Use Our Resources and Tools to Get Started With Your Preparation!

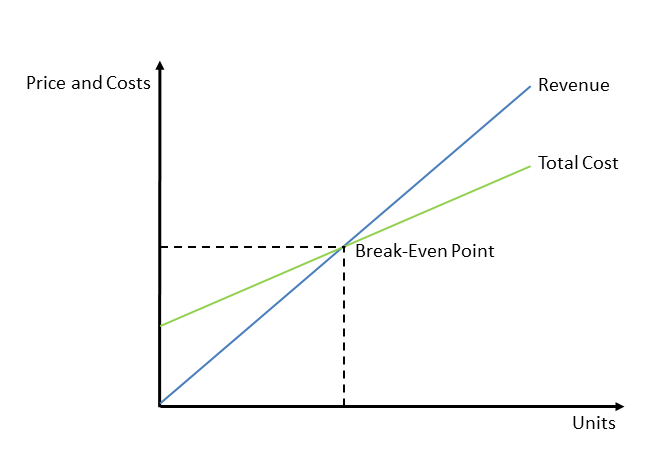

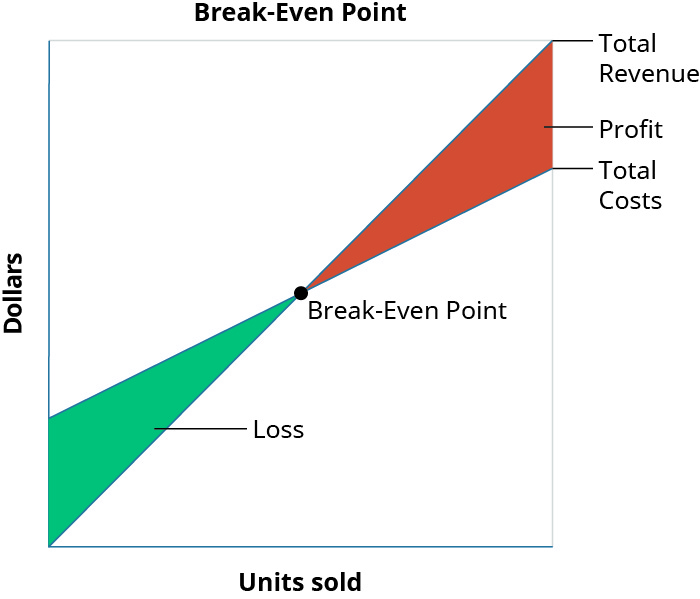

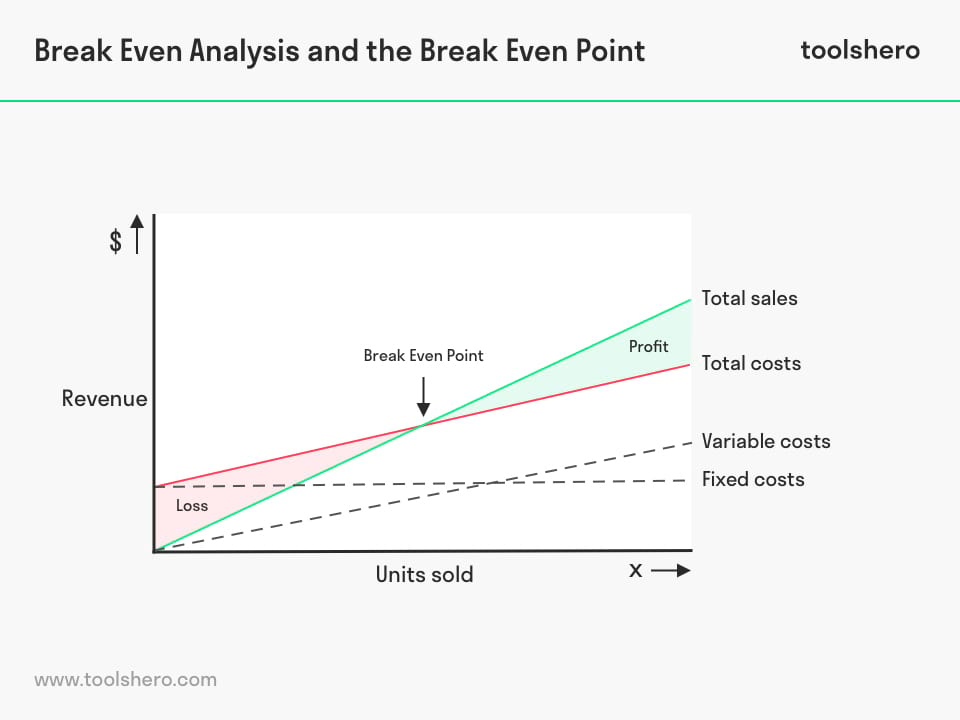

Break-even analysis, a break-even analysis helps determine the point at which total revenues equal total costs.

A break-even analysis helps to determine the number of product units that need to be sold for a business to be profitable, knowing the price and the cost of the product. It is crucial to understand the concept of fixed and variable costs to correctly calculate the break-even point during your case interview , but also in your daily work as a consultant. If the fixed costs are greater than zero, then it is important to have a positive contribution margin per unit (i.e. price>variable costs) to reach a break-even point at all.

A break-even analysis helps illustrate the relationship between profits, revenues, and costs

Because of the positive contribution margin, the slope of the revenue line is steeper than the slope of the total costs line . Therefore, revenue per unit is higher than cost per unit. If there were no fixed costs, then obviously the business would be profitable from the beginning. In the example shown above, the costs involved when zero units are sold are the fixed costs only. To cover these fixed costs, the business needs to sell a certain number of units to reach this break-even point or cover the fixed costs.

High break-even points usually suggest that a business could benefit from economies of scale

A detailed break-even analysis can provide some insight regarding the economics of a certain project or the entire industry. Imagine you come across a business that has a high break-even point, since the business needs to sell a lot of products to become profitable (e.g., Intel). This scenario is usually due to large fixed costs (so-called asset-heavy industries) which need to be covered by high product sales. In such situations, economies of scale play a major role: The more units you sell, the more you cover the fixed costs. In addition, due to the experience/learning curve, you tend to have fewer variable costs and therefore more control over prices . Also, high fixed costs are a serious entry barrier for new competitors (see Porter's Five Forces for more details).

Apply the break-even analysis in weak profitability situations

For instance, your client is operating at increasing losses even though revenues have increased. You find that the issue is increased costs because of a newly opened factory . The additional fixed costs are still higher than the gain in revenues, leading to losses.

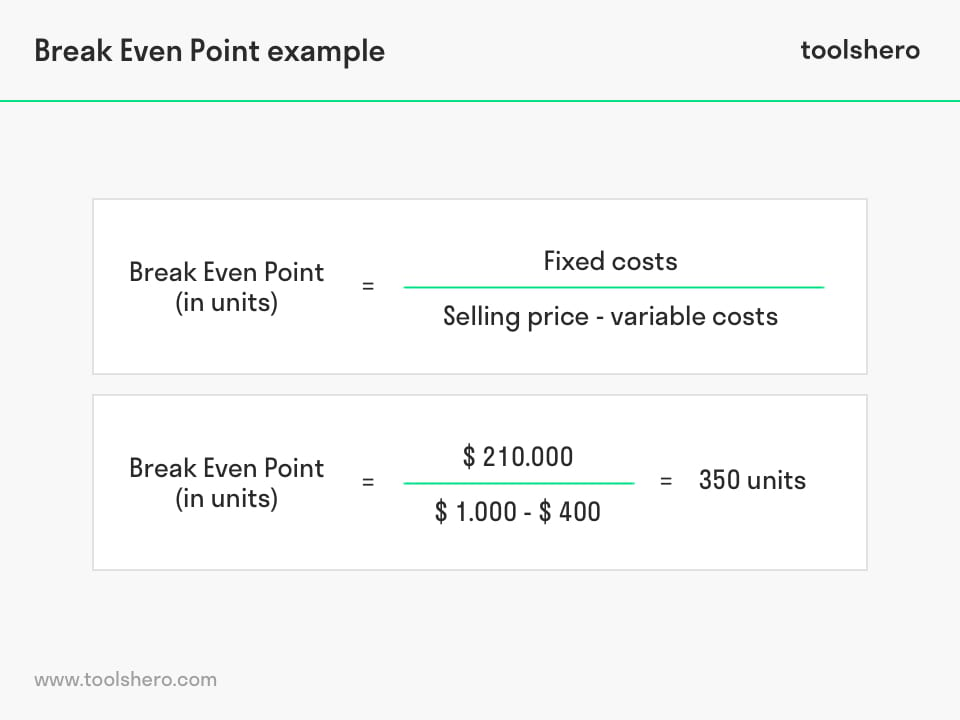

In this case, we can start by hypothesizing the need to increase revenues to fix profitability. In this scenario, it would make sense to check the break-even number of units sold before recommending increased marketing efforts. For a break-even analysis, you need to have information such as fixed costs, variable costs, and price.

Required data

- Yearly fixed costs: $50m

- Average variable cost/product: $1000

- Average price/product: $1500

Calculation

- Profit/product: $1,500 - $1,000 = $500

- $500 * x units = $50m

- x units = 100,000

As a result, the factory needs to produce and sell 100,000 units. Make sure to check its feasibility and if infeasible, your advice could be to divest the new factory .

Key takeaways

- At the break-even point, a business has no net gain/loss .

- To determine the break-even point, you will need a breakdown of the costs and revenues of the product.

Related Cases

Caribbean Island – MBB Final Round

Bain 1st Round Case – BlissOttica

Rally racing, universal tv.

Facilities in a restroom

Hacking the Case Interview

A breakeven analysis is a common quantitative calculation you’ll perform in case interviews. You may need to conduct a breakeven analysis when you are determining whether a company should enter a new market, launch a new product , or acquire a company.

A breakeven analysis helps a company to determine whether or not they should make a particular business decision. All companies have a goal of being profitable from the decisions that they make.

By looking at the circumstances that need to be true in order for a company to recoup its investment costs, a company can see how likely it is that they will be profitable.

If the conditions for breaking even are favorable, a company may decide to pursue an investment. If the conditions for breaking even are unfavorable, the company may decide to pursue something else.

In this article, we’ll cover:

- The breakeven analysis formula for case interviews

- How to interpret breakeven in case interviews

- Breakeven analysis examples in case interviews

- Breakeven analysis case interview tips

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

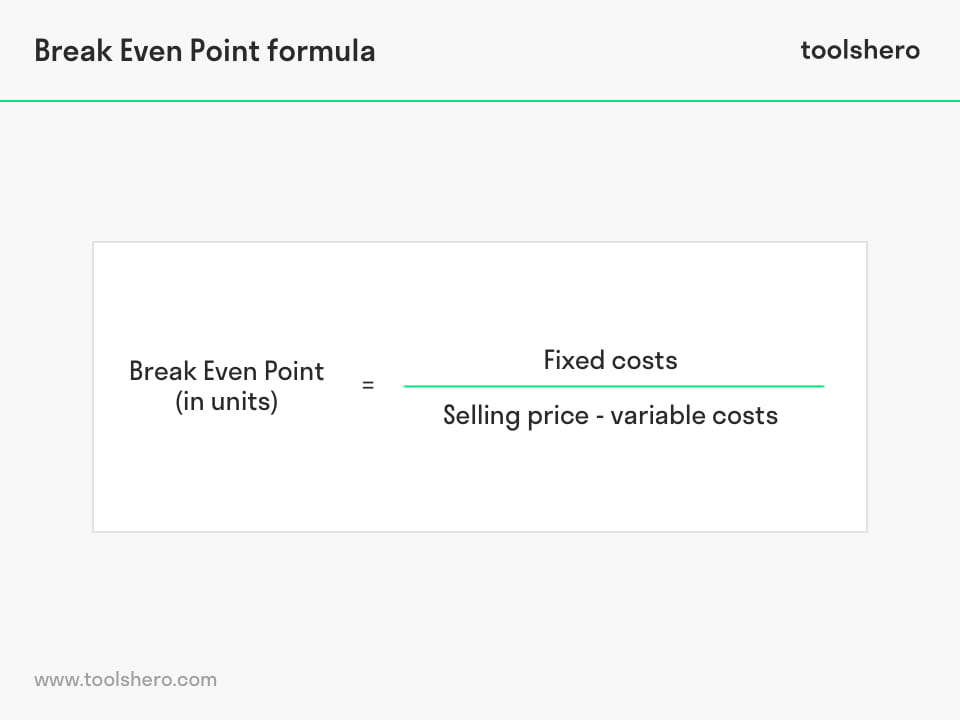

Breakeven Analysis Formula for Case Interviews

By definition, breakeven occurs when a company earns as much money as it has spent. In other words, breakeven occurs when the revenue generated from operations has grown to the point that the company has recouped all of its costs.

To get the formula for breakeven, we set profit equal to zero. This is the same thing as setting revenue equal to costs.

Profit = Revenue – Costs

$0 = Revenue - Costs

Revenue = Costs

We can further breakdown revenue as the product of price and quantity of units sold. We can also breakdown costs into variable costs and fixed costs. Remember that variable costs is equal to the quantity of units sold times the variable cost per unit.

Quantity * Price = (Quantity * Variable Cost) + Fixed Costs

We can simplify this formula to get our formula for breakeven analysis.

Fixed Costs = (Price – Variable Cost) * Quantity

This is the only formula you need to know to solve any breakeven problem in a case interview. You should memorize this formula so that you will not need to derive it from scratch during a case interview.

However, if you understand the intuitive meaning behind this formula, as explained in the next section, you won’t even need to memorize it.

How to Interpret Breakeven in Case Interviews

To understand the breakeven formula better, let’s go through each of the terms.

Fixed costs are costs that the company has to incur regardless of how many units of product are produced. Fixed costs include:

Variable costs are costs that increase as the number of units produced increases. They are costs associated with directly producing a unit of product. Variable costs include:

- Raw materials

- Direct labor

Price is the amount the product is being sold for. In other words, it is the amount of money the company receives for each unit sold.

Finally, quantity is the number of units of product that are sold.

Here is how to understand the formula intuitively in your case interviews.

For each product sold, the company makes an amount of profit equal to the difference between the product’s price and variable cost. If you multiply this by the quantity of units sold, this is the total profit the company makes.

However, the company has fixed costs that it has paid for or needs to pay for. Therefore, the profit made from selling product has to at least equal fixed costs in order for the company to actually be profitable.

If you can understand the concept of breakeven from this perspective, you should be able to immediately recall the breakeven formula in any case interview situation.

Breakeven Analysis Examples in Case Interviews

The breakeven analysis formula has four different terms. When given a breakeven analysis problem in case interview, you’ll typically know three of these terms and be asked to solve for the fourth term that is unknown.

Therefore, there are four different types of questions you could be asked.

Breakeven Analysis Example #1

You operate a lemonade stand that sells a cup of lemonade for $4. The cost to produce a cup of lemonade is $1. To legally operate a lemonade stand, you had to purchase a permit for $600. How many cups of lemonade do you need to sell to break even?

$600 = ($4 - $1) * Quantity

$600 = $3 * Quantity

Quantity = 200

You will need to sell 200 cups of lemonade.

Breakeven Analysis Example #2

Your company produces and sells widgets. Each widget costs $500 to produce. You have $100,0000 in fixed costs and expect to be able to sell 1,000 widgets. What minimum price do you need to set for your widgets to break even?

$100,000 = (Price - $500) * 1,000

$100 = Price - $500

Price = $600

You need to price your widgets for at least $600.

Breakeven Analysis Example #3

A pharmaceutical company is considering investing money to research a new drug. They believe they can sell 10,000 units of this drug for $201 each over the course of the drug’s lifetime. The cost to produce each drug is $1. How much does the company need to keep research costs under in order to generate a profit?

Fixed Costs = ($201 - $1) * 10,000

Fixed Costs = $200 * 10,000

Fixed Costs = $2,000,000

The company needs to keep fixed costs under $2,000,000.

Breakeven Analysis Example #4

Your company is a roofing tile distributor. You purchase roofing tiles from suppliers and sell them to retailers for a profit. Your annual fixed costs are $100,000. Each tile that you sell is priced at $1 and you sell ten million tiles a year. What is the maximum price per tile that you can purchase tiles for and still break even?

$100,000 = ($1 – Variable Cost) * 10,000,000

$0.01 = $1 – Variable Cost

Variable Cost = $0.99

You can purchase the tiles for $0.99 each at most.

Breakeven Analysis Case Interview Tips

During your case interview, follow these tips to ensure that your breakeven analysis proceeds smoothly.

1. Make sure to include all costs

When doing breakeven analysis, it is important that you include all of the potential costs involved in managing and operating the business. Leaving out even a single cost element will change your answer.

2. Distinguish between variable costs and fixed costs

Whether a particular cost is a variable cost or a fixed cost can drastically change your answer. Therefore, ensure that you are correctly identifying each cost as either a variable cost or fixed cost.

The simplest way to assess this is to determine whether the cost element would increase if an additional unit is produced. If it does increase, then it is likely a variable cost. If it does not increase, then it is probably a fixed cost.

3. Check that price is greater than variable costs

It is impossible for a company to break even if its variable cost per unit is greater than the price that it charges for its product. Therefore, if you observe that price is less than variable costs, know that there is no way for the company to break even.

4. Talk the interviewer through each of your steps

Whenever you are doing math during a case interview, you want to make it as easy as possible for the interviewer to follow what you are doing. So, before you begin doing any calculations, walk the interviewer through your approach.

Start by explaining the breakeven formula that you are going to be using. Then, as you perform each calculation, talk through exactly what you are doing out loud.

This is beneficial for two reasons. One, you’ll be less likely to make math mistakes if you are talking through the calculations out loud. Two, it will be easier for the interviewer to give you hints or help you out if they know exactly what you are doing.

5. State the implications of your answer

Once you finish calculating your answer, don’t just stop there. Remember, the purpose of a breakeven analysis is to help a company determine whether it should make a particular investment.

Based on the answer that you calculated, do you think the company can realistically achieve the conditions to at least break even? If so, you could hypothesize that the company should make the investment. If not, you should consider what the company could do to increase the likelihood that it will be profitable.

Stating the implications of your breakeven analysis demonstrates that you are a proactive problem solver. This is a quality that separates outstanding case interview candidates from average candidates.

Learn Case Interviews 10x Faster

Here are the resources we recommend to learn the most robust, effective case interview strategies in the least time-consuming way:

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

- Case Interview Coaching : Personalized, one-on-one coaching with former consulting interviewers

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer

- Resume Review & Editing : Transform your resume into one that will get you multiple interviews

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

A Quick Guide to Breakeven Analysis

It’s a simple calculation, but do you know how to use it?

In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You’ve probably heard of it. Maybe even used the term before, or said: “At what point do we break even?” But because you may not entirely understand the math — and because understanding the formula can only deepen your understanding of the concept — here’s a closer look at how the concept works in reality.

- Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast , and the author of two books: Getting Along: How to Work with Anyone (Even Difficult People) and the HBR Guide to Dealing with Conflict . She writes and speaks about workplace dynamics. Watch her TEDx talk on conflict and follow her on LinkedIn . amyegallo

Partner Center

Igniting Brilliance, Inspiring Success with Regenesys. Enrol Now --> Enrol Now

Get Free Consultation

By submitting this form, you agree to our Terms & Conditions.

Case Study: Understanding Break-Even Analysis

Please rate this article

2.5 / 5. 27

Join Regenesys’s 25+ Years Legacy

Awaken your potential.

- Latest Posts

- Is a Doctorate in Business Management As Good As a PhD? - November 28, 2022

- Why the Global Value chain is important for growth - July 21, 2022

- Case Study: Understanding Break-Even Analysis - July 21, 2022

Break Even Analysis allows you to evaluate if your business is making a profit or not, so is integral in not only running a business, but also in directing the future of the business.

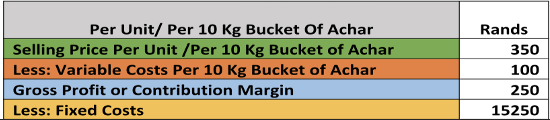

Break-Even Analysis Case Study: The Achar Company

The Achar Company is a small company started in 2020. They produce and distribute 10 kg buckets of achar. The Achar Company makes delicious affordable achar from the scratch using fresh and quality ingredient and delivering at a small fee according to orders across Gauteng.

The Selling Price per unit is R350 per 10 kg bucket of achar and the variable costs per bucket are R100, and that makes the gross profit to be R250 per bucket, but the fixed costs are R15250 per month.

In conclusion, we can see that this business is making enough profit only to cover the monthly fixed costs therefore the business is not making profit nor making a loss.

As the business owner, they can also identify other ideas in order to make profit. Such as:

- Increase the selling price per unit.

- Increase production units per month (make more Buckets of achar per months).

- Add another achar making machine,

- Rent a cheaper place

- Restructure or retrenchment

- Reduce salaries

- Review cheaper insurances etc.

Dr Dennis Mark Laxton

DBA, MBL, MBA, BTech Academic Team Leader and Senior Lecturer Regenesys Business School

Related Posts

Bbpress public forum.

Transforming Bad Financial Habits into Sustainable Behaviours

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Explore Courses

- Digital Programmes

- Digital Regenesys

- HR & Payroll

Break-Even Analysis Explained - Full Guide With Examples

Did you know that 30% of operating small businesses are losing money? Running your own business is trickier than it sounds. You have to plan ahead carefully to break-even or be profitable in the long run.

Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point .

Performing break-even analysis is a crucial activity for making important business decisions and to be profitable in business.

So how do you do it? That is what we will go through in this article. Some of the key takeaways for you when you finish this guide would be:

- Understand what break-even point is

- Know why it is important

- Learn how to calculate break-even point

- Know how to do break-even analysis

- Understand the limitations of break-even analysis

So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on.

What is Break-Even Point?

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable .

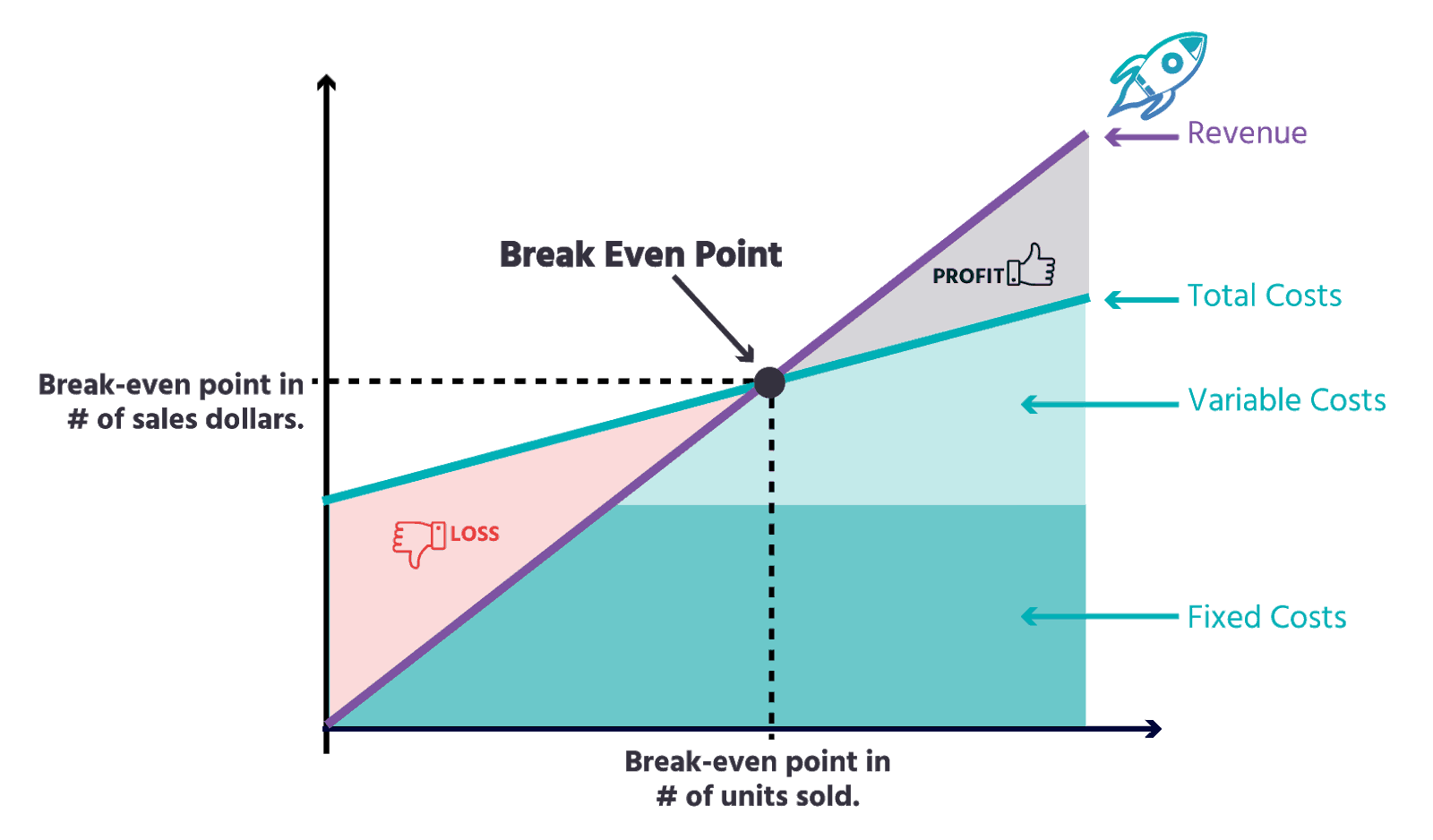

In a small business, a break-even point is a point at which total revenue equals total costs or expenses. At this point, there is no profit or loss — in other words, you 'break-even'.

Break-even as a term is used widely, from stock and options trading to corporate budgeting as a margin of safety measure.

On the other hand, break-even analysis lets you predict, or forecast your break-even point. This allows you to course your chart towards profitability.

Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations.

The total profit at the break-even point is zero. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit.

Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs.

Importance of Break-Even Analysis for Your Small Business

A business could be bringing in a lot of money; however, it could still be making a loss. Knowing the break-even point helps decide prices, set sales targets, and prepare a business plan.

The break-even point calculation is an essential tool to analyze critical profit drivers of your business, including sales volume, average production costs, and, as mentioned earlier, the average sales price. Using and understanding the break-even point, you can measure

- how profitable is your present product line

- how far sales drop before you start to make a loss

- how many units you need to sell before you make a profit

- how decreasing or increasing price and volume of product will affect profits

- how much of an increase in price or volume of sales you will need to meet the rise in fixed cost

How to Calculate Break-Even Point

There are multiple ways to calculate your break-even point.

Calculate Break-even Point based on Units

One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit.

For this method, simply use the formula below:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Fixed costs are those that do not change no matter how many units are sold. Don't worry, we will explain with examples below. Revenue is the income, or dollars made by selling one unit.

Variable costs include cost of goods sold, or the acquisition cost. This may include the purchase cost and other additional costs like labor and freight costs.

Calculate Break-Even Point by Sales Dollar - Contribution Margin Method

Divide the fixed costs by the contribution margin. The contribution margin is determined by subtracting the variable costs from the price of a product. This amount is then used to cover the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Let’s take a deeper look at the some common terms we have encountered so far:

- Fixed costs: Fixed costs are not affected by the number of items sold, such as rent paid for storefronts or production facilities, office furniture, computer units, and software. Fixed costs also include payment for services like design, marketing, public relations, and advertising.

- Contribution margin: Is calculated by subtracting the unit variable costs from its selling price. So if you’re selling a unit for $100 and the cost of materials is $30, then the contribution margin is $70. This $70 is then used to cover the fixed costs, and if there is any money left after that, it’s your net profit.

- Contribution margin ratio: is calculated by dividing your fixed costs from your contribution margin. It is expressed as a percentage. Using the contribution margin, you can determine what you need to do to break-even, like cutting fixed costs or raising your prices.

- Profit earned following your break-even: When your sales equal your fixed and variable costs, you have reached the break-even point. At this point, the company will report a net profit or loss of $0. The sales beyond this point contribute to your net profit.

Small Business Example for Calculating Break-even Point

To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress.

These costs might cover the software and materials needed to design the dress and be sure it meets the requirement of the brand, the fee paid to a designer to design the look and feel of the dress, and the development of promotional materials used to advertise the dress.

These costs are fixed as they do not change per the number of dresses sold.

The variable costs would include the materials used to make each dress — embellishment’s for $30, the fabric for the body for $20, inner lining for $10 — and the labor required to assemble the dress, which amounted to one and a half hours for a worker earning $50 per hour.

Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). If she sells the dress for $150, she’ll make a unit margin of $40.

Given the $40 unit margin she’ll receive for each dress sold, she will cover her $45,500 total fixed cost will be covered if she sells:

Break-Even Point (Units) = $45,000 ÷ $40 = 1,125 Units

You can see per the formula , on the right-hand side, that the Break-even is 1,125 dresses or units

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. If she sells fewer than 1,125 units, she will lose money. And if she sells more than 1,125 units, she will turn a profit. That’s the break-even point.

What if we change the price?

Suppose our dressmaker is worried about the current demand for dresses and has concerns about her firm’s sales and marketing capabilities, calling into question her ability to sell 1,125 units at a price of $150. What would be the effect of increasing the price to $200?

This would increase the unit margin to $90.Then the number of units to be sold would decline to 500 units. With this information, the dressmaker could assess whether she was better off trying to sell 1,125 dresses at $150 or 500 dresses at $200, and priced accordingly.

What if we want to make an investment and increase the fixed costs?

Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments. For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000.

This would be worthwhile if the dressmaker believed that the endorsement would result in total sales of $66,000 (the original fixed cost plus the $20,000 for Ms. Madonna).

With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units.

In other words, if the endorsement led to incremental sales of 525 dress units, the endorsement would break-even. If it led to incremental sales of greater than 525 dresses, it would increase profits.

What if we change the variable cost of producing a good?

Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good.

Imagine that our dressmaker could switch from using a rather plain $20 fabric for the dress to a higher-end $40 fabric, thereby increasing the variable cost of the dress from $110 to $130 and decreasing the unit margin from $40 to $20. How much would your sales need to increase to compensate for the extra cost?

Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers.

You likely aren’t a dressmaker or able to get a celebrity endorsement from Ms. Madonna, but you can use break-even analysis to understand how the various changes of your product, from revenue, costs, sales, impact your small business’s profitability .

What Are the Benefits of Doing a Break-even Analysis?

Smart Pricing : Finding your break-even point will help you price your products better. A lot of effort and understanding goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover Fixed Costs : When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You will still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Avoid Missing Expenses : When you do a break-even analysis, you have to lay out all your financial commitments to figure out your break-even point. It’s easy to forget about expenses when you’re thinking through a business idea. This will limit the number of surprises down the road.

Setting Revenue Targets : After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set better sales goals for you and your team.

Decision Making : Usually, business decisions are based on emotion. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Manage Financial Strain : Doing a break-even analysis will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes by being aware of the risks and knowing when to avoid a business idea.

Business Funding : For any funding or investment, a break-even analysis is a key component of any business plan. You have to prove your plan is viable. It’s usually a requirement if you want to take on investors or other debt to fund your business.

When to Use Break-even Analysis

Starting a new business.

If you’re thinking about a small online business or e-commerce, a break-even analysis is a must. Not only does it help you decide if your business idea is viable, but it makes you research and be realistic about costs, as well as think through your pricing strategy.

Creating a new product

Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling.

Adding a new sales channel

If you add a new sales channel, your costs will change. Let's say you have been selling online, and you’re thinking about opening an offline store; you’ll want to make sure you at least break-even with the brick and mortar costs added in. Adding additional marketing channels or expanding social media spends usually increases daily expenses. These costs need to be part of your break-even analysis.

Changing the business model

Let's say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis. Your costs might vary significantly, and this will help you figure out if your prices need to change too.

Limitations of Break-even Analysis

- The Break-even analysis focuses mostly on the supply-side (i.e., costs only) analysis. It doesn't tell us what sales are actually likely to be for the product at various prices.

- It assumes that fixed costs are constant. However, an increase in the scale of production is likely to lead to an increase in fixed costs.

- It assumes average variable costs are constant per unit of output, per the range of the number of sales

- It assumes that the number of goods produced is equal to the number of goods sold. It believes that there is no change in the number of goods held in inventory at the beginning of the period and the number of goods held in inventory at the end of the period

- In multi-product companies, the relative proportions of each product sold and produced are fixed or constant.

So that's a wrap. Hope you found this article interesting and informative. Feel free to subscribe to our blog to get updates on awesome new content we publish for small business owners.

Key Takeaways

Break-even analysis is infinitely valuable as it sets the framework for pricing structures, operations, hiring employees, and obtaining future financial support.

- You can identify how much, or how many, you have to sell to be profitable.

- Identify costs inside your business that should be alleviated or eliminated.

Remember, any break-even analysis is only as strong as its underlying assumptions.

Like many forecasting metrics, break-even point is subject to it's limitations; however it can be a powerful and simple tool to provide a small business owner with an idea of what their sales need to be in order to start being profitable as quickly as possible.

Lastly, please understand that break-even analysis is not a predictor of demand .

If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point. To avoid this, make sure you have done the groundwork before setting up your business.

Head over to our small business guide on setting up a new business if you want to know more.

Want to calculate break even point quickly? Use our handy break-even point calculator.

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

How it works

For Business

Join Mind Tools

Article • 6 min read

Break-Even Analysis

Determining when a product becomes profitable.

By the Mind Tools Content Team

In business, your ultimate objective is to make money.

So, when you launch a new product or purchase a new piece of equipment, how do you know whether a potential investment will at least cover the costs associated with it?

You could simply make a wish and hope it all works out – or you can evaluate the project more formally to see if it makes financial sense. One way of doing this is to complete a Break-Even Analysis.

This determines the break-even point – the level of output at which the revenues generated by a project equal costs. At the break-even point, you don't make or lose money. Once you pass break-even, you make money; below break-even, you lose it.

Using a Break-Even Analysis, you can answer questions like:

- What are the projected profits and losses at any given output level?

- At what minimum sales level do you avoid making a loss?

- Do your sales projections for a new product exceed break-even?

- If you drop a product, will your break-even improve?

- How will raising or lowering prices affect your profitability?

- If costs increase, what is the effect on your break-even position?

- How does investing in facility improvements affect your break-even point?

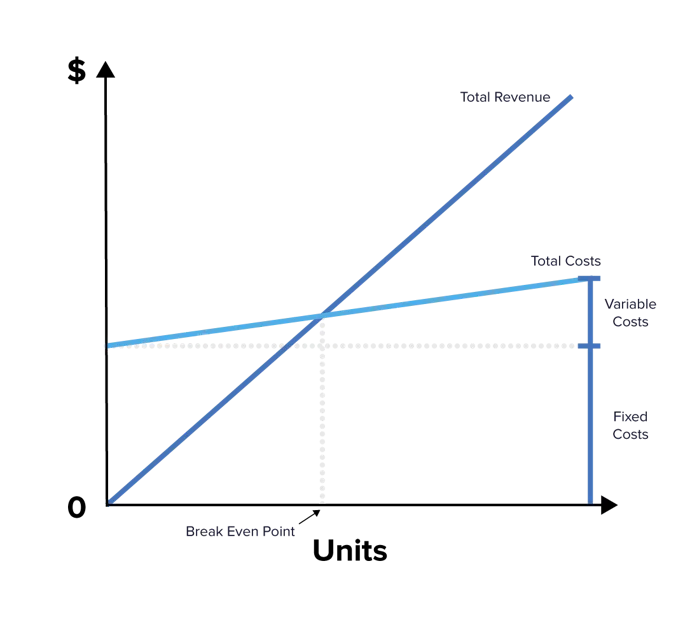

Calculating the Break-Even Point

Determining the break-even point involves a simple mathematical equation. You reach break-even at the point where total costs (TC) equal total revenues (TR), or

Total costs have fixed and variable components:

- Fixed costs (FC) remain the same, regardless of your output. Rent, insurance, and base salaries are examples of fixed costs.

- Variable costs (VC) change with the number of units produced or sold. Examples are materials, sales commissions, and direct labor costs. Therefore, total variable costs (TVC) equal the variable costs multiplied by the number of units, or TVC = n x VC, where n is the number of units.

- Total costs equal total fixed costs plus total variable costs: TC = FC + (n x VC).

You can see how these costs vary with the number of units sold in figure 1, below:

Total revenue is the price charged per unit multiplied by the number of units produced or sold: TR = n x P, where P equals the unit price.

Again, you can see the line for Total Revenue in figure 1, with break-even occurring where the TR line crosses the TC line.

You can calculate the break-even point by expanding the break-even equation:

TC = TR FC + (n x VC) = n x P

Solving for n gives you the number of units you need to break even:

n = FC/(P – VC)

If you have a specific profit target, you can use the break-even equation to calculate the number of units you must sell to achieve that target:

n x P = FC + (n x VC) + Profit n = (FC + Profit)/(P – VC)

A Break-Even Example

Let's imagine that you're considering launching a new product. Market research has shown that customers will pay $115 for it, and your sales team is confident that they can sell at least 500 units per month. The equipment you'll need to produce the product costs $900,000 and this will be spread over three years, giving you a fixed cost of $25,000 per month. You need to decide if the product is financially viable.

To calculate the break-even point, use this equation:

n = FC/(P – VC) n = 25,000/(115 – 50) n = 384.6

The break-even point is 385 units per month. This is below the minimum sales volume that the sales team thinks they can achieve, so the product has a good chance of making money.

Break-Even Analysis can also be useful in thinking about pricing. For example, how much would the break-even point increase if you reduced the price to $105? This should increase the sales volume, but would that compensate enough for the lower price? Using the break-even point, you can manipulate a variety of costs and revenue variables to understand the effects of various scenarios.

Limitations of Break-Even Analysis

A Break-Even Analysis is best used as a preliminary planning tool. In our example, there are many other issues to consider. What is the opportunity cost of spending $900,000 on the equipment as a capital expense, as opposed to investing the money in something else? Would another product give a better Return on Investment (RoI)?

Break-Even Analysis is also very restrictive in what it includes in the equation. Cost and revenue calculations can be much more complex than those considered in a Break-Even Analysis. Material costs and other costs can change dramatically, and it's not always clear which fixed costs should be included. For example, what portion of executive salaries should you use? Break-Even Analysis also doesn't consider cash flow or how the proposed project might affect economies of scale , nor does it take into account the value of money as it varies with time.

For these reasons and many others, Break-Even Analysis is most often used in the early stages of thinking about a decision. From there, you can decide whether further analysis is needed.

Break-even is the point at which the costs associated with production equal the revenue generated.

To use Break-Even Analysis effectively, you should have a reasonable understanding of the costs involved in your operations.

When it's used as a general decision-making tool, Break-Even Analysis can highlight projects that have a good chance of contributing to profits and those that don't. It's not the tool to use for your final decision, but it can be useful for the early planning stages.

You've accessed 1 of your 2 free resources.

Get unlimited access

Discover more content

Data security in your team.

Protecting Your Electronic and Online Assets

Developing Emotional Intelligence

Enhancing Your EQ

Add comment

Comments (0)

Be the first to comment!

Team Management

Learn the key aspects of managing a team, from building and developing your team, to working with different types of teams, and troubleshooting common problems.

Sign-up to our newsletter

Subscribing to the Mind Tools newsletter will keep you up-to-date with our latest updates and newest resources.

Subscribe now

Business Skills

Personal Development

Leadership and Management

Member Extras

Most Popular

Newest Releases

SWOT Analysis

SMART Goals

Mind Tools Store

About Mind Tools Content

Discover something new today

How to stop procrastinating.

Overcoming the Habit of Delaying Important Tasks

What Is Time Management?

Working Smarter to Enhance Productivity

How Emotionally Intelligent Are You?

Boosting Your People Skills

Self-Assessment

What's Your Leadership Style?

Learn About the Strengths and Weaknesses of the Way You Like to Lead

Recommended for you

Abcd learning objectives model.

Outlining Learning Essentials

Business Operations and Process Management

Strategy Tools

Customer Service

Business Ethics and Values

Handling Information and Data

Project Management

Knowledge Management

Self-Development and Goal Setting

Time Management

Presentation Skills

Learning Skills

Career Skills

Communication Skills

Negotiation, Persuasion and Influence

Working With Others

Difficult Conversations

Creativity Tools

Self-Management

Work-Life Balance

Stress Management and Wellbeing

Coaching and Mentoring

Change Management

Managing Conflict

Delegation and Empowerment

Performance Management

Leadership Skills

Developing Your Team

Talent Management

Problem Solving

Decision Making

Member Podcast

- Search Search Please fill out this field.

What Is Break-Even Analysis?

Break-even point formula.

- Calculating BEP and Contribution Margin

Who Calculates the BEP?

Why break-even analysis matters, the bottom line.

- Investing Basics

Break-Even Analysis: Formula and Calculation

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

Break-even analysis compares income from sales to the fixed costs of doing business. Five components of break-even analysis include fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs to begin generating a profit. The break-even point formula can help find the BEP in units or sales dollars.

Key Takeaways:

- Using the break-even point formula, businesses can determine how many units or dollars of sales cover the fixed and variable production costs.

- The break-even point (BEP) is considered a measure of the margin of safety.

- Break-even analysis is used broadly, from stock and options trading to corporate budgeting for various projects.

Investopedia / Paige McLaughlin

Break-even analysis involves a calculation of the break-even point (BEP) . The break-even point formula divides the total fixed production costs by the price per individual unit, less the variable cost per unit.

BEP = Fixed Costs / (Price Per Unit - Variable Cost Per Unit)

Break-even analysis looks at the fixed costs relative to the profit earned by each additional unit produced and sold. A firm with lower fixed costs will have a lower break-even point of sale and $0 of fixed costs will automatically have broken even with the sale of the first product, assuming variable costs do not exceed sales revenue. Fixed costs remain the same regardless of how many units are sold. Examples of fixed and variable costs include:

Calculating the Break-Even Point and Contribution Margin

Break-even analysis and the BEP formula can provide firms with a product's contribution margin. The contribution margin is the difference between the selling price of the product and its variable costs. For example, if an item sells for $100, with fixed costs of $25 per unit, and variable costs of $60 per unit, the contribution margin is $40 ($100 - $60). This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin.

Contribution Margin = Item Price - Variable Cost Per Unit

To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Assume total fixed costs are $20,000. With a contribution margin of $40 above, the break-even point is 500 units ($20,000 divided by $40). Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0.

BEP (Units) = Total Fixed Costs / Contribution Margin

To calculate the break-even point in sales dollars, divide the total fixed costs by the contribution margin ratio. The contribution margin ratio is the contribution margin per unit divided by the sale price.

Contribution Margin Ratio = Contribution Margin Per Unit / Item Price

BEP (Sales Dollars) = Total Fixed Costs / Contribution Margin Ratio

The contribution margin ratio is 40% ($40 contribution margin per item divided by $100 sale price per item). The break-even point in sales dollars is $50,000 ($20,000 total fixed costs divided by 40%).

In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable.

- Entrepreneurs

- Financial Analysts

- Stock and Option Traders

- Government Agencies

Although investors are not interested in an individual company's break-even analysis on their production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.

- Pricing : Businesses get a comprehensible perspective on their cost structure with a break-even analysis, setting prices for their products that cover their fixed and variable costs and provide a reasonable profit margin.

- Decision-Making : When it comes to new products and services, operational expansion, or increased production, businesses can chart their profit to sales volume and use break-even analysis to help them make informed decisions surrounding those activities.

- Cost Reduction : Break-even analysis helps businesses find areas to reduce costs to increase profitability.

- Performance Metric: Break-even analysis is a financial performance tool that helps businesses ascertain where they are in achieving their goals.

What Are Some Limitations of Break-Even Analysis?

Break-even analysis assumes that the fixed and variable costs remain constant over time. Costs may change due to factors such as inflation, changes in technology, or changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

What Are the Components of Break-Even Analysis?

There are five components of break-even analysis including fixed costs, variable costs, revenue, contribution margin, and the break-even point (BEP).

Why Is the Contribution Margin Important in Break-Even Analysis?

The contribution margin represents the revenue required to cover a business' fixed costs and contribute to its profit. Through the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

How Do Businesses Use the Break-Even Point in Break-Even Analysis?

The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even to measure its repayment of debt or how long that repayment will take to complete.

Break-even analysis is a tool used by businesses and stock and option traders. Break-even analysis is essential in determining the minimum sales volume required to cover total costs and break even. It helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps find the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

U.S. Small Business Administration. " Break-Even Point ."

Professor Rosemary Nurre, College of San Mateo. " Accounting 131: Chapter 6, Cost-Volume-Profit Relationships ."

:max_bytes(150000):strip_icc():format(webp)/BreakevenPoint-b6ed6dc69b2742358a937e280a3fc103.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

7.2 Breakeven Analysis

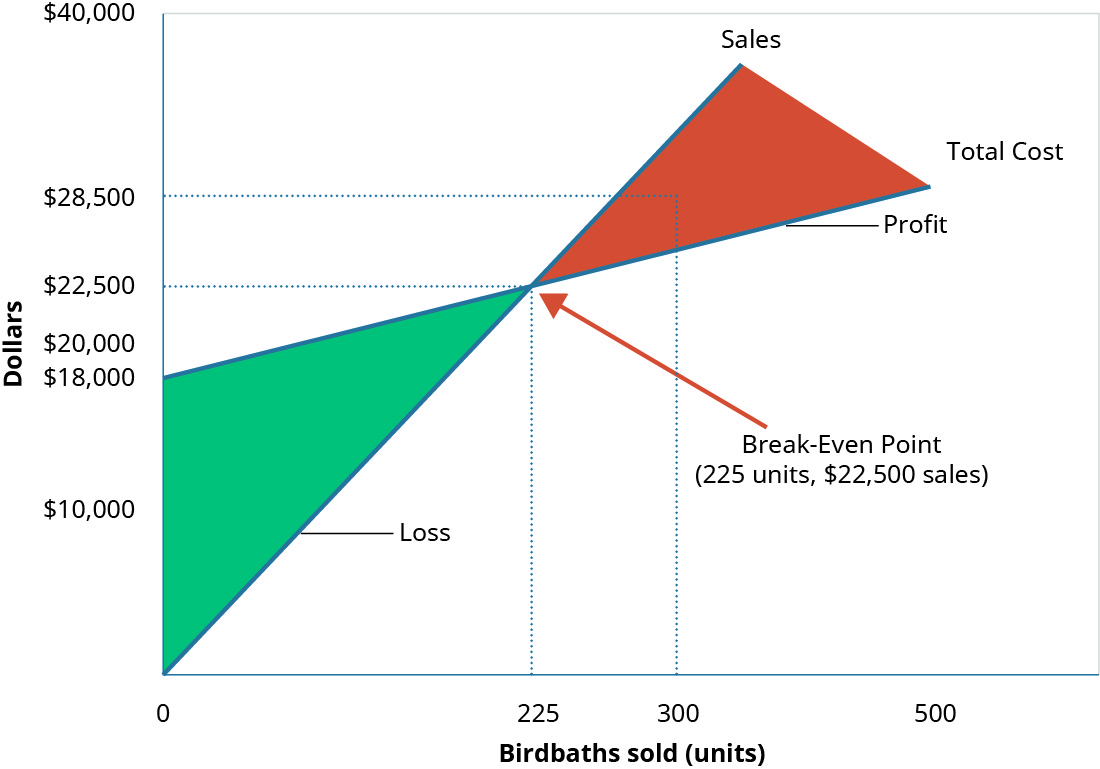

The break-even point is the dollar amount (total sales dollars) or production level (total units produced) at which the company has recovered all variable and fixed costs. In other words, no profit or loss occurs at break-even because Total Cost = Total Revenue. Figure 7.15 illustrates the components of the break-even point:

The basic theory illustrated in Figure 7.15 is that, because of the existence of fixed costs in most production processes, in the first stages of production and subsequent sale of the products, the company will realize a loss. For example, assume that in an extreme case the company has fixed costs of $20,000, a sales price of $400 per unit and variable costs of $250 per unit, and it sells no units. It would realize a loss of $20,000 (the fixed costs) since it recognized no revenue or variable costs. This loss explains why the company’s cost graph recognized costs (in this example, $20,000) even though there were no sales. If it subsequently sells units, the loss would be reduced by $150 (the contribution margin) for each unit sold. This relationship will be continued until we reach the break-even point, where total revenue equals total costs. Once we reach the break-even point for each unit sold the company will realize an increase in profits of $150.

For each additional unit sold, the loss typically is lessened until it reaches the break-even point. At this stage, the company is theoretically realizing neither a profit nor a loss. After the next sale beyond the break-even point, the company will begin to make a profit, and the profit will continue to increase as more units are sold. While there are exceptions and complications that could be incorporated, these are the general guidelines for break-even analysis.

As you can imagine, the concept of the break-even point applies to every business endeavor—manufacturing, retail, and service. Because of its universal applicability, it is a critical concept to managers, business owners, and accountants. When a company first starts out, it is important for the owners to know when their sales will be sufficient to cover all of their fixed costs and begin to generate a profit for the business. Larger companies may look at the break-even point when investing in new machinery, plants, or equipment in order to predict how long it will take for their sales volume to cover new or additional fixed costs. Since the break-even point represents that point where the company is neither losing nor making money, managers need to make decisions that will help the company reach and exceed this point as quickly as possible. No business can operate for very long below break-even. Eventually the company will suffer losses so great that they are forced to close their doors.

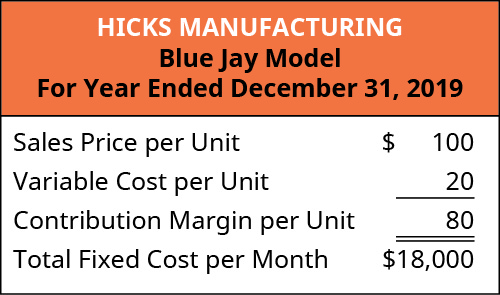

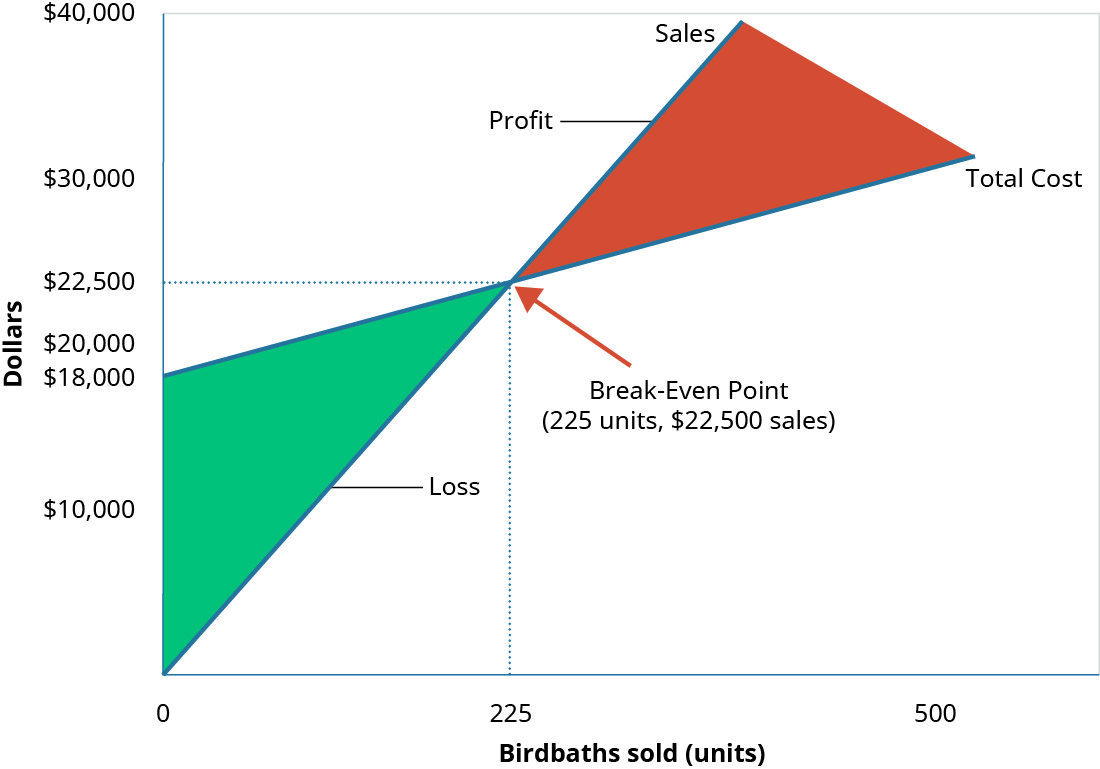

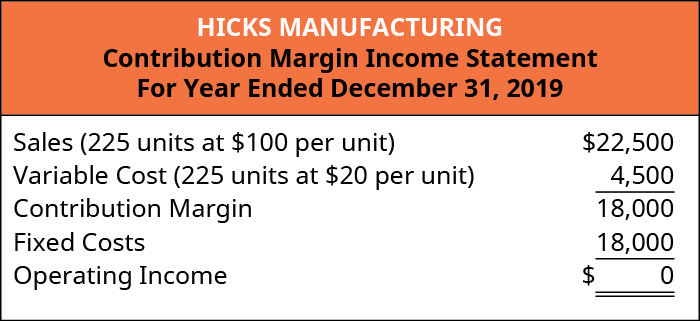

To illustrate the concept of break-even, we will return to Hicks Manufacturing and look at the Blue Jay birdbath they manufacture and sell.

Sales Where Operating Income Is $0

Hicks Manufacturing is interested in finding out the point at which they break even selling their Blue Jay Model birdbath. They will break even when the operating income is $0. The operating income is determined by subtracting the total variable and fixed costs from the sales revenue generated by an enterprise. In other words, the managers at Hicks want to know how many Blue Jay birdbaths they will need to sell in order to cover their fixed expenses and break even. Information on this product is:

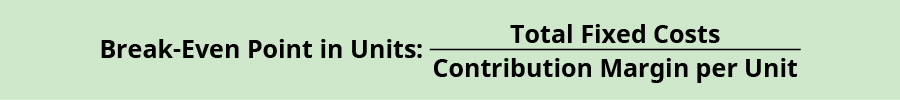

In order to find their break-even point, we will use the contribution margin for the Blue Jay and determine how many contribution margins we need in order to cover the fixed expenses, as shown in the formula in Figure 7.17 .

Applying this to Hicks calculates as:

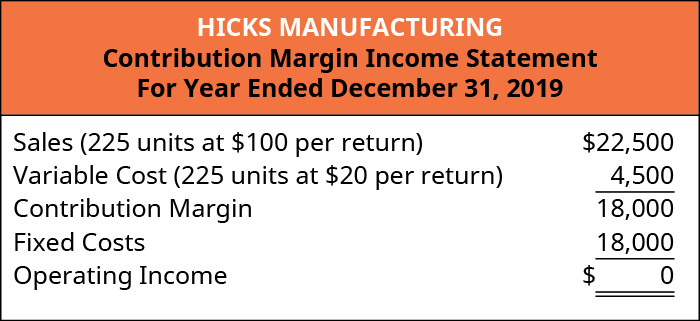

What this tells us is that Hicks must sell 225 Blue Jay Model birdbaths in order to cover their fixed expenses. In other words, they will not begin to show a profit until they sell the 226 th unit. This is illustrated in their contribution margin income statement.

The break-even point for Hicks Manufacturing at a sales volume of $22,500 (225 units) is shown graphically in Figure 7.19 .

As you can see, when Hicks sells 225 Blue Jay Model birdbaths, they will make no profit, but will not suffer a loss because all of their fixed expenses are covered. However, what happens when they do not sell 225 units? If that happens, their operating income is negative.

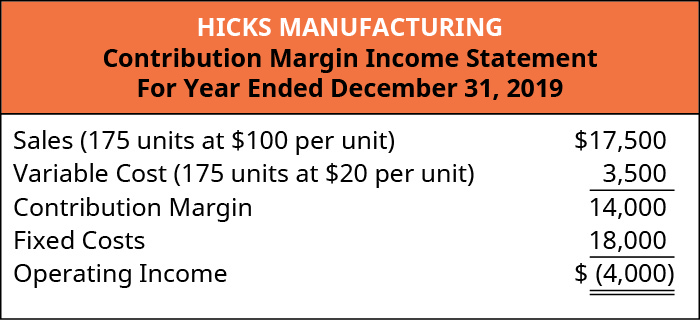

Sales Where Operating Income Is Negative

In a recent month, local flooding caused Hicks to close for several days, reducing the number of units they could ship and sell from 225 units to 175 units. The information in Figure 7.20 reflects this drop in sales.

At 175 units ($17,500 in sales), Hicks does not generate enough sales revenue to cover their fixed expenses and they suffer a loss of $4,000. They did not reach the break-even point of 225 units.

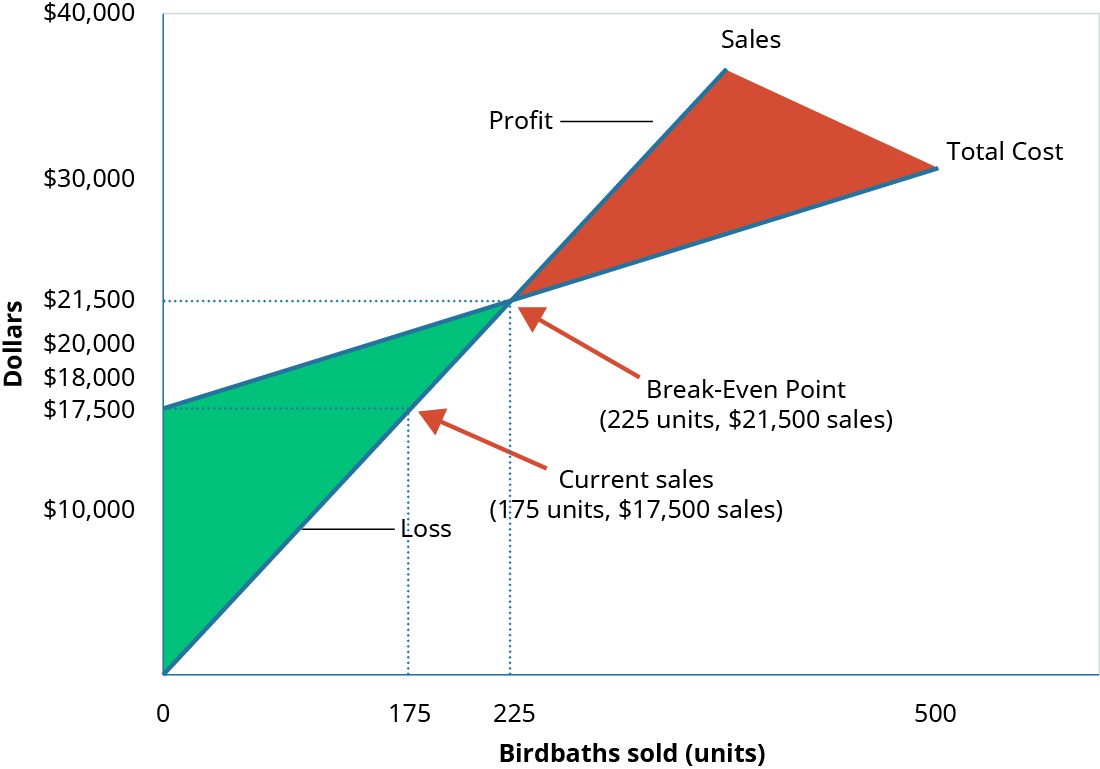

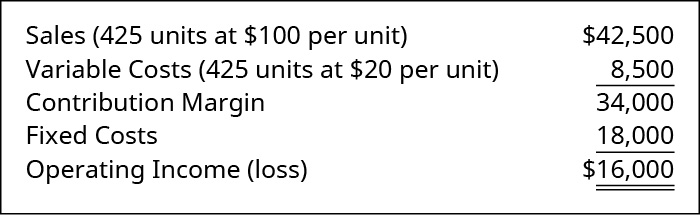

Sales Where Operating Income Is Positive

What happens when Hicks has a busy month and sells 300 Blue Jay birdbaths? We have already established that the contribution margin from 225 units will put them at break-even. When sales exceed the break-even point the unit contribution margin from the additional units will go toward profit. This is reflected on their income statement.

Again, looking at the graph for break-even ( Figure 7.23 ), you will see that their sales have moved them beyond the point where total revenue is equal to total cost and into the profit area of the graph.

Hicks Manufacturing can use the information from these different scenarios to inform many of their decisions about operations, such as sales goals.

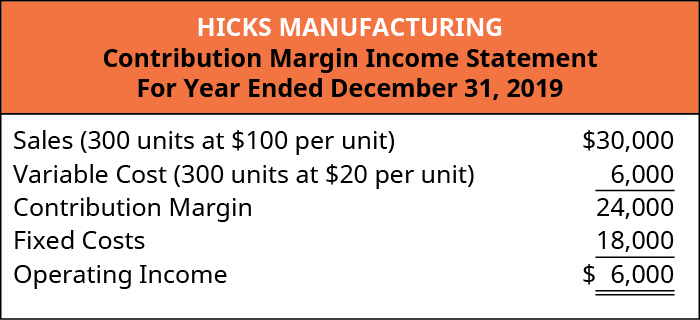

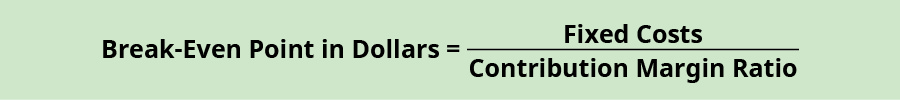

However, using the contribution margin per unit is not the only way to determine a break-even point. Recall that we were able to determine a contribution margin expressed in dollars by finding the contribution margin ratio. We can apply that contribution margin ratio to the break-even analysis to determine the break-even point in dollars. For example, we know that Hicks had $18,000 in fixed costs and a contribution margin ratio of 80% for the Blue Jay model. We will use this ratio ( Figure 7.24 ) to calculate the break-even point in dollars.

Applying the formula to Hicks gives this calculation:

Hicks Manufacturing will have to generate $22,500 in monthly sales in order to cover all of their fixed costs. In order for us to verify that Hicks’ break-even point is $22,500 (or 225 units) we will look again at the contribution margin income statement at break-even:

By knowing at what level sales are sufficient to cover fixed expenses is critical, but companies want to be able to make a profit and can use this break-even analysis to help them.

Examples of the Effects of Variable and Fixed Costs in Determining the Break-Even Point

Companies typically do not want to simply break even, as they are in business to make a profit. Break-even analysis also can help companies determine the level of sales (in dollars or in units) that is needed to make a desired profit. The process for factoring a desired level of profit into a break-even analysis is to add the desired level of profit to the fixed costs and then calculate a new break-even point. We know that Hicks Manufacturing breaks even at 225 Blue Jay birdbaths, but what if they have a target profit for the month of July? They can simply add that target to their fixed costs. By calculating a target profit, they will produce and (hopefully) sell enough bird baths to cover both fixed costs and the target profit.

If Hicks wants to earn $16,000 in profit in the month of May, we can calculate their new break-even point as follows:

We have already established that the $18,000 in fixed costs is covered at the 225 units mark, so an additional 200 units will cover the desired profit (200 units × $80 per unit contribution margin = $16,000). Alternatively, we can calculate this in terms of dollars by using the contribution margin ratio.

As done previously, we can confirm this calculation using the contribution margin income statement:

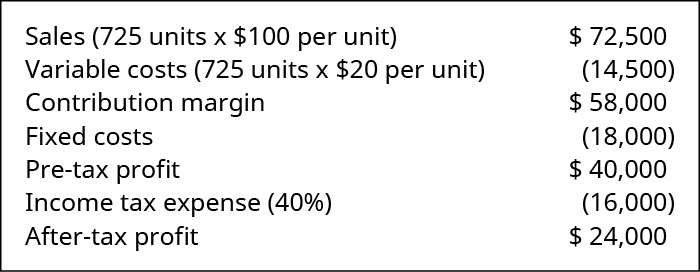

Note that the example calculations ignored income taxes, which implies we were finding target operating income. However, companies may want to determine what level of sales would generate a desired after-tax profit. To find the break-even point at a desired after-tax profit, we simply need to convert the desired after-tax profit to the desired pre-tax profit, also referred to as operating income, and then follow through as in the example. Suppose Hicks wants to earn $24,000 after-taxes, what level of sales (units and dollars) would be needed to meet that goal? First, the after-tax profit needs to be converted to a pre-tax desired profit:

If the tax rate for Hicks is 40%, then the $24,000 after-tax profit is equal to a pre-tax profit of $40,000:

The tax rate indicates the amount of tax expense that will result from any profits and 1 – tax rate indicates the amount remaining after taking out tax expense. The concept is similar to buying an item on sale. If an item costs $80 and is on sale for 40% off, then the amount being paid for the item is 60% of the sale price, or $48 ($80 × 60%). Another way to find this involves two steps. First find the discount ($80 × 40% = $32) and then subtract the discount from the sales price ($80 – $32 = $48).

Taxes and profit work in a similar fashion. If we know the profit before tax is $100,000 and the tax rate is 30%, then tax expenses are $100,000 × 30% = $30,000. This means the after-tax income is $100,000 – $30,000 = $70,000. However, in most break-even situations, as well as other decision-making areas, the desired after-tax profit is known, and the pre-tax profit must be determined by dividing the after-tax profit by 1 – tax rate.

To demonstrate the combination of both a profit and the after-tax effects and subsequent calculations, let’s return to the Hicks Manufacturing example. Let’s assume that we want to calculate the target volume in units and revenue that Hicks must sell to generate an after-tax return of $24,000, assuming the same fixed costs of $18,000.

Since we earlier determined $24,000 after-tax equals $40,000 before-tax if the tax rate is 40%, we simply use the break-even at a desired profit formula to determine the target sales.

This calculation demonstrates that Hicks would need to sell 725 units at $100 a unit to generate $72,500 in sales to earn $24,000 in after-tax profits.

Alternatively, target sales in sales dollars could have been calculated using the contribution margin ratio:

Once again, the contribution margin income statement proves the sales and profit relationships.

Thus, to calculate break-even point at a particular after-tax income, the only additional step is to convert after-tax income to pre-tax income prior to utilizing the break-even formula. It is good to understand the impact of taxes on break-even analysis as companies will often want to plan based on the after-tax effects of a decision as the after-tax portion of income is the only part of income that will be available for future use.

Application of Break-Even Concepts for a Service Organization

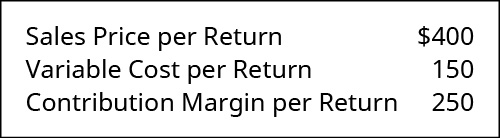

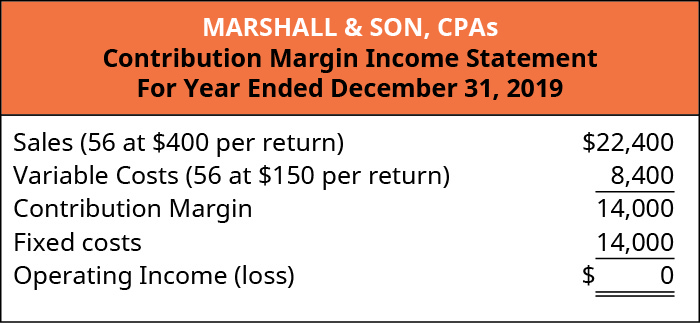

Because break-even analysis is applicable to any business enterprise, we can apply these same principles to a service organization. For example, Marshall & Hirito is a mid-sized accounting firm that provides a wide range of accounting services to its clients but relies heavily on personal income tax preparation for much of its revenue. They have analyzed the cost to the firm associated with preparing these returns. They have determined the following cost structure for the preparation of a standard 1040A Individual Income Tax Return:

They have fixed costs of $14,000 per month associated with the salaries of the accountants who are responsible for preparing the Form 1040A . In order to determine their break-even point, they first determine the contribution margin for the Form 1040A as shown:

Now they can calculate their break-even point:

Remember, this is the break-even point in units (the number of tax returns) but they can also find a break-even point expressed in dollars by using the contribution margin ratio. First, they find the contribution margin ratio. Then, they use the ratio to calculate the break-even point in dollars:

We can confirm these figures by preparing a contribution margin income statement:

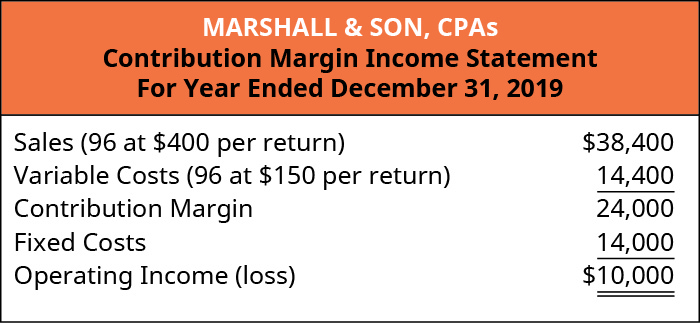

Therefore, as long as Marshall & Hirito prepares 56 Form 1040 income tax returns, they will earn no profit but also incur no loss. What if Marshall & Hirito has a target monthly profit of $10,000? They can use the break-even analysis process to determine how many returns they will need to prepare in order to cover their fixed expenses and reach their target profit:

They will need to prepare 96 returns during the month in order to realize a $10,000 profit. Expressing this in dollars instead of units requires that we use the contribution margin ratio as shown:

Marshall & Hirito now knows that, in order to cover the fixed costs associated with this service, they must generate $38,400 in revenue. Once again, let’s verify this by constructing a contribution margin income statement:

As you can see, the $38,400 in revenue will not only cover the $14,000 in fixed costs, but will supply Marshall & Hirito with the $10,000 in profit (net income) they desire.

As you’ve learned, break-even can be calculated using either contribution margin per unit or the contribution margin ratio. Now that you have seen this process, let’s look at an example of these two concepts presented together to illustrate how either method will provide the same financial results.

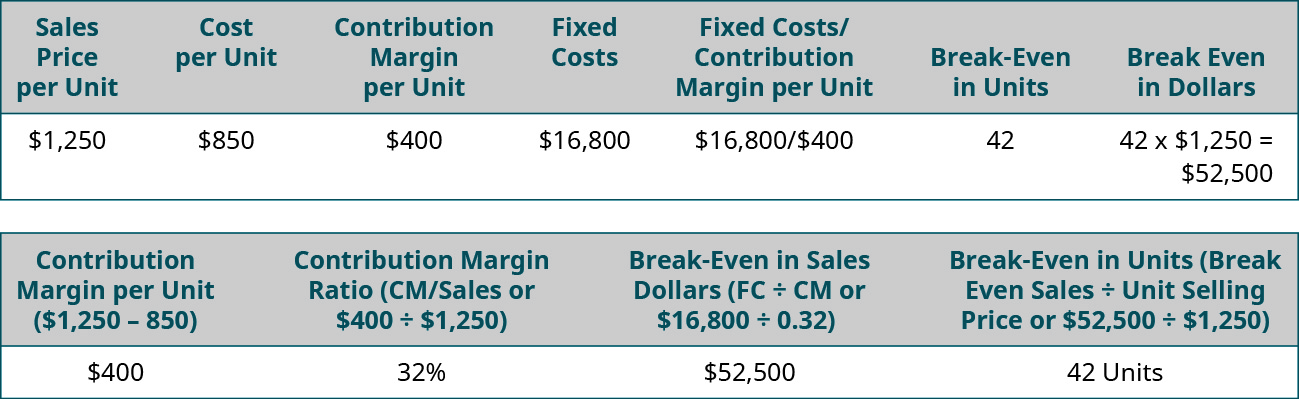

Suppose that Channing’s Chairs designs, builds, and sells unique ergonomic desk chairs for home and business. Their bestselling chair is the Spine Saver. Figure 7.32 illustrates how Channing could determine the break-even point in sales dollars using either the contribution margin per unit or the contribution margin ratio.

Note that in either scenario, the break-even point is the same in dollars and units, regardless of approach. Thus, you can always find the break-even point (or a desired profit) in units and then convert it to sales by multiplying by the selling price per unit. Alternatively, you can find the break-even point in sales dollars and then find the number of units by dividing by the selling price per unit.

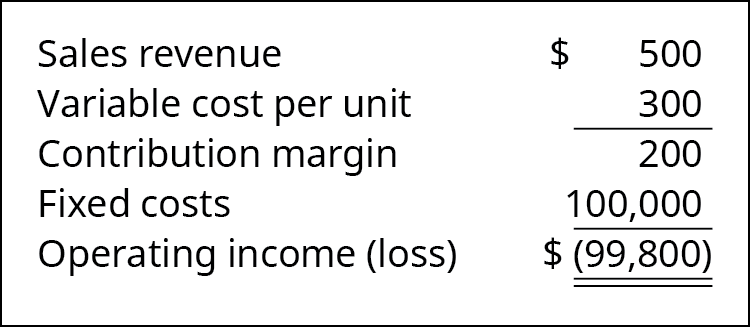

College Creations

College Creations, Inc (CC), builds a loft that is easily adaptable to most dorm rooms or apartments and can be assembled into a variety of configurations. Each loft is sold for $500, and the cost to produce one loft is $300, including all parts and labor. CC has fixed costs of $100,000.

- What happens if CC produces nothing?

- Now, assume CC produces and sells one unit (loft). What are their financial results?

- Now, what do you think would happen if they produced and sold 501 units?

- How many units would CC need to sell in order to break even?

- How many units would CC need to sell if they wanted to have a pretax profit of $50,000?

A. If they produce nothing, they will still incur fixed costs of $100,000. They will suffer a net loss of $100,000.

B. If they sell one unit, they will have a net loss of $99,800.

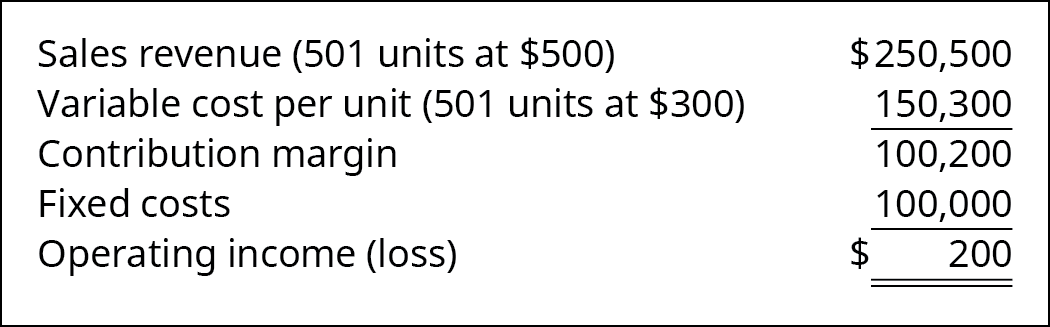

C. If they produce 501 units, they will have operating income of $200 as shown:

D. Break-even can be determined by FC ÷ CM per unit: $100,000 ÷ $200 = 500. Five hundred lofts must be sold to break even.

E. The desired profit can be treated like a fixed cost, and the target profit would be (FC + Desired Profit) ÷ CM or ($100,000 + $50,000) ÷ $200 = 750. Seven hundred fifty lofts need to be sold to reach a desired income of $50,000. Another way to have found this is to know that, after fixed costs are met, the $200 per unit contribution margin will go toward profit. The desired profit of $50,000 ÷ $200 per unit contribution margin = 250. This means that 250 additional units must be sold. To break even requires 500 units to be sold, and to reach the desired profit of $50,000 requires an additional 250 units, for a total of 750 units.

The Effects on Break-Even under Changing Business Conditions

Circumstances often change within a company, within an industry, or even within the economy that impact the decision-making of an organization. Sometimes, these effects are sudden and unexpected, for example, if a hurricane destroyed the factory of a company’s major supplier; other times, they occur more slowly, such as when union negotiations affect your labor costs. In either of these situations, costs to the company will be affected. Using CVP analysis, the company can predict how these changes will affect profits.

Changing a Single Variable

To demonstrate the effects of changing any one of these variables, consider Back Door Café, a small coffee shop that roasts its own beans to make espresso drinks and gourmet coffee. They also sell a variety of baked goods and T-shirts with their logo on them. They track their costs carefully and use CVP analysis to make sure that their sales cover their fixed costs and provide a reasonable level of profit for the owners.

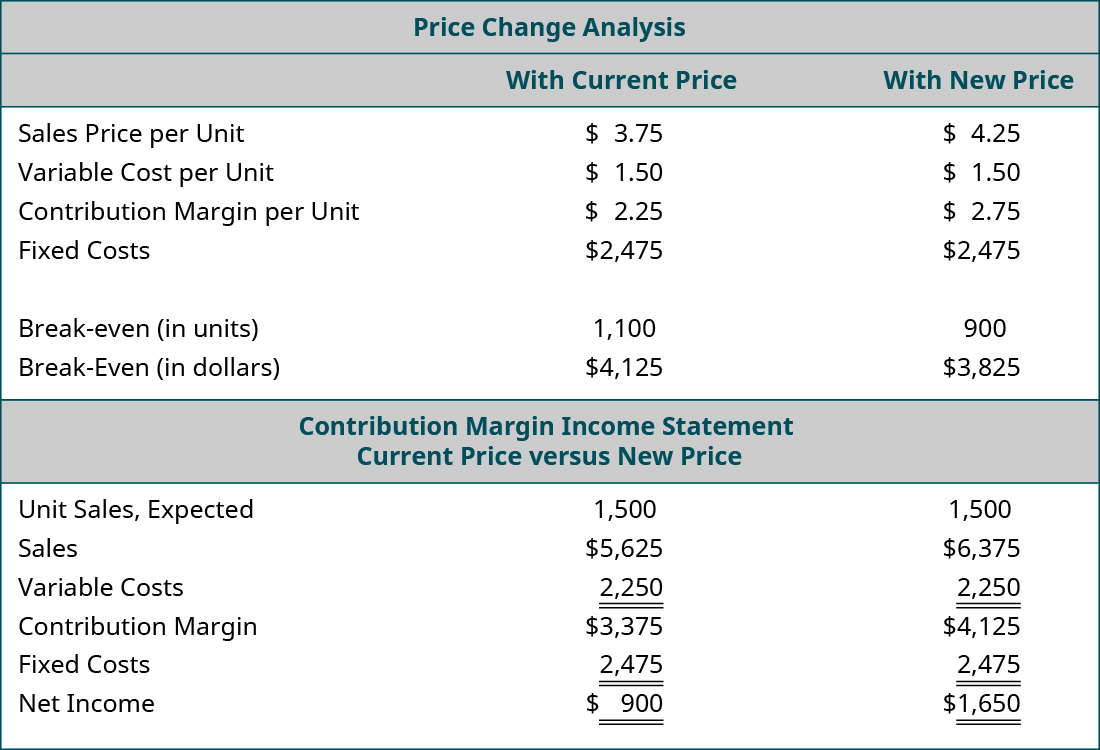

Change in Sales Price

The owner of Back Door has one of her employees conduct a survey of the other coffee shops in the area and finds that they are charging $0.75 more for espresso drinks. As a result, the owner wants to determine what would happen to operating income if she increased her price by just $0.50 and sales remained constant, so she performs the following analysis:

The only variable that has changed is the $0.50 increase in the price of their espresso drinks, but the net operating income will increase by $750. Another way to think of this increase in income is that, if the sales price increases by $0.50 per expresso drink and the estimated sales are 1,500 units, then this will result in an increase in overall contribution margin of $750. Moreover, since all of the fixed costs were met by the lower sales price, all of this $750 goes to profit. Again, this is assuming the higher sales price does not decrease the number of units sold. Since the other coffee shops will still be priced higher than Back Door, the owner believes that there will not be a decrease in sales volume.

When making this adjustment to their sales price, Back Door Café is engaging in target pricing , a process in which a company uses market analysis and production information to determine the maximum price customers are willing to pay for a good or service in addition to the markup percentage. If the good can be produced at a cost that allows both the desired profit percentage as well as deliver the good at a price acceptable to the customer, then the company should proceed with the product; otherwise, the company will not achieve its desired profit goals.

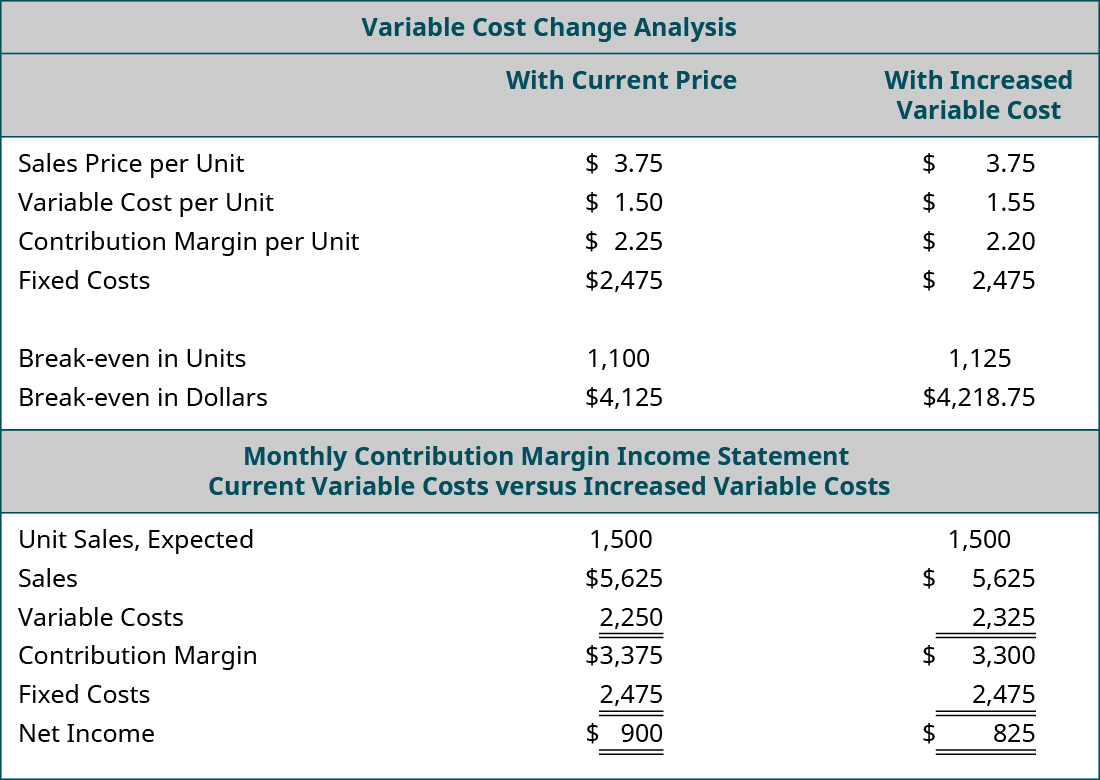

Change in Variable Cost

In March, the owner of Back Door receives a letter from her cups supplier informing her that there is a $0.05 price increase due to higher material prices. Assume that the example uses the original $3.75 per unit sales price. The owner wants to know what would happen to net operating income if she absorbs the cost increase, so she performs the following analysis:

She is surprised to see that just a $0.05 increase in variable costs (cups) will reduce her net income by $75. The owner may decide that she is fine with the lower income, but if she wants to maintain her income, she will need to find a new cup supplier, reduce other costs, or pass the price increase on to her customers. Because the increase in the cost of the cups was a variable cost, the impact on net income can be seen by taking the increase in cost per unit, $0.05, and multiplying that by the units expected to be sold, 1,500, to see the impact on the contribution margin, which in this case would be a decrease of $75. This also means a decrease in net income of $75.

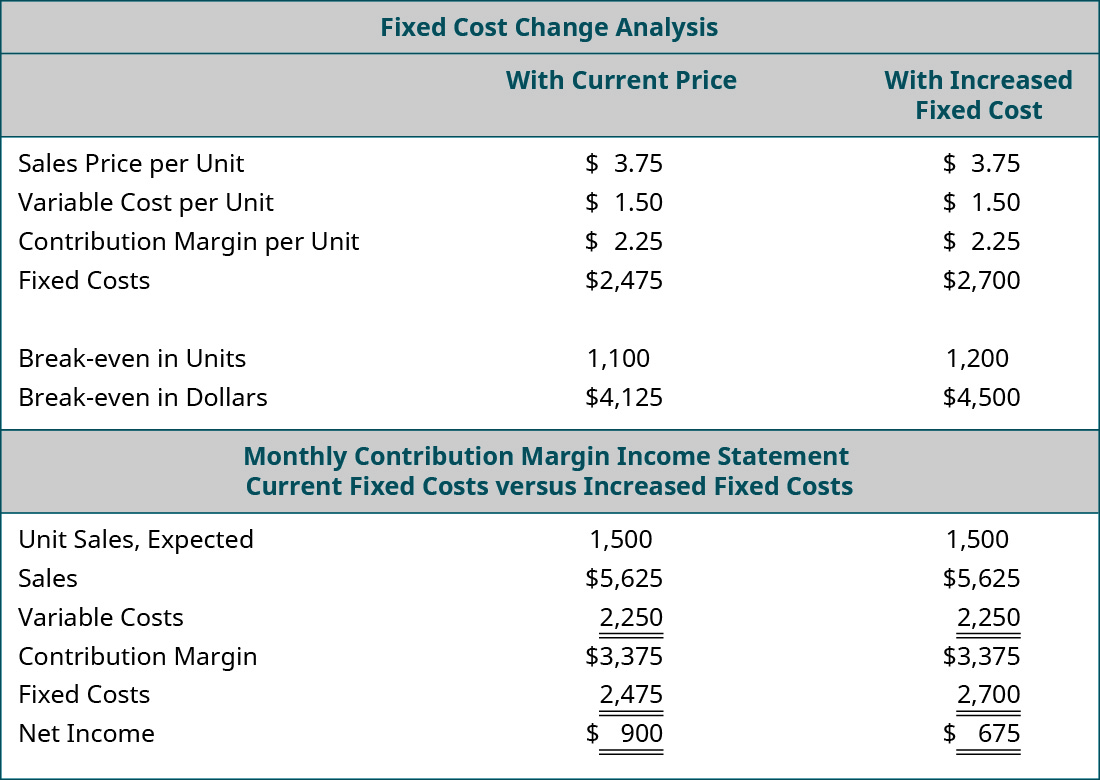

Change in Fixed Cost

Back Door Café’s lease is coming up for renewal. The owner calls the landlord to indicate that she wants to renew her lease for another 5 years. The landlord is happy to hear she will continue renting from him but informs her that the rent will increase $225 per month. She is not certain that she can afford an additional $225 per month and tells him she needs to look at her numbers and will call him back. She pulls out her CVP spreadsheet and adjusts her monthly fixed costs upwards by $225. Assume that the example uses the original $3.75 per unit sales price. The results of her analysis of the impact of the rent increase on her annual net income are:

Because the rent increase is a change in a fixed cost, the contribution margin per unit remains the same. However, the break-even point in both units and dollars increase because more units of contribution are needed to cover the $225 monthly increase in fixed costs. If the owner of the Back Door agrees to the increase in rent for the new lease, she will likely look for ways to increase the contribution margin per unit to offset this increase in fixed costs.

In each of the prior examples, only one variable was changed—sales volume, variable costs, or fixed costs. There are some generalizations that can be made regarding how a change in any one of these variables affects the break-even point. These generalizations are summarized in Table 7.1.

Changing Multiple Variables

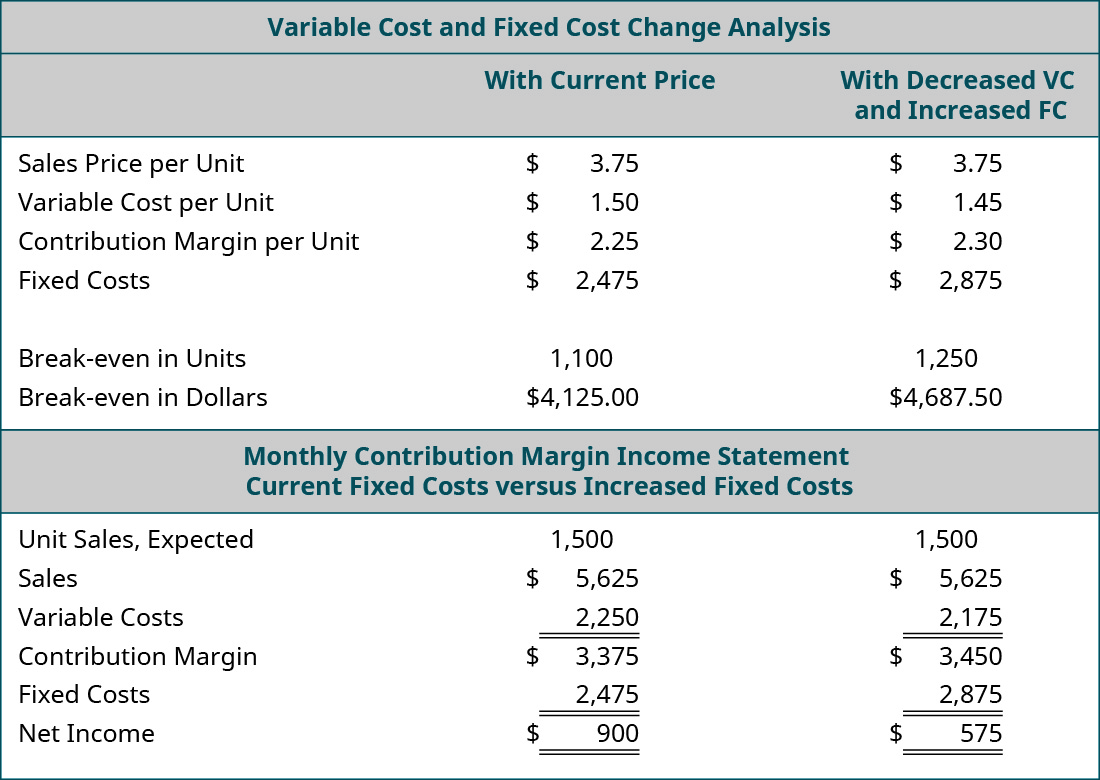

We have analyzed situations in which one variable changes, but often, more than one change will occur at a time. For example, a company may need to lower its selling price to compete, but they may also be able to lower certain variable costs by switching suppliers.

Suppose Back Door Café has the opportunity to purchase a new espresso machine that will reduce the amount of coffee beans required for an espresso drink by putting the beans under higher pressure. The new machine will cost $15,000, but it will decrease the variable cost per cup by $0.05. The owner wants to see what the effect will be on the net operating income and break-even point if she purchases the new machine. She has arranged financing for the new machine and the monthly payment will increase her fixed costs by $400 per month. When she conducts this analysis, she gets the following results:

Looking at the “what-if” analysis, we see that the contribution margin per unit increases because of the $0.05 reduction in variable cost per unit. As a result, she has a higher total contribution margin available to cover fixed expenses. This is good, because the monthly payment on the espresso machine represents an increased fixed cost. Even though the contribution margin ratio increases, it is not enough to totally offset the increase in fixed costs, and her monthly break-even point has risen from $4,125.00 to $4,687.50. If the new break-even point in units is a realistic number (within the relevant range), then she would decide to purchase the new machine because, once it has been paid for, her break-even point will fall and her net income will rise. Performing this analysis is an effective way for managers and business owners to look into the future, so to speak, and see what impact business decisions will have on their financial position.

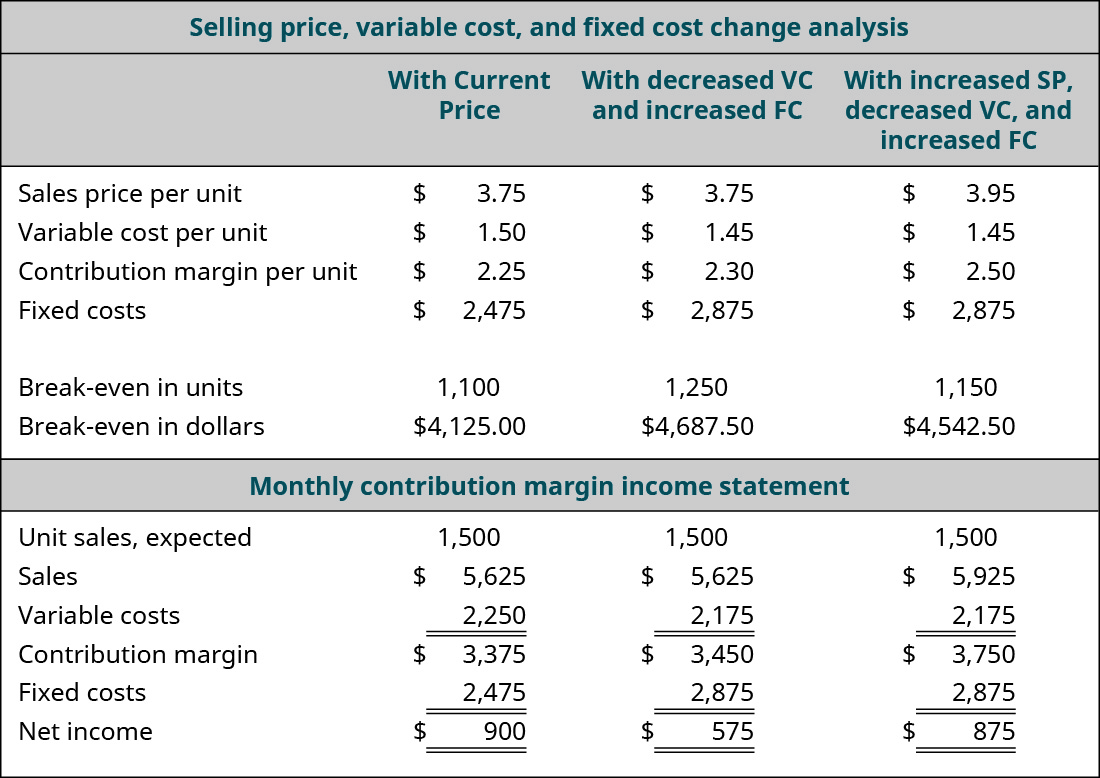

Let’s look at another option the owner of the Back Door Café has to consider when making the decision about this new machine. What would happen if she purchased the new machine to realize the variable cost savings and also raised her price by just $0.20? She feels confident that such a small price increase will go virtually unnoticed by her customers but may help her offset the increase in fixed costs. She runs the analysis as follows:

The analysis shows the expected result: an increase in the per-unit contribution margin, a decrease in the break-even point, and an increase in the net operating income. She has changed three variables in her costs—sales price, variable cost, and fixed cost. In fact, the small price increase almost gets her back to the net operating income she realized before the purchase of the new expresso machine.

By now, you should begin to understand why CVP analysis is such a powerful tool. The owner of Back Door Café can run an unlimited number of these what-if scenarios until she meets the financial goals for her company. There are very few tools in managerial accounting as powerful and meaningful as a cost-volume-profit analysis.

Long Descriptions

A graph of the Break-Even Point where “Dollars” is the y axis and “Units Sold” is the x axis. A line goes from the origin up and to the right and is labeled “Total Revenue.” Another line, labeled “Total Costs” goes up and to the right, starting at the y axis above the origin and is not as steep as the first line. There is a point where the two lines cross labeled “Break-Even Point.” The space between the lines to the left of that point is colored in and labeled “Loss.” The space between the lines to the right of that point is colored in and labeled “Profit.” Return

A graph of the Break-Even Point where “Dollars” is the y axis and “Birdbaths Sold” is the x axis. A line goes from the origin up and to the right and is labeled “Sales.” Another line, representing “Total Costs” goes up and to the right, starting at the y axis at $18,000 and is not as steep as the first line. There is a point where the two lines cross labeled “Break-Even Point.” There are dotted lines going at right angles from the breakeven point to both axes, showing the units sold are 225 and the cost is $22,500. The space between the lines to the left of that point is colored in and labeled “Loss.” The space between the lines to the right of that point is colored in and labeled “Profit.” Return

A graph of the Break-Even Point where “Dollars” is the y axis and “Birdbaths Sold” is the x axis. A line goes from the origin up and to the right and is labeled “Sales.” Another line, representing “Total Costs” goes up and to the right, starting at the y axis at $18,000 and is not as steep as the first line. There is a point where the two lines cross labeled “Break-Even Point.” There are dotted lines going at right angles from the breakeven point to both axes showing the units sold are 225 and the cost is $22,500. There is also a dotted line at the point at 175 units level going up to the sales and costs lines with a point on each. A dotted line from each is going to the y axis crossing at $21,500 from the cost line and $17,500 from the sales line. The difference between these two points is the $4,000 loss. Return

A graph of the Break-Even Point where “Dollars” is the y axis and “Birdbaths Sold” is the x axis. A line goes from the origin up and to the right and is labeled “Sales.” Another line, representing “Total Costs” goes up and to the right, starting at the y axis at $18,000 and is not as steep as the first line. There is a point where the two lines cross labeled “Break-Even Point.” There are dotted lines going at right angles from the breakeven point to both axes showing the units sold are 225 and the cost is $22,500. There is also a dotted line going up from the units x axis at 300 units to both the cost and the sales lines. The points at which they cross have a dotted line going to the Y axis crossing at $24,000 from the cost point and $28,500 from the sales point. The difference between these two points represents the $6,000 profit. Return

Sales and profit relationships. Sales of 725 units × $100 per unit = $72,500, and variable costs of 725 units × $20 per unit = (14,500) for a contribution margin of $58,000. Fixed costs are (18,000), pre-tax profit is $40,000, and income tax expense of 40% is (16,000) for an after-tax profit of $24,000. Return

Sales Price per Unit $1,250, Cost per Unit $850, Contribution Margin per Unit $400, Fixed Costs $16,800, Fixed Cost divided by Contribution Margin per Unit $16,800 divided by $400, Break-Even in Units 42, Break Even in Dollars 42 times $1,250 equals $52,500, Contribution Margin Ratio (CM divided by Sales or $400 divided by $1,250) 32 percent, Break-even in Sales Dollars (FC divided by CM or $16,800 divided by .32 equals $52,500, Break-Even in Units (Break Even Sales divided by Unit Selling Price or $42,500 divided by $1,250 equals 42 units. Return

Price Change Analysis: With Current Price, With New Price (respectively): Sales Price per Unit $3.75, $4.25; Variable Cost per Unit 1.50, 1.50; Contribution Margin per Unit $2.25, $2.75; Fixed Costs $2,475, $2,475; Break-even in Units 1,100, 900; Break-even in Dollars $4,125, $3,825. Contribution Margin Income Statement: Current Price, New Price (respectively): Unit Sales Expected 1,500, 1,500; Sales $5,625, $6,375; Variable Costs 2,250, 2,250; Contribution Margin $3,375, $4,125; Fixed Costs 2,475, 2,475; Net Income $900, $1,650. Return

Variable Cost Change Analysis: With Current Price, With Increased Variable Cost (respectively): Sales Price per Unit $3.75, $3.75; Variable Cost per Unit 1.50, 1.55; Contribution Margin per Unit $2.25, $2.20; Fixed Costs $2,475, $2,475; Break-even in Units 1,100, 1,125; Break-even in Dollars $4,125, $4,218.75. Monthly Contribution Margin Income Statement: Current Variable Cost, Increased Variable Costs (respectively): Unit Sales Expected 1,500, 1,500; Sales $5,625, $5,625; Variable Costs 2,250, 2,325; Contribution Margin $3,375, $3,300; Fixed Costs 2,475, 2,475; Net Income $900, $825. Return