- Screen Reader

- Skip to main content

- Text Size A

- Language: English

Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

India Organic Biofach 2022

Gulfood dubai 2023, automobiles, indian automobiles industry analysis, india is the world’s third-largest automobile market, the largest manufacturer of three-wheelers, passenger vehicles, and tractors, and the second-largest manufacturer of two-wheelers., advantage india, growing demand.

* Rising middle-class income and a huge youth population will result in strong demand.

* In November 2023, the total production of passenger vehicles*, three-wheelers, two-wheelers, and quadricycles was 2.22 million units.

* The global EV market was estimated at approximately US$ 250 billion in 2021 and by 2028, it is projected to grow by 5 times to US$ 1,318 billion.

Opportunities

* India could be a leader in shared mobility by 2030, providing opportunities for electric and autonomous vehicles.

* Focus is shifting to electric vehicles to reduce emissions.

* By 2030, the Indian government has committed that 30% of the new vehicle sales in India would be electric.

Rising Investment

* The automobile sector received a cumulative equity FDI inflow of about US$ 35.40 billion between April 2000 - September 2023.

* India is on track to become the largest EV market by 2030, with a total investment opportunity of more than US$ 200 billion over the next 8-10 years.

Policy Support

* Automotive Mission Plan 2016-26 is a mutual initiative by the Government of India and the Indian automotive industry to lay down the roadmap for the development of the industry.

* FAME Scheme was extended for a further period of 2 years up to March 31st, 2024.

Automobiles Industry Report

India enjoys a strong position in the global heavy vehicles market as it is the largest tractor producer, second-largest bus manufacturer, and third-largest heavy truck manufacturer in the world. India’s automobile sector is split into four segments, i.e., two-wheelers, three-wheelers, passenger vehicles, and commercial vehicles, each having a few market leaders. Two-wheelers and passenger vehicles dominate the domestic demand.

In terms of market size, the Indian passenger car market was valued at US$ 32.70 billion in 2021, and it is expected to reach a value of US$ 54.84 billion by 2027 while registering a CAGR of over 9% between 2022-27. The global EV market was estimated at approximately US$ 250 billion in 2021 and by 2028, it is projected to grow by 5 times to US$ 1,318 billion.

India has a strong market in terms of domestic demand and exports. In November 2023, total passenger vehicle sales reached 3,34,130*. Sales of Passenger Vehicles in November 2023 have been the highest, with a marginal growth of 3.7%, compared to November 2022. This is because India has significant cost advantages, as automobile firms save 10-25% on operations vis-a-vis Europe and Latin America. The Indian automotive industry is targeting to increase the export of vehicles by five times during 2016-26. In FY23, total automobile exports from India stood at 47,61,487. This sector's share of the national GDP increased from 2.77% in 1992–1993 to around 7.1% presently. It employs about 19 million people directly and indirectly.

In November 2023, the total production of passenger vehicles*, three-wheelers, two-wheelers, and quadricycles was 2.22 million units. In (April-November) 2023-24, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was 15.56 million units.

In the first quarter of 2023-24*, total production of passenger vehicles, commercial vehicles, three wheelers, two wheelers, and quadricycles was 6.01 million units.

Foreign companies such as Kia Motors and Volkswagen have adapted themselves to cater to the large Indian middle-class population by dropping their traditional structure and designs. This has allowed them to compete directly with domestic firms, making the sector highly competitive.

India is currently shifting focus to electric cars to reduce emissions. India accomplished a significant milestone, with the sale of 8,32,434 EVs in 2023-24 (till August 2023). In terms of electric vehicles (EVs), in Q4 FY22, sales reached a new high of 60,94,960 units. Overall, in 2022-23, 2,12,04,162 EVs were sold in India, indicating a 168% YoY growth over last year’s sales. A report by India Energy Storage Alliance estimated that the EV market in India is likely to increase at a CAGR of 36% until 2026. In addition, the projection for the EV battery market is forecast to expand at a CAGR of 30% during the same period.

There have been plenty of investments in the automobile sector recently, as the Government of India expects the automobile sector to attract US$ 8-10 billion in local and foreign investments by 2023. The automobile sector received a cumulative equity FDI inflow of about US$ 35.40 billion between April 2000 - September 2023. India is on track to become the largest EV market by 2030, with a total investment opportunity of more than US$ 200 billion over the next 8-10 years.

India accomplished a significant milestone, with the sale of 8,47,439 EVs in FY24 (till August 2023). A y-o-y growth of 209.17% was witnessed with 1.02 million registered EVs in FY23, as compared to FY22.

Ola Electric IPO to be the first auto company in India to launch an IPO in over two decades (20 years). It has an expected size of Rs. 8,500 crore (US$ 1.01 billion).

In November 2023, Mercedes-Benz sold 1,234 luxury cars, the highest in the segment, which gave it a market share of 0.34%. BMW sold 1,000 cars in November 2023.

In November 2023, Tata Motors inaugurated its state-of-the-art Registered Vehicle Scrapping Facility in Chandigarh.

In October 2023, Hero MotoCorp inaugurated its first state-of-the-art premium dealership in India.

In October 2023, Tata Motors signed a definitive agreement to acquire a 27% stake in Freight Tiger, a software-as-a-service (SaaS) company, for Rs. 150 crore (US$ 17.99 million).

In July 2023, Renault Nissan to invest US$ 1,68,762.86 (Rs. 1.4 crore) to upgrade infrastructure at eight schools near Chennai.

In July 2023, Mahindra & Mahindra is in advanced talks with British International Investment (BII) and some other global investors to raise up to US$ 602.72 million (Rs. 5,000 crore) for its electric vehicles (EV) unit.

In June 2023, Tata Motors will invest US$ 2 billion towards developing new products and platforms over the next four years.

In June 2023, Hero MotoCorp to invest up to US$ 180.81 million (Rs. 1,500 crore) for developing premium bikes and EVs in India.

In June 2023, Kinetic Green Energy and Power Solutions are planning to raise up to US$ 100 million by selling a 10-15% stake in the company to investors.

In May 2023, Maruti Suzuki India plans to invest over US$ 5.5 billion to double capacity by 2030.

In April 2023, Power Finance Corporation Ltd (PFC) approves US$ 76.39 million (Rs. 633 crore) loan for 5,000 passenger EVs and 1000 cargo EVs.

In March 2023, the Central government sanctions US$ 72.41 million (Rs. 800 crore) under FAME India Scheme Phase II to Indian Oil (IOCL), Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL), for setting up 7,432 public fast charging stations across the country.

In the January-June period this year, Mercedes-Benz posted its best-ever half-yearly sales in India at 8,528 units, a growth of 13% a year-ago. During the same period BMW and Audi came at the 2nd and 3rd position with sales of 5,867 and 3,474 units, respectively.

In February 2023, Nissan and Renault plan to invest US$ 600 million in India over the next 3-5 years to expand their market share in passenger cars and electric vehicles.

In February 2023, German luxury car maker Audi India began local production of the Audi Q3 and Audi Q3 Sportback at the Skoda Auto Volkswagen India Private Limited (SAVWIPL) plant in Aurangabad.

In January 2023, MG Motor India planned to invest US$ 100 million to expand capacity, eyes 70% growth in 2023.

Tata Group Chairman, Mr. N Chandrasekaran said that "EV contribution in our portfolio is likely to increase to 25% in five years and reach 50% by 2030, thus significantly increasing investments in this sector“ in January 2023.

In January 2023, Global chief executive officer (CEO) Mr. Ola Kallenius said that India was Mercedes-Benz’s fastest-growing market worldwide in 2022 and plans on investing more.

Indian carmakers commit US$ 10 billion to add new capacity of 2.2 to 3 million units.

Investment flow into EV start-ups in 2022 (until September 15) has raised funds worth around $673 million, according to Fintrackr. There is a need to set up proper charging infrastructure for EVs in India. To install electric vehicle supply equipment (EVSE) infrastructure for EVs, various public sector firms, ministries, and railways have come together to create infrastructure, and manufacture components.

In November 2022, Mahindra & Mahindra announced that they had tied up with three electric vehicle infrastructure partners - Jio-bp, Statiq, and Charge+Zone - to offer charging solutions for their range of passenger electric vehicles.

In December 2022, Mahindra & Mahindra planned to invest Rs. 10,000 crore (US$ 1.2 billion) for an EV manufacturing plant in Pune.

In September 2022, Kinetic Engineering Limited (KEL) invested in Ahmednagar to set up a dedicated production line with an initial capacity of 5,000 sets per month.

The Indian government has planned US$ 3.5 billion in incentives over a five-year period until 2026 under a revamped scheme to encourage the production and export of clean technology vehicles. Initiatives like Make in India, the Automotive Mission Plan 2026, and NEMMP 2020 will be net positive for the sector.

Mr. Nitin Gadkari, Minister of Road Transport and Highways has revealed plans to roll out Bharat NCAP, India’s own vehicle safety assessment program. In 2021, Prime Minister Mr. Narendra Modi launched the Vehicle Scrappage Policy, which aims to phase out old polluting vehicles in an environmentally safe manner.

The Government aims to develop India as a global manufacturing and research and development (R&D) hub. It has set up National Automotive Testing and R&D Infrastructure Project (NATRiP) centres as well as the National Automotive Board to act as facilitators between the Government and the industry. Under (NATRiP), five testing and research centres have been established in the country since 2015.

In August 2022, the Indian government launched India’s first double-decker electric bus in Mumbai. Looking long term, the government feels it is necessary to overhaul the country’s transportation system. It is working to create an integrated electric vehicle (EV) mobility ecosystem with a low carbon footprint and high passenger density with an emphasis on urban transportation reform. The government's strategy and policies are intended to promote greater adoption of electric vehicles in response to growing customer demand for cleaner transportation options.

Following the COVID-19 pandemic, the Indian automobile sector is expected to bounce back and show strong growth in FY23. If it continues on its upward trajectory, India could be a leader in shared mobility by 2030, providing opportunities for electric and autonomous vehicles.

Notes: *Data except for BMW, Mercedes, Tata Motors & Volvo Auto

References: International Organization of Motor Vehicle Manufacturers, Media Reports, Press Releases, Department for Promotion of Industry and Internal Trade (DPIIT), Automotive Component Manufacturers Association of India (ACMA), Society of Indian Automobile Manufacturers (SIAM), Union Budget 2023-24

Related News

India becomes Suzuki's second market to cross the 3 crore cumulative production mark, company plans expansion to achieve a 4 million unit capacity by 2030-31.

The Ministry of Heavy Industries has launched the Electric Mobility Promotion Scheme 2024 (EMPS 2024) with a budget of US$ 60 million (Rs. 500 crore) to encourage the nationwide adoption of electric vehicles.

Spinny reports a surge in used-car sales to women, citing Delhi-NCR, Mumbai, and Bengaluru as key markets.

A study conducted by CareEdge Ratings highlights a notable change in India's automotive industry, with the country targeting 30% of total vehicle sales to be electric by 2030.

The Ministry of Heavy Industries introduced the Electric Mobility Promotion Scheme (EMPS) to strengthen India's electric vehicle (EV) sector, closely aligning with the ideals of Atmanirbhar Bharat.

Automobile Clusters

- Mumbai-Pune-Nashik-Aurangabad

- Chennai-Bengaluru-Hosur

- Delhi-Gurgaon-Faridabad

- Kolkata-Jamshedpur

- Sanand-Hansalpur-Vithalpur

Industry Contacts

- Automotive Component Manufacturers of India (ACMA)

- Society of Indian Automobile Manufacturers (SIAM)

- Automotive Research Association of India (ARAI)

- Automobile Association of Southern India (AASI)

India is expected to become the third largest market for electric vehicles by 2025 at 2.5 million vehicles.

IBEF Campaigns

APEDA India Pavilion Gulfood February 20th-26th, 2022 | World Trade Centre,...

Ibef Organic Indian Pavilion BIOFACH2022 July 26th-29th, 2022 | Nuremberg, ...

India's White Revolution

The "White Revolution" in India refers to the successful implementation of Operation Flood, a dairy development program launched on January ...

The Growth of Ayurveda in India

Ayurveda, an ancient health system originating from India, has a longstanding history. It revolves around using plants and herbs to maintain health an...

The Success of Digital India

India's digital ecosystem has undergone an enormous change in recent years. The progressive integration of government services into digital platfo...

Unlocking India's Digital SME Credit Gap and Economic Potential

The Indian economy thrives on the contributions of the Micro, Small, and Me...

The Inevitable Emergence of Digital Engineering

Digital Engineering involves utilizing digital tools and technologies to de...

Introduction to Digital Payments- Unified Payments Interface (UPI) and RuPay credit cards in India

India's digital payment ecosystem has undergone a remarkable transforma...

Not a member

Indian Automobile Industry Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029)

The Report of Indian Automobile Industry Analysis is Segmented by Vehicle Types (Two-Wheelers, Passenger Cars, Commercial Vehicles, and Three-Wheelers), by Fuel Type (Diesel, Petrol/Gasoline, Electric, CNG/LPG, and Others), and by Region (North India, East India, West India, and South India). The Report Covers the Market Size and Forecasts for the India Automotive Market in Value (USD Billion) for all the Above Segments.

India Automobile Market Size

Need a report that reflects how COVID-19 has impacted this market and its growth?

India Automobile Market Analysis

The Analysis Of Automobile Industry In India Market is expected to register a CAGR of 8.10% during the forecast period.

India's Automotive Market was valued at USD 100 billion in 2021 and is expected to reach USD 160 billion in 2027.

India is a well-recognized Automobile manufacturing hub worldwide because of its low-cost production. Cheap labor, easy availability and low cost of raw materials, and a weak currency are the factors driving the manufacturing Industry. India is the 4th largest producer of Automobiles in the world, with an average annual production of more than 4 million motor vehicles.

Although vehicle production was hampered due to the global pandemic and worldwide lockdown, now, as the situation is easing, the number of vehicles produced is expected to increase in the upcoming years. For instance,

In 2019 a total of 4.5 million vehicles were sold in the country, and in 2020 the number dropped by about 3 %. However, in 2021, the number of vehicles produced rose by about 30% compared to 2020. Hence, considering the rising demand and the production in full swing, the number of vehicles produced is expected to increase during the forecast period.

Due to the rise in the middle-class income and rising young population, the India Automobile market is expected to witness strong growth. Additionally, due to the rising demand for automobiles, export from the country has also seen a significant increase. For instance,

From April to December 2021, Indian automobile exports were 424,037 units, up from 291,170 units from April to December 2020.

Major players in the passenger car segment include Maruti Suzuki, Tata Motors, Hyundai Motor Company, Mahindra and Mahindra, Kia Motor Company, and others. Players in the two-wheeler segment include Hero Moto Corp., Honda, TVS, Bajaj, Royal Enfield, and others.

India Automobile Market Trends

Rising investments and government initiatives are expected to drive the market.

The automobile sector accounts for 7.1% of India's GDP and 49 % of manufacturing GDP. Hence, the automobile sector in India is a significant driver of macroeconomic growth and technological advancement. So, the government is focused on increasing the share of the automobile industry by introducing various norms and schemes.

By 2023, the Indian government expects the vehicle sector to receive USD 8-10 billion in domestic and foreign investment.

For instance, the Prime Minister introduced the Make in India program in 2014 as part of a broader set of nation-building efforts. Make in India was designed as a timely solution to a crisis to transform India into a global design and manufacturing hub.

As a result, many manufacturers are investing in new manufacturing plans and existing plants to cater to the increasing demand for the production of vehicles in the country. Like in July 2021, Maruti Suzuki India stated that it would invest INR 18,000 crore (USD 2.42 billion) in a new production facility in Haryana, with an annual manufacturing capacity of 7.5-10 lakh vehicles.

Additionally, in 2021, the Government of India introduced a new vehicle scrappage policy, where the key objective was to identify and scrap unfit automobiles from the road. This is done to reduce the emission of more greenhouse gases from the older vehicles and make way for the new vehicle compliant with BS6 (Bharat Stage 6 - similar to Euro6) emission norms.

When scrapping an old vehicle, vehicle owners may be eligible for tax savings as an incentive. As a result, the recycling business will generate more cash. Compared to older automobiles, the new vehicles will be safer, aiding the overall automobile market in India.

Electric Vehicles Segment is Expected to Witness Significant Growth

In India, about 300,000 electric vehicles were sold in 2021, a 168% increase over the 100,000 units sold the previous year, with passenger EV sales in India tripled in 2021 to about 15,000 units and are still showing signs of growth.

The government of India has undertaken multiple initiatives to promote the manufacturing and adoption of electric vehicles in India to reduce emissions and develop e-mobility in the wake of rapid urbanization.

The National Electric Mobility Mission Plan (NEMMP) and Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India (FAME I and II) helped create the initial interest and exposure for electric mobility.

As of June 2021, in phase two of the FAME scheme, 87,659 electric automobiles have been sponsored through incentives, and 6,265 electric buses have been sanctioned to various state/city transportation undertakings, totaling INR 871 crore (USD 117 million).

Hence in 2021, the government announced an extension of phase two of the FAME scheme through 2024. This phase focuses on the electrification of public and shared transportation through subsidizing e-buses, electric three-wheelers, electric passenger vehicles, and electric two-wheelers.

The Indian government has also provided tax exemptions and subsidies to EV manufacturers and consumers to promote the domestic electric vehicle industry. As per the phased manufacturing proposal, the government has imposed a 15% customs duty on parts used to manufacture electric vehicles and 10% on imported lithium-ion cells.

With 100% FDI allowed, new production centers, and a greater drive to improve charging infrastructure, India's electric vehicle sector is picking up speed. Other development factors for the Indian EV sector include federal subsidies and policies supporting more significant discounts for Indian-made electric two-wheelers and a boost for localized ACC battery storage manufacturers. Improved government regulations and policies, like no license required to operate EV charging stations in India, further aid the market's growth.

With the increasing sales of electric vehicles in India, automakers are investing in developing new technologies and electric infrastructure and increasing their production capacities to accommodate the demand. For instance,

- In November 2021, Indian Oil Corporation and other public oil companies exclaimed aff 22,000 electric vehicle charging stations over the next 3-5 years.

- In May 2022, Toyota Group revealed plans to invest INR 48 billion (USD 624 million) in India to manufacture electric vehicle components.

Hence, the India Automotive Market is expected to witness robust growth in the forecast period due to the aforementioned reasons.

India Automobile Industry Overview

The India Automotive Market is reasonably concentrated, with the top five players having most of the market share in all the segments. The major players in the passenger car segment include Maruti Suzuki India Limited (Suzuki Motor Corporation), Tata Motors Limited, Hyundai Motor Company, Mahinda and Mahindra limited, and Honda Motor Company.

The two-wheeler market is also concentrated, with major players occupying the majority share of the market. The key players in the two-wheeler market include Hero MotoCorp Limited, Honda Motorcycle & Scooter India Pvt. Ltd. (Honda Motor Company), TVS Motor Company, Bajaj Auto Limited, and Royal Enfield ( Eicher Motors Limited )

Major players in the various segments are investing in R&D and infrastructure to gain the upper hand. For instance,

- In October 2021, Tata Motors revealed intentions to invest up to USD 2 billion in India over the next four years to develop ten new electric vehicles.

- In December 2021, Hyundai Motor aimed to invest INR 4,000 crore (USD 531.12 million) in India by 2028 to launch six new electric vehicles.

India Automobile Market Leaders

Mahindra & Mahindra Ltd

Hyundai Motor Company

Tata Motors Limited

Honda Cars India Ltd (Honda Motor Company)

Maruti Suzuki India Ltd. (Suzuki Motor Corporation)

*Disclaimer: Major Players sorted in no particular order

India Automobile Market News

- In November 2021, Skoda Auto revealed ambitions to produce electric vehicles in India. However, before committing to local manufacture, the company may bring its first EV, the Enyaq, to market as a CBU.

- In January 2022, As part of its 'Be the Future of Mobility' strategy, Hero MotoCorp announced an INR 420 crore (USD 55.76 million) investment in Ather Energy.

- In November 2021, TVS Motor agreed to invest INR 1,200 crore (USD 159.33 million) with the Tamil Nadu government to develop new electric vehicle technologies and expand their manufacturing capacity.

India Automobile Market Report - Table of Contents

1. INTRODUCTION

1.1 Study Assumptions

1.2 Scope of the Study

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

4. MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter's Five Forces Analysis

4.3.1 Threat of New Entrants

4.3.2 Bargaining Power of Buyers/Consumers

4.3.3 Bargaining Power of Suppliers

4.3.4 Threat of Substitute Products

4.3.5 Intensity of Competitive Rivalry

5. MARKET SEGMENTATION

5.1 By Vehicle Type

5.1.1 Two-Wheelers

5.1.2 Passenger Cars

5.1.3 Commercial Vehicles

5.1.4 Three-wheelers

5.2 By Fuel Type

5.2.1 Diesel

5.2.2 Petrol/Gasoline

5.2.3 CNG and LPG

5.2.4 Electric

5.2.5 Others

5.3 By Region

5.3.1 North India

5.3.2 South India

5.3.3 East India

5.3.4 West India

6. COMPETITIVE LANDSCAPE

6.1 Vendor Market Share

6.1.1 Two-Wheelers

6.1.2 Passenger Cars

6.1.3 Commercial Vehicles

6.1.4 Three-wheelers

6.2 Company Profiles*

6.2.1 Two-Wheelers

6.2.1.1 TVS Motor Company

6.2.1.2 Hero Moto Corp.

6.2.1.3 Honda Motorcycle & Scooter India Pvt. Ltd.

6.2.1.4 Royal Enfield

6.2.1.5 Bajaj Auto Corp.

6.2.1.6 Suzuki Motorcycle India Private Limited

6.2.2 Passenger Cars and Commercial Vehicles

6.2.2.1 Maruti Suzuki India Limited

6.2.2.2 Tata Motors Limited (includes Tata and Jaguar)

6.2.2.3 Hyundai Motor India Ltd

6.2.2.4 Mahindra & Mahindra Limited

6.2.2.5 MG Motor India Pvt. Ltd

6.2.2.6 Volkswagen India

6.2.2.7 Renault Group (Includes Nissan and Renault)

6.2.2.8 Honda Cars India Ltd.

6.2.2.9 BYD Company Ltd.

6.2.2.10 BMW AG (includes BMW and MINI)

6.2.2.11 Mercedes-Benz India Pvt Ltd

6.2.3 Three-wheelers

6.2.3.1 Lohia Auto Industries

6.2.3.2 Piaggio & C. SpA

6.2.3.3 Scooters India Ltd.

6.2.3.4 Atul Auto Limited

6.2.3.5 Terra Motors India Corp.

6.2.3.6 Kinetic Green Energy & Power Solutions Ltd

7. MARKET OPPORTUNITIES AND FUTURE TRENDS

India Automobile Industry Segmentation

The India Automotive Market is segmented By Vehicle Types (Two-Wheelers, Passenger Vehicles, Commercial Vehicles, and Three Wheelers), By Fuel Type (Diesel, Petrol/Gasoline, Electric, CNG/LPG, and Others), and By Region (North India, East India, West India, and South India). The report covers the market size and forecast for the India Automotive market in value (USD billion) for all the above segments.

India Automobile Market Research FAQs

What is the current india automobile market size.

The India Automobile Market is projected to register a CAGR of 8.10% during the forecast period (2024-2029)

Who are the key players in India Automobile Market?

Mahindra & Mahindra Ltd, Hyundai Motor Company, Tata Motors Limited, Honda Cars India Ltd (Honda Motor Company) and Maruti Suzuki India Ltd. (Suzuki Motor Corporation) are the major companies operating in the India Automobile Market.

What years does this India Automobile Market cover?

The report covers the India Automobile Market historical market size for years: 2019, 2020, 2021, 2022 and 2023. The report also forecasts the India Automobile Market size for years: 2024, 2025, 2026, 2027, 2028 and 2029.

What is the future outlook for the Automobile Industry in India?

The future of India's Automobile Industry growth is fueled by: a) Growth in domestic demand b) Growing demand for EV segment c) Increased foreign investments, and d) Technological advancements

Our Best Selling Reports

- White Oil Market

- Mercury Market

- Recovered Carbon Black Market

- Ceramic Coatings Market

- Anti-microbial Coatings Market

- Food 3D Printing Market

- Middle East and Africa Sweet Biscuits Market

- Hair Care Products Market

- Metal Foam Market

- Frozen Yogurt Market

Automobile in India Industry Report

The Indian automotive market is on a significant upward trajectory, fueled by an expanding middle class, technological advancements, and supportive government initiatives, leading to a surge in demand for electric vehicles, passenger cars, commercial vehicles, and two-wheelers. Enhanced by government policies like tax incentives and vehicle scrappage schemes for cleaner vehicles, along with rising disposable income and better financing options, the market is becoming more accessible to a wider audience. Investments in manufacturing and infrastructure are further boosting production capacities to meet this growing demand. With a keen focus on electric mobility and new technologies, the Indian automotive industry is set for robust growth, presenting vast opportunities for manufacturers, investors, and consumers. For detailed insights, Mordor Intelligence™ Industry Reports offer a comprehensive analysis, including market share, size, revenue growth rate, and a forecast outlook, available as a free report PDF download.

Automobile Industry in India Report Snapshots

- Automobile Industry in India Market Size

- Automobile Industry in India Market Share

- Automobile Industry in India Market Trends

- Automobile Industry in India Companies

Please enter a valid email id!

Please enter a valid message!

Analysis Of Automobile Industry In India Get a free sample of this report

Please enter your name

Business Email

Please enter a valid email

Please enter your phone number

Get this Data in a Free Sample of the Analysis Of Automobile Industry In India Report

Please enter your requirement

Thank you for choosing us for your research needs! A confirmation has been sent to your email. Rest assured, your report will be delivered to your inbox within the next 72 hours. A member of our dedicated Client Success Team will proactively reach out to guide and assist you. We appreciate your trust and are committed to delivering precise and valuable research insights.

Please be sure to check your spam folder too.

Sorry! Payment Failed. Please check with your bank for further details.

Add Citation APA MLA Chicago

➜ Embed Code X

Get Embed Code

Want to use this image? X

Please copy & paste this embed code onto your site:

Images must be attributed to Mordor Intelligence. Learn more

About The Embed Code X

Mordor Intelligence's images may only be used with attribution back to Mordor Intelligence. Using the Mordor Intelligence's embed code renders the image with an attribution line that satisfies this requirement.

In addition, by using the embed code, you reduce the load on your web server, because the image will be hosted on the same worldwide content delivery network Mordor Intelligence uses instead of your web server.

- Transportation & Logistics ›

Vehicles & Road Traffic

Automotive industry in India - statistics & facts

Major players of india’s automotive industry, challenges and counter measurements, key insights.

Detailed statistics

Number of operating vehicles in India FY 1951-2020

Indian automobile industry market share FY 2023, by segment

Two-wheeler sales volume in India FY 2021-2023, by manufacturer

Editor’s Picks Current statistics on this topic

Current statistics on this topic.

Passenger Cars

Passenger car market share India 2023, by vendor

Two-wheeler domestic sales in India FY 2011-2023

Related topics

Recommended.

- Railway industry in India

- Water transportation in India

- Air transportation in India

- Commercial vehicles in India

- Passenger vehicles in India

Recommended statistics

- Basic Statistic Leading car manufacturing countries worldwide 2023

- Premium Statistic Number of road transport passengers in India FY 2001-2020

- Premium Statistic Number of registered vehicles in India FY 1951-2020

- Premium Statistic Automotive sector employment India FY 2013-2019

- Premium Statistic Automotive components market size in India FY 2016-2023

- Premium Statistic Indian central government road transport tax revenue FY 2010-2019

Leading car manufacturing countries worldwide 2023

Motor vehicle production volume worldwide in 2023, by country (in 1,000 units)

Number of road transport passengers in India FY 2001-2020

Passenger movement by road in India from financial year 2001 to 2020 (in billion passengers per kilometer)

Number of registered vehicles in India FY 1951-2020

Number of registered vehicles across India from financial year 1951 to 2020 (in millions)

Automotive sector employment India FY 2013-2019

Employment in the automotive sector across India from financial year 2013 to 2019 (in 1,000s)

Automotive components market size in India FY 2016-2023

Size of automotive component market across India from financial year 2016 to 2023 (in billion U.S. dollars)

Indian central government road transport tax revenue FY 2010-2019

Value of Indian central government road transport tax revenue from financial year 2010 to 2019 (in trillion Indian rupees)

- Premium Statistic Export volume of passenger vehicles from India FY 2015-2023

- Basic Statistic Export volume of commercial vehicles India FY 2015-2023

- Premium Statistic Export volume of two-wheelers India FY 2015-2023

- Premium Statistic Three-wheeler export volume India FY 2015-2023

- Premium Statistic Value of automotive parts exports India FY 2009-2023

Export volume of passenger vehicles from India FY 2015-2023

Export volume of passenger vehicles from India from financial year 2015 to 2023 (in 1,000s)

Export volume of commercial vehicles India FY 2015-2023

Export volume of commercial vehicles from India between financial year 2015 and 2023 (in 1,000s)

Export volume of two-wheelers India FY 2015-2023

Export volume of two-wheelers from India between financial year 2015 and 2023 (in 1,000s)

Three-wheeler export volume India FY 2015-2023

Export volume of three-wheelers from India between financial year 2015 to 2023 (in 1,000s)

Value of automotive parts exports India FY 2009-2023

Value of automotive parts exports from India between financial year 2009 to 2023 (in billion U.S. dollars)

- Premium Statistic Production volume of vehicles India FY 2011-2023, by segment

- Premium Statistic Passenger vehicles production volume India FY 2014-2023

- Premium Statistic Production volume of M&HCV in India FY 2008-2021

- Premium Statistic Production volume of two wheelers India FY 2008-2023

- Premium Statistic Production volume of three wheelers India FY 2008-2023

Production volume of vehicles India FY 2011-2023, by segment

Production volume of vehicles across India from financial year 2011 to 2023, by segment (in millions)

Passenger vehicles production volume India FY 2014-2023

Production volume of passenger vehicles in India from financial year 2014 to 2023 (in millions)

Production volume of M&HCV in India FY 2008-2021

Production volume of medium and heavy commercial vehicles across India from financial year 2008 to 2021 (in 1,000s)

Production volume of two wheelers India FY 2008-2023

Production volume of two wheelers across India from financial year 2008 to 2023 (in millions)

Production volume of three wheelers India FY 2008-2023

Production volume of three wheelers across India from financial year 2008 to 2023 (in 1,000s)

- Premium Statistic Passenger vehicles sales volume India FY 2014-2023

- Premium Statistic Commercial vehicles sales volume India FY 2012-2023

- Premium Statistic Two-wheeler domestic sales in India FY 2011-2023

- Premium Statistic Three-wheelers domestic sales volume in India FY 2015-2023

- Premium Statistic Top selling cars in India in 2023

Passenger vehicles sales volume India FY 2014-2023

Sales volume of passenger vehicles across India from financial year 2014 to 2023 (in millions)

Commercial vehicles sales volume India FY 2012-2023

Sales volume of commercial vehicles across India from financial year 2012 to 2023 (in 1,000s)

Two-wheeler domestic sales in India from from financial year 2011 to 2023 (in million units)

Three-wheelers domestic sales volume in India FY 2015-2023

Domestic sales volume of three-wheelers across India from financial year 2015 to 2023 (in 1,000s)

Top selling cars in India in 2023

Best-selling cars by volume across India in 2023

- Premium Statistic Passenger car market share India 2023, by vendor

- Premium Statistic Commercial vehicle market share India FY 2021-2023, by manufacturer

- Premium Statistic Market share of two-wheelers India FY 2023, by leading manufacturers

- Premium Statistic Domestic three-wheeler market share India FY 2023, by company

- Basic Statistic Sales volume of Maruti Suzuki cars in India 2023, by leading model

- Basic Statistic Sales volume of Tata cars in India 2023, by leading model

- Basic Statistic Sales volume of Mahindra cars in India 2023, by leading model

Passenger car market share across India in 2023, by vendor

Commercial vehicle market share India FY 2021-2023, by manufacturer

Market share of commercial vehicles across India in financial year 2021 and 2023, by manufacturer

Market share of two-wheelers India FY 2023, by leading manufacturers

Market share of two-wheelers across India in financial year 2023, by leading manufacturers

Domestic three-wheeler market share India FY 2023, by company

Market share in the three-wheeler sector across India in financial year 2023, by company

Sales volume of Maruti Suzuki cars in India 2023, by leading model

Sales volume of Maruti Suzuki cars across India in 2023, by leading model (in 1,000s)

Sales volume of Tata cars in India 2023, by leading model

Sales volume of Tata cars across India in 2023, by leading model (in 1,000s)

Sales volume of Mahindra cars in India 2023, by leading model

Sales volume of Mahindra cars across India in 2023, by leading model (in 1,000 units)

Further reports Get the best reports to understand your industry

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- fdi policy ,

- taxation in india ,

- major investors

Centre sanctions INR 800 Cr under FAME Scheme Phase II for 7432 public fast charging stations

Sector Expert Arishna Saxena

- ALL SECTORS

Industry Scenario

Production linked incentive (pli) scheme, investible projects, major investors.

- Infrastructure Map

- Gallery/Latest News

Latest In Automobile

- FAQs/Market Research

Invest India closely works with

Quick links, running in the top gear, india is the world’s third-largest automobile market.

The Automobile industry produced a total 25.93 Mn vehicles including Passenger Vehicles, Commercial Vehicles, Three Wheelers, Two Wheelers, and Quadricycles in Apr 2022 to Mar 2023. India holds a strong position in the international heavy vehicles arena as it is the largest tractor manufacturer, second-largest bus manufacturer, and third largest heavy trucks manufacturer in the world.

- Automobile Sector resulted in 5.35% of the total FDI inflow as per the Dec 2023 DPIIT Report.

- The EV market is expected to grow at CAGR of 49% between 2022-2030 and the EV industry would create 5 Mn direct and indirect jobs by 2030.

- A market size of $50 Bn for the financing of EVs in 2030 has been identified, about 80% of the current size of India’s retail vehicle finance industry, worth $60 Bn now.

- India’s trucking market is expected to grow over 4x by 2050. The number of trucks is expected to more than quadruple, from 4 Mn in 2022 to roughly 17 Mn trucks by 2050.

- As per the Society of Indian Automobile Manufacturers (SIAM), the Auto industry generates employment of 13 persons for each truck, 6 persons for each car and four persons for each three wheelers and one person for each two-wheelers

- There is a shift in preferences of the customers as they have started to move towards larger/more powerful vehicles across all segments: ‒ UVs (amongst PVs) – 49% in FY22 (vs. 39% in FY21) ‒ M&HCVs (amongst CVs) – 33% in FY22 (vs. 28% in FY21)

100% FDI allowed under automatic route.

For further details, please refer FDI Policy

Share in India's GDP

Employment generated

Share in global R&D

Share in India's exports

Explore Related Sub Sectors

India is the world’s largest manufacturer of two-wheelers, with over 21 Mn produced annually.

India is the world largest manufacturer of tractors.

World’s third largest heavy truck manufacturer and fourth largest car manufacturer

- FOREIGN INVESTMENT

- INDUSTRY TRENDS

- POLICIES & SCHEMES

India aims to double its auto industry size to INR 15 Lakh Cr by end of year 2024.

In the Automobile market in India, Two-wheelers and passenger cars accounted for 76% and 17.4% market share, respectively. Passenger car sales are dominated by small and midsized cars.

Export of total number of automobiles in 2022-23 was recorded at 47,61,487 out of which two wheelers accounted for about 77% of the total exports.

In Apr 2022 to Mar 2023, Passenger Vehicle Exports increased from 5,77,875 to 6,62,891 units, registering a positive growth of 14.7%.

In the Union Budget 2023, the government has increased the budget allocation of FAME II by 78%.

GROWTH DRIVERS

Growing income.

India’s per capita Net National Income (NNI) increased by 35.12% from INR 72,805 in 2014-15 to INR 98,374 in 2022-23.

'Youngest Nation' by 2025

India to become the youngest nation by 2025 with an average age of 25 years

Vehicle penetration

Expected to reach 72 vehicles per 1000 people by 2025

Expanding R&D hub

India accounts for 40% of total $31 Bn of global engineering and R&D spend. 8% of the country’s R&D expenditure is in the automotive sector.

Atmanirbhar Bharat Abhiyaan - Self Reliant India

Special economic and comprehensive package of INR 20 Lakh Cr towards promoting manufacturing in India.

The Union Cabinet chaired by the Prime Minister, Shri Narendra Modi announced the Production-Linked Incentive (PLI) Scheme in the Automobile and Auto Components sectors. The PLI scheme (outlay of $3.5 Bn) for the automobile sector proposes financial incentives of up to 18% to boost domestic manufacturing of advanced automotive technology products and attract investments in the automotive manufacturing value chain. Incentives are applicable for determined sales of products manufactured in India from April 1, 2022, for a period of five consecutive years.

The Ministry of Heavy Industries has announced the extension of the tenure of the Production Linked Incentive (PLI) Scheme for Automobile and Auto Components by one year. Under the amended scheme, the incentive will be applicable for a total of five consecutive financial years, starting from the financial year 2023-24.

Recent Developments: 1) Total of 115 companies had filed their application under this scheme. Out of 115, total 85 applicants have been approved under this PLI scheme - 18 applicants for Champion OEM Incentive scheme and 67 applicants have been approved under Component Champion Incentive scheme. 2) The scheme has been successful in attracting proposed investment of INR 67,690 Cr against the target estimate of investment INR 42,500 Cr over a period of five years. 3) Apart from Indian business groups, approved applicants for Champion OEM Incentive scheme include groups from countries such as Republic of Korea, USA, Japan, France, Italy, UK and Netherlands.

INR 25,938 Cr

Scheme Outlay

- Scheme Details

- Auto Components

Industrial Land Bank Portal

Gis - based map displaying available infrastructure for setting up business operations in the state., investment opportunities in automobile.

Latest News

Automobile manufacturer Kia India looks to expand sales, and service …

Remsons Industries forms JV with Switzerland's Aircom Group to manufa…

Japanese auto major Nissan Motor Co Ltd plans to launch three all-new…

SJS Enterprises plans INR 30 Cr investment in optical cover glass cap…

Auto components maker Uno Minda ties up with Starcharge Energy to man…

Automobiles and Auto-Components: Driving New India's Growth

Tenure of Production Linked Incentive (PLI) Scheme for Automobile and Auto Components extended by One Year…

Invest India and World Association of Investment Promotion Agencies (WAIPA) to host the 27th World Investment…

Battery Swapping Policy to play critical role in the growth of electric vehicles in the country

Steps taken by the Government to promote charging infrastructure for EVs

FAME and PLI Schemes promotes use of electric vehicles in the country

BATTERY SWAPPING: India's Opportunity for Global Dominance

Freight Greenhouse Gas Calculator User Instruction Guide

Investment Promotion Reforms in India

Union Budget 2021: Key amendments impacting Automotive sector

Standing up India’s EV (Electric Vehicle) ecosystem – who will drive the charge?

Automobiles and Auto-Components: Driving New…

Press Release

Tenure of Production Linked Incentive (PLI)…

Invest India and World Association of…

Press release

Battery Swapping Policy to play critical…

Steps taken by the Government to promote…

FAME and PLI Schemes promotes use of…

BATTERY SWAPPING: India's Opportunity for…

Freight Greenhouse Gas Calculator User…

Union Budget 2021: Key amendments impacting…

Market Research

Standing up India’s EV (Electric Vehicle)…

Frequently Asked Questions

As per paragraph 5 of the notification dated 09/11/2021 regarding (i) Application Form and (ii) List of Advanced Automotive Technology Products, the window for receiving applications through the Notice Inviting Applications will be open for a period of 60 days from the date of its publication in the official Gazette. Accordingly, the window for receiving Applications is already open with effect from 11th November, 2021 till 23:59:59 hours IST on 9th January, 2022.

Was it helpful?

As per question 47 of the FAQs dated 8th October, 2021, the capital expenditure on Engineering Research & Development (ER&D) and product design & development is allowed under the scheme. It is further clarified that the Capital expenditure on ER&D and product design & development related to the eligible products shall be allowed for the purpose of Investment under the Scheme. The term “related” here refers to all stages in the entire value chain of the goods proposed to be manufactured including software integral to the functioning of the same. Such expenditure shall include expenditure on in-house and captive ER&D, directly attributable to eligible products, including all stages in the entire value chain of the goods proposed to be manufactured including software integral to the functioning of the same. Such expenditure shall include test and measuring instruments, prototypes used for testing, purchase of design tools, software cost (directly used for ER&D) & license fees, expenditure on technology & transfer of technology (ToT) Agreements including the purchase of technology, IPR, Patents and copyrights for ER&D, subject to all relevant documents for same being submitted to MHI/ PMA.

No. Revenue/ investment/ net worth of individual promoters will not be considered under Global group revenue/ Global Investment/ Global net worth, respectively, for eligibility under the Scheme because the scheme recognises company/ group company(ies), not individual promoters.

Yes, as per clause 2.17 of the guidelines, such companies shall be treated as group companies under the Scheme.

IFCI Limited (IFCI), having its Registered and Head/ Corporate Office at IFCI Tower, 61 Nehru Place, New Delhi – 110019, has been appointed as PMA for the Scheme. Email ID of the PMA is [email protected]

India’s Potential in the Midstream of Battery Production

Fleet electrification in india, e-mobility investment landscape report for the indian market, union budget 2023-24: analysis report, economic survey 2022-23, government ministry/department.

- Ministry of Heavy Industries & Public Enterprises, Government of India

Industry Associations

- Automotive Research Association of India(ARAI)

- Society of Indian Automobile Manufacturers (SIAM)

- Doing Business in India

- Team India News

New India Timeline @2047

08 January , 11:57 AM

Ms. Nivruti Rai, MD & CEO, Invest India, in her remarks at the curtain raiser ... Read More

08 January , 11:44 AM

Shri Piyush Goyal, Hon'ble Minister of Commerce & Industries, GoI, kicked off ... Read More

12 December , 11:10 AM

Invest India hosted a visit by Mr. Jozef Sikela, Ministry of Industry and Trade ... Read More

09 September , 01:48 PM

23 August , 11:45 AM

Adani TotalEnergies E-Mobility Limited (ATEL) will set up EV charging ... Visit Page

21 August , 12:08 PM

Gujarat, one of India's newer automobile manufacturing hubs, is showing promise ... Visit Page

18 August , 12:13 PM

Mahindra & Mahindra expects electric vehicle production at its upcoming plant in ... Visit Page

17 August , 01:57 PM

The Cabinet has approved a bus scheme “PM-eBus Sewa” for augmenting city bus ... Visit Page

17 August , 11:52 AM

Ola Electric's founder & CEO, Bhavish Aggarwal, has said that India's first ... Visit Page

08 June , 08:40 AM

Hero MotoCorp, which has long ruled the Indian roads with its internal ... Visit Page

06 June , 08:44 AM

Automobile manufacturer Renault Nissan Automotive India Pvt Ltd was progressing ... Visit Page

06 June , 08:40 AM

Integrated battery recycling and repurposing solutions provider Lohum on Monday ... Visit Page

02 June , 08:33 AM

Kinetic Green Energy and Power Solutions, the e-mobility venture of the Kinetic ... Visit Page

31 May , 04:23 PM

30 May , 08:51 AM

Altigreen Propulsion Labs Pvt Ltd. is considering raising about $ 85 mn in a ... Visit Page

Disclaimer : All views and opinions that may be expressed in the posts on this page as well as post emanating from this page are solely of the individual in his/her personal capacity

- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

To view this video please enable JavaScript, and consider upgrading to a web browser that supports HTML5 video

AUTOMOBILE INDUSTRY IN INDIA: New Production Paradigm

Published by Prosper Dickerson Modified over 8 years ago

Similar presentations

Presentation on theme: "AUTOMOBILE INDUSTRY IN INDIA: New Production Paradigm"— Presentation transcript:

Innovation Economics Class 6.

The Strategy of International Business

Economic Growth in Southern and Eastern Asia

An Overview of Corporate Strategy and Performance Team Belinda Spring 2008.

CHAPTER 12 HOW MARKETS DETERMINE INCOMES

Lim Sei cK. A: Cost of losing a job? B: Cost of starting a business? C: Cost of employing staff? D: Cost of something given up?

Master in Engineering Policy and Management of Technology, 8 th Edition Science, Technology and Innovation Policy GLOBAL STRATEGIES FOR THE DEVELOPMENT.

Indian Manufacturing Sector

Economic Growth Chapter 17. Introduction Two definitions of economic growth (from Chapter 8) – The increase in real GDP, which occurs over a period of.

ORGANIZATION OF PRODUCTION. Specialization in Production by Firms Each person or group concentrating on doing what they are best at doing.

Introduction and Factor Demands. 1. The Economy’s Factors of Production ▫Markets in which factors of production are bought and sold are called factor.

Positioning the Tata Nano (A) Sania Moazzam. Corporate Strategy Revolutionize Ultra low cost cars SEC C & D Product Development Improve life’s quality.

Industrial landscapes Revision. Distribution pattern of the bottling uneven distribution agglomerated in south-western part according to the population.

CLASSIFICATION OF BUSINESS ACTIVITIES.

CORPORATE STRATEGY OF TATA MOTORS

Economies of Scale Is Bigger Really Better?. Economies of Scale Economies of scale refers to the phenomena of decreased per unit cost as the number of.

AUTOMOBILE INDUSTRY Presented by:- Ashutosh Mandeep Singh Manpreet Singh Smriti Sharma Ravneet Singh.

MT220 – UNIT 9. 1) Lower costs, and 2) Add value for the customer? WHERE? Let’s take it step by step…

Globalization The world economic globalization process

Long term growth, short term differentiation and profits from sustainable products and services A global survey of business executives.

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

India EV sales to rise 66% this year after nearly doubling in 2023, report says

- BYD Co Ltd Follow

- Mahindra and Mahindra Ltd Follow

- Tata Motors Ltd Follow

WHY IT'S IMPORTANT

By the numbers.

Stay up to date with the latest news, trends and innovations that are driving the global automotive industry with the Reuters Auto File newsletter. Sign up here.

Reporting by Zaheer Kachwala in Bengaluru; Editing by Shounak Dasgupta

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Dutch set to comply with U.S. demands on China exports

U.S. demands that chipmaking giant ASML stop servicing some equipment it has sold to Chinese customers are a diplomatic and business headache for the Dutch government, but signs are it will continue to align with Washington on export restrictions.

- Ground Reports

- 50-Word Edit

- National Interest

- Campus Voice

- Security Code

- Off The Cuff

- Democracy Wall

- Around Town

- PastForward

- In Pictures

- Last Laughs

- ThePrint Essential

By VarunVyas Hebbalalu BENGALURU (Reuters) -Maruti Suzuki, Tata Motors and Mahindra & Mahindra reported higher car sales in March and the companies ended fiscal 2024 with record sales figures, monthly data from the automakers showed on Monday.

Each month, automobile makers in India release wholesale numbers, or vehicle sales to dealers.

Hero MotoCorp and Bajaj Auto will report monthly data for its two-wheelers later in the day.

WHY IT’S IMPORTANT

The numbers are seen as a key indicator of private consumption in India. The auto sector carries more than 50% weightage in calculating the country’s economic growth.

A surge in domestic sales of pricier sport utility vehicles (SUVs) last year has extended into 2024. Utility vehicles accounted for nearly 60% of total passenger vehicle sales from April 2023 to February 2024, according to industry data.

Entry-level car sales floundered last year. In a bid to increase demand, automakers have banked on higher discounts in the segment.

Meanwhile, product launches and improved rural demand for entry-level models have helped bolster two-wheeler sales amid heated competition in the high-end segment.

BY THE NUMBERS

Manufacturer Total March Sales Y/Y change in Total FY24 Sales Y/Y change in

(units) March (%) (units) FY24 (%)

Mahindra & 68,413 3.5 824,939* 18.1

Mahindra Auto

Mahindra & 26,024 -25.7 378,386 -7.1

Mahindra Farm

Hyundai Motor 65,601 6.7 777,876* 8.0

Tata Motors 92,559 1.7 969,340* 1.5

Maruti Suzuki 187,196 10.1 2,135,323* 8.6

Eicher Motors 75,551 4.6 912,732* 9.3

Motorcycles

Eicher Motors 11,242 -5.6 85,560 7.5

Trucks and Buses

* Record high sales

(Reporting by Varun Hebbalalu in Bengaluru; Editing by Shounak Dasgupta)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.

Subscribe to our channels on YouTube , Telegram & WhatsApp

Support Our Journalism

India needs fair, non-hyphenated and questioning journalism, packed with on-ground reporting. ThePrint – with exceptional reporters, columnists and editors – is doing just that.

Sustaining this needs support from wonderful readers like you.

Whether you live in India or overseas, you can take a paid subscription by clicking here .

LEAVE A REPLY Cancel

Save my name, email, and website in this browser for the next time I comment.

Most Popular

Ed reply to kejriwal plea against arrest: ‘didn’t oppose remand, can’t disregard approver at probe stage’, ‘upright’, 26/11 hero & expert from terror to financial fraud: who is sadanand date, new chief of nia, 64 indians fly to israel ‘under g2g agreement’ to fill construction job vacancies left by palestinians.

Required fields are marked *

Copyright © 2024 Printline Media Pvt. Ltd. All rights reserved.

- Terms of Use

- Privacy Policy

- Share full article

Advertisement

Supported by

Ford Slows Its Push Into Electric Vehicles

The automaker said it would delay new battery-powered models and shift its focus to hybrid cars, sales of which are rising fast.

By Neal E. Boudette

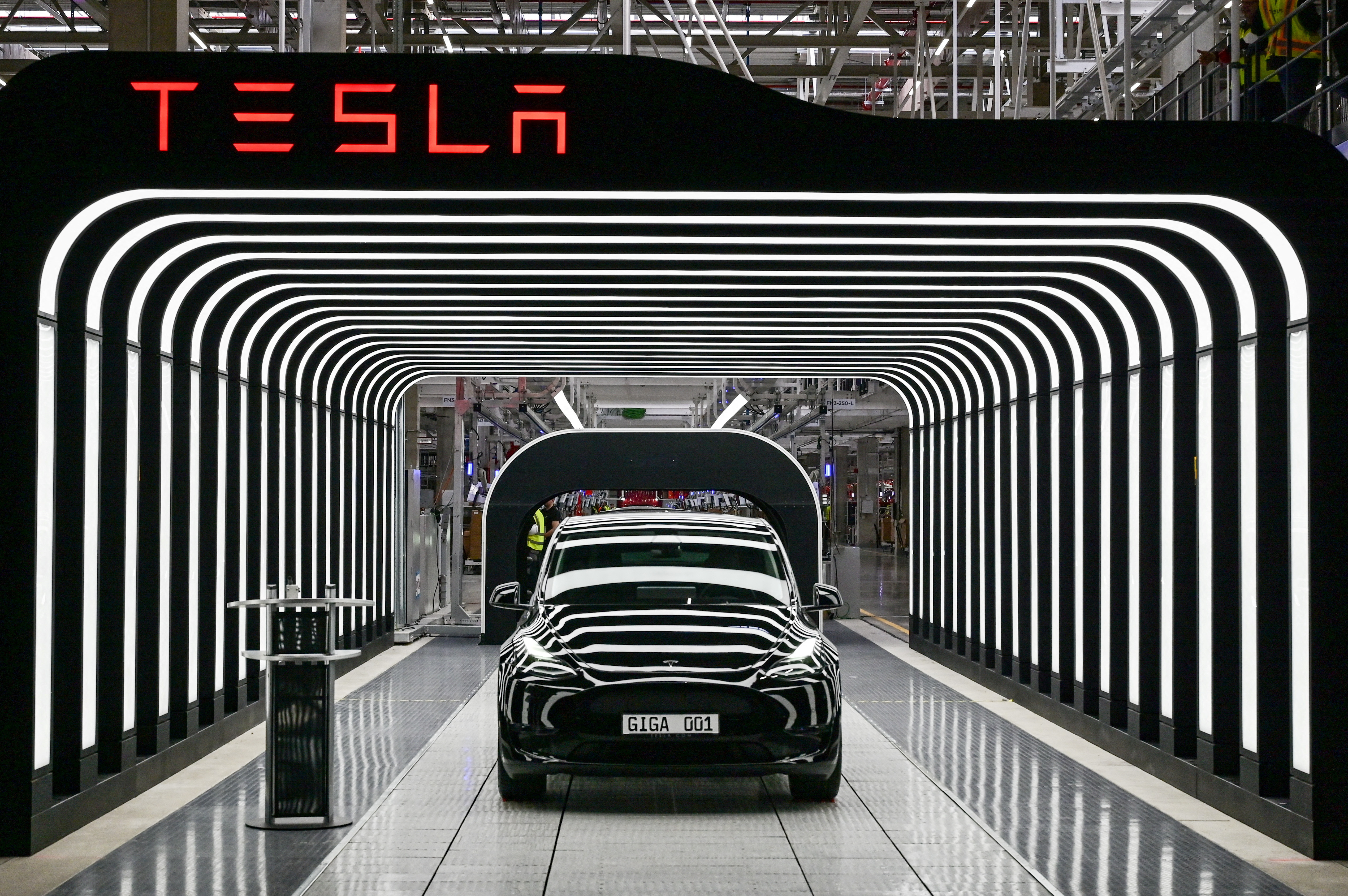

Ford Motor on Thursday delayed the production of at least two new electric cars and said it would pivot to making more hybrids. Its decision was the latest sign that large automakers have been forced to rethink their strategy for electric vehicles because sales for those models are slowing.

The shift by Ford and automakers like General Motors and Mercedes-Benz, which have also pushed back their electric car plans, has been prompted largely by the companies’ difficulties in making and selling enough electric cars and doing so profitably.

Sales of such vehicles are still growing, but the pace has slowed sharply in recent months as automakers have tapped out many of the early adopters who were willing to spend more than $50,000 on a new battery-powered car. Because they are still learning how to make the cars and their batteries at lower cost, the companies have not been able to bring out more affordable models.

“Many companies rushed in too fast with E.V.s that were too expensive and there was not as much of a market for them as they thought,” Sam Abuelsamid, principal analyst for transportation and mobility at the research firm Guidehouse Insights, said. “That’s made it a lot tougher to sell those vehicles.”

Some consumers are also reluctant to buy electric models because they can’t charge the vehicles at home or are worried that there won’t be enough public chargers available when they want to travel more than a couple of hundred miles.

Many car buyers interested in electric vehicles appear to be choosing hybrid cars, which can cost just a few hundred dollars more than comparable gasoline-only models and in some cases offer much better fuel economy. Those cars are also easier for consumers to get used to because they don’t have to be plugged in and are fueled like conventional models.

Andy Goodrich, a retired software engineer in Ann Arbor, Mich., was considering buying a Tesla Model 3 or a Rivian sport-utility vehicle, but had concerns about finding charging stations. Ultimately, he chose a Toyota RAV4 Prime plug-in hybrid, which can go about 40 miles on electric power alone before switching to a gasoline engine.

“I do most of my driving locally, so I can go a week or more without using any gas,” Mr. Goodrich, 72, said. “I charge in my garage overnight and I’m all set for the day. If I have to go to Grand Rapids or something, then the gas engine gets me there.”

Ford said on Thursday that it hoped to offer a hybrid version of every model it sold by the end of the decade. It already makes hybrid versions of two pickups — the Maverick and the F-150 — and its Escape crossover.

The company said it was now planning to start making a large electric S.U.V. at its plant in Oakville, Ontario, in 2027, two years later than it had planned. A plant that Ford is building in Tennessee will start making an electric pickup truck in 2026, a year later than originally scheduled.

“We are committed to scaling a profitable E.V. business, using capital wisely and bringing to market the right gas, hybrid and fully electric vehicles at the right time,” Ford’s chief executive, Jim Farley, said in a statement.

Ford has set up a small team in Irvine, Calif. — far from the company’s headquarters in Dearborn, Mich. — to develop components that can be used to produce lower-cost electric vehicles. That group is led by a former Tesla executive, Alan Clarke.

“We’re also adjusting our capital, switching more focus onto smaller E.V. products,” Mr. Farley said in a conference call in February. Ford’s electric vehicle business lost $4.7 billion before interest and taxes in 2023. By contrast, the division that makes gasoline and hybrid vehicles for consumers made a $7.5 billion profit.

The slowdown in sales is also hurting the leading maker of electric models in the United States, Tesla. This week it reported an unexpected 8.5 percent decrease in sales of its electric cars in the first three months of the year.

On Wednesday, Ford said its sales of electric vehicles had grown 86 percent in the quarter, to 20,223 vehicles, but the total was well below the level the company once hoped to reach and came after it cut some prices.

The company sold more than 7,700 F-150 Lightning pickups, its flagship electric model, in the three months. As recently as last summer, Ford hoped to be able to produce some 150,000 Lightnings trucks a year. The company recently reduced Lightning production to one shift per day from two.

Two years ago, Ford, G.M., Volkswagen and other automakers were planning to introduce dozens of new electric cars and trucks, expecting consumers to make a rapid transition to electric vehicles from gasoline-powered vehicles.

But starting in the second half of 2023, the growth in electric sales decreased significantly, forcing manufacturers to scale back their ambitions. Ford and G.M. have also slowed work on factories that are supposed to supply battery packs for their new electric models.

Neal E. Boudette is based in Michigan and has been covering the auto industry for two decades. He joined The New York Times in 2016 after more than 15 years at The Wall Street Journal. More about Neal E. Boudette

IMAGES

VIDEO

COMMENTS

The Indian automotive ...

Automotive is one of the core sectors of the Indian economy and, to a great extent, serves as a bellwether for its current state. An ominous fall in commercial-vehicle (CV) sales foretold impending economic challenges in both 2012 and 2019, while a steep rise in passenger-vehicle (PV) and two-wheeler (2W) sales was a harbinger of good economic news in 2010.

Article (PDF-556 KB) India is expected to emerge as the world's third-largest passenger-vehicle market by 2021. 1 It took India around seven years to increase annual production to four million vehicles from three million. 2 However, the next milestone—five million—is expected in less than five years.

The automotive industry in India is one of the main pillars of the economy. With strong backward and forward linkages, it is a key driver of growth. Liberalization and conscious policy interventions over the past few years created a vibrant, competitive market, and brought several new players, resulting in capacity ...

The Analysis Of Automobile Industry In India Market is expected to register a CAGR of 8.10% during the forecast period. India's Automotive Market was valued at USD 100 billion in 2021 and is expected to reach USD 160 billion in 2027. India is a well-recognized Automobile manufacturing hub worldwide because of its low-cost production.

The global automotive industry has demonstrated remarkable resilience over the last two years. The COVID-19 pandemic and, more recently, the war in Ukraine exacerbated the slowdown in global sales that had set in before the pandemic. However, despite near-term supply disruptions, the long-term prospects for the industry remain strong.

Other key growth drivers are Low car penetration and rise in income, Greater Availability of cheaper and easier finance, among others. The INR 8.7 trillion (US$ 118 billion) Indian automobile industry is expected to reach INR 16- 18 trillion (US$ 251- 282 billion) by 2026 with strong policy support from the government.

Executive Summary. The automotive industry is a pillar of Indian economy and a key driver of macroeconomic growth and technological advancement. Currently, the automotive industry contributes more than 7% to the total GDP and provides employment to about 32 million people, directly and indirectly.

India. The automotive industry in India has come a long way from the 1950s when the annual production of vehicles was limited to 40 thousand. Early stages of production were confined to the three ...

The automotive industry in India is the fourth-largest by production in the world as per 2022 statistics. As of 2023, India is the 3rd largest automobile market in the world in terms of sales. In 2022, India became the fourth largest country in the world by the valuation of its automotive industry. As of April 2022, India's auto industry is worth more than US$100 billion and accounts for 8% of ...

The Indian Scenario: The Indian automotive sector is a US$100+ billion industry1, of which exports comprises of US$27 Billion (2019). Auto OEMs exports out of India 2is US$11.7 Billion , which puts around 12 countries ahead of India in terms of export performance. The auto-component industry's exports amounted to US$15 billion3 in FY 2019

Automobile Sector resulted in 5.35% of the total FDI inflow as per the Dec 2023 DPIIT Report. The EV market is expected to grow at CAGR of 49% between 2022-2030 and the EV industry would create 5 Mn direct and indirect jobs by 2030. A market size of $50 Bn for the financing of EVs in 2030 has been identified, about 80% of the current size of ...

(1995), "The restructuring of the Indian automobile industry: Indian state and Japanese capital," W orld Development , 23(3): 485-502. Table 2 Mode of entry of selected companies, 1983-2007

viii The future of mobility in India: Challenges & opportunities for the auto component industry The global automotive industry is on the verge of disruption. Digitization, increasing automation and new business models have revolutionized other industries, and the automotive industry will be no exception to such a revolution. The Indian ...

The Indian Automobile industry includes two-wheelers, trucks, cars, buses and three-wheelers which play a crucial role in growth of the Indian economy. India has emerged as Asia's fourth largest exporter of automobiles, behind Japan, South Korea and Thailand. The country is expected to top the world in car

INTRODUCTION The automotive sector is one of the core industries of Indian Economy, whose prospect is reflective of the economic reliance of the country. The industry currently accounts for nearly 4% of GNP and 17% of indirect tax revenue. The well developed Indian Automotive Industry has a presence among all vehicle segment and key components. According to Report of Society of Indian ...

Maruti Suzuki, Tata Motors and Mahindra & Mahindra reported higher car sales in March, wrapping up fiscal 2024 at record levels, showed data from automakers.

25-28%. Shaping the new normal: India's auto component industry 11. Helped by incentives, EV growth is expected to return to key markets by 2022 with market penetration estimated to grow to 12 to 14 percent from the current 5 percent in China, and to 12 to 15 percent from the current 3 percent in Europe.20.

Electric-vehicle sales in India are expected to rise 66% this year after nearly doubling in 2023 as state subsidies help fuel demand and supporting infrastructure comes up in the country ...

BENGALURU (Reuters) -Maruti Suzuki, Tata Motors and Mahindra & Mahindra reported higher car sales in March and the companies ended fiscal 2024 with record sales figures, monthly data from the automakers showed on Monday. Each month, automobile makers in India release wholesale numbers, or vehicle sales to dealers.

India's automobile industry. The Indian automotive OEM industry is already in a strong position. Globally, it is at the forefront of many segments—leading in two-wheelers, segment A cars, and tractors. 3 The industry aspires to nearly triple vehicle sales by 2026, from 26 mn to 65 mn to 76 mn

Neal E. Boudette is based in Michigan and has been covering the auto industry for two decades. He joined The New York Times in 2016 after more than 15 years at The Wall Street Journal.