SAP SD Tax Determination Procedure Tutorial: VK12, OX10, OVK4, OVK1

SAP uses Condition Method technique to calculate taxes (except Withholding Tax) in the system. Tax Calculation Procedures (defined in the system) together with the Tax Codes are used in calculating the amount of tax.

The Tax Code is the first step in the tax calculation procedure. The Tax code describes following –

- Tax type (Tax Type can be defined by T-code –OVK1).

- Amount of tax calculated / entered.

- GL account for tax posting.

- Calculation of additional tax .

Each country has a specific Tax Procedure defined in the standard system. A Tax calculation procedure contains the following fields:

- Steps — It determine the sequence of lines within the procedure.

- Condition Types — Indicates how the tax calculation model will work (whether the records are for fixed amount or percentages and whether the records can be processed automatically.)

- Reference Step s— System obtains the amount/value it uses in its calculation (e.g. the base amount).

- Account/Process Keys — Provide the link between the tax procedure and the GL accounts to which tax data is to be posted. This helps in automatic tax account assignments. To enable this automatic assignment, there is a need to define the following:

- Posting keys (unless there is a specific requirement, it will be sufficient to use the GL posting keys: Debit: 40, Credit: 50).

- Rules to determine on which fields the account determination is to be based (such as the tax code or country key).

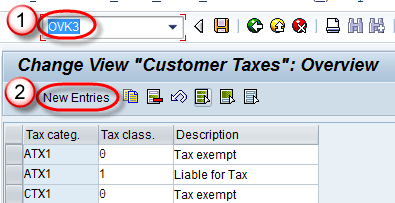

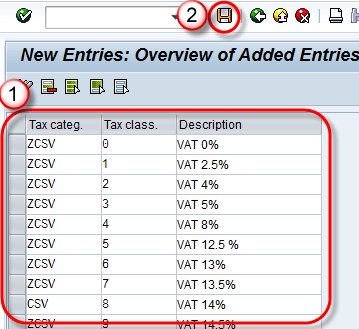

Step 1) Tax Category

Tax Category is used to group and manage similar product tax rates or service tax rates. Tax Rates are defined for each of the tax codes. The tax rates are linked to Tax Types and are included in the tax procedures (in this relationship, it is technically possible that a single tax code can have multiple tax rates for various tax types.) The tax code is assigned to a Tax Procedure, which attaches to a GL master record. A specific tax procedure is accessed whenever that GL account is used in document processing.

- Enter T-code OVK3 in the command field .

- Click on New Entries Button.

- Enter Tax Categories ,Tax class and description.

- Click on save button.

A Message “Data was saved ” is displayed.

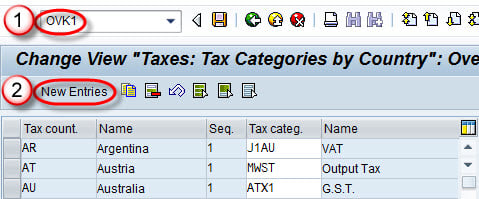

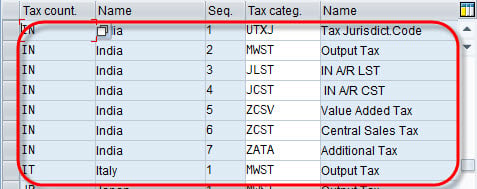

Step 2) Define Tax Types

- Enter T-code – OVK1 in the command field.

- Click on new entries button.

Step 2.2) Enter Tax country / Sequence / tax category and save the data .

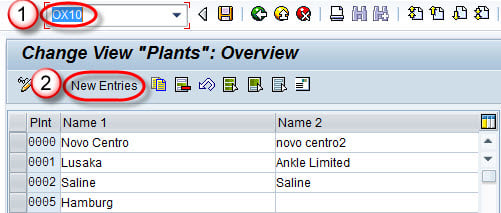

Step 3) Assign the plant for Tax Determination

- Enter T-code OX10 in the command field.

- Click on New entries Button.

- Enter Plant / Name1.

- Enter country code / city code.

- Save the data.

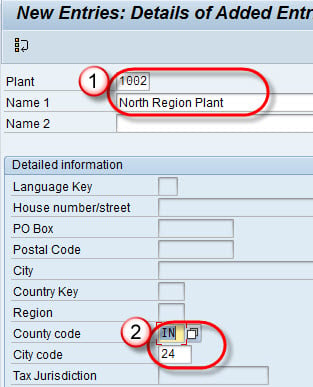

Step 4) Define the Material Taxes.

- Enter T-code OVK4 in the command field.

- Enter Tax category / Tax classification and description.

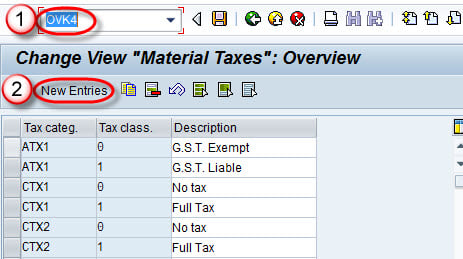

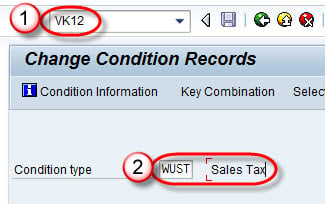

Step 5) Define the Tax Determination

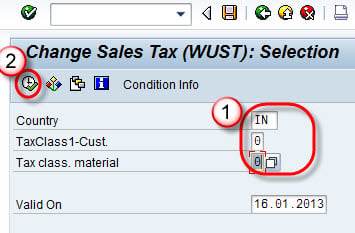

- Enter T-code VK12 in the command field.

- Enter condition type .

Step 5.2) Select Domestic taxes.

- Enter Country / customer tax class / material tax class.

- Run the report.

Step 5.4) Enter Customer Tax class/Material Tax class / amount / validity period and tax code.

Save the record.

- SAP SD – Return Order, Free of Charge & Subsequent Delivery

- All About Consignment Process in SAP SD

- Output Determination in SAP SD using Tcode V/30

- Substitution Reasons OVRQ in SAP

- CS01: How to Create Bill of Material (BoM) in SAP SD

- How to Create Invoice Correction Request in SAP SD

- Define & Assign Blocking Reason in SAP (OVV4, S_ALR_87007670)

- SAP Item Category Determination: VOV7, VOV4

404 Not found

/support/notes/service/sap_logo.png)

2463279 - General Tax determination in ERP MM – Guided Answers

The following Guided Answer decision tree will assist you with configuration and troubleshooting of tax determination in ERP Material Management.

Topics investigated in this decision tree:

- Customizing of tax condition type

- Tax code determination

- Settings of Tax Jurisdiction in MM

- Error FF 805 - Tax statement item missing for tax code (MIRO, MR8M, EDI)

Environment

- Materials Management (MM)

- Logistics Invoice Verification (LIV)

- SAP ERP Central Component

- SAP Enhancement package for SAP ERP

- SAP Enhancement package for SAP ERP, version for SAP HANA

- SAP S/4HANA

FF805, Error message Tax, FS02, Tax procedure, Proposal Input Output VAT, decision tree, FF 805, FTXP, Material Management, MM-IV, G/L account, TXJCD, Guided Answer , KBA , MM-IV-INT-TAX , Tax , FI-GL-GL-F , Value Added Tax (VAT) , Problem

About this page

Search for additional results.

Visit SAP Support Portal's SAP Notes and KBA Search .

Privacy | Terms of use | Legal Disclosure | Copyright | Trademark

TutorialKart

Sap taxprocedure tables, top sap tables.

Blog about all things SAP

ERProof » SAP FI » SAP FI Training » SAP Tax Configuration

SAP Tax Configuration

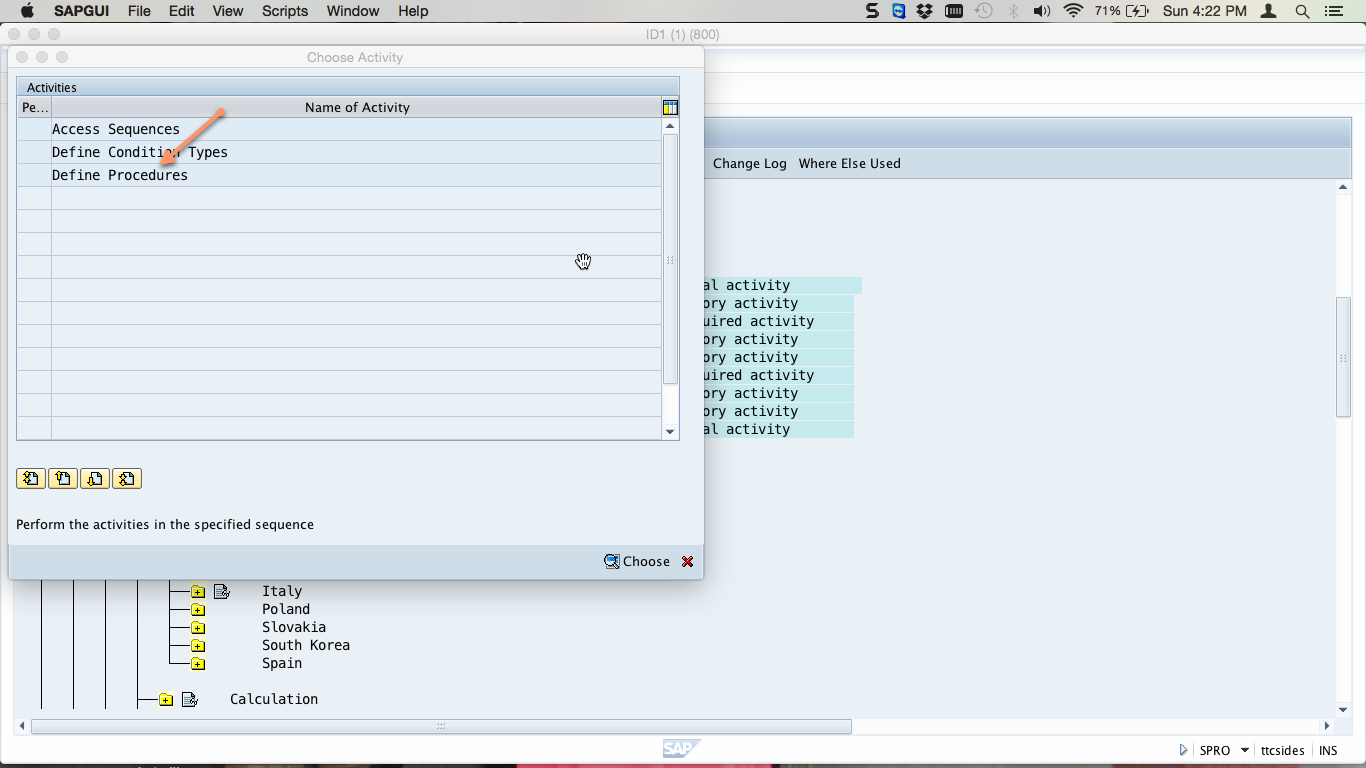

SAP tax configuration for sales and purchases is summarized in three customizing menus which we will present as separate sections in this tutorial:

- Basic settings

Calculation

Before starting this tutorial, it is recommended to get familiar with the overview about SAP FI taxes .

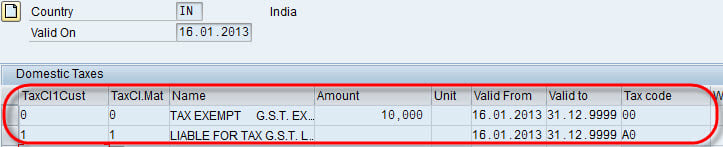

Basic Settings

To access the configuration activities under basic settings, use the customizing path below in transaction code SPRO :

Financial Accounting – Financial Accounting Global Settings – Tax on Sales/Purchases – Basic Settings

The menu explodes into various optional, mandatory and nonrequired activities as shown below:

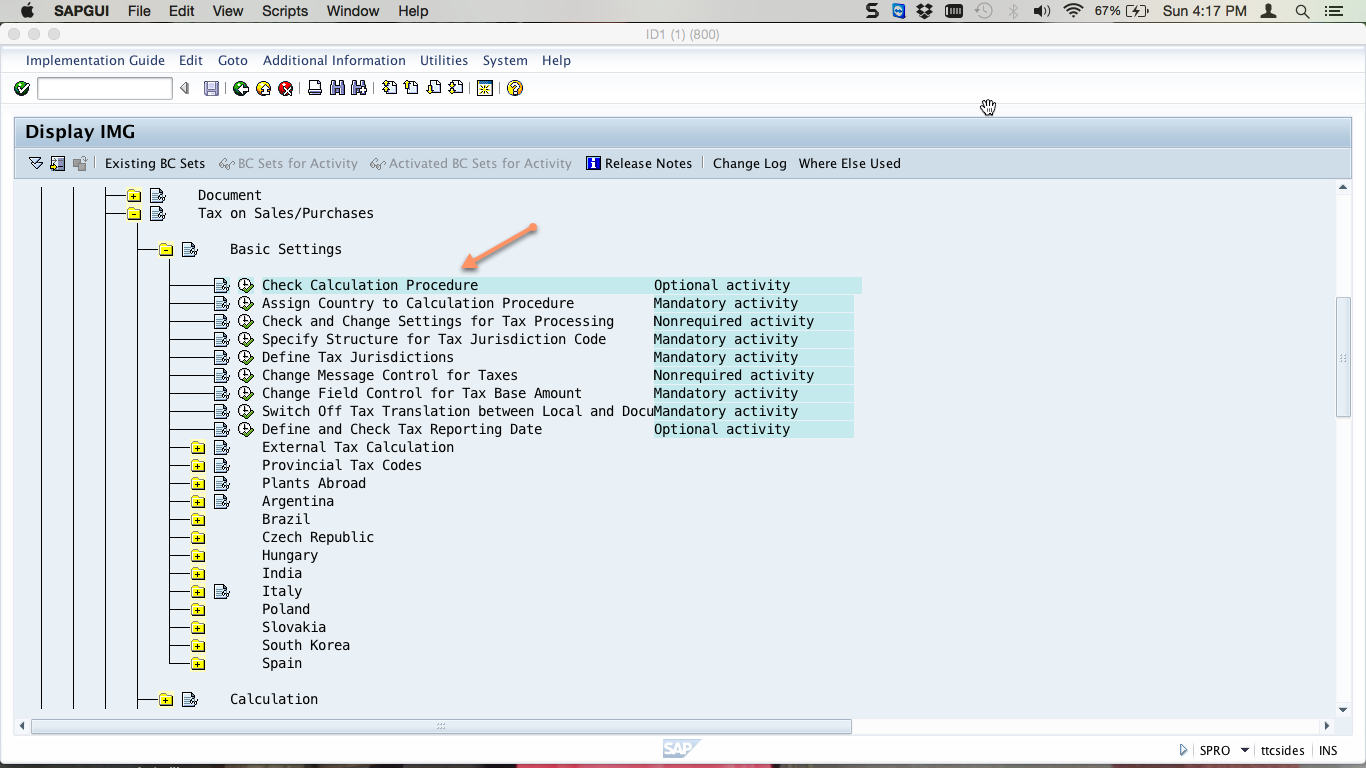

Check Calculation Procedure

Execute the check calculation procedure activity under SAP tax configuration basic settings. You will be presented with various sub-activities. Select the Define Procedures activity as shown below:

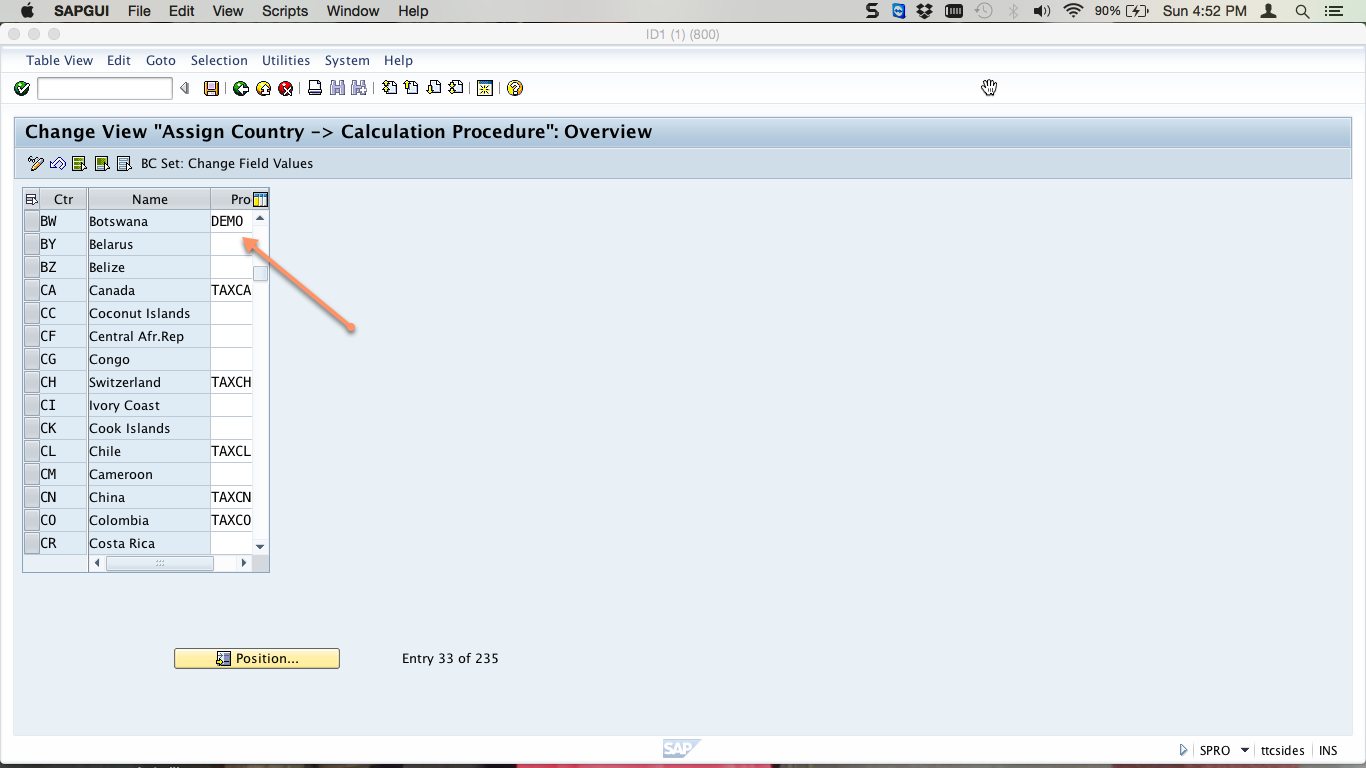

Assign Country to Calculation Procedure

Now enter the calculation procedure you created to assign it to the country as shown below:

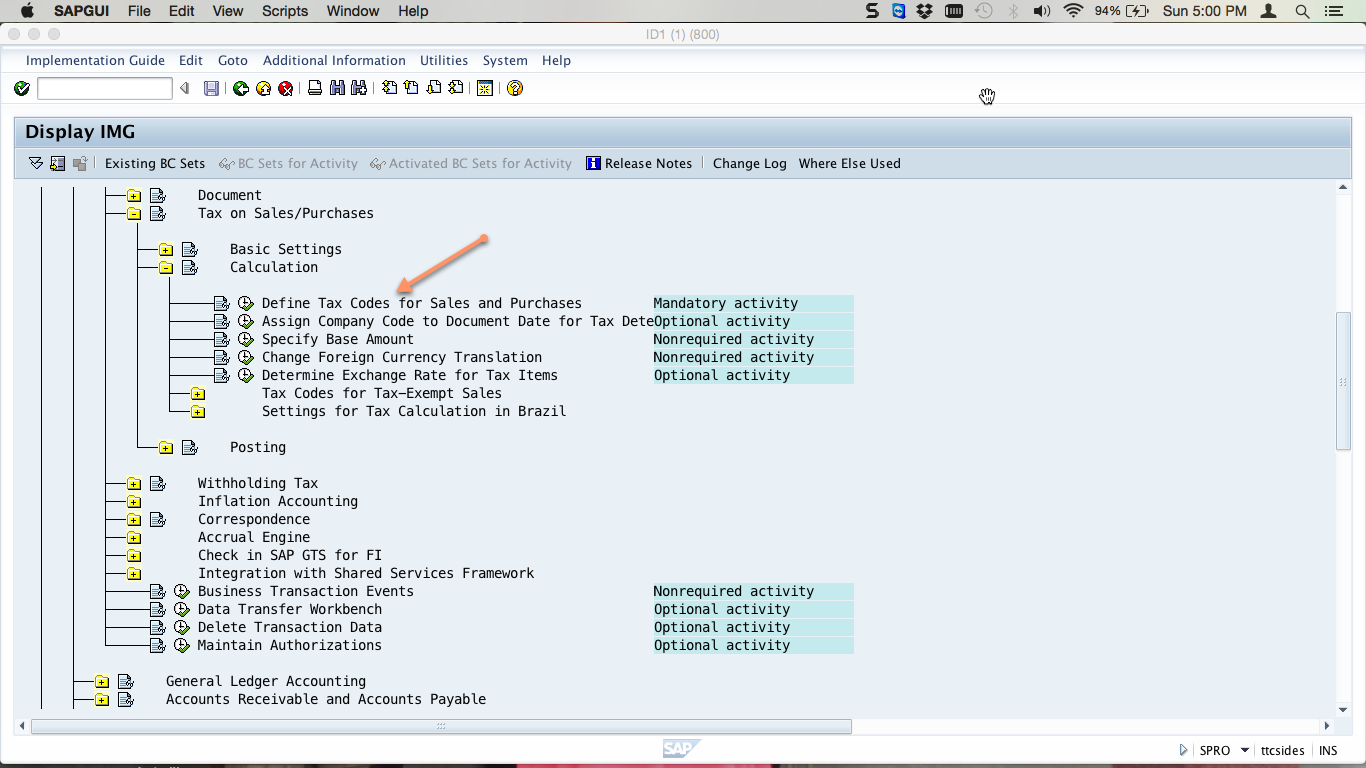

Now, access the calculation SAP tax configuration activities using the customizing path below in transaction code SPRO :

Financial Accounting – Financial Accounting Global Settings – Tax on Sales/Purchases – Calculation

Define Tax Codes for Sales and Purchases

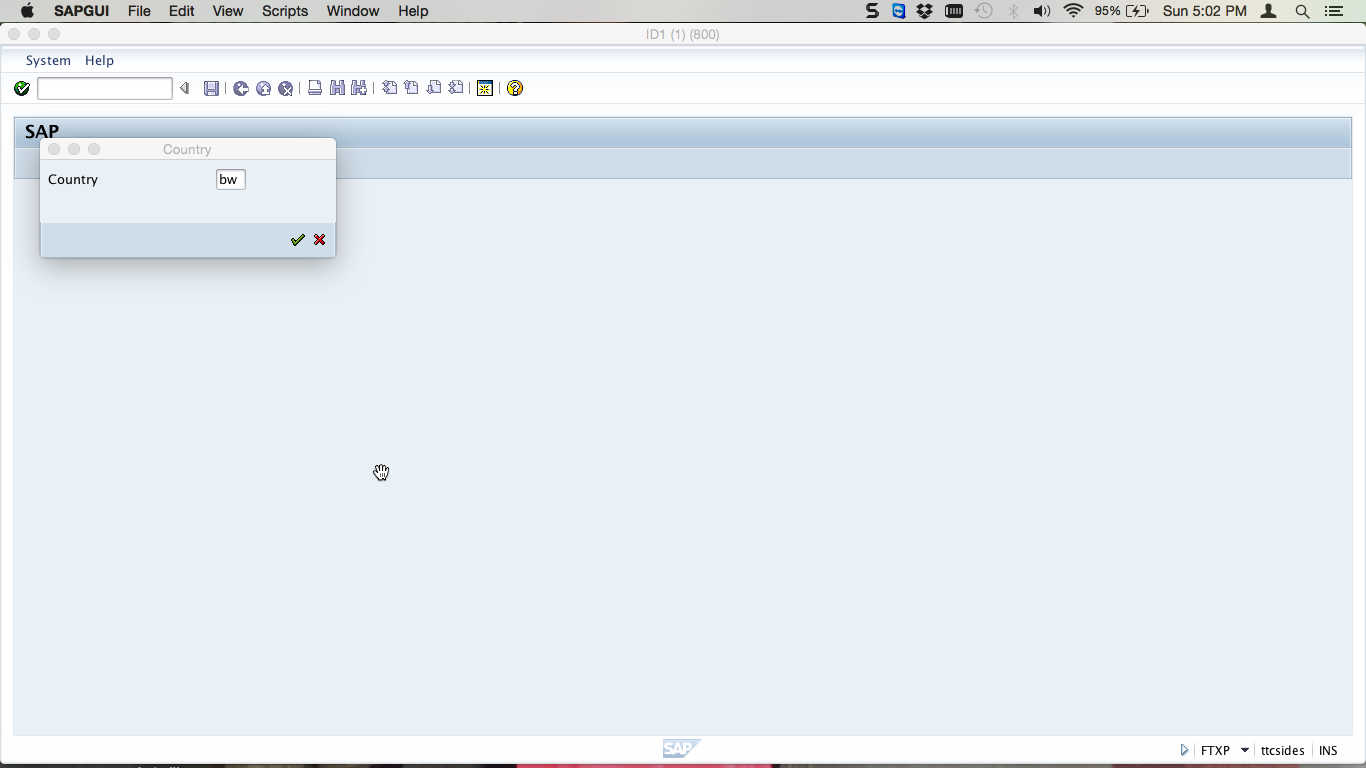

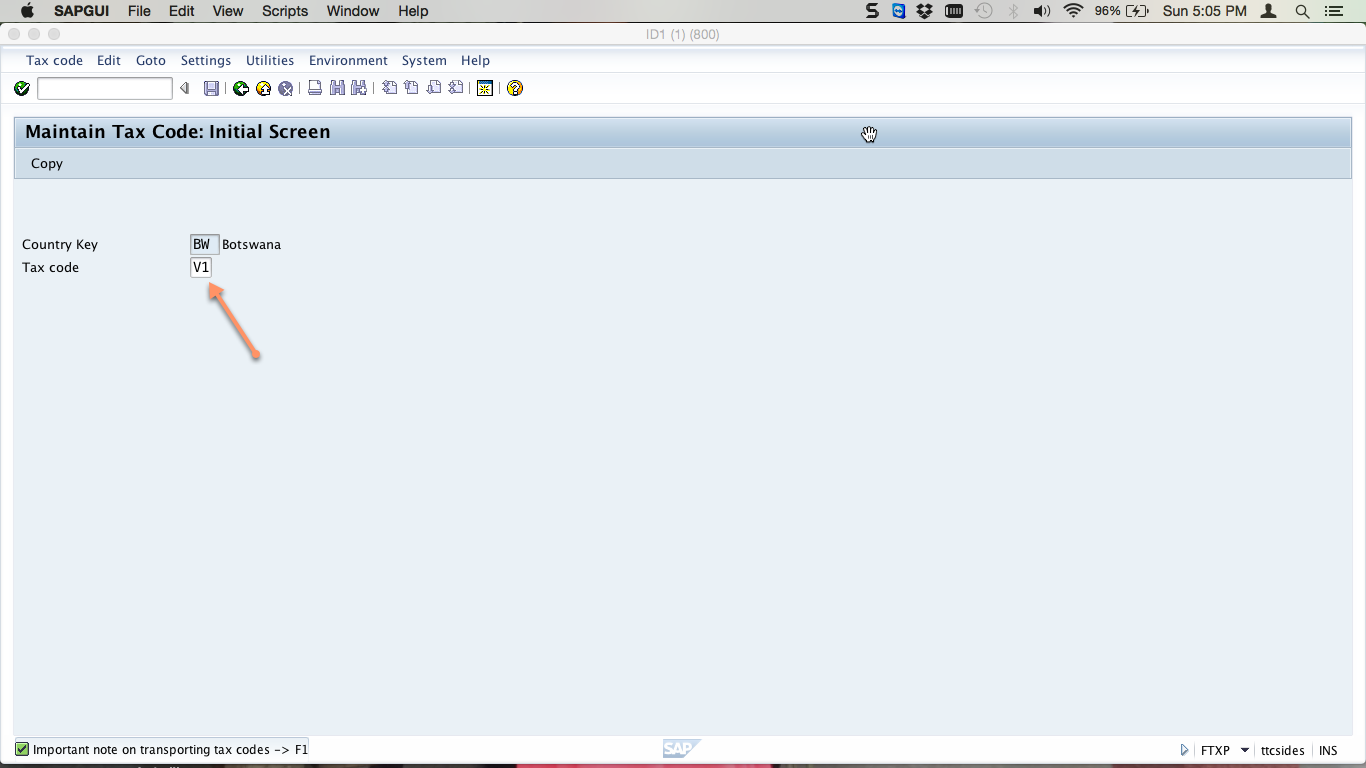

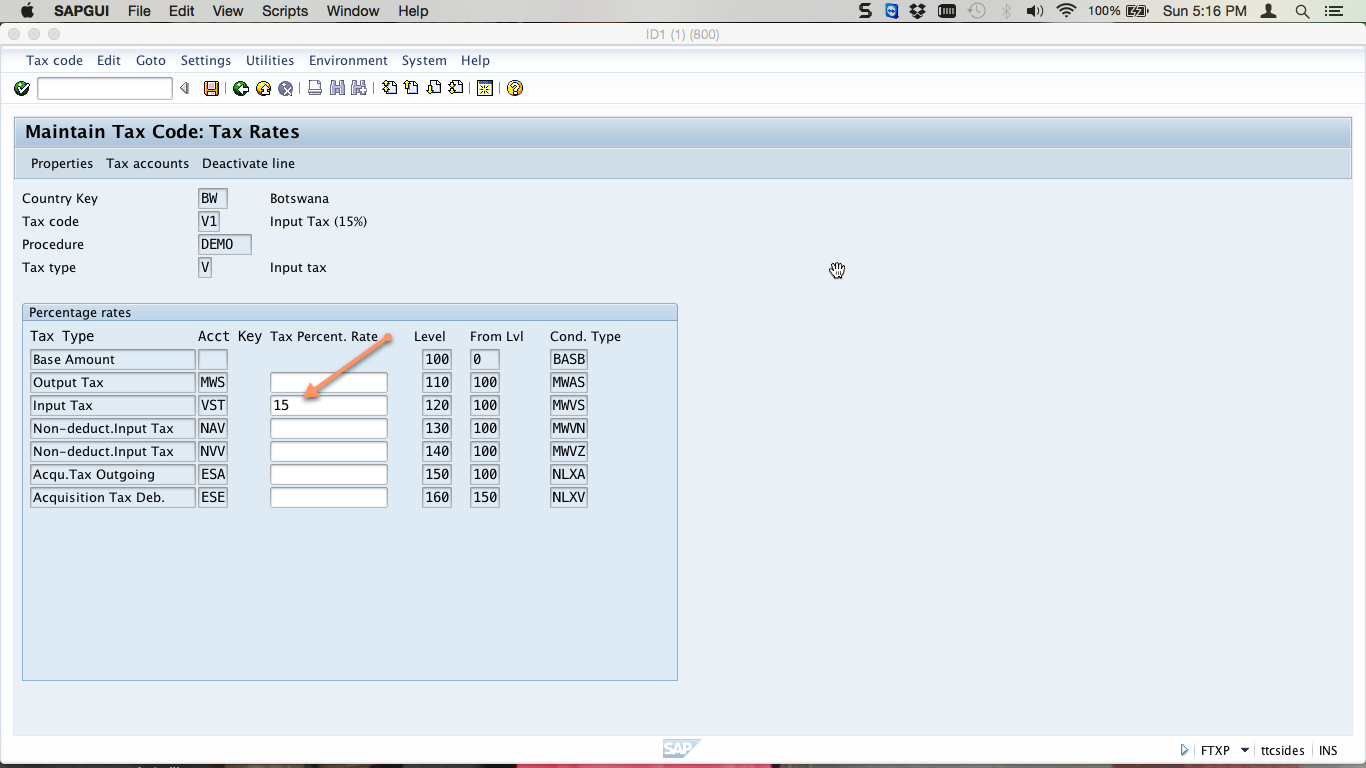

Define tax codes for sales and purchases by executing the first activity in the calculation menu. Enter your country code and press enter.

Enter two-digit alphanumeric characters as your new tax code. Press enter to proceed.

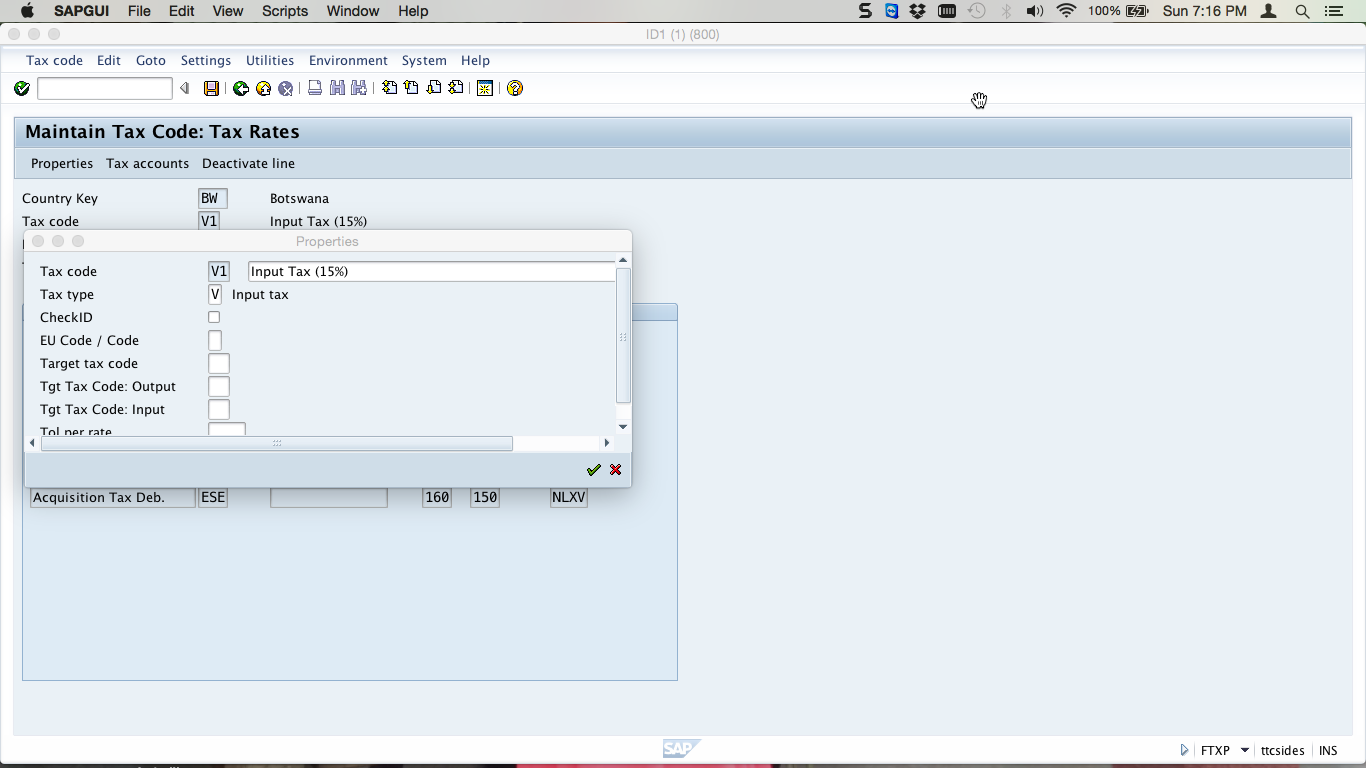

Enter a long description for your tax code and specify tax type of V for input tax or A for output tax, as demonstrated below:

Press enter to go to the next page.

Enter the tax percentage rate on the appropriate line, depending on whether it is input tax or output tax. For example, the below tax code is an input tax at a rate of 15%:

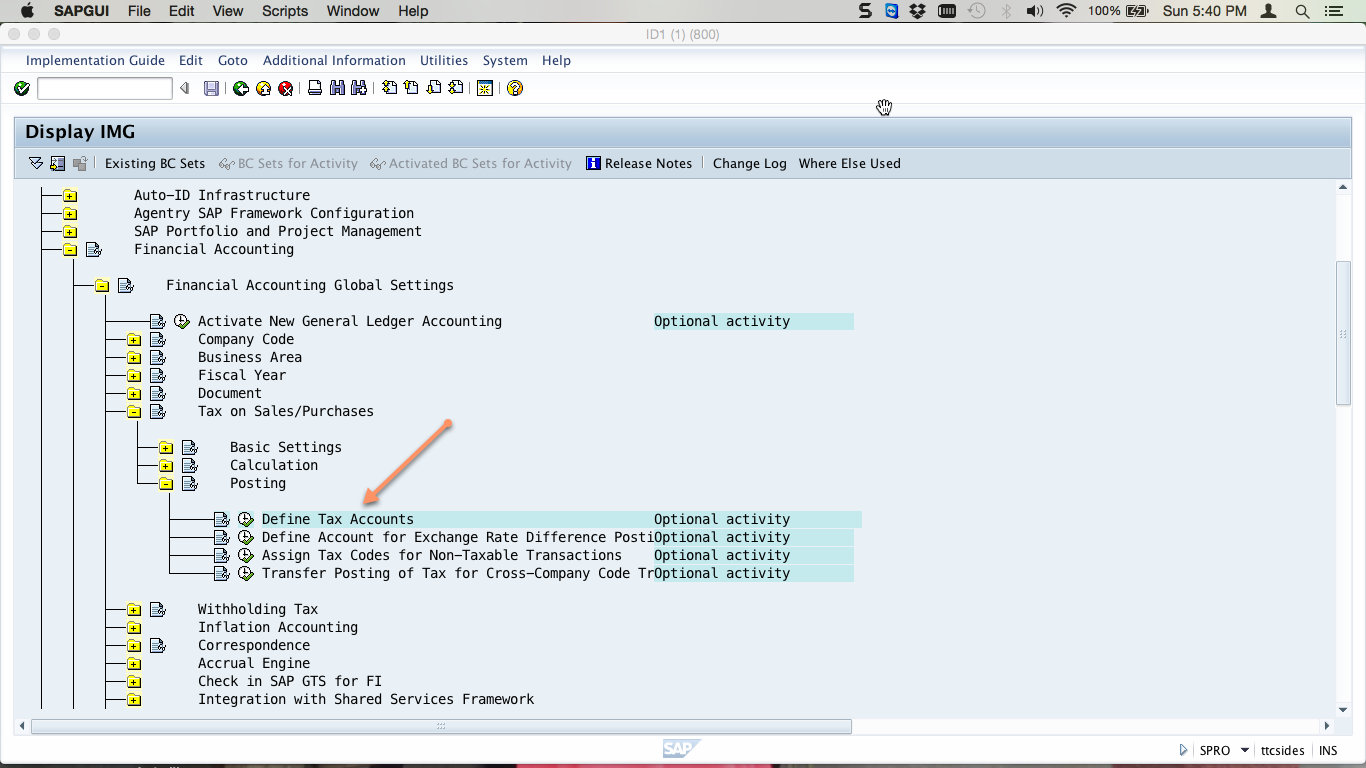

Now, access the SAP tax configuration activities for posting using the customizing path below in transaction code SPRO :

Financial Accounting – Financial Accounting Global Settings – Tax on Sales/Purchases – Posting

The menu explodes into various optional, mandatory and non-required activities as shown below:

Define Tax Accounts

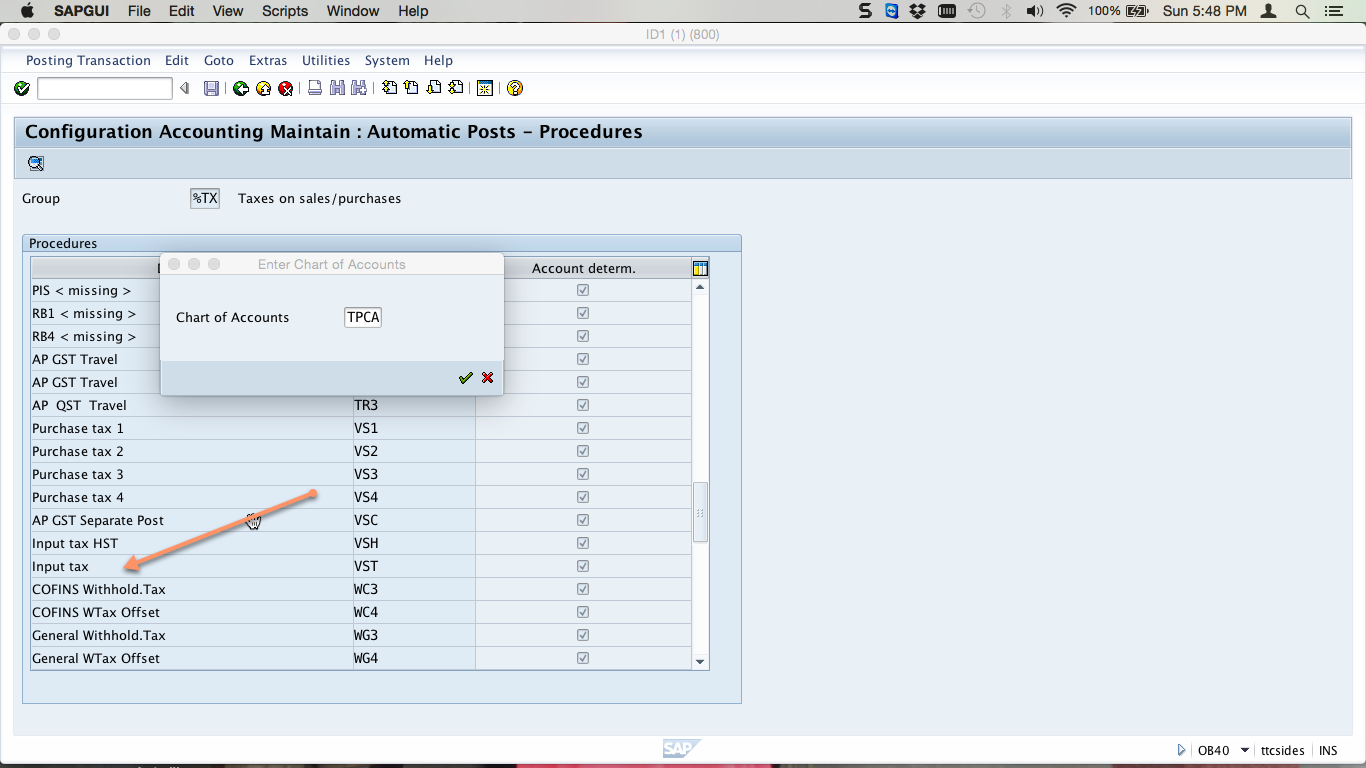

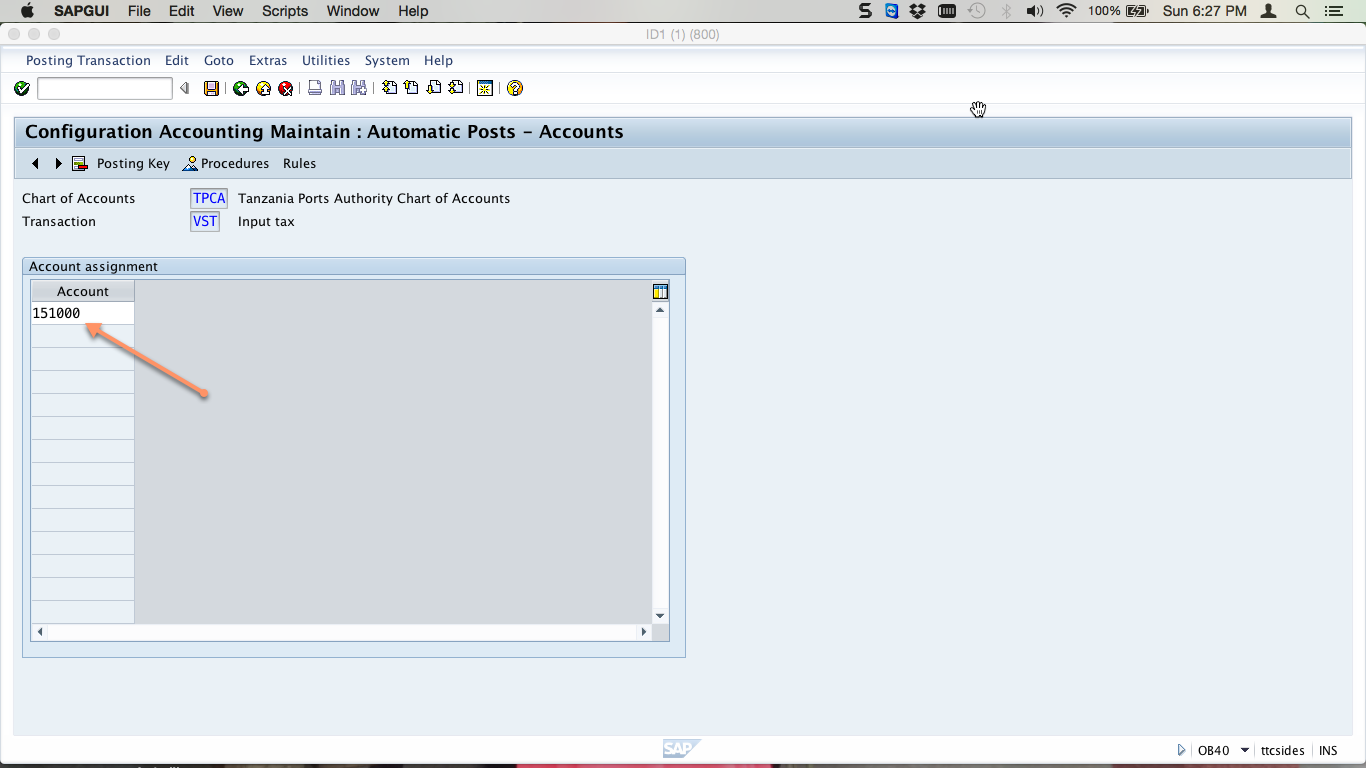

Execute the define tax accounts activity, and select the tax type. In our example, we select Input tax , as shown below. Press enter, specify the chart of accounts and press enter again.

Enter the general ledger account that all tax codes of this tax type shall post to. In our example, when a user picks any input tax code when posting a document, the system will automatically post to G/L account 151000 :

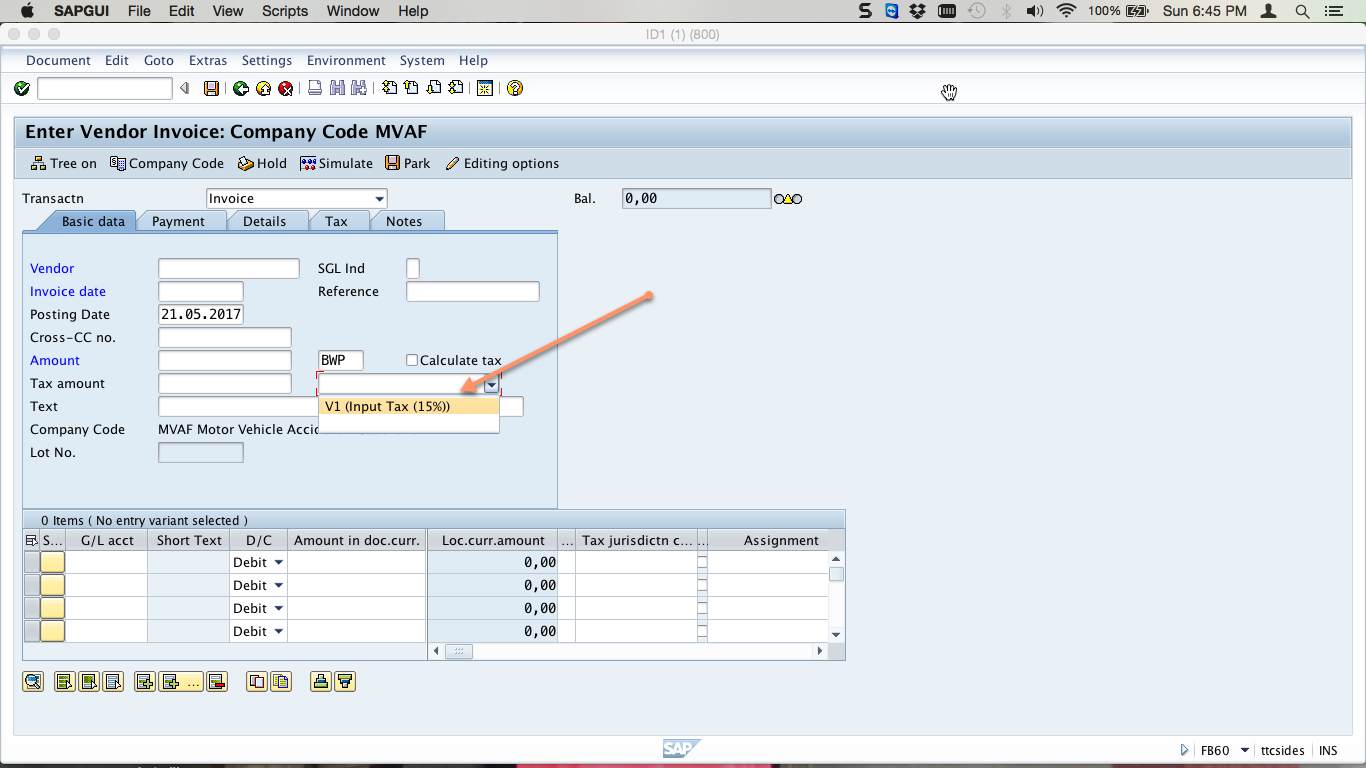

All necessary SAP tax configuration settings have now been completed. The newly created tax code will appear when entering a document and the tax will calculate and post automatically to the specified G/L account .

Finally, check that your tax code was created correctly by posting a test document. In our example, we created an input tax code relevant to vendor invoices. Therefore, go to transaction code FB60 . Here you can see the new tax code in the dropdown for available tax codes:

Did you like this tutorial? Have any questions or comments? We would love to hear your feedback in the comments section below. It’d be a big help for us, and hopefully it’s something we can address for you in improvement of our free SAP FI tutorials.

Navigation Links

Go to next lesson: SAP Document Change Rules

Go to previous lesson: SAP FI Tax

Go to overview of the course: Free SAP FI Training

7 thoughts on “SAP Tax Configuration”

Hi, Middle East is going on VAT implementation for 5% from Jan 2018. Does the procedure is same or is it different? Can you published same prodedure for Middle East SAP user companies. it will be great benefits to online learners and experts.. Regards, Neelu

The general principles of VAT configuration are the same. It is difficult for us to create a tutorial for Middle East SAP user companies without knowing detailed business and legal requirements in these countries. If you can share your experience of VAT implementation for Middle East countries in 2018, we will be happy to publish it on this blog.

Hello Cleo,

VAT implementation and legal requirement is same is EU as per BIG4 Audit firms. 5% on SALES & PURCHASES. Net of each month will be payable to Tax Authorities here in Middle East. There are few companies exempted but the principal remains same as what is in EU.

Will keep you progressed with Tax Law to be published as nothing has been declared yet. It’s 5 % we know as of now.. So probably the implementation rule remains the same and tax code to be created and assigned on sales & purchases..

Regards, Neelu Bhojwani

Don’t make excuses for failure, just find a way for success

Could you please share complete end to end tax procedure for India after entry of GST in India. It would help a lot.

Please provide details to configure non-deductible tax for purchasing, and tax procedure where vat is calculated on cost plus non-deductible tax.

THANKS A LOT for your valuable work! A few comments to this article: 1) It would be great to mention here the importance of maintenance of “Tax category” and “Posting without tax allowed” in the GL master. Without these settings the system will not calculate tax on sales/purchases, even if the customizing correctly done and the a tax code is specified in the document. 2) Would be nice, if you can make an additional tutorial for the case, when “Plants abroad” functionality is activated for a client. – This case will require additional customizing settings to post sales/purchases tax accounts automatically.

Leave a Reply Cancel reply

Do you have a question and want it to be answered ASAP? Post it on our FORUM here --> SAP FORUM !

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Assign Tax Calculation Procedure to Country in SAP for GST

How to assign tax calculation procedure to country for gst in sap.

You need to assign tax calculation procedures to every country where your company is operating the business.

You can assign tax calculation procedure to country IN (India) for SAP GST by using the following navigation method

- IMG Path : IMG > Financial Accounting > Financial Accounting Global Setting > Tax on Sales/Purchases > Basic Settings > Assign country to calculation procedure.

- Transaction code : OBBG.

Important Configurations to be done before assignment

- GST Calculation Procedures

Refer below step-by-step procedure on how to assign tax calculation procedure to country IN (India) for SAP GST

Step 1 ) Execute the transaction code “OBBG” as shown below

Step 2 ) In the next screen change view “Assign Country -> Calculation procedure” overview, the complete list of countries displays on the screen for assignment of country to calculation procedure. Choose the position option and enter the country key India as IN.

Step 3 ) Now enter the tax calculation procedure procedure key “GSTIN” for the country IN (India) in the filed procedure and press enter to continue.

After the assignment of tax calculation procedure to country IN, Choose save icon and save the configured details.

Also Refer: Next Configuration steps

Define Access Sequence for GST

Define Condition types for GST

Define account keys for GST.

Tax procedure Table in SAP

- T5A2D Table for Tax procedure / reasons for tax exemption Table Type : POOL Package : PB03 Module : PA-PA-AT

- EEDMSETTLPROCPA Table for Settlement Procedure (Procedure Parameters) Table Type : TRANSP Package : EE_EDM_SET Module : IS-U-EDM

- EEDMSETTLPROCPAG Table for Settlement Procedure (Profiles as Procedure Parameters) Table Type : TRANSP Package : EE_EDM_SET Module : IS-U-EDM

- EEDMSETTLPROCSER Table for Settlement Procedure (Service Type for Procedure) Table Type : TRANSP Package : EE_EDM_SET Module : IS-U-EDM

- TJJ85 Table for Sales Agent Procedure (for Pricing Procedure Determination) Table Type : TRANSP Package : JAS Module : IS-M

- /SAPSLL/CUCPAV Table for Link: Procedure / Additional Procedure Table Type : TRANSP Package : /SAPSLL/LEGAL_CUS_CORE Module : SLL-LEG

- CDBC_TB071_T Table for Tax Classification Texts: Assignment of Tax Groups to Tax Table Type : TRANSP Package : CDB Module : CRM-MSA

- J_1IEWT_MIGRATE Table for Map Classic tax code to EWT Tax type - Tax codes Table Type : TRANSP Package : J1ICIN30A Module : FI-LOC

- SMOTB071 Table for Tax Classification: Assignment of Tax Groups to Tax Types Table Type : TRANSP Package : CDB Module : CRM-MSA

- TB071_CM Table for Tax Classification: Assignment of Tax Groups to Tax Types Table Type : TRANSP Package : CCCI Module : LO-MD-BP-CM

- CDBC_T_GROSSPROC Table for Assign Gross Tax Calculation Procedure Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_PRCTAXMAP Table for Mapping between Tax Type and Procedure Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_PROCEDDET Table for Tax Calculation Procedure Determination Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_PROCEDURE Table for Tax Procedure Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_TAX_MAP Table for Mapping between Tax Type and Procedure Table Type : TRANSP Package : CDB Module : CRM-MSA

- CRMC_TAX_PROC Table for Assignment country - pricing procedure for tax calculation Table Type : TRANSP Package : CRM_TAX_CALC Module : CRM-BF-TAX

- J_1BMWSKZKALSM Table for Assign Alternative Calculation Procedure per FI/MM Tax Code Table Type : TRANSP Package : J1BA Module : CRM-LOC-BR

- T5A2T Table for Tax Procedure (A) Table Type : POOL Package : PB03 Module : PA-PA-AT

- T5D2G Table for Tax Procedure (D) Table Type : POOL Package : PB01 Module : PA-PA-DE

- TAX_RFD_RATES Table for Country Tax Rates for VAT Refund Procedure Table Type : TRANSP Package : FBAS Module : CRM

- TE503_TAX Table for Deifne Tax Determination Procedure Per Company Code Group Table Type : TRANSP Package : EE21 Module : IS-U-IN

- TKKV007AT Table for Insurance Tax Determination Procedure (Texts) Table Type : TRANSP Package : ISCDFUN Module : FS-CD

- TKKV007B Table for Insurance Tax Determination Procedure (Assignment) Table Type : TRANSP Package : ISCDFUN Module : FS-CD

- TTE2C_PROCED_DET Table for Tax Calculation Procedure Determination Table Type : TRANSP Package : AP_TTE Module : AP-TTE

- TTE2C_TAX_MAP Table for Mapping between Tax Type and Procedure Table Type : TRANSP Package : AP_TTE Module : AP-TTE

- TTEC_GROSSPROC Table for Assign Gross Tax Calculation Procedure Table Type : TRANSP Package : AP_TTE Module : AP-TTE

- TTEC_PRC_TAX_MAP Table for [3.x only] Mapping between Tax Type and Procedure Table Type : TRANSP Package : AP_TTE Module : AP-TTE

- TTEC_PROCEDURE Table for Tax Procedure Table Type : TRANSP Package : AP_TTE Module : AP-TTE

- A116 Table for Tax Exemption - Customer/Tax Classification 2-Material Table Type : TRANSP Package : VKON Module : AP-PRC-PR

- BBP_TAXGROUP_FAV Table for User-Specific Favorites: Tax Groups for Tax Type Table Type : TRANSP Package : BBP_GENERAL Module : SRM-EBP

- BTXTAX Table for BSI: Grouping Tax Authority Tax Category Table Type : TRANSP Package : PZ1B Module : PY-US-NT-TX-BSI

- BTXTAXC Table for BSI: BSI Tax Authorities SAP Tax Authorities Grouping Table Type : TRANSP Package : PZ1B Module : PY-US-NT-TX-BSI

- CDBC_T_SPREGJSD Table for Determine Special Tax Region from Tax Jurisdiction Code Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_TAXCODE2 Table for Assign Tax Events to Tax Code Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_TAXFRTO Table for Partner Role determination: Tax from/Tax to Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_TAXTYPDET Table for Tax Types by Tax Event Table Type : TRANSP Package : CDB Module : CRM-MSA

- CDBC_T_TAXTYPEXM Table for Mapping TTE Tax Types to External Tax Types Table Type : TRANSP Package : CDB Module : CRM-MSA

- COMC_TTE_NFMAP Table for Assignment TTE Tax Type to Nota Fiscal Tax Type Table Type : TRANSP Package : CRM_LOC_BRAZIL Module : CRM-LOC

- CRMC_FS_TAX_ITO Table for Categorize One-Time Tax/Fee Payment as Tax Table Type : TRANSP Package : CRM_FS_1O_EXT_TAX_CUST Module : CRM-IFS-BF

- CRMC_FS_TAX_OTFR Table for Determine tax exemption for One-Time Tax in change process Table Type : TRANSP Package : CRM_FS_1O_EXT_TAX_CUST Module : CRM-IFS-BF

- CRMC_LEAS_ROE_TQ Table for Assignment of Tax Payments to Tax Fields Table Type : TRANSP Package : CRM_LEASING_ROE Module : CRM-LAM-BTX-CTR

- ETXDCJ Table for Ext. tax document: tax rates and amounts by Jurisdict. level Table Type : TRANSP Package : FYTX/ETXDC Module : FI-GL-GL

- FKK_EBS_EXT_STAX Table for IDoc with Revenue Item Tax Data Determination of Tax Subitem Table Type : TRANSP Package : FKKIDOC Module : FI-CA

- FKK_EBS_INT_STAX Table for IDoc with Revenue Item Tax Data Determination of Tax Subitem Table Type : TRANSP Package : FKKIDOC Module : FI-CA

- IDCFMSETX_RATE Table for Tax rates for tax reports TRM Brazil Table Type : TRANSP Package : ID-CFM Module : FIN-FSCM-TRM-TM

- J_1BIMPCONDAS Table for Assign Tax Types to Tax Groups for Import Data Upload Table Type : TRANSP Package : J1BA Module : CRM-LOC-BR

- J_1BTXJUR Table for Tax Jurisdiction Codes For Brazilian Tax Calculation Table Type : TRANSP Package : J1BA Module : CRM-LOC-BR

- J_1IEXCTAX Table for Tax calc. - Excise tax rates Table Type : TRANSP Package : J1IN Module : FI-LOC

- J_3RTNTVEH Table for Tax-free code of vehicle (358 asset of tax codex) Table Type : TRANSP Package : J3RT Module : FI-LOC

- J_3RUMSV Table for Tax Balances per Comp.Code, Tax Code and Process.Key+ client Table Type : TRANSP Package : J3RF Module : FI-LOC

- J_3R_PTAX_ABROAD Table for Tax Paid Abroad Property tax Table Type : TRANSP Package : J3RALF Module : FI-LOC

- PCA_TTYPE Table Data element for Tax type - Fed. tax.,Prv. basic tax, surtax, flat tax ...

- SMO3KALVG Table Data element for Document procedure (for determining pricing procedure)

- KALVG_DEF Table Data element for Doc.Procedure Proposal (to Determine Pricing Procedure)

- MVEND_AKT_VK Table Data element for Do not End Dunning Procedure with Dunning Procedure Change

- RMA_SCHEMA Table Data element for Repair procedure: Procedure

- VF_SCHEMA Table Data element for Variant matching procedure: procedure

- TATYP Table Data element for Tax category (sales tax, federal sales tax,...)

- SMO3TATYP Table Data element for Tax category (sales tax, federal sales tax,...)

- DZMWEA Table Data element for Target Tax Code for Deferred EU Acquisition Tax, Output Tax

- DZMWEE Table Data element for Target Tax Code for Deferred EU Acquisition Tax, Input Tax

- TTET_PRICING_PROC Table Data element for Tax Calculation Procedure

- TTET_BASE_COMP Table Data element for Base Value from Tax Calculation Procedure Line

Tax procedure related terms

Definitions.

SAP is the short form of Systems, Applications & Products in Data Processing. It is one of the largest business process related software. This software focused on business processes on ERP & CRM.

Like most other software, SAP also using database tables to store the data. In SAP thousands of tables are there to store different data. A table contains several fields and some of the fields will be key fields.

Popular Table Searches

Latest table searches.

IMAGES

VIDEO

COMMENTS

In Customizing for Financial Accounting , choose Financial Accounting Global Settings Tax on Sales/Purchases Posting Define Tax Accounts . You can also use transaction OB40. You maintain the table T030K . Verify that the transaction keys (or account keys) used, for example, VS1 - VS4 and MW1 - MW4 are defined.

But tax procedure are country specific. (i.e) For each country tax procedure will be assigned. From the below mentioned spro path that can be identified. SPRO-->Financial Accounting-->Financial Accounting Global Settings-->Tax on Sales/purchase-->Assign Country to Calculation Procedure.

Step 1) Tax Category. Step 2) Define Tax Types. Step 3) Assign the plant for Tax Determination. Step 4) Define the Material Taxes. Step 5) Define the Tax Determination. Each country has a specific Tax Procedure defined in the standard system. A Tax calculation procedure contains the following fields: Steps — It determine the sequence of lines ...

Step 1) Enter transaction code "OBYZ" in the SAP command field and enter. Step 2) A pop up window condition element screen displays with options, you need to choose procedures so double click on it. Step 3) On change view procedure screen, click on new entries button for definition of new tax procedure in SAP. Step 4) On new entries ...

Hi. . In FTXP we create Tax code and assign the GL account under the Chart of account in Question. In FS00, you can specify if the account is a tax account (it has tax entries) or an account on which tax is applicable. If you specify a specific tax code here, you can post to the account only with that tax code. Regards.

In the system acquisition tax is mapped using account keys ESE und ESA. In properties EU flag has to be set to "9". The tax type is "V". 2) Assign country to calculation procedure: Predefined calculation procedures are delivered for certain countries (e.g. Germany TAXD, Austria TAXAT). The tax procedure for each country is set here.

SAP Levy Operation Tables : TTEC_PROCEDURE - Tax Method Tcode, T5A2T - Charge Procedure (A) Tcode, T5D2G - Tax Procedure (D) Tcode, T5W2F - (Old) RSA Tax Operating Tcode, TTE2C_TAX_MAP - Mapping between Tax Type and Procedure Tcode

You can find it in the KONV table, you will have to find the condition record number for the billing document (KNUMV) for the billing document and input fort he table KONV and get the details of all the pricing conditions there in the billing document. You can also get the total tax values in the VBRP-MWSBP. Solved: In which Table does the ...

Also assign VAT GL Account to Tax Code thru T-Code OB40 - select transaction (mostly JN5 or JN6) & assign GL account against TAx code. This will ensure that your VAT amount is posted in particular GL account. 07-18-2008. No. Tax code is not required to assign in Tax Dtermination Procedure.

Transparent Table 47 : T5D2G tax procedure (D) PA - Germany: Pooled Table 48 : T5W2F (Old) RSA tax procedure s PA - South Africa: Pooled Table 49 : TTEC_PROCEDURE tax procedure: AP - Transaction Tax Engine: Transparent Table 50 : FIESSII_TAXPROC tax procedure Settings for SII FI - Localization: Transparent Table 51 : T5A2TT tax procedure (A ...

The following Guided Answer decision tree will assist you with configuration and troubleshooting of tax determination in ERP Material Management. Topics investigated in this decision tree: Customizing of tax condition type Tax code determination Settings of Tax Jurisd

SAP Tax Procedure Tables : TTEC_PROCEDURE - Tax Procedure Tcode, T5A2T - Tax Procedure (A) Tcode, T5D2G - Tax Procedure (D) Tcode, T5W2F - (Old) RSA Tax Procedures Tcode, TTE2C_TAX_MAP - Mapping between Tax Type and Procedure Tcode ... Taxes: Material, Plant, Account Assignment and Origin: SD-MD: A094: Taxes: Material, Plant, Origin and Region ...

Welcome to our tutorial on SAP tax configuration. When users post documents in SAP they only need to select a tax code. The system automatically calculates the tax amounts and posts to tax accounts. Here, as part of our free SAP FI course, we walk you through the customizing settings step-by-step to enable the automatic posting of tax using a ...

The SAP Partner Groups will be INACCESSIBLE January 16-23 for a technical migration. For more information, please click the button at right to view the partner page ... Search Questions and Answers . 0. Mayuresh Kshirsagar. Sep 19, 2013 at 07:57 AM Assignment of pricing procedure to TAX procedure. 1205 Views. Follow RSS Feed Hello Gurus, How do ...

Step 1) Execute the transaction code "OBBG" as shown below. Step 2) In the next screen change view "Assign Country -> Calculation procedure" overview, the complete list of countries displays on the screen for assignment of country to calculation procedure. Choose the position option and enter the country key India as IN.

Most important Database Tables for Tax Procedure In Sap # TABLE Description Application Table Type; 1 : KONV: Conditions (Transaction Data) SD - Conditions: Cluster Table 2 : ... Distribution Items with Account Assignment FI - Contract Accounts Receivable and Payable: Transparent Table 27 :

In SAP thousands of tables are there to store different data. A table contains several fields and some of the fields will be key fields. List of Tax procedure tables in SAP. T5A2D for Tax procedure / reasons for tax exemption. EEDMSETTLPROCPA for Settlement Procedure (Procedure Parameters). EEDMSETTLPROCPAG for Settlement Procedure (Profiles as ...