Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

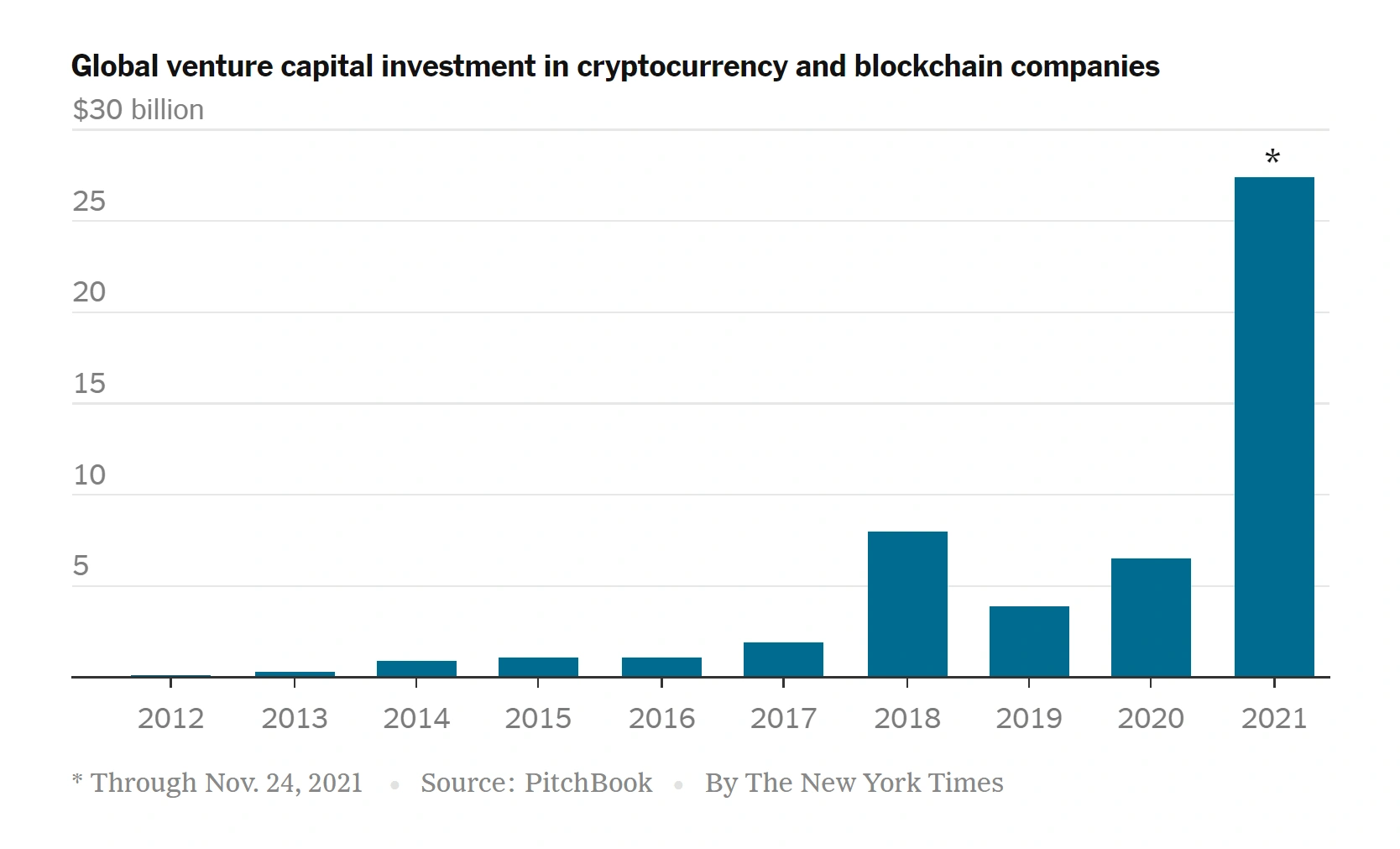

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews, the effects of heterogeneous csr on corporate stock performance: evidence from covid-19 pandemic in china.

COVID-19, the Russia–Ukraine war and the connectedness between the U.S. and Chinese agricultural futures markets

- Yongmin Zhang

- Yingxue Zhao

The complex relationship between credit and liquidity risks: a linear and non-linear analysis for the banking sector

- Jihen Bouslimi

- Abdelaziz Hakimi

- Kais Tissaoui

Theoretical foundations of voluntary tax compliance: evidence from a developing country

- Agumas Alamirew Mebratu

Evaluating financial fragility: a case study of Chinese banking and finance systems

Assessment of financial and social disclosure level of Ethiopian commercial banks

- Degu Kefale Chanie

- Keshav Malhotra

- Monika Aggarwal

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

- Browse All Articles

- Newsletter Sign-Up

CorporateFinance →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

- Open access

- Published: 20 December 2023

Emerging new themes in green finance: a systematic literature review

- H. M. N. K. Mudalige ORCID: orcid.org/0000-0002-4497-4750 1

Future Business Journal volume 9 , Article number: 108 ( 2023 ) Cite this article

2723 Accesses

Metrics details

There is a need for an extensive understanding of the emerging themes and trends within the domain of green finance, which is still evolving. By conducting a systematic literature review on green finance, the purpose of this study is to identify the emerging themes that have garnered significant attention over the past 12 years. In order to identify the emerging themes in green finance, bibliometric analysis was performed on 978 publications that were published between 2011 and 2023 and were taken from the databases of Scopus and Web of Science. The author examined annual scientific production, journal distribution, countries scientific production, most relevant authors, most frequent words, areas where empirical research is lacking, words' frequency over time, trend topics, and themes of green finance. The outcome of the review identified the following seven themes: (i) green finance and environmental sustainability; (ii) green finance and investments; (iii) green finance and innovation; (iv) green finance policy/green credit guidelines; (v) green finance and economy; (vi) green finance and corporate social responsibility; (vii)trends/challenges/barriers/awareness of green finance. The analysis of these emerging themes will contribute to the existing corpus of knowledge and provide valuable insights into the landscape of green finance as it evolves.

Introduction

Cities will face their greatest challenges ever during the next 30 years, and three-quarters of the world's population will reside in urban areas by 2050 due to the unparalleled rate of urbanization as a result of population growth, resource scarcity, such as peak oil, water shortages, and food security [ 100 ].

One of the main challenges in building and maintaining sustainable cities is discovering the sources required to fund vital infrastructure, development, and maintenance activities that have a sustainable future. To achieve the creation of sustainable cities, there is a need for green projects via green financial bonds, green banks, carbon market tools, other new financial instruments, new policies, fiscal policy, a green central bank, fintech, community-based green funds, and expanding the financing of investments that provide environmental benefits [ 26 , 78 ].

It is evident that green financing plays a crucial role in promoting sustainable initiatives. Thus, a transition from a rising economy to a green economy necessitates that a country's leadership offers green financing [ 112 ]. To assure green economic growth, nations around the world have invested in green projects to promote, invent, and employ environmentally friendly technologies to safeguard the environment and maximize environmental performance [ 55 ]. Because of new stakeholders' and institutions' understanding of environmental issues, regulatory authorities are likely to seek out extra ecologically acceptable financial resources. In an effort to establish environmental legitimacy, this type of environmental proactivity will be required when new methods of providing financial resources and green financing arise.

In numerous ways, the impact of adopting green financing is proven. First, green finance provides financial support for firms engaged in green innovation, including the purchase of green equipment, the introduction of new environmentally efficient technologies, and the training of their personnel. Second, green funding from various projects can assist stakeholders (organizations, governments, and regulators) in spending R&D funds on environmental challenges and minimize the associated risk with green legislation. Lastly, green policies have higher costs than conventional practices, and green finance can assist an organization in covering these expenses without encountering significant financial obstacles. As a result, green finance-driven economic growth can significantly support green policies, lessen environmental pollution, and build sustainable cities [ 128 ].

There have previously been systematic literature reviews conducted in the green finance area. However, a study's reliance on one database can exclude some recent developments in green finance from its analysis [ 93 ]. Findings from several databases could be compared and contrasted to create a more all-encompassing view of the area. Therefore, this study focuses on using Scopus and WoS databases.

Though additional methods, such as systematic literature reviews (SLR) and more complex network analyses such as co-occurrence of index terms, citations, co-citations, and bibliometric coupling, are available, previously conducted studies used a fundamental bibliometric technique [ 23 ]. A more detailed picture of the green finance study setting may emerge from an examination of the identification of various themes.

As part of a systematic review of the literature concerning emerging trends in green finance, it is critical to ascertain the dominant themes that are present in the field. By adopting this methodology, an intentional emphasis is placed on maintaining the review's relevance and excluding any studies that are obsolete. In addition, by identifying and classifying these themes, one can gain significant knowledge regarding the ever-changing characteristics of green finance, thereby illuminating the latest advancements and patterns. A study conducted by Pasupuleti and Ayyagari [ 99 ] identified different themes in green finance, but the researchers were only focused on polluting companies. By amalgamating insights from the literature review, one can attain a holistic comprehension of the current state of research in the field of green finance. Additionally, this process identifies areas where additional inquiry is necessary. Engaging in such an undertaking provides advantages not only to the scholarly community but also carries practical implications for policymakers, practitioners, and investors, assisting them in formulating effective policies and investment strategies and making well-informed decisions.

Green finance research is growing rapidly. However, the rising themes and trends in green finance literature must be comprehended. A comprehensive literature review can summarize current knowledge, identify research gaps, and identify the field's most relevant topics. This study seeks to uncover green finance's emerging themes through a rigorous literature review. This research aims to advance green finance knowledge by synthesizing and analyzing a wide range of scholarly articles.

Methods and methodology

Study selection process and methods.

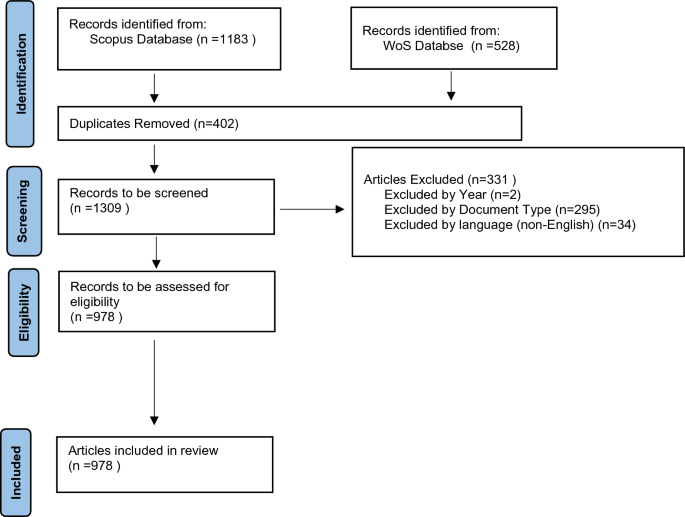

In this study, a systematic literature review (SLR) was applied. It used inclusion criteria, analysis techniques, and a more objective method of article selection. As recommended for SLRs [ 65 ] with regard to the article selection process, the PRISMA article selection steps were adhered to. The steps are "identification," "screening," and "included". The steps that were taken in this study are shown in Fig. 1 .

PRISMA article selection flow diagram. Note : Search algorithm; “green finance” . Sources (s) Authors Construct, 2023

In the identification phase, the search terms, search criteria, databases, and data extraction technique are chosen. The keyword to use in the search was "green finance" as the study is aimed at identifying emerging themes in green finance.

The identified articles need to be screened in accordance with the PRISMA guidelines. The tasks carried out at the screening were the screening, retrieval, and evaluation of each article's eligibility. According to Priyashantha et al. in [ 103 ], articles in each task that did not meet the inclusion criteria were removed. The "empirical studies" published in "Journals" from "2011–2023" in "English" were the inclusion criteria for screening the articles. In 2023, up to May, the journal articles were chosen.

This screening was carried out both manually and automatically. Utilizing Scopus' and Web of Science's (WoS) automatic article screening features by study type, language, report type, and publication date, articles achieving the inclusion criteria "empirical studies" published in "English" "journals" from "2011–2023″ were included. The other publication types such as conference papers, book chapters, reviews, research notes, editor's comments, short surveys, and unpublished data, as well as non-English articles and articles published within the considered year range, were excluded. The full versions of the screened articles were then retrieved for the eligibility assessment, the next stage of screening. The author manually evaluated each article's eligibility.

Study risk of bias assessment

Researcher bias in article selection and analysis lowers the quality of reviews [ 8 , 102 ]. Avoiding bias in article selection and analysis requires using a review protocol, adhering to a systematic, objective article selection procedure, using objective analysis methods [ 8 , 102 ], and performing a parallel independent quality assessment of articles by two or more researchers [ 8 ]. By adhering to all of these requirements, the risk of bias in the articles was removed.

Methods of analysis

Biblioshiny and VOSviewer were used for bibliometric analysis. Green finance literature was captured by Scopus and WoS. These databases were used exclusively to get a representative sample of journal articles to study green finance articles. The data were collected and analyzed using Biblioshiny. Select databases can be systematically extracted and analyzed with the software. It collects year-by-year article distribution, journal distribution, country-specific scientific production, most relevant authors, most frequent words, word frequency over time, trend topics, density visualization, etc.

Trends and patterns were found by analyzing green finance paper distribution by year. This analysis shows green finance research's growth. By analyzing article distribution by year, we may also establish green financing and rising theme trends. To identify green finance research publications, article distribution was studied. Academic journal distribution can indicate green finance's prominence in various academic journals. Analyzing scientific production by region reveals regional green finance research tendencies. Scientific production across nations identifies knowledge-producing regions.

Analyzing influential green finance authors helps identify their contributions. This strategy acknowledges influential scholars. The research's most frequently used words reveal the fundamental questions and ideas of environmentally responsible economics. This analysis reveals the discipline's primary topics and studies. By counting words, it may focus on green finance's most important and widely used components. Word frequency can show how green finance's focus has shifted. By tracking word usage, it can identify trending topics. This analysis reveals changing green finance research priorities. Biblioshiny explores green financial trends. This study reveals new topics, research gaps, and subject interests. The trend themes allow us to evaluate green finance studies.

Results and findings

Study selection.

The PRISMA flow diagram illustrates that during the identification step, 528 articles from the WoS database and 1183 articles from the Scopus database that include the term "green finance" were identified. There were 402 duplicates, which were removed. The overall number of articles remained at 1302 at that point. Further attempts were made to include papers on empirical investigations in the final versions that were published in English. 34 non-English articles were thus disregarded. In addition, 295 papers from conferences, book chapters, reviews, news articles, notes, letters, abstracts, and brief surveys were not included. Two articles were disqualified because they were published before 2011. The next step was to retrieve the remaining 978 articles and transfer their pertinent data to an MS Excel file, including the article's title, abstract, keywords, authors' names and affiliations, journal name, citation counts, and year of publication. After that, each article was examined by a third party to determine whether it met the requirements for its eligibility.

Study characteristics

Main information.

This study examined 978 studies by 1830 authors from 59 countries. They've been published in 281 publications. The average number of citations each article received was 12.37. There were a total of 2206 keywords and 44,712 references. This information is detailed in Table 1 .

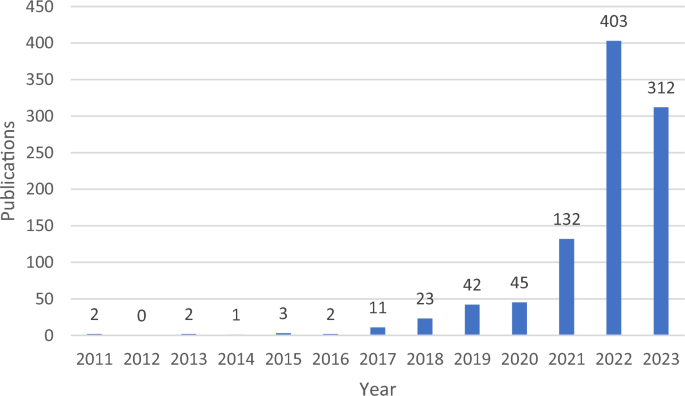

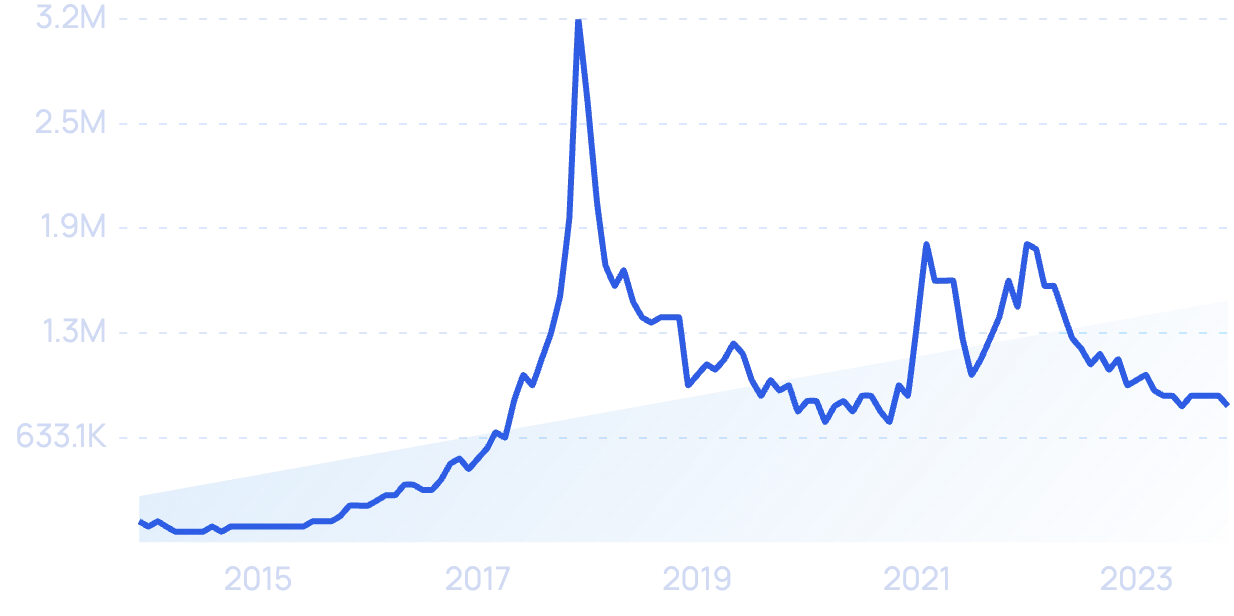

Annual scientific production

The fluctuations in green financing for scientific production are depicted in Fig. 2 . In 2011, two articles were published that demonstrated interest in this research. No publications were released in 2012, indicating a paucity of research or interest. The trend persisted in 2013 with two articles. One publication appeared in 2014, indicating a halt in research. Since 2015, scientific output has gradually increased. In 2015, three articles contributed to the development of green finance research. Two articles survived in 2016. With eleven articles published in 2017, green finance has become a significant area of study. In 2018, 23 articles were published; in 2019, there will be 42. With 45 publications in 2020, green finance research remains robust. Green finance research increased to 132 publications in 2021. This significant increase in articles on the subject indicates a growing interest in the matter. The publication of 403 research articles in 2022 represents a notable increase. This increase reflects the expanding literature on green finance and its academic significance.

Year-wise research article distribution. Source (s): Author created, 2023

Journal distribution

Table 2 consists of a list of journals that were included in the sample and had more than six relevant papers published inside the journals. The majority of the journals that publish articles relating to green finance are, unsurprisingly, those that focus on environmental science, renewable energy, and sustainability. This is despite the fact that finance is considered an essential component of green financing. Not a single journal in the field of finance was able to attract more than 10 papers.

Based on the number of papers, Environmental Science and Pollution Research emerges as the top journal, demonstrating a strong focus on comprehending the intersection between environmental science, pollution, and financial aspects. The prevalence of journals focused on renewable energy and sustainability, each of which publishes 50 papers, demonstrates the growing interest in examining the financial aspects of sustainable development and renewable energy sources. The fact that Resources Policy was included in the list of 49 papers indicates that a significant emphasis was placed on understanding the financial implications of resource management and extraction.

Green finance is interdisciplinary in nature, exploring the connections between finance and various environmental issues, as evidenced by the existence of interdisciplinary journals like Frontiers in Environmental Science. The existence of journals like Finance Research Letters and Economic Research-Ekonomska Istrazivanja highlights the importance of economic and financial analysis in the context of green finance.

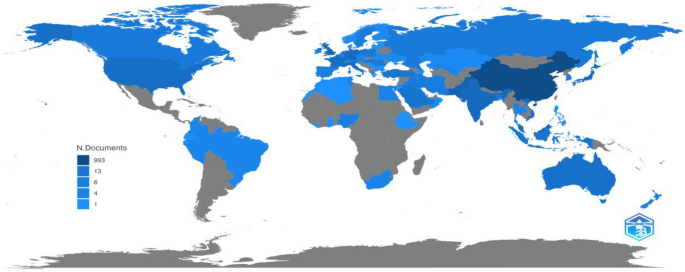

Countries scientific production

The analysis of region frequencies in the provided data in Fig. 3 reveals intriguing patterns and highlights the varying levels of research focus in various countries. The analysis is focused on the top ten countries for scientific production on green finance.

China is the part of the world most frequently mentioned, with a striking frequency of 993. This suggests a significant research interest in comprehending and analyzing diverse aspects of China's economy, policies, and development. Given China's status as the world's most populous nation and its growing global influence, it is unsurprising that researchers have devoted considerable effort to examining China's position in various fields, including finance, sustainability, and innovation.

Pakistan follows with a frequency of 79, indicating a notable but relatively lower research emphasis. Researchers may have investigated particular Pakistan-related topics, such as its economy, governance, or social issues. Pakistan may be of particular interest to a subset of researchers, or there may be a paucity of relevant literature in the analyzed dataset.

With a frequency of 60, the UK is the third-most-mentioned region. This demonstrates a sustained interest in researching various aspects of the UK, such as its economy, financial sector, and policies. It is possible that the historical significance of the UK, particularly in terms of finance and international relations, contributed to its prominence in literature.

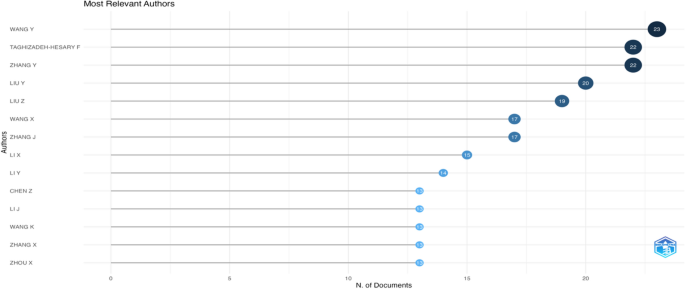

Most relevant authors

The prominent and active contributors to the discipline are shown in Fig. 4 . Wang Y has significantly added to the body of literature. The top authors have a constant record of publishing, which shows a dedication to knowledge advancement and suggests a high level of expertise in their field of study.

In this section, the findings that conform to the aims of the research are reported. The conclusions were generated through the use of trend themes, keyword co-occurrence analysis, "most frequent words," and "word frequency over time." During the course of the investigation, both the "keyword co-occurrence; network visualization" and the "density visualization" methods were applied.

Most frequent words

The analysis of the most frequent words sheds light on the emerging themes in the field of green finance, as illustrated in Table 3 and Fig. 5 . A significant emphasis on China, which appears 253 times in the literature, is one of the important observations. This indicates that China's initiatives and role in the context of sustainable finance and green investment are gaining increasing recognition. China's approach to green finance and its potential implications for global sustainability initiatives are likely the primary focus of researchers and policymakers.

The term "finance" appears 122 times, emphasizing the importance of financial mechanisms and instruments to the advancement of green initiatives. This emphasizes the significance of financial institutions, policies, and frameworks that support environmental protection and sustainable development. The frequency of the term "investment" (103) emphasizes the significance of allocating financial resources to environmentally friendly businesses and initiatives.

The 105 occurrences of "sustainable development" indicate the close relationship between green finance and broader sustainability goals. This indicates that researchers and practitioners recognize the need to align financial decisions with environmental, social, and governance (ESG) factors in order to achieve long-term sustainable development objectives.

The terms "green economy" (75) and "environmental economics" (57) refer to the integration of environmental considerations into economic systems and decision-making procedures. This emphasizes the importance of transitioning to environmentally sustainable economic models and policies.

The frequency of terms such as "carbon," "carbon emissions," and "carbon dioxide" (55, 55, and 51 times, respectively) indicates a focus on mitigating greenhouse gas emissions and addressing climate change via financial mechanisms. This is consistent with the worldwide drive for decarbonization and the transition to low-carbon economies.

In addition, the terms "innovation" (71), "impact" (67), and "efficiency" (49) emphasize the significance of technological advancements, measurable outcomes, and resource optimization in green finance. These ideas illustrate the ongoing pursuit of innovative strategies and solutions to promote positive environmental impact while maximizing resource utilization.

The terms "sustainability" (44), "policy" (49), and "financial system" (41) highlight the need for policy frameworks and a robust financial system to facilitate the incorporation of sustainability considerations into mainstream finance. These themes emphasize the critical role that regulations, incentives, and institutional arrangements play in promoting green finance practices and nurturing a sustainable economy.

In addition, the terms "climate change" (50) and "alternative energy" (42) suggest an emphasis on addressing climate-related issues and investigating renewable and sustainable energy sources. This demonstrates an acknowledgment of the role of green finance in the transition to a low-carbon, resilient future.

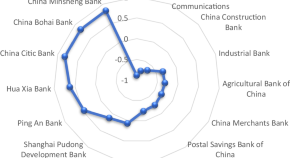

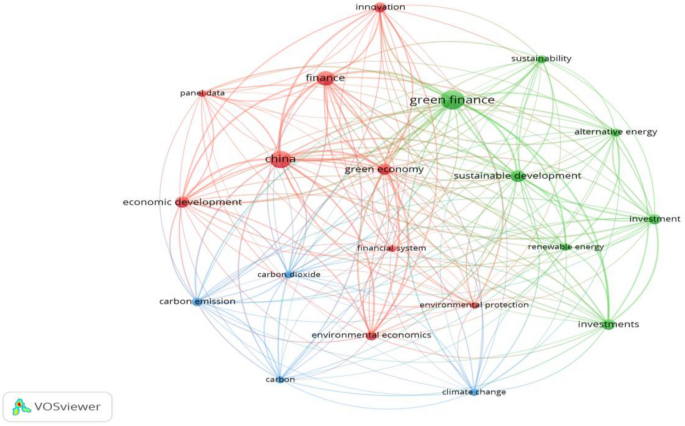

The relationships between the keywords depicted as nodes are displayed in Fig. 6 's keyword co-occurrence network visualization. The link shows how each keyword relates to the others. In particular, the thickness of the line indicates how strong the relationship is. As a result, Fig. 8 illustrates how China and green finance are connected by a thicker line, showing that the majority of green finance research is carried out in China. Additionally, the connection between finance, sustainable development, and investments in green finance shows their connection to green finance. In Fig. 6 , the nodes are grouped into the red, green, and blue clusters. These clusters contain the keywords listed in Table 3 for each one. The various clusters in Fig. 6 demonstrate how different areas of research had distinct effects on green financing. When keywords are grouped together, it indicates that the topics they refer to are quite likely to be the same. As a result, the red, green, and blue clusters in Fig. 6 highlight common themes, while Table 4 provides explanations for the clusters.

The keyword co-occurrence network visualization

Areas where empirical research is lacking

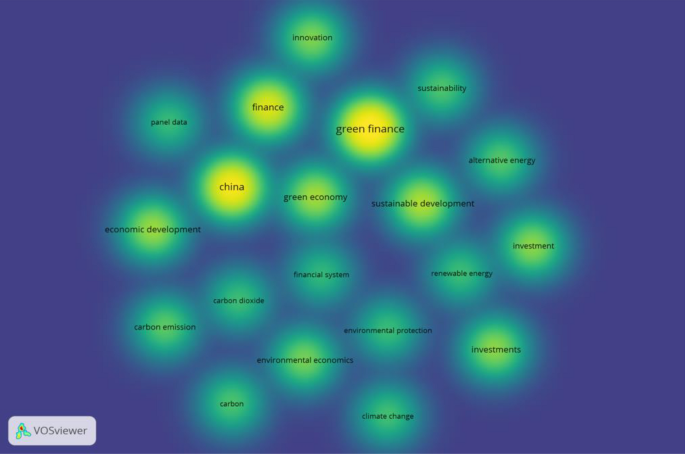

Figure 7 displays the density visualization map that the VOSviewer generated. The VoSviewer manual states that a node with a red background denotes sufficient research for established knowledge and that it is evident that more study on green finance is still needed. On the other hand, keyword nodes with a green background show that there hasn't been much research on those particular keywords. Other than finance and China, the other keywords in the figure are therefore in the green background, which denotes insufficient research.

The keyword co-occurrence density visualization

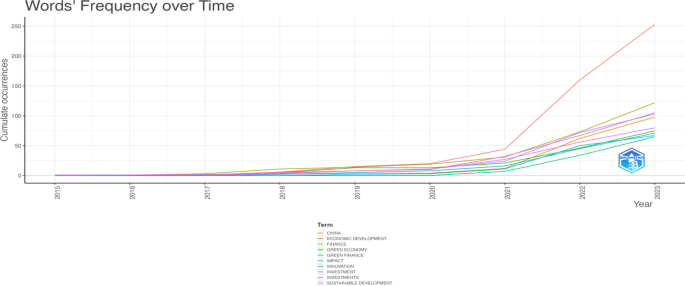

Word’s frequency over time

The analysis of words' frequency over time in Fig. 8 reveals a number of significant trends. Beginning in 2018, the frequency of the term "China" increases considerably, with a significant rise in 2022 and a peak of 253 occurrences in 2023. This indicates a growing emphasis on China's role in green finance and its expanding prominence in the academic literature.

The persistent occurrence of the term "finance" over the years indicates the sustained significance of financial mechanisms and instruments in the context of green finance research. Its increasing frequency over time demonstrates the continued emphasis placed on financial aspects of the field.

The consistent growth of the term "sustainable development" from 2016 to 2019 indicates a growing recognition of the connection between green finance and broader sustainability objectives. However, after 2019, its occurrence remains comparatively stable, indicating that sustainable development has become a well-established and consistent theme in the literature.

Similarly, the term "investment" has maintained a consistent presence throughout the years, indicating a continued emphasis on allocating financial resources to green and sustainable initiatives. Its frequency fluctuates but remains relatively high throughout the period under consideration.

The frequency of the term "economic development” increased gradually until 2021, after which it remained relatively stable. This indicates that researchers have acknowledged the need to incorporate economic development and sustainable practices, resulting in a continued emphasis on this topic.

Similar to the term "investments," it has maintained a consistent presence throughout the years. This demonstrates a persistent desire to investigate investment opportunities and strategies within the context of green finance.

The frequency of the term "green economy” increased until 2020, after which it stabilized. This demonstrates an ongoing commitment to transitioning to a greener and more sustainable economy.

The terms "innovation" and "impact" have exhibited a general upward trend over the years. This suggests that innovative approaches to measuring the impact of green finance initiatives and projects are gaining importance.

The term "green finance" has been used significantly more frequently, particularly after 2021. This demonstrates the increasing interest and focus on the specific discipline of green finance, reflecting its emergence as a distinct research area within the context of sustainable finance as a whole.

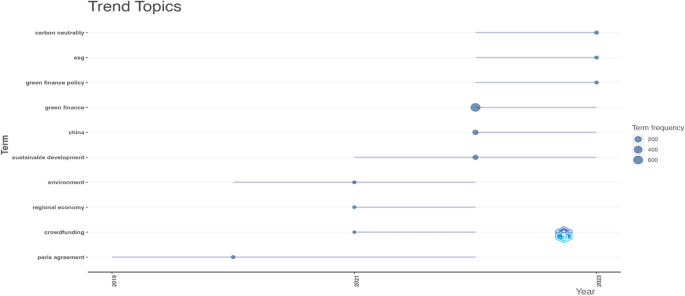

Trend topics

Insights into novel areas and their developments over time can be gained from an analysis of trend themes using author keywords in the bibliometric data, as shown in Fig. 9 .

Trend Topics

There are nine times where the "Paris Agreement" is mentioned as a subject. It was consistently present from 2019 to 2022, demonstrating a strong interest in comprehending the ramifications and execution of this global climate agreement. The Paris Agreement's effects on environmental regulations and attempts to slow down climate change were probably among the topics on which researchers concentrated.

Seven uses of the word "environment" show that it is a recurring subject. This implies maintaining a focus on environmental concerns and the interactions between human actions and the environment as a whole. It's likely that academics and researchers have examined numerous environmental concerns and their effects on various industries and regulations.

Six occurrences of "regional economy" are found in the literature. This shows a rise in interest in learning about the dynamics and growth of regional economies and how they relate to sustainable practices. The emphasis on regional economies indicates that scholars are looking at the regional and context-specific elements affecting sustainable development and economic progress.

Another subject with five mentions per topic is "crowdfunding". This shows that crowdsourcing is becoming more and more popular as a method of finance, especially for sustainable projects. Crowdfunding's ability to assist green projects, as well as the opportunities and challenges that come with it, has probably been studied by researchers.

With 631 occurrences, the topic "green finance" stands out due to its very high frequency and demonstrates its rising importance in the literature. This demonstrates a rise in interest in the nexus between finance and environmental sustainability. The methods, laws, and procedures that encourage financial investments in green projects and companies have probably been studied by academics and policymakers.

With 92 mentions, "China" stands out as being quite popular. In the context of green finance and sustainable development, this suggests a strong focus on China's participation. Researchers are probably looking at China's policies and initiatives and how they may affect international sustainability efforts.

The phrase "sustainable development" also comes up 70 times, demonstrating a steadfast interest in learning and implementing sustainable practices in a variety of fields. There is a good chance that academics have looked into the frameworks, policies, and tactics that help achieve long-term sustainable development goals.

Seventeen times are mentioned when the term "carbon neutrality" is brought up, which shows that efforts to achieve it are becoming more and more of a priority. To minimize greenhouse gas emissions and combat climate change, researchers have probably looked into a variety of strategies and regulations.

ESG (environmental, social, and governance) is a term with a frequency of ten references, which reflects the growing understanding of the significance of ESG aspects in investment choices and company practices. The incorporation of ESG factors into financial analysis and decision-making processes has probably been researched by researchers and practitioners.

Last but not least, the phrase "green finance policy" is used nine times, showing that policies that support and oversee green finance efforts are a particular emphasis of the study. It's likely that academics and policymakers have looked at how well these policies work and how they affect the growth of sustainable practices and investments.

In conclusion, study subjects that have attracted interest over time are shown by an analysis of trend topics in the bibliometric data. These themes show the continued attempts to understand and manage environmental concerns through research, policy, and finance, from global agreements like the Paris Agreement to specific topics like green finance and sustainable development.

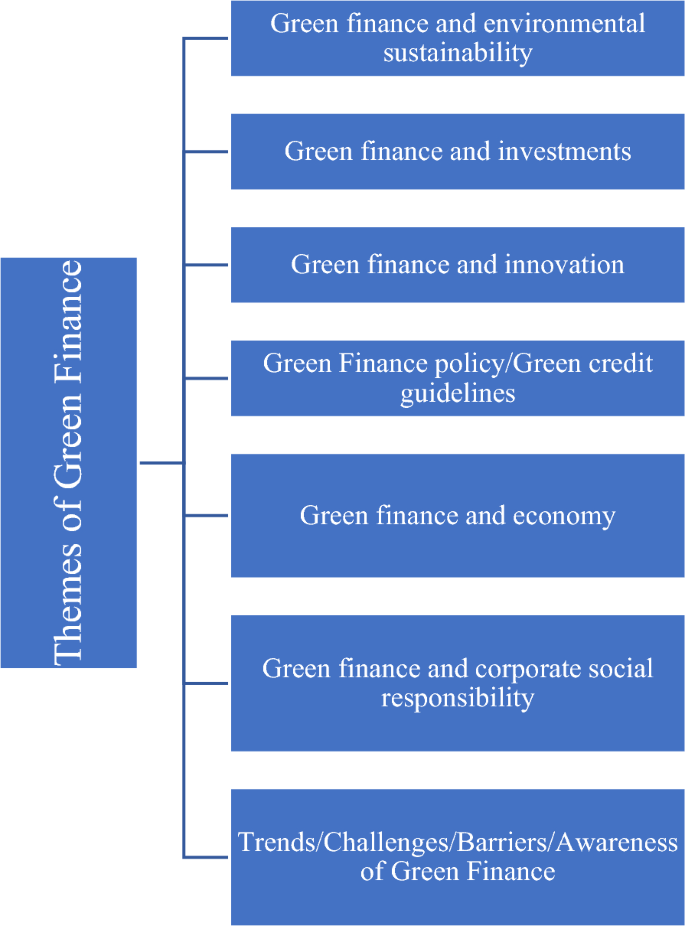

Themes of green finance

This study uncovered a variety of topics relating to green finance as well as potential areas for further research. The descriptions of the themes are presented in Fig. 10 . Different themes related to green finance, along with significant studies that contributed significantly, are discussed below.

Green finance and environmental sustainability

In recent years, there has been a growing emphasis on the significance of green finance and environmental sustainability, leading to increased attention and focus in both academic research and practical applications. The world is currently experiencing an unparalleled environmental crisis, with issues like resource depletion, biodiversity loss, and climate change becoming more pressing. Green finance, which falls under the umbrella of sustainable finance, centers its attention on investments and financial methods that not only yield economic profits but also contribute to favorable environmental consequences.

Existing research mostly focuses on green finance and environmental sustainability in Asian countries, with specific focus on China. Green finance's function in low-carbon development has been thoroughly studied in relation to carbon emissions [ 13 , 147 ]. Green financing and renewable energy growth have also received attention, aiding China's clean energy revolution [ 4 , 12 , 20 , 21 , 40 , 49 , 51 , 56 , 61 , 67 , 72 , 75 , 76 , 80 , 85 , 89 , 97 , 104 , 105 , 107 , 109 , 110 , 119 , 121 , 129 , 135 , 144 , 145 , 149 , 169 , 172 ]. Environmental rules and green finance have also been studied to determine how well they promote sustainable financing [ 19 , 22 , 62 , 114 , 123 , 145 , 159 ].

When it comes to the study of regions outside of Asia, such as Africa, South America, and parts of Europe, there is a significant knowledge gap. It may be helpful to gain useful insights into regional variances and strategies if one is able to comprehend the various ways in which these various regions approach green financing and environmental sustainability initiatives.

Green finance and investments

Following a global shift toward sustainable and ecologically responsible economic practices, green finance and investments have developed dramatically.

Green bond quality and effectiveness, notably in China, is a major study topic. Green bonds finance ecologically friendly projects, therefore verifying their quality is crucial to green financial markets. To help green bonds meet sustainability goals, researchers have studied their quality procedures and standards [ 3 , 6 , 9 , 10 , 33 , 34 , 35 , 38 , 79 , 92 , 95 , 108 , 115 , 164 ]. The relationship between green and non-green investments is another frequent research topic. Researchers have studied the hedging or diversification impacts of these two assets. This study examines how green and non-green investments affect portfolio strategies, risk management, and the financial environment [ 1 , 116 ]. Another interesting relationship is natural resource richness, FDI, and regional eco-efficiency. Given global agreements like COP26, scholars are studying how natural resources and FDI effect regional ecological efficiency as states attempt to combine economic growth with environmental sustainability [ 15 , 36 , 42 , 143 , 157 ].

A key feature of green finance study is how financial institutions, integrate green investment and financing teams. The green finance agenda requires understanding how bank’s structure and behave to encourage sustainable investment. Green financial instrument creation and effect are another study topic. Researchers have examined green finance products including green bonds and minibonds to determine their performance and impact on environmental and sustainability goals. This field helps design policies and strategies to optimize industrial structures and promote sustainable development.

Green finance research examines how it affects industrial structures. Studies have examined how green finance initiatives including loans and investments optimize and shift industrial sectors toward sustainability. These findings are crucial for governments and business stakeholders seeking financial incentives for eco-friendly operations [ 12 , 31 , 46 , 57 , 85 , 96 , 124 , 130 , 139 ].

Green finance market interactions with financial variables must also be assessed for sustainable financial development. Researchers examine the relationship between green financial indices and other financial indicators to better understand how green finance affects the financial landscape [ 27 , 32 , 48 , 68 , 137 ].

Green finance and investments have many unexplored areas, presenting research opportunities. The behavioral dimensions of green investment focus on the psychological drivers and biases that influence investment choices; subnational and local initiatives, which are frequently ignored despite their crucial role in ecological action; cross-country comparisons to provide a more holistic view of effective green finance practices; the role and impact of green finance in emerging economies; and innovative green financial instruments like blockchain. Examining these lesser-known aspects could improve our understanding of sustainability in the financial sector and offer insightful information to investors, financial institutions, and legislators that want to make a positive impact on a more sustainable and environmentally friendly future.

Green finance and innovation

The convergence of green finance and innovation is a crucial topic that addresses the pressing global concerns of environmental sustainability and financial stability. Much study has been done on green finance and innovation, yet various themes and gaps emerge, demonstrating its complexity.

Green financing policies and instruments promote innovation, especially in environmental technologies and renewable energy. Many studies have studied how green funding affects green innovation and if it promotes sustainable technology. They've studied green bonds, green banking, and green finance reform laws, offering empirical evidence that financial incentives combined with green practices can stimulate environmental innovation [ 16 , 41 , 44 , 47 , 52 , 64 , 70 , 81 , 87 , 107 , 133 , 152 , 162 ].

The role of environmental legislation in green financing and innovation is another common theme. Researchers have studied how these restrictions affect green finance's impact on technology. Studying how financial policies and regulatory frameworks interact has helped explain the complex dynamics affecting innovation in environmentally sensitive industries [ 11 , 29 , 54 , 84 , 120 , 126 , 132 , 151 , 152 , 174 ].

Nevertheless, there are obvious gaps in the existing knowledge within the field. The effects of green finance on innovation have been extensively studied, but a better knowledge of the factors driving innovation in other areas is needed. Further study may reveal how green funding might boost innovation in non-environmental industries. How can financial mechanisms support sustainable transportation, agricultural, and urban planning innovation.

Further research is needed on education and the human element in green innovation. How green finance, educational investments, and innovation interact can help individuals, businesses, and societies develop a sustainable future. Green finance and innovation's impact on environmental adaptation and resilience also understudied. More research is needed to determine how financial mechanisms and new solutions may help communities and organizations adapt to climate change.

Green finance policy/green credit guidelines

Climate change and environmental degradation are major worldwide issues. Green finance, which promotes environmentally and socially responsible investments, is a key instrument in this battle. Research and discussion have focused on how green finance policies affect the economy and environment.

The switch to renewable energy is crucial to fighting climate change globally. This transition relies on green financing initiatives. Researchers are investigating how well such regulations promote renewable energy. They examined how green finance regulations affect renewable energy output, investment, and job development in this growing sector. Understanding these implications helps improve green finance initiatives for sustainability [ 18 , 98 , 118 ].

China and other nations have implemented green finance pilot programs to test the waters and stimulate innovation. This research evaluates pilot policy implementation and impacts. Scholars use synthetic control and other tools to study how these initiatives affect green innovation. The results help determine the real-world implications of such experiments and their potential for wider use [ 48 , 113 , 121 , 131 , 146 , 162 ].

Green financing policies vary worldwide. Comparative research of green financing rules can highlight policy differences among jurisdictions. Researchers compared the EU and Russia's green financing laws. These studies emphasize differences, similarities, and the potential influence of these policies on green finance development, promoting cross-border cooperation and knowledge exchange [ 60 , 125 ].

Monitoring and measuring green finance progress is essential for future development. Researchers are developing green finance indices to assess green finance in a country or region. These indices help policymakers, investors, and the public understand green finance's growth and potential [ 141 ].

Despite significant and informative research on green finance policies and their effects on the economy and environment, several research gaps and opportunities for additional investigation remain. First, a thorough evaluation of the durability and long-term sustainability of green finance policies is lacking in the literature. Many studies focus on short-term outcomes, but long-term planning and implementation need understanding these policies' long-term implications. Second, green finance policies' cross-border effects need greater study. As the global economy grows more interconnected, it's important to understand how regional policies affect others and the possibility for international collaboration. Green finance and social effects as creating employment and community development are understudied. Such studies could illuminate these policies' overall impact. Finally, additional multidisciplinary research combining economics, environmental science, and social science are needed to comprehend green finance policies' complex implications. Scholars can fill these gaps to improve our understanding of this crucial topic and inform sustainable policymaking.

Green finance and economy

The relationship between carbon intensity and economic development is a growing topic in green finance research. How nations may shift to low-carbon economies while maintaining economic growth has been studied. Several studies have quantified how green finance policies reduce carbon emissions and boost economic growth [ 63 , 71 , 122 , 155 , 175 ].

The study of the impact of green financing on agriculture, particularly in China, is gaining attention. Green financing impacts agricultural trade, sustainability, and food security, according to researchers [ 37 , 140 ]. Given its connection with economics, food production, and sustainability, this type of researches is crucial.

Efficient utilization of natural resources in Asian countries has gained attention for promoting green economic growth. Researchers have studied how nations might maximize economic gains from natural resources while reducing environmental harm. Addressing sustainable economic development concerns requires this area [ 86 , 101 , 146 , 166 ].

The significance of judicial quality in reducing emissions without hindering economic growth is a common issue in green finance research. Researchers examine how strong legal systems can enforce environmental laws and promote green practices while boosting the economy [ 154 ].

Even while the previously stated research topics have unquestionably enhanced our understanding of the intricacies of green finance, there are still a number of uncharted territories and research gaps that need to be investigated further. Currently, research on green finance mostly focuses on economic and environmental concerns. Integrated research combining economic, environmental, and social science is needed. It can provide a holistic view of green finance policy' many implications. The globalization of green finance policy has significant implications and cross-border effects. These policies' worldwide spillover effects and country collaboration are rarely studied. Research is lacking on how regional policies affect others and international cooperation.

Green finance and corporate social responsibility

Fostering CSR requires understanding how environmental regulations affect companies' sustainable strategies. Researchers should examine how CSR goals can be better aligned with regulations to improve environmental and social outcomes. Researchers have studied green finance-CSR approaches to promote sustainability. This research seeks to understand how green finance initiatives like green bonds and sustainable investment practices affect CSR performance [ 173 ]. Businesses and investors looking to maximize their environmental and social impact must understand these mechanisms.

One intriguing research topic is empirical evidence from heavily polluting enterprises, especially in China. This study shows how green finance can reduce environmental harm and promote CSR in industries with a high environmental impact [ 45 , 66 ]. Researchers can find ways to help heavily polluting companies become more sustainable by studying their experiences.

Bangladesh banks' CSR and green finance practices have also been studied [ 168 ]. This study studies how green financing affects financial institution CSR and environmental performance. Financial organizations can use these results to incorporate environmental responsibility while being profitable. Another relevant research topic is post-pandemic CSR practices as a business strategy to combat volatility and drive energy and environmental transition [ 53 ]. Understanding how CSR and green finance can help companies whether economic downturns and pandemics are crucial. This research can help businesses adapt to changing business conditions.

Further studies can explore socially responsible mutual funds and low-carbon economies. The impact of the investment industry on sustainability and environmental responsibility can be better understood by scholars by examining how these funds affect company behavior and investment decisions. Investors and businesses pursuing sustainable development may find these insights to be beneficial.

Green bond issuance is growing, thus study on its effects on company performance and CSR is needed. Investors seeking to support environmentally responsible businesses and companies contemplating green finance must have a comprehensive understanding of the repercussions on associated with green financing.

Trends/challenges/barriers/awareness of green finance

Regional patterns in China's green finance trends are well-studied, but little is known about applying these findings elsewhere, especially in countries with similar environmental issues [ 24 , 30 , 83 , 88 ]. Analysis of green finance growth by sector is common; however, there may be a knowledge vacuum about how sectors might learn from each other to create more successful sectoral plans [ 28 , 50 , 142 ].

Analyzing the structural barriers to green financing is vital, but also understanding how consumers, financial institutions, and governments can work together to close this gap is crucial. Political and institutional restrictions in green financing have been extensively examined, but cross-national comparisons might reveal similar concerns and inventive solutions. Cultural variety is crucial in ethical and green finance, but the challenges of adapting cultural methods to different places may not be adequately examined [ 7 ].

There were 213 papers pertaining to green finance research that were published between the years 2011 and 2021. However, between 2022 and May 2023, there was an enormous increase in the number of publications, which was 715. These publications can be found in Scopus and WoS. This spike can be associated with a number of causes that have encouraged both academia and industry to focus on sustainable and environmentally friendly practices. These drivers can be found in both the public and private sectors.

To begin, there has been a growing awareness of the urgent need to address climate change and its adverse impacts on the world. An increasing number of demands for action have accompanied this recognition. Green finance provides a means by which funds can be directed toward projects and investments that promote environmental sustainability, such as the development of sustainable infrastructure, clean technologies, and renewable sources of energy. In addition, global initiatives such as the Paris Agreement have put pressure on governments and financial institutions to align their strategies with climate goals, which has led to an increased demand for research on green finance practices and regulations [ 58 ]. Additionally, investors and consumers are becoming more aware of the environmental impact of their financial actions, which is contributing to an increase in demand for environmentally responsible investing products and services [ 39 ]. As a direct consequence of these developing tendencies, researchers and academics have developed responses to them, adding to the expanding body of literature on green finance.

993, more than any other nation, are references to China. This shows a keen interest in learning about China's economy, politics, and development. Researchers have concentrated on China's position in finance, sustainability, and innovation given its status as the world's largest population country and its growing global relevance due to its critical role in fostering sustainable and low-carbon development. Reduced energy use and waste are the goals of energy efficiency measures, which also have a positive effect on the environment by reducing greenhouse gas emissions. Researchers want to comprehend the procedures, regulations, and financial tools that can successfully encourage and support energy efficiency projects, which will ultimately contribute to a greener and more sustainable future. This is why they are focused on energy efficiency within the context of green finance [ 2 , 14 , 60 , 67 , 69 , 74 , 106 , 117 , 134 , 136 , 156 , 160 , 170 ].

The construction of pilot zones for green finance reform and innovations (GFRI) is a significant step the Chinese government has taken to build a green economy. Many authors have conducted surveys on China's GFRI policy and its impact on innovations. The GFRI policy program supports green innovation in large, polluting companies and urban green development by enhancing total factor productivity in pilot cities, emphasizing the importance of debt finance in corporate green innovation [ 40 , 82 , 148 , 150 , 153 , 158 ]. A different study by Wang et al. in 2022 [ 127 ] discovered that while the GFRP generally plays a positive role in fostering green technology innovation capabilities, the extent to which it has an impact varies depending on the region's resources, environment, and level of economic development, with middle- and high-income areas seeing a more noticeable impact. Wang et al. in 2022 [ 127 ] propose a green finance index, employing statistical indicators from 2011 to 2019, to analyze China's green finance development and predict its growth from 2020 to 2024. New energy, green mobility, and new energy vehicles have boosted China's green finance index during the previous nine years, according to research.

The Green Financial Reform and Innovation Pilot Zones (GFPZ) policy's effect on the ESG ratings of Chinese A-share listed firms between 2014 and 2020 is examined in another study. The findings showed that the GFPZ policy raises ESG scores, which are mainly based on social responsibility, and helps businesses in the pilot zones do better financially and environmentally [ 17 ]. In 2023, Shao and Huang [ 111 ] reviewed China's green finance policy mix, showing a shift toward market-based approaches and greater private sector engagement, influenced by dynamic vertical interactions between different levels of government.

Chen et al. [ 14 ] examined the response of China's equity funds to institutional pressure on green finance in 2021. The results showed that funds with negative screening strategies, which exclude environmentally harmful investments, have higher green investment levels and higher financial returns, while funds with positive screening strategies face negative investor reactions despite their green investments.

A study done by Lv et al. [ 88 ] found that while green finance development in China is improving, regional disparities and a polarization trend exist, requiring measures to narrow the gap and promote coordinated development across economic regions. Because it is crucial for striking a balance between economic development, environmental conservation, and social well-being, researchers in green finance concentrate on sustainability. The authors focused on studies on sustainable investment options, analyzed how environmental, social, and governance aspects are incorporated into financial decision-making, and evaluated how sustainability affects financial performance. Researchers are expected to advance ethical and sustainable financial practices and help the world accomplish its sustainability goals by studying sustainability within the context of green finance [ 5 , 25 , 43 , 46 , 59 , 73 , 77 , 90 , 91 , 94 , 104 , 109 , 138 , 161 , 163 , 165 , 167 , 171 ].

In conclusion, research on green finance has primarily focused on Asian countries, particularly China, where it plays a crucial role in low-carbon development and renewable energy growth. However, there is a significant knowledge gap in regions outside Asia, such as Africa, South America, and parts of Europe. Further research is needed to understand regional variances and strategies in these areas.

Studies have examined various aspects of green finance, including green bond quality, the relationship between green and non-green investments, and the impact of green finance on environmental and sustainability goals. Behavioral dimensions of green investment, subnational and local initiatives, cross-country comparisons, and the role of green finance in emerging economies have also been explored. Additionally, the role of green finance in stimulating innovation in environmental technologies and renewable energy has been studied, but there are gaps in understanding its impact on non-environmental industries and the human element in green innovation.

Further research is needed to understand the role of environmental legislation in green finance, its impact on technology, and its cross-border effects. The durability and long-term sustainability of green finance policies should also be examined, along with their social effects such as employment creation and community development. The relationship between carbon intensity and economic development, as well as the alignment of corporate social responsibility goals with environmental regulations, are important areas for investigation.

There is a need for more research on applying the findings from China's green finance trends to other countries facing similar environmental issues. Structural barriers to green financing should be analyzed, and the collaboration between consumers, financial institutions, and governments in closing this gap should be explored. Cultural diversity in ethical and green finance should also be considered, along with the challenges of adapting cultural methods to different places. Overall, further research in these areas can contribute to a more sustainable and environmentally friendly future.

When compared to other fields of study, it is clear that research on green finance has not been investigated to the same extent. In contrast to the less-researched areas of carbon, carbon emissions, climate change, financial systems, policymaking, agriculture, CSR, supply chain, risk management, corporate strategy, regional planning, and governance, green financing has been well-liked with investments, sustainable developments, green innovations, and green economies. On the other hand, taking into account the growing attention paid to sustainability on a worldwide scale and the pressing need to find solutions to the problems posed by the environment, it is quite likely that research into green finance will become more important in the years to come.

The increasing significance of sustainable development and the change to an economy with lower carbon emissions will require the development of innovative financial solutions to support green initiatives and assist the shift toward a financial system that is more friendly to the environment and more sustainable. It is anticipated that researchers will devote a greater amount of attention to green finance as the level of awareness regarding the environmental and social impacts of financial activities continues to rise. These researchers will investigate topics such as sustainable investment strategies, green bond markets, sustainable banking practices, and the incorporation of environmental considerations into financial decision-making. In addition to this, the incorporation of environmentally friendly financial practices into policy frameworks and regulatory measures further emphasizes the requirement for research in this particular area. In general, it is projected that research on green finance will pick up steam in the years to come because it plays such an important role in the process of sculpting a financially sustainable and resilient.

Availability of data and materials

SCOPUS and WoS databases.

Abbreviations

Corporate social responsibility

Financial Technology

Green finance reform and innovations

Green Financial Reform and Innovation Pilot Zones

- Systematic literature review

Akhtaruzzaman M, Banerjee AK, Ghardallou W, Umar Z (2022) Is greenness an optimal hedge for sectoral stock indices? Econ Model. https://doi.org/10.1016/j.econmod.2022.106030

Article Google Scholar

An Q, Lin C, Li Q, Zheng L (2023) Research on the impact of green finance development on energy intensity in China. Front Earth Sci 11:1118939. https://doi.org/10.3389/feart.2023.1118939

Azhgaliyeva D, Kapsalyamova Z, Mishra R (2022) Oil price shocks and green bonds: An empirical evidence. Energy Econ. https://doi.org/10.1016/j.eneco.2022.106108

Bai J, Chen Z, Yan X, Zhang Y (2022) Research on the impact of green finance on carbon emissions: evidence from china. Econ Res-Ekon Istraz 35(1):6965–84. https://doi.org/10.1080/1331677X.2022.2054455

Bai X, Wang K-T, Tran TK, Sadiq M, Trung LM, Khudoykulov K (2022) Measuring china’s green economic recovery and energy environment sustainability: econometric analysis of sustainable development goals. Econ Anal Policy. https://doi.org/10.1016/j.eap.2022.07.005