Do you REALLY need a business plan?

The top three questions that I get asked most frequently as a professional business plan writer will probably not surprise you:

- What is the purpose of a business plan – why is it really required?

- How is it going to benefit my business if I write a business plan?

- Is a business plan really that important – how can I actually use it?

Keep reading to get my take on what the most essential advantages of preparing a business plan are—and why you may (not) need to prepare one.

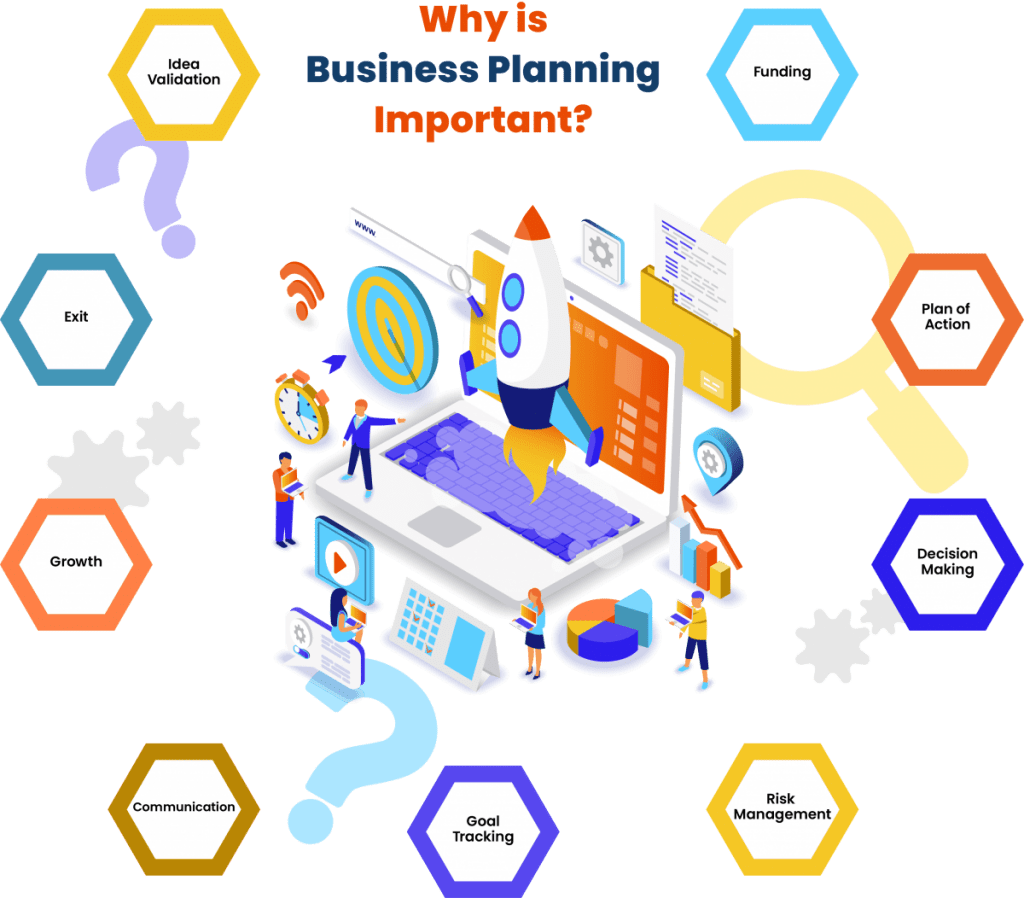

The importance, purpose and benefit of a business plan is in that it enables you to validate a business idea, secure funding, set strategic goals – and then take organized action on those goals by making decisions, managing resources, risk and change, while effectively communicating with stakeholders.

Let’s take a closer look at how each of the important business planning benefits can catapult your business forward:

1. Validate Your Business Idea

The process of writing your business plan will force you to ask the difficult questions about the major components of your business, including:

- External: industry, target market of prospective customers, competitive landscape

- Internal: business model, unique selling proposition, operations, marketing, finance

Business planning connects the dots to draw a big picture of the entire business.

And imagine how much time and money you would save if working through a business plan revealed that your business idea is untenable. You would be surprised how often that happens – an idea that once sounded so very promising may easily fall apart after you actually write down all the facts, details and numbers.

While you may be tempted to jump directly into start-up mode, writing a business plan is an essential first step to check the feasibility of a business before investing too much time and money into it. Business plans help to confirm that the idea you are so passionate and convinced about is solid from business point of view.

Take the time to do the necessary research and work through a proper business plan. The more you know, the higher the likelihood that your business will succeed.

2. Set and Track Goals

Successful businesses are dynamic and continuously evolve. And so are good business plans that allow you to:

- Priorities: Regularly set goals, targets (e.g., sales revenues reached), milestones (e.g. number of employees hired), performance indicators and metrics for short, mid and long term

- Accountability: Track your progress toward goals and benchmarks

- Course-correction: make changes to your business as you learn more about your market and what works and what does not

- Mission: Refer to a clear set of values to help steer your business through any times of trouble

Essentially, business plan is a blueprint and an important strategic tool that keeps you focused, motivated and accountable to keep your business on track. When used properly and consulted regularly, it can help you measure and manage what you are working so hard to create – your long-term vision.

As humans, we work better when we have clear goals we can work towards. The everyday business hustle makes it challenging to keep an eye on the strategic priorities. The business planning process serves as a useful reminder.

3. Take Action

A business plan is also a plan of action . At its core, your plan identifies where you are now, where you want your business to go, and how you will get there.

Planning out exactly how you are going to turn your vision into a successful business is perhaps the most important step between an idea and reality. Success comes not only from having a vision but working towards that vision in a systematic and organized way.

A good business plan clearly outlines specific steps necessary to turn the business objectives into reality. Think of it as a roadmap to success. The strategy and tactics need to be in alignment to make sure that your day-to-day activities lead to the achievement of your business goals.

4. Manage Resources

A business plan also provides insight on how resources required for achieving your business goals will be structured and allocated according to their strategic priority. For example:

Large Spending Decisions

- Assets: When and in what amount will the business commit resources to buy/lease new assets, such as computers or vehicles.

- Human Resources: Objectives for hiring new employees, including not only their pay but how they will help the business grow and flourish.

- Business Space: Information on costs of renting/buying space for offices, retail, manufacturing or other operations, for example when expanding to a new location.

Cash Flow It is essential that a business carefully plans and manages cash flows to ensure that there are optimal levels of cash in the bank at all times and avoid situations where the business could run out of cash and could not afford to pay its bills.

Revenues v. Expenses In addition, your business plan will compare your revenue forecasts to the budgeted costs to make sure that your financials are healthy and the business is set up for success.

5. Make Decisions

Whether you are starting a small business or expanding an existing one, a business plan is an important tool to help guide your decisions:

Sound decisions Gathering information for the business plan boosts your knowledge across many important areas of the business:

- Industry, market, customers and competitors

- Financial projections (e.g., revenue, expenses, assets, cash flow)

- Operations, technology and logistics

- Human resources (management and staff)

- Creating value for your customer through products and services

Decision-making skills The business planning process involves thorough research and critical thinking about many intertwined and complex business issues. As a result, it solidifies the decision-making skills of the business owner and builds a solid foundation for strategic planning , prioritization and sound decision making in your business. The more you understand, the better your decisions will be.

Planning Thorough planning allows you to determine the answer to some of the most critical business decisions ahead of time , prepare for anticipate problems before they arise, and ensure that any tactical solutions are in line with the overall strategy and goals.

If you do not take time to plan, you risk becoming overwhelmed by countless options and conflicting directions because you are not unclear about the mission , vision and strategy for your business.

6. Manage Risk

Some level of uncertainty is inherent in every business, but there is a lot you can do to reduce and manage the risk, starting with a business plan to uncover your weak spots.

You will need to take a realistic and pragmatic look at the hard facts and identify:

- Major risks , challenges and obstacles that you can expect on the way – so you can prepare to deal with them.

- Weaknesses in your business idea, business model and strategy – so you can fix them.

- Critical mistakes before they arise – so you can avoid them.

Essentially, the business plan is your safety net . Naturally, business plan cannot entirely eliminate risk, but it can significantly reduce it and prepare you for any challenges you may encounter.

7. Communicate Internally

Attract talent For a business to succeed, attracting talented workers and partners is of vital importance.

A business plan can be used as a communication tool to attract the right talent at all levels, from skilled staff to executive management, to work for your business by explaining the direction and growth potential of the business in a presentable format.

Align performance Sharing your business plan with all team members helps to ensure that everyone is on the same page when it comes to the long-term vision and strategy.

You need their buy-in from the beginning, because aligning your team with your priorities will increase the efficiency of your business as everyone is working towards a common goal .

If everyone on your team understands that their piece of work matters and how it fits into the big picture, they are more invested in achieving the objectives of the business.

It also makes it easier to track and communicate on your progress.

Share and explain business objectives with your management team, employees and new hires. Make selected portions of your business plan part of your new employee training.

8. Communicate Externally

Alliances If you are interested in partnerships or joint ventures, you may share selected sections of your plan with the potential business partners in order to develop new alliances.

Suppliers A business plan can play a part in attracting reliable suppliers and getting approved for business credit from suppliers. Suppliers who feel confident that your business will succeed (e.g., sales projections) will be much more likely to extend credit.

In addition, suppliers may want to ensure their products are being represented in the right way .

Professional Services Having a business plan in place allows you to easily share relevant sections with those you rely on to support the organization, including attorneys, accountants, and other professional consultants as needed, to make sure that everyone is on the same page.

Advisors Share the plan with experts and professionals who are in a position to give you valuable advice.

Landlord Some landlords and property managers require businesses to submit a business plan to be considered for a lease to prove that your business will have sufficient cash flows to pay the rent.

Customers The business plan may also function as a prospectus for potential customers, especially when it comes to large corporate accounts and exclusive customer relationships.

9. Secure Funding

If you intend to seek outside financing for your business, you are likely going to need a business plan.

Whether you are seeking debt financing (e.g. loan or credit line) from a lender (e.g., bank or financial institution) or equity capital financing from investors (e.g., venture or angel capital), a business plan can make the difference between whether or not – and how much – someone decides to invest.

Investors and financiers are always looking at the risk of default and the earning potential based on facts and figures. Understandably, anyone who is interested in supporting your business will want to check that you know what you are doing, that their money is in good hands, and that the venture is viable in the long run.

Business plans tend to be the most effective ways of proving that. A presentation may pique their interest , but they will most probably request a well-written document they can study in detail before they will be prepared to make any financial commitment.

That is why a business plan can often be the single most important document you can present to potential investors/financiers that will provide the structure and confidence that they need to make decisions about funding and supporting your company.

Be prepared to have your business plan scrutinized . Investors and financiers will conduct extensive checks and analyses to be certain that what is written in your business plan faithful representation of the truth.

10. Grow and Change

It is a very common misconception that a business plan is a static document that a new business prepares once in the start-up phase and then happily forgets about.

But businesses are not static. And neither are business plans. The business plan for any business will change over time as the company evolves and expands .

In the growth phase, an updated business plan is particularly useful for:

Raising additional capital for expansion

- Seeking financing for new assets , such as equipment or property

- Securing financing to support steady cash flows (e.g., seasonality, market downturns, timing of sale/purchase invoices)

- Forecasting to allocate resources according to strategic priority and operational needs

- Valuation (e.g., mergers & acquisitions, tax issues, transactions related to divorce, inheritance, estate planning)

Keeping the business plan updated gives established businesses better chance of getting the money they need to grow or even keep operating.

Business plan is also an excellent tool for planning an exit as it would include the strategy and timelines for a transfer to new ownership or dissolution of the company.

Also, if you ever make the decision to sell your business or position yourself for a merger or an acquisition , a strong business plan in hand is going to help you to maximize the business valuation.

Valuation is the process of establishing the worth of a business by a valuation expert who will draw on professional experience as well as a business plan that will outline what you have, what it’s worth now and how much will it likely produce in the future.

Your business is likely to be worth more to a buyer if they clearly understand your business model, your market, your assets and your overall potential to grow and scale .

Related Questions

Business plan purpose: what is the purpose of a business plan.

The purpose of a business plan is to articulate a strategy for starting a new business or growing an existing one by identifying where the business is going and how it will get there to test the viability of a business idea and maximize the chances of securing funding and achieving business goals and success.

Business Plan Benefits: What are the benefits of a business plan?

A business plan benefits businesses by serving as a strategic tool outlining the steps and resources required to achieve goals and make business ideas succeed, as well as a communication tool allowing businesses to articulate their strategy to stakeholders that support the business.

Business Plan Importance: Why is business plan important?

The importance of a business plan lies in it being a roadmap that guides the decisions of a business on the road to success, providing clarity on all aspects of its operations. This blueprint outlines the goals of the business and what exactly is needed to achieve them through effective management.

Sign up for our Newsletter

Get more articles just like this straight into your mailbox.

Related Posts

Recent Posts

Table of Contents

What is a business plan, the advantages of having a business plan, the types of business plans, the key elements of a business plan, best business plan software, common challenges of writing a business plan, become an expert business planner, business planning: it’s importance, types and key elements.

Every year, thousands of new businesses see the light of the day. One look at the World Bank's Entrepreneurship Survey and database shows the mind-boggling rate of new business registrations. However, sadly, only a tiny percentage of them have a chance of survival.

According to the Bureau of Labor Statistics, about 20% of small businesses fail in their first year, about 50% in their fifth year.

Research from the University of Tennessee found that 44% of businesses fail within the first three years. Among those that operate within specific sectors, like information (which includes most tech firms), 63% shut shop within three years.

Several other statistics expose the abysmal rates of business failure. But why are so many businesses bound to fail? Most studies mention "lack of business planning" as one of the reasons.

This isn’t surprising at all.

Running a business without a plan is like riding a motorcycle up a craggy cliff blindfolded. Yet, way too many firms ( a whopping 67%) don't have a formal business plan in place.

It doesn't matter if you're a startup with a great idea or a business with an excellent product. You can only go so far without a roadmap — a business plan. Only, a business plan is so much more than just a roadmap. A solid plan allows a business to weather market challenges and pivot quickly in the face of crisis, like the one global businesses are struggling with right now, in the post-pandemic world.

But before you can go ahead and develop a great business plan, you need to know the basics. In this article, we'll discuss the fundamentals of business planning to help you plan effectively for 2021.

Now before we begin with the details of business planning, let us understand what it is.

No two businesses have an identical business plan, even if they operate within the same industry. So one business plan can look entirely different from another one. Still, for the sake of simplicity, a business plan can be defined as a guide for a company to operate and achieve its goals.

More specifically, it's a document in writing that outlines the goals, objectives, and purpose of a business while laying out the blueprint for its day-to-day operations and key functions such as marketing, finance, and expansion.

A good business plan can be a game-changer for startups that are looking to raise funds to grow and scale. It convinces prospective investors that the venture will be profitable and provides a realistic outlook on how much profit is on the cards and by when it will be attained.

However, it's not only new businesses that greatly benefit from a business plan. Well-established companies and large conglomerates also need to tweak their business plans to adapt to new business environments and unpredictable market changes.

Before getting into learning more about business planning, let us learn the advantages of having one.

Since a detailed business plan offers a birds-eye view of the entire framework of an establishment, it has several benefits that make it an important part of any organization. Here are few ways a business plan can offer significant competitive edge.

- Sets objectives and benchmarks: Proper planning helps a business set realistic objectives and assign stipulated time for those goals to be met. This results in long-term profitability. It also lets a company set benchmarks and Key Performance Indicators (KPIs) necessary to reach its goals.

- Maximizes resource allocation: A good business plan helps to effectively organize and allocate the company’s resources. It provides an understanding of the result of actions, such as, opening new offices, recruiting fresh staff, change in production, and so on. It also helps the business estimate the financial impact of such actions.

- Enhances viability: A plan greatly contributes towards turning concepts into reality. Though business plans vary from company to company, the blueprints of successful companies often serve as an excellent guide for nascent-stage start-ups and new entrepreneurs. It also helps existing firms to market, advertise, and promote new products and services into the market.

- Aids in decision making: Running a business involves a lot of decision making: where to pitch, where to locate, what to sell, what to charge — the list goes on. A well thought-out business plan provides an organization the ability to anticipate the curveballs that the future could throw at them. It allows them to come up with answers and solutions to these issues well in advance.

- Fix past mistakes: When businesses create plans keeping in mind the flaws and failures of the past and what worked for them and what didn’t, it can help them save time, money, and resources. Such plans that reflects the lessons learnt from the past offers businesses an opportunity to avoid future pitfalls.

- Attracts investors: A business plan gives investors an in-depth idea about the objectives, structure, and validity of a firm. It helps to secure their confidence and encourages them to invest.

Now let's look at the various types involved in business planning.

Become a Business and Leadership Professional

- Top 10 skills in demand Business Analysis As A Skill In 2020

- 14% Growth in Jobs Of Business Analysis Profile By 2028

Business Analyst

- Industry-recognized certifications from IBM and Simplilearn

- Masterclasses from IBM experts

Post Graduate Program in Business Analysis

- Certificate from Simplilearn in collaboration with Purdue University

- Become eligible to be part of the Purdue University Alumni Association

Here's what learners are saying regarding our programs:

Assistant Consultant at Tata Consultancy Services , Tata Consultancy Services

My experience with Simplilearn has been great till now. They have good materials to start with, and a wide range of courses. I have signed up for two courses with Simplilearn over the past 6 months, Data Scientist and Agile and Scrum. My experience with both is good. One unique feature I liked about Simplilearn is that they give pre-requisites that you should complete, before a live class, so that you go there fully prepared. Secondly, there support staff is superb. I believe there are two teams, to cater to the Indian and US time zones. Simplilearn gives you the most methodical and easy way to up-skill yourself. Also, when you compare the data analytics courses across the market that offer web-based tutorials, Simplilearn, scores over the rest in my opinion. Great job, Simplilearn!

I was keenly looking for a change in my domain from business consultancy to IT(Business Analytics). This Post Graduate Program in Business Analysis course helped me achieve the same. I am proficient in business analysis now and am looking for job profiles that suit my skill set.

Business plans are formulated according to the needs of a business. It can be a simple one-page document or an elaborate 40-page affair, or anything in between. While there’s no rule set in stone as to what exactly a business plan can or can’t contain, there are a few common types of business plan that nearly all businesses in existence use.

Here’s an overview of a few fundamental types of business plans.

- Start-up plan: As the name suggests, this is a documentation of the plans, structure, and objections of a new business establishments. It describes the products and services that are to be produced by the firm, the staff management, and market analysis of their production. Often, a detailed finance spreadsheet is also attached to this document for investors to determine the viability of the new business set-up.

- Feasibility plan: A feasibility plan evaluates the prospective customers of the products or services that are to be produced by a company. It also estimates the possibility of a profit or a loss of a venture. It helps to forecast how well a product will sell at the market, the duration it will require to yield results, and the profit margin that it will secure on investments.

- Expansion Plan: This kind of plan is primarily framed when a company decided to expand in terms of production or structure. It lays down the fundamental steps and guidelines with regards to internal or external growth. It helps the firm to analyze the activities like resource allocation for increased production, financial investments, employment of extra staff, and much more.

- Operations Plan: An operational plan is also called an annual plan. This details the day-to-day activities and strategies that a business needs to follow in order to materialize its targets. It outlines the roles and responsibilities of the managing body, the various departments, and the company’s employees for the holistic success of the firm.

- Strategic Plan: This document caters to the internal strategies of the company and is a part of the foundational grounds of the establishments. It can be accurately drafted with the help of a SWOT analysis through which the strengths, weaknesses, opportunities, and threats can be categorized and evaluated so that to develop means for optimizing profits.

There is some preliminary work that’s required before you actually sit down to write a plan for your business. Knowing what goes into a business plan is one of them.

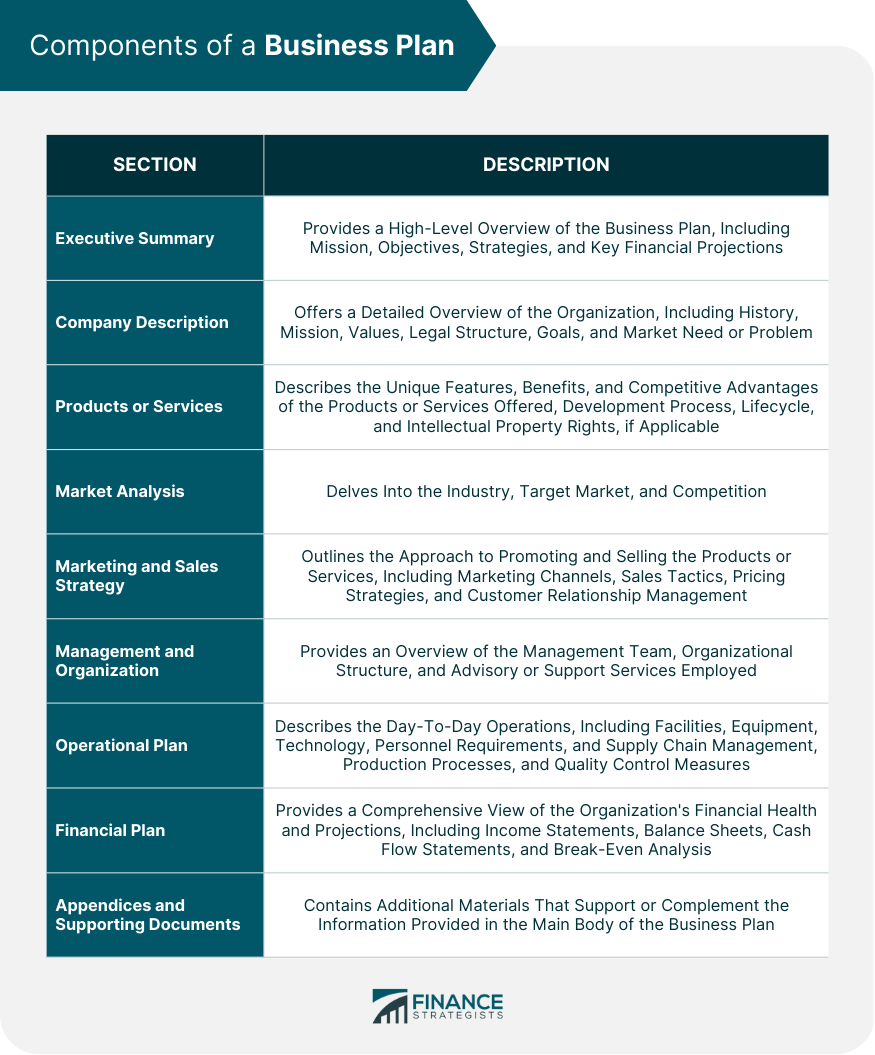

Here are the key elements of a good business plan:

- Executive Summary: An executive summary gives a clear picture of the strategies and goals of your business right at the outset. Though its value is often understated, it can be extremely helpful in creating the readers’ first impression of your business. As such, it could define the opinions of customers and investors from the get-go.

- Business Description: A thorough business description removes room for any ambiguity from your processes. An excellent business description will explain the size and structure of the firm as well as its position in the market. It also describes the kind of products and services that the company offers. It even states as to whether the company is old and established or new and aspiring. Most importantly, it highlights the USP of the products or services as compared to your competitors in the market.

- Market Analysis: A systematic market analysis helps to determine the current position of a business and analyzes its scope for future expansions. This can help in evaluating investments, promotions, marketing, and distribution of products. In-depth market understanding also helps a business combat competition and make plans for long-term success.

- Operations and Management: Much like a statement of purpose, this allows an enterprise to explain its uniqueness to its readers and customers. It showcases the ways in which the firm can deliver greater and superior products at cheaper rates and in relatively less time.

- Financial Plan: This is the most important element of a business plan and is primarily addressed to investors and sponsors. It requires a firm to reveal its financial policies and market analysis. At times, a 5-year financial report is also required to be included to show past performances and profits. The financial plan draws out the current business strategies, future projections, and the total estimated worth of the firm.

The importance of business planning is it simplifies the planning of your company's finances to present this information to a bank or investors. Here are the best business plan software providers available right now:

- Business Sorter

The importance of business planning cannot be emphasized enough, but it can be challenging to write a business plan. Here are a few issues to consider before you start your business planning:

- Create a business plan to determine your company's direction, obtain financing, and attract investors.

- Identifying financial, demographic, and achievable goals is a common challenge when writing a business plan.

- Some entrepreneurs struggle to write a business plan that is concise, interesting, and informative enough to demonstrate the viability of their business idea.

- You can streamline your business planning process by conducting research, speaking with experts and peers, and working with a business consultant.

Whether you’re running your own business or in-charge of ensuring strategic performance and growth for your employer or clients, knowing the ins and outs of business planning can set you up for success.

Be it the launch of a new and exciting product or an expansion of operations, business planning is the necessity of all large and small companies. Which is why the need for professionals with superior business planning skills will never die out. In fact, their demand is on the rise with global firms putting emphasis on business analysis and planning to cope with cut-throat competition and market uncertainties.

While some are natural-born planners, most people have to work to develop this important skill. Plus, business planning requires you to understand the fundamentals of business management and be familiar with business analysis techniques . It also requires you to have a working knowledge of data visualization, project management, and monitoring tools commonly used by businesses today.

Simpliearn’s Executive Certificate Program in General Management will help you develop and hone the required skills to become an extraordinary business planner. This comprehensive general management program by IIM Indore can serve as a career catalyst, equipping professionals with a competitive edge in the ever-evolving business environment.

What Is Meant by Business Planning?

Business planning is developing a company's mission or goals and defining the strategies you will use to achieve those goals or tasks. The process can be extensive, encompassing all aspects of the operation, or it can be concrete, focusing on specific functions within the overall corporate structure.

What Are the 4 Types of Business Plans?

The following are the four types of business plans:

Operational Planning

This type of planning typically describes the company's day-to-day operations. Single-use plans are developed for events and activities that occur only once (such as a single marketing campaign). Ongoing plans include problem-solving policies, rules for specific regulations, and procedures for a step-by-step process for achieving particular goals.

Strategic Planning

Strategic plans are all about why things must occur. A high-level overview of the entire business is included in strategic planning. It is the organization's foundation and will dictate long-term decisions.

Tactical Planning

Tactical plans are about what will happen. Strategic planning is aided by tactical planning. It outlines the tactics the organization intends to employ to achieve the goals outlined in the strategic plan.

Contingency Planning

When something unexpected occurs or something needs to be changed, contingency plans are created. In situations where a change is required, contingency planning can be beneficial.

What Are the 7 Steps of a Business Plan?

The following are the seven steps required for a business plan:

Conduct Research

If your company is to run a viable business plan and attract investors, your information must be of the highest quality.

Have a Goal

The goal must be unambiguous. You will waste your time if you don't know why you're writing a business plan. Knowing also implies having a target audience for when the plan is expected to get completed.

Create a Company Profile

Some refer to it as a company profile, while others refer to it as a snapshot. It's designed to be mentally quick and digestible because it needs to stick in the reader's mind quickly since more information is provided later in the plan.

Describe the Company in Detail

Explain the company's current situation, both good and bad. Details should also include patents, licenses, copyrights, and unique strengths that no one else has.

Create a marketing plan ahead of time.

A strategic marketing plan is required because it outlines how your product or service will be communicated, delivered, and sold to customers.

Be Willing to Change Your Plan for the Sake of Your Audience

Another standard error is that people only write one business plan. Startups have several versions, just as candidates have numerous resumes for various potential employers.

Incorporate Your Motivation

Your motivation must be a compelling reason for people to believe your company will succeed in all circumstances. A mission should drive a business, not just selling, to make money. That mission is defined by your motivation as specified in your business plan.

What Are the Basic Steps in Business Planning?

These are the basic steps in business planning:

Summary and Objectives

Briefly describe your company, its objectives, and your plan to keep it running.

Services and Products

Add specifics to your detailed description of the product or service you intend to offer. Where, why, and how much you plan to sell your product or service and any special offers.

Conduct research on your industry and the ideal customers to whom you want to sell. Identify the issues you want to solve for your customers.

Operations are the process of running your business, including the people, skills, and experience required to make it successful.

How are you going to reach your target audience? How you intend to sell to them may include positioning, pricing, promotion, and distribution.

Consider funding costs, operating expenses, and projected income. Include your financial objectives and a breakdown of what it takes to make your company profitable. With proper business planning through the help of support, system, and mentorship, it is easy to start a business.

Our Business And Leadership Courses Duration And Fees

Business And Leadership Courses typically range from a few weeks to several months, with fees varying based on program and institution.

Get Free Certifications with free video courses

Business and Leadership

Business Analysis Basics

Data Science & Business Analytics

Business Intelligence Fundamentals

Learn from Industry Experts with free Masterclasses

Product Manager's Approach to Designing Nike Smart Shoes

Career Information Session: Find Out How to Become a Business Analyst with IIT Roorkee

From Concept to Market - How to Excel at Product Management in 2024 with SP Jain Program

Recommended Reads

Business Intelligence Career Guide: Your Complete Guide to Becoming a Business Analyst

Corporate Succession Planning: How to Create Leaders According to the Business Need

Top Business Analyst Skills

Business Analytics Basics: A Beginner’s Guide

Financial Planning for Businesses Across the Globe

How to Become a Business Analyst

Get Affiliated Certifications with Live Class programs

- PMP, PMI, PMBOK, CAPM, PgMP, PfMP, ACP, PBA, RMP, SP, and OPM3 are registered marks of the Project Management Institute, Inc.

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

Why Is Strategic Planning Important?

- 06 Oct 2020

Do you know what your organization’s strategy is? How much time do you dedicate to developing that strategy each month?

If your answers are on the low side, you’re not alone. According to research from Bridges Business Consultancy , 48 percent of leaders spend less than one day per month discussing strategy.

It’s no wonder, then, that 48 percent of all organizations fail to meet at least half of their strategic targets. Before an organization can reap the rewards of its business strategy, planning must take place to ensure its strategy remains agile and executable .

Here’s a look at what strategic planning is and how it can benefit your organization.

Access your free e-book today.

What Is Strategic Planning?

Strategic planning is the ongoing organizational process of using available knowledge to document a business's intended direction. This process is used to prioritize efforts, effectively allocate resources, align shareholders and employees on the organization’s goals, and ensure those goals are backed by data and sound reasoning.

It’s important to highlight that strategic planning is an ongoing process—not a one-time meeting. In the online course Disruptive Strategy , Harvard Business School Professor Clayton Christensen notes that in a study of HBS graduates who started businesses, 93 percent of those with successful strategies evolved and pivoted away from their original strategic plans.

“Most people think of strategy as an event, but that’s not the way the world works,” Christensen says. “When we run into unanticipated opportunities and threats, we have to respond. Sometimes we respond successfully; sometimes we don’t. But most strategies develop through this process. More often than not, the strategy that leads to success emerges through a process that’s at work 24/7 in almost every industry.”

Strategic planning requires time, effort, and continual reassessment. Given the proper attention, it can set your business on the right track. Here are three benefits of strategic planning.

Related: 4 Ways to Develop Your Strategic Thinking Skills

Benefits of Strategic Planning

1. create one, forward-focused vision.

Strategy touches every employee and serves as an actionable way to reach your company’s goals.

One significant benefit of strategic planning is that it creates a single, forward-focused vision that can align your company and its shareholders. By making everyone aware of your company’s goals, how and why those goals were chosen, and what they can do to help reach them, you can create an increased sense of responsibility throughout your organization.

This can also have trickle-down effects. For instance, if a manager isn’t clear on your organization’s strategy or the reasoning used to craft it, they could make decisions on a team level that counteract its efforts. With one vision to unite around, everyone at your organization can act with a broader strategy in mind.

2. Draw Attention to Biases and Flaws in Reasoning

The decisions you make come with inherent bias. Taking part in the strategic planning process forces you to examine and explain why you’re making each decision and back it up with data, projections, or case studies, thus combatting your cognitive biases.

A few examples of cognitive biases are:

- The recency effect: The tendency to select the option presented most recently because it’s fresh in your mind

- Occam’s razor bias: The tendency to assume the most obvious decision to be the best decision

- Inertia bias: The tendency to select options that allow you to think, feel, and act in familiar ways

One cognitive bias that may be more difficult to catch in the act is confirmation bias . When seeking to validate a particular viewpoint, it's the tendency to only pay attention to information that supports that viewpoint.

If you’re crafting a strategic plan for your organization and know which strategy you prefer, enlist others with differing views and opinions to help look for information that either proves or disproves the idea.

Combating biases in strategic decision-making requires effort and dedication from your entire team, and it can make your organization’s strategy that much stronger.

Related: 3 Group Decision-Making Techniques for Success

3. Track Progress Based on Strategic Goals

Having a strategic plan in place can enable you to track progress toward goals. When each department and team understands your company’s larger strategy, their progress can directly impact its success, creating a top-down approach to tracking key performance indicators (KPIs) .

By planning your company’s strategy and defining its goals, KPIs can be determined at the organizational level. These goals can then be extended to business units, departments, teams, and individuals. This ensures that every level of your organization is aligned and can positively impact your business’s KPIs and performance.

It’s important to remember that even though your strategy might be far-reaching and structured, it must remain agile. As Christensen asserts in Disruptive Strategy , a business’s strategy needs to evolve with the challenges and opportunities it encounters. Be prepared to pivot your KPIs as goals shift and communicate the reasons for change to your organization.

Improve Your Strategic Planning Skills

Strategic planning can benefit your organization’s vision, execution, and progress toward goals. If strategic planning is a skill you’d like to improve, online courses can provide the knowledge and techniques needed to lead your team and organization.

Strategy courses can range from primers on key concepts (such as Economics for Managers ), to deep-dives on strategy frameworks (such as Disruptive Strategy ), to coursework designed to help you strategize for a specific organizational goal (such as Sustainable Business Strategy ).

Learning how to craft an effective, compelling strategic plan can enable you to not only invest in your career but provide lasting value to your organization.

Do you want to formulate winning strategies for your organization? Explore our portfolio of online strategy courses and download the free flowchart to determine which is the best fit for you and your goals.

About the Author

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

What Are the Benefits of a Business Plan?

- Small Business

- Running a Business

- Benefits of a Business

- ')" data-event="social share" data-info="Pinterest" aria-label="Share on Pinterest">

- ')" data-event="social share" data-info="Reddit" aria-label="Share on Reddit">

- ')" data-event="social share" data-info="Flipboard" aria-label="Share on Flipboard">

Checklist for a Business Plan

Why is an effective business plan introduction important, what does "abridged" mean on a business plan.

- What Does a Business Plan Consist Of?

- Importance of Following a Business Plan

What is a business plan, and what’s the point of a business plan? To understand the benefits of a business plan, it is important to first understand why it's useful and how to create one.

In essence, a business plan describes a business in detail, including its goals and how it intends to achieve them. Business plans are typically written for new businesses, though they can be written for existing ones as well. The plan includes the operational, financial and marketing aspects of the venture.

The business plan is a fundamental tool and is necessary for a startup that needs a sense of direction. One of the reasons a business plan is so important is that it is one of the main requirements of venture capital firms and banks interested in investing funds in businesses. The business plan usually starts with an executive summary, followed by a description of the business in detail, including its products and services, and a section on how the business is going to achieve its goals from operational, financial and marketing standpoints. The business plan also typically includes a brief look at the industry within which the business will operate and how the business will differentiate itself from the competition.

What Are the Various Types of Business Plans?

There are many types of business plans. These include: feasibility plans, annual plans, internal plans, operations plans, growth plans and more. These different types of plans are drafted to match the different business situations. For example, if you’re preparing a business plan for internal reasons and not to seek funding from a financial institution, there is absolutely no need to include background information in your business plan. When you’re preparing a business plan for external investors, you should describe the management team; if you’re preparing the business plan for a bank, you should include the financial history and background of the company. With different circumstances, different pieces of information are included in the business plan.

Business Plans for Start-Ups

The business plan you prepare for a startup is about as standard as it gets when it comes to explaining all the steps that need to be taken by a new business to achieve its goals. These plans typically include information on the financial analysis of the business, the milestones for implementation, the management team, the strategy of the business, various forecasts, the marketplace and the product or service offering of the organization.

Notable among the plan's forecasts are predictions for the sales, profit, loss, cash flow and balance sheet of the company. There will also likely be additional tables included in the section on financial analysis, as well as the monthly projections for the first year. The plan for a startup usually begins with an abstract and contains an appendix at the end.

Internal Business Plans

Any business plan you do not prepare with the intent to show a financial institution, an external investor or any other third party is known as an internal business plan. In such plans, you don’t really need to describe in detail the organization or the management team. You may also choose whether or not to include financial projections like forecasts and budget. Usually, in internal business plans, the whole plan is written as a report using paragraph form. The main points will either be depicted as bullet points or as slides, in the case of a PowerPoint presentation.

Operational Business Plans

Operational business plans are typically prepared for use by the business itself, so they are strictly a type of internal business plan. They are also known as annual plans and include detailed information on deadlines, implementation milestones, specific dates, and the responsibilities of teams and their managers.

The operational business plan doesn’t go into much detail about who needs to do what and when. It looks at the responsibilities and dates from the perspective of what is a top priority and what is high level. It typically arranges data in the form of bullet points on slides in a presentation. There's no need for descriptions of the management teams or the organization. You also won’t find detailed explanations of all financial projections in these business plans. They are typically not regarded at all when the business plan is being used to formulate strategies going forward.

Growth Business Plans

Some business plans do not concern themselves with the entirety of the business. They are only interested in a part of the business or a specific area of interest. These are called growth plans, new product plans or expansion plans, depending on what they are looking to achieve. They may or may not be internal plans, depending whether they are meant to attract outside investment or meet the loan requirements of a bank. For example, you could prepare a startup plan to attract new investment when the business is just starting out. When you need to attract new funding or some kind of debt finance, you would prepare an expansion plan. Both plans should include a detailed description of the organization as well as extensive background data on each member of the management team. If, however, the expansion plan is for the business’s own internal consumption, it will be categorized as an internal business plan and won’t contain details about the organizations or the management team. Internal expansion and growth plans are used to strategize on the steps the business needs to take to expand and grow. Such internal plans also involve internal funding provided by the business itself. There may or may not be detailed financial projections. However, the projections of the sales and costs of any expansion plans are typically laid out in detail.

The bigger picture: This is one of the key advantages of a business plan. When you plan your business right, you can get a clearer picture of the business as a whole. You can easily comnect the dots between strategy and tactics, and everything is easier to work out.

Strategic focus: As a startup, you need to create an identity and focus on building that identity. It is usually defined by your target market, and the products and services you are tailoring to match their needs.

Set priorities: It’s impossible to do everything at once in a business. When you plan your business, you can order things in terms of their importance and allocate your effort, resources and time in an efficient and strategic manner.

Manage change: When you plan your business effectively, you can check your assumptions, track your progress and see new developments right from the beginning, allowing you to adjust accordingly.

Forces you to be accountable: When you plan effectively, you set expectations for yourself and a means by which you will be able to track your results. You can constantly review your business plan in terms of what you expect and what eventually happens.

- Score: What is the purpose of a business plan?

- Investment Bank: Types of Business Plans

- Reference for Business: BUSINESS PLAN

- U.S. Small Business Administration: Handle Legal Concerns--Legal FAQ's

- My Own Business: Business Licenses, Permits, and Business Names

Nicky is a business writer with nearly two decades of hands-on and publishing experience. She's been published in several business publications, including The Employment Times, Web Hosting Sun and WOW! Women on Writing. She also studied business in college.

Related Articles

6 types of business plans, how to conclude a business plan, why is planning an important step in starting a business, what are the main purposes of a business plan, four types of information in a business plan, what is the difference between a marketing & business plan, how to simply write a business plan for a loan, what is the overall purpose of a business plan, what is a business plan template, most popular.

- 1 6 Types of Business Plans

- 2 How to Conclude a Business Plan

- 3 Why Is Planning an Important Step in Starting a Business?

- 4 What Are the Main Purposes of a Business Plan?

Entrepreneurs! Want to earn

$75 by going outside? — Learn more

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

Business Planning

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Get Any Financial Question Answered

Table of contents, what is business planning.

Business planning is a crucial process that involves creating a roadmap for an organization to achieve its long-term objectives. It is the foundation of every successful business and provides a framework for decision-making, resource allocation, and measuring progress towards goals.

Business planning involves identifying the current state of the organization, determining where it wants to go, and developing a strategy to get there.

It includes analyzing the market, identifying target customers, determining a competitive advantage, setting financial goals, and establishing operational plans.

The business plan serves as a reference point for all stakeholders , including investors, employees, and partners, and helps to ensure that everyone is aligned and working towards the same objectives.

Importance of Business Planning

Business planning plays a critical role in the success of any organization, as it helps to establish a clear direction and purpose for the business. It allows the organization to identify its goals and objectives, develop strategies and tactics to achieve them, and establish a framework of necessary resources and operational procedures to ensure success.

Additionally, a well-crafted business plan can serve as a reference point for decision-making, ensuring that all actions taken by the organization are aligned with its long-term objectives.

It can also facilitate communication and collaboration among team members, ensuring that everyone is working towards a common goal.

Furthermore, a business plan is often required when seeking funding or investment from external sources, as it demonstrates the organization's potential for growth and profitability. Overall, business planning is essential for any organization looking to succeed and thrive in a competitive market.

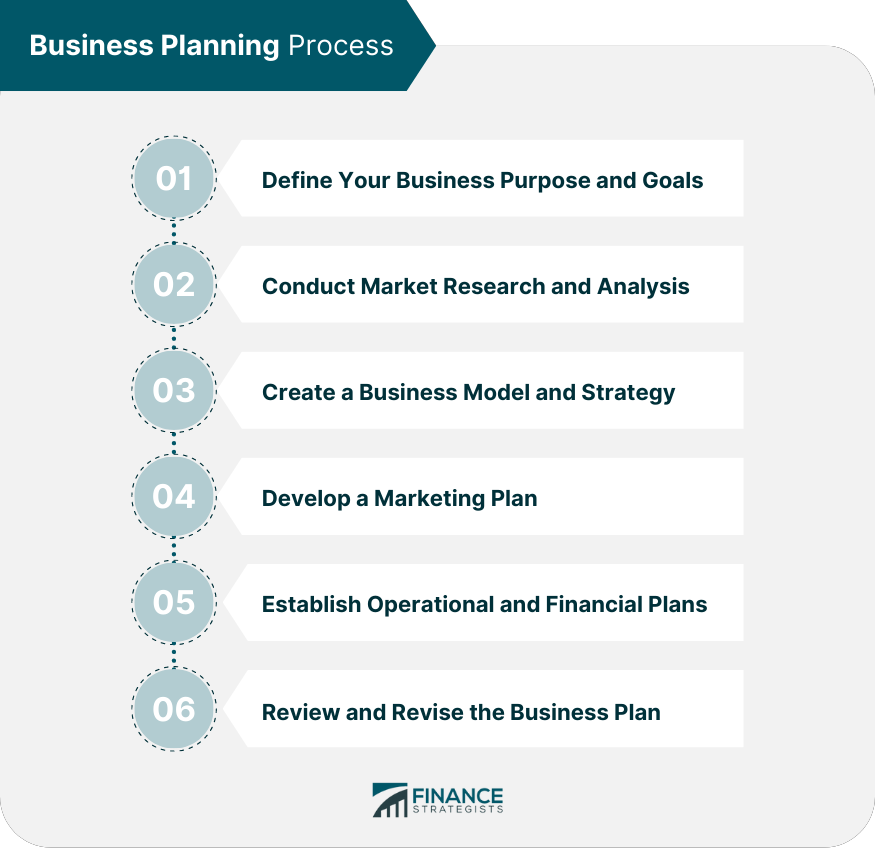

Business Planning Process

Step 1: defining your business purpose and goals.

Begin by clarifying your business's purpose, mission, and long-term goals. These elements should align with the organization's core values and guide every aspect of the planning process.

Step 2: Conducting Market Research and Analysis

Thorough market research and analysis are crucial to understanding the industry landscape, identifying target customers, and gauging the competition. This information will inform your business strategy and help you find your niche in the market.

Step 3: Creating a Business Model and Strategy