- Search Search Please fill out this field.

- Checking Accounts

Negotiable Instruments: Definition, Types, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Investopedia / Xiaojie Liu

What Is a Negotiable Instrument?

A negotiable instrument is a signed document that promises a payment to a specified person or assignee. In other words, it is a formalized type of IOU : A transferable, signed document that promises to pay the bearer a sum of money at a future date or on-demand.

Common examples of negotiable instruments include personal checks, cashier's checks , money orders, certificates of deposit (CDs) , promissory notes , and traveler's checks. The person receiving the payment, known as the payee , must be named or otherwise indicated on the instrument. Because they are transferable and assignable, some negotiable instruments may trade on a secondary market .

Key Takeaways

- A negotiable instrument is a signed document that promises a payment to a specified person or assignee.

- Negotiable instruments are transferable, which allows the recipient to take the funds as cash, then use them as preferred.

- Examples of negotiable instruments include checks, money orders, and promissory notes.

Understanding Negotiable Instruments

Negotiable instruments are transferable, so the holder can take the funds as cash or use them for a transaction or other way as they wish. The fund amount listed on the document includes the specific amount promised, and must be paid in full either on-demand or at a specified time. A negotiable instrument can be transferred from one person to another. Once the instrument is transferred, the holder gains full legal title to the instrument.

These documents provide no other promise on the part of the entity issuing the instrument. In addition, no other instructions or conditions can be made for the bearer to receive the amount listed on the negotiable instrument.

For an instrument to be negotiable, it must be signed , with a mark or signature, by the maker of the instrument—the one issuing the draft. This entity or person is known as the drawer of funds.

The term "negotiable" refers to the fact that the note in question can be transferred or assigned to another party; "non-negotiable" describes one that is firmly established and can't be adjusted or amended.

Examples of Negotiable Instruments

One of the more well-known negotiable instruments is the personal check. It serves as a draft, payable by the payer’s financial institution once it's received, in the exact amount specified. Similarly, a cashier’s check serves the same function but it requires the funds to be allocated, or set aside, for the payee prior to the check being issued.

Money orders are similar to checks but may or may not be issued by the payer’s financial institution. Often, cash must be received from the payer before the money order is issued. Once the money order is received by the recipient, it can be exchanged for cash.

Traveler’s checks function differently, as they require two signatures to complete a transaction. At the time of issue, the holder must sign the document to provide a specimen signature. Once the payer determines to whom the payment will be issued, a countersignature must be provided for payment. Traveler's checks are generally used when someone is traveling to a foreign country and is looking for a payment method that provides an additional level of security against theft or fraud while traveling.

Other common types of negotiable instruments include bills of exchange, promissory notes, drafts, and CDs.

What Is a Negotiable Instrument Used For?

A negotiable instrument promises a payment to a specified person or assignee. It is transferable, so it allows the holder to take the funds as cash, then use the money as they see fit.

What Is the Benefit of a Negotiable Instrument?

A negotiable instrument is easily transferable. There are no formalities and limited paperwork involved in making such a transfer. The instrument's ownership can be shifted simply by delivery or by a valid endorsement.

What Are the Two Kinds of Negotiable Instruments?

There are two basic types of negotiable instruments: an order to pay (this covers drafts and checks) and a promise to pay (promissory notes and CDs).

The Bottom Line

A negotiable instrument, like as a personal or cashier's check, is a document that promises an amount of money to a particular person or entity. It's characterized by being transferable; ownership of the instrument can be handed over simply by delivery or by a valid endorsement. The most common types of negotiable instruments are personal, cashier's, traveler's checks, money orders, promissory notes, and CDs.

Cornell Law School - Legal Information Institute. " Negotiable Instrument ."

Republic Bank. " Traveler's Checks: A Guide for the Modern Globetrotter ."

Cornell Legal Information Institute. " Negotiable Instruments Law: An Overview ."

:max_bytes(150000):strip_icc():format(webp)/MoneyOrderFilledOut-582cf3b75f9b58d5b15bfef3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Key Differences

Know the Differences & Comparisons

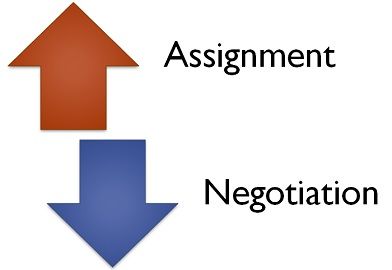

Difference Between Negotiation and Assignment

On the other hand, assignment alludes to the transfer of ownership of the negotiable instrument, in which the assignee gets the right to receive the amount due on the instrument from the prior parties.

The most important difference between negotiation and assignment is that they are governed by different acts. To know more differences amidst the two types of transfers, take a read of the article below.

Content: Negotiation Vs Assignment

Comparison chart, definition of negotiation.

Negotiation can be described as the process in which the transfer of negotiable instrument, is made to any person, in order to make that person, the holder of the negotiable instrument. Therefore the negotiable instrument aims at transferring the title of the instrument to the transferee.

The term of negotiation for any person except maker, drawer or acceptor, until payment and in the case of the maker, drawer or acceptor, it should be until the due date. The two methods of negotiation are:

- By delivery : Negotiation is possible by mere delivery, in the case of bearer instrument, but that should be voluntary in nature.

- By endorsement and delivery : In the case of order instrument, there must be endorsement and delivery of the negotiable instrument. The delivery must be voluntary, with an intention of transferring the underlying asset, to the transferee to complete the negotiation.

Definition of Assignment

By the term assignment we mean, the transfer of contractual rights, ownership of property or interest, by a person, in order to realise the debt.

An assignment is a written transfer of rights or property, in which the assignor transfers the instrument to assignee with the aim of conferring the right on the assignee, by signing an agreement called assignment deed. Thus, the assignee is entitled to receive the amount due on the negotiable instrument, from the liable parties.

Key Differences Between Negotiation and Assignment

The primary differences between negotiation and assignment presented in the points below:

- The transfer of the negotiable instrument, by a person to another to make that person the holder of it, is known as negotiation. The transfer of rights, by a person to another, for the purpose of receiving the debt payment, is known as assignment.

- When it comes to regulation of negotiable instrument, negotiation governs the Negotiable Instrument, 1881, while the assignment is regulated by Transfer of Property Act, 1882.

- Negotiation can be effected by mere delivery in case of bearer instrument and, endorsement and delivery in case of order instrument.

- In the case of bearer instrument, the negotiation is done by mere delivery of the instrument, but in the case of bearer instrument, endorsement and delivery of the instrument must be effected. Conversely, the assignment is effected by written agreement to be signed by the transferor, both in the case of order and bearer instrument.

- In negotiation, the consideration is presumed, whereas, in the case of assignment, the consideration is proved.

- There is no requirement of transfer notice, in negotiation. On the contrary, notice of assignment is compulsory, so as to bind the debtor.

- In negotiation, the transferee has the right to sue the third party in his/her own name. As against, in the assignment, the assignee does not have any right to sue the third party, in his/her own name.

- In negotiation, there is no requirement of payment of stamp duty. Unlike, in the assignment, stamp duty must be paid.

In negotiation, the transfer of negotiable instrument, entitles the transferor, the right of a holder in due course. On the other extreme, in the assignment the title of the assignee, is a bit defective one, as it is subject to the title of assignor of the right.

You Might Also Like:

Girmay says

April 24, 2023 at 8:42 am

Your note is so good, and Like it.keep it up!.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

What is Negotiable Instrument: Everything You Need to Know

What is negotiable instrument? This term refers to any promise or order to pay that serves as a substitute for money, including but not limited to checks, bearer bonds, drafts, certain CDs, bank notes, and promissory notes. 3 min read updated on February 01, 2023

What is negotiable instrument? This term refers to any promise or order to pay that serves as a substitute for money, including but not limited to checks, bearer bonds, drafts, certain CDs, bank notes, and promissory notes.

Characteristics of Negotiable Instruments

All negotiable instruments have three main characteristics:

- Property or assets that are transferred from one person to another when the instrument is delivered or endorsed

- Acceptance of the instrument in good faith and the ability to file suit if it is not honored

- The liable party does not need to be notified about the transfer

Notes and drafts, including certificates of deposit (CDs) are used in business to secure and distribute loans and the movement of goods through financing. Negotiable instruments must adhere to Article 3 of the Uniform Commercial Code (UCC) and must not include fund transfers, investment securities, or money.

Most cases are subject to the rule of derivative title, which means a property owner cannot transfer rights in a larger piece of property. This rule is suspended when it comes to negotiable instruments. The person who endorses the instruments certifies that he or she has good title or represents another person with good title and that the transfer is rightful overall.

Negotiable instruments are transferable, meaning that the person who holds them can either exchange them for cash or transfer them to someone else. The value must be stated on the instrument. The person who receives an instrument in a transfer holds legal title to its entire value.

A valid negotiable instrument must:

- Exist in a written document that is signed by the drawee or maker

- Contain an unconditional order or promise to pay a certain amount of money with no other promises attached unless the additional conditions are authorized by the UCC

- Be payable at a definite time or on demand

- Be payment to bearer or to order

If a negotiable instrument is refused when it is presented, it is considered dishonored.

Some negotiable instruments do not need to be endorsed, while others can be endorsed using several methods. Bearer instruments just need to be delivered and don't need endorsement. They may list the person's name or have a blank endorsement. Order instruments must be signed by the payee before they are delivered to the payer.

Qualified endorsements are those that must be endorsed by a specific payee. These endorsements include an implied warranty . If an unqualified endorser receives consideration or payment, the warranty is implied to all subsequent holders. The unqualified endorser is stating that he or she has or is representing a person who has good title; that all signatures are authorized or genuine; that the instrument has not been altered in any material way; that no defense of a prior party can be used against the endorser; and that he or she has no knowledge of insolvency.

Forged negotiable instruments are invalid. Past-dated negotiable instruments are valid as long as the antiquated date was not included for a fraudulent or illegal purpose.

Common Negotiable Instruments

Perhaps the most common negotiable instrument is the check, which is a draft in a specific amount that will be honored by the payer's bank or financial institution. Money orders are similar to checks and are often purchased from the bank by the payer. The recipient can then exchange it for cash at the issuing bank.

Another example is the traveler's check, which is signed by the payer when it is issued and again when it is given to another as a form of payment. This provides an additional level of fraud protection when traveling in a foreign country.

A promissory note is a negotiable instrument in which one party promises to pay a certain amount to another party to settle an outstanding debt.

A bill of exchange is a negotiable instrument between three parties:

- The drawer, who drafts the bill

- The drawee, who is responsible for making payments on the bill

- The payee, who receives payment

A check is actually a type of bill of exchange in which the bank is the drawee, the person who writes the check is the drawer, and the person who receives and cashes the check is the payee.

If you need help with a negotiable instrument, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- UCC Section 3

- Is a Promissory Note a Negotiable Instrument?

- Holder In Due Course

- Equity Instruments

- Statute of Limitations Promissory Note California

- Full Endorsement

- Can a Signed Document Be Legal

- Uniform Commercial

- Uniform Commercial Code Explained

Negotiable Instrument

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 12, 2023

Get Any Financial Question Answered

Table of contents, what is a negotiable instrument.

A negotiable instrument is a written document that guarantees the payment of a specific sum of money to the bearer or the assigned recipient.

It serves as a legal medium for transferring monetary obligations or rights from one party to another. Negotiable instruments are widely used in commercial and financial transactions to facilitate trade and provide security in payment .

The purpose of a negotiable instrument is to provide a means of payment and transfer of financial obligations in a secure and efficient manner.

It allows parties to engage in business transactions with confidence, knowing that they can rely on the negotiability and enforceability of the instrument.

Negotiable instruments offer convenience, flexibility, and legal protection to parties involved in financial transactions.

Types of Negotiable Instruments

Promissory notes.

A promissory note is a negotiable instrument that contains a promise to pay a specified sum of money at a designated time or upon demand. It involves two parties: the maker, who promises to pay, and the payee , who will receive the payment.

Promissory notes are commonly used in lending agreements, credit transactions , and other situations where one party owes a debt to another.

Bills of Exchange

A bill of exchange is a written order issued by one party, known as the drawer, to another party, known as the drawee, instructing the drawee to pay a specified sum of money to a third party, known as the payee.

Bills of exchange are often used in international trade or as a form of short-term credit. They enable businesses to create a financial instrument that can be used for payment or to obtain financing.

Cheques are negotiable instruments issued by individuals or businesses to pay a specific sum of money to a recipient or payee.

They are drawn on a bank or financial institution and provide a secure and convenient method of payment. Cheques are commonly used for various purposes, such as paying bills, making purchases, or transferring funds between accounts.

Features of Negotiable Instruments

Transferability.

One of the key features of negotiable instruments is their transferability. They can be freely transferred from one party to another by delivery or endorsement, enabling the assignment of rights and obligations.

The ability to transfer ownership of the instrument facilitates the flow of funds in commercial transactions.

Unconditional Payment

Negotiable instruments provide for the unconditional payment of a specific sum of money. The payment obligation is not subject to any conditions or contingencies, ensuring that the instrument holder can rely on the promised payment without any qualifications or limitations.

Specific Amount

Negotiable instruments specify a specific sum of money that is payable to the bearer or the assigned recipient. This clarity regarding the amount ensures certainty and predictability in financial transactions, allowing parties to determine the exact value of the instrument.

Payable on Demand or at a Fixed Time

Negotiable instruments can be payable on demand, meaning they are immediately payable upon presentation, or at a fixed time in the future. The payment terms are clearly stated in the instrument, providing a clear timeline for the fulfillment of the payment obligation.

Importance of Negotiable Instruments

Role in financial transactions.

Negotiable instruments play a crucial role in facilitating financial transactions, particularly in the context of commerce and trade.

They provide a secure and standardized method of transferring financial obligations, ensuring that parties involved can confidently engage in business transactions.

Convenience and Safety

Negotiable instruments offer convenience and safety in financial transactions. They provide a paper trail that serves as proof of payment and can be used for record-keeping and accounting purposes.

The use of negotiable instruments reduces the need for carrying large sums of cash and minimizes the risk of loss or theft.

Contribution to Economic Development

Negotiable instruments contribute to economic development by promoting business activities, trade, and investment .

They provide a reliable mechanism for conducting financial transactions, which encourages businesses to engage in commercial activities and fosters economic growth .

Negotiable instruments enable businesses to obtain credit, expand their operations, and manage their cash flow effectively.

Moreover, negotiable instruments facilitate the circulation of money within the economy. By providing a means of payment and transfer, they promote liquidity and enable the efficient allocation of financial resources.

This liquidity enhances the velocity of money, leading to increased economic activity and productivity.

Negotiable instruments also play a vital role in international trade. Bills of exchange and other negotiable instruments are widely used in cross-border transactions, providing a mechanism for businesses to buy and sell goods and services across different countries.

The ability to issue and accept negotiable instruments facilitates global commerce and contributes to international economic integration.

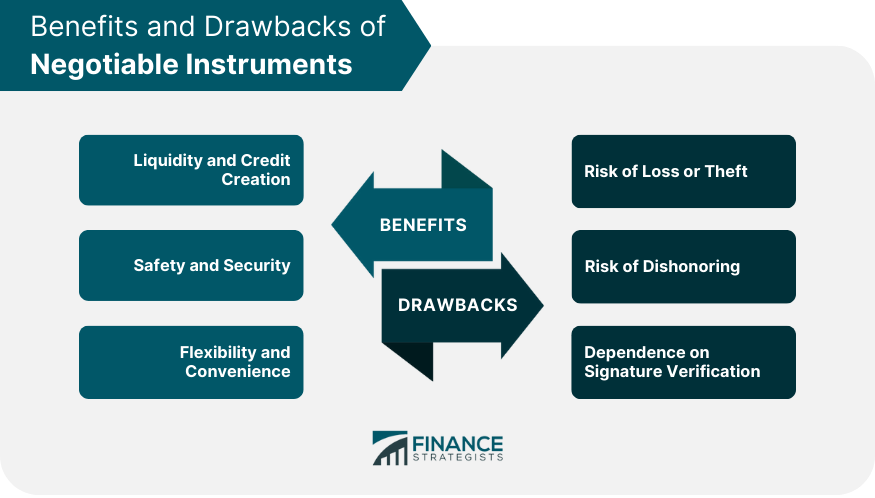

Benefits of Negotiable Instruments

Liquidity and credit creation.

Negotiable instruments enhance liquidity by providing a mechanism for creating credit. They allow businesses and individuals to access funds by leveraging the value of the instrument.

For example, a business can use a negotiable instrument, such as a promissory note, to obtain a loan from a financial institution, thereby increasing its available funds for investment or working capital.

Safety and Security

Negotiable instruments offer a high level of safety and security in financial transactions. They provide legal protections and enforceability, ensuring that parties involved in the transaction are legally bound to fulfill their obligations.

This reduces the risk of payment default and enhances trust between transacting parties.

Flexibility and Convenience

Negotiable instruments offer flexibility and convenience in financial transactions. They can be customized to meet the specific needs of the parties involved, such as determining the payment terms, maturity dates , or other conditions.

Additionally, negotiable instruments can be easily transferred, enabling parties to adapt and modify their financial arrangements as circumstances change.

Drawbacks of Negotiable Instruments

Risk of loss or theft.

One drawback of negotiable instruments is the risk of loss or theft. Since negotiable instruments represent a monetary value, if they are lost or stolen, there is a potential for financial loss.

Therefore, it is important to handle negotiable instruments with care and take necessary precautions to safeguard them.

Risk of Dishonoring

Negotiable instruments are subject to the risk of dishonoring, meaning that the party obligated to make the payment fails to do so.

This can occur due to various reasons, such as insufficient funds, lack of creditworthiness, or intentional refusal to honor the obligation. In such cases, the holder of the negotiable instrument may face difficulties in obtaining the payment owed to them.

Dependence on Signature Verification

Negotiable instruments rely on the verification of signatures to ensure their validity and enforceability. However, signature verification can be subject to fraud or forgery, posing a risk to the parties involved in the transaction.

To mitigate this risk, it is important to implement robust security measures and ensure proper authentication of signatures on negotiable instruments.

Bottom Line

A negotiable instrument is a written document that guarantees the payment of a specific sum of money to the bearer or the assigned recipient. It serves as a means of payment and transfer in financial transactions.

Negotiable instruments have characteristics such as transferability, unconditional payment, specific amount, and payment terms that contribute to their effectiveness in financial transactions.

Negotiable instruments offer benefits such as liquidity, safety, security, flexibility, and convenience. However, they also come with drawbacks, including the risk of loss or theft, the risk of dishonoring, and the reliance on signature verification.

Negotiable instruments are an integral part of the financial landscape, enabling the seamless flow of funds, facilitating credit creation, and contributing to economic growth.

They provide a framework for trust and reliability in financial transactions, offering benefits such as liquidity, safety, and flexibility.

Negotiable Instrument FAQs

Are negotiable instruments only used in commercial transactions.

No, negotiable instruments are used in both commercial and non-commercial transactions. While they are commonly associated with business dealings, they can also be utilized for personal loans, private agreements, and other non-commercial financial transactions.

Can anyone create a negotiable instrument?

Yes, anyone can create a negotiable instrument as long as it meets the legal requirements and fulfills the essential elements of a negotiable instrument. However, it's important to note that the enforceability and acceptance of a negotiable instrument may depend on various factors, such as the credibility and reputation of the issuer.

What happens if a negotiable instrument is lost or stolen?

If a negotiable instrument is lost or stolen, the rightful owner should take immediate action to protect themselves from potential financial loss. They should inform the relevant parties, such as the issuer or drawee, and provide necessary documentation to report the loss or theft. Depending on the circumstances, legal remedies may be pursued to recover the funds or hold the responsible party accountable.

Can a negotiable instrument be modified or altered?

Generally, a negotiable instrument should not be modified or altered once it has been issued. Any changes to the terms or conditions of the instrument may render it invalid or raise doubts about its authenticity. It is crucial to preserve the integrity of negotiable instruments to ensure their enforceability and legal standing.

Are electronic forms of negotiable instruments recognized and accepted?

With the advancements in technology, electronic forms of negotiable instruments have emerged. Digital signatures, electronic transfers, and other electronic mechanisms have gained acceptance in many jurisdictions. However, the recognition and acceptance of electronic negotiable instruments may vary depending on local laws, regulations, and the consent of the parties involved. It is important to consult legal and financial professionals to ensure compliance with applicable rules and requirements.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Alternatives to Opening a Bank Account Without an SSN

- Bank Account Deposits

- Bank Account Overdraft

- Bank Account Pending Transaction vs Posted Transaction

- BlueOr Bank Review

- Business Bank Accounts

- Business vs Personal Bank Account

- Can I Get a Loan Without a Bank Account

- Can a Debt Collector Withdraw Money From Your Bank Account?

- Does Closing a Bank Account Affect Your Credit?

- Frozen Bank Account

- How Business Bank Accounts Work

- How Foreigners Can Open Bank Accounts in the US

- How Interest Works on a Bank Account

- How an Account Freeze Works

- How to Open Bank Account Without a Physical Address

- How to Open a Kid's Bank Account

- How to Switch From Personal to Business Bank Account

- How to Transfer Bitcoins to Your Bank Account

- How to Transfer Money From Bank Account to Prepaid Card

- How to Transfer Visa Gift Card Balance to a Bank Account

- IRS Bank Account Levy

- Opening a Bank Account With Bad Credit

- Opening a Bank Account Without a Job

- Overdraft Protection

- Routing Number vs Account Number

- Strategies on How to Protect Your Bank Account From Creditors

- Types of Bank Account Overdrafts

- Using a Personal Bank Account for Business

- What Happens to a Student Bank Account Upon Graduation?

Ask a Financial Professional Any Question

Find bank branches and atms near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

U.C.C. - ARTICLE 3 - NEGOTIABLE INSTRUMENTS (2002)

Primary tabs.

- PART 1. GENERAL PROVISIONS AND DEFINITIONS

- § 3-101 . SHORT TITLE.

- § 3-102 . SUBJECT MATTER.

- § 3-103 . DEFINITIONS.

- § 3-104 . NEGOTIABLE INSTRUMENT.

- § 3-105 . ISSUE OF INSTRUMENT.

- § 3-106 . UNCONDITIONAL PROMISE OR ORDER.

- § 3-107 . INSTRUMENT PAYABLE IN FOREIGN MONEY.

- § 3-108 . PAYABLE ON DEMAND OR AT DEFINITE TIME.

- § 3-109 . PAYABLE TO BEARER OR TO ORDER.

- § 3-110 . IDENTIFICATION OF PERSON TO WHOM INSTRUMENT IS PAYABLE.

- § 3-111 . PLACE OF PAYMENT.

- § 3-112 . INTEREST.

- § 3-113 . DATE OF INSTRUMENT.

- § 3-114 . CONTRADICTORY TERMS OF INSTRUMENT.

- § 3-115 . INCOMPLETE INSTRUMENT.

- § 3-116 . JOINT AND SEVERAL LIABILITY; CONTRIBUTION.

- § 3-117 . OTHER AGREEMENTS AFFECTING INSTRUMENT.

- § 3-118 . STATUTE OF LIMITATIONS.

- § 3-119 . NOTICE OF RIGHT TO DEFEND ACTION.

- PART 2. NEGOTIATION, TRANSFER, AND INDORSEMENT

- § 3-201 . NEGOTIATION.

- § 3-202 . NEGOTIATION SUBJECT TO RESCISSION.

- § 3-203 . TRANSFER OF INSTRUMENT; RIGHTS ACQUIRED BY TRANSFER.

- § 3-204 . INDORSEMENT.

- § 3-205 . SPECIAL INDORSEMENT; BLANK INDORSEMENT; ANOMALOUS INDORSEMENT.

- § 3-206 . RESTRICTIVE INDORSEMENT.

- § 3-207 . REACQUISITION.

- PART 3. ENFORCEMENT OF INSTRUMENTS

- § 3-301 . PERSON ENTITLED TO ENFORCE INSTRUMENT.

- § 3-302 . HOLDER IN DUE COURSE.

- § 3-303 . VALUE AND CONSIDERATION.

- § 3-304 . OVERDUE INSTRUMENT.

- § 3-305 . DEFENSES AND CLAIMS IN RECOUPMENT.

- § 3-306 . CLAIMS TO AN INSTRUMENT.

- § 3-307 . NOTICE OF BREACH OF FIDUCIARY DUTY.

- § 3-308 . PROOF OF SIGNATURES AND STATUS AS HOLDER IN DUE COURSE.

- § 3-309 . ENFORCEMENT OF LOST, DESTROYED, OR STOLEN INSTRUMENT.

- § 3-310 . EFFECT OF INSTRUMENT ON OBLIGATION FOR WHICH TAKEN.

- § 3-311 . ACCORD AND SATISFACTION BY USE OF INSTRUMENT.

- § 3-312 . LOST, DESTROYED, OR STOLEN CASHIER'S CHECK, TELLER'S CHECK, OR CERTIFIED CHECK.

- PART 4. LIABILITY OF PARTIES

- § 3-401 . SIGNATURE.

- § 3-402 . SIGNATURE BY REPRESENTATIVE.

- § 3-403 . UNAUTHORIZED SIGNATURE.

- § 3-404 . IMPOSTORS; FICTITIOUS PAYEES.

- § 3-405 . EMPLOYER'S RESPONSIBILITY FOR FRAUDULENT INDORSEMENT BY EMPLOYEE.

- § 3-406 . NEGLIGENCE CONTRIBUTING TO FORGED SIGNATURE OR ALTERATION OF INSTRUMENT.

- § 3-407 . ALTERATION.

- § 3-408 . DRAWEE NOT LIABLE ON UNACCEPTED DRAFT.

- § 3-409 . ACCEPTANCE OF DRAFT; CERTIFIED CHECK.

- § 3-410 . ACCEPTANCE VARYING DRAFT.

- § 3-411 . REFUSAL TO PAY CASHIER'S CHECKS, TELLER'S CHECKS, AND CERTIFIED CHECKS.

- § 3-412 . OBLIGATION OF ISSUER OF NOTE OR CASHIER'S CHECK.

- § 3-413 . OBLIGATION OF ACCEPTOR.

- § 3-414 . OBLIGATION OF DRAWER.

- § 3-415 . OBLIGATION OF INDORSER.

- § 3-416 . TRANSFER WARRANTIES.

- § 3-417 . PRESENTMENT WARRANTIES.

- § 3-418 . PAYMENT OR ACCEPTANCE BY MISTAKE.

- § 3-419 . INSTRUMENTS SIGNED FOR ACCOMMODATION.

- § 3-420 . CONVERSION OF INSTRUMENT.

- PART 5. DISHONOR

- § 3-501 . PRESENTMENT.

- § 3-502 . DISHONOR.

- § 3-503 . NOTICE OF DISHONOR.

- § 3-504 . EXCUSED PRESENTMENT AND NOTICE OF DISHONOR.

- § 3-505 . EVIDENCE OF DISHONOR.

- PART 6. DISCHARGE AND PAYMENT

- § 3-601 . DISCHARGE AND EFFECT OF DISCHARGE.

- § 3-602 . PAYMENT.

- § 3-603 . TENDER OF PAYMENT.

- § 3-604 . DISCHARGE BY CANCELLATION OR RENUNCIATION.

- § 3-605 . DISCHARGE OF INDORSERS AND ACCOMMODATION PARTIES.

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

23.2: Transfer and Negotiation of Commercial Paper

- Last updated

- Save as PDF

- Page ID 25667

LEARNING OBJECTIVES

- Understand what a transfer of commercial paper is.

- Recognize the rights and liabilities of transferees and the liabilities of transferors.

- Know how a transfer becomes a negotiation payable to order or to bearer.

Definitions, Rights, and Liabilities

Transfer means physical delivery of any instrument—negotiable or not—intending to pass title. Section 3-203(a) of the Uniform Commercial Code (UCC) provides that “an instrument is transferred when it is delivered by a person other than its issuer for the purpose of giving to the person receiving delivery the right to enforce the instrument.”

Negotiation and Holder

Section 3-201(a) of the UCC defines negotiation as “a transfer of possession, whether voluntary or involuntary, of an instrument to a person who thereby becomes its holder if possession is obtained from a person other than the issuer of the instrument.” A holder is defined in Section 1-201(2) as “a person who is in possession of an instrument drawn, issued, or indorsed to him or his order or to bearer or in blank” (“in blank” means that no indorsement is required for negotiation). The original issuing or making of an instrument is not negotiation, though a holder can be the beneficiary of either a transfer or a negotiation. The Official Comment to 3-201(a) is helpful:

A person can become holder of an instrument when the instrument is issued to that person, or the status of holder can arise as the result of an event that occurs after issuance. “Negotiation” is the term used in article 3 to describe this post-issuance event. Normally, negotiation occurs as the result of a voluntary transfer of possession of an instrument by a holder to another person who becomes the holder as a result of the transfer. Negotiation always requires a change in possession of the instrument because nobody can be a holder without possessing the instrument, either directly or through an agent. But in some cases the transfer of possession is involuntary and in some cases the person transferring possession is not a holder.…[S]ubsection (a) states that negotiation can occur by an involuntary transfer of possession. For example, if an instrument is payable to bearer and it is stolen by Thief or is found by Finder, Thief or Finder becomes the holder of the instrument when possession is obtained. In this case there is an involuntary transfer of possession that results in negotiation to Thief or Finder.Uniform Commercial Code, Section 3-201, Official Comment.

In other words, to qualify as a holder, a person must possess an instrument that runs to her. An instrument “runs” to a person if (1) it has been issued to her or (2) it has been transferred to her by negotiation (negotiation is the “post-issuance event” cited in the comment). Commercially speaking, the status of the immediate person to whom the instrument was issued (the payee) is not very interesting; the thing of interest is whether the instrument is passed on by the payee after possession, through negotiation. Yes, the payee of an instrument is a holder, and can be a holder in due course, but the crux of negotiable instruments involves taking an instrument free of defenses that might be claimed by anybody against paying on the instrument; the payee would know of defenses, usually, so—as the comment puts it—“use of the holder-in-due-course doctrine by the payee of an instrument is not the normal situation.…[r]ather, the holder in due course is an immediate or remote transferee of the payee.”Uniform Commercial Code, Section 3-302, Comment 4.

Liability of Transferors

We discuss liability in Chapter 25 "Liability and Discharge" . However, a brief introduction to liability will help in understanding the types of indorsements discussed in this chapter. There are two types of liability affecting transferors: contract liability and warranty liability.

Contract Liability

Persons who sign the instrument—that is, makers, acceptors, drawers, indorsers—have signed a contract and are subject to contract liabilities. Drafts (checks) and notes are, after all, contracts. Makers and acceptors are primary parties and are unconditionally liable to pay the instrument. Drawers and indorsers are secondary parties and are conditionally liable. The conditions creating liability—that is, presentment, dishonor, and notice—are discussed in Chapter 25 "Liability and Discharge" .

Warranty Liability

The transferor’s contract liability is limited. It applies only to those who sign and only if certain additional conditions are met and, as will be discussed, can even be disclaimed. Consequently, a holder who has not been paid often must resort to a suit based on one of five warranties. These warranties are implied by law; UCC, Section 3-416, details them:

(A) A person who transfers an instrument for consideration warrants all of the following to the transferee and, if the transfer is by indorsement, to any subsequent transferee:

(1) The warrantor is a person entitled to enforce the instrument.

(2) All signatures on the instrument are authentic and authorized.

(3) The instrument has not been altered.

(4) The instrument is not subject to a defense or claim in recoupment of any party which can be asserted against the warrantor.

(5) The warrantor has no knowledge of any insolvency proceeding commenced with respect to the maker or acceptor or, in the case of an unaccepted draft, the drawer.

Breach of one of these warranties must be proven at trial if there is no general contract liability.

Liability of Transferees

The transferee takes by assignment; as an assignee, the new owner of the instrument has only those rights held by the assignor. Claims that could be asserted by third parties against the assignor can be asserted against the assignee. A negotiable instrument can be transferred in this sense without being negotiated. A payee, for example, might fail to meet all the requirements of negotiation; in that event, the instrument might wind up being merely transferred (assigned). When all requirements of negotiability and negotiation have been met, the buyer is a holder and may (if a holder in due course—see Chapter 24 "Holder in Due Course and Defenses" ) collect on the instrument without having to prove anything more. But if the instrument was not properly negotiated, the purchaser is at most a transferee and cannot collect if defenses are available, even if the paper itself is negotiable.

How Negotiation Is Accomplished

Negotiation can occur with either bearer paper or order paper.

Negotiation of Instrument Payable to Bearer

An instrument payable to bearer— bearer paper —can be negotiated simply by delivering it to the transferee (see Figure 23.1 "Negotiation of Bearer Paper" ; recall that “Lorna Love” is the proprietor of a tennis club introduced in Chapter 22 "Nature and Form of Commercial Paper" ): bearer paper runs to whoever is in possession of it, even a thief. Despite this simple rule, the purchaser of the instrument may require an indorsement on some bearer paper anyway. You may have noticed that sometimes you are requested to indorse your own check when you make it out to cash. That is because the indorsement increases the liability of the indorser if the holder is unable to collect. Chung v. New York Racing Association ( Section 23.4 "Cases" ) deals with issues involving bearer paper.

Figure 23.1 Negotiation of Bearer Paper

Negotiation of Instrument Payable to Order

Negotiation is usually voluntary, and the issuer usually directs payment “to order”—that is, to someone’s order, originally the payee. Order paper is this negotiable instrument that by its term is payable to a specified person or his assignee. If it is to continue its course through the channels of commerce, it must be indorsed—signed, usually on the back—by the payee and passed on to the transferee. Continuing with the example used in Chapter 22 "Nature and Form of Commercial Paper" , Rackets, Inc. (the payee) negotiates Lorna Love’s check (Lorna is the issuer or drawer) drawn to the order of Rackets when an agent of Rackets “signs” the company’s name on the reverse of the check and passes it to the indorsee, such as the bank or someone to whom Rackets owed money. (A company’s signature is usually a rubber stamp for mere deposit, but an agent can sign the company name and direct the instrument elsewhere.) The transferee is a holder (see Figure 23.2 "Negotiation of Order Paper" ). Had Rackets neglected to indorse the check, the transferee, though in physical possession, would not be a holder. Issues regarding indorsement are discussed in Section 23.2 "Indorsements" .

Figure 23.2 Negotiation of Order Paper

Key Takeaway

A transfer is the physical delivery of an instrument with the intention to pass title—the right to enforce it. A mere transferee stands in the transferor’s shoes and takes the instrument subject to all the claims and defenses against paying it that burdened it when the transferor delivered it. Negotiation is a special type of transfer—voluntary or involuntary—to a holder. A holder is a person who has an instrument drawn, issued, or indorsed to him or his order or to bearer or in blank. If the instrument is order paper, negotiation is accomplished by indorsement and delivery to the next holder; if it is bearer paper or blank paper, delivery alone accomplishes negotiation. Transferors incur two types of liability: those who sign the instrument are contractually liable; those who sign or those who do not sign are liable to the transferee in warranty.

- What is a transfer of commercial paper, and what rights and liabilities has the transferee?

- What is a negotiation of commercial paper?

- What is a holder?

- How is bearer paper negotiated?

- How is order paper negotiated?

- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

US Bank N.A. v Nelson

Jared B. Foley, for appellants.

Katherine Wellington, for respondent.

New York State Foreclosure Defense Bar, amicus curiae.

MEMORANDUM:

The order of the Appellate Division should be affirmed, with costs, and the certified question answered in the affirmative.

We conclude that, under the circumstances of this case, Supreme Court did not err in granting plaintiff's motions for summary judgment and for a judgment of foreclosure and sale. Defendants failed to raise standing in their answers or in pre-answer motions as required by CPLR 3211 (e) and accordingly, under the law in effect at the time of the orders appealed from, the defense was waived (see Fossella v Dinkins, 66 NY2d 162, 167 [1985]). Defendants' argument that ownership is an essential element of a foreclosure action, raised for the first time in support of their motion for reargument at the Appellate Division, is unpreserved for our review. We do not reach the issue of whether RPAPL 1302-a, enacted while this appeal was pending, affords defendants an opportunity to raise standing at this stage of the litigation. Defendants are free to apply to the trial court for any relief that may be available to them under that statute.

The dispute here, which has roiled the lower courts, arises from a simple misnomer. Whether a plaintiff is a party to a contract — and therefore can sue for breach of contract — is not a question of "standing." New York law suggests that true standing must be pleaded as an affirmative defense. But whether a plaintiff is a party to a contract and, therefore, can sue for breach, is not a question of standing — it is an essential element of a plaintiff's claim, which must be pleaded affirmatively in a complaint.

A promissory note is a contract. A suit to recover on a note or to foreclose on a mortgage securing that note is a contract action. Installment notes secured by a mortgage — which are what people commonly use to buy homes and other real property, and what is at issue here — have existed for centuries. It is only recently that the New York courts have used the term "standing" to refer to whether the plaintiff in a foreclosure action is a party to the contract (or other person with the right to enforce the contract)[FN1]. The dispute and confusion as to whether the borrower must plead "lack of standing" as an affirmative defense arises purely from the misuse of the word "standing" to relate to the question of whether the plaintiff is the holder of the note.

Recognizing that borrowers have been saddled by this terminological mishap, the legislature stepped in, first in 2013, and again in 2019. In 2013, the legislature required that a plaintiff suing to foreclose on a home mortgage must "includ[e] the mortgage, security agreement and note or bond underlying the mortgage executed by defendant and all instruments of assignment" (CPLR 3012-b)[FN2]. Last December, the legislature, addressing the forfeitures caused [*2]by the courts' misuse of "standing," directed that the so-called issue of "standing" in foreclosure actions related to a home loan may be raised at any time prior to the entry of a judgment of foreclosure. The legislature further directed that the legislation apply immediately, which would include this case. In truth, the legislation is unnecessary, because a plaintiff suing to foreclose on a mortgage or to sue on a promissory note has the affirmative obligation to plead (and prove, if put at issue) that it is the holder of the note forming the basis of the suit.

Here, U.S. Bank's complaint properly alleged that it was the holder of the note executed by the Nelsons. (The foreclosure action predated CPLR 3012-b's enactment, so U.S. Bank was not obligated to provide the required documentation when it commenced the foreclosure action.) The Nelsons, whose loan originated with a completely different and unrelated lender, appropriately answered that they lacked knowledge or information as to whether U.S. Bank was the holder of the note under which they were obligated. Under ordinary rules of civil procedure, that answer put U.S. Bank on notice that it would have to prove that it held the note.[FN3]

I concur in the result here for a reason unrelated to the standing fiasco: in moving for summary judgment, U.S. Bank tendered evidence that it was the holder of the note. The Nelsons did not offer any contrary proof or any argument that the proof was deficient. Accordingly, Supreme Court properly granted summary judgment in favor of U.S. Bank.

Both appellants and respondents frame the pivotal issue in terms of what they refer to as "standing," by which they mean whether the Nelsons' denial of US Bank's assertion that it is the holder of their note was sufficient to put at issue whether U.S. Bank was the holder of the note on which it sued at the time it sued. The actual doctrine of standing has nothing to do with this case — or with any foreclosure action.

Standing comes in two flavors: constitutional and prudential. The former is derived from the Case or Controversy Clause of article III, § 2 of the United States Constitution, and has three elements; injury in fact, [*3]causation and redressability (Lujan v Defenders of Wildlife, 504 US 555, 560—561 [1992]). The United States Supreme Court has defined injury in fact as "an invasion of a legally protected interest which is (a) concrete and particularized . . . and (b) 'actual or imminent, not 'conjectural' or 'hypothetical'" (id. at 560, quoting Whitmore v Arkansas, 495 US 149, 155 [1990]). The New York Constitution contains no case or controversy requirement; hence, federal constitutional standing doctrine is of little or no relevance.[FN4]

In contrast, prudential standing is "not derived from Article III and 'not exhaustively' defined" (Lexmark Intern., Inc. v Static Control Components, Inc., 572 US 118, 126 [2014], quoting Elk Grove Unified Sch. Dist. v Newdow, 542 US 1, 12 [2004]; see also Charles Alan Wright et al., 33 Fed Prac & Proc Judicial Review § 8343 [Oct 2020 update]). Though not bound by federal doctrine on prudential standing, our Court has adopted the prudential requirement that "a party must show that the in-fact injury of which it complains falls within the 'zone of interests,' or concerns, sought to be promoted or protected by the statutory provision under which the agency has acted" (Society of Plastics Indus., Inc. v County of Suffolk, 77 NY2d 761, 773 [1991]).[FN5]

Standing comes into play when parties aim to enforce public — as opposed to private — rights.[FN6] The doctrine emerged in response to a growing administrative state and the increasing use of litigation to "enforce public, primarily constitutional values" (William A. Fletcher, The Structure of Standing, 98 Yale L J 221, 225 [1988]). At the height of the Lochner era, certain judges, particularly Justice Brandeis, sought to limit judicial intervention in the legislative process and protect Progressive Era legislation from attack (Cass R. Sunstein, Standing and the Privatization of Public Law, 88 Colum L Rev 1432, 1437—1438 [1988]; Cass R. Sunstein, What's Standing After Lujan? Of Citizen Suits, "Injuries," and Article III, 91 Mich L Rev 163, 179 [1992]; see also Daniel E. Ho & Erica L. Ross, Did Liberal Justices Invent the Standing Doctrine? An Empirical Study of the Evolution of Standing, 62 Stan L Rev 591 [2010]). In a series of taxpayer standing cases, the U.S. Supreme Court drew on the law of equity, namely the requirement that plaintiffs assert an interest or right that a court of equity could enforce, to reject constitutional challenges to legislation (Steven L. Winter, The Metaphor of Standing and the Problem of Self-Governance, 40 Stan L Rev 1371, 1422, 1441—1449 [1988]). Although the term "standing" was employed in the 19th Century as shorthand for that question, it was not explicitly linked to the case or controversy requirement until Justice Frankfurter's concurring opinion in Coleman v Miller (id. at 1422, 1449).[FN7]

The rise of impact litigation at midcentury brought standing back to the forefront of the Supreme Court's jurisprudence (see generally Abram Chayes, Public Law Litigation and the Burger Court, 96 Harv L Rev 4 [1982])[FN8]. The major standing cases since the 1960s generally involve private individuals or organizations challenging government policies and practices (see, e.g., Flast v Cohen, 392 US 83 [1968]; Schlesinger v Reservists Comm. to [*4]Stop the War, 418 US 208 [1974]; City of Los Angeles v Lyons, 461 US 95 [1983]; Allen v Wright, 468 US 737 [1984]; Clapper v Amnesty Intl., 568 US 398 [2013]).[FN9] Like their predecessors, more recent jurists have expressed concern these suits transformed judges into legislators and violated the separation of powers, a process described by Justice Scalia as the "overjudicialization of the processes of self-governance" (Antonin Scalia, The Doctrine of Standing as an Essential Element of the Separation of Powers, 17 Suffolk U L Rev 881, 881 [1983]). The judicial power, they argued, should be restricted to resolving disputes that were "traditionally amenable to, and resolved by, the judicial process" (Vermont Agency of Natural Resources v United States ex rel Stevens, 529 US 765, 774 [2000]). In accordance with that view, the U.S. Supreme Court has significantly limited who can bring suit to challenge government action and what kind of relief they can seek (see, e.g., Lujan, 504 US at 565 [reasoning that profession of an intent to travel to observe endangered species in the future do not support a finding of "actual or imminent" injury sufficient to establish standing]; Clapper, 568 US at 415—417 [rejecting argument that human rights activists' "costly and burdensome measures" to avoid government of surveillance constitute an ongoing injury]).

Our decisional law on standing treats it as a prudential issue focused on the enforcement of public rights — typically, whether a plaintiff has suffered some injury and "is arguably within the zone of interest to be protected by the statute" or regulation

(Dairylea Coop, Inc. v Walkley, 38 NY2d 6, 9 (1975); see also Matter of Acevedo v New York State Dept. of Motor Vehicles, 29 NY3d 202 [2017] [holding plaintiffs had standing to challenge DMV regulation]; Matter of Sierra Club v Village of Painted Post, 26 NY3d 301 [2015] [holding plaintiff had standing to challenge governmental land use decision]; Matter of Colella v Board of Assessors, 95 NY2d 401 [2000] [concluding that taxpayers lack standing to challenge tax exemption granted to a temple]). "Standing is a threshold determination, resting in part on policy considerations, that a person should be allowed access to the courts to adjudicate the merits of a particular dispute that satisfies the other justiciability criteria" (Society of Plastics Indus., Inc., 77 N.Y.2d at 769). Needless to say, when someone purporting to be a party to a contract sues to enforce that contract, no issue of standing is involved. You're either a party to the contract or not.

Standing has increasingly been misapplied in cases where private rather than public rights are at issue (see Charles Alan Wright et al., 13A Fed Prac & Proc Juris § 3531 [Oct 2020 update] ["The fascination of complex standing doctrine and the concern to observe constitutional limits on the judicial power occasionally lead courts to invoke public-law concepts to resolve concerns that are better addressed through private-law concepts. . . . It would be better to rely directly on cause-of-action, real-party-in-interest, capacity, intervention, and like concepts"]). The U.S. Supreme Court likewise cautioned against confusing standing with the existence of a cause of action:

"[T]he distinct concepts [of standing and cause of action] can be difficult to keep separate. If, for instance, the person alleging injury is remote from the zone of interests a statute protects, whether there is a legal injury at all and whether the particular litigant is one who may assert it can involve similar inquiries . . . Still, the question whether a plaintiff states a claim for relief 'goes to the merits' in the typical case, not the justiciability of a dispute, and conflation of the two concepts can cause confusion (Bond v US, 564 US 218—219 [2011])."

Substituting standing for the proper inquiry confuses the legal principle at issue. This is such a case.

The law of negotiable instruments has been four centuries in the making. The use of negotiable instruments, particularly the bill of exchange, became common in England following Parliament's repeal of the ban on charging interest in 1623 (Ann M. Burkhart, Lenders and Land, 64 Mo L Rev 249, 261 [1999]). Easily transportable and readily exchangeable, the bill of exchange became a stand-in for currency (id.). By the close of the 17th Century, [*5]common law had recognized the right of purchasers to enforce bills of exchange, laying the foundation for the doctrine of holder in due course (id.). In 1704, the Statute of Anne provided that promissory notes properly indorsed, like bills of exchange, could be enforced by bona fide purchasers, and sixty years later, in Grant v Vaughan, Lord Mansfield recognized promissory notes as negotiable instruments (Frederick K. Beutel, The Development of Negotiable Instruments in Early English Law, 51 Harv L Rev 813, 844 [1938]). The Statute of Anne was adopted by most American states, and when the term "bona fide purchaser" was replaced with "holder in due course" by the English Bills of Exchange Act in 1882, American law followed suit (Burkhart at 263).

Since their inception, negotiable instruments have been understood as contracts, a fact recognized by this Court (Oddo Asset Mgt. v Barclays Bank PLC, 19 NY3d 584, 593 [2012] ["A debtor and a creditor have no special relationship of confidence and trust . . . and the relationship is generally controlled by contract"]; see also Official Comment 3 to NY UCC 3-119 ["As between the immediate parties a negotiable instrument is merely a contract]). Holders of notes sue for breach of contract when the borrower fails to pay.

Negotiable instruments differ from other contracts in a way germane to this case: ordinarily, the parties to a contract remain static and are known to each other. Negotiable instruments by definition are meant to be bought, sold and traded, so that the "drawer" or "obligor" on the note (the person who promises to pay back the money) may not, down the road, have any idea who holds the note and, consequently, to whom the money is presently owed. When a negotiable instrument is an installment note, such as a typical home mortgage, the persons entitled to receive the payments may change over time, even repeatedly. For that reason, proof that the plaintiff is the current holder of the defendant's note is much more frequently at issue in suits involving negotiable instruments than suits involving other types of contracts.

The law governing that determination is not our jurisprudence on standing but rather the law of negotiable instruments, codified in New York's Uniform Commercial Code. NY UCC 3-301 makes it clear that the holder of the note is entitled to enforce it, and so courts must determine whether the plaintiff is in "possession of a negotiable instrument that is payable either to bearer or to an identified person that is the person in possession" (NY UCC 1-201 [b] [21] [A]). A purchaser of a note becomes the holder through negotiation (NY UCC 3-202). "If the instrument is payable to order it is negotiated by delivery with any necessary indorsement; if payable to bearer it is negotiated by delivery" (id.). Therefore, the issue of what documentation is necessary to establish a plaintiff's right to demand payment on a negotiable instrument is properly understood as a question of whether the note in question has been negotiated such that the plaintiff becomes the holder (see 80 NY Jur 2d Negotiable Instruments § 269 [2d ed 2013] ["The mere possession of a promissory note endorsed in blank, just like a check, provides presumptive ownership of that note by the current holder; such is the foundation of negotiable instruments law. Assuming that execution of a negotiable instrument if put in issue has been proved, its possession and production at the trial of the action to enforce it is sufficient prima facie proof of the plaintiff's ownership. This is the rule applicable to an instrument payable to bearer or indorsed in blank"])[FN10].

Our seminal jurisprudence in this area does not reference standing, instead framing the question whether the plaintiff has produced proof that the negotiable instrument had been assigned to it (Merritt v Bartholick, 36 NY 44, 44 [1867] [holding that third party assignee of mortgage "obtained no interest in the mortgage" in the absence of the assignment of the bond]; Payne v Wilson, 74 NY 348, 354—355 [1878] [reasoning that plaintiff who was not expressly assigned mortgage had right to foreclose because an "assignment of the debt transferred the interest of the owner of it in the land mortgaged"]; Bergen v Urbahn, 83 NY 49, 50 [1880] [concluding that plaintiff who failed to produce the note "was not entitled to recover"]). As recently as 1998, the Appellate Division affirmed the dismissal of a foreclosure action on the grounds that plaintiff "had no legal or equitable interest" in a mortgage that had been assigned to a third party; the court did not mention standing (Katz v East-Ville Realty Co, 249 AD2d 243 [1st Dept 1998]; see also Kluge v Fugazy, 145 AD2d 537, 538 [2d Dept 1988] ["The plaintiff's first and second causes of action for foreclosure and deficiency judgment, respectively, must fail since foreclosure of a mortgage may not be brought by one who has no title to it and absent transfer of the debt, the assignment of the mortgage is a nullity"]).

Although New York courts occasionally used the term "standing" to refer to the question of whether a plaintiff is the holder of a note prior to the financial crisis of 2008,[FN11] the vast majority of such cases arose in its aftermath. Borrowers began to raise "standing" as a defense in part because the process of securitization, particularly the transfer of notes and mortgages to new entities, made it more difficult to ascertain the identity of the note holder at the time of default (see, e.g., US Bank, NA v Collymore, 68 AD3d 752 [2d Dept 2009]; see also Adam J. Levitin, The Paper Chase: Securitization, Foreclosure, and the Uncertainty of Mortgage Title, 63 Duke LJ 637 [2013]; Mark C. Dillon, Unsettled Times Make Well-Settled Law: Recent Developments in New York State's Residential Mortgage Foreclosure Statutes and Case Law, 76 Alb L Rev 1085 [2013]).

The Nelsons' case is an archetypical illustration of the uncertainty generated by the securitization process. The Nelsons initially executed a note in favor of Knightsbridge Mortgage Bankers, and a mortgage in favor of the Mortgage Electronic Registration Systems (MERS). MERS is a private mortgage registry system created in the early 1990s to track ownership and servicing interests in mortgages, thereby reducing the transaction costs that arise from registering mortgages in public land records systems (Levitin at 649, 677—676).[FN12] The note changed hands at least twice, passing from Knightsbridge to Wells Fargo before it was indorsed in blank and sold, according to the plaintiffs, to the Deutsche ALT-A Securities Mortgage Loan Trust, of which US Bank is the trustee.

In the past decade, New York courts have firmly adopted the mistaken use of the word "standing" to refer to questions about whether the plaintiff in a foreclosure action holds the defendant's note. The consequence of that mislabeling has caused many courts to hold that the note's obligor (the homeowner, typically) must plead "lack of standing" as an affirmative defense (see, e.g., Security Pacific Natl. Bank v Evans, 31 AD3d 278, Wells Fargo Bank Minnesota, Natl. Assn. v Mastropaolo, 42 AD3d 239, 244 [2d Dept 2007]; Nationstar Mortg., LLC v Alling, 141 AD3d 916, 917 [3d Dept 2016]; JPMorgan Chase Bank, Nat. Assn. v Kobee, 140 AD3d 1622, 1623 [4th Dept 2016]), while others have held the contrary (Nationstar Mtge., LLC v Wong, 132 AD3d 825, 826 [2d Dept 2015]; US Bank, Natl. Assn. v Faruque, 120 AD3d 575, 576 [2d Dept 2014]).

As to true, prudential standing, although some cases hold otherwise, the weight of the authority suggests that standing must be pleaded as an affirmative defense (See Santoro v Schreiber, 263 AD2d 953, 954 [4th Dept 1999] ["Respondents waived any objection to petitioner's standing because they did not raise the defense of lack of standing either in a pre-answer motion or in their responsive pleadings"]; Klein v Garfinkle, 12 AD3d 604, 605 [1st Dept 2004] ["(A)s the issue of standing was not raised as an affirmative defense in an answer or in the pre-answer motions to dismiss the petition, the issue was waived"]; see also 3 Carmody-Wait 2d § 19:10 [Nov 2020 update])[FN13]. The prevailing view that true standing must be pleaded as an affirmative defense, when combined with the misuse of "standing" in mortgage foreclosure actions, has led courts to hold that the failure of a homeowner to plead affirmatively the plaintiff is not the noteholder waives any challenge on that issue. Courts now regularly and erroneously describe that issue as "standing," when the question really is whether the plaintiff holds the note, and therefore possesses a cause of action.

"CPLR 3018 (b), which governs affirmative defenses, reads:

A party shall plead all matters which if not pleaded would be likely to take the adverse party by surprise or would raise issues of fact not appearing on the face of a prior pleading such as arbitration and award, collateral estoppel, culpable conduct claimed in diminution of damages as set forth in article fourteen A, discharge in bankruptcy, facts showing illegality either by statute or common law, fraud, infancy or other disability of the party defending, payment, release res judicata, statute of frauds, or statute of limitation. The application of this subdivision shall not be confined to the instances enumerated."

A fundamental requirement of any breach-of-contract action is for the plaintiff to allege that it is a party to the contract (or has acquired the rights of a party). Moreover, whatever arguments might be made about whether CPLR 3018 (b) requires true standing to be pleaded as an affirmative defense, the chain of indorsements on a note entitling the plaintiff to foreclose on a mortgage is nothing that would take the plaintiff by surprise — it is information principally in the possession of the plaintiff and often unknown to the defendant. CPLR 3012-b expressly recognizes that fact by requiring the noteholder to provide proof of ownership of the note at the time it commences an action.

In any event, given the holdings of numerous courts that the failure to plead lack of standing as an affirmative defense in mortgage foreclosure actions disabled borrowers from determining whether the plaintiff really was the present noteholder, the legislature modified the Real Property Actions and Proceedings Law. Adopting the "standing" language pervasive in recent judicial decisions, the RPAPL now provides that "any objection or defense based on the plaintiffs lack of standing in a foreclosure proceeding related to a home loan . . . shall not be waived if a defendant fails to raise the objection or defense in a responsive pleading or pre-answer motion to dismiss" (§ 1302-a). As warned by the Supreme Court in Bond, misapplication of the standing doctrine confuses a merits question — whether the plaintiff holds the note and, as such, has the right to enforce it — with a threshold determination of justiciability. Our legislature has intervened twice to undo that confusion.

Returning to the question at the crux of this case, U.S. Bank affirmatively pleaded that a mortgage executed by the Nelsons as security for a $660,000 loan had been assigned to it in its capacity as trustee for Deutsche ALT-A Securities Mortgage Loan Trust in August of 2009 and that it was the holder of the Nelsons' note. Ordinary rules of pleading in contract actions required US Bank to do so. The Nelsons answered that they lacked "knowledge or information sufficient to form a belief as to the truth of the allegations" as to U.S. Bank's allegation that it held the note and mortgage. It is hardly surprising that the Nelsons did not know whether their note had been negotiated, and US Bank cannot possibly claim surprise that its ownership of the note and mortgage was put to proof (see 80 NY Jur 2d, Negotiable Instruments § 700 [2d ed 2013] ["As in other actions, a general denial usually puts in issue every material allegation on the complaint on a negotiable instrument. It goes to the root of the cause of action and permits the introduction of any proper evidence tending to controvert the facts which the plaintiff must establish to sustain his or her case"]). Indeed, U.S. Bank understood that its ownership of the note and mortgage was at issue, and tendered proof of such when it moved for summary judgment. Because the question of whether U.S. Bank is the holder of a negotiable instrument has nothing to do with standing and is, instead, an essential element of the holder's claim the Nelsons were not required to raise it as an affirmative defense.[FN14] In this case, the issue of whether the plaintiff was the noteholder was properly before the court in exactly the way it should have been raised.

However, the Nelsons have an unrelated, dispositive problem. When U.S. Bank moved for summary judgment, it attached the Nelsons' note, indorsed in blank, the mortgage, and the assignment of the mortgage. Doing so established, prima facie, U.S. Bank's right to judgment as a matter of law. To defeat U.S. Bank's motion for summary judgment, the Nelsons were required to adduce admissible facts controverting U.S. Bank's proof of [*7]ownership (see, e.g., Deutsche Bank Natl. Trust Co. v Monica, 131 AD3d 737, 740 [3d Dept 2015]). That they utterly failed even to attempt to do. U.S. Bank, therefore, was entitled to summary judgment.

Although I can join neither the majority's rationale nor the numerous courts' mistaken treatment of negotiable instrument ownership as a question of standing, I concur in the result.

Order affirmed, with costs, and certified question answered in the affirmative, in a memorandum. Chief Judge DiFiore and Judges Rivera, Stein, Fahey, Garcia and Feinman concur. Judge Wilson concurs in result in an opinion.

Decided December 17, 2020

Some case metadata and case summaries were written with the help of AI, which can produce inaccuracies. You should read the full case before relying on it for legal research purposes.

Get free summaries of new New York Court of Appeals opinions delivered to your inbox!

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

Assignment Of Rights Agreement

Jump to section, what is an assignment of rights agreement.

An assignment of rights agreement is a written document in which one party, the assignor, assigns to another party all or part of their rights under an existing contract. The most common example of this would be when someone wants to sell their shares of stock in a company.

When you buy shares from someone else (the seller), they agree to transfer them over and give up any control they had on that share. This way, another party can take ownership without going through the trouble of trying to buy the whole company themselves.

Common Sections in Assignment Of Rights Agreements

Below is a list of common sections included in Assignment Of Rights Agreements. These sections are linked to the below sample agreement for you to explore.

Assignment Of Rights Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-99.(H)(7) 5 dex99h7.htm FORM OF ASSIGNMENT AGREEMENT , Viewed December 20, 2021, View Source on SEC .