- The Ultimate Guide to Craft Successful Domestic Money Transfer Business Plan in India

Are you considering to expand your business horizons to the money transfer industry? Look no further, since you are at the right place.

Welcome to the ultimate guide that will provide you with all the essential information and strategies to craft a successful Money Transfer Business Plan in India.

As the demand for convenient and efficient fund remittance continues to grow, it’s crucial to have a well-thought-out plan to navigate the competitive landscape and capture your target market. In this comprehensive guide, we will be covering everything from the requirements to enter the industry to identifying the best business software and developing a multitude of strategies to make sustainable income from it.

Whether you’re an aspiring entrepreneur or an established business looking for growth, this guide is your roadmap to success. So, let’s dive in and unlock the secrets to crafting a winning Business Plan for Money Transfer Agency.

What is the Domestic Money Transfer Business?

Let’s start by understanding what this business actually is. The process of transferring funds from one bank account to another electronically is called Domestic Money Transfer. It becomes a business when an individual registers himself for providing these services further to the customers. He can charge a small amount of service fee from the customer as an income for providing these services.

If you are also looking for a profitable business idea with low capital, then this is a sure-shot business opportunity for you. Let’s go ahead and discuss what are the eligibilities to start a Money Transfer Business in India.

Must-Have Eligibility for a Money Transfer Business Franchise:

Running your fund remittance venture as a Money Transfer Business Franchise is not a tough cookie to crack. However, there are eligibilities you must possess before applying for this. Look down for the list of eligibilities.

- The candidate must be a citizen of India.

- The candidate must be of 18 years or above

- Valid ID documents such as Aadhaar Card and PAN Card along with proof of address for the business place.

- The candidate must have a valid mobile number & email ID.

These are the only requirements to step into this field. If you pass this eligibility criteria and are interested in this industry, then you are good to start your Money Transfer Business where the sky is the only limit.

How to Become a Money Transfer Business Franchise:

If you pass all the eligibility mentioned above, then it’s time to register for the franchise to get started. This business works on the franchise-based model where you get access to fund remittance services from a dedicated portal provided by the franchisor or service provider. Depending on the company you are choosing, you will need to pay a monthly franchise rental along with a one-time activation fee. Here’s the general process to become a Money Transfer Business Franchise.

- Contact the service provider company and submit your request to become a franchise.

- Provide necessary details to the franchisor.

- Pay the franchise fee (if applicable) & complete the KYC process with proper documentation.

- Meanwhile, arrange the resources required to run the business.

- Get the credentials of the Money Transfer Business Software & avail the training to operate it.

How to make Profit Margin in Money Transfer Business?

This is one of the often asked questions how can one actually earn from this business? Since you are not directly selling any product, you might wonder how you will earn. There is no rocket science behind it. Let’s understand the income model for this business with a simple real-world instance.

Suppose you are a Money Transfer Business Franchise and a customer comes to your shop with some cash amount to transfer into his bank account. So you will process the transaction through your software. Once the transaction is completed, you will collect the cash amount from the customer plus a small amount of service fee. This service fee is your major source of income. However, it is not your net income since you will need to pay a small amount of surcharge per transaction to your service provider company for using their services. So the net profit margin in the money remittance business is the remaining amount after subtracting the surcharge amount.

Apart from the service fee, there are some ways too, to earn in this business. You can run a DMT shop alongside your existing business. Providing the money remittance service will drive more customers to your existing business resulting in more income. This way you can increase your monthly earnings to a great extent.

Which is the Best Company for taking Money Transfer Business Franchise from?

While making the business plan for your money transfer agency, one of the key decisions you will make is to choose the company for taking franchisee. The overcrowded market filled with companies with lucrative offerings might confuse you. Therefore, before making any decision, make sure you ask yourself the following questions.

- What is your investment potential?

- Will you need to pay monthly rentals for using the services?

- What is the per transaction surcharge amount of the company?

- For how many years, the company has been working in the industry or is it a newbie?

- Are the existing franchises of the company satisfied with service quality?

These questions will filter out the long list of service providers and will provide you with a few shortlisted franchisors. Now your task will be less complex. If you are discovering a company that offers profitable business opportunity with no requirement of significant income then you must choose Dogma Soft. Why?

Dogma Soft does not charge any monthly rental or one-time activation fee for money remittance services. You can become its Money Transfer Franchise for free. Additionally, it offers the least amount of surcharge on fund transfers, increasing the profit margin for you. Once you have become its franchise partner, you get lifetime free access to this service.

Bottom Line

Navigating the roadmap of your own Money Transfer Agency and earning is a dynamic journey that requires adaptability, strategic foresight, and a commitment to continuous improvement.

From crafting a robust Money Transfer Business Plan to implementing effective income-generating strategies, each step plays a vital role in the success of your venture. However, choosing the right service provider, offering quality service & on-time support to customers, and some other tactics can really make your work easy & efficient. In this blog, we dived deeply into the ins & outs of the DMT industry as well as learned the different stages of this business thoroughly. So now, let’s become a Money Transfer Business Franchise with Dogma Soft & embark on a successful business journey of your own.

Recent Posts

- How to Withdraw Money Using Aadhaar Card: Simplifying AEPS Cash Withdrawal Process

- All-In-One Guide to Activate AEPS 2 Factor Authentication (2FA) in Dogma Wallet

- 5 Reasons Mini ATM is Game-Changer POS Swipe Machine for Small Businesses

- Harness the Power of Authorized NSDL Software for PAN Card Agency: A Comprehensive Guide

- Frequently Asked Questions (FAQ)

How to Start a Successful Money Transfer Business with Ezeepay: A Comprehensive Guide

- April 13, 2023

Mr. Shams Tabrez founded Ezeepay Digital Bharat in 2018 to increase digital banking access in rural areas of India. Leveraging the existing retail infrastructure in these regions, the company aimed to create new revenue opportunities for local entrepreneurs. As an Ezeepay agent, you can start your money transfer business without any initial investment and begin offering financial services to your customers.

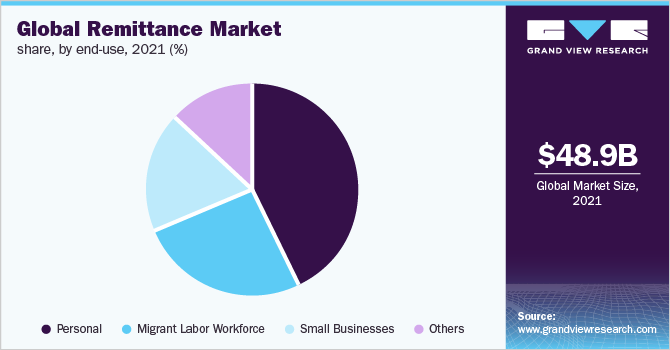

Understanding the Money Transfer Business

The term “money transfer business” describes the business that transfers money between people or organizations, locally or worldwide. Banks, MTOs, and fintech companies compete in this sector by providing customers with various digital payment services. Globalization of trade and the proliferation of digital technology that provide instantaneous and low-cost money transfers have contributed to the market’s meteoric expansion over the past few decades.

Companies that deal in aeps money transfer must adhere to anti-money-laundering regulations established by the countries’ governments to which their clients send money to prevent the transfer of illicit funds and the financing of terrorist activities. Money transfer businesses risk punishment from government agencies if they do not adhere to these rules. Fines and disciplinary action are two examples of these consequences. In addition, Money Service Businesses that are involved in terrorist financing and money laundering suffer devastating reputational damage.

A money transfer app, often known as a P2P app or person-to-person payments app, is a mobile-friendly digital platform that facilitates the transfer of funds from one user’s bank account to another user’s bank account or digital wallet. With these apps, you can send and receive money quickly and easily, and there’s no need for any physical currency, cheques, or credit cards.

Overview of Ezeepay’s services for Businesses

Banking services.

As an Ezeepay Retailer, you can earn up to Rs. 50,000 per month by offering a wide range of financial services to your customers, such as Cash Withdrawal, Money Transfer, Cash Deposit, Mini Statement, Aadhar Pay, M-ATM, Balance Enquiry, Prepaid Cards, Loans, and many more.

Ezeepay also allows retailers to manage their customer credit and accounting. With this product, any storefront can function as a branch of a financial institution.

Utility & Bill Payments

Ezeepay’s mission is to serve the modern entrepreneur who takes their financial future into their own hands. You make money by paying other people’s bills, whether for electricity, postpaid services, or anything else.

Insurance Services

Ezeepay allows you to sell various insurance policies to local customers, from life insurance to auto insurance. The prices and coverage details of multiple plans can be compared so that stores can provide customers with various insurance options. You can make a solid living off of commissions by peddling insurance policies.

Travel Services

Ezeepay, a mobile payment program, has many uses for retailers. They might profit by reserving IRCTC, airline, bus, and other transportation tickets for customers in remote places. In addition, shops can earn substantial commissions by booking hotels for customers.

E-Governance Services

With Ezeepay, merchants in rural areas can provide their clients with various e-governance services, including PAN card creation. Customers can generate TTR filings, OST registrations, MSME registrations, and other financial papers recognized by the government without ever having to set foot inside a government office, thanks to the tools included in Ezeepay.

Neo Banking Services

Be your consumers’ bank of choice by adopting Neo Banking practices. All of the banking services it offers are open for you to provide, and that’s not all. Gain a cut of the action with every successful platform transaction. Increase your income by increasing your social interaction.

Advantages of partnering with Ezeepay

Lowest Possible Outlay

All of their services are available on a safe, low-cost platform.

Numerous Goods and Services

The company provides its agents with 60+ services to help them provide the best possible service to their customers.

Get Paid With Every Sale You Make!

With Ezeepay, affiliates can earn a maximum commission on all service transactions.

Respect and Loyal Clientele

The confidence and dedication of Ezeepay’s agents allowed the company to grow to a family of 500k agents.

Steps to Starting a Business with Ezeepay

By becoming a retail agent for Ezeepay Digital Bharat, you may launch a profitable business with no initial capital outlay. You need an established retail operation to qualify. Through the Ezeepay app, you can extend your business offerings to include money transfers, bill payments, travel bookings, and insurance payments. In addition, the Ezeepay money transfer agent portal sells micro-ATMs that may be used with the Aadhaar Enabled Payment System . (AePS).

By accepting Ezeepay, nearly half a million merchants are increasing their monthly revenue by more than INR 25,000.

If you have one of the following, you can use Ezeepay to launch your business immediately:

- Kirana Store,

- Medical Stor

- Clothing Store

- Hardware Store

- Fertilizer Shop

- Travel Agency

Stores of a different type should contact Ezeepay to see if they qualify.

Here are the steps you need to take to become an Ezeepay agent

Step 1: Get started with Ezeepay Digital Bharat by installing it from the app store. (e.g. Google Play Store)

Step 2: Key in your phone number and look out for an OTP:

Step 3: After verifying your phone number, fill up your profile information.

Step 4: Give your home address and phone number on the form.

Step 5: Fill in your Permanent Account Number (PAN) and Aadhaar.

Step 6: Select “Retailer” as your membership type to launch your risk-free enterprise

Furthermore, becoming a master distributor or a district franchise is an option if you are seeking a business opportunity on a greater scale. Despite the higher upfront costs, both strategies result in greater profits and access to more resources. Ezeepay provides numerous options for generating a healthy profit margin, regardless of the nature of your business.

How to Start a Domestic Money Transfer Business with Your Own Brand?

May 9, 2022 #domestic money transfers #money transfer api #money transfer api provider #dmt api provider.

Starting and growing a domestic money transfers firm can provide several advantages and attractive rewards. Money transfers are made every day from different parts of the country, so you can be certain that there will always be a market for your product. Perhaps most importantly, you will feel a sense of accomplishment knowing that you are assisting folks in meeting their financial obligations.

What Is Domestic Money Transfer?

In the money transfer industry, you have the ability to transmit money rapidly and round the clock to any IMPS bank in India. Domestic Money Transfers is a service offered by a variety of organizations that allows you to transfer money from one bank account to another in any region of the country.

Transferring money is a really straightforward process. The person wishing to transmit money must first deposit the funds with a domestic money transfer agent. The amount would then be sent to the sender via NEFT or IMPS technology by the agent to the recipient.

Advantages Of Domestic Money Transfer Business:

There is no need for a physical presence in today’s world of online businesses. As a result, you may avoid the expenditures of rent, office furniture, personnel, and other expenses associated with a physical office.

Setting Up A Money Transfer Business-

Because money transfer businesses are required to be licensed in the majority of nations and territories, it is important to begin by learning how licensing works and then proceed from there.

There are different levels of difficulty in getting a license for a domestic money transfer business. The difficulty level from lowest to highest goes as follows:

● Affiliate

● Correspondent

● Correspondent / ISO

● Authorized Delegate

● Licensed

● Banking Agent

Working capital:

The next thing you need for your business is working capital. If you choose the Affiliate path, you should spend your money on landing pages, blog posts, SEO, SEM, ad campaigns, and social media marketing.

If you choose the correspondent method, you will be asked to put up a minimal investment that will be added to your pre-paid wallet which will be used for performing the activities required by the clients. Additionally, you will need the IT hardware to perform these activities like a mobile phone and fingerprint scanner.

Banking access:

It is difficult to find a bank ready to collaborate with a Money Service Business (MSBs) engaged in the cross-border money transfer business. Hence this might prove a difficult aspect in starting your domestic money transfer business.

However, there are multiple providers like Eko Connect , which can enable you to act on behalf of banks to perform transactions.

Compliance Program:

A well-thought-out, pragmatic, and ever-improving Compliance Program is the foundation of any well-established money-transfer organization.

Make your compliance program with the best business you can afford. Each legal corridor through which you operate and the transaction/financial model through which your organization operates have their own nuanced features that can make or break a compliance program; this is where expertise comes in.

Software and allied services:

Unless your agreement includes software (to run your money transfer business) and linked services such as ID verification, you will need to make your own arrangements. This work should begin concurrently as soon as possible because the implementation can take some time. The goal is to create a system that can provide both front-office and back-office services, as well as audit records for auditors.

Business plan:

You should be very explicit about the structure of your transaction set. How the money will be distributed. Many people enter the business without giving much thought to how much money they would make.

Every last dime must be tracked. You should understand exactly how this works and how much money is deducted at each stage of the journey. You should also be aware of who is holding this money.

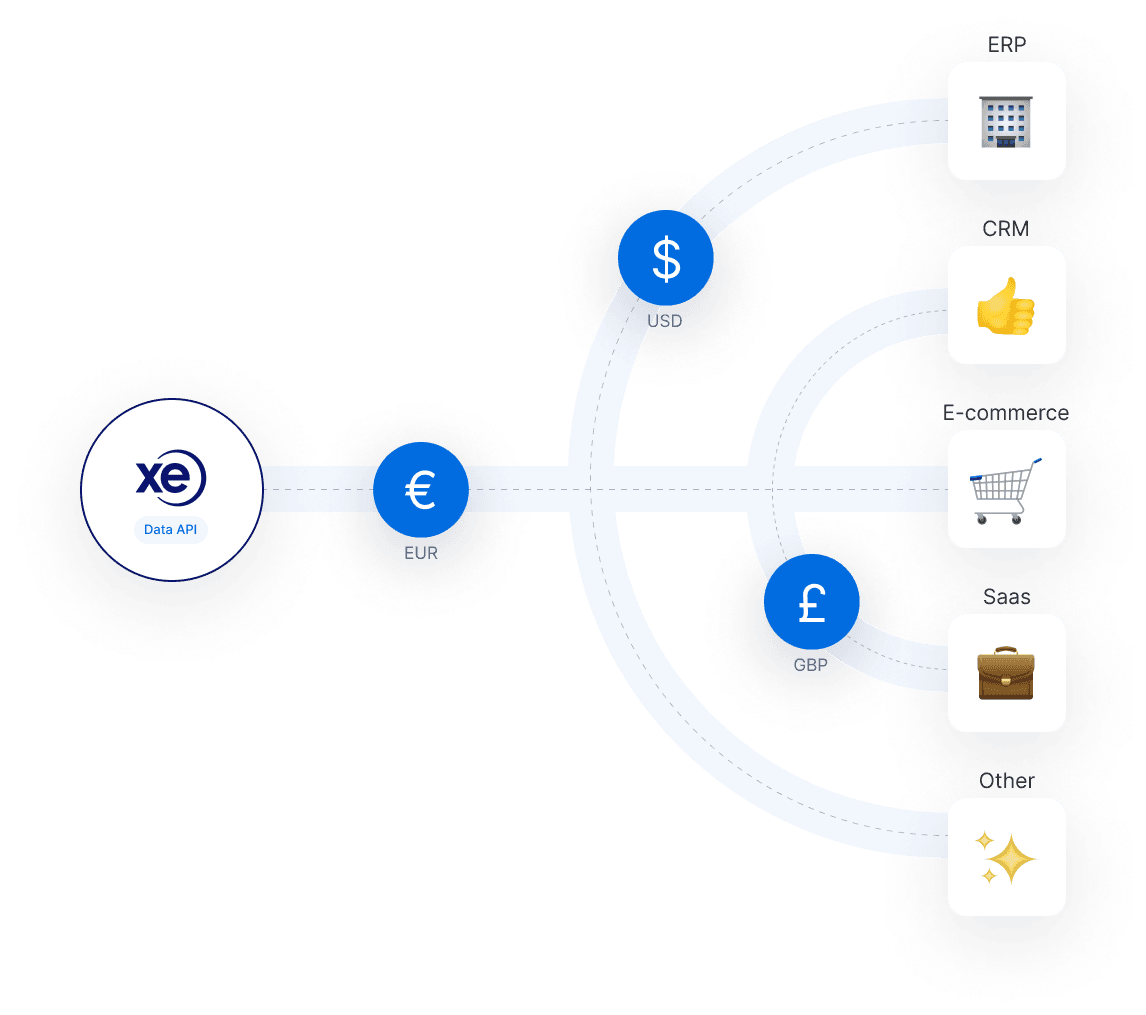

Money transfer API:

Domestic Money Transfer API is an excellent option for website owners, SMEs, and other organizations to gain additional cash. Intelligent payment routing for maximum profit at the lowest possible cost. APIs are utilized by many banks all around the world. Money Transfer API is an essential component of the banking system.

There are numerous money transfer API providers in India that can give you the right APIs according to your needs. However, before embarking on a partnership with these DMT API providers it is wise to do research and make inquiries about the legitimacy of the company.

If you are planning to launch your own money transfer application in India or planning to add this as an additional feature to your pre-existing application, you can take benefit from services like Eko Platform Services (EPS) , which can get you started on the required services in the most compliant manner. EPS provides various API’s like, AePS API , DMT API , BBPS API , mATM API.

Reach us at [email protected] or 08045681131 .

- Business Ideas

- Registered Agents

How to Start a Money Transfer Business in 14 Steps (In-Depth Guide)

Updated: February 22, 2024

BusinessGuru.co is reader-supported. When you buy through links on my site, we may earn an affiliate commission. Learn more

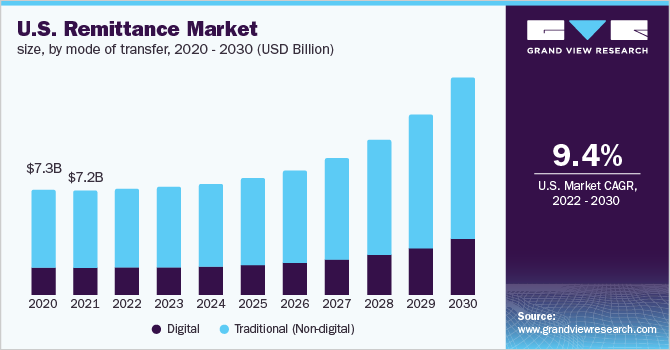

The money transfer industry is expected to reach $95.1 billion by 2032. With more people living abroad and sending money home, it’s a market ripe for new entrants.

The process of building your own money transfer business can seem daunting. You may wonder how to get started, what legal and regulatory requirements exist, and whether there is room to carve out a niche in this competitive space.

This guide breaks down startup costs, critical factors for long-term viability, and step-by-step instructions on acquiring licensure, launching marketing, and obtaining an EIN. With strategic planning and execution, you can be successful. Learn how to start a money transfer business here.

1. Conduct Money Transfer Market Research

Market research helps you develop a business plan for your remittance business. It offers insight into your target market, trends in the money transfer industry, and even which social media platforms are being used by competitors to get money transfer business posted online.

Some details you’ll learn through market research include:

- Global migration patterns mean more people than ever live abroad as expatriates and migrant workers.

- Improving economic conditions in developing countries leads to rises in disposable income available for family members to send home.

- Advances in digital transfer technology have significantly increased accessibility, convenience, and affordability compared to traditional cash-based means.

- A closer look at the underlying demographics reveals promising target consumer segments.

- Expatriate workers are the largest contributors, responsible for over 70% of money transfers.

- With over 164 million migrant workers globally, there is a huge addressable audience here.

- The end-user opportunity is immense, and systemic changes create space for new entrants.

- Stricter regulations have led some banks, including JP Morgan Chase and Bank of America , to pull back from the consumer remittance sector, opening a gap for non-bank specialists.

- Services like PayPal’s Xoom , Remitly and WorldRemit have all expanded operations, but still account for less than 5% of total volume, signaling ample remaining share up for grabs.

With accessible technology, low overhead costs compared to traditional models, and exponential end-market growth anticipated, the conditions for building a money transfer business are ideal. Capitalizing on this potential requires contending with regulatory requirements and significant competition.

2. Analyze the Competition

To understand the competitive landscape, first look at the traditional brick-and-mortar money transfer operators. Observe customer demographics, pain points in the process, and customer service quality. This will reveal targetable weaknesses alongside their brand dominance.

Complement this in-person competitive analysis by evaluating their online capabilities. Register accounts, try transferring funds, and scrutinize strengths like transfer speed, payment options, currency support, and loyalty programs.

While Western Union and MoneyGram ’s immense scale can seem daunting, don’t underestimate startups gaining traction in the digital space. Companies like Remitly and Azimo have managed to carve out multi-million dollar niches with more convenient, transparent, and affordable online-first offerings.

Replicate using their services to experience features that delight customers first-hand. Sign up for demos, explore integrations with payment platforms like PayPal , and evaluate customization for funding sources and payout methods. This reveals winning strategies to emulate and build upon.

By benchmarking both traditional big names and emerging digital disruptors, you gain invaluable insight into market positioning and customer priorities. Blend this with target user and region-specific research to identify strategic white space opportunities.

3. Costs to Start a Money Transfer Business

Launching a money transfer business demands a meticulous approach to financial planning. Let’s explore the initial expenses involved in getting your venture off the ground:

Startup Costs

- Licensing and Legal Fees: Ensuring compliance with regulatory requirements is paramount. Allocate funds for obtaining federal and state licenses, alongside adherence to regulations like the Bank Secrecy Act. Estimate these expenses to range from $1,000 to $5,000, varying by jurisdiction complexity.

- Location Costs: Securing a suitable commercial space is crucial for visibility and accessibility. Anticipate monthly rent or lease costs between $1,000 to $5,000, contingent on the location’s size and foot traffic.

- Equipment and Technology: Invest in essential equipment and technology infrastructure, including POS terminals and security systems. Initial expenses can range from $5,000 to $10,000, depending on operational scale.

- Staffing Expenses: Quality personnel are indispensable for customer service and regulatory compliance. Budget for salaries, benefits, and training, ranging from $3,000 to $10,000 monthly, based on staff numbers and local wage rates.

- Marketing and Advertising: Promotion is key to attracting customers. Allocate funds for marketing materials and online advertising, typically ranging from $500 to $5,000 initially.

- Insurance Coverage: Shield your business from potential risks with adequate insurance coverage. Estimate annual premiums between $1,000 to $5,000, factoring in coverage limits and operational risks.

Ongoing Costs

Maintaining operational continuity requires foresight in managing ongoing expenses. Let’s delve into the recurring costs:

- Rent or Lease Payments: Monthly rental or lease payments for commercial space are recurring. Expect costs between $1,000 to $5,000 per month, reflecting market rates and location.

- Staff Salaries and Benefits: Sustain business operations by budgeting for ongoing staff salaries, benefits, and training, ranging from $3,000 to $10,000 monthly.

- Technology Maintenance and Upgrades: Ensure seamless operations by allocating funds for technology upkeep and upgrades, typically ranging from $500 to $2,000 per period.

- Compliance and Regulatory Costs: Maintain adherence to regulatory standards with ongoing compliance costs, varying from $500 to $2,000 annually, dependent on operational complexity.

- Marketing and Advertising Expenses: Sustain brand visibility through periodic marketing campaigns, with expenses typically ranging from $500 to $2,000 per cycle.

- Insurance Premiums: Renew insurance coverage annually to mitigate risks, with premiums ranging from $1,000 to $5,000 per year.

By meticulously accounting for both startup and ongoing costs, aspiring entrepreneurs can chart a clear financial course for their money transfer business. Regular monitoring and adjustments are essential to ensure financial stability and adaptability in a dynamic market landscape.

4. Form a Legal Business Entity

When launching a money transfer business, one of the most important early decisions is selecting your legal entity structure. This carries major implications for legal liability, taxation, raising capital, and regulatory requirements. There are four main legal entities to choose from:

Limited Liability Company (LLC)

LLC maintenance tends to have less demand than corporations in most states. Record keeping and required meetings are typically simpler, with fewer forms and filings. LLC formalization separates legally from sole proprietors, makes clear financial accounting a necessity, and boosts perception among license-issuing bodies.

Sole Proprietorship

A sole proprietorship is best suited for a business with a single owner, or a married couple. It puts you in the driver’s seat in terms of ownership but comes with a downside. Sole proprietorships don’t separate personal and professional assets in cases of liability.

With money transmission licenses central to operations, the risks of non-compliance and handling client funds make limiting personal assets at stake prudent.

Partnership

A partnership works much the same as a sole proprietorship but is intended for a group of business owners. This is a good option for a business run by a family, where each member has an equal investment in the company. Like a sole proprietorship, a partnership doesn’t provide separation between personal and business assets.

Corporation

A corporation is the most advanced form of legal business entity there is. It offers the most protection and the greatest level of customization for owners. On the downside, a corporation is the most complicated and expensive to initiate.

5. Register Your Business For Taxes

One of the key regulatory requirements for launching a money transmission company is obtaining an Employer Identification Number (EIN) from the IRS. The EIN serves as a unique taxpayer ID that identifies your business to federal and state authorities for reporting and filing purposes.

Registering for an EIN is free and can be completed online via the IRS website in just minutes.

To apply, you will need to provide basic information about your LLC such as name, address, and ownership details. The online wizard will guide you through a simple 7-step process that includes reviewing and submitting supporting documentation for your entity.

Upon completion, you will be provided an EIN confirmation notice containing your new tax ID number. This universal business identifier will be used on state money transmitter license applications and down the line for employee onboarding, banking, and payment provider integrations.

In addition to the federal EIN, be sure to look at state and local licensing bureaus to understand sales tax permit requirements for money transfer provider services in your geographic areas of operation. The costs are typically minimal ($50 or less).

While EIN receipt alone does not require filing regular business tax returns, integration with payment systems and employing workers down the line will trigger tax and information reporting obligations. The EIN serves as the consistent tracking number tied to your LLC as these tax scenarios emerge over time.

Obtaining an EIN only takes a few minutes but is a mandatory step to operate legally as a money services business in the United States. With the EIN secured, you can proceed to acquire requisite state money transmitter licenses with confidence.

6. Setup Your Accounting

Maintaining rigorous accounting is crucial for money transfer businesses to track high transaction volumes across customer payments. Money transfer businesses must carefully reconcile payroll for expanding local agents and staff, monitor contractor payout pipelines, and more.

Some ways to optimize your accounting include:

Accounting Software

All complex financial workflows are made smoother by leveraging meticulous accounting software like QuickBooks . QuickBooks works to centralize real-time tracking to reconcile and organize every expense. It streamlines accounting services and allows small businesses to avoid an in-house accounting team.

Hire an Accountant

Along with using accounting software, you should work with an accountant part-time or at the end of the year. Accountants are trained in the intricate methods and tools involved in maintaining and balancing records and can help you meet the part-time requirements of your money transfer license as far as the government is concerned.

Open a Business Bank Account

Another way to organize business finances is to open a business bank account. Remittance services should never mix personal and business funds. Adhering to the Bank Secrecy Act is made easier by having separate accounts to remain transparent to shareholders, customers, and partners.

7. Obtain Licenses and Permits

Obtaining the proper money transmitter and related financial services licenses is essential for legally facilitating cross-border transactions and handling customer funds as a money transfer provider. Find federal license information through the U.S. Small Business Administration . The SBA also offers a local search tool for state and city requirements.

For example, requirements to research may include:

- Money transmitter licensing in states where operations will be based

- Registration as a licensed MSB (Money Services Business) with entities like FINCEN on the federal level

- Acquiring positive background checks and compliance histories for owners/officers

- Securing bonds and meeting minimum capitalization requirements

Because policies frequently evolve, it is advisable to enlist guidance from legal and compliance advisors with a specialized understanding of updated changes proposed by complex regulators like the Conference of State Bank Supervisors .

8. Get Business Insurance

Comprehensive business insurance is considered a prudent move for any company handling sensitive customer data and funds. For regulated financial services like money transmission, insurance can provide an added backstop that demonstrates good faith risk management to licensing authorities.

Potential risks include internal fraud, cybersecurity breaches, failing compliance audits, or events like fires or floods that physically destroy servers and records. Having policies that reimburse customers and restore business operations quickly after disasters minimizes business continuity disruptions.

Common coverage includes:

- Employee theft insurance

- Data breach plans

- Errors & omissions liability

- Property/casualty

With manufacturers crafting over 150 niche solutions, expert guidance is key. Evaluating local transmission regulations to quantify specific coverage gaps, projected customer base value, disaster likelihoods, and growth trajectories can inform smarter buys.

Collaborating closely with an independent broker well-versed in the financial technology sector can illuminate advantageous products unknown to laypersons. They can also assist in interfacing with carriers negotiating tailored solutions like enhanced cyber plans with breach coaches.

While more affordable than some industries, underinsured transmission businesses still risk major continuity threats, hefty non-compliance fines or lawsuits, and even shutdown orders. But those taking a proactive rather than reactive stance on comprehensive insurance enjoy peace of mind as a worthy investment.

9. Create an Office Space

Having a professional office can facilitate customer meetings, support staff collaboration, safely store sensitive documents, and establish legitimacy for licensing boards. Locations projecting security and financial competence may strengthen trust in handling client funds.

Home Office

Many founders launch from home offices minimizing overhead until revenue stabilizes. This allows concentrating resources on core business operations rather than real estate early on. Upgrading later as needs emerge can work well for web-based models.

Coworking Office

For location flexibility at affordable monthly rates, coworking spaces like WeWork provide turnkey environments configurable as teams grow. Built-in amenities, networking events, and central locations offer cost-efficient flexibility difficult to replicate elsewhere.

Retail Office

The option of a retail storefront could provide neighborhood visibility and convenience for cash pay-ins/payouts. But weigh higher fixed costs against target customer digital expectations and foot traffic potential.

Commercial Office

Long-term, strict security and compliance needs may merit eventually overseeing internal spaces like stand-alone commercial offices. This enables highly customized build-outs aligning to data and money-handling best practices as businesses scale up.

10. Source Your Equipment

Many money transmitters function predominantly through web-based platforms, minimizing extensive physical equipment needs early on. But some key components could include:

- Computer hardware/software for building digital platforms and interfaces

- Smartphones/tablets for testing, demos, communications

- Office equipment like printers, and scanners for customer onboarding

When starting, relying on modern personal devices to develop minimally viable technology can suffice and cost little. As efforts grow more sophisticated, upgrading to commercial-grade equipment may support resilience and capacity.

Buying new equipment ensures modern furniture and electronics, extended warranty options, and a longer life span. You can obtain new supplies for your business office through retailers like Staples and Office Depot .

To save money as you start, your transferring money business could invest in used equipment. Check platforms like Facebook Marketplace or Craigslist for deals. Be sure to check that everything is in working order before paying for products.

11. Establish Your Brand Assets

Entering an industry reliant on consumer confidence in the safe, reliable passage of hard-earned funds internationally. Branding your business helps potential clients recognize you, and for your brand to in turn grow in value online.

Some ways to begin developing your brand include:

Design a Logo

Logos offer a visual indicator of who your company is and what it can do. It helps set you apart from competitors and even inspires consumers and business owners to make a change from a competing service. A great place to get started with logo design is Looka .

Design a Website

In the digital age, it’s more important than ever before for businesses to develop easily navigable websites. Designing websites has become easy, even for newcomers. Wix is a great do-it-yourself option. You can also invest in freelance platforms like Fiverr for a more professional custom design.

Print Business Cards

Business cards provide a professional jumping-off point for referrals and word-of-mouth marketing. As a tangible marketing resource, business cards give potential customers memorable access to your business phone number, website, and more. Try Vistaprint for quick, affordable, and professionally printed business cards.

Get a Business Phone Number

Business phone services from RingCentral provide a focused point of contact for customers, investors, and more. A business phone line helps maintain organization between personal and business calls.

Get a Business Domain Name

An indicator of serious long-term market commitment comes through seemingly small touches. Official domain names, like your logo, help brand your business and offer a memorable way for customers to find you. Check out providers like Namecheap for affordable .com addresses.

12. Join Associations and Groups

Joining localized trade organizations, chambers of commerce chapters, or money transmitter alliances creates opportunities to regularly exchange guidance with specialists navigating similar regulatory nuances, banking bottlenecks, and risk climates within overlapping regions.

Local Associations

There are many groups designed to support newcomers in the financial business sector. The International Association of Money Transfer Networks and Money Services Business Association will connect you with like-minded professionals.

Local Meetups

In-person venues provide local mentorship opportunities. Meetup is a great avenue to find events and trade shows in your area. Don’t see one you like? Create a meetup of your own.

Facebook Groups

Tapping forums comprised of principal compliance officers and licensed transmitters via Facebook Groups is a good place to begin. Check out How to Money and Money Transfer Hub to get started. LinkedIn is also a great digital platform to network. It provides mentorship from long-tenured practitioners over common pitfalls.

13. How to Market a Money Transfer Business

Marketing is essential to starting a money transfer services business. It draws in new interest and encourages current customers to use your service again and share it with others. Some of the major ways to market your business as a money transfer operator include:

Referral Marketing

Gaining visibility and trust in a highly regulated industry often hinges on referral networks stemming from exemplary customer service. Providing transfer fee discounts or cash bonuses to satisfied customers who refer other senders could incentivize organic word-of-mouth promotion.

Digital Marketing

Digital tactics useful for amplifying reach may include:

- Search ads on Google Ads to drive users from relevant money-oriented keyword searches

- Social media ads on platforms like Facebook to target expatriate demographics

- Optimized blogging and video content to organically appear for searched money questions

- Email nurture tracks guiding interested leads through account signup

- Retargeting ads remarketing the brand to site visitors

Traditional Marketing

More traditional outlets typically demanding higher spending like billboards or radio may prove less traceable but still contextually valuable:

- Transit posters in high-traffic pickup and delivery locales

- TV or radio ads placed strategically around key cultural events when sending spikes

- Community sponsorships aligned with relevant diaspora organizations

With heavy compliance considerations, however, professional guidance would be advisable before deploying ads to confirm acceptable creative approaches across mediums.

14. Focus on the Customer

In an industry dependent on deep trust to protect clients’ sensitive, hard-earned money, delivering highly responsive, individualized support helps forge meaningful relationships that fuel referrals. Doing whatever it takes to ensure customers feel taken care of can pay dividends.

Consider this scenario: Throwing in a small transfer fee discount for a repeat customer who frequently sends remittances to cover a loved one’s medical bills abroad costs little but signals meaningful support. When their grateful friend later asks where to send their niece’s college tuition, a heartfelt personal recommendation carries far more weight than any advertisement.

Even providing customized guidance to new customers overwhelmed by the transfer options, compliance documentation required, and international policies cements your brand as an ongoing resource at their side rather than just a transactional platform.

By consistently making people the bottom line by nurturing consumer experiences you put yourself in a prime position for return customers.

You Might Also Like

April 1, 2024

0 comments

How to Start a Septic Tank Cleaning Business in 14 Steps (In-Depth Guide)

The septic tank cleaning industry is a hidden gem, with a market size projected ...

March 8, 2024

How to Start a Budgeting Coach Business in 14 Steps (In-Depth Guide)

The personal finance coaching industry has exploded in recent years. Between the overall task ...

How to Start a Credit Score Counseling Business in 14 Steps (In-Depth Guide)

The credit score counseling industry has seen steady growth in recent years. According to ...

March 1, 2024

How to Start an Investment Advisory Business in 14 Steps (In-Depth Guide)

The investment advisory services industry is on the rise. It’s expected to grow at ...

Check Out Our Latest Articles

How to start a headstone cleaning business in 14 steps (in-depth guide), how to start a steam cleaning business in 14 steps (in-depth guide), how to start a dryer vent cleaning business in 14 steps (in-depth guide), how to start a yard cleaning business in 14 steps (in-depth guide).

Instant Money Transfer

Make your shop a money transfer center. instantly activate and start earning in minutes., why choose paypoint for your money transfer center.

PayPoint is an RBI approved entity The company’s operations have been compliant under the Payment and Settlement ACT of the Reserve bank of India for more than 8 years. The platform is robust and can effortlessly handle any rush of transactions on weekends and bank holidays with almost 99.99% up-time.

It has everything you need to serve the huge labour force and migrant workers who want to transfer money back to their homes. Banks have limited service hours and long queues. Provide INSTANT money transfer 24*7 to any bank account via IMPS, NEFT and wallet. All you need is a smartphone or computer with an Internet connection.

Transparent Pricing, Highest commission Industry-leading commission and incentive structures. Simple pricing, lowest transfer cost and transparent structure with no hidden charges or monthly fee.

What is the activation process?

Everything about PayPoint’s Instant Money Transfer is superfast. Activate your Money transfer account online in minutes with e-KYC and start transferring money immediately. Get the commission instantly and transaction settlement reports in real-time. Best user-experience that is easy to use and requires fewer steps. For example, you can add new beneficiaries and make transactions on the same page to save you time.

What about support and training?

PayPoint offers best-in-class support and training. With regional offices in Mumbai, Thane, Delhi, Lucknow, Hyderabad, Guwahati and Calcutta; and operations across India the company closely understands the retailer’s needs and concerns. Systems, processes and support have been refined over the years with learning from more than 64,000 retailers.

The dedicated regional, limit, support and technology desks provide you with all the assistance you need to manage and grow your business. The company also creates and shares detailed training material online which you can access at any time.

Top Features

A deep understanding of the market’s pulse allows us to constantly add new services.

- Instant Retailer Activation

- Send money 24X7X365

- Instant transfer to any Bank Account

- Send Via IMPS, NEFT and Mobile Wallet

- Available on mobile and computer

- High Commision Margin

Testimonials

Paypoint is the source of my income. It gave me my identity in my neighborhood. My career has taken great shape thanks to PayPoint.

Arif Enterprises

PayPoint Portal is the easiest to use. It has all the services and I don't need any other portal. Money transfer and Aadhar ATM are my favorite and highest earning products.

S K Telecom

It was very easy and almost instant to start Domestic Money Transfer through PayPoint. The commission is high and the system is never down.

Deepak Shah

Bs associate.

I have become an entrepreneur thanks to PayPoint. They continuously add more and more services. The latest one, Amazon E-commerce, is my current favourite.

Sabri Communication & Telecom

PayPoints mobile application is the best thing for me. I can give service to customers even when i'm not in my shop. It is very easy to use and has all the services.

Rajesh Kumar

Mmaa gayatri general store.

Pay Point is a very good service provider company. I use all the services for customers. I got success and respect in my area because of PayPoint. Thank You Pay Point.

D.R Printout Hub

The support and sales team is always available to help. I use almost all the services in the portal. My walk-ins and income have both gone up after taking their service.

Tarun Kumar Acharya

St paypoint.

I started my journey with PayPoint in June-19, I had lots of issues initially but the customer care team was always there, especially Amirul Islam. Now, my business has spread and I have earned success, respect and financial stability.

Instantly activate and earn a high commission with RBI approved PayPoint’s Money Transfer service.

Please fill in your contact details and we'll get in touch with you.

Start Currency Exchange Business in India: Advantages & Scope

Radha Dhaked | April 5, 2022 | Company Formation

After the announcement of demonetization in 2016, the general public received a jolt of reality. For Indians who had no idea what was about to happen, it was chaos. Ever since demonetization, there has been a rapid growth in online payment systems. Hence, you can start currency exchange business in India as there are several benefits. In this article, you will understand how to start currency exchange business in India and also its scope.

What is Currency Exchange Business?

A Full Fledged Money Changer (FFMC) is an approved organization that may buy foreign currency from non-residents and Indian residents and sell it solely to those going abroad for private and commercial purposes.

Per the Foreign Exchange Management Act (1999), only registered money changers are allowed to conduct money-changing operations and provide required foreign exchange services within India.

Certain enterprises and hotels have also been granted the ability to trade in foreign currency notes, coins, and traveler’s checks in accordance with the directives provided by the RBI on an ongoing basis.

Advantages and scope to start currency exchange business in India

The foreign exchange market is among the most liquid in the world, transacting $6.6 trillion in value daily. However, it is also extremely volatile and has a high degree of risk.

A wide range of financial institutions participates in the currency trading market, including large enterprises, central banks, wealth management firms, hedge funds, and retail forex brokers.

As a result, Forex trading or currency exchange business in India is a legal means of making money and a highly profitable business in India.

You can also earn money through commission while you provide currency exchange services.

Process to start currency exchange business in India

Get Company Registration

Company Registration is the primary step to start currency exchange business in India.

It is legal registration and intimidation to the government that you are starting this business. Company Registration also allows you to decide the liability and the tax structure that you want to avail for your business.

Apply for FFMC Registration

If a corporation wants to engage in money-changing activities, such as forex currency exchange, it must be registered with the Financial Futures and Markets Commission (FFMC).

AMC (Approved Money Changers) are businesses or persons authorized by the RBI under Section 10 (1) of the FEMA Act (Foreign Exchange Management Act), 1999. Full Fledged Money Changers are the AMCs that fall within this category.

Thus, If you want to run a money exchange company or market it, you need an active RBI-issued FFMC license.

As a result, any company that engages in money-changing activities without the consent of the RBI may face fines.

Get Trademark Registration

These days multiple businesses fail because they don’t protect their branding.

Hence, getting a trademark registration to start currency exchange business in India is essential. There are also several other advantages of Trademark Registration such as:

- The trademark confirms the quality of your products and services, making it easy for buyers to place their faith in you.

- An organization’s Intellectual Property (IP) becomes a good investment when a trademark registration is completed. A trademark registration creates a right that can be sold, transferred, licensed, or commercially contracted.

- You have trademarked your wordmark or logo, and no one else may use it.

- Registration of trademarks online may be done for a very minimal cost. Only maintenance and renewal costs are required once the trademark is registered for ten years.

- Your company’s or organization’s uniqueness may be conveyed through its logo. Hence, after having Logo Design, you should also trademark it.

Apply for Shop Establishment Registration

Shop and establishment laws (“Acts”) are enacted by state legislatures. As a general rule, the Act’s provisions are the same in every state. The states’ Labor Departments are in charge of enforcing the Shop and Establishment Act.

All stores and business enterprises in the state are subject to the provisions of the Act. The Act’s registrations are issued by the individual states, and hence the process varies significantly from state to state.

Therefore, Shop Establishment Registration is mandatory for every shop or establishment that is conducting business.

GST Registration

GST(Goods and Service Tax) is an indirect taxation system in India. In India, it is mandatory to have GST Registration if you cross the turnover limit.

However, you can also get GST Registration and do GST Return Filing to avail the various advantages that it offers.

GST Registration also assists you in opening a current bank account that you will need to carry out your currency exchange business. Moreover, if you have MSME Registration , you can also avail a business loan easily.

In the article above, you have understood the process to start currency exchange business in India. If you require further guidance in relation to starting currency exchange business or any other business, feel free to contact our business advisors.

Explore the 7 Types of Company Registration in India

Moreover, If you want any other guidance relating to Company Formation . Please feel free to talk to our business advisors at 8881-069-069 .

Download E-Startup Mobile App and Never miss the latest updates narrating to your business.

Startup Schemes for Women Entrepreneurs in India

Start dry fruit business in india: advantages & registration, leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

How Do I Set Up A Remittance Money Transfer Business?

Unlock the secrets of running a successful money transfer business: read our comprehensive guide now.

This article provides a comprehensive guide to starting and running a successful money transfer business, covering key areas such as licensing, compliance, technology, partner selection, marketing, and risk management. It offers valuable insights, tips, and practical examples for entrepreneurs and business owners looking to enter the money transfer industry or improve their existing operations. With a focus on innovation, customer experience, and regulatory compliance, this article is a must-read for anyone interested in launching a successful money transfer business in today’s competitive market.

Introduction

Entering the remittance industry is not particularly difficult as long as you have a basic understanding of how businesses operate. However, it is crucial to keep in mind that the transfer of money is a regulated activity that requires compliance with the law.

Failure to obtain the necessary licenses and follow the appropriate regulations can result in significant consequences, including fines and imprisonment.

Therefore, you should consult with local regulatory bodies and attorneys specializing in this field before proceeding with any plans to enter the remittance industry.

Diving Into The Money Transfer Business

It is common for individuals to enter the remittance industry without adequately researching and understanding the field. They may spend a few hours reading about it or even try transferring money themselves, but this is insufficient to become an industry expert. In fact, becoming knowledgeable and successful in the remittance industry requires significant time and dedication. Without a deep understanding of the industry and a commitment to the business, competing with others and making a profit can be challenging.

Additionally, it is important to be aware that the remittance industry is often viewed as a low-hanging fruit, which can lead to intense competition. This can make it difficult to survive in the business, as there are likely to be many other individuals and companies vying for a share of the market.

Dip Your Toes Into the Water

Before you find out the hard way, it is always better to start small. Everyone wants to be able to do this…

However, the rider you see on that bike most likely started with the vehicle below and worked their way up…

Yes. Training Wheels! Put them on!

It is advisable to start small and proceed with caution when entering the remittance industry, as investing too much money and time too quickly can lead to significant losses. Starting small allows you to make mistakes and learn from them, which is an important aspect of the process.

Additionally, it is important to pay attention to the industry’s subtle nuances, as these can ultimately determine your success.

For example, suppose you are planning to set up a physical location for your remittance business. In that case, it may be wise to start with a small location in a less competitive area before expanding to a larger, more competitive location. By starting small and carefully, you can gain valuable experience and knowledge that will help you succeed in the long run.

- Establishing partnerships with other companies or individuals: This can involve negotiating terms, setting up contracts, and finding mutually beneficial arrangements.

- Seeking help and advice from relevant sources: This could include consulting with legal professionals, regulatory bodies, industry experts, or other individuals with experience in the remittance industry.

- Working with vendors and suppliers: This may involve identifying reliable and cost-effective sources for necessary goods and services, negotiating terms, and building relationships with these companies.

- Maximizing the use of your working capital: This could involve finding ways to reduce expenses, increase efficiency, or generate additional income in order to maximize the use of your available financial resources.

- Marketing your business and targeting specific client groups: This may involve creating marketing materials, identifying potential customers, and developing strategies to reach and attract these individuals.

- Testing different approaches and measuring their effectiveness: A/B testing involves comparing two or more versions of something (such as a marketing message or website design) in order to determine which is most effective.

- Understanding and complying with relevant regulations: This may involve obtaining necessary licenses and permits, following industry standards and guidelines, and staying up-to-date on any changes to the regulatory environment.

- Knowing your competition and their strategies: This may involve researching other companies in the industry, analyzing their offerings and marketing techniques, and developing ways to differentiate your business from theirs.

- Paying attention to the specific characteristics and trends of different remittance corridors: This could involve analyzing data on exchange rates, fees, and other factors that can impact the cost and feasibility of transferring money in different regions.

- Building relationships with banks and other financial institutions: This may involve negotiating terms, complying with their requirements, and finding ways to make your business an attractive partner for these organizations.

- Carefully calculating the costs associated with transferring money: This could involve analyzing expenses such as fees, exchange rates, and other charges that can impact the overall cost of a transaction.

- Increasing the volume of money transferred: This may involve finding new customers, expanding to new regions, or offering additional services in order to grow your business.

- Effectively managing Know Your Customer (KYC) processes: This could involve developing and implementing procedures to verify the identity of your customers and ensure compliance with relevant regulations.

- Avoiding involvement in money laundering or terrorist financing: This may involve implementing policies and procedures to prevent your business from being used to funnel illicit funds.

- Building a strong and effective team: This could involve recruiting and hiring skilled and dedicated employees, training and developing their skills, and creating a positive and supportive work environment.

Remember, there is no shame in starting small. It pays in the long run to start small and grow.

It All Starts With Licensing

In most countries and territories, operating a money transfer business requires a license. Therefore, it is advisable to research and understand the licensing process before proceeding with any plans to enter the industry.

This may involve consulting with regulatory bodies and attorneys, obtaining the necessary permits and approvals, and fulfilling any other requirements set forth by the authorities.

By taking the time to properly address the licensing issue from the outset, you can avoid potential legal issues and set your business up for success.

In order of difficulty (from lowest to highest):

- Correspondent

- Correspondent / ISO

- Authorized Delegate

- Banking Agent

A more detailed explanation of the route you can take with respect to licensing is explained here: US Money Transmitter License

Licensing Alternatives

One option to consider when entering the remittance industry is becoming an affiliate. There are several advantages to this approach, including:

- Minimal financial investment: As an affiliate, you typically do not need to invest a significant amount of money upfront, making it a relatively low-risk option.

- Rapid learning: Working as an affiliate allows you to gain hands-on experience and quickly become familiar with industry terminology and processes.

- Comprehensive understanding: While you may not learn about every aspect of the industry as an affiliate, you will still gain a thorough understanding of how money transfer works and the various factors involved.

- Practical experience: Rather than simply learning about the industry theoretically, becoming an affiliate allows you to gain firsthand experience and see the practical applications of what you have learned.

- Testing the waters: By becoming an affiliate, you can gauge the difficulty of acquiring and retaining clients, which can be valuable information as you consider expanding your business.

- Flexibility: If things do not work out as an affiliate, you can walk away without incurring significant losses or being tied to long-term contracts. You can also enroll with another money transfer operator as an affiliate if you wish to continue exploring the industry.

- Free education: The MTOs you work with may provide additional training and support to help you better understand the industry and succeed as an affiliate.

Once you feel confident in your understanding of the remittance industry and your own risk tolerance, you may be ready to move on to the next level of involvement. This could involve transitioning from a training wheels approach, such as becoming an affiliate, to a more advanced level of involvement such as becoming an authorized delegate or agent.

Alternatively, if you have already gained significant knowledge and experience in the industry through internships or work with an MTO, you may be ready to pursue your own licenses and establish your own business.

Ultimately, the appropriate level of involvement will depend on your understanding of the business and your comfort with the associated risks.

Players in the Ecosystem

The next thing is to understand the different players in the money transfer business that make up the ecosystem:

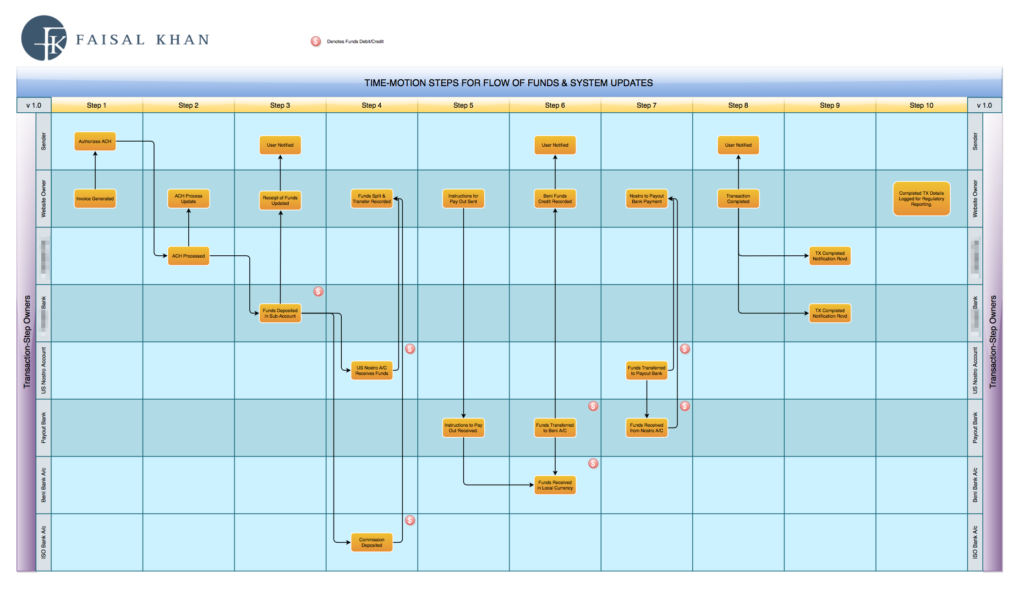

The image below depicts more or less a complete model of all the players that will ever be:

- Sender: The individual who is sending the remittance.

- Sender’s Bank: The bank that the sender will use to fund the remittance transaction. This can also be funded in cash at an agent location or by using other payment instruments such as credit/debit cards or mobile credits.

- Beneficiary: The person who will be receiving the remittance money.

- Beneficiary’s Bank: The bank where the remittance money is credited. Alternative methods include mobile wallets (which also involve a bank on the back end) or cash-over-counter (COC), in which case the beneficiary can receive cash upon presenting proper identification at an agent location or bank.

- Money Transfer Operator (Sending Side): The licensed entity in the sending country that is legally responsible for facilitating the remittance.

- Money Transfer Operator Bank (Sending Side): The financial institution(s) that the MTO in the sending country uses to aggregate the funds and distribute them.

- Money Transfer Operator/Bank (Receiving Side): The counterparty in the receiving country, which may be a licensed MTO or a bank.

- Correspondent Bank (Sending Side): A correspondent bank may be involved in hosting the sending bank/MTO’s Nostro account or in channeling funds between the sending MTO and the receiving MTO/bank.

- Payment Processor: A payment processor may be used if payment instruments such as ACH, debit/credit cards, or other platforms like PayPal or Dwolla are being utilized. The payment processor is contracted by the money transfer operator (sending side).

- ID Verification (KYC): A third party service may be used to authenticate and verify the IDs submitted as part of the onboarding process by the sending MTO.

- Agent/Affiliate: An agent or affiliate may be used on the sending side to onboard the transaction and on the receiving side to offload the remittance transaction.

- Payment Network: MTOs may use various payment networks to route the remittance transfer, such as a third-party network like Earthport to settle transactions in countries where the MTO is not directly integrated.

Diving Into The Business

Before entering the money transfer industry, it is advisable to consider taking two steps to gain a better understanding of the field:

- Attend a money transfer conference: There are several conferences that focus on the money transfer industry, such as the CrossTech , formerly known as International Money Transfer Conference (IMTC) and the International Association of Money Transfer Networks (IAMTN) . Attending one of these conferences can provide valuable insights and networking opportunities.

- Find a mentor: Having a mentor in this field can be extremely beneficial, as they can provide guidance and support as you navigate the industry. It may be helpful to reach out to professionals with experience in the money transfer industry to see if they are willing to mentor you.

Working Capital

Regardless of your approach to entering the money transfer industry, it is important to have access to working capital. If you are considering the affiliate route, you may need financial resources to invest in marketing efforts such as creating landing pages, writing blog articles, and utilizing search engine optimization, search engine marketing, and social media marketing.

On the other hand, if you are pursuing the correspondent route, you may be required to provide pre-funding to the sending MTO. This means you will be responsible for providing the necessary financial resources to cover the cost of the transaction before it is completed. It is important to carefully consider your financial needs and plan accordingly when entering the money transfer industry.

If you’re going the Authorized Delegate route, then you can read up the following articles to better understand:

- Access to US Money Transfer Market

- Should you own a Money Transmitter License?

- FAQs on ISO/Correspondent Relationship

- Correspondent vs. Authorized Delegate

For trying to obtain your own licensing, you can check the amount of money needed from each financial regulator, by visiting their website. The complete list can be found here: List of Money Transmitter License Regulators

Access to Banking

This could be a very difficult proposition for you. Finding a bank (read: MSB Friendly Banks ), willing to work with an MSB engaged in the cross-border money transfer business is not easy.

Because of Operation Chokepoint, there is a lot of De-Risking of MSBs going on in the banks.

You can read more about this in these 3-series articles that I wrote:

- The Sandstorm that is blanketing the Money Services Business

- Can’t find MSB Friendly Banks?

- Banking De-Risking: The Domino Effect Is Now In Full Force.

Most MTOs will not provide you with access to banking (unless you’re 100% purely affiliate). If you are going to come on-board as an ISO/Correspondent, Authorized Delegate, etc. you bring your own banking relationship to the equation.

Anti-Money Laundering Training

One of the reasons that MTOs and banks may be hesitant to work with small businesses and individuals is due to a lack of knowledge about anti-money laundering (AML) and Know Your Customer (KYC) regulations. It is crucial for everyone in the money transfer industry to undergo AML training, and this includes affiliates.

To gain a thorough understanding of the industry and the associated terminology, it is advisable to invest time in obtaining advanced training. These trainings can be completed online and may take anywhere from one week to several weeks to complete.

Before beginning advanced training, it may be beneficial to read extensively about AML and KYC regulations. There are numerous books and manuals available online that can provide a solid foundation of knowledge in these areas. Additionally, there is a wealth of free educational material available on YouTube and other online platforms that can help explain key concepts.

Compliance Officer

In addition to being an affiliate, most other programs or associations in the money transfer industry will require you to have a full-time compliance officer on staff at your organization. It is important to ensure that your compliance officer is fully qualified and has undergone comprehensive training in areas such as anti-money laundering (AML), Know Your Customer (KYC), and Customer Identification Procedures (CIP). A certification such as the Certified Anti-Money Laundering Specialist (CAMS) may be preferred.

While it may be tempting to try to save money in this area, it is important to invest in a highly qualified and competent compliance officer. A solid compliance officer can provide credibility and stability for your business, and can be well worth the investment in the long run.

Compliance Program

An effective and constantly improving compliance program is essential for any reputable money transfer company. It is not uncommon for a significant portion of a company’s human resources, such as 5-10%, to be dedicated to running the compliance program.

To ensure the success of your compliance program, it is advisable to work with a high-quality compliance specialty company to develop and implement the program. These companies have expertise in the subtle elements that can impact a compliance program, and can help ensure that your program is tailored to the specific legal corridors and transaction/financial models under which your business operates.

While it may be tempting to try to cut costs in this area, it is important to invest in a top-quality compliance program. Skimping on this aspect of your business can have serious consequences and is not worth the risk.

Choosing Your Corridor

One important step in entering the money transfer industry is identifying the markets in which you want to operate. Depending on your arrangement, you may already have an established bank or MTO to work with, or you may need to find one and establish a partnership with your principal license holder in the sending country.

Establishing partnerships, or “tie-ups,” can be a tedious process involving a significant amount of paperwork and time. However, these partnerships are essential for operating in both markets and should not be overlooked. It is important to carefully consider your market strategy and ensure that you have the necessary partnerships in place to succeed.

Software & Allied Services

If your arrangement does not include software and related services such as ID verification, OFAC checks, and sanctions list checks, it is important to make arrangements for these resources. It is advisable to begin this process as early as possible, as it can take some time to implement.

The goal is to have a system that can handle both front-office and back-office functions, and that can provide audit logs for auditors. A list of transaction data points that may be required for an MSB audit can be found here: List of Transaction Data Points for an MSB Audit (Note: this is just an example).

There are various options available for obtaining software for your money transfer business, such as purchasing, leasing, renting, or using a software as a service (SaaS) model with original equipment manufacturers (OEMs). A list of OEMs that offer software for the money transfer industry can be found using Google or talking to peers in the industry who might be able to recommend something for you. It is important to carefully consider your options and choose the solution that best fits the needs of your business.

Put a Plan Together

It is crucial to have a clear understanding of your transaction set and the flow of funds in your business. This includes being aware of the potential profits and ensuring that every penny is accounted for. It is important to have a detailed understanding of how the process works and how much money is being deducted at each step, as well as who is responsible for keeping this money. This knowledge will help you to run a profitable and transparent business.

A sample flow can look like this:

Some Essential Homework

Before starting your business, it is important to take care of the following tasks:

- Choose a name for your business. This may or may not be the same as your brand name, but it is necessary to have a legal name for your company.

- Decide where to incorporate your business. Consider factors such as location, tax laws, and the overall business environment.

- Choose a brand name for your remittance product, even if you are initially going the ISO/Affiliate route.

- Purchase a domain name for both your business and brand name.

- Obtain Google Apps to have a professional email address for your company.

- Get a dedicated phone number for your business.

- Create social media profiles on platforms such as Facebook, Twitter, LinkedIn, TikTok, Pinterest, Quora, and Instagram.

- Build a professional website with the help of a design and development team. Consider using a customizable WordPress theme.

- Hire a professional writer or firm to create content for your website.

- Have a professional design a logo for your business.

- Set up a mailing list using a service like MailChimp, and create a “Launching Soon” landing page.

- Conduct market research by interviewing potential customers and gathering data on their needs and preferences, as well as the current state of the market.

- Determine your target market and the cities you will initially focus on for marketing.

- Estimate the cost of marketing efforts.

- Consult with local regulators and specialized attorneys to ensure compliance with relevant laws and regulations.

- Determine the best way to access banking services, considering factors such as fees, account requirements, and potential hurdles.

- Calculate the costs associated with transferring money, including fees for banking services, currency exchange, and other expenses.

- Develop a plan for growth, including strategies for increasing volume and improving control over know-your-customer (KYC) processes.

- Consider the risks and benefits of partnering with vendors and suppliers, and determine the most suitable arrangement for your business.

- Evaluate the competition and identify opportunities to differentiate your business in the market.

- Determine the best way to leverage your working capital, considering factors such as investment opportunities, marketing efforts, and potential risks.

- Implement marketing and focus your efforts on acquiring clients. Consider using techniques such as A/B testing to determine the most effective strategies.

- Build a team of skilled and reliable professionals to support the growth and success of your business.

- Stay up-to-date on industry trends and developments, and continually seek out opportunities to improve and evolve your business model.

Research and Data are extremely important for you to proceed ahead. Go out into the real world and interview potential customers. Take notes.

- What facilities are desired by potential customers?

- What are the pain points of potential customers when using current services?

- Who do potential customers currently use for money transfer services?

- Why would potential customers choose your service over others?

- What is the average amount of money being transferred by potential customers?

- How long does it typically take for money to arrive at its destination for potential customers?

- What improvements can be made to the customer experience?

- What is the exchange rate typically experienced by potential customers?

- What aspects of current money transfer services are disliked by potential customers?

- What aspects of current money transfer services are liked by potential customers?

- If you were to offer a service today, would potential customers switch from their current provider?

- How many existing players are in the market? Is it overcrowded?

- What sets your service apart from others in the market?

- In which cities would you initially focus your marketing efforts?

- How much would it cost to effectively market your service in these cities?

Business Plan

It is important to create a business plan, as it helps to give structure to your ideas and approach. It can also be a helpful tool to refer to in order to stay on track and make informed decisions. There are many templates available online to guide you in writing a business plan. Remember to make time to develop this important document and consult it regularly as you work on your new venture.

Here are some tips to consider when creating your business plan:

- Determine your goals and objectives. What are you trying to achieve with your money transfer business?

- Understand your target market. Who are you targeting as your customers?