KPMG Personalization

- Reaction: Five trends that will shape the 2021 chemical industry

There is sound evidence supporting the need for the chemical industry to keep a focus on five areas that will emerge as critical in 2021 and beyond.

- Share Share close

- Download Reaction: Five trends that will shape the 2021 chemical industry pdf Opens in a new window

- 1000 Save this article to my library

- View Print friendly version of this article Opens in a new window

- Go to bottom of page

- Home ›

- Insights ›

A look back at 2020

If the chemical and performance technologies industry in the year 2020 was to be summarized in a single word, that word would be “disruption.” Some companies surged, for example, makers of disinfectants and diagnostic reagents, while others struggled—those exposed to automotive, refining, and construction end markets to name but a few. However, whether gearing up to meet sudden spikes in demand or struggling to survive, both outcomes resulted in major disruption.

So much has changed in just a year. Established strategies of the past are no longer relevant. The pandemic exposed industry weaknesses and significantly accelerated transformation programs. As businesses navigated uncharted territory, it was digital transformation that proved to be the critical lifeline. Digital will continue to be fast-tracked across every aspect of the chemical industry, as one of five key trends that will shape 2021.

Top five reasons why 2021 will be different

While the challenges of last year are not yet behind us, there is sound evidence supporting the need for the chemical industry to keep a focus on these five areas that will emerge as critical in 2021 and beyond:

1. Expanded digitalization

The pandemic raised everyone’s awareness of the fundamental importance of technology. The unprecedented scale and speed of the crisis brought a colossal surge in technology investments. In fact, rarely can a surge in digital transformation be seen in gross domestic product data, but this past pandemic year was an exception.

While few organizations would have planned for something as momentous as COVID-19, digital leaders entered the crisis in much better shape than others. Most notably, they had better infrastructure in place to deal with the immediate need to pivot to remote work and remote operations.

The 2021 digital focus will be on modifying structures and processes—connecting across front, middle, and back offices—so that information flows easily between each. This helps ensure access to all appropriate information for decision-making, planning, and support. A connected enterprise will likely require greater adoption of emerging technologies such as robotic automation, artificial intelligence, machine learning, and natural language processing. These investments will pay back in gains in revenue and efficiency—and better service to the customer.

The chemical industry, a slow mover compared to many others, should leverage digital leading practices from industries that have successfully made the transition to a connected enterprise, such as media, telecom, and technology industries.

Action steps

- Understand the full suite of available products and options—digital advancement doesn’t necessarily mean an enterprise resource planning “big bang” upgrade.

- Use technology across the front, middle, and back office. Don’t just settle for predictive maintenance or bots in shared service centers. For example, exploit digital tools for elevating the employee experience; use customer analytics to grow the top and bottom line, etc.

- Link to return on investment: apply the same core chemical industry metrics around product profitability to digital investment.

2. Elevated ESG goals

The chemical industry has been a leader on environmental, social, and governance (ESG) factors, but there is so much more to do. It’s time to double down on ESG strategies.

ESG is becoming more mainstream due to intensifying investor, regulatory, and consumer pressure holding companies accountable for ESG impacts. Some examples: surging demand for responsible investments has large fund managers exiting investments in non-climate-conscious companies; European Union sustainability-related regulations require ESG impacts on all products to be disclosed; consumers are publicly demanding that businesses move beyond token gestures and into hard action; and C-suite executives will increasingly be measured on, and rewarded for, progress against ESG targets.

A recent KPMG/Eversheds survey identified significant increase in C-suite focus on climate change.

The chemical industry holds the key to unlocking climate strategies across the industrial manufacturing value chain. This will be accomplished through the supply of sustainably produced products into downstream industries. Other prominent ESG industry focus areas include decarbonization, renewable energy, CO2 reduction, and circular plastics.

Incorporating ESG builds competitive advantage. Strong ESG practices are becoming an essential prerequisite for employee recruitment, brand enhancement, and investor funding. In short, ESG creates a virtuous circle for all—employees, customers, and investors.

Action steps:

- Get specific: articulate priority ESG initiatives that best map to your mission.

- Develop disciplined methodology to measure and report your ESG metrics journey.

- Transition energy supplies to renewable sources.

- Implement more effective reporting to publicize ESG efforts that are already going on in your company—to your employees, stockholders, and community.

3. Increased diversity in leadership

Although there has been some progress recently, participation of women and minorities in chemical leadership remains stubbornly low. Leadership has typically followed a very traditional model: most have a chemical engineering degree and comparable business experience and share similar backgrounds—these commonalties potentially leading to a lack of diversity of thought. In the current dynamic environment, greater diversity is needed to bring fresh perspectives and ideas to deliver greater agility in response to new challenges. Diversity boosts innovation, aids in talent acquisition and retention, and improves customer connections with an increasingly diverse consumer base.

Diversity needs to be reflected throughout the organization. The chemical companies that will be the most successful in the coming years will be those that can win the war for diverse and digitally-savvy talent—and that is a war that will be fought across multiple industries.

- Set challenging diversity goals with delivery tied to executive compensation.

- Invest in leadership development and establish a mentorship program to encourage diversity on all rungs of the corporate ladder.

- Recruit outside the standard pool to draw talent from nontraditional schools/majors and from other digitally strong sectors.

4. Increased M&A activity

COVID-19 didn’t stop deal activity. Even in a challenged market, there were multiple billion-dollar and multibillion-dollar deals. To name a few: Trinseo acquired Arkema’s PMMA business; BP sold its petrochemical business to INEOS; PPG acquired the global coatings manufacturer Ennis-Flint and has since announced its intention to acquire Tikkurila Oyj; and a consortium of Cinven and Bain Capital has announced its intention to acquire Lonza’s Specialty Ingredients business in a $4.7 billion deal.

In fact, right now is the most active mergers and acquisitions (M&A) market ever seen in chemicals. There are sponsor-owned assets in process of sale, large-scale corporate carve-outs (e.g., Clariant pigments business and Eastman’s tire additives and adhesives resins business units), as well as smaller corporate carve-outs comprising product lines, and even single manufacturing plants.

There are a multitude of factors driving M&A activity, among them cheap and plentiful debt, burgeoning private equity interest in the industry, liquidity pressures on distressed companies due to the pandemic impact, and a desire by some corporates to divest underperforming or noncore businesses.

There are promising possibilities on either side of the buy/sell equation. Portfolios should be strategically assessed to determine where to focus finite resources in order to meet business objectives. If there are assets in the market that would make a good fit, now might be a good time to reach out to the owner as they may be considering selling. Conversely, if a part of your business doesn’t align with your organization’s strategy, start thinking of ways to maximize value in preparation for sale—to private equity investors, corporations, or both.

- Assess noncore assets for possible spin off—are you the best owner for each individual asset/group of assets?

- Target acquisitions and think like an activist: (1) diversified portfolio and underperforming business units; (2) underperformance compared to peers; (3) value erosion due to unsuccessful M&A.

- Plan and execute better separation and integration by avoiding the three areas that tend to destroy more than 50 percent of deal value: (1) lack of execution; (2) organizational confusion/disruption; and (3) information technology systems disruption/issues.

5. Diversified portfolios

Historically, many of the biggest chemical companies have been diversified—typically as a result of past M&As, although over the past 10 years, there has been pressure to restructure portfolios to focus on fewer, core businesses—much of this exerted by activist investor pressure in the U.S. However, during the pandemic, those companies that were focused on the “wrong” segments of the market were those that suffered the worst during the crisis

Learning from the lessons of 2020, it’s a strategic imperative for all chemical companies to actively assess their portfolios and determine whether a change in direction is required. Diversification should no longer be a dirty word in the industry—as long as diversification doesn’t become an excuse for lack of focus.

- Assess whether COVID-19 showed you to be under- or over-exposed to certain segments.

- Determine whether you would benefit from an increase in portfolio diversification to protect you from potential future external shocks and become more resilient.

- Continue to improve operational performance via cost reduction, a better understanding of customer and product profitability, efficiencies captured through automation, restructured executive compensation, reconsidered pricing, the exploration of new markets, etc.

A look ahead

The global chemicals and performance technologies industry has its work cut out if it’s to rebound from the most disruptive year in memory. The encouraging news is that there is a defined path forward. By keeping these five trends at the forefront of your strategy, your company will be well positioned to promptly evaluate and respond to new opportunities…and help make the world a better place in the process.

KPMG Global Energy Institute

The KPMG Global Energy Institute (GEI) is a worldwide knowledge-sharing form on current and emerging industry issues. Launched in 2007, the GEI interacts with over 30,000 members through multiple media channels, including audio and video webcasts, publications and white papers, podcasts, events, and quarterly newsletters. Subscribe today to begin receiving valuable insights covering critical business topics and industry issues by visiting read.kpmg.us/gei .

For more information, please visit: www.kpmg.com/chemicals .

Some or all of the services described herein may not be permissible for KPMG audit clients and their affiliates or related entities.

Reaction: Five trends that will shape the 2021 Chemical industry

While the challenges of last year are not yet behind us, there is sound evidence supporting the need for the chemical industry to keep a focus on these five areas that will emerge as critical in 2021 and beyond

Paul Harnick

Principal, Global Head of Chemicals & Performance Technologies

KPMG in the U.S.

External issues tearing up established business models

REACTION is a publication that focuses on key issues impacting the chemical and performance technology industry.

REACTION is a publication that focuses on key issues impacting the chemical..

Chemical companies trying to manage the impact of COVID-19 have several options for introducing greater flexibility and liquidity.

Chemical companies trying to manage the impact of COVID-19..

For the best Oliver Wyman website experience, please upgrade your browser to IE9 or later

- Global (English)

- India (English)

- Middle East (English)

- South Africa (English)

- Brazil (Português)

- China (中文版)

- Japan (日本語)

- Southeast Asia (English)

- Belgium (English)

- France (Français)

- Germany (Deutsch)

- Italy (Italiano)

- Netherlands (English)

- Nordics (English)

- Portugal (Português)

- Spain (Español)

- Switzerland (Deutsch)

- UK And Ireland (English)

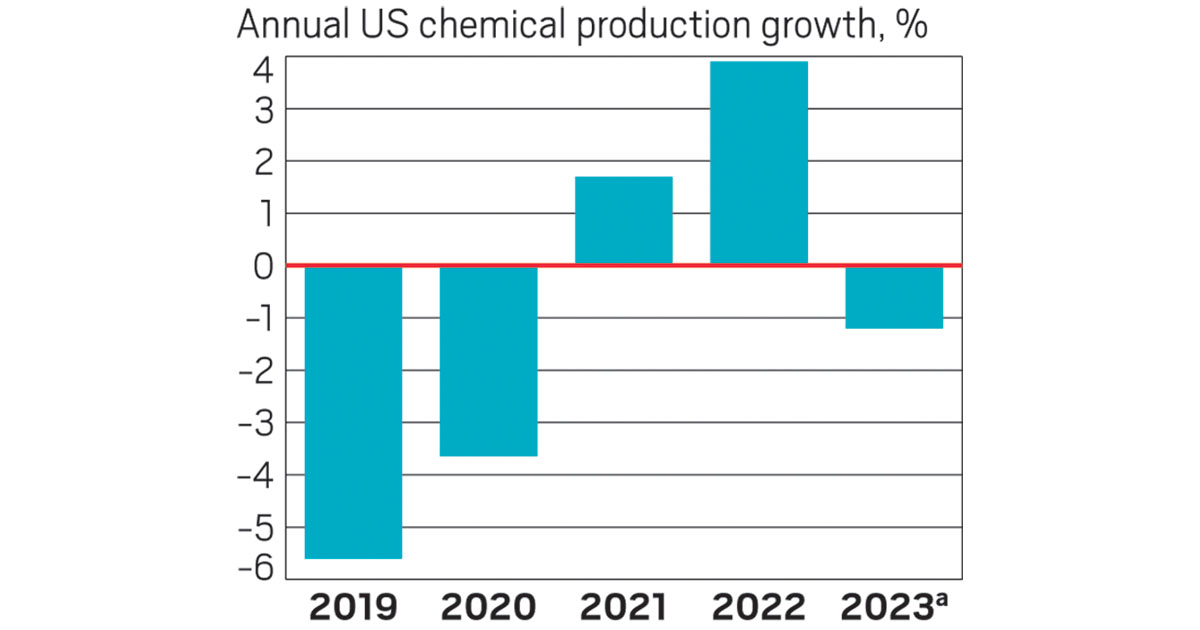

Chemical companies have spent the past two years in “firefighting” mode as COVID-19 tested corporate resilience and the industry struggled with supply-chain disruptions, increased feedstock volatility, changing customer behavior, and higher costs of doing business. Overcoming pandemic-driven disruption preoccupied company agendas, particularly as distorted oil and gas prices complicated feedstock management.

Looking forward, the risks and disruption facing the industry will become increasingly transformative. And while COVID-19 may not be officially done with us yet, it’s time for the industry to switch its focus from short-term problem solving to the development of strategic agendas centered on sustainability and the needs of decarbonization.

Time’s up to act

For the past 100 years, the industry’s business model has been to sell ever greater volumes of the energy-intensive, carbon-based products that essentially define it to this day. That business model cannot survive long-term in a world that is struggling to achieve net-zero carbon emissions in the next 30 years.

We’ve reached a tipping point, and failure to deal with the challenges of climate change and the dramatic overhaul of supply chains and value propositions that it portends may spell a company’s doom — maybe not this year or in five, but certainly at some point over the next 10 to 20 years. Proving a company’s sustainability will define the decade’s winners and losers. At present, few in the industry are fully prepared to embrace that journey toward the reimagined business models that will define the industry’s next 100 years.

For an industry that depends so heavily on oil, the pressure to decarbonize will become the overarching disrupter, whether in response to regulation or pressure from activist investors and consumers.

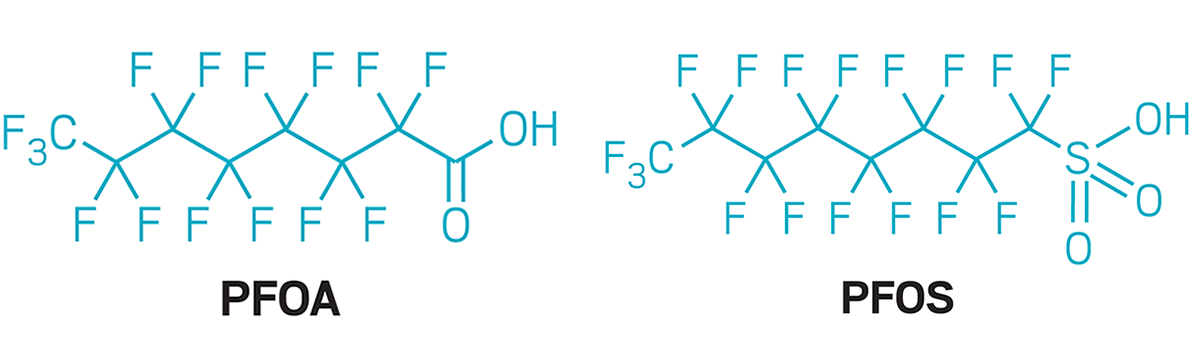

But it’s not only about taking out the carbon. There are also increasing calls for the industry to make less-toxic products that are safer for humans and the environment.

Relying on ESG priorities

Companies must begin evaluating all issues through an environmental, social, and governance (ESG) lens moving forward. With anticipated population growth and the increasing demand for almost everything because of it, players will need to find sustainable ways to serve these customers through alternative technologies, new feedstocks, and portfolio realignments. The bar is being raised on both corporate transparency and responsibility, and companies that fall short are also likely to find it hard to find funding.

That’s the cloud that hangs over the industry. Even so, 2022 is likely to be a year of moderate to strong expansion, as the world emerges from COVID. If the industry is forward-thinking, it will use the financial momentum in 2022 to help finance the gradual shift away from fossil fuels and invest in new ways of manufacturing and increased recycling that will define chemicals moving forward. So far, much of the industry has chosen to sit on the sidelines — producing more promises than real progress on cutting carbon emissions and redefining sustainability.

While sustainability has been on the corporate radar for a long time, most companies remain overwhelmed by both the magnitude of the problem and the investment required to address it.

Strategic levers to consider

But demands from regulators, investors, and customers are only likely to get louder, and companies that are not seen making progress are apt to get punished in the marketplace. Increasingly, failure to meet sustainability targets represents the single greatest long-term risk to companies, putting even their license to operate in jeopardy. Companies that fail the sustainability test may find themselves locked out of financing, especially as banks and other institutional investors focus on greening portfolios and making ESG priorities core to investment strategies.

The chemical industry is in a unique position for value creation for itself and other industries through the development of alternative materials and fuels. But it is time to graduate from just talking about opportunities and move toward realizing them.

Here are four strategic levers that can help chemical companies accelerate that transformation:

1. Apply a customer-centric lens.

Key to identifying ESG-related transformation opportunities is a deep understanding of the changing customer buying behaviors and new priorities that will put various parts of the portfolio at risk.

While chemical manufacturers allowed an increasingly commoditized marketplace govern their agendas, value for next-generation chemicals will be defined as much by service as by delivery of a product.

2. Think circular economy.

Reliance on a circular economy will reshape many value chains—with plastics being the most obvious one. Embracing a circular mindset requires rethinking all activities, from product development to end-use. In other words, you need not only tell customers to recycle; you need to design products with that in mind and then track every phase of product life until they make it back into raw materials.

Recycling can no longer be regarded as good citizenship; instead, it must become good economics. Besides designing with products with recyclability in mind, the industry must invest in the development of efficient, large-scale technologies. All forms of plastic must be made to be recycled and recycled easily to allow municipalities and businesses of all sizes to participate economically.

3. Participate in new ecosystems.

With the rise of new materials and technologies, alternative energy sources and fuels, and circular-economy business models, new business ecosystems should and will emerge. The waste management industry, for example, will become a full-fledged player in the chemical industry and will need to become part of every chemical producer’s value chain. Incumbent chemical players need to understand these emerging marketplace dynamics, so they can form the partnerships and alliances necessary to thrive.

4. Leverage technology across value chains.

Digitization is an enabler of the coming change. In this new low-carbon environment, companies will have to achieve end-to-end transparency into supply chains, tracking molecules from origin to use. For instance, intelligent transport systems can guide logistics to routes with lower emissions, or data-driven insights can support optimizing energy and resource use in customer processes. But all this presumes much deeper customer integration and interaction than exists today.

As the decade progresses, it will become painfully evident that sustainability and viability will depend on strategic transformation of business models and supply chains. And that necessity is likely to materialize as early as 2022. The industry is embarking on an exciting time full of opportunity, innovation, and hard work, but also with plenty of potential pitfalls along the way — especially for those who think they can coast.

Niklas Steinbach also contributed to this article.

More Thoughts on the 2022 Outlook From the Chemicals Practice

Responding to Inflation in a Volatile Environment

As raw material inflation takes shape at an increasing rate, a targeted price response will be key to managing risk. Learn more about Oliver Wyman's customized digital tools or reach out to [email protected].

- Iris Herrmann and

- Stephan Struwe

Energy's Transition

Decarbonizing Steel

This transition will require a whole spectrum of technology changes and individual efforts to increase efficiencies to move the industry forward.

Day Of Reckoning For Natural Gas

How to reduce gas-related emissions efficiently and progressively.

- Link copied

How to accelerate growth in the chemicals industry

EY Global Chemicals & Advanced Materials Industry Leader and Global Advanced Manufacturing & Mobility Supply Chain Leader

Visionary in markets and business development for the chemical industry. Enjoys race boarding in the mountains. Enthusiastic golfer.

EY Americas Chemicals and Advanced Materials Industry Leader

Relentless servant leader dedicated to effective and inclusive teaming. Driving agile, pragmatic disruption. Architecting and accelerating value chain excellence for manufacturers.

Show resources

How to accelerate revenue growth in chemicals (pdf), innovation, pricing strategy and customer-centricity are helping chemical companies find new ways to thrive amid a challenging outlook..

C hemical companies are facing slower global economic growth, trade disruptions and weakened end-market demand in key industries such as automotive and construction. The general downturn in demand, coupled with ongoing oversupply in commodity chemicals, drives weaker pricing that makes achieving organic growth even more difficult.

For most of the past decade, many chemical companies have been investing in cost and efficiency efforts as the growth agenda receded into the background. After years of consolidation, product commoditization, the rise of new competitors in growth economies and increasing cost control programs, achieving organic growth has become increasingly challenging.

Despite sluggish growth, EY Capital Confidence Barometer (CCB) 2019 survey data indicates that 64% of chemical sector respondents expect their revenue to increase in the next 12 months. The strategies and operating models of high-growth companies offer three core levers that companies should use to achieve sustainable growth: innovation, pricing strategy and customer-centricity. We explore each lever below, and in more depth in the full EY report (pdf) .

“Challenges present opportunities, and both are in abundance in the current environment for the chemical sector,” said Frank Jenner, EY Global Chemical Industry Leader. “Rethinking your approach to digital, sustainability, and talent and culture can offer differentiating advantages over the short and long term, ultimately positioning you for the next era of growth.”

of chemical sector respondents plan significant investments and see significant opportunity in improving customer experience and creating products and services, according to EY CCB.

To focus on key growth levers in a balanced and integrated manner, companies need to embed these levers in their strategy, culture and mindset. But they also need to realize it will take time to realize top-line benefits. One approach is to determine what can be changed now, over the next three years and beyond.

Lever 1: Innovation

Innovation needs to be embedded in every company’s corporate DNA to drive organic revenue growth, but no company can do it alone.

Innovation in the chemical industry should not be limited to developing new products. Chemical players need to leverage the entire chemical ecosystem to develop new business models and discovery methods, explore new markets, and increase innovation efficiency. Companies can innovate in products and new discovery methods, as well as in several additional areas.

While companies are increasingly turning to data-driven innovation, they also need to focus on new applications and processes to sustain a robust innovation pipeline. For instance, innovation across categories can encompass:

- Applications: new products with broader use cases, such as repairing human tissue, energy storage, aerospace, future of mobility

- Business models: closer collaboration with customers, cross-selling and channel consolidation; multiple players joining platform business

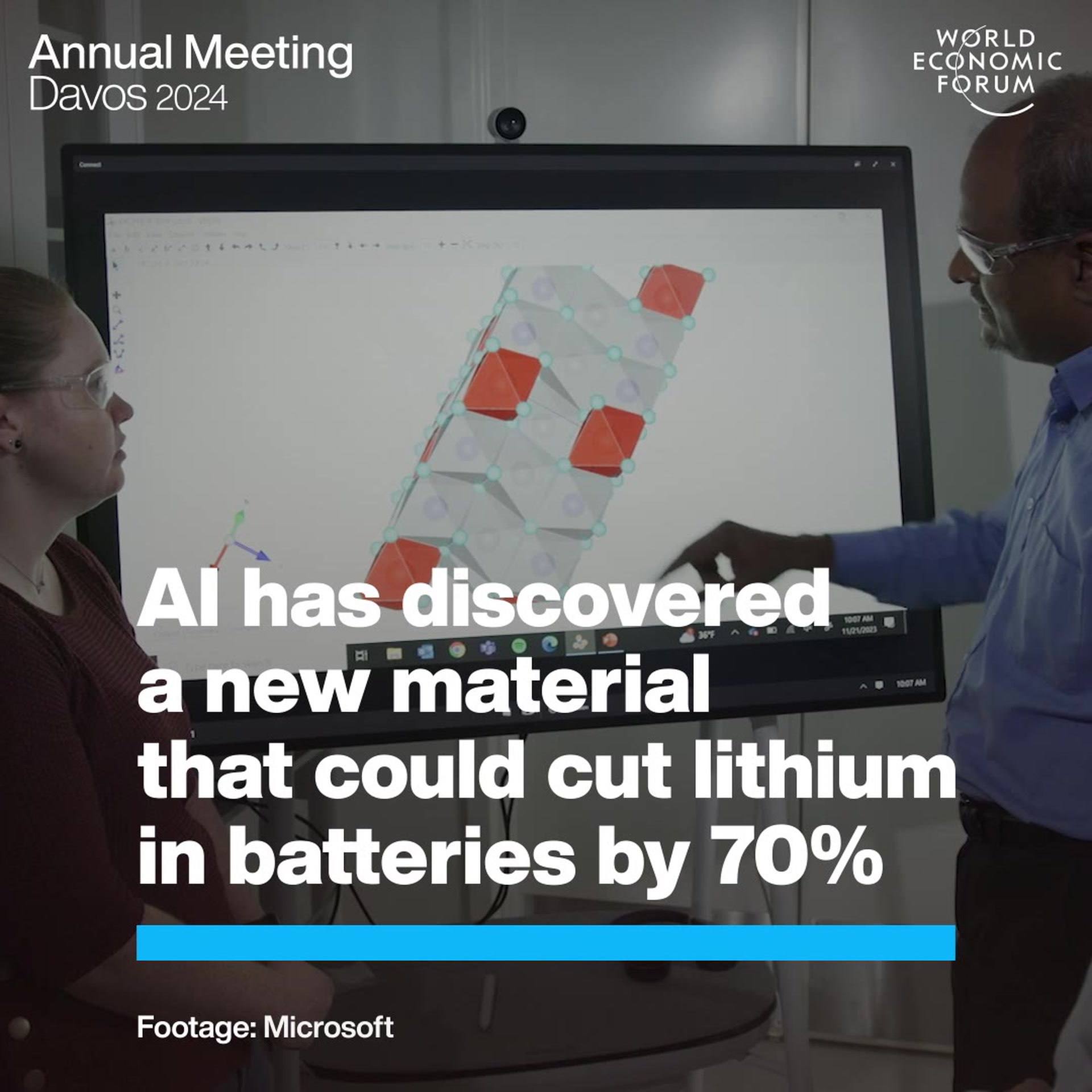

- Products and discovery methods: recyclability, new chemistry including green, quantum chemistry, multi-scale nano-materials, material for 4D printing, AI/ML in materials design and discovery

- Processes: process simulation; 3D printing; lower-carbon-footprint processes; conversion of CO2, coal and waste into chemicals; and use of bio-based raw materials

Companies should also consider their investment allocation. They cannot afford to miss current trends, but at the same time they need to prepare for upcoming megatrends to innovate faster than competitors. Internally, management should promote a culture and environment of open innovation through a model of test fast, fail fast, reiterate.

Externally, they need to be agile to co-create with various members of the ecosystem, from suppliers and technology partners to customer organizations and consumers. They also should seek to crowdfund new ideas and work with idea providers from concept to product-scale stage.

How EY can help

Strategy consulting.

EY-Parthenon professionals recognize that CEOs and business leaders are tasked with achieving maximum value for their organizations’ stakeholders in this transformative age. We challenge assumptions to design and deliver strategies that help improve profitability and long-term value.

It’s time to understand that customer demand is not just actual or forecasted orders, but includes their buyers’ values matched with innovative, differentiated solutions. Orders then follow.

Here’s what you should be thinking about.

- Plan for multi-pronged innovation: products, process, operating model, applications

- Increase R&D spending in growth areas (e.g., electrical/autonomous vehicles, nutrition, 5G, microbiome health, 3D printing, renewable energy)

- Develop chemicals and processes that have minimal ecological impact

Next (one to three years)

- Embed an innovation strategy into corporate strategy

- Design operations to manage needs of new business models

- Ensure that new products and processes are aligned with UN Sustainable Development Goals

- Exploit data to generate new revenue streams

- Offer a combination of products and services to support recycling and the circular economy throughout the value chain

- Leverage cognitive search and analytics to amplify R&D expertise

Looking ahead

of respondents said they are significantly investing in innovation beyond traditional product R&D, according to the EY Industrial Products Innovation Survey 2018.

Lever 2: Pricing strategy

Unrealized price potential is one of the biggest lost opportunities as chemical companies try to maximize top- and bottom-line growth.

Marketing and sales excellence is a key driver for organic growth, and it has often been a hot topic for chemical companies. Within a company, the development of the sales organization is significantly connected to long-term success, including profitability and market share growth. Successful chemical companies are much better positioned with respect to the levers in the EY sales and marketing excellence model, shown below, due to their clear alignment of the sales and marketing functions. Ideas for improvement can be found in all sales functions, but implementation of those remains a challenge. A systematic review of key marketing and sales success levers is needed to navigate a digitizing environment.

The EY model provides sales excellence guidance and addresses eight fundamental elements of sales, divided into strategic or operational elements and company- or employee-driven elements. In applying this model as an analytical and optimization tool to various chemical industry segments, successful organizations were found to be significantly stronger in all eight sales elements.

Out of this framework, strategy and voice of customer heavily influence pricing strategy, which is key to achieving sustainable organic growth by capturing maximum value from each customer.

A review of the top 20 chemical players 1 that stated the impact of price on revenues in their business presentations found they were able to pass on to the customer only about one-quarter of any cost of goods increase. Numerous challenges drive this phenomenon, including increasing competition among chemical players, a volatile oil price environment, increasing environmental regulations and the continued commoditization of core products.

In addition, differentiated supply chain models for distinguished product groups are a baseline for proper allocation of production and fulfilment cost. This provides another pricing advantage in a commodity and specialty environment, since it provides real cost per product group and not just averages.

Chemical companies have rarely considered pricing as a top management priority, which explains why the industry has lagged in managing price effectively. In this era of digital transformation, where the customer has increasing access to pricing information and competitors are rapidly advancing their digital capabilities, companies that are slow to act may find it difficult to maintain margins as raw material and freight costs fluctuate.

Related article

It’s only when you truly understand the needs of your customer’s customer that you are able to provide differentiated solutions that stand out from the rest.

However, increasing prices is not always an option, productivity gains can provide a better price position especially for commodity chemicals. Nevertheless, companies that focus on the key pricing strategy levers can outgrow the competition in terms of organic revenue while maintaining a strong bottom line.

- Manage raw material cost fluctuations by using index- or market-based price agreements

- Improve effectiveness of price increases by regularly monitoring price realizations

- Clearly define roles and ownership for the pricing process, including pricing control and transaction profitability

- Adopt dynamic pricing to enhance value-based pricing capabilities

- Align pricing with value for different customer segments based on value perception

- Embrace a digital pricing model to align prices to innovation or value delivered by products and services to monetize innovation

- Apply analytics to understand the price variance for various customers and visibility into transaction profitability

- Drive culture change so that all company employees perceive pricing as a priority issue and a major contributor to revenue growth

Lever 3: Customer-centricity

Technology advances must be embedded into the whole customer experience for chemical companies to evolve in today’s changing consumer world.

As technology advancements enable a better customer experience, the customer needs of end-use industries increase. These dynamics, coupled with intensifying competition, causes business-to-business (B2B) customers to require much more than simply a low-cost product.

They value everything from the speed of delivery, high customization, multichannel buying portals to technologically advanced and environmentally friendly products. Emerging technologies such as artificial intelligence, the Internet of Things, and augmented and virtual reality are beginning to enable solutions to increasing customer expectations.

“Chemical players need to place the customer at the beginning of their value chains — not the end — by aligning customer strategies and priority areas with their own,” said Frank Jenner, EY Global Chemical Industry Leader. “It’s only when you truly understand the needs of your customer’s customer that you are able to provide differentiated solutions that stand out from the rest.”

Satisfying these customers is a business imperative. The EY Commercial Transformation 2019 Survey indicates that 64% of leading manufacturing companies (those with revenue growth between 5% and 15%) are customer-centric.

B2B e-commerce platforms are setting standards of efficiency and speed in delivery, further increasing customer expectations. Lastly, increased demand for green products and the implementation of sustainability-oriented regulations by governments are pushing chemical players to intensify their development of sustainable products and processes.

Developing and implementing a customer-centric strategy requires revisiting the company’s strategy and moving ahead with the customer at the core. This strategy and set of values need to be reflected in the company’s policies and culture. Chemical players need to integrate their external focus areas such as marketing and sales, product enhancement and customer experience with their internal strategy, policies, communication and culture.

There’s also a need for chemical companies to move closer to the customer of their customer. Only then will they be in a position to promptly act or react to demand dynamics (tailored products, reduced time-to-market and cost savings). Such a transition will lead to a win for all participants, but moving out of a pure supplier role will not be easy for chemical companies.

While co-creating products has many upsides, end customers do not want to be locked in with a supplier and unable to switch in an environment of constant price increases and little innovation.

Moving in this direction could entail becoming part of the customer ecosystem, buying data to innovate and provide better service through enhanced AI or apps, or being a user but not necessarily an owner of a platform.

Customer experience services

Generate long-term value and help deliver CX that improves customer engagement, traffic and revenue.

Additionally, digitization can provide key tools to enable customer engagement and add value to the customer experience beyond the product being offered. Like business-to-consumer players, chemical companies need to provide omnichannel sales networks by ramping up e-commerce, both direct and through third parties.

Further, chemical companies can enhance their offering by using machine learning for additional post-sale services, blockchain-protected processes for instilling trust, and data and analytics to help enhance post-sale product performance.

It’s clear that chemical companies need to incorporate their customers’ key focus areas within their medium- to long-term strategies. A consistent customer connection from as early as product development will lead to sales that can enable chemical players to keep pace with their customers’ evolving needs and demands.

“It’s time to understand that customer demand is not just actual or forecast orders,” said Jade Rodysill, EY Americas Consulting Chemicals Leader. “It’s the realization of their buyers’ values matched with innovative, differentiated solutions. Orders then follow.”

Here’s what you should also be thinking about.

- Shift from selling products to innovative selling solutions

- Deliver customer experience through digitalization — CRM platforms, mobility apps, blockchain-enabled transactions, data science and predictive analytics

- Strengthen sales and marketing to realize better pricing, more channels and higher brand initiatives

- Develop more personalized experience via “digital stores”

- Become an ecosystem company rather than a product company

- Offer data-enabled services to customers

- Move to new fit-for-purpose organizational structure to increase customer focus

- Enable customers to deliver differentiating solutions and grow in their markets through innovation

Toward a sustainable future

Chemical leaders must create businesses and cultures that can drive the duality of optimal performance today and innovation for the future.

The challenge for all chemical companies, regardless of size, is to consistently focus on commercial growth in all economic and industrial cycles — upward or downward. A steady focus on sustainable business growth will prove to be a firm’s competitive advantage and enable it to weather challenging times.

Chemical companies need to identify key industry or macro trends that will spur the next wave of growth. For example, meeting rising global demand for food and achieving food security is a UN Sustainable Development Goal. There is a need for strong collaboration and thus a significant opportunity for the energy, fertilizer and agricultural markets to help achieve these objectives.

As chemical companies embark on their transformation journey to accelerate revenue growth through the key growth levers, they should adopt an agile mindset. This can be more challenging than it sounds, because change involves taking people out of their comfort zones (and their current way of working) and pushing them to do things differently. The leadership role becomes most critical in driving that change throughout the organization.

There are various opportunities through which chemical companies can drive a shift in mindset from “traditional” to “agile”:

- From being a manufacturer of products to identifying as a provider of solutions and services that may require manufacturing

- From being broadly risk averse to adopting a risk profile that is fit-for-purpose — being thoughtful but agile

- From having a “do it in-house” mentality to collaborating with various ecosystem participants (e.g., suppliers, customers, universities)

- From defining customer needs by orders to defining their needs by their buyer values and their customers’ buyer values

- From focusing solely on attracting talent to focusing equally on attracting, retaining and developing talent

- From focusing on technology infrastructure too much and too soon in lieu of process and people to becoming business-led, process-driven and technology-enabled

- From having a short-term focus that self-justifies continuous improvement to having a longer-term focus enabling agile transformation

- From rewarding for responding to problems and issues to rewarding for a lack of “noise” — sensing and assessing over responding

- From running safe plays or replicating peer strategies to exploring innovative solutions built on tested, trusted methods and components

Building, accelerating and sustaining momentum across innovation, customer-centricity and pricing levers require companies to be self-critical and self-aware of the traits and tendencies typically displayed in the chemical industry. Such awareness will enable a new mindset that drives agility, individual and business performance and shareholder value.

Show article references

- As per 2018 revenues. Includes only those players that disclosed the impact of prices on their revenues.

Chemical companies need to focus on innovation, pricing strategy and customer centricity simultaneously. Each of these levers relies on strong capabilities in digital, talent and culture, and sustainability, so business leaders will need to think, operate, organize, hire and invest differently.

About this article

Connect with us

Our locations

Do Not Sell or Share My Personal Information

Legal and privacy

Accessibility

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY | Assurance | Consulting | Strategy and Transactions | Tax

EY is a global leader in assurance, consulting, strategy and transactions, and tax services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. For more information about our organization, please visit ey.com.

© EYGM Limited. All Rights Reserved.

EYG/OC/FEA no.

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

Welcome to EY.com

In addition to cookies that are strictly necessary to operate this website, we use the following types of cookies to improve your experience and our services: Functional cookies to enhance your experience (e.g. remember settings), and Performance cookies to measure the website's performance and improve your experience . , and Marketing/Targeting cookies , which are set by third parties, allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with content or service offerings in accordance with your preferences.

We have detected that Do Not Track/Global Privacy Control is enabled in your browser; as a result, Marketing/Targeting cookies , which are set by third parties that allow us to execute marketing campaigns, manage our relationship with you, build a profile of your interests and provide you with the content or service offerings in accordance with your preferences are automatically disabled.

You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website.

Review our cookie policy for more information.

Customize cookies

I decline optional cookies

Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

- S&P Global

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Merger Information

- Stock & Dividends

- Shareholder Services

- Español

- Português

- English (Australia)

- Get Support

- System Notifications

- Delivery Platforms

- Regulatory Engagement

- Commodity Insights Login

- Access IHS Markit Products

Chemical Consulting: Strategy and Business Planning

Deep insight and robust analysis, provided by highly credible and experienced consultants, is crucial to effectively evaluate and determine strategies to establish and maintain growth..

Built on S&P Global reputation for integrity and our extensive industry intellectual capital and proprietary information, our consulting team has developed deep expertise performing business evaluations, to develop and propose strategies that support companies operating at any point across the chemical spectrum. Our strategy team assists clients with major decisions that entail external market and competitive considerations. From pricing, portfolio and procurement assessments, and performance improvement, to determining long term corporate plans; we help organizations formulate strategies that will maximize value.

Combining the unmatched breadth and depth of the information and insight provided in our multi-subscriber databases and reports, with our consultants' first-hand industry experience, we uniquely understand the complex and dynamic chemical industry. S&P Global is equipped to anticipate the risks and opportunities of strategic choices, and provide critical thinking to support companies to progress their most profitable strategic opportunities.

We can help answer:

- How do I pursue a downstream integration strategy?

- What are the most prosperous portfolio and product strategies?

- How do I successfully expand to a new region or entry a new market segment?

- What is the most effective corporate strategy for my company?

- What is the impact of megatrends or external shocks on my strategy?

- What strategic options do we have for maximizing shareholder value?

- What role should inorganic growth play in my strategy?

Our capabilities include:

- Corporate strategy development

- Portfolio optimization strategy

- Market entry strategy

- Diversification strategies

- Capital investment planning

- Price benchmarking and optimization

- Procurement benchmarking and strategy

- Go-to-market planning

- Supply chain design

- Performance improvement and business turnaround

Qualifications and Experience

This list is not exhaustive and is intended to serve as an introduction to Chemical Consulting’s breadth of services offered by S&P Global:

Case Studies

Challenge: A major North American resin supplier engaged Chemical to develop a polyolefin market entry strategy capitalizing on shifting global trade patterns.

Solution: We developed an analysis of the global and regional polyolefin markets to determine the viability of overseas supply to the North American market. The market analysis included the supply, demand and margin environments, detailed market segmentation and the market opportunity for imported resins. A global cost analysis was developed to determine the cost competitiveness of potential polyolefin suppliers. This project also included a detailed analysis of the polyolefin value chain in North America. Key players and prevalent business models were identified with an emphasis on resin producers, plastics converters and distributors. Buying behavior and buyer decision criteria were determined for each end use market segment.

Results: The client received a market entry strategy with various options, including addressable market segments and supplier requirements.

Challenge: A North American packaging resin producer hired Chemical to develop strategic options for maximizing shareholder value.

Solution: We examined the client’s main options, including continuation as a stand-alone company, as well as potential M&A options for enhancing shareholder value. Project analysis included a competitive cost analysis for the North American packaging resin industry, including overseas suppliers to the market. We also developed a detailed analysis of the packaging resin value chain in North America. Key players along the value chain were identified and profiled. Prevalent business models were defined. The packaging resin market was also segmented by major end uses. Market growth, industry trends and competitor positions in each end use market were determined. Competitive positions were determined based on a combination of buyer behavior-oriented bases of competition as well competitive cost position and business portfolio considerations.

Results: Based on the packaging resin industry analysis, a competitive map for the North American packaging resin market was developed. We identified potential industry evolution along alternative paths as well as the implications for shareholder maximization options.

Challenge: A Middle Eastern petrochemical producer engaged Chemical to design a more unified go-to-market approach for its diverse petrochemical and joint venture portfolio.

Solution: We benchmarked the client against leading global marketing and logistics practices.

Results: The client received a recommended go-to-market strategy that better aligned with its competitive market requirements, as well as enabled an extended market reach. We also recommended the client realign its market organization to more effectively conduct sales for the client and its joint venture partners.

Challenge: A global confectionary company hired Chemical to help formulate a response to its narrow and declining supplier base against a background of increasing price volatility for its petrochemical-based raw materials.

Solution: As part of the engagement, we helped the client better understand the nature of the factors driving the supply and demand and pricing of these key raw materials.

Results: Working with the client, we developed a procurement strategy that reduced supply risk, increased the long-term supply base and optimized category spending through a combination of improved contracting structures and practices, as well as the identification of potential alternative suppliers and alternative raw materials.

Challenge: Chemical was retained to examine the financial viability of constructing a world-scale, gas-based petrochemical complex in the Far East of Russia.

Solution: As part of the study, we examined the facilities at three different locations in the Far East of Russia that would deliver product into China, Northeast Asia and the global markets.

Results: We provided the client with a cash flow analysis of potential options and a marketing plan indentifying the optimal mix of sales into each of the regions.

Challenge: An energy company in Southeast Asia/Oceania hired Chemical to provide a systematic and strategic master plan that identified midstream and downstream opportunities tied to natural gas.

Solution: We analyzed target markets, project descriptions, estimated economic returns, capital requirements and joint venture and alliance opportunities.

Results: The client received a study comparing and recommending multiple products over several years.

You may be interested in

Chemical Consulting: Commercial and Feasibility Studies

Chemical Consulting: Transaction and M&A Support

Chemical Consulting: Litigation and Expert Witness

Chemical Consulting: Commercial Renewables

Chemical Consulting: Technology

Ammonium Sulfate - Chemical Economics Handbook (CEH)

Specialty Adhesives and Sealants - Specialty Chemicals Update Program (SCUP)

Catalysts Emission Control - Specialty Chemicals Update Program (SCUP)

Thermoplastics, High-Performance - Specialty Chemicals Update Program (SCUP)

Coatings, Radiation Curable - Specialty Chemicals Update Program (SCUP)

Lubricants, Synthetic - Specialty Chemicals Update Program (SCUP)

Coatings, Thermosetting Powder - Specialty Chemicals Update Program (SCUP)

Chlorobenzenes - Chemical Economics Handbook (CEH)

Cresols, Xylenols and Cresylic Acids - Chemical Economics Handbook (CEH)

Dimethylterephthalate (DMT) and Terephthalic Acid (TPA) - Chemical Economics Handbook (CEH)

Energy - Chemical Economics Handbook (CEH)

Expandable Polystyrene - Chemical Economics Handbook (CEH)

Linear Alkylbenzene Sulfonic Acid (LABSA)/Linear Alkylate Sulfonate (LAS) - Chemical Economics Handbook (CEH)

Chemical Trading Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Chemical Sector

Are you about starting a chemical trading company? If YES, here is a complete sample chemical trading business plan template & feasibility report you can use for FREE .

Okay, so we have considered all the requirements for starting a chemical trading company. We also took it further by analyzing and drafting a sample chemical trading marketing plan template backed up by actionable guerrilla marketing ideas for chemical trading companies. So let’s proceed to the business planning section.

Interested in making money as an aspiring entrepreneur? Then, you should consider starting a chemical trading business. Those who are involved in chemical trading purchase and resell chemicals and allied products.

It is important to state that the chemical industry is a very delicate industry hence proper training is required if you want to do business in the industry. As a matter of fact, you would need chemical handling permits and other relevant permits before you can be legally allowed to go into the trading of chemicals.

If you are sure that this type of business is what you truly want to do after you must have conducted your market research and feasibility studies.

The next step is to write a good business plan; a detailed blueprint of how you intend raising your capital, setting up the business, managing the flow of the business, sorting out tax and marketing your services amongst others. Below is a sample chemical trading business plan template that will help you to successfully write your own.

A Sample Chemical Trading Business Plan Template

1. industry overview.

Chemical trading business is part of the chemical wholesaling industry and players in this industry wholesale chemicals and related products, including compressed gas, chemical additives and synthetic rubber, to the manufacturing, construction and mining industries.

This industry does not wholesale agricultural or medicinal chemicals, paints or varnishes, fireworks or plastics materials.

If you are conversant with happenings in the Chemical Wholesaling industry, you will agree that the Chemical Wholesaling industry plays an important role in the chemical supply chain. The construction and manufacturing sectors are the key customers of chemical wholesalers and, as a result, their production levels largely determine industry demand.

As overall conditions have improved in the US economy, downstream demand has grown, boosting industry production over the five years to 2017. Looking ahead, the industry is projected to experience strong demand from the manufacturing and construction sectors, which, in conjunction with recovering oil prices, will drive up revenue.

The Chemical Wholesaling industry is indeed a large industry and pretty much active in most countries of the world most especially in the united states of America, Taiwan, Japan, China, Germany and India et al.

Statistics has it that in the United States of America alone, there are about 8,734 registered and licensed chemical trading cum wholesaling companies scattered all across the United States responsible for employing about 127,480 people and the industry rakes in a whopping sum of $177 billion annually.

The industry is projected to enjoy -0.7 percent annual growth within 2012 and 2017. It is important to state that no company has the lion share of the available market in this industry.

Research carried out by IBISWorld indicates that the industry is in the mature phase of its life cycle. While newer technologies enable a more efficient distribution process, there are few new developments that could push the industry back into the growth phase.

Additionally, the report shows that the industry’s key buying markets remain in the manufacturing sector (e.g. chemical and construction material manufacturers).

In the 10 years to 2022, industry value added (IVA), or the industry’s contribution to the overall economy, is expected to increase at an annualized rate of 2.1 percent. GDP is expected to increase at an annualized 2.0 percent over the same period, indicating that the industry is growing at roughly the same rate as the economy as a whole.

Over and above, the chemical wholesaling industry is a profitable industry and it is open for any aspiring entrepreneur to come in and establish his or her business; you can choose to start on a small scale or you can choose to start on a large scale servicing a wide range of clientele not only in the United States’ market space, but exporting to other countries of the world.

2. Executive Summary

Parsley Rowlands® Chemicals Trading Co, Inc. is a registered chemical trading company that will be located in Dover – Delaware; in an ideal location, highly suitable for the kind of business we want to establish.

We have been able to secure a long-term lease for a facility in a strategic location with an option of a long-term renewal on terms and conditions that are favorable to us. The facility has government approval for the kind of chemical trading business we want to run and the facility is easily accessible.

Parsley Rowlands® Chemicals Trading Co, Inc. will be involved in trading cum wholesaling chemicals such as alkalies and chlorine, industrial gases, detergents and soaps, biofuels, adhesives, automotive chemicals and other organic and inorganic chemicals.

We are set to service a wide range of clientele in and around Dover – Delaware and throughout the United States of America.

We are aware that there are several chemical trading companies all around the United States of America, which is why we spent time and resources to conduct thorough feasibility studies and market survey so as to be positioned to favorably compete with all our competitors.

Parsley Rowlands® Chemicals Trading Co, Inc. will at all times demonstrate her commitment to sustainability, both individually and as a firm by actively participating in our communities and integrating sustainable business practices wherever possible.

We will ensure that we hold ourselves accountable to the highest standards by meeting our customers’ needs precisely and completely whenever they patronize our products.

Parsley Rowlands® Chemicals Trading Co, Inc. will ensure that all our customers are given first class treatment whenever they visit our warehouse. We have a CRM software that will enable us manage a one on one relationship with our customers no matter how large they may grow to.

We will ensure that we get our customers involved when making some business decisions that will directly or indirectly affect them.

Parsley Rowlands® Chemicals Trading Co, Inc. is a family business that is owned by Parsley Rowlands and his immediate family members. Parsley Rowlands has a Degree in Business Administration, with over 10 years’ experience in the chemical wholesaling industry .

3. Our Products and Services

Parsley Rowlands® Chemicals Trading Co, Inc. is in the chemical wholesaling industry to service a wide range of clients and of course to make profits, which is why we will ensure we go all the way to give our clients and potential clients options.

We will do all that is permitted by the law of the United States to achieve our business goal. Our product offerings are listed below;

- Wholesaling acids

- Wholesaling chemical additives (e.g. concrete, food, fuel and oil)

- Wholesaling compressed gases (except liquefied petroleum gas)

- Wholesaling explosives (except ammunition and fireworks)

- Wholesaling industrial chemicals

- Wholesaling laundry soap, chips and powder

- Wholesaling oil additives

- Wholesaling resins and synthetic rubber

- Wholesaling sulfuric acid

- Wholesaling synthetic rubber

4. Our Mission and Vision Statement

- Our vision is to become one of the leading brands in the chemical wholesaling industry not just in Dover – Delaware but in the whole of the United States of America.

- Our mission is to establish a one stop chemical trading company that will become a major distributor for topflight chemical products manufacturing companies in the United States of America.

Our Business Structure

Parsley Rowlands® Chemicals Trading Co, Inc. do not intend to start a chemical trading business like the usual mom and pop business; our intention of starting a chemical trading company is to build a standard business whose business influence will transcend Dover – Delaware to other States in the US and of course other countries of the world.

We will ensure that we put the right structures in place that will support the kind of growth that we have in mind while setting up the business. We will ensure that we hire people that are qualified, honest, customer centric and are ready to work to help us build a prosperous business that will benefit all the stakeholders.

As a matter of fact, profit-sharing arrangement will be made available to all our senior management staff and it will be based on their performance for a period of ten years or more. In view of that, we have decided to hire qualified and competent hands to occupy the following positions;

- Chief Executive Officer (Owner)

- Shop Manager

- Human Resources and Admin Manager

Sales and Marketing Manager

Merchandize Manager

- Accountants/Cashiers

- Customer Service Executive

- Distributors/Truck Drivers

5. Job Roles and Responsibilities

Chief Executive Officer – CEO:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results; developing incentives; developing a climate for offering information and opinions.

- Responsible for fixing prices and signing business deals

- In control of providing direction for the business

- Creates, communicates, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

Admin and HR Manager

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out induction for new team members

- Responsible for training, evaluation and assessment of employees

- In charge of arranging travel, meetings and appointments

- Oversees the smooth running of the daily office activities.

Store/Warehouse Manager:

- Responsible for overseeing the smooth running of the chemical trading store/warehouse

- Responsible for managing the daily activities in the store

- Ensures that proper records of goods are kept and warehouse does not run out of products

- Ensures that the store facility is in tip top shape and goods are properly arranged and easy to locate

- Ensures that the warehouse meets the expected safety and health standard at all times.

- Controls chemicals distribution and supply inventory

- Supervises the workforce in the warehouse / store

- Manages external research and coordinate all the internal sources of information to retain the organizations’ best customers and attract new ones

- Models demographic information and analyze the volumes of transactional data generated by customer purchases

- Identify, prioritize, and reach out to new partners, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts; participates in the structuring and financing of projects; assures the completion of development projects.

- Responsible for supervising implementation, advocate for the customer’s needs, and communicate with clients

- Develops, executes and evaluates new plans for expanding sales

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps to increase sales and growth for the company

- Manages vendor relations, market visits, and the ongoing education and development of the organizations’ buying teams

- Helps to ensure consistent quality of chemicals in our warehouse / store

- Responsible for the purchase of goods and products for the organizations

- Responsible for planning sales, monitoring inventory, selecting the merchandise, and writing and pricing orders to vendors

Accountant/Cashier:

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, development budgets, and accounting reports; analyzes financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensuring compliance with taxation legislation

- Handles all financial transactions for the organization

- Serves as internal auditor for the organization

Distribution Truck Drivers

- Assists in loading and unloading chemicals meant for distribution

- Maintains a logbook of their driving activities to ensure compliance with federal regulations governing the rest and work periods for operators.

- Keeps a record of vehicle inspections and make sure the truck is equipped with safety equipment

- Assists the transport and logistics manager in planning their route according to a delivery schedule.

- Inspect vehicles for mechanical items and safety issues and perform preventative maintenance

- Complies with truck driving rules and regulations (size, weight, route designations, parking, break periods etc.) as well as with company policies and procedures

- Collects and verifies delivery instructions

- Reports defects, accidents or violations

Client Service Executive

- Welcomes guests and clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the manager in an effective and timely manner

- Consistently stays abreast of any new information on the company’s products, promotional campaigns etc. to ensure accurate and helpful information is supplied to clients

- Receives parcels/documents for the company

- Distributes mails in the organization

6. SWOT Analysis

Parsley Rowlands® Chemicals Trading Co, Inc. is in business to become one of the leading chemical trading companies in the whole of Dover – Delaware and we are fully aware that it will take the right business concept, management and organizational structure to achieve our goal.

We are quite aware that there are several chemical wholesaling cum trading companies all over the United States of America and even in the same location where we intend locating ours, which is why we are following the due process of establishing a business.

We know that if a proper SWOT analysis is conducted for our business, we will be able to position our business to maximize our strength, leverage on the opportunities that will be available to us, mitigate our risks and be welled equipped to confront our threats.

Parsley Rowlands® Chemicals Trading Co, Inc. employed the services of an expert HR and Business Analyst with bias in wholesaling business to help us conduct a thorough SWOT analysis and to help us create a Business model that will help us achieve our business goals and objectives. This is the summary of the SWOT analysis that was conducted for Parsley Rowlands® Chemicals Trading Co, Inc.;

Part of what is going to count as positives for Parsley Rowlands® Chemicals Trading Co, Inc. is the vast experience of our management team; we have people on board who understand how to grow business from the scratch to becoming a national phenomenon.

So also, our large distribution network and of course our excellent customer service culture will definitely count as a strong strength for the business.

A major weakness that may count against us is the fact that we are a new chemical trading company and we don’t have the financial capacity to engage in the kind of publicity that we intend giving the business especially when big names are already determining the direction of the market both in the United States and in the global market.

- Opportunities:

The opportunities for chemical trading companies are enormous. This is because chemical products are used in our daily life.

As a result of that, we were able to conduct a thorough market survey and feasibility studies so as to position our business to take advantage of the existing market and also to create our own new market. We know that it is going to require hard work, and we are determined to achieve it.

We are quite aware that one of the major threats that we are likely going to face is economic downturn and unfavorable government policies . Another threat that may likely confront us is the arrival of a new chemical trading company in same location where ours is located.

7. MARKET ANALYSIS

- Market Trends

If you are conversant with the trends in the Chemical Wholesaling industry, you will agree that the industry has benefited from improved industrial activity over the last half a decade. Revenue from generic chemicals and related products has been falling due to product standardization, with increasing competition from low-cost, low-priced imports produced in China and elsewhere.

Economic recovery and increasing manufacturing activity have helped boost chemical sales. Operators have altered their current business procedures to correspond with new laws and profit margins. On the other hand, the chemicals and similar products segment has been growing steadily and its sales are becoming more significant to the overall performance of the industry.

Precision-turned products are high in demand in the pharmaceutical production industry, as well as agriculture, medical manufacturing and other applications. In the coming years, the industry is expected to benefit from persistent demand for chemicals by downstream markets and from rising world chemical prices.

The chemical wholesaling landscape has seen tremendous changes in the last 20 years; it has grown from the smaller enterprise to a more organized and far reaching chemical trading company. This trend has benefited them in such a way that they can comfortably sell their chemicals and related products nationally and also export them to other countries of the world.

8. Our Target Market

It will be safe to submit that the chemical wholesaling industry has the widest range of customers as chemicals and related products are used in various industries. In view of that, we have positioned our chemical trading company to service a wide range of clientele in and all around Dover – Delaware and every other location where we intend distributing our products.

We have conducted our market research and feasibility studies and we have ideas of what our target market would be expecting from us. We are in business to trade a wide range of chemicals and related products for the following clients;

- Chemical retailers

- Paint manufacturing companies

- Pesticide manufacturing companies

- Pharmaceutical manufacturing companies

- Celluloid and film production companies

- Inorganic fertilizer manufacturing companies

- Cosmetics and beauty care manufacturing companies

Our Competitive Advantage

A close study of the chemical wholesaling industry reveals that the market has become much more intensely competitive over the last decade. As a matter of fact, you have to be highly creative, customer centric and proactive if you must survive in this industry.

We are aware of the competition and we are prepared to compete favorably with other leading chemical trading companies in Dover – Delaware and throughout the United States of America.

Parsley Rowlands® Chemicals Trading Co, Inc. is launching a standard chemical trading company that will become the preferred choice of businesses in Dover – Delaware. Our chemical trading company is located in an ideal property highly suitable for the kind of manufacturing company that we want to run.

Part of our competitive advantages are guaranteed supply of key inputs, we have robust links with suppliers and we have a loyal customer base cum far reaching national distribution network.

One thing is certain; we will ensure that we trade in a wide range of chemicals to meet international standards. One of our business goal is to make Parsley Rowlands® Chemicals Trading Co, Inc. a one stop chemical trading company for both cottage companies and chemical retailing stores.

Our excellent customer service culture, online store, various payment options and highly secured facility will serve as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

We will also give good working conditions and commissions to freelance sales agents that we will recruit from time to time.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Parsley Rowlands® Chemicals Trading Co, Inc. is in business to trade a wide range of chemicals to clients in the United States of America.

We are in the chemical wholesaling industry to maximize profits and we are going to go all the way out to ensure that we achieve or business goals and objectives. Parsley Rowlands® Chemicals Trading Co, Inc. will generate income by engaging in;

10. Sales Forecast

When it comes to the chemical trading business, if your warehouse is well located and you have good business network, you will always attract customers cum sales that will sure translate to increase in revenue generation.

We are well positioned to take on the available market in the United States of America and we are quite optimistic that we will meet our set target of generating enough profits from the first six months of operation and grow the business and our clientele base beyond Dover – Delaware to other states in the United States of America.

We have been able to critically examine the chemical wholesaling industry, we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. The sales projections are based on information gathered on the field and some assumptions that are peculiar to startups in the United States of America.

- First Fiscal Year: $250,000

- Second Fiscal Year: $650,000

- Third Fiscal Year: $900,000

N.B : This projection was done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and there won’t be any major competitor wholesaling same products as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

Prior to choosing a location to establish Parsley Rowlands® Chemicals Trading Co, Inc. we conducted thorough market survey and feasibility studies in order for us to penetrate the available market and become the preferred choice for stakeholders in and around Dover – Delaware.

We have detailed information and data that we were able to utilize to structure our business to attract the number of customers we want to attract per time.

We hired experts who have good understanding of the chemical wholesaling industry to help us develop marketing strategies that will help us achieve our business goal of winning a larger percentage of the available market in Dover – Delaware and throughout the United States of America.

In summary, Parsley Rowlands® Chemicals Trading Co, Inc. will adopt the following sales and marketing approach to win customers over;

- Introduce our chemical trading company by sending introductory letters alongside our brochure to key stake holders in and around Dover – Delaware and parts of the United States

- Ensure that we distribute a wide range of chemicals and related products

- Make use of attractive hand bills to create awareness and also to give direction to our warehouse

- Position our signage / flexi banners at strategic places around Dover – Delaware

- Position our greeters to welcome and direct potential customers

- Create a loyalty plan that will enable us reward our regular customers

- List our business and products on yellow pages ads (local directories)

- Leverage on the internet to promote our business

- Engage in direct marketing and sales

- Encourage the use of Word of mouth marketing (referrals)

- Join local chambers of commerce and industries with the aim of networking and marketing our products

11. Publicity and Advertising Strategy

Regardless of the fact that our chemical trading company is well located, we will still go ahead to intensify publicity for the business. We are going to explore all available means to promote our company.

Parsley Rowlands® Chemicals Trading Co, Inc. has a long – term plan of opening warehouse outlets in various locations around Delaware and key cities in the United States which is why we will deliberately build our brand to be well accepted in Delaware before venturing out.

Here are the platforms we intend leveraging on to promote and advertise Parsley Rowlands® Chemicals Trading Co, Inc.;

- Place adverts on community based newspapers, radio and TV stations.