- Furniture e-commerce: Top trends and how to sell furniture online

The growth of furniture e-commerce has doubtlessly been accelerated by a global pandemic, and things won’t be slowing down anytime soon. In the US alone, online furniture sales are estimated to cross $208.2 billion by 2025.

Despite this exponential growth, the home goods and furniture industry is not without its hurdles. Supply chain disruption, material shortages, and reduced consumer spending all shape the way organizations have thought about digital transformation and strategy.

What is furniture e-commerce?

The term furniture e-commerce has become a catch-all term for offerings that fall under the “home goods” industry online. This can include both B2B and B2C products such as floor and wall coverings, upholstery, home textiles, cookware, and even cleaning materials.

While the US is the largest global consumer of furniture e-commerce, Asia-Pacific is not far behind, with two out of six of the world’s largest markets originating from the region.

5 trends you need to know in furniture e-commerce

A rapidly evolving industry comes with trends that are equally dynamic. While there are some e-commerce trends that remain common regardless of industry, here are the most relevant trends to watch out for within the furniture e-commerce industry:

#1: Streamlined and cost-effective processes with integrated e-commerce

One of the most significant hurdles for home goods organizations tends to be undertaking the usually high costs and processes involved in shipping and returns. For organizations in the furniture e-commerce industry, a mistaken or damaged order can be a costly error.

More companies are looking to integrated e-commerce solutions to mitigate this risk. True integration with the ERP enables B2B organizations to centralize and streamline their shipping and returns processes, ensuring the margin of error for stock levels and estimated delivery timings is minimal.

#2: Personalized shopping experiences that cater directly to customers

While personalization is a trend that has been on the rise across industries, in furniture e-commerce particularly, the need for a tailored approach has been a focus. Some organizations have gone as far as to offer online consultations to strengthen their offering to customers.

Others have used analytics and AI-powered insights to begin recommending products they believe customers could be interested in. Certain e-commerce platforms will also enable you to consolidate offline and online purchasing history to target customers with tailored promotional messaging, incentivizing upsell and cross-sell further.

#3: B2B companies begin to adopt the D2C model to stay competitive

For supply chain channel partners in B2B furniture and home goods sales, direct-to-consumer selling is growing, and making the e-commerce opportunity even more significant than it is for B2C businesses.

Today, almost all B2B buyers prefer to do online business with manufacturers and distributors, citing convenience and efficiency as the primary reasons. For organizations that focus on delivering a seamless shopping experience online and account for both their B2B and D2C customers, the potential payoff is huge.

The right platform is ready for anything.

Read more about our e-commerce solution for the home goods and furniture industry.

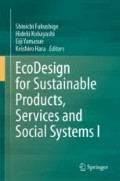

#4: A focus on sustainable, mission-driven materials and products

Across B2B and B2C, millennials make up a significant chunk of the buyer pie. For these customers, energy-efficient resources and sustainable approaches can play a significant role in their purchase decision.

Whether it’s by implementing energy-efficient tooling with cloud-based approaches, paperless processes or sustainable shipping, home furniture e-commerce providers have begun to try and go the extra mile when it comes delivering a product offering that is also socially conscious.

#5: Augmented reality to help consumers make better decisions

Technological advancements in AR and VR visualization has enabled customers to miss very little from the in-person experience. Furniture shopping online is usually a challenge because of an inability to accurately estimate size. Accurate renderings with augmented reality mean customers can visualize a piece of furniture without ever leaving their home.

A good example of AR in action is B2C giant IKEA – whose IKEA Place app enables customers to move furniture around within their homes.

Tips for selling furniture and home goods online

Though there’s no question surrounding the ROI of having an effective e-commerce channel, a lot of organizations have trouble ensuring their e-commerce projects are successful. Here are three top tips that ensure you’re avoiding common e-commerce project snags, whether you sell directly to consumers or fellow businesses:

Lean on your ERP

Centralizing your e-commerce strategy around your ERP system gives you easy and near-limitless access to all your business logic, customer data, and product data. An ERP-integrated e-commerce approach for B2B ensures that your web store always displays correct, real-time product information and detailed images: Factors that are fundamental in providing a strong customer experience.

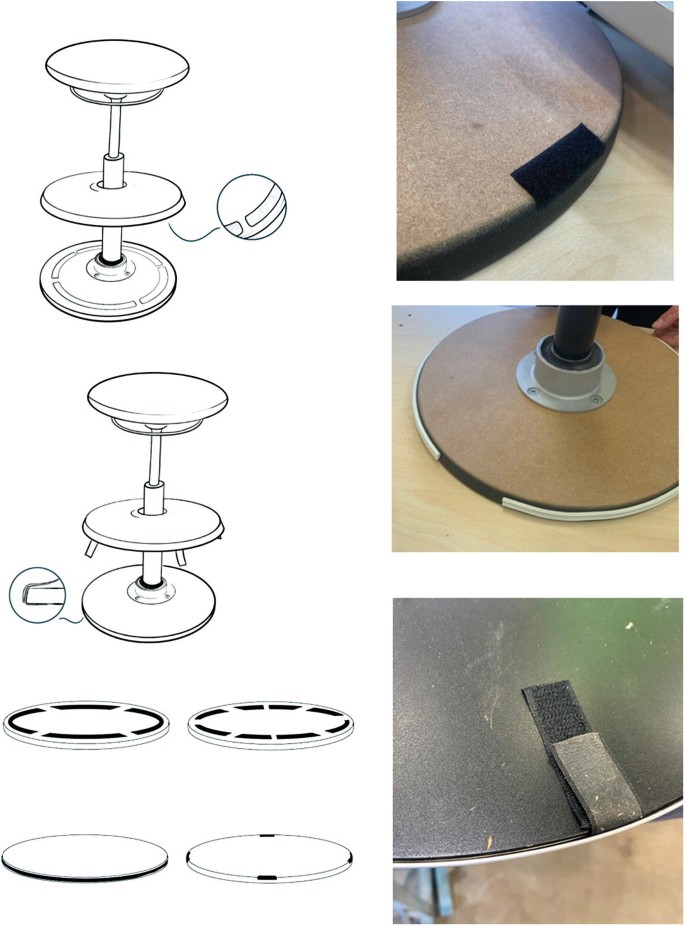

While B2C consumers want more personalized features, like product recommendations (which boost purchase rate by 70%) and customer-specific front-end experiences, B2B buyers are more worried about easier repeat ordering, speedier and more hassle-free logistics and a streamlined fulfillment process.

Still, a few demands are consistent across B2B and B2C, including fast checkout and delivery tracking. With your ERP powering your web store (as it does with a Sana solution for businesses running SAP or Microsoft Dynamics ERPs), all these demands can be met easily and quickly, regardless of your business model.

Think omnichannel (and don’t shy away from emerging technology)

The numbers don’t lie. Statistics reveal:

- Over 90% of customers start their purchasing journey by browsing online, regardless of where they ultimately purchase

- 47% of millennials use Buy Online, Pick Up In-Store (BOPIS) as a fulfillment method

- 51% of millennials prefer to visit a store that uses mobile or other purchase-enhancing technology, and often webroom (browse online to buy in-store) or showroom (browse in-store to buy online).

The above reveals the benefits inherent to enhancing your offline experiences with mobile and other technology. For B2C businesses in the sector, augmented and virtual reality may be a more innovative and worthwhile investment. Don’t hesitate to leverage the tools at your disposal.

Nonetheless, the key here is to remember that e-commerce is a highly influential channel, whether it is ultimately the converting channel or not.

Dive into Direct-to-Consumer (D2C) sales with e-commerce

If you choose to leverage e-commerce as a way to enable D2C furniture sales, the right platform can make all the difference. For B2B organizations specifically, using tooling that understands the unique needs of your customers and ensures you’re able to leverage your relationships for a sales channel that is truly effective.

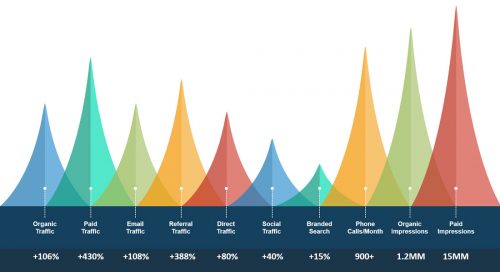

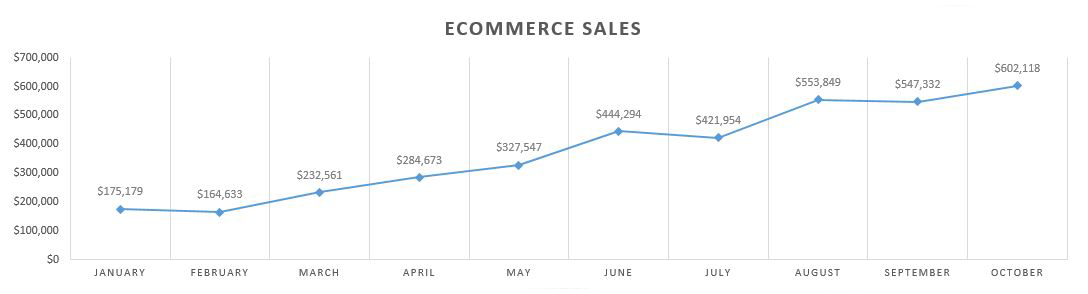

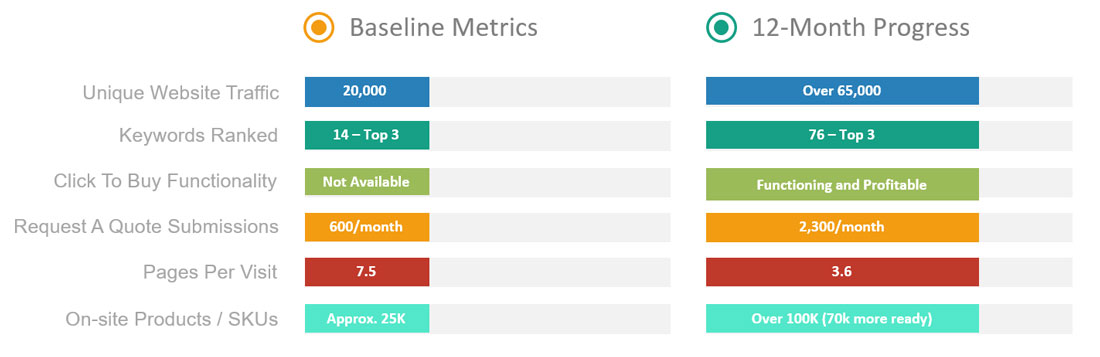

Furniture e-commerce case study: How Arizona Fireplaces built a thriving web store using integration

Arizona Fireplaces, experts in luxurious interior fireplaces, saw their options expand when they launched an ERP-integrated web store for their ERP SAP Business One .

“I thought the product was good, but then I got to work with the team and that was even better,” says Greg Lewis, Arizona Fireplaces’ Director of IT.

The integration at the heart of Sana Commerce got rid of their maintenance headaches to give them more opportunity to scale and grow their entire business. For Arizona, this offered a way to improve their IT architecture and integrate important central business systems that were previously siloed.

The key to better furniture e-commerce is here

Learn more about Sana Commerce Cloud, our flagship solution for B2B organizations seeking better e-commerce.

More interesting resources

Top 8 b2b commerce trends in 2024 and beyond, 5 reasons your omnichannel strategy is failing, 7 tips for creating an e-commerce website on a budget.

- Sana Commerce

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Share Podcast

How IKEA Evolved Its Strategy While Keeping Its Culture Constant

If you’re leading your team through big changes, this episode is for you.

- Apple Podcasts

- Google Podcasts

The Swedish furniture maker IKEA found huge success producing quality furniture at affordable prices. But in 2017, the company was at a crossroads. Its beloved founder had died, and the exponential rise of online shopping posed a new challenge.

In this episode, Harvard Business School professors Juan Alcacer and Cynthia Montgomery break down how IKEA developed, selected, and embraced new strategic initiatives, while fortifying its internal culture. They studied how IKEA made big changes for the future and wrote a business case about it.

They explain how the company reworked its franchise agreements to ensure consistency among its global stores. They also discuss how IKEA balanced global growth with localization, developing all-new supply chains.

Key episode topics include: strategy, growth strategy, disruptive innovation, emerging markets, leadership transition, competitive strategy, company culture, succession.

HBR On Strategy curates the best case studies and conversations with the world’s top business and management experts, to help you unlock new ways of doing business. New episodes every week.

- Listen to the original HBR Cold Call episode: IKEA Navigates the Future While Staying True to Its Culture (2021)

- Find more episodes of Cold Call

- Discover 100 years of Harvard Business Review articles, case studies, podcasts, and more at HBR.org .

HANNAH BATES: Welcome to HBR On Strategy , case studies and conversations with the world’s top business and management experts, hand-selected to help you unlock new ways of doing business. The Swedish furniture maker IKEA found huge success producing quality furniture at affordable prices. But in 2017, they were at a crossroads. Their beloved founder had died, and the exponential rise of online shopping posed a new challenge. Today, we bring you a conversation about how to develop, select, and embrace a new strategic initiative – with Harvard Business School professors Juan Alcacer and Cynthia Montgomery. They studied how IKEA made big changes for the future while fortifying its internal culture and its external identity. In this episode, you’ll learn how the company reworked its franchise agreements to create a more managerial and modern culture, and ensure consistency among its global stores. You’ll also learn how they balanced global growth with localization – including new supply chains. This episode originally aired on Cold Call in June 2021. Here it is.

BRIAN KENNY: For some of the world’s most celebrated founders, the entrepreneurial drive kicks off at an early age. Mark Zuckerberg developed Facebook in his Harvard dorm room at the age of 18. Michael Dell made $200,000 upgrading computers in his first year of business, he was 19. Before Jack Dorsey founded Twitter, he created a dispatch routing platform for taxis in his hometown of St. Louis, while he was in middle school. But then there’s Ingvar Kamprad who began selling matches at the age of five to neighbors in his rural Swedish homestead. By the age of seven, he was buying matches in bulk in Stockholm and selling them at a profit back home. Ingvar learned early on that you can sell things at a low price and still make a good profit. A philosophy that fueled the success of his next business venture, IKEA. Today on Cold Call , we welcome professors, Juan Alcacer, and Cynthia Montgomery to discuss their case entitled, “What IKEA Do We Want?” I’m your host, Brian Kenny, and you’re listening to Cold Call on the HBR Presents network. Juan Alcacer’s research focuses on the international strategies of firms in the telecommunications industry and Cynthia Montgomery studies the unique roles leaders play in developing and implementing strategy. They are both members of the Strategy unit at Harvard Business School. And thank you both for joining me today. It’s great to have you on the show.

CYNTHIA MONTGOMERY: Thanks Brian.

JUAN ALCACER: Thank you for having us.

BRIAN KENNY: You’re both here for the first time, so we’ll try and make it painless so we can get you to come back on. I think people are going to love hearing about IKEA and getting an inside view. Most of us have had that experience of being like mice in a maze. When you go into an IKEA store, you are compelled to walk through the whole place. It’s really brilliant, so many of the touches and things that they’ve done. And this case helps to shine a light, I think, on some of those decisions and how they were made. I had no idea how old the company was. So just starting with its history, it’s going to be good to hear about that. Juan, I want you to start, if you could, by telling us what would your cold call be to start this case in the classroom?

JUAN ALCACER: I like to start the case, bringing in the emotions of the students and their relationship with IKEA. So most of our students have had some experience with IKEA. So I’d just start asking how many of you have been in IKEA, and then I’d start asking why? Why did you go to IKEA? And this time telling you all the things that you just mentioned, for instance, walking through the maze, going to eat the meatballs. So they started bringing all these small, decisions that were made through the years, that made IKEA, IKEA.

BRIAN KENNY: Who doesn’t love the meatballs? Cynthia, let me ask you, you’re both in the Strategy unit at Harvard Business School, there’s a lot of strategy underlying this whole case. I’m curious as to what made you decide to look at IKEA and sort of, how does it relate to your scholarship and the things that you think about; the questions you try to answer?

CYNTHIA MONTGOMERY: I’m really interested in the choices firms make about who they will be and why they will matter? The core questions at the identity of a company. In 1976 Kamprad laid out very, very carefully. What IKEA would do, who it would be. He identified its product range. The customers it would serve, the company’s pricing policy, all in a document called, The Testament of a Furniture Dealer. And he described it as, “the essence of our work.” And 45 years later, it was still required reading for all of the IKEA’s employees. It’s probably the most compelling statement of corporate purpose I’ve ever seen.

BRIAN KENNY: Remarkable in a company that’s based on furniture. It was a very, sort of powerful thing. There’s an exhibit in the case that shows the whole Testament. Maybe we can dig a little bit into the history here. I alluded to the fact that it’s been around for a long time. Cynthia, just tell us a little bit about how the company came to be and how it evolved over time.

CYNTHIA MONTGOMERY: IKEA started actually as a mail-order business in Sweden and in the late 1940s Kamprad noticed that despite a lot of demand for furniture, agreements between the furniture manufacturers and retailers were keeping furniture prices real high. He was interested in a different set of customers. And he decided that to attract farmers and working class customers, he needed to be able to offer quality furniture at lower prices.

BRIAN KENNY: What were some of the early challenges that they faced. I’m also curious a little bit about the Swedish culture and how that sort of factors in here. Because there was definitely undertones of that factoring into the way they set this up.

CYNTHIA MONTGOMERY: It’s a virtue to be frugal and to be very careful about how you spend your money. And that made a huge impression, particularly given his background, growing up on a farm for Kamprad, he decided he really wanted to lower the prices of furniture and began to do so. And it turned out that there was a very, very strong response from other furniture manufacturers who basically said that they were going to boycott him. They wouldn’t allow him into their furniture fairs, him personally, as well as his company. And so in turn, what happened was that they also pressured local suppliers not to sell to a IKEA anymore, basically trying to force him out of the market. And what happened was that that actually drove Kamprad to Poland as a source of supply because local firms wouldn’t supply him anymore. And in the process, he discovered that Polish manufacturers could actually make furniture at far, far lower costs than Swedish manufacturers. And that essentially gave IKEA a cost structure that was more like a difference in kind, than a difference in degree. And that proved enormously important to building almost insurmountable competitive advantage for IKEA.

BRIAN KENNY: He was also really keen with innovations early on that things like the restaurant area and the childcare space, what were some of the insights that drove him to make those kinds of decisions?

CYNTHIA MONTGOMERY: One of the things that he decided quite early on is that he wanted to have the stores located out of town. And the reason is because land there was much, much cheaper. So he built these ,as you described earlier, Brian, these gigantic stores on the outskirts of town and they had lots and lots of square footage and lots and lots of merchandise, but you know, it took time to get there. It took time to shop there and what he wanted to do was make it worth it for the customers to make the trip, worth it for them to spend a lot of time in the stores. So he decided to add restaurants and the now famous meatballs, which come in several flavors, actually around the world, and to add childcare centers that would care for young children while the parents shopped. On the low cost front, he was innovative in other ways, he actually borrowed the idea of flat pack from another innovator, but he’s the one that actually brought it to life in such a big way. Then he discovered that if you let the clients go in and pick off the furniture packs themselves, they could even save more money and lower the costs in the store.

BRIAN KENNY: So they have a pretty complicated org structure, when we start to dig into some of the nuance of the case. Juan, could you describe for us, how they’re set up from an org structure standpoint?

JUAN ALCACER: You have to realize that coming from Sweden, which is one of the countries with the highest taxation for corporations in the world. So early on, they decided to find some organization structure and legal structure that would allow them to lower taxes. And that created basically an ownership based on foundations, based in the Netherlands. And they decided, early on, to separate the company into pieces. One is the franchise store, which is basically running the brand and running the management image of the brand. And then the operational part of the company, which is a franchisee. And for many years, those two things were separated. The franchisee was also in charge of manufacturing and so forth. So it was a very strange structure, that was put in place in part by the charisma and the leadership style of Ingvar Kamprad. If I can go back to your question about the Swedish culture. One of the things that, at least for me, is very striking is that when you look at multinationals, there’s a thing called the liability of being a foreigner, which means that when you go to another country, you have some disadvantages. And you try to mitigate that liability of being a foreigner, by pretending to be of that particular country. IKEA went with a totally different approach, they’re totally Swedish. Names of their products are impossible to pronounce. The fact that they have meatballs, they have their Swedish flags all over the place. They embrace the Swedish spirit as a part of the brand. You don’t see many multinationals with that. That makes IKEA what it is today.

BRIAN KENNY: I definitely think that’s part of the appeal here in the US, for sure, is people being exposed to the Swedish culture in a way they never had before. What is the culture of the company like, what’s it like to work there?

JUAN ALCACER: We went to both the Netherlands and to Sweden and we had a great time. It’s a very egalitarian culture. All the VP’s, high-level managers, none of them have an assistant. Only the CEO has an assistant. They don’t have offices, so everybody shares an open space. The whole place is decorated with IKEA furniture, everybody talks to each other by their first name. It’s very collegial, very friendly.

CYNTHIA MONTGOMERY: I would add to that. I think IKEA was incredibly generous to us, in the sense that they shared all kinds of confidential, internal documents and were really willing to talk in a very open and forthright way, about both their strengths and their challenges, which was incredibly refreshing. And as Juan said, that it was very egalitarian, and not surprisingly IKEA was one of the first companies to embrace democratic design. And that spirit was everywhere in the company.

BRIAN KENNY: Cynthia, what would you say are some of the keys to their success over the years?

CYNTHIA MONTGOMERY: I’d say that IKEA basically picked a lane and stuck with it. They had clarified, as I said at the top of the show, very, very carefully about what they wanted to do, who they wanted to be. And what they said is, look, this is what we’re going to be about. We’re going to offer an extensive range of practical, well-designed furnishings at low prices. And we’re going to serve the many, not the few. And the many are those with limited financial resources. When you have such clarity about what you want to do, then you can set out and try to maximize how you approach that. Essentially IKEA built a system, to do exactly that, extremely well and their distinctiveness made them truly an iconic firm. And it’s great when you talk with students about, what’s the purpose of your business?, What are you doing? What’s interesting is that oftentimes they can describe much more carefully what IKEA is doing, than what their own businesses doing. The last thing I would add, is that as Juan one said, they’re really synonymous with Sweden and they put that right out there. It’s almost like the way that Coca-Cola is synonymous with the US. And that has been a big part of their advantage.

BRIAN KENNY: Okay. So we’ve painted a very rosy picture for IKEA, but it’s an HBS case. So there’s tension, inevitably. So let’s dig in a little bit to where the case brings us. I’m going to mispronounce his name. I hope I don’t, but Torbjörn Lööf is that close?

CYNTHIA MONTGOMERY: Yeah.

BRIAN KENNY: He is the protagonist in the case. And he is stepping into a leadership role here really after an iconic leader has stepped back and that’s a challenge. Any time that happens, and a leader has to step in. And as he starts to sort of peek underneath the hood a little bit, he starts to see some of the challenges that IKEA is facing in this now seventh decade, I guess, of their existence. So Juan, maybe you can set that up for us a little bit.

JUAN ALCACER: It’s not only that he is stepping in the shadow of a leader that created the company. It’s that the company is still controlled by the family. So this is not a public firm, this is a private firm. So, he had to basically walk a very, very thin line, trying to take IKEA towards the future, but still preserving the past. And he had basically two main tasks, one is short term, that organization restructure that we were talking about, that was very complicated was created products. As I said before, the franchisee, which is basically the one that was running all the operations, was also the manufacturer. But there were other franchises. So for instance, the operations in Middle East are run by another company. So they wanted to create a system of transparency, that all the franchises are run the same way. When you have a franchisee that has basically represented 80% of your sales, and the ones that are representing 2% or 3%, there is an imbalance of power. So they tried to create a structure that is more managerial, that is more modern, that will allow to create incentives for new franchisees to come into the system. So that transaction was basically transferring production and transferring the functions that were in the franchisee back to the franchisor. There were 25,000 people that have to move from one place to another.

BRIAN KENNY: Wow.

JUAN ALCACER: They didn’t move physically, but in terms of the legal status they shift around. And the second is to bring IKEA to the world. What they observed is that there were some changes in demographics, they were targeting the low-income, what they call the thin wallets of the world, but it turned out that people that would go to IKEA are not thin wallets anymore. These people have already moved towards the middle-class and they also have this whole, to increase the number of consumers to three billion, and that meant that they have to basically grow globally, at a rate that they have never done, before they had two or three markets, like China and India. They also have the issue of eCommerce, to pick up and every retailer in the world is dealing with that. So, it’s two steps. One, getting the house in order, and second one, creating a path for the future for IKEA to become an icon for the next 75 years.

BRIAN KENNY: Yeah. And I also think at some level it’s hard to sustain that original mission that they set out with, when you’re trying to expand so rapidly and bring in a much larger audience. Cynthia, I don’t know if you have other observations about these changes they were facing.

CYNTHIA MONTGOMERY: Absolutely. Because one thing is that you can look at the challenges that came from expanding into new geographies. But the other thing that they found in a large study that they did, is that there were challenges in their core business as well, that the countries they’d been in for a number of years, and what I’ll call the big blue box stores, mostly in developed countries. What they found is that increasingly many of their customers in those markets wanted new conveniences. They wanted stores that were located closer to city centers because a number of people say in their late twenties, early thirties are not driving and don’t have cars. And they found that there was an increasing demand for delivery and assembly services for shopping online. These trends are worrying to a huge number of retailers, but particularly a challenge to IKEA because low price, low, low price, so low that that people can recognize the difference. That being at the heart of their strategy. And customers’ willingness to spend time getting to the store, hauling furniture about, ultimately assembling it. Those are at the very, very heart of their low-cost strategy and their very distinctive value proposition. It was a big challenge within the developed markets as well.

BRIAN KENNY: And depending on where they went in the world, a different set of challenges pops up almost everywhere. Juan, you mentioned earlier that they pushed back against localization, but is that a sustainable strategy? When you’re trying to go into entirely new markets like China and India.

JUAN ALCACER: The beauty of IKEA is that they found a segment across different cultures that was very similar. College students the United States, that needed to have furniture for a few years only, it could be young couples that are opening a new house, in some places it’s immigrants that are moving from one country to another country that need to buy furniture, but they don’t have the money to do so. So there was this very common segment across the world that they were able to then define, that allows them to have basically 80% of their line, of their range, is common across countries. And they have around 10% to 20% that varies by country. Now, when they go to China, and they go to India, they find that the changes have to be of a higher scale for three reasons. One, the tastes are different, also the materials, when you are going to India and you are going to houses that are in a high humidity environment, the type of wood that you can use is different. Now you start, not only changing the look of the product but you also have to change how you made it. And the third big challenge is when you look at what is defined as thin wallet, in these markets, is really thin. It’s not thin wallet in Sweden, it’s not thin wallet in the United States. So, you have to go to prices that are really, really low. And that means that you are already a low cost producer but you have to go even lower. That means that you have to change your supplier, so it starts changing the fundamental parts of the business model that they created through the years.

BRIAN KENNY: And it could probably, pretty easily, get away from you. So this does call for a strategy. Cynthia, can you describe for us what the three roads forward are? This was sort of underpinned their strategy going forward and how they were going to deal with some of these challenges.

CYNTHIA MONTGOMERY: Basically, the three roads, the first was affordability, as Juan said, this isn’t affordability in the way that they, at the level at which they’ve traditionally thought about it. This is affordability for wallets that are either very thin or actually where the willingness to pay just isn’t as high, because they’re accustomed to having goods that are at very low prices. So they wanted to attack affordability for people who could not afford IKEA today. They cared a lot about accessibility. They’ve got to reach and interact with people where they are. And the last is sustainability, and they felt really, really strongly about this. And I think much in line with what you see with a number of other countries in Europe, that they cared a lot about the sustainability of the products and wanted to make a positive impact for people, society and the planet. And they’re taking on all three of these aspirations at once.

BRIAN KENNY: You have written many cases, I’m sure that parallel this, what are some other firms that have faced similar challenges and maybe figured out a way to deal with the same sets of challenges?

JUAN ALCACER: The challenge of going overseas, we didn’t write cases about multinationals for many years. They always have this tension between coordination in headquarters and adaptability in each one of the subsidiaries. So IKEA was very good at playing that game for many, many years. In a way they were going to countries that were somehow similar to Sweden. Now that they are venturing to countries that are farther away in many dimensions, not only physically, but also in terms of economic distribution, in terms of taste. They are seeing this tension to be amplified. We have seen that in many companies, Procter and Gamble has been doing that for years and years, Unilever has been doing that for years and years. IKEA has done it for 75 years. They went overseas very early on. But now the challenge is a little bit higher. The other challenge is that Cynthia also mentioned, which is basically adapting to new technologies and new demographics. Every retailer is facing that. Any supermarket, any chain that has been selling in brick and mortar is facing those challenges. So, what is interesting about IKEA is that they are facing these all at the same time and they’re facing this during the process of transition from the leader that created the company to a new set of managers that are more professional and are not part of the family.

BRIAN KENNY: You mentioned technology. I’m just curious, the role that the internet plays in this, because now everybody can see, you know, through YouTube and other things, what the experience is like from one place to the other, and how important is consistency across all those geographies, versus a little bit of localization to make it feel a little bit more like this is the China version of IKEA versus the European version of IKEA. Cynthia, do you have thoughts on that?

CYNTHIA MONTGOMERY: That’s the real challenge here in the sense that, how do you take this whole model that has been developed over so many years? And it’s very, very hard to imitate, which has given them a lot of strength over the years, but when the environment changes, instead of responding in a piecemeal way to all kinds of external stimuli, it’s how do you take this whole model and evolve it in some coherent way that stays true to the iconic sense of who IKEA is? I really see it fundamentally, as an existential question for IKEA.

BRIAN KENNY: Such a great point. Look, I want to thank both of you. This has been a really interesting discussion about a brand that we all know and have experienced many times firsthand. I have one more question for each of you before we part ways. And that would be if there’s one thing you want people to take away from this case, what would it be? Juan, let’s start with you.

JUAN ALCACER: What I would like listeners to take from this, is we have this mentality of growth, growth, growth, and expanding and doing different things, and when you look at IKEA, you have to wonder, is it better that IKEA stays doing what they do well, or do they have to keep growing and entering all these markets and adapt to overseas. We have this basic assumption that growth at any cost should be the goal. I would like the listeners, when they look at the case and think about the cases, to question that very basic assumption.

BRIAN KENNY: Cynthia?

CYNTHIA MONTGOMERY: One of the things about IKEA that I think it’s really, really important to know is that they really brought something different to the world and they did it in a very compelling way. So at the heart, to do something that’s distinctive, that adds value. It comes through really strong in the IKEA story. At the same time, when the environment changes, how do you evolve, is really challenging. And so the fact that they’re being so open in how they’re confronting this, I think there’s a lot to learn there. It’s a challenge. I think it’s really important to remember what’s at the heart of this company, is that they’re really bringing something that’s very unique and they need to continue to do that.

BRIAN KENNY: Juan Alcacer, Cynthia Montgomery, thank you so much for joining me. The case is called, “What IKEA do we want?” Thanks again.

JUAN ALCACER: Thank you.

HANNAH BATES: You just heard Harvard Business School professors Juan Alcacer and Cynthia Montgomery in conversation with Brian Kenny on Cold Call . We’ll be back next Wednesday with another hand-picked conversation about business strategy from the Harvard Business Review. If you found this episode helpful, share it with your friends and colleagues, and follow our show on Apple Podcasts, Spotify, or wherever you get your podcasts. While you’re there, be sure to leave us a review. We’re a production of the Harvard Business Review. If you want more podcasts, articles, case studies, books, and videos like this, find it all at HBR dot org. This episode was produced by Anne Saini, and me, Hannah Bates. Ian Fox is our editor. Special thanks to Maureen Hoch, Adi Ignatius, Karen Player, Ramsey Khabbaz, Nicole Smith, Anne Bartholomew, and you – our listener. See you next week.

- Subscribe On:

Latest in this series

This article is about disruptive innovation.

- Emerging markets

- Growth strategy

Partner Center

To read this content please select one of the options below:

Please note you do not have access to teaching notes, wakefit innovations: overcoming challenges of online sales of furniture & furnishings.

Publication date: 22 August 2023

Teaching notes

Learning outcomes.

After reading and discussing the case, the participants would be able to: apply 7S and VRIO framework for online furniture retail; evaluate the profitability of horizontal versus vertical marketplaces for selling furniture online; articulate the challenges faced by online furniture retailers; discuss the applicability of technology to enhance customer experience in online furniture retail; and discuss the omni-channel strategy which online furniture companies can adopt.

Case overview/synopsis

Although furniture has traditionally been an unorganized category, the online furniture platforms have been on an upward curve since past few years. Digitization of economy and usage of smartphones to access internet had given a thrust to online purchases. This case on Wakefit Innovations Private Limited is intended to provide the readers with the business and marketing insights of selling furniture using online platform. The readers will be able to understand how retailing furniture using e-commerce is full of challenges and how various marketing activities have helped Wakefit improve their customer base. The readers can discuss the advantages and disadvantages of horizontal versus vertical e-commerce marketplaces and various challenges associated with online furniture retailing. Whether Wakefit should continue setting up experience centres and the benefits that could accrue by usage of virtual reality, augmented reality and data analytics are additional dimensions which can be discussed by the readers. The case will benefit the professionals in understanding the challenges and marketing strategies used by online furniture retailers and the same can be replicated by other players in this sector.

Complexity academic level

This case is suitable for students enrolled for full credit course on e-commerce at post graduate level. The case can be discussed towards the middle of the course once the students have studied different formats of e-commerce marketplace.

Supplementary materials

Teaching notes are available for educators only.

Subject code

CSS 8: Marketing.

- Online shopping

- Marketing strategy

Acknowledgements

Funding: The authors have not received any funding to develop the case.

Declaration: There is no potential source of conflict in this research.

Disclaimer. This case is written solely for educational purposes and is not intended to represent successful or unsuccessful managerial decision-making. The authors may have disguised names; financial and other recognizable information to protect confidentiality.

Attri, R. (2023), "Wakefit Innovations: overcoming challenges of online sales of furniture & furnishings", , Vol. 13 No. 2. https://doi.org/10.1108/EEMCS-11-2022-0401

Emerald Publishing Limited

Copyright © 2023, Emerald Publishing Limited

You do not currently have access to these teaching notes. Teaching notes are available for teaching faculty at subscribing institutions. Teaching notes accompany case studies with suggested learning objectives, classroom methods and potential assignment questions. They support dynamic classroom discussion to help develop student's analytical skills.

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- InternetRetailing

- Sustainability

- Merchandise

- Performance

- RetailCraft Podcast

- Subscription Podcast

- DeliveryX: Beyond the Buy Button Podcast

- Video Channel

- Browse All Reports

- Sector Reports

- Country Reports

- Ranking Reports

- Marketplace Reports

- Whitepapers

Featured Reports

- Top500 2024

- Growth 1000 2023

- Global Elite 1000 2023

- RetailX Brand Index 2023

- RetailX Europe Growth 3000 2024

- RetailX Europe Ecommerce Region 2023

Buy Data pack

- RetailX European TOP1000 Data Pack 2023

- RetailX Top500 2024 Data Pack

- Download Free Sample Data Pack

- RetailX Events

- RetailX Events Spring Festival

- SubscriptionX

- SustainabilityX

- Ecommerce World Review

- Upcoming Webinars

- Upcoming Events

- Past Events

- ChannelX World

- Editorial Calendar

- Join our Press List

- Work with us

- Research Partners

- Terms and Conditions

- Privacy Policy

You are in: Home » Industry » FURNITURE REPORT 2021: B&Q case study

FURNITURE REPORT 2021: B&Q case study

By scarlette isaac.

The Furniture 2021 report offers a market-leading analysis of the $1.33tr furniture sector from a commercial and strategic perspective. Inside, we bring the research to life with quick-read graphics and practical case study examples on 11 retail giants.

Digital Editor, Scarlette Isaac, zooms in on the highlights of the B&Q case study.

B&Q is a leading brand in home improvement and garden living with a retail presence of some 300 stores. Following lockdown, the DIY merchant dramatically improved its online traffic in alignment with the accelerated shift online. With this uplift in traffic, sales for 2020/21 are looking positive.

Kingfisher, the brand’s owner, has also seen strong growth – particularly in the first quarter of the financial year, to April 30 2021, where the group reported online sales up by 63% compared to the same time last year – and by 258% on the same time two years ago.

Sales also grew in Kingfisher’s French (+97.4% to £1.2bn), Iberian (+110.8% to £90m), and Romanian (+67.2% to £72m) businesses. In Poland (-8.9%) sales fell as all stores were closed between March 27 and May 3, partly offset as customers opted to collect their online orders at contactless drive thru’ and car park collection points.

Kingfisher chief executive Thierry Garnier, says demand from existing and new customers continues to be high. “We continue to develop, test and roll out multiple innovative propositions for our customers, with more compact store tests and we have also started to roll out our NeedHelp services marketplace in B&Q and Poland. With the strong start to the year, we now anticipate first half sales and adjusted pre-tax profit to be ahead of our previous expectations. Whilst the second half of the financial year remains naturally uncertain, we continue to see supportive long-term trends for our industry and are confident of continued outperformance of our wider markets.”

The analysis included in this article was originally featured in the RetailX Sector Analyst Report: Furniture 2021 . For further insight into this dynamic sector, download the full version here.

You may also like

Register for Newsletter

Receive 3 newsletters per week

Gain access to all Top500 research

Personalise your experience on IR.net

Privacy Overview

The 24 Best eCommerce Retail Case Studies Worth Reading

In the fast-paced world of retail and eCommerce, staying ahead of the game is not just a goal; it’s the lifeline of our industry. For seasoned retail executives, inspiration often comes from the experiences and successes of industry giants who paved the way with their innovative thinking and managed to thrive through thick and thin. That’s why we’re excited to bring you an exclusive collection of the 30 best eCommerce case studies meticulously curated to provide you with a wealth of insights and ideas to fuel your strategies. These case studies are more than just success stories; they are beacons of guidance for retail professionals navigating the ever-changing landscape of our industry.

In this article, we delve deep into the journeys of retail giants who have not only weathered the storms of disruption but have emerged as trailblazers in eCommerce. From adapting to shifting consumer behaviors to mastering the art of online engagement, this compilation offers a treasure trove of wisdom for the modern retail executive.

Table of Contents

- > Case studies for grocery/wholesale eCommerce retailers

- > Case studies for fashion eCommerce retailers

- > Case Studies for home & furniture eCommerce retailers

- > Case Studies for health & beauty eCommerce retailers

- > Case studies for electronics and tools eCommerce retailers

- > Case Studies for toys and leisure eCommerce retailers

Case studies for grocery/wholesale eCommerce retailers

Retail case study #1: tesco .

Industry : Grocery stores

Why worth reading:

- Historical evolution: Understanding Tesco’s rise from a group of market stalls to a retail giant provides valuable lessons on growth and adaptation to market changes.

- Customer service focus: Tesco’s long-term emphasis on customer service, which is consistent across their physical and online platforms, showcases the importance of customer-centric strategies.

- Innovation in eCommerce: The case study covers Tesco’s pioneering of the world’s first virtual grocery store in South Korea, a testament to its innovative approach to digital retailing.

- Crisis management: Insights into how Tesco handled the Horse Meat Scandal, including efforts to tighten its supply chain, contributing to its logistical success.

- Financial integrity: The study discusses the Accounting Scandal, offering a sobering look at financial transparency and the repercussions of financial misreporting.

Read the full Tesco case study here .

Retail case study #2: Walmart

Industry : Discount department and grocery stores

- Data-driven success: The case study provides a wealth of data, showcasing Walmart’s remarkable achievements. With an annual revenue of almost $570 billion, a global presence in 24 countries, and a customer base exceeding 230 million weekly, it’s a testament to the effectiveness of their strategies.

- Marketing strategies: The case study delves deep into Walmart’s marketing strategies. It highlights their focus on catering to low to middle-class demographics, the introduction of the Walmart Rewards loyalty program, and their commitment to environmental sustainability, all of which have contributed to their success.

- eCommerce transformation: As eCommerce continues to reshape the retail landscape, this case study details how Walmart shifted significantly towards omnichannel retail. Readers can learn about their innovative technologies and approaches, such as personalized shopping experiences and augmented reality, that have helped them adapt to changing consumer behavior.

- Supply chain innovation: Walmart’s proficiency in supply chain management is a crucial takeaway for retail executives. Their decentralized distribution center model , in-house deliveries, and data-driven optimization exemplify the importance of efficient logistics in maintaining a competitive edge.

Read the full Walmart case study here .

Retail case study #3: Sainsbury’s

Industry : Grocery stores

- Omnichannel success amidst pandemic challenges: With the fastest growth in online shopping among major retailers, the study illustrates how Sainsbury’s adapted and thrived during unprecedented times.

- Dynamic brand positioning: The analysis delves into Sainsbury’s strategic shift in brand positioning, demonstrating a keen responsiveness to changing consumer preferences. This shift showcases the brand’s agility in aligning with contemporary health-conscious consumer trends, supported by relevant data and market insights.

- Supply chain and quality assurance: The study highlights Sainsbury’s commitment to a stellar supply chain, emphasizing the correlation between high product quality, ethical sourcing, and customer loyalty. With data-backed insights into the extensive distribution network and sourcing standards, retail executives can glean valuable lessons in maintaining a competitive edge through a robust supply chain.

- Innovative technological integration: Sainsbury’s implementation of cutting-edge technologies, such as Amazon’s “Just Walk Out” and Pay@Browse, demonstrates a commitment to providing customers with a seamless and convenient shopping experience.

- Diversification beyond grocery: The case study unveils Sainsbury’s strategic partnerships with companies like Amazon, Carluccio’s, Itsu, Leon, and Wasabi, showcasing the brand’s versatility beyond traditional grocery retail.

Read the full Sainsbury’s case study here .

Retail case study #4: Ocado

- From startup to industry leader: The Ocado case study presents a remarkable journey from a three-employee startup in 2000 to becoming the UK’s largest online grocery platform.

- Omnichannel excellence: The study emphasizes Ocado’s success in implementing an omnichannel approach, particularly its early adoption of smartphone technology for customer engagement.

- Operational efficiency: From automated warehouses with machine learning-driven robots to digital twins for simulating order selection and delivery processes, the data-rich content sheds light on how technology can be leveraged for operational efficiency.

- Navigating challenges through innovation: Ocado’s strategic response to challenges, particularly its shift from primarily a grocery delivery service to a technology-driven company, showcases the power of innovative thinking. The case study details how Ocado tackled complexities associated with grocery deliveries and embraced technology partnerships to stay ahead.

- Strategic partnerships: The study sheds light on Ocado’s strategic partnerships with grocery chains and companies like CitrusAd for advertising opportunities on its platform.

Read the full Ocado case study here .

Retail case study #5: Lidl

Industry : Discount supermarkets

- Longevity and evolution: The article provides a detailed overview of Lidl’s origins and evolution, offering insights into how the brand transformed from a local fruit wholesaler to a global retail powerhouse. Understanding this journey can inspire retail executives to explore innovative strategies in their own companies.

- Global success: Retail executives can draw lessons from Lidl’s international expansion strategy, identifying key factors that contributed to its success and applying similar principles to their global ventures.

- Awards and recognitions: The numerous awards and accomplishments earned by Lidl underscore the effectiveness of its marketing strategy. Marketers and eCommerce professionals can learn from Lidl’s approach to quality, innovation, and customer satisfaction.

- Comprehensive marketing components: The article breaks down Lidl’s marketing strategy into key components, such as pricing strategy, product diversification, and target audience focus. Readers can analyze these components and consider incorporating similar holistic approaches in their businesses to achieve well-rounded success.

- Omnichannel transformation: The discussion on Lidl’s transformation to an omnichannel strategy is particularly relevant in the current digital age. This information can guide executives in adopting and optimizing similar omnichannel strategies to enhance customer experiences and drive sales.

Read the full Lidl case study here .

Retail case study #6: ALDI

Industry : FMCG

- Omnichannel approach: Aldi’s growth is attributed to a robust omnichannel strategy that seamlessly integrates online and offline channels. The case study delves into how Aldi effectively implemented services that can overcome the intricacies of a successful omnichannel approach in today’s dynamic retail landscape.

- Target market positioning: Aldi’s strategic positioning as the most cost-effective retail store for the middle-income group is explored in detail. The case study elucidates how Aldi’s pricing strategy, emphasizing the lowest possible prices and no-frills discounts, resonates with a wide audience.

- Transparency: Aldi’s commitment to transparency in its supply chain is a distinctive feature discussed in the case study. For retail executives, understanding the importance of transparent supply chain practices and their impact on brand perception is crucial in building consumer trust.

- Differentiation: Aldi’s successful “Good Different” brand positioning, which communicates that low prices result from conscientious business practices, is a key focus of the case study. Effective differentiation through brand messaging contributes to customer trust and loyalty, especially when combined with ethical business practices.

- CSR Initiatives: The case study highlights Aldi’s emphasis on social responsibility to meet the expectations of millennial and Gen-Z shoppers. By consistently communicating its CSR efforts, such as sustainable sourcing of products, Aldi creates a positive brand image that resonates with socially conscious consumers and builds brand reputation.

Read the full Aldi case study here .

Retail case study #7: ASDA

Industry : Supermarket chain

- Omnichannel implementation: The case study details how ASDA seamlessly integrates physical and virtual channels, offering customers a diverse shopping experience through in-store, digital checkouts, Click & Collect services, and a dedicated mobile app.

- Market segmentation strategies: The incorporation of partnerships with young British designers and influencer collaborations, coupled with socially progressive messaging, reflects a strategic shift that can inspire marketers looking to revitalize product lines.

- Crisis management and ethical branding: The study highlights ASDA’s strong response to the COVID-19 crisis, with ASDA’s actions showcasing a combination of crisis management and ethical business practices. This section provides valuable insights for executives seeking to align their brand with social responsibility during challenging times.

- Product and format diversification: ASDA’s product categories extend beyond groceries, including clothing, home goods, mobile products, and even insurance. The case study explores how ASDA continues to explore opportunities for cross-promotion and integration.

- Website analysis and improvement recommendations: The detailed analysis of ASDA’s eCommerce website provides actionable insights for professionals in the online retail space. This section is particularly beneficial for eCommerce professionals aiming to enhance user experience and design.

Read the full ASDA case study here .

Case studies for fashion eCommerce retailers

Retail case study #8: Farfetch

Industry : Fashion retail

- Effective SEO strategies: The Farfetch case study offers a detailed analysis of the company’s search engine optimization (SEO) strategies, revealing how it attracted over 4 million monthly visitors. The data presented underscores the importance of patient and dedicated SEO efforts, emphasizing the significance of detailed page structuring, optimized content, and strategic backlinking.

- Paid search advertising wisdom and cost considerations: The study delves into Farfetch’s paid search advertising approach, shedding light on its intelligent optimization tools and the nuances of running localized advertisements. Moreover, it discusses the higher cost of visitor acquisition through paid search compared to organic methods, providing valuable insights for marketers navigating the paid advertising landscape.

- Innovative LinkedIn advertising for talent acquisition: Farfetch’s unique use of LinkedIn advertising to attract talent is a standout feature of the case study and highlights the significance of proactive recruitment efforts and employer branding through social media channels.

- Strategic use of social media platforms: Exploring the brand’s highly consistent organic marketing across various social media channels, with a focus on visual content, highlights Farfetch’s innovative use of Instagram’s IGTV to promote luxury brands. The emphasis on social media engagement numbers serves as a testament to the effectiveness of visual content in the eCommerce and fashion sectors.

- Website design and conversion optimization insights: A significant portion of the case study is dedicated to analyzing Farfetch’s eCommerce website, providing valuable insights for professionals aiming to enhance their online platforms. By identifying strengths and areas for improvement in the website’s design, marketers, and eCommerce professionals can draw actionable insights for their platforms.

Read the full Farfetch case study here .

Retail case study #9: ASOS

Industry : Fashion eCommerce retail

- Mobile shopping success: eCommerce executives can draw inspiration from ASOS’s commitment to enhancing the mobile shopping experience, including features such as notifications for sale items and easy payment methods using smartphone cameras.

- Customer-centric mentality: ASOS emphasizes the importance of engaging customers on a personal level, gathering feedback through surveys, and using data for continuous improvement. This approach has contributed to the brand’s strong base of loyal customers.

- Inclusive marketing: ASOS’s adoption of an ‘all-inclusive approach’ by embracing genderless fashion and featuring ‘real’ people as models reflects an understanding of evolving consumer preferences. Marketers can learn from ASOS’s bold approach to inclusivity, adapting their strategies to align with the latest trends and values embraced by their target audience.

- Investment in technology and innovation: The case study provides data on ASOS’s substantial investment in technology, including visual search, voice search, and artificial intelligence (AI). eCommerce professionals can gain insights into staying at the forefront of innovation by partnering with technology startups.

- Efficient global presence: ASOS’s success in offering a wide range of brands with same and next-day shipping globally is attributed to its strategic investment in technology for warehouse automation. This highlights the importance of operational efficiency through technology, ensuring a seamless customer experience and reduced warehouse costs.

Read the full ASOS case study here .

Retail case study #10: Tommy Hilfiger

Industry : High-end fashion retail

- Worldwide brand awareness: The data presented highlights Tommy Hilfiger’s remarkable journey from a men’s clothing line in 1985 to a global lifestyle brand with 2,000 stores in 100 countries, generating $4.7 billion in revenue in 2021. This strategic evolution, exemplified by awards and recognitions, showcases the brand’s adaptability and enduring relevance in the ever-changing fashion landscape.

- Adaptation and flexibility to changing market trends: The discussion on how the brand navigates changing trends and overcame market saturation, particularly in the US, provides practical insights for professionals seeking to navigate the challenges of evolving consumer preferences.

- Successful omnichannel marketing: Tommy Hilfiger’s success is attributed to a brand-focused, digitally-led approach. The analysis of the brand’s omnichannel marketing strategy serves as a map for effective promotion and engagement across various channels.

- Decision-making and customer engagement: The case study emphasizes the brand’s commitment to data-driven decision-making with insights into customer behavior, leveraging data for effective customer engagement.

Read the full Tommy Hilfiger case study here .

Retail case study #11: Gap

- Overcoming challenges: The case study provides a comprehensive look at Gap Inc.’s financial performance, and growth despite the challenges. These insights can offer valuable takeaways into effective financial management and strategies for sustained success.

- Strong branding: Gap’s journey from a single store to a global fashion retailer reveals the importance of strategic brand positioning. Understanding how Gap targeted different market segments with unique brand identities, can inspire retail executives looking to diversify and expand their brand portfolios.

- Omnichannel adaptation: The case study delves into Gap’s omnichannel strategy, illustrating how the company seamlessly integrates online and offline experiences.

- Unique use of technology: By exploring the technologies Gap employs, such as Optimizely and New Relic, retail executives can learn about cutting-edge tools for A/B testing, personalization, and real-time user experience monitoring. This insight is crucial for staying competitive in the digital retail landscape.

- Inspiring solutions: The case study highlights challenges faced by Gap, including logistical, technological, financial, and human resource challenges.

Read the full Gap case study here .

Retail case study #12: Superdry

- Success story: The case study emphasizes SUPERDRY’s successful transition to an omnichannel retail strategy, with in-depth insights into their adaptation to online platforms and the integration of technologies like the Fynd app.

- Mobile-first and social-first strategies: As mobile internet usage continues to rise, understanding how SUPERDRY leverages videos and social media to engage customers can offer valuable takeaways for optimizing digital strategies.

- Sustainable fashion focus: Executives looking to appeal to environmentally conscious consumers can gain insights into how SUPERDRY navigated the shift towards sustainable practices and became a leader in eco-friendly fashion.

- Data-driven marketing strategies: The case study delves into SUPERDRY’s social media marketing strategies, showcasing how the company uses targeted campaigns, influencers, and seasonal keywords.

- Global market understanding: By exploring SUPERDRY’s experience in the Chinese market and its decision to exit when faced with challenges, the case study offers valuable insights into global market dynamics.

Read the full SUPERDRY case study here .

Retail case study #13: New Look

Industry : Fast-fashion retail

- Strategic pivots for profitability: A decade of revenue contraction led New Look to adopt transformative measures, from restructuring credits to withdrawing from non-profitable markets.

- Omnichannel strategy: Marketers and eCommerce professionals can study New Look’s journey, understanding how the integration of physical stores and online platforms enhances customer experience, reduces costs, and improves profitability.

- Social media mastery: The case study underscores the pivotal role of social media in engaging audiences, showcasing how New Look leverages user-generated content to build brand loyalty and maintain a positive brand perception.

- Effective partnerships for growth: New Look strategically partners with major eCommerce platforms like eBay & Next to expand its brand presence, and tap into new audiences and markets.

Read the full New Look case study here .

Retail case study #14: Zara

- Rapid international expansion through innovative strategies: Zara’s unique approach to continuous innovation and quick adaptation to fashion trends fueled its global success. Marketers can learn how to build brand narratives that resonate across diverse markets, and eCommerce professionals can glean strategies for seamless international expansion.

- Revolutionary eCommerce tactics: The case study provides a deep dive into Zara’s eCommerce strategy, emphasizing the importance of agility and responsiveness. The brand can be a bright example of implementing supply chain strategies for a swift market adapting to rapid fashion cycles.

- Visionary leadership: Amancio Ortega’s low-profile persona and visionary leadership style are explored in the case study, aiding retail executives to learn about leadership strategies that prioritize customer-centric business models.

- Omnichannel marketing and integrated stock management: Zara’s successful integration of automated marketing and stock management systems is a focal point in the case study. With insights into implementing integrated stock management systems to meet the demands of both online and offline channels, Zara can inspire professionals to improve their operations.

- Co-creation with the masses: Zara’s innovative use of customer feedback as a driving force for fashion trends is a key takeaway. Marketers can learn about the power of customer co-creation in shaping brand identity, and eCommerce professionals can implement similar models for product launches and updates.

Read the full Zara case study here .

Case Studies for home & furniture eCommerce retailers

Retail case study #15: john lewis.

Industry : Homeware and clothing retail

- Omnichannel perspective: The data-driven approach, especially in tracking orders and customer behavior, serves as a blueprint for any retail business aiming to enhance its omnichannel experience.

- Strategic growth factors: This case study offers concrete data on the strategies that contributed to the company’s sustained success, inspiring similar endeavors.

- Innovative customer engagement: John Lewis’s take on customer engagement showcases the brand’s agility and responsiveness to evolving consumer needs, supported by data on the effectiveness of these initiatives.

- eCommerce best practices and pitfalls: The analysis of John Lewis’s eCommerce website provides a data-backed evaluation of what works and what could be improved. The critique is grounded in data, making it a valuable resource for those looking to optimize their online platforms.

Read the full John Lewis case study here .

Retail case study #16: Argos

Industry : Homeware catalog retail

- Adaptation to the changing retail landscape: Argos’s journey from a catalog retailer to a retail giant demonstrates its ability to successfully adapt to the evolving retail landscape.

- Omnichannel success story: The case study provides a detailed analysis of Argos’s omnichannel strategy, showcasing how the company effectively integrated online and offline channels to achieve a seamless shopping experience across multiple touchpoints.

- Market share and financial performance: The inclusion of data on Argos’s market share and financial performance offers retail executives concrete metrics to evaluate the success of the marketing strategy. Understanding how Argos maintained a robust market share despite challenges provides actionable insights.

- Technological advancements: The case study delves into the technologies employed by Argos, such as Adobe Marketing Cloud, New Relic, and ForeSee.

- Overcoming obstacles: By examining the challenges faced by Argos, including logistical, technological, financial, and human resources challenges, retail executives can gain a realistic understanding of potential obstacles in implementing omnichannel strategies.

Read the full Argos case study here .

Retail case study #17: IKEA

Industry : Home & furniture retail

- Data-driven evolution: This detailed case study offers a data-rich narrative, illuminating the brand’s evolution into a leader in omnichannel retail.

- Pandemic response: This exploration delves into the integration of eCommerce strategies, online expansions, and the balance between physical and digital customer experiences.

- Advanced mobile apps and AR integration: A deep dive into IKEA’s innovative applications, notably the AR app “IKEA Place,” showcases how the brand leverages technology for a seamless customer experience.

- Democratic design approach: The study meticulously breaks down IKEA’s success factors, emphasizing the brand’s holistic approach through the lens of “Democratic Design.”

- DIY mentality and demographic targeting: A detailed analysis of how IKEA’s affordability is intertwined with a Do-It-Yourself (DIY) mentality. The case study explores how IKEA strategically tapped into a shift in consumer behavior, particularly among younger demographics, influencing not only purchasing patterns but also reshaping industry norms.

Read the full IKEA case study here .

Retail case study #18: Marks & Spencer

Industry : Clothing and home products retail

- Valuable lessons in eCommerce: The Marks & Spencer eCommerce case study offers a profound exploration of the brand’s journey from a latecomer to the online scene to a digital-first retailer.

- Real-world application of effective solutions: By diving into the history of Marks & Spencer, the case study provides tangible examples of how a retail giant faced setbacks and strategically pivoted to revitalize its eCommerce platform.

- Data-driven analysis of eCommerce failures: The case study meticulously analyzes the pitfalls Marks & Spencer encountered during its eCommerce journey, offering a data-driven examination of the repercussions of a poorly executed website relaunch.

- Multichannel customer experience: Marks & Spencer’s shift towards a multichannel customer experience is dissected in the case study, emphasizing the significance of a seamless user journey for increased customer satisfaction and loyalty.

- Embracing technology: Exploring Marks & Spencer’s technological innovations, such as the introduction of an intelligent virtual assistant can enhance the customer shopping journey, foster engagement, and contribute to revenue growth.

Read the full Marks & Spencer case study here .

Retail case study #19: Macy’s

Industry : Clothing and homeware retail

- Resilience and adaptability: The case study showcases Macy’s ability to navigate and triumph over obstacles, especially evident during the COVID-19 pandemic. Despite hardships, Macy’s not only survived but thrived, achieving $24.4 billion in net sales for 2022.

- Omnichannel innovation: Macy’s successful transition to omnichannel retailing is a standout feature. The case study delves into Macy’s implementation of a seamless omnichannel strategy, emphasizing the integration of physical and digital retail channels.

- Private label strategy: The introduction of new private brands and the emphasis on increasing the contribution of private brands to sales by 2025 provides a strategic lesson. Retailers can learn from Macy’s approach to enhancing control over production and distribution by investing in private brands, ultimately aiming for a more significant share of profits.

- Groundbreaking retail media strategy: Macy’s innovative approach to retail media and digital marketing is another compelling aspect. For marketers, this presents a case study on how to leverage proprietary shopper data for effective advertising, including entry into connected TV (CTV).

- Community engagement and social responsibility: The case study explores Macy’s “Mission Every One” initiative, highlighting its commitment to corporate citizenship and societal impact, integrating values into business strategies.

Read the full Macy’s case study here .

Case Studies for health & beauty eCommerce retailers

Retail case study #20: the body shop .

Industry : Beauty, health, and cosmetics

- Activism and ethical values: The Body Shop has pioneered promoting eco-friendly, sustainable, and cruelty-free products. The brand’s mission is to empower women and girls worldwide to be their best, natural selves. This strong ethical foundation has been integral to its identity.

- Recycling, community fair trade, and sustainability: The Body Shop initiated a recycling program early on, which turned into a pioneering strategy. It collaborates with organizations to create sustainable solutions for recycling, such as the Community Trade recycled plastic initiative in partnership with Plastics for Change.

- Product diversity: The Body Shop’s target demographic primarily focuses on women, but it has expanded some product lines to include men. Its products include skincare, hair and body treatments, makeup, and fragrances for both men and women.

- Omnichannel strategy, technology, and eCommerce best practices: The Body Shop has embraced an omnichannel approach that incorporates personalization, customer data and analytics, and loyalty programs. The Body Shop utilizes technology, including ContactPigeon, for omnichannel customer engagement, personalization, and data-driven decision-making.

Read the full The Body Shop case study here .

Retail case study #21: Boots

Industry : Pharmacy retail

- Long-term success: Boots’ rich history serves as a testament to the effectiveness of the brand’s strategies over time, offering valuable insights into building a brand that withstands the test of time.

- Strategic omnichannel approach: The Boots case study provides a deep dive into the marketing strategy that propelled the brand to success, with valuable insights into crafting effective omnichannel growth.

- Impactful loyalty program: Marketers can glean insights into designing loyalty programs that resonate with customers, fostering brand allegiance.

- Corporate Social Responsibility (CSR) as a pillar: The case study sheds light on how Boots addresses critical issues like youth unemployment and climate change, showcasing how a socially responsible approach can positively impact brand perception.

- Adaptive strategies during crises: Boots’ proactive role during the COVID-19 pandemic, offering vaccination services and supporting the National Health Service (NHS), demonstrates the brand’s agility during crises.

Read the full Boots case study here .

Retail case study #22: Sephora

Industry : Cosmetics

- Authentic customer experience-focused mentality: Backed by an impressive array of data, the case study meticulously outlines how Sephora transforms its in-store spaces into digital playgrounds, leveraging mobile technologies, screens, and augmented reality to enhance the customer shopping experience.

- Exceptional omnichannel business plan: The early adoption of an omnichannel strategy has been pivotal to Sephora’s ascendancy. The case study delves into the mobile app’s central role, acting as a comprehensive beauty hub with data-driven insights that drive the success of groundbreaking technologies.

- Omnichannel company culture: The case study illuminates this by detailing how this amalgamation allows a holistic view of the customer journey, blurring the lines between online and in-store interactions. This unique approach positions Sephora as a global leader in turning omnichannel thinking into a robust business strategy.

- Turning data into growth: Sephora’s adept utilization of mobile technologies to harness customer insights is a beacon for retailers in an era where data reigns supreme. The case study dissects how a surge in digital ad-driven sales, showcases the power of data-driven decision-making.

Read the full Sephora case study here .

Case studies for electronics and tools eCommerce retailers

Retail case study #23: screwfix.

Industry : Tools and hardware retail

- Innovative omnichannel approach: The case study highlights how the company strategically implemented online ordering with in-store pickup, creating a seamless shopping experience that contributed to a significant sales growth of 27.9% in just one year.

- Customer-centric strategies: Marketers can gain insights from Screwfix’s emphasis on customer experience. By studying customer feedback and incorporating personalized shopping experiences, Screwfix achieved success in the competitive home improvement sector.

- Supply chain management for rapid growth: The company strategically opened distribution centers to keep up with demand, ensuring efficient inventory management for both online and in-store orders.

- Mobile-first approach for trade professionals: With a customer base primarily consisting of trade professionals, the company’s mobile app allows for easy inventory search, order placement, and quick pickups, catering to the needs of time-sensitive projects.

- Commitment to employee well-being and community: Retail executives and marketers can draw inspiration from Screwfix’s commitment to building a positive workplace culture.

Read the full Screwfix case study here .

Case Studies for toys and leisure eCommerce retailers

Retail case study #24: lego.

Industry : Toys and leisure retail

- Global reach strategies: LEGO’s case study meticulously outlines LEGO’s focused approach, investing in flagship stores and understanding the local market nuances.

- Diversification and licensing brilliance: LEGO’s commitment to diversification through licensing and merchandising emerges as a beacon for marketers. The collaboration with well-established brands, the creation of movie franchises, and themed playsets not only elevate brand visibility but also contribute significantly to sales.

- Social media takeover: The case study unveils LEGO’s unparalleled success on social media platforms, boasting over 13 million Facebook followers and 10.04 billion views on YouTube. LEGO’s adept utilization of Facebook, Instagram, and YouTube showcases the power of social media in engaging customers.

- User-generated content (UGC) as a cornerstone: LEGO’s innovative use of digital platforms to foster a community around user-generated content is a masterclass in customer engagement. This abundance of UGC not only strengthens brand loyalty but also serves as an authentic testament to LEGO’s positive impact on users’ lives.

- Education as a marketing pillar: LEGO’s unwavering commitment to education, exemplified by its partnerships and $24 million commitment to educational aid, positions the brand as more than just a toy. Aligning brand values with social causes and leveraging educational initiatives, builds trust and credibility.

- Cutting-edge mobile strategy: Sephora’s foresight into the mobile revolution is dissected in the case study, presenting a playbook for retailers aiming to capitalize on the mobile landscape.

Read the full LEGO case study here .

Tons of eCommerce retail inspiration, in one place