Skip to content

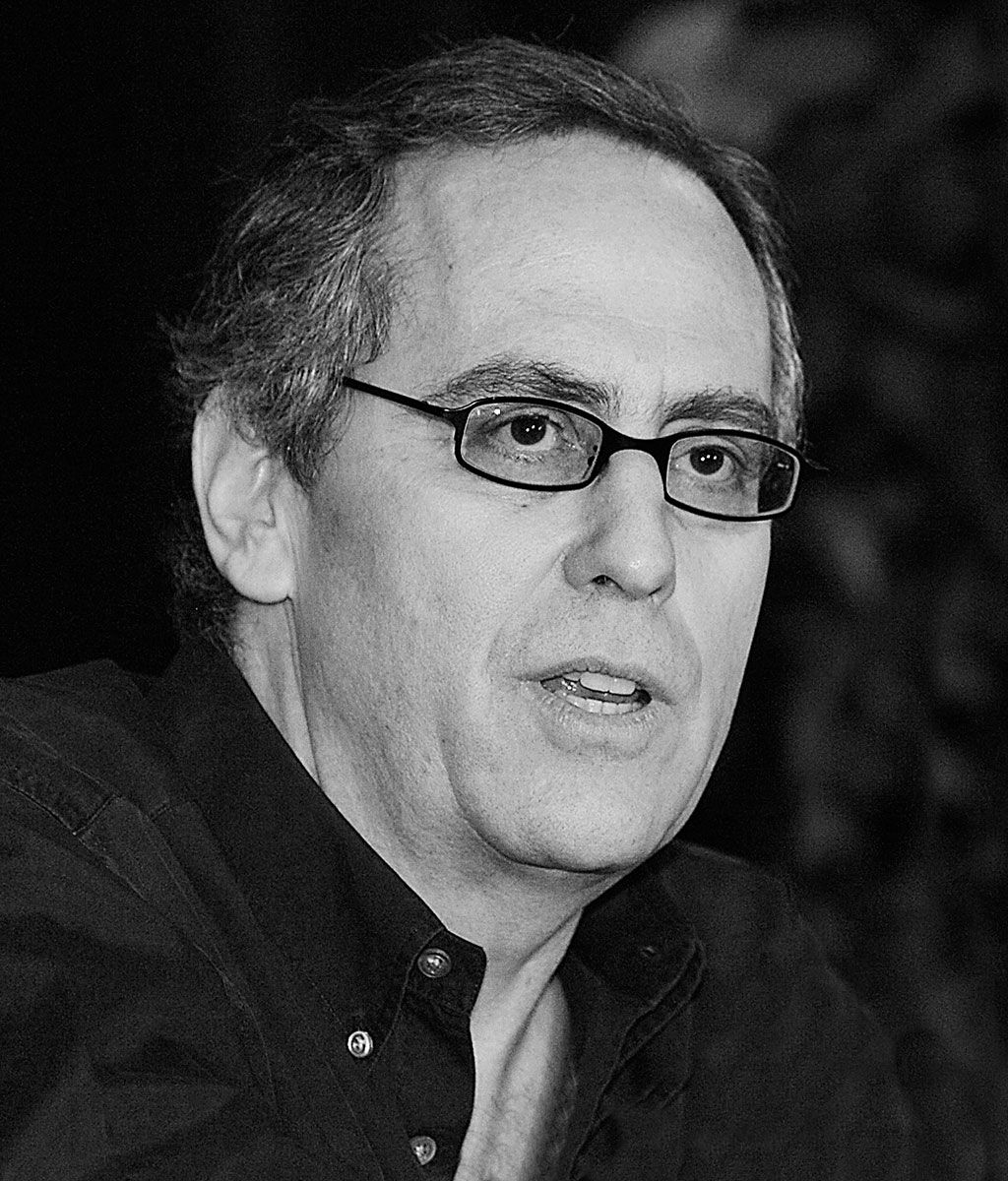

David E. Shaw, PhD

- Adjunct Professor of Biochemistry and Molecular Biophysics (in Biomedical Informatics and Systems Biology)

Profile Navigation

Credentials & experience.

David E. Shaw serves as chief scientist of D. E. Shaw Research, and as a senior research fellow and adjunct professor at Columbia University. He received his Ph.D. from Stanford University in 1980, served on the faculty of the Computer Science Department at Columbia until 1986, and founded the D. E. Shaw group in 1988. Since 2001, Dr. Shaw has devoted his time to hands-on research in the field of computational biochemistry.

Academic Appointments

Education & training.

- PhD, Stanford University

Use of very long molecular dynamics simulations to study the structural changes in proteins associated with protein folding, protein-ligand binding, molecular signaling, ion transport, and other biologically significant processes.

Drug Discovery

D. E. Shaw Research conducts drug discovery programs both independently and in collaboration with other biopharmaceutical companies and research laboratories. All of our computational work is performed in‑house using a combination of our special‑purpose Anton supercomputers and high‑speed commodity hardware. We do not maintain in‑house “wet lab” facilities, but routinely design experiments for execution under our direction by various specialized contract research organizations (CROs).

Our drug discovery activities fall into three categories, each of which is enabled in part by the use of Anton‑based MD simulations, machine learning methods, and other advanced computational technologies:

- Elucidating the molecular mechanisms of pathological biological processes

- Identifying previously undiscovered biomolecular phenomena that may be relevant to the pathogenesis of potentially treatable human diseases

- Determining how the binding of a given molecule at a given binding site modulates the function of a protein implicated in a given disease

- Exploring at an atomic level of detail the effects of inherited or acquired mutations that are known to be associated with certain pathologies

- Identifying new molecular strategies for pharmaceutical intervention

- Discovering potentially druggable three‑dimensional protein configurations that have been inaccessible to experimental structure determination

- Finding new, previously untargeted binding sites, including cryptic or ephemeral binding pockets and novel sites for allosteric modulation

- Identifying ligand features that tend to stabilize or destabilize particular protein structures, or to promote or preclude particular interactions

- Creating novel, precisely targeted, highly selective drugs

- Using a combination of computational and experimental techniques to generate or screen small‑molecule compounds

- Designing highly selective compounds that bind strongly to the target protein while avoiding toxicity‑inducing interactions with related proteins

- Predicting and optimizing biopharmaceutical properties such as solubility and membrane permeability

Our research, technologies, and pharmaceutical expertise have each played an important role in bringing six drugs into clinical trials. We designed two of these drugs independently; the other four were discovered under a multi‑target collaboration and licensing agreement with Relay Therapeutics (NASDAQ: RLAY), a separate company of which D. E. Shaw Research was a co‑founder.

Our first independently developed drug, DES‑7114, is an orally administered medication that inhibits the ion channel protein Kv1.3 in a highly selective manner. Our preclinical studies demonstrated the efficacy of this first‑in‑class therapeutic in models of several chronic inflammatory and autoimmune diseases, including ulcerative colitis, Crohn’s disease and atopic dermatitis, and we successfully completed a Phase 1 clinical trial in healthy human volunteers in early 2022. In May 2022, we entered into an exclusive global license agreement with Eli Lilly for further clinical development and commercialization of our program of Kv1.3‑targeted therapeutics, including DES‑7114. Another drug we developed independently, DES‑9384, entered a Phase 1 clinical trial in 2023. DES‑9384 inhibits the ion channel TrpA1, a protein involved in various respiratory and inflammatory diseases (such as chronic cough and rheumatoid arthritis), and in various types of pain (such as arthritic pain, diabetic neuropathy, and chronic lower back pain).

The four drugs on which D. E. Shaw Research collaborated with Relay Therapeutics are all designed for the treatment of cancer. RLY‑4008 targets the receptor tyrosine kinase FGFR2, which is frequently altered in certain malignancies; RLY‑2608 is designed to be the first allosteric, pan‑mutant (H1047X, E542X and E545X) and isoform‑selective PI3Kα inhibitor; RLY‑5836 is a chemically distinct, pan‑mutant and selective PI3Kα inhibitor; and GDC‑1971 (formerly RLY‑1971) is designed to bind and stabilize the protein tyrosine phosphatase SHP2 in its inactive conformation. In December 2020, Relay entered into a worldwide license and collaboration agreement with Genentech for the development and commercialization of GDC‑1971. (To learn more about Relay, click here .)

D. E. Shaw Research welcomes the opportunity to collaborate with other pharmaceutical and biotech companies on the discovery and development of novel therapeutics.

- Work & Careers

- Life & Arts

DE Shaw: inside Manhattan’s ‘Silicon Valley’ hedge fund

- DE Shaw: inside Manhattan’s ‘Silicon Valley’ hedge fund on x (opens in a new window)

- DE Shaw: inside Manhattan’s ‘Silicon Valley’ hedge fund on facebook (opens in a new window)

- DE Shaw: inside Manhattan’s ‘Silicon Valley’ hedge fund on linkedin (opens in a new window)

- DE Shaw: inside Manhattan’s ‘Silicon Valley’ hedge fund on whatsapp (opens in a new window)

Robin Wigglesworth in New York

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In 1988, Revolution Books, a tatty Communist bookstore near New York’s Union Square, got some strange new upstairs neighbours: a bunch of geeky programmers trying to crack the code to financial markets.

In the early days, the embryonic hedge fund founded by David Shaw, a former computer science professor at Columbia University, was a ramshackle start-up. Exposed pipes and extension cords meant that tripping on a cable could take out its entire trading system. Yet today DE Shaw is one of the hedge fund industry’s biggest players, managing over $50bn of assets.

It has enjoyed some mainstream fame as the place where a young Jeff Bezos first worked on what would ultimately become Amazon. But most importantly for a wider investment industry desperately trying to reinvent itself for the 21st century, DE Shaw has evolved dramatically from the algorithmic, computer-driven “quantitative” trading it helped pioneer in the 1980s.

It is now a leader in combining quantitative investing with traditional “fundamental” strategies driven by humans, such as stockpicking. This symbiosis has been dubbed “ quantamental ” by asset managers now attempting to do the same. Many in the industry believe this is the future, and are rushing to hire computer scientists to help realise the benefits of big data and artificial intelligence in their strategies.

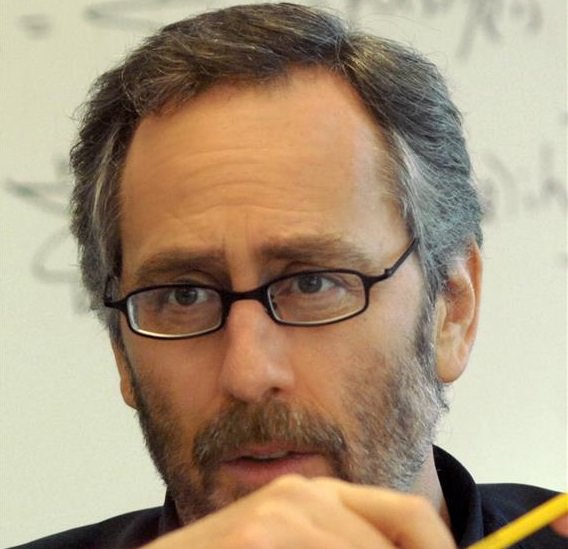

Eric Schmidt, the former Google chairman who owns a 20 per cent stake in DE Shaw, predicts that this approach will profoundly reshape the investment management industry. “People have gone insane about this, but in a good way,” Mr Schmidt says. “We are at the beginning of a new era in artificial intelligence. These technologies should benefit investing as well.”

There are plenty of pitfalls though, with experts warning that poor implementation can lead to disastrous results. Wall Street has seen several cycles of quant hype before, and many remain sceptical that traditional firms can retool their culture sufficiently to unlock the potential advantages of a more hybrid approach.

The combination of DE Shaw’s performance and the secrecy around exactly what it does both vexes and fascinates rivals and counterparties. “They’re like a calibrated machine that can respond to nearly every market,” says the head of an investment bank’s hedge fund trading desk. In a series of interviews with senior DE Shaw executives, the Financial Times has had a rare glimpse of how the “machine” operates.

Little known outside investing’s arcane corners, DE Shaw is the fourth-highest grossing hedge fund group of all time, having made over $29bn for its investors since those early days near Union Square , according to LCH Investments.

Last year its flagship $14bn Composite Fund — which has been closed to new investors since 2013 — returned over 11 per cent to investors net of fees, despite the turmoil in financial markets. That was its seventh double-digit gain of the past decade, over which period it has not suffered a losing year. Its $7.6bn “macro” fund, Oculus, returned 5.9 per cent in 2018, and the $7bn stocks-focused Valence made 8 per cent.

Even among peers on Wall Street, DE Shaw is still a largely unknown quantity. “They’re really smart, but I’ve never quite understood them,” says one quant hedge fund manager. “They are one of those places where you just don’t know exactly what [it is] they do, except that it is some mix of quantitative and discretionary investing.”

This hybrid approach is not new. DE Shaw ventured out of its quantitative roots soon after its founding. But it now manages a wide array of strategies, ranging from completely machine-driven and dizzyingly complex, to human and artisanal, such as “distressed debt” investing and activism. Roughly half of the $50bn it manages are in quant strategies, and the rest in discretionary or more hybrid funds.

“The world tends to view quantitative and fully discretionary investing as distinct and separate, but the opportunity set [to make money] is not as cleanly divided,” says Max Stone, one of the five members of DE Shaw’s executive committee, along with Eddie Fishman, Eric Wepsic, Julius Gaudio and Anne Dinning .

Some rivals question whether it has departed too far from its roots. For instance, Two Sigma — a major quant hedge fund started by former senior DE Shaw executives — has eschewed their former colleagues’ hybrid methods.

DE Shaw executives stress that their one constant is to have a data-driven “quanty” approach across the board, whether it is in high-speed arbitrage or investing in renewable energy. “Our core strength is thinking scientifically about things, so it doesn’t feel like we are wandering away from our roots,” says Alexis Halaby, head of investor relations at the company.

It currently employs about 1,300 people, which includes over 80 PhDs and 25 International Math Olympiad medal holders. All interviewees at DE Shaw face a series of analytical questions to demonstrate their suitability to work there — something even former US Treasury secretary Larry Summers had to go through ahead of a stint at the fund in 2006.

That approach seeps through into the culture, say observers. Mahmood Noorani, a former hedge fund manager who now leads Quant Insight, an analytics company, describes the people at DE Shaw as “less alpha male and more gentle scientists”.

This has helped the company survive the type of leadership transition that has felled some rivals. Most hedge funds see their fortunes fade once their founder steps down, but DE Shaw has thrived since Mr Shaw, 67, semi-retired in the early 2000s to pursue research into “computational biochemistry”.

Fittingly for a company started above a bookstore selling Marxist treatises, the day-to-day running of the hedge fund is now handled by the central committee of five, rather than a single, imperial impresario typical of the industry. “You’d be hard-pressed to find a management textbook that says a committee is a good way of running a company,” says Mr Stone. “But it works for us.”

This was among the factors that attracted Mr Schmidt when he scooped up the 20 per cent stake in DE Shaw held by the bankrupt estate of Lehman Brothers in 2015. “It feels like Silicon Valley in Manhattan,” he says. “People get consumed by hierarchy, but the evidence shows that flat structures and diverse teams operating collectively have better outcomes.”

Sometimes things go awry, however. In an unusually public spat for a company that shuns publicity, DE Shaw last year fired Daniel Michalow , a senior fund manager, after an internal review found “gross violations of our standards and values”.

In an open letter Mr Michalow conceded that he might have deserved his dismissal for being “an abrasive boss” but insisted that his departure was not related to any sexual misconduct. He did, however, paint a very different picture of DE Shaw criticising the hedge fund for “lavish, alcohol-filled parties” and said visits to strip clubs and senior employee relationships with their juniors were common. DE Shaw declined to comment on the accusations, citing ongoing legal proceedings. Mr Michalow is suing DE Shaw for defamation and other claims relating to the announcement of his termination.

The hedge fund’s executives are happier to discuss how it manages money, even if the details can be opaque. DE Shaw runs some quant strategies so complex or quick that they are in practice almost beyond human understanding — something that many quantitative analysts are reluctant to concede.

The goal is to find patterns on the fuzzy edge of observability in financial markets, so faint that they haven’t already been exploited by other quants. They then hoard as many of these signals as possible and systematically mine them until they run dry — and repeat the process. These can range from tiny, fleeting arbitrage opportunities between closely-linked stocks that only machines can detect, to using new alternative data sets such as satellite imagery and mobile phone data to get a better understanding of a company’s results.

Yet, the hedge fund’s executives say they also frequently use common sense to overrule their algorithms, another anathema in an industry where human tinkering can be considered a foible.

Some of these manual interventions are obvious. For example, when Russia annexed the Crimean part of Ukraine in 2014 and started fomenting unrest in its eastern province, DE Shaw quickly dialled back its exposure to the Moscow stock market. And when the Volkswagen emission cheating scandal erupted a year later — another of the unexpected shocks that machines are ill-equipped to deal with — it pared back bets on the carmaker.

Other strategies require a heavier human hand, such as taking advantage of periodically wide discrepancies between Tencent and Naspers, the South African holding company that owns nearly a third of the Chinese tech giant. Normally they trade in lockstep, but sometimes they diverge because of broader emerging market stress or South African politics — opening up a valuable opportunity. The optimal time to pounce can be modelled, but is best paired with the discretion of a human fund manager.

Yet, DE Shaw still sees plenty of opportunities in the quantitative investing side, especially its “long-only”, non-hedge fund investing business, DE Shaw Investment Management. DESIM has quintupled in size since 2011 and now manages $24bn. To grow this further, the company is expanding into something dubbed “risk premia” , systematically exploiting theoretically timeless drivers of returns, such as the tendency for smaller or cheaper stocks to outperform the overall market over time.

Historically these have been factors that hedge funds might explicitly or indirectly harness — and charge hefty fees for — but they have now been packaged up into simpler, cheaper vehicles by the likes of AQR and BlackRock.

DE Shaw is also ramping up its investment in the bleeding edge of computer science, setting up a machine learning research group led by Pedro Domingos, a professor of computer science and engineering and author of The Master Algorithm , and investing in a quantum computing start-up.

It is early days, but Cedo Crnkovic, a managing director at DE Shaw, says a fully-functioning quantum computer could potentially prove revolutionary. “Computing power drives everything, and sets a limit to what we can do, so exponentially more computing power would be transformative,” he says.

Nearly every traditional investment company is scrambling to hire data scientists, programmers and technologists, and turn themselves into human-machine hybrids. DE Shaw’s apparent success in bridging those two worlds offers an alluring template for rivals.

However, many “pure” quants are sceptical that traditional asset managers have the cultural architecture needed to make a success, arguing that companies cannot just hire a bunch of computer scientists, tell them to work with 50-year-old fund managers with MBAs and hope that magic will ensue. Others fret that by not fully grasping the limitations, they might even do damage to themselves, and or investors.

Mr Stone has a stuffed albino peacock sitting on a cabinet in his office, a reminder that sometimes markets — like nature — serve up the unexpected. He is wary of criticising the quantamental rush, but also cautions that it could end in tears.

“There are some good ideas at the intersection of systematic and discretionary investing,” he says. Nonetheless, “if you don’t have experience of separating signal from noise,” he adds, “you can easily be led astray by extraneous data.”

‘Crowding’ fears Will quants be able to ride out the next crisis?

For many, the summer of 1998 was defined by the Monica Lewinsky scandal enveloping the White House, the Spice Girls losing a member and France’s stunning victory at the football World Cup. But for the finance industry, that summer will forever be remembered as the period when some of the finest minds on Wall Street came undone.

The collapse of Long-Term Capital Management, the hedge fund led by Salomon Brothers’ former star trader John Meriwether and advised by Nobel laureates Myron Scholes and Robert Merton, hogged the headlines. But the market maelstrom also nearly killed DE Shaw, which had made many of the same trades as LTCM with similarly massive dollops of leverage. “The market environment was harrowing,” says Eddie Fishman, who now sits on the DE Shaw executive committee. “But the lessons served us well in subsequent crises.”

The 1998 crisis, and the “quant quake” in August 2007, are reminders that even the most sophisticated computer-powered strategies can implode. Given the popularity of quantitative investing and the competition to find and mine new trading signals, there are concerns that markets are primed for a rerun.

History indicates that the two main dangers are leverage and “crowding”. The toxicity of aggressive leverage — whether debt or through derivatives — is well-known, but too many investors crowding into the same security or trade can also cause severe damage, especially when trading conditions deteriorate quickly.

While most hedge funds use far less leverage than in 1998 or 2007, the sheer amount of money raised by quant funds since the crisis is leading to fears of crowding, lowering returns for everyone and ultimately raising the risk of an abrupt reversal, which would in turn lead to a crash as burnt investors dash for the exit.

Promoted Content

Follow the topics in this article.

- Hedge funds Add to myFT

- Financial services Add to myFT

- Quant investing Add to myFT

- D. E. Shaw and Company Add to myFT

- The Big Read Add to myFT

International Edition

Things you buy through our links may earn Vox Media a commission.

How a Misfit Group of Computer Geeks and English Majors Transformed Wall Street

In the 1980s, a quiet hedge fund located above a Marxist bookstore launched a revolution that would change finance (and give us Amazon).

In celebration of New York Magazine’s 50th anniversary, this series, which will continue through October 2018, tells the stories behind key moments that shaped the city’s culture.

In the summer of 1988, the hedge-fund manager Donald Sussman took a call from a former Columbia University computer-science professor wanting advice on his new Wall Street career.

“I’d like to come see you,” David Shaw, then 37 years old, told Sussman. Shaw had grown up in California, receiving a Ph.D. at Stanford University, then moved to New York to teach at Columbia before joining investment bank Morgan Stanley, which had a new secretive trading group that was using computer modeling. A neophyte in the ways of Wall Street, Shaw wanted Sussman, who founded the investment firm Paloma Partners, to look at an offer he had received from Morgan Stanley’s rival, Goldman Sachs.

Sussman’s career has been built on recognizing and financing hedge-fund talent, but he had never encountered anyone like David Shaw. The cerebral computer scientist would go on to become a pioneer in a revolution in finance that would computerize the industry, turn long-standing practices on their head, and replace a culture of tough-guy traders with brainy eccentrics — not just math and science geeks, but musicians and writers — wearing jeans and T-shirts.

A harbinger of the techies who would storm Wall Street in a decade, this new generation of hedge-fund introverts would replace the profanity-laced trading rooms of the 1980s with quiet libraries of algorithmic research in every corner of the markets. They would also launch an early email system and look into the prospect of online retailing, leading one of Shaw’s most ambitious employees to take the idea and run with it. Yes, the seeds of Jeff Bezos’s Amazon were planted at a New York City hedge fund.

Thirty years ago, all of that was yet to come. All Shaw told Sussman at the time was, “I think I can use technology to trade securities.”

Sussman told Shaw the Goldman offer he had received was inadequate. “If you’re confident this idea is going to work, you should come work for me,” Sussman told Shaw. The offer led to three days of sailing in Long Island Sound on Sussman’s 45-foot sloop with the financier, Shaw, and his partner, Peter Laventhol. The two men —without disclosing many details — “convinced me they believed they could generate models that would identify portfolios that would be market-neutral and able to outperform others,” Sussman remembers. In lay terms, the strategy would make a lot of money without taking much risk.

Hedge funds were still fairly primitive, and while they were already using mathematical formulas to capture small price disparities in such esoteric instruments as convertible bonds — then a dominant hedge-fund strategy — Shaw was planning to take the math to a whole new level.

Paloma Partners agreed to invest $30 million with D.E. Shaw. Since then, the company has grown into an estimated $47 billion firm, earning its investors more than $25 billion — as of the end of 2016, tied for the third biggest haul ever. It has made millionaires out of scores of employees and a multibillionaire out of Shaw, who stepped back in 2001 from day-to-day operation of the firm to start D.E. Shaw Research, which conducts computational biochemistry research in an effort to help cure cancer and other diseases. Shaw is estimated by Forbes to be worth $5.5 billion, and remains as elusive as ever: He declined to speak to New York for this article.

Meanwhile, the quantitative revolution D.E. Shaw helped spawn has become the biggest trend in hedge funds today, capturing some $500 billion of the industry’s more than $3 trillion in assets and dominating the top tier. Seven out of the top ten largest funds are considered “quants,” including D.E. Shaw itself. One of those seven quants, Two Sigma, was started by D.E. Shaw veterans. But the changes D.E. Shaw wrought haven’t just been felt in hedge funds. Shaw spit out orders accounting for an estimated 2 percent of the trading volume of the New York Stock Exchange in its early years, and thanks to it and other emerging quants, the NYSE was forced to automate. By the end of the 1990s, electronic stock exchanges were driving trading prices down, and by 2001, stocks began to be traded in penny increments, instead of eighths. These changes made it cheaper and easier for all investors to get into the game, leading to an explosion in trading volume.

From the beginning, D.E. Shaw was a quirky enterprise, even for a hedge fund. The first office was far from Wall Street, in a loftlike space above Revolution Books, a communist bookstore on 16th Street, in what was then a still fairly seedy Union Square. The office, about 1,200 square feet, was bare, with freshly painted walls and a tin ceiling. But it boasted two Sun Microsystem computers — the fastest, most sophisticated computers then in vogue on Wall Street. “He needed Ferraris; we bought him Ferraris,” says Sussman.

As Shaw sought to build his newfangled firm, he didn’t want to hire people steeped in Wall Street’s ways. Likewise, those who joined D.E. Shaw typically disdained the notion of working on the Street. “I thought to myself, No way ,” says Lou Salkind, remembering a call he received from Shaw in the summer of 1988 asking him if he would be interested in joining his start-up. Salkind was finishing his Ph.D. in computer science at New York University and on the hunt for a job, but Wall Street turned him off. “The year before, I’d been recruited by a few firms on Wall Street. I was skeptical I would like anything in finance.”

Lacking any other job offers, he agreed to meet with Shaw. After all, his hedge fund’s office was about ten blocks away from NYU. The two men went to lunch at nearby Union Square Cafe, where they got to talking about gambling, one of Salkind’s passions. Born in New York City, Salkind had learned to count cards at an early age and developed a horse-betting system at age 13. He had no idea such mathematical skills would come in handy at a hedge fund. “I had a blast,” he recalls.

When they returned to the office, Shaw began laying out his vision. “What I want to build here is a company at the intersection of technology and finance,” he told Salkind. As with Sussman, Shaw wouldn’t tell Salkind much more than that, but he did speculate that his firm might be able to replace Wall Street market makers: “They prepare to buy at the bid, hold, and sell at a higher price. The difference is what you try to capture. We could do a lot of this stuff automatically with computers,” he told the fellow computer scientist.

“Oh, you’re like a bookie. That’s the vig,” said Salkind, who was immediately sold on the job. Salkind, who retired in 2014, became one of the first employees of D.E. Shaw.

In the hedge fund’s early days, Sussman would visit the office weekly. “Once they started trading, they started making money out of the box,” he remembers. “These were very serious folks. I used to go and sit next to them watching them trade. They didn’t miss a goddamn thing,” he recalls. “The atmosphere of the place was unlike any other investment firm. It was like going into the research room in the Library of Congress.”

In 1990, Anne Dinning, another NYU computer-science Ph.D. who knew Salkind from his days there, struck up a conversation with Shaw at a party at Salkind’s home. “I didn’t even know what a hedge fund was,” she recalls, but agreed to interview for a job at Shaw “as a lark,” and ended up joining, despite her initial desire to become an academic.

“My first job was to work on some forecast of Japanese equities,” she says. Dinning didn’t have to know anything about the companies or the Japanese stock market. The computer would figure it all out. In the early days, she would run 24-hour simulations, waking up every six hours in the night to check on their progress. Once the algorithms were ready for live trading, “I’d look at the P&L every day and see if it’s doing what I thought it would. It was like an experiment. And I could see the immediate results,” says Dinning. As the firm expanded, Dinning ended up running both the London and Tokyo offices of D.E. Shaw, and both she and Salkind became members of an unorthodox six-person executive committee that ran the firm in a surprisingly effective consensus manner after Shaw stepped back from its day-to-day management. (He is still involved in strategic decisions.)

While D.E. Shaw was minting money, David Shaw’s vision didn’t stop with creating a quantitative hedge fund. Technology, he knew, had the capacity to transform our everyday lives. As an academic, Shaw had already used the Arpanet, the precursor to the internet, to communicate with other scientists. That helped inspire one of the first free internet-based email systems, Juno. With equity capital from D.E. Shaw, the service launched in 1996, went public, and eventually merged with a competitor.

Free email was only one of Shaw’s early initiatives, explains Charles Ardai, who joined Shaw in 1991 with a degree in English (specifically, British Romantic poetry) from Columbia, one of the first of many unconventional hires who didn’t have a background in the hard sciences.

“He went to one of my co-workers and said, ‘I think people will buy things on the internet. They’re going to shop on the internet. What’s more, they’re not just going to shop.’ This, I swear to you, is what David said: ‘Not only will people shop, but when they buy something — let’s say they buy a pipe for watering their garden — they’re going to try a pipe, and they’re going to say, this pipe is good, or this pipe is bad, and they’re going to post reviews, and other people will see them and pick the right instead of the wrong pipe, because somebody else told them, I like this pipe. I don’t like that pipe.’”

Jeff Bezos, who had joined in 1990, was in charge of the online retailing project at D.E. Shaw. He became so enthused about the possibilities that he asked Shaw if he could take the idea and run with it on his own. Shaw agreed, and Amazon was soon born. (Shaw didn’t take a stake in the now-$620 billion company.)

Upon graduating from Columbia, Ardai says he had been so surprised to receive a letter from Shaw asking him to apply for a job that he thought “it must be a scam.” Soon after the 22-year-old joined, he was tasked with setting up Shaw’s recruiting department. “We’ve filled the company with everything from a chess master, to published writers, to stand-up comedians — people who really excel in one field or another — we had an Olympic-caliber fencer, and at one point we had a demolitions expert,” he says. One of D.E. Shaw’s best traders had tattoos all over his arms and couldn’t get hired anywhere on Wall Street. Another was a trombone player who eventually left to create a music program in the Bronx. (Ardai also has other interests; he is the founder and editor of Hard Case Crime, a line of pulp-style paperback crime novels.)

D.E. Shaw’s hiring process may have a far-flung reach, but by no means is it egalitarian. In fact, its recruiting letters once started with an assertion that the firm is “unapologetically elitist.” Once eyebrow-raising, the hedge fund’s hiring practices are no longer abnormal, as they have been adopted by giant tech firms like Google, and of course, Amazon, which even uses the same grading system as D.E. Shaw when interviewing candidates.

The casual dress code embraced by D.E. Shaw has also become de rigueur at tech giants. Though viewed as shocking in Shaw’s early years, such attire is also common at many New York hedge funds today. “One of the goals at D.E. Shaw has always been ‘let’s remove all of the unnecessary constraints,’ for example, why require people to wear neckties?” explains Ardai. The crew at D.E. Shaw was so disheveled that, according to Shaw lore, one disgusted white-shoe law firm moved out of a midtown office tower that the hedge fund occupied — in protest. These days, David Shaw, whose research project is housed across the street from the hedge fund, is often seen wearing a black T-shirt and cargo shorts — even in the middle of winter.

For all of its attempts at modesty, D.E. Shaw has come a ways from its years above a communist bookstore. With more than 1,000 employees, in 2010 the firm moved into new offices at 1166 Sixth Avenue (its fourth New York City home) whose austere reception area has a ceiling and walls covered with screens designed to look like computer punch cards.

In 2015, former Google executive chairman Eric Schmidt, a longtime investor in D.E. Shaw’s hedge funds, took a 20 percent stake in the firm, buying out bankrupt Lehman Brothers’ earlier investment. These days, there’s so much money chasing quants that the earlier strategy of betting on inefficiencies in public equity markets has become less profitable. Innovator D.E. Shaw has moved from its beginnings in equity arbitrage into other arenas like distressed debt and emerging markets, where it uses its quantitative techniques to help give it an edge while relying on humans, not computer models, to make trading decisions.

As the firm gets ready to celebrate its 30th anniversary, David Shaw has not disappointed his first investor, Donald Sussman, whose firm eventually had hundreds of millions of dollars invested with D.E. Shaw. “I never doubted him for a minute,” he says. “I never envisioned that D.E. Shaw would be $47 billion, but I did envision how David would change the world of finance.”

Order Highbrow, Lowbrow, Brilliant, Despicable: 50 Years of New York , a celebratory book chronicling the magazine’s history with powerful images and behind-the-scenes stories from staff and subjects.

- 50th anniversary

- wall street

- hedge funds

- donald sussman

- new york beginnings

Most Viewed Stories

- Trump Second-Term Plan Includes Federal Reserve Coup

- Kristi Noem Killed Her Dog. Why Is She Telling Us This?

- Donald Trump Is a Special Kind of Courtroom-Discipline Problem

- Donald Trump Snatches Final Shred of William Barr’s Dignity

- What Happened in the Trump Trial Today: Pecker Barraged

- The Professor Protesting Columbia’s Own Students

- Andrew Huberman’s Mechanisms of Control

Editor’s Picks

Most Popular

- Kristi Noem Killed Her Dog. Why Is She Telling Us This? By Margaret Hartmann

- Trump Second-Term Plan Includes Federal Reserve Coup By Jonathan Chait

- Donald Trump Is a Special Kind of Courtroom-Discipline Problem By Elie Honig

- Donald Trump Snatches Final Shred of William Barr’s Dignity By Jonathan Chait

- What It Means That Weinstein’s Conviction Was Reversed By Irin Carmon

- The Professor Protesting Columbia’s Own Students By Matt Stieb

- Andrew Huberman’s Mechanisms of Control By Kerry Howley

What is your email?

This email will be used to sign into all New York sites. By submitting your email, you agree to our Terms and Privacy Policy and to receive email correspondence from us.

Sign In To Continue Reading

Create your free account.

Password must be at least 8 characters and contain:

- Lower case letters (a-z)

- Upper case letters (A-Z)

- Numbers (0-9)

- Special Characters (!@#$%^&*)

As part of your account, you’ll receive occasional updates and offers from New York , which you can opt out of anytime.

Current Opportunities

Asic architect and hardware engineer.

Successful candidates will have excellent analytical and communication skills and expertise in the architecture, analysis, or implementation of hardware solutions. Particularly relevant experience would include high-speed (multi-GHz) ASIC design, current custom chip technologies, parallel computation, microprocessor architecture, machine learning acceleration, hardware/software co-design, computer arithmetic, high-speed interconnection networks, and digital systems simulation.

The expected annual base salary for this position is $230,000–$550,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office on Tuesday through Thursday, and have the option of working from home on Monday and Friday.

Computational Chemistry/Physics Methods Developer

Candidates should have a demonstrated track record of achievement in computational and theoretical chemical physics, applied mathematics, or other computational sciences with a strong background in theory. Relevant areas of experience might include the development of methods for molecular dynamics simulations, such as integrators or efficient approximations of long-range forces, methods for enhanced sampling or free-energy calculations, or statistical approaches for analyzing large data sets. Specific knowledge of any of these areas is less critical, however, than strong research skills, and a history of innovation and accomplishment.

The expected annual base salary for this position is $300,000–$475,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office on Tuesday through Thursday, and have the option of working from home on Monday and Friday.

Drug Discovery Biologist

Ideal candidates will have a demonstrated track record of achievement in pre-clinical translational science. This is a high-visibility, high-impact role that affords the opportunity to help shape our drug discovery programs. Relevant areas of experience include leadership of pre-clinical drug discovery programs, design of in vitro assays as well as in vivo disease models, and formulation of translational plans. Specific knowledge of any of these areas is less critical, however, than strong research and communication skills, and a record of impact in drug discovery.

The expected annual base salary for this position is $350,000–$500,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office on Tuesday through Thursday, and have the option of working from home on Monday and Friday.

Drug Discovery Software Associate and Engineer

Successful candidates will be creative and independent problem solvers who have excellent communication skills and are extremely detail-oriented. Ideal candidates will have a background or deep interest in scientific research and experience using Python to script and automate scientific workflows, software used for computational drug discovery, and managing chemical data. They should be committed to providing superb support to users of drug discovery and biomolecular simulation software, and have a demonstrated track record of improving past work environments. This position requires familiarity with Linux/UNIX operating systems and Python or other Shell scripting.

The expected annual base salary for this position is $200,000–$300,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office on Tuesday through Thursday, and have the option of working from home on Monday and Friday.

Force Field Developer

Candidates should have a demonstrated track record of achievement in force field development or related areas. Relevant areas of experience might include development of physics-based force fields, modeling of polarization and quantum effects, novel parameterization strategies (for example, machine learning, statistical inference, or multi-objective methods), ligand and small molecule parameterization, and force field validation and verification. Specific knowledge of any particular area is less critical, however, than strong research skills, and a record of innovation and accomplishment. Successful candidates will contribute to the development of more accurate force fields for biomolecular simulation.

Information Security Engineer

Ideal candidates will have strong knowledge of information security fundamentals, including threat detection and response, vulnerability management, penetration tests, common attack vectors, and endpoint detection and response. Relevant areas of expertise might include operational experience in DevSecOps, developing information security policies and procedures, deploying security tools, and automating the process of detecting and mitigating potential vulnerabilities, in addition to strong programming and scripting ability. Candidates should have excellent communication skills, and we will consider candidates at all levels of experience.

The expected annual base salary for this position is $230,000–$550,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office three days per week, and have the option of working from home the other two days per week.

In-House Counsel

Successful candidates will work closely with our team of world-class scientists and engineers, facilitating groundbreaking contributions in science, technology, and drug discovery. Responsibilities will include:

- Negotiating, drafting, and reviewing contracts in the life sciences and technology spaces, including license agreements, collaboration agreements, master services agreements, and employment and independent contractor agreements

- Advising on structure of life sciences and technology transactions

- Helping to establish and maintain internal best practices and policies in areas such as IP, compliance, and information security

- Advising company leadership on legal and business issues as they arise.

The expected annual base salary for this position is $350,000–$600,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office on Tuesday through Thursday, and have the option of working from home on Monday and Friday.

Machine Learning Researcher and Engineer

Successful hires will expand the group's ongoing efforts applying machine learning to drug discovery, biomolecular simulation, and biophysics. Ideal candidates will have demonstrated expertise in developing deep learning techniques, as well as strong Python programming skills. Relevant areas of experience might include molecular dynamics, structural biology, medicinal chemistry, cheminformatics, and/or quantum chemistry, but specific knowledge of any of these areas is less critical than intellectual curiosity, versatility, and a track record of achievement and innovation in the field of machine learning.

The expected annual base salary for this position is $300,000–$600,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office on Tuesday through Thursday, and have the option of working from home on Monday and Friday.

Scientific Associate

D. E. Shaw Research is seeking early-career scientists with impressive records of achievement to join the group on a full-time basis. Serious consideration will be given to candidates with strong quantitative abilities, excellent communication skills, and a bachelor's or master's degree in the natural sciences and/or engineering. Successful candidates will work closely with a number of the world's leading biochemists, electrical engineers, and computer scientists, and will have the opportunity to make groundbreaking contributions within the fields of biology, chemistry, and medicine. Scientific Associates are expected to commit to D. E. Shaw Research for a minimum of two years; following their time at D. E. Shaw Research, previous Scientific Associates have gone on to top Ph.D. programs in the country and abroad.

The expected annual base salary for this position is $200,000–$240,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and immigration assistance. The applicable annual base salary paid to a successful applicant will be determined based on multiple factors including the nature and extent of prior experience and educational background. We follow a hybrid work schedule, in which employees work from the office on Tuesday through Thursday, and have the option of working from home on Monday and Friday.

Scientific Software Developer

Successful hires will contribute to software development and workflow engineering for drug discovery, including development of cheminformatics tools and algorithms; large-scale virtual screening and docking; computer-aided molecule design; development of scalable chemical databases; modeling, analysis and visualization of molecular systems; and a range of similar tasks integral to advancing our scientific and drug discovery programs.

Software Developer for Drug Discovery

Successful hires will work on developing large-scale scientific workflows to support our drug discovery research efforts. Relevant areas of expertise might include large-scale data analysis, tool integration, workflow engineering/development, high performance data-parallel computing, systems software, machine learning, and Python programming, but specific knowledge of any of these areas is less critical than intellectual curiosity, versatility, and a track record of achievement.

Software Engineer, Data Infrastructure

Successful hires will directly contribute to creating systems and infrastructure for modeling, curating, and indexing the petabytes of data generated by our special-purpose supercomputers and our large Linux HPC and GPU clusters; to implementing pipelines for processing computational and experimental data sets; and to developing and maintaining data management policies and toolkits for drug discovery data processing.

Systems Software Developer

Ideal candidates will have a computer science or engineering degree, prior experience with non-trivial parallel or distributed systems software projects, deep knowledge of operating systems internals, strong debug skills, strong C/C++/Python programming ability, and excellent verbal and written skills. Familiarity with device drivers, Linux or BSD kernels, distributed filesystems, run-time systems, communication protocols, event-driven and thread-based concurrency, bootstrap code, x86 hardware and BIOS, and/or bringup of new hardware is a plus, but specific knowledge of any of these areas is less critical than intellectual curiosity, versatility, and a track record of achievement.

About Join Renew Donate Advertise News Store

- Become a Member

- Join the Society

- Renew Your Membership

- Member Benefits

- Member Types

- Membership FAQs

- Communities

- Primarily Undergraduate Institution (PUI) Network

- Get Involved

- BPS Discussion Forums

- Membership Directory

- Student Chapters

- Find a Student Chapter

- Start Your Own Student Chapter

- Student Chapter Resources

- Funding Opportunities

- Diversity, Equity, and Inclusion

- Annual Meeting

- 2024 Annual Meeting

- 2025 Annual Meeting

- Upcoming Annual Meetings

- Past Annual Meetings

- Past BPS Lecture Videos

- Past BPS Lecturers

- Thematic Meetings

- 2023 Canterbury Thematic Meeting

- 2024 Trieste Thematic Meeting

- Upcoming Thematic Meetings

- Past Thematic Meetings

- Past Discussions Meetings

- Criteria and Submission Information

- BPS Conferences

- 2023 Estes Park BPS Conference

- 2023 Tahoe Proton Reaction

- 2024 Tahoe BPS Conference

- Upcoming BPS Conferences

- Past BPS Conferences

- Special Sessions

- Biophysicists Address COVID-19 Challenges

- Protein Data Bank 50th Anniversary

- On-Demand Resources

- Career Development

- Diversity, Equity & Inclusion

- Education & Teaching

- Policy, Funding & Advocacy

- Research & Techniques

- Networking Events

- Upcoming Networking Events

- Past Networking Events

- Other Meetings of Interest

- Important Dates

- BPS Events Calendar

- Biophysical Journal

- Submit Manuscript

- Information for Authors

- Become a Reviewer

- Editorial Board

- Articles Online Now

- BJ in the News

- BJ Postdoctoral Reviewer Program

- The Biophysicist

- Biophysical Reports

- BPS Bulletin

- Deadlines and Submissions

- Publication Resources

- Publication FAQs

- Travel Awards

- Poster Competitions

- Image Contest

- Society Awards

- Subgroup Awards

- Family Care Grant

- Student Chapter Events Grant

- Education Resources

- What Is Biophysics

- COVID-19: Science, Stories, and Resources

- Lesson Plans & Experiments

- BPS Video Library

- Selected Topics in Biophysics

- Additional Education Resources

- Career Resources

Profiles in Biophysics

- Becoming a Biophysicist

- Career Articles

- Additional Career Resources

- Biophysics Programs

- Summer Research Program

- Starting a Biophysics Program

- Biophysics Degree Programs

- JUST-B Poster Session

- Career Development Webinars

- Education & Career Events

- Virtual Graduate Fair Participants

- Biophysics Week

- Affiliate Events

- Be an Affiliate Event Organizer

- Biophysicists in Profile

- Science Fairs

- Ambassador Program

- BPS Ambassadors

- USA Science and Engineering Festival

- Find a Biophysicist (FaB)

- Advocacy Toolkit

- Communicating Your Science

- Advocate for Biophysics in Your Community

- Advocacy Around the World

- Communicating with Congress

- Take Action

- Stay Informed

- BPS in the Beltway

- U.S. Federal Budget

- Policy Issues

- Congressional Fellowship

- Program Eligibility and Requirements

- Fellowship Alumni

No two biophysicists have the same story. Read about the many paths that led each of them to become a biophysicist.

Search Profiles

David E. Shaw

David E. Shaw , Chief Scientist, D.E. Shaw Research, always believed that he would work as a scientific researcher; he never imagined the unexpected detour he would take into the world of finance, as a pioneer in quantitative trading. Shaw’s father was a theoretical plasma physicist, his mother a researcher in education, and his stepfather was an economist and professor at the University of California, Los Angeles (UCLA). “I was raised in Los Angeles, near UCLA, and my parents used to take me there so frequently that it was some time before I learned the difference between a university and a public park,” he recalls. “They looked pretty much the same to me, though the university had a wider range of interesting things going on, and was generally more entertaining.”

Shaw attended the University of California, San Diego, where he double-majored in mathematics and in applied physics and information science. He then earned his PhD from Stanford University in 1980. Shaw wrote a doctoral dissertation that provided a theoretical framework for a new class of computer architectures and algorithms that could be shown to offer asymptotically superior performance for certain mathematical operations related to artificial intelligence and database management.

He joined the faculty of the Computer Science Department at Columbia University, conducting research on the design of massively parallel special-purpose supercomputers for various applications. “Although my thesis at Stanford hadn’t involved the construction of any actual hardware,” Shaw explains, “after arriving at Columbia, I received government funding to actually start building one of the weird supercomputers I’d designed on paper.” The machine could not be constructed using standard components, so Shaw and his students designed their own integrated circuits, and then connected them to assemble a small-scale working prototype. They wrote code for the machine that implemented some of Shaw’s algorithms. “We were thrilled when the whole thing actually started working,” Shaw recalls.

Hooked on the idea of designing and building these special-purpose supercomputers, Shaw saw that building full-scale machines would require a much larger budget than government grants could likely provide. He wrote a business plan for a proposed startup venture that would manufacture massively parallel supercomputers for commercial use, and began meeting with venture capitalists.

It quickly became clear to Shaw that this venture would not take off, but in the course of seeking funding, he had a chance meeting with executives from Morgan Stanley that led him on a career detour. “The executives I met with at Morgan Stanley told me that someone there had discovered a mathematical technique for identifying underpriced stocks,” Shaw says. “A group of financial and technical people there had written some software that was using this technique to make investment decisions on a fully automated basis, and they were consistently earning an unusually high rate of return.” Shaw was intrigued that they were using quantitative and computational methods in the stock market, “and I couldn’t help wondering whether state of the art methods that were being explored in academia could be used to discover other investment opportunities that weren’t visible to the human eye,” Shaw, explains. Though he had no experience in finance, in June 1986, Shaw shaved his beard, put on a suit, and left academia for a stint on Wall Street.

In 1988, Shaw started his own investment firm, D.E. Shaw & Co., which initially focused exclusively on the application of quantitative and computational methods to investment management. For the first few years, Shaw was directly involved in much of the firm’s research, but as time went on and the company expanded, Shaw found himself spending less time on research and more on management. “I could feel my scientific and mathematical skills beginning to atrophy,” he says, “and I found myself missing the days when I solved technical puzzles for a living.”

Shaw wanted to return to full-time research, and hoped to contribute to the search for new, potentially life-saving drugs. He also wanted to design algorithms and machine architectures, which he had always enjoyed. His sister, Suzanne Pfeffer, professor of biochemistry at Stanford University, brought Shaw by the office of Michael Levitt , who was sitting at his computer running a molecular dynamics (MD) simulation. Shaw had never seen one before. “I thought it was incredibly cool,” he says. He later connected with Rich Friesner , who tutored him on quantum chemistry, statistical mechanics, protein structure, and other relevant subjects. “Rich believed that MD simulations had the potential to provide important insights into the behavior of biologically significant molecules, but were so computationally demanding that many biological processes couldn’t be simulated long enough to yield such insights,” Shaw says. “I convinced myself that it might be possible to design special-purpose hardware and algorithms that could simulate the dynamics of biological macromolecules over periods a couple orders of magnitude longer than had been feasible on conventional supercomputers.”

With a research direction in mind, he founded D.E. Shaw Research in 2001, and put together an interdisciplinary team of researchers. “Since then, we’ve been working together on the design of novel algorithms and machine architectures for high-speed molecular dynamics simulation, and on the application of such simulations to biological research and computer-aided drug design,” Shaw explains. “Our research focuses on the structural changes associated with protein folding, protein-ligand binding, molecular signaling, ion transport, and other biologically significant processes. We don’t have our own wet lab, but we often collaborate with experimentalists, both to validate the phenomena we observe in our simulations and to exchange hypotheses and ideas for further studies.”

One such experimentalist is Arthur Horwich , professor of genetics at Yale University School of Medicine, who met Shaw after the latter visited Yale for a seminar. The two discussed the possibility of working together on simulating the binding of a non-native polypeptide chain to the hydrophobic lining of a ring of GroEL. “That [first] conversation was just electrical,” Horwich says. “He immediately saw what we wished to do and suggested I come down to D.E. Shaw Research in New York for a day, to chat with his team and consider all of the aspects of such a simulation. […]We realized that this experiment was a little beyond reach, but we had a lot of fun together considering this. David is one of the most thoughtful and generous people I have ever met.”

Walter Englander , professor of biochemistry, biophysics, and medical science at the University of Pennsylvania and one of Shaw’s colleagues in the protein folding field, agrees with this assessment, “He is very smart, focused—but self-effacing— generous, hard-working, eager to give credit rather than take it. [Shaw and his group] freely share their results and make their detailed calculations available to whoever asks,” he says.

Shaw has found great success by applying the skills and knowledge acquired in one field to others, approaching problems from a fresh vantage point. He recommends that young scientists consider an interdisciplinary path. “Milking an existing research paradigm to extend the frontiers of an existing research area can be important and gratifying,” Shaw says, “but the juiciest, lowest-hanging fruit is often found in interstitial research areas that haven’t yet been explored, and in the use of techniques and technologies borrowed from other fields. I also recommend flossing your teeth. You’ll thank me when you’re older.”

Related articles

- Patricia O'Hara

- Arne Gennerich

- Theanne Griffith

- Emily M. Mace

- Yamini Dalal

Other Interesting Reads

The nobel prize and biophysics, popular tags.

This website uses cookies to optimize your experience. If you would like to learn more about our use of cookies, click on the More Information button below to read our Cookie Notice.

Add job to your application bundle

Job added to your application bundle

To apply for this job, please email your resume and the job title to [email protected] .

Other Job s Selected

Original Submission s :

Removing these jobs from your application bundle will withdraw your application from consideration towards this position.

New Submission s :

View all internships

Fundamental Research Analyst Intern (New York) – Summer 2025

Join our investment analysis team in new york.

The D. E. Shaw group seeks talented individuals with unique perspectives to join our Fundamental Research Analyst Internship. Research analysts are vital to the firm’s fundamental investing groups. Analyst interns may have a passion for investing, but they may also be newcomers to the field and interested in solving complex, multifaceted problems. This is a ten-week program that will take place in New York and is expected to run from June to August 2025.

What you’ll do day-to-day

You’ll research, analyze, and perform due diligence on specific companies or industries to help the group assess potential investments. You’ll be tasked with analyzing data from a variety of sources, reading company reports, and staying up to date on current news and trends.

Who we’re looking for

- Candidates with keen problem-solving skills who have a demonstrated interest in financial markets will excel in this role.

- Successful interns will not only analyze new investment ideas but also contribute ideas of their own.

- Preference will be given to students approaching their final year of full-time study toward a bachelor’s or advanced degree, though all are encouraged to apply.

- We welcome applicants from all fields of study. No previous finance experience is necessary.

- The position offers a monthly base salary of $15,000, overtime pay, a sign-on bonus of $10,000, travel coverage to and from the internship, and choice of furnished summer housing or a $10,000 housing allowance. It also includes a $3,300 stipend for self-study materials and a $4,000 stipend for personal technology equipment. If you have any questions about the compensation, please ask one of our recruiters.

At the D. E. Shaw group, we believe the diversity of our employees is core to our strength and success. We are committed to supporting our people in work and in life, which is why we offer benefits such as a family planning and surrogacy program and a charitable gift match to all full-time employees.

Additionally, our staff-led affinity groups are pillars of our community, helping to celebrate diversity, promote leadership and development opportunities, and facilitate inclusive mentorship. Members and allies organize a wide range of educational and social programming, from expert talks to film festivals.

The members of the D. E. Shaw group do not discriminate in employment matters on the basis of race, color, religion, gender, gender identity, pregnancy, national origin, age, military service eligibility, veteran status, sexual orientation, marital status, disability, caregiver status, or any other category protected by law. We are committed to the principles of diversity, equity, and inclusion, and are eager to hear from individuals having a wide range of backgrounds and personal characteristics.

The applicable annual base salary or hourly rate paid to a successful applicant will be determined based on multiple factors, including without limitation the nature and extent of prior experience and educational background.

Candidates to positions in D. E. Shaw group offices in the European Union (any such candidate, an “EU Candidate”) should click here for our European Union Recruitment Personal Data Privacy Notice.

Candidates to positions in D. E. Shaw group offices in the United Kingdom (any such candidate, a “UK Candidate”) should click here for our United Kingdom Recruitment Personal Data Privacy Notice.

Candidates who are residents of California (any such candidate, a “California Resident”) should click here for our CCPA Recruitment Personal Information Privacy Notice.

The D. E. Shaw group may collect, use, hold, transfer, and process candidates’ resumes and associated information (including personal information contained therein) for purposes reasonably related to their application, including without limitation: review and management of employment applications and supporting materials; administration and management of offers to and communication with candidates; and administration, management, and improvement of the recruiting operations of the D. E. Shaw group; and/or where reasonably required in connection with a proposed sale, spin-out, reorganization, or outsourcing of all or some of the business of the D. E. Shaw group. The D. E. Shaw group will not use such information for purposes unrelated to the foregoing, such as direct marketing of third-party products to candidates, without candidate consent. As used herein, the term “personal information” is meant to broadly describe information identifying or relating to a specific individual; it is intended to encompass “personal data,” “sensitive personal data,” and “personally identifiable information” and similar terms, as those terms are defined by law in the jurisdictions in which the D. E. Shaw group operates.

The D. E. Shaw group may transfer such personal information within and outside the country and jurisdiction of the locations where the D. E. Shaw group maintains offices, to other D. E. Shaw group affiliates, to government and regulatory authorities, and to third parties which provide or may provide support and/or services to the D. E. Shaw group and for the purposes set forth above. The persons who may have access to this personal information are other employees of the D. E. Shaw group, in connection with the performance of their duties of employment, and the other parties listed above, in connection with the business of the D. E. Shaw group. (Of course, candidates will be considered for employment opportunities only in those countries in which they express interest.)

The D. E. Shaw group will use reasonable care to maintain the confidentiality of personal information (including appropriate technical measures against unauthorized or unlawful processing and against accidental loss or destruction of, or damage to, such information) and will retain such data as required by applicable law or regulation. Candidates have the right to request access to, and correction of, their personal information in accordance with applicable law; any such request should be submitted to [email protected] . Candidates who have submitted a resume to the D. E. Shaw group and do not wish to proceed with their applications should email [email protected] . Personal information of candidates who have been the subject of background checks may have been transferred in accordance with applicable regulations, and any concerns with such transfers should be submitted to [email protected] .

The D. E. Shaw group may retain candidates’ information for prospective recruiting activities, including sourcing candidates for employment opportunities and for organizing events with prospective candidates, in accordance with our internal data retention procedures. Candidates who do not agree to such future use should email [email protected] .

Return to Library page

IMAGES

VIDEO

COMMENTS

Shaw Research develops and uses paradigm-shifting computational technologies to design precisely targeted new therapeutics for the treatment of disease. Core Technologies; Research; Drug Discovery ... D. E. Shaw Research 120 W. 45th St., 39th Fl. New York, NY 10036. [email protected].

Website. www .deshawresearch .com. D. E. Shaw Research (DESRES) is a privately held biochemistry research company based in New York City. Under the scientific direction of David E. Shaw, the group's chief scientist, D. E. Shaw Research develops technologies for molecular dynamics simulations (including Anton, [1] [2] a massively parallel ...

Who We Are. Founded in 1988 over a small bookstore in downtown New York City, the D. E. Shaw group began with six employees and $28 million in capital and quickly became a pioneer in computational finance. In the early days of exposed pipes and extension cords, tripping on a cable could take out our whole trading system. Today, the firm has ...

D. E. Shaw Research | 23,449 followers on LinkedIn. D. E. Shaw Research (DESRES) is a New York-based drug discovery and computational biochemistry research company developing and using advanced ...

D. E. Shaw & Co., L.P. is a multinational investment management firm founded in 1988 by David E. Shaw and based in New York City.The company is known for developing complicated mathematical models and computer programs to exploit anomalies in financial markets. As of December 1, 2023, D. E. Shaw has $60 billion in AUM, including alternative investments and long strategies.

David E. Shaw serves as chief scientist of D. E. Shaw Research, and as a senior research fellow and adjunct professor at Columbia University. He received his Ph.D. from Stanford University in 1980, served on the faculty of the Computer Science Department at Columbia until 1986, and founded the D. E. Shaw group in 1988. Since 2001, Dr. Shaw has ...

Drug Discovery. D. E. Shaw Research conducts drug discovery programs both independently and in collaboration with other biopharmaceutical companies and research laboratories. All of our computational work is performed in‑house using a combination of our special‑purpose Anton supercomputers and high‑speed commodity hardware.

The D. E. Shaw group is a global investment and technology development firm founded in 1988 with offices in North America, Europe, and Asia. The firm has earned an international reputation for successful investing based on innovation, careful risk management, and the quality and depth of its staff.

Little known outside investing's arcane corners, DE Shaw is the fourth-highest grossing hedge fund group of all time, having made over $29bn for its investors since those early days near Union ...

Share this article. NEW YORK, June 13, 2022 /PRNewswire/ -- D. E. Shaw Research (DESRES) today announced that it has entered into an exclusive global license agreement with Eli Lilly and Company ...

David E. Shaw is the chief scientist of D. E. Shaw Research, where he is engaged in… · Experience: D. E. Shaw Research · Education: Stanford University · Location: New York City Metropolitan ...

Founded in 1988 over a small bookstore in downtown New York City, the D. E. Shaw group began with six employees and $28 million in capital and quickly became a pioneer in computational finance. In ...

The casual dress code embraced by D.E. Shaw has also become de rigueur at tech giants. Though viewed as shocking in Shaw's early years, such attire is also common at many New York hedge funds today.

The expected monthly base salary for this position is $21,000. Our compensation package includes travel to the internship, overtime for all hours worked over 40 per week, a sign-on bonus, and choice of corporate housing or a summer housing allowance. At the D. E. Shaw group, we believe the diversity of our employees is core to our strength and ...

Candidates should have excellent communication skills, and we will consider candidates at all levels of experience. The expected annual base salary for this position is $230,000-$550,000. Our compensation package also includes variable compensation in the form of sign-on and year-end bonuses, and generous benefits, including relocation and ...

David E. Shaw. January 2016 // 17639. David E. Shaw, Chief Scientist, D.E. Shaw Research, always believed that he would work as a scientific researcher; he never imagined the unexpected detour he would take into the world of finance, as a pioneer in quantitative trading. Shaw's father was a theoretical plasma physicist, his mother a ...

Research analysts are vital to the firm's fundamental investing groups. Analyst interns may have a passion for investing, but they may also be newcomers to the field and interested in solving complex, multifaceted problems. This is a ten-week program that will take place in New York and is expected to run from June to August 2025.

David Elliot Shaw (born March 29, 1951) is an American billionaire scientist and former hedge fund manager.He founded D. E. Shaw & Co., a hedge fund company which was once described by Fortune magazine as "the most intriguing and mysterious force on Wall Street". A former assistant professor in the computer science department at Columbia University, Shaw made his fortune exploiting ...