Counterpoint Research: Global Smartphone Market - Apple gained the top spot in Q4 2019 while Huawei surpassed Apple to become the second-largest brand in CY 2019

- Apple iPhone shipments grew in 11% YoY during Q4 2019, even without a 5G variant

- realme was the fastest-growing brand in CY 2019 (453% YoY)

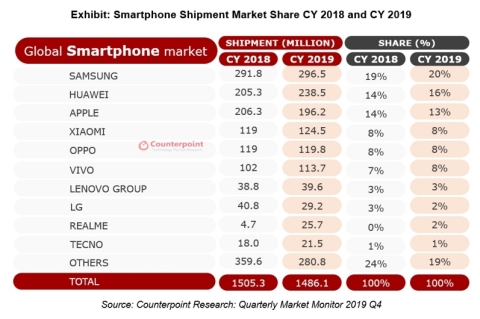

SEOUL, South Korea & HONG KONG & NEW DELHI & BEIJING & LONDON & BUENOS AIRES, Argentina & SAN DIEGO--( BUSINESS WIRE )--The global smartphone market declined 1% YoY in CY 2019, according to the latest research from Counterpoint’s Market Monitor service . This is the first time that the smartphone market has declined for two consecutive years. However, the decline was slower than in 2018 (4% YoY). The smartphone market actually grew 3% YoY in Q4 2019, indicating signs of a recovery and is expected in 2020.

2019 brought both innovations, 5G, folding displays, but also an uncertain trade and political climate. Commenting on the global market dynamics, Tarun Pathak, Associate Director at Counterpoint Research noted, “There have been growing tensions among several countries that have impacted the smartphone market. For example, the US pressure on Huawei , and tensions between Japan-Korea that led to uncertainties in the memory market. Supply chains have been upset, causing various companies to rethink their strategies and reduce dependence on single markets. 2020 will likely see efforts to further diversify investments across geographies to mitigate risks. The current Coronavirus outbreak in China is the latest issue to threaten supply chains.”

Despite the sanctions, Huawei surpassed Apple to become the second-largest brand in 2019 driven by aggressive push from Huawei in the Chinese market, where it achieved almost 40% market share. Within the quarter however, after two-years, Apple gained the top spot in the Global Smartphone Market. This was driven by the iPhone 11 series beating expectations.

We also saw smartphone brands changing their strategies in 2019. For example, Samsung revamped its A series , giving a push to the mid-segment. Apple launched its iPhone 11 , with multiple cameras, at a lower price than its predecessor. 5G also provided an opportunity for OEMs to gain mindshare by launching industry-first “5G-capable” devices in markets that were early to launch 5G services. 2020 is expected to be the breakout year, with 5G smartphones poised to grow to around 18% of total global smartphone shipment volumes in 2020 as compared to 1% in 2019.

For a more detailed analysis click here

Analyst Contact: Tarun Pathak [email protected] Follow Counterpoint Research [email protected]

- Work & Careers

- Life & Arts

Become an FT subscriber

Limited time offer save up to 40% on standard digital.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital.

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- Everything in Print

- Everything in Premium Digital

The new FT Digital Edition: today’s FT, cover to cover on any device. This subscription does not include access to ft.com or the FT App.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

- Counterpoint Research

- iPhone 15 Pro Max

iPhone 15 Pro Max costs Apple 8% more to make than iPhone 14 Pro Max

Counterpoint Research published a new report today on the “blended bill of materials,” or BoM, cost for Apple’s iPhone 15 Pro Max. This report reveals how much it costs Apple to make each iPhone unit, and according to it, this year’s high-end model costs Apple 8% more than the iPhone 14 Pro Max.

Apple takes more than 60% of global premium market in Q1 2022 thanks to iPhone 13 series

After Counterpoint Research revealed that the iPhone 13 continues to dominate as the global best-selling smartphone in April , the company has now shared new data that shows that Apple takes 62% of the premium market in the first quarter of 2022.

- AAPL Company

Apple takes home a third of smartphone revenue, two-thirds of profits

Apple takes home 32% of total smartphone revenue, and 66% of total smartphone industry profits, according to a new estimate today.

The estimate was made by Counterpoint Research, which presented a graph (below) showing that no other brand comes anywhere close to the iPhone’s profitability…

Expand Expanding Close

- iOS Devices

- Tech Industry

Here’s how the iPhone is performing in global marketshare against the competition

We learned this week that Apple shipped 74.8 million iPhones globally during the recent holiday quarter, which is just slightly up from the 74.4 million shipped during the same quarter the year prior and just under the 75 million that analysts expected.

Today Strategy Analytics has released new data showing how Apple’s last two years of shipments compare to competitors like Samsung and Huawei. The data also breaks down how Apple’s global smartphone marketshare stacks up to those same competitors.

The smartphone sales figures are in — and the iPhone dominates Android

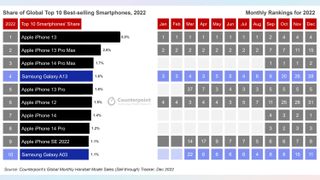

Apple snags 8 out of top 10 best sellers

Grab one of the most popular handsets to go on sale in the past year, and chances are good, it's going to have an Apple logo stamped on the back.

That's according to Counterpoint Research, which posted its rankings of the best-selling smartphones of 2022 . The list is essentially a round-up of the best iPhones , as Apple claimed 8 of the 10 spots in Counterpoint's rankings, which cover the global market. That's the first time a single phone maker has done that, according to the market research firm.

The iPhone 13 claimed the No. 1 slot, with a 5% overall share of the market. The iPhone 13 Pro Max came in second, followed by the iPhone 14 Pro Max , which came out in late 2022 but still managed to grab a 1.7% share.

The iPhone 13 lineup had an advantage over many other devices that landed in Counterpoint's Top 10. Since those phones debuted in October 2021, they were on sale for the entirety of 2022. A price cut to the iPhone 13 following the iPhone 14's launch in September 2022 likely helped boos sales in what Counterpoint Research calls developing markets.

Apple claimed 8 of the 10 spots in Counterpoint's rankings. That's the first time a single phone maker has done that.

The iPhone 14 Pro Max's top 3 finish is also noteworthy, as Counterpoint says it's the first time the Pro Max version of Apple's phone enjoyed greater sales than the Pro and standard variations. In comparing the iPhone 14 vs. the iPhone 14 Pro , it's clear Apple loaded up its Pro models with more significant features, most notably improved cameras and faster processors. That's clearly motivated shoppers to pay up for the iPhone 14 Pro and iPhone 14 Pro Max, with the Pro Max's larger screen likely adding to that model's appeal.

Only two non-Apple phones landed in the Top 10 of 2022 smartphone sales, and both belong to Samsung. The Galaxy A13 landed at the fourth spot on Counterpoint's list, while the Galaxy A03 closed out the Top 10. Both are budget devices — Samsung sells the Galaxy A13 5G for $215, while the Galaxy A03 hover around the $100 mark — with Samsung's flagships and high-priced foldables missing out on the top 10.

What the best sellers tell us about the smartphone market

Android phones still make up the vast majority of devices that get sold around the world, with Statista claiming Android enjoyed a 71.7% market share to iOS's 27.6% share at the end of the fourth quarter in 2022. Nevertheless, individual iPhone models seem to enjoy greater popularity. Apart from customer loyalty and preference for one mobile OS over the other, we'd imagine the factors driving sales toward individual iPhone models include their performance, design and reputation for being among the best camera phones.

Sign up to get the BEST of Tom’s Guide direct to your inbox.

Upgrade your life with a daily dose of the biggest tech news, lifestyle hacks and our curated analysis. Be the first to know about cutting-edge gadgets and the hottest deals.

Looking closer at the Counterpoint Research numbers, we can make a few interesting observations about the handsets that landed in the Top 10 for global phone sales as well as those that missed the cut.

There's a demand for budget devices

Only two non-Apple phones landed in the Top 10 of 2022 smartphone sales, and they're both cheap Samsung phones.

We mentioned that the only Android phones to make the top 10 cost less than $220. But iPhone enthusiasts seemingly like a good bargain, too. The iPhone SE 20202 , which costs $429, landed in the top 10 for smartphone sales, where it was joined by the iPhone 12 . That latter model may have debuted back in 2020, but a series of price cuts have kept the device around as a low-cost alternative to more recent iPhones.

Flagship devices are certainly exciting, but they're not the only phones that people are snapping up. There's a growing interest in midrange and budget models , and you're seeing that reflected in the devices smartphone makers are putting out. It's why we're eager to see what Samsung and Google have planned for the Galaxy A54 and Pixel 7a , respectively, with both phones expected to debut in the coming months at Google I/O 2023 .

Where the heck is Samsung Galaxy S22?

You can forgive the Galaxy S23 's absence from the Counterpoint Research list, since it's only looking at phones that were on sale in 2022 and the latest Samsung flagships only came out last month. But not a single Galaxy S22 model landed in the top 10 despite those phones being on sale since February 2022. What gives?

If we had to guess, we'd assume that the absence is explained by the Galaxy S22 and Galaxy S22 Plus being modest upgrades over recent Galaxy S models. If you had bought a Samsung flagship within the last two years or so, there was little in those two S22 offerings to tempt you to upgrade. The bigger features were reserved for the Galaxy S22 Ultra , which, at $1,199, remains Samsung's most expensive phone outside of the Galaxy Z Fold 4 .

A high cost isn't enough to stop people from buying your phone, as the iPhone 14 Pro Max's high ranking proves. But clearly shoppers found that phone more compelling than the S22 Ultra. It will be interesting to see if the same fate befalls the Galaxy S23 Ultra and its 200MP main camera a year from now when the 2023 global sales figures become available.

Apple's iPhone 14 Plus struggles

While you'll find a lot of iPhones in that Top 10 list, you won't see the iPhone 14 Plus — the only iPhone 14 model not to crack the Top 10. You could argue that the iPhone 14 Plus didn't have that big a sales window — it shipped a few weeks after the rest of Apple's fall phone releases — but the iPhone 13 mini was on sale the whole year, and it didn't make the list either. In fact, it was the only iPhone 13 model not to do so.

That's two iPhone release cycles where four models proved to be one iPhone too many. That would seem more evidence to back the argument that Apple should drop that fourth model — be it plus-sized or mini — and concentrate solely on the standard, Pro and Pro Max sizes that have proven more popular.

Based on iPhone 15 rumors, though, it's unlikely to happen. Most observers expect Apple to release four new models this fall, with an iPhone 15 Plus remaining in the lineup alongside the standard iPhone and the two iPhone 15 Pro models.

It's hard to break through the Apple/Samsung duopoly

With Apple and Samsung making up the entire top 10 of phone sales for the past year, it's more clear than ever that those two companies are the dominant players in the phone market and everyone else is just fighting for scraps. It's a question we asked before when wondering why Google's Pixel phones aren't more popular , despite the improvements Google's made with the Pixel 7 .

Some of it comes down to availability — phones like the Pixel haven't been marketed in as many places in the past as devices from Apple and Samsung — and some of it's a matter of focus. (Motorola does a respectable business with its low-cost Moto G series, but there are so many different variations, it's harder for a single model to break through.) Whatever the case, it appears to be a Samsung and Apple World — and more Apple than Samsung, according to the numbers — and the rest of us are just living in it.

More from Tom's Guide

- The best phones you can buy right now

- Galaxy S23 Ultra vs. iPhone 14 Pro Max

- iPhone vs. Android: Which is better for you?

Philip Michaels is a Managing Editor at Tom's Guide. He's been covering personal technology since 1999 and was in the building when Steve Jobs showed off the iPhone for the first time. He's been evaluating smartphones since that first iPhone debuted in 2007, and he's been following phone carriers and smartphone plans since 2015. He has strong opinions about Apple, the Oakland Athletics, old movies and proper butchery techniques. Follow him at @PhilipMichaels.

iPhone SE 4 leak just revealed the biggest design changes

Samsung's Bixby is getting a big generative AI upgrade — what you need to know

A brand-new 'Bridgerton' season 3 clip teases the book's steamy mirror scene

Most Popular

By Alan Martin April 01, 2024

By Dave LeClair April 01, 2024

By Hunter Fenollol April 01, 2024

By Josh Bell April 01, 2024

By Kelly Woo April 01, 2024

By Kate Kozuch April 01, 2024

By Brittany Vincent April 01, 2024

By Tom Wardley March 31, 2024

By Alyse Stanley March 31, 2024

- 2 Score! iPad mini just crashed to all-time price low

- 3 Lululemon’s ‘We Made Too Much’ sale is live — here’s my favorite deals from $9

- 4 Massive Best Buy sale is now live — here's the 15 deals I recommend now

- 5 Discord will soon show ads — here's how this will change the beloved gaming chat app

- 2 Lululemon’s ‘We Made Too Much’ sale is live — here’s my favorite deals from $9

- 3 Massive Best Buy sale is now live — here's the 15 deals I recommend now

- 4 Discord will soon show ads — here's how this will change the beloved gaming chat app

- 5 iPhone SE 4 leak just revealed the biggest design changes

- Share full article

Advertisement

Supported by

Has China Lost Its Taste for the iPhone?

Apple has deep ties in the country, its second-largest market. But there are signs that Chinese consumers are becoming a harder sell.

By Meaghan Tobin , Alexandra Stevenson and Tripp Mickle

Meaghan Tobin reported from Taipei, Taiwan; Alexandra Stevenson from Shanghai and Beijing; and Tripp Mickle from San Francisco.

For years, Apple dominated the market for high-end smartphones in China. No other company made a device that could compete with the iPhone’s performance — or its position as a status object in the eyes of wealthy, cosmopolitan shoppers.

But evidence is mounting that, for many in China, the iPhone no longer holds the appeal it used to. During the first six weeks of the year, historically a peak season for Chinese shoppers to spring for a new phone, iPhone sales fell 24 percent from a year earlier, according to Counterpoint Research, which analyzes the smartphone market.

Meanwhile, sales for one of Apple’s longstanding Chinese rivals, Huawei, surged 64 percent.

It’s a challenging time for Apple. Analysts say its latest product, a $3,500 virtual reality headset released in February, is still years away from gaining mainstream appeal. This month, Apple has taken two regulatory hits: a European Union fine of nearly $2 billion for anticompetitive music streaming practices and a U.S. government lawsuit claiming Apple violated antitrust laws.

For a decade, China has been the iPhone’s most important market after the United States and accounted for roughly 20 percent of Apple’s sales. Now the company’s grip on China could be dislodged by a series of factors: a slowdown in consumer spending , growing pressure from Beijing for people to shun devices made by U.S. companies and the resurgence of national champion Huawei.

“The golden time for Apple in China is over,” said Linda Sui, a senior director at TechInsights, a market research firm. One of the biggest reasons is the rising tension between the United States and China over trade and technology, Ms. Sui said. Without a significant lessening of geopolitical stress, it will be difficult for Apple to retain its position.

“It’s not just about consumers,” Ms. Sui said. “It’s about the big picture, the two superpowers competing with each other — that’s a fundamental thing behind the whole shift.”

Few American companies have more to lose from these heightened tensions than Apple, whose newest handset, the iPhone 15, went on sale in September. It is the first iPhone line to feature a titanium frame and include an action button that can be programmed to take photos or turn on the flashlight.

“Five years ago, Apple had really strong branding in China — people would bring tents to wait through the whole night outside the Apple Store for the next product launch,” said Lucas Zhong, a Shanghai-based analyst at Canalys, a market research firm. “The iPhone 15 launch wasn’t nearly as popular.”

Six months later, Apple has plastered billboards across cities like Shanghai, reminding residents they can still buy an iPhone 15 nearby. Similar promotions helped the iPhone account for four of the six top-selling smartphones in China in the final three months of last year, the company said during a call with Wall Street analysts. But the prominent advertising did not persuade Jason Li, 22, to visit the Apple Store on Nanjing East Road, in the heart of Shanghai’s shopping district, when he needed to replace his iPhone 13 Pro Max.

Instead, Mr. Li went to the Huawei flagship store directly across the street, where he contemplated the Mate 60 Pro.

“I don’t want to use iOS anymore,” he said, referring to the iPhone’s operating system. “It’s a bit stale.”

Apple declined to comment.

For some in China, buying a phone has become a political statement. Debates over whether using an iPhone is disrespectful to Chinese tech companies or akin to handing personal data over to the U.S. government have erupted online. Last year, employees at some Chinese government agencies reported being told not to use iPhones for work .

These directives surfaced less than two weeks after Huawei unveiled the Mate 60 Pro , a smartphone equipped with the company’s own operating system and a computer chip more advanced than had previously been made in China.

Huawei released the device in the final days of a trip to China by Gina M. Raimondo , the U.S. commerce secretary. Chinese commentators and state media heralded it as a triumph for Huawei in the face of Washington’s attempts to restrict the company from developing just such technology.

The Mate 60 Pro was an immediate sensation. Its boost to Huawei’s sales carried over into the first six weeks of this year, when the company claimed the second-largest share of the smartphone market, up to 17 percent from 9 percent a year earlier, according to data from Counterpoint.

“Today, holding the Mate 60 series gives people a feeling like they had many years ago if someone saw them holding an iPhone on the street,” said Ivan Lam, a senior analyst at Counterpoint Research in Hong Kong. This is especially true for people over 35, the age group that buys the most smartphones, he said.

China’s smartphone market is divided up by a number of companies. The domestic brands Vivo, Oppo and Xiaomi jostle with Apple and Huawei for the largest pieces.

Apple started selling iPhones in China in 2009. The last time it was losing ground to Huawei , in 2019, the Trump administration inadvertently extended Apple a lifeline by restricting U.S. technology firms from dealing with Huawei . Google, which makes the Android operating system, and several semiconductor companies cut off their support of the Chinese smartphone maker.

As Huawei struggled, Apple rebounded. In 2022, its share of phones sold in China rose to 22 percent, from 9 percent in 2019, according to Counterpoint. Apple reported record revenue of $74 billion from the region during its fiscal year ending in September 2022.

But the restrictions also forced Huawei to develop its own wireless chip and operating system, resulting in the technology behind the Mate 60 Pro. The operating system has been a draw for Chinese shoppers, and many of China’s biggest tech companies have made apps exclusively for it, further walling off users from platforms used outside China.

Huawei’s innovation has made Apple’s latest models appear stodgy by comparison. And as China’s economy has struggled to rebound from the Covid pandemic, many consumers are hesitant to spend on what feels like an incremental upgrade. The owners of about 125 million out of 215 million iPhones in China have not upgraded to newer devices in the last three years, according to Daniel Ives, an Apple analyst at Wedbush Securities.

Apple has responded to the challenges in China. Its chief executive, Tim Cook, has traveled to the country and visited Apple’s suppliers. Last week, he attended the splashy opening of an Apple Store near Shanghai’s Jing’an Temple — the company’s eighth store in Shanghai and 57th in China — to a crowd of Apple fans. The company also said it was expanding its research and development labs in Shanghai .

But for some shoppers, Apple’s efforts have been overshadowed by Washington’s approach to the company’s Chinese rival.

While waiting at the Genius Bar for help with his ailing iPhone 12 at the Apple Store on Nanjing East Road in Shanghai, Chi Miaomiao, 38, said he had recently bought Huawei’s Mate 60 Pro as his second phone. He was drawn to Huawei after its chief financial officer, Meng Wanzhou, was arrested by the Canadian authorities in 2018 at the request of the United States, which accused her of misleading banks about Huawei’s business in Iran. Ms. Meng’s detention set off a flood of support in China, where many saw her as a hostage.

“Huawei is our own brand, and because of this political incident, I think we Chinese should be united,” Mr. Chi said.

Upstairs on the Apple sales floor, Li Bin, 23, and two friends debated the latest iPhone models. Huawei and Apple were nearly comparable in quality, Mr. Li said, and though he thought the iPhone was slightly better, it was also more expensive.

“I may switch to an iPhone,” Mr. Li said, “when I get richer in the future.”

Li You and Zixu Wang contributed research.

Meaghan Tobin is a technology correspondent for The Times based in Taipei, covering business and tech stories in Asia with a focus on China. More about Meaghan Tobin

Alexandra Stevenson is the Shanghai bureau chief for The Times, reporting on China’s economy and society. More about Alexandra Stevenson

Tripp Mickle reports on Apple and Silicon Valley for The Times and is based in San Francisco. His focus on Apple includes product launches, manufacturing issues and political challenges. He also writes about trends across the tech industry, including layoffs, generative A.I. and robot taxis. More about Tripp Mickle

Apple's iPhone China shipments in February look even worse than estimated

- Apple's iPhone shipments in China have fallen again, government data show.

- Apple shipped roughly 2.4 million smartphones in February — a 33% drop from 2023, per Bloomberg.

- It's the latest sign of the company's struggles in China as rivals like Huawei take market share.

The latest iPhone data out of China imply Apple's still having a tough time in one of its biggest markets.

The tech giant shipped around 2.4 million smartphones in February in the country, according to Bloomberg . That's a 33% drop from the same month in 2023, Bloomberg said, citing data from the China Academy of Information and Communications Technology, a government body.

And while it's not as bad as January — when Apple shipped an estimated 5.5 million units there, or roughly 39% fewer phones year on year, according to Bloomberg — it still looks worse than a major report suggested recently.

Counterpoint Research, in its report released in early March, estimated that iPhone sales in China had dropped by 24% in the first six weeks of the year. That decline, at a slower pace than China's more recent data show, sparked concern at the time among investors about Apple's stability in the country, weighing on shares. The stock slipped a little on Tuesday; it's fallen more than 11% in 2024.

"This has been a very difficult period for Apple in China," Dan Ives, a technology analyst at Wedbush Securities, wrote in a recent note.

Related stories

One of Apple's issues is stiff competition from Huawei, a local telecom giant, which has dethroned the iPhone as the No. 1 smartphone in the country, according to Counterpoint. The Chinese government has also banned iPhones from some government agencies and companies amid US-China tech and trade tensions, and an economic slowdown could be pushing consumers to spend less.

Nicole Peng, an analyst at Canalys, told Bloomberg that an excess inventory of iPhones shipped to China in the last quarter of 2024 could also be to blame.

But today's news is "a sign of a slowing trend for the upcoming months for Apple in China, especially when the Chinese peers are driving very aggressively the AI smartphone messages," Peng said.

Apple has already been having a tough time in the country. In its latest quarterly earnings for the three months through December 2023, Greater China sales dropped to $20.8 billion — a 13% year-over-year decline.

That's on top of a broader selection of challenges in 2024, including a nearly $2 billion fine from the EU, a DOJ antitrust lawsuit , struggles with rapidly advancing its AI technology, and the decision to end its self-driving car project.

Now, Apple's leaders appear to be trying to rebuild bridges in the country. CEO Tim Cook has been in China this month to visit Apple's newest store in Shanghai and attend the high-profile China Development Forum in Beijing, which aims to strengthen ties between the CCP and the rest of the world.

"The timing of this trip was important," Ives wrote in his note. "In essence, Apple needs China, and China needs Apple."

Apple didn't immediately respond to a request for comment from Business Insider before publication.

Watch: Apple's antitrust lawsuit is just one of its major battles

- Main content

Special Features

Vendor voice.

This article is more than 1 year old

China to push RISC-V to global prominence – but maybe into a corner, too, says analyst

Which may not be a good thing for arm, or anyone.

Attempts to restrict technology transfer to China could see the RISC-V architecture become more prominent, but also reduce the diversity of development around the platform.

So says analyst firm Counterpoint Research, which on Monday noted that Arm today owns more than a third of the market for semiconductor IP and is well placed as that market enjoys 11 per cent compound annual growth to reach $8.6bn per year by 2025.

But Arm won't have things entirely its own way.

"The rise of RISC-V cannot be ignored," Counterpoint stated. "In fact, RISC-V is now a rising star in the industry, largely due to its open-source advantage, better power consumption performance promise [and] reliable security functions."

The firm predicts RISC-V could pick up 25 per cent of the Internet of Things market by 2025.

Another of RISC-V's qualities Counterpoint admires is its "lower political risk impact" – a reference to the fact that the architecture's open-source status means policies that prevent proprietary tech being transferred to China won't be easy to apply.

"The global economic uncertainty and trade tensions between the US, China and Taiwan will accelerate localization of the semiconductor supply chain," stated Counterpoint research director Dale Gai.

"With over 70 per cent of RISC-V premier members coming from China, their efforts for semiconductor expansion will reinforce China's IP library and IC design capability, shape the supply chain, scale dynamics and extend RISC-V's footprint across different product categories.

"This will call for a checkpoint in future on how the RISC-V ecosystem evolves, with success conditional to the diversity of members, respective contributions and geographical influence."

- Russia's Elbrus has a RISC-V competitor as Yadro prepares native chips for launch

- India selects RISC-V for semiconductor self-sufficiency contest: Use these homegrown cores to build kit

- Chinese chip designers hope to topple Arm's Cortex-A76 with XiangShan RISC-V design

Gai didn't explain what such a "checkpoint" would achieve and did not detail how "geographical influence" of a China-dominated RISC-V ecosystem could become a problem.

It's certainly conceivable that China's government could direct its chipmakers to focus on certain designs for domestic use; to provide alternatives to the kind of tech the Middle Kingdom finds increasingly harder to acquire from Qualcomm or Intel; and then prevent those designs from being sold abroad. Such a development could stymie development of the global RISC-V ecosystem, but also leave other designers with scope to do their own work. ®

Narrower topics

- China Mobile

- China telecom

- China Unicom

- Cyberspace Administration of China

- Great Firewall

- Semiconductor Manufacturing International Corporation

- Uyghur Muslims

Broader topics

Send us news

Other stories you might like

Alibaba's research arm promises server-class risc-v processor due this year, us house goes bang, bang on tiktok sale-or-ban plan, how to improve chinese tv better censorship, says top tellie-maker, protecting distributed branch office environments from ransomware.

Apple to settle class action for $490 million after Tim overcooked China outlook

Microsoft faces bipartisan criticism for alleged censorship on bing in china, beijing issues list of approved cpus – with no intel or amd, apple iphone ai to be powered by baidu in china, maybe, india quickly unwinds requirement for government approval of ais, chinese snoops use f5, connectwise bugs to sell access into top us, uk networks, hong kong promises its latest national security law is not a ban on social media, samsung and sk halt sales of used chipmaking gear to brokers.

- Advertise with us

Our Websites

- The Next Platform

- Blocks and Files

Your Privacy

- Cookies Policy

- Privacy Policy

- Ts & Cs

Copyright. All rights reserved © 1998–2024

Global smartphone market set to rebound in 2024, report says

The Technology Roundup newsletter brings the latest news and trends straight to your inbox. Sign up here.

Reporting by Arsheeya Bajwa and Aditya Soni in Bengaluru; Editing by Shilpi Majumdar

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Cryptoverse: Ether fettered by fate of spot ETF proposals

Cryptocurrency ether is struggling to keep pace with soaring big brother bitcoin.

- 智能手机 AP/SoC

- Press releases

- Events & Webinars

- 半导体的专业行业参与者

- 智能手机行业的专业行业参与者

Research Portal

- Automotive (205)

- Content, Applications and Services (7)

- Emerging technologies (339)

- Mobile and Telecom (1,615)

- Semiconductors & Other Components (284)

- Software (63)

- 5G and networks (95)

- Chipsets (71)

- Component Tracker (16)

- Display (7)

- Foundry (15)

- Imaging (7)

- Teardown and BOM (166)

- Consumer Lens (43)

- Bangladesh (15)

- Canada (22)

- IndiaPremium (127)

- LatinAmerica (17)

- OtherCountries (46)

- Russia (12)

- US Inventory Tracker (2)

- Vietnam (2)

- Connected devices expansion (2)

- Standard reports (76)

- Technology expansion (1)

- Cloud Ecosystem (12)

- Emerging Tech (51)

- Robotics (12)

- eSIM developments (41)

- eSIM Intelligence Tracker (33)

- Extended Reality (XR) (37)

- Foldable_Devices (34)

- Top 100 (3)

- Top 30% (3)

- Top 300 (23)

- Top 99% (101)

- Individual reports (851)

- ODM ecosystem (3)

- Infographics (72)

- Premium (420)

- Standard (205)

- IoT Applications (101)

- IoT Connections (16)

- IoT Modules Basic (30)

- IoT Modules Premium (82)

- IoT Platforms (15)

- Location Ecosystem (7)

- Macro and geo-political tracker (24)

- Manufacturing Ecosystem (39)

- Premium expansion (79)

- Sell-in Inventory (8)

- Standard reports (208)

- ASP expansion (28)

- Model expansion (22)

- Standard reports (206)

- Technology expansion (25)

- Secondary Smartphone Market Reports (6)

- Automotive (53)

- Automotive Futures (1)

- Autonomous Vehicles (21)

- Connected Vehicles (72)

- Electric Vehicles (43)

- Micro & Shared Mobility (5)

- Smartwatch (146)

- China (350)

- Eastern Europe (30)

- Global (622)

- India (284)

- Latin America (31)

- Middle East & Africa (73)

- Western Europe (42)

Report Type

- Blog / PR (2,074)

- Podcast (73)

- Report (4,807)

- Whitepaper (26)

Time Period

- Half-yearly (88)

- Monthly (396)

- Quarterly (533)

- Weekly (40)

- Yearly (11)

Counterpoint Smartphone Intelligence Tracker, March 2024

- Industry Beats, Standard

- / 4月 1, 2024

- / Mohammed Junaid

Overview: Counterpoint’s monthly Smartphone I ...

- Subscription required

Market Pulse: Flagship Model Sales (February 2024)

- Monthly Market Pulse, Standard reports

- / Ankit Malhotra, Ravyansh Yadav

Overview: Counterpoint Research’s Market Puls ...

Market pulse: smartphone insights and analysis (february 2024), market pulse: oem sales (february 2024), global foldable market analysis, q4 2023.

- Foldable Devices, Foldable_Devices

- / 3月 29, 2024

- / Jene Park

Overview: Global foldable smartphone shipment ...

China’s smartphone landscape before chinese new year.

- Country Reports, China

- / Mengmeng Zhang, Ivan Lam

Overview: During the four weeks leading up to ...

Europe’s competitive landscape – tough going outside the top three.

- Industry Beats, Premium

- / Jan Stryjak

Overview Europe’s smartphone market has becom ...

India smartwatch shipment by model tracker, q4 2023.

- IoT, IoT Applications

- / 3月 28, 2024

- / Harshit Rastogi, Mahima Jatwala, Anshika Jain

Overview: India smartwatch market grew 41% Yo ...

Global smartphone chipset market analysis q4 2023.

- Component Tracker, Chipsets

- / Shivani Parashar

Overview: This report tracks smartphone AP/So ...

Social media.

- Privacy Policy

Copyright ⓒ Counterpoint Technology Market Research | All rights reserved

Only fill in if you are not human

- Events & Webinars

Term of Use and Privacy Policy

- Technology & Telecommunications ›

Consumer Electronics

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

- Global sales volume for true wireless hearables 2018-2021

What is behind the growth in hearables?

From ridicule to must-have device, unit sales of true wireless hearables worldwide from 2018 to 2021 (in millions).

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

Counterpoint Research

2018 to 2021

*Forecast Values have been compiled from various reports.

Other statistics on the topic Wearables

- Wearables shipments worldwide market share 2014-2023, by vendor

- Connected wearable devices worldwide 2019-2022

- Wearables shipments worldwide market share 2014-2022, by vendor

- Smartwatch unit shipment share worldwide 2018-2023, by vendor

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Statistics on " Wearables "

- Digital fitness & well-being device market revenue worldwide 2019-2028, by segment

- Total wearable device unit shipments worldwide 2014-2022

- Wearable device shipments worldwide 2021-2027, by product category

- Unit shipment forecast of smart wristwear worldwide 2016-2026

- Revenue of the smartwatches industry worldwide 2019-2028

- Smartwatch shipments 2020-2022, by region

- Unit sales share of TWS hearables worldwide 2020-2021, by price

- Wearables unit shipments worldwide 2014-2022, by vendor

- Quarterly wearables shipments worldwide 2014-2023, by vendor

- Companies with the most wearables patents worldwide 2012-2021

- Global smartwatch market share 2020-2022, by vendor

- Wearable devices ownership in selected countries 2023

- Wearable devices usage in selected countries 2023

- Most used eHealth tracker / smart watches by brand in the U.S. 2023

- Most used eHealth tracker / smart watches by brand in the UK 2023

- Most used eHealth tracker / smart watches by brand in Germany 2023

- Most used headphones by brand in the U.S. 2023

- Most used headphones by brand in the UK 2023

- Most used headphones by brand in Germany 2023

- AR/VR B2C market revenue worldwide 2017-2027, by segment

- Revenue of the VR headsets industry worldwide 2018-2028

- Revenue growth of VR headsets worldwide 2019-2028

- Volume of VR headsets worldwide 2018-2028

- Comparison of AR headsets and glasses worldwide 2024, by price

Other statistics that may interest you Wearables

- Premium Statistic Digital fitness & well-being device market revenue worldwide 2019-2028, by segment

- Premium Statistic Total wearable device unit shipments worldwide 2014-2022

- Premium Statistic Wearable device shipments worldwide 2021-2027, by product category

- Premium Statistic Connected wearable devices worldwide 2019-2022

- Premium Statistic Unit shipment forecast of smart wristwear worldwide 2016-2026

- Premium Statistic Revenue of the smartwatches industry worldwide 2019-2028

- Premium Statistic Smartwatch shipments 2020-2022, by region

- Premium Statistic Global sales volume for true wireless hearables 2018-2021

- Premium Statistic Unit sales share of TWS hearables worldwide 2020-2021, by price

- Premium Statistic Wearables unit shipments worldwide 2014-2022, by vendor

- Premium Statistic Quarterly wearables shipments worldwide 2014-2023, by vendor

- Premium Statistic Wearables shipments worldwide market share 2014-2022, by vendor

- Premium Statistic Wearables shipments worldwide market share 2014-2023, by vendor

- Premium Statistic Companies with the most wearables patents worldwide 2012-2021

- Premium Statistic Global smartwatch market share 2020-2022, by vendor

- Basic Statistic Smartwatch unit shipment share worldwide 2018-2023, by vendor

Consumption

- Premium Statistic Wearable devices ownership in selected countries 2023

- Premium Statistic Wearable devices usage in selected countries 2023

- Premium Statistic Most used eHealth tracker / smart watches by brand in the U.S. 2023

- Premium Statistic Most used eHealth tracker / smart watches by brand in the UK 2023

- Premium Statistic Most used eHealth tracker / smart watches by brand in Germany 2023

- Premium Statistic Most used headphones by brand in the U.S. 2023

- Premium Statistic Most used headphones by brand in the UK 2023

- Premium Statistic Most used headphones by brand in Germany 2023

Special focus: XR devices

- Premium Statistic AR/VR B2C market revenue worldwide 2017-2027, by segment

- Premium Statistic Revenue of the VR headsets industry worldwide 2018-2028

- Premium Statistic Revenue growth of VR headsets worldwide 2019-2028

- Premium Statistic Volume of VR headsets worldwide 2018-2028

- Premium Statistic Comparison of AR headsets and glasses worldwide 2024, by price

Further related statistics

- Premium Statistic Global sales of headphones/headsets 2013-2017

- Premium Statistic Share of people who bought earphones in Norway 2014-2020

- Premium Statistic Estimated number of earphone sold in Norway 2014-2020

- Premium Statistic Attitude towards price and brand of earphones and headphones South Korea 2018

- Premium Statistic Apple's AirPod customer satisfaction rate in the U.S. 2017, by feature

- Premium Statistic Canadian wireless earbud ownership rate in 2018, by province

- Premium Statistic Sales volume of headphones in Germany 2008-2022

- Premium Statistic Share of people who bought headphones and/or earphones in Norway 2014-2021

- Basic Statistic Share of headphone owners by brand in the United States 2017

- Premium Statistic Average price of headphones and universal remotes in Germany 2005-2022

- Premium Statistic Preference of earphones and headphones South Korea 2018, by cable type

- Premium Statistic Import value of headphones and headsets in the United Kingdom (UK) 2016-2022

- Basic Statistic Earphone & headphone worldwide consumer sales 2014-2017

- Premium Statistic Average spending on earphones and headphones South Korea 2018

- Premium Statistic Headphone sales (factory level) in the United States 2018-2023

- Premium Statistic Sales revenue from headphones in Germany 2008-2022

- Premium Statistic Earphone and headphone market by product in Asia Pacific 2014-2025

- Premium Statistic Headphone and earphone usage in France 2016-2017, by product type

- Premium Statistic Export value of headphones and headsets in the United Kingdom (UK) 2016-2022

- Premium Statistic Revenue from headphone sales in Germany 2008-2022

Further Content: You might find this interesting as well

- Global sales of headphones/headsets 2013-2017

- Share of people who bought earphones in Norway 2014-2020

- Estimated number of earphone sold in Norway 2014-2020

- Attitude towards price and brand of earphones and headphones South Korea 2018

- Apple's AirPod customer satisfaction rate in the U.S. 2017, by feature

- Canadian wireless earbud ownership rate in 2018, by province

- Sales volume of headphones in Germany 2008-2022

- Share of people who bought headphones and/or earphones in Norway 2014-2021

- Share of headphone owners by brand in the United States 2017

- Average price of headphones and universal remotes in Germany 2005-2022

- Preference of earphones and headphones South Korea 2018, by cable type

- Import value of headphones and headsets in the United Kingdom (UK) 2016-2022

- Earphone & headphone worldwide consumer sales 2014-2017

- Average spending on earphones and headphones South Korea 2018

- Headphone sales (factory level) in the United States 2018-2023

- Sales revenue from headphones in Germany 2008-2022

- Earphone and headphone market by product in Asia Pacific 2014-2025

- Headphone and earphone usage in France 2016-2017, by product type

- Export value of headphones and headsets in the United Kingdom (UK) 2016-2022

- Revenue from headphone sales in Germany 2008-2022

IMAGES

VIDEO

COMMENTS

Counterpoint provides data and insights for smartphones, wearables, TVs and other TMT industries. See how they help clients with weekly tracking, consumer research, market forecasting and more.

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in ...

Counterpoint Research is an Asia-based firm that provides market research and consulting services for the technology industry. Watch videos on the latest trends, products and innovations in mobile, digital consumer goods, software and more.

Counterpoint is a market research company dedicated to delivering in-depth intelligence of the technology markets to the C-levels of the mobile industry. Founded by Analysts based out of Korea ...

Counterpoint Research, a global technology industry research firm, has acquired DSCC, a display industry specialist, to strengthen its supply chain and end-market analysis. The acquisition will enhance Counterpoint Research's market coverage, data and insights for clients across various IT products and segments.

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms ...

Counterpoint Research Expects Semiconductor Shortage to Ease in 2H 2022 on Higher Component Inventories, Softening Smartphone Demand

Counterpoint Technology Market Research | 17,228 followers on LinkedIn. Unbiased, Fact-Based, Timely, High Quality Insights & Data | Counterpoint is a market research company dedicated to delivering in-depth intelligence of the technology markets to the C-levels of the mobile industry. Founded by Analysts based out of Korea, India & UK Our senior team of renowned industry analysts has seen ...

The global smartphone market declined 1% YoY in CY 2019, according to the latest research from Counterpoint's Market Monitor service. This is the firs

The 50 per cent landmark — the iPhone's highest share since it launched in 2007 — was first passed in the quarter ending in June, according to data from Counterpoint Research. Some 150 ...

Counterpoint Research published a new report today on the "blended bill of materials," or BoM, cost for Apple's iPhone 15 Pro Max. This report reveals how much it costs Apple to make each ...

The global smartphone market returned to growth in October after more than two years of slump, helped by a recovery in the emerging markets, according to data from Counterpoint Research.

The report analyzes the global market share and trends of smartphones with embedded hardware security, such as eSE, inSE, PUF and TPM. Apple leads with 42% market share, followed by Huawei and Samsung, while Google uses a different approach with TPM.

Counterpoint Research expects Apple sell-in volumes to grow 4% YoY in 2020, while the global smartphone market will retract by 10%. The research firm forecasts a significant upgrade cycle for iPhone 12 family in Q4, driven by 5G, display sizes and price points.

Counterpoint Research put out a list of the 10 best selling phones in 2022 and the iPhone claimed eight spots. We look at why and dig into the numbers to find out what shoppers are saying about ...

In 2022, its share of phones sold in China rose to 22 percent, from 9 percent in 2019, according to Counterpoint. Apple reported record revenue of $74 billion from the region during its fiscal ...

Counterpoint Research, in its report released in early March, estimated that iPhone sales in China had dropped by 24% in the first six weeks of the year. That decline, at a slower pace than China ...

Counterpoint Technology Market Research is a fast-growing, innovative and independent market research and consulting firm. Counterpoint is Asia based and a premier technology market research firm with global footprint and offices in the key high growth markets. Counterpoint's research, consulting and advisory services spans across the ...

Counterpoint Research provides quarterly updates on the global smartphone market share by top OEMs, regions and operating systems. Download the latest data and reports on smartphone shipments, sales, trends and insights.

The firm predicts RISC-V could pick up 25 per cent of the Internet of Things market by 2025. Another of RISC-V's qualities Counterpoint admires is its "lower political risk impact" - a reference to the fact that the architecture's open-source status means policies that prevent proprietary tech being transferred to China won't be easy to apply.

Global shipments had declined more than 4% last year, opens new tab, earlier data from the research firm showed, as consumers tightened their purse strings in an uncertain economy.

Counterpoint Research is a market research company dedicated to providing innovative solutions to complex problems. Established in 1991 our ability to get beyond the obvious has made us one of the ...

Xiaomi formally launched its much-anticipated electric car — the new Speed Ultra 7 (SU7) sedan — on Thursday night in Beijing. Lei Jun, founder and CEO of the popular Chinese smartphone brand ...

Access the latest reports on smartphone, smartwatch, tablet, 5G, IoT and other markets from Counterpoint Research. Subscription required for some reports.

Research expert covering the global consumer technology industry. Get in touch with us now. , Jan 31, 2024. Sales of true wireless hearables (TWS) increased to just below 300 million units ...