Just one more step to your free trial.

.surveysparrow.com

Already using SurveySparrow? Login

By clicking on "Get Started", I agree to the Privacy Policy and Terms of Service .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Enterprise Survey Software

Enterprise Survey Software to thrive in your business ecosystem

NPS Software

Turn customers into promoters

Offline Survey

Real-time data collection, on the move. Go internet-independent.

360 Assessment

Conduct omnidirectional employee assessments. Increase productivity, grow together.

Reputation Management

Turn your existing customers into raving promoters by monitoring online reviews.

Ticket Management

Build loyalty and advocacy by delivering personalized support experiences that matter.

Chatbot for Website

Collect feedback smartly from your website visitors with the engaging Chatbot for website.

Swift, easy, secure. Scalable for your organization.

Executive Dashboard

Customer journey map, craft beautiful surveys, share surveys, gain rich insights, recurring surveys, white label surveys, embedded surveys, conversational forms, mobile-first surveys, audience management, smart surveys, video surveys, secure surveys, api, webhooks, integrations, survey themes, accept payments, custom workflows, all features, customer experience, employee experience, product experience, marketing experience, sales experience, hospitality & travel, market research, saas startup programs, wall of love, success stories, sparrowcast, nps benchmarks, learning centre, apps & integrations.

Our surveys come with superpowers ⚡

Blog Best Of

Customer Research 101: Definition, Types, and Methods

12 February 2024

Table Of Contents

What is Customer Research?

Why is customer research important, types of customer research.

- 6 Customer Research Methods

- How SurveySparrow Can Help

Do you want to improve your marketing or product? Then, customer research can help.

Your customer is at the heart of all your business decisions. In fact, everything revolves around a customer. A business is about having a paying customer, and it wouldn’t exist without one.

The effectiveness of your product or marketing depends on how well you know your customers. When you know your customers better, you can make better product or marketing decisions.

In this article, we break down:

- What customer research is

- Why it’s valuable for your business

- Different types of customer research

- Six customer research methods you can use to refine and grow your business

Customer research (or consumer research ) is a set of techniques used to identify the needs, preferences, behaviors, and motivations of your current or potential customers.

Simply put, the consumer research process is a way for businesses to collect information and learn from their customers so they can serve them better.

Businesses typically conduct customer research to uncover new insights on their customers. They then use these newly uncovered insights to improve their product, craft an effective marketing strategy, and more.

Here are 2 key questions customer research helps you answer:

- Who are my ideal customers? Who is the best fit (or worst fit) for our product?

- What channels can I use to find and communicate with my ideal customers?

Online survey tools like SurveySparrow can help you answer these questions. With omnichannel survey distribution, snazzy data visualization, and 1,500+ integrations with your favorite tools, SurveySparrow simplifies customer research for your GTM and product teams.

Looking for a Full-Fledged Customer Research Tool?

Discover Deeper Insights With SurveySparrow. Sign Up for Free.

Please enter a valid Email ID.

- 14-Day Free Trial

- • Cancel Anytime

- • No Credit Card Required

- • Need a Demo?

A. How well do you know your customers? Not knowing enough about your customers can cost you time and money.

For example, a recent survey revealed that 46% of customers broke up with a brand because they received irrelevant content pushes.

Successful marketers realize that research is necessary to understand and cater to the ever-changing needs of today’s customers. According to a study by Coschedule:

- Successful marketers are 242% more likely to conduct audience research at least once every quarter.

- 56% of the study’s most elite marketers research at least once a month.

B. You shouldn’t make assumptions about your customers’ preferences or needs. You have to go out there and get opinions from real customers.

C. You need to go beyond your general idea about your customers. The more you understand your customers, the better you’ll be able to serve them with your product or service.

D. If you want to make your product the best in the market, you need to identify any unmet needs and learn how well your product serves the needs of your current customers.

E. Customer research helps you learn more about your customers, both the potential and existing ones. Serving your customers better than the alternatives starts with understanding them better and more deeply.

F. Here are other key reasons why you should research customers:

- Know the Why : Your analytics dashboard merely tells you what your customers do. Only research can help you understand why they do that.

- Validate Assumptions and Best Practices : In most cases, guesswork leads to terrible decisions. Your customers might not need what you think they need. And what works for most businesses might not work for you. The only real way to know is to talk to your customers.

Customer research can be done in two distinct ways: primary and secondary.

Primary research

Primary research is research you conduct yourself. In other words, in primary research, you collect the data yourself. Some examples of primary research are face-to-face interviews, surveys, and social media interactions.

Secondary research

Secondary research (or desk research ) is done by someone else. In secondary research, you make use of data that’s been collected by other people. A few examples of secondary research are forums or communities, industry reports, and online databases.

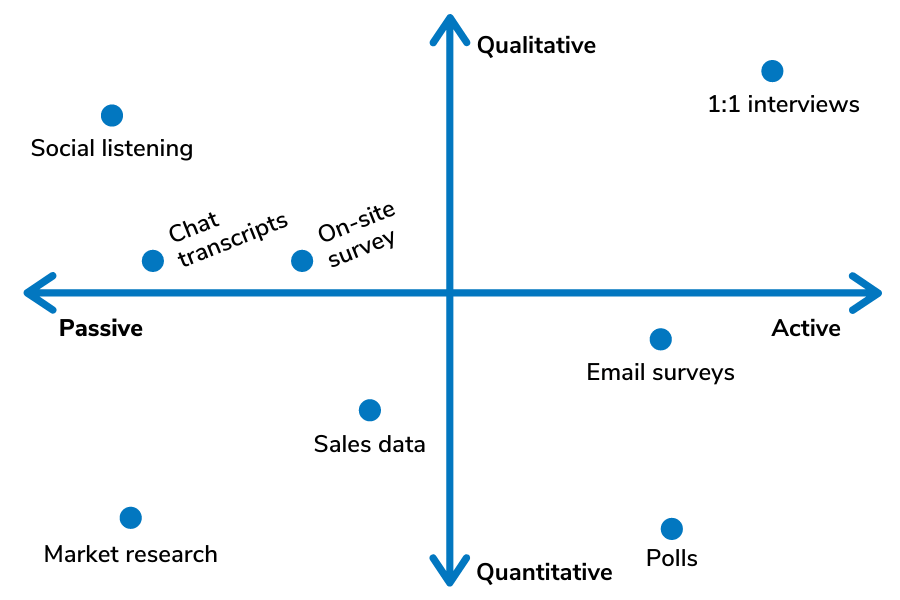

Primary and secondary research can be further broken down into two kinds of data: qualitative and quantitative.

Qualitative data

Qualitative data is descriptive and conceptual. And the nature of the data makes it subjective and interpretive. Examples of qualitative data include descriptions of certain attributes, such as blue eyes or chocolate-flavored ice cream .

Quantitative data

Quantitative data can be expressed using numbers, which means it can be counted or measured. As opposed to qualitative data, it’s objective and conclusive. Examples of quantitative data include numerical values such as measurements , length , cost , or weight .

Customer Research Methods that Work in 2024 (and Beyond)

Now that you know what customer research is and why it’s important, read on to learn the different consumer research methods you can use to make the most of it.

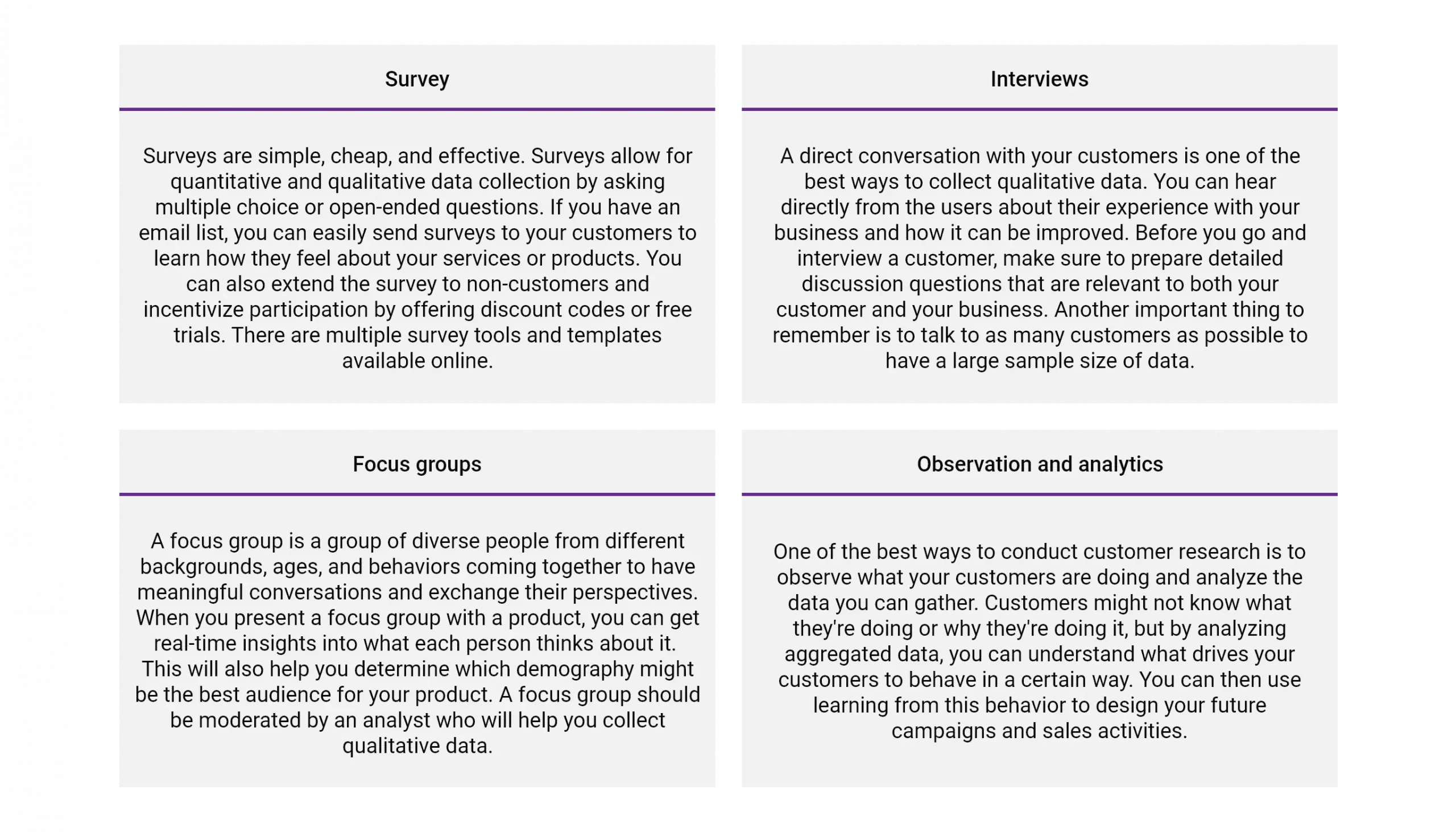

In a survey, you ask a series of questions to your customers regarding a subject or concept.

You can conduct a survey in person, over the phone, through emails, or online forms.

Here are some advantages of conducting customer research through surveys:

- Quickly collect a ton of insightful data without the high costs.

- The data you collect using surveys is simple to analyze.

- You can ask various questions since you get a wide range of question formats.

When it comes to surveys, it’s all about how you ask. Clear and concise questions can help you get reliable information.

An online survey tool is your best bet for quickly gathering customer information. All you need to do is create a survey with a ready-to-use template and send your customers a link to take it.

If you’re in need of a cost-free and easy-to-use solution for conducting customer research surveys and beyond, consider exploring SurveySparrow . This tool aids in gathering essential data by enabling you to conduct thorough data analysis via its user-friendly and conversational survey format.

Check Out SurveySparrow for Free here!

14-Day Free Trial • No Credit Card Required • No Strings Attached

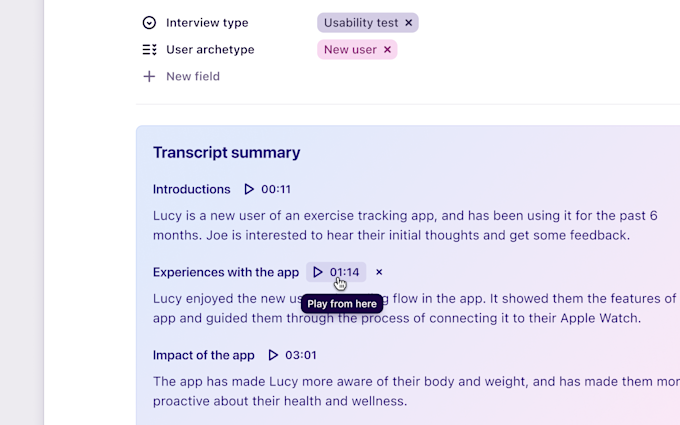

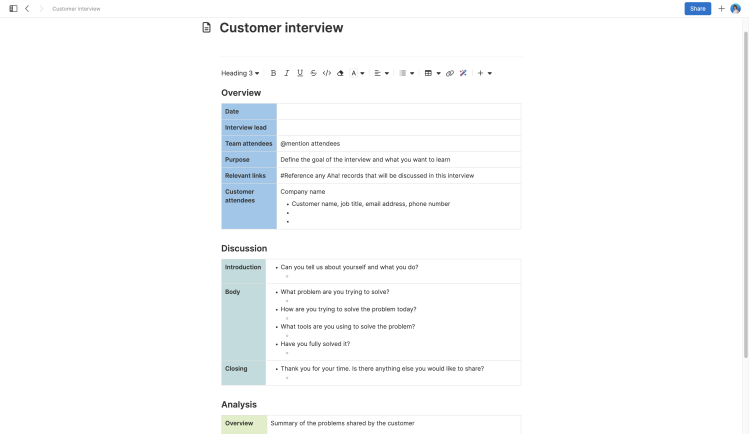

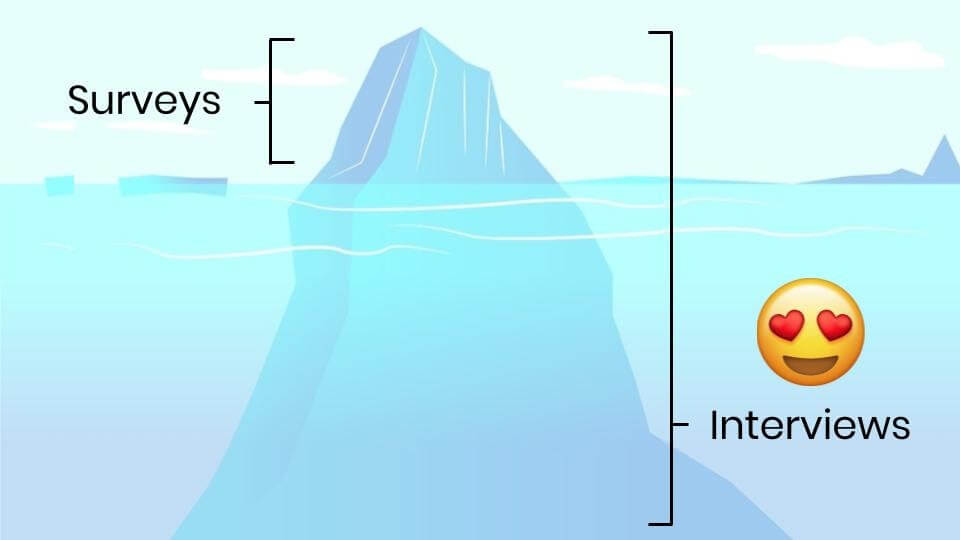

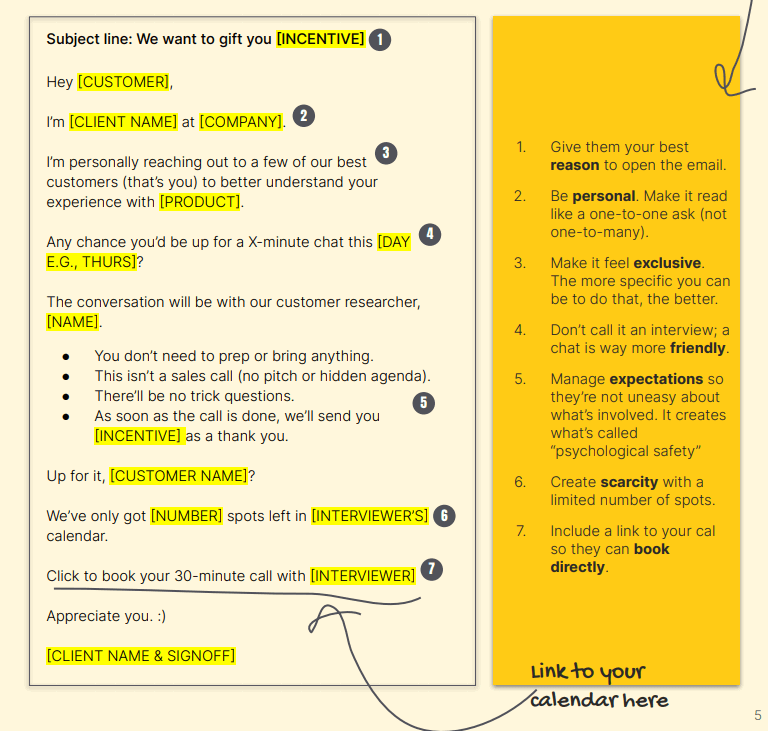

In an interview, you speak directly to your customers and ask them open-ended questions.

- Interviews allow you to have deep, one-on-one conversations with your customers and explore a topic in-depth.

- You can go into the details, obtain data beyond surface-level information, and gather deeper insights.

While interviews allow you to probe deeper into a subject, success depends on the expertise and skills of the researcher (or interviewer) conducting the interviews.

Conducting interviews isn’t easy. It’s time-consuming and costly. However, the information you collect can be invaluable for your company’s growth.

You can meet your customers in person to conduct your interviews. Or you can use video conferencing tools such as Google Meet or Zoom to converse with your customers online.

Your analytics dashboard lets you in on your customers’ actions within your product.

Just a glance at it and you’ll know what your customers do and how they engage with your product.

The irony is that customers don’t know what they want or why. They might think they need something but that might not be the case.

What they say they need doesn’t equate to what they do.

The point is that customer-reported behavior is different from actual behavior. That’s why it pays to track and observe your customers’ behavior.

You can use heatmaps, click tracking, scroll mapping, and user-recorded sessions to gain insights into your users’ actions and behavior.

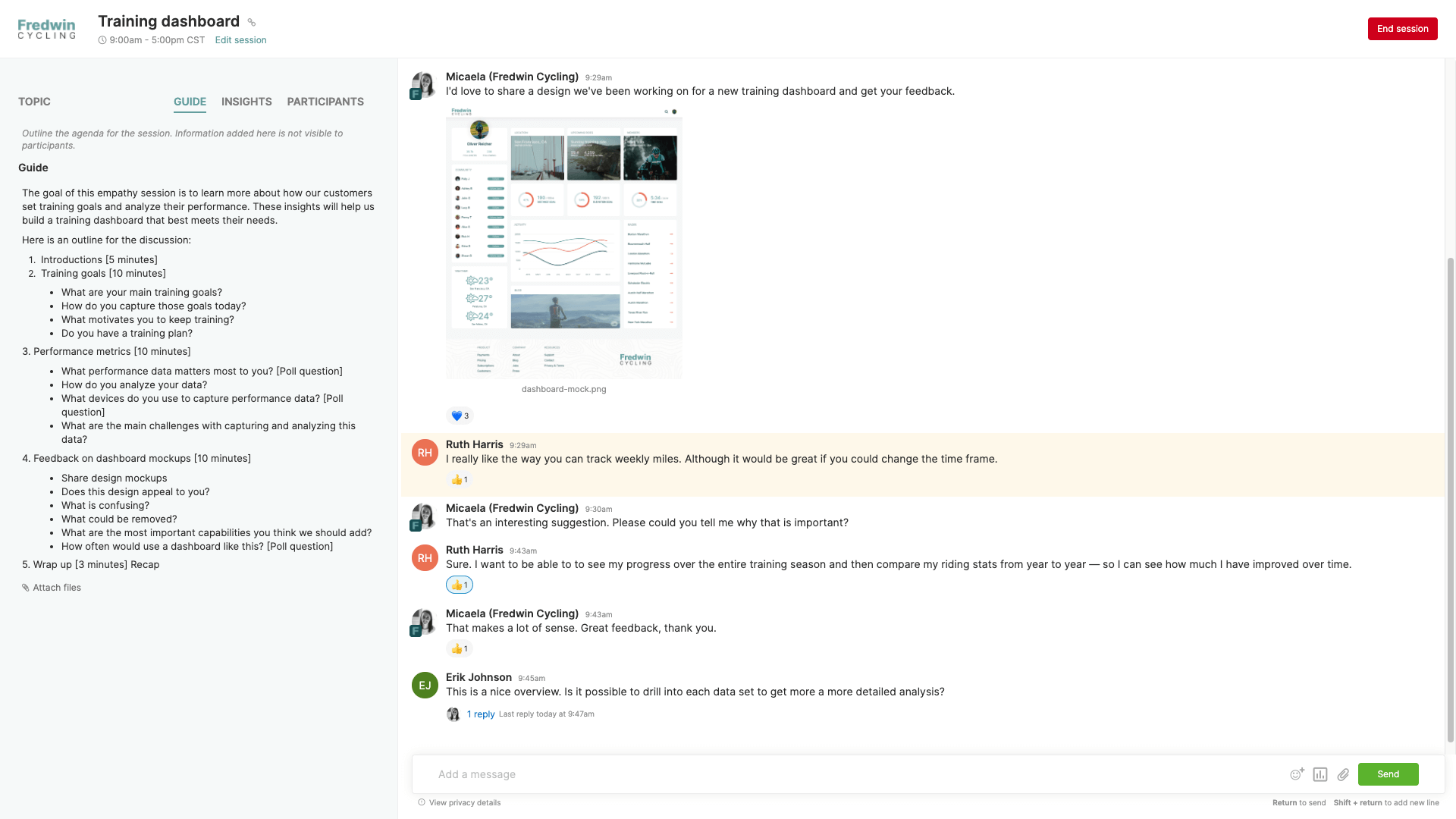

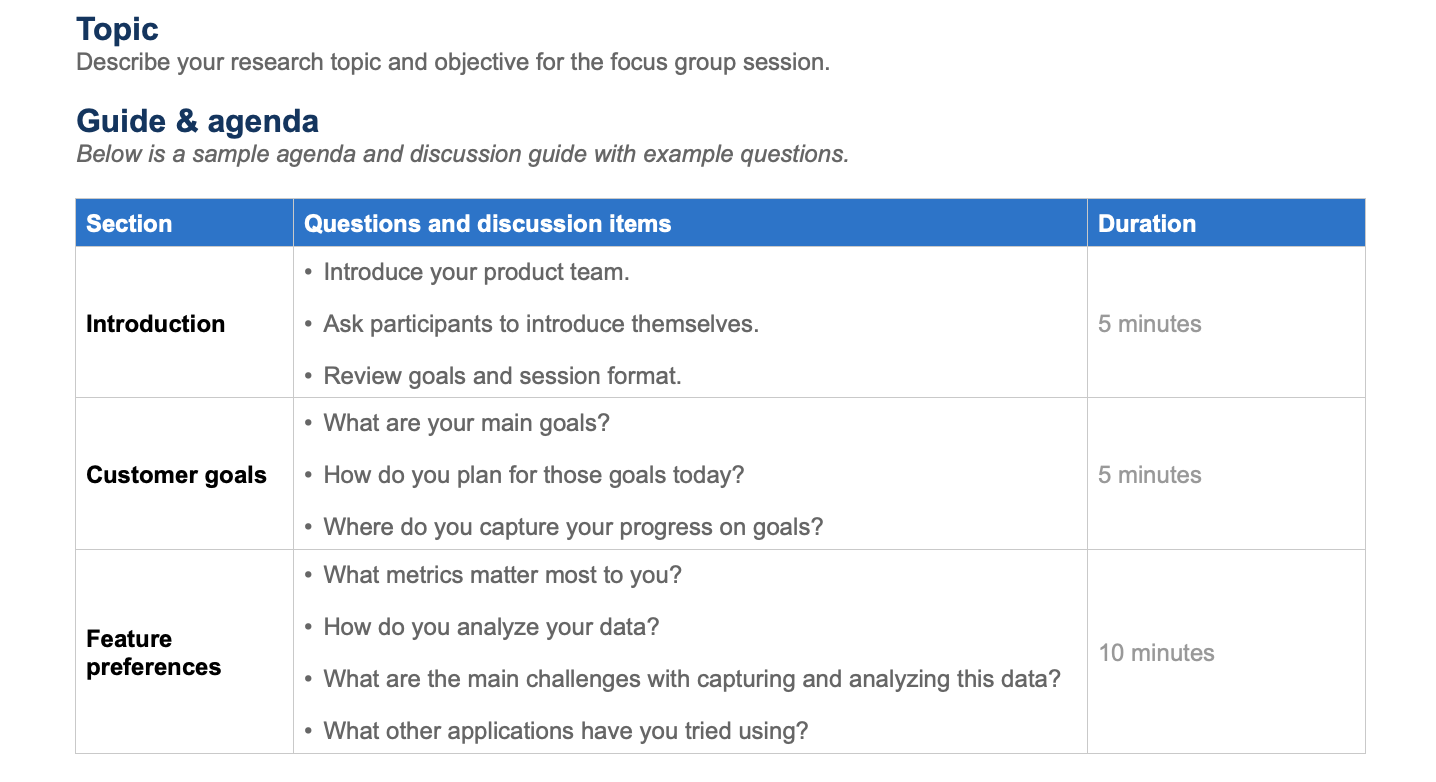

Focus Groups

In this method, you combine a small group based on certain criteria such as demographic, firmographic, or behavioral attributes.

And you ask this group about whatever topic or concept. It could be about your product, marketing message, or something else that’s related to your customers or business.

The idea is to get them to talk to each other and have meaningful conversations.

A moderator helps facilitate the conversations between the individuals in this group. The moderator will try to draw meaningful insights from these conversations and discussions.

You mainly use this technique to understand a certain topic or subject better.

Competitive Analysis

Studying your competitors’ strategies and tactics is a great way to learn more about the target market and the existing solutions.

You can analyze both your direct and indirect competitors depending on the needs you address and the customers you cater to.

You can conduct a competitive analysis from a marketing or product perspective.

If you conduct your analysis from a marketing perspective, you study your competition’s SEO strategy , landing page copy, blog content, PR coverage, social media presence, etc.

You can also conduct your competitive analysis from a product perspective and analyze your competitors’ user experience, features, pricing structure, etc.

Review Mining

The reviews of you and your competitors are another great way to get inside your customer’s head. This method can be especially valuable if you are a SAAS company.

It helps you better understand your competitor’s strengths and weaknesses as well as your own. This understanding helps you improve your own products and better address the needs of your ideal customers.

This kind of data is easy to acquire as it’s publicly available, and you can get them on:

- Review sites such as G2Crowd and Capterra.

- Forums and niche communities such as ProductHunt, Reddit, Quora, etc.

Why SurveySparrow is the Best Customer Research Tool

SurveySparrow facilitates comprehensive customer research by enabling businesses to efficiently collect, analyze, and act on customer feedback, leading to better informed and customer-centric decisions.

- Collect Feedback Easily : Create simple surveys to find out what customers think about your products or services.

- Understand Satisfaction : Use surveys to figure out how happy customers are with what you offer.

- Learn Buying Habits : Find out why customers buy certain products, which helps in planning what to sell.

- Get Product Opinions : Ask customers what they like or don’t like about your products to make improvements.

- See How People View Your Brand : Understand how customers see your brand, which is important for your marketing.

- Keep Up with Trends : Regular surveys help you stay updated on what your customers want or need.

- Group Customers : Identify different types of customers to target them more effectively with your marketing.

- Improve Customer Experience : Learn where you can make the buying process better for your customers.

- Test New Ideas : Before launching new products, check if your customers would be interested.

- Check Customer Loyalty : Find out if customers would keep using your products or recommend them to others.

Sign up for a free trial.

please enter a valid email id. signup for free 14-day free trial • no credit card required • no strings attached, final thoughts.

Businesses that deeply understand their customers have a huge advantage over the ones that don’t. Period.

Whatever you’re looking to learn or achieve, it becomes a lot clearer with a little research.

When done right, customer research can be your competitive advantage.

Be sure to pick a method that’s right for your situation. What are you looking to learn and achieve? Think through each research method carefully and pick the one that works best for you.

Have you conducted customer research? What did you learn? And how did it go? Tell us about that in the comment section below.

And if you’re looking to conduct customer research through surveys, feel free to check out SurveySparrow .

I'm a developer turned marketer, working as a Product Marketer at SurveySparrow — A survey tool that lets anyone create beautiful, conversational surveys people love to answer.

You Might Also Like

Sample size calculator – slovin’s formula to calculate sample size for surveys, top 10 zoho forms alternatives for simplified form building, top 3 surveysparrow alternatives you can use in 2024, cherry-picked blog posts. the best of the best..

Leave us your email, we wont spam. Promise!

Start your free trial today

No Credit Card Required. 14-Day Free Trial

Request a Demo

Want to learn more about SurveySparrow? We'll be in touch soon!

Research Your Customers with Conversational Surveys!

Create beautiful surveys that your customers will love to answer boost your response rates by 40%.

14-Day Free Trial • No Credit card required • 40% more completion rate

Hi there, we use cookies to offer you a better browsing experience and to analyze site traffic. By continuing to use our website, you consent to the use of these cookies. Learn More

Customer Research 101: A Complete Guide! (Importance & Types)

Know your customers or perish – over 90% of startups fail due to a lack of market need. Ouch! But fear not, customer research is here to save the day. By truly understanding your target audience, you can create products and messaging that resonate.

In this ultimate guide, we’ll explore the what, why, and how of effective customer research. You’ll learn both quantitative and qualitative methods to uncover real insights from potential and current customers. With the right research game plan, you can identify customer pain points, behaviors, and needs to drive innovation and loyalty.

We’ll cover essential techniques like surveys, interviews, focus groups, and user testing. Whether you’re an enterprise or a scrappy startup, you’ll find proven ways to maximize research on any budget. Ready to get inside the minds and hearts of customers? Let’s dive into the importance of research for business success! This comprehensive guide will equip you with the tools to avoid failure and align your offerings with what buyers want.

What is Customer Research?

Have you ever wondered what goes on behind the scenes at your favorite companies? The reality is, they spend a lot of time trying to get inside their customers’ heads. Conducting customer research is like doing a deep dive into what real people really want.

Businesses use research tools like surveys, interviews and focus groups to literally ask customers questions.

- “What matters most to you?”

- “Which parts of our product could use improvement?” and

- “What do you hope to see in the future?”

Market research helps too – keeping an ear to the ground on changes happening outside helps adjust to new customer needs. Testing things out with a small group of people before huge launches also saves companies from potential embarrassment!

All this valuable input guides important choices about everything from how things are designed to how customers learn about brands. It’s basically like a customer think-tank to solve problems and fuel innovation.

At the end of the day, customer research is about genuinely understanding perspectives from the user side. It’s how businesses stay in sync with real human desires and build genuine connections worth sticking around for. So speak up – your honest feedback is what keeps brands on their toes!

Now that we’ve covered what customer research entails, the next section will explore why it is so critically important for businesses to conduct thorough customer research on a regular basis.

Why is Customer Research Important?

To truly succeed in business, you need to understand the perspectives and priorities of your customers. Regular customer research provides invaluable insights that can guide strategic decision making. By learning directly from the people you serve, you gain a deeper understanding of their true needs and priorities. Here are 5 key reasons why actively researching customers is so critical:

1. Product Development

Customer feedback is a treasure trove of information that can drive product development . By actively seeking out customer opinions, you can pinpoint the exact features, functionalities, or improvements they desire. This is a more targeted approach than simply guessing what customers might want. Such a strategy can lead to products and services that not only satisfy existing customer needs but also attract new customers. It lowers the risk of product failure and increases the likelihood of customer loyalty and repeat purchases.

2. Identify Market Trends

Market trends can shape the success or failure of a business. Through customer research, you can spot emerging patterns in consumer behavior, preferences, and decision-making processes. This can include shifts in preferences for digital shopping, desire for sustainable products, or emerging technologies. Being able to identify these trends before they become mainstream gives you a competitive edge. You can swiftly adapt your offerings to meet changing demands, thus staying relevant in the market.

Read More: Market Research 101: How To Conduct Research Like A Pro!

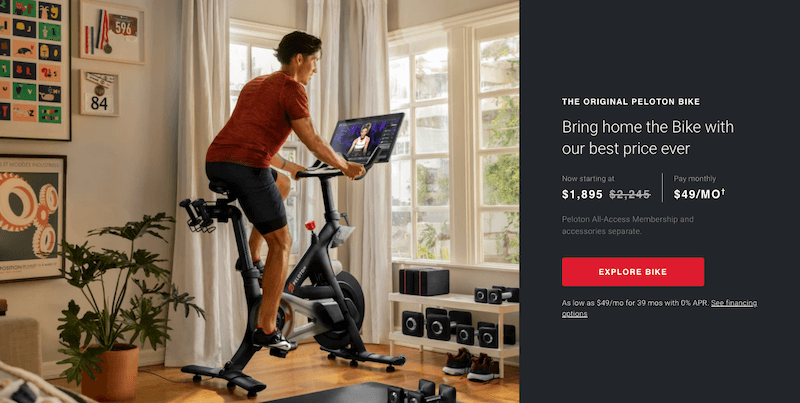

3. Pricing Strategy

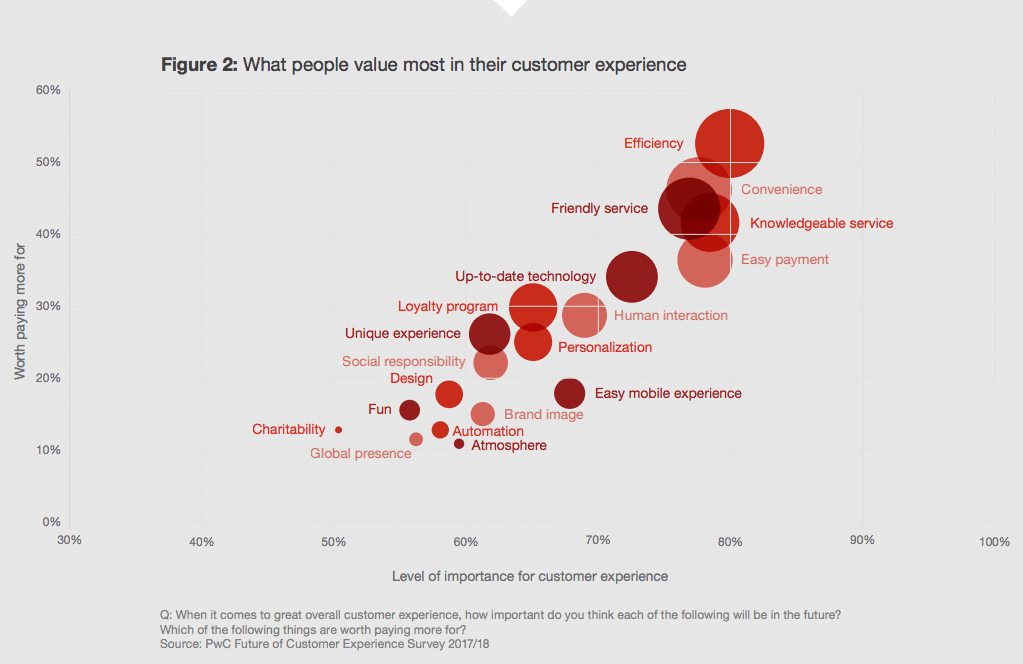

Pricing is more than just a cost-recovery mechanism; it’s a powerful tool for communicating a product’s value. Customer research can reveal how much customers are willing to pay for your product and the factors influencing their perception of its value. With this information, you can develop a pricing strategy that maximizes profit while ensuring your product or service still appears attractive to customers. This can involve techniques like value-based pricing, psychological pricing, or price skimming, depending on your findings.

4. Effective Marketing

Understanding your customers’ preferences, habits, and motivations allows you to create more effective marketing campaigns. Knowing which channels your customers prefer (e.g., email, social media, print, etc.) helps you reach them more efficiently. Additionally, knowing their motivations and pain points allows you to craft messages that resonate more deeply with them. This increases the chances of converting prospects into customers and improves the return on investment (ROI) of your marketing efforts.

5. Customer Retention

Acquiring new customers is often more costly than retaining existing ones. Therefore, understanding what keeps customers loyal to your brand is crucial. Regular customer research can uncover the key drivers of satisfaction and loyalty, as well as reasons for customer churn. This can include factors like product quality, customer service, pricing, or brand reputation. By addressing any issues and continually meeting customers’ needs , you can increase customer lifetime value (CLV), which in turn boosts profitability. Regular research keeps you in touch with customer sentiment and helps you maintain strong, lasting relationships with your customers.

Read More: Customer Loyalty Program: What is it & What are the Benefits? [Examples]

By gaining real customer perspectives, businesses can make more informed decisions to better serve their audiences now and into the future.

Understanding the importance of customer research is key, and there are various methods used to collect important customer data. In the next section, we will explore the different types of customer research that can be conducted.

Types of Customer Research

Customer research is a cornerstone of successful business strategy. It empowers organizations to gain insights into their target audience, understand their needs, preferences, and behaviors, and make informed decisions to improve products, services, and overall customer satisfaction. Four primary types of customer research play pivotal roles in this process: qualitative, quantitative, primary, and secondary research. In this section, we will delve into these four types of customer research, shedding light on their significance and how they can be effectively applied.

1. Qualitative Research

Qualitative research involves gathering non-numerical data and insights. This method includes techniques such as focus groups, in-depth interviews, and ethnographic research. Qualitative research is ideal for uncovering underlying motivations, emotions, and opinions of customers. It provides rich, descriptive information that helps businesses understand the “why” behind customer actions and preferences, allowing for more targeted decision-making.

2. Quantitative Research

Quantitative research, in contrast to qualitative research, focuses on numerical data and statistical analysis. Surveys, questionnaires, and experiments are common quantitative research tools. This approach is essential for collecting data on customer behaviors, preferences, and trends at scale. It provides quantifiable metrics and enables businesses to make data-driven decisions, such as product feature prioritization and pricing strategies.

Read More: Data-driven Marketing: Steps, Best Practices, Challenges & More!

3. Primary Research

Primary research involves collecting firsthand data specifically for a company’s unique needs. This can be achieved through surveys, interviews, observations, or experiments conducted directly by the business. Primary research is highly tailored and provides up-to-date, relevant information tailored to a company’s specific goals and objectives. It is particularly useful when seeking insights into niche markets or when addressing specific business challenges.

4. Secondary Research

Secondary research involves gathering and analyzing existing data and information from external sources such as industry reports, academic studies, and market research published by others. This cost-effective approach helps companies stay informed about industry trends, competitor strategies, and customer demographics without conducting new research from scratch. Secondary research is valuable for benchmarking, trend analysis, and validating primary research findings.

By employing various types of customer research, including qualitative, quantitative, primary, and secondary research, companies can gain a comprehensive understanding of their customers, markets, and competitors. Armed with these insights, businesses can fine-tune their strategies, create more customer-centric products and services, and ultimately thrive in today’s dynamic and competitive business landscape.

Now that we’ve explored the different types of customer research, the next section will cover effective ways to actually conduct this research.

Effective Ways To Conduct Customer Research

Conducting effective customer research is crucial for businesses looking to understand their target audience, improve their products or services, and ultimately, boost their bottom line. By gaining insights into customer preferences, pain points, and behavior, companies can make informed decisions that drive growth and customer satisfaction. In this section, we will explore 7 effective ways to conduct customer research.

1. Surveys and Questionnaires

Surveys and questionnaires are versatile tools for gathering valuable customer insights. They allow you to collect structured data on a wide range of topics, from product satisfaction to demographic information. Ensure that your surveys are concise, well-designed, and easy to complete to maximize response rates. Online survey platforms like SurveyMonkey and Google Forms make it simple to create and distribute surveys to your target audience.

2. Customer Interviews

One-on-one interviews provide an in-depth understanding of your customers’ thoughts and feelings. Conduct both structured and unstructured interviews to dig deeper into specific issues or to uncover unexpected insights. Make sure to create an open and non-judgmental environment where customers feel comfortable sharing their opinions. These interviews can be conducted in person, over the phone, or via video conferencing.

3. Social Media Monitoring

Social media platforms are treasure troves of customer feedback and sentiment. Use social media listening tools to track mentions, comments, and reviews related to your brand or industry. Analyzing this data can reveal emerging trends, customer concerns, and opportunities for engagement. Engage with your audience on social media to build rapport and gain more insights organically.

4. Customer Analytics

Leverage web analytics tools like Google Analytics or customer relationship management (CRM) systems to track user behavior on your website or within your product. Analyze metrics such as click-through rates, bounce rates, and conversion rates to identify pain points and areas for improvement. By understanding how customers interact with your online presence, you can optimize their experience and increase conversion rates.

5. Online Forums and Communities

Online forums and communities dedicated to your industry or niche can provide a wealth of information. Participate in these communities or simply observe discussions to identify common challenges, desires, and preferences among your target audience. Platforms like Reddit, Quora, and specialized industry forums are excellent places to start.

6. Competitor Analysis

Analyzing your competitors can offer valuable insights into customer behavior and preferences. Study their customer reviews, social media engagement, and market positioning to identify gaps in the market or areas where you can differentiate your offering. Understanding why customers choose your competitors over you can help you refine your strategy.

7. A/B Testing

A/B testing involves comparing two or more variations of a webpage, email, or advertisement to determine which one performs better with your target audience. By systematically testing different elements like headlines, images, or call-to-action buttons, you can make data-driven improvements to optimize customer engagement and conversion rates.

By using surveys, interviews, social media monitoring, analytics, online communities, competitor analysis, and A/B testing, you can gain a 360-degree view of your customers’ preferences and behaviors. This knowledge will enable you to make informed decisions, enhance your products or services, and ultimately, build stronger, lasting customer relationships. Remember that customer research is an ongoing process; regularly revisit these methods to stay attuned to evolving customer needs and market dynamics.

And there you have it – the complete lowdown on customer research! We covered what it is, why bothering to listen to your patrons is pivotal, different ways to gather intel, and tips for doing it well.

While digging deep into customer minds may sound tedious, we hope this guide showed how fascinating and fruitful the process can be. Staying curious about your crew keeps your finger on the pulse of what truly fuels their passions.

So don’t be afraid to spy on them in action, quiz big crowds, chat one-on-one, or analyze clues hidden in the numbers. Customers have a story to share if you make the effort to understand their perspective.

Turning feedback into slick new perks or smoother experiences will wow existing fans and catch the eyes of potential newbies. With an open ear, you can design offerings that resonate authentically instead of going rogue on assumptions alone.

Research may require dedication, but the rewards of truly knowing your people makes it a total blast. Now get out there and start some conversational focus circles, surveys, observations – whatever fire sparks your customer curiosity! The more you explore what makes them tick, the more success you’ll attract.

Further Reads:

What is Customer Delight? Learn More!

Customer Touch Points & How To Identify Them? (Examples & Tips)

AIDA Model: How To Connect & Engage With Your Customers?

Customer Journey Map: Definition, Importance, and Process!

User Persona: What is it & How to Create it?

What is Diversity & Inclusion in The Workplace? (Definition & Benefits)

Social Media Skills: A Quick Guide To Improve Them! (Types & Examples)

Related posts

10 crm tools and software you should explore right now, 9 client management software you must check out, 10 best online subscription billing software platforms, data-driven marketing: steps, best practices, challenges & more, how to create effective issue tracking documents for your company, customer success vs sales: the key differences & similarities.

About Bit.ai

Bit.ai is the essential next-gen workplace and document collaboration platform. that helps teams share knowledge by connecting any type of digital content. With this intuitive, cloud-based solution, anyone can work visually and collaborate in real-time while creating internal notes, team projects, knowledge bases, client-facing content, and more.

The smartest online Google Docs and Word alternative, Bit.ai is used in over 100 countries by professionals everywhere, from IT teams creating internal documentation and knowledge bases, to sales and marketing teams sharing client materials and client portals.

👉👉Click Here to Check out Bit.ai.

Recent Posts

Top 12 ai assistants of 2024 for maximized potential, maximizing digital agency success: 4 ways to leverage client portals, how to create wikis for employee onboarding & training, what is support documentation: key insights and types, how to create a smart company wiki | a guide by bit.ai, 9 must-have internal communication software in 2024.

Join thousands of product people at Insight Out Conf on April 11. Register free.

Insights hub solutions

Analyze data

Uncover deep customer insights with fast, powerful features, store insights, curate and manage insights in one searchable platform, scale research, unlock the potential of customer insights at enterprise scale.

Featured reads

Inspiration

Three things to look forward to at Insight Out

Tips and tricks

Make magic with your customer data in Dovetail

Four ways Dovetail helps Product Managers master continuous product discovery

Events and videos

© Dovetail Research Pty. Ltd.

- What is customer research?

Last updated

14 February 2023

Reviewed by

Designing products that both delight customers and solve their problems is essential in a competitive landscape.

But how do you identify what your customers want and need, let alone who your customers really are?

Customer research enables you to learn more about your customers, understand their motivations, and get to grips with their behavior on a deeper level. You can use all this knowledge to create truly user-centric products.

Customer research is how you understand your customers—their needs, pain points, and demographics.

It also allows you to dive into key aspects of customers’ motivations and behaviors. It’s about learning how customers act and what will encourage them to take certain actions.

This is important when developing products. Deeply understanding your customers helps you deliver products that are easy to use, satisfying, and better at solving problems.

You’ll keep designing products that fall short if you don’t know your customers well and can’t see things from their point of view.

- What’s the difference between customer research, market research, and user research

You may have heard the terms customer research, market research, and user research. They might sound similar and have some related functions, but they are distinct types of research.

Market research is generally conducted in the early stages of product creation. Its role is to generate an understanding of the whole market, including what people need and want from products. This type of research typically identifies market readiness, size, competition, and demographics.

While market research is broad, customer research is more specific. It’s a process by which data and information collected during market research are analyzed, grouped, and evaluated. You can think of it as an extension of market research, though some organizations may perform these functions simultaneously.

The focus of user research is generally on understanding what is and isn’t working with current products and where helpful innovation can occur.

- Types of customer research

Primary and secondary research are some of the main types of customer research.

Quantitative and qualitative data are two types of data.

It’s helpful to know the difference between these groups to ensure you collect the right data and information for your project.

Primary vs. secondary research

Primary research is data collected directly by the organization from customers. It is obtained through research methods like surveys, focus groups, or analytics.

The advantage of primary research is having the power to obtain the data that’s most relevant for you. Knowing exactly what data has been collected and how to collate that information into meaningful insights is also more simple.

Secondary research is data collected by external sources, such as research groups, governments, and other companies. You can use it to discover more about customers.

Using data collected by other sources gives you less control, but it can save you money.

Ideally, a combination of both primary and secondary research will help you build a true picture of who your customers are.

Qualitative vs. quantitative data

You also need to understand which type of data will be most helpful for the relevant project.

Qualitative data is obtained directly from users, usually through methods such as in-depth interviews, focus groups, usability testing, and field studies.

This type of data can help designers understand why users do things and gain insights into how to solve their issues.

Quantitative data consists of numeral value measurements gained indirectly from users.

This type of data usually involves measurements like how much, how many, and how many times. Surveys, metrics, and user tests are some of the methods through which it can be collated.

- The best customer research methods

The best customer research method will be the one that’s most relevant and useful for your project. So, what works for one product may not be the best match for another.

Before deciding on a customer research method, asking the following questions can be helpful:

What do we most need to know about our customers?

What do we not know about our customers?

Are we satisfied that our product has a market?

Do we truly understand our competitors?

Do we deeply understand our target market?

Is our product solving a real-world issue for people? Do we have data to back that up?

Is this product the best possible solution for our customers?

These questions can act as a starting point to discover knowledge gaps. They can also help your team choose the research methods that can plug any of these holes.

Customer surveys

Surveys involve asking customers a series of targeted questions. They’re a popular research method because they can be conducted in several ways, such as with an online questionnaire, phone call, or email.

Surveys can help organizations quickly discover large amounts of useful information. They are also relatively inexpensive, as many free templates are available online.

Keep in mind that a survey is only as good as its questions. Ensure that you’re asking questions that will help you discover the most relevant and helpful data about your customers.

Surveys that follow best practices include the following:

Open-ended questions to get the most information from customers

Consistent ranking scales to avoid ambiguity

Questions that are relevant to the team’s end goal

A short series of questions to avoid overwhelming participants

Customer interviews

Interviewing customers is one of the most straightforward and helpful ways to discover their views, wants, and needs.

Customer interviews include a team member or neutral party having a discussion with a customer. They offer the chance to discover new insights that might not otherwise have been uncovered.

This technique won’t enable you to gather quantitative data, but you will gain new insights into how your customers think and perceive products.

Here are some best practices to follow when conducting customer interviews:

Clarify answers. If there’s any ambiguity in what a customer said, make sure you follow up with further questions to aid true understanding.

Challenge your assumptions. Don’t bring any assumptions to the table. Instead, ask customers how they really think and feel. Having a neutral moderator can help remove any bias the team may bring.

Keep things open. Asking open-ended questions and offering a safe space to share answers are essential steps. Doing so will help you gain real thoughts, not hear what participants think they should say.

The benefit of real data should never be overlooked when it comes to customers. People might say they act in certain ways, but their behavior can show otherwise.

Analytics (in a product dashboard or other data collection method, for example) will reveal a great deal of information about customer behavior. It can help streamline your business, remove areas of friction, and improve the overall customer experience .

Metrics like heat maps, time spent, click tracking, and number of sessions can help you build a picture of your customer’s behavior.

Are customers failing to complete their payment information? Are people landing on your page and immediately clicking away? Is a particular aspect of your experience retaining your customers’ attention? These are just a few useful questions you can ask as you go through your analytics.

Focus groups

Focus groups are a well-known and popular research method. They help teams discover a large amount of information in a short time period.

In a focus group, a small number of people—usually eight or fewer—gather together to discuss products, pain points, preferences, and how they might engage with products.

Focus groups are run by a moderator or a person from the organization who can act neutrally. The moderator will set out a series of questions or topics for the group to discuss.

The benefits of focus groups include the following:

Gaining insights into how users perceive your product

Spontaneous responses you may not have discovered otherwise

Information about key problems and pain points

An understanding of what your users want from a solution

However, focus groups also present some challenges. Louder voices in a group may sway others to agree with the consensus rather than share their real opinions. To combat this, offer all members of the group a safe space to share their thoughts. Encourage varying responses.

Competitor analysis

Competitor analysis helps you dive into what the market is currently offering. It shows what competitors are doing well and what could be done better. This helps you create new products that solve your customers’ problems more effectively.

The following are best practices for conducting competitor analysis

Be clear on who your competitors are

Identify your competitors’ strengths and weaknesses

Clarify who holds the largest market share and why

Analyze online presence, reviews, and product information

Speak to competitors’ customers

Competitor analysis isn’t just about discovering information about your competitors; another goal is to turn information into action. You’ll ideally want to improve on what a competitor currently offers and provide a product that’s more satisfying for customers.

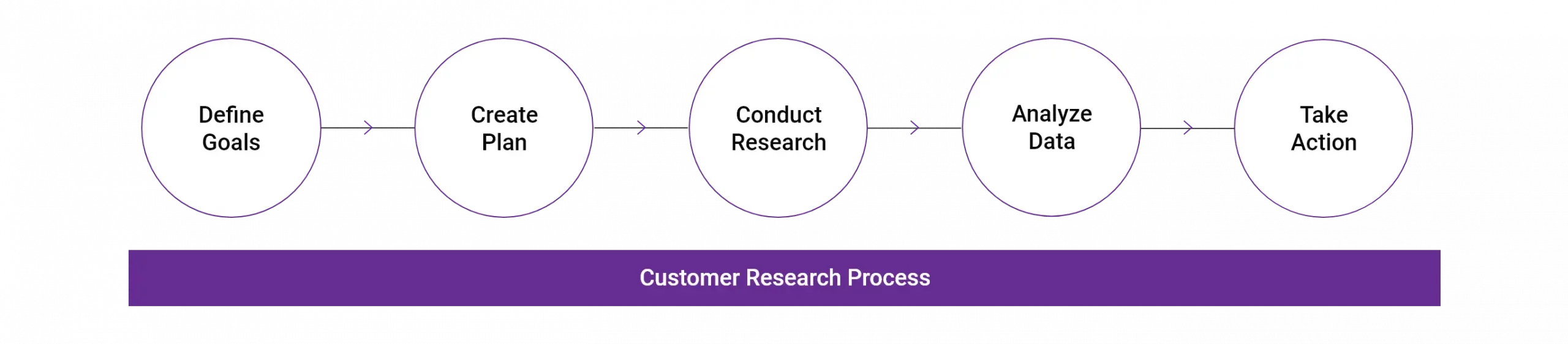

- How to conduct customer research

The following key steps will enable you to conduct useful customer research.

Set clear objectives

There’s a broad range of data and information that can be collected with customer research. However, not all of it will be relevant to your specific project.

That’s why setting clear objectives from the outset is critical. All methods and data should lead back to these objectives.

Use multiple methods

One research method is unlikely to gather enough information for your project. And no one method is perfect.

Conducting multiple forms of research ensures you discover more about your customers and that your team gathers enough helpful data.

Find the right people

Your research won’t be effective if you’re talking to the wrong customer group. But how do you find the right people?

If you already have a product, it would be enormously beneficial to speak to your current customers . They have proven that they’re in your target audience.

Forums, advertising, local groups, and organizations are good ways to identify potential customers to participate.

Let’s say you’re designing a dog-sitting app. In this case, you’ll need to speak to dog owners who would like more flexibility to travel. You could find these people in online groups, through a local meeting, or even at a park that’s popular for dog walking.

Consider incentives

It’s also worth considering incentives. These can encourage the right people to get on board. For example, you might offer participants the chance to win a voucher or give them a small amount of cash to participate.

Ensure any incentives are meaningful for your target audience.

Develop meaningful insights

Collecting a range of data and information from multiple methods is helpful. However, it’s ultimately meaningless if that data isn’t collated into useful insights .

Ensure that data is accurately grouped and represented clearly and concisely so that the entire business can benefit from the learnings. You might need to hire a data analyst.

- Surprise and delight your customers

Keeping customers at the center of what you do is the only way to create products that are helpful for people.

All products should help customers, whether that’s by solving a problem, making their life a little bit easier, or entertaining them in some way. Customers should want to use your product and enjoy the process.

By researching your customers, you can truly understand how they feel , where their pain points are, how they behave in real-life situations, and what solutions would please them. Ultimately, all this helps you better serve your customers.

Get started today

Go from raw data to valuable insights with a flexible research platform

Editor’s picks

Last updated: 22 February 2024

Last updated: 20 March 2024

Last updated: 16 March 2024

Last updated: 29 February 2024

Last updated: 5 April 2023

Last updated: 22 May 2023

Last updated: 31 January 2024

Last updated: 29 May 2023

Last updated: 2 March 2024

Last updated: 10 February 2024

Last updated: 25 June 2023

Latest articles

Related topics, log in or sign up.

Get started for free

.webp)

Customer Research Methods: Key Strategies for Market Insights in 2024

- Customer surveys : Survey tools such as Survicate are essential for conducting quantitative and qualitative research across various customer touchpoints and improving digital CX

- Diverse research methods : Employ a mix of customer research methods like different types of surveys , interviews, focus groups, observational studies, and usability testing to gain comprehensive insights into customer behavior and product interaction.

- Importance of continuous feedback : Establishing feedback loop mechanisms is crucial for ongoing improvement, ensuring that products and services evolve in response to customer needs .

- Data analysis : Systematic data collection followed by thorough analysis using appropriate customer research tools is key to identifying trends and making informed decisions.

- Actionable feedback : Prioritize and strategize based on research findings to create actionable insights that drive measurable improvements in customer experience management and business processes.

Cutting through the chatter to hear your customers' true opinions is no small feat.

Tailored for business owners and marketers, this article zeroes in on how to conduct customer research . We'll highlight the strategies that directly connect you to your audience's preferences and pain points. By tapping into these insights, you'll be equipped to make informed, impactful business decisions.

Dive in to transform customer feedback into a clear direction for your brand's growth and success.

What is customer research?

Customer research is an essential practice focused on collecting data about your customers to understand their characteristics, needs, and behaviors.

Why is customer research important?

- Informed Decision-Making: You gain actionable insights into customer preferences and satisfaction, empowering you to make data-driven decisions.

- Enhanced Customer Experience: Understanding what your customers value guides your efforts to improve their experiences with your product or service.

- Strategic Focus: Tailoring your business strategy becomes more focused as you identify key demographics and market segments.

- Product Development: Product features and improvements align better with customer expectations when informed by customer research.

- Competitive Edge: Detailed knowledge about your customers can give you a competitive advantage by identifying opportunities and gaps in the market.

Customer research vs. market research

Customer research and market research serve distinct purposes in understanding buyers and the competitive environment.

Customer research dives deep into your existing or potential customers' behaviors, needs, and preferences . It aims to create a detailed understanding of the customer journey , from awareness to purchase and is often qualitative in nature.

On the other hand, market research takes a broader approach, examining the market as a whole, including industry trends, competitor analysis, and market share.

While customer research is about the 'who' and 'why' behind purchasing decisions, conducting market research addresses the 'what' and 'how' of market conditions and opportunities.

Both types of research are crucial for informed decision-making but focus on different aspects of the business landscape. Customer research is about improving the customer experience and tailoring products or services to consumer needs. Market research is about understanding the market landscape to strategize and position offerings effectively.

Primary research vs. secondary research

In customer research, understanding the distinction between primary research and secondary research is crucial for choosing the right approach to obtain your insights.

Primary research

Primary research involves collecting data firsthand for your specific research goal. This data is original and gathered through methods directly controlled by you. Examples include:

- Surveys and questionnaires : Deploying custom surveys to collect customer feedback on a new product or service.

- Interviews : Conducting one-on-one dialogues to dive deep into customer opinions and experiences.

- Focus groups : Facilitated group discussions to obtain a range of perspectives on a particular topic.

Secondary research

Secondary research methods rely on data previously collected by others. It's an evaluation of existing information that may include:

- Industry Reports : Analyzing market research findings related to your sector.

- Academic Journals : Reviewing studies and papers for trends and outcomes that align with your interests.

- Market Analysis : Assessing competitor data and market summaries to inform your strategies.

Types of customer data

Before diving into specific categories, understand that customer data is essential to personalize your marketing strategies and enhance customer experiences. This data comes in two core types: qualitative and quantitative.

Qualitative data

Qualitative research gathers non-numeric information that captures your customers' opinions, motivations, and attitudes. This data often comes from:

- Interviews , direct conversations that provide in-depth insights.

- Open-ended survey responses allow customers to express their thoughts in their own words.

Quantitative data

Quantitative research collects numerical data and can be measured and analyzed statistically. Key sources include:

- Transaction records : Sales data showing purchasing patterns.

- Website analytics : Metrics like page views and click-through rates representing user behavior.

Best customer research methods

When conducting customer research, you need to select the right methodology to gain valuable insights. Various research methods cater to different needs, from understanding user behavior to gauging customer satisfaction.

Customer surveys and questionnaires

Deploy online surveys and questionnaires to quickly gather quantitative and qualitative data from a large audience. For example, a survey tool such as Survicate offers a variety of different distribution channels:

- surveys embedded in emails

- website pop-up surveys

- mobile app surveys

- link surveys

- in-product surveys

Surveys are a cost-effective way to gather market research insights from the entire customer digital journey . If you use them as a part of a feedback loop, they can help you improve the CX considerably.

widely via email, websites, or social media platforms. Ensure your questions are direct and easy to understand to maximize response rates.

Conduct interviews to collect in-depth qualitative data. One-on-one interviews allow for a deep dive into customer opinions, beliefs, and experiences. Record these sessions, if possible, to ensure that none of the details are lost.

Focus groups

Utilize focus groups to explore customer attitudes and behaviors in a group setting. This method sparks conversation and can uncover insights that might not surface in one-on-one interactions. Be wary of group dynamics such as conformity, which can influence individual responses.

Observational studies

Observational studies involve watching how users interact with your product in their natural environment. This method provides unfiltered, real-world user behavior that can be invaluable in understanding how your product is used.

Usability testing

Usability testing is imperative for evaluating the functionality and design of your product. Recruit participants to complete specific tasks while observers note where they encounter issues or experience confusion.

Field trials

Conduct field trials by providing users a prototype or beta version of your product for a certain period. This hands-on approach yields feedback on your product's performance in real-life scenarios.

Review mining

Lastly, review mining involves analyzing customer feedback found in online reviews and forums. This passive method is particularly useful for identifying common pain points and areas for improvement without the need for direct interaction.

Types of customer research

Customer research encompasses various methodologies aimed at understanding your market and clientele. Tailoring these approaches helps you stay informed and make data-driven decisions.

Competitive research

You analyze your competitors to benchmark your products, services, and customer satisfaction levels against them. This helps in identifying industry standards and areas for improvement.

Customer journey mapping

Journey mapping involves charting the steps your customers take, from discovering your brand to making a purchase and beyond. It's a strategic approach to understanding customer interactions with your brand.

Buyer persona research

You create detailed profiles of your typical customers based on demographic and psychographic data. These personas help in crafting targeted marketing strategies.

Customer experience research

You assess customers' overall experience with your brand, from the usability of your website to customer service interactions, to optimize every touchpoint.

Customer segmentation research

Market segmentation divides your customer base into distinct groups based on common characteristics to provide more personalized products and services.

Customer needs research

You investigate your customers' underlying needs and desires to develop products that solve specific problems or enhance their lives.

Customer satisfaction research

You measure how your products and services meet, exceed, or fall short of customer expectations, often using surveys, feedback forms, and follow-up interviews.

Pricing research

You evaluate customers' responses to pricing changes and their perception of your product's value to establish an optimal pricing strategy.

Brand perception research

You gauge how customers perceive your brand to ensure your messaging aligns with their beliefs and your company values.

Designing a research plan

Precision and structure are pivotal for gathering actionable insights in constructing a customer research plan. These steps will guide you through creating an effective framework for your research efforts.

Set objectives

Identify what you want to achieve with your research. For instance, you may aim to understand customer satisfaction , identify buying patterns, or test product concepts. These objectives should be Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) to ensure clarity and focus.

Identify target audience

Determine who your customers are by segmenting the market. To accurately represent your overall market, include demographics, psychographics, and behaviors in your segmentation. Knowing your audience can tailor your research to yield more relevant data.

Recruit participants

Once you know who to target, select participants who best represent your customer base. Employ strategies such as customer databases, social media outreach, or third-party panels to gather a varied group that reflects your target audience's diversity.

Choose appropriate methods

Your objectives will dictate the methods you choose. Qualitative approaches like interviews afford depth, while quantitative methods like surveys provide breadth. Select the right blend of methods to gain a multidimensional view of customer sentiments.

Sampling techniques

Employ sampling techniques to generalize your findings. Random sampling ensures everyone has an equal chance of selection, while stratified sampling involves dividing your audience into subgroups and sampling from these categories to ensure all segments are represented.

Build a continuous process with feedback loops

Establish ongoing mechanisms to capture customer feedback regularly. This could involve periodic surveys or real-time feedback systems. Make sure you continuously iterate your product or service based on this input, creating a virtuous cycle of improvement.

Data collection and analysis

Effective customer research hinges on the systematic collection and meticulous analysis of data to decipher patterns, understand behaviors, and make informed decisions.

Gather data systematically and analyze it to uncover patterns and trends. Use analytical tools that can handle your data type and amount. Look for relationships between variables and compare these findings against your goals.

Quantitative data analysis

You'll handle numerical data that can be measured and compared in a straightforward manner. Quantitative analysis often employs statistical tools to interpret data sets and deduce meaningful insights. Common techniques include:

- Descriptive Statistics: Summarize your data through means, medians, and modes.

- Inferential Statistics: Make predictions and infer trends from your sample data.

- Regression Analysis: Determine the relationship between variables.

Qualitative data assessment

With qualitative data, your focus is on interpretative analysis of non-numerical information, such as customer interviews or open-ended survey responses. Key approaches involve:

- Thematic Analysis: Identify patterns or themes within qualitative data.

- Content Analysis: Categorize text to understand the frequency and relationships of words or concepts.

- Narrative Analysis: Explore the structure and content of stories to gain insights into customer perspectives.

Mixing methods

Combining quantitative and qualitative analysis can provide a holistic view of your customer research. Employ a 'mixed methods' strategy to:

- Validate findings across different data types.

- Gain a richer, more nuanced understanding of research questions.

- Balance the depth of qualitative assessment with the generalizability of quantitative analysis.

Interpreting and reporting results

Turn your data into action by using insights to inform business decisions. Whether it is refining product features or adjusting marketing strategies, use the research to create value for your customers and your business.

Drawing conclusions

When you are ready to draw conclusions from your customer research, begin by assessing the data's significance. Look for patterns and trends in the feedback and quantifiable data. Tabulate your findings when possible, as this makes comparisons clearer:

- Quantitative Data : Calculate averages, frequencies, and percentages. A table showing the response distribution for each question can clarify these statistics.

- Qualitative Data : Group feedback into themes. For instance, list common descriptors used by customers when discussing a product feature.

Conclusions should directly relate to the research objectives you set before the study.

Creating actionable insights

After drawing conclusions, it's crucial to translate them into actionable insights:

- Prioritize : Determine which findings substantially impact your objectives or pose the biggest challenge to your CX.

- Strategize : For each priority area, brainstorm potential strategies. This may involve a simple list or a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) for complex decisions.

Always ensure that your insights are actionable; they should inform decisions and lead to measurable improvement in consumer experience or business processes. Communicate these insights with clear, straightforward language to the relevant stakeholders in your organization.

Emerging trends in customer research

Conduct market research with ai.

Customer research is adapting to leverage cutting-edge technologies. You'll notice a significant shift towards harnessing data analytics and artificial intelligence (AI) to derive deeper insights into customer behavior.

You can leverage Survciate AI-powered features as well. Try the AI survey creator that will design your customer or market research survey in under a minute after you describe your needs and objectives.

After you collect feedback, you can use the AI Topics feature to speed up getting qualitative insights. It will automatically categorize and summarize answers to your open-ended questions. Worth trying, isn't it?

Social listening

Social listening tools are another trend on the rise. They enable you to monitor your brand's social media presence and gather direct feedback from conversations about your products or services. Mobile ethnography also offers a way to observe customer interactions in a natural setting, providing contextually rich data.

Predicting customer behavior

Lastly, as the emphasis on personalization grows, predictive analytics are being adopted to tailor customer experiences. These techniques analyze past behavior to anticipate future needs, enhancing your ability to meet customer expectations preemptively.

Remember, these methods involve collecting various forms of customer data, so being vigilant about privacy and ethical data use is crucial. Follow regulations and best practices to ethically manage the information you gather.

Survicate for your market and customer research

As we've explored, the key to thriving in the current market is to truly understand your customers. The challenge, however, lies in efficiently gathering and interpreting their feedback to inform your business strategies.

With its user-friendly interface, Survicate allows you to create targeted surveys, collect real-time feedback, and analyze the data with ease, ensuring that every customer voice is heard and accounted for.

Survicate's suite of features simplifies the process of connecting with customers and extracting the insights you need to make data-driven decisions. Whether it's through NPS , customer satisfaction surveys, or user experience research, Survicate provides the clarity and direction required to adapt and excel in a fast-paced market.

For those ready to elevate their customer research, consider giving Survicate a try. Start your journey to clearer insights today with a free 10-day trial of the Business Plan , and experience the full potential of focused customer feedback. Take the step today, and transform the way you connect with your audience.

We’re also there

Customer Research: Types of Customer Research, Methods, and Best Practices.

In the ever-evolving landscape of business, understanding your customers is the key to success. Customer research, a systematic process of gathering and analyzing information about customers, plays a pivotal role in making informed business decisions and developing effective strategies. In this comprehensive guide, we delve into the types of customer research, the methodologies involved, and best practices for optimal results.

Comprehensive Guide to Customer Research: Types, Methods, and Best Practices

What is customer research.

Customer research involves the systematic exploration of customer behaviors, needs, preferences, and experiences. It combines qualitative and quantitative studies to gain insights into the target audience, facilitating informed decision-making and the development of strategies to meet customer expectations. The essential components of customer research include:

1. Research Objectives

Clearly defining research objectives is paramount. It involves determining the specific information or insights the organization aims to gather, ensuring the collected data aligns with organizational needs.

2. Target Audience Definition

Identifying the target audience is crucial, representing the group the research focuses on. This audience should mirror the organization’s customer base or intended market.

3. Research Methodology

Choosing appropriate research methods is vital. Whether surveys, interviews, focus groups, or data analytics, the methods should align with objectives, providing desired depth and breadth of insights.

4. Data Collection

Conducting data collection activities is core to customer research. Proper techniques, such as surveys, interviews, or data analysis, ensure the accuracy and reliability of gathered information.

5. Data Analysis

Organizing, categorizing, and interpreting collected data is essential. From quantitative techniques to qualitative research, the goal is to derive actionable insights that inform decision-making.

6. Findings and Insights

Effectively communicating research findings involves summarizing and presenting results. Visualizations, reports, and dashboards convey information clearly and understandably.

7. Recommendations

Based on findings, practical and actionable recommendations guide business decisions, whether for product improvements, marketing strategies, or customer experience enhancements.

8. Iteration and Continuous Improvement

Customer research is an iterative process. Regularly incorporating insights into strategies ensures organizations remain responsive to customer expectations and market changes.

Types of Customer Research

Understanding the various types of customer research is crucial for tailoring approaches to specific objectives. Some common types include:

1. Customer Satisfaction Research

Definition:.

Customer satisfaction research revolves around measuring and analyzing how satisfied customers are with a product or service. It helps in identifying areas for improvement and gauges overall customer contentment.

Key Elements:

- Surveys and Feedback Forms: Use structured surveys or feedback forms to quantify satisfaction levels.

- Net Promoter Score (NPS): Measures the likelihood of customers recommending a product or service.

Implementation:

Regularly conduct surveys and analyze feedback to gauge customer sentiment, focusing on enhancing areas with lower satisfaction.

2. Customer Needs and Preferences Research

This type of research aims to uncover the underlying needs, desires, and preferences of customers. It provides insights into what customers are looking for in a product or service.

- In-depth Interviews: Engage in one-on-one interviews to delve into the motivations and preferences of customers.

- Observational Studies: Observe customer behavior in real-life scenarios to identify unmet needs.

Conduct qualitative research through interviews and observational studies to gain a deep understanding of customer needs, informing product development.

3. Customer Experience (CX) Research

CX research focuses on understanding and optimizing the overall customer journey, identifying pain points, and ensuring a seamless and satisfying experience.

- Customer Journey Mapping: Visualize the entire customer experience, from initial interaction to post-purchase.

- Usability Testing: Evaluate the ease with which customers navigate through products or services.

Create detailed customer journey maps, conduct usability tests, and analyze customer interactions to enhance overall experience.

4. Brand Perception Research

This research assesses how customers perceive a brand, including awareness, image, associations, and loyalty. It helps in shaping and maintaining a positive brand identity.

- Brand Surveys: Measure brand awareness, associations, and loyalty.

- Competitor Analysis: Understand how the brand compares to competitors.

Regularly conduct brand perception surveys and analyze competitor strategies to maintain a positive brand image.

5. Customer Segmentation Research

Customer segmentation involves categorizing customers based on shared characteristics, behaviors, or needs. It enables targeted marketing strategies.

- Demographic Segmentation: Grouping customers based on age, gender, income, etc.

- Behavioral Segmentation: Segmenting based on purchasing behavior or product usage.

Analyze customer data to identify commonalities, enabling personalized marketing strategies for different segments.

6. Competitive Research

Competitive research involves analyzing competitors’ strategies, products, and customer experiences to identify opportunities for differentiation.

- Competitor Product Analysis: Evaluate features, pricing, and positioning of competitors’ products.

- Social Media Monitoring: Track customer sentiments regarding competitors on social media.

Regularly monitor competitors, analyze product offerings, and gather customer feedback to identify areas for improvement and differentiation.

7. Customer Journey Mapping

Customer journey mapping visualizes the end-to-end customer experience, identifying touchpoints, emotions, and areas for improvement.

- Customer Touchpoints: Identify and analyze all the touchpoints a customer has with the brand.

- Emotion Analysis: Understand customer emotions at each stage of the journey.

Create detailed customer journey maps, incorporating feedback from various touchpoints to enhance the overall journey.

These types of customer research provide organizations with a holistic view of their customers, enabling them to make informed decisions, improve products and services, and stay ahead in a competitive market. Each type serves a unique purpose, and a combination of these approaches ensures a comprehensive understanding of customer behaviors and preferences.

How to Conduct Customer Research: 10 Key Steps

Conducting effective customer research involves a systematic approach:

1. Define Research Objectives

Clearly define specific objectives to guide the research process and focus on relevant questions.

2. Identify Target Audience

Determine the specific target audience or customer segment that aligns with research goals.

3. Choose Research Methods

Select appropriate research methods and techniques, considering advantages, limitations, and resource requirements.

4. Develop Research Instruments

Design clear, concise research instruments such as survey questionnaires or interview guides.

5. Recruit Participants

Recruit participants matching the target audience criteria through various channels, ensuring communication clarity.

6. Conduct Data Collection

Implement chosen research methods, maintaining ethical guidelines, privacy, and data confidentiality.

7. Analyze Data

Use appropriate analysis techniques, whether quantitative or qualitative, ensuring rigor and alignment with research objectives.

8. Interpret Findings

Analyze patterns, trends, and relationships in data to gain insights into customer behaviors, preferences, or needs.

9. Communicate Results

Present findings clearly through reports, presentations, or visualizations, tailored to the target audience.

10. Apply Insights

Apply insights to inform business decisions, enhancing product development, marketing, and customer experiences.

Customer research is iterative; monitor outcomes, conduct follow-up research, and stay responsive to evolving customer needs.

Examples of Customer Research Questions

Crafting effective customer research questions is essential. Examples include:

- What factors influenced your decision to purchase our product/service?

- How did you first hear about our company?

- What specific features or aspects of our product/service do you find most valuable?

- What improvements or enhancements would you like to see in our product/service?

- How likely are you to recommend our product/service to others? Why?

- What obstacles or challenges did you encounter when using our product/service?

- How does our product/service compare to competitors in the market?

- How satisfied are you with the level of customer support you received?

- What are your expectations for pricing and value in relation to our product/service?

- How frequently do you use our product/service, and for what purposes?

Tailoring questions to the industry or service being researched ensures gathering relevant information.

Best Practices for Customer Research

Following best practices is essential for accurate and valuable insights:

1. Clearly Define Research Objectives

Identify specific goals and objectives to guide research, focusing on relevant questions and areas of investigation.

2. Use a Mix of Qualitative and Quantitative Methods

Combine qualitative and quantitative research methods for a comprehensive understanding of customers.

3. Identify Your Target Audience

Clearly define the characteristics and demographics of the target audience for accurate representation.

4. Create Unbiased and Neutral Questions

Formulate clear, unbiased, and neutral questions to avoid leading or influencing participant responses.

5. Use a Variety of Data Collection Methods

Explore various data collection methods, including surveys, interviews, focus groups, and social media listening.

6. Engage With Customers at Different Touchpoints

Interact with customers at different stages, from pre-purchase to post-purchase, to understand the entire customer journey.

7. Maintain Confidentiality and Anonymity

Assure participants of confidentiality and anonymity to encourage honest and unbiased feedback.

8. Analyze and Interpret Data Systematically

Systematically analyze data using appropriate techniques, identifying patterns and key insights.

9. Continuously Iterate and Improve

Regularly revisit research objectives, update methods, and gather feedback for continuous improvement.

10. Communicate Findings and Take Action

Present research findings to stakeholders, using insights to inform strategic decisions, product development, and marketing.

By following these best practices, organizations can conduct effective customer research, gaining valuable insights into customer behaviors and preferences.

Enhance Your Research with IdeaScale

IdeaScale is an innovation management solution that inspires people to take action on their ideas. With features like community whiteboards, services for government and nonprofits, and extensive resources, IdeaScale elevates research and

Empowering Businesses Globally: A Comprehensive Guide to Customer Research by Arensic

Welcome to the realm of Arensic International , your strategic partner in unlocking the full potential of businesses on the global stage. As a leading international market research and management consulting firm, Arensic transcends boundaries to deliver strategic solutions that drive informed decisions and foster sustainable growth.

About Arensic International

At Arensic , we go beyond being a service provider; we are your visionary partner, committed to creating a dynamic and collaborative environment where innovative ideas flourish, decisions are informed, and business growth is realized. Our goal is to be the catalyst for your success in the competitive business landscape.

Related Posts

AI Impact on Society: Ethical Landscape of AI for a Positive Societal Impact

Types of Market Research: A Deep Dive into Types of Marketing Research

- 1-800-553-8159 Expand Menu

- Subscribe to Our Emails Expand Menu

- Chat with Sales Expand Menu

- Contact Us Expand Menu

Customer Experience Research 101: A Comprehensive Guide

February 7, 2024

Every customer expects quality treatment from the company they interact with, seeking positive interactions to nurture lasting relationships. The key to ensuring this consistency at every touchpoint lies in customer experience research. By understanding and addressing the customer's journey, identifying gaps, and actively working to fill them, your brand can guarantee a positive experience every single time.

Keep reading to explore more about CX research, understand its importance, and find effective strategies for its successful implementation.

What is Customer Experience Research?

Customer Experience Research is a systematic and comprehensive approach to collecting, analyzing, and interpreting data related to customers' interactions with a company's products or services. It encompasses various research methods, such as surveys, interviews, and feedback analysis, with the goal of understanding, improving, and optimizing the overall customer experience.

CER is essential for enhancing customer satisfaction, reducing churn, and gaining a competitive edge. It empowers businesses to make informed decisions, delivering better-tailored solutions and fostering loyalty. Positive customer experiences, guided by CER insights, not only ensure brand loyalty but also contribute to a favorable reputation, attracting new customers and establishing the company as a customer-centric leader in the market.

Types of Customer Experience Research