Bank Of Baroda Q4FY23 Quarter Results

- 16 May 2023

- Bank Of Baroda’s net revenues (net interest income plus other income) grew by 7.2% quarter-on-quarter (QoQ) during the quarter ended March (Q4FY23).

- On a year-on-year (YoY) basis, it witnessed a growth of 44.8%.

- Its expenses for the quarter were up by 12.8% QoQ and 44.2% YoY.

- Provisions & contingencies decreased by 39% QoQ and 50% YoY.

- The bank’s net profit grew 22.1% QoQ and 158.7% YoY

- The bank’s capital adequacy ratio (CAR) stood at 16.73% in March 2023 quarter.

- Net non-performing assets (NPAs) were at 0.89% of net advances as of March 2023.

- The earnings per share (EPS) of Bank Of Baroda stood at 10.2 during Q4FY23.

Bank Of Baroda’s financial statements for Q4FY23:

(Rs, crores)

Total Income

Total Expenses

Provisions & contingencies

Profit before tax

Profit after tax

Earnings per share

Data Source: BSE, Company announcements

Want to keep a tab on Indian listed companies? Open an account and get daily stock research updates from Kotak Securities.

The securities quoted are exemplary and are not recommendatory. Past performance is not indicative of future results

I agree to terms and conditions

I agree to all terms and conditions

Hanna Loikkanen Chief representative, Moscow, East Capital Private Equity

Jul 23, 2014

130 likes | 279 Views

ECFF Investor update. Hanna Loikkanen Chief representative, Moscow, East Capital Private Equity. EMEA and European banks performance. Share price performance , %. Source: Bloomberg, last price as of October 3, 2011. Downside risks are being priced in.

Share Presentation

- thus various

- gross loans source

- european banks performance

- green circles

Presentation Transcript

ECFF Investor update Hanna LoikkanenChief representative, Moscow, East Capital Private Equity

EMEA and European banks performance Sharepriceperformance, % Source: Bloomberg, last price as of October 3, 2011

Downside risks are being priced in P/BV multiplesbased on 2010YE book Source: VTB Capital, Banks Watch monthly issues

Bankingsectorgrowth has remained strong Depositgrowth in ourregions y-o-y % change in localcurrency Loangrowth in ourregions y-o-y % change in localcurrency The bankingsectorin our regions havecontinuedtogrow on both sides ofthe balancesheetwithmorepronouncedgrowth in Russia and Georgia

Improved LTD ratios favourable for NIM Net customer loans to deposits Source: Banks data, National banks green circles= RU tradedbanks that are not Fund’sholdings

The banks are mostly deposit funded Deposits/assets Source: Banks data, National banks green circles= RU tradedbanks that are not Fund’sholdings

Improved asset qualityaddstohigherprofitability Provisions/gross loans Source: Banks data, National banks green circles= RU tradedbanks that are not Fund’sholdings

NIM and ROaEsareimproving in 1H2011 Return On Average Equity (in EUR) Net InterestMargin (in localcurrency) Source: Banks data

EastCapitalFinancialsFundperformance %Inception y-t-d 3m NAV -46,3 -11,6 -15,0 RTS FI 4,1 -28,9 -27,2 OTC Price -71,0 -12,1 -25,6 Latest NAV as ofOctober 31, 2011 Jan 2006 - Oct 2011

Portfolio valuation(as of October 31, 2011) 1 Latest available book value, currency adjusted *38.1m Equity and 19.3m Convertible debt 2 Several purchases and thus various multiples ** 1m Equity and 4m Convertible loan 3 Not applicable 4 Asian - Pacific Bank merged with Kolyma Bank and Kamchatprombank. Purchase price and fair value are the sums of banks’ prices and valuations the Fund received by external appraiser

Road towards exit • Focus on value enhancement • Secure availability and sufficiency of funding • Focus on profitability (ROE, F&C income, cost of risk) • Strengthen market position and brand recognition • Active preparation for exit • Mandate advisors/quiet marketing • Review and update marketing material • Increase in market valuations necessary to facilitate exits

- More by User

Venture Capital and Private Equity Session 3

Venture Capital and Private Equity Session 3. Professor Sandeep Dahiya Georgetown University. Course Road Map. What is Venture Capital - Introduction VC Cycle Fund raising Investing VC Valuation Methods Term Sheets Design of Private Equity securities Exiting

410 views • 20 slides

Entrepreneurial Finance, Private Equity and Venture Capital

704 views • 52 slides

Venture Capital and Private Equity Session 4

Venture Capital and Private Equity Session 4. Professor Sandeep Dahiya Georgetown University. Course Road Map. What is Venture Capital - Introduction VC Cycle Fund raising Investing VC Valuation Methods Term Sheets Design of Private Equity securities Exiting

606 views • 25 slides

Marcus Svedberg Chief Economist, East Capital

Global Economic Outlook. Marcus Svedberg Chief Economist, East Capital. The setting. Global growth is being revised down ,.. … and uncertainties over Eurozone debt linger . Eastern Europe will slow down due to weak external demand , but …

223 views • 9 slides

Venture Capital and Private Equity Session 2

Venture Capital and Private Equity Session 2. Professor Sandeep Dahiya Georgetown University. Course Road Map. What is Venture Capital - Introduction VC Cycle Fund raising Investing Exiting Time permitting – Corporate Venture Capital (CVC). ONSET What Happened.

526 views • 28 slides

Venture Capital and Private Equity Session 2. Professor Sandeep Dahiya Georgetown University. This Course. No easy answers – Boot Camp (Up to 100+pages of reading before class!!) Main Perspective Key aspects and practices of industry

661 views • 46 slides

Venture Capital and Private Equity Session 6

Venture Capital and Private Equity Session 6. Professor Sandeep Dahiya Georgetown University. Course Road Map. What is Venture Capital - Introduction VC Cycle Fund raising Investing VC Valuation Methods Term Sheets Design of Private Equity securities Exiting

508 views • 27 slides

Private Equity in Middle East

Private Equity in Middle East. October 2005. Istithmar Overview. A major investment holding company based in the UAE Focuses on Private Equity, Alternative Investments, and Real Estate Set up in June 2003 with an initial capital pool of USD 2 Billion

201 views • 7 slides

Ian Armitage Chief Executive Mercury Private Equity

Private Equity. Ian Armitage Chief Executive Mercury Private Equity. Dissecting Private Equity. What is Private Equity? Why Should Your Clients Do It? Why Should Your Clients Not Do It? Investment Routes Have new investors missed the boat?. What is Private Equity?. Venture Capital

538 views • 31 slides

Offerings for Venture Capital / Private Equity

Offerings for Venture Capital / Private Equity. Agenda. About YES Bank Knowledge Banking Approach Transaction Banking Group Cash Management Services Foreign Currency Remittances Capital Markets & Escrow Account Services YES Bank Proposition for Employees. About YES Bank.

353 views • 15 slides

Venture Capital and Private Equity Session 5

Venture Capital and Private Equity Session 5. Professor Sandeep Dahiya Georgetown University. Course Road Map. What is Venture Capital - Introduction VC Cycle Fund raising Investing VC Valuation Methods Term Sheets Design of Private Equity securities Exiting

632 views • 42 slides

Italian Private Equity and Venture Capital Association

Italian Private Equity and Venture Capital Association. Anna Gervasoni. Il mercato del seed e venture capital in Italia. Pavia , 2 7 th May 2002. A.I.F.I. Investment activity by number, companies and amount. - 26 %. A.I.F.I. 2001: % stage distribution of investments. A.I.F.I.

552 views • 39 slides

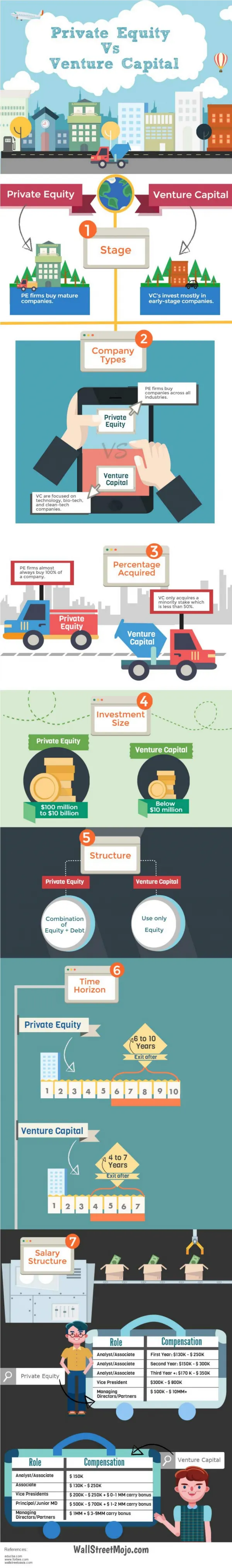

Private Equity vs Venture Capital

Are you confused whether to opt for private equity or venture capital. Don’t be. You only need 90 secs to clarify your doubts. Private equity and venture capital have some similarities but there are major differences between the two. You will acquire different types of skills, you will study different subjects also you will get different job prospects, go through the infographics on private equity vs venture capital and get to know the same. wallstreetmojo

208 views • 1 slides

Nueterra Capital - Private Equity Healthcare Firm

Nueterra Capital Healthcare is a highly focused private equity and we are a strong team of investment professionals and healthcare operators who have collectively gathered an ability to conceptualize, develop and grow successful businesses in our target markets.

126 views • 6 slides

Venture Capital and Private Equity Tools

Check out my new free guide: Venture Capital and Private Equity Tools Discover the many tools that others (and I) are using to increase their productivity and effectiveness. The Guide itself will increase your success by saving you time searching as I’ve already done the legwork for you! I hope you find these of use, and let me know what tools you recommend as well! Please join our Facebook Community of over 2100 likeminded folks were you can participate by sharing what cool tools you have found as well as seeing what others use: https://www.facebook.com/groups/ALifeInFull/ Thanks again for all you do, and let us know how we can be of help. Cheers, Chris http://ALifeInFull.org

63 views • 6 slides

Private Equity Venture Capital - Affinity

Do you know which is private equity venture capital? Its very important to know private equity venture capital to invest. You can get the information about venture capital from Affinity.co and read the blog as well: https://www.affinity.co/solutions/venture-capital-private-equity

66 views • 6 slides

Private Equity – Venture Capital Partnership for Success

Private Equity – Venture Capital Partnership for Success. BI Bachelor in Entrepreneurship September 26, 2006 Erik Berger Investment Director CapMan Tech. Schedule. Background The PE/VC Earnings Model The PE/VC Investment Model Closing Remarks Q&A. Schedule. Background

184 views • 18 slides

Venture Capital & Private Equity Email List

Get customized Venture Capital and Private Equity Executives Mailing list based on your marketing campaign, you can select variety of channels for multi channel b2b marketing campaigning to go viral and to expand market presence. . http://www.globalb2bcontacts.com https://globalb2bcontacts.com/Healthcare-email-list.html https://globalb2bcontacts.com/email-database.html

78 views • 7 slides

REBOUND: Foreign Institutional Investors Buy More of Moscow Exchange

Posted on 07/02/2014

The Central Bank of Russia is selling a stake of the Moscow Exchange to a consortium of institutional investors led by the Russian Direct Investment Fund (RDIF). The RDIF was a cornerstone investor in the Moscow Exchange’s initial public offering back in February 2013.

Institutional Investors

These institutional investors include: Cartesian Capital, BlackRock, and the European Bank for Reconstruction and Development (EBRD). A few sovereign wealth funds joined in the deal as well such as the Kuwait Investment Authority and China Investment Corporation (CIC). Some of these investors were earlier investors in the exchange including BlackRock and the CIC.

In the press release, Kirill Dmitriev, CEO of RDIF commented, “We are delighted that RDIF managed to attract our partners as co-investors from China, Singapore, Qatar, UAE, USA, UK and Germany. As the basis of the financial infrastructure in Russia, we believe that the Moscow Exchange has considerable capitalization growth potential.”

- Cartesian Capital

- Central Bank of Russia

- Central Banking

- China Investment Corporation

- Kuwait Investment Authority

- Moscow Exchange

- Russian Direct Investment Fund

Get News, People, and Transactions, Delivered to Your Inbox

Related news.

- Construction

- Manufacturing

- Infrastructure

- Agriculture

Sanctions Weighing on Investors’ Decisions on Russia: Credit Bank of Moscow VP

The fear of new U.S. economic sanctions against Russia is weighing on the minds of investors when it comes to Russia, Eric de Beauchamp, Senior Vice President at Credit Bank of Moscow , has said in an interview with Bonds & Loans.

“Possible new sanctions against Russia and, consequently, resumption of foreign capital outflows, are likely to remain the central factor that will affect the ruble exchange rate. On top of this, purchases of hard currency by the Ministry of Finance and the Bank of Russia, which were postponed for several months, may restart from early 2019,” de Beauchamp said.

“Recent months have seen no clear correlation between oil prices and the value of the Russian currency. While oil prices have dropped by nearly 20% since this summer, from about $80 to $60 per barrel, the ruble has only shed 1.5% of its value against the dollar, from 65.5 to 66.5 per USD. In this regard, an oil price in the range of $60 to $80 per barrel should not significantly impact the USD-RUB exchange rate,” CBOM’s VP said.

He added that given the geopolitical situation and the need to resume dollar purchases on part of the Ministry of Finance starting early in 2019, the ruble is likely coming under increasing pressure in the months to follow.

Asked if the current tougher stretch in the economy shows signs of corporates shifting from bond market borrowing to loans and syndications, de Beauchamp said it is too early to see this.

“This year we are indeed witnessing some jitters in the capital markets, associated primarily with sanctions-related negativity, but no more than that. Of course, against this backdrop, the current market situation looks worse than last year and placements of new bond issues decreased. We have already been living under sanctions for several years, and the majority of market participants (both borrowers and representatives of the investment community) have already developed a certain immunity. That said, this year the most negative impact on the market has been driven not so much by the imposed sanctions, but by the uncertainty concerning potential future ones,” de Beauchamp said.

RELATED ARTICLES MORE FROM AUTHOR

Metinvest Provides Housing for IDP Workers

Donetsk Oblast Receives 5,400 Food Packages from Rinat Akhmetov Foundation

Rinat Akhmetov Foundation Donates 2,400 hygiene kits to the IamMariupol IDP Support Center

Get in touch, recent posts, most popular.

Combatants from Zaporizhia Receive Bulletproof Vests from Metinvest

Metinvest Provides 500,000 Litres of Fuel to the Army

Russia Hosts High-Level Talks between Armenia and Azerbaijan

Russia Denies Entry to More Israelis as Visa Spat Escalates

Turkish Exports to Russia Surge 26% in January-February

Trending now.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Credit Bank of Moscow seeks to buy back up to $200M in loan participation notes

Banking Essentials Newsletter: 7th February Edition

A Bank Outsources Data Gathering to Meet Basel III Regulations

Private Markets 360° | Episode 8: Powering the Global Private Markets (with Adam Kansler of S&P Global Market Intelligence)

Banks’ Response to Rising Rates & Liquidity Concerns

- 23 Mar, 2020

- Author Beata Fojcik

- Theme Banking

CBOM Finance, at the request of PAO Credit Bank of Moscow, launched an invitation to repurchase up to $200 million worth of loan participating notes maturing in 2021, 2023, 2024 and 2025.

The minimum purchasing price for the 2021 notes, 2023 notes and 2025 notes has been set at $910, $840 and $720 per $1,000 principal amount, respectively. The minimum price for the dollar-denominated notes maturing in 2024 amounts to $830 per $1,000 principal amount, and the minimum price for the euro-denominated notes maturing in 2024 is set at €830 per €1,000 principal amount.

The invitation expires March 26, and buyback results will be announced March 27. The transaction will be settled on or around March 31.

Citigroup Global Markets Ltd. and Société Générale will act as dealer managers, while Lucid Issuer Services Ltd. will act as tender agent for the transaction.

- Beata Fojcik

IMAGES

VIDEO

COMMENTS

Q4FY23 Presentation on financial results for the period ended 31st March, 2023 29th April, 2023. 2 Consolidated Highlights FY23 ... Kotak Mahindra Bank 3,496 2,767 2,792 10,939 8,573 28% Kotak Mahindra Prime 224 313 225 829 886 -6% Kotak Mahindra Investments 100 101 86 326 371 -12%

Hello Investors, feel free to contact us. * Time : 10 A.M. to 5 P.M. (Monday to Friday - except bank holidays) Investor Relations with Kotak Mahindra Bank.

Kotak Mahindra Bank April 29, 2023 Page 3 of 22 Moderator: Ladies and gentlemen, good day and welcome to the Kotak Mahindra Bank Limited Q4 FY'23 Earnings Conference Call. As a reminder, all participant lines will be in the listen-only mode, and there will be an opportunity for you to ask questions after the presentation concludes.

Q4FY23 was ₹ 4,566 crore, up 17% YoY from ₹ 3,892 crore in Q4FY22. PAT of Bank and key subsidiaries given below: PAT (₹ crore) FY23 FY22 Q4FY23 Q4FY22 Kotak Mahindra Bank 10,939 8,573 3,496 2,767 Kotak Mahindra Life Insurance 1,053 425 205 267 Kotak Securities 865 1,001 182 252 Kotak Mahindra Prime 829 886 224 313

Launched a robust cloud based trading platform with cutting-edge technology stack. Upgraded customer experience across Login, Trade, Payment, Portfolio view. Introduced new features eg order slicing, stock fundamental and screeners. Extended Net banking facility for additional 31 banks.

INVESTOR PRESENTATION Q4FY21 Presentation on financial results for the period ended 31st March, 2021 3rd May, 2021. 2 ... Kotak Mahindra Bank 63,727 49,015 61,914 Kotak Mahindra Prime 6,623 6,088 6,439 Kotak Mahindra Investments 2,117 1,860 2,044 Kotak Securities 5,321 4,529 5,081 Kotak Mahindra Capital 689 622 680 ...

Presentation on financial results for the period ended 30th June, 2023 22nd July, 2023. 2 ... Kotak Mahindra Bank 87,011 74,652 83,460 Kotak Mahindra Prime 8,507 7,634 8,306 ... Lower tax provisions in Q4FY23 due to favorable income tax order - ₹ 108 crore. 7

Kotak Mahindra Bank 87,011 74,652 83,460 ... presentation. Lower employee retiral cost in Q1FY23 and Q4FY23 mainly due to ... Lower tax provisions in Q4FY23 due to favorable income tax order - ₹ 108 crore. 7 AssetQuality ^ Fund based outstanding for borrowers with exposure > ₹ 5 cr ₹cr 30-Jun-23 30-Jun-22 31-Mar-23 GNPA 5,909 6,379 5,768

Presentation on financial results for the period ended 31st December, 2022 21st January, 2023. 2 Consolidated Highlights Q3FY23 Figures in grey are Q3FY22 numbers ... Kotak Mahindra Bank 79,936 69,617 77,076 Kotak Mahindra Prime 8,081 7,182 7,856 Kotak Mahindra Investments 2,715 2,388 2,629

Retail Relations with Kotak Mahindra Bank. Watch the show to catch the key highlights of our Integrated Years Report 2022-23- please click here View to online edition of Kotak's Integrated Per Report 2022-23- please click here

Presentation on financial results for the period ended 30th September, 2022 22nd October, 2022. 2 Consolidated Highlights Q2FY23 Figures in grey are Q2FY22 numbers # As per Basel III, including unaudited profits. Excluding profits CAR: 22.5%, CET I: 21.5% (30th Sep, 2021: CAR: 22.8%, CET I: 21.8%) ... Kotak Bank -An Early Adopter ...

Bank, 72% Consolidated PAT ₹cr Q2FY23 Q2FY22 Q1FY23 FY22 Kotak MahindraBank 2,581 2,032 2,071 8,573 Kotak MahindraPrime (KMP) 222 240 157 886 Kotak Mahindra Investments 78 89 63 371 Kotak Securities 224 243 219 1,001 Kotak MahindraCapital 22 58 51 245 Kotak Mahindra Life Ins 270 155 248 425 Kotak Mahindra General Ins (17) (16) (18) (83)

Investor Presentation Q3FY22 Presentation on financial results for the period ended 31st December, 2021 28th January, 2022. 2 Consolidated Highlights Q3FY22 ... Kotak Mahindra Bank 2,131 1,854 2,032 6,965 Kotak Mahindra Prime 254 149 240 535 Kotak Mahindra Investments 111 68 89 258 Kotak Securities 270 184 243 793 ...

Kotak Mahindra Bank 89,956 77,076 87,011 Kotak Mahindra Prime 8,715 7,856 8,507 Kotak Mahindra Investments 3,043 2,629 2,917 BSS Microfinance 830 456 722 Kotak Securities 7,602 6,685 7,279 ... presentation. Other income includes dividend received from subsidiaries - Q1FY24: ₹ 309 crore FY23: 242 crore. 7

Kotak Mahindra Bank

Quarterly Results Q4FY23 Cumulative provisions (standard + additional non-NPA) 2 Axis Bank at a glance Axis Bank Market Share 41 mn+ Customers ~91,900 Employees Traditional Banking Segment 4.22% Net Interest Margin 4 2.25% Cost to Assets 2.92% Operating Profit Margin 4 Digital Banking Segment 5.4% Assets 1 6.0% Advances 2 5.1% Deposits 18% UPI ...

The bank's net profit grew 22.1% QoQ and 158.7% YoY; The bank's capital adequacy ratio (CAR) stood at 16.73% in March 2023 quarter. Net non-performing assets (NPAs) were at 0.89% of net advances as of March 2023. The earnings per share (EPS) of Bank Of Baroda stood at 10.2 during Q4FY23.

Maintaining healthy profitability & sustainability metrics. Consistent improvement in return ratios with Q4FY23 ROA at 1.90% and ROE at 15.26%. FY23 Net profit at Rs.7,443cr (up 55% YoY) and EPS at Rs.96 with healthy Capital Adequacy Ratio of 17.86%. 3.

Federal Bank Q3FY24 Quarter Results. 16 Jan 2024; Federal Bank's net revenues (net interest income plus other income) grew by 6.8% quarter-on-quarter (QoQ) during the quarter en

ECFF Investor update. Hanna Loikkanen Chief representative, Moscow, East Capital Private Equity. EMEA and European banks performance. Share price performance , %. Source: Bloomberg, last price as of October 3, 2011. Downside risks are being priced in. Slideshow 2197128 by beate

The Central Bank of Russia is selling a stake of the Moscow Exchange to a consortium of institutional investors led by the Russian Direct Investment Fund (RDIF). The RDIF was a cornerstone investor in the Moscow Exchange's initial public offering back in February 2013. Institutional Investors These institutional investors include: Cartesian Capital, BlackRock, and the […]

Argan's consolidated revenue for the year increased by 26% to $573.3 million. Full-year EBITDA reached $51.3 million. The company's project backlog grew to $757 million. Argan closed the fiscal ...

SVNDY. 0.15%. |. In their recent earnings call, Seven & i Holdings Co., Ltd. (3382.T) dispelled rumors of selling Ito-Yokado shares and expressed their intention to reach new record highs in ...

The fear of new U.S. economic sanctions against Russia is weighing on the minds of investors when it comes to Russia, Eric de Beauchamp, Senior Vice President at Credit Bank of Moscow, has said in an interview with Bonds & Loans. "Possible new sanctions against Russia and, consequently, resumption of foreign capital outflows, are likely to remain the central factor that will affect the ruble ...

CBOM Finance, at the request of Credit Bank of Moscow, launched an invitation to repurchase up to $200 million worth of loan participating notes maturing in 2021, 2023, 2024 and 2025.