please fill out this field.

What Is Financial Analysis?

Understanding financial analysis, corporate financial analysis, investment financial analysis, types of financial analysis, horizontal vs. vertical analysis.

- Example of Financial Analysis

- Financial Analysis FAQs

The Bottom Line

- Corporate Finance

- Financial statements: Balance, income, cash flow, and equity

Financial Analysis: Definition, Importance, Types, and Examples

:max_bytes(150000):strip_icc():format(webp)/david-kindness-cpa-headshot1-beab5f883dec4a11af658fd86cb9009c.jpg)