Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Commerce Bank Case Analysis and Case Solution

Posted by Peter Williams on Aug-09-2018

Introduction of Commerce Bank Case Solution

The Commerce Bank case study is a Harvard Business Review case study, which presents a simulated practical experience to the reader allowing them to learn about real life problems in the business world. The Commerce Bank case consisted of a central issue to the organization, which had to be identified, analysed and creative solutions had to be drawn to tackle the issue. This paper presents the solved Commerce Bank case analysis and case solution. The method through which the analysis is done is mentioned, followed by the relevant tools used in finding the solution.

The case solution first identifies the central issue to the Commerce Bank case study, and the relevant stakeholders affected by this issue. This is known as the problem identification stage. After this, the relevant tools and models are used, which help in the case study analysis and case study solution. The tools used in identifying the solution consist of the SWOT Analysis, Porter Five Forces Analysis, PESTEL Analysis, VRIO analysis, Value Chain Analysis, BCG Matrix analysis, Ansoff Matrix analysis, and the Marketing Mix analysis. The solution consists of recommended strategies to overcome this central issue. It is a good idea to also propose alternative case study solutions, because if the main solution is not found feasible, then the alternative solutions could be implemented. Lastly, a good case study solution also includes an implementation plan for the recommendation strategies. This shows how through a step-by-step procedure as to how the central issue can be resolved.

Problem Identification of Commerce Bank Case Solution

Harvard Business Review cases involve a central problem that is being faced by the organization and these problems affect a number of stakeholders. In the problem identification stage, the problem faced by Commerce Bank is identified through reading of the case. This could be mentioned at the start of the reading, the middle or the end. At times in a case analysis, the problem may be clearly evident in the reading of the HBR case. At other times, finding the issue is the job of the person analysing the case. It is also important to understand what stakeholders are affected by the problem and how. The goals of the stakeholders and are the organization are also identified to ensure that the case study analysis are consistent with these.

Analysis of the Commerce Bank HBR Case Study

The objective of the case should be focused on. This is doing the Commerce Bank Case Solution. This analysis can be proceeded in a step-by-step procedure to ensure that effective solutions are found.

- In the first step, a growth path of the company can be formulated that lays down its vision, mission and strategic aims. These can usually be developed using the company history is provided in the case. Company history is helpful in a Business Case study as it helps one understand what the scope of the solutions will be for the case study.

- The next step is of understanding the company; its people, their priorities and the overall culture. This can be done by using company history. It can also be done by looking at anecdotal instances of managers or employees that are usually included in an HBR case study description to give the reader a real feel of the situation.

- Lastly, a timeline of the issues and events in the case needs to be made. Arranging events in a timeline allows one to predict the next few events that are likely to take place. It also helps one in developing the case study solutions. The timeline also helps in understanding the continuous challenges that are being faced by the organisation.

SWOT analysis of Commerce Bank

An important tool that helps in addressing the central issue of the case and coming up with Commerce Bank HBR case solution is the SWOT analysis.

- The SWOT analysis is a strategic management tool that lists down in the form of a matrix, an organisation's internal strengths and weaknesses, and external opportunities and threats. It helps in the strategic analysis of Commerce Bank.

- Once this listing has been done, a clearer picture can be developed in regards to how strategies will be formed to address the main problem. For example, strengths will be used as an advantage in solving the issue.

Therefore, the SWOT analysis is a helpful tool in coming up with the Commerce Bank Case Study answers. One does not need to remain restricted to using the traditional SWOT analysis, but the advanced TOWS matrix or weighted average SWOT analysis can also be used.

Porter Five Forces Analysis for Commerce Bank

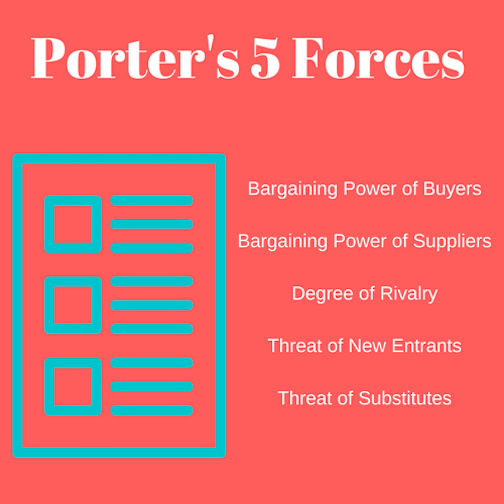

Another helpful tool in finding the case solutions is of Porter's Five Forces analysis. This is also a strategic tool that is used to analyse the competitive environment of the industry in which Commerce Bank operates in. Analysis of the industry is important as businesses do not work in isolation in real life, but are affected by the business environment of the industry that they operate in. Harvard Business case studies represent real-life situations, and therefore, an analysis of the industry's competitive environment needs to be carried out to come up with more holistic case study solutions. In Porter's Five Forces analysis, the industry is analysed along 5 dimensions.

- These are the threats that the industry faces due to new entrants.

- It includes the threat of substitute products.

- It includes the bargaining power of buyers in the industry.

- It includes the bargaining power of suppliers in an industry.

- Lastly, the overall rivalry or competition within the industry is analysed.

This tool helps one understand the relative powers of the major players in the industry and its overall competitive dynamics. Actionable and practical solutions can then be developed by keeping these factors into perspective.

PESTEL Analysis of Commerce Bank

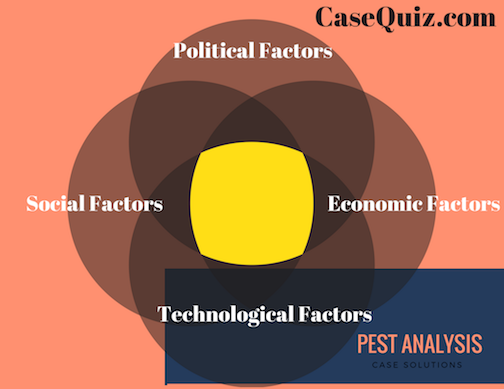

Another helpful tool that should be used in finding the case study solutions is the PESTEL analysis. This also looks at the external business environment of the organisation helps in finding case study Analysis to real-life business issues as in HBR cases.

- The PESTEL analysis particularly looks at the macro environmental factors that affect the industry. These are the political, environmental, social, technological, environmental and legal (regulatory) factors affecting the industry.

- Factors within each of these 6 should be listed down, and analysis should be made as to how these affect the organisation under question.

- These factors are also responsible for the future growth and challenges within the industry. Hence, they should be taken into consideration when coming up with the Commerce Bank case solution.

VRIO Analysis of Commerce Bank

This is an analysis carried out to know about the internal strengths and capabilities of Commerce Bank. Under the VRIO analysis, the following steps are carried out:

- The internal resources of Commerce Bank are listed down.

- Each of these resources are assessed in terms of the value it brings to the organization.

- Each resource is assessed in terms of how rare it is. A rare resource is one that is not commonly used by competitors.

- Each resource is assessed whether it could be imitated by competition easily or not.

- Lastly, each resource is assessed in terms of whether the organization can use it to an advantage or not.

The analysis done on the 4 dimensions; Value, Rareness, Imitability, and Organization. If a resource is high on all of these 4, then it brings long-term competitive advantage. If a resource is high on Value, Rareness, and Imitability, then it brings an unused competitive advantage. If a resource is high on Value and Rareness, then it only brings temporary competitive advantage. If a resource is only valuable, then it’s a competitive parity. If it’s none, then it can be regarded as a competitive disadvantage.

Value Chain Analysis of Commerce Bank

The Value chain analysis of Commerce Bank helps in identifying the activities of an organization, and how these add value in terms of cost reduction and differentiation. This tool is used in the case study analysis as follows:

- The firm’s primary and support activities are listed down.

- Identifying the importance of these activities in the cost of the product and the differentiation they produce.

- Lastly, differentiation or cost reduction strategies are to be used for each of these activities to increase the overall value provided by these activities.

Recognizing value creating activities and enhancing the value that they create allow Commerce Bank to increase its competitive advantage.

BCG Matrix of Commerce Bank

The BCG Matrix is an important tool in deciding whether an organization should invest or divest in its strategic business units. The matrix involves placing the strategic business units of a business in one of four categories; question marks, stars, dogs and cash cows. The placement in these categories depends on the relative market share of the organization and the market growth of these strategic business units. The steps to be followed in this analysis is as follows:

- Identify the relative market share of each strategic business unit.

- Identify the market growth of each strategic business unit.

- Place these strategic business units in one of four categories. Question Marks are those strategic business units with high market share and low market growth rate. Stars are those strategic business units with high market share and high market growth rate. Cash Cows are those strategic business units with high market share and low market growth rate. Dogs are those strategic business units with low market share and low growth rate.

- Relevant strategies should be implemented for each strategic business unit depending on its position in the matrix.

The strategies identified from the Commerce Bank BCG matrix and included in the case pdf. These are either to further develop the product, penetrate the market, develop the market, diversification, investing or divesting.

Ansoff Matrix of Commerce Bank

Ansoff Matrix is an important strategic tool to come up with future strategies for Commerce Bank in the case solution. It helps decide whether an organization should pursue future expansion in new markets and products or should it focus on existing markets and products.

- The organization can penetrate into existing markets with its existing products. This is known as market penetration strategy.

- The organization can develop new products for the existing market. This is known as product development strategy.

- The organization can enter new markets with its existing products. This is known as market development strategy.

- The organization can enter into new markets with new products. This is known as a diversification strategy.

The choice of strategy depends on the analysis of the previous tools used and the level of risk the organization is willing to take.

Marketing Mix of Commerce Bank

Commerce Bank needs to bring out certain responses from the market that it targets. To do so, it will need to use the marketing mix, which serves as a tool in helping bring out responses from the market. The 4 elements of the marketing mix are Product, Price, Place and Promotions. The following steps are required to carry out a marketing mix analysis and include this in the case study analysis.

- Analyse the company’s products and devise strategies to improve the product offering of the company.

- Analyse the company’s price points and devise strategies that could be based on competition, value or cost.

- Analyse the company’s promotion mix. This includes the advertisement, public relations, personal selling, sales promotion, and direct marketing. Strategies will be devised which makes use of a few or all of these elements.

- Analyse the company’s distribution and reach. Strategies can be devised to improve the availability of the company’s products.

Commerce Bank Blue Ocean Strategy

The strategies devised and included in the Commerce Bank case memo should have a blue ocean strategy. A blue ocean strategy is a strategy that involves firms seeking uncontested market spaces, which makes the competition of the company irrelevant. It involves coming up with new and unique products or ideas through innovation. This gives the organization a competitive advantage over other firms, unlike a red ocean strategy.

Competitors analysis of Commerce Bank

The PESTEL analysis discussed previously looked at the macro environmental factors affecting business, but not the microenvironmental factors. One of the microenvironmental factors are competitors, which are addressed by a competitor analysis. The Competitors analysis of Commerce Bank looks at the direct and indirect competitors within the industry that it operates in.

- This involves a detailed analysis of their actions and how these would affect the future strategies of Commerce Bank.

- It involves looking at the current market share of the company and its competitors.

- It should compare the marketing mix elements of competitors, their supply chain, human resources, financial strength etc.

- It also should look at the potential opportunities and threats that these competitors pose on the company.

Organisation of the Analysis into Commerce Bank Case Study Solution

Once various tools have been used to analyse the case, the findings of this analysis need to be incorporated into practical and actionable solutions. These solutions will also be the Commerce Bank case answers. These are usually in the form of strategies that the organisation can adopt. The following step-by-step procedure can be used to organise the Harvard Business case solution and recommendations:

- The first step of the solution is to come up with a corporate level strategy for the organisation. This part consists of solutions that address issues faced by the organisation on a strategic level. This could include suggestions, changes or recommendations to the company's vision, mission and its strategic objectives. It can include recommendations on how the organisation can work towards achieving these strategic objectives. Furthermore, it needs to be explained how the stated recommendations will help in solving the main issue mentioned in the case and where the company will stand in the future as a result of these.

- The second step of the solution is to come up with a business level strategy. The HBR case studies may present issues faced by a part of the organisation. For example, the issues may be stated for marketing and the role of a marketing manager needs to be assumed. So, recommendations and suggestions need to address the strategy of the marketing department in this case. Therefore, the strategic objectives of this business unit (Marketing) will be laid down in the solutions and recommendations will be made as to how to achieve these objectives. Similar would be the case for any other business unit or department such as human resources, finance, IT etc. The important thing to note here is that the business level strategy needs to be aligned with the overall corporate strategy of the organisation. For example, if one suggests the organisation to focus on differentiation for competitive advantage as a corporate level strategy, then it can't be recommended for the Commerce Bank Case Study Solution that the business unit should focus on costs.

- The third step is not compulsory but depends from case to case. In some HBR case studies, one may be required to analyse an issue at a department. This issue may be analysed for a manager or employee as well. In these cases, recommendations need to be made for these people. The solution may state that objectives that these people need to achieve and how these objectives would be achieved.

The case study analysis and solution, and Commerce Bank case answers should be written down in the Commerce Bank case memo, clearly identifying which part shows what. The Commerce Bank case should be in a professional format, presenting points clearly that are well understood by the reader.

Alternate solution to the Commerce Bank HBR case study

It is important to have more than one solution to the case study. This is the alternate solution that would be implemented if the original proposed solution is found infeasible or impossible due to a change in circumstances. The alternate solution for Commerce Bank is presented in the same way as the original solution, where it consists of a corporate level strategy, business level strategy and other recommendations.

Implementation of Commerce Bank Case Solution

The case study does not end at just providing recommendations to the issues at hand. One is also required to provide how these recommendations would be implemented. This is shown through a proper implementation framework. A detailed implementation framework helps in distinguishing between an average and an above average case study answer. A good implementation framework shows the proposed plan and how the organisations' resources would be used to achieve the objectives. It also lays down the changes needed to be made as well as the assumptions in the process.

- A proper implementation framework shows that one has clearly understood the case study and the main issue within it.

- It shows that one has been clarified with the HBR fundamentals on the topic.

- It shows that the details provided in the case have been properly analysed.

- It shows that one has developed an ability to prioritise recommendations and how these could be successfully implemented.

- The implementation framework also helps by removing out any recommendations that are not practical or actionable as these could not be implemented. Therefore, the implementation framework ensures that the solution to the Commerce Bank Harvard case is complete and properly answered.

Recommendations and Action Plan for Commerce Bank case analysis

For Commerce Bank, based on the SWOT Analysis, Porter Five Forces Analysis, PESTEL Analysis, VRIO analysis, Value Chain Analysis, BCG Matrix analysis, Ansoff Matrix analysis, and the Marketing Mix analysis, the recommendations and action plan are as follows:

- Commerce Bank should focus on making use of its strengths identified from the VRIO analysis to make the most of the opportunities identified from the PESTEL.

- Commerce Bank should enhance the value creating activities within its value chain.

- Commerce Bank should invest in its stars and cash cows, while getting rid of the dogs identified from the BCG Matrix analysis.

- To achieve its overall corporate and business level objectives, it should make use of the marketing mix tools to obtain desired results from its target market.

Baron, E. (2015). How They Teach the Case Method At Harvard Business School. Retrieved from https://poetsandquants.com/2015/09/29/how-they-teach-the-case-method-at-harvard-business-school/

Bartol. K, & Martin, D. (1998). Management, 3rd edition. Boston: Irwin McGrawHill.

Free Management E-Books. (2013a). PESTLE Analysis. Retrieved from http://www.free-management-ebooks.com/dldebk-pdf/fme-pestle-analysis.pdf

Gupta, A. (2013). Environment & PEST analysis: an approach to the external business environment. International Journal of Modern Social Sciences, 2(1), 34-43.

Hambrick, D. C., MacMillan, I. C., & Day, D. L. (1982). Strategic attributes and performance in the BCG matrix—A PIMS-based analysis of industrial product businesses. Academy of Management Journal, 25(3), 510-531.

Hill, C., & Jones, G. (2010). Strategic Management Theory: An Integrated Approach, Ninth Ed. Mason, OH: South-Western, Cengage Learning.

Hussain, S., Khattak, J., Rizwan, A., & Latif, M. A. (2013). ANSOFF matrix, environment, and growth-an interactive triangle. Management and Administrative Sciences Review, 2(2), 196-206.

IIBMS. (2015). 7 Effective Steps to Solve Case Study. Retrieved from http://www.iibms.org/c-7-effective-steps-to-solve-case-study/

Kim, W. C., & Mauborgne, R. (2004). Blue ocean strategy. If you read nothing else on strategy, read thesebest-selling articles., 71.

Kotler, P., & Armstrong, G. (2010). Principles of marketing. Pearson education.

Kulkarni, N. (2018). 8 Tips to Help You Prepare for the Case Method. Retrieved from https://www.hbs.edu/mba/blog/post/8-tips-to-help-you-prepare-for-the-case-method

Lin, C., Tsai, H. L., Wu, Y. J., & Kiang, M. (2012). A fuzzy quantitative VRIO-based framework for evaluating organizational activities. Management Decision, 50(8), 1396-1411.

Nixon, J., & Helms, M. M. (2010). Exploring SWOT analysis – where are we now?: A review of academic research from the last decade. Journal of Strategy and Management, 3(3), 215-251.

Panagiotou, G. (2003). Bringing SWOT into Focus. Business Strategy Review, 14(2), 8-10.

Pickton, D. W., & Wright, S. (1998). What's swot in strategic analysis? Strategic Change, 7(2), 101-109.

Porter, M. E. (2001). The value chain and competitive advantage. Understanding Business Processes, 50-66.

Porter, M. E. (1985). Competitive advantage: creating and sustaining superior performance (Vol. 2). New York: Free Press.

Porter, M.E. (1979, March). Harvard Business Review: Strategic Planning, How Competitive Forces Shape Strategy. Retrieved July 7, 2016, from https://hbr.org/1979/03/how-competitive-forces-shape-strategy

Rastogi, N., & Trivedi, M. K. (2016). PESTLE Technique–a Tool to Identify External Risks in Construction Projects. International Research Journal of Engineering and Technology (IRJET), 3(1), 384-388.

Rauch, P. (2007). SWOT analyses and SWOT strategy formulation for forest owner cooperations in Austria. European Journal of Forest Research, 126(3), 413-420.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here .

9410 Students can’t be wrong

PhD Experts

Amber Reginald

It’s really a great service. Thanks!

Ignore all negative reviews concerning this service because these are fake. This is a good and affordable service & I’m honest.

Delivery was on time. Prices were affordable. I scanned the assignment through plagiarism checker and found no plagiarism. Highly recommended service!

Megon Samuel

I needed help with my assignment and ordered this service. The paper was perfectly explained. Thank you!

Calculate the Price

(approx ~ 0.0 page), total price $0, next articles.

- Providian Trust: Tradition And Technology (A) Case Analysis

- Pilgrim Bank (A): Customer Profitability Case Analysis

- Innovation At Progressive (A): Pay As You Go Insurance Case Analysis

- Lotus MarketPlace: Households Case Analysis

- ING Direct Canada Case Analysis

- Charles Schwab Corp. (A), Spanish Version Case Analysis

- Bank Of America (A) Case Analysis

- Pilgrim Bank (B): Customer Retention, Spanish Version Case Analysis

- FleetBoston Financial: Online Banking, Portuguese Version Case Analysis

- Paul Revere Insurance Co. (C): Competing For The Baldrige Award The Malcolm Baldrige National Quality Award Exercise Case Analysis

Previous Articles

- Tong Yang Cement (A): Logistics And Incentives Case Analysis

- Rating Environmental Performance In The Building Industry: Leadership In Energy And Environmental Design (LEED) Case Analysis

- CEMEX: Global Growth Through Superior Information Capabilities (Abridged) Case Analysis

- U.S. Plastic Lumber Case Analysis

- Unicon Concrete Products (H.K.) Ltd. Case Analysis

- New Technology Adoption At Century Real Estate Case Analysis

- Rockwell Automation: The Channel Challenge Case Analysis

- Honeywell Residential Division: New Product Development Case Analysis

- Tong Yang's Cement (B): Demand Forecasting And Globalization Case Analysis

- Genzyme Center (C) Case Analysis

Be a great writer or hire a greater one!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Case48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

Fern Fort University

Commerce bank case study analysis & solution, harvard business case studies solutions - assignment help.

Commerce Bank is a Harvard Business (HBR) Case Study on Technology & Operations , Fern Fort University provides HBR case study assignment help for just $11. Our case solution is based on Case Study Method expertise & our global insights.

Technology & Operations Case Study | Authors :: Frances X. Frei, Corey Hajim

Case study description.

Taught in the second module of a course on Managing Service Operations, which addresses the design of sustainable service models (606-031).Commerce Bank has become one of the fastest growing banks in the country, despite having defied conventional wisdom about how to grow deposits. Banks historically have grown either by competing on deposit rates or through acquisitions that expand their deposit base. Commerce has the lowest deposit rates in each of the local markets it serves and has acquired no other banks, yet its growth rate is unparalleled. Its secret? Commerce differentiates itself on service. Explores the highly refined service model that guides the design of its operations and service features and considers the trade-offs involved in competing on service.

Supply chain

Order a Technology & Operations case study solution now

To Search More HBR Case Studies Solution Go to Fern Fort University Search Page

[10 Steps] Case Study Analysis & Solution

Step 1 - reading up harvard business review fundamentals on the technology & operations.

Even before you start reading a business case study just make sure that you have brushed up the Harvard Business Review (HBR) fundamentals on the Technology & Operations. Brushing up HBR fundamentals will provide a strong base for investigative reading. Often readers scan through the business case study without having a clear map in mind. This leads to unstructured learning process resulting in missed details and at worse wrong conclusions. Reading up the HBR fundamentals helps in sketching out business case study analysis and solution roadmap even before you start reading the case study. It also provides starting ideas as fundamentals often provide insight into some of the aspects that may not be covered in the business case study itself.

Step 2 - Reading the Commerce Bank HBR Case Study

To write an emphatic case study analysis and provide pragmatic and actionable solutions, you must have a strong grasps of the facts and the central problem of the HBR case study. Begin slowly - underline the details and sketch out the business case study description map. In some cases you will able to find the central problem in the beginning itself while in others it may be in the end in form of questions. Business case study paragraph by paragraph mapping will help you in organizing the information correctly and provide a clear guide to go back to the case study if you need further information. My case study strategy involves -

- Marking out the protagonist and key players in the case study from the very start.

- Drawing a motivation chart of the key players and their priorities from the case study description.

- Refine the central problem the protagonist is facing in the case and how it relates to the HBR fundamentals on the topic.

- Evaluate each detail in the case study in light of the HBR case study analysis core ideas.

Step 3 - Commerce Bank Case Study Analysis

Once you are comfortable with the details and objective of the business case study proceed forward to put some details into the analysis template. You can do business case study analysis by following Fern Fort University step by step instructions -

- Company history is provided in the first half of the case. You can use this history to draw a growth path and illustrate vision, mission and strategic objectives of the organization. Often history is provided in the case not only to provide a background to the problem but also provide the scope of the solution that you can write for the case study.

- HBR case studies provide anecdotal instances from managers and employees in the organization to give a feel of real situation on the ground. Use these instances and opinions to mark out the organization's culture, its people priorities & inhibitions.

- Make a time line of the events and issues in the case study. Time line can provide the clue for the next step in organization's journey. Time line also provides an insight into the progressive challenges the company is facing in the case study.

Step 4 - SWOT Analysis of Commerce Bank

Once you finished the case analysis, time line of the events and other critical details. Focus on the following -

- Zero down on the central problem and two to five related problems in the case study.

- Do the SWOT analysis of the Commerce Bank . SWOT analysis is a strategic tool to map out the strengths, weakness, opportunities and threats that a firm is facing.

- SWOT analysis and SWOT Matrix will help you to clearly mark out - Strengths Weakness Opportunities & Threats that the organization or manager is facing in the Commerce Bank

- SWOT analysis will also provide a priority list of problem to be solved.

- You can also do a weighted SWOT analysis of Commerce Bank HBR case study.

Step 5 - Porter 5 Forces / Strategic Analysis of Industry Analysis Commerce Bank

In our live classes we often come across business managers who pinpoint one problem in the case and build a case study analysis and solution around that singular point. Business environments are often complex and require holistic solutions. You should try to understand not only the organization but also the industry which the business operates in. Porter Five Forces is a strategic analysis tool that will help you in understanding the relative powers of the key players in the business case study and what sort of pragmatic and actionable case study solution is viable in the light of given facts.

Step 6 - PESTEL, PEST / STEP Analysis of Commerce Bank

Another way of understanding the external environment of the firm in Commerce Bank is to do a PESTEL - Political, Economic, Social, Technological, Environmental & Legal analysis of the environment the firm operates in. You should make a list of factors that have significant impact on the organization and factors that drive growth in the industry. You can even identify the source of firm's competitive advantage based on PESTEL analysis and Organization's Core Competencies.

Step 7 - Organizing & Prioritizing the Analysis into Commerce Bank Case Study Solution

Once you have developed multipronged approach and work out various suggestions based on the strategic tools. The next step is organizing the solution based on the requirement of the case. You can use the following strategy to organize the findings and suggestions.

- Build a corporate level strategy - organizing your findings and recommendations in a way to answer the larger strategic objective of the firm. It include using the analysis to answer the company's vision, mission and key objectives , and how your suggestions will take the company to next level in achieving those goals.

- Business Unit Level Solution - The case study may put you in a position of a marketing manager of a small brand. So instead of providing recommendations for overall company you need to specify the marketing objectives of that particular brand. You have to recommend business unit level recommendations. The scope of the recommendations will be limited to the particular unit but you have to take care of the fact that your recommendations are don't directly contradict the company's overall strategy. For example you can recommend a low cost strategy but the company core competency is design differentiation.

- Case study solutions can also provide recommendation for the business manager or leader described in the business case study.

Step 8 -Implementation Framework

The goal of the business case study is not only to identify problems and recommend solutions but also to provide a framework to implement those case study solutions. Implementation framework differentiates good case study solutions from great case study solutions. If you able to provide a detailed implementation framework then you have successfully achieved the following objectives -

- Detailed understanding of the case,

- Clarity of HBR case study fundamentals,

- Analyzed case details based on those fundamentals and

- Developed an ability to prioritize recommendations based on probability of their successful implementation.

Implementation framework helps in weeding out non actionable recommendations, resulting in awesome Commerce Bank case study solution.

Step 9 - Take a Break

Once you finished the case study implementation framework. Take a small break, grab a cup of coffee or whatever you like, go for a walk or just shoot some hoops.

Step 10 - Critically Examine Commerce Bank case study solution

After refreshing your mind, read your case study solution critically. When we are writing case study solution we often have details on our screen as well as in our head. This leads to either missing details or poor sentence structures. Once refreshed go through the case solution again - improve sentence structures and grammar, double check the numbers provided in your analysis and question your recommendations. Be very slow with this process as rushing through it leads to missing key details. Once done it is time to hit the attach button.

Previous 5 HBR Case Study Solution

- Tong Yang Cement (A): Logistics and Incentives Case Study Solution

- Rating Environmental Performance in the Building Industry: Leadership in Energy and Environmental Design (LEED) Case Study Solution

- CEMEX: Global Growth Through Superior Information Capabilities (Abridged) Case Study Solution

- U.S. Plastic Lumber Case Study Solution

- Unicon Concrete Products (H.K.) Ltd. Case Study Solution

Next 5 HBR Case Study Solution

- Providian Trust: Tradition and Technology (A) Case Study Solution

- Pilgrim Bank (A): Customer Profitability Case Study Solution

- Innovation at Progressive (A): Pay-As-You-Go Insurance Case Study Solution

- Lotus MarketPlace: Households Case Study Solution

- ING Direct Canada Case Study Solution

Special Offers

Order custom Harvard Business Case Study Analysis & Solution. Starting just $19

Amazing Business Data Maps. Send your data or let us do the research. We make the greatest data maps.

We make beautiful, dynamic charts, heatmaps, co-relation plots, 3D plots & more.

Buy Professional PPT templates to impress your boss

Nobody get fired for buying our Business Reports Templates. They are just awesome.

- More Services

Feel free to drop us an email

- fernfortuniversity[@]gmail.com

- (000) 000-0000

- Harvard Business School →

- Faculty & Research →

- December 2002 (Revised October 2006)

- HBS Case Collection

Commerce Bank

- Format: Print

- | Pages: 22

About The Author

Frances X. Frei

More from the authors.

- November–December 2023

- Harvard Business Review

Storytelling That Drives Bold Change

- Faculty Research

Move Fast and Fix Things: The Trusted Leader's Guide to Solving Hard Problems

Bringing ideas to life: the story of paul english.

- Storytelling That Drives Bold Change By: Frances X. Frei and Anne Morriss

- Move Fast and Fix Things: The Trusted Leader's Guide to Solving Hard Problems By: Frances X. Frei and Anne Morriss

- Bringing Ideas to Life: The Story of Paul English By: Youngme Moon, Frances X. Frei and F. Katelynn Boland

- Business Case Studies

Technology & Operations

Commerce Bank

Commerce Bank ^ 603080

Want to buy more than 1 copy? Contact: [email protected]

Product Description

Publication Date: December 02, 2002

Source: Harvard Business School

Taught in the second module of a course on Managing Service Operations, which addresses the design of sustainable service models (606-031). Commerce Bank has become one of the fastest growing banks in the country, despite having defied conventional wisdom about how to grow deposits. Banks historically have grown either by competing on deposit rates or through acquisitions that expand their deposit base. Commerce has the lowest deposit rates in each of the local markets it serves and has acquired no other banks, yet its growth rate is unparalleled. Its secret? Commerce differentiates itself on service. Explores the highly refined service model that guides the design of its operations and service features and considers the trade-offs involved in competing on service.

This Product Also Appears In

Buy together, related products.

Valuing Currency Management: TOM vs. U.S. Commerce Bank

The Transparency Problem in Corporate Philanthropy

Valuing Currency Management: TOM vs. U.S. Commerce Bank, Assignment Questions

Copyright permissions.

If you'd like to share this PDF, you can purchase copyright permissions by increasing the quantity.

Order for your team and save!

Prepare your students to navigate business challenges by immersing them in real-world scenarios.

Transform business education

Bring excitement into your classroom with engaging case discussions and introduce students to the challenge and fun of making important decisions.

Illustrate business concepts

Help students learn by doing with over 50,000+ cases featuring real-world business scenarios spanning across multiple areas of business.

Encourage new ways of thinking

Student build confidence and critical thinking skills while learning to express their ideas and convince others, setting them up for success in the real world.

Explore Different Types of Cases

Find cases that meet your particular needs.

New! Quick Cases

Quickly immerse students in focused and engaging business dilemmas. No student prep time required.

Traditional cases from HBS and 50+ leading business schools.

Multimedia Cases

Cases that keep students engaged with video, audio, and interactive components.

Search Cases in Your Discipline

Select a discipline and start browsing available cases.

- Business & Government Relations

- Business Ethics

- Entrepreneurship

- General Management

- Human Resource Management

- Information Technology

- International Business

- Negotiation

- Operations Management

- Organizational Behavior

- Service Management

- Social Enterprise

Case Teaching Seminar

Register now for our Teaching with Cases Seminar at Harvard Business School, held June 21 - 22 . Learn how to lead case discussions like a pro and earn a certificate from Harvard Business Publishing.

Fundamentals of Case Teaching

Our new, self-paced, online course guides you through the fundamentals for leading successful case discussions at any course level.

Case Companion: Build Students’ Confidence in Case Analysis

Case Companion is an engaging and interactive introduction to case study analysis that is ideal for undergraduates or any student new to learning with cases.

Discover Trending Cases

Stay up to date on cases from leading business schools.

Discover new ideas for your courses

Course Explorer lets you browse learning materials by topic, curated by our editors, partners, and faculty from leading business schools.

Teach with Cases

Explore resources designed to help you bring the case method into your classroom.

Inspiring Minds Articles on Case Teaching

Insights from leading educators about teaching with the case method.

Book: Teaching with Cases: A Practical Guide

A book featuring practical advice for instructors on managing class discussion to maximize learning.

Webinar: How ChatGPT and Other AI Tools Can Maximize the Learning Potential of Your Case-Based Classes

Register now.

Supplements: Inside the Case

Teaching tips and insights from case authors.

Guide: Teaching Cases Online

A guide for experienced educators who are new to online case teaching.

Educator Training: Selecting Cases to Use in Your Classes

Find the right materials to achieve your learning goals.

Educator Training: Teaching with Cases

Key strategies and practical advice for engaging students using the case method.

Frequently Asked Questions

What support can I offer my students around analyzing cases and preparing for discussion?

Case discussions can be a big departure from the norm for students who are used to lecture-based classes. The Case Analysis Coach is an interactive tutorial on reading and analyzing a case study. The Case Study Handbook covers key skills students need to read, understand, discuss and write about cases. The Case Study Handbook is also available as individual chapters to help your students focus on specific skills.

How can I transfer my in-person case teaching plan to an online environment?

The case method can be used in an online environment without sacrificing its benefits. We have compiled a few resources to help you create transformative online learning experiences with the case method. Learn how HBS brought the case method online in this podcast , gather some quick guidance from the article " How to Teach Any Case Online ", review the Teaching Cases Online Guide for a deep dive, and check out our Teaching Online Resources Page for more insights and inspiration.

After 35 years as an academic, I have come to the conclusion that there is a magic in the way Harvard cases are written. Cases go from specific to general, to show students that business situations are amenable to hard headed analysis that then generalize to larger theoretical insights. The students love it! Akshay Rao Professor, General Mills Chair in Marketing at the University of Minnesota

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- Browse All Articles

- Newsletter Sign-Up

BanksandBanking →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

- Search Search Search …

- Search Search …

Commerce Bank

Subjects Covered Innovation Service management

by Frances X. Frei, Corey Hajim

Source: HBS Premier Case Collection

22 pages. Publication Date: Dec 02, 2002. Prod. #: 603080-PDF-ENG

Commerce Bank Harvard Case Study Solution and HBR and HBS Case Analysis

Related Posts

You may also like

U.S. Government Debt Market and the Structure of Interest Rates

Subjects Covered Bonds Federal government Interest rates by Scott P. Mason 23 pages. Publication Date: Jun 20, 1985. Prod. #: 285186-PDF-ENG U.S. […]

PremiumSoft: Managing Creative People

Subjects Covered Change management Control systems Creativity Entrepreneurship Growth strategy Human resource management Incentives Management controls by Neale O’Connor, April Yu, Melissa […]

Hulu: An Evil Plot to Destroy the World

Subjects Covered Advertising media Business models Internet Marketing channels Technology by Anita Elberse, Sunil Gupta Source: Harvard Business School 29 pages. Publication […]

Ford Motor Co.: Dealer Sales and Service

Subjects Covered Customer relationship management Customer service Franchises by Leonard A. Schlesinger, Mark Pelofsky Source: Harvard Business School 21 pages. Publication Date: […]

Commerce Bank Case

- Harvard Case Studies

Harvard Business Case Studies Solutions – Assignment Help

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

porter’s five forces model

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

Harvard Case Study Solutions

STEP 2: Reading The Commerce Bank Case Harvard Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

- Pest analysis

STEP 3: Doing The Case Analysis Of Commerce Bank Case:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Commerce Bank Case and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Commerce Bank Case HBR Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Commerce Bank Case is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Commerce Bank Case.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

STEP 5: PESTEL/ PEST Analysis of Commerce Bank Case Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

- Perform cost benefit analyses and take the appropriate action.

PEST FACTORS:

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Commerce Bank Case.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

- Employment patterns, job market trend and attitude towards work according to different age groups.

case study solutions

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Commerce Bank Case Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

porter’s five forces model

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS:

- as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES:

- this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY:

- the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS:

- it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS:

- this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: VRIO Analysis of Commerce Bank Case:

Vrio analysis for Commerce Bank Case case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable. Therefore there must be some resources and capabilities in an organization that can facilitate the competitive advantage to company. The four components of VRIO analysis are described below: VALUABLE: the company must have some resources or strategies that can exploit opportunities and defend the company from major threats. If the company holds some value then answer is yes. Resources are also valuable if they provide customer satisfaction and increase customer value. This value may create by increasing differentiation in existing product or decrease its price. Is these conditions are not met, company may lead to competitive disadvantage. Therefore, it is necessary to continually review the Commerce Bank Case company’s activities and resources values. RARE: the resources of the Commerce Bank Case company that are not used by any other company are known as rare. Rare and valuable resources grant much competitive advantages to the firm. However, when more than one few companies uses the same resources and provide competitive parity are also known as rare resources. Even, the competitive parity is not desired position, but the company should not lose its valuable resources, even they are common. COSTLY TO IMITATE: the resources are costly to imitate, if other organizations cannot imitate it. However, imitation is done in two ways. One is duplicating that is direct imitation and the other one is substituting that is indirect imitation. Any firm who has valuable and rare resources, and these resources are costly to imitate, have achieved their competitive advantage. However, resources should also be perfectly non sustainable. The reasons that resource imitation is costly are historical conditions, casual ambiguity and social complexity. ORGANIZED TO CAPTURE VALUE: resources, itself, cannot provide advantages to organization until it is organized and exploit to do so. A firm (like Commerce Bank Case) must organize its management systems, processes, policies and strategies to fully utilize the resource’s potential to be valuable, rare and costly to imitate.

STEP 8: Generating Alternatives For Commerce Bank Case Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 9: Selection Of Alternatives For Commerce Bank Case Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

STEP 10: Evaluation Of Alternatives For Commerce Bank Case Case Solution:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

STEP 11: Recommendations For Commerce Bank Case Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

Case Study Solutions

Commerce Bank

Subjects Covered Innovation Service management

by Frances X. Frei, Corey Hajim

Source: HBS Premier Case Collection

22 pages. Publication Date: Dec 02, 2002. Prod. #: 603080-PDF-ENG

Commerce Bank Harvard Case Study Solution and HBR and HBS Case Analysis

Clients Who Bought This Case Solution Also Bought:

- Order Status

- Testimonials

- What Makes Us Different

Commerce Bank Harvard Case Solution & Analysis

Home >> Finance Case Studies Analysis >> Commerce Bank

Background and Problem:

Commerce Bank was founded by, Hill and commenced its operation in 1973 . It started as a smaller bank in southern New Jersey with an aim to differentiate it from other banks. Soon it increased its branches in areas such as New York, Pennsylvania and Delaware.

Since its inception, the bank has been on the verge of working for long hours and even during the weekend for modified hours. In addition to that, the bank adopted a very different approach and unlike other banks which focused on earning profits, it instead focused on designing and providing high-quality services to its client. Moreover, it viewed the highest quality service as a critical element by which an organization can increase its value in the long term.

Recently, the organization started its Retailtainment program in order to win customers. This program generally involved providing entertainment to the customer during the Halloween and other special occasions where the bank’s staff dressed in a particular way to amuse the customers. Similarly, for this purpose the mascots were hired to enhance such a delighted experience along with this the free delivery of newspaper, coffee and hot dog were all part of this scheme in order to exceed the customers’ expectation and give them the experience that they have never witnessed before.

Jacovelli, who proposes such initiatives to the top management was concerned about the benefits of this program and intended to critically evaluate it in terms of the following way:

- Whether the customer really wanted to get entertained whenever they enter the bank?

- Did the provision of this program put the main service at risk?

- Did it adopt a retail experience too far?

The organization’s delivery system, its competitive position and critical factor for success:

The organization’s service delivery system prior to Retailtainment is as follows:

- The customer is treated offered a friendly service and after opening one of the checking accounts; he is provided with a free gift for opening the account.

- The high-quality service is provided at each channel, including both the manual and online. Unlike its competitors which forced the customer to take electronic delivery due to low cost ; Commerce Bank decided not to adopt such practice and instead supported the customer regarding every type of delivery channel.

- The organization follows a philosophy of increasing its deposit account from the customer rather than focusing on increasing its revenue by giving loans. The competitors of Commerce Bank were more concerned about increasing their loan base however; the organization prefers to focus on increasing its deposit base where it expects to earn money on the clients’ balances.

- The organization provided a low rate on its deposit account in return for generating the savings from the lower rate; they instead invest the money on providing high-quality service to the client, unlike its competitors which only focuses on providing a higher rate on deposit account and doesn’t concentrate on improving their services.

- The organization also refunds the ATM card payments to the clients if they use it in other banks’ ATM system.

- Commerce Bank introduces the policy of doing anything which might be expensive, however; its cost would be justified as long as it keeps generating the customer traffic to the bank.

- The organization introduces a wow program where it provide incentives, awards and various bonuses schemes to its employees for performing well regarding services such as core deposit growth, consumer loan growth, total losses etc.

- As part of this wow program, it is urged to every employee that he needs to improve the quality of service offered to the client in various ways.

As a result of this service design, the organization is able to increase its deposit rate to 30% since 1996, which increased furthermore to 40% during the year 2001. In comparison to the whole United States, whose cumulative growth is at 5%, the organization performs very well in relation to its competitors and develops a strong competitive position. In addition to that, even the customer of the organization seems to act as a fan by remaining loyal to it. Consequently, these initiatives allow the company to move-up the bar and gain reputation in the eyes of the customer of the banking industry, which was very weak few years ago.

The decision which has been very critical in its success was the use of customer centric philosophy which views the quality service as much more of an important element as compared to the increasing numbers of client on the base loan. It puts more emphasis on providing the highest quality service, which satisfies the client, solve their problems and listen to their needs. It would continue to ignore the expense of any services that it provides as long as it keeps on satisfying the client and it also made huge investments in various projects to enhance the client experience.

Retailtainment, its effect on meeting goals and any modification of the program:

The motivation for the Retailtainment comes from the following factors:

- The organization followed a philosophy of becoming customer centric, focusing on providing high quality service.

- It was willing to invest in anything that seems to satisfy the client and exceed their expectations.

- As the competition started to get tough because various organizations started to copy the style of the bank, so it became imperative for the bank to stay ahead of the competition and adopt some new approaches.

- Most important of all, it wanted to adopt a way that would entertain those clients who were waiting in queue to get their work done.

As a result of these factors, the organization started to adopt various approaches, even the whacky ones in order to entertain the client.

However; the effect of this strategy is limited in its approach:

- Firstly, it gives full autonomy to the branch manager in suggesting whatever suits the customer, so the managers started to suggest those techniques which had high risk but they did not bother to think about their precautions such as the case with a hot dog cart, which caught fire and resulted in total a disaster for the branch.

- Secondly, various customers view the provision of Retailtainment as a non-valued added service and waste of resources, which should be focused on speeding up the process for more productive areas such as the processing of a particular transaction.

- Finally it conflicts with the main purpose of the organization and that is to provide reliable and fast banking service to the client however; with the execution of this program, the focus is on the client’s entertainment (which is not originally the purpose of a bank), rather than improving the service in more productive areas such as processing of the transaction, responding to customer query, ease of transfer funds and also the time taken to complete a particular transaction, all of which are critical success factors for the business.

The program should be modified in this manner:

The organization should focus on improving the core areas of its services such as the time taken to process the transaction, ease of funds transfer, response to client inquiry, number of possible solutions for the client and most important of all the activities is that the staff should be more productive rather than just greeting the client or entertaining them....................

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Finance Case Studies Analysis

- Gardiner Wholesalers Incorporated (A)

- Blackstone and the Sale of Citigroup's Loan Portfolio

- GigaTera Inc: Pulling The Plug?

- Continental Media Group: Business Highlights

- Bel: Inventing New Horizons For The Family Firm

- Pricing Police: An Activity-Based Costing Model of Police Services

- Target Corporation

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

Global site search

Commerce commission main navigation.

- Media releases

IMAGES

VIDEO

COMMENTS

Frei, Frances X., and Corey B. Hajim. "Commerce Bank." Harvard Business School Case 603-080, December 2002. (Revised October 2006 ...

The Commerce Bank case study is a Harvard Business Review case study, which presents a simulated practical experience to the reader allowing them to learn about real life problems in the business world. The Commerce Bank case consisted of a central issue to the organization, which had to be identified, analysed and creative solutions had to be ...

Commerce Bank has defied the traditional norms of a bank and has focused to blow away its customers through offering a retail format bank where consumers are entertained. The company also focuses on providing high quality customer service which constitutes a customer base of 62%, while its competitors have been focused upon serving 3% of the ...

Step 2 - Reading the Commerce Bank HBR Case Study . To write an emphatic case study analysis and provide pragmatic and actionable solutions, you must have a strong grasps of the facts and the central problem of the HBR case study. Begin slowly - underline the details and sketch out the business case study description map.

"Commerce Bank." Harvard Business School Case 603-080, December 2002. (Revised October 2006.) View Details. Frei, Frances X. "Creating New Services, Module Overview Note TN." Harvard Business School Teaching Note 602-178, May 2002. ... HBS students have traditionally been immersed in a case-study method that has encouraged them to think like ...

Commerce Bank has become one of the fastest growing banks in the country, despite having defied conventional wisdom about how to grow deposits. Banks historically have grown either by competing on deposit rates or through acquisitions that expand their deposit base. ... "Commerce Bank." Harvard Business School Case 603-080, December 2002 ...

Banking and investment industry. Source: Harvard Business School. Product #: 603080-PDF-ENG. Length: 22 page (s) Commerce Bank has become one of the fastest growing banks in the country, despite having defied conventional wisdom about how to grow deposits. Banks.

Commerce Bank has become one of the fastest growing banks in the country, despite the fact defied conventional about how to grow deposits. Banks historically risen or compete in deposit rates, or through acquisitions that expand its deposit base. Commerce has the lowest rate for deposits in each of the local markets it serves, and acquired no ...

Commerce Bank has become one of the fastest growing banks in the country, despite having defied conventional wisdom about how to grow deposits. Banks historically have grown either by competing on deposit rates or through acquisitions that expand their deposit base. Commerce has the lowest deposit rates in each of the local markets it serves ...

Harvard Business Publishing offers case collections from renowned institutions worldwide. Case method teaching immerses students in realistic business ... Case Companion is an engaging and interactive introduction to case study analysis that is ideal for undergraduates or any student new to learning with cases. Learn More. Discover Trending Cases.

Case - Commerce Bank Case Solution. How does the organization seek to compete and provide value to its customers? Commerce bank competes on providing low interest rates to the customers and consistently focuses on improving the quality of service provided by the bank to its customer base. 24/7 customer service is the common example of customer satisfaction initiative taken by the bank.

Between 2008 and 2014, the Top 4 banks sharply decreased their lending to small business. This paper examines the lasting economic consequences of this contraction, finding that a credit supply shock from a subset of lenders can have surprisingly long-lived effects on real activity. 26 Jun 2017. Working Paper Summaries.

View Commerce Bank Case.pdf from ECON 693 at Rutgers University, Camden. assess HARVARD BUSINESS SCHOOL 9603980 REV: MARCH 18, 2003 FRANCES X. FREI Commerce Bank The hardest thing about becoming a ... Commerce Bank Case Study.pdf. Indian Institute Of Management, Kozhikode. EPGP 301. Commerce Bank.pdf. Solutions Available. Symbiosis ...

Subjects Covered Innovation Service management. by Frances X. Frei, Corey Hajim. Source: HBS Premier Case Collection. 22 pages. Publication Date: Dec 02, 2002. Prod. #: 603080-PDF-ENG. Commerce Bank Harvard Case Study Solution and HBR and HBS Case Analysis