- Search Search Please fill out this field.

What Is an Indirect Tax?

How an indirect tax works.

- Regressive Nature

Common Indirect Taxes

The bottom line.

- Personal Finance

Indirect Tax: Definition, Meaning, and Common Examples

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

An indirect tax is collected by one entity in the supply chain, such as a manufacturer or retailer, and paid to the government. However, the tax is passed onto the consumer by the manufacturer or retailer as part of the purchase price of a good or service. The consumer is ultimately paying the tax by paying more for the product.

Investopedia / Ryan Oakley

In contrast to direct taxes, indirect taxes are taxation on an individual or entity, which is ultimately paid for by another person. The body that collects the tax will then remit it to the government. With direct taxes, the person immediately paying the tax is the person that the government is seeking to tax.

Excise duties on fuel, liquor, and cigarettes are all considered examples of indirect taxes. By contrast, income tax is the clearest example of a direct tax, since the person earning the income is the one immediately paying the tax. Admission fees to a national park are another example of direct taxation.

Some indirect taxes are also referred to as consumption taxes, such as a value-added tax (VAT) .

Regressive Nature of an Indirect Tax

Indirect taxes are commonly used and imposed by the government to generate revenue . They are essentially fees that are levied equally upon taxpayers , no matter your income, so rich or poor, everyone has to pay them.

But many consider them to be regressive taxes as they can bear a heavy burden on people with lower incomes who end up paying the same amount of tax as those who make a higher income.

For example, the import duty on a television from Japan will be the same amount, no matter the income of the consumer purchasing the television. And because this levy has nothing to do with a person's income, that means someone who earns $25,000 a year will have to pay the same duty on the same television as someone who earns $150,000.

There are also concerns that indirect taxes can be used to further a particular government policy by taxing certain industries and not others.

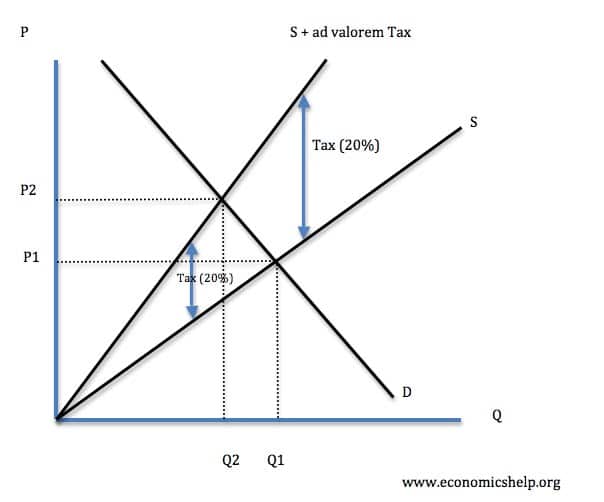

Some economists argue that indirect taxes lead to an inefficient marketplace and alter market prices from their equilibrium price.

The most common example of an indirect tax is import duties . The duty is paid by the importer of a good at the time it enters the country. If the importer goes on to resell the good to a consumer, the cost of the duty , in effect, is included in the price that the consumer pays. The consumer is likely to be unaware of this, but they will be indirectly paying the import duty.

Essentially, any taxes or fees imposed by the government at the manufacturing or production level is an indirect tax. In recent years, many countries have imposed fees on carbon emissions to manufacturers. These are indirect taxes since their costs are passed along to consumers.

Sales taxes can be direct or indirect. If they are imposed only on the final supply to a consumer, they are direct. If they are imposed as value-added taxes (VATs) along the production process, then they are indirect.

What Are Indirect Taxes in the U.S.?

Some examples of indirect taxes in the U.S. include taxes like sales taxes that are not paid directly to the government, but paid to a business that pays taxes to the government. Import taxes are also levied on goods coming into the U.S. The U.S. does not have a national sales tax.

How Do Businesses Offset the Cost of Taxes?

Businesses may increase the purchase price of the goods you buy with a sales tax to try to recoup some of the losses they face paying taxes.

What Are Value-Added Taxes (VATs)?

Value-added taxes (VATs) are taxes that are added in the production stages of a product. That cost can be deducted at the next stage of production. When the consumer pays for the product, the VAT is not deducted so the consumer ends up paying the tax.

Indirect taxes are common taxes levied on goods on services paid for by the consumer. They're not charged to an individual or a company. No matter your income, you will pay the same indirect sales tax on a product that other consumers pay.

Georgia State University, Andrew Young School of Policy Studies. " Direct Versus Indirect Taxation: Trends, Theory and Economic Significance ," Pages 1-2.

European Parliament. " Indirect Taxation ."

Institute of Economic Affairs. " Aggressively Regressive: The 'Sin Taxes' That Make the Poor Poorer ," Pages 8-9.

U.S. Customs and Border Protection. " Customs Duty Information ."

Gillingham, Robert. “Poverty and Social Impact Analysis by the IMF,” International Monetary Fund , 2008, pp. 34-53.

The University of Edinburgh. " Tax Team ."

Congressional Research Service. " Attaching a Price to Greenhouse Gas Emissions With a Carbon Tax or Emissions Fee: Considerations and Potential Impacts ," Pages 1-10.

Tax Foundation. " Value Added Tax (VAT) ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1872339315-ec70a249ad55498ab4642e06340ebf96.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Tax and accounting regions

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

- North America

- News & media

- Risk management

- thomsonreuters.com

- More Thomson Reuters sites

Join our community

Sign up for industry-leading insights, updates, and all things AI @ Thomson Reuters.

Empowering retailers to thrive and modernize tax management in the omnichannel landscape.

Learn how to equip yourself with the knowledge and strategies to simplify tax management operations, ensuring a consistent and exceptional customer journey, and driving growth and success.

Corporate tax software and services for seamless tax and trade compliance for companies and large accounting firms around the globe

Indirect tax software solutions

Take control over your company's tax strategies and confidently manage global sales and use taxes, VAT, and GST — no matter where in the world you do business.

Related posts

Implementation cost, ROI, and cost savings from indirect tax technology investment

Research shows significant savings, accuracy, and ROI from indirect tax technology

Benefits and savings with an automated indirect tax software: Forrester study

More answers.

Technology’s role in global trade management

Can the HIPAA Privacy and Security Official Position be Held by a Third Party?

Severance Agreement Not a Substitute for COBRA Compliance

Indirect taxes

An indirect tax is charged on producers of goods and services and is paid by the consumer indirectly. Examples of indirect taxes include VAT, excise duties (cigarette, alcohol tax) and import levies.

Example of VAT as an indirect tax

VAT rates may be set at 20%. This percentage tax is known as an ad Valorem tax – it means the producer is charged a percentage of the price. For example, If the good is priced at £100, the firm has to pay £20 to the government, and this will be partly absorbed by the consumer through higher prices.

Import duties as indirect tax

If the government imposed import duties on goods such as whiskey imports. The supermarket importing the whisky is responsible for paying the import duty on arrival in the country. This import levy will influence the price that the supermarket charges to the consumer.

The burden of indirect taxes

If the government imposes an indirect tax on a good, the effect on the final price depends on the elasticity of demand. If demand is price inelastic, then the firm will be able to pass on the majority of the tax to the consumer (consumer burden). If the demand is price elastic, then the producer will absorb most of the tax in reduced profit margin (known as producer burden)

Comparison with direct taxes

A direct tax is paid for by the individual the government is aiming to tax. For example, with income tax, workers pay the tax directly to the government. Direct taxes can have a higher political cost because the impact is more pressing to the individual.

Advantages of indirect taxes

- It is easier for firms to pay indirect taxes than consumers

- In the US, some sales taxes are direct. This means when a good is bought. The shop adds the indirect tax onto the good. This means consumers see incorrect prices and the final price can be an awkward amount to pay e.g. $4.99 becomes $5.44 after 9% sales tax.

- Indirect taxes can be used to overcome market failure and make people pay the full social cost. For example, excise duties like cigarette and tobacco tax can internalise the external cost of smoking and drinking alcohol.

Potential disadvantages of indirect taxes

- Regressive nature of indirect taxes. Indirect taxes tend to take a higher percentage of income from those on low income. For example, a smoker who pays £1,000 a year in smoking duties. For a smoker on low-income (£10,000), this will be a high percentage of income 10%. For someone on high income, £120,000 – this same tax will be much smaller percentage 0.8%

- Can encourage tax evasion. Cigarette taxes can encourage a black market in bootleg cigarettes.

- Direct taxes

- Tax on negative externality

- Regressive tax

- Specific tax

Tax Assignment and Revenue Sharing

- First Online: 10 April 2021

Cite this chapter

- Parthasarathi Shome 3 , 4

Part of the book series: Springer Texts in Business and Economics ((STBE))

934 Accesses

A decentralised economy comprises different levels of government with independent fiscal powers. A crucial issue is the design of appropriate assignment of taxes and expenditures to different levels of government. The rationale for decentralising fiscal responsibility derives from the premise that the welfare generated by providing public goods and services is maximised by reflecting, as closely as possible, the preferences revealed by the population at the subnational levels of government. Accordingly, governments that comprise several levels assign different expenditure responsibilities to each level. Tax assignment also follows a stratification of objectives. A central government function is achieving appropriate redistribution which should be assigned to it since, otherwise, people bearing any resultant burden of local redistribution policies would emigrate to another state or province or local jurisdiction. The central government must also remain ultimately responsible for overall macroeconomic stabilisation since local attempts at stabilisation policies would have spillover effects across jurisdictions. Subnational—state and local—governments, on the other hand, are assigned taxes that do not adversely affect the efficiency of resource allocation. The mix of tax and expenditure responsibilities of different levels of government is referred to as fiscal federalism. This chapter focuses on the taxation side of fiscal federalism.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

An early proponent of this hypothesis to bring in the supremacy of consumption preferences at local levels of government was Tiebout ( 1956 ).

See, for example, Musgrave ( 1959 ).

Shome ( 2002 ) took India’s 14 major states in an empirical study over two decades up to the late 1990s. He found that decentralisation of both developmental and non-developmental expenditure, financed through greater transfers from the central to state governments, led to higher economic growth.

See De Mello and Barenstein ( 2001 ).

As already indicated, an empirical study by Shome ( 2002 ), op. cit., arrived at this conclusion.

The prevailing decentralisation of revenues reflects a legal framework for tax assignment and revenue sharing drawn up in Brazil’s 1988 Constitution. The constitutional assignment of income taxes to the federal—or central—level conforms to the same framework.

Silvani and dos Santos ( 1996 ) and Shome ( 2002 ), op. cit., Chap. 3 , and others, discuss the case of Brazil.

See Bird and Smart ( 2014 ) for a discussion of the Canadian case.

Bagchi ( 1997 ) carried out an initial analysis setting out a possible framework. A detailed analysis is also found in Shome ( 2002 ), op. cit., Chap. 3 .

See Versano ( 1999 ) for initial suggestions later adopted by implementing countries.

This is one example of the ‘clearing house’ mechanism that could be operated by the states themselves or by the central government.

The CIS was formed in December 1991 by the former Soviet republics other than the Baltic states of Estonia, Latvia and Lithuania. Georgia joined in 1993.

See Tanzi and Bovenberg ( 1990 ) on this issue.

See European Community News ( 1992 ).

See de le Fuente and Gardner ( 1990 ) on this issue.

Supreme Court 870 (1971), 1 SCJ 14. Quoted from Basu ( 2020 ), Chap. 25 , p. 369.

For an exhaustive list, refer Basu ( 2020 ), op. cit., Chap. 25 , pp. 370–373.

Inserted by the Constitution (73rd Amendment) Act, 1992, w.e.f. 24 April 1993. Panchayats are rural counties.

Inserted by the Constitution (74th Amendment) Act, 1992, w.e.f. 1 July 1993.

A total 28 of 29 states set up SFCs. Three small north-eastern states, Meghalaya, Mizoram and Nagaland, were exempted from constituting SFCs. However, Nagaland constituted its first SFC in August 2008 and Mizoram in September 2011. Telangana, the newest state formed out of Andhra Pradesh in June 2014 constituted its first SFC in December 2017. See Gupta and Chakraborty ( 2019 ).

The report of the Government of Karnataka( 2001 ) is a voluminous and well-articulated report at the state level of the then prevailing system of taxation in the state and recommendations for needed reform.

Bagchi, Amaresh. 1997. A State Level VAT? Harmonizing Sales Taxes: A Comparison of India and Canada. In Value-Added Tax in India , ed. Parthasarathi Shome. New Delhi: Centax Publications Pvt Ltd.

Google Scholar

Basu, Durga Das. 2020. Introduction to the Constitution of India . 24th ed. Gurgaon: Lexis Nexis.

Bird, Richard Miller, and Michael Smart. 2014. VAT in a Federal System: Lessons from Canada. Public Budgeting & Finance 34(4): 38–60. https://ssrn.com/abstract=2534198 or https://doi.org/10.1111/pbaf.12052 .

De Mello, Luiz, and Matias Barenstein. 2001. Fiscal Decentralisation and Governance: A Cross-Country Analysis . IMF Working Paper WP/01/71. https://www.imf.org/external/pubs/ft/wp/2001/wp0171.pdf . Accessed 18 Nov 2020.

European Community News. 1992. Tax Notes International 4 (13), March.

de le Fuente, Angelo, and Edward Gardner. 1990. Corporate Tax Harmonization and Capital Allocation in the European Community . Working Paper No. WP/90/103. Washington, DC: International Monetary Fund (IMF).

Government of Karnataka. 2001. Report of the Tax Reform Commission . Bangalore: Government of Karnataka.

Gupta, Manish, and Pinaki Chakraborty. 2019. State Finance Commissions: How Successful Have They Been in Empowering Local Governments? NIPFP Working Paper No. 263. https://www.nipfp.org.in/media/medialibrary/2019/05/WP_263_2019.pdf . Accessed 18 Nov 2020.

Musgrave, Richard A. 1959. The Theory of Public Finance: The Study of Public Economy . New York: McGraw-Hill Book Co.

Shome, Parthasarathi. 2002. India’s Fiscal Matters . New Delhi: Oxford University Press.

Silvani, Carlos, and Paulo dos Santos. 1996. Administrative Aspects of Brazil’s Consumption Tax Reform. International VAT Monitor 7: 123–132.

Tanzi, Vito, and A. Lans Bovenberg. 1990. Is There a Need for Harmonizing Capital Income Taxes Within EC Countries? In Reforming Capital Income Taxation , ed. Horst Siebert, 171–197. Tübingen: Mohr-Paul Siebeck.

Tiebout, Charles M. 1956. A Pure Theory of Local Expenditures. Journal of Political Economy 64: 416–424. https://www.jstor.org/stable/1826343 .

Versano, Ricardo. 1999. Subnational Taxation and the Treatment of Interstate Trade in Brazil: Problems and a Proposed Solution. In Decentralisation and Accountability of the Public Sector. Annual World Bank Conference Volume on Development in Latin America and the Caribbean. Valdivia: World Bank.

Download references

Author information

Authors and affiliations.

London School of Economics, London, UK

Parthasarathi Shome

International Tax Research and Analysis Foundation, Bengaluru, India

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Shome, P. (2021). Tax Assignment and Revenue Sharing. In: Taxation History, Theory, Law and Administration. Springer Texts in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-68214-9_12

Download citation

DOI : https://doi.org/10.1007/978-3-030-68214-9_12

Published : 10 April 2021

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-68213-2

Online ISBN : 978-3-030-68214-9

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

AI Summary to Minimize your effort

Goods & Services Tax (GST) What is GST in India? Indirect Tax Law Explained

Updated on : Mar 21st, 2023

22 min read

1. What is GST in India?

GST is known as the Goods and Services Tax. It is an indirect tax which has replaced many indirect taxes in India such as the excise duty, VAT, services tax, etc. The Goods and Service Tax Act was passed in the Parliament on 29th March 2017 and came into effect on 1st July 2017.

In other words, Goods and Service Tax (GST) is levied on the supply of goods and services. Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is a single domestic indirect tax law for the entire country.

Before the Goods and Services Tax could be introduced, the structure of indirect tax levy in India was as follows:

Under the GST regime, the tax is levied at every point of sale. In the case of intra-state sales, Central GST and State GST are charged. All the inter-state sales are chargeable to the Integrated GST.

Now, let us understand the definition of Goods and Service Tax, as mentioned above, in detail.

Multi-stage

An item goes through multiple change-of-hands along its supply chain: Starting from manufacture until the final sale to the consumer.

Let us consider the following stages:

- Purchase of raw materials

- Production or manufacture

- Warehousing of finished goods

- Selling to wholesalers

- Sale of the product to the retailers

- Selling to the end consumers

The Goods and Services Tax is levied on each of these stages making it a multi-stage tax.

Value Addition

A manufacturer who makes biscuits buys flour, sugar and other material. The value of the inputs increases when the sugar and flour are mixed and baked into biscuits.

The manufacturer then sells these biscuits to the warehousing agent who packs large quantities of biscuits in cartons and labels it. This is another addition of value to the biscuits. After this, the warehousing agent sells it to the retailer.

The retailer packages the biscuits in smaller quantities and invests in the marketing of the biscuits, thus increasing its value. GST is levied on these value additions, i.e. the monetary value added at each stage to achieve the final sale to the end customer.

Destination-Based

Consider goods manufactured in Maharashtra and sold to the final consumer in Karnataka. Since the Goods and Service Tax is levied at the point of consumption, the entire tax revenue will go to Karnataka and not Maharashtra.

2. The Journey of GST in India

The GST journey began in the year 2000 when a committee was set up to draft law. It took 17 years from then for the Law to evolve. In 2017, the GST Bill was passed in the Lok Sabha and Rajya Sabha. On 1st July 2017, the GST Law came into force.

3. Objectives Of GST

- To achieve the ideology of ‘One Nation, One Tax’

GST has replaced multiple indirect taxes, which were existing under the previous tax regime. The advantage of having one single tax means every state follows the same rate for a particular product or service. Tax administration is easier with the Central Government deciding the rates and policies. Common laws can be introduced, such as e-way bills for goods transport and e-invoicing for transaction reporting. Tax compliance is also better as taxpayers are not bogged down with multiple return forms and deadlines. Overall, it’s a unified system of indirect tax compliance.

- To subsume a majority of the indirect taxes in India

India had several erstwhile indirect taxes such as service tax, Value Added Tax (VAT), Central Excise, etc., which used to be levied at multiple supply chain stages. Some taxes were governed by the states and some by the Centre. There was no unified and centralised tax on both goods and services. Hence, GST was introduced. Under GST, all the major indirect taxes were subsumed into one. It has greatly reduced the compliance burden on taxpayers and eased tax administration for the government.

- To eliminate the cascading effect of taxes

One of the primary objectives of GST was to remove the cascading effect of taxes. Previously, due to different indirect tax laws, taxpayers could not set off the tax credits of one tax against the other. For example, the excise duties paid during manufacture could not be set off against the VAT payable during the sale. This led to a cascading effect of taxes. Under GST, the tax levy is only on the net value added at each stage of the supply chain. This has helped eliminate the cascading effect of taxes and contributed to the seamless flow of input tax credits across both goods and services.

- To curb tax evasion

GST laws in India are far more stringent compared to any of the erstwhile indirect tax laws. Under GST, taxpayers can claim an input tax credit only on invoices uploaded by their respective suppliers. This way, the chances of claiming input tax credits on fake invoices are minimal. The introduction of e-invoicing has further reinforced this objective. Also, due to GST being a nationwide tax and having a centralised surveillance system, the clampdown on defaulters is quicker and far more efficient. Hence, GST has curbed tax evasion and minimised tax fraud from taking place to a large extent.

- To increase the taxpayer base

GST has helped in widening the tax base in India. Previously, each of the tax laws had a different threshold limit for registration based on turnover. As GST is a consolidated tax levied on both goods and services both, it has increased tax-registered businesses. Besides, the stricter laws surrounding input tax credits have helped bring certain unorganised sectors under the tax net. For example, the construction industry in India.

- Online procedures for ease of doing business

Previously, taxpayers faced a lot of hardships dealing with different tax authorities under each tax law. Besides, while return filing was online, most of the assessment and refund procedures took place offline. Now, GST procedures are carried out almost entirely online. Everything is done with a click of a button, from registration to return filing to refunds to e-way bill generation. It has contributed to the overall ease of doing business in India and simplified taxpayer compliance to a massive extent. The government also plans to introduce a centralised portal soon for all indirect tax compliance such as e-invoicing, e-way bills and GST return filing.

- An improved logistics and distribution system

A single indirect tax system reduces the need for multiple documentation for the supply of goods. GST minimises transportation cycle times, improves supply chain and turnaround time, and leads to warehouse consolidation, among other benefits. With the e-way bill system under GST, the removal of interstate checkpoints is most beneficial to the sector in improving transit and destination efficiency. Ultimately, it helps in cutting down the high logistics and warehousing costs.

- To promote competitive pricing and increase consumption

Introducing GST has also led to an increase in consumption and indirect tax revenues. Due to the cascading effect of taxes under the previous regime, the prices of goods in India were higher than in global markets. Even between states, the lower VAT rates in certain states led to an imbalance of purchases in these states. Having uniform GST rates have contributed to overall competitive pricing across India and on the global front. This has hence increased consumption and led to higher revenues, which has been another important objective achieved.

4. Advantages Of GST

GST has mainly removed the cascading effect on the sale of goods and services. Removal of the cascading effect has impacted the cost of goods. Since the GST regime eliminates the tax on tax, the cost of goods decreases.

Also, GST is mainly technologically driven. All the activities like registration, return filing, application for refund and response to notice needs to be done online on the GST portal, which accelerates the processes.

5. What are the components of GST?

There are three taxes applicable under this system: CGST, SGST & IGST .

- CGST: It is the tax collected by the Central Government on an intra-state sale (e.g., a transaction happening within Maharashtra)

- SGST: It is the tax collected by the state government on an intra-state sale (e.g., a transaction happening within Maharashtra)

- IGST: It is a tax collected by the Central Government for an inter-state sale (e.g., Maharashtra to Tamil Nadu)

In most cases, the tax structure under the new regime will be as follows:

Illustration:

- Let us assume that a dealer in Gujarat had sold the goods to a dealer in Punjab worth Rs. 50,000. The tax rate is 18% comprising of only IGST.

In such a case, the dealer has to charge IGST of Rs.9,000. This revenue will go to Central Government.

- The same dealer sells goods to a consumer in Gujarat worth Rs. 50,000. The GST rate on goods is 12%. This rate comprises CGST at 6% and SGST at 6%.

The dealer has to collect Rs.6,000 as Goods and Service Tax, Rs.3,000 will go to the Central Government and Rs.3,000 will go to the Gujarat government since the sale is within the state.

6. Tax Laws before GST

In the earlier indirect tax regime, there were many indirect taxes levied by both the state and the centre. States mainly collected taxes in the form of Value Added Tax (VAT). Every state had a different set of rules and regulations.

Inter-state sale of goods was taxed by the centre. CST (Central State Tax) was applicable in case of inter-state sale of goods. The indirect taxes such as the entertainment tax, octroi and local tax were levied together by state and centre. These led to a lot of overlapping of taxes levied by both the state and the centre.

For example, when goods were manufactured and sold, excise duty was charged by the centre. Over and above the excise duty, VAT was also charged by the state. It led to a tax on tax effect, also known as the cascading effect of taxes.

The following is the list of indirect taxes in the pre-GST regime:

- Central Excise Duty

- Duties of Excise

- Additional Duties of Excise

- Additional Duties of Customs

- Special Additional Duty of Customs

- Central Sales Tax

- Purchase Tax

- Entertainment Tax

- Taxes on advertisements

- Taxes on lotteries, betting, and gambling

CGST, SGST, and IGST have replaced all the above taxes.

However, certain taxes such as the GST levied for the inter-state purchase at a concessional rate of 2% by the issue and utilisation of ‘Form C’ is still prevalent.

It applies to certain non-GST goods such as:

- Petroleum crude;

- High-speed diesel

- Motor spirit (commonly known as petrol);

- Natural gas;

- Aviation turbine fuel; and

- Alcoholic liquor for human consumption.

It applies to the following transactions only:

- Use in manufacturing or processing

- Use in certain sectors such as the telecommunication network, mining, the generation or distribution of electricity or any other power sector

7. How Has GST Helped in Price Reduction?

During the pre-GST regime, every purchaser, including the final consumer paid tax on tax. This condition of tax on tax is known as the cascading effect of taxes.

GST has removed the cascading effect. Tax is calculated only on the value-addition at each stage of the transfer of ownership. Understand what the cascading effect is and how GST helps by watching this simple video:

The indirect tax system under GST will integrate the country with a uniform tax rate. It will improve the collection of taxes as well as boost the development of the Indian economy by removing the indirect tax barriers between states.

Based on the above example of the biscuit manufacturer, let’s take some actual figures to see what happens to the cost of goods and the taxes, by comparing the earlier GST regimes.

Tax calculations in earlier regime:

The tax liability was passed on at every stage of the transaction, and the final liability comes to a rest with the customer. This condition is known as the cascading effect of taxes, and the value of the item keeps increasing every time this happens.

Tax calculations in current regime:

In the case of Goods and Services Tax, there is a way to claim the credit for tax paid in acquiring input. The individual who has already paid a tax can claim credit for this tax when he submits his GST returns.

In the end, every time an individual is able to claims the input tax credit , the sale price is reduced and the cost price for the buyer is reduced because of lower tax liability. The final value of the biscuits is therefore reduced from Rs.2,244 to Rs.1,980, thus reducing the tax burden on the final customer.

8. What are the New Compliances Under GST?

Apart from online filing of the GST returns, the GST regime has introduced several new systems along with it.

e-Way Bills

GST introduced a centralised system of waybills by the introduction of “ E-way bills” . This system was launched on 1st April 2018 for inter-state movement of goods and on 15th April 2018 for intra-state movement of goods in a staggered manner.

Under the e-way bill system, manufacturers, traders and transporters can generate e-way bills for the goods transported from the place of its origin to its destination on a common portal with ease. Tax authorities are also benefited as this system has reduced time at check -posts and helps reduce tax evasion.

E-invoicing

The e-invoicing system was made applicable from 1st October 2020 for businesses with an annual aggregate turnover of more than Rs.500 crore in any preceding financial years (from 2017-18). Further, from 1st January 2021, this system was extended to those with an annual aggregate turnover of more than Rs.100 crore.

These businesses must obtain a unique invoice reference number for every business-to-business invoice by uploading on the GSTN’s invoice registration portal. The portal verifies the correctness and genuineness of the invoice. Thereafter, it authorises using the digital signature along with a QR code.

e-Invoicing allows interoperability of invoices and helps reduce data entry errors. It is designed to pass the invoice information directly from the IRP to the GST portal and the e-way bill portal. It will, therefore, eliminate the requirement for manual data entry while filing GSTR-1 and helps in the generation of e-way bills too.

For further reading and understanding, check out our articles:

- Know about gst.gov.in

- GST Council

- EWay Bill Guide for rules

- Guide on How to login to GSTN

- GST registration

- Best GST Software in India

- New GST returns

- e-Invoicing

Quick Summary

Was this summary helpful.

Clear offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. Clear serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India.

Efiling Income Tax Returns(ITR) is made easy with Clear platform. Just upload your form 16, claim your deductions and get your acknowledgment number online. You can efile income tax return on your income from salary, house property, capital gains, business & profession and income from other sources. Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing.

CAs, experts and businesses can get GST ready with Clear GST software & certification course. Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. Clear can also help you in getting your business registered for Goods & Services Tax Law.

Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.

Cleartax is a product by Defmacro Software Pvt. Ltd.

Company Policy Terms of use

Data Center

SSL Certified Site

128-bit encryption

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50+ Focused Taxation Research Topics For Your Dissertation

Published by Ellie Cross at December 29th, 2022 , Revised On April 26, 2024

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance on and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper explaining the importance of accounting in the tax department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time.

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK tax studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK.

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, conduct a thorough investigation of enhancing tax benefits among British nationals.

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy.

- The effect and limitations of bilateral and multilateral tax treaties in addressing double taxation and preventing tax evasion.

- Assess solutions: OECD/G20 Base Erosion and Profit Shifting (BEPS) project and explore the implications for multinational corporations.

- The Impact of Tax cuts in Obtaining Social, monetary, and Aesthetic Ends That Benefit the Community.

- Exploring the Effect of Section 1031 of the Tax Code During Transactions on Investors and Business People.

- Investigating the role of environmental taxes and incentives in addressing global environmental challenges.

- Evaluating the impact of increased transparency on multinational enterprises and global efforts to combat tax evasion and illicit financial flows.

- Exploring the health and financial effects of a proposed policy to increase the excise tax on cigarettes.

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyse cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

This is a list of dissertation topics related to the lives and experiences of lesbian, gay, bisexual, transgender, queer/questioning (LGBTQIA+) individuals.

Engineering is one of the most rewarding careers in the world. With solid research, investigation and analysis, engineering students dig deep through different engineering scopes to complete their degrees.

Need interesting and manageable medicine and nursing dissertation topics or titles? Here are the trending medicine and nursing dissertation titles so you can choose the most suitable one.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

A PROJECT REPORT ON DIRECT TAXATION SUBMITTED: MASTER OF COMMERCE PART II Under The Guidance Of

this is a project on direct tax mumbai university

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Disadvantages of Indirect Tax

An indirect tax is charged on producers of goods and services and is paid by the consumer indirectly. These taxes tend to take a higher percentage of income from those on a low income. The disadvantage is mainly for peoples, that it increases the cost of the product. Examples of indirect taxes include VAT, excise duties (cigarette, alcohol tax) and import levies.

(a) The indirect tax is uncertain. These taxes are not equitable. As demand fluctuates, the tax will also fluctuate. The tax will raise the price and contract the demand. As soon as a tax on a commodity is imposed its price rises.

(b) It is regretful as the tax burden to the rich and poor is the same. The tax is wrapped in the price. Hence, rich and poor pay the same amount, which is obviously unfair.

(c) Indirect tax has a bad effect on consumption, production, and employment. Higher taxes will reduce all of them. A fraction of the money unit cannot be calculated, so ever middleman tends to charge more than the tax.

(d) Most of the taxes are included in the price of goods or services. As a result, taxpayers do not know how much tax they are paying to the government. These taxes do not categorize on the income-based.

(e) The cost of collection is quite heavy. Every source o production has to be guarded. The large administrative staff is required to administer such taxes. This doesn’t stop corruption as the easiest way of not declaring a sales bill to avoid tax, still works.

(f) These Taxes discourage industries if raw materials are taxed. This will raise the cost of production and impair its competitive capacity.

In simple words, as these taxes fail to satisfy the principle of distributive justice, it is considered to be a regressive tax. However, poor people feel more burden.

Demerits of Equity Shares Capital

Dissimilarities between auditing and investigation, role of responsibility accounting, reserve liability, drug addiction treatment, a lion dance that you have watched, future of computer training, conversational ux the missing piece in your chatbot strategy, astronomy and space science, why action in copenhagen is urgently required, latest post, forward converter, plate tectonics, plastic contamination can harm a number of ocean embryos, modeling the larger impacts of wildfires in siberia, the enigma of the deep earth’s electrical system is solved, key features and characteristics of the continental crust.

Civilsdaily

No. 1 UPSC IAS Platform for preparation

Taxation in India: Classification, Types, Direct tax, Indirect tax

Click:- register & discuss economics concepts & your upsc preparation with cd mentors for free, taxation in india.

The India Constitution is quasi-federal in nature, and the country has three tier government structure.

To avoid any disputes between the centre and state the Constitution envisage following provisions regarding taxation:

- Division of powers to levy taxes between centre and state is clearly defined.

- There are certain taxes which are levied by the centre, but their proceeds are distributed between both centre and the state. Example- Union Excise Duty.

- There are certain taxes which are levied by the centre, but their proceeds are transferred to the states. Example-Estate duty on property other than agriculture income.

- There are certain taxes which are levied by the central government, but the responsibility to collect them is vested with the states. Example- Stamp Duty other than included in the Union List.

- There are certain taxes which are levied by the states, and their proceeds are also kept by states. Example: Erstwhile VAT

Classification of Taxes

What is a Tax?

Taxes are generally an involuntary fee levied on individuals and corporations by the government in order to finance government activities. Taxes are essentially of quid pro quo in nature. It means a favour or advantage granted in return for something.

Direct Tax versus Indirect Tax

Understanding Regressive Nature of Indirect Taxes .

Government Levies a tax of 5 percent on a pack of 5KG Rice worth Re1000.

Tax Burden on the Pack: 5/100*1000= 50 Re

- Rich Individual Case (Monthly Earning 1 Lakh)

He buys the rice pack and pays a tax of 50 Re.

The proportion of his income that went on paying tax on Rice is 0.05 Percent (50/100000) of his total earning.

- Poor Individual Case (Monthly income 1000 Re)

He buys Rice pack and pays a tax of Re 50.

The proportion of his income that went on paying tax on rice is 5 percent (50/1000) of his total earning.

As you can clearly see, a poor individual is paying a higher proportion of his income as indirect tax as compared to the richer individual.

Ad valorem versus Specific Tax

Taxes in India

In India, Taxes are levied on income and wealth. The most important direct tax from the point of view of revenue is personal income tax and corporation tax.

Income Tax:

- Income tax is levied on the income of individuals, Hindu undivided families, unregistered firms and other association of people.

- In India, the nature of income tax is progressive.

- For taxation purpose income from all sources is added and taxed as per the income tax slabs of the individual.

- The budget of 2017-18 proposed the following slab structure:

Surcharge of 10% of income tax where the total income exceeds Rs 50 lakh up to Rs 1 Crore.

Surcharge of 15% of income tax, where the total income exceeds Rs 1 Crore.

Corporation Tax

- Corporation tax levied on the income of corporate firms and corporations.

- For taxation purpose, a company is treated as a separate entity and thus must pay a separate tax different from personal income tax of its owner.

- Companies both public and private which are registered in India under the companies act 1956 are liable to pay corporate tax.

- The Budget 2017-18 proposed following tax structure for domestic corporate firms:

- For the Assessment Year 2017-18 and 2018-19, a domestic company is taxable at 30%.

- For Assessment Year 2017-18, the tax rate would be 29% where turnover or gross receipt of the company does not exceed Rs. 5 crores in the previous year 2014-15.

- However, for Assessment year 2018-19, the tax rate would be 25% where turnover or gross receipt of the company does not exceed Rs. 50 crores in the previous year 2015-16.

Tax on Wealth and Capital

Estate Duty: First introduced in 1953. It was levied on the total property passing on the death of a person. The whole property of the deceased person constituted his wealth and is liable for the tax. The tax now stands abolish w.e.f 1985.

Wealth Tax: First introduced in 1957. It was levied on the excess of net wealth (over 30,00,00,0 @ 1 percent) of individuals, joint Hindu families and companies. Wealth tax has been a minor source of revenue. The tax now stands abolish wef 2015.

Gift Tax: First introduced in 1958. The gift tax was levied on all donations except the one given by the charitable institution’s government companies and private companies. The tax now stands abolished wef 1998.

Capital Gain Tax: Ay profit or gain that arises from the sale of the capital asset is a capital gain. The profit from the sale of capital is taxed. Capital Asset includes land, building, house, jewellery, patents, copyrights etc.

- Short-term capital asset – An asset which is held for not more than 36 months or less is a short-term capital asset.

- Long-term capital asset – An asset that is held for more than 36 months is a long-term capital asset. From FY 2017-18 onwards – The criteria of 36 months has been reduced to 24 months in the case of immovable property being land, building, and house property.

- For instance, if you sell house property after holding it for a period of 24 months, any income arising will be treated as long-term capital gain provided that property is sold after 31st March 2017.

But this change is not applicable to movable property such as jewellery, debt oriented mutual funds etc. They will be classified as a long-term capital asset if held for more than 36 months as earlier.

- Tax on long-term capital gain: the Long-term capital gain is taxable at 20% + surcharge and education cess.

- Tax on the short-term capital gain when securities transaction tax is not applicable: If securities transaction tax is not applicable, the short-term capital gain is added to your income tax return, and the taxpayer is taxed according to his income tax slab.

- Tax on the short-term capital gain if securities transaction tax is applicable: If securities transaction tax is applicable, the short-term capital gain is taxable at the rate of 15% +surcharge and education cess.

Indirect Taxes in India

Custom Duty:

- It is a duty levied on exports and imports of goods.

- Import duty is not only a source of revenue from the government but also have also been employed to regulate trade.

- Import duties in India is levied on ad valorem basis.

- Example: if an Indian plan to buy a Mercedes from abroad. He must pay the customs duty levied on it.

- The purpose of the customs duty is to ensure that all the goods entering the country are taxed and paid for.

- Just as customs duty ensures that goods for other countries are taxed, octroi is meant to ensure that goods crossing state borders within India are taxed appropriately.

- It is levied by the state government and functions in much the same way as customs duty does.

Excise Duty

- An excise duty is in the true sense is a commodity tax because it is levied on production of goods in India and not on the sale of the product.

- Excise duty is explicitly levied by the central government except for alcoholic liquor and narcotics.

- It is different from customs duty because it is applicable only to things produced in India and is also known as the Central Value Added Tax or CENVAT.

Service Tax

- Service tax is levied on the services provided in India.

- Service tax was first introduced in 1994-95 on three services telephone services, general insurance and share broking.

- Since then, every year the service net has been widened by including more and more services. We now have an exclusion criterion based on ‘negative list’, where some services are excluded out of tax net.

- The current rate of service tax in India was 15% before being replaced by Goods and Service tax.

Value Added Tax

- The India’s indirect tax structure is weak and produces cascading effects.

- The structure was by, and large uncertain and complex and its administration was difficult.

- As a result, various committees on taxation recommended ‘Value Added Tax’. The Indirect Taxation enquiry committee argued for VAT.

- The VAT has a self-monitoring mechanism which makes tax administration easier.

- The VAT is properly structured removes distortions.

- Accordingly, VAT has been introduced in India by all states and UTs (except UTs of Andaman Nicobar and Lakshadweep).

- The State VAT being implemented till 1 July 2017, had replaced erstwhile Sales Tax of States.

- The tax is levied on various goods sold in the state, and the amount of the tax is decided by the state itself.

Indirect Taxes in a nutshell

By Himanshu Arora Doctoral Scholar in Economics & Senior Research Fellow, CDS, Jawaharlal Nehru University

Revisiting the Basics

JOIN THE COMMUNITY

Join us across social media platforms..

Your better version awaits you!

Indirect Tax INTRODUCTION 3 MAIN BODY3

Added on 2020-12-18

About This Document

Added on 2020-12-18

End of preview

Want to access all the pages? Upload your documents or become a member.

sources of information on VAT lg ...

Indirect tax assignment - (solution) lg ..., indirect tax introduction lg ..., indirect tax introduction task 11 lg ..., indirect tax assignment (solution) lg ..., assignment on value added tax lg ....

- Allstate United States

- Allstate Northern Ireland

- Allstate India Private Limited

- Personal Financial Representative

- Allstate Agency Ownership

- Licensed Sales Professional (LSP)

- Recruitment Fraud

Indirect State Tax Consultant

Date Opened: Apr 25, 2024

Location: Remote, Remote, US

Company: Allstate Insurance Company

The world isn’t standing still, and neither is Allstate. We’re moving quickly, looking across our businesses and brands and taking bold steps to better serve customers’ evolving needs. That’s why now is an exciting time to join our team. You’ll have opportunities to take risks, challenge the status quo and shape the future for the greater good.

You’ll do all this in an environment of excellence and the highest ethical standards – a place where values such as integrity, inclusive diversity and accountability are paramount. We empower every employee to lead, drive change and give back where they work and live. Our people are our greatest strength, and we work as one team in service of our customers and communities.

Everything we do at Allstate is driven by a shared purpose: to protect people from life’s uncertainties so they can realize their hopes and dreams. For more than 89 years we’ve thrived by staying a step ahead of whatever’s coming next – to give customers peace of mind no matter what changes they face. We acted with conviction to advocate for seat belts, air bags and graduated driving laws. We help give survivors of domestic violence a voice through financial empowerment. We’ve been an industry leader in pricing sophistication, telematics, digital photo claims and, more recently, device and identity protection.

We are the Good Hands. We don’t follow the trends. We set them.

The Tax Consultant position requires two to four years of experience in indirect state tax (e.g. sales/use tax and insurance premium tax) accounting and compliance. In addition, there is a variety of projects related to insurance and noninsurance companies.

- Gather detail and support for monthly sales/use tax returns

- Review and analyze purchases to ensure accurate use tax accrual

- Review use tax returns for accuracy and completeness

- Prepare use tax account reconciliations/validation and reconcile the account balances to the specific transaction detail

- Review estimated premium tax payments

- Review premium tax reconciliations and prepare monthly premium tax accrual

- Review premium tax effective tax rate calculations and true ups

- Manage tax calendar for all indirect tax deadlines and external reporting due dates

- Preparation of 1099 forms

- Assess procedures for enhancement and analyze the utilization of analytics

- Special projects as assigned including gathering relevant information to respond to taxing authority notices, audit requests, and assisting in tax research projects

• 4 year Bachelors Degree (Preferred)

• 2 or more years of experience (Preferred)

• In lieu of the above education requirements, an equivalent combination of education and experience may be considered.

• No Certification, License or Registration is required for the job.

- Keen attention to detail and accuracy

- Strong organizational skills

- Excellent numeric abilities

- Efficient worker

- Effective communication and interpersonal skills

- Proficiency in Excel, Word, SAP S/4HANA, and tax research software

Compensation offered for this role is $59,250.00-$96,937.50 per year and is based on experience and qualifications.

The candidate(s) offered this position will be required to submit to a background investigation, which includes a drug screen.

Good Hands. Greater Together. ℠

As a Fortune 100 company and industry leader, we provide a competitive salary – but that’s just the beginning. Our Total Rewards package also offers benefits like tuition assistance, medical and dental insurance, as well as a robust pension and 401(k). Plus, you’ll have access to a wide variety of programs to help you balance your work and personal life -- including a generous paid time off policy. For a full description of Allstate’s benefits, visit https://www.allstate.jobs/benefits/

Learn more about life at Allstate. Connect with us on Twitter , Facebook , Instagram and LinkedIn or watch a video .

Allstate generally does not sponsor individuals for employment-based visas for this position.

Effective July 1, 2014, under Indiana House Enrolled Act (HEA) 1242, it is against public policy of the State of Indiana and a discriminatory practice for an employer to discriminate against a prospective employee on the basis of status as a veteran by refusing to employ an applicant on the basis that they are a veteran of the armed forces of the United States, a member of the Indiana National Guard or a member of a reserve component.

For jobs in San Francisco, please click “ here ” for information regarding the San Francisco Fair Chance Ordinance. For jobs in Los Angeles, please click “ here ” for information regarding the Los Angeles Fair Chance Initiative for Hiring Ordinance.

To view the “EEO is the Law” poster click “ here ”. This poster provides information concerning the laws and procedures for filing complaints of violations of the laws with the Office of Federal Contract Compliance Programs

To view the FMLA poster, click “ here ”. This poster summarizing the major provisions of the Family and Medical Leave Act (FMLA) and telling employees how to file a complaint.

It is the Company’s policy to employ the best qualified individuals available for all jobs. Therefore, any discriminatory action taken on account of an employee’s ancestry, age, color, disability, genetic information, gender, gender identity, gender expression, sexual and reproductive health decision, marital status, medical condition, military or veteran status, national origin, race (include traits historically associated with race, including, but not limited to, hair texture and protective hairstyles), religion (including religious dress), sex, or sexual orientation that adversely affects an employee's terms or conditions of employment is prohibited. This policy applies to all aspects of the employment relationship, including, but not limited to, hiring, training, salary administration, promotion, job assignment, benefits, discipline, and separation of employment.

All Comments © Copyright 2020 All Rights Reserved

IMAGES

VIDEO

COMMENTS

Indirect Tax: An indirect tax is a tax that is paid to the government by one entity in the supply chain, but it is passed on to the consumer as part of the price of a good or service. The consumer ...

Indirect taxes are basically taxes that can be passed on to another entity or individual. They are usually imposed on a manufacturer or supplier who then passes on the tax to the consumer. The most common example of an indirect tax is the excise tax on cigarettes and alcohol. Value Added Taxes (VAT) are also an example of an indirect tax.

What is indirect tax? Unlike direct tax, indirect tax is a tax that can be passed on to another entity or individual. Indirect taxes are levied on goods and services. The supplier or manufacturer passes on the tax to the consumer, who is the one ultimately paying the tax. The supplier or manufacturer collects the tax and then remits it to the ...

Tax planning and management is one of the primary areas accountants help their clients. Taxes are either direct tax or indirect tax. Where the amount of direct tax owing can be influenced by other factors, indirect taxes are straightforward in that their calculation is typically a predetermined percentage or rate and the cost is passed along the supply chain ultimately landing on the consumer ...

Sales tax (and a corresponding use tax) is the primary indirect tax in the United States. Sales tax is a tax on consumer expenditures and is collected on sale transactions. Most jurisdictions in the US require that the seller collects sales tax on the sale of taxable goods or services and remit the tax to the appropriate jurisdiction's tax ...

Indirect tax is a tax that can be passed on to another individual or entity. Indirect tax is generally imposed on suppliers or manufacturers who pass it on to the final consumer. Examples of an Indirect Tax. Excise Duty, Customs Duty, Entertainment Tax, Service Tax, Sales Tax, Gross Receipts Tax and Value-Added Tax (VAT) are examples of ...

An indirect tax (such as sales tax, per unit tax, value-added tax (VAT), or goods and services tax (GST), excise, consumption tax, tariff) is a tax that is levied upon goods and services before they reach the customer who ultimately pays the indirect tax as a part of market price of the good or service purchased. Alternatively, if the entity ...

Indirect taxes tend to take a higher percentage of income from those on low income. For example, a smoker who pays £1,000 a year in smoking duties. For a smoker on low-income (£10,000), this will be a high percentage of income 10%. For someone on high income, £120,000 - this same tax will be much smaller percentage 0.8%. Can encourage tax ...

The GST replaced the above-described tax assignment of indirect taxes—sales tax/VAT and other small taxes of the states, the tax on inter-state trade, and central excise duties or CENVAT together with the service tax of the centre—to formulate a consolidated fiscal federal tax on all goods and services comprising both the central government ...

Indirect Tax. Article. Indirect Tax. An indirect tax is a tax imposed on one person but partly or wholly paid by another. It is a type of tax where the incidence and impact of taxation do not fall on the same entity. These taxes are typically added to the prices of goods or services. The most common example of indirect tax is the excise tax on ...

Yes. The key test though for a non-established business is if they are considered to be carrying on business in Canada. The CRA will look to a number of factors to make this determination. As of 1 July 2021, a "simplified" GST/HST registration obligation was imposed on non-established businesses even if they are not considered to be carrying on business in Canada if they make taxable ...

Let's discuss a few indirect taxes that were earlier imposed in India: Customs Duty- It is an Import duty levied on goods coming from outside the country, ultimately paid for by consumers and retailers in India. Central Excise Duty - This tax was payable by the manufacturers who would then shift the tax burden to retailers and wholesalers.

Indirect taxes cannot be escaped from because these are charged automatically on goods and services. Direct taxes can help address inflation while indirect taxes can lead to inflation. Direct taxes lessen the savings of earners, but indirect taxes encourage the opposite because they make products and services more expensive and unaffordable. ...

Goods and Services Tax Law in India is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. GST is a single domestic indirect tax law for the entire country. Before the Goods and Services Tax could be introduced, the structure of indirect tax levy in India was as follows: Under the GST regime, the tax is ...

GST will subsume majority of the indirect taxes levied by central and state governments such as Central Excise Duty, Service tax, State Value Added Tax, Central Sales Tax, Entry tax, Purchase tax, etc. GST being the biggest and most significant tax reform in the fiscal history of India since Independence, it is critical for businesses to plan ...

To find taxation dissertation topics: Study recent tax reforms. Analyse cross-border tax issues. Explore digital taxation challenges. Investigate tax evasion or avoidance. Examine environmental tax policies. Select a topic aligned with law, economics, or business interests.

For many centuries, revenue from taxes went to the Monarch. In Northern England, taxes were levied on land and on moveable property such as the Saladin title in 1188. Later on, these were supplemented by introduction of poll taxes, and indirect taxes known as "Ancient Customs" which were duties on wool, leather and hides.

Disadvantages of Indirect Tax. (a) The indirect tax is uncertain. These taxes are not equitable. As demand fluctuates, the tax will also fluctuate. The tax will raise the price and contract the demand. As soon as a tax on a commodity is imposed its price rises. (b) It is regretful as the tax burden to the rich and poor is the same.

Direct Tax. Indirect Tax. Meaning. The tax that is levied by the government directly on the individuals or corporations are called Direct Taxes. The tax that is levied by the government on one entity (Manufacturer of goods), but is passed on to the final consumer by the manufacturer. Incidence.

Hello Visitors, this is my little effort to help the #NMIMS MBA students. Here I have shared the references to help you guys get a pathway of the answers for...

This video will provide a detailed explanation on NMIMS Assignment for Taxation - Direct and Indirect Subject for December 2022 cycle.

Hello Visitors, this is my little effort to help the #NMIMS MBA students. Here I have shared the references to help you guys get a pathway of the answers for...

INTRODUCTION Indirect Taxes are those taxes which are applied by the State or Central Government on the Goods and Services and not on the income or property of an individual. These taxes are added to the price of some goods or services. The example can be custom duty charges, VAT, CST, imports, excise duty charges, etc. The assignment will focus on VAT, a type of Indirect Tax.

The Tax Consultant position requires two to four years of experience in indirect state tax (e.g. sales/use tax and insurance premium tax) accounting and compliance. ... hiring, training, salary administration, promotion, job assignment, benefits, discipline, and separation of employment. Apply now » ...