How to Create a Self-Storage Business Plan [Plus a Free Template!]

By the end of 2020, roughly 4.35 million hopeful individuals had filed new business applications .

Perhaps the motivation was the loss of jobs or that people were fed up with the traditional 9-5 gig. Whatever the case, entrepreneurship has been a popular theme lately.

Many new business owners opted to pursue a real estate investment, specifically a self-storage business. For those of you on this path, let’s discuss creating a self-storage business plan and how a few purposeful decisions can catapult your business to the forefront.

It starts with a solid self-storage business plan.

Developing a business plan

Before you can start creating your business plan, you need to do some market research first. Start by relying on others’ history and experience. Do lots of market research. Network and learn from other marketing strategies. Attend an industry trade show. Diligently learn the ins and outs of running a small business.

Start to hone in on the details as you begin to formulate your plan. For example, , are you building or renovating your own potential storage space? You’ll need to consider the zoning in your chosen area, and contemplate the land cost and interest rate from a lender or two. In terms of marketing strategies, will construction costs or developmental costs be worth the initial investment? Thinking through these aspects with some “back of the napkin” math early on will help you as you start to formalize your business plan

Self-storage business plan template

Putting the vision for your self-storage business to paper is important. Not only will it help you develop a roadmap for all the things you need to do to make your business dreams a reality, but it will allow you to easily share your vision with others. This is necessary if you want to bring in funding partners or borrow money for a lender.

Download a business plan template and start drafting your own self-storage business plan. Dive deep into a recent market analysis to determine any possible cash flow outcomes. Understand that your first year as a startup might be your most challenging. Read various feasibility studies, and talk to your peers in the industry.

Your business plan should look at least two years out into the future. Plan for different scenarios in regards to your return on investment projections. Consider your returns under a best case scenario and a worst case scenario, as well as a conservative median projection.

Components of a self-storage business plan

Aside from the initial planning phase, remember to consider the operational logistics it will take to run this business. Fortunately, self-storage business investments are desirable because of the traditionally low operating expenses.

Make sure your business plan includes these components:

Executive summary

Business description, market research and strategy, management and personnel, financial reporting documents.

An executive summary is a brief overview of your business. Think of it as the first thing you would tell someone about your business in a conversation. For example, an executive summary for a self-storage business might start something like this:

“The purpose of this business is to develop and operate a 100-unit facility on a parcel of land outside of Colorado Springs, Colorado.”

Or, like this:

“This venture seeks to find and acquire value-add self-storage facilities in secondary markets in the Southeast. The business will modernize and update the facilities with the latest technologies to increase their profitability over the next two years.”

An executive summary should go on to summarize and highlight key elements from your business plan, such as total costs and projected revenue.

Everything You Need to Know About How to Start a Self-Storage Business

What kind of business will you be: sole proprietor, LLC, C- or S-corporation?

Here, you can describe the details of how your self-storage business will operate. Beyond your legal status, cover the operational details of your business such as branding, services offered and projected expenses.

Businesses are more tech-enabled than ever before, with easy-to-navigate websites , advanced phone systems, user-friendly apps and online payment services . Of course, these things aren’t always necessary to achieve success; however, having a few tech-powered options will put you ahead of the game. Consider how you will use these technologies sooner, rather than later.

Also consider things like your hiring plans, insurance needs , and maintenance procedures. Include additional revenue sources besides self-storage rents, such as sales of tenant insurance or moving supplies.

Remember all that market research you did on the self-storage industry? Lay out your most relevant findings and how they support your self-storage business idea in this part of your business plan. Examine the demographics and supply and demand story of your target market. For example, if individuals need RV storage, consider offering that option. Decide how you will make money and attract new renters (i.e., social media , content marketing, etc.).

Like any industry, the self-storage industry has a unique ebb and flow to it. Knowing these trends will help you execute a more successful self-storage project.

This is the who’s who of your self-storage business. Discuss the experience, qualifications and duties of the executive team, as well as additional employees that you have or need to hire to execute your plan.

Is your self-storage business plan financially feasible? Here is where you demonstrate that it is, by laying out details of your financial situation. What are your assets and liabilities? Will you have debt service?

This section should include the projected profit and loss, balance sheet and cash flow for your business for the next two to three years.

Expect the unexpected

Once your business is up and running, you will no doubt encounter challenges and situations that your plan did not anticipate. However, a strong business plan will greatly increase your chances that your business will succeed. If you are looking to do more with your business, Storable offers a host of technology solutions to help your self-storage operation thrive in a competitive environment.

Financing Options for Self-Storage Businesses

Resolve your questions about how to get financing for your self storage business. Keep Reading

Is a Self-Storage Business Profitable?

Is owning a self-storage business profitable? Find out how an investment in a self storage facility can turn into a lucrative business for you. Keep Reading

How to Buy a Self-Storage Facility

Thinking about buying a self-storage facility? Here is what you need to know before starting your search. Keep Reading

Self Storage Business Plan Template

Written by Dave Lavinsky

Self Storage Business Plan

You’ve come to the right place to create your Self Storage business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Self Storage companies.

Below is a template to help you create each section of a storage unit business plan.

Executive Summary

Business overview.

Secure Self Storage is a startup self storage company located in Nashville, Tennessee. The company is founded by Bill Williams, an experienced self storage manager who has been working in the self storage industry for over a decade. Bill has recently earned a bachelor’s degree in Business Administration. Now that Bill has obtained the education and experience that will allow him to successfully navigate the process of starting a business, Bill is ready to open his own company, Secure Self Storage. Bill plans on recruiting a team of highly qualified professionals to help manage the day to day responsibilities of running a successful self storage facility – marketing, security, maintenance, accounting, and rent collection.

Secure Self Storage will provide a convenient, safe, and secure self storage solution for anyone in the Nashville area who needs to store their belongings. Secure will ensure that every storage need of the customer is being met. Secure Self Storage will be the ultimate choice in Nashville for self storage solutions while being the best-priced company in the area.

Product Offering

The following are the self storage solutions that Secure Self Storage will provide:

- Small Storage Units (5×5)

- Medium Storage Units (10×10)

- Large Storage Units (10×25)

- Vehicle Storage Units

- Temperature Controlled Units

- Extra Security Units

- Pickup & Delivery Services

- Disposal Services

Customer Focus

Secure Self Storage will target adults 18 years old and over in Nashville who need a storage unit for any reason such as moving, decluttering, doing home renovations, or those who need storage for business, college, or to store an automobile. No matter the customer, Secure Self Storage will deliver the best communication, service, and security.

Management Team

Secure Self Storage will be owned and operated by Bill Williams. Bill has a bachelor’s degree in Business Administration and has been working as a self storage manager for another local storage facility for over a decade. Now that Bill has obtained the education and experience that will allow him to successfully navigate the process of starting a business, Bill is ready to venture out and open his own self storage company. Bill will be the owner and manager of Secure Self Storage.

Bill has recruited his peer, Ken Smith, a financial professional with a Masters degree and fifteen years of experience doing financial work for various construction companies, to be the financial manager. Ken will help manage all of the finances for the company from finding a cost-effective location to set up shop to reporting and budgeting to make sure the facility is profitable.

Success Factors

Secure Self Storage will be able to achieve success by offering the following competitive advantages:

- Self storage units are easily accessible 24 hours a day, temperature controlled, and have the latest security technology to keep customers’ belongings safe and secure.

- On-site security guards are deployed 24 hours a day to ensure belongings, customers, and employees are safe at all times.

- On-site staff to answer questions, help customers, and keep the facility clean.

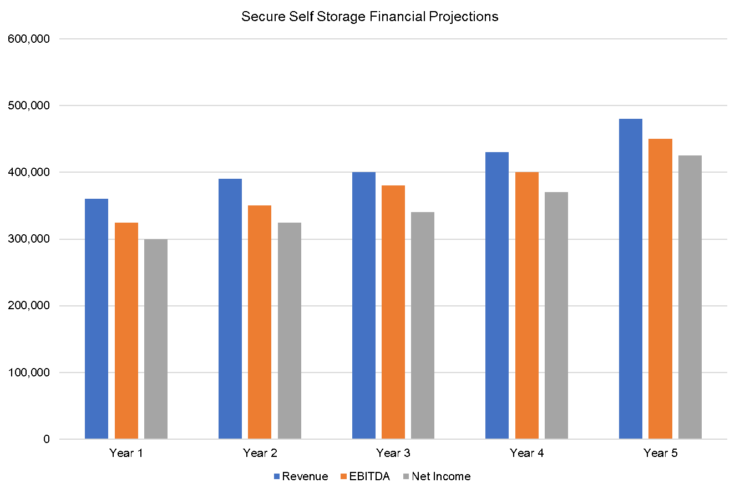

Financial Highlights

Secure Self Storage is seeking $250,000 in debt financing to launch its self storage business. The funding will be dedicated towards securing the facility space and purchasing equipment and supplies. Funding will also be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs. The breakout of the funding is below:

- Self storage facility build-out: $50,000

- Equipment, supplies, and materials: $20,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $15,000

- Working capital: $15,000

The following graph below outlines the pro forma financial projections for Secure Self Storage.

Company Overview

Who is secure self storage.

Secure Self Storage is a newly established high security self storage company in Nashville, Tennessee. Secure Self Storage will be the most convenient, secure, and customer-focused choice for storage unit renters in Nashville. Secure will provide a variety of self storage solutions for anyone looking for a secure storage option. The company’s customer-centric approach will include 24/7 on-site security and customer service staff, the latest security technology, and temperature controlled units.

Secure Self Storage will give customers peace of mind that their belongings are secure. The management team is composed of experienced professionals including business managers, security officers, and maintenance technicians. Secure Self Storage removes all headaches of the self storage unit renter and ensures all issues are taken care off expeditiously while delivering the best customer service.

Secure Self Storage History

Secure Self Storage is owned and operated by Bill Williams, an experienced self storage manager who has a bachelor’s degree in Business Administration from the University of Tennessee. Bill has worked for a local self storage company in Nashville for over a decade. Bill’s tenure with the self storage company combined with his education has given him the skills and knowledge required to venture out on his own and start his own company.

Since incorporation, Secure Self Storage has achieved the following milestones:

- Registered Secure Self Storage, LLC to transact business in the state of Tennessee.

- Has scouted a few location options and reached out to the owners for more information.

- Reached out to numerous contacts to include former customers to let them know about the upcoming facility.

- Began recruiting a staff of accountants, maintenance workers, security, and other facility personnel to work at Secure Self Storage.

Secure Self Storage Services

Industry analysis.

The United States self storage industry generates an estimated $39.5B in annual revenue with over 49,000 storage facilities throughout the country. The total rentable self storage space is approximately 1.9B square feet. An estimated 10.6% of U.S. households are currently renting a self storage unit. The average self storage space used per person is 5.9 square feet. The average monthly cost to rent a self storage unit is $90.

Self storage construction spending has nearly doubled in the past five years. According to the Self Storage Almanac, the market is highly fragmented with 31% of space being owned by six large public companies, 16% being owned by the next top 94 companies, and 53% being owned by small businesses. Self storage industry operators have the potential to achieve highly lucrative businesses if they manage them smartly. The average self storage company’s profit margin is around 11 percent, which is much higher than many other small businesses in other industries that are often closer to 3-5 percent.

Customer Analysis

Demographic profile of target market.

Secure Self Storage will target adults 18 years of age and older requiring self storage services in Nashville, Tennessee. The company will target people in need of storage space for a variety of reasons including moving, renovating, college, business, or to store a vehicle.

The precise demographics for Nashville, Tennessee are:

Customer Segmentation

Secure will primarily target the following customer profiles:

- People who are in the process of moving

- People who need storage space for a vehicle

- People who need storage for business

- People who need storage for college

- People who are renovating their homes

Competitive Analysis

Direct and indirect competitors.

Secure Self Storage will face competition from other companies with similar business profiles. A description of each competitor company is below.

Nashville Self Storage

Nashville Self Storage is a temperature controlled self storage facility operating in Nashville, Tennessee. The facility has 400 units of varying sizes from 2×5 up to 30×30. Nashville Self Storage uses state of the art security systems with cameras throughout the facility to keep its patrons and their belongings safe and secure. The company currently has one facility with plans to open a second location in the next few months. The owners of Nashville Self Storage have been working in the storage industry for over 20 years and pride themselves on providing exceptional customer service.

ALottaStuff Self Storage

ALottaStuff Self Storage is a Nashville-based self storage facility that provides outstanding service and storage solutions for its customers. ALottaStuff Self Storage takes the risk out of leaving your valuables in an unsecure storage facility by providing 24/7 secure monitoring of all of its units. They have temperature controlled units available in addition to non-temperature controlled units. Customers can depend on ALottaStuff Self Storage to handle their belongings with the best of care. The company provides pickup and delivery services for an extra fee.

In-Boxes Self Storage

In-Boxes Self Storage is a trusted Nashville self storage company that provides superior service to customers in Nashville and the surrounding areas. They are able to provide a convenient storage solution for a wide range of customers with multiple locations throughout the city. In-Boxes Self Storage offers low prices for do-it-yourself storage facilities. Drive-up units are available for a flat monthly fee and indoor temperature controlled units are available for an additional charge. In-Boxes Self Storage maintains a clean, secure atmosphere with friendly staff available during office hours to assist with customers’ storage needs.

Competitive Advantage

Secure Self Storage will be able to offer the following advantages over their competition:

- On-site staff are available to answer questions, help customers, and keep the facility clean at all times.

Marketing Plan

Brand & value proposition.

Secure Self Storage will offer the unique value proposition to its customers:

- Experienced team of security professionals, customer service associates, and maintenance staff on-site 24/7 to help customers and keep the facilities clean, safe, and secure.

- Unbeatable pricing to its clients – Secure Self Storage offers competitive pricing with promotions and discounts for new and returning customers.

Promotions Strategy

The promotions strategy for Secure Self Storage is as follows:

Word of Mouth/Referrals

Bill Williams has built rapport with an extensive list of customers over the years by providing exceptional service during his tenure as a self storage manager. Many have communicated to Bill that they referred their friends to the storage facility because they were happy with the service he was providing. Once Bill advised them he was leaving to open his own self storage business, many contacts have committed to help spread the word of Secure Self Storage.

Professional Associations

Secure Self Storage will become a member of professional associations such as the Self Storage Association, the Nashville Self Storage Association, and Inside Self Storage. Bill will attend industry expos and events to promote the company.

Print Advertising

Secure Self Storage will have print ads and flyers made for newspapers, magazines, direct mailers, and to post around the city and hand out at industry events.

Website & Content Marketing

Secure Self Storage will create and maintain an easy to navigate, well organized, informative, website that will list all of the available storage options and pricing. The website will also contain an informative blog with storage related posts.

SEO Marketing

The company will use SEO marketing tactics so that any time someone types in the Google or Bing search engine “Nashville self storage” or “self storage near me”, Secure Self Storage will be listed at the top of the search results.

Social Media Marketing

Secure Self Storage will create and maintain an active presence across social media platforms including LinkedIn, Facebook, Instagram, Twitter, TikTok, and YouTube.

The pricing of Secure Self Storage will be competitive so customers feel they receive value when purchasing their services.

Operations Plan

The following will be the operations plan for Secure Self Storage.

Operation Functions:

- Bill Williams will be the Owner and Manager of the company. He will oversee all staff and operations. Bill has spent the past year recruiting the following staff:

- Ken Smith – Financial Manager who will provide all accounting, budgeting, tax payments, and monthly financial reporting.

- Shannon Bowman – Marketing Manager who will provide all sales and marketing initiatives for Secure Self Storage including management of the company website and social media accounts.

- Benjamin Stephens – Maintenance Manager who will oversee all maintenance of the facility.

- Micheal Brown – Head of Security who will provide all security for the facility and oversee a small team of on-site security guards.

Milestones:

Secure Self Storage will have the following milestones complete in the next six months.

8/1/2022 – Finalize contract to lease facility space.

8/15/2022 – Finalize personnel and staff employment contracts for the management team.

9/1/2022 – Begin build out of the facility.

9/15/2022 – Begin networking and marketing campaign.

9/22/2022 – Begin moving into the Secure Self Storage facility.

10/1/2022 – Secure Self Storage opens its facility for business.

Bill has recruited the help of his peer, Ken Smith, a financial professional with a Masters degree and fifteen years of experience doing financial work for various construction companies. Ken will help manage the finances for the company from finding a cost-effective location to set up shop to reporting and budgeting to make sure the facility is profitable.

Financial Plan

Key revenue & costs.

The revenue drivers for Secure Self Storage are the self storage fees that will be charged to the customers for their services. The company will charge a monthly fee for unit rentals. The fee will vary depending on the size of the unit.

The cost drivers will be the overhead costs required in order to staff a self storage facility. The expenses will be the payroll cost, utilities, maintenance costs, and marketing materials.

Funding Requirements and Use of Funds

Secure Self Storage is seeking $250,000 in debt financing to launch its self storage business. The funding will be dedicated towards securing the facility space and purchasing equipment and supplies. Funding will also be dedicated towards three months of overhead costs to include payroll of the staff, rent, and marketing costs for the print ads and association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Average number of occupied units per month: 200 out of the total 500 units (40%)

- Average fees per month: $30,000 (average $150.00 per medium sized unit)

- Annual Lease on Facility: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, self storage business plan faqs, what is a self storage business plan.

A self storage business plan is a plan to start and/or grow your self storage business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your self storage business plan using our Self Storage Business Plan Template here .

What are the Main Types of Self Storage Businesses?

There are a number of different kinds of self storage business , some examples include: Portable container, Climate controlled storage, and Vehicle storage.

How Do You Get Funding for Your Self Storage Business Plan?

Self storage businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Self Storage Business?

Starting a self storage business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Self Storage Business Plan - The first step in starting a business is to create a storage facility business plan pdf or doc that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your self storage business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your self storage business is in compliance with local laws.

3. Register Your Self Storage Business - Once you have chosen a legal structure, the next step is to register your self storage business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your self storage business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Self Storage Equipment & Supplies - In order to start your self storage business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your self storage business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful self storage business:

- How to Start a Self Storage Business

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Self-Storage Business Plan

Start your own self-storage business plan

Westbury Storage, Inc.

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

This storage business plan describes a proposed self-storage facility to be established in Westbury, New York involving the conversion of an existing building. Total project costs are estimated at $1,054,487 including purchase price, conversion costs, and pre-opening expenses (see section on Start-up Summary). Based on current and projected strong demand for self-storage units, rental revenue is projected to grow rapidly as units fill up from the first year’s target of $320,000 to $684,000 by year three.

After achieving experience and success in their present self-storage facility in Plainview, New York the principals of this proposed project plan to take advantage of the strong demand in the self-storage industry to achieve a major presence in Westbury. The ownership connection with Stote Moving will assist in gaining full occupancy quickly. Goals have been set to rent 50% of the proposed 300 unit spaces within the first six months of Year 1. An additional 25% will be rented in the second half of Year 1, with the remainder to be filled in Year 2.

The mission of the principals is to serve the Long Island community’s local residential and commercial storage and moving needs.

Keys to Success

The keys to success in the self-storage business are:

- To be able to adapt as storage and market needs change.

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Westbury Storage is a start-up project to be located in Westbury. The owners are experienced in the moving and storage field, owning a well-established moving company (Stote Movers) and a successful self-storage facility in nearby Plainview (Plainview Storage). The building to be purchased for this project is a large brick building originally constructed as a bleachers around 1910. This building as well as surrounding buildings, were connected with the now dying leather industry which flourished a few decades ago. A large building of similar size located next door and connected by a walk bridge has already been converted successfully and is operating well. The Westbury Storage building contains three floors of heavy-duty wood and steel beam construction ideally suited to the planned purpose of self-storage units. The building is heated by oil. One of the two elevator shafts will be the home for a new over-sized passenger elevator suitable for transporting storage contents from the ground level to the units on the second and third floors. A large separate parking lot area comes with the building but will not be needed for this project. This lot could be sold or could be the site of additional future storage units to be set up using one of several one-story steel storage systems.

It is estimated that, with purchase of the building taking place in June of this year, the conversion into storage units could be completed and ready for occupancy by the end of the year. Demand for the units is strong, as evidenced by the market survey of existing self-storage facilities. Bank financing for 70% of the project costs is expected with the remainder supplied by shareholder equity.

Company Ownership

The company will be incorporated as an S Corporation, and will be owned by three individuals: Roger Black, Sebastian Stote and Daley Thompson. Each will own 1/3 of the stock. Roger Black and Sebastian Stote are 50-50 owners of Plainview Storage which is a 110 unit self-storage facility converted in 1993 from a former piano factory. All units are fully rented. Sebastian Stote is owner of Stote Movers, which is a family business providing residential and commercial moving since 1917. In addition to being the source of many of the rentals at Plainview Storage, Stote Movers has 52 filled 45-foot trailers located in Roslyn-by-the-Sea. These trailers contain customers’ stored goods pending delivery at a new location.

Company Locations and Facilities

Westbury Storage will be located in Westbury, in a central location about 1/2 mile from the monument in the center of Westbury. The owners’ present self-storage facilities are located at in Plainview with further storage capacity in 52 trailers in Roslyn.

Start-up Summary

Advertising and promotion will rely heavily ads in the Yellow Pages, as well as initial local newspaper ads at the time of opening. We are assuming three directories for Yellow Pages ads with 1/8th page ads costing $165/month each. The ads in the local papers ( Springfield News and community newspapers) are estimated to cost $300 monthly for the first year only. They will be reduced in the second year to half this amount and eliminated in the third year.

Property taxes ($11,946) are projected at the actual rate of the last tax year. Significant increases are not expected.

Building maintenance is normally a very substantial item on a building of this size built in 1910. However, the roof has been completely redone fairly recently and the basic structure of the building is very robust. The start-up costs reflect adequate amounts to ready the building for opening in good order. Also, it should be noted that expenditures for building maintenance would need to be larger if the building were being used for offices rather than storage. We assume an annual amount for maintenance equal to 5% of the purchase price which works out to $27,500.

- The total for utilities is estimated to be $900 monthly.

Insurance: Property and Liability Insurance amounted to $15,000 annually for the present tenant. We’ll assume the same annual cost.

Telephone: Most of the telephone bill will be the charges for the Yellow Pages ads. These costs are already included in advertising and promotion. We assume the telephone bill to amount to $150/month.

Bookkeeping/auditors/legal: Bookkeeping and billing will be handled by the same system used at Plainview Storage and charged at a rate of $300 per month. Auditor charges will run about $4,000 annually.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Competitive Comparison

All self-storage facilities that could be found in Westbury or the area bordering Westbury were surveyed with the following results:

Prices average at $1.20 per sq. ft. per month. Mean price is closer to $1.40.

Market Analysis Summary how to do a market analysis for your business plan.">

In a similar split experienced by management’s existing storage facilities, Westbury Storage is expecting to rent 70% of its available units to non-commercial renters and the remaining 30% to the commercial sector of the market. A total of 300 self-storage units of various sizes will be created and offered for rent by Westbury Storage in a central location in downtown Westbury. The present supply of these units is insufficient to meet the demand as evidenced by a survey of all self-storage facilities within easy reach of Westbury residents. The price realized by these existing units is more than double the national average.

Market Segmentation

Self-storage units are needed by residential customers for storage of personal items as well as by commercial customers for storage of stock. It is envisaged that 70% of the planned self-storage units will be taken up by the residential segment of the market and the remaining 30% will be directed toward the commercial segment. This split is expected based on the existing customers of management’s present self-storage facilities in Plainview. The commercial segment are small businesses, many of which are run out of people’s homes such as an interior designer who needs space to store hundreds of expensive sample fabric books, or a retail shop with inadequate on premises storage.

The market research shows that the annual market potential for the commercial self-storage service in the Westbury area is about 10,000 customers. As stated above, these are mostly small businesses. The residential segment potential is substantially higher at 150,000 customers per year and is based on the Self Storage Association’s assumption that 40% to 55% of population has used self-storage facilities. This estimate includes individuals who need storage facilities due to moving arrangements or to store excess household property. Both of the market segments are expected to grow at a 5% annual rate. The table and chart below outline the market potential for the both customer segments.

Target Market Segment Strategy

Since the demand for local self-storage services substantially exceeds the local supply, Westbury Storage will simultaneously market its services to the two major customer segments–residential customers and small business customers. The company will not pursue large business segment due to the limited service scope it can provide to such customers at the existing facilities.

The market analysis shows that local self-storage rates are substantially higher than the national averages. Westbury Storage will position itself to the both customer segments as a conveniently located and affordable quality self-storage facility. Both customer segments will be effectively reached via the local Yellow Pages ads and through the referrals of Stote Movers owned by one of the Westbury Storage’s co-owners.

Market Needs

Customer needs in the self-storage industry have certain similarity across different market segments. The underlying need is for a reliable, safe, dry and accessible self-storage facility. Due to the overwhelming demand, customers are less price sensitive and consider convenient location as the major buying decision criterion.

Residential customers use self-storage facilities to temporarily store their property while moving to a new location. This need originates in the mobility of the American population and the affordability of rental accommodations. Such customers usually rent 25 to 100 square feet depending on the size of their household and they rent on a weekly or monthly basis. The other cluster of residential customers rents self-storage facilities for longer periods to keep their oversize property like boats or other equipment that either does not fit in their garages or is not used on a constant basis.

Small business customer segment requires self-storage facilities to temporarily store their stock or merchandise. These customers may use the storage facilities more often than residential customers and they benefit from convenient loading areas, extended operating hours and better equiped storage units of bigger size.

Service Business Analysis

According to an article in the November 15th issue of Inside Self-storage the national industry average rental income generated by self-storage units is $6.00 per square foot per year, or $.50/sq. ft. per month. In the market to be served by Westbury Storage the average storage rate (see section on Competitive Comparison) is more than double this amount. Washington Storage in Westbury is a typical example. They charge $50/month for an 8X6 ft unit which works out to $12.50 per sq. ft. per year. A 9X9 unit on the second floor also rents for this same amount only because there is no elevator. All of their units are fully rented! All units within the area were surveyed. The average rate is $1.20/sq. ft. per month ($14.40 per year) and the mean was closer to $1.40/sq. ft. per month ($16.80 per year). The story concerning availability was uniform. Either the facility was full or only had one or two available units to chose from. E-Z Mini Storage in S. Centreport said, “There’s some turn-over at the end of every month. Leave your name and we will call you when one becomes vacant.” Extra Space Storage in Springfield said, “We need one week advanced notice.” North Shore Self-Storage said, “We have nothing available on the ground floor.” U-Haul reported, “We have one small unit available, otherwise we are all full.”

The self-storage industry really only started in the late 1960’s when a few far-sighted people recognized the growing need for residential and commercial storage. The industry has doubled in size each decade. Returns on investment have been very impressive–often twice that of other forms of real estate investment. The reasons for this have been the mobile society, the tendency to live in rental apartments, and the general increase in the accumulation of property, especially leisure articles such as skis, wind-surfers, exercise equipment, etc.

It could be argued that the higher than national average rates enjoyed by local self-storage facilities may not continue indefinitely, but there is no indication of any downward pressure at this time. It should also be pointed out that during an economic down-turn the self-storage industry does not suffer to the extent that other industries suffer.

Should the supply of self-storage units begin to outstrip demand, Westbury Storage should be well positioned to deal with the competition due to its ability to offer heated units (nearly all competing units are unheated) and its ability to supply electric outlets to individual units (for hobby/workshop purposes).

Business Participants

Although there are a few nation-wide players in the self-storage market, the industry is still fairly dispersed in which many small companies take part. (See the section on Competitive Analysis for a complete listing.)

Competition and Buying Patterns

Convenience is probably the single most import factor in the decision of where to rent a self-storage unit. For example, Hicksville and Huntington have no self-storage facilities. Residents choose to rent one in a nearby town probably based on proximity to the route taken by the renter to and from work. If no units are available nearby, then renters will travel further afield. Units on the ground floor are favored, especially if no elevator is available.

Main Competitors

See the section on Competitive Comparison for names of competitors. In the present market situation, competition plays a very weak role.

Strategy and Implementation Summary

The sales and marketing strategy is fairly simple by virtue of the fact that self-storage facilities are in short supply. Westbury Storage will simply have to inform the public of its existence by advertising in local newspapers, and by placing Yellow Pages ads.

Competitive Edge

Although the current local demand exceeds the supply and Westbury Storage will have no problems fully utilizing its capacity, the market situation may change in the future. The company will fully utilize its management’s seasoned experience in the storage business in order to establish a strong foothold in the local community. This will be reached by providing excellent service and offering extra service features like the heated and well-lit rental units, which will supplement the great location of the storage facility.

Sales Strategy

Most inquiries will come through the Yellow Pages ads. Proper telephone manners and professional handling of on-site inquiries are essential. Even though there is an excess of demand over supply, an unfriendly manager or clumsiness over the telephone will cause needless lost sales.

As is the case with the owners’ present self-storage facility in Plainview, many sales are directed through Stote Movers, who are in constant contact with people on the move and, therefore are most likely to require temporary storage.

Sales Forecast

Due to the fact that demand has been outstripping supply in this market, Westbury Storage may well be able to rent out all of its new units within the first year of operation. Prices paid for self-storage units reflect this strong market demand. The ground floor units will rent at $1.40 per sq. ft. per month and the upper floors, served by an over-sized elevator will rent for $1.20/sq. ft. per month. It is assumed that half of the units will rent in the first six months of operation. The second half of 1999 will see a further 25% of the total space rented, leaving the final 25% to be reached in the year 2000. Within these time spans, the growth, for projection purposes, will be assumed to be straight line, i.e. the first 50% of the total space will be reached in equal monthly increments during the first six months, and so forth.

The building measures 240 ft. X 80 ft. A section at one end (40′ X 80′ =3,200 sq. ft. per floor) will be reserved for future offices. This leaves total space dedicated to self-storage units of 48,000 sq. ft. (16,000 per floor). Some space is lost when the partitioning is done. Floor plan “D” suggests a way to partition an area 200 ft. X 40 ft. Doubled, this is exactly the space available in the Westbury building after deducting the office area. This 16,000 sq. ft. (200′ X 40′ X 2′) would be reduced somewhat to allow walkway/passages on the sides. So instead of 16,000 sq. ft. of rental space per floor, we would end up with about 15,000 sq. ft. Total self-storage net rentable space would be 45,000 sq. ft. The 15,000 sq. ft. on the ground floor would rent for $21,000 monthly and each of the other floors would rent for $18,000 each on a monthly basis.

Sales for the first month would be $4,750 (50% of total $57,000 divided by 6). The second month would have $9,500 in sales, etc.

Many self-storage companies charge administration fees to first-time customers. Deposits are also not uncommon. In addition to these sources of income, the sale of certain related items such as cardboard boxes, tape, packing materials, storage containers, plastic mattress covers, etc. can be substantial. However, for projection purposes, it is assumed that income from these sources will wash out any credit losses.

Strategic Alliances

An important strategic alliance is the common ownership connection to Stote Movers. By virtue of its contact with people changing addresses, Stote Movers is in a position to direct a lot of storage business to Westbury Storage.

The following table shows the milestones that Westbury Storage has established.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

The management of Westbury Storage will rest with Roger Black and Sebastian Stote, both of whom are successful in the moving and self-storage industries.

Personnel Plan

Operating hours are planned to be 7 a.m. to 7 p.m. Monday through Friday and 9 a.m. to 5 p.m. on Saturdays. Westbury Storage will be closed on Sundays.

The manager will work a normal 40 hour week at an annual salary of $35,000. A maintenance man will be employed at a salary of $24,000. A night watchman will be employed at a salary of $24,000.

Financial Plan investor-ready personnel plan .">

A commercial loan needs to be negotiated to finance approximately 70% of the total project costs. A 15-year mortgage will be applied for with an 8.5% interest rate. First drawdown upon agreement of the seller and buyer concerning the terms of sale of the building. Last drawdown around the end of the year when all conversion to self-storage units should be completed. First repayment of principle is planned in April of 1999 with monthly installments of interest and principle to continue until the loan is fully repaid in 2013.

Important Assumptions

Key financial indicators.

The following chart shows the benchmarks for Westbury.

Break-even Analysis

The following table and chart show our Break-even Analysis.

Projected Profit and Loss

Property taxes ($11,946) are projected at the actual rate of the tax year 7/1/96-6/30/97. Significant increases are not expected.

Projected Cash Flow

The following chart and table represent the cash flow for Westbury Storage.

Projected Balance Sheet

The following table presents the balance sheet for Westbury Storage.

Business Ratios

Business ratios for Westbury for the years of this plan are shown below. Industry profile ratios based on the Standard Industrial Classification (SIC) code 4225, General Warehousing and Storage, are shown for comparison.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

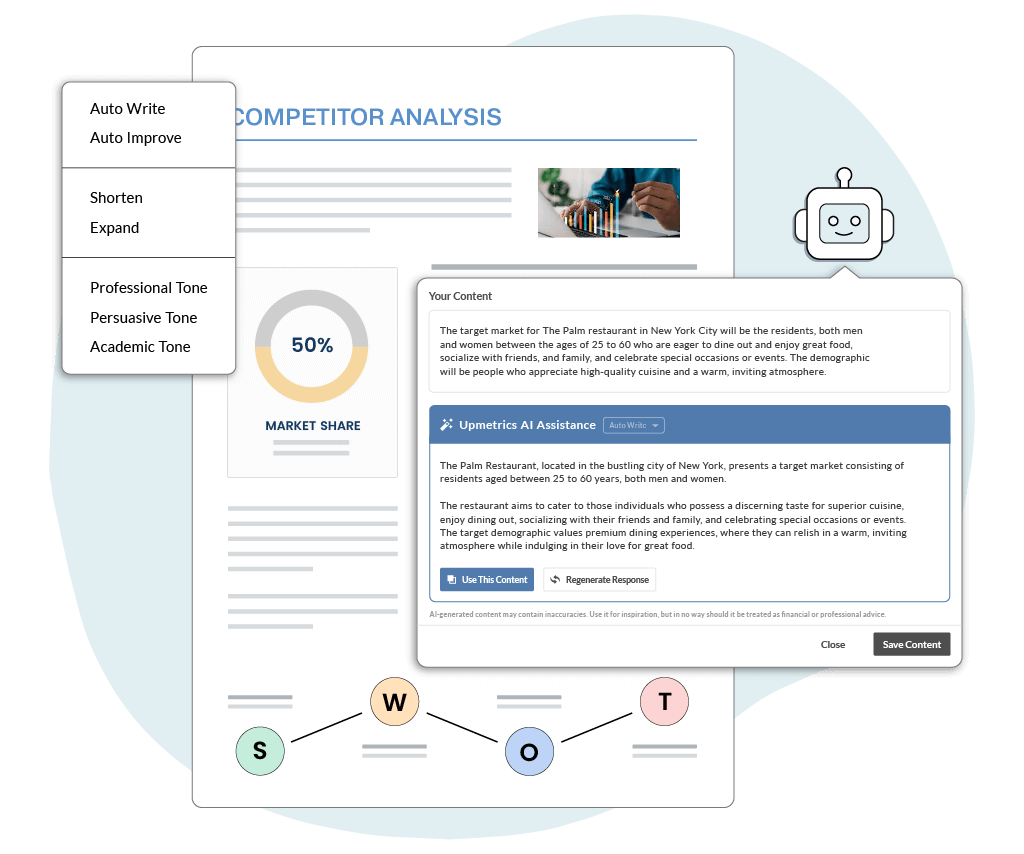

Upmetrics AI Assistant: Simplifying Business Planning through AI-Powered Insights. Learn How

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

- WHY UPMETRICS?

Customers Success Stories

Business Plan Course

Small Business Tools

Strategic Canvas Templates

E-books, Guides & More

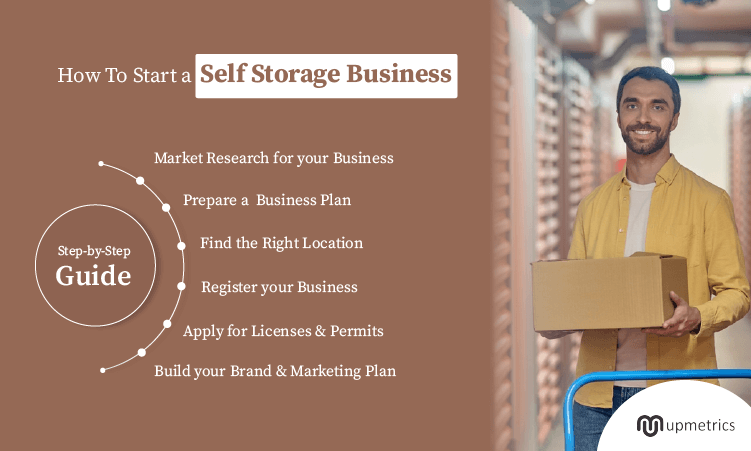

How to Start a Self Storage Business in (2024): Step-by-Step Guide

Matthew Khalili

10 Min Read

The 44.37 billion dollars self-storage market grows prolifically as the demand for self-storage facilities has grown throughout the country.

With an average occupancy rate of 85-90%, most self-storage businesses in the US enjoy a profit margin of 11-18%. It is indeed a profitable business venture for someone ready to invest and put in some hard work.

Well, if you have made up your mind to venture into the self-storage industry you must be wondering how to start a self-storage business and turn it profitable.

Well, this guide has all your answers. It details all the essential steps that will help you set up a well-planned and legally compliant self-storage business in a hassle-free manner.

So without any further ado, let’s dive right in.

Steps to Start a Self-Storage Business

- Self-Storage Business Planning and Market Research

- Prepare your Self-Storage Business Plan

- Choose the Location for your Storage Facility

- Register Self-Storage Business

- Acquire Essential Licenses and Permits

- Insure the Self-Storage Facilities

- Open a Business Bank Account

- Calculate your Startup and Operational Costs

- Acquire the Fundings

- Build your Brand and Marketing Plan

Let’s uncover this step-by-step guide that will help you set up a legally compliant and financially planned storage business in a proper way.

1. Self-Storage Business Planning and Market Research

As the first step of starting a self-storage facility, evaluate the feasibility of your storage business idea. For this, you must gather a foundational understanding of the market by diving deep into the research.

Analyze your market area by studying its current population and projected population growth. Evaluate the competitive landscape and see if there is room for new self-storage businesses in your chosen locality or region.

Dive further deep, understanding who your ideal customer is. For instance, would you open your self-storage facility for commercial people or residential people?

An answer to this will influence many other decisions like location, size of self-storage units, storage facilities you will be offering, and your startup costs.

Further, decide whether you will operate the self-storage company on your own or hire a third-party company to oversee the management.

Once you have a rough idea of your business concept, take a step further and nail your business planning with a solid plan.

2. Prepare your Self-Storage Business Plan

Proceeding without a business plan is like aiming your shot in the dark hoping it reaches the target. Well, you sure don’t want to take that risk, especially when planning to invest millions in your self-storage business.

A realistic and credible business plan is a worthy document that will drive your business in a specific direction helping you realize your business goals and objectives. Besides, most investors won’t even pay you heed if you don’t have a business plan.

So, better start writing a credible self-storage business plan that resonates with your core objectives, mission values, goals, and business concepts.

Keep in mind that the business plan for getting an existing self-storage facility off the ground will be much different than building a new storage business. However, if we consider the fundamental components of a business plan, you must try to cover the following topics:

- Executive Summary

- Company Overview

- Industry and Market Analysis

- Self-storage products and services

- Management Team

- Self-Storage operations plan

- Marketing and sales plan

- Financial plan

Writing a business plan is taxing. It requires utmost attention to detail and precision and is time-consuming.

Need Assistance Writing a Self-Storage Business Plan?

Get Upmetrics’ business plan template, import data directly into the editor, and start editing using Upmetrics AI Assistant.

Start Planning Now

3. Choose Location for your Storage Facility

Location plays a crucial role in determining the success of self-storage businesses. It’s better to start sourcing the ideal location for your storage space business ASAP!

The preliminary market research will help you identify the localities that have surging or unmet demands. For instance, the demand for self-storage facilities is high in commercial regions and densely populated residential areas.

Now, answer whether you will buy land for storage facilities or remodel an existing facility. Besides, do you plan to spread across the facilities on the same level or will you create multi-story facilities? And lastly, will you offer indoor access to the facilities or only drive-up to storage units?

Usually, the self-storage facilities are spread across a 10,000-100,000 sq. ft. area housing nearly 500 storage units. Now, evaluate your needs and start looking for easy-to-access locations near your target market.

Take help from real estate investors to help you find the right business location. While finalizing the contract, ensure that all the legal compliances are met.

4. Register Self-Storage Business

It is essential to legally register your business with the state. While registering, you have to choose between different business entities like sole proprietorship, partnership, LLC (limited liability company), and Corporation.

Businesses in the self-storage industry can benefit greatly from registering LLCs and Corporations as their legal entity.

Further, register your self-storage business for state and federal taxes and acquire your Employer Identification Number (EIN) from the IRS portal .

EIN is a 9-digit security code unique to your self-storage business and is essential for filing taxes, registering a business bank account, applying for business credit cards, and generating payroll. Besides, EIN can be generated for free.

5. Acquire Essential Licenses and Permits

To ensure all-around compliance, identify the permits and licenses essential for your self-storage facilities from SBA .

If you are building a self-storage facility from the ground level up, get a Certificate of occupancy (CO) ensuring that your business meets all the zoning, government, and building code requirements.

However, if you are renting an existing self-storage facility, ensure that the owner has an occupancy certificate essential for your compliant business.

Ensure that you have all the essential licenses that comply with Occupational Safety and Health Administration requirements.

While it is still a long way before you start offering your storage unit for rent, draft the service agreement contracts highlighting the terms and conditions, payment terms, and rental time to minimize the legal dispute.

Failure to get your business legally compliant can attract fines, penalties, and sometimes permanent closure of the business. Ideally, you should avail a legal help to look after the compliances for your business.

6. Insure the Self-Storage Facilities

Just like licenses, you need insurance to ensure that your storage unit business operates safely and lawfully. Federally, business insurance is mandatory for all businesses.

Now, if there is one insurance you definitely need, it is general liability insurance. This offers general protection against injuries, thefts, and property damage- so it’s a good start for your business.

Now, if you are hiring workers to look after your storage unit business, you also need a worker’s compensation fund to cover employees’ injuries and health expenses.

Also, it is wise to get tenant protection insurance to secure the interest of prospective tenants. This can enhance the credibility of your self-storage business amongst your target audience.

Lastly, get umbrella insurance to secure your business interests on all fronts.

7. Open a Business Bank Account

Setting up a separate bank account for your storage unit business helps you protect your personal assets from business liabilities. Not only that, it also eases the bookkeeping and tax filing for your business.

With that EIN procured earlier, you can apply for a separate business bank account. While you apply for a bank account, also apply for a separate business credit card.

A credit card will build credit history for your business making it easier for you to acquire loans in the future.

8. Calculate your Startup and Operational Costs

If the financial section of your business plan is not worked out yet, it is time to calculate your startup cost and operating expenses now.

Evaluate your startup costs by making projections for different expenses. This includes accounting for land purchase, construction, permits, insurance, and much more.

While you calculate your startup costs, also consider the operating expenses for the first 3-6 months. This is a good enough time for you to reach at least break even.

Talking about self-storage operating expenses, here are a few things you should include in your startup cost calculation:

- Mortgage/ Lease payments

- Payroll expenses

- Utility bills

- Professional services bills

- Insurance payments

- Marketing and advertising

Depending on the concept, size, location, and nature of your self-storage business, you can expect to spend anywhere between $1 million-$2.5 million to start your business.

However, it is possible to start a small business with less than a million dollars if you decide to lease or buy existing storage facilities in the lower borough regions of your town.

Once you have a rough estimate of your initial capital needs, you can start making arrangements for the same.

9. Acquire the Funding

As we discussed, it’s quite expensive to start a self-storage business even on a small scale. Personal savings aren’t adequate especially when you need a million dollars for an upfront investment.

Evaluate your monetary position and determine how much funding you require to turn your idea into a successful self-storage business.

In terms of funding options, you can opt for a variety of loans. This includes SBA (small business administration)-guaranteed loans for small businesses, business loans, acquisition loans, construction loans, working capital loans, etc. Evaluate your credit standing and interest rates before choosing this mode of finance.

Additionally, you can raise capital by seeking funding from angel investors and Venture Capitalists. For a certain stake in your business, these investors will provide you with essential funding.

Apart from this, you can also choose the mode of crowdfunding and lending from friends and families to gather essential capital.

10. Build your Brand and Marketing Plan

A strong self-storage business brand is essential to build a successful and profitable business. Ideally, you should start the branding and marketing activities as the facilities start shaping up together.

Define your brand elements to put together a consistent brand image across all the platforms. Get your self-storage business website ready and create your social media accounts to grow your brand’s presence.

You want your target market to find you easily. So get the banners, freeway hoardings, and billboards ready to guide the customers to your self-storage facility.

Define different marketing strategies you will use to attract potential clients to your business. This includes streamlining your GMB (Google My Business) account, email marketing, setting up your phone system, running paid ads, content marketing, and much more.

Allocate your resources to different marketing activities and track the results to see what type of marketing brings you the most benefit.

By now you must have a thorough understanding regarding how to set up your own self-storage business. Let’s take the first step and translate your business idea into a business plan by referring to online business plan samples .

Also, ease your business planning process by using cutting-edge tools from the Upemtrics business planning app . We have financial forecasting and AI writing assistant tools to strengthen your business planning along with free resources and extensive guides to help small business startups.

So let’s turn your vision for self storage business into a reality.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks, AI-assistance, and automatic financials make it easy.

Frequently Asked Questions

How much money do you need to start a self-storage business.

The cost of starting a self-storage business right from ground level up costs anywhere between $1M-$2.5M . However, it is comparatively much cheaper to buy existing storage facilities and upscale them to meet the concepts and nature of your self-storage business idea.

Are storage businesses profitable?

Absolutely yes. The average profit margins of a self-storage unit business in the US is anywhere between 11-18% Sometimes, storage units with streamlined operations and consistent occupancy rates can manage to earn margins up to 40% as well.

Is starting a storage business a good idea?

Indeed, starting a storage business would add a prominent source of income to your financial standing. In fact, most of the storage business owners hire a third party for facility management. This way they can earn a significant passive income while working on their other business ventures. Moreover, since storage facilities are always in demand, you can stay assured of reaping high benefits by running a highly functional storage unit business.

How many storage units are there at a self-storage facility?

Considering a 10*10 square foot size for one storage unit, you can fit nearly 130-215 units in one acre of land. Generally, self-storage facilities are spread over 10,000-100,000 sq. ft. of land making room for nearly 500-600 storage units in total.

What is the average sq. ft rent in self-storage facilities?

According to Statista, the average asking rent per square foot for storage facilities in the US is $1.3. Considering a 10*10 average size per unit, per month rental of a storage unit is anywhere around $130 .

About the Author

Matthew Khalili is an experienced business planning expert and the founder of The Plan Writers. With over a decade of experience in the field, he has helped numerous entrepreneurs in creating investor-ready pitch decks and business plans. Matt has enabled 5000+ startups to raise over $1 billion through his business plan, market research, and financial modeling services. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

How To Start a Storage Business

Our Comprehensive Guide to Launching a Profitable Self-Storage Rental Unit Business in 2023

We’re about to dive deep into the thriving, fast-paced world of the self storage business.

Believe it or not, this under-the-radar sector of commercial real estate has been steadily growing, churning out a staggering $39 billion in annual revenue as of 2023, with the U.S. leading the charge. It’s a veritable gold rush, and it’s time you staked your claim.

So, you might be thinking, “That sounds great, but how do I start a self-storage business?”

Don’t worry, we’ve got your back.

In This Article

Flexible Pricing

Brand awareness, customer service, property selection, getting to grips with the landscape of the mini storage unit business, identifying the key drivers of demand when starting a self-storage business, licenses and permits, zoning laws, business structure, average occupancy and facility size, construction costs, technology and operations, revenues and profit margins, startup costs, financing options, establish a strong brand identity, build a robust online presence, implement a referral program, collaborate with local businesses, deciphering the average cost, implementing a pricing strategy, the most in-demand cities for self storage units, revenue generation, wrapping up: starting and running a successful self storage business – a recap, self-storage keys to success.

Adapt your storage unit prices to the ever-changing demand in your local market.

Integrate your company into the community and make sure residents know who you are!

Meet your customer’s needs to reduce turnover and increase word-of-mouth advertising.

Find land that is affordable, yet accessible. Work with a real estate agent to identify the best fit.

This comprehensive guide is packed to the brim with all the crucial information you’ll need. From breaking down financial projections to unraveling the complexities of operational strategies, and even unveiling insights from industry case studies, we’ve left no stone unturned.

After navigating through this guide, you won’t just understand the ins and outs of how to kick-start a storage business, you’ll be pumped and ready to plunge into your very own storage unit venture.

So, are you ready to turn the key and open the door to your future in the self storage business?

Let’s hit the ground running!

Let’s flip the lid and take a peek at the vast expanse of the self-storage industry. Now, if you’re wondering whether there’s room for one more in this arena, let’s crunch some numbers. As of 2023, this buzzing beehive of a business is generating a hefty $39 billion in annual revenue right here in the U.S. alone. That’s no small change, my friends! And get this, the U.S. is not just playing in the big leagues, it’s practically owning the entire stadium, accounting for 90% of the global self-storage inventory.

But what about the competition, you ask? Well, there’s no sugarcoating it – the storage business is a bustling marketplace. With over 182,000 storage businesses operating nationwide, you’re certainly not alone. But don’t let that intimidate you! This number also serves as a testament to the industry’s robust nature and the vast demand for storage space.

The beauty of the storage unit business lies in its versatility. From folks looking to declutter their homes to businesses in need of extra space storage, there’s a demand across the board. And that’s precisely what makes this business such a good bet. It caters to a need that’s not going away anytime soon.

Starting a self storage business may seem like a daunting task, but with the right plan, resources, and a dash of entrepreneurial spirit, it’s a mountain you can conquer. So, are you ready to ride this wave and make your mark in the storage industry? Let’s roll up those sleeves and get down to business!

Now, let’s get down to brass tacks and look at who is driving the demand in the mini storage business. As a potential new business owner, understanding consumer demand is the compass that’ll guide your storage unit business towards success. Here’s a snapshot of the movers and shakers in the storage market:

- The Nomads: With life on the move becoming the norm, moving remains the primary reason folks seek out mini storage solutions. Be it a job relocation, downsizing, or even a gap year spent globetrotting, having a safe space to store their belongings offers peace of mind during these transitional periods. So, if you’re wondering how to start a self storage business that resonates with this demographic, consider offering flexible rental terms and hassle-free access to the storage units.

- The Space Savers: Did you know that over 1 in 5 renters in the U.S. utilize self storage units? That’s a significant market slice to cater to! From apartment dwellers looking to declutter their space to small businesses needing extra inventory storage, the demand spans across various user groups. Offering a range of unit sizes can help you cater to this diverse clientele.

- Generation X: Representing a considerable user group within the self-storage industry, Gen Xers often require storage space for myriad reasons. From moving homes to storing inherited items, their demand for storage facilities is quite robust. To start a storage business that appeals to this demographic, you might want to consider offering services like controlled storage or extra space storage.

- The Ladies: Female renters constitute another significant user group in the self-storage industry. Safety and cleanliness are often high on their priority list. To attract this demographic, focus on ensuring well-lit facilities, 24/7 surveillance, and immaculate storage units.

It’s clear as day that the storage business is not a one-size-fits-all kind of deal. The key to running a successful storage business lies in understanding the unique needs of these consumer groups and tailoring your services to meet them. And with the right approach, you could be well on your way to turning your business idea into a thriving self-storage business in 2023!

Comprehending Legal and Regulatory Essentials for Running a Self Storage Unit Business

When you’re ready to start your mini storage business, it’s crucial to get your ducks in a row when it comes to legal and regulatory requirements. It might seem like you’re jumping through hoops, but each step is essential for getting your business off the ground and avoiding potential hiccups down the line. Here’s a breakdown:

Every business, including a storage facility, requires specific licenses and permits to operate legally. Typically, you’ll need a general business license, but depending on your location and the nature of your business, additional permits may be required. For instance, if your self-storage unit business plans on offering RV storage, you might need extra permits. Remember, it’s important to register your business and open a business bank account to keep your finances in order.

Do you know the saying, “location, location, location”? Well, it’s not just about finding a spot with high demand. Zoning laws can dictate what type of business you can run in certain areas. These laws vary widely, so you’ll need to check with your local planning or zoning department to ensure your storage facilities are in compliance.

Here’s the deal: starting a self-storage business in 2023 without the right insurance policies is like walking a tightrope without a safety net. Different types of insurance, such as property insurance, liability insurance, and workers’ compensation insurance, will protect your business from potential financial losses. It’s also worth considering specialized insurance that covers customers’ belongings in storage.

Deciding on your business structure isn’t just a box to tick—it’s a decision that can impact your business in many ways, from how much you pay in taxes to your personal liability. You can choose to set up as a sole proprietorship, partnership, corporation, or Limited Liability Company (LLC). Each type of business entity has pros and cons, so it’s essential to get advice from a professional or the Small Business Administration.

Starting a storage business involves more than just renting out storage units—it requires a good understanding of the legal and regulatory landscape. However, with a little bit of elbow grease and the right guidance, you can navigate these waters and launch your business with confidence.

Planning Facilities and Operations for Your Startup Self Storage Business

Starting a mini storage business is no small task—it requires careful planning and efficient operations management. It’s not just about having space; it’s about making the best use of that space and providing exceptional customer service. To give you an idea of what you’re stepping into, here’s a bit of data and a few considerations for you.

If you’re thinking about starting a storage company, the numbers are promising. In the U.S., the average occupancy rate for storage facilities sits at an impressive 96.5 percent.

When it comes to facility size, the average mini storage facility in the U.S. covers approximately 56,900 square feet. This doesn’t mean your facility must fit this mold—it’s just the average. Your facility size will depend on factors like location, demand, and your business plan.

When it comes to construction costs, figures can range from $1.25 million to $3.5 million. The costs can vary depending on factors like location, land cost, facility size, and construction materials.

Remember, starting a business is an investment, and the initial costs can be steep. However, with the right planning, management, and a good business loan, you can navigate these costs and set up a profitable storage unit business.

In today’s digital age, the incorporation of technology into your storage business operations is more of a necessity than a luxury. There’s a wealth of management software and online booking systems available that can streamline your operations and enhance the customer experience. Consider the following:

- Management Software : These tools can help you track your occupancy rate, manage rental rates, and handle other administrative tasks.

- Online Booking Systems : These can offer convenience to your customers, allowing them to book storage units at their leisure and streamline the rental process.

- Security Systems : High-quality surveillance systems and access control are a must for any self-storage unit business. Customers need to know that their belongings are safe.

- Website : Your business online is essential in this digital age. An intuitive, user-friendly website can help you reach more customers and provide them with the information they need about your storage services.

Starting a self storage business might seem daunting, but with the right planning and a clear understanding of the industry, it’s a journey you can confidently embark on. Remember, every business requires dedication and hard work—yours will be no exception. So, are you ready to take the leap?

Financial Aspects to Consider: From Business Plan to Small Business Loan

Money makes the world go ’round, and it certainly sets the wheels in motion for your storage business. Understanding the financial aspects, from revenues and profit margins to startup costs and financing options, is crucial. So let’s dive into the numbers, shall we?

Let’s talk earnings. The average annual revenue for a self-storage business is about $450,000, boasting a healthy profit margin of 41%.

These figures can vary based on factors like location, unit sizes, number of units, and additional services you may offer. So, while you might start a bit lower as a newcomer, with strategic planning and excellent customer service, there’s potential for growth.

The start-up cost for a mini storage business can seem a tad intimidating, ranging from $1.5 million to $2.4 million, averaging around $2 million. These figures account for land acquisition, construction, operational setup, and initial marketing efforts.

While it might seem like a lot, remember that starting a business is a significant investment. It’s about putting in the capital now to reap the benefits later.

With numbers like these, it’s no wonder you might be considering financing options. One viable route is through SBA (Small Business Administration) loans. These loans are designed to help entrepreneurs like you get their dreams off the ground.

- SBA 7(a) Loans : This is the most common type of SBA loan. It can be used for a variety of purposes, including purchasing land or buildings, construction costs, or even as working capital.

- SBA CDC/504 Loans : These loans are specifically for purchasing major fixed assets like land or buildings. If you’re looking at building a new facility, this could be a great option.

Remember, it’s crucial to have a solid business plan when applying for these loans. The lenders want to see that you’ve thought things through and have a plan for making your business profitable.

The journey of starting a self storage business might seem daunting, especially when you’re staring at these numbers. But don’t let it deter you. With the right planning, a clear understanding of your costs, and the help of financial tools, you’re one step closer to opening for business. Remember, every successful business started with someone taking that first daunting step. Are you ready to take yours?

Mastering Marketing and Customer Acquisition for Your Self Storage Business

In a world where competition is fierce and standing out is vital, setting up a winning marketing and customer acquisition strategy for your storage business is a must. From brand identity to digital marketing, let’s roll up our sleeves and dive into the nuts and bolts of getting your business noticed and attracting customers.

A strong brand identity sets your business apart from the competition. This goes beyond just your business name. It includes everything from your logo and tagline to your company’s mission and values.

- Choose a Unique Business Name : Research existing storage businesses to avoid duplication and check if the name is available for trademark. Your business name should be easy to spell, pronounce, and remember. It should also hint at the services you provide. Use tools like a business name generator for inspiration and don’t forget to check domain availability for your website.

- Design a Memorable Logo : Your logo should reflect the nature and values of your business. Consider hiring a professional graphic designer who can bring your vision to life. Tools like Canva also offer easy-to-use design templates for those on a budget. Remember, your logo will be on your website, marketing materials, and possibly even on the signboard of your storage facility, so it’s worth the investment.

- Define Your Mission and Values : This involves a deep understanding of your business, your goals, your customers, and the market you operate in. A mission statement should clearly communicate what your business does, who it serves, and how it does it. Your values should reflect the principles and beliefs that guide your company’s actions. These will help you to create a business culture and a brand that resonates with your target audience.

In 2023, your digital footprint matters more than ever. From your website to social media, make sure your self-storage company is easy to find and hard to forget.