Do PhD Students Pay Council Tax?

- Maisie Dadswell

- September 6, 2023

When you apply to become a full-time PhD student in the UK, you will almost never have to worry about paying council tax. Whether you are an international student or a home student, all full-time university students are exempt from council tax. In this article, we will cover some circumstances that may mean you do not qualify for the exemption after covering what council tax is, how it is calculated, and how to inform your local council that you are exempt.

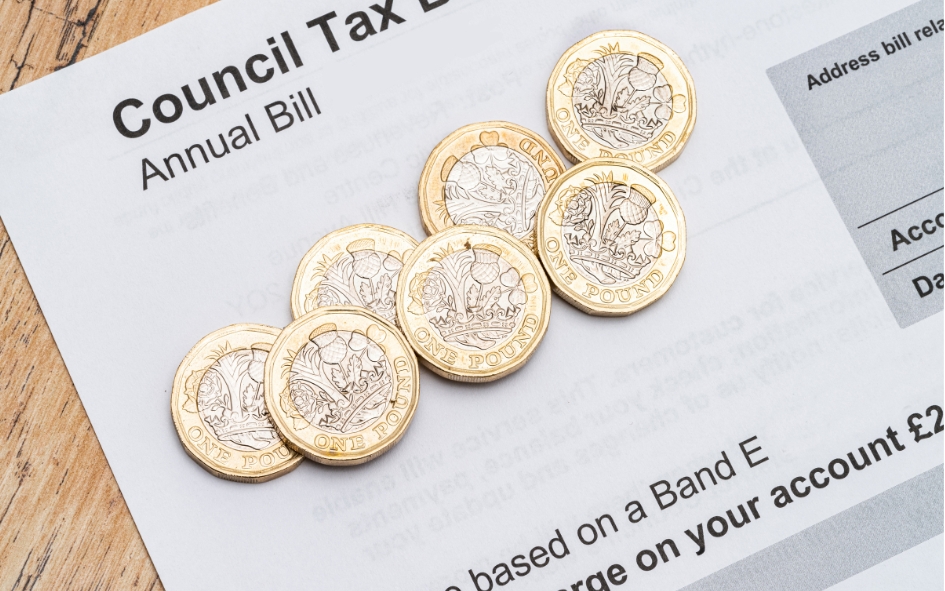

What is Council Tax?

Council tax is levied onto households by their local authority based on the number of people living in a household, and the estimated value of the property. Each property is under a different band, which will outline how much council tax you need to pay. The tax helps the local council to fund the services they provide to their residents. Your council tax bill will go towards your rubbish collection, recycling, street lighting and cleaning, and community services for the elderly and vulnerable, such as Meals on Wheels.

UK residents become liable for council tax when they reach the age of 18; a full bill is based on two or more adults living in the same house or flat; for adults living alone, there is a 25% discount. One of the biggest perks of being a full-time student in the UK is the exemption from council tax payments. If every member of a household is a full-time college, undergraduate or postgraduate student, the entire dwelling will be exempt. PhD students living in University Halls of Residence will be automatically exempt from making council tax payments. If one member of the household isn’t in full-time higher education, the exemption will not be granted. However, if there is only one non-full-time student in the household, they will still be granted the 25% monthly discount.

Who is Classed as a Full-Time Student?

For council tax exemption, you will be regarded as a full-time student if:

- Your course lasts for at least one academic or calendar year and runs for at least 24 weeks out of the year.

- Your course typically involves over 21 hours of study, work experience or tuition per week during term time.

If you are in the writing-up stage of your PhD, it is slightly more difficult to prove to your local council that you are in full-time education. However, it is not impossible. Speak to your PhD supervisor, who will be able to draft a letter confirming that you are in the process of writing up your thesis . During the writing-up stage, you won’t need to be attending university to be exempt from council tax.

If you are between courses, for example, if you have finished your Masters degree and are waiting for the new academic year to start your PhD research and study, you may be liable for council tax. This liability phase will only apply when you are not in the formal period of the course you have just finished or the one you will start.

If you have chosen to undertake your PhD as a part-time student, you will not be eligible for the council tax exemption available to students. However, you may be able to qualify for a council tax reduction.

Learn more: How long is a PhD?

Exemptions While Taking Time Off from PhD Study

If circumstances require you to take time off, such as family commitments or illness, this doesn’t automatically mean you will need to start making council tax payments. It isn’t uncommon for students to take breaks from their course; if, for any reason, you need to suspend your studying but intend to return to your degree and remain registered on the course you won’t be liable to pay council tax as you will still be classed as a full-time student. Though you will be fully exempt if you are interrupting your study or re-sitting out of attendance, this doesn’t prevent some local authorities from stating that you are liable to pay council tax payments. If this should happen, and you are not in your final year of study, you can appeal the council tax charges with the help of the Citizens Advice Bureau or your welfare office at UWS London.

Do I Need to Be Paying Full Tuition Fees to Be Exempt?

As long as you meet all the conditions to qualify as a full-time student, there is no rule to say that you need to pay full tuition fees to be exempt from council tax. Your PhD supervisor must confirm with your local authority that even though you are no longer paying full-time fees, you are still a full-time student, undertaking more than 21 hours of study a week for a minimum of 24 weeks out of the academic year. The letter written by your PhD supervisor should also disclose that writing up your PhD can be undertaken on the university campus or at home.

Read more: PhD fees in the UK .

How to Claim Council Tax Exemption as a PhD Student

You will only be able to claim council tax exemption from the official start date of your course, and this can only happen after you have enrolled and the university has confirmed your place. To qualify for council tax exemption, you may need proof that you are a full-time student. You can request a letter or certificate from your university or PhD supervisor to confirm you are studying full-time. If you move during the academic year, don’t assume you will automatically be exempt from council tax in your new accommodation – especially if you have moved to a different borough. You will need to complete the relevant exemption forms from the new borough you have relocated to.

Living with Non-Students and Part-Time Students

If, while you are a full-time PhD student at UWS London, you move into a house share or any other existing living arrangement with non-full-time students, there will usually be a council tax bill sent to your dwelling. However, as a full-time student, you will never hold any liability to pay it. Only non-full-time students will be legally responsible for the council tax bills – regardless of any insistence that household bills should be split evenly and fairly. If the bills are included in the total weekly or monthly cost to live in a property, always ask for a full breakdown of them.

However, if you own the property you share with people who are not in full-time education or have any other form of legal interest, you will still need to make council tax payments under the hierarchy of liability regulations. The Citizens Advice Bureau will be able to give you more guidance if you are obligated to pay under the hierarchy of liability.

There are also different council tax exemption rules for international students living with their civil partners or spouses while undertaking their PhD in the UK. If you only share your residence with a non-student, aged 18 or over, and they are not a British Citizen or have limited permission to stay in the country, in most instances, you will not need to pay council tax. However, this depends on what the wording in their immigration permission states. The Citizens Advice Bureau will be best placed to help you with these matters.

What to Do if You Still Receive a Council Tax Bill as an Exempt Full-Time PhD Student

Even if you are exempt from paying council tax, if you receive a bill or payment reminders in the post, you mustn’t ignore them. The sanctions for non-payment of council tax bills are far more severe than leaving any other utility bill unpaid and unacknowledged. Imprisonment is one of the most severe punishments for unpaid council tax. If you receive a bill and are unsure what to do next, contact a welfare advisor at your university, or visit the www.gov.uk website to inform them of your exemption. Never delay contacting your local council tax office and finding out why they believe you are liable to make paymenats. More often than not, this is due to the tax office missing vital information about your exemption.

For More Support and Information

Understanding council tax exemptions can be complicated, especially for international students who are unfamiliar with the form of taxation. At UWS London, we support our PhD students in every aspect of their study to ensure they can focus on writing their thesis. For more information on council tax, you can contact the UWS London Students’ Union or seek advice from the university advice centre. Citizens Advice also helps students resolve queries about council tax and other financial matters.

Read more: What can you do with a PhD?

You might also like

Do You Get Paid for a PhD?

Do You Get Paid for a PhD? For many students who don’t have the luxury of never worrying about money, one of the main considerations

Where Can a PhD in Finance Take Me?

Where Can a PhD in Finance Take Me? In the dynamic world of finance, a PhD is not just an academic accolade; it’s a launchpad

Should I Do a PhD in London?

Should I Do a PhD in London? Embarking on a PhD journey is a significant decision, one that shapes your academic and professional future. Once

Enquire with us

We are here to help and to make your journey to UWS London as smooth as possible. Please use the relevant button below to enquiry about a course you would like to apply, or to clarify any questions you may have about us and our admission’s process. After you submit your enquiry, one of our advisers will get back to you as soon as possible.

Cookie preferences

This website uses cookies to improve your experience. We'll assume you're ok with this, but you can opt-out if you wish.

Privacy Overview

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc.

Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Housing and local services

- Council Tax

How Council Tax works

Discounts for full-time students.

Households where everyone’s a full-time student do not have to pay Council Tax. If you do get a bill, you can apply for an exemption .

To count as a full-time student, your course must:

- last at least 1 year

- involve at least 21 hours study per week

If you study for a qualification up to A level and you’re under 20, your course must:

- last at least 3 months

- involve at least 12 hours study per week

You’ll get a Council Tax bill if there’s someone in your household who’s not a full-time student, but your household might still qualify for a discount .

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. We’ll send you a link to a feedback form. It will take only 2 minutes to fill in. Don’t worry we won’t send you spam or share your email address with anyone.

Do Masters or PhD students pay council tax?

Home > Blog > Do Master’s or PhD students pay council tax?

If you’re a postgraduate student about to start your Master’s or PhD, you might wonder how council tax works. Full-time undergraduate students are exempt from paying council tax, but does the same apply to Master’s and PhD students?

This guide covers everything you need to know, including what council tax is, if Master’s students are exempt, if PhD students are exempt, if part-time postgraduate students are exempt, and how to claim an exemption.

What is council tax?

Council tax is an annual fee most households must pay their local council. The exact amount depends on the number of people in the household and what council tax band the property is in (this is usually calculated based on the property’s value).

It’s typically paid in monthly instalments , and the money is used to fund important local services, like rubbish collection and street lighting.

Do Master’s students pay council tax?

Full-time students in the UK are exempt from paying council tax, including Master’s students. If you live with other full-time students, the entire property is exempt from paying council tax, giving you one less household bill to think about!

If you live with housemates or a partner who’s not a student, they’ll still have to pay council tax. However, if only one person in your household is not a full-time student, they’ll be given a 25% ‘single person’ discount . Essentially, all full-time students are invisible when it comes to council tax, so they won’t be counted as living in the property.

Do PhD students pay council tax?

Good news – you won’t have to worry about paying council tax while completing your demanding PhD. Just like undergraduate and Master’s students, full-time PhD students are exempt from paying council tax.

Are part-time Master’s and PhD students exempt from paying council tax?

We’ve mentioned above that full-time postgraduate students don’t have to worry about paying council tax, but what about part-time ones?

Unfortunately, you’ll need to be classed as a full-time student to be exempt from council tax. Your course must:

- Last for at least one calendar or academic year and run for at least 24 weeks of the year.

- Normally involve at least 21 hours of study, work experience or tuition per week (in term time).

This means if you’re studying for your Master’s or PhD part-time, you’ll usually be liable to pay council tax. But if you’re living with full-time students, you’ll be able to get a 25% council tax discount, providing that there are no other part-time or non-students in the household.

Sometimes, part-time students are counted as full-time students for council tax purposes if they study for more than 21 hours a week. However, don’t assume this is the case. Always check with your local authority if you’re unsure your student status qualifies you for an exemption.

How to claim council tax exemption as a PhD or Master’s student

If you live in a privately rented student property and study full-time, you’ll likely automatically be exempt from paying council tax. However, you’ll have to apply for an exemption if you receive a council tax bill.

You’ll only be able to claim the exemption from the official start date of your course, and you might need to prove you’re a full-time student. If the council asks for proof, you should be able to get a letter or certificate from your university or PhD supervisor to confirm you’re studying full-time. If you’re during the writing-up stage of your PhD thesis, you won’t need to attend university to qualify as a full-time student.

Bill-splitting service designed for students

Even though you won’t have to worry about paying council tax as a full-time postgraduate student, managing the rest of your household bills can still be a lot of hassle. From setting up utility accounts to getting all your housemates to pay on time, living in a shared house isn’t always easy. This is where we come in…

Split The Bills is a bill-splitting service trusted by thousands of students nationwide. Our team will handle everything on your behalf – we’ll set up utility accounts, call suppliers, and manage your direct debits. All you have to do is pay your portion of the household bills each month, giving you more time to focus on perfecting your dissertation or thesis. There’s no need to worry if your housemates pay late, as you’re only responsible for your own monthly payment!

You can even create a personalised package based on what your house needs. You can include energy, broadband, water and even a TV licence if you plan on watching live TV.

If you want to simplify your shared household bills, learn more about how Split The Bills works or get a price today!

What is a utility bill? A guide for students and young professionals

The move from first to second year at university often comes with a lot of change as most students will have to start paying bills for the first time. In this feature we discuss how you can keep your finances organised and pay bills responsibly.

What are Halls of Residence?

10 ways to Make Money as a Student

Global main menu

- Advice and Counselling Service

- Money and practical advice

Planning and managing your money

Council tax exemption.

Council tax is charged by local authorities on homes in their area to pay for local public services.

Other groups of people who are disregarded are listed on the gov.uk website

Who counts as a full-time student?

The council tax rules say that you will count as a full-time student if:

- you are undertaking a full-time programme of study, tuition or work experience at a recognised educational establishment (whether on campus or elsewhere)

- of at least one academic year and;

- which lasts at least 24 weeks in each academic or calendar year and;

- which normally involves at least 21 hours of study, tuition or work experience per week during term time in each academic or calendar year (this does not mean 21 hours of supervised study – it can also include periods of study by yourself)

Student Halls of Residence are exempt dwellings so you are automatically not required to pay council tax.

If you live in privately rented accommodation and all of the occupants are full-time students you will not need to pay council tax but will need to apply for your exemption.

We have examples of how other individual circumstances will affect council tax liability in the sections below.

How to claim council tax exemption

If you live in certain London boroughs, Queen Mary reports to the relevant council the names of all students who are eligible for council tax exemption. However, you must also complete a student disregard form on the relevant council’s website. Please refer to the Queen Mary ARCS website for details of which boroughs are included and for links to the student disregard forms.

If you live in a borough that Queen Mary does not report to, you will need to provide the Council with proof you are a full-time student. To evidence your student status you can download your Student Status Letter from your Gradintelligence account. You will need to provide a new letter at the start of each academic year. You may also need to complete forms for your Local Authority – please check the relevant authority’s website .

If you change address within an academic year, update your address in MySIS straight away. Complete the relevant exemption forms for the borough you move to.

You can only claim Council tax exemption as a full-time student from the official start date of your course, once you have enrolled. If your course is longer than one year you will be exempt from paying Council tax during the summer vacation(s) between academic years.

I live with non-students, or part-time students

If you live with non-students, or part-time students, there will usually be a council tax bill for your dwelling. However, as a full-time student who is disregarded for council tax you will not be jointly liable for paying the bill with other residents of the same status or legal interest in the dwelling as you, for example joint tenants or joint residents. The non-student residents will be legally responsible for paying the council tax.

However, if you have a higher status or legal interest in the dwelling to the non-student resident(s), for example, if you own the dwelling and a non-student is lodging with you, you will be liable for the council tax. This is sometimes known as the hierarchy of liability. For more information about who is liable for council tax see the Citizens Advice Bureau council tax guidance.

If you live with just one other adult who is not a full-time student, they will count as the only resident in the dwelling. This means they will usually be able to apply for a 25% single occupant discount on their council tax bill. If you live with two or more adults who are not full-time students, there will usually be a full council tax bill for the dwelling.

I am interrupting or re-sitting out of attendance

If you are interrupting or resitting out of attendance, provided you are registered on a full-time programme of study, the council tax legislation states you continue to remain exempt from paying council tax, unless you are in the final year of your programme.

Despite this, some local authorities may still state you are liable to pay. If this happens see the later section Appealing a council tax charge.

If you have completed attendance on the taught part of your programme and you are only resitting out of attendance to complete the final assessments such as final exams or coursework, some local authorities will consider that you are no longer eligible for the student exemption and you will have to pay council tax.

You may be able to claim Council Tax Reduction.

I’m a PhD student writing up

If you are writing up, you would normally continue to be exempt from liability on the basis you are still a registered full-time student. There is no requirement that you are paying full-time tuition fees.

For any issues with Gradintelligence and your student status letter , please contact the Research Degrees Office.

If your local authority refuses your council tax exemption, please read the section of this page ‘ Appealing a council tax charge. ’

Note that if you are claiming welfare benefits on the basis of being a part-time student while writing up, you cannot then claim council tax exemption but you may be able to claim Council Tax Reduction

I am a part-time student

If your course is designated a part-time course, you are not eligible for the student council tax exemption. You can check if you are eligible for Council Tax Reduction.

If you or someone you live with has a disability you may be able to apply for a council tax discount. The gov.uk website has information about this.

I’m a final year student with August exams

If you have to sit final year exams in August, Queen Mary cannot change your official course end date. This will remain on MySIS as the last date of term in June. The Student Enquiry Centre can normally give you a letter which will include your original course end date but with a sentence explaining that you also have exams to sit in August. You could take this letter to the Council and ask whether they will extend your Council tax exemption to the end of your August exams, but this may not necessarily be successful.

I am an international student living with my spouse or civil partner

If the only non-student adult you share your dwelling with is your spouse or civil partner, who is not a British citizen and who currently has limited permission to stay in the UK, e.g. as your dependant, and the wording of their immigration permission states that they have no recourse to public funds or that employment is prohibited, then your dwelling should be exempt.

To apply for council tax exemption you need to send your local authority council tax office a copy of your partner’s immigration permission as well as proving your own student status [link to how to claim council tax exemption section]

UKCISA has further information about this.

Claiming council tax exemption does not count as claiming a public fund. If a condition of your immigration permission is that you have ‘no recourse to public funds’ you can still claim council tax exemption without breaching the conditions of your immigration permission in the UK.

Council Tax Reduction

If you are a student who is liable for council tax, you may be able to claim Council Tax Reduction which is for people on low incomes to help them pay their council tax. There is information about this on the Citizens Advice Bureau website. If you live with your parents and they claim Council Tax Reduction, this should not be reduced due to you living there because no deduction should be made in respect of a resident who is a full-time student.

Appealing a Council Tax charge

If you have been charged for council tax and you believe you are exempt, contact your local council tax office immediately. Find out why they think you are liable to pay. They may be missing the information they need to evidence your full-time student status, so find out what the issue is and how it can be resolved.

If you live in one of the boroughs that Queen Mary reports council tax exemption to, check with the Student Enquiry Centre that this has been reported. Also check that the form you need to submit to the council has been received. If you live in a borough that Queen Mary does not report for, have you provided the information required to prove your full-time student status? [please link to How to claim council tax exemption section above]

Ensure you quickly update any change to your address in MySIS.

If you have followed these steps and the council have all the required information but are still charging you council tax, contact a Welfare Adviser at Queen Mary straightaway for advice.

Citizens Advice also has information about appealing a council tax decision.

What happens if I receive a council tax bill and don't pay it?

Sanctions for non-payment of council tax can be extremely serious including imprisonment. Therefore it is essential that you respond immediately to any demands for payment. Contact a Welfare Adviser at Queen Mary straightaway for advice.

The gov.uk website explains what happens if council tax is not paid.

How to fund your studies

- Uni Reviews

- Student Guide

- Student stories

- UK Survival Service

Written by the Great British Mag editorial team on 11 Nov 2020.

As a student in higher education you will be exempt from paying some taxes altogether or will pay a reduced amount, and Council Tax is one of them. Find out what Council Tax is and how you can opt out of paying it as an international student.

What is Council tax?

People living in the UK pay a local tax that covers the cost of amenities in their area, such as rubbish collection, the police, and the fire brigade. This tax is paid to the local authority and in England, Scotland, and Wales it is called ‘Council Tax’ and in Northern Ireland it is called ‘Rates’.

Do international students have to pay Council Tax?

There is not a simple yes or no answer because even as a student you must meet certain requirements. You will qualify for a full rebate if you fall into one of these categories:

- A full -time student enrolled on a course which lasts for a minimum of 24 weeks in each academic year where you study for 21 hours per week during term time.

- A trainee nurse or midwife

- A sabbatical officer with the students union at the end of your studies

- You qualify for the doctorate extension scheme

- You are a postgraduate doctor or dentist

You will be liable for all or part of the Council Tax bill if:

- You are a part-time student, studying for less than 21 hours a week and your course lasts for less than 24 weeks.

- You are sharing the property with a British citizen or someone settled in the UK, with indefinite leave to enter or remain as well as someone from the EEA or Swiss national, or the family member of an EEA or Swiss national, who is exercising a right of free movement in the UK.

- You are on an NHS apprenticeship or other apprenticeship pathway

- You are studying in Northern Ireland

How to prove you are a student?

What you will need to do to be exempt from Council Tax will depend on which part of the UK you live in. To find out what you must do log onto the local authorities’ website in your area, and ask your university. If proof is needed that you are a full-time student your university can provide it free of charge

How is the Council Tax Bill calculated?

A Council Tax bill is calculated by the local authority based on the value of the property you live in and the number of permanent residents live in the property that are over 18 years old.

The value of the property is calculated by the local authority by placing it into one of eight ‘bands’, and you can check which band your property fall into by going to the Government website and entering your postcode.

Do you have to pay Council Tax if your spouse and adult children live with you?

If you have moved to the UK with your husband or wife, civil partner or an adult dependant and they have been given immigration permission to be in the UK and are not allowed to work or claim any form of aid from the government they will be exempt from paying Council Tax.

You can check their immigration status by looking at their visa or Biometric Residence Permit .

They will not be exempt if they are:

- An EEA or Swiss national, or the family member of an EEA or Swiss national, who is exercising a right of free movement in the UK

- A British citizen

- Settled in the UK with ‘indefinite leave to enter’ or ‘indefinite leave to remain’

Are you liable to pay Council Tax if you defer or take time off?

If you miss a few classes because of illness, this will not affect your Council Tax exemption or discount. However, if you suspend studies for a longer period or leave your studies you will need to get in touch with your local authority who will adjust your Council Tax liability.

If you intend to stay in the UK outside term time, such as the summer holidays, you will become liable for Council Tax and need to get in touch with your local authority.

What happens if you don’t pay your Council Tax bill?

If you are liable but fail to pay the bill, the local authority will usually start legal proceedings to recover the money. If you disagree with the bill, have difficulty paying it, or have allowed arrears to build up and owe a lot of money, you should seek advice from your university or Citizens Advice.

If the bill is wrong, the local authority may agree that you can delay payment until the bill is corrected. However, if you are in dispute about the bill, the local authority may expect you to make some payments while the dispute is in the process of being resolved.

How can I appeal against a Council Tax bill?

You should contact your local authority immediately if you have received a bill and you think it is for the wrong amount or that you are exempt from paying the bill.

The bill should provide you with instructions of how to notify your local authority. The authority then has two months to decide whether you are liable to pay the bill. If it fails to do so within that time or if you disagree with its decision you can appeal to an Independent Valuation Tribunal.

You might also want to read

Five things you should know before signing a tenancy agreement

How to report a bad landlord

How to resolve problems with housemates

RELATED ARTICLES MORE FROM AUTHOR

What is freshers week, how many hours can international students work in the uk, the innovator visa – explained, privacy overview, sierra leonian students studying in the uk: the top 10 things..., 5 best revision apps for university students.

We use cookies to improve your experience of our website. You can find out more or opt-out from some cookies .

Paying council tax if you’re a student

Your property is ‘exempt’ from council tax if it’s only occupied by full-time university or college students. Student halls of residence are automatically exempt.

If your property isn’t exempt, some people, including full-time students, are ‘disregarded’. This means the council tax is calculated as if you don’t live there. This might mean that whoever does have to pay the council tax can get a discount.

Check if you’re a full-time student

You’re a full-time student for council tax purposes if your course:

lasts at least 1 calendar or academic year for at least 24 weeks out of the year, and

normally involves at least 21 hours of study, tuition or work experience per week during term time.

The local council might ask for proof that you're a full-time student. You can ask for a certificate from your university or college which must provide it, unless more than a year has passed since your course finished.

You can read more about council tax discounts for students on GOV.UK.

How a council tax bill is calculated

A full council tax bill is based on at least 2 adults living in a property.

A discount is applied for people living on their own, and for those who live with people who don’t count as adults for council tax purposes, for example, full-time students.

If someone you share with isn't a full-time student

The property won’t be exempt from council tax and you’ll get a bill. However, whoever is liable to pay the council tax might qualify for a discount.

For example, if you share with an employed person or a part-time student, they will probably be liable for 75% of the council tax bill. There is a 25% discount because there is only 1 eligible adult in the property. As the full-time student, you’re disregarded when counting the number of eligible adults in the property for discount purposes.

If you share with 2 or more employed people who aren’t students, they’re likely to be liable for 100% of the council tax bill, unless 1 or both of them qualifies as a disregarded person for council tax discount purposes. In this situation, the local council can only pursue the non-students for payment of the council tax bill.

Special rules apply where you live only with your non-British spouse, partner or dependant. Contact your nearest Citizens Advice to speak to an adviser if you're in this situation.

If you live in an HMO

The owner of the property is liable to pay council tax if you live in a house in multiple occupation (HMO).

For council tax purposes, a property is likely to be an HMO if it’s occupied by:

- more than 1 household

- 1 or more tenants who each have their own tenancy agreement

If your home is exempt but you still get a council tax bill

If you receive a council tax bill but you don't think you should have, you can apply for an exemption.

You can apply for a council tax exemption on GOV.UK.

If you're taking time off from your course

As a full-time student, you might need to take some time out from your course, for example, because of an illness or family commitments.

If you suspend your course but remain registered because you intend to go back, you should still be regarded as a student for the purposes of council tax.

If you're between courses

If you've finished a course and you’re waiting to start another, you might have to pay council tax - for example, if you've finished an undergraduate degree and plan to start a postgraduate course in the next academic year.

You might be liable to pay council tax in these circumstances because you aren't within the formal period of either course.

If you’re a postgraduate student

You might have difficulty proving you’re a student for council tax purposes if your study, tuition or work doesn’t take place on the university or college campus or you’re in the thesis ‘writing up’ stage of your course.

However, you only need to be 'undertaking' a course for the necessary period of time and don’t need to be physically attending university or college for that time. If this affects you, you might be able to challenge the local council's decision and you should get advice from your students’ union or university’s advice centre.

Getting help to pay council tax

If you or someone you live with is liable to pay council tax, you might be able to get help.

Please tell us more about why our advice didn't help.

Thank you, your feedback has been submitted.

Additional feedback.

Council Tax: Do Students Pay?

If you’ve just moved into a uni flat with your friends and are trying to navigate the world of council tax, don’t worry. We’ve got you covered.

Let’s start by going back to the basics.

What Is Council Tax?

In the UK, most households have to pay an annual fee to the local council which helps finance the services that they provide. Council tax pays for things like maintaining roads, collecting rubbish and street lighting.

Whether or not you have to pay this fee depends on who is living in the property. For example, full-time students , carers, diplomats and under 18s don’t need to pay this annual fee, regardless of who they live with.

Do I Have To Pay Council Tax As A Student?

In general, full-time students do not need to pay council tax. If you’re a part time student you will have to pay the tax, although you might be eligible for a deduction.

In households where everyone is a full-time student, you don’t need to pay at all.

To qualify as a full-time student, your course must last for at least a year and have 21 or more study hours per week. That’s a lot of library time.

But if you aren’t physically in Uni for 21 hours a week, don’t worry. You can still pass these requirements even if you study remotely. However, you must be enrolled in a full-time course. Post-graduate and PhD students are also eligible for an exemption.

If someone in your household does not qualify as a full-time student, unfortunately, you will need to pay council tax. But, you may still be eligible for a discount.

If only one person in your 4 person household is not a student for example, you may be able to receive a 25% discount. But, you still need to fill in a form to notify the council and claim this.

In cases where there are two or more non-students in your house, you will not receive any discount and will have to pay as normal. Bummer.

Am I Automatically Exempt From Paying Council Tax?

If you live in University owned accommodation, you are automatically exempt from paying council tax. Students living in halls of residence do not need to fill out any council tax forms. Phew.

However, if you live in privately owned accommodation, or a student house, you might receive a council tax bill. You do not need to pay this bill, but you do need to apply for an exemption on GOV.UK.

What Do I Do If I'm A Student And The Council Chase Me For Council Tax?

First of all, don’t worry! You only need to apply for an exemption if you have received a bill from the council.

Applying for an exemption as a student is a really easy process. You simply have to ask your university or college for proof that you are a full-time student. They will give you a certificate which is valid up until a year after your course finishes. Then, you upload this document, along with answers to other short questions, to an online form via this link :

Apply for a Council Tax discount - GOV.UK ( www.gov.uk )

Once you have filled in this form, the council will approve your exemption and you will not need to pay the bill.

You will also need to follow the exact same process if you are applying for a discount. However, you must declare if not everyone in your household is a full-time student.

In summary, most properties in the UK must pay council tax, but full-time students never need to pay. If you are living in University owned accommodation, you do not need to worry about doing anything. However, if you live in privately-owned accommodation, you might need to apply for an exemption.

Using government websites should help you navigate through the rules and regulations, so you can stop worrying about taxes and get back to enjoying university life.

Want to improve your financial literacy and work towards your savings goals? Get started with Prograd today .

We've got more for you 👇

How Much Does The Average 22-Year-Old Earn In The UK?

What Is A Plan 1 Or Plan 2 Student Loan?

How Much Do I Need To Save For A Flat Deposit?

Council Tax Exemption: PhD and MPhil students writing up a thesis

Full-time PhD students will automatically be certified as exempt from Council Tax during their registration and fee-paying period (normally 3 years). After that, they are not registered as full-time students, and are no longer required to be resident in Aberystwyth or to study on a full-time basis. Many will go into full-time employment while completing their thesis. The University does not, therefore, automatically notify the Council of exemption from Council Tax for full-time PhD students after their registration period ends. However, certificates of exemption are provided on request to students up to the end of the fourth year because the course normally takes 4 years to complete and we recognise that many students will continue to study full-time in that period.

Similarly, full-time MPhil students will automatically be certified as exempt from Council Tax during their registration and fee-paying period (normally 1 year) and certificates of exemption are provided on request to students for a six month period after that because the course normally takes 18 months to complete.

Please note that exemption will not normally be provided after the 4 th year for PhD students, or after 18 months for MPhil students, even where an extension to the submission deadline has been approved. This is based on legal advice that the basis for exemption is the length of the course and not the time taken by an individual student to complete the course.

Students who require certificates of exemption can have a look at our Certification website for more information and how to get in touch.

Council Tax

Council tax is a form of local taxation that helps pay for local services, such as bin collection, care for the elderly and the police and fire services. It is a charge on residential property and is set and collected by local councils.

The local authority responsible for council tax in Loughborough is Charnwood Borough Council. You can find your local council by entering your post-code on gov.uk .

Do I have to pay council tax?

There is no automatic exemption for students, but most full-time students do not have to pay council tax because they live in properties which are exempted such as:

- Halls of residence

- Property occupied only by students

- Property occupied only by students and their spouses and/or dependants (providing the non-student spouse or dependant is not a British citizen and is prevented by their visa conditions from taking paid employment OR claiming benefits).

If a student shares accommodation with non-students, there will be a council tax bill, but in most cases either the landlord or the non-students will be liable to pay. There are, however, certain circumstances where students are liable for council tax.

You may have to pay if you:

- own or rent a house and you let or sub-let a room to someone who is not a student.

- are between courses (e.g. in the summer between undergraduate and postgraduate study).

- live in off-campus accommodation before your course starts or after your course has finished.

- are a pre-sessional student living off-campus, even if you are moving onto your main course at the end of the pre-sessional course.

What to do next?

For more information see the relevant tile below.

Bachelor’s and Master’s students

This includes guidance for Master’s students at our Loughborough London campus.

PhD Students

This includes guidance for students at our London campus

Pre-sessional Students

This is guidance specific for students studying on a pre-sessional English language course

Frequently Asked Questions

Who is a ‘student’ for council tax purposes.

A student is a person undertaking a ‘full time course of education’, which is defined for council tax purposes as:

- a course lasting for at least one academic year, and

- at least 24 weeks per year and

- amount to an average of at least 21 hours per week.

All full-time undergraduate and postgraduate degree programmes at Loughborough University fulfil these criteria, so any student on a full-time Bachelor’s, Master’s or PhD programme is considered a ‘student’ for council tax purposes.

The University’s pre-sessional English language courses are not full-time courses of education for council tax purposes as they do not last for an academic year. If you are a student on a pre-sessional course, you are not considered to be a ‘student’ for council tax purposes.

If you are registered on a programme that the University calls part-time, you are unlikely to be considered a ‘student’ for council tax purposes.

I am an international student arriving before my studies start, do I have to pay council tax?

You may have to pay council tax if you live in off-campus accommodation before your course starts or after your course has finished, regardless of whether you hold student visa permission at that time.

I am a student on placement, do I have to pay council tax?

Generally, no. If you are a ‘student’ for council tax purposes and you are working on a placement as part of your course you will retain your student status. In most cases you will not have to pay council tax.

What happens if I have to leave my course?

If you take a leave of absence from your course, you retain student status for council tax purposes. In most cases this means you will not have to pay council tax.

If you withdraw or are dismissed from your course, your status as a ‘student’ for council tax purposes comes to an end. In most cases this means council tax will be payable where you live, and depending on the circumstances you may be liable for the bill.

External Resources

Last Updated: 15th March 2023

- Student Sign In

- Associate Sign In

Added to basket!

- Council Tax

- Adviceplace

- Accommodation

- Duringyourtenancy

Council Tax is a charge made by local authorities for each property within their designated area. It helps to pay for local services such as schools, libraries and rubbish collection. The amount of council tax you pay depends on a range of factors including the value of the property you live in.

Each liable property gets one council tax bill. Depending on who lives in the property, none, some or all of the residents will have to pay all or some of the bill. Some buildings and people are exempt from paying council tax, some people are disregarded, and some people can receive discounts or reductions.

Do I Have to Pay Council Tax?

Most full-time students are exempt from paying council tax. However you might be responsible for payment if you:

Own your property and rent to other students

Are a visiting student and enrolled on a course for just one semester (scroll down for more information)

Are undertaking a PhD programme (scroll down for more information)

Part-time students are generally not exempt from council tax but exceptions do apply in cases in which a student is studying part-time on a temporary basis. More information on this can be found in the section entitled "Part-time and Part-time Repeat Year Students" below.

If you are the only person in your property with a legal responsibilty to pay council tax, you may be able to access a 25% single occupancy discount.

If you live in a property where you share facilities with other tenants who are on separate leases to you (e.g. you share a bathroom or kitchen), then your landlord may be the person liable for council tax. You should claim your exemption as normal to ensure that you do not get a bill.

If you are liable for payment of council tax, it is worth reviewing available payment methods and executing your preferred method as soon as possible.

Do I Have to Claim Exemption?

Unless you live in an exempt dwelling, you must APPLY for student council tax exemption and provide any evidence requested by the council.

Most, but not all, university accommodation blocks, are classified as exempt dwellings. Persons living in an exempt dwelling do not have any legal responsibility to pay council tax vis-a-vis their occupancy of an exempt building. If you are unsure if your accommodation is an exempt dwelling or not, do get in touch and we can advise.

How to Claim Council Tax Exemption

Unless you live in an exempt dwelling, you will need to apply for council tax exemption as soon as you can. You don't need to claim this every academic year, but you do need to let the Council know if you move address so your exemption can be applied to a new property. The University shares information about student status with Edinburgh City Council and with Midlothian Council.

If you live within Edinburgh City then you can claim exemption by completing this online form .

If you live in Midlothian then you can claim exemption by completing this online form .

When you completed your online registration with the University at the start of your programme, you were asked if they could share your data with the Council. If you chose ‘yes’ then the Council will have been provided with confirmation of your student status and when your course ends.

If you chose to not allow the University to share your information then they will not be able to tell the Council that you are a student and you may need to provide the Council with a copy of your Council Tax Exemption Letter, available from the Launch Self-service button in the Personal Details then Documents tab in MyEd.

If you live outside of these council areas, it is likely you’ll be required to provide your council with a copy of your University Council Tax Exemption Letter as part of your application for exemption.

Part-Time and Part-Time Repeat Year Students

The Council Tax regulations stipulate that a full time student is one who is enrolled on a course at an EU instututution which requires attendance for at least 24 weeks of the year and requires, on avaerage, at least 21 hours a week study and/or tuition during term time. The University of Edinburgh does not provide certification of exempt status to students who are enrolled on part time programme of study.

Students who are enrolled on a full-time programme of study but are temporarily studying part time due to a need to repeat certain modules or a decision to transfer course, may still be eligible for student council tax exemption. If you have any questions about this, please contact our service.

Living with Students and Non-Students

The council tax charge for a property is based on its' value and size. This means that if you are the only person in a property with a legal responsiblity for payment of council tax (e.g. if you are a part-time student living with lots of full-time students), your council tax cost could be very high. But you would be eligible for a 25% single occupancy discount.

A full-time student who has been granted exempt status by their council should not be billed or pursued by the council for payment of council tax. This applies even if the student is living with non-students. Sometimes in this situation non-students might prefer to live with someone else who will also be contributing towards the bill. Some students may offer to contribute towards a council tax bill in order to secure a reasonably priced flat.

International Students with a Dependent Spouse/Partner

Some international students are accompanied to Edinburgh by a partner or spouse who is not a student. If the partner or spouse is here on a dependent’s visa, they could be exempt from paying council tax but it depends on what is written in their visa. If the visa states, either that they are not able to work in the UK OR that they have no recourse to public funds (unable to claim benefits etc. in the UK), then they should be exempt and not have to pay Council Tax.

To apply for this exemption, you should submit photocopies of your passport and your partner’s passport and visa documents to the council. You can do this in writing, e-mail or by visiting the Council Offices.

Visiting students

If you normally study at an EU institution and you are visiting Edinburgh for one semester, you will need to show evidence to the council, from your home university that your course lasts for at least 24 weeks of the year. A document with the start and end dates of your course should be sufficient. You will also need to provide evidence from the University of Edinburgh that you are studying full-time. This is available on your certificate of matriculation, which you can download from the Mydetails section of your MyEd page in Documents.

If you normally study at an EU institution or at an institution outside the EU and you are visiting Edinburgh for one academic year and studying on a full-time basis, then your certificate of matriculation from the University of Edinburgh should prove your Council Tax exemption and you should not have to pay Council Tax.

If you normally study at an institution within the EU and you are visiting Edinburgh for one semester, you may be exempt from Council Tax if you can provide evidence of your student status from your home institution.

If you normally study at an institution within the EU and you are visiting Edinburgh for one semester, you may not be exempt from Council Tax. We have seen the council accept evidence in one case from an international institution that a student was studying full time for at least 24 weeks of the year. However, in other cases they have not accepted this evidence from institutions outside the EU. If they don't accept this evidence then you will need to pay the Council Tax unless you live in an exempt dwelling such as hall of residence provided by the University or a private student accommodation provider.

Interrupting your studies

If you take an interruption from your studies and you later return to study, the University counts you as still being on a full-time programme and will usually be able provide evidence of Council Tax exemption for the full period. This may not happen automatically and there may be some exceptions. If you do not return to study, the University and the Council may class you as liable to pay Council Tax from the date that you originally interrupted. This is also the case for students taking maternity or family leave.

Ending your studies

Once you stop being a student your student exemption stops and you become liable to pay Council Tax. If you withdraw from your programme, this will happen from the withdrawal date.

If you complete your programme then this will happen at the course end date (not from your graduation date). Most Undergraduate students are likely to become liable for Council Tax from the end of May.

If you are studying two separate full-time courses then you will be liable from the end date of your Undergraduate course until the start date of your Postgraduate course.

If you are studying a full-time integrated Masters programme, you will be exempt for the whole period as it is one course.

If you are studying a 2+2 programme (where you complete your degree at two different universities) you may need to obtain evidence from the University to confirm continuous study.

PhD rules

The University will provide evidence of Council Tax exemption for PhD students during their maximum period of study. Full-time PhD students can request a council tax exemption letter directly from student administration if they are within the first four years of their doctoral programme. They can then use this letter to apply for exemption via their local council.

Full time students in year 5 of a doctoral programme that is normally 3 years with one year of writing up will generally need to provide a letter from their school confirming that:

-they have been granted an extension for a period of 24 weeks or more

-AND that they will be required to undertake at least 21 hours/week of study over the period of the extension,

before the university’s student administration team will issue a council tax exemption letter. These students can then apply for exemption via their local council.

We should highlight, however, that Edinburgh Council have recently started rejecting large numbers of exemption requests from students who are in year 5+ of their PhD programme. If your request for exemption is rejected or if you have received an unexpected bill, please get in touch with us. Our caseworkers can provide guidance on challenging this decision and/or mitigating its’ impact.

If you are a UK student and do not want to pay council tax while in a writing up period longer than a year, it is possible that you could go to part-time and apply for Universal Credit and be granted council tax exemption as someone receiving benefits. However, please speak to your school and arrange a meeting with an Advice Place caseworker to discuss how this decision might affect your studies and your finances.

Finally, it is worth noting that doctoral students who have submitted their thesis cease to be exempt from the official date of submission. This rule applies regardless of how long a student has been enrolled on their doctoral programme. But, if that student, is subsequently granted major corrections of 6 months or more, they may be able to access exemption status retrospectively. If you have any questions in this regard, contact our team .

Understanding your council tax bill or statement

If you live in a private flat or in a University managed property that is not exempt from Council Tax, it is likely that you will receive a bill. The bill will be either for the full financial year from April to March or for however much time is left until the following March. Don’t worry if you will have moved out before then. You just need to let the Council know when you are moving out using their online forms and they should send you a revised bill that only covers the time when you were living in the property.

If the Council are aware of your student exemption then all your names should be listed on the bill and the full cost of Council Tax for the full year will be listed at the top. Below this, there will be a section which states how much of the year you are liable for and then a revised cost for only these days. The next section details any deductions and then a revised charge. If all tenants are students for the whole period, the total charge should be £0. The adjustments are listed at the bottom and will mention a student exemption.

Council Tax reduction

Some part-time students and students whose exemption had ended may be able to apply for a reduction in council tax. Contact the Advice Place for more information on eligibility.

Resolving issues

If you think that your bill is incorrect then you must contact the Council to get it resolved. Do not ignore a bill as you may be liable to pay charges, even if the Council decides you are exempt from Council Tax. If you have sent in documents or completed the online form about your student exemption recently, then allow the Council at least 2 weeks to process this before contacting them.

It is possible to speak to someone on the phone if you call the Edinburgh Council Tax and benefits phone line 0131 608 1111.

If your Council Tax bill is passed onto the bailiffs to chase payment, a fine will usually be added. However, if the bill has been raised in error, there is still a chance to contact the Council and get the bill cancelled.

As always, if you have any questions or would like our help or support with any of the above, please get in touch .

Last Updated: 21 March, 2024

Section Links

Students and council tax

Full-time students don’t usually have to pay council tax. Find out if you’re eligible for an exemption.

Council tax is paid to your local council so that they can spend the money on providing local services like transport, police, fire, libraries, leisure and recreation, and rubbish collection. It’s a tax on domestic property and how much you pay is determined by how much your property is worth.

Council tax eligibility

For council tax purposes, a full-time student is enrolled on a course that:

- lasts at least 1 year;

- involves at least 21 hours of study per week.

If you don’t meet the definitions of full-time student, you can’t claim exemption from council tax, even if your course is defined as full-time by your university or college.

You will need a Statement of Student Status to prove you are eligible. You can print out a copy of your own statement in Portico .

You are eligible for council tax exemption:

- if you are a full-time student and live in a house where everyone is a student (halls of residences are automatically exempt);

- if you are a full-time student and have interrupted your studies.

If you are a full-time student and live in a house with others who are not students, you may be eligible for a discount, but council tax will still be payable on the property.

You are not eligible for council tax exemption:

- if you are withdrawing from your course, as you will no longer be considered a student;

- if you have finished studying and have passed your programme end date - once you have finished studying, you are no longer classed as a full-time student, even if you have not yet received your results or been to your graduation ceremony.

If you move into your privately rented property before the start date of your programme, you may be liable for the period from when you move in to the first day of your programme.

For more information on council tax in your London borough, please visit the London Councils’ Directory and select your borough.

Further advice is available from the Students' Union UCL Advice Service.

How to apply

Council tax exemption certificates

In some situations, you may need to provide the Council or your landlord with proof of your student status to apply for exemption. They might ask for what's called a ' Certificate of student status ' or ' C ouncil tax exemption certificate' (often shortened to 'student certificate') in order to prove that you're in full-time education. You can use your Statement of Student Status to prove you are eligible. You can download or print out a copy of your Statement of Student Status from your Portico account .

You should apply for exemption to your local council. If you can’t apply online, you will need to contact your council to find out how to apply.

Browse the GOV.UK directory of local councils to find yours .

Find out more about how you can apply online for council tax exemption .

More information

Further guidance is available from the Citizens Advice Bureau .

Related content

- Fund your studies

- Manage your money

- UCL Financial assistance fund

Student council tax

- Student Records

- Alumni and Supporters

- Student Council Tax

- Part Time Students

- Explanatory Notes

- Council Tax FAQs

Council Tax Certificates

Information regarding eligibility for a certificate for confirmation of full-time student status for Council Tax purposes, and how to obtain one.

Council Tax is the way in which local Councils in England and Wales fund the services and facilities they provide. All the households within the Council's district should register with the Council for Council Tax purposes and each household will receive a Council Tax bill from the Council. In simple terms, the bill is calculated partly on the value of the property and partly on the number and type of occupants living in the property. The Council Tax year runs from 1 April in one year to 31 March in the following year (eg 1 April 2015 to 31 March 2016).

Full time students on courses of at least a full academic year and one-semester Visiting Exchange students are entitled to student status for Council Tax purposes and will receive a Council Tax certificate confirming their status from the University.

Take a look at the Council Tax Explanatory Notes page for further information on the following:

- Council Tax Exemption

- Eligibility for student status

- How to register with the Council for Council Tax Purposes

- What to do if you cease to be eligible for student status

- The status of students who interrupt their studies.

As University residences are exempt from Council Tax, students living in them do not need to register with their local Council for Council Tax purposes.

Students living outside of University residences should register with their local Council for Council Tax purposes. For most students this is likely to be Norwich City Council, whose contact details are: Revenue Services, City Hall, Norwich NR2 1WJ. You can call their main telephone number 0344 980 3333 and further information is available on the Norwich City Council website .

Please note that if you remain living outside of University residences after the end date stated on your Council Tax Exemption Certificate you may no longer be eligible for Council Tax exemption. Please check with your local Council Tax office.

Part Time Students and Council Tax

We have a further guidance note on the page regarding part time students and council tax .

Further Information and Advice Regarding Council Tax

Any queries regarding your Council Tax bill should initially be addressed to your local Council Tax Office. If you would like further help or advice with Council Tax, you might like to contact the Union of UEA Students Advice Centre, based in Union House.

Additional Information For Postgraduate Research Students

Council Tax Exemption Certificates will be available to you whilst you are in your full-time period of advanced study and research. When you commence the writing-up period for your thesis you will no longer be entitled to a certificate. You can, however, obtain a letter covering your writing-up period.

Please submit your request via our online Letter Request form .

How to Obtain a Council Tax Certificate

Once students have completed all elements of registration at the beginning of each academic year they can print their own Council Tax Exemption Certificate from the relevant link on their e:Vision home page.

It is the University's policy to only issue Council Tax Certificates directly to students and we will not issue certificates to third parties without the student's consent to do so.

Harvard Griffin GSAS students may have tax obligations based on the grants or stipends received through their financial support package.

- Dissertation

- Fellowships

- Maximizing Your Degree

- Before You Arrive

- First Weeks at Harvard

- Harvard Speak

- Pre-Arrival Resources for New International Students

- Alumni Council

- Student Engagement

- Applying to Degree Programs

- Applying to the Visiting Students Program

- Admissions Policies

- Cost of Attendance

- Express Interest

- Commencement

- Diversity & Inclusion Fellows

- Student Affinity Groups

- Recruitment and Outreach

- Find Your Financial Aid Officer

- Funding and Aid

- Financial Wellness

- Consumer Information

- Life Sciences

- Policies (Student Handbook)

- Student Center

- Title IX and Gender Equity

Any grant or stipend amount awarded in excess of tuition, required fees, books, and supplies is subject to federal income tax, as is any funding contingent upon providing service to the University (for example, teaching fellowships or research assistantships). Depending on citizenship and physical location, income taxes may or may not be withheld from stipend payments. More details are available from Harvard University Student Financial Services . Students are urged to review this information and ensure that they incorporate any resulting tax obligation into their financial planning.

If you have questions about US income taxes, visit the taxes page of Harvard's University Student Financial Services (SFS), where you will find information about federal and Massachusetts taxes, information specific to international students, access to Harvard-issued tax forms, and tax FAQs.

Harvard Griffin GSAS partners with the Harvard Griffin GSAS Student Council in hosting tax workshops for domestic and international students. Upcoming Tax Talks are posted on the GSAS calendar and past events appear on Harvard Griffin GSAS’s YouTube channel.

Watch the tax talks

Financial Aid

Share this page, explore events.

- Publications

Toggle navigation

Tax Reform and Higher Education

On Dec. 22, 2017, the Tax Cuts and Jobs Act (H.R. 1) was signed into law by President Trump. It is the most sweeping change to the U.S. tax code in decades and contains several provisions affecting higher education, including: a new, unprecedented tax on the endowments of some private colleges and universities; a limit on the state and local tax (SALT) deduction that may result in decreased state funding for public higher education institutions; and changes to higher education finance in the use of bond financing and the application of the unrelated business income tax (UBIT).

The final legislation also increased the standard deduction, which will likely lower the number of U.S. tax payers that itemize and removes an incentive for using the charitable deduction. It dropped a House proposal to repeal a number of benefits helping students and families finance a college education, including the Student Loan Interest Deduction (SLID) and Sec. 117(d) exemption from taxation for tuition waivers.

Below and in the tabs above are documents relating to the legislative process in both the House and Senate, along with answers to common questions about the legislation and how it will affect higher education. This page served as a resource hub during the legislative process, allowing campus stakeholders to monitor developments and share their views and concerns about the legislation with lawmakers. November/December 2017.

General Information

Full Text of the Final Tax Cuts and Jobs Act (470 KB)

Comparison of Current Law and House-Senate Conference Agreement (PDF; 100 KB)

Letter to Congress As Conference Committee Begins Negotiations (PDF; 100 KB)

Comparison of the Higher Education Provisions in the House and Senate Versions of the Tax Cuts and Jobs Act (PDF; 100 KB)

House Bill

Full text of the Tax Cuts and Jobs Act (H.R. 1) (Congress.gov)

Summary of the Higher Education Provisions in the House Tax Bill (PDF; 100 KB)

Section-by-Section Summary (PDF; 900 KB) (Committee on Ways and Means)

Letter to House Ways and Means Committee Leaders on the Tax Cuts and Jobs Act (PDF; 100 KB)

Letter to the House in Advance of the Floor Vote on the Tax Cuts and Jobs Act (PDF; 100 KB)

Senate Bill

Description of the Chairman’s Mark (PDF; 900 KB) (Joint Committee on Taxation)

Summary of the Higher Education Provisions in the Senate Bill (PDF; 100 KB)

Letter to the Senate Finance Committee on the Tax Cuts and Jobs Act (PDF; 100 KB)

Letter to the Senate on the Tax Cuts and Jobs Act Endowment Excise Tax Provision (PDF; 500 KB)

Letter to the Senate on Education Benefits in the House Version of the Tax Cuts and Jobs Act (PDF; 400 KB)

Letter to the Senate on Higher Education Provisions in the Senate Version of the Tax Cuts and Jobs Act (PDF; 400 KB)

Letter to the Senate on Charitable Giving Amendment Offered by Sen. James Lankford (R-OK)

Who We Are

resources.

Association Statements on the Tax Cuts and Jobs Act

American Association of State Colleges and Universities

American Council on Education

Association of American Universities

Association of Public and Land-grant Universities

Council for Advancement and Support of Education

National Association of College and University Business Officers

Talking Points: Tax Reform and Higher Education

Comments to the Senate Finance Committee on Tax Reform and Higher Education

Federal Tax Issues Affecting Higher Education

Association of American Universities

- Camp Tax Reform Act of 2014 – Provisions of Interest to Higher Education

Charitable Giving

Now more than ever, the ability of colleges and universities to fulfill their teaching, research and public service missions depends upon charitable giving. According to the Council for Aid to Education , colleges and universities in 2016 received about $41 billion in charitable gifts, an increase of 1.7 percent over the previous year.

Private donations work in concert with federal and state investments in student aid to ensure access to higher education for students regardless of their socioeconomic status. Charitable gifts also support teaching, groundbreaking research and technological innovation, and the public-service activities of colleges and universities. In short, the partnership between private donors and colleges and universities has delivered enormous economic benefits to our society.

What's At Stake

The House and Senate bills, as currently written, would double the standard deduction for individuals and couples and reduce the number of taxpayers who itemize, significantly reducing the value of the charitable deduction and leading to a drop in donations to all nonprofits, including colleges and universities.

Currently, the charitable deduction is only available to the roughly 30 percent of U.S. taxpayers who itemize their tax returns. If lawmakers enact the tax proposals being discussed on Capitol Hill—all of which include a doubling of the standard deduction threshold—only 5 percent of U.S. taxpayers would be able to deduct their charitable gifts. The result would be a significant decline in charitable giving to educational institutions and other charitable organizations, according to a study commissioned by Independent Sector . A Nov. 7 memorandum from the Joint Committee on Taxation (JCT) found that 41 million donors would claim around $241.1 billion under the deduction in 2018 under current law, as opposed to nine million donors claiming approximately $146.3 billion under the House plan. That would be a $95 billion drop—or 40 percent—in the use of the charitable deduction under H.R. 1

To solve this problem, higher education has joined with the Charitable Giving Coalition and other allies in the nonprofit sector to support the enactment of a universal charitable deduction. A universal charitable deduction would provide a charitable giving incentive to all by allowing taxpayers to subtract charitable gifts from their income before they determine whether to take the standard deduction or itemize their tax returns. The Independent Sector study found that the inclusion of the universal charitable deduction in tax reform would result in a $4.8 billion increase in charitable giving.

Endowments

The partnership between higher education and donors has been critical in helping create and sustain endowments, which play an increasingly critical role in the financing equation of higher education and in making a college education affordable. While the vast majority of the nation’s 4,700 colleges and universities do not have significant endowments, colleges and universities with larger endowments use those resources to provide substantial student financial aid to enhance access, particularly for low- and middle-income students. Indeed, the institutions with the largest endowments often have the lowest net price because they provide significant grant aid to students.

Institutions also depend on their endowments to support new and emerging fields of study and research, along with nearly every aspect of an institution’s operation. Each dollar spent from an endowment to deliver an education—from libraries to laboratories—reduces the cost to all students. At many institutions with the largest endowments, funds from endowments are the largest source of financial support, ranging from 20-50 percent of their operating budgets.

Endowments are collections of hundreds or thousands of individual funds established by donors and managed and invested by institutions to serve current and future needs. Institutions only solicit and accept gifts that further that mission and align with strategic institutional priorities. Endowments are not savings accounts or rainy day funds being built up to demonstrate wealth but instead provide a steady and reliable long-term funding source to support students, research, and other programs that would otherwise be paid for by tuition, state and federal funding, or other resources.

What's At Stake

Both the House and Senate bills would create a new excise tax of 1.4 percent on endowments at certain private colleges and universities, reducing the value of these endowments and redirecting dollars away from those institutions and their students to the federal government.

Part of what is driving this proposal is the suggestion that colleges and universities could hold down tuition increases and lower the cost of attendance by creating new federal mandates on university endowments. It ignores the fact that many institutions are already devoting a great deal of their resources, including from endowment funds, to increase access for these students. It also reflects a lack of understanding about how university endowments operate and the restricted nature of endowed funds.

However well-intentioned, “one size fits all” federal mandates such as payout requirements or excise taxes will do more harm than good, redirecting funds away from their charitable purpose while making it more difficult for institutions to meet their legal and fiduciary obligations.

Background

Senate GOP Tax Plan Jeopardizes Charitable Giving (Nov. 28, 2017)

Congressional Joint Economic Committee