- Search Search Please fill out this field.

- US & World Economies

- Economic Terms

MSCI Index and What It Measures

Erika Rasure is globally-recognized as a leading consumer economics subject matter expert, researcher, and educator. She is a financial therapist and transformational coach, with a special interest in helping women learn how to invest.

:max_bytes(150000):strip_icc():format(webp)/CSP_ER9-ErikaR.-5942904ef41f4814a94dd1a5c1c03f32.jpg)

How They Work

What they measure, msci emerging market index, msci frontier markets index, msci eafe index.

- MSCI World Index

MSCI History

uniquely India/Getty Images

The MSCI Indexes are a measurement of stock market performance in a particular area. Like other indexes , such as the Dow Jones Averages or the S&P 500, it tracks the performance of the stocks included in the index.

MSCI Indexes are used as the base for exchange-traded funds . The ETF duplicates the Index's stock holdings. That allows investors to profit from gains in the Index.

Similarly, Indexes are also the benchmarks that actively managed mutual funds use as bases. The exchange-traded funds follow the MSCI Indexes. Managed mutual funds try to outperform them by picking better stocks.

MSCI selects stocks for its equity indexes that are easily traded and have high liquidity. The stocks must have active investor participation and be without owner restrictions. MSCI must balance accuracy and efficiency. It must include enough stocks to represent the underlying equity market. At the same time, it can't have so many stocks that ETFs and mutual funds can't mimic the index.

Each Index sums up the total value of all stocks' market capitalization. That's the stock price multiplied by the number of outstanding shares. The S&P 500, but not the Dow, uses the same methodology. Market caps are calculated in both U.S. dollars and in local currency. That gives you an idea of how the index is doing without the impact of exchange rates.

Each index is updated daily, Monday through Friday. Additionally, each index is reviewed quarterly and rebalanced twice a year. That's when its manager adds or subtracts stocks to make sure the index still accurately reflects the composition of the underlying equity market it measures.

For that reason, MSCI Indexes have the power to change the market. When an index is rebalanced, all the ETFs and mutual funds that track it must buy and sell the same stocks. Stocks that are added to the index usually find their share prices rising. The opposite happens to stocks that are dropped from an index.

MSCI has indexes for a variety of geographic sub-areas, as well as global indexes for stock categories such as small-cap, large-cap, and mid-cap. The four most popular track emerging markets, frontier markets, developed markets excluding the United States and Canada, and the world market.

The Emerging Markets Index tracks the performance of stock markets in the following 26 developing countries: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Pakistan, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and United Arab Emirates. The MSCI Kuwait Index will be included in the MSCI Emerging Markets Index beginning November 2020.

In June 2017, MSCI Inc. announced it was adding over 200 China A-shares. Those shares are listed in Shanghai and Shenzhen and denominated in yuan. As a result, all exchange-traded funds that track the MSCI index were forced to add those shares.

Saudi Arabia is also included in the Gulf Cooperation Council Country Index.

The index compiles the market capitalization of all companies that are listed in these countries' stock markets. The index is considered a good measurement of the stock performance of emerging markets.

The Frontier Markets Index tracks the stock markets of countries which are even more volatile than emerging markets. It was created in 2007. The countries in the Index are Bahrain, Bangladesh, Croatia, Estonia, Jordan, Kazakhstan, Kenya, Kuwait, Lebanon, Lithuania, Mauritius, Morocco, Nigeria, Oman, Romania, Serbia, Slovenia, Sri Lanka, Tunisia, and Vietnam. That also includes the West African Economic and Monetary Union. It consists of the following countries: Benin, Burkina Faso, Ivory Coast, Guinea-Bissau, Mali, Niger, Senegal, and Togo. Currently, the MSCI WAEMU Indexes include securities classified in Senegal, Ivory Coast, and Burkina Faso.

The following frontier countries are in their own standalone country indexes. They aren't included in the Frontier Market Index: Bosnia and Herzegovina, Botswana, Bulgaria, Iceland, Jamaica, Malta, Palestine, Panama, Trinidad & Tobago, Ukraine, and Zimbabwe.

Frontier markets can also very profitable since they have lots of room for growth. The main risk is that they are very thinly traded. This makes them difficult to sell if the economy deteriorates. It also means they can more easily be manipulated by hedge funds. You need to understand the countries, their political systems, and their economic challenges. These countries are vulnerable to global shifts in trade, currency, and central bank policy changes.

The EAFE Index measures developed markets excluding the United States and Canada. EAFE stands for Europe, Australasia, and the Far East. It covers 85% of the market capitalization in each of the countries.

The MSCI EAFE Index consists of the following developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

MSCI World Index

The World Index measures the market performance of large and mid-cap companies that have a global presence. It is often quoted by financial media to describe how the world's stock market is doing. It excludes stocks from emerging market countries, so it should be considered a developed world index.

It includes the following countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, United Kingdom, and the United States.

The MSCI AC World Index includes all the countries in the World and Emerging Markets Indexes. "AC" stands for "All Country."

In 1968, Morgan Stanley published the Capital International Indexes. These were the first indexes for markets outside of the United States. The MSCI Developed Market Indexes were published the following year.

It took almost 20 years, until 1987, for the Emerging Markets Index to be published. In 1996, MSCI published the All Country Indexes for developing markets and emerging markets.

On July 2, 1998, MSCI Inc. was incorporated. In addition to the indexes, it provides services that analyze risk and return for various markets. Its competitors are Axioma Inc., BlackRock Solutions, Bloomberg Finance L.P., CME Group Inc., CME Group Services LLC, FactSet Research Systems Inc., London Stock Exchange Group PLC, S&P Global Inc., and WisdomTree and Goldman Sachs Asset Management.

In 2007, MSCI launched the Global Islamic Index and the Factor Indexes. Since 2010, it has launched several new indexes each year.

MSCI Inc. " Exchange Traded Products Based on MSCI Indexes ," Page 3.

Fidelity. " Actively Managed Funds ."

U.S. Securities and Exchange Commission. " Market Capitalization ."

U.S. Securities and Exchange Commission. " Market Indices ."

MSCI Inc. " MSCI Announces the Next Eight Index Review Dates ."

MSCI Inc. " Index Solutions ."

MSCI Inc. " MSCI Emerging Markets Index ."

MSCI Inc. " MSCI Announces the Results of the 2020 Annual Market Classification Review ."

MSCI Inc. " Results of MSCI 2017 Market Classification Review ."

MSCI Inc. " The MSCI Saudi Arabia & Gulf Countries Indexes ."

MSCI Inc. " MSCI EAFE Index (USD) ."

MSCI Inc. " MSCI ACWI Index ."

MSCI Inc. " MSCI World Index (USD) ."

U.S. Securities and Exchange Commission. " MSCI Inc, Form 10-K ."

MSCI Inc. " Global Indexes ," Page 13.

- Search Search Please fill out this field.

What Is MSCI?

Understanding msci, msci indexes.

- Reviews and Weightings

The Bottom Line

- Company Profiles

- Financial Companies

MSCI: What Does It Stand For and Its Importance

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Investopedia / Jake Shi

MSCI is an acronym for Morgan Stanley Capital International. It is an investment research firm that provides stock indexes , portfolio risk and performance analytics, and governance tools to institutional investors and hedge funds. MSCI is perhaps best known for its benchmark indexes—including the MSCI Emerging Market Index and MSCI Frontier Markets Index—which are managed by MSCI Barra. The company continues to launch new indexes each year.

Key Takeaways

- MSCI provides investment data and analytics services to investors.

- MSCI was formed when Morgan Stanley bought the licensing rights to Captial International data in 1986.

- The firm is perhaps best known for its series of stock indexes, which are used by many mutual funds and ETFs as benchmarks.

Capital International introduced a number of stock indexes in 1965 to mirror the international markets—the first global stock market indexes for markets outside the United States. When Morgan Stanley bought the licensing rights to Capital's data in 1998, it began using the acronym MSCI, with Morgan Stanley becoming its largest shareholder.

In 2004, MSCI acquired Barra, a risk management and portfolio analytics firm, for approximately $816.4 million. The merger of both entities resulted in a new firm, MSCI Barra, which was spun off in an initial public offering (IPO) in 2007, and began trading on the New York Stock Exchange (NYSE) under the stock ticker MSCI. The firm became a fully independent, stand-alone public company in 2009.

The firm provides its clients with investment tools including those from Barra, RiskMetrics, and Measurisk. It also publishes indexes that are widely available to the investing public.

MSCI is perhaps best known for its stock indexes, which focus on different geographic areas and stock types such as small-caps, mid-caps, and large-caps. They track the performance of the stocks that are included in them and act as a base for exchange-traded funds (ETFs). As of Q4 2022, there were $14.97 trillion in assets under management (AUM) benchmarked to the firm's indexes.

MSCI offers more than 160,000 indexes. Some of the most widely used are the Emerging Markets Index, Frontier Markets Index, All Country World Index, and EAFE Index.

MSCI Emerging Market Index

Launched in 1988, this index lists constituents from 24 emerging economies including China, Egypt, India, Korea, Thailand, Brazil, South Africa, and Mexico. It compiles the market capitalization of all the companies that are listed on these countries' stock exchanges.

The Emerging Markets Index is considered a good way to track the performance and growth of emerging markets. Emerging markets offer investors growth potential as their economies expand, as well as creating risk diversification for global investors.

MSCI Frontier Markets Index

The Frontier Market Index is used to track markets in countries that are considered more volatile and unpredictable than emerging markets. This index focuses on 28 markets from the Middle East, Africa, South America, and Europe. Some of the frontier regions with stocks included in this index are Vietnam, Morocco, Iceland, Romania, and Bahrain.

Frontier markets can be profitable for investors since they have plenty of room for growth. However, they are not heavily traded, which can make them difficult to sell if a country's economy takes a downturn due to global or local changes.

MSCI All Country World Index (ACWI)

This is the firm's flagship global equity index, which tracks the performance of small- to large-cap stocks from 23 developed and 24 emerging markets. The more than 2,900 stocks represented are for companies that have a global presence. It covers about 85% of the market capitalization in each market that it includes.

The ACWI is often used as a way to represent the global stock market.

MSCI EAFE Index

EAFE is an abbreviation for Europe, Australasia, and the Far East. This lists 826 stocks from 21 developed market countries excluding Canada and the United States. It covers approximately 85% of the market capitalization in each of the countries it includes.

EAFE countries are considered highly stable. They are widely traded, making it easy to both buy and sell, even in times of economic trouble.

Index Reviews and Weightings

The MSCI indexes are market cap-weighted indexes , which means stocks are weighted according to their market capitalization—calculated as stock price multiplied by the total number of shares outstanding . The stock with the largest market capitalization gets the highest weighting on the index. This reflects the fact that large-cap companies have a bigger impact on an economy than mid- or small-cap companies. A percent change in the price of the large-cap stocks in an MSCI index will lead to a bigger movement in the index than a change in the price of a small-cap company.

Each index in the MSCI family is reviewed quarterly and rebalanced twice a year. Stocks are added or removed from an index by analysts within MSCI to ensure that the index still acts as an effective equity benchmark for the market it represents.

When an MSCI index is rebalanced, ETFs and mutual funds must also adjust their fund holdings since they are created to mirror the performance of the indexes.

What Is the Purpose of MSCI?

MSCI provides tools to support and inform the investment industry. The firm provides research, data, and tools to help clients analyze and invest in different global markets. MSCI is also known for its stock indexes, which are used as benchmarks for funds tracking different global markets.

What Is the Difference Between the S&P 500 and MSCI?

The S&P 500 Index is a market value-weighted index of 500 stocks that generally represent the broader U.S. stock market. The MSCI All Country World Index is a market capitalization-weighted index that measures market performance in both developed and emerging markets.

How Many Stocks Are In the MSCI World?

The MSCI All Country World Index includes nearly 3,000 stocks from 47 markets. It includes both developed and emerging markets around the world.

Morgan Stanley Capital International, or MSCI, is a firm that provides investment data and analytics services to investors. It was formed in 1986 when Morgan Stanley bought the licensing rights to data from Captial International.

MSCI is known for its stock indexes, which are used by mutual funds, ETFs, and individual investors as market benchmarks. There are multiple MSCI indexes tracking different sectors of the global economy, including emerging, frontier, developed, and global markets.

Capital Group. " Who Put the 'CI' in MSCI? "

MSCI. " Barra to be Acquired and Combined with MSCI ."

MSCI. " MSCI Prices Initial Public Offering ."

MSCI. " MSCI Annual Report 2009 ," Page 4.

U.S. Securities and Exchange Commission. " Subsidiaries of MSCI Inc. "

MSCI. " MSCI Reports Financial Results for Fourth Quarter and Full Year 2022 ."

MSCI. " Emerging Markets ."

MSCI Inc. " MSCI Emerging Markets Index ."

MSCI. " MSCI Frontier Markets Index (USD) ."

MSCI. " MSCI ACWI Index ."

MSCI. " MSCI EAFE Index (USD) ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-84951211-812a083569b54d4aa06778fc9f77d0c6.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

At Morgan Stanley, we lead with exceptional ideas. Across all our businesses, we offer keen insight on today's most critical issues.

Personal Finance

Learn from our industry leaders about how to manage your wealth and help meet your personal financial goals.

Market Trends

From volatility and geopolitics to economic trends and investment outlooks, stay informed on the key developments shaping today's markets.

Technology & Disruption

Whether it’s hardware, software or age-old businesses, everything today is ripe for disruption. Stay abreast of the latest trends and developments.

Sustainability

Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics.

Diversity & Inclusion

Multicultural and women entrepreneurs are the cutting-edge leaders of businesses that power markets. Hear their stories and learn about how they are redefining the terms of success.

Wealth Management

Investment Banking & Capital Markets

Sales & Trading

Investment Management

Morgan Stanley at Work

Sustainable Investing

Inclusive Ventures Group

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals.

We have global expertise in market analysis and in advisory and capital-raising services for corporations, institutions and governments.

Global institutions, leading hedge funds and industry innovators turn to Morgan Stanley for sales, trading and market-making services.

We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions.

We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

We provide comprehensive workplace financial solutions for organizations and their employees, combining personalized advice with modern technology.

We offer scalable investment products, foster innovative solutions and provide actionable insights across sustainability issues.

From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success.

Core Values

Giving Back

Sponsorships

Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Underpinning all that we do are five core values.

Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back.

Morgan Stanley leadership is dedicated to conducting first-class business in a first-class way. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years.

The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

Morgan Stanley is differentiated by the caliber of our diverse team. Our culture of access and inclusion has built our legacy and shapes our future, helping to strengthen our business and bring value to clients.

Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research.

At Morgan Stanley, giving back is a core value—a central part of our culture globally. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best asset—Morgan Stanley employees.

As a global financial services firm, Morgan Stanley is committed to technological innovation. We rely on our technologists around the world to create leading-edge, secure platforms for all our businesses.

At Morgan Stanley, we believe creating a more equitable society begins with investing in access, knowledge and resources to foster potential for all. We are committed to supporting the next generation of leaders and ensuring that they reflect the diversity of the world they inherit.

Why Morgan Stanley

How We Can Help

Building a Future We Believe In

Get Started

Stay in the Know

For 88 years, we’ve had a passion for what’s possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

At Morgan Stanley, we focus the expertise of the entire firm—our advice, data, strategies and insights—on creating solutions for our clients, large and small.

We have the experience and agility to partner with clients from individual investors to global CEOs. See how we can help you work toward your goals—even as they evolve over years or generations.

At Morgan Stanley, we put our beliefs to work. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give back—all to contribute to a future that benefits our clients and communities.

Meet one of our Financial Advisors and see how we can help you.

Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

- Opportunities

- Technology Professionals

Experienced Financial Advisors

We believe our greatest asset is our people. We value our commitment to diverse perspectives and a culture of inclusion across the firm. Discover who we are and the right opportunity for you.

Students & Graduates

A career at Morgan Stanley means belonging to an ideas-driven culture that embraces new perspectives to solve complex problems. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

Experienced Professionals

At Morgan Stanley, you’ll find trusted colleagues, committed mentors and a culture that values diverse perspectives, individual intellect and cross-collaboration. See how you can continue your career journey at Morgan Stanley.

At Morgan Stanley, our premier brand, robust resources and market leadership can offer you a new opportunity to grow your practice and continue to fulfill on your commitment to deliver tailored wealth management advice that helps your clients reach their financial goals.

MSCI Barra Announces MSCI Global Investable Market Indices Methodology and Transition Plan for the MSCI Standard and Small Cap Indices

MSCI Barra, a leading provider of benchmark indices and risk management analytics products, announced today the details of the MSCI Global Investable Market Indices methodology and the plan for transitioning the MSCI Standard and Small Cap Indices to the methodology. The transition plan involves a two-phase transition implemented as of the close of November 30, 2007 and the close of May 30, 2008, respectively.

“Today’s announcement will result in enhancements to the existing MSCI International Equity Indices as well as the creation of new indices. The resulting integrated investable family of indices will provide investors with broader market coverage of international equity markets segmented by market cap size, value and growth, and industries," said Henry Fernandez, CEO and President of MSCI Barra. “The changes announced today demonstrate that as markets and investment processes continue to evolve, MSCI Barra remains committed to enhancing the MSCI International Indices to provide the benchmark tools investors need for global asset allocation, mandate attribution, portfolio construction, and performance evaluation”.

MSCI Barra has posted the Global Investable Market Indices methodology book, including the transition plan, on its website at https://www.mscibarra.com/products/indices/GIMImethodology.html . A pro-forma list of constituents of the MSCI Global Investable Market Indices – including the new Large Cap, Mid Cap, and Investable Market Indices as well as the Provisional Standard and Provisional Small Cap Indices – will be available on May 3, 2007. The changes resulting from the May 2007 Index Review of the current Standard Indices and Small Cap Indices will also be announced at the same time, earlier than the usual announcement schedule.

MSCI Barra will begin calculating the Provisional Standard and Small Cap Indices based on the Global Investable Market Indices methodology, as well as the new Large Cap, Mid Cap, and Investable Market Indices, as of the close of May 31, 2007 and begin distributing the indices from June 5, 2007.

Index Construction and Maintenance Methodology: The enhancements to the current Standard and Small Cap Index methodologies set forth in the MSCI Global Investable Market Indices methodology reflect the changing nature of international equity markets and the evolution of investment processes globally. The final methodology is largely similar to the one presented in the earlier consultation proposal with minor changes to the global minimum size range and parameters for index continuity and periodic maintenance. The enhancements will allow the MSCI Standard and Small Cap Indices to continue to meet the needs of investors seeking indices that reflect the international opportunity set and geographic, style and sector diversification within equity global equity markets.

- The enhanced Standard Indices will exhaustively cover the large- and mid-cap segments of the investable equity universe by targeting a range around 85% coverage of the free float-adjusted market capitalization in each market, while striving to achieve a balance between appropriate market representation in size segment composites within countries and reasonable size integrity across countries.

- The enhanced Small Cap Indices will exhaustively cover the small-cap segment of the investable equity universe by targeting for inclusion all companies with a market capitalization below that of the companies in the enhanced Standard Indices and within the top 99% of the investable equity universe in each market in both Developed and Emerging Markets, subject to a global minimum size requirement.

- The enhanced Standard and Small Cap Indices will be combined to create an Investable Market Index in each market to provide broad and exhaustive coverage of the large-cap, mid-cap, and small-cap companies in the investable equity universe, and, along with style segments, result in an integrated investable market index family.

- For index construction and size segmentation purposes, the MSCI Developed Markets countries in Europe will be aggregated and treated as a single market. The country indices for MSCI Developed Markets countries within Europe will be derived from the MSCI Europe Index.

- The Global Investable Market Indices methodology will continue to use a building block approach to allow the creation and calculation of meaningful composite indices. The Global Investable Market Indices methodology also features sector indices created using the Global Industry Classification Standard (GICS®) and value and growth indices created using the existing MSCI Global Value and Growth methodology, for all size segments.

Transition: The transition will occur in two phases rather than three phases as was proposed during the consultation. The details of the transition plan are available in the transition section of the Global Investable Market Indices methodology book. The transition will be synchronized for all markets and composite indices.

- The two phases of the transition of the current Standard Index and the current Small Cap Index will occur as of the close of November 30, 2007 and May 30, 2008, respectively.

- The final additions and deletions of constituents for each phase will be announced at least 4 weeks in advance of their implementation in the Standard and Small Cap Indices.

Provisional Indices

- In order to add transparency to the transition process and to assist clients in planning and implementing their individual transition strategies, MSCI Barra will provide Provisional Indices for the Standard and Small Cap Indices constructed and maintained according to the Global Investable Market Indices methodology.

- These Provisional Indices will begin to be calculated as of the close of May 31, 2007 and will be distributed to clients from June 5, 2007.

Transition Methodology

- In the first phase of the transition in November 2007, half of the differences between the Provisional Standard and the Standard Indices will be implemented. That is, all companies in the Provisional Standard Index not in the Standard Index will be added to the Standard Index at half of their free float-adjusted market capitalization, and companies in the Standard Index and not in the Provisional will have half of their free float-adjusted market capitalization removed.

- In the second and final phase of the transition in May 2008, after the rebalancing of the Provisional Indices, any and all differences between the MSCI Standard and the MSCI Provisional Standard Indices will be fully reflected in the MSCI Standard Index.

- The transition of the Small Cap Indices will follow the same approach.

Maintenance of the Current Standard and Small Cap Indices during the Transition

- MSCI Barra will maintain its schedule of regular index reviews for its current Standard and Small Cap Indices.

- During the period from the announcement of the pro forma constituents to the end of the transition (May 3, 2007 through May 30, 2008), MSCI Barra will seek to minimize changes in the current indices not related to the transition.

- In order to minimize reverse turnover, starting with the May 2007 Index Review for the Standard Indices will use the same minimum size and other investability requirements that will be applied in the construction of the Provisional Standard Indices.

- The changes resulting from the May 2007 Index Reviews of the current Standard and Small Cap Indices will be available on May 3, 2007 at the same time the pro-forma list of constituents of the MSCI Global Investable Market Indices, including the Provisional Indices, are made available.

MSCI Global Value and Growth Indices

- The MSCI Global Value and Growth Indices will continue to be derived from the Standard Indices and follow the two-phase transition of the Standard Indices. Starting with the first phase of the transition in November 2007, the constituents of the Global Value and Growth Indices will adopt the style inclusion factors of the Provisional Standard Indices.

Indices based on the Standard Indices

- Indices constructed with the Standard Indices as their basis, such as the High Dividend Yield Indices, GDP-weighted indices, 10/40 Indices and other custom indices, will continue to be derived from the Standard Indices throughout the transition.

Standalone Country Indices: MSCI Barra also intends to apply the general framework used to create the Global Investable Market Indices to the MSCI stand-alone country indices.

- This approach will target broader coverage of those markets while satisfying investability requirements that are reasonable and relevant for these countries and offer non-overlapping size segmentation with exhaustive coverage of the size segments.

- For countries included in the MSCI GCC (Gulf Cooperation Council) Countries Index, MSCI Barra will announce the methodology and implementation schedule on May 3, 2007.

Documents: The methodology documents for the Global Investable Market Indices are available at https://www.mscibarra.com/products/indices/GIMImethodology.html .

MSCI Barra has clarified and updated its methodology for country classification of securities. Please refer to Appendix I of the Methodology Book for the Standard or Small Cap Index Series, posted at www.mscibarra.com , for the full document. The clarifications and updates are effective immediately.

Further information on the MSCI International Equity Indices can be found on www.mscibarra.com .

About MSCI Barra

MSCI Barra develops and maintains equity, fixed income, multi-asset class, REIT and hedge fund indices that serve as benchmarks for an estimated USD 3 trillion on a worldwide basis. MSCI Barra’s risk models and analytics products help the world’s largest investors analyze, measure and manage portfolio and firm-wide investment risk. MSCI Barra is headquartered in New York, with research and commercial offices around the world. Morgan Stanley, a global financial services firm and a market leader in securities, asset management, and credit services, is the majority shareholder of MSCI Barra, and Capital Group International, Inc. is the minority shareholder.

For further information on MSCI Barra, please visit our web site at www.mscibarra.com .

For media enquiries please contact:

Ben Curson | Clare Milton, Penrose Financial, London + 44.20.7786.4888

Ann Taylor Reed | Mary Beth Grover, Abernathy MacGregor, New York + 1.212.371.5999

MSCI Barra Global Client Service:

Aatish Suchak, MSCI Barra, London + 44.20.7618.2222

Cecile Distel, MSCI Barra, New York + 1.212.762.5790

Jackson Wang, MSCI Barra, San Francisco + 1.415.576.2323

Alick Lei, MSCI Barra, Hong Kong + 852.2848.7333

Pavithra Ramasubban, MSCI Barra, Sydney + 61.2.9220.9333

Jun Nishiyama, MSCI Barra, Tokyo + 813.5424.5470

This document and all of the information contained in it, including without limitation all text, data, graphs, charts (collectively, the “Information”) is the property of Morgan Stanley Capital International Inc. (“MSCI”), Barra, Inc. (“Barra”), or their affiliates (including without limitation Financial Engineering Associates, Inc.) (alone or with one or more of them, “MSCI Barra”), or their direct or indirect suppliers or any third party involved in the making or compiling of the Information (collectively, the “MSCI Barra Parties”), as applicable, and is provided for informational purposes only. The Information may not be reproduced or redisseminated in whole or in part without prior written permission from MSCI or Barra, as applicable.

The Information may not be used to verify or correct other data, to create indices, risk models or analytics, or in connection with issuing, offering, sponsoring, managing or marketing any securities, portfolios, financial products or other investment vehicles based on, linked to, tracking or otherwise derived from any MSCI or Barra product or data.

Historical data and analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction.

None of the Information constitutes an offer to sell (or a solicitation of an offer to buy), or a promotion or recommendation of, any security, financial product or other investment vehicle or any trading strategy, and none of the MSCI Barra Parties endorses, approves or otherwise expresses any opinion regarding any issuer, securities, financial products or instruments or trading strategies. None of the Information, MSCI Barra indices, models or other products or services is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such.

The user of the Information assumes the entire risk of any use it may make or permit to be made of the Information.

NONE OF THE MSCI BARRA PARTIES MAKES ANY EXPRESS OR IMPLIED WARRANTIES OR REPRESENTATIONS WITH RESPECT TO THE INFORMATION (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY LAW, MSCI AND BARRA, EACH ON THEIR BEHALF AND ON THE BEHALF OF EACH MSCI BARRA PARTY, HEREBY EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS, NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE) WITH RESPECT TO ANY OF THE INFORMATION.

Without limiting any of the foregoing and to the maximum extent permitted by law, in no event shall any of the MSCI Barra Parties have any liability regarding any of the Information for any direct, indirect, special, punitive, consequential (including lost profits) or any other damages even if notified of the possibility of such damages. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

Any use of or access to products, services or information of MSCI or Barra or their subsidiaries requires a license from MSCI or Barra, or their subsidiaries, as applicable. MSCI, Barra, MSCI Barra, EAFE, Aegis, Cosmos, BarraOne, and all other MSCI and Barra product names are the trademarks, registered trademarks, or service marks of MSCI, Barra or their affiliates, in the United States and other jurisdictions. The Global Industry Classification Standard (GICS) was developed by and is the exclusive property of MSCI and Standard & Poor’s. “Global Industry Classification Standard (GICS)” is a service mark of MSCI and Standard & Poor’s.

The governing law applicable to these provisions is the substantive law of the State of New York without regard to its conflict or choice of law principles.

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

- United States

- Location not listed

Change your location

Ishares u.s. infrastructure etf.

You can trade this ETF now.

- NAV as of Apr 02, 2024 $42.90 52 WK: 34.56 - 43.35

- 1 Day NAV Change as of Apr 02, 2024 -0.20 (-0.47%)

- NAV Total Return as of Apr 01, 2024 YTD: 7.55%

- Fees as stated in the prospectus Expense Ratio: 0.30%

1. Exposure to U.S. infrastructure companies that could benefit from a potential increase in domestic infrastructure activities

2. Access to two groups of infrastructure companies that are equally weighted: owners and operators, such as railroads and utilities, and enablers, such as materials and construction companies

3. Use to express a thematic view on U.S. infrastructure stocks

INVESTMENT OBJECTIVE

The iShares U.S. Infrastructure ETF seeks to track the investment results of an index composed of equities of U.S. companies that have infrastructure exposure and that could benefit from a potential increase in domestic infrastructure activities.

Performance

- Growth of Hypothetical $10,000

- Historical NAVs

Distributions

- Distributions Schedule

- Understanding Dividends

Premium/Discount

- Average Annual

- Calendar Year

Portfolio Characteristics

Sustainability characteristics.

Sustainability Characteristics provide investors with specific non-traditional metrics. Alongside other metrics and information, these enable investors to evaluate funds on certain environmental, social and governance characteristics. Sustainability Characteristics do not provide an indication of current or future performance nor do they represent the potential risk and reward profile of a fund. They are provided for transparency and for information purposes only. Sustainability Characteristics should not be considered solely or in isolation, but instead are one type of information that investors may wish to consider when assessing a fund. Learn more

This fund does not seek to follow a sustainable, impact or ESG investment strategy. The metrics do not change the fund’s investment objective or constrain the fund’s investable universe, and there is no indication that a sustainable, impact or ESG investment strategy will be adopted by the fund. For more information regarding the fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodologies behind Sustainability Characteristics using the links below.

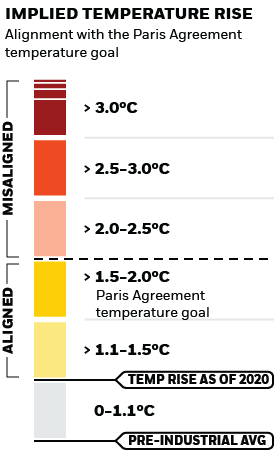

What is the Implied Temperature Rise (ITR) metric? Learn what the metric means, how it is calculated, and about the assumptions and limitations for this forward-looking climate-related metric.

To address climate change, many of the world's major countries have signed the Paris Agreement. The temperature goal of the Paris Agreement is to limit global warming to well below 2°C above pre-industrial levels, and ideally 1.5 °C, which will help us avoid the most severe impacts of climate change.

What is the ITR metric?

The ITR metric is used to provide an indication of alignment to the temperature goal of the Paris Agreement for a company or a portfolio. ITR employs open source 1.55° C decarbonization pathways derived from the Network of Central Banks and Supervisors for Greening the Financial System (NGFS). These pathways can be regional and sector specific and set a net zero target of 2050, in line with GFANZ (Glasgow Financial Alliance for Net Zero) industry standards. We make use of this feature for all GHG scopes. This enhanced ITR model was implemented by MSCI on February 19, 2024.

How is the ITR metric calculated?

The ITR metric is calculated by looking at the current emissions intensity of companies within the fund's portfolio as well as the potential for those companies to reduce its emissions over time. If emissions in the global economy followed the same trend as the emissions of companies within the fund's portfolio, global temperatures would ultimately rise within this band.

Note, only corporate issuers are covered within the calculation. A summary explanation of MSCI’s methodology and assumptions for its ITR metric can be found here.

Because the ITR metric is calculated in part by considering the potential for a company within the fund’s portfolio to reduce its emissions over time, it is forward-looking and prone to limitations. As a result, BlackRock publishes MSCI’s ITR metric for its funds in temperature range bands. The bands help to underscore the underlying uncertainty in the calculations and the variability of the metric.

What are the key assumptions and limitations of the ITR metric?

This forward-looking metric is calculated based on a model, which is dependent upon multiple assumptions. Also, there are limitations with the data inputs to the model. Importantly, an ITR metric may vary meaningfully across data providers for a variety of reasons due to methodological choices (e.g., differences in time horizons, the scope(s) of emissions included and portfolio aggregation calculations).

There is not a universally accepted way to calculate an ITR. There is not a universally agreed upon set of inputs for the calculation. At present, availability of input data varies across asset classes and markets. To the extent that data becomes more readily available and more accurate over time, we expect that ITR metric methodologies will evolve and may result in different outputs. Funds may change bands as methodologies evolve. Where data is not available, and / or if data changes, the estimation methods vary, particularly those related to a company’s future emissions.

The ITR metric estimates a fund’s alignment with the Paris Agreement temperature goal based on a credibility assessment of stated decarbonization targets. However, there is no guarantee that these estimates will be reached. The ITR metric is not a real time estimate and may change over time, therefore it is prone to variance and may not always reflect a current estimate.

The ITR metric is not an indication or estimate of a fund’s performance or risk. Investors should not rely on this metric when making an investment decision and instead should refer to a fund’s prospectus and governing documents. This estimate and the associated information is not intended as a recommendation to invest in any fund, nor is it intended to indicate any correlation between a fund’s ITR metric and its future investment performance.

To be included in MSCI ESG Fund Ratings, 65% (or 50% for bond funds and money market funds) of the fund’s gross weight must come from securities with ESG coverage by MSCI ESG Research (certain cash positions and other asset types deemed not relevant for ESG analysis by MSCI are removed prior to calculating a fund’s gross weight; the absolute values of short positions are included but treated as uncovered), the fund’s holdings date must be less than one year old, and the fund must have at least ten securities.

Business Involvement

Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments.

Business Involvement metrics are not indicative of a fund’s investment objective, and, unless otherwise stated in fund documentation and included within a fund’s investment objective, do not change a fund’s investment objective or constrain the fund’s investable universe. For more information regarding a fund's investment strategy, please see the fund's prospectus.

Review the MSCI methodology behind the Business Involvement metrics, using links below.

Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund's market value exposure to the listed Business Involvement areas above.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement. Business Involvement metrics are only displayed if at least 1% of the fund’s gross weight includes securities covered by MSCI ESG Research.

The amounts shown above are as of the current prospectus, but may not include extraordinary expenses incurred by the Fund over the past fiscal year. Amounts are rounded to the nearest basis point, which in some cases may be "0.00".

The values shown for “market value,” “weight,” and “notional value” (the “calculated values”) are based off of a price provided by a third-party pricing vendor for the portfolio holding and do not reflect the impact of systematic fair valuation (“the vendor price”). The vendor price is not necessarily the price at which the Fund values the portfolio holding for the purposes of determining its net asset value (the “valuation price”). Holdings data shown reflects the investment book of record, which may differ from the accounting book of record used for the purposes of determining the Net Assets of the Fund. Additionally, where applicable, foreign currency exchange rates with respect to the portfolio holdings denominated in non-U.S. currencies for the valuation price will be generally determined as of the close of business on the New York Stock Exchange, whereas for the vendor price will be generally determined as of 4 p.m. London. The calculated values may have been different if the valuation price were to have been used to calculate such values. The vendor price is as of the most recent date for which a price is available and may not necessarily be as of the date shown above. Please see the “Determination of Net Asset Value” section of each Fund’s prospectus for additional information on the Fund’s valuation policies and procedures.

Exposure Breakdowns

% of Market Value

How to Buy iShares ETFs

There are many ways to access iShares ETFs. Learn how you can add them to your portfolio.

Discuss with your financial planner today

Share this fund with your financial planner to find out how it can fit in your portfolio.

Buy through your brokerage

iShares funds are available through online brokerage firms. All iShares ETFs trade commission free online through Fidelity. By clicking on the button below, you will leave iShares.com.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares ETF and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Before engaging Fidelity or any broker-dealer, you should evaluate the overall fees and charges of the firm as well as the services provided. Free commission offer applies to online purchases of select iShares ETFs in a Fidelity account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). For iShares ETFs, Fidelity receives compensation from the ETF sponsor and/or its affiliates in connection with an exclusive long-term marketing program that includes promotion of iShares ETFs and inclusion of iShares funds in certain Fidelity Brokerage Services platforms and investment programs. Please note, this security will not be marginable for 30 days from the settlement date, at which time it will automatically become eligible for margin collateral. Additional information about the sources, amounts, and terms of compensation can be found in the ETF’s prospectus and related documents. Fidelity may add or waive commissions on ETFs without prior notice. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). ©2024 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES , the iShares Core Graphic, CoRI and the CoRI logo are registered and unregistered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners. iCRMH0224U/S-3358623

Explore more

FIND A FUND

- View all funds

- Explore by goals

- Compare ETFs

- Discover by holdings

- Find correlated funds

ASSET CLASS

- Fixed Income

- Commodities & Digital Assets

- Real Estate

PRODUCT RANGE

- Target Date

- Sustainable

- ADVISORS: HELP MEET CLIENTS' NEEDS WITH iSHARES ETFs

Investment Strategies

EXPLORE NOW

- OUR STRATEGIES

GET STARTED

- Explore simplified investing

- Simplify retirement with Target Date ETFs

- Invest with bond ETFs

- Access factor-based strategies

- Find income with ETFs

- Access Bitcoin with ETFs

- Navigate turbulent markets

- Invest in the future with thematics

- Diversify internationally

- Access commodities with ETPs

THINK SUSTAINABLE

- Learn about sustainable investing

- Match your investment goals to sustainable ETFs

- ADVISORS: REDESIGN PORTFOLIOS

- INSTITUTIONS: EXPLORE FIXED INCOME ETFs

Market Insights

- OUTLOOK & INSIGHTS

MARKET INSIGHTS

- iShares 2024 Year Ahead Outlook

- All about ETFs: Answers to twelve popular questions about ETFs

- 2024 Thematic Outlook

- What does a Fed pause mean for investors?

- Last month's ETF flows

- View all ETF flows

- ADVISORS: EXPLORE INSIGHTS BY BLACKROCK

- GET OUR INSIGHTS DELIVERED TO YOUR INBOX

- What is an ETF?

- ETFs vs. Mutual Funds

- How to buy ETFs

- ETF ecosystem

INDEX INVESTING

- What is index investing?

- What is bond indexing?

- What is smart beta?

- What is sustainable investing?

INTRODUCTION TO INVESTING

- Planning for retirement

- ADVISORS: EARN CE CREDITS

- Build a diversified portfolio

- View all tools

- Financial & legal

- View all documents

- iShares tax center

- Tax documents

- Capital gains distributions

- ADVISORS: EXPLORE MORE TOOLS

Institutional Investors

- PARTNER WITH iSHARES

INVESTMENT STRATEGIES

- Explore fixed income ETFs

- Capture factors with ETFs

INSIGHTS & SERVICES

- Access insights & market commentary

- iShares model consulting service

- Request a portfolio consultation

- How insurers utilize iShares ETFs

- Events & webcasts

- Build a liquidity sleeve

- Explore U.S. ETFs

- Estimate trading costs

GET TO KNOW iSHARES

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

© 2024 BlackRock, Inc. All rights reserved.

Important Information

Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1 ESG Fund Ratings ; 2 Index Carbon Footprint Metrics ; 3 Business Involvement Screening Research ; 4 ESG Screened Index Methodology ; 5 ESG Controversies ; 6 MSCI Implied Temperature Rise

For funds with an investment objective that include the integration of ESG criteria, there may be corporate actions or other situations that may cause the fund or index to passively hold securities that may not comply with ESG criteria. Please refer to the fund’s prospectus for more information. The screening applied by the fund's index provider may include revenue thresholds set by the index provider. The information displayed on this website may not include all of the screens that apply to the relevant index or the relevant fund. These screens are described in more detail in the fund’s prospectus, other fund documents, and the relevant index methodology document.

Certain information contained herein (the “Information”) has been provided by MSCI ESG Research LLC, a RIA under the Investment Advisers Act of 1940, and may include data from its affiliates (including MSCI Inc. and its subsidiaries (“MSCI”)), or third party suppliers (each an “Information Provider”), and it may not be reproduced or redisseminated in whole or in part without prior written permission. The Information has not been submitted to, nor received approval from, the US SEC or any other regulatory body. The Information may not be used to create any derivative works, or in connection with, nor does it constitute, an offer to buy or sell, or a promotion or recommendation of, any security, financial instrument or product or trading strategy, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between equity index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties (which are expressly disclaimed), nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

If the Fund invests in any underlying fund, certain portfolio information, including sustainability characteristics and business-involvement metrics, provided for the Fund may include information (on a look-through basis) of such underlying fund, to the extent available.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Shares of ETFs are bought and sold at market price (not NAV) and are not individually redeemed from the fund. Any applicable brokerage commissions will reduce returns. Beginning August 10, 2020, market price returns for BlackRock and iShares ETFs are calculated using the closing price and account for distributions from the fund. Prior to August 10, 2020, market price returns for BlackRock and iShares ETFs were calculated using the midpoint price and accounted for distributions from the fund. The midpoint is the average of the bid/ask prices at 4:00 PM ET (when NAV is normally determined for most ETFs). The returns shown do not represent the returns you would receive if you traded shares at other times.

Index returns are for illustrative purposes only. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor's tax situation and may differ from those shown. The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Certain sectors and markets perform exceptionally well based on current market conditions and iShares and BlackRock Funds can benefit from that performance. Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated.

Distribution Yield and 12m Trailing Yield results may have period over period volatility due to factors including tax considerations such as treatment of passive foreign investment companies (PFICs), treatment of defaulted bonds or excise tax requirements; exceptional corporate actions; seasonality of dividends from underlying holdings; significant fluctuations in fund shares outstanding; or fund capital gain distributions.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

Although BlackRock shall obtain data from sources that BlackRock considers reliable, all data contained herein is provided “as is” and BlackRock makes no representation or warranty of any kind, either express or implied, with respect to such data, the timeliness thereof, the results to be obtained by the use thereof or any other matter. BlackRock expressly disclaims any and all implied warranties, including without limitation, warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose.

BlackRock provides compensation in connection with obtaining or using third-party ratings and rankings.

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2024 BlackRock, Inc. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH0324U/S-3456084

- Business News

- Markets News

- Sensex News

What is the MSCI India Index and why it matters

Visual Stories

PPF Calculator

This financial tool allows one to resolve their queries related to Public Provident Fund account.

FD Calculator

When investing in a fixed deposit, the amount you deposit earns interest as per the prevailing...

NPS Calculator

The National Pension System or NPS is a measure to introduce a degree of financial stability...

Mutual Fund Calculator

Mutual Funds are one of the most incredible investment strategies that offer better returns...

Other Times Group News Sites

Popular categories, hot on the web, trending topics, living and entertainment, latest news.

IMAGES

VIDEO

COMMENTS

To use the "Search Methodology by Index Name or Index Code" tool, type in the first four letters of the index name leaving out "MSCI" (e.g., for MSCI Emerging Market Index, type in Emer) or the index code, wait for the list of indexes to appear, choose the index and click "Go". For additional tips on searching the methodology toolbox, please ...

MSCI GLOBAL INVESTABLE MARKET INDEXES METHODOLOGY | MAY 2021 Appendix X: Updating the Global Minimum Size References and Ranges 140 General Principles for Updating the Global Minimum Size References and Ranges 140 Appendix XI: Frontier Markets Country Classification 142 Appendix XII: MSCI DR Indexes 143 Constructing the MSCI DR Indexes 143

investment community, MSCI enhanced its Standard Index methodology, by moving from a sampled multi-cap approach to an approach targeting exhaustive coverage with non-overlapping size and style segments. The MSCI Standard and MSCI Small Cap Indexes, along with the other MSCI equity indexes based on them, transitioned to the Global Investable

The MSCI Index Calculation Methodology document provides a detailed description of the rules and formulas used to calculate the MSCI equity indexes, covering topics such as index construction, maintenance, rebalancing, and dissemination. The document is intended for investors who want to understand the technical aspects of the MSCI index methodology and how it affects their portfolio ...

MSCI

Market Indices Methodology | April 2010. This document is a summary of certain select provisions of MSCI's Global Investable Market Indices ("GIMI") methodology. This summary does not contain, and is not intended to contain, every element of the GIMI methodology. It is provided for informational purposes only in order to highlight certain ...

The MSCI Indexes are a measurement of stock market performance in a particular area. Like other indexes, such as the Dow Jones Averages or the S&P 500, it tracks the performance of the stocks included in the index. MSCI Indexes are used as the base for exchange-traded funds. The ETF duplicates the Index's stock holdings.

MSCI INDEX CALCULATION METHODOLOGY | NOVEMBER 2020 1 MSCI Price Index Methodology Price indexes measure the market prices performance for a selection of securities. They are calculated daily and, for some of them, on a real time basis. Each index captures the market capitalization weighted return of all constituents included in the index.

MSCI Inc is an investment research firm that provides indices, portfolio risk and performance analytics, and governance tools to institutional investors and hedge funds. MSCI provides its clients ...

MSCI Barra will begin calculating the Provisional Standard and Small Cap Indices based on the Global Investable Market Indices methodology, as well as the new Large Cap, Mid Cap, and Investable Market Indices, as of the close of May 31, 2007 and begin distributing the indices from June 5, 2007.

of 30-day volatility implied for the respective MSCI index option classes. This document is intended to describe the methodology used to calculate volatility indices that are based on the selected Cboe MSCI index options that use a 30-day target expected volatility term. This document provides the step-by-step calculation and the attributes of ...

The three new MSCI index options are designed to provide a range of investors exposure to international, developed and emerging markets and U.S. equity market performance. ... Developed using Cboe's proprietary VIX ® Index methodology, these indices are based on existing MXEA and MXEF options and are designed to provide a transparent measure ...

In addition to our flagship indices, Bloomberg publishes thousands of bespoke benchmarks and actively works with index users in a consultative manner on benchmark design, methodology, back-testing ...

MSCI World Price Index (1969-2020) Map of all countries included in the MSCI World index as of 28 Sep 2018 The MSCI World is a widely followed global stock market index that tracks the performance of around 1400 large and mid-cap companies across 23 developed countries. It is maintained by MSCI, formerly Morgan Stanley Capital International, and is used as a common benchmark for global stock ...

1. Introduction. The MSCI Nihonkabu ESG Select Leaders Index (the "Index") is a free float-adjusted market capitalization-weighted index designed to represent the performance of companies that are selected from the MSCI Nihonkabu Investable Market Index ("Parent Index") based on Environmental, Social and Governance ("ESG") criteria.

Review the MSCI methodology behind the Sustainability Characteristics and Business Involvement metrics: 1 ESG Fund Ratings; ... Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund's assets under management or other measures. MSCI has established an information barrier between equity index ...

Overview Of MSCI. MSCI has three flagship indices — MSCI World Index, MSCI EM Index and MSCI ACWI. MSCI World Index, launched in 1986, is one of the most followed global stock indices and tracks large and mid-cap companies in 23 developed markets. MSCI EM was introduced in 1988 for investors looking to diversify.

1 MSCI Price Index Methodology . Price indexes measure the market prices performance for a selection of securities. They are calculated daily and, for some of them, on a real time basis. Each index captures the market capitalization weighted return of all constituents included in the

Index methodoology: The index is based on the MSCI Global Investable Indexes (GIMI) Methodology—a comprehensive and consistent approach to index construction that allows for meaningful global ...

MSCI INDEX CALCULATION METHODOLOGY | NOVEMBER 2018 1 MSCI PRICE INDEX METHODOLOGY Price indexes measure the market prices performance for a selection of securities. They are calculated daily and, for some of them, on a real time basis. Each index captures the market capitalization weighted return of all constituents included in the index.

From 1972 to 2023, the REIT index posted an average annual return of 12.7% compared to 10.2% for the S&P 500. REITs also performed better over the past 20 and 25 years.