Does your provider accept Medicare as full payment?

You can get the lowest cost if your doctor or other health care provider accepts the Medicare-approved amount as full payment for a covered service. This is called “accepting assignment.” If a provider accepts assignment, it’s for all Medicare-covered Part A and Part B services.

Using a provider that accepts assignment

Most doctors, providers, and suppliers accept assignment, but always check to make sure that yours do.

If your doctor, provider, or supplier accepts assignment:

- Your out-of-pocket costs may be less.

- They agree to charge you only the Medicare deductible and coinsurance amount, and usually wait for Medicare to pay its share before asking you to pay your share.

- They have to submit your claim directly to Medicare and can't charge you for submitting the claim.

How does assignment impact my drug coverage?

Using a provider that doesn't accept Medicare as full payment

Some providers who don’t accept assignment still choose to accept the Medicare-approved amount for services on a case-by-case basis. These providers are called "non-participating."

If your doctor, provider, or supplier doesn't accept assignment:

- You might have to pay the full amount at the time of service.

- They should submit a claim to Medicare for any Medicare-covered services they give you, and they can’t charge you for submitting a claim. If they refuse to submit a Medicare claim, you can submit your own claim to Medicare. Get the Medicare claim form .

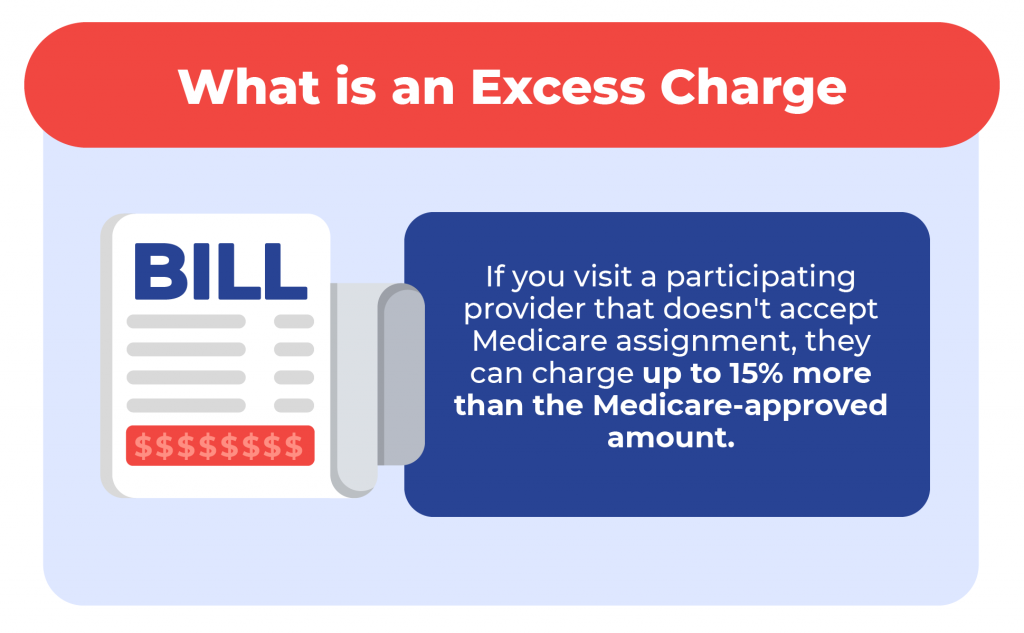

- They can charge up to 15% over the Medicare-approved amount for a service, but no more than that. This is called "the limiting charge."

Does the limiting charge apply to all Medicare-covered services?

Using a provider that "opts-out" of Medicare

- Doctors and other providers who don’t want to work with the Medicare program may "opt out" of Medicare.

- Medicare won’t pay for items or services you get from provider that opts out, except in emergencies.

- Providers opt out for a minimum of 2 years. Every 2 years, the provider can choose to keep their opt-out status, accept Medicare-approved amounts on a case-by-case basis ("non-participating"), or accept assignment.

Find providers that opted out of Medicare.

Private contracts with doctors or providers who opt out

- If you choose to get services from an opt-out doctor or provider you may need to pay upfront, or set up a payment plan with the provider through a private contract.

- Medicare won’t pay for any service you get from this doctor, even if it’s a Medicare-covered service.

What are the rules for private contracts?

You may want to contact your State Health Insurance Assistance Program (SHIP) for help before signing a private contract with any doctor or other health care provider.

What do you want to do next?

- Next step: Get help with costs

- Take action: Find a provider

- Get details: How to get Medicare services

- Type 2 Diabetes

- Heart Disease

- Digestive Health

- Multiple Sclerosis

- COVID-19 Vaccines

- Occupational Therapy

- Healthy Aging

- Health Insurance

- Public Health

- Patient Rights

- Caregivers & Loved Ones

- End of Life Concerns

- Health News

- Thyroid Test Analyzer

- Doctor Discussion Guides

- Hemoglobin A1c Test Analyzer

- Lipid Test Analyzer

- Complete Blood Count (CBC) Analyzer

- What to Buy

- Editorial Process

- Meet Our Medical Expert Board

Medicare Assignment: Everything You Need to Know

Medicare assignment.

- Providers Accepting Assignment

- Providers Who Do Not

- Billing Options

- Assignment of Benefits

- How to Choose

Frequently Asked Questions

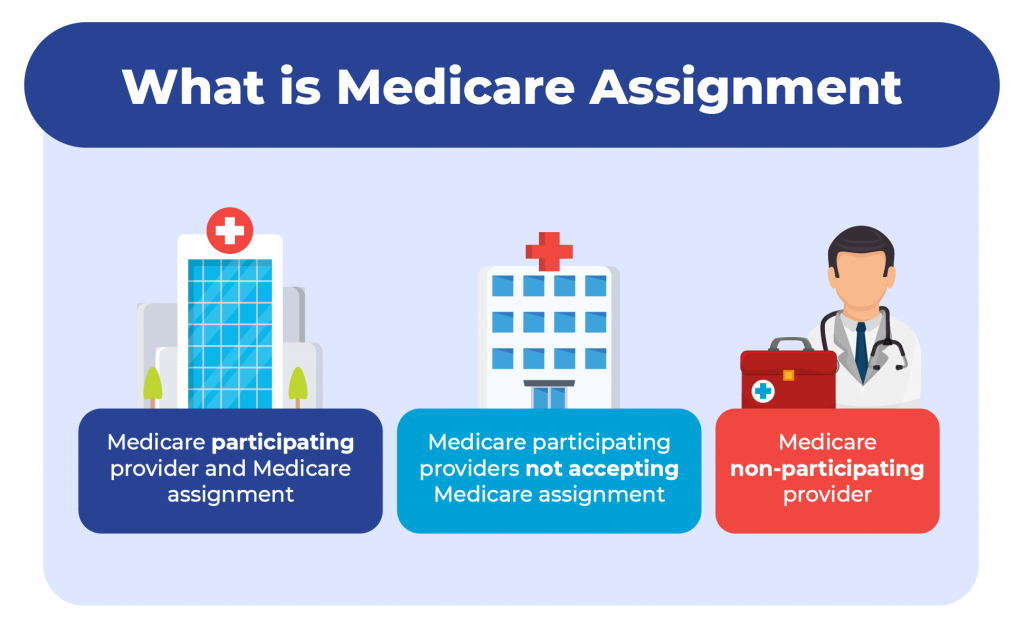

Medicare assignment is an agreement between Medicare and medical providers (doctors, hospitals, medical equipment suppliers, etc.) in which the provider agrees to accept Medicare’s fee schedule as payment in full when Medicare patients are treated.

This article will explain how Medicare assignment works, and what you need to know in order to ensure that you won’t receive unexpected bills.

fizkes / Getty Images

There are 35 million Americans who have Original Medicare. Medicare is a federal program and most medical providers throughout the country accept assignment with Medicare. As a result, these enrollees have a lot more options for medical providers than most of the rest of the population.

They can see any provider who accepts assignment, anywhere in the country. They can be assured that they will only have to pay their expected Medicare cost-sharing (deductible and coinsurance, some or all of which may be paid by a Medigap plan , Medicaid, or supplemental coverage provided by an employer or former employer).

It’s important to note here that the rules are different for the 29 million Americans who have Medicare Advantage plans. These beneficiaries cannot simply use any medical provider who accepts Medicare assignment.

Instead, each Medicare Advantage plan has its own network of providers —much like the health insurance plans that many Americans are accustomed to obtaining from employers or purchasing in the exchange/marketplace .

A provider who accepts assignment with Medicare may or may not be in-network with some or all of the Medicare Advantage plans that offer coverage in a given area. Some Medicare Advantage plans— health maintenance organizations (HMOs) , in particular—will only cover an enrollee’s claims if they use providers who are in the plan's network.

Other Medicare Advantage plans— preferred provider organizations (PPOs) , in particular—will cover out-of-network care but the enrollee will pay more than they would have paid had they seen an in-network provider.

Original Medicare

The bottom line is that Medicare assignment only determines provider accessibility and costs for people who have Original Medicare. People with Medicare Advantage need to understand their own plan’s provider network and coverage rules.

When discussing Medicare assignment and access to providers in this article, keep in mind that it is referring to people who have Original Medicare.

How to Make Sure Your Provider Accepts Assignment

Most doctors, hospitals, and other medical providers in the United States do accept Medicare assignment.

Provider Participation Stats

According to the Centers for Medicare and Medicaid Services, 98% of providers participate in Medicare, which means they accept assignment.

You can ask the provider directly about their participation with Medicare. But Medicare also has a tool that you can use to find participating doctors, hospitals, home health care services, and other providers.

There’s a filter on that tool labeled “Medicare-approved payment.” If you turn on that filter, you will only see providers who accept Medicare assignment. Under each provider’s information, it will say “Charges the Medicare-approved amount (so you pay less out-of-pocket).”

What If Your Provider Doesn’t Accept Assignment?

If your medical provider or equipment supplier doesn’t accept assignment, it means they haven’t agreed to accept Medicare’s approved amounts as payment in full for all of the services.

These providers can still choose to accept assignment on a case-by-case basis. But because they haven’t agreed to accept Medicare assignment for all services, they are considered nonparticipating providers.

Note that "nonparticipating" does not mean that a provider has opted out of Medicare altogether. Medicare will still pay claims for services received from a nonparticipating provider (i.e., one who does not accept Medicare assignment), whereas Medicare does not cover any of the cost of services obtained from a provider who has officially opted out of Medicare.

If a Medicare beneficiary uses a provider who has opted out of Medicare, that person will pay the provider directly and Medicare will not be involved in any way.

Physicians Who Have Opted Out

Only about 1% of all non-pediatric physicians have opted out of Medicare.

For providers who have not opted out of Medicare but who also don’t accept assignment, Medicare will still pay nearly as much as it would have paid if you had used a provider who accepts assignment. Here’s how it works:

- Medicare will pay the provider 95% of the amount they would pay if the provider accepted assignment.

- The provider can charge the person receiving care more than the Medicare-approved amount, but only up to 15% more (some states limit this further). This extra amount, which the patient has to pay out-of-pocket, is known as the limiting charge . But the 15% cap does not apply to medical equipment suppliers; if they do not accept assignment with Medicare, there is no limit on how much they can charge the person receiving care. This is why it’s particularly important to make sure that the supplier accepts Medicare assignment if you need medical equipment.

- The nonparticipating provider may require the person receiving care to pay the entire bill up front and seek reimbursement from Medicare (using Form CMS 1490-S ). Alternatively, they may submit a claim to Medicare on behalf of the person receiving care (using Form CMS-1500 ).

- A nonparticipating provider can choose to accept assignment on a case-by-case basis. They can indicate this on Form CMS-1500 in box 27. The vast majority of nonparticipating providers who bill Medicare choose to accept assignment for the claim being billed.

- Nonparticipating providers do not have to bill your Medigap plan on your behalf.

Billing Options for Providers Who Accept Medicare

When a medical provider accepts assignment with Medicare, part of the agreement is that they will submit bills to Medicare on behalf of the person receiving care. So if you only see providers who accept assignment, you will never need to submit your own bills to Medicare for reimbursement.

If you have a Medigap plan that supplements your Original Medicare coverage, you should present the Medigap coverage information to the provider at the time of service. Medicare will forward the claim information to your Medigap insurer, reducing administrative work on your part.

Depending on the Medigap plan you have, the services that you receive, and the amount you’ve already spent in out-of-pocket costs, the Medigap plan may pay some or all of the out-of-pocket costs that you would otherwise have after Medicare pays its share.

(Note that if you have a type of Medigap plan called Medicare SELECT, you will have to stay within the plan’s network of providers in order to receive benefits. But this is not the case with other Medigap plans.)

After the claim is processed, you’ll be able to see details in your MyMedicare.gov account . Medicare will also send you a Medicare Summary Notice. This is Medicare’s version of an explanation of benefits (EOB) , which is sent out every three months.

If you have a Medigap plan, it should also send you an EOB or something similar, explaining the claim and whether the policy paid any part of it.

What Is Medicare Assignment of Benefits?

For Medicare beneficiaries, assignment of benefits means that the person receiving care agrees to allow a nonparticipating provider to bill Medicare directly (as opposed to having the person receiving care pay the bill up front and seek reimbursement from Medicare). Assignment of benefits is authorized by the person receiving care in Box 13 of Form CMS-1500 .

If the person receiving care refuses to assign benefits, Medicare can only reimburse the person receiving care instead of paying the nonparticipating provider directly.

Things to Consider Before Choosing a Provider

If you’re enrolled in Original Medicare, you have a wide range of options in terms of the providers you can use—far more than most other Americans. In most cases, your preferred doctor and other medical providers will accept assignment with Medicare, keeping your out-of-pocket costs lower than they would otherwise be, and reducing administrative hassle.

There may be circumstances, however, when the best option is a nonparticipating provider or even a provider who has opted out of Medicare altogether. If you choose one of these options, be sure you discuss the details with the provider before proceeding with the treatment.

You’ll want to understand how much is going to be billed and whether the provider will bill Medicare on your behalf if you agree to assign benefits (note that this is not possible if the provider has opted out of Medicare).

If you have supplemental coverage, you’ll also want to check with that plan to see whether it will still pick up some of the cost and, if so, how much you should expect to pay out of your own pocket.

A medical provider who accepts Medicare assignment is considered a participating provider. These providers have agreed to accept Medicare’s fee schedule as payment in full for services they provide to Medicare beneficiaries. Most doctors, hospitals, and other medical providers do accept Medicare assignment.

Nonparticipating providers are those who have not signed an agreement with Medicare to accept Medicare’s rates as payment in full. However, they can agree to accept assignment on a case-by-case basis, as long as they haven’t opted out of Medicare altogether. If they do not accept assignment, they can bill the patient up to 15% more than the Medicare-approved rate.

Providers who opt out of Medicare cannot bill Medicare and Medicare will not pay them or reimburse beneficiaries for their services. But there is no limit on how much they can bill for their services.

A Word From Verywell

It’s in your best interest to choose a provider who accepts Medicare assignment. This will keep your costs as low as possible, streamline the billing and claims process, and ensure that your Medigap plan picks up its share of the costs.

If you feel like you need help navigating the provider options or seeking care from a provider who doesn’t accept assignment, the Medicare State Health Insurance Assistance Program (SHIP) in your state may be able to help.

A doctor who does not accept Medicare assignment has not agreed to accept Medicare’s fee schedule as payment in full for their services. These doctors are considered nonparticipating with Medicare and can bill Medicare beneficiaries up to 15% more than the Medicare-approved amount.

They also have the option to accept assignment (i.e., accept Medicare’s rate as payment in full) on a case-by-case basis.

There are certain circumstances in which a provider is required by law to accept assignment. This includes situations in which the person receiving care has both Medicare and Medicaid. And it also applies to certain medical services, including lab tests, ambulance services, and drugs that are covered under Medicare Part B (as opposed to Part D).

In 2021, 98% of American physicians had participation agreements with Medicare, leaving only about 2% who did not accept assignment (either as a nonparticipating provider, or a provider who had opted out of Medicare altogether).

Accepting assignment is something that the medical provider does, whereas assignment of benefits is something that the patient (the Medicare beneficiary) does. To accept assignment means that the medical provider has agreed to accept Medicare’s approved fee as payment in full for services they provide.

Assignment of benefits means that the person receiving care agrees to allow a medical provider to bill Medicare directly, as opposed to having the person receiving care pay the provider and then seek reimbursement from Medicare.

Centers for Medicare and Medicaid Services. Medicare monthly enrollment .

Centers for Medicare and Medicaid Services. Annual Medicare participation announcement .

Centers for Medicare and Medicaid Services. Lower costs with assignment .

Centers for Medicare and Medicaid Services. Find providers who have opted out of Medicare .

Kaiser Family Foundation. How many physicians have opted-out of the Medicare program ?

Center for Medicare Advocacy. Durable medical equipment, prosthetics, orthotics, and supplies (DMEPOS) updates .

Centers for Medicare and Medicaid Services. Check the status of a claim .

Centers for Medicare and Medicaid Services. Medicare claims processing manual. Chapter 26 - completing and processing form CMS-1500 data set .

Centers for Medicare and Medicaid Services. Ambulance fee schedule .

Centers for Medicare and Medicaid Services. Prescription drugs (outpatient) .

By Louise Norris Norris is a licensed health insurance agent, book author, and freelance writer. She graduated magna cum laude from Colorado State University.

Use our RMD calculator to estimate your required withdrawals from tax-deferred retirement plans.

Popular Searches

AARP daily Crossword Puzzle

Hotels with AARP discounts

Life Insurance

AARP Dental Insurance Plans

Suggested Links

AARP MEMBERSHIP — $12 FOR YOUR FIRST YEAR WHEN YOU SIGN UP FOR AUTOMATIC RENEWAL

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

- right_container

Work & Jobs

Social Security

AARP en Español

- Membership & Benefits

AARP Rewards

- AARP Rewards %{points}%

Conditions & Treatments

Drugs & Supplements

Health Care & Coverage

Health Benefits

Staying Fit

Your Personalized Guide to Fitness

AARP Hearing Center

Ways To Improve Your Hearing

Brain Health Resources

Tools and Explainers on Brain Health

How to Save Your Own Life

Scams & Fraud

Personal Finance

Money Benefits

View and Report Scams in Your Area

AARP Foundation Tax-Aide

Free Tax Preparation Assistance

AARP Money Map

Get Your Finances Back on Track

Budget & Savings

Make Your Appliances Last Longer

Small Business

Age Discrimination

Flexible Work

Freelance Jobs You Can Do From Home

AARP Skills Builder

Online Courses to Boost Your Career

31 Great Ways to Boost Your Career

ON-DEMAND WEBINARS

Tips to Enhance Your Job Search

Get More out of Your Benefits

When to Start Taking Social Security

10 Top Social Security FAQs

Social Security Benefits Calculator

Medicare Made Easy

Original vs. Medicare Advantage

Enrollment Guide

Step-by-Step Tool for First-Timers

Prescription Drugs

9 Biggest Changes Under New Rx Law

Medicare FAQs

Quick Answers to Your Top Questions

Care at Home

Financial & Legal

Life Balance

LONG-TERM CARE

Understanding Basics of LTC Insurance

State Guides

Assistance and Services in Your Area

Prepare to Care Guides

How to Develop a Caregiving Plan

End of Life

How to Cope With Grief, Loss

Recently Played

Word & Trivia

Atari® & Retro

Members Only

Staying Sharp

Mobile Apps

More About Games

Right Again! Trivia

Right Again! Trivia – Sports

Atari® Video Games

Throwback Thursday Crossword

Travel Tips

Vacation Ideas

Destinations

Travel Benefits

Beach vacation ideas

Vacations for Sun and Fun

Plan Ahead for Tourist Taxes

AARP City Guide

Discover Seattle

How to Pick the Right Cruise for You

Entertainment & Style

Family & Relationships

Personal Tech

Home & Living

Celebrities

Beauty & Style

TV for Grownups

Best Reality TV Shows for Grownups

Robert De Niro Reflects on His Life

Free Online Novel

Read 'Chase'

Sex & Dating

Spice Up Your Love Life

Navigate All Kinds of Connections

How to Create a Home Gym

Store Medical Records on Your Phone?

Maximize the Life of Your Phone Battery

Virtual Community Center

Join Free Tech Help Events

Create a Hygge Haven

Soups to Comfort Your Soul

AARP Smart Guide

Spring Clean All of Your Spaces

Driver Safety

Maintenance & Safety

Trends & Technology

How to Keep Your Car Running

We Need To Talk

Assess Your Loved One's Driving Skills

AARP Smart Driver Course

Building Resilience in Difficult Times

Tips for Finding Your Calm

Weight Loss After 50 Challenge

Cautionary Tales of Today's Biggest Scams

7 Top Podcasts for Armchair Travelers

Jean Chatzky: ‘Closing the Savings Gap’

Quick Digest of Today's Top News

AARP Top Tips for Navigating Life

Get Moving With Our Workout Series

You are now leaving AARP.org and going to a website that is not operated by AARP. A different privacy policy and terms of service will apply.

Go to Series Main Page

What is Medicare assignment and how does it work?

Kimberly Lankford,

Because Medicare decides how much to pay providers for covered services, if the provider agrees to the Medicare-approved amount, even if it is less than they usually charge, they’re accepting assignment.

A doctor who accepts assignment agrees to charge you no more than the amount Medicare has approved for that service. By comparison, a doctor who participates in Medicare but doesn’t accept assignment can potentially charge you up to 15 percent more than the Medicare-approved amount.

That’s why it’s important to ask if a provider accepts assignment before you receive care, even if they accept Medicare patients. If a doctor doesn’t accept assignment, you will pay more for that physician’s services compared with one who does.

AARP Membership — $12 for your first year when you sign up for Automatic Renewal

How much do I pay if my doctor accepts assignment?

If your doctor accepts assignment, you will usually pay 20 percent of the Medicare-approved amount for the service, called coinsurance, after you’ve paid the annual deductible. Because Medicare Part B covers doctor and outpatient services, your $240 deductible for Part B in 2024 applies before most coverage begins.

All providers who accept assignment must submit claims directly to Medicare, which pays 80 percent of the approved cost for the service and will bill you the remaining 20 percent. You can get some preventive services and screenings, such as mammograms and colonoscopies , without paying a deductible or coinsurance if the provider accepts assignment.

What if my doctor doesn’t accept assignment?

A doctor who takes Medicare but doesn’t accept assignment can still treat Medicare patients but won’t always accept the Medicare-approved amount as payment in full.

This means they can charge you up to a maximum of 15 percent more than Medicare pays for the service you receive, called “balance billing.” In this case, you’re responsible for the additional charge, plus the regular 20 percent coinsurance, as your share of the cost.

How to cover the extra cost? If you have a Medicare supplement policy , better known as Medigap, it may cover the extra 15 percent, called Medicare Part B excess charges.

All Medigap policies cover Part B’s 20 percent coinsurance in full or in part. The F and G policies cover the 15 percent excess charges from doctors who don’t accept assignment, but Plan F is no longer available to new enrollees, only those eligible for Medicare before Jan. 1, 2020, even if they haven’t enrolled in Medicare yet. However, anyone who is enrolled in original Medicare can apply for Plan G.

Remember that Medigap policies only cover excess charges for doctors who accept Medicare but don’t accept assignment, and they won’t cover costs for doctors who opt out of Medicare entirely.

Good to know. A few states limit the amount of excess fees a doctor can charge Medicare patients. For example, Massachusetts and Ohio prohibit balance billing, requiring doctors who accept Medicare to take the Medicare-approved amount. New York limits excess charges to 5 percent over the Medicare-approved amount for most services, rather than 15 percent.

AARP NEWSLETTERS

%{ newsLetterPromoText }%

%{ description }%

Privacy Policy

ARTICLE CONTINUES AFTER ADVERTISEMENT

How do I find doctors who accept assignment?

Before you start working with a new doctor, ask whether he or she accepts assignment. About 98 percent of providers billing Medicare are participating providers, which means they accept assignment on all Medicare claims, according to KFF.

You can get help finding doctors and other providers in your area who accept assignment by zip code using Medicare’s Physician Compare tool .

Those who accept assignment have this note under the name: “Charges the Medicare-approved amount (so you pay less out of pocket).” However, not all doctors who accept assignment are accepting new Medicare patients.

AARP® Vision Plans from VSP™

Exclusive vision insurance plans designed for members and their families

What does it mean if a doctor opts out of Medicare?

Doctors who opt out of Medicare can’t bill Medicare for services you receive. They also aren’t bound by Medicare’s limitations on charges.

In this case, you enter into a private contract with the provider and agree to pay the full bill. Be aware that neither Medicare nor your Medigap plan will reimburse you for these charges.

In 2023, only 1 percent of physicians who aren’t pediatricians opted out of the Medicare program, according to KFF. The percentage is larger for some specialties — 7.7 percent of psychiatrists and 4.2 percent of plastic and reconstructive surgeons have opted out of Medicare.

Keep in mind

These rules apply to original Medicare. Other factors determine costs if you choose to get coverage through a private Medicare Advantage plan . Most Medicare Advantage plans have provider networks, and they may charge more or not cover services from out-of-network providers.

Before choosing a Medicare Advantage plan, find out whether your chosen doctor or provider is covered and identify how much you’ll pay. You can use the Medicare Plan Finder to compare the Medicare Advantage plans and their out-of-pocket costs in your area.

Return to Medicare Q&A main page

Kimberly Lankford is a contributing writer who covers Medicare and personal finance. She wrote about insurance, Medicare, retirement and taxes for more than 20 years at Kiplinger’s Personal Finance and has written for The Washington Post and Boston Globe . She received the personal finance Best in Business award from the Society of American Business Editors and Writers and the New York State Society of CPAs’ excellence in financial journalism award for her guide to Medicare.

Discover AARP Members Only Access

Already a Member? Login

More on Medicare

How Do I Create a Personal Online Medicare Account?

You can do a lot when you decide to look electronically

I Got a Medicare Summary Notice in the Mail. What Is It?

This statement shows what was billed, paid in past 3 months

Understanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices

Recommended for You

AARP Value & Member Benefits

Learn, earn and redeem points for rewards with our free loyalty program

AARP® Dental Insurance Plan administered by Delta Dental Insurance Company

Dental insurance plans for members and their families

The National Hearing Test

Members can take a free hearing test by phone

AARP® Staying Sharp®

Activities, recipes, challenges and more with full access to AARP Staying Sharp®

SAVE MONEY WITH THESE LIMITED-TIME OFFERS

Medicare Interactive Medicare answers at your fingertips -->

Participating, non-participating, and opt-out providers, outpatient provider services.

You must be logged in to bookmark pages.

Email Address * Required

Password * Required

Lost your password?

If you have Original Medicare , your Part B costs once you have met your deductible can vary depending on the type of provider you see. For cost purposes, there are three types of provider, meaning three different relationships a provider can have with Medicare . A provider’s type determines how much you will pay for Part B -covered services.

- These providers are required to submit a bill (file a claim ) to Medicare for care you receive. Medicare will process the bill and pay your provider directly for your care. If your provider does not file a claim for your care, there are troubleshooting steps to help resolve the problem .

- If you see a participating provider , you are responsible for paying a 20% coinsurance for Medicare-covered services.

- Certain providers, such as clinical social workers and physician assistants, must always take assignment if they accept Medicare.

- Non-participating providers can charge up to 15% more than Medicare’s approved amount for the cost of services you receive (known as the limiting charge ). This means you are responsible for up to 35% (20% coinsurance + 15% limiting charge) of Medicare’s approved amount for covered services.

- Some states may restrict the limiting charge when you see non-participating providers. For example, New York State’s limiting charge is set at 5%, instead of 15%, for most services. For more information, contact your State Health Insurance Assistance Program (SHIP) .

- If you pay the full cost of your care up front, your provider should still submit a bill to Medicare. Afterward, you should receive from Medicare a Medicare Summary Notice (MSN) and reimbursement for 80% of the Medicare-approved amount .

- The limiting charge rules do not apply to durable medical equipment (DME) suppliers . Be sure to learn about the different rules that apply when receiving services from a DME supplier .

- Medicare will not pay for care you receive from an opt-out provider (except in emergencies). You are responsible for the entire cost of your care.

- The provider must give you a private contract describing their charges and confirming that you understand you are responsible for the full cost of your care and that Medicare will not reimburse you.

- Opt-out providers do not bill Medicare for services you receive.

- Many psychiatrists opt out of Medicare.

Providers who take assignment should submit a bill to a Medicare Administrative Contractor (MAC) within one calendar year of the date you received care. If your provider misses the filing deadline, they cannot bill Medicare for the care they provided to you. However, they can still charge you a 20% coinsurance and any applicable deductible amount.

Be sure to ask your provider if they are participating, non-participating, or opt-out. You can also check by using Medicare’s Physician Compare tool .

Update your browser to view this website correctly. Update my browser now

What Is Medicare Assignment?

Written by: Rachael Zimlich, RN, BSN

Reviewed by: Eboni Onayo, Licensed Insurance Agent

Key Takeaways

Medicare assignment describes the fee structure that your doctor and Medicare have agreed to use.

If your doctor agrees to accept Medicare assignment, they agree to be paid whatever amount Medicare has approved for a service.

You may still see doctors who don’t accept Medicare assignment, but you may have to pay for your visit up front and submit a claim to Medicare for reimbursement.

You may have to pay more to see doctors who don’t accept Medicare assignment.

How Does Medicare Assignment Work?

What is Medicare assignment ?

Medicare assignment simply means that your provider has agreed to stick to a Medicare fee schedule when it comes to what they charge for tests and services. Medicare regularly updates fee schedules, setting specific limits for what it will cover for things like office visits and lab testing.

When a provider agrees to accept Medicare assignment, they cannot charge more than the Medicare-approved amount. For you, this means your out-of-pocket costs may be lower than if you saw a provider who did not accept Medicare assignment. The provider acknowledges that the amount Medicare set for a particular service is the maximum amount that will be paid.

You may still have to pay a Medicare deductible and coinsurance, but your provider will have to submit a claim to Medicare directly and wait for payment before passing any share of the costs onto you. Doctors who accept Medicare assignment cannot charge you to submit these claims.

Find the Medicare Plan that works for you.

How Do I Know if a Provider Accepts Medicare Assignment?

There are a few levels of commitment when it comes to Medicare assignment.

- Providers who have agreed to accept Medicare assignment sign a contract with Medicare.

- Those who have not signed a contract with Medicare can still accept assignment amounts for services of their choice. They do not have to accept assignment for every service provided. These are called non-participating providers.

- Some providers opt out of Medicare altogether. Doctors who have opted out of Medicare completely or who use private contracts will not be paid anything by Medicare, even if it’s for a covered service within the fee limits. You will have to pay the full cost of any services provided by these doctors yourself.

You can check to see if your provider accepts Medicare assignment on Medicare’s website .

Billing Arrangement Options for Providers Who Accept Medicare

Doctors that take Medicare can sign a contract to accept assignment for all Medicare services, or be a non-participating provider that accepts assignment for some services but not all.

A medical provider that accepts Medicare assignment must submit claims directly to Medicare on your behalf. They will be paid the agreed upon amount by Medicare, and you will pay any copayments or deductibles dictated by your plan.

If your doctor is non-participating, they may accept Medicare assignment for some services but not others. Even if they do agree to accept Medicare’s fee for some services, Medicare will only pay then 95% of the set assignment cost for a particular service.

If your provider does plan to work with Medicare, either the provider or you can submit a claim to Medicare, but you may have to pay the entire cost of the visit up front and wait for reimbursement. They can’t charge you for more than the amount approved by Medicare, but they can charge you above the Medicare-approved amount. This is called the limiting charge, and can be up to 15% more than Medicare-approved amount for non-participating providers.

What Does It Mean When a Provider Does Not Accept Medicare Assignment?

Providers who refuse Medicare assignment can still choose to accept Medicare’s set fees for certain services. These are called non-participating providers.

There are a number of providers who opt out of participating in Medicare altogether; they are referred to as “opt-out doctors”. This means they have signed an opt-out agreement with Medicare and can’t be paid by Medicare at all — even for services normally covered by Medicare. Opt-out contracts last for at least two years. Some of these providers may only offer services to patients who sign contracts.

You do not need to sign a contract with a private provider or use an opt-out provider. There are many options for alternative providers who accept Medicare. If you do choose an opt-out or private contract provider, you will have to pay the full cost of services on your own.

Let’s find your ideal Medicare Advantage plan.

Do providers have to accept Medicare assignment?

No. Providers can choose to accept a full Medicare assignment, or accept assignment rates for some services as a non-participating provider. Doctors can also opt out of participating in Medicare altogether.

How much will I have to pay if my provider doesn't accept Medicare assignment?

Some providers that don’t accept assignment as a whole will accept assignment for some services. These are called non-participating providers. For these providers and providers who have completely opted out of Medicare, you will pay the majority of or the full amount for your care.

How do I submit a claim?

If you need to submit your own claim to Medicare, you can call 1-800-MEDICARE or use Form CMS-1490S .

Can my provider charge to submit a claim?

No. Providers are not allowed to charge to submit a claim to Medicare on your behalf.

Lower Costs with Assignment. Medicare.gov.

Fee Schedules . CMS.gov.

This website is operated by GoHealth, LLC., a licensed health insurance company. The website and its contents are for informational and educational purposes; helping people understand Medicare in a simple way. The purpose of this website is the solicitation of insurance. Contact will be made by a licensed insurance agent/producer or insurance company. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. Our mission is to help every American get better health insurance and save money. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

Let's see if you're missing out on Medicare savings.

We just need a few details.

Related Articles

What Is Medicare IRMAA?

What Is an IRMAA in Medicare?

Do All Doctors Accept Medicare?

What Does It Mean for a Doctor to Accept Medicare Assignment?

How to Report Medicare Fraud

Medicare Fraud Examples & How to Report Abuse

How to Change Your Address with Medicare

Reporting a Change of Address to Medicare

Can I Get Medicare if I’ve Never Worked?

Can You Get Medicare if You've Never Worked?

Why Are Some Medicare Advantage Plans Free?

Why Are Some Medicare Advantage Plans Free? $0 Premium Plans Explained

Am I Enrolled in Medicare?

When and How Do I Enroll?

When and How Do I Enroll in Medicare?

Medicare Frequently Asked Questions

Let’s see if you qualify for Medicare savings today!

Medicare Assignment: Understanding How It Works

Medicare assignment is a term used to describe how a healthcare provider agrees to accept the Medicare-approved amount. Depending on how you get your Medicare coverage, it could be essential to understand what it means and how it can affect you.

What is Medicare assignment?

Medicare sets a fixed cost to pay for every benefit they cover. This amount is called Medicare assignment.

You have the largest healthcare provider network with over 800,000 providers nationwide on Original Medicare . You can see any doctor nationwide that accepts Medicare.

Understanding the differences between your cost and the difference between accepting Medicare and accepting Medicare assignment could be worth thousands of dollars.

Doctors that accept Medicare

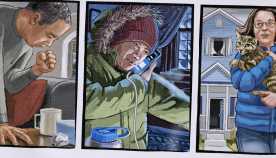

Your healthcare provider can fall into one of three categories:

Medicare participating provider and Medicare assignment

Medicare participating providers not accepting medicare assignment, medicare non-participating provider.

More than 97% of healthcare providers nationwide accept Medicare. Because of this, you can see almost any provider throughout the United States without needing referrals.

Let’s discuss the three categories the healthcare providers fall into.

Participating providers are doctors or healthcare providers who accept assignment. This means they will never charge more than the Medicare-approved amount.

Some non-participating providers accept Medicare but not Medicare assignment. This means you can see them the same way a provider accepts assignment.

You need to understand that since they don’t take the assigned amount, they can charge up to 15% more than the Medicare-approved amount.

Since Medicare will only pay the Medicare-approved amount, you’ll be responsible for these charges. The 15% overcharge is called an excess charge. A few states don’t allow or limit the amount or services of the excess charges. Only about 5% of providers charge excess charges.

Opt-out providers don’t accept Original Medicare, and these healthcare providers are in the minority in the United States. If healthcare providers don’t accept Medicare, they won’t be paid by Medicare.

This means choosing to see a provider that doesn’t accept Medicare will leave you responsible for 100% of what they charge you. These providers may be in-network for a Medicare Advantage plan in some cases.

Avoiding excess charges

Excess charges could be large or small depending on the service and the Medicare-approved amount. Avoiding these is easy. The simplest way is to ask your provider if they accept assignment before service.

If they say yes, they don’t issue excess charges. Or, on Medicare.gov , a provider search tool will allow you to look up your healthcare provider and show if they accept Medicare assignment or not.

Medicare Supplement and Medicare assignment

Medigap plans are additional insurance that helps cover your Medicare cost-share . If you are on specific plans, they’ll pay any extra costs from healthcare providers that accept Medicare but not Medicare assigned amount. Most Medicare Supplement plans don’t cover the excess charges.

The top three Medicare Supplement plans cover excess charges if you use a provider that accepts Medicare but not Medicare assignment.

Medicare Advantage and Medicare assignment

Medicare assignment does not affect Medicare Advantage plans since Medicare Advantage is just another way to receive your Medicare benefits. Since your Medicare Advantage plan handles your healthcare benefits, they set the terms.

Most Medicare Advantage plans require you to use network providers. If you go out of the network, you may pay more. If you’re on an HMO, you’d be responsible for the entire charge of the provider not being in the network.

Do all doctors accept Medicare Supplement plans?

All doctors that accept Original Medicare accept Medicare Supplement plans. Some doctors don’t accept Medicare. In this case, those doctors won’t accept Medicare Supplements.

Where can I find doctors who accept Medicare assignment?

Medicare has a physician finder tool that will show if a healthcare provider participates in Medicare and accepts Medicare assignments. Most doctors nationwide do accept assignment and therefore don’t charge the Part B excess charges.

Why do some doctors not accept Medicare?

Some doctors are called concierge doctors. These doctors don’t accept any insurance and require cash payments.

What is a Medicare assignment?

Accepting Medicare assignment means that the healthcare provider has agreed only to charge the approved amount for procedures and services.

What does it mean if a doctor does not accept Medicare assignment?

The doctor can change more than the Medicare-approved amount for procedures and services. You could be responsible for up to a 15% excess charge.

How many doctors accept Medicare assignment?

About 97% of doctors agree to accept assignment nationwide.

Is accepting Medicare the same as accepting Medicare assignment?

No. If a doctor accepts Medicare and accepts Medicare assigned amount, they’ll take what Medicare approves as payment in full.

If they accept Medicare but not Medicare assignment, they can charge an excess charge of up to 15% above the Medicare-approved amount. You could be responsible for this excess charge.

What is the Medicare-approved amount?

The Medicare-approved amount is Medicare’s charge as the maximum for any given medical service or procedure. Medicare has set forth an approved amount for every covered item or service.

Can doctors balance bill patients?

Yes, if that doctor is a Medicare participating provider not accepting Medicare assigned amount. The provider may bill up to 15% more than the Medicare-approved amount.

What happens if a doctor does not accept Medicare?

Doctors that don’t accept Medicare will require you to pay their full cost when using their services. Since these providers are non-participating, Medicare will not pay or reimburse for any services rendered.

Get help avoiding Medicare Part B excess charges

Whether it’s Medicare assignment, or anything related to Medicare, we have licensed agents that specialize in this field standing by to assist.

Give us a call, or fill out our online request form . We are happy to help answer questions, review options, and guide you through the process.

Related Articles

- What are Medicare Part B Excess Charges?

- How to File a Medicare Reimbursement Claim?

- Medicare Defined Coinsurance: How it Works?

- Welcome to Medicare Visit

- Guide to the Medicare Program

CALL NOW (833) 972-1339

Everything PTs Need to Know About Accepting Medicare Assignment

There's no one-size-fits-all answer as to whether or not a PT should accept Medicare assignment, but you can better understand your options.

There's no one-size-fits-all all answer as to whether or not a PT should accept Medicare assignment, but you can better understand your options.

Get the latest news and tips directly in your inbox by subscribing to our monthly newsletter

Discuss any topic within rehab therapy, and chances are that Medicare will come up at some point. Whether it’s talking about Medicare and direct access or Medicare supervision requirements , it’s hard to avoid discussing the ins and outs of the program, given its prominence in healthcare at large. However, there’s one question that probably doesn't get asked enough: do providers have to participate in Medicare? We’re going to dive into the specifics of what rehab therapists can and can’t do when it comes to accepting Medicare assignment, and the pros and cons of each.

What it means to “accept Medicare assignment”

In short, accepting Medicare assignment means signing a contract to accept whatever Medicare pays for a covered service as full payment. Participating and non-participating status only applies to Medicare Part B; Medicare Advantage plans operate with contracts similar to commercial insurance with in-network and out-of-network providers.

Participating Providers

If you’re accepting Medicare assignment for all covered services, you are considered to be a participating provider under Medicare and may not charge patients above and beyond what Medicare agrees to pay. In this case, you can charge 100% of the Medicare Physician Fee Schedule (MPFS) and are paid at 80% of that rate, minus the Multiple Procedure Payment Reduction (MPPR) and the 2% sequestration adjustment.

You may, however, collect patient deductibles and coinsurances—although, as explained in the Medicare payer guide , these providers typically ask Medicare to pay its share before collecting anything from the patient. Per the same resource, these providers are required to submit claims directly to Medicare for reimbursement and cannot charge patients for the claim submission. As Dr. Jarod Carter, PT, DPT, MTC, writes in Medicare and Cash-Pay PT Services , “This is the most common and best-understood relationship that physical therapists have with Medicare.”

Because Medicare beneficiaries often pay less out-of-pocket costs when receiving care from a provider who accepts assignment, patients may be more willing to work with these providers. Thus, if you accept assignment, you may have access to not only more Medicare patients but also more potential referral partners who only work with assignment-accepting providers.

You must accept whatever Medicare deems appropriate compensation, and as we know, that’s below market value more often than not. Given the recently announced cuts to assistant-provided services and the 8% cut to all physical therapy services , accepting assignment may be increasingly less appealing to physical therapists. That said, if you serve a large Medicare population, the volume of patients you see may make it financially beneficial for you to continue playing by Medicare’s rules.

If you don’t want to accept Medicare assignment, what are your other options?

Non-participating providers.

As Meredith Castin explains in 4 Things to Know About Billing for Cash-Pay PT , Medicare also allows physical therapists to be non-participating providers (a.k.a. non-enrolled providers), which simply means that, while they are still in a contractual relationship with Medicare (and thus, are eligible to provide covered services to Medicare beneficiaries), they have not agreed to accept assignment across the board.

If a non-participating provider opts to accept assignment for a case, they can charge 95%.

If they do not accept assignment but still treat the patient, these providers may charge up to what Medicare calls “the limiting charge” for a service—which is 15% above the Medicare allowed amount. Non-participating providers may choose to accept assignment for some services, but not others —or no services at all. For services that are not under assignment, the provider may collect payment directly from the patient; however, he or she must still bill Medicare, so that Medicare may reimburse the patient.

Non-participating providers are still eligible to serve Medicare beneficiaries, but they maintain some degree of freedom when it comes to pricing their services. In other words, if you are a non-participating provider, you are less beholden to what Medicare deems as appropriate payment than you are as a participating provider.

That said, you do still have to charge within Medicare’s limit, which means your freedom is far from total. Additionally, because patients may have to pay more out of pocket for your services and/or pay and wait for reimbursement from Medicare, you may have to work harder to convince them that you’re worth the financial investment. With the right data and marketing , it’s definitely doable; it may just require more effort.

No Relationship with Medicare

Physicians are eligible to “opt-out” of Medicare, which means that even if they are neither participating nor non-participating providers, they can still see Medicare beneficiaries on a cash-pay basis. Physical therapists do not enjoy the same privilege. So, if you decide not to be a Medicare participating provider or non-participating provider, then you effectively have no relationship with Medicare. Thus, you are not able to provide Medicare-covered services to Medicare beneficiaries.

That said, all physical therapists, regardless of their relationship with Medicare, may provide never-covered services to Medicare beneficiaries, including wellness services. According to Castin, though, providers who go down that route, “need to be very clear about Medicare’s definition of ‘wellness services’ versus ‘physical therapy services.’” According to cash-pay PT Jarod Carter , it’s imperative for your documentation to clearly support that the services were indeed wellness as opposed to therapy.

As a provider with no relationship with Medicare, you’re not required to play by Medicare’s rules when it comes to reporting requirements or (lowball) payments. You’re also not at all affected by Medicare’s most recent cuts, which, quite frankly, is a big bonus.

However, as of 2007 , 15% of the US population was enrolled in Medicare; that’s 44 million people—most of whom could benefit from seeing a physical therapist to improve function and mobility and decrease pain. And that number is projected to grow to 79 million people by 2030. As such, choosing not to play ball with Medicare means you’re walking away from a very large market of patients who need your services.

It’s your decision.

Deciding on accepting Medicare assignment—and what type of relationship you’d like to have with Medicare—is not an easy decision to make, and there are a lot of factors to take into consideration before getting involved or breaking it off with this substantial federal payer. That said, it is important to know that you have options. Have more questions about what it means to accept assignment as a PT? Ask them below, and we’ll do our best to find you an answer.

Related posts

Four Things You Need to Know About OT Salary

Founder Letter: What We Can Learn from Change Healthcare

How to Document and Bill for Home-Based Physical Therapy Services

Medicare and Cash-Pay PT Services, Part 1: The Must-Know Concepts to Avoid Legal Issues and Capitalize on Opportunities

Medicare and Direct Access

The Medicare Maintenance Care Myth

Learn how WebPT’s PXM platform can catapult your practice to new heights.

Sixty-Five Incorporated

Sponsored by interim healthcare ®.

- When Can I Sign Up For Medicare

- i65 Resources

What does ‘accepting assignment’ mean?

Accepting assignment is a real concern for those who have Original Medicare coverage. Physicians (or any other healthcare providers or facilities) who accept assignment agree to take Medicare’s payment for services. They cannot bill a Medicare beneficiary in excess of the Medicare allowance, which is the copayment or coinsurance. While providers who participate in the Medicare program must accept assignment on all Medicare claims, they do not have to accept every Medicare beneficiary as a patient.

There are basically three Medicare options for physicians.

- Physicians may sign a participating agreement and accept Medicare’s allowed charge as payment-in-full for all of their Medicare patients. Use the Physician Compare database to find physicians who accept assignment.

- They may elect to be non-participating, in which case, they make decisions about accepting Medicare assignment on a case-by-case basis. They can bill patients up to 15% more than the Medicare allowance. Some Medigap policies offer a benefit to cover this amount, known as Part B excess charges.

- Or, they may opt out of Medicare entirely and become private contracting physicians. They establish contracts with their patients to bill them directly. Neither the physicians nor the patients would receive any payments from Medicare.

Accepting assignment can also be a concern for beneficiaries with coverage other than Original Medicare, including those:

- in a Medicare Advantage Private Fee-for-service (PFFS) plan who get services outside the network.

- in a Medicare Advantage Medical Savings Account (MSA) plan because this plan does not utilize networks.

Learn the “Lingo” of Medicare Part D

Comparing Medicare Part D drug plans is useless – unless you know the lingo . What is Catastropic Coverage and the Coverage Gap? What are tiers and quantity limits? Find out!

Get the FREE Part D Lingo whitepaper.

Medicare Options

To help ensure that physicians are making informed decisions about their contractual relationships with the Medicare program, the AMA has developed a “Medicare Participation Kit”(www.ama-assn.org) that explains the various participation options that are available to physicians. A summary of those options is presented below. The AAFP is not advising or recommending any of the options. The purpose of sharing this information is merely to ensure that physician decisions about Medicare participation are made with complete information about the available options. Please note that the summary below does not account for any payment adjustments that a participating or non-participating physician may incur through one of the Medicare initiatives, such as the Physician Quality Reporting System. Physicians wishing to change their Medicare participation or non-participation status for a given year are usually required to do so by December 31 of the prior year (e.g., December 31, 2015 for 2016). Participation decisions are effective January 1 of the year in question and are binding for the entire year.

The Three Options

There are basically three Medicare contractual options for physicians. Physicians may sign a participating (PAR) agreement and accept Medicare's allowed charge as payment in full for all of their Medicare patients. They may elect to be a non-PAR physician, which permits them to make assignment decisions on a case-by-case basis and to bill patients for more than the Medicare allowance for unassigned claims. Or they may become a private contracting physician, agreeing to bill patients directly and forego any payments from Medicare to their patients or themselves. Physicians who wish to change their status from PAR to non-PAR or vice versa may do so annually. Once made, the decision is generally binding until the next annual contracting cycle except where the physician's practice situation has changed significantly, such as relocation to a different geographic area or a different group practice. To become a private contractor, physicians must give 30 days notice before the first day of the quarter the contract takes effect. Those considering a change in status should first determine that they are not bound by any contractual arrangements with hospitals, health plans or other entities that require them to be PAR physicians. In addition, some states have enacted laws that prohibit physicians from balance billing their patients.

Participation

PAR physicians agree to take assignment on all Medicare claims, which means that they must accept Medicare's approved amount (which is the 80% that Medicare pays plus the 20% patient copayment) as payment in full for all covered services for the duration of the calendar year. The patient or the patient's secondary insurer is still responsible for the 20% copayment but the physician cannot bill the patient for amounts in excess of the Medicare allowance. While PAR physicians must accept assignment on all Medicare claims, however, Medicare participation agreements do not require physician practices to accept every Medicare patient who seeks treatment from them.

Medicare provides a number of incentives for physicians to participate:

- The Medicare payment amount for PAR physicians is 5% higher than the rate for non-PAR physicians.

- Directories of PAR physicians are provided to senior citizen groups and individuals who request them.

- Medicare administrative contractors (MAC) provide toll-free claims processing lines to PAR physicians and process their claims more quickly.

Non-Participation

Medicare approved amounts for services provided by non-PAR physicians (including the 80% from Medicare plus the 20% copayment) are set at 95% of Medicare approved amounts for PAR physicians, although non-PAR physicians can charge more than the Medicare approved amount.

Limiting charges for non-PAR physicians are set at 115% of the Medicare approved amount for non-PAR physicians. However, because Medicare approved amounts for non-PAR physicians are 95% of the rates for PAR physicians, the 15% limiting charge is effectively only 9.25% above the PAR approved amounts for the services. Therefore, when considering whether to be non-PAR, physicians must determine whether their total revenues from Medicare, patient copayments and balance billing would exceed their total revenues as PAR physicians, particularly in light of collection costs, bad debts and claims for which they do accept assignment. The 95% payment rate is not based on whether physicians accept assignment on the claim, but whether they are PAR physicians; when non-PAR physicians accept assignment for their low-income or other patients, their Medicare approved amounts are still only 95% of the approved amounts paid to PAR physicians for the same service. Non-PAR physicians would need to collect the full limiting charge amount roughly 35% of the time they provided a given service in order for the revenues from the service to equal those of PAR physicians for the same service. If they collect the full limiting charge for more than 35% of the services that they provide, their Medicare revenues will exceed those of PAR physicians.

Assignment acceptance, for either PAR or non-PAR physicians, also means that the MAC pays the physician the 80% Medicare payment. For unassigned claims, even though the physician is required to submit the claim to Medicare, the program pays the patient, and the physician must then collect the entire amount for the service from the patient.

Example: A service for which Medicare fee schedule amount is $100

Private contracting.

Provisions in the Balanced Budget Act of 1997 give physicians and their Medicare patients the freedom to privately contract to provide health care services outside the Medicare system. Private contracting decisions may not be made on a case-by-case or patient-by-patient basis, however. Once physicians have opted out of Medicare, they cannot submit claims to Medicare for any of their patients for a two-year period.

A physician who has not been excluded under sections 1128, 1156 or 1892 of the Social Security Act may, however, order, certify the need for, or refer a beneficiary for Medicare-covered items and services, provided the physician is not paid, directly or indirectly, for such services (except for emergency and urgent care services). For example, if a physician who has opted out of Medicare refers a beneficiary for medically necessary services, such as laboratory, DMEPOS or inpatient hospitalization, those services would be covered by Medicare.

To privately contract with a Medicare beneficiary, a physician must enter into a private contract that meets specific requirements, as set forth in the sample private contract below. In addition to the private contract, the physician must also file an affidavit that meets certain requirements, as contained in the sample affidavit below. To opt out, a physician must file an affidavit that meets the necessary criteria and is received by the MAC at least 30 days before the first day of the next calendar quarter. There is a 90-day period after the effective date of the first opt-out affidavit during which physicians may revoke the opt-out and return to Medicare as if they had never opted out.

Emergency and Urgent Care Services Furnished During the "Opt-Out" Period

Physicians who have opted-out of Medicare under the Medicare private contract provisions may furnish emergency care services or urgent care services to a Medicare beneficiary with whom the physician has previously entered into a private contract so long as the physician and beneficiary entered into the private contract before the onset of the emergency medical condition or urgent medical condition. These services would be furnished under the terms of the private contract.

Physicians who have opted-out of Medicare under the Medicare private contract provisions may continue to furnish emergency or urgent care services to a Medicare beneficiary with whom the physician has not previously entered into a private contract, provided the physician:

- Submits a claim to Medicare in accordance with both 42 CFR part 424 (relating to conditions for Medicare payment) and Medicare instructions (including but not limited to complying with proper coding of emergency or urgent care services furnished by physicians and qualified health care professionals who have opted-out of Medicare).

- Collects no more than the Medicare limiting charge, in the case of a physician (or the deductible and coinsurance, in the case of a qualified health care professional).

Note that a physician who has been excluded from Medicare must comply with Medicare regulations relating to scope and effect of the exclusion (42 C.F.R. § 1001.1901) when the physician furnishes emergency services to beneficiaries, and the physician may not bill and be paid for urgent care services.

Sample Medicare Private Contract and Affidavit

The sample private contract and affidavit below contain the provisions that Medicare requires (unless otherwise noted) to be included in these documents.

Private contracts must meet specific requirements:

- The physician must sign and file an affidavit agreeing to forgo receiving any payment from Medicare for items or services provided to any Medicare beneficiary for the following 2-year period (either directly, on a capitated basis or from an organization that received Medicare reimbursement directly or on a capitated basis).

- Medicare does not pay for the services provided or contracted for. The contract must be in writing and must be signed by the beneficiary before any item or service is provided.

- The contract cannot be entered into at a time when the beneficiary is facing an emergency or an urgent health situation.

In addition, the contract must state unambiguously that by signing the private contract, the beneficiary:

- gives up all Medicare payment for services furnished by the "opt out" physician;

- agrees not to bill Medicare or ask the physician to bill Medicare;

- is liable for all of the physician's charges, without any Medicare balance billing limits;

- acknowledges that Medigap or any other supplemental insurance will not pay toward the services; and acknowledges that he or she has the right to receive services from physicians for whom Medicare coverage and payment would be available.

If you determine that you want to "opt out" of Medicare under a private contract, we recommend that you consult with your attorney to develop a valid contract containing other standard non-Medicare required provisions that generally are included in any standard contract.

Download sample contracts:

- Sample Medicare Private Contract

- Sample Medicare Private Contracts "Opt-Out" Affidavit

Copyright © 2024 American Academy of Family Physicians. All Rights Reserved.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

CMS Newsroom

Search cms.gov.

- Physician Fee Schedule

- Local Coverage Determination

- Medically Unlikely Edits

Provider Assignment

On this page:, provider nomination and the geographic assignment rule.

- Part A and Part B (A/B) and Home Health and Hospice (HH+H)

- Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS)

- Specialty Providers and Demonstrations

- Railroad Retirement Beneficiaries Entitled to Medicare

- Qualified Chains

- Out-of-Jurisdiction Providers (OJP)

Section 911(b) of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA), Public Law 108-173 , repealed the provider nomination provisions formerly found in Section 1816 of the Title XVIII of the Social Security Act and replaced it with the Geographic Assignment Rule. Generally, a provider or supplier will be assigned to the Medicare Administrative Contractor (MAC) that covers the state where the provider or supplier is located. The Center for Medicare & Medicaid Services’ (CMS) has defined the following approach for assigning providers, physicians, and suppliers to MACs.

return to top

Part A/Part B (A/B) and Home Health and Hospice (HH+H) Rule

All A/B and HH+H providers will be assigned to the MAC contracted by CMS to administer A/B and HH+H claims for the geographic locale in which the provider is physically located. Learn more about the current A/B MAC jurisdictions and HH+H areas and view the corresponding maps at Who are the MACs.

Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) Rule

Each DMEPOS supplier submits claims to the DME MAC contracted by CMS to administer DMEPOS claims for the geographic locale in which the beneficiary resides permanently. Learn more about the current DME MAC jurisdictions and view the corresponding map at Who are the MACs.

Specialty Providers and Demonstrations Rule

Specialty providers and providers involved with certain demonstrations will submit claims to a specific MAC designated by CMS. Learn more about a specific A/B MAC or DME MAC and view the corresponding maps at Who are the MACs .

Railroad Retirement Beneficiaries Entitled to Medicare Rule

Physicians and other suppliers (except for DMEPOS suppliers) will continue to enroll with and bill the contractor designated by the Railroad Retirement Board for Part B services furnished to their beneficiaries. Each DMEPOS supplier will submit claims to the DME MAC contracted by CMS to administer DMEPOS claims for the geographic locale in which the beneficiary resides permanently. Learn more about the current DME MAC jurisdictions and view the corresponding map at W ho are the MACs.

Qualified Chains Rule

The Geographic Assignment Rule states that generally, a provider or supplier will be assigned to the MAC that covers the state where the provider or supplier is located. However, it does provide an exception for qualified chains. A qualified chain home office may request that its hospitals and skilled nursing facilities be serviced by the A/B MAC that covers the state where the home office is located. A qualified chain home office may send an inquiry to: CMS [email protected]

Out-of-Jurisdiction Providers (OJP) Rule

An OJP is a provider that is not currently assigned to an A/B MAC in accordance with the geographic assignment rule and the qualified chain exception. For example, a hospital not part of a qualified chain located in Maine, but currently assigned to the A/B MAC in Jurisdiction F would be an OJP.

Each A/B MAC will initially service some OJPs until CMS undertakes the final reassignment of all OJPs to their destination MACs based on the geographic assignment rule and its exceptions.

CMS has not set a timetable for moving OJP’s.

- Newsletters

- FAC Articles

Working from home?

Keep your critical coding and billing tools with you no matter where you work.

Create your Find-A-Code account today!

Find-A-Code Articles, Published 2014, August 1

What does accept assignment mean.

by InstaCode Institute Aug 1st, 2014 - Reviewed/Updated Mar 5th

What does it mean to accept assignment on the CMS 1500 claim form - also called the HCFA 1500 claim form.? Should I accept assignment or not? What are the guidelines for accepting assignment in box 27 of the 1500 claim?

These commonly asked questions should have a simple answer, but the number of court cases indicates that it is not as clear cut as it should be. This issue is documented in the book “Problems in Health Care Law” by Robert Desle Miller. The definition appears to be in the hands of the courts. However, we do have some helpful guidelines for you.

One major area of confusion is the relationship between box 12, box 13 and box 27. These are not interchangeable boxes and they are not necessarily related to each other.

According to the National Uniform Claim Committee (NUCC), the "Accept Assignment" box indicates that the provider agrees to accept assignment. It simply says to enter an X in the correct box. It does NOT define what accepting assignment might or might not mean.

It is important to understand that if you are a participating provider in any insurance plan or program, you must first follow the rules according to the contract that you sign. That contract supersedes any guidelines that are included here.

Medicare Instructions / Guidelines

PARTICIPATING providers MUST accept assignment according to the terms of their contract. The contract itself states:

“Meaning of Assignment - For purposes of this agreement, accepting assignment of the Medicare Part B payment means requesting direct Part B payment from the Medicare program. Under an assignment , the approved charge, determined by the Medicare carrier, shall be the full charge for the service covered under Part B. The participant shall not collect from the beneficiary or other person or organization for covered services more than the applicable deductible and coinsurance.”

By law, the providers or types of services listed below MUST also accept assignment:

- Clinical diagnostic laboratory services;

- Physician services to individuals dually entitled to Medicare and Medicaid;

- Services of physician assistants, nurse practitioners, clinical nurse specialists, nurse midwives, certified registered nurse anesthetists, clinical psychologists, and clinical social workers;

- Ambulatory surgical center services for covered ASC procedures;

- Home dialysis supplies and equipment paid under Method II;

- Ambulance services;

- Drugs and biologicals; and

- Simplified Billing Roster for influenza virus vaccine and pneumococcal vaccine.

NON-PARTICIPATING providers can choose whether to accept assignment or not, unless they or the service they are providing is on the list above.

The official Medicare instructions regarding Boxes 12 and 13 are:

“Item 12 – The patient's signature authorizes release of medical information necessary to process the claim. It also authorizes payments of benefits to the provider of service or supplier when the provider of service or supplier accepts assignment on the claim.” “Item 13 - The patient’s signature or the statement “signature on file” in this item authorizes payment of medical benefits to the physician or supplier. The patient or his/her authorized representative signs this item or the signature must be on file separately with the provider as an authorization. However, note that when payment under the Act can only be made on an assignment-related basis or when payment is for services furnished by a participating physician or supplier, a patient’s signature or a “signature on file” is not required in order for Medicare payment to be made directly to the physician or supplier.”

Regardless of the wording on these instructions stating that it authorizes payments to the physician, this is not enough to ensure that payment will come directly to you instead of the patient.To guarantee payment comes to you, you MUST accept assignment.

Under Medicare rules, PARTICIPATING providers are paid at 80% of the physician fee schedule allowed amount and NON-participating providers are paid at 80% of the allowed amount, which is 5% less than the full Allowed amount for participating providers. Only NON-participating providers may "balance bill" the patient for any amounts not paid by Medicare, however, they are subject to any state laws regarding balance billing.

TIP: If you select YES, you may or may not be subject to a lower fee schedule, but at least you know the payment is supposed to come to you.

NON-MEDICARE Instructions / Guidelines

PARTICIPATING providers MUST abide by the terms of their contract. In most cases, this includes the requirement to accept assignment on submitted claims.

NON-PARTICIPATING providers have the choice to accept or not accept assignment.

YES means that payment should go directly to you instead of the patient. Generally speaking, even if you have an assignment of benefits from the patient (see box 12 & 13), payment is ONLY guaranteed to go to you IF you accept assignment.

NO is appropriate for patients who have paid for their services in full so they may be reimbursed by their insurance. It generally means payment will go to the patient.

What Does Accept Assignment Mean?. (2014, August 1). Find-A-Code Articles. Retrieved from https://www.findacode.com/articles/what-does-accept-assignment-mean-34840.html

Article Tags (click on a tag to see related articles)

Thank you for choosing Find-A-Code, please Sign In to remove ads.

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Health Care Financ Rev

- v.1(3); Winter 1980

Physicians' Charges Under Medicare: Assignment Rates and Beneficiary Liability

Under Medicare's Part B program, the physician decides whether to accept assignment of claims. When assignment is accepted, the physician agrees to accept as full payment Medicare's allowed charge. Physicians' acceptance of assignment is of considerable importance in relieving the beneficiaries of the burden of the costs of medical care services. This factor and the beneficiaries' liabilities for premiums, the annual deductible, and coinsurance are analyzed in considerable detail in this report.

Data from physicians' claims for services in 1975 show that 45.8 percent of the services and 47.2 percent of the charges were assigned for the aged. There were wide variations in the rate of acceptance of assignment by physician specialty, and by age, race, and residence of beneficiaries. Total beneficiary liability from the deductible, coinsurance, and from unassigned claims amounted to 37.7 percent of total physicians' charges due. When the premium which the beneficiary pays for Part B is included, beneficiary liability rises to 69.2 percent of total physicians' charges due.

Medicare's Part B program (Supplementary Medical Insurance) provides basic health insurance coverage to ease the financial burden of health care services for the aged population of the nation, for disabled Social Security beneficiaries, and for persons with end stage renal disease. Although the program was not intended to cover all the costs of medical care, several factors can diminish the protection beneficiaries have against the burden of large medical bills. These factors include the level of physicians' acceptance of assignment and the program's cost-sharing mechanisms.