- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, weekend print + standard digital, weekend print + premium digital.

Today's FT newspaper for easy reading on any device. This does not include ft.com or FT App access.

- 10 additional gift articles per month

- Global news & analysis

- Exclusive FT analysis

- Videos & Podcasts

- FT App on Android & iOS

- Everything in Standard Digital

- Premium newsletters

- Weekday Print Edition

- FT Weekend Print delivery

- Everything in Premium Digital

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Everything in Print

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

We couldn’t find any results matching your search.

Please try using other words for your search or explore other sections of the website for relevant information.

We’re sorry, we are currently experiencing some issues, please try again later.

Our team is working diligently to resolve the issue. Thank you for your patience and understanding.

News & Insights

The Case for Investment in Japan

July 21, 2022 — 04:35 pm EDT

Written by [email protected] (ETF Trends) for ETF Trends ->

The strengthening dollar could mean hardship for much of the global economy and emerging market currencies, but on the other side of the world, Japan looks to be well positioned for several reasons.

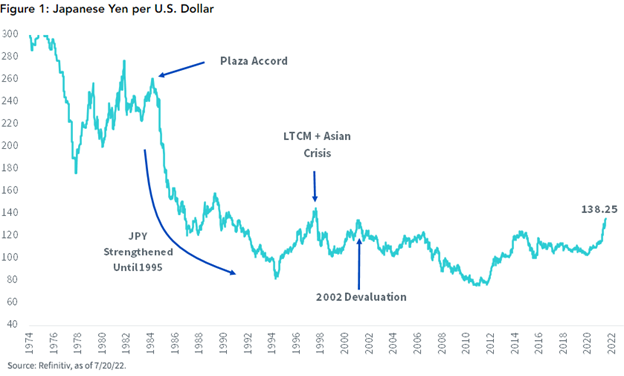

The yen, Japan’s currency, has weakened over the last two years, and Jeff Weniger, head of equity strategy, finds that particularly noteworthy because it has done so despite a lack of inflation.

Image source: WisdomTree blog

“The yen’s collapse is even more remarkable when you consider that Japan’s consumer price inflation was 2.5% over the last year — a far cry from the 9.1% rate in the U.S.,” Weniger wrote in a recent WisdomTree blog post.

The yen’s weakness could mean an opportunity for Japan, particularly when looking at it in comparison to the Chinese yuan. Japan and China are the largest trade rivals in their region and the yen is nearing a conversion of ¥20.56 per Chinese yuan, the weakest it will have ever been to the CNY. It means that much of Japan’s industry is now attractively priced when compared to China and could prompt a shift in foreign interest and trade away from China and to Japan.

“Another thing that I think is wildly bullish is the BOJ (Bank of Japan) is not balking; they are committed to QE (quantitative easing),” said Weniger on a call with VettaFi.

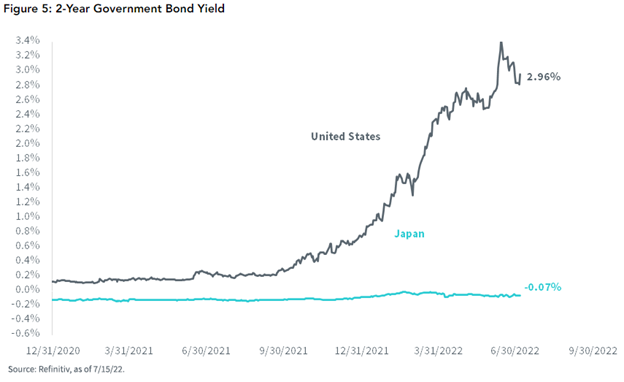

While the Federal Reserve will continue to hike until they have undeniable proof that inflation is retreating, the Bank of Japan continues to sit at a zero interest rate, which has big implications when looking at investing from a TINA perspective.

TINA is a term that was invented around the Financial Crisis of 2008-2009 and stands for “There Is No Alternative” when it comes to equities. It essentially means that investors have no choice but to invest in stocks because bonds and other alternatives are performing worse, or equities are simply performing that strongly. TINA has been a popular investment thesis in the long bull run of the last decade in the U.S. and invests essentially along momentum.

In the U.S. TINA investing goes away the higher Fed funds go but in Japan with a zero-interest rate policy, TINA remains a favorable framework. Weniger explains one way to look at it: if you were to compile a list of all the S&P 500 stocks that have yields 10% higher than the two-year Treasury yield and also compile a list of companies in Japan from the TOPIX 500 using the same method with the two-year JGBs, there would be 38 companies in the S&P 500 and 133 in the TOPIX 500 that meet the criteria.

The WisdomTree Japan Hedged Equity Fund (DXJ) offers investment into the Japanese equity market while hedging for currency fluctuations. It’s a pure play on Japanese stocks, as it removes the impact that the yen’s value has while still offering exposure to Japan’s equities. It is a popular choice when the yen is weak relative to the U.S. dollar.

DXJ carries an expense ratio of 0.48%, and top holdings include Toyota Motor Corp at 5.37%, Japan Tobacco Inc. at 4.72%, and Mitsubishi UFJ Financial Group at 4.22%.

For more news, information, and strategy, visit the Modern Alpha Channel .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Stocks mentioned

More related articles.

This data feed is not available at this time.

Sign up for the TradeTalks newsletter to receive your weekly dose of trading news, trends and education. Delivered Wednesdays.

To add symbols:

- Type a symbol or company name. When the symbol you want to add appears, add it to My Quotes by selecting it and pressing Enter/Return.

- Copy and paste multiple symbols separated by spaces.

These symbols will be available throughout the site during your session.

Your symbols have been updated

Edit watchlist.

- Type a symbol or company name. When the symbol you want to add appears, add it to Watchlist by selecting it and pressing Enter/Return.

Opt in to Smart Portfolio

Smart Portfolio is supported by our partner TipRanks. By connecting my portfolio to TipRanks Smart Portfolio I agree to their Terms of Use .

Guide to Investing in Japan

Japan is changing in significant ways, which is having a strong positive impact on the country’s long-term growth potential. Read this guide to learn why and how we believe you should consider gaining exposure to Japan.

Significant policy and structural reform initiatives are shaping future economic growth. Key areas of change in Japan are:

- I mproved corporate governance: Government-led reforms have caused companies to focus more on shareholder returns.

- Labor/culture reforms: To compensate for a shrinking workforce, new policies have brought more immigrants, women, and retirees into the workforce, and the practice of lifetime employment is starting to fade.

- Demographics-driven innovation: An aging population and low birth rates have spurred innovation in industries such as factory automation, robotics, and healthcare.

These macro-level changes and a stable political environment, combined with attractive valuations, make Japan an excellent investment opportunity.

Explore Our Guide to Investing in Japan:

Top reasons to consider investing in japan, current outlook for investing in japan, how to invest in japan.

- Finding the Best Japan Mutual Funds

1. Abenomics provides a foundation for growth

Before 2012, Japan had spent many years in a deflationary environment, sometimes referred to as the "lost decade”, and investment in Japan was greatly inhibited. Upon his election, Prime Minister Shinzo Abe instituted economic policies, known as “Abenomics”, which focused on weakening the yen through monetary easing and increasing inflation to 2%. Also, Abenomics included many structural reforms and fiscal reform initiatives described below.

As a result of these policies, the Japanese economy exited deflation on a sustained basis for the first time in two decades, and the return on equity (ROE) of Japanese stocks has almost doubled since 2012, prices and wages are rising, employment is rising and cap-ex has been setting new highs.

2. Compelling valuations

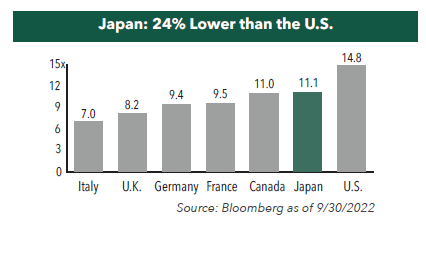

As seen on the charts below, Japanese stocks are trading at compelling valuation levels compared to other developed equity markets around the world and relative to their own historical averages, offering another reason to consider purchasing Japanese mutual funds.

- Attractive Price-to-Earnings Multiple

Learn more about current Japanese valuations

3. Improved corporate governance

A primary focus of Abenomics’ structural reform was corporate governance, which put more focus on shareholder returns and included the initiation of Japan's "Stewardship Code." This has resulted in higher shareholder dividend payouts, increased shareholder activism, higher corporate profit margins, and higher returns of equity for many Japanese companies.

4. Stable, pro-growth political environment

The combination of Japan’s reform-minded, pro-growth government and pro-business, pro-inflation central bank has provided a strong impetus to economic growth. Prime Minister Shinzo Abe, who resigned in August due to health issues, was succeeded by his close ally and chief cabinet secretary, Yoshihide Suga. Prime Minister Suga is expected to continue his predecessor's policies with economic growth as the priority. Japan has enjoyed a stable political environment, which makes it likely that the current pro-growth policies will remain in place over the coming years.

5. Labor reforms and cultural shifts offset a shrinking workforce

To help offset the national labor shortage brought on by the decline in Japanese workers, a recent suite of labor reforms were enacted. A new visa system was introduced to bring in more foreign labor, underfunded pensions encouraged retirees to continue working, and Abenomics’ child care initiatives brought almost two million more Japanese women into the labor force since 2012.

Beyond government-mandated policies, corporate culture in Japan is also modernizing. The days of Japan, Inc’s rigid, closed corporate culture and “lifetime employment” are starting to fade as companies move toward a more merit-based system.

6. Rising profitability

Japanese corporations are catching up with their Western counterparts in profitability, with their return on equity (ROE) rising due to innovation, cost-cutting, and growing export sales. In 2018, the ROE of the Tokyo Stock Price Index approached 10% for the first time since the great financial crisis. While that level has declined in recent months, we view this as a temporary setback because of the continuous improvement in corporate governance and a strong focus on ROE.

With a benign currency environment and low interest rates, Japan’s ROE is expected to rebound, potentially rising above 10% and closer to levels achieved in Europe and the U.S.

7. High-quality, globally-oriented companies

There are many high-quality, globally-oriented companies with able management in Japan that are protected by high barriers to entry. The stocks of these companies provide investors with growth opportunities around the world, including exposure to developing countries. However, Japanese companies generally offer more transparency, better corporate governance, and higher liquidity than companies domiciled in emerging markets. This makes investing in Japan through mutual funds that carefully select these companies an attractive long-term investment opportunity.

8. Demographic factors driving innovation

An aging population and low birth rates may be seen as negative factors for future growth. But in Japan, these demographic trends are a driving force behind the emergence of Japanese companies with high growth potential. This is because necessity has been the mother of innovation. For example, new solutions are required for citizens who are living longer and healthier lives, which has spurred a boom of innovation in the healthcare industry. And new solutions are required for the lack of available labor force, which has helped fuel Japanese innovation and leadership in robotics and factory automation, as highlighted below.

9. Global leadership in robotics and automation

Japan is an undisputed leader in the production of factory automation systems and robots. Five of the top 10 producers in the world are in Japan and these companies possess nearly 30% of the worldwide market share. Japanese automation and robotics companies are currently benefiting from strong demand growth for their products. For example, worldwide sales of industrial robots have grown six-fold in less than a decade, and Asia is by far the world’s largest end market for factory automation products.

Learn more about Japan’s factory automation revolution.

"We believe the Hennessy Japan Fund is well-positioned as the portfolio is built around Japan's manufacturing excellence." - MASA TAKEDA

The Japan Fund is invested in companies that demonstrate Japan’s manufacturing excellence and high-quality craftsmanship along with asset-light technology businesses. Read our Sector Highlight: Japan's Most Durable Advantage

With many challenges facing global investors, we asked Masa Takeda, Portfolio Manager of the Hennessy Japan Fund to provide his insights. In our latest manager commentary,he shares his views on the Japanese market, how the Fund is positioned to take advantage of "growth in disguise" companies, and why investors may want to consider Japanese equities for the long term. Here are the key takeaways:

• Japan has begun to slowly reopen to overseas tourists. While the Fund has no direct exposure, we believe new holding ORIX Corp. could be an indirect beneficiary. • Many Japanese exporters have benefited from the Yen depreciation, yet investors have not rewarded these exporters equally. • Japanese companies look attractively priced compared to U.S. companies, with the Tokyo Stock Price Index trading at 12.2x 2022 estimated earnings as of September 6, 2022, compared to 17.3x for the S&P 500® Index. • We believe new holding Tokio Marine, Japan’s largest general insurance group, is an example of a “growth in disguise” company that has compelling growth prospects but the stock is valued at what we believe to be a low price to earnings multiple. • Despite macro challenges, we believe it’s important to focus on individual market-leading companies that are well run and globally competitive.

Read our latest portfolio manager commentary Investing in "Growth in Disguise" Japanese Companies

Individual Japanese stocks

A common approach for investing in Japan is to purchase shares in publicly held Japanese companies. While these investments are highly liquid and give you total control over the companies you invest in, this approach has significant drawbacks. Building a portfolio of individual stocks requires extensive research into each company you invest in, and you need to buy several individual stocks to diversify. Plus, you may have to pay a commission each time you buy or sell.

Japanese Mutual Funds

Japan mutual funds (also known as equity funds) represent a portfolio of investments in stocks of companies that are located in Japan and can cover a wide range of market caps, sectors, and styles. The funds can be passively or actively managed by teams that are based in Japan or remotely. We believe one of the best ways to take advantage of Japan’s future growth potential is by investing in Japanese stocks and mutual funds.

Passive vs. Active Management

Mutual funds can be passively or actively managed. While passively managed (or index) funds and ETFs can offer some advantages such as lower fees, it can sometimes be difficult to capitalize on the best opportunities through index funds, particularly in Japan. This is because most Japanese index funds and the Tokyo Price Index (TOPIX), Japan’s major stock index, are dominated by traditional, slow-growing behemoths — not the nimble, globally competitive companies that make investing in Japan an attractive opportunity.

To maximize Japanese investment opportunities, we believe you should choose active, rather than passive, Japanese mutual funds. Active managers perform in-depth, company-specific research to build a portfolio of Japanese companies they believe can outperform due to their business model, management team, balance sheet strength, competitive moat, or product advantage.

Importance of In-Country Management

Japan remains a mystery for many U.S. investors. Japan’s language and corporate culture are very unique, and we believe the best way to access the market is by active investment management with in-country managers and research teams that understand the nuances of the Japanese language and corporate culture and have decades-long relationships with Japan's company management. This way, portfolio managers truly understand the inner workings of Japanese companies and the market as a whole and can correctly interpret and translate research into winning investment ideas.

Plus, due to job rotation programs in Japanese financial institutions, there is a lack of professional, tenured, institutional investment managers in Japan.

While data on large-cap Japanese companies is readily available, many smaller companies lack research. Being located in Asia allows for local research, where portfolio managers and analysts can visit offices, plants, stores, suppliers, and customers in the region to gain direct, on-the-ground insights. This helps portfolio managers uncover real-time information about current investment opportunities that might go undiscovered without a local presence.

Selecting Japan Mutual Funds

We encourage investors to compare all available funds to find the best Japanese mutual funds that match their investment objectives. Hennessy Funds offers two funds, both highly rated by Morningstar: the Hennessy Japan Fund and Hennessy Japan Small Cap Fund . To view the Morningstar ratings, please click here.

We believe Japan’s growth story is just starting to unfold and that active management with a local presence provides a critical advantage for investors interested in Japan. Both of the Hennessy Japan funds offer the opportunity to invest in the potential rebound of the Japanese economy. Here are a few highlights for both funds:

- Actively managed, concentrated portfolios. Through intensive, fundamental research, the portfolio managers limit investments to their best ideas, to give the best opportunity to outperform the market over the long-term.

- In-country teams . Based in Tokyo, our team has decades-long familiarity with Japan’s business landscape and unique corporate culture, which allows them to analyze day-to-day research and translate insights into winning investment ideas. Managers have access to real-time information about specific companies and investment opportunities, instead of relying on second- or even third-hand research and data.

- Sound, proven investment criteria. Our portfolio managers focus on sustainable growth while limiting the downside by seeking Japanese companies with exceptional management, well-capitalized balance sheets and minimal debt, high ROE, strong cash flow, above-average earnings growth rate that’s sustainable and predictable, with a durable competitive advantage and compelling valuations.

- Long-term, high-conviction strategy . The Hennessy Japan Fund managers invest with a long-term horizon and maintain positions in stocks that they are confident can outperform over market cycles.

Actively managed, the Fund maintains a highly concentrated, best ideas portfolio of Japanese companies.

Japan Small Cap Fund

Actively managed, the Fund maintains a relatively concentrated portfolio of Japanese small-cap companies.

Frequently Asked Questions About Investing in Japan

Here are a few questions we often hear about investing in Japan:

Is Japan a good investment?

The economic policies often referred to as Abenomics have ended decades of deflation and are supporting strong economic growth in Japan. The return on equity (ROE) of Japanese stocks has nearly doubled since Abenomics, and Japanese equities offer tremendous growth potential compared to other foreign nations, which makes investing in Japan attractive.

How do I invest in Japan?

A good way for individuals to invest in Japan is to purchase shares in Japanese mutual funds. To maximize Japanese investment opportunities, you should choose active, rather than passive, mutual funds. In addition, Japanese mutual funds should have feet-on-the-street research capabilities to uncover the best Japanese investment opportunities.

How can U.S. investors access Japanese equities?

U.S. residents, including those living overseas, can invest in Japan by purchasing shares in Japanese mutual funds that are registered for sale within the U.S. The Hennessy Funds are specifically designed to allow U.S. investors to easily invest in the Japanese market.

Is the Japanese stock market undervalued?

Japanese equities are currently trading at compelling valuation levels compared to the U.S. and other markets around the world and relative to their own historical averages, making investing in Japan attractive.

Price-to-earnings and price-to-book for each country is in U.S. dollar terms and measured by the following indices: United States (S&P 500® Index), Japan (Tokyo Stock Price Index), France (CAC 40 Index), Canada (S&P/TSX Composite Index), United Kingdom (FTSE 100 Index), Italy (FTSE MIB Index), Germany (Deutsche Boerse AG German Stock Index). The Tokyo Stock Price Index is a market capitalization-weighted index of all companies listed on the First Section of the Tokyo Stock Exchange. The S&P 500® Index is an unmanaged index and is commonly used as a measure of the performance of the U.S. stock market as a whole. The CAC 40 is a benchmark French stock market index and is a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris. The S&P/TSX Composite Index is the benchmark Canadian index, representing roughly 70% of the total market capitalization on the Toronto Stock Exchange. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The FTSE MIB Index is the benchmark stock market index for the Italian national stock exchange. The Deutsche Boerse AG German Stock Index is a blue chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. One cannot invest directly in an index. Index performance is not indicative of the Funds’ performance.

Get insights and news delivered to you.

Learn how hennessy approaches investing., let's work together to get you on your way..

- Meet Our Team

- View Fund Performance

- Check My Account

Subscribe for Updates

*Required Fields

List of Research Papers Related to International Finance

- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

Dissertations / Theses on the topic 'Japanese Investment'

Create a spot-on reference in apa, mla, chicago, harvard, and other styles.

Consult the top 50 dissertations / theses for your research on the topic 'Japanese Investment.'

Next to every source in the list of references, there is an 'Add to bibliography' button. Press on it, and we will generate automatically the bibliographic reference to the chosen work in the citation style you need: APA, MLA, Harvard, Chicago, Vancouver, etc.

You can also download the full text of the academic publication as pdf and read online its abstract whenever available in the metadata.

Browse dissertations / theses on a wide variety of disciplines and organise your bibliography correctly.

Price, Tracy J. E. "Japanese direct foreign investment : sources and sustainability." Thesis, University of British Columbia, 1989. http://hdl.handle.net/2429/27263.

Taniai, Tatsuya 1966. "IT investment allocation in Japanese banking industry." Thesis, Massachusetts Institute of Technology, 2003. http://hdl.handle.net/1721.1/17004.

Ichikawa, Nobuko. "Japanese investment in Thai development : NIC or NAIC?" Thesis, Massachusetts Institute of Technology, 1990. http://hdl.handle.net/1721.1/67390.

Suehiro, Yasutaka 1962. "Strategic challenges of the Japanese investment banking industry." Thesis, Massachusetts Institute of Technology, 2004. http://hdl.handle.net/1721.1/17900.

Mizuto, Akemi, and Toshihiro Toyoshima. "Strategic evolution of Japanese investment in U.S. real estate." Thesis, Massachusetts Institute of Technology, 1992. http://hdl.handle.net/1721.1/68747.

Chapman, Paul. "The policy implications of Japanese foreign direct investment in Australia /." Title page, synopsis and contents only, 2001. http://web4.library.adelaide.edu.au/theses/09PH/09phc4662.pdf.

Ursacki, Terry. "Foreign direct investment in the Japanese and Korean banking sectors." Thesis, University of British Columbia, 1990. http://hdl.handle.net/2429/32180.

Munday, M. C. R. "The history of Japanese manufacturing investment in Wales since 1972." Thesis, Swansea University, 1988. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.638276.

Lindner, Russell C., and Edward L. Monahan. "Japanese investment in U.S. real estate : status, trends and outlook." Thesis, Massachusetts Institute of Technology, 1986. http://hdl.handle.net/1721.1/75986.

Pierce, Michael M. (Michael Murray). "Japanese Real Estate Investment Trusts : champagne bubbles or price bubble." Thesis, Massachusetts Institute of Technology, 2005. http://hdl.handle.net/1721.1/33179.

Blom, Remko Hendrik-Jan. "Japanese direct investment in the Benelux and Germany, 1951-1995." Kyoto University, 2005. http://hdl.handle.net/2433/144826.

Nel, Philip Rudolph. "Japanese investment in the South African economy : prospects for the future." Thesis, Link to the online version, 2005. http://hdl.handle.net/10019/318.

Blandon, Peter. "Forecasting investment behaviour : the felling behaviour of Japanese private forest owners." Thesis, Bangor University, 1993. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.358017.

Shah, Sajad Afzal. "Japanese industrial groupings (Keiretsu) and foreign direct investment in the UK." Thesis, London School of Economics and Political Science (University of London), 1997. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.266059.

Jiang, Li. "Temporal process and spatial organization of Japanese automotive investment in Guangzhou." HKBU Institutional Repository, 2019. https://repository.hkbu.edu.hk/etd_oa/613.

Hajdu, Joseph George, and mikewood@deakin edu au. "Japanese investment on the Gold Coast: The interface of globalization and locality." Deakin University. School of Australian and International Studies, 2000. http://tux.lib.deakin.edu.au./adt-VDU/public/adt-VDU20050915.161432.

Iqbal, Uqbah [Verfasser]. "The Historical Development of Japanese Investment in Malaysia (1910-2003) / Uqbah Iqbal." Munich : GRIN Verlag, 2016. http://d-nb.info/1118507274/34.

Kim, Young-Chan. "Single European market and Japanese foreign direct investment in the European Union." Thesis, Royal Holloway, University of London, 1999. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.313730.

Guyton, Lynne E. "The organisation of Japanese FDI in Southeast Asia : implications for regional economic development." Thesis, University of Cambridge, 1995. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.361605.

Yoshida, Jiro 1970. "Effects of uncertainty on the investment decision : an examination of the option-based investment model using Japanese real estate data." Thesis, Massachusetts Institute of Technology, 1999. http://hdl.handle.net/1721.1/70726.

Doran, Desmond. "An examination of the impact of Japanese automotive investment upon UK-based component suppliers." Thesis, University of Portsmouth, 2000. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.323279.

Bancarzewski, Maciej Albert. "Japanese foreign direct investment : varieties of capitalism, employment practices and worker resistance in Poland." Thesis, University of Hertfordshire, 2015. http://hdl.handle.net/2299/17112.

Kurihara, Tamiko. "Japanese direct foreign investment in the United States and Canada by sogo shosha since 1951." Thesis, University of British Columbia, 1986. http://hdl.handle.net/2429/27123.

Han, Seung. "INTERNAL CAPITAL MARKETS AND BANK RELATIONSHIP - EVIDENCE FROM JAPANESE CORPORATE SPIN-OFFS.INTERNAL CAPITAL MARKETS, INVESTMENT." Doctoral diss., University of Central Florida, 2005. http://digital.library.ucf.edu/cdm/ref/collection/ETD/id/3306.

Lo, Wai Lun. "Bilateral trade effects of Japan's outward direct investment in East Asian manufacturing industries." HKBU Institutional Repository, 2009. http://repository.hkbu.edu.hk/etd_ra/986.

Ono, Takanori. "Corporate portfolio management within Japanese diversified trading & investment companies : what role does real estate play?" Thesis, Massachusetts Institute of Technology, 2012. http://hdl.handle.net/1721.1/77126.

Walker, Paul Martin. "Foreign investment : a historical, theoretical and empirical analysis for the cases of the UK, the FRG and Japan with particular reference to manufacturing direct investment." Thesis, University of Reading, 1990. http://catalog.hathitrust.org/api/volumes/oclc/29402793.html.

Kim, Young-Chan. "Japanese inward investment in UK car manufacturing : a case study in international business; national government relations within the context of the European Union." Thesis, Royal Holloway, University of London, 1999. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.310678.

Aaron, Carl. "The political economy of Japanese foreign direct investment in the US and the UK : supranational, national and local factors in locational decision making." Thesis, University of Oxford, 1997. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.363482.

Gerken, Jens Michael. "Die Bedeutung der japanischen Direktinvestitionen in Taiwan für die taiwanischen Direktinvestitionen in China : am Beispiel der Branchen Elektro & Elektronik sowie Autoteile / The impact of the Japanese direct foreign investment in Taiwan for the Taiwanese direct foreign investment in China." Gerhard-Mercator-Universitaet Duisburg, 2001. http://www.ub.uni-duisburg.de/ETD-db/theses/available/duett-05232001-094631/.

Martins, Renato Furuse. "Os determinantes do investimento direto japonês no Brasil: um estudo através dos censos de 1995, 2000 e 2005 e de sua respectiva indústria automobilística no país." Pontifícia Universidade Católica de São Paulo, 2010. https://tede2.pucsp.br/handle/handle/9422.

Yip, Chi-wai Rudolph. "A study of American and Japanese electronics manufacturing investments in Hong Kong /." [Hong Kong : University of Hong Kong], 1988. http://sunzi.lib.hku.hk/hkuto/record.jsp?B12369792.

Tsang, Chiu-hok Victor. "The Japanization of Hong Kong industry /." [Hong Kong] : University of Hong Kong, 1992. http://sunzi.lib.hku.hk/hkuto/record.jsp?B13302802.

Wong, Sik-ho Calvin, and 黃錫豪. "The patterns and characteristics of Japanese investments in China." Thesis, The University of Hong Kong (Pokfulam, Hong Kong), 2003. http://hub.hku.hk/bib/B26756444.

Yoon, Byungtae. "Motives for savings and portfolio choice evidence from micro-data for Japan /." Diss., Columbia, Mo. : University of Missouri-Columbia, 2006. http://hdl.handle.net/10355/4433.

Inoue, Akemi. "Personnel training in Japanese companies in Indonesia." Thesis, Canberra, ACT : The Australian National University, 1995. http://hdl.handle.net/1885/127607.

Yip, Chi-wai Rudolph, and 葉志偉. "A study of American and Japanese electronics manufacturing investmentsin Hong Kong." Thesis, The University of Hong Kong (Pokfulam, Hong Kong), 1988. http://hub.hku.hk/bib/B31264207.

Dhanaraj, Charles. "Legitimacy and stability of Japanese overseas subsidiaries." Thesis, National Library of Canada = Bibliothèque nationale du Canada, 2000. http://www.collectionscanada.ca/obj/s4/f2/dsk1/tape2/PQDD_0016/NQ58123.pdf.

"Japanese investment in the PRC." Chinese University of Hong Kong, 1994. http://library.cuhk.edu.hk/record=b5888058.

Auyeong, Josephine C. Y. "Financing of Japanese direct foreign investment." Phd thesis, 1987. http://hdl.handle.net/1885/128739.

"Japanese investment and influence in Thai development." The MIT Japan Program, Massachusetts Institute of Technology, 1991. http://hdl.handle.net/1721.1/17086.

Gullett, Nell Sorrells. "The impacts of direct foreign investment on host country trade and output a study of Japanese and United States investment in Columbia and Brazil /." 1990. http://catalog.hathitrust.org/api/volumes/oclc/23056153.html.

Chang, Ju Tsun. "Factors influencing Taiwanese and Japanese investment in California." 1989. http://catalog.hathitrust.org/api/volumes/oclc/23443072.html.

Ozawa, Noriko. "Corporate governance and investment incentives of Japanese firms /." 2006. http://link.library.utoronto.ca/eir/EIRdetail.cfm?Resources__ID=442517&T=F.

蔡嘉惠. "Studies on Japanese foreign direct investment:1994~2007." Thesis, 2009. http://ndltd.ncl.edu.tw/handle/78624626210223047827.

Huang, Gene. "Comparative analyses of U.S. and Japanese overseas direct investment." 1992. http://catalog.hathitrust.org/api/volumes/oclc/29643367.html.

Evans-Klock, Christine. "Japanese direct investment in U.S. manufacturing management strategies and location decisions /." 2005. http://catalog.hathitrust.org/api/volumes/oclc/69175808.html.

Palugod, Nora Custodio. "Japanese multinationals in the United States the determinants of their direct investment /." 1990. http://catalog.hathitrust.org/api/volumes/oclc/29425248.html.

"Japanese foreign direct investment and technology transfer in Asia." Center for International Studies, MIT Japan Program, Massachusetts Institute of Technology, 1996. http://hdl.handle.net/1721.1/16584.

吉田稔司. "A study of Taiwanese and Japanese direct foreign investment." Thesis, 1991. http://ndltd.ncl.edu.tw/handle/25886603939407243020.

ValueAct's reputation gamble in Japan pays off

- Medium Text

For more insights like these, click here New Tab , opens new tab to try Breakingviews for free.

Editing by Una Galani and Nivedita Bhattacharjee

Breakingviews Reuters Breakingviews is the world's leading source of agenda-setting financial insight. As the Reuters brand for financial commentary, we dissect the big business and economic stories as they break around the world every day. A global team of about 30 correspondents in New York, London, Hong Kong and other major cities provides expert analysis in real time. Sign up for a free trial of our full service at https://www.breakingviews.com/trial and follow us on Twitter @Breakingviews and at www.breakingviews.com . All opinions expressed are those of the authors.

Thomson Reuters

Anshuman Daga is a Singapore-based Asia Columnist for Breakingviews. He writes on investment banking, corporate activity and financial services, with a focus on Southeast Asia. Anshuman switched to financial commentary after 25 years with Reuters News including in London and Mumbai. During his 15 years in the Lion City, Anshuman has covered the emergence of Southeast Asia’s tech startups and Singapore’s growing status as a financial centre.

Breakingviews Chevron

How one firm made child’s play of tricky m&a games.

Corporate takeovers tend to be messier than preschoolers at craft time. Even friendly transactions involve a lot of fussing over price and scribbling out contract revisions, while contested ones add sharp elbows and tantrums. It’s ironic, then, that a buyer recently found a way to sidestep such tumult at a company catering to kids. Whether the feat can be replicated elsewhere will be the challenge

Table set for Honda's massive bet on Canada's electric vehicle sector

What to watch for as honda announces its new presence in canada's ev industry.

Social Sharing

When word of Honda's soon-to-be-announced electric vehicle investment leaked to Bloomberg News on Sunday, Ontario Premier Doug Ford saw an opening to boast about his government's success in getting into the automotive battery business.

"We've overtaken China and knocked them off the pedestal for the first time ever," he told the First Nations Major Project Coalition conference on Monday morning, referring to Canada's top spot in a recent global supply chain ranking . "That's absolutely huge."

Expect more superlatives when Honda Canada makes its official announcement in Alliston, Ont., on Thursday, as government and industry leaders celebrate the fact that the company behind some of Canada's most popular models is settling in for the long haul in Canada's EV sector.

"This may be Honda's biggest bet anywhere on the planet," Flavio Volpe, the president of the Automotive Manufacturers Association of Canada, told CBC News. He called it a "double down" on Canada and "an announcement that I think will be heard around the world."

Honda doesn't make speculative bets, he said. "They've been in Canada for almost 40 years. They've never retreated, they've never gone back. This is, for Canadian suppliers, an extremely bankable customer to get."

- Honda expected to announce multi-billion dollar deal to assemble EVs in Ontario: sources

Enjoying the hype this announcement is generating means ignoring, for the time being, the fact that most of Northern Ontario's critical minerals are years (if not decades) away from powering all the new EVs Canadians will be federally mandated to purchase after 2035 to meet federal carbon emissions targets.

It means overlooking the fact that Ford's government remains well short of the Indigenous partnerships and permissions it will need to fulfil its Ring of Fire mining aspirations. It means dismissing the failure to date of early consumer incentives and spiking spring gas prices to set off a rush of EV sales, and the fact that many of the new EVs on Ontario's roads were imported from a Tesla gigafactory in Shanghai.

"Here in Ontario, we've become a world leader in the electric vehicle revolution," Ford bragged.

How big is 'big'?

Ford said the deal coming this week will be "double the size of Volkswagen."

The $7 billion VW battery plant now under construction in St. Thomas, Ont., covers roughly 150 hectares — over 200 football fields. It's "like a city in itself," Ford said.

It was not clear from Ford's comments if he meant Honda's new operation will cover twice the acreage of the Volkswagen plant, or if its investment is double the size of the Volkswagen deal. Either way, it's historic.

In January, the Japanese news outlet Nikkei was the first to report Honda was considering an investment of 2 trillion yen (about $18 billion Cdn) to start up an EV supply chain in Canada.

Ford's economic development minister, Vic Fedeli, appeared to confirm Thursday's figures could be on that scale when speaking to reporters at Queen's Park on Monday.

Ontario's EV investments "went from zero to $28 billion in three years," he said, before hedging slightly.

"If the premier, if his comments are correct," he added, "then next week we'll be announcing $43 billion in EV, or a number in and around there."

So is Honda about to invest $15 billion in Ontario?

Not so fast. In a subsequent report published Tuesday, Nikkei said Honda was preparing a one-trillion yen announcement (approximately $8.8 billion.)

As the premier told his Monday audience, "stay tuned."

How much will taxpayers contribute?

The timing of Honda's announcement was a business decision — but it's a happy coincidence for Prime Minister Justin Trudeau that it fell in the midst of his ministers' post-budget marketing tour.

Only a few months after Trudeau signalled that the federal government was running out of money for automotive subsidies — prompting fears that Toyota Canada would hit the brakes on further Ontario expansion — a change in government tactics apparently paid off.

Canada's share of North American manufacturing could have been in jeopardy if the federal and provincial governments hadn't stepped up with both investment tax credits and production subsidies to compete with the Inflation Reduction Act introduced by U.S. President Joe Biden.

Those billions were enough to land Ontario its first two battery plants: the VW plant in St. Thomas and the Stellantis facility in Windsor. But the Trudeau government warned at the time that their production subsidies aren't sustainable.

The sweeteners offered to land this Honda deal are more predictable because they're based on the value of Honda's investment, not future production levels.

In the 2023 federal budget, the Liberals introduced a clean manufacturing investment tax credit that rebates 30 per cent of the cost of new machinery and equipment. Its implementation legislation, C-59, has yet to pass; the Liberals hope it receives royal assent by June.

Last week, the 2024 federal budget introduced a ten per cent electric vehicle supply chain investment tax credit to offset the cost of buildings. Companies receiving the tax credit must invest in three parts of the EV supply chain: EV assembly, battery production and production of cathode active material for those batteries.

Finance Minister Chrystia Freeland's department took the lead in federal talks with Honda; her budget forecasts a $80 million expenditure on this tax credit over the next five years. The federal government has hinted it anticipates about $800 million in investment on eligible buildings between now and 2029.

Honda appears set to be the first — and possibly the only — carmaker to make the vertical investments required to access this credit, with an expansion of its facilities in Alliston as well as other yet-to-be announced expansions in Ontario.

Honda expected to announce plans to build EVs in Canada

CBC News has not confirmed that a site earmarked for EV battery production in St. Clair township near Sarnia, Ont. , is part of Honda's negotiations. Fedeli said Monday that land in Wilmot township near Waterloo, Ont ., was not part of Honda's plans.

Quebec's economy minister, Pierre Fitzgibbon, told reporters at the National Assembly Tuesday that he was in talks to land a piece of Honda's business at the industrial park in Bécancour, Que., where other automotive giants are setting up cathode materials manufacturing.

Fitzgibbon admitted he was outbid by Ontario .

To help attract EV investment, Ontario's 2023 provincial budget included a 10 per cent refundable corporate income tax credit for eligible investments in buildings, machinery and equipment, worth up to $2 million a year for individual corporations.

The Toronto Star has reported that when the Stellantis deal was in jeopardy, the federal government convinced the Ford government to pile on more provincial subsidies in return for federal cooperation on the environmental assessments required to build Highway 413.

It's not known whether a similar last-minute squeeze happened in the Honda talks. Ontario Finance Minister Peter Bethlenfalvy's statement in reaction to the April 16 federal budget nodded to this Highway 413 quid pro quo and revived Ontario's demand for the federal government to "eliminate duplicative reviews and processes that are slowing down" Ring of Fire projects.

Are more Japanese investments coming?

Volpe said the new rules hammered out during the NAFTA renegotiation talks anticipated the transition to electrified powertrain products and batteries by making sure carmakers couldn't source components offshore (China, mainly) without risking tariffs.

During a 2023 visit to Canada, Japanese Prime Minister Fumio Kishida called China a "central challenge."

Geopolitically, Japan is far more comfortable working with Canada to source the critical minerals its automotive engineers need.

Last September, Japan's economy, trade and investment minister Yasutoshi Nishimura visited Ottawa with a delegation of Japanese businesspeople from its battery supply chain association ( BASC ) and corporations like Panasonic Energy, Asahi-Kasei, Mitsubishi, Mitsui and Sumitomo. They signed memoranda of cooperation with Canadian companies about sharing technology and business intelligence.

- Climate warrior Jane Goodall isn't sold on carbon taxes and electric vehicles

- Analysis What Tesla's troubles tell us about the EV industry

- U.S. eases vehicle emissions rules, but overall reduction targets remain unchanged

This week's Honda announcement will be Canada's biggest EV investment deal so far. But it wasn't the first and it's not expected to be the last.

Now that Honda's seen enough to place its bet and become Ontario's third EV battery maker, attention will turn to whether Toyota might reconsider becoming the fourth — and whether Canada's clean power grids can accommodate more ambition.

"Every single car company is spending all of their future R&D dollars on electrified product or fuel cell project product, anything that's zero emission," Volpe said, dismissing the naysayers who've lost faith due to slow consumer sales.

"We all know where we're going."

ABOUT THE AUTHOR

Senior reporter

Janyce McGregor joined the CBC's parliamentary bureau in 2001, after starting her career with TVOntario's Studio 2. Her public broadcaster "hat trick" includes casual stints as a news and current affairs producer with the BBC's World Service in London. After two decades of producing roles, she's now a senior reporter filing for CBC Online, Radio and Television. News tips: [email protected]

- Follow Janyce on Twitter

Related Stories

IMAGES

VIDEO

COMMENTS

February-2009. Even though Japanese equities have recovered post GFC, and in particular post 2012 when the Bank of Japan ("BOJ") under Governor Kuroda started purchasing ETFs, between 1990 and 2023, investors in Japan would have earned an abysmal compounded annual rate of return of -0.3%.* * Credit Suisse Global Investment Returns Yearbook ...

Maybe I'll look at some small-cap funds over the coming months. Overall, though, my investment thesis remains intact: Japan has attractive valuations and increasingly shareholder-friendly ...

impacts of Japanese private fixed investment change over time. There is substantial research into aggregate investment, and it remains an active ... This thesis makes the following five original contributions to the literature on the drivers and impacts of private fixed investment. First, it is the first work to provide

The Causes of Japan's Economic Slowdown and Necessary Policies: An Analysis Based on the Japan Industrial Productivity Database 2018. 1 ... In 2005-2015, Japan saw a downturn in capital investment due to the global financial crisis triggered by the collapse of Lehman Brothers in 2008, the subsequent appreciation of the yen, and the Tohoku ...

the investments by their CVC, the effects of the investments by Japanese companies are still unclear, and many failures has been reported in Japan. This thesis focuses on a comparison analysis of Japanese CVCs with Western CVCs. In this thesis, I will research a purpose, investment policy, prioritized return and operations management for their CVC,

Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world

Master Thesis Outward Foreign Direct Investment and its impact on Trade: Japan and ASEAN economies Student: Andrew Kei Benito Ito (595306) Supervisor: Prof. dr. Felix Ward ... and investment relation that Japan has had with the ASEAN economies in the past decades, as well as

The Case for Investment in Japan July 21, 2022 — 04:35 pm EDT ... TINA has been a popular investment thesis in the long bull run of the last decade in the U.S. and invests essentially along ...

The certified thesis is available in the Institute Archives and Special Collections. Includes bibliographical references (leaves 69-71). ... Real estate investment indices in Japan and their role in optimal international portfolio allocation. Author(s) Endo, Takashi, S.M. Massachusetts Institute of Technology ...

Japan's Infrastructure Investment Policy in the Indo-Pacific: Analysing from Realist and Liberal Perspectives By Yu Myat Mon 51120603 September 2022 Master's Thesis Presented to Ritsumeikan Asia Pacific University In Partial Fulfillment of the Requirements for the Degree of Master of Asia Pacific Studies . 2 Table of Contents

Top Reasons to Consider Investing in Japan. 1. Abenomics provides a foundation for growth. Before 2012, Japan had spent many years in a deflationary environment, sometimes referred to as the "lost decade", and investment in Japan was greatly inhibited. Upon his election, Prime Minister Shinzo Abe instituted economic policies, known as ...

Japan Equities. Looking back over 2020, a challenging year for many reasons, there were two key investment decisions that helped the performance of the FSSA Japan Equity strategy. Firstly, in the early days of the pandemic we started to identify companies that might benefit from the acceleration of secular investment trends.

A risk to the investment thesis in the Japanese market is the decline in households enrolled in insurance programs. A longer-term threat is the expanding influence of foreign reinsurers in Japan.

Japan has the third-largest economy in the world, but its VC market, as measured by the amount of investment into Japanese startups, is comparable to a mid-size VC market in the United States. It ...

Apr. 28, 2015. Toward Further Development of the Repo Market. July 22, 2014. Japan's International Investment Position at Year-End 2013. June 19, 2014. Portfolio Rebalancing Following the Bank of Japan's Government Bond Purchases: A Fact Finding Analysis Using the Flow of Funds Accounts Statistics. June 19, 2014.

side of the Gulf. As Fig. 2 shows, Japanese investment in the Middle East increased from $36 million in 1971 to $492 million in 9178 because of the bolstered FDI to the Iran-Japan Petrochemical Co. (IJPC) in 1978.10 Japanese direct investment in the Middle East peaked in 1978 at nearly 11% of total outward FDI (Fig. 2).

Regressing 5-year changes in Japan's ROC vs. its real effective exchange rate and the global profit cycle (proxied by changes in U.S. ROC) suggests cyclical drivers explain about 40% of the changes in Japan's long-term profitability. While cyclical forces matter, we believe the remaining 60% of the change in Japan's ROC is due to secular ...

The investment thesis is no more or less than a definitive statement, based on a clear understanding of how money is made in your business, that outlines how adding this particular business to your portfolio will make your company more valuable. Many of the best acquirers write out their investment theses in black and white.

Dissertations / Theses on the topic 'Investments in Japan' To see the other types of publications on this topic, follow the link: Investments in Japan. Author: Grafiati. Published: 24 April 2022 Create a spot-on reference in APA, MLA, Chicago, Harvard, and other styles. Select a source type: ...

The targets of Japanese investment were mainly focused on Asian region, due to geographical concern and historical ties with Asian countries. However, 2007-8 global food crisis had created a 'turning point' for Japan's offshore strategy. In 2009, Japanese Ministry of Agriculture, Forestry and Fisheries (MAFF) and Ministry of Foreign Affairs ...

IIA Navigator. International investment agreements (IIAs) are divided into two types: (1) bilateral investment treaties and (2) treaties with investment provisions. A bilateral investment treaty (BIT) is an agreement between two countries regarding promotion and protection of investments made by investors from respective countries in each other's territory.

Last year, Japanese foreign direct investment to the US exceeded $750 billion, Kishida said, making Japan the biggest foreign investor in America and creating more than 1 million jobs.

Relevant bibliographies by topics / Japanese Investment / Dissertations / Theses. Dissertations / Theses on the topic 'Japanese Investment' To see the other types of publications on this topic, follow the link: Japanese Investment. Author: Grafiati. Published: 2 March 2023 Create a spot-on reference in APA, MLA, Chicago, Harvard, and other ...

Aflac Japan is the division that invests more, with a total investment sum of $86.7 billion. In contrast, the U.S. division has invested a relatively smaller amount of a 'mere' $16.7 billion.

The Myanmar-Japan Bilateral Investment Treaty 3 2.0 Investment Treaties: An overview The first investment treaty was signed between Germany and Pakistan over 50 years ago. Early investment treaties were almost always bilateral agreements between a developed and a developing country. During the 1990s the

ValueAct Capital can breathe a sigh of relief. The U.S. investment firm prefers to chide management of underperforming companies in private, but it turned heads last year when it publicly lost its ...

As growth has increased, so has the stock's valuation. The stock has an average price-to-earnings ratio of 41.0 since 2019 and 34.1 since 2014. According to Seeking Alpha, analysts expect that ...

It is rare for a foreign head of government to visit North Carolina — but Japan's Prime Minister Fumio Kishida's arrival is proof that the country's influence in the Tar Heel State is ascendant.. Why it matters: Japan has become an increasingly important part of North Carolina's economy, recently overtaking Germany as the largest source of foreign direct investment, according to the N.C ...

Those are significant news items, but Oracle's AI investment in Japan could be game changing. Sure, $8 billion is a hefty investment, but it will enable Oracle to "grow Oracle Cloud ...

In January, the Japanese news outlet Nikkei was the first to report Honda was considering an investment of 2 trillion yen (about $18 billion Cdn) to start up an EV supply chain in Canada.